ORDER

Dr. Dipak P. Ripote, Accountant Member.- These two appeals filed by the Assessee are against the common order of ld.Commissioner of Income Tax(Appeal), Pune-11 passed under section 250 of the Income Tax Act, 1961 for A.Y.2019-20 and 2020-21, both dated 02.05.2024 emanating from separate Assessment Order u/s.153A r.w.s 144 of the I.T.Act, both dated 23.09.2021.For the sake of convenience, these two appeals were heard together and are being disposed of by this common order.

1.1 The assessee in ITA No.1438/PUN/2024 has raised following grounds of appeal :

“1.On the facts and in the circumstances of the case and in law Ld. CIT has erred in disallowing the interest paid on housing loan of Rs. 55,292 without appreciating the facts of the case and further rejecting the appellant’s contention that copy of loan account statement wherein the interest paid is clearly reflected, should be sufficient compliance of the supporting documents called for. Your appellant prays for deleting the disallowance of such interest.

2. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of the consultancy charges of Rs.5,00,000/- debited to Profit and Loss account by disregarding the appellant’s submission, and concluding that such charges debited to Profit and Loss account are not genuine. Your appellant contents that these consultancy charges paid are genuine and pray for deletion of the entire addition.

3. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of Rs.5,70,774/- being sales promotion and travelling expenses made by appellant without appreciating the facts of the case. Your appellant prays for deletion of entire addition.

4. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making disallowance of Rs.11,84,777/- being GST paid by invoking the provisions of section 43B of Income Tax Act, 1961. Your appellant contents that the GST payable of Rs.11,84,777/- has been paid before the due date offiling of the return and therefore no disallowance is warranted.

5. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of Rs.64,81,702/- under section 68-unexplained cash credits, being unsecured loans by concluding that appellant has failed to discharge its primary onus, given an opportunity your appellant is in position to provide all the details of such loan amount credited in bank account and therefore the entire addition in unwarranted.

6. On the facts and in the circumstances of the case and in law Ld. CIT has erred in disallowing the claim of deduction of Rs.1,50,000/- under section 80C of IT ACT, 1961, being the principal amount repaid on housing loan without appreciating the facts of the case and further rejecting the appellant’s contention that copy of loan account statement wherein the principal repayment is clearly reflected, should be sufficient compliance of the supporting documents called for. Your appellant prays to allowance of such deduction.

7. Your appellant craves for to add, alter amend, modify, delete any or all grounds of appeal beforeor during the course of hearing in the interest of natural justice. “

Submission of Id.AR :

2. Ld.Authorised Representative(ld.AR) for the Assessee submitted a paper book which contained documents filed before the Assessing Officer and ld.CIT(A). As far as question of interest certificate for housing loan, ld.AR admitted that no interest certificate has been filed by Assessee.

2.1 Regarding the 43B disallowance, ld.AR admitted that details were not filed before Assessing Officer / ld.CIT(A). Ld.AR requested that one more opportunity may be provided.

3. Regarding the Unsecure Loans, ld.AR submitted that loans were repaid in subsequent years. Ld.AR also submitted that all payments were through banking channel.

Submission of Id.DR :

3.1 Ld.Departmental Representative(ld.DR) for the Revenue relied on the order of Assessing Officer and ld.CIT(A). Ld.DR submitted that Assessee was provided more than enough opportunities. Ld.CIT(A) admitted Additional Evidence and called for Remand Report from Assessing Officer. Therefore, no further opportunity should be provided. Ld.DR submitted that even in the paper book, Assessee has not filed any evidence to prove the same. Regarding Unsecured Loans, ld.DR submitted that though ld.AR has claimed that Unsecured Loans were repaid in subsequent years, no evidence has been filed. Therefore, ld.DR submitted that order of ld.CIT(A) may be affirmed.

Findings & Analysis :

4. We have heard both the parties and perused the records. In this case, Assessee had filed Original Return of Income on 31.10.2019 declaring total income of Rs.38,22,450/-. It is mentioned in the assessment order that there was a search action u/s.132 in the case of the Assessee on 14.11.2019, accordingly, Assessing Officer issued notice u/s.153A of the Act, dated 04.01.2021. Assessee filed Return of Income in response to notice u/s.153A on 26.08.2021 declaring total income at Rs.38,22,450/-. It is also mentioned in the assessment order that notice u/s.143(2) was issued on 08.09.2021. It is mentioned in the assessment order that hearing was scheduled on 17.08.2021 and 13.09.2021. The Assessing Officer i.e.Assistant Commissioner of Income Tax, Central Circle-1(3), Pune passed Assessment Order u/s.153A of the Act r.w.s 144 of the Act on 23.09.2021 assessing the total income at Rs.1,57,56,610/-.

