No unconditional stay was granted on a demand while challenging Section 16(2)(c).1

Issue

In a writ petition that challenges the constitutional validity of Section 16(2)(c) of the CGST Act, is a taxpayer entitled to an unconditional stay on the recovery of a tax demand, especially when other High Courts have already upheld the validity of the said provision?

Facts

- A taxpayer filed a writ petition challenging the constitutional validity of Section 16(2)(c) of the CGST Act. This is the highly debated provision that makes a buyer’s right to claim Input Tax Credit (ITC) conditional on their supplier having actually paid the tax to the government.

- The petitioner also challenged a specific demand order for approximately ₹1 crore in tax, plus another ₹1 crore in interest and penalty.

- They requested the High Court to grant an unconditional stay on the recovery of this demand. Their main arguments for this were:

- Their supplier, who had defaulted, had already paid a sum of ₹21 lakhs to the department.

- Had they filed a normal statutory appeal instead of a writ petition, they would only have had to make a pre-deposit of 10% of the disputed tax (which would be ₹10 lakhs) to get an automatic stay on the recovery of the balance.

Decision

The High Court ruled procedurally in favour of the revenue.

- It refused to grant an unconditional stay on the recovery of the demand.

- The court’s reasoning was that a private dispute between the petitioner (the buyer) and their supplier cannot be a ground for denying the government its statutory dues.

- It also took significant note of the fact that at least three other High Courts had already upheld the constitutional validity of Section 16(2)(c), which significantly weakened the petitioner’s case for getting a full, unconditional stay.

- However, the court did grant a conditional stay. It directed that the recovery of the demand would be stayed, but this was made subject to the petitioner depositing ₹20 lakhs with the High Court.

Key Takeways

- A Dispute with a Supplier is Not a Defense Against the Government: If your supplier fails to pay their taxes to the government, your ITC can be denied under Section 16(2)(c).2 The law makes it clear that your remedy is to sue your supplier to recover the money; you cannot use that dispute as a reason to not pay the government’s demand against you.

- Courts are Reluctant to Grant Unconditional Stays in Tax Matters: In tax disputes, and especially when a taxpayer is challenging the validity of a law that other courts have already upheld, it is very difficult to get an unconditional stay on the recovery of the demand. The courts will typically require a significant deposit to balance the interests of the taxpayer and the revenue.

- The Judicial Trend is to Uphold Section 16(2)(c): The court’s specific observation that multiple High Courts have already upheld the validity of Section 16(2)(c) is very significant. It indicates a clear and consistent judicial trend that is not in favour of the taxpayers on this particular constitutional challenge.

- A Writ Petition Can Sometimes Be More Expensive: It’s interesting to note that by filing a writ petition instead of a statutory appeal, the petitioner was asked to deposit ₹20 lakhs for a stay. Had they filed a normal appeal, the mandatory pre-deposit to get an automatic stay would have been only 10% of the disputed tax, which was ₹10 lakhs.

HIGH COURT OF DELHI

DK Enterprises

v.

Union of India

PRATHIBA M. SINGH and SHAIL JAIN, JJ.

W.P. (C) No.10921 of 2025

CM APPL. No. 45022 of 2025

CM APPL. No. 45022 of 2025

SEPTEMBER 17, 2025

Viraj Datar, Sr. Adv., Kartik Jindal, Ms. Palak Gupta and Rajiv Sorihi, Advs. for the Petitioner. Ms. Anushree Narain, SSC, Naman Choula, Ms. Khushi Ramuka, Advs. and Siddhartha Shankar Ray, CGSC for the Respondent.

JUDGMENT

Prathiba M. Singh, J.- This hearing has been done through hybrid mode.

2. The present petition has been filed by the Petitioner under Article 226 of the Constitution of India, seeking quashing of the impugned order dated 04th February, 2025 (hereinafter ‘impugned order’).

