ORDER

Rajesh Kumar, Accountant Member.- These are appeals preferred by the Revenue against the orders of the Commissioner of Income-tax (Appeals), Kolkata-20 (hereinafter referred to as the “Ld. CIT(A)”] dated 30.12.2024, 02.01.2025 for the AYs2011-12 to 2017-18.

2. At the outset, we observe from the appeal folder that there is a delay of 80 days in IT(SS)A Nos. 55 to 58/KOL/2025& ITA No. 1090/Kol/2025& 49 days in IT(SS)A Nos. 59 & 60/Kol/2025 in filing the appeal by the department and in support of this a condonation petition was filed. It was stated in the condonation petition that the delay has occurred due to obtaining the administrative approval from the competent authorities, which took quite a long time and accordingly, the delay may be condoned. The ld. AR, on the other hand, did not oppose the condonation of delay. Considering the reasons cited before us, we are inclined to condone the delay and admit the appeal for hearing.

A.Y. 2011-12 IT(SS)A No. 55/KOL/2025

3. The issue raised in ground no.1 is against the order of ld. CIT (A) restricting the addition to Rs. 15,42,994/-, being brokerage earned as against the addition of Rs. 1.00 crore made by the Id. AO, based on the seized documents in search conducted u/s 132 of the Act.

3.1. The facts in brief are that the assessee filed the return of income on 31.03.2012, declaring total loss of Rs. 2,07,116/-, which was processed u/s 143(1) of the Act on 19.04.2012, accepting the returned loss. Thereafter, a search action u/s 132 of the Act was conducted on the assessee on 03.02.2017 and some incriminating documents were found and seized. The assessee derived income by way of director remuneration, commission, brokerage and interest etc. Notice u/s 153A of the Act was issued on 01.02.2018. The assessee complied with the said notice by filing the return of income on 05.04.2018, declaring total loss of Rs. 2,70,116/-. Thereafter, notice u/s 143(2) and 142(1) of the Act along with questionnaire were issued and assessee replied the said notices/questionnaires. The ld. AO during the course of assessment proceedings, noted that the assessee has disclosed Rs. 20.00 crores before Additional DIT (Investigation), Unit-1, Kolkata on account of undisclosed income from A.Y. 2011-12 to A.Y.2017-18. The ld. AO extracted the details of disclosure made in various assessment years on page no.1 of the assessment order. The ld. AO noted that the assessee did not include the said undisclosed income in the return of income filed by the assessee. The assessee claimed before the ld. AO that he was not aware of any disclosure made of 20.00 crores before the ld. AO nor did have any documents/ signed documents in that regard. Thereafter, the assessee was given a copy of statement signed by him on 22.10.2018, and he withdrew the disclosure made on 01.11.2018. The assessee submitted before the ld. AO that he was rendering services as broker only and carrying out the transactions on behalf of other parties. The ld. AO however, did not accept the contention of the assessee and accordingly, added Rs. 1.00 crore (relating to this assessment year) to the income of the assessee in the assessment framed u/s 153A / 143(3) of the Act vide order dated 31.12.2018.

3.2. In the appellate proceedings, the ld. CIT (A) partly allowed the appeal of the assessee after taking into consideration the submissions and contentions of the assessee and also the evidences filed during the appellate proceedings. The ld. CIT (A) called for the remand report from the ld. AO and the assessee was confronted with the same. The assessee filed rejoinder to the remand report, which was extracted by the ld. CIT (A) in the appellate order. The ld. CIT (A) also called for the assessment records from the ld. AO and found that notices were issued u/s 133(6) of the Act to few parties and their replies were available in the assessment folder. Finally, the ld. CIT (A) after considering all these facts on record partly allowed the appeal of the assessee by observing and holding as under by sustaining the addition to the extent of Rs.15,42,994/- on the basis of seized documents:-

“7.1 I have duly considered the facts of the case, submissions of the appellant, assessment order and remand repot of the A.O. I find that the assessee was a finance broker earning income from brokerage in financing activities of cash as well as cheque transactions. This fact is not denied by the AO and in fact the same has been accepted as can be seen from the assessment order itself. The nature of business of the assessee in the assessment order is described as “Commission and Brokerage”. It is also on record that main search was in the case of one of the financier and client of the assessee namely Sri B L Bothra and Vikash Bothra which can be seen from the question No. 6 raised before Sri Deepak Bhansali whose statement was recorded u/s. 132(4) on 5.2.2017 in the course of search. It is also stated in question no. 7 wherein Sri Deepak Bhansali stated that they are earning income from brokerage by arranging funds. The AO has relied on the disclosure made by the assessee for the purpose of making the addition.

