ORDER

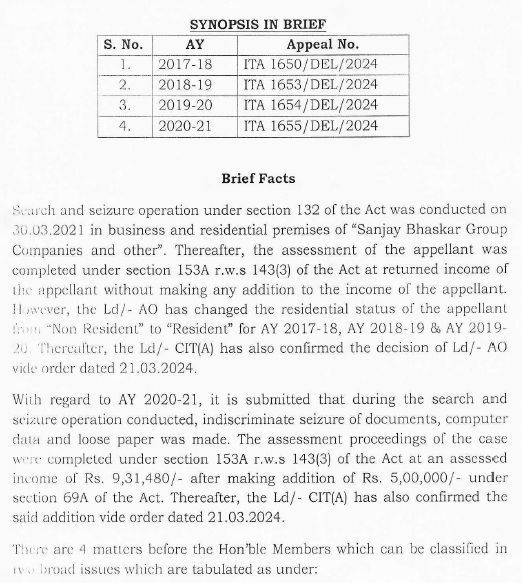

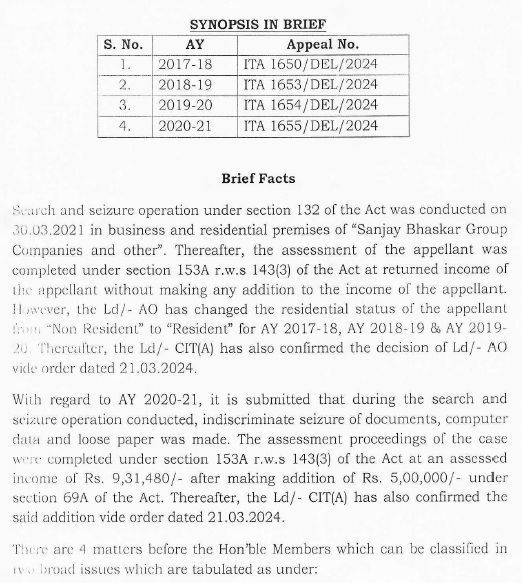

Manish Agarwal, Accountant Member.- The captioned appeals are filed by assessee against the different orders of Ld. CIT(A)-26, New Delhi u/s 250 of the Income Tax Act, 1961 [“the Act”] all are dt. 21.03.2024 arising out of different assessment orders for various assessment years tabulated as below:

| Sr. Nos. | ITA Nos. | Asstt. Year | Assessment Order dated | Assessment Order under section |

| 1 | ITA No.1650/Del/2024 | 2017-18 | 18.04.2022 | 153A r.w.s. 143(3) of the Income Tax Act, 1961. |

| 2. | ITA No.1653/Del/2024 | 2018-19 | 18.04.2022 | – do – |

| 3. | ITA No.1654/Del/2024 | 2019-20 | 18.04.2022 | – do – |

| 4. | ITA No.1655/Del/2024 | 2020-21 | 06.05.2022 | – do – |

2. The issues in all these appeals being common, interlinked and related to the same assessee for various assessment years, therefore, all these by the assessee have been heard together and accordingly, adjudicated by a common order.

3. First we take the appeals of the assessee in ITA No.1650, 1653 & 1654/Del/2024 [Assessment Years 2017-18 to 2018-19].

ITA Nos.1650, 1653 & 1654/Del/2024 c [Assessment Years 2017-18 to 2018-19]