3. The present case is one wherein there are allegations, inter alia, of fraudulent availment of Input Tax Credit (hereinafter, ‘ITC’). The argument by ld. Sr. Counsel for the Petitioner is that the Petitioner was issued a Show cause notice dated 24th May, 2022 (hereinafter, ‘SCN’) through e-mail, and thereafter, the Petitioner approached the GST Department for filing a reply to the said SCN. However, he was asked to upload the said reply on the GST portal, despite the fact that the SCN itself was not uploaded on the GST portal.

4. The impugned order has thus been passed without a reply to the SCN on behalf of the Petitioner, and without any personal hearing.

5. On the last date of hearing i.e., 28th July, 2025, the Court had directed the GST Department to place on record the facts relating to uploading of SCN, and whether any opportunity for personal hearing was granted to the Petitioner or not.

6. Ld. SSC for the GST Department has placed certain documents on record, which reveals the following:-

| (i) | That the SCN dated 24th May, 2022 along with Relied Upon Documents (hereinafter ‘RUDs’) was served upon the Petitioner at the registered email ID i.e., dippaknmittal@hotmail.com, on 25th May, 2022 at 23:54, and again on 26th May, 2022 at 7:46 AM. |

| (ii) | That personal hearing notices were served to all the noticees, including the Petitioner. The same were stated to have been dispatched by Speed Post by the Department on 9th January, 2025. |

| (iii) | There were four notices, which were sent for personal hearing for fixing the dates of hearing, on 14th January, 2025, 15th January, 2025 and 17th January, 2025 and again on 20th January, 2025 and 21st January, 2025. |

7. Ld. Counsel for the GST Department submits that the actual speed post receipts are being traced by the GST Department. However, the fact that they were issued is clear from the generation of the DIN numbers on the notices, which were issued to all the noticees.

8. Ld. Sr. Counsel for the Petitioner submits that the admitted position, therefore, would be that, till date, hearing notices have not been uploaded on the Portal. This fact is confirmed by the GST Department, that the hearing notices have not been uploaded on the GST portal, due to considerable workload during the said period.

9. However, the GST Department is stated to have rectified this position. Additionally, recently, attempts are being made to not merely email the notice, but also ensure that all the notices are uploaded.

10. Ld. Sr. Counsel for the Petitioner also submits that since the Petitioner has had no opportunity to put forth its case, the impugned order may be set aside, and the Petitioner be given an opportunity to file a reply, as also personal hearing be granted to the Petitioner.

11. Further, ld. Sr. Counsel for the Petitioner also submits that insofar as the Petitioner is concerned, around the same time, three SCNs is stated to have been received, and in respect of two SCNs, replies were filed by the Petitioner, and there was no reason why the Petitioner would not file reply to the SCN dated 24th May 2022, except inability to do so in view of the fact that the email was received, but the same was not uploaded on the GST portal.

12. Heard. The present case is one where, DK Enterprises has been found to be the main entity involved in fraudulent availment of ITC. Mr. Deepak Mittal is the proprietor of the said firm (hereinafter ‘proprietor’). The role of DK Enterprises, including its proprietor has been set out in paragraph 8 of the impugned order, as under:

“8 Role of M/s D.K.Enterprises (Proprietor, Deepak Mittal)

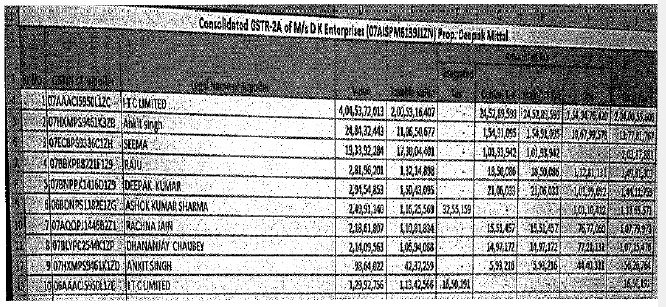

8.1 Whereas summons dated 18.02.2020, 05.08.2020,16.11.2020 and 07.12.2020 were issued to Shri Depak Mittal, Proprietor of M/s D. K. Enterprises, but he did not turn up. For further investigation, GSTR 2A of M/s DK Enterprises was abstracted from the GSTIN and the major suppliers shown, consolidated as under.