5. Aggrieved by the assessment order, Assessee filed appeal before the ld.CIT(A). Assessee filed additional evidences before the ld.CIT(A). Ld.CIT(A) called for Remand Report from Assessing Officer. After considering the submission of the assessee and remand report filed by Assessing Officer, ld.CIT(A)-11, Pune passed an order u/s.250 of the Income Tax Act, on 02.05.2024 for A.Y.2019-20 and A.Y.2020-21.

6. Aggrieved by the order of ld.CIT(A), Assessee filed appeal before this Tribunal.

7. We will discuss each ground separately.

Ground No.1 :

8. This Ground relates to Disallowance of Rs.55,292/-. Assessee had claimed disallowance of Rs.55,292/- as interest on self-occupied house property under the head “Income from House Property”. As per the computation of total income filed by the Assessee at page no.1 to 9 of the paper book, it is observed that Assessee had claimed deduction under section 24(b) of the Act, of Rs.55,292/- for Flat No.7, Plot No.60/61, S.No.165/1B, Shivanjali Near Mahadev Temple, Indra Nagae, Chinchwad, Pune – 411033. During the assessment proceedings, Assessing Officer asked assessee to file Interest Certificate and copy of loan sanction letter issued by Bank. Assessee failed to file the same, hence, Assessing Officer disallowed assessee’s claim of deduction u/s.24(b) of the Act. Before the appellate proceedings before the ld.CIT(A), Assessee again failed to produce copy of the Interest Certificate and Loan Sanction Letter from Bank. Ld.CIT(A) has discussed this issue in paragraph 11 of the order, the same is reproduced here as under :

“11. I have considered the facts of the case and the submissions made by the appellant. The above discussion clearly suggests that the appellant has failed to file the interest certificate from the bank or loan sanction letter and he is trying to claim the deduction only on the basis of ‘loan statement’ issued by SBI. A perusal of said loan statement suggests that nowhere on this statement, it is mentioned that this pertains to any home loan account. Further the details of property for which the said loan was taken is also not mentioned. As per the provisions of the Act, interest on home loan can be allowed as deduction while computing ‘income from house property’, only if the loan is taken for acquiring that particular house. In this case, the appellant has neither filed the copy of loan sanction letter nor any interest certificate and he is trying to claim the deduction on the basis of a loan statement which does not mention that the said loan statement corresponds to any home loan.

Considering these facts, the claim of the appellant cannot be accepted and the addition of Rs. 55,292/- is upheld.

Addition on account of undisclosed contract receipts. “

9. During the proceedings before this Tribunal, ld.AR for the Assessee admitted that no interest certificate has been filed. It is specifically mentioned by ld.CIT(A) that the so-called loan statement filed by Assessee does not establish that the loan was Housing Loan.

10. Section 24(b) of the Income Tax Act, 1961 is reproduced here as under :

Quote. “Deductions from income from house property.

24. Income chargeable under the head “Income from house property” shall be computed after making the following deductions, namely:—

(a) ………………………;

(b) where the property has been acquired, constructed, repaired, renewed or reconstructed with borrowed capital, the amount of any interest payable on such capital:

Provided that in respect of property referred to in sub-section (2) of section 23, the amount of deduction 33[or, as the case may be, the aggregate of the amount of deduction]shall not exceed thirty thousand rupees :

Provided further that where the property referred to in the first proviso is acquired or constructed with capital borrowed on or after the 1st day of April, 1999 and such acquisition or construction is completed within five years from the end of the financial year in which capital was borrowed, the amount of deduction 33[or, as the case may be, the aggregate of the amounts of deduction] under this clause shall not exceed two lakh rupees.

Explanation.—Where the property has been acquired or constructed with borrowed capital, the interest, if any, payable on such capital borrowed for the period prior to the previous year in which the property has been acquired or constructed, as reduced by any part thereof allowed as deduction under any other provision of this Act, shall be deducted under this clause in equal instalments for the said previous year and for each of the four immediately succeeding previous years:

Provided also that no deduction shall be made under the second proviso unless the assessee furnishes a certificate, from the person to whom any interest is payable on the capital borrowed, specifying the amount of interest payable by the assessee for the purpose of such acquisition or construction of the property, or, conversion of the whole or any part of the capital borrowed which remains to be repaid as a new loan. ” Unquote.

