ORDER

George George K, Vice President. – These six appeals filed by the Revenue are directed against different orders of Commissioner of Income Tax (Appeal), Chennai-19, passed under section 250 of the Income Tax Act, 1961 (hereinafter called ‘the Act’). The orders of CIT(A) arise out of orders of AO imposing penalties u/s.271(1)(c) / 270A / 271AA of the Act. The relevant Assessment Years are 2015-16, 2017-18, to 2021-22. The details of the respective appeals preferred by the Revenue are as under:-

| s. No. | ITA No. | AY | Date of order of CIT(A) | Date of order of AO | Penalty levied by the AO u/s. | Amount of penalty levied (Rs.) |

| 1 | 1650/Chny/2025 | 2015-16 | 13.03.2025 | 30.09.2022 | 271(l)(c) | 1,11,89,533 |

| 2 | 1651/Chny/2025 | 2017-18 | 12.03.2025 | 28.09.2022 | 270A | 62,74,154 |

| 3 | 1652/Chny/2025 | 2018-19 | 12.03.2025 | 28.09.2022 | 270A | 92,46,838 |

| 4 | 1653/Chny/2025 | 2019-20 | 12.03.2025 | 27.09.2022 | 270A | 1,09,97,688 |

| 5 | 1654/Chny/2025 | 2020-21 | 12.03.2025 | 28.09.2022 | 270A | 1,46,69,968 |

| 6 | 1655/Chny/2025 | 2021-22 | 13.03.2025 | 22.09.2022 | 271AAB | 2,39,98,544 |

2. There is a delay of 5 days in filing the above appeals. The AO has filed an affidavit in each of the appeals, stating therein the reasons for belated filing of these appeals. On perusal of the reasons stated in the affidavit, we are of the view that there is ‘sufficient cause’ and no latches can be attributed to the Department. Hence, we condone the delay of 5 days in filing these appeals and proceed to dispose off the same on merits.

3. Common issues are raised in these appeals, hence they were heard together and are being disposed off by this consolidated order. We shall first adjudicate the appeal preferred by the Revenue in ITA No.1650/Chny/2025 pertaining to the A.Y.2015-16, which arises out of the order passed by the CIT(A), whereby the penalty levied by the AO u/s.271(1)(c) of the Act has been deleted.

ITA No.1650/CHNY/2025 (AY 2015-16)

4. The brief facts of the case are that the assessee is an individual and a partner in various partnership firms engaged in the finance business. For the A.Y.2015-16, the assessee filed his return of income u/s.139(1) of the Act on 23.11.2015, declaring a total income of Rs.34,01,220/-. The case was selected for scrutiny and the assessment was completed u/s.143(3) of the Act on 16.08.2017, determining the total income at Rs.42,26,220/-.

5. A search and seizure operation u/s.132 of the Act was conducted in the case of M/s.Arunai Group & Others on 25.03.2021. The assessee was also subjected to search. During the course of the search, certain loose sheets in the form of nonjudicial stamp papers were found and seized from the premises of the assessee. Among the seized documents was an undertaking executed on non-judicial stamp paper dated 11.07.2011, signed by Shri Kalidas, a sculptor. In the said undertaking, Shri Kalidas confirmed his agreement to construct a temple tower for Shri Paramananda Trust at Mathur for a consideration of Rs.56,00,000/-. He further acknowledged the receipt of (i) Rs.30,00,000/-, (ii) Rs.10,00,000/-, and (iii) Rs.2,00,000/- in cash on 03.06.2014, and also consented to receive the balance of Rs.10,50,000/- at a later date. Additionally, vide a plain paper document dated 24.09.2014, he acknowledged having received another Rs.5,00,000/- in cash.