The above chart shows that apart from input tax credit availed from M/s ITC Ltd., M/s DK Enterprises has also shown 8 other “suppliers”, on whose invoices input tax credit of total Rs.22.80 Cr. has been availed. The first of these is M/s AS Traders (Prop. shown as Ankit Singh), which was found to be a take and non-existent firm (para 5.2 above). They also availed input tax credit on invoices issued by M/s SM Enterprises (Prop, shown as Seema), which was also found to be a fake entity (para 4.4 above). Similarly, M/s Archana Enterprises (Prop. shown as Raju was also found fake in another investigation, in which show cause notice [F.No. DGGI/GZU/Gr.G/Inv/81/2018-19/376-435 dated 21.05.2020] was issued to them as well as M/s DK Enterprises for availing fake input tax credit of 3,05,07,684 – from July 2017 to Nov. 2018 from this non existent entity. They also similarly availed input tax credit from M/s Om Traders (Prop. shown as Rachna Jain) and another M/s AS Traders registered on the same PAN as fake other with the same fake Proprietor, both of which have been found fake (para 4.3 above). The same is the case with M/s Himani Sales (Prop. shown as Deepak) and M/s Rajesh Impex (Prop. shown as fake Dhananjay Chaubey, who was also found fake in another fake firm registered on the same PAN, namely M/s KS Traders, which was covered in the aforecited show cause notice dated 21.05.2020). M/s Ashok Agencies (Prop. shown as Ashok Kumar Sharma) was found to have filed no GSTR3B (para 6.17) and as such never discharged GST on any of their outward billing from 20.02.2018 to March 2019. It was also found to be a fake firm. As such, it appears that M/s DK Enterprises showed availment/passing on of fake input tax credit of more than 22.80 crores on account of invoices of fake firms without goods.

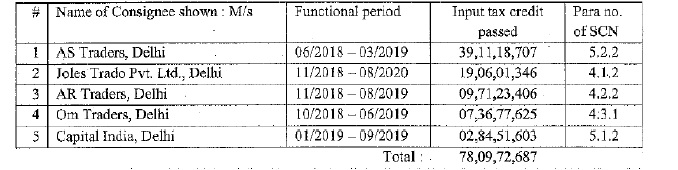

8.2 Apart from above fake inward receipts, M/s DK Enterprises also appears to have passed on input tax credit to entities found outrightly fake and non-existent and/or dummy, as follows:-

The above chart shows that M/s DK Enterprises showed supplies to firms which did not exist at all and company which was dummy and existed only on paper on forged particulars. As these five entities were fake dummy, supplies shown to them appear to be only paper transactions without goods. In some of the invoices, the transport details were mentioned which were also verified. As discussed above, the owner of vehicles denied any transport to any of the above five firms/ company via his vehicles, whose numbers were misdeclared by M/s DK Enterprises to feign a transport of goods which never happened (para 7.3.2 above). In absence of the existence of these firms to whom clearances were shown, the goods appear to have been cleared into the open market. Significantly, all these sales were not found reflected in the daily clearance declarations made by M/s DK Enterprises to M/s ITC Ltd. on their Sify software. Thus what was actually cleared into the market on the counter/ hawker sales, where the element of input tax credit is redundant and not utilized, appears to have been made “use of” by creating this paper trail so as to facilitate the movement of fake input tax credit through these fake/ dummy entities to their ultimate encashment by exporter firms. The illicit input tax credit of Rs.62.24 crores passed onto five fake firms/ dummy company (para 41), found its way to said five exporters, who encashed it by getting refunds on GST discharged via utilizing this non-existent input tax credit.

