ORDER

1. This is an appeal filed by the assessee against the order passed by the ld.Addl/JCIT(A), Gwalior, dated 02.06.2025 for the assessment year 2024-2025.

2. It was submitted by the ld. AR that the assessee is an employee of M/s Think & Learn Private Limited. It was the submission that the assessee had been receiving salary from the said concern. The said concern had deducted TDS from his salary to an extent of Rs.14,881,489/-. It was the submission that the said concern admittedly had not deposited the TDS to the account of the Central Government. When the assessee had filed his return of income, the assessee had claimed credit of the TDS was deducted in the salary. It was submission that in the intimation issued, the credit of the TDS had not been granted and a demand was raised against the assessee in lieu of the credit of the TDS not granted. It was submission that in view of the Instruction issued by CBDT in Instruction No.275/29/2014-(IT)-(B), dated 01/06/2015, the assessee should be put at any inconvenience on account of default of deposit of tax into the Government account by the deductor. The said instruction reads as follows:-

INSTRUCTION NO.275/29/2014-IT(B)

SECTION 199 OF THE INCOME-TAX ACT, 1961-DEDUCTION OF TAX AT SOURCE-CREDIT FOR TAX DEDUCTED-NON-DEPOSIT OF TAX DEDUCTED AT SOURCE

INSTRUCTION NO.275/29/2014-IT-(B), DATED 1-6-2015

Grievances have been received by the Board from many taxpayers that in their cases the deductor has deducted tax at source from payments made to them in accordance with the provisions of Chapter-XVII of the Income-tax Act, 1961 (hereafter ‘the Act’) but has failed to deposit the same into the Government account leading to denial of credit of such deduction of tax to these taxpayers and consequent raising of demand.

2. As per Section 199 of the Act credit of Tax Deducted at Source is given to the person only if it is paid to the Central Government Account. However, as per Section 205 of the Act the assessee shall not be called upon to pay the tax to the extent tax has been deducted from his income where the tax is deductible at source under the provisions of Chapter- XVII. Thus the Act puts a bar on direct demand against the assessee in such cases and the demand on account of tax credit mismatch cannot be enforced coercively.

3. This may be brought to the notice of all the assessing officers in your region so that if the facts of the case so justify, the assessees are not put at any inconvenience on account of default of deposit of tax into the Government account by the deductor.

4. This issues with the approval of Chairperson, CBDT.

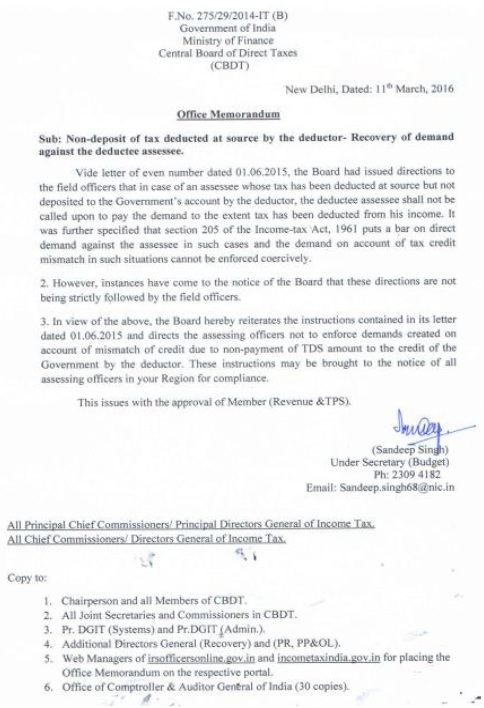

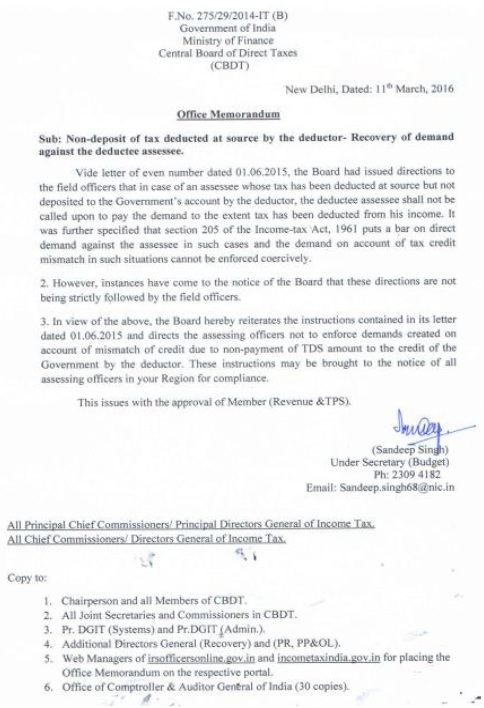

3. The assessee could not be fastened with the liability in respect of the TDS deducted but not credited by the employer to the account of the Central Government. The Ld. AR also placed reliance on the Office Memorandum issued by the CBDT dated 11/03/2016 to the same effect which reads as follows:-

4. It was further submission that in view of the provisions of section 205 of the Act also the assessee could not be fastened with the liability in respect of the TDS which has been deducted from salary but not credited by the employer to the account of the Central Government. The Ld. AR also placed reliance on the decision of the coordinate bench of this Tribunal Mumbai Bench in the case of Aditya Ramniwas Dhoot v. Dy. CIT [ITAppeal No.313(M) of 2025, dated 25-3-2025] as also the decision of Hon’ble Guwahati High Court in the case of Asstt. CIT v. Om Prakash Gattani (Gauhati)/[2000] 242 ITR 638 (Gauhati). It was the submission that assessee may be granted the credit of the TDS deducted from the assessee’s salary.

5. In reply, Ld. Sr. DR vehemently supported the orders of the AO and the JCIT(A).

6. We have considered the rival submissions. A perusal of the instruction of the CBDT, as also the Office Memorandum, extracted above, and the provisions of Section 205 of the Income Tax Act, clearly shows that once a TDS has been deducted from the salary of an employee, it is deemed that taxes to such extent of the TDS deducted has already been paid by the said employee. The said employee cannot be revisited with the said taxes which has already been deducted. This being so, the AO is directed to grant the assessee the benefit of the TDS which has been deducted from the salary of the employee.

7. Here, we would also like to draw the attention of the revenue wherein the ld. JCIT(A) has taken a stand that the decision of the coordinate bench of this tribunal as also the decision of Hon’ble High Court in this country is not binding on the revenue, insofar as it does not pertain to the jurisdiction of the assessee of the appellant. Judicial discipline requires, nay, demands that when a superior authority passes an order, however, difficult to peel it is to swallow, it incumbent on all subordinate authorities to follow such decisions. Failure to follow judicial discipline, would lead to miscarriage of justice. This is not what is expected from an appellate authority much less than judicial authority. Here, we may also mention that in view of the provision of Section 201 of the Act, the revenue is very much at liberty to recover the TDS so deducted by the said employer. The failure on the of the part of the revenue to take appropriate action to recover the dues to it which has been collected on behalf of the revenue by a concerned cannot be treated as the failure on the part of the assessee to face a demand. This being so, respectfully following the decision of the coordinate bench of this Tribunal Mumbai bench, referred to supra, as also the decision of the Guwahati High Court the AO is directed to grant the assessee to benefit of the credit of the TDS as claimed by the assessee.

8. In the result, the appeal of the assessee stands allowed.