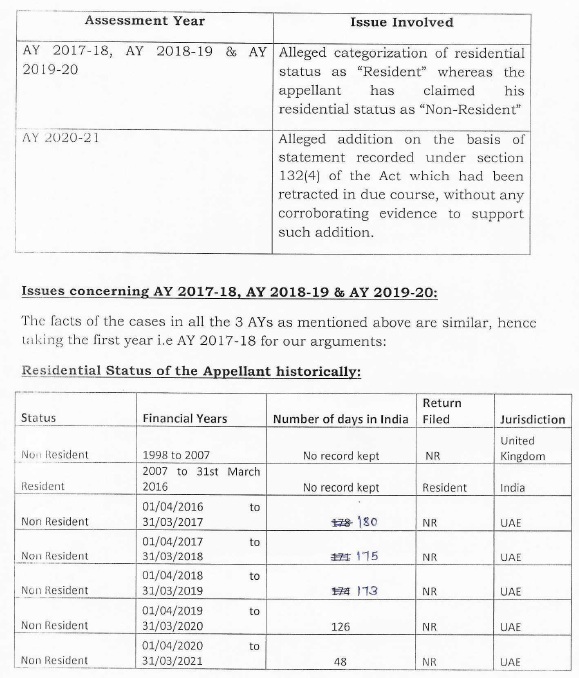

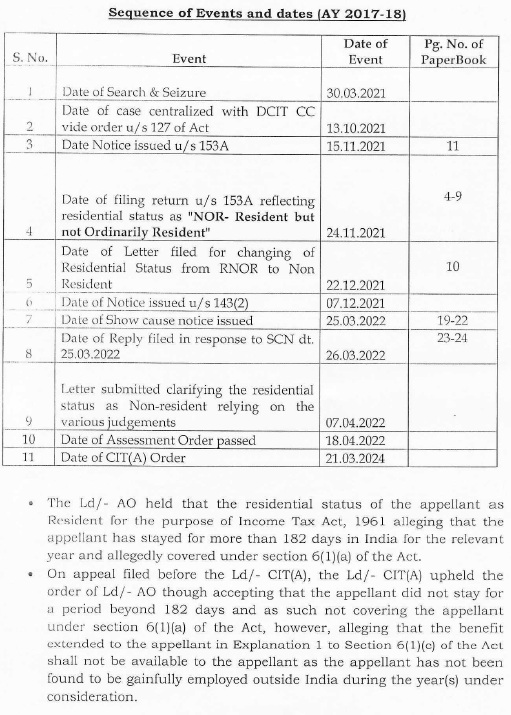

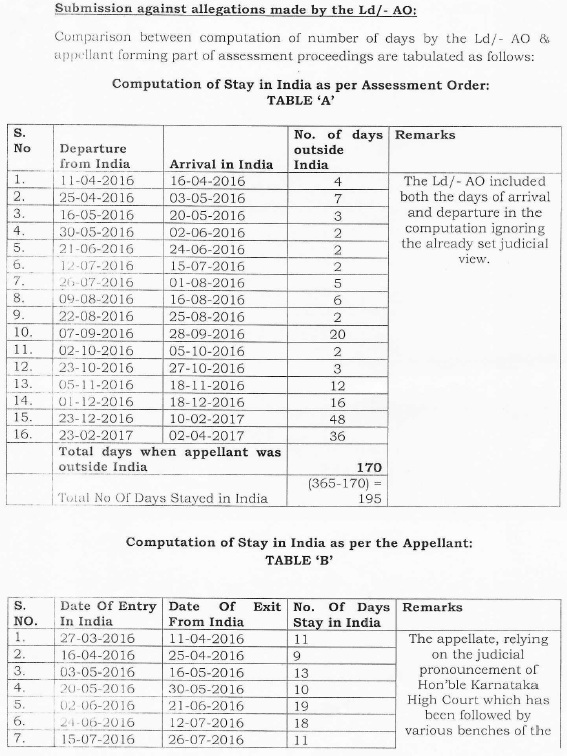

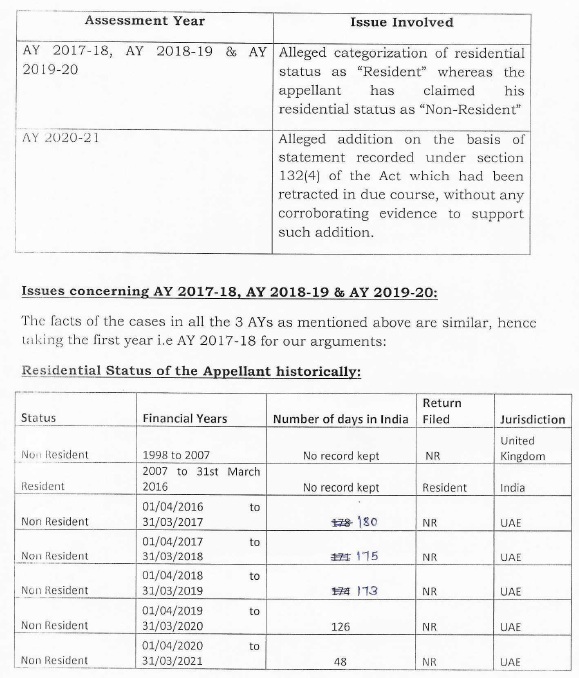

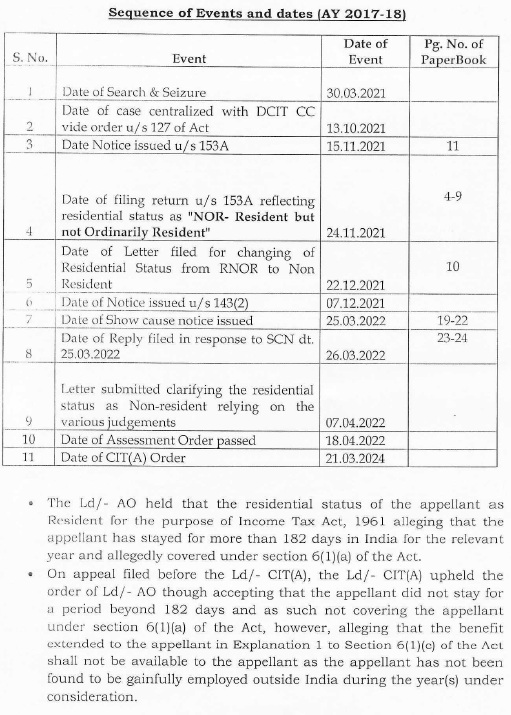

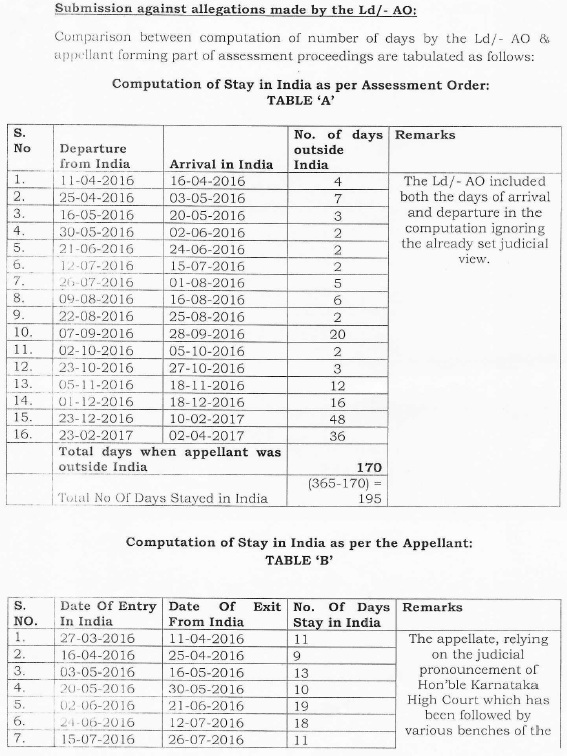

4. Brief facts of the case are that a search and seizure operation u/s 132 was carried out on 30.03.2021 and on subsequent dates at different business and residential premises of “Sanjay Bhaskar Group Companies and other”. During the course of search various incriminating papers/documents were found and seized. Thereafter notice u/s 153A was issued on 15.11.2021, in response which, assessee filed his return of income, declaring total income of INR 2,23,910/- as was declared in the return filed u/s 139(1) of the Act. Statutory notices u/s 143(2) issued on 07.12.2021, followed by notices u/s 142(1) alongwith questionnaire were issued from time to time. In response to notices, there was no compliance by the assessee. Again, notice u/followed s 142(1) dated 19.12.2021 was issued. In response, assessee filed submissions wherein it is claimed that during the previous years relevant to AY 2017-18 to 2019-20, assessee was in India for period of less than 182 days and therefore, the status of the assessee is non -resident, however, inadvertently in the return of income filed the status was shown as Resident. However, the AO has not accepted the contention of the assessee and computed the total number of days stay in India by taking both the date of arrival and date of departure and hold that assessee was in India for more than 182 days.

5. Against the said order, assessee filed an appeal before Ld. CIT(A) who vide order dated 31.03.2024, dismissed the appeals of the assessee.

6. Aggrieved by the order of Ld. CIT(A), assessee is in appeal before the Tribunal by taking following grounds of appeal:-

1- BECAUSE, the search operation cannot be said to have validly initiated on 30/03/2021 in the case of the Appellant, as there existed no material (prior to the authorization) which could lead to the formation of belief that his case falls in any of the three categories mentioned in section 132(1) of the Act and consequently the assessment order passed in pursuance of such proceedings is wholly illegal and without jurisdiction.

WITHOUT PREJUDICE TO ABOVE

2- BECAUSE, the appellant denies its liability to be assessed in terms of Assessment order dated 18/04/2022 passed by the AO under section 153A of the Act and confirmed by the Ld. CIT(A).