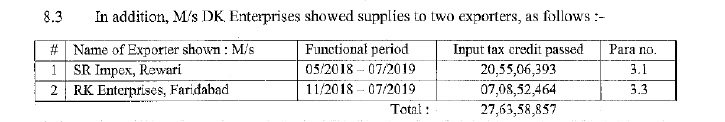

8.3 In addition, M/s DK. Enterprises showed supplies to two exporters, as follows :-

In some of the cases, transport details were found mentioned on the invoices issued. As such, verification was caused and only few transporters were found. M/s JBM Roadlines was found to be fake and non-existent (para 7.2.1) and denied any transport from M/s DK Enterprises to the exporter firm, M/s SR Impex, as claimed by them (para 7.2.3). Similarly the owner of vehicles, Sh. Amit Taluja (para 7.3.1 above) denied transporting goods shown through their vehicles to said exporter firm, M/s SR Impex. M/s Alpha Sea and Air Pvt. Ltd. also denied transport from M/s DK Enterprises to M/s SR Impex, Rewari (para 7.1.2). This appears to show that the fake input tax credit availed by M/s DK. Enterprises was passed on to the aforesaid two exporter firms to encash the same.

8.4 Instead of responding to aforecited Summons, Shri Deepak Mittal, Proprietor of M/s DK Enterprises, filled a writ petition dated 04.12.2020 in the Punjab and Haryana High Court, Chandigarh for anticipatory bails against arrest under section 132 of the CGST Act 2017. The Hon’ble Punjab & Haryana High Court vide interim orders dated 16.12.2020 granted stay on the arrest of Shri Deepak Mittal till further orders but and ordered him to appear before the department during investigation proceedings, which he was avoiding so far. In compliance to the said court order, Shri Deepak Mittal appeared before the department and his Statement was recorded on 28.12.2020, 30.12.2020, 14.01.2021, 22.01.2021 and 01.02.2021, in the presence (at a visible but not audible distance) of his advocate, Sh. Manish Kinha. He stated that he was the Proprietor of M/s D.K.Enterprises since its inception in 2001 and looked after all its business affairs. That apart from their purchases from M/s ITC Ltd., they had also purchased from M/s AS Traders [07HXMPS9461K3ZB], M/s Archana Enterprises [07BBXPR8221F1Z5], M/s Rajesh Impex [07BLYPC2544K1ZP], M/s SM Enterprises, [07ECBPS9336C1ZH], M/s Ashok Agency [06BDNPS1182E12G] and M/s CPL Trading Co. Pvt. Ltd., [07AACCC5466H1ZM] and had availed ITC on those purchases. That the GSTR-1 (Detail of sale of Cigarette to GST registered buyers made by M/s D.K.Enterprises) consolidated chart shown to him by the officers was prepared correctly. He agreed that they provide a daily closing stock position to M/s ITC Limited through SIFY software provided to them by M/s ITC Limited for the same purpose and they provide the same data on SIFY software to M/s ITC Ltd. before 10 PM every day. That they were also required to provide weekly sale data in SIFY software on 7th 14th, 21st and at last day of every month and they had provided to M/s ITC Ltd. the same. That he had submitted consolidated bank statement chart showing debit and credit entries for major parties of M/s D.K. Enterprises. He stated that he dealt with Sh. Gopal Sharma, Prop. M/s G.S.Nut, in respect of transactions with M/s G.S.Nuts, M/s Gopal Associates and M/s S.M. Enterprises and he or his employee did not know any other person except Sh. Gopal Sharma in all those firms. That he or his employees had never visited the GST registered premises of those firms. That for transaction with respect to M/s A.R.Enterprises, M/s A R Traders, M/s A S Traders, M/s Archana Enterprises, M/s Archana Traders, M/s Ashok Agencies, M/s Capital India, M/s GR Nuts Pvt. Ltd., M/s HK Sales, M/s Himani Sales, M/s India Overseas, M/s Jai Guru Traders, M/s Jai International, M/s Joles Trado Pvt. Ltd., M/s Laxmi Trading Co., M/s Om Traders, M/s SM Enterprises, M/s SR Impex, M/s SR International, M/s Sangam Sales, M/s Sharda Enterprises, M/s Sharp International, M/s Super Sales, Ms/ United India, M/s Kapoor Trading Co., and M/s V K Traders, he had dealt with Sh. Ritesh Aggarwal and thereafter only Sh. Ritesh Aggarwal had dealt in respect of all those firms, which they never visited. That he knew only Sh. Ritesh Aggarwal in all these firms. That he had submitted party-wise ledger for above mentioned firms, wherein it was found that they had shown supplies at first instance, before receipt of any payments, from M/s SR Impex, Rewari, M/s RK