10.1 Thus, Proviso to Section 24(b) of the Income Tax Act, specifically stated that no deduction shall be allowed unless assessee furnishes the certificate from the person to whom interest is payable on capital borrowed specifying purpose. In this case, admittedly Assessee has not filed any interest certificate issued by bank. It has been claimed that assessee had paid interest to State Bank of India. However, ld.CIT(A) has noted that the statement issued by State Bank of India do not establish that it is a Housing Loan. The SBI statement also do not specify that it was a Housing Loan for Flat No.7 Shivanjali Near Mahadev Temple, Indra Nagae, Chinchwad, Pune-411033 against which the Assessee has claimed deduction u/s.24(b) claiming this impugned flat as self-occupied property. In these facts and circumstances of the case, the deduction of Rs.55,292/- is upheld. Accordingly, Ground No.1 of the Assessee is dismissed.

Ground No.2 :

11. This Ground relates to Disallowance of Rs.5 lakhs which assessee has claimed as consultancy charges. The Assessee had claimed Rs.5 lakhs as consultancy charges in the profit and loss account. The Assessing Officer asked assessee evidence of the same. However, Assessee failed to file any details, hence, Assessing Officer disallowed Rs.5 lakhs claimed as consultancy charges. Before ld.CIT(A), Assessee filed certain bills and claimed that the amount was paid to Shailaja Rupchand Paul for liaison work with Government Departments.

11.1 The relevant paragraph no.22 of the ld.CIT(A)’s Order is reproduced as under :

“22.1.I have considered the facts of the case and the submissions made by the appellant. The copies of bills raised by the said consultant suggest that the same are serially numbered indicating that the services were rendered only to the appellant. This issue was raised by the AO in the remand report and the appellant has not rebutted the same.

22.2. These bills are computer printed (not computer generated) and do not carry any GST number.

22.3. Also, the appellant has not deducted any TDS on these consultancy charges.

22.4. The copy of any agreement with the said consultant has also not been filed. The nature of services mentioned in the bills is quite general and does not specify as to what exact services were received by the appellant. It is further seen from the assessment order that almost all the receipts are from a private company namely Garware Technical Fibers Limited and therefore why the expenditure was incurred on government liaison is beyond anyone’s understanding.

22.5. It is also seen that monthly bills were raised during the period June to October, 2018 but the payments are claimed to have been made on 29/12/2018, 31/12/2018 and 04/01/2019. It is not understood as to why a consultant will wait for the payment for more than 5 months, without any correspondence.

22.6. Merely because the payments were made through bank does not substantiate the genuineness of expenses. Considering the totality of facts of the case, I am of the opinion that the consultancy charges debited in the P&L account amounting to Rs.5,00,000/- are not genuine and therefore, the addition made by the assessing officer is upheld.

Disallowance out of sales promotion and travel expenses. “

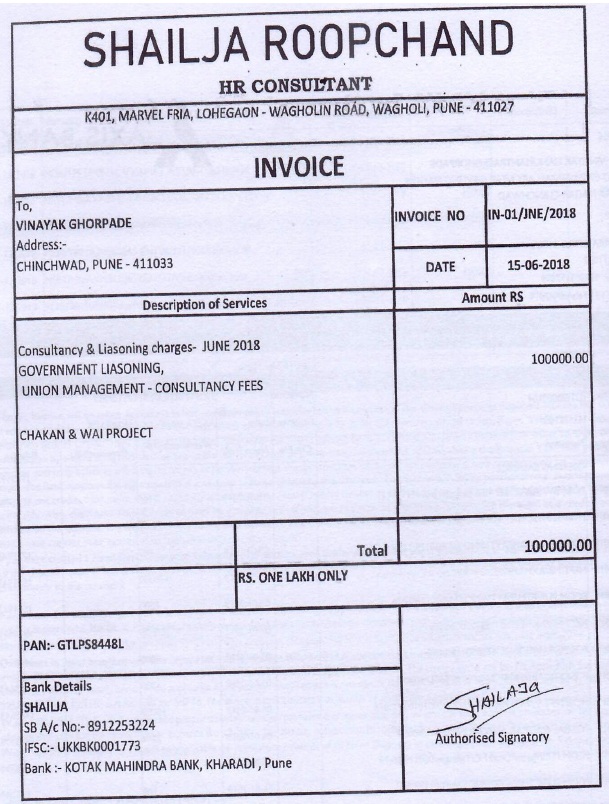

12. We have perused the copy of the invoices which are at page no.190 to 194 of the paper book. It is observed that these invoices are simple print outs, claimed to have been issued by SHAILJA ROOPCHAND, HR CONSULTANT which is scanned as under :