3- BECAUSE, in the facts and circumstances of the case, material on record and submission made, the ld. CIT (Appeals) has grossly erred in confirming the action of the AO in changing the status of the Appellant from ‘Non Resident’ to RESIDENT, which is wrong and has been made arbitrarily without bringing any material/ evidence on record.

4- BECAUSE, the rejection of explanation given by the Appellant during the course of appellate proceedings, by the Ld. CIT (A) is arbitrary without bringing any evidence on record. The confirmation of action of the Assessing officer by the Ld. CIT(A) is entirely an exercise, based on unfounded presumption, assumptions, surmises and pure guess work which cannot take the place of evidence.

5- BECAUSE, the Ld. CIT (A) has grossly erred in confirming the action of the AO in changing the status of the Appellant from ‘Non Resident’ to RESIDENT purely on wrong understanding of Law and facts of the case. The Appellant was having the status “Non Resident” in the relevant Assessment year in view of clause (b) of explanation 1 to section 6(1)(c) the Income Tax Act, however the Ld. CIT (A) has incorrectly mentioned that the explanation (1) is not applicable in the case of Appellant. The order passed by the ld CIT (A) is erroneous and based on wrong understanding of law and facts of the case and without bringing anything material on record.

6- The confirmation of action of the Assessing officer by the Ld CIT(A) is entirely an exercise, based on unfounded presumption, assumptions, surmises and pure guess work which cannot take the place of evidence.

7- The appellant craves leave to add or alter one more ground(s) during the course of proceedings.

7. During the course of hearing vide letter dated 29.10.2024, assessee has filed an application for admission of additional grounds of appeal and for the admission of the same, relied upon the judgement of Hon’ble Supreme Court in the case of NTPC v. CIT (SC)/229 ITR 383 (SC) and submits that both the additional grounds of appeal are legal in nature and requires no further verification of facts therefore, the same be admitted for adjudication. The additional grounds raised by the assessee read as under:-

“1. That the Ld. CIT(A) has erred in law and facts of the case in confirming the decision of Ld. AO in changing residential status of the appellant from “Non Resident” to “Resident” without bringing any incriminating material or evidence on record which is highly arbitrary’ unlawful and bad in law.

2. That the Ld. CIT(A) has erred in law and facts of the case by alleging that the appellant was not engaged in gainful employment outside India by completely disregarding the employment contract with DMCC which is completely unjustified uncalled for and bad in law.