7.2 As per assessment order, the A.O has made the addition on the basis of the statement of disclosure made by the assessee. In the course of assessment proceeding the assessee submitted that he was only a broker and was not aware of any disclosure petition. On being given the copy of statement, the assessee immediately retracted the same. However, the AO was of the view that assessee could not prove that the transactions were related to other parties. The AO also observed that presence of Rukka does not prove that the brokerage was the only source of income of the assessee. The AO also relied on the statement of Deepak Bhansali and the assessee to support the addition of Rs.20 crores bifurcated in number of years. The AO issued show cause notice on 22.10.2018 wherein it was stated that the disclosure was made on the basis of incriminating material. However, no such incriminating document was enclosed along with the said show cause notice. In reply to the said show cause notice the assessee denied any suchdisclosure and asked for the copy of such alleged statement. It was stated by himthat all seized documents speak of his brokerage business and that he was finance broker. The assessee also stated that some Rukkas were seized from his custody which belonged to the clients and that it was evident from such Rukka that he was a finance broker. After the reply of the assessee, the AO provided the assessee with the copy of the alleged statement vide notice dated 19.11.2018 which again was replied by the assessee reiterating that he was only finance broker. The assessee also filed an affidavit retracting the statement. The AO again issued show cause notice. The assessee replied to the said show cause notice denying any disclosure and reiterated that he was only a finance broker. The AO concluded the assessment and assessed the total income on the basis of the statement of disclosure made by the assessee. However, the AO in the process also computed the total income based on the seized documents which computation is also part of the assessment order and is annexed as Annexure -2 of the assessment order. The AO, also referred to the seized documents having ID/ DB/8 page 3 with regard to the cash transaction of 50lakhs wherein interest @ 7% was mentioned for 6 months. The AO also referred to seized paper ID DB.9 page 14 wherein again cash transaction of 10 lakhs was mentioned. I have looked into the said two pages. The seized paper DB/8 page 3, is a Rukka issued by Srijan Building tomorrows in favour of R K Jain. It is clearly stated therein that the said Srijan has received Rs. 50000/- from R K Jain for 6 months. This establishes that the lender and borrower were the clients of the assessee and the transaction was not of the assessee. This proves that the assessee was only a middleman. Similarly, DB/9 page 14 is also a Rukka issued by Parakh Creation of 7 Hardutt Rai Chamaria Road, Howrah in favour of Tusharji. This also proves the same fact as in DB/8 page 3.

7.3 The AO while making the assessment has relied on the statement made by the assessee. However, no specific details of the seized material have been referred while making the addition. I find that at all stages of the proceedings, the assessee is accepted to be a finance broker. The search party also raised its question nos. 8,9,10,11,12,13 and 14 to Deepak Bhansali son of the assessee who was available at the time of search which questions also suggests that the assessee was a broker.

7.4 It is apparent from those questions and replies that everywhere the assessee is accepted as broker. This is further proved from the tabulation prepared in reply to question no. 27 of the statement dated 5.12.2018 wherein the AO himself has stated the name of the borrowers and lenders, the amount, duration and rate of interest. Therefore, there cannot be any doubt that the assessee was acting as finance broker on behalf of investors. I also find from the Rukka being seized paper DB/8 – pg no.52, 67, 74, 76, 91 & 92 that the assessee has been described as middlemen between the lender and the borrowers. In the Rukka seized from the assessee there were names and address of the borrowers and lenders. Not only that the signatures of the borrowers were also there in such Rukkas. I also find that during the search and post investigation the AO has not found any substantial asset with the assessee to match the figure of Rs. 20 crores assessed as undisclosed income of the assessee. It also appears from question No. 6 raised to Deepak Bhansali on 05.02.2017 that search in the hands of the assessee was consequential search, the main search was in the premises of one Babulal Bothra and Vikash Bothra.

7.5 I also find from the assessment order that no material has been collected in the course of assessment proceedings to support the statement of disclosure made by the assessee. Furthermore, the AO has not brought on record any corroborative material to support the disclosure made by the assessee. There cannot be any dispute that addition cannot be made relying on the disclosure petition alone unless there is material to support the same.