6. Based on the aforesaid seized documents, the AO initiated proceedings u/s.153A of the Act for the A.Y. 2015-16 by issuing notice dated 10.12.2021. In compliance, the assessee filed return of income on 07.03.2022 declaring total income of Rs.3,68,15,120/-, which included an additional income of Rs.3,25,88,900/- offered as under:

| Sl, No | Particulars | Amount (Rs.) |

| 1 | Interest and cover amount on the basis of day book impounded during the course of survey from the premises of M/s. Life Line Auto Finance. | 09,37,500 |

| 2 | Income voluntarily offered without any incriminating material seized in the course of search | 2,00,51,400 |

| Total | 3,25,88,900 |

7. The AO thereafter issued notice u/s.143(2) of the Act on 09.03.2022, followed by several notices u/s.142(1) of the Act. During the course of assessment proceedings, the AO observed that the temple had been constructed at a cost of Rs.56,00,000/-and that Shri Kalidas, the sculptor, had confirmed the receipt of Rs.47,00,000/-. The AO issued a show cause notice requiring the assessee to explain why the said expenditure of Rs.56,00,000/-should not be treated as undisclosed income for the A.Y. 2015-16.

8. The assessee objected to the proposed addition. The AO, however, rejected the objections on the grounds that the temple is situated behind the Arunai College campus and there is no evidence of contributions or crowd-funding from the public for the temple construction. Further, AO observed that the incriminating documents evidencing the transactions were seized from the residence of the assessee. The AO accordingly concluded that the entire expenditure of Rs.56,00,000/- towards the temple construction was borne by the assessee out of undisclosed income. Consequently, the AO added the said amount to the income returned by the assessee and completed the assessment u/s.143(3) r.w.s 153A of the Act on 24.03.2022, assessing the total income at Rs.4,24,15,120/-.

9. In the assessment order, the AO recorded a finding that penalty proceedings u/s.271(1)(c) of the Act will be initiated for concealment of particulars of income. Pursuant thereto, the AO, vide notice dated 27.03.2022 issued u/s.274 r.w.s 271(1)(c) of the Act, called upon the assessee to show cause as to why penalty should not be levied for concealment of particulars of income.

10. The assessee, in reply to the show cause notice issued by the AO submitted that no incriminating material, documents, or valuable articles evidencing any undisclosed income relatable to A.Y.2015-16 were found or seized during the course of the search and seizure operation conducted u/s.132 of the Act at the premises of the assessee.

11. With regard to the proposed addition of Rs.56,00,000/-, the assessee contended that the said addition was made solely on the basis of certain seized material which neither pertained to nor belonged to the assessee. It was further submitted that the impugned transactions were not referable to the relevant assessment year, i.e., A.Y. 2015-16. Accordingly, the assessee requested the AO to keep the penalty proceedings initiated u/s.271(1)(c) of the Act be kept in abeyance, inasmuch as the very quantum addition is sub judice before the first appellate authority.

12. The assessee further submitted that the returned income of Rs.3,68,15,120/-, as declared in the return of income furnished u/s.153A of the Act, was accepted by the AO without any variation or addition. Consequently, in respect of the said returned income, there was no occasion for initiation of penalty proceedings u/s.271(1)(c) of the Act.

13. It was also submitted by the assessee that the deeming provisions contained in Explanation 5A to section 271(1)(c) of the Act were not applicable to the facts of the present case. The assessee submitted that during the course of search proceedings, he was neither found to be the owner of any money, bullion, jewellery or other valuable article or thing, nor was there any detection of undisclosed income based on entries in books of account, documents or transactions, which had been admitted in any statement recorded u/s.132(4) of the Act as representing undisclosed income of any previous year.

14. The assessee, relying upon various judicial pronouncements, contended that for invoking Explanation 5A to section 271(1)(c) of the Act, it is a condition precedent that incriminating material or documents must be unearthed during the course of search, and that such material must form the very foundation of the assessment framed u/s.153A of the Act. It was stated that in the absence of any such incriminating material discovered during the course of search at the premises of the assessee, the deeming provisions of Explanation 5A were not attracted. In light of aforesaid submission, the assessee requested the AO to drop the penalty proceedings initiated u/s.271(1)(c) of the Act.

15. The AO upon consideration of the assessee’s submissions, refrained from levying penalty in respect of the addition of Rs.56,00,000/- made in the assessment proceedings, as the said addition was contested by the assessee before the first appellate authority. However, with regard to the additional income of Rs.3,25,88,900/- declared by the assessee in the return of income filed u/s.153A of the Act, the AO rejected the explanation furnished by the assessee and held that penalty u/s.271(1)(c) of the Act was exigible thereon, as the said income was not in dispute.

