A cancellation order is invalid if it ignores the taxpayer’s reply and gives no reasons.

Issue

Is a retrospective cancellation of a GST registration legally valid if the final order does not appear to have considered the taxpayer’s reply to the show-cause notice and fails to provide any specific reasons justifying the retrospective application of the cancellation?

Facts

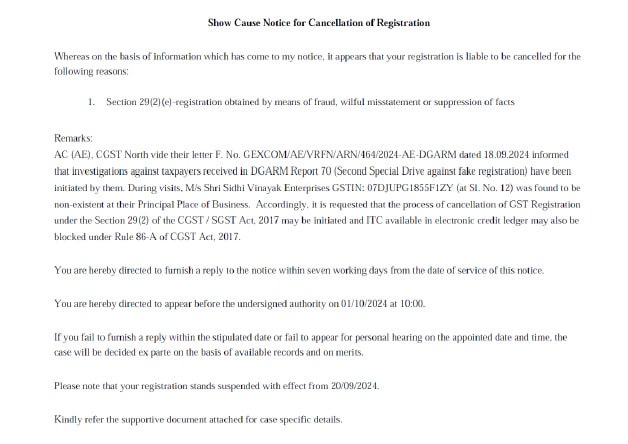

- The GST department issued a Show Cause Notice (SCN) to the petitioner on September 20, 2024. The notice alleged that the petitioner had availed excess Input Tax Credit (ITC).

- The petitioner duly submitted a reply to this SCN, providing their explanation for the alleged ITC discrepancy.

- The Proper Officer, however, passed a final order on June 10, 2025, cancelling the petitioner’s GST registration with retrospective effect from October 19, 2023.

- The petitioner filed a writ petition challenging this order, arguing that it was passed without due process and proper application of mind.

Decision

The High Court ruled in favour of the assessee.

The court found two significant and fatal flaws in the Proper Officer’s order:

- It appeared to have completely ignored the explanation that the petitioner had submitted in their reply to the SCN.

- It did not contain any reasons or justification for taking the harsh measure of cancelling the registration retrospectively, rather than from a current or future date.

Holding that the order was unreasoned and had been passed in violation of the principles of natural justice, the court set aside the impugned order. The matter was remanded back to the officer with a clear direction to pass a fresh, reasoned order after properly considering the petitioner’s reply.

Key Takeways

- Authorities Must Consider the Taxpayer’s Reply: A taxpayer’s reply to a show-cause notice is a critical part of the adjudication process. An officer cannot simply ignore it and pass an order. The final order must demonstrate that the officer has applied their mind to the taxpayer’s submissions, even if they ultimately disagree with them.

- Reasons are the Heartbeat of an Order: Passing a reasoned, “speaking” order is a fundamental requirement of natural justice. This is even more critical when a harsh and punitive action like retrospective cancellation is taken. The order must clearly explain why such a step is necessary and justified based on the facts of the case.

- Retrospective Cancellation is Not a Routine Action: Cancelling a registration from a past date can have severe consequences for a taxpayer and their customers (as it can impact the validity of past input tax credits). It is not a routine action and must be specifically justified by the officer.

- The Remedy for a Non-Speaking Order is Remand: When an order is found to be unreasoned or passed in violation of natural justice, the standard judicial remedy is to set it aside and remand the case back to the original authority for a fresh and fair hearing.

CM APPL. 57358 of 2025

“1-5.

6. Neither the show cause notice, nor the order spell out the reasons for retrospective cancellation. In fact, in our view, order dated 13.07.2022 does not qualify as an order of cancellation of registration.

7-8.

9. In terms of Section 29(2) of the Central Goods and Services Tax Act, 2017, the proper officer may cancel the GST registration of a person from such date including any retrospective date, as he may deem fit if the circumstances set out in the said sub-section are satisfied. The registration cannot be cancelled with retrospective effect mechanically. It can be cancelled only if the proper officer deems it fit to do so. Such satisfaction cannot be subjective but must be based on some objective criteria. Merely, because a taxpayer has not filed the returns for someperiod does not mean that the taxpayer’s registration is required to be cancelled with retrospective date also covering the period when the returns were filed and the taxpayer was compliant.

10. It is important to note that, according to the respondent, one of the consequences for cancelling a tax payer’s registration with retrospective effect is that the taxpayer’s customers are denied the input tax credit availed in respect of the supplies made by the tax payer during such period. Although, we do not consider it apposite to examine this aspect but assuming that the respondent’s contention in this regard is correct, it would follow that the proper officer is also required to consider this aspect while passing any order for cancellation of GST registration with retrospective effect. Thus, a taxpayer’s registration can be cancelled with retrospective effect only where such consequences are intended and are warranted.

11. The show cause notice does not even state that the registration is liable to be cancelled from a retrospective date.

12. The petition is allowed. The impugned show cause notice dated 07.04.2022, order of cancellation dated 13.07.2022 and the order in appeal dated 29.12.2023 are accordingly set aside. GST registration of the petitioner is restored, subject to petitioner filing requisite returns upto date. ”

“1-3.

4. Show Cause Notice dated 04.09.2021 was issued to the Petitioner seeking to cancel its registration. However, the Show Cause Notice also does not put the petitioner to notice that the registration is liable to be cancelled retrospectively. Accordingly, the petitioner had no opportunity to even object to the retrospective cancellation of the registration.

5. Further, the impugned order dated 15.12.2021 passed on the Show Cause Notice dated 04.09.2021 does not give any reasons for cancellation. It, however, states that the registration is liable to be cancelled for the following reason “whereas no reply to the show cause notice has been submitted”. However, the said order in itself is contradictory. The order states “reference to your reply dated 15.12.2021 in response to the notice to show cause dated 04.09.2021” and the reason stated for the cancellation is “whereas no reply to notice show cause has been submitted”. The order further states that effective date of cancellation of registration is 01.07.2017 i.e., a retrospective date.

6. Neither the show cause notice, nor the order spell out the reasons for retrospective cancellation. In fact, in our view, order dated 15.12.2021 does not qualify as an order of cancellation of registration. On one hand, it states that the registration is liable to be cancelled and on the other, in the column at the bottom there are no dues stated to be due against the petitioner and the table shows nil demand.

7. Learned Counsel for the Petitioner submits that the said order reflected that the GST registration of petitioner stands cancelled from 01.07.2017 even though returns thereafter have been filed by the Petitioner.

8. He further submits that the petitioner is no longer interested in continuing the business and the business has been discontinued.

9. In terms of Section 29(2) of the Act, the proper officer may cancel the GST registration of a person from such date including any retrospective date, as he may deem fit if the circumstances set out in the said sub-section are satisfied. Registration cannot be cancelled with retrospective effect mechanically. It can be cancelled only if the proper officer deems it fit to do so. Such satisfaction cannot be subjective but must be based on some objective criteria. Merely, because a taxpayer has not filed the returns for some period does not mean that the taxpayer’s registration is required to be cancelled with retrospective date also covering the period when the returns were filed and the taxpayer was compliant.

10. It is important to note that, according to the respondent, one of the consequences for cancelling a tax payer’s registration with retrospective effect is that the taxpayer’s customers are denied the input tax credit availed in respect of the supplies made by the tax payer during such period. Although, we do not consider it opposite to examine this aspect but assuming that the respondent’s contention in required to consider this aspect while passing any order for cancellation of GST registration with retrospective effect. Thus, a taxpayer’s registration can be cancelled with retrospective effect only where such consequences are intended and are warranted.”

| • | Email: shrisidhivinayak5 7@gmail. com |

| • | M: 7303482684 |