7.6 On the aforesaid facts, my predecessor called for a remand report from the AO vide his letter dated 20.09.2019. It can be seen from the said letter that the AO was specifically asked to submit the report by working out the taxable income of the assessee ignoring the disclosure statement and to work out the same on the basis of seized material and post search enquires. The AO was given sufficient time to make necessary enquires. The AO vide her letter dated 04-10-2024 asked for further time up to 14.11.2024. The remand report dated 21.11.2024 was submitted on 25.11.2024. The copy of the said remand report was served on the assessee. The assessee was asked to submit his reply on the said remand report. The assessee filed rejoinders to the remand report. The remand report and the rejoinders have been reproduced in the earlier part of this order.

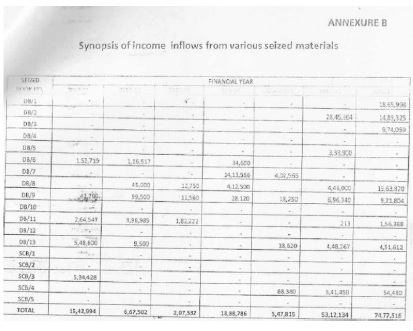

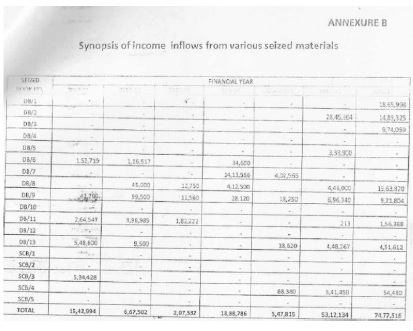

7.7 In the remand report the AO has again accepted the fact that the assessee was a finance broker in between the lenders and borrowers. The Ld AO has not submitted any computation of the undisclosed income with reference to the seized papers as asked for. The AO has mainly relied on the disclosure statement and has submitted that the same was retracted very late. The assessee has submitted the reasons for the delay as according to the assessee the retraction was filed immediately after the copy of the statement was received. The assessee submitted that he was not aware of the disclosure since he as broker. Therefore, there was no occasion to file aseparate statement admitting some income other than brokerage income. There appears to be some logic in the submissions of the assessee. In any case assessment has to be based on analysis of the seized materials and not on the basis of disclosure statement unless the same is backed by seized documents or any other corroborative material. As stated, the assessee filed the disclosure statement before Investigation wing. However, I find that the assessee also filed a separate computation of undisclosed income /receipts and expenditure along with said disclosure with the heading “synopsis of Income inflows from various seized materials” which was prepared from all the seized documents. The AO has also enclosed the same as annexure B of the assessment order. The said computation has not been disputed by the AO. In the said statement, year wise receipts/income has been computed as taken out from all the seized documents. The said computation has not been found by the AO to be incorrect. In fact, the same has also been made part of the assessment order vide Annexure B. The AO has not considered the same by stating that the same as undisclosed cash inflow and outflowwhen in fact the heading of the statement speaks otherwise. The copy of written submission wherein the said annexure was relied on by the assessee was also filed before the AO. There is no adverse comment about the same in the remand report. The AO inspite of sending computation of the undisclosed income on the basis of seized materials, only supported the order of the AO. The AO, in the remand report has taken support from the page wise explanation filed by the assessee before the Investigation wing. The assessee has filed rejoinder to remand report wherein it has been submitted that the cash inflow and outflow has been taken into account by the AO for the purpose of computation of income which is not correct since such cash flow statement is not supported by any document or seized paper. The AO in the remand repot also has not relied on any paper or document to support the said statement. In fact the AO has not stated anything about the cash flow statement though the same was Annexure A of the assessment order itself, adopted from the disclosure statement. It has been submitted that all the papers in DB/8 and DB/9 areRukka issued by borrowers in favour of lenders. It was submitted that Rukka was issued by the borrower on its own letter had duly singed by him and the same was issued in favour of the lender. This was clearly visible from the Rukka itself. It has been submitted that sec 292C comes into play and only inference which can be drawn is that the assessee was only a broker in between lender and borrower. The nature of business of the assessee is not disputed.

7.8 I also called for the assessment records of the assessee. I found that the A.O. issued notices u/s.133(6) to few parties. It is found from the replies to notice u/s 133(6) that one, Sri Anil Baid has admitted to have taken loan through the assessee.