13. In the paper book, Assessee has filed invoices as under :

| Invoice No. | Date | Total |

| IN-01/JNE/2018 | 15-06-2018 | 100000.00 |

| IN-02/JL/2018 | 16-07-2018 | 100000.00 |

| IN-03/AG/2018 | 14-08-2018 | 100000.00 |

| IN-04/SPT/2018 | 15-09-2018 | 100000.00 |

| IN-05/OCT/2018 | 15-10-2018 | 100000.00 |

| Total | 500000.00 |

13.1 Thus, it can be observed that the person SHAILJA ROOPCHAND have issued five invoice(table above) between the period of June to October, 2018 having Invoice No.1 to 5. It means, from June to October 2018, the person SHAILJA ROOPCHAND has exclusively worked for Assessee only as the Invoice No.1 to 5 have been issued to Assessee only. It is also noted that NO GST Number has been mentioned in the Invoice. It is also noted that NO TDS has been deducted on these consultancy charges. It has been specifically mentioned by the Assessing Officer and ld.CIT(A) that almost entire receipts of the Assessee are from Garware Technical Fibers Limited. The Assessee has claimed expenditure of Rs.5 lakhs as consultancy charges paid to SHAILJA ROOPCHAND. Though apparently, it is highly unlikely that a person doing consultancy issues all serially numbered invoices from 1 to 5 between June to October 2018 to only one person. However, this cannot be the only reason for disallowance. We are aware that Assessee has to prove the genuineness of expenditure. However, in this case, Assessee has filed Invoices issued by SHAILJA ROOPCHAND and Copy of Ledger Account. The Invoice does mention PAN Number as follows :

i. GTLPS8448L

14. Once the Invoices were filed by Assessee, the Assessing Officer should have conducted further enquiries. However, it seems that Assessing Officer has not conducted any enquiry. Assessing Officer should have verified from SHAILJA ROOPCHAND the nature services provided by SHAILJA ROOPCHAND to Assessee. In these facts and circumstances of the case, we set-aside the Disallowance of Rs.5 lakhs to Assessing Officer for denovo adjudication. The Assessing Officer shall provide opportunity to the Assessee. If deemed fit, the Assessing Officer may issue summons under section 131 of the Act, to SHAILJA ROOPCHAND. Accordingly, Ground No.2 raised by the Assessee is allowed for statistical purpose.

Ground No.3:

15. The Ground No.3 is regarding disallowance of Rs.5,70,774/-. In the Profit and Loss Account the Assessee had debited Rs.3,07,352/- under the head Sales Promotion and Rs.8,34,195/-under the head “Travelling Expenses”. Assessing Officer asked Assessee to prove that these expenses were wholly and exclusively for the purpose of the business of the Assessee. On the basis of the seized documents, Assessing Officer realized that almost all receipts were from Garware Technical Fibres Limited. Assessee had entered into an agreement with Garware Technical Fibres Limited for supply of Labour and Assessee has also done job work for Garware Technical Fibres Limited. Since assessee failed to substantiate the claim, Assessing Officer disallowed 50% of Rs.11,41,547/-(Rs.3,07,352/- + Rs.8,34,195/- =Rs.11,41,547/-). Ld.CIT(A) upheld the disallowance as assessee failed to file the details. Even before us, ld.AR only pleaded that these amounts were paid through banking channel. Ld.AR claimed that these were expenditure for the business of the Assessee. We have perused the sample invoices filed by Assessee in the paper book which is at page no.196 to 203 of the paper book. It is observed that No GST Number is mentioned, No PAN Number is mentioned, rather for BABUTRAO BAVDHANE, no proper address is mentioned. Similarly, for MINAL KAMAT, the address is only “RYTHEM, WAKAD, PUNE -411057″ which is incomplete address. The onus was on assessee to prove that the expenditure has been incurred wholly and exclusively for the purpose of the business of the Assessee. Hence, for all the reasons discussed above, the addition of Rs.5,70,774/- is upheld. Accordingly, Ground No.3 raised by the Assessee is dismissed.

Ground No.4 :

16. This Ground relates to Disallowance of Rs.11,84,777/-. The Assessing Officer has observed that the Assessee had shown GST Payable of Rs.11,84,777/-. The Assessing Officer asked Assessee the evidence of payment. Since assessee failed to file any evidence, Assessing Officer disallowed the GST payable of Rs.11,84,777/-u/s.43B of the Act.