16. The AO observed that the assessee had earned interest income and cover amount in respect of his investment in M/s. Life Line Auto Finance, which came to light during the course of survey proceedings conducted in the case of the said entity. The AO held that the assessee had understated his income to the extent of Rs.3,25,88,900/- in the return of income originally filed u/s.139 of the Act, and that the said income was subsequently offered only in the return of income filed u/s.153A of the Act. The AO further recorded that the assessee would not have disclosed such additional income but for the search action carried out at his premises on 25.03.2021. Accordingly, the AO was of the view that, since the additional income declared was not in dispute, such income admitted in the return furnished on or after the date of search is deemed to represent concealed income within the meaning of section 271(1)(c) of the Act. In support of this finding, the AO placed reliance on the judgment of the Hon’ble Kerala High Court in P. Rajaswamy, Raja Jewellery v. CIT (Kerala), wherein it was held that a declaration to avoid penalty must be voluntary and prior to the detection of concealed income by the Department. On the basis of the aforesaid findings, the AO concluded that the additional income of Rs.3,25,88,900/- offered by the assessee was admitted solely as a consequence of the search and is, therefore, deemed to be concealed income. Consequently, by order dated 30.09.2022 passed u/s.271(1)(c) of the Act, the AO imposed a penalty of Rs.1,11,89,533/-, being 100% of the tax sought to be evaded on the said sum of Rs.3,25,88,900/-.

17. Aggrieved by the above penalty order, assessee carried the matter before the CIT(A). The assessee submitted before the CIT(A) that the assessment order in the present case was passed on 24.03.2022, whereas the show cause notice u/s.274 r.w.s section 271(1)(c) of the Act was issued on 27.03.2022. It was, therefore, contended by the assessee that the penalty proceedings were not initiated during the course of the assessment proceedings as mandated under the provisions of the Act. Consequently, the assessee urged that the show cause notice issued by the AO u/s.274 r.w.s 271(1)(c) of the Act, dated 27.03.2022, is invalid in law, and therefore, the consequential penalty order dated 30.09.2022 is also without jurisdiction and liable to be quashed. In support of this contention, assessee placed reliance on various judicial precedents before the CIT(A).

18. The assessee further submitted that the provisions of Explanation 5A to section 271(1)(c) of the Act are attracted only where income is admitted on the basis of incriminating material unearthed during the course of a search under the Act. The assessee submitted that in the present case, the additional income of Rs.3,25,88,900/- was offered voluntarily and not on account of any incriminating material discovered during the course of a search, and therefore, the deeming fiction of concealment under Explanation 5A is not applicable. It was further submitted that once the returned income has been accepted by the AO, there can be no concealment with respect to such income. Accordingly, the assessee contended that the penalty imposed u/s.271(1)(c) of the Act is not sustainable in law.

19. The CIT(A), upon due consideration of the submissions advanced on behalf of the assessee, deleted the penalty levied by the AO holding that neither Explanation 5A(i) nor 5A(ii) to section 271(1)(c) of the Act is applicable to the facts of the assessee’s case. The CIT(A) observed that initiation of penalty proceedings under Explanation 5A was outside the permissible scope, since the assessee was not found to be in possession of any undisclosed money, bullion, jewellery, or other valuable articles as contemplated under Explanation 5A(i). It was further noted that the income surrendered by the assessee was voluntary and suo motu, without reference to or discovery of any incriminating material during the course of search. Consequently, the CIT(A) held that invocation of Explanation 5A to section 271(1)(c) could not justify imposition of penalty.

20. The CIT(A) further distinguished the reliance placed by the AO on the decision of the Hon’ble Kerala High Court in P. Rajaswamy, Raja Jewellery (supra), holding that the said decision pertained to a period prior to the introduction of Explanation 5A (effective from 01.06.2007) and was, therefore, inapplicable to the present case, which falls within the ambit of the post amendment regime.

21. The CIT(A) also recorded that while the assessment order for the impugned assessment year was passed on 24.03.2022, the penalty notice u/s.271(1)(c) of the Act was issued only thereafter, on 27.03.2022. The CIT(A) took the view that such issuance of notice was not in consonance with the settled legal position. In support of this conclusion, reliance was placed upon the decision of the coordinate bench of this Tribunal in Srinivasan Chandrasekara Chandilya v. ACIT [IT Appeal Nos.1478 to 1487/Chny/2024, dated 30.08.2024].