It also appears from the records that notices u/s.133(6) were issued to the Sreejan Reality, Aayush Agarwal, Amit Rungta, Parakh Creation and Others along with Rukkas duly signed by them. Srijan Reality of whose Rukka was relied on by the AO in his favour was from DB/8 page 3. The said party duly replied, accepted the transaction, disclosed the same and paid tax. The other parties stated above did not reply even though notices were served on them which suggest that they did not deny the transaction. The AO relied on another paper DB/9 page 14 which is Rukka issued by Parekh Creation. Notice was served on the said party but did not reply. I also called for the assessment records of Sri Babulal Bothra. I find that he has made disclosure of a very large sum before the Settlement Commission wherein the name of the assessee also appeared. Shri Bothra admitted before the Settlement Commission that he did financial transaction through the assessee and his son. Therefore, it cannot be disputed that assessee acted as finance broker and income was from brokerage on these transactions.

7.9 In my opinion, thus the assessee was a finance broker for arranging cash loans and was a middleman between the lenders and borrowers. This fact is also corroborated form the questions raised, reply given before the investigation wing, the assessment order, seized materials including Rukkas, the remand report sent by the AO and rejoinder to remand report. The assessee’s income therefore consisted of the brokerage as was available from the transactions recorded in the seized materials. There can be no dispute that in case of broker who was accommodating the clients only his commission can be added. The issue is covered by the judgements of ITAT in the case of Dy. CITR v. Biharilal Shaduram Chhabriya in ITA No. 106 to 109/Nag/2023 dated 21.8.2024 wherein similar issue of determination of the income in the hands of finance broker was considered. Support is also taken from the decisions of ITA in the case of ACIT v. Shri Pankaj Khandelwala ITA No. 83/SRT/2022 darted 23.11.2023 and Bombay High Court judgment in the case of Alang Securities Ltd. (in ITA No. 1512 of 2017 vide order dated 12.06.2020 and Calcutta High court in ITA/165/2010 in CIT, Central-I, Kolkata v. Pramod Sharma decided on 05.02.2024. Therefore, income of the assesseeshould have been determined with reference to the seized papers and by accepting that the assessee acted only as finance broker.

7.10 Apart from that when the cash in flow and out flow pertaining to the lenders and borrowers is taken out from the page wise explanation (though figures are not corroborated) the figures of income will be less than what has been disclosed by the assessee in Annexure B. As per the said statement year wise computation ofreceipts/income has been made total of which for all the seven years comes to Rs.1,76,44,279/-. It is not understood as to why the AO has taken cognizance of the disclosure statement when computation of undisclosed income as per seized documents was also filed by the assessee before investigation wing.

7.11 Further, the AO in the remand report has also relied on the figures in Annexure A to the disclosure statement. However, none of the figures have been corroborated with any of seized papers and documents either in the assessment order or in the remand report. Therefore, neither the disclosure statement nor annexure A has any evidentiary value. There is no dispute that the assessee was broker. The total amount of transactions as broker even if assumed at Rs. 20 cores for all the seven years then brokerage only can be added. It is found from the Rukkas that the tenure of one loan transaction is generally 6 months. Therefore, it can be presumed that in one year there were two rotations of the loan transactions which means that during the block period the total rotation was twice Rs. 20 crores i.e. 40 cores. If the brokerage income is taken at 3% in average on the total transaction, the brokerage will be about Rs. 1.20 crores which can be said to have been earned by the assessee as broker. Therefore, higher of the two amounts i.e. the undisclosed income as per annexure B and estimated brokerage can safely be taken as undisclosed income of the assessee from the brokerage business. Since the assessee’s computation asworked out from seized documents for all the years is higher, the same also being not disputed by the AO, is considered as undisclosed income of the assessee. I find that the assets found with the assessee in the course of search is less than the amount worked out in annexure “B”. The said Annexure “B” is as under: –

Though the assessee has disputed the said computation on the ground that the same also included the income already disclosed, but there is no such indication in the statement so prepared. Since the said computation was filed before the AO which does not show that the income disclosed in the return was also included therein, the said claim is not accepted. The undisclosed income as worked out from the seized documents is taken at Rs.15,42,994/-. Accordingly, the total undisclosed income for the assessment 2011-12 is reduced to Rs.15,42,994/-. “