3. The appellant craves the right to add, amend, modify the grounds of appeal.”

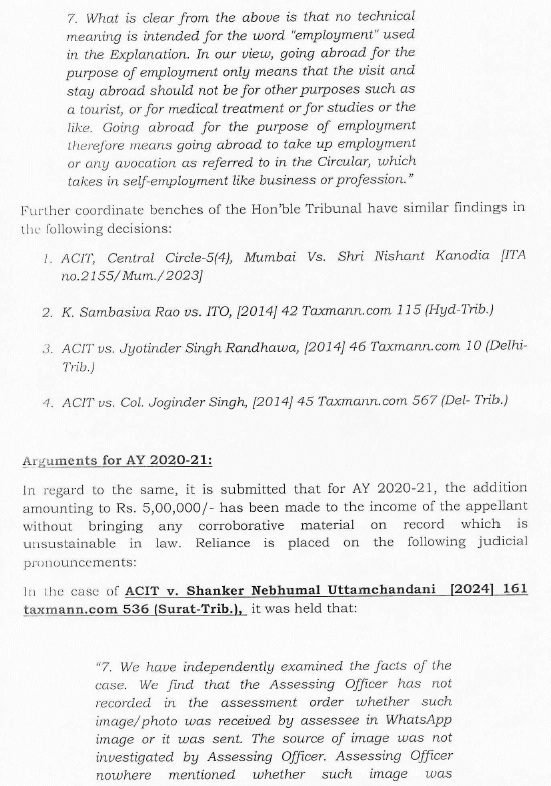

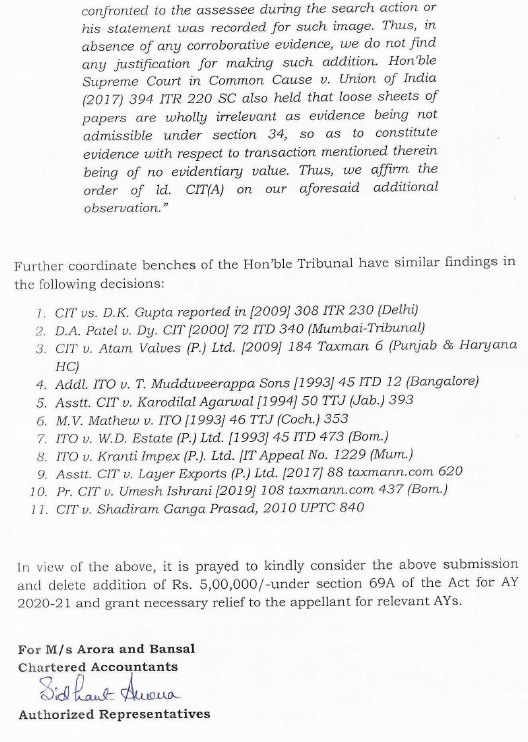

8. Before us, Ld.AR submits that the assessee during the previous year under appeal stayed in India for less than 182 days and therefore, has enjoyed the status of ‘non-resident’ in terms of clause (b) of explanation 1 to section 6(1)(c) the Income Tax Act, however, the AO has held the assessee as ‘resident’. Ld.AR also submits that during the course of assessment proceedings, a chart was submitted before the AO in support of the claim that he stayed in India for a period less than 182 days in all the three previous years and therefore, his status is ‘non-resident’. He prayed accordingly. Ld. AR also filed a written submission which reads as under:

9. On the other hand, Ld. Sr. DR for the Revenue vehemently supported the orders of the lower authorities and submits that in the assessment order, the AO has correctly aworked out number of days stayed in India and further at page 5 of the appellate order, there is a table according to which, total number of days stay in India by the assessee was mentioned, according to which his stay in India was more than 182 days therefore, Ld. CIT(A) held that the status of the assessee as “Resident”. Ld. CIT(A) further observed assessee had not submitted copy of salary receipt from the employer i.e. DMCC, Dubai and as per bank statement, he has not received salary on regular basis from the employer and accordingly, Ld. CIT(A) held that Explanation (1) to section (6) of the Act, is not applicable in the case of the assessee since he was not found to be gainfully outside India and further as per provision of section 6(1)(c) of the Act, the assessee has been found resident in India therefore, Ld.CIT(A) upheld the status of the assessee as ‘resident’ which orders deserves to be upheld. He prayed accordingly.

10. Heard the contentions of both parties and perused the material available on record. From the facts, it transpired that for Assessment Years 2017-18 to 2019-20, the AO treated the assessee as ‘resident’ and for AY 2020-21 as ‘non-resident’. The sole dispute is regarding calculation of period of stay in India during these three assessment years. As per AO, assessee had stayed more than 182 days in India in all the three previous years relevant to AYs 2017-18 to 2019-20 whereas as per assessee, his stay in India was for a period of 180 days in FY 2016-17; 175 days in FY 2017-18; and 173 days in FY 2018-19. As observed above, the dispute is with respect to the calculation of number of days stayed in India where the AO has taken both the days i.e. arrival and departure for computing the number of days stayed in India however, as per assessee, the day of arrival should be excluded for this purpose. For this, assessee placed reliance on the judgment of Hon’ble Karnataka High Court in the case of Director, International Taxation, Bangalore v. Manoj Kumar Reddy (Karnataka) wherein the hon’ble Court had confirmed the order of the Co-ordinate Bench of ITAT, Bangalore Manoj Kumar Reddy v. ITO (International Taxation) [2009] 34 SOT 180 (Bangalore). The coordinate Bangalore bench of ITAT in para 3.24 & 3.25 of the order, observed as under:-

| 3.24 | | Thus, there are two views in respect of ignoring the fraction of a day. However, we can look at the issue from a different angle. When one has to compute the period for which an assessee is in India, one has to start the counting from a particular day and to end the same with specific day. The period is to be counted from the date of arrival of the assessee in India to the date he leaves India. Thus, the words ‘from’ and ‘to’ are to be inevitably used for ascertaining the period though these words are not mentioned in the statute. Section 9 of the General Clauses Act is as under :— |

| “(1) | | In any (Central Act) or Regulation made after the commencement of this Act, it shall be sufficient, for the purpose of excluding the first in a series of days or any other period of time to use the word “from”, and, for the purpose of including the last in a series of days or any other period of time, to use the word “to”. |

| (2) | | This section applies also to all (Central Acts) made after the third day of January, 1868, and to all Regulations made on or after the fourteenth day of January, 1887.” |

| 3.25 | | As per the General Clauses Act, the first day in a series of a day is to be excluded if the word ‘from’ issued. Since for computation of the period, one has to necessarily import the word ‘from’ and, therefore, accordingly, the first day is to be excluded. In the instant case, if the first day, i.e., 31-1-2005 is excluded then the period of stay will be 59 days. Since the period of stay will be less than 60 days, therefore, section 6(1)(c)will not be applicable and the status of the assessee will be non-resident. We, therefore, accept the second alternate contention of the appellant and hold that the status of the assessee will be non-resident. |

11. The CO-ordinate Bench of ITAT, Ahmadabad Bench in the case of Pradip Kumar Joshi v. ITO (Ahmedabad – Trib.)/[2022] 192 ITD 577 (Ahmedabad – Trib.) has followed the aforesaid judgement of the Hon’ble Karnataka High Court and held as under.