22. On the basis of the aforesaid findings, the CIT(A) proceeded to delete the penalty of Rs.1,11,89,533/- levied by the AO u/s.271(1)(c) of the Act. The relevant observations of the CIT(A) in deleting the penalty levied by the AO are as under:

“6.2.6 As evident in the assessment order, it can be seen that the AO in the assessment order had no occasion to record any findings about the deliberate concealment of income by the Appellant warranting to initiate penalty proceedings u/s 271 (1) (c) of the Act. The AO in the assessment order while initiating penalty proceedings has merely observed “penalty proceedings u/s 271 (1) (c) will be initiated for concealment of particulars of income.”

6.2.7 The above finding made by the A.O. implies that the Appellant had concealed income. The Penalty leviable u/s 271(1)(c) of the Act is Penal in nature. It is distinct from the regular order passed by the A.O. u/s 143(3) r.w.s 153A of the Act, where the Assessment is made to collect the Tax due to the Exchequer. On the other hand, the Penal Provisions are contemplated as a deterrent. Thus, while imposing the penalty the A.O. being a quasi-judicial authority must be confident enough to make a recording in the assessment order as to how the appellant has concealed income and the relevant provisions of the Act that is violated by the assessee and the necessity that warrant the levy of Penalty. Making a simple observation, that “penalty proceedings u/s 271 (1) (c) will be initiated separately for concealment of particulars of income.” definitely cannot be the basis for arriving a conclusion to levy the penalty. Before levying the penalty the A.O. must establish in unequivocal term about the existence of concealment and make a speaking order.

6.2.9 Further during the course of appellate proceedings, the AR has clearly demonstrated that neither Explanation 5A(i) nor (ii) applies to the case. This omission undermines the validity of the penalty proceedings as there is no clarity on the basis for their initiation. If the penalty was initiated under Explanation 5A, the AO failed to appreciate that the appellant was not found to own any undisclosed money, bullion, jewellery, or other valuable articles (as required under Explanation 5A(i)). Further, if the surrender of income by the appellant was voluntary and suo moto, in such cases it has been consistently held that the same is outside the purview of Explanation 5A in various cases including such as Ajay Traders, Financial technologies (I) Ltd and Radhey Shyam Mittal as referred by the appellant in the written submission. These cases establish that penalty under Explanation 5A requires incriminating evidence, which was absent in the appellant’s case.

6.2.10 The appellant has further claimed that the AO erred in dismissing the appellant’s detailed explanations and valid grounds without providing any reasoning. The penalty order merely states that the explanations were “not acceptable”, without addressing the specific arguments raised or the judicial precedents cited by the appellant. This lack of reasoning further weakens the validity of the penalty imposed. Additionally, the AO relied on the decision in P. Rajaswamy, Raja Jewellery v. CIT (Kerala), which pertains to a period prior to the introduction of explanation 5A (effective from 01.06.2007). This decision is not applicable to the appellant’s case, as Explanation 5A governs penalty proceedings for search-related cases post-2007. The reliance on this outdated precedent highlights the AO’s failure to apply the correct legal framework.

6.2.11 Besides the appellant claimed that judicial precedents, such as Ajay Traders v. DCIT [ITA No. 296/JP/2014 dated 06.05. 2016 reported in (2016) 179 TTJ_UO (JP)(UO) 51] and Radhey Shyam Mittal, which emphasize that penalties under Explanation 5A require incriminating documents to be found during the course of the search. In the appellant’s case, no such incriminating documents were found during the course of search. The AO also failed to address or distinguish these decisions in the penalty order, further undermining the validity of the penalty.