16.1 The relevant paragraph of 34.2 of the ld.CIT(A)’s Order is reproduced here as under :

“34.2 In this connection, I have perused the copies of Form GSTR-3B filed by the appellant during the appellate proceedings. It is seen that the appellant has filed copies of Form GSTR-3B for the months of December 2018, January. 2019, February, 2019 and March 2019. The details of taxpayment through ITC and through cash as mentioned in these GST returns are as under:-

| Period | Date of filing GSTR-3 | Total tax payable | Tax paid through ITC (col 6.1 of Form B) | Tax paid in cash (col 6.1 of Form 3B) |

| December 2018 | 06/02/2019 | 5,46,976 | 0 | 5,46,976 |

| January, 2019 | 11/04/20019 | 2,53,936 | 0 | 2,53,936 |

| February, 2019 | 12/04/2019 | 2,42,436 | 5,400 | 2,37,036 |

| March 2019 | 24/04/2019 | 2,52,802 | 0 | 2,52,802 |

The above details clearly suggest that the claim of the appellant that GST was paid through ITC is factually incorrect. Since, the appellant in the GSTR-3B has claimed that the amount of outstanding GST was paid in cash, therefore, it is imperative for the appellant to file the copies of relevant tax payment challans. Since, the appellant has failed to file the copies of these challans and to substantiate that the payment was made through ITC, the addition of Rs.11,84,777/- is upheld.”

16.2 Thus, ld.CIT(A) upheld the disallowance only because Assessee failed to file copy of the challans. Ld.AR for the Assessee had accepted that these details were not filed before Assessing Officer /ld.CIT(A).Ld.AR pleaded that one more opportunity may be provided to file the details before the Assessing Officer.

17. It is important to understand that the Chart which ld.CIT(A) has prepared based on Form GSTR-3B, shows that apparently Assessee had paid the GST Amount on the dates mentioned in the Chart. As per Section 43B of the Act, if the amount is paid before filing Return of Income, then it is an allowable deduction. In these facts and circumstances of the case, we direct ld.Assessing Officer to verify whether the impugned amount was paid before filing the Return of Income or Not!

17.1 If required, the Assessing Officer may collect the said information from GST Office. Accordingly, Ground No.4 raised by the Assessee is allowed for statistical purpose.

Ground No.5 :

18. This Ground relates to addition u/s.68 of Rs.64,81,702/-. Assessing Officer observed that Assessee had taken Unsecured Loan as under :

| Sr. No. | Name of the Creditor | Amount Credited | Whether confirmation submitted | Whether copies of ITR of the creditor Submitted? | Whether copies of bank statement of the creditor Submitted |

| 1. | MP Enterprises | 4,25,000 | No | No | No |

| 2. | Tip Top Services – Ajinkyatara | 49,06,702/- | No | No | No |

| 3. | Tip Top Services – Personal | 4,00,000/- | No | No | No |

| 4. | Harish Shankar Burange | 7,50,000/- | No | No | No |

| 5. | Total | 64,81,702/- | | | |

19. Since Assessee failed to prove genuineness, identity, creditworthiness of the above persons, Assessing Officer made addition u/s.68 of the Act.

20. Ld.CIT(A) upheld the addition of Rs.64,81,702/-. Copy of Return of Income and copies of confirmation of M P Enterprises, Tip Top Services were filed before ld.CIT(A). Confirmation of Harish Shankar Burange was filed. However, copy of Return of Income of Harish Shankar Burange was not filed.

21. Before us, ld.AR for the Assessee submitted that all these Unsecured Loans were repaid in subsequent years. However, this fact was not mentioned before Assessing Officer / ld.CIT(A). Therefore, in the interest of justice, we set-aside the addition of Rs.64,81,702/- to Assessing Officer for denovo adjudication. Accordingly, Ground No.5 raised by the Assessee is allowed for statistical purpose.