3.3. After hearing the rival contentions and perusing the materials available on record, we note from the assessment orders for all the years that the income has been assessed by the AO only on the basis of disclosure made by the assessee during the search operation. We note that the assessee has denied having made any disclosure during search. We note that the assessee prepared a statement of income from the seized books as required by the Ld. AO which is annexure II of the assessment order and the Ld. AO has treated the same as unaccounted cash inflow and cash outflow. We note that the assessee has also retracted the disclosure statement on 1.11.2018 once the copy of the statement was given to him on 22.10.2018. We observe from the appellate order that Ld CIT(A) duly noted the same vide para 7.2 of his order. The search was consequential search. The main search was in the case of one Babulal Bothra who was cash loan financier. We note that in that connection statement of son of the assessee was recorded wherein he categorically stated they were finance brokers which has been recorded by the appellate authority in para 7.1 of the Ld CIT(A) order. The Ld CIT(A) also recorded a finding vide para 7.3 of his order that at all stages the of the proceedings,the assessee was accepted as finance broker. The Ld CIT(A) also referred to the tabulation prepared by the AO himself in question no. 27 of statement recorded on 5.12.2018 wherein the AO himself stated the names of the borrowers and lenders, the amounts, duration, rate of interest and have also referred to number of specific seized papers without mentioning the source either in the disclosure petition or in the assessment order much less in the remand report too. In fact, there were no such figures in any of the seized papers which were specifically disputed by the assessee. Thus the said disclosure was bereft of any corroborative material and was not coming out of any seized papers.

3.4. We also note that even closing balance or peak also never exceeded 1,93,85,157/- then how the figures of 20.00 crores was arrived at. We note that the CBDT vide its circular dated 10.3.200 (relied on by Ld CIT (A) vide page 19 of his order) stated that no addition should be made on confessions but addition should be based on the seized material. The judgments/decisions on this issue were also cited in page 16 to 20 of the CIT(A)’s order. We note that the disclosure petition which was not only retracted but even otherwise there was no material for name sake to support the figures taken as income. In our considered view the addition cannot be based on disclosure petition alone unless there is corroborative materials. It was stated before us that this statement was available with the AO and prepared at his instance. Therefore, the Ld CIT(A) on the facts was perfectly justified in adopting the said figures of undisclosed income for the purpose of addition. It is stated that the Ld CIT(A) has relied on the judgements in the case of ACIT v. Pankaj Khandelwala [ITAppeal No. 83(SRT) of 2022, dated 23-11-2023] and CIT v. Pramod Sharma (Calcutta) to decide that in finance brokers cases only brokerage income is to be added. The Ld CIT(A) also recorded his finding that no material in support of the disclosure was brought on record or collected by the AO in the appellate order vide para 7.5. In the remand report the Ld AO again harped on the disclosure statement. The AO also gave a finding that he issued notices to the borrowers and the lenders to verify the claim of the assessee but none of them replied. The Ld CIT(A) called for the records and have given a finding vide para 7.8 of his order that many of the parties replied and accepted that they did cash loan transactions with the assessee. The Ld. CIT (A) also found that substantial amount was disclosed by Babulal Bothra before settlement commission and that he did cash financial transactions through the assessee. Thus, it was established that the assessee was only finance broker.The Ld AO also referred to some seized Rukkas as if the same were in favour of the assessee vide first para of page 5 (DB/9 page 14 and Page 3 of DB/8 of the assessment order. The Ld CIT(A) dealt with those Rukka vide para 7.2 Of his order and found that the same were issued by actual borrowers in favour of the lenders and the names of the borrowers have also been stated therein. The Ld AO in the remand report which was reproduced in page 43-44 of the order of Ld CIT(A), stated some rukkas as if the same belonged to the assessee’s own finance for which explanation and evidence was produced and noted down by Ld CIT(A) in page 49/50 of the order. Not only that the contents of the documents no. DB/8 and DB/9 were mentioned by the Ld AO at page 50/55 of the CIT(A) order wherein the name of loan taker and loan giver is specifically stated along with the amount. Thus, it is proved beyond doubt that the assessee was only finance broker. Considering these facts we are inclined to uphold the order of ld. CIT(A) by dismissing the appeal of the revenue.

A.Ys. 2012-13 to 2017-18 IT(SS)A No. 56 to 60/KOL/2025 & ITA No. 1090/KOL/2025

4. The issue raised in these appeals are similar to one as decided by us in IT(SS)A No.55/Kol/2025 (supra). Accordingly, our decision would, mutatis mutandis, apply to this appeal of assessee in IT(SS)A No. 56 to 60/Kol/2025 and ITA No. 1090/Kol/2025. Hence, the appeals of the Revenue are dismissed.

5. In the result, the appeals of the appeal of the Revenue are dismissed.