6.2.12 The undersigned has carefully examined the issue under consideration. As evident from the records, it can be seen that the penalty notice issued by the AO u/s 271(1)(c) of the Act is for concealment of income. The penalty notice issuance process must follow specific procedural requirements under the Act, and any deviation from these processes can render the penalty invalid. The undersigned observes the various aspects of the penalty notice issuance, its implications and on the order passed in this case viz.

| • | | The returned income filed u/s 153A was accepted without any deviation. |

| • | | The additional income declared was not out of any incriminating materials found during the search in the case of the appellant. |

| • | | The AO passed the assessment order for AY 2016-17 on 24.03.2022. However, the penalty notice u/s 271(1)(c) of the Act was issued three days later, i.e. on 27.03.2022. This is against the legal position of law as held by the Jurisdictional Hon’ble ITAT, ‘A’ Bench, Chennai on 30.08.2024 in the case of Srinivasan Chandrasekara Chandilya v. Asst. Commissioner of Income Tax, in ITA Nos. 1478 to 1487/Chny/2024. |

| • | | The provisions of section 271(1)(c) of the Act requires the AO to form an opinion regarding the concealment of income or furnishing of inaccurate particulars of income during the course of the assessment proceedings. The notice u/s 274 r.w.s 271(1)(c) of the Act is typically issued if the AO is satisfied during the course of assessment that the taxpayer has concealed income. |

| • | | In Para 5.1 of the order imposing penalty, the AO has observed that it is pertinent mention that the assessee has understated his income… and however, the penalty notices u/s 274 r.w.s 271(1)(c) was issued for ‘concealed the particulars of income’. Thus, the penalty levied is in contradiction to the show cause notice issued. As claimed and demonstrated by the appellant, neither Explanation 5A(i) nor 5A(ii) applies to the case to fall within the ambit of penalty. |

6.2.13. In view of the above findings and relying on the judicial pronouncements as discussed above, the penalty levied consequence to the issue of notice u/s 271(1)(c) of the Act is not sustainable in the eyes of law. Therefore, all the grounds raised by the appellant upon the levy of the penalty are hereby treated as allowed and the AO is directed to delete the penalty levied amounting Rs.1,11,89,533/- for the AY 2015-16.”

23. Aggrieved by the order of the CIT(A) in deleting the penalty of Rs.1,11,89,533/- imposed by the AO u/s.271(1)(c) of the Act, the Revenue is in appeal before us, raising the following grounds of appeal:

| 1. | | “The order of the learned Commissioner of Income Tax (Appeals) is erroneous on facts of the case and in law. |

| 2. | | The Ld.CIT(A) erred in deleting the penalty without appreciating the assessee did not declare the additional income voluntarily but had declared the same only after the proceedings of the search unearthed the undisclosed income, thereby rendering it not voluntary to claim immunity from penalty proceedings. |

| 3. | | The Ld.CIT(A) erred in giving relief to the assessee by not appreciating that Explanation 5A provided to the section 271, that in cases of search initiated on or after 1 June 2007, if the assessee is found to be owner of any income based on any entry in any books of accounts or other documents or any other transactions and he claims that the entry in the books of accounts or other documents or transactions represent his income for any previous year which had ended before the search and where he had not included such income in his return of income furnished before the due date, he shall be deemed to have concealed the particulars of income or furnished inaccurate particulars of such income for the purposes of levy of penalty u/s 271(1)(c). |

| 4. | | The Ld.CIT(A) failed to take cognizance of the decision of the Hon’ble Supreme Court in the case of MAK Data Pvt Ltd V CIT (SC)/MAK Data (P.) Ltd. v. CIT (SC)/[2013] 358 ITR 593 (SC) wherein the Hon’ble Supreme Court held that where surrender of income not being voluntary in nature, authorities below were justified in levying penalty under section 271(1)(c). |

| 5. | | For these grounds and any other ground including amendment of grounds that may be raised during the course of the appeal proceedings, the order of learned CIT (Appeals) may be set aside and that of the Assessing Officer be restored.” |

24. The Ld.DR, in support of the grounds of appeal, contended that the assessee had disclosed an additional income of Rs.3,25,88,900/- only pursuant to the search proceedings, and that such income would have otherwise escaped assessment but for the said search. It was further submitted that the additional income, though voluntarily offered, is liable to be regarded as deemed concealment of income for the purposes of imposition of penalty u/s.271(1)(c) of the Act. The Ld.DR, therefore, prayed that the order of the CIT(A) be set aside and the penalty levied by the AO u/s.271(1)(c) of the Act be upheld.