Ground No.6 :

22. This Ground relates to Disallowance of Rs.1,50,000/- under section 80C of the Income Tax Act. The relevant paragraph 57 of the ld.CIT(A)’s Order is reproduced here as under :

“57. As regards to the claim of deduction on account of payment of principal amount of loan, I have considered the facts of the case and the submissions made by the appellant. The facts of the matter clearly suggest that the appellant has failed to file any certificate from the bank or loan sanction letter and he is trying to claim the deduction only on the basis of ‘loan statement’ issued by SBI. A perusal of said loan statement suggests that nowhere on this statement, it is mentioned that this pertains to any home loan account. Further the details ofproperty for which the said loan was taken is also not mentioned. As per the provisions of the Act, deduction for repayment of principal amount of home loan can be allowed as deduction, only if the loan is taken for acquiring a house. In this case, the appellant has neither filed the copy of loan sanction letter nor any certificate and he is trying to claim the deduction on the basis of a loan statement which does not mention that the said loan statement corresponds to any home loan. Considering these facts, the claim of the appellant cannot be accepted and the addition of ‘Rs.1,50,000/- is upheld. “

23. The fact that copy of Loan Sanction Letter or Certificate from the Bank had not been submitted by the Assessee. Even before us, no such certificate was filed. Assessee has to prove that he had taken Housing Loan. In this case, Assessee has not proved by documentary evidence that he has taken Housing Loan. Therefore, we uphold the addition of Rs.1,50,000/-. Accordingly, Ground No.6 raised by the assessee is dismissed.

24. In the result, appeal in ITA No.1438/pUN/2024 is partly allowed for statistical purpose.

ITA No.1439/PUN/2024 for A.Y.2020-21

25. Assessee has raised the following grounds of appeal :

“1. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of Rs. 4,70,316/- being the difference in contract receipts reflected in 26 AS and amount reported in Profit and Loss account under the head Revenue from operations (Rs. 1,01,29,300 – Rs. 96,58,984), without appreciating the facts of the case and rejecting the appellant’s contention that entire income receipts of Rs. 1,01,29,300/- are reflected in Profit and Loss account under the different heads. Therefore, appellant prays for deletion of such addition.

2. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making a disallowance of Rs. 6,75,072/- by invoking provisions of section 36(1)(va) of IT Act, 1961, being ESIC contribution of AY 2019-20, by rejecting the appellant’s contention.

3. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of the consultancy charges of Rs.60,000/- debited to Profit and Loss account by disregarding the appellant’s submission, and concluding that such charges debited to Profit and Loss account are not genuine. Your appellant contents that these consultancy charges paid are genuine and pray for deletion of the entire addition.

4. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of Rs. 3,03,218/- being sales promotion and travelling expenses made by appellant without appreciating the facts of the case. Your appellant prays for deletion of entire addition.

5. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making a disallowance of Rs. 1,98,089/- being Bonus paid for AY 2019-20, by rejecting the appellant’s contention.

6. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making disallowance of Rs. 90,000/- being GST paid by invoking the provisions of section 438 of Income Tax Act, 1961. Your appellant contents that the GST payable of Rs. 90,000/-has been paid before the due date of filing of the return and therefore no disallowance is warranted.

7. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of Rs. 1,165/- being interest received from Pune Peoples Co-operative bank without appreciating the facts of the case and by rejecting the appellant’s submission. Your appellant prays for deletion of entire addition.

8. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of Rs. 3,50,000/-being Capital Introduced during the year, by rejecting the appellant’s contention that said capital is introduced out of sales proceeds from agricultural land held by him. Your appellant prays for deletion of entire addition.

9. On the facts and in the circumstances of the case and in law Ld. CIT has erred in making an addition of Rs. 3,75,000/- under section 68-unexplained cash credits, being unsecured loans by concluding that appellant has failed to discharge its primary onus, given an opportunity your appellant is in position to provide all the details of such loan amount credited in bank account and therefore the entire addition in unwarranted.

Your appellant craves for to add, alter amend, modify, delete any or all grounds of appeal before or during the course of hearing in the interest of natural justice. “

26. We will take up each ground separately.

Ground No.1 :

27. This ground pertains to addition of Rs.4,70,316/- being difference in contract receipts reflected in 26AS and amount reported in profit and loss account. Ld.Authorised Representative for the Assessee submitted that the amount of Rs.4,70,316/- has already been offered for taxation in the Computation of Income. Ld.AR invited our attention to page no.81 of the paper book. Since this fact needs verification, we set-aside this issued to ld.Assessing Officer for denovo adjudication. Ld.AO shall provide opportunity of hearing to the assessee. Accordingly, Ground No.1 raised by the Assessee is allowed for statistical purpose.