| 9. | | It appears that though it has already been held by different benches that while counting days of stay in India for considering the status of “Resident” the days of arrival has to be excluded, the Ld. CIT(A) while counting days of stay in India purportedly counted the date of arrival of the assessee in India without giving any cogent reason thereon which in our considered opinion having no basis. |

| 10. | | We do not find any reason to deviate from the ratio laid down by the Honb’le Bangalore Bench as narrated thereinabove and relying upon the identical facts in the case in hand we exclude the date of arrival in counting the days of stay in India in the case of the assessee. |

| 11. | | We, thus, hold that the assessee stayed in India during the year under consideration for less than 182 days and finally cannot be considered as the resident of India in the year under consideration. In that view of the matter the impugned assessment made against the assessee considering him as the resident of India is not sustainable in the eye of law and thus deleted. |

| 12. | | In the result, the appeal preferred by the assessee is allowed. |

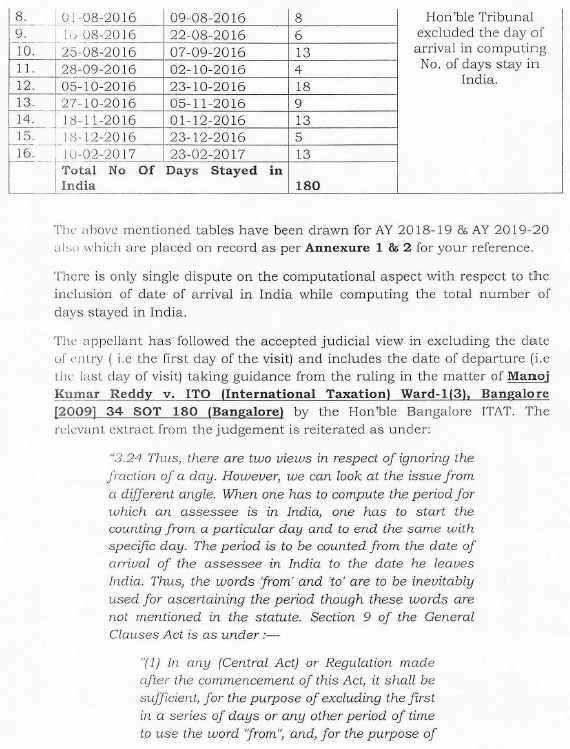

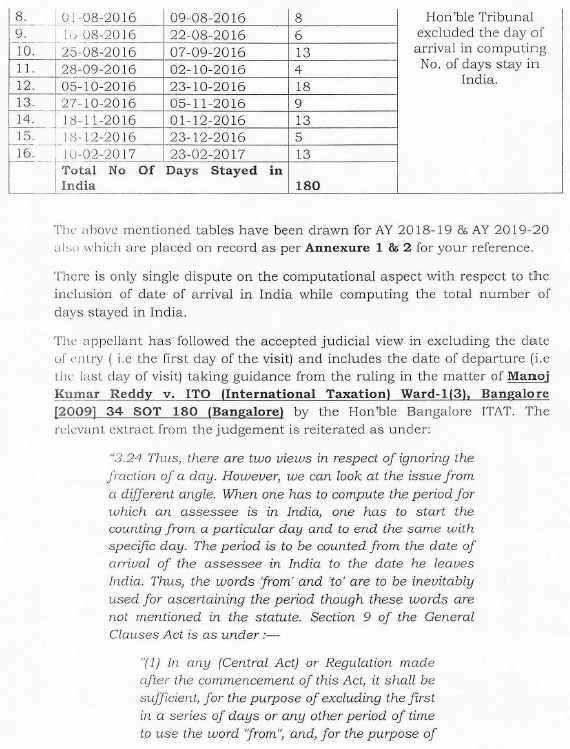

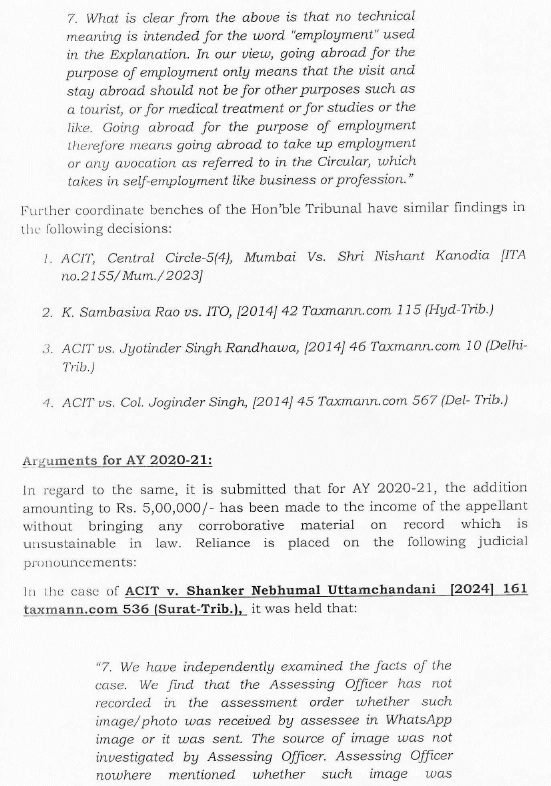

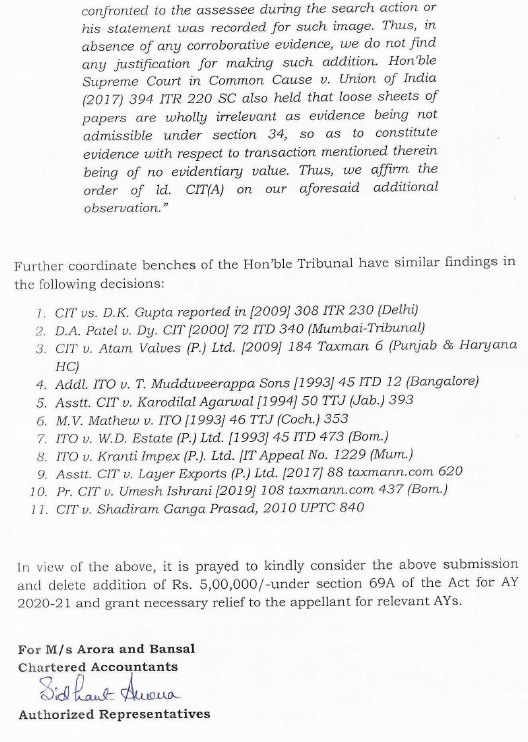

12. Thus, by respectfully following the judgement of hon’ble Karnatka high court and of the coordinate benches, if the day of arrival in India is excluded, the total number of days in India during these three assessment years, is as under:

| Assessment Year | Total No. of Visits | Total no. of days in India (As per AO) | Total No of Days in India (After excluding day of arrival) |

| 2017-18 | 16 | 195 | 180 |

| 2018-19 | 15 | 192 | 175 |

| 2019-20 | 12 | 184 | 173 |

13. In view of the above, stay of the assessee in Inida for the total number of days is less than 182 days in all the three assessment years.

14. Now, coming to the provisions applicable in the instant case, the definition of “resident” in India as provided in section (6) has been reproduced as under:-

Residence in India.

6. For the purposes of this Act,—

(1) An individual is said to be resident in India in any previous year, if he—

(a) is in India in that year for a period or periods amounting in all to one hundred and eighty-two days or more ; or

(b) [***]

(c) having within the four years preceding that year been in India for a period or periods amounting in all to three hundred and sixty-five days or more, is in India for a period or periods amounting in all to sixty days or more in that year.

Explanation 1.—In the case of an individual,—

(a) being a citizen of India, who leaves India in any previous year as a member of the crew of an Indian ship as defined in clause (18) of section 3 of the Merchant Shipping Act, 1958 (44 of 1958), or for the purposes of employment outside India, the provisions of sub-clause (c) shall apply in relation to that year as if for the words “sixty days”, occurring therein, the words “one hundred and eighty-two days” had been substituted ;

(b) being a citizen of India, or a person of Indian origin within the meaning of Explanation to clause (e) of section 115C, who, being outside India, comes on a visit to India in any previous year, the provisions of subclause (c) shall apply in relation to that year as if for the words “sixty days”, occurring therein, the words “one hundred and eighty-two days” had been substituted and in case of such person having total income, other than the income from foreign sources, exceeding fifteen lakh rupees during the previous year, for the words “sixty days” occurring therein, the words “one hundred and twenty days” had been substituted.