25. Per contra, the Ld.AR supported the order of the CIT(A) contending that the said order is a reasoned and legally correct. It was submitted that the CIT(A), after duly considering various judicial precedents, has correctly held that the levy of penalty u/s.271(1)(c) of the Act is unwarranted in the facts of the assessee’s case. According to the Ld.AR, the impugned order suffers from no infirmity and accordingly deserves to be upheld.

26. The Ld.AR further invited our attention to the fact that the quantum assessment order u/s.143(3) r.w.s 153A of the Act for the A.Y.2015-16 was passed on 24.03.2022, whereas the show cause notice for levy of penalty u/s.274 r.w.s 271(1)(c) of the Act was issued only on 27.03.2022, i.e., subsequent to the assessment order, and not contemporaneously. It was submitted that the initiation of penalty proceedings must be in the course of assessment proceedings and not thereafter. Consequently, since the penalty notice was issued only after completion of assessment, the said notice cannot be regarded as validly initiated in the course of assessment proceedings. Thus, the notice dated 27.03.2022 issued by the AO is bad in law and vitiates the entire penalty proceedings. In support, reliance was placed on the judgment of the Hon’ble Delhi High Court in CIT v. Rajinder Kumar Somani (Delhi), as well as the decision of the coordinate bench of this Tribunal in Srinivasan Chandrasekara Chandilya (supra). It was further contended that the Revenue’s appeal itself is infructuous since no specific grounds of challenge have been raised against the CIT(A)’s finding that the penalty notice dated 27.03.2022 is invalid in law.

27. The Ld.AR further relied upon the judgement of the Hon’ble Delhi High Court in Pr. CIT v. Neeraj Jindal ITR 1 (Delhi), to contend that once the AO accepts the revised return filed u/s.153A of the Act, no reference can be made to the earlier return filed u/s.139 of the Act and for all purposes, including levy of penalty u/s.271(1)(c) of the Act, the return to be considered is the one filed u/s.153A of the Act. It was submitted that once the AO accepts the return u/s.153A of the Act, the original return u/s.139 stands abated and becomes non est. Thus, concealment, if any, has to be examined only with reference to the section 153A return. In the present case, since the assessee voluntarily disclosed an additional income of Rs.3,25,88,900/- in the return filed u/s.153A of the Act, which was duly accepted by the AO, such disclosure cannot be construed as concealment attracting penalty u/s.271(1)(c) of the Act. Accordingly, the Ld.AR prayed for affirming the order of the CIT(A) on this count also.

28. The Ld. AR also placed reliance upon various judicial precedents considered by the CIT(A) to argue that post-search penalty u/s.271(1)(c) of the Act is governed by Explanation 5A thereto. However, such explanation is attracted only when the additional income disclosed is directly linked to incriminating material unearthed during the course of search. In the present case, the additional income of Rs.3,25,88,900/- offered by the assessee comprised of (i) Rs.29,37,500/- offered pursuant to a statement recorded during survey in the case of M/s. Life Line Auto Finance; and (ii) the balance sum of Rs.2,96,51,400/-voluntarily offered by the assessee, unconnected with any incriminating material. Thus, it was submitted that the disclosure was not attributable to any incriminating material found during search, and consequently Explanation 5A to section 271(1)(c) is inapplicable. Thus, the Ld.AR submitted that the CIT(A) was therefore justified in deleting the penalty levied by the AO.

29. In rejoinder, the Ld.DR fairly conceded that although the assessee has offered additional income in the return filed u/s.153A of the Act, such disclosure is not on account of any incriminating material found for the year under consideration. Further, the Ld.DR also candidly admitted that no grounds are raised by the Revenue challenging the CIT(A) findings that penalty notice dated 27.03.2022 is invalid in law.

30. We have heard rival submissions and perused the material on record. We note that a search and seizure operation u/s.132 of the Act was conducted at the premises of the assessee on 25.03.2021. Consequent thereto, notice u/s.153A of the Act was issued by the AO on 10.12.2021. In compliance, the assessee filed his return of income on 07.03.2022, admitting a total income of Rs.3,68,15,120/- u/s.153A of the Act, which included an additional income of Rs.3,25,88,900/-. The AO, while completing the assessment, accepted the additional income so declared by the assessee. However, the AO proceeded to levy penalty u/s.271(1)(c) of the Act amounting to Rs.1,11,89,533/-, being 100% of the tax allegedly sought to be evaded on the said additional income. The AO’s reasoning was that the additional income would not have been offered but for the search action, thereby attracting the deeming fiction of concealment of income u/s.271(1)(c) of the Act.