Ground No.2 :

28. This ground pertains to Disallowance of Rs.6,75,072/-u/s.36(1)(va) of the Act, for A.Y.2019-20. The relevant paragraph no.66 and 67 of ld.CIT(A)’s Order are reproduced here as under :

“66. I have considered the facts of the case and the submissions made by the appellant. The appellant has submitted that the outstanding amount at the beginning of the year was on account of ESIC contribution which stands disallowed in AY 2019-20. The appellant has also given the dates of the payments made in FY 2019-20 corresponding to AY 2020-21. In this connection, it is seen that while completing the assessment for AY 2019-20, the assessing officer disallowed an amount of Rs.5,71,290/- being unpaid employer’s contribution towards ESIC. However, during the appellate proceedings for AY 2019-20, the appellant submitted that out of this amount, only an amount of Rs.1,50,960/- is disallowable which stands added back in the computation of income. For remaining amount, the appellant has submitted that the said amount was paid in two installments i.e. Rs.1,41,629/- on 11/04/2019 and Rs. 2,78,701/- on 08/04/2019. On the basis of the evidences furnished, the assessing officer in the remand report for AY 2019-20 has submitted that no disallowance on account of employer’s contribution for ESIC is required for AY 2019-20. Accordingly, while deciding the appeal for AY 2019-20, the said addition of Rs.5,71,290/- stands deleted by me.

67. The above discussion clearly suggests that since there is no disallowance on account of employer’s contribution towards ESIC in AY 2019-20, the appellant’s claim made before me shall amount to double deduction (once in AY 2019-20 and second time in the computation of income for AY 2020-21), which cannot be allowed. Since, the appellant has failed to substantiate that an amount of Rs. 6,75,012/- corresponds to employer’s contribution towards ESIC and has been taxed in AY 2019-20, the addition made by the assessing officer, is upheld.

Disallowance of Consultancy Charges. “

29. Ld.AR made the same plea before us that the said amount has already been disallowed for A.Y.2019-20. However, it can be observed from the paragraph 67 of ld.CIT(A) that ld.CIT(A) has given categorical finding that ld.CIT(A) had verified this fact and arrived at a conclusion that no disallowance was made in A.Y.2019-20.Ld.AR has accepted that Challans were never filed before Assessing Officer / ld.CIT(A). In these facts and circumstances of the case, we confirm the disallowance of Rs.6,75,012/-. Accordingly, Ground No.2 raised by the Assessee is dismissed.

Ground No.3 :

30. This ground pertains to addition of Rs.60,000/-. The relevant paragraph no.69 and 70 of ld.CIT(A)’s Order is reproduced here as under:

“69. In this regard, the appellant has submitted as under :-

| S.No. | Payee | PAN | Amount | Nature of consultancy |

| 1 | Sundry cash- PF and ESIC filing fee | | 18,000/- | PF and ESOC return filing fee |

| 2 | Sundry cash – Accounting charges | | 18,000/- | Accounting charges |

| 3 | IU Thakur – GST filing – through bank | | 10,000/- | GST filing |

| 4 | Sundry cash-IT return filing charges | | 14,000/- | IT return filing charges |

The ledger account of consultancy charges along with copy of bank statements wherein the payment made of Rs.5 lakhis reflected is attached.

Findings

70. The above details filed by the appellant suggests that he has simply given the nature of expenses which are mostly made in cash. No name/address/pAN numbers of the persons have been filed. The appellant has also not filed the copies of invoices raised by these persons even though the same were specifically requested by the assessing officer. It is a well settled legal position that onus of substantiating the genuineness of an expense is on the assessee. Merely making ledger entries regarding expenses without producing supporting documents is not sufficient to allow deduction u/s 37 of the Act.

Since, the appellant has failed to substantiate the genuineness of these expenses with the help of supporting documents, the addition of Rs. 60,000/-made by the assessing officer is upheld.

Disallowance out of sales promotion and travel expenses. “

31. No specific evidence has been filed by the Assessee before us. The Onus is on assessee to prove the genuineness of the expenditure. Assessee failed to prove genuineness of the expenditure. Assessee failed to prove that the said expenditure was incurred wholly and exclusively for the purpose of business of assessee. Accordingly, Ground No.3 raised by the assessee is dismissed.

Ground No.4 :

32. This ground pertains to disallowance of Rs.3,03,218/- on account of Sales Promotion and Travel Expenses. Our finding Ground No.3 in ITA No.1438/pUN/2024 shall apply mutatis-mutandis to this ground also. Accordingly, Ground No.4 raised by the Assessee is dismissed.