Explanation 2.—For the purposes of this clause, in the case of an individual, being a citizen of India and a member of the crew of a foreign bound ship leaving India, the period or periods of stay in India shall, in respect of such voyage, be determined in the manner and subject to such conditions as may be prescribed.

(1A)….

(2)….

(3)….

(4)….

(5)….

(6)….

15. In the instant case the assessee was non resident since 1998 and he took up the permanent residence in UK for which a detailed chart showing yearwise residential status of the Appellant was filed before the AO and therefore, he was non-resident in terms of the provision of Explanation (e) to Section 115C and this fact was not in dispute. Thus, as per clause (b) to Explanation 1 to sub-section (1) of section (6) of the Act as reproduced above, if he is in India for a period of less than 182 days, the assessee cannot be treated as ‘resident’ for these three assessment years AY 2017-18, 2018-19 & 2019-20. As per the chart given by the assessee where the numbers of days stays in India are calculated by excluding the day of arrival as held by the Hon’ble Karnataka High Court in the case of Manoj Kumar Reddy (supra), total stay of the assessee in India was less than 182 days (180 days in FY 2016-17, 173 days in FY 2017-18 and 175 days in FY 2018-19). Therefore, in our considered opinion in the Three previous years relevant to Assessment years 1017-18 to 2019-20, the status of assessee should be ‘non-resident’. Regarding observations of Ld.CIT(A) that the assessee was not engaged in the gainful employment on regular basis outside India, we find that it is not the allegation of the AO that the assessee was outside India for the purposes of tourist visit or medical treatment or for studies. The Hon’ble Kerala High Court in the case of Commissioner of Income-tax v. O. Abdul Razak (Kerala)/337 ITR 350 (Kerala) has held as under:-

6. During hearing, learned senior counsel for the revenue has relied on the decision of the Supreme Court in Lakshminarayan Ram Gopal & Son Ltd. v. Government of Hyderabad [1954] 25 ITR 449. We do not think the decision is applicable to the facts of this case. Learned senior counsel for the assessee has relied on the Memorandum explaining the provisions of the Finance Bill introducing the Explanation, contained in 134 ITR 137 (St.) [Para 35 of the Finance Bill], which reads as follows :—

“(iii) It is proposed to provide that where an individual who is a citizen of India leaves India in any year for the purposes of employment outside India, he will not be treated as resident in India in that year unless he has been in India in that year for 182 days or more. The effect of this amendment will be that the ‘test’ of residence in (c) above will stand modified to this extent in such cases.”

Similarly the Central Board of Direct Taxes issued Circular No. 346, dated 30-6-1982, which reads as follows:

“7.3 With a view to avoiding hardship in the case of Indian citizens, who are employed or engaged in other avocations outside India, the Finance Act has made the following modifications in the tests of residence in India :—

(i) & (ii) ******

(iii) Where an individual who is a citizen of India leaves India in any year for the purposes of employment outside India, he will not be treated as resident in India in that year unless he has been in India in that year for 182 days or more. The effect of this amendment will be that the test of residence in (c) above will stand modified to that extent in such cases.”