Enterprises, Faridabad, M/s Joles Trado Pvt. Ltd., Delhi, M/s Jai Guru Traders, Gurugram, M/s GR Nuts Pvt. Ltd., Delhi, M/s Capital India, Delhi, M/s Ashok Agency, Rewari, M/s A S Traders, Delhi. On query on this anomaly, he stated that Sh, Ritesh Aggarwal made him payments from other firms with whom he had done only bank transactions without making any sale purchase. He was confronted with the fact that M/s D. K.Enterprises had shown bank transactions, of Rs. 1.16 Crore with M/s Archana Enterprises, Rs. 1.02 Crores with M/s GS Nuts, Rs. 2 Crores with M/s HK Sales, 0.60 Crore with M/s Indian Overseas, Rs. 3.53 Crores with M/s Laxmi Trading Co., Rs. 1.45 Crores with M/s SR International and Rs. 3.43 Cores with M/s Sharda Enterprises, even though there was no sale/ purchase of any goods/services with these companies. He replied that all these bank transactions were done with Sh. Ritesh Aggarwal and Sh. Gopal Sharma with respect to their business transactions in their other firms. On being asked how he could do this, he stated that Sh. Ritesh Aggarwal and Shri. Gopal Sharma were managing all the above firms/companies, so on their direction he did the same transaction of sale/purchase in one firm and payment/receipt of the same in another firm. On being asked, he stated that with reference to all his business transaction with respect to M/s A R Traders, Delhi(07KWAPS8688J1ZF) M/s Joles Trado Pvt. Ltd. (07AADCJ9113F1ZQ), M/s Om Traders(07AQOP11446B2ZO), M/s CapitalIndia (07AALFC6636R1Z0), M/s SR Impex (06ADSPA88834Z5) and M/s SR International(06AARHA6667C2Z5), he dealt with Sh.Ritesh Aggarwal only. That in M/s SR International, he did not supply /receive any goods and yet he received Rs. 1.45 Crores on 20.02.2019 and 22.02.2019 from M/s SR International, as the amount was transferred by Sh. Ritesh Aggarwal for supplies made in his some other firm/entities and the same amount was returned back to M/s SR International by him on 07.03.2019 and 25.03.2019, after receipt of payments from those firms. He stated that they had never paid transport charges for supplies to any entities of Mr. Ritesh Aggarwal, Mr. Gopal Sharma or Rajesh Kasera. He denied having any transport documents/register/slips for all these transactions shown with these entities. He stated that for all these entities of Mr. Ritesh Aggarwal/ Rajesh Kasera, he had prepared Part-B of e-way bill for all transaction in Delhi and vehicle numbers were noted on loading. He was confronted with the transporter statements denying any such transport. Thus, he was shown the statement of Sh. Amit Taluja dated 21.09.2020 (para7.3.1) who denied any transport of goods from M/s DK Enterprises to M/s- SR Impex and stated their vehicle numbers were planted in e-way bills. He was also shown the statement of Sh. Mukesh dated 25.09.2020 (para 7.3.2) denying transport from M/s DK Enterprises to the fake firms / dummy company, M/s Joles Trado Pvt. Ltd., M/s Om Traders, M/s Capital India, M/s AS Traders and M/s AR Traders and maintained their vehicles were mis represented in the eway bills. However, Sh. Deepak Mittal could not reply to these transporter statements. He was also shown the statement dated 27.09.2019 of Sh. Sanjeev Goel, Director of M/s Alpha Sea and Air Pvt. Ltd. (para 7.1.2), wherein he denied any transport of any goods from M/s DK Enterprises to M/s SR Impex, and again Sh. Deepak Mittal was unable to say anything in that regard that M/s ITC Ltd. He was also confronted with their own declarations in the SIFY software data of their sales and purchases which were uploaded for M/s ITC Ltd., which was obtained from M/s ITC Ltd. in soft copy, which did not show any sale to any of these entities, namely, M/s AS Traders, M/s AR Traders, M/s Om Traders, M/s Joles Trado Pvt. Ltd., M/s SR Impex, M/s Capital India, M/s RK Enterprises etc. operated by. Sh. Ritesh Aggarwal/Rajesh Kasera. He stated that they did not want to show these outside sale to M/s ITC Ltd. and had shown the same stock sold in cash sale/local sale. On being confronted with the fake and dummy nature of these entities floated by Sh. Ritesh Aggarwal/ Gopal Sharma combine, he stated that both had breached his trust and had got wrongly issued invoices to those entities.”

