Misleading court with fake video of business premises invites writ dismissal with heavy costs

Issue

Whether a writ petition seeking cancellation of GST registration is maintainable when the petitioner attempts to mislead the Court by fabricating evidence (video of a sign board) to cover up the non-existence of business at the registered premises and evade investigation into fraudulent ITC.

Facts

Application for Cancellation: The petitioner, a GST registrant, applied for cancellation of registration with effect from 30.06.2025 and filed a closure application.

Departmental Inaction: The Department issued a notice seeking information, to which the petitioner replied. Alleging inaction on the closure application, the petitioner filed a writ petition.

Allegations of Fraud: The Revenue Department flagged that the petitioner had availed prima facie fraudulent Input Tax Credit (ITC) and that the cancellation request was a ploy to evade investigation.

Field Inspection: A field visit by the Department revealed that the business was non-existent at the registered premises. There was no sign board, no business activity, and the contact details were inactive.

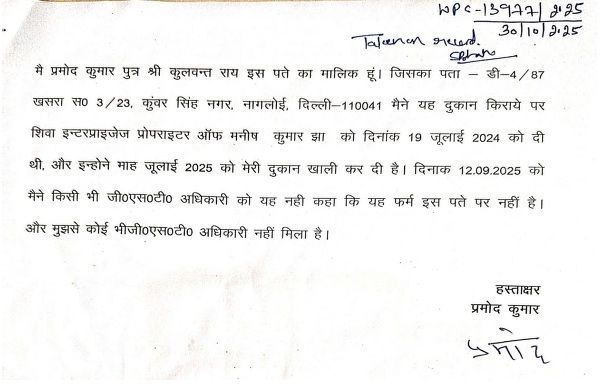

Fabricated Evidence: To counter the Department’s claim, the petitioner produced a video showing a sign board at the premises. However, the landlord’s certificate on record contradicted this, confirming that the premises had been vacated in July 2025.

Admission: Upon query, it was revealed that the sign board was installed solely for the purpose of recording the video to mislead the Court.

Decision

Misleading Conduct: The High Court held that the petitioner and the landlord had deliberately misled the forum. The installation of the board was a staged act to create false evidence of business existence.

Evasion Attempt: The Court observed that the entire exercise appeared to be an attempt to evade statutory action regarding the ITC availed from fraudulent entities.

Rejection of Relief: The Court ruled that such deceptive conduct ( suppressio veri, suggestio falsi) cannot be condoned. A party approaching the Writ Court must come with clean hands.

Dismissal with Costs: Since fresh show cause notices had already been issued by the Department for the irregularities, the writ petition for cancellation was dismissed. The Court imposed heavy costs (reported as ₹5,00,000 in the related Shiva Enterprises judgment) on the petitioner for abusing the judicial process.

Key Takeaways

Doctrine of Clean Hands: Writ jurisdiction is an equitable remedy. Attempting to mislead the High Court with staged evidence (like a temporary sign board) will lead to immediate dismissal and imposition of exemplary costs.

Fraud Investigation Priority: A taxpayer cannot use the “cancellation of registration” route to shut down proceedings when there are pending investigations into serious fraud like fake ITC availment.

Physical Verification Validity: A contemporaneous field inspection report by GST authorities holds significant evidentiary value and cannot be easily displaced by self-serving videos created later.

| • | Name: Delhi High Court Bar Association |

| • | Account No.: 15530100000478 |

| • | IFSC Code: UCBA0001553 |

| • | Bank & Branch: UCO Bank, Delhi High Court |

| • | Demand Draft in the name of ‘Commissioner, Trade & Taxes, Delhi‘ payable at Delhi |

| • | Name: Sales Tax Bar Association |

| • | Account No.: 90672010003811 |

| • | Bank Name: Canara Bank |

| • | IFSC: CNRB0019067 |