7. What is clear from the above is that no technical meaning is intended for the word “employment” used in the Explanation. In our view, going abroad for the purpose of employment only means that the visit and stay abroad should not be for other purposes such as a tourist, or for medical treatment or for studies or the like. Going abroad for the purpose of employment therefore means going abroad to take up employment or any avocation as referred to in the Circular, which takes in self-employment like business or profession.

So much so, in our view, taking up own business by the assessee abroad satisfies the condition of going abroad for the purpose of employment covered by Explanation (a) to section 6(1)(c) of the Act. Therefore, we hold that the Tribunal has rightly held that for the purpose of the Explanation, employment includes self-employment like business or profession taken up by the assessee abroad.

We therefore dismiss the appeal filed by the revenue.

16. Under identical circumstances, the Co-ordinate Bench of Mumbai in the case of Assistant Commissioner of Income-tax v. Nishant Kanodia ITD 20 (Mumbai – Trib.)/ITA No.2155/Mum/2023 & C.O.No.115/Mum/2023 vide order dated 08.01.2024 has held as under:-

12. We find that the issue of whether the term —employment outside India] includes —doing Business] by the taxpayer, came up for consideration before the Hon’ble Kerala High Court in CIT v/s O. Abdul Razak, [2011] 337 ITR 350 (Ker.) wherein the Hon’ble Court while deciding the issue in favour of the taxpayer took into consideration the CBDT Circular no.346 dated 30/06/1982 and held that no technical meaning can be assigned to the word —employmenti used in the Explanation and thus going abroad for the purpose of employment also means going abroad to take up selfemployment like business or profession. Therefore, the Hon’ble Kerala High Court has interpreted the term —employmenti in wide terms. The Hon’ble Kerala High Court, however, held that the term —employmenti should not mean going outside India for purposes such as tourists, medical treatment, studies, or the like. The relevant findings of the Hon’ble Kerala High Court, in the aforesaid decisions, are reproduced as under:-

6. During hearing, learned senior counsel for the revenue has relied on the decision of the Supreme Court in Lakshminarayan Ram Gopal & Son Ltd. v. Government of Hyderabad [1954] 25 ITR 449. We do not think the decision is applicable to the facts of this case. Learned senior counsel for the assessee has relied on the Memorandum explaining the provisions of the Finance Bill introducing the Explanation, contained in 134 ITR 137 (St.) [Para 35 of the Finance Bill], which reads as follows:-

“(iii) lt is proposed to provide that where an individual who is a citizen of India leaves India in any year for the purposes of employment outside India, he will not be treated as resident in India in that year unless he has been in India in that year for 182 days or more. The effect of this amendment will be that the ‘test’ of residence in (c) above will stand modified to this extent in such cases.”

Similarly the Central Board of Direct Taxes issued Circular No. 346, dated 30-6-1982, which reads as follows:

“7.3 With a view to avoiding hardship in the case of Indian citizens, who are employed or engaged in other avocations outside India, the Finance Act has made the following modifications in the tests of residence in India:

(i) & (ii) **

(iii)Where an individual who is a citizen of India leaves India in any year for the purposes of employment outside India, he will not be treated as resident in India in that year unless he has been in India in that year for 182 days or more. The effect of this amendment will be that the test of residence in (c) above will stand modified to that extent in such cases.”

7. What is clear from the above is that no technical meaning is intended for the word “employment” used in the Explanation. In our view, going abroad for the purpose of employment only means that the visit and stay abroad should not be for other purposes such as a tourist, or for medical treatment or for studies or the like. Going abroad for the purpose of employment therefore means going abroad to take up employment or any avocation as referred to in the Circular, which takes in self-employment like business or profession.

So much so, in our view, taking up own business by the assessee abroad satisfies the condition of going abroad for the purpose of employment covered by Explanation (a) to section 6(1)(c) of the Act. Therefore, we hold that the Tribunal has rightly held that for the purpose of the Explanation, employment includes self-employment like business or profession taken up by the assessee abroad.

We therefore dismiss the appeal filed by the revenue.

13. We further find that similar findings have been rendered by the Coordinate Bench of the Tribunal in the following decisions:-

(i) K. Sambasiva Rao v/s ITO, (Hyd-Trib.);

(ii) ACIT v/s Jyotinder Singh Randhawa, (Del-Trib.);

(iii) ACIT v/s Col. Joginder Singh, (DelTrib.).

14. Therefore, even if the taxpayer has left India for the purpose of business or profession, in the aforesaid decisions, the same has been considered to be for the purpose of employment outside India under Explanation-1(a) to section 6(1) of the Act. Accordingly, even if it is accepted that the assessee went to Mauritius as an Investor in Firstland Holdings Ltd., Mauritius, in which he holds 100% shareholding, we are of the considered view that by applying the ratio of aforesaid decisions the assessee is entitled to claim the benefit of the extended period of 182 days, as provided in Explanation-1(a) to section 6(1) of the Act, for the determination of residential status. Since it is undisputed that the assessee has stayed in India only for a period of 176 days during the year, which is less than 182 days as provided in Explanation 1(a) to section 6(1) of the Act, the assessee has rightly claimed to be a “Non-Resident” during the year for the purpose of the Act. Accordingly, we find no infirmity in the findings of the learned CIT(A) on this issue. As a result, the grounds raised by the Revenue are dismissed. 15. In the result, the appeal by the Revenue is dismissed.

17. Accordingly, in view of the above and by respectfully following the judgements of Hon’ble Karnataka High Court and Hon’ble Kerala High Court, we are of the view that the status of the assessee was “non-resident” for AY 2017-18 to 2019-20 as he was enjoying the status of Non-resident in terms of Explanation (e) to Section 115C and during these assessment years he was out of India for the purpose of employment. Therefore, we allow the additional grounds of appeal in all these three appeals taken by the assessee.