13. The factual position recorded in the impugned order would show that there were various supplies, which were shown by DK Enterprises to several entities, which did not exist. They were mere fake/dummy entities. DK Enterprises also availed ITC on the invoices issued to the firms, which were completely fake and non-existent.

14. The impugned order also records that repeated summons were issued to DK Enterprises. However, the proprietor failed to appear, but instead chose to file the writ petition dated 4th December 2020, in Punjab & Haryana High Court, for anticipatory bail. Stay of arrest was granted initially and, thereafter, the proprietor appeared before the GST Department on 28th December, 2020, 30th December 2020, 14th January 2021, 22nd January 2021, and 1st February 2021, wherein his statements were recorded.

15. In the statements of the proprietor, various details relating to the manner in which ITC was availed of, were disclosed. Details of Transport vehicles, which were reflected as transporters used for transporting the goods, were also recorded. The statements reveal that the numbers of the transport vehicles were merely implanted, as there was no actual transportation of goods that took place.

16. A detailed analysis, which has been done, by the Department would clearly show that, it was the intention of the Petitioner to avail of fraudulent ITC, and pass it on as well by creating a network of dummy/fake entities.

17. There can be no doubt that the principles of natural justice ought to be complied with in adjudication of proceedings. In this case, however, the Court notes that the proprietor i.e., Mr. Deepak Mittal has been all along aware of the entire investigation, which was going on, as also various proceedings that had been commenced against him, and related entities. SCNs were served upon the Petitioner. He had appeared in the investigation and statements have also been recorded. Thus, there was no reason why the physical copy of the reply to the SCN was not filed, and no follow up was done with the GST Department, in order to ensure that hearings are duly attended. Admittedly, the SCN was sent by email to the Petitioner and he had complete knowledge of the proceedings. Hence, it cannot be said that there is violation of the principles of the natural justice.

18. Moreover, in the batch of petitions involving SR Impex, the Court has already relegated the parties to avail of the appellate remedy in accordance with law. The details of the said petitions are as under:

| 1. | W.P.(C) 6441/2025 | M/s Sheetal and Sons v. Union of India and Anr. |

| 2. | W.P.(C) 6443/2025 | Sunny Jagga v. Union of India & Anr. |

| 3. | W.P.(C) 6447/2025 | Sunny Jagga v. Union of India & Anr. |

| 4. | W.P.(C) 6449/2025 | M/s. Vikas Traders v. Union of India & Anr. |

19. Under such circumstances, in cases involving large scale availment of fraudulent ITC, this Court has already taken the view that exercising the writ jurisdiction would not ordinarily be permitted. In all these matters in case of availment of fraudulent ITC, there are several factual issues, which would need to be looked into, which cannot be adjudicated in a writ petition. This view has already been taken by this Court in several matters. Further, the Supreme Court in the context of CGST Act, has, in Asstt. Commissioner of State Tax v. Commercial Steel Limited 180/88 GST 799/52 GSTL 385 (SC)/Civil Appeal No. 5121/2021 dated 3rd September, 2021 titled, held as under:

“11. The respondent had a statutory remedy under section 107. Instead of availing of the remedy, the respondent instituted a petition under Article 226. The existence of an alternate remedy is not an absolute bar to the maintainability of a writ petition under Article 226 of the Constitution. But a writ petition can be entertained in exceptional circumstances where there is: (i) a breach of fundamental rights; (ii) a violation of the principles of natural justice; (iii) an excess of jurisdiction; or (iv) a challenge to the vires of the statute or delegated legislation.

12. In the present case, none of the above exceptions was established. There was, in fact, no violation of the principles of natural justice since a notice was served on the person in charge of the conveyance. In this backdrop, it was not appropriate for the High Court to entertain a writ petition. The assessment of facts would have to be carried out by the appellate authority. As a matter of fact, the High Court has while doing this exercise proceeded on the basis of surmises. However, since we are inclined to relegate the respondent to the pursuit of the alternate statutory remedy under Section 107, this Court makes no observation on the merits of the case of the respondent.

13. For the above reasons, we allow the appeal and set aside the impugned order of the High Court. The writ petition filed by the respondent shall stand dismissed. However, this shall not preclude the respondent from taking recourse to appropriate remedies which are available in terms of Section 107 of the CGST Act to pursue the grievance in regard to the action which has been adopted by the state in the present case”

20. The said legal position has also been reiterated by this Court in Sheetal and Sons v. Union of India 597 (Delhi)/(2025: DHC: 4057- DB) and by the Allahabad High Court in Elesh Aggarwal v. Union of India [Writ Tax No. 753 of 2023, dated 31-5-2023] wherein the Allahabad High Court has held that no ground is made for interference on merits in exercise of extra ordinary jurisdiction. The relevant portion of the decision in M/s Sheetal and Sons & Ors. (supra) reads as under:

“15. The Supreme Court in the decision in Civil Appeal No 5121 of 2021 titled ‘The Assistant Commissioner of State Tax & Ors. v. M/s Commercial Steel Limited’ discussed the maintainability of a writ petition under Article 226. In the said decision, the Supreme Court reiterated the position that existence of an alternative remedy is not absolute bar to the maintainability of a writ petition, however, a writ petition under Article 226 can only be filed under exceptional circumstances.

xxx xxx xxx

16. In view of the fact that the impugned order is an appealable order and the principles laid down in the abovementioned decision i.e. The Assistant Commissioner of State Tax & Ors. (supra), the Petitioners are relegated to avail of the appellate remedy.”

21. Moreover, the impugned order was available to the Petitioner, way back on 4th February, 2025, through the GST portal. The Petitioner has, however, sought to challenge the same by filing the present writ petition, sometime in July 2025, i.e., after expiry of the limitation period for filing the appeal.

22. Under these circumstances, the Petition itself could have been dismissed. However, considering that the Petitioner and similarly placed parties, who had challenged the impugned order, have already been relegated to the appellate remedy, this Court, in exercise of the writ jurisdiction, permits the Petitioner to file its appeal against the impugned order by 15th November, 2025 along with requisite pre-deposit in accordance with law.

23. If any deposits have been made during the course of investigation, the credit of the same shall be given to the Petitioner. If the Petitioner files the appeal by 15th November, 2025, the same shall not be dismissed on the ground of being barred by limitation, and shall be adjudicated on its own merits.

24. The observations made in this order would not affect the final adjudication of the appeal, before the Appellate Authority.

25. The present writ petition is disposed of in the above terms. All the pending applications, if any, are also disposed of.