ORDER

Prathiba M. Singh, J.- This hearing has been done through hybrid mode.

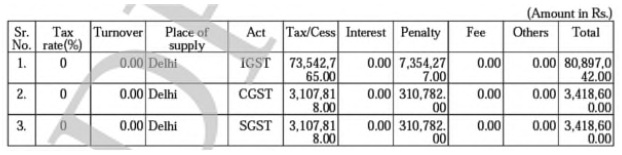

2. The present petition has been filed by Future Consumer Ltd. challenging the impugned order-in-original dated 24th August, 2024 (hereinafter, ‘the impugned order’) by which a demand has been raised against the Petitioner in the following terms:

3. The main ground of challenge urged by ld. Counsel for the Petitioner in this case is that the impugned order does not bear the signature of the official who has passed the order. Hence, it is contended that the impugned order is invalid and is liable to be set aside.

4. On the other hand, ld. Counsel for the Respondent points out that the impugned order is accompanied by a DRC-07 which contains the name and designation of the concerned officer. It is also submitted that post 1st June, 2024 the mechanism that has been set up in the GST portal is that every Officer who is uploading an order has to upload the same along with his credentials – thus there is no possibility of any irregularities.

5. Ld. Counsel for the Petitioner states that they had also filed a rectification application in respect of the impugned order, which was decided vide order dated 26th December, 2024 in the following terms:

“xxx

In this regard, it is to inform you that above Order was passed by the Additional Commissioner, CGST Delhi West Commissionerate, vide O-in-O No. 60/CGST WEST/GST/SKJ/ADC/2024-25 dated 24.08.2024 and summery of said order DRC-07 was generated by the undersigned as per direction of the adjudicating authority. However, you have applied for rectification of above order to the undersigned. On scrutiny of your submission. it is observed that you had also submitted your said reply before adjudicating authority and the adjudicating was not satisfied with the said clarification/reply and accordingly, demand was confirmed by the them. As per provisions of Section 161 of the CGST Act, 2017, rectification order may be issued only to rectify any error or mistake which is apparent of records which is not in the present case. In such case, you are required to file appeal before appellate authority. In view of above please state within seven days as to why your application for rectification should not be rejected. “

6. Ld. Counsel for the Petitioner further submits that the Petitioner was undergoing insolvency proceedings and it was operating under strict lender surveillance through a trust and retention account. The said submission is stated in the petition in the following terms :

“G. Because the Petitioner had been declared a Non-Performing Asset (NPA) effective from 07.05.2021 and its operations were placed under strict lender surveillance through a Trust and Retention Account, leaving it financially and administratively constrained to attend to GST compliances during the relevant period.”

7. Heard. The Court has considered the submissions made on part of the parties. With respect to the contention regarding the unsigned order-in-original, this Court is of the view that once an order-in-original is accompanied by a DRC-07 which is duly containing the name of the official, the designation and the ward etc., such an objection would not be tenable. In the present case, the DRC-07 issued along with the impugned order contains all the necessary details of the concerned official as well as the department passing the said order. Hence, this contention of the Petitioner is rejected.

8. Further, though it has not been urged by the Petitioner, one of the issues that has been noticed by the Court in this case is that the order of rectification dated 26th December, 2024 has been passed without affording a personal hearing to the Petitioner.

9. This Court is of the view that a personal hearing would be mandatory in terms of the third proviso of Section 161 of the Central Goods and Service Tax Act, 2017. The said provision reads as under:

” Section 161 Rectification of errors apparent on the face of record-

Without prejudice to the provisions of section 160, and notwithstanding anything contained in any other provisions of this Act, any authority, who has passed or issued any decision or order or notice or certificate or any other document, may rectify any error which is apparent on the face of record in such decision or order or notice or certificate or any other document, either on its own motion or where such error is brought to its notice by any officer appointed under this Act or an officer appointed under the State Goods and Services Tax Act or an officer appointed under the Union Territory Goods and Services Tax Act or by the affected person within a period of three months from the date of issue of such decision or order or notice or certificate or any other document, as the case may be:

Provided that no such rectification shall be done after a period of six months from the date of issue of such decision or order or notice or certificate or any other document:

Provided further that the said period of six months shall not apply in such cases where the rectification is purely in the nature of correction of a clerical or arithmetical error, arising from any accidental slip or omission:

Provided also that where such rectification adversely affects any person, the principles of natural justice shall be followed by the authority carrying out such rectification. “

10. The said position has been laid down this Court in HVR Solar (P.) Ltd. v. Sales Tax Officer, Class II Avato Ward 67 GSTL 131 (Delhi)/W.P. (C) 4506/2025, in the following terms:

“12. The Madras High Court has in its decision in Suriya Cement Agency (supra) also observed as under:

“8. A perusal of the order does not also indicate that there had been no error apparent on the record to reject the rectification. He had only extracted the tables indicating the figures which the petitioner is liable to pay. There is also no reasonings as to why there is no error apparent on the face of the record. For this reason, the impugned order dated 02.02.2024 is liable to be set aside. Even though, strenuous efforts had been made by the learned Additional Government Pleader that no personal hearing need to be given when an application had been made at the instance of the assessee, I am not in agreement with the learned Additional Government Pleader. The Proviso indicates that when an order is being made adverse to the assessee, then he should be given an opportunity of being heard when the rectification adversely affects any person. The principles of natural justice had been inbuilt by way of the 3rd Proviso to Section 161. If pursuant to a Rectification Application, if a rectification is made and if it adversely affects the assesse, Proviso 3 contemplates an opportunity of hearing to be given. However, when an Rectification Application is made at the instance of assessee and the rectification is being sought to be rejected without considering the reasons for rectification or by giving reasons as to why such rectification could not be entertained. It is also imperative that the assessee to be put on notice.

9. For the aforesaid reasons, Iam inclined to hold that the order of rectification passed by the first respondent dated 02.02.2024 is contrary to the provisions of Section 161 and in that aspect, the same alone is set aside and the Rectification Application filed by the petitioner shall be taken afresh by the first respondent and after giving an opportunity to the petitioner, the first respondent shall pass appropriate orders and in accordance with law. If any such order is made in the Rectification Application, it is for the petitioner to work out his remedy in the manner known to law.”

13. In view of the above legal position, the personal hearing ought to have been afforded to the Petitioner, which has not been done. Accordingly, the order in rectification application dated 28th February, 2025 is set aside.

14. Let the Petitioner be afforded a hearing in the rectification application and the order be passed in accordance with law.”

11. The Court further notes that the impugned order dated 24th August, 2024 is an appealable order. In view of the infraction of the principles of natural justice in deciding the order of rectification dated 26th December, 2024, this Court, in exercise of its power under writ jurisdiction, is inclined to permit the Petitioner to file an appeal against the impugned order dated 24th August, 2024.

12. For the reason stated hereinabove, let the appeal be filed by the Petitioner against the impugned order by 30th November, 2025 along with the requisite pre-deposit.

13. If the appeal is filed by the Petitioner within the stipulated time period, the same shall be decided on merits and shall not be dismissed on ground of limitation. A reasoned order shall be passed by the Appellate Authority.

14. The petition is disposed of in these terms. Pending applications, if any, are also disposed of.