18. Since, we have already allowed the additional grounds of assessee, the other grounds of appeal raised by the assessee became academic.

19. In the result, all the three appeals for Ay 2017-18 to 2019-20 of the assessee are allowed.

ITA No.1655/Del/2024 [Assessment Year 2020-21]

20. Brief facts of the case are that the assessment was completed u/s 153A r.w.s.143(3) of the Act wherein an addition of INR 5 Lakhs was made by holding that assessee had received INR 5 Lakhs as advance against the sale of property as found in digital form in the mobile of the assessee. The AO has made the addition on the basis of the statement of the assessee wherein the assessee accepted the receipt of INR 5 Lakhs during the year under appeal.

21. Heard the contentions of both parties and perused the material available on record. The sole issue leading to this addition is that there was a hand-written paper recovered from the mobile of the assessee which was unsigned and when the assessee was confronted with the said paper, he admitted the same as his additional income. Thereafter the assessee has retracted from the said statements, however, the AO had made the addition for the same.

22. From the perusal of orders of lower authorities, it is seen that though the statements of assessee were recorded u/s 132(4) of the Act wherein he admitted that the said amount as receipt of cash however, later he denied receipt of cash and retracted from the statement. The AO solely based on such retracted statement made the addition by ignoring the fact that except this admission, there is no evidence whatsoever available with him or brought on record after making independent enquiry or investigation to support the allegation that the assessee has received INR 5 Lakhs. Hon’ble Supreme Court in the case of Pullangode Rubber Produce Co. Ltd. v. State of Kerala [1973] 91 ITR 18 (SC) observed as under:

“It is no doubt true that entries in the account books of the assessee amount to an admission that the amount in question was laid out or expended for the cultivation, upkeep or maintenance of immature plants from which no agricultural income was derived during the previous year. An admission is an extremely important piece of evidence but it cannot be said that it is conclusive. It is open to the person who made the admission to show that it is incorrect.”

23. The Hon’ble High Court of Rajasthan in the case of CIT v. Mantri Share Brokers Pvt. Ltd. (Rajasthan) as under:

“Section 69B of the Income-tax Act, 1961- undisclosed investments (Burden of proof)- whether where except statement of director of assessee-company offering additional income during survey in his premises, there was no other material either in form of cash, bullion, jewellery or document or in any other form to conclude that statement made was supported by some documentary evidence, said sum could not be added in hands of assessee as undisclosed investments – Held, yes [Paras 10-11] 1In favour of assessee]. Para 10 & 11 of the order is as under:

10. Before proceeding with the matter, it will not be out of place to mention that except the statement in the letter, the AO has no other material on record to assess the income of Rs. 1,82,00,000/-.

11. It is settled proposition of law that merely on the statement that too also was taken in view of threat given in question No.36 as narrated by Mr. Gupta and the same sought to have been relied upon, there is no other material either in the form of cash, bullion, jewellery or document in any other form which can come to the conclusion that the statement made was supported by some documentary evidence. We have gone through the record and find that the CIT (A) has rightly observed as stated hereinabove, which was confirmed by the Tribunal.”

24. The aforesaid judgement stood confirmed by the Hon’ble Supreme Court.

25. The Hon’ble Delhi High Court in case of CIT v. Harjeev Agarwal (Delhi) held as under:

“…A plain reading of Section 132 (4) of the Act indicates that the authorized officer is empowered to examine on oath any person who is found in possession or control of any books of accounts, documents, money, bullion, jewellery or any other valuable article or thing. The explanation to Section 132 (4), which was inserted by the Direct Tax Laws (Amendment) Act, 1987 w.e.f. 1st April, 1989, further clarifies that a person may be examined not only in respect of the books of accounts or other documents found as a result of search but also in respect of all matters relevant for the purposes of any investigation connected with any proceeding under the Act. However, as stated earlier, a statement on oath can only be recorded of a person who is found in possession of books of accounts, documents, assets, etc. Plainly, the intention of the Parliament is to permit such examination only where the books of accounts, documents and assets possessed by a person are relevant for the purposes of the investigation being undertaken. Now, if the provisions of Section 132(4) of the Act are read in the context of Section 158BB (1) read with Section 1588 (b) of the Act, it is at once clear that a statement recorded under Section 132(4) of the Act can be used in evidence for making a block assessment only if the said statement is made in the context of other evidence or material discovered during the search. A statement of a person, which is not relatable to any incriminating document or material found during search and seizure operation cannot, by itself, trigger a block assessment. The undisclosed income of an Assessee has to be computed on the basis of evidence and material found during search. The statement recorded under Section 132(4) of the Act may also be used for making the assessment, but only to the extent it is relatable to the incriminating evidence/material unearthed or found during search. In other words, there must be a nexus between the statement recorded and the evidence/material found during search in order to for an assessment to be based on the statement recorded….”

26. The hon’ble Delhi High Court in case of PCIT v. Best Infrastructure 2017 (Delhi)/[2017] 397 ITR 82 (Delhi) by following the aforesaid judgement of Harjeev Agarwal observed that “.statements recorded under Section 132 (4) of the Act of the Act do not by themselves constitute incriminating material.”.

27. In the instant case, merely for the reason that assessee has admitted the receipt of such cash without any corroborative material, the same could not be treated as the income of the assessee solely on the basis of the retracted statements. Therefore, in our considered opinion, the addition made is without any basis and we direct the AO to delete the same. Thus, all the grounds of appeal raised by the assessee are allowed.

28. In the result, appeal of the assessee is allowed.

29. In the final result, all appeals of the assessee in ITA Nos. 1650, 1653 to 1655/Del/2024 [Assessment Years 2017-2018 to 2020-21] are allowed.