Ground No.5 :

33. Paragraph no.74 of ld.CIT(A)’s Order is reproduced here as under :

“74. Bonus & Exgratia Payble: The appellant claimed that the said amount stands disallowed in AY 2019-20 is factually incorrect. As discussed earlier in this order, no such disallowance was made by the appellant while filing the ITR. However, an addition of Rs.1,98,089/-was made by the AO which has been deleted by me as the said amount was paid on 23/04/2019. As per the assessment order, the amount of Rs.1,98,089/- remains outstanding as on 31.03.2020 meaning thereby that the said liability was incurred during FY 2019-20 which remains unpaid till the date of filing of ITR. Considering these facts, the addition of Rs.1,98,089/- made by the assessing officer is upheld. “

34. The Assessee has not filed any specific details during the proceedings before this Tribunal. Therefore, the facts mentioned by ld.CIT(A) becomes unrebutted, accordingly, addition is confirmed. Ground No.5 raised by the Assessee is dismissed.

Ground No.6 :

35. This Ground pertains to Disallowance of Rs.90,000/- on account of GST Payable. Our finding in ITA No.1438/pUN/2024 of Ground No.4 shall apply mutatis-mutandis to this ground also. Accordingly, Ground No.6 raised by the Assessee is allowed for statistical purpose.

Ground No.7 :

36. This Ground pertains to addition of Rs.1,165/- being interest received from Pune Peoples Co-operative Bank. Ld.AR submitted that the said interest amount of Rs.1,165/- is already shown in the total interest shown at Rs.32,195/- in the Return of Income. Since no details of interest received of Rs.32,195/- was filed before Assessing Officer, the Assessing Officer had no opportunity to verify. Accordingly, the issue of addition of Rs.1,165/- is set-aside to the Assessing Officer for denovo adjudication. Assessing Officer shall provide opportunity of hearing to the Assessee. Accordingly, Ground No.7 raised by the Assessee is allowed for statistical purpose.

Ground No.8 :

37. This Ground pertains to Addition of Rs.3,50,000/-. The Assessing Officer noted that Assessee had shown Rs.8,07,195/- as Income from Other Sources in the Capital Account. However, in the Computation of Income, Income under the head “Income from Other Sources” was only Rs.4,57,195/-. Since assessee failed to explain, Assessing Officer made addition of Rs.3,50,000/-. Before ld.CIT(A), Assessee submitted that he had sold land to Seems Harish Burange vide registered agreement dated 04.07.2018. Assessee submitted that the amount of Rs.11,55,000/-, sale consideration for the said land was received on 25.06.2018. Ld.CIT(A) confirmed the addition of Rs.3,50,000/- stating that Assessee failed to explain the Computation to arrive at Rs.3,50,000/-.We have perused the Copy of Registered Sale Deed which is at page no.145 to 229 of the paper book. According to the said Sale Deed, Assessee has sold land to Seema Harish Burange residing in Mumbai having PAN Number AIAPB2650D vide registered sale deed dated 25.06.2018. However, in the said agreement, it is vaguely mentioned that the purchaser has paid Rs.11,55,000/- to Assessee on various dates. No specific dates or mode of transfer has been mentioned in the said agreement. In this case, the addition of Rs.3,50,000/- has been made for A.Y.2020-21 as Assessee failed to explain the addition to Capital Account of Rs.3,50,000/-.

38. Before us, ld.AR for the Assessee pleaded that said amount pertains to amount received from Seema Harish Burange on account of sale of land. We have already mentioned that the impugned sale deed is dated 25.06.2018 and dates of disbursement of amount of Rs.11,55,000/- has not been mentioned anywhere. Therefore, it is presumed that the amount must have been received on or before date of registration i.e.25.06.2018. Therefore, there is no evidence filed by Assessee to prove the Capital Introduction of Rs.3,50,000/-during A.Y.2020-21(F.Y.2019-20), accordingly, the addition is confirmed. Accordingly, Ground No.8 raised by the Assessee is dismissed.

Ground No.9 :

39. This ground pertains to addition u/s.68 of the Act, of Rs.3,75,000/-. It is mentioned in the assessment order that Auditor of the Assessee in Assessee’s Audit Report has mentioned that Assessee has accepted Unsecured Loan of Rs.3,75,000/- from M.P. Enterprises. In ITA No.1438/pUN/2024, we have already set-aside this issue to the Assessing Officer for denovo adjudication. Accordingly, we set-aside Ground No.9 raised by the Assessee to the Assessing Officer for denovo adjudication.

40. In the result, appeal in ITA No.1439/PUN/2024 is partly allowed for statistical purpose.