31. On appeal, the CIT(A) deleted the penalty, holding that the additional income voluntarily disclosed by the assessee was not relatable to any incriminating material discovered during the course of the search proceedings. The CIT(A) further observed that the deeming provisions contained in Explanation 5A to section 271(1)(c) of the Act were not applicable to the assessee’s case, as no incriminating material was found at the assessee’s premises. In addition, the CIT(A) held that the show-cause notice issued by the AO u/s.274 r.w.s 271(1)(c) of the Act, dated 27.03.2022, was issued subsequent to the completion of the assessment proceedings and, therefore, was legally untenable.

32. The issue that arises for our adjudication is whether the CIT(A) was justified in deleting the penalty of Rs.1,11,89,533/-levied by the AO u/s.271(1)(c) of the Act. The assessee pursuant to a search u/s.132 of the Act offered an additional sum of Rs.3,25,88,900/- in the return of income furnished u/s.153A of the Act. The said sum has been duly accepted by the AO in completing the assessment. Admittedly, the aforesaid additional income offered by the assessee was not attributable to, nor did it emanate from, any incriminating material unearthed during the course of search operations carried out at the assessee’s premises. The AO, however, has recorded that the disclosure of such additional income in the return filed u/s.153A of the Act was occasioned by the factum of the search itself, and therefore, in his opinion, the disclosure could not be regarded as voluntary. On this basis, the AO inferred that the assessee had concealed income within the meaning of Section 271(1)(c) of the Act.

33. It is a settled position, supported by numerous judicial pronouncements, that the mere fact of an assessee offering a higher income in a return filed u/s.153A of the Act when compared to the return originally filed u/s.139 of the Act does not, in itself, constitute concealment of income so as to justify the imposition of penalty u/s.271(1)(c) of the Act. In the absence of any specific incriminating evidence unearthed during the search pointing towards suppression or concealment, the higher disclosure by itself cannot be construed as a deliberate act of concealment.

34. The scheme of assessment u/s.153A of the Act is governed by a non obstante clause, which, inter alia, overrides the provisions of Section 139 of the Act. Consequently, the return filed u/s.153A of the Act is to be treated, for all practical and legal purposes, as the return of income furnished u/s.139 of the Act. Thus, once the assessee furnishes a return in compliance with Section 153A, such return supplants and substitutes the original return filed u/s.139 of the Act, rendering the latter non est in the eyes of law. For the purposes of determining concealment or furnishing of inaccurate particulars of income u/s.271(1)(c) of the Act, the return filed u/s.153A of the Act must be taken into consideration, if the additional income disclosed in the said return of income is not based on any incriminating material found during the course of search.

35. In the present case, since the assessee has duly disclosed the additional income of Rs. 3,25,88,900/- in the return filed u/s.153A of the Act, and the said return has been accepted by the AO without any variation, there arises no occasion to allege concealment vis-a-vis the earlier return filed under Section 139 of the Act. The concealment, if any, has to be assessed only with reference to the return filed under Section 153A, and in the facts of the instant case, there exists no concealment in such return, since the said additional income was not on the basis of any incriminating material found for the impugned assessment year during the course of search at the premises of the assessee. Accordingly, we are of the considered view that the penalty sought to be imposed u/s.271(1)(c) of the Act is unwarranted and unsustainable in law. Therefore, we hold that the CIT(A) has rightly deleted the penalty imposed by the AO u/s.271(1)(c) of the Act.

36. Our above view is supported by the judgment of the Hon’ble Delhi High Court in the case of Neeraj Jindal (supra). In the said judgment, the Hon’ble Court categorically held that where an assessee has furnished a revised return of income subsequent to the conduct of a search, and such revised return has been duly accepted by the AO, the mere fact that the revised return reflects a higher income than what was originally declared does not, by itself, warrant the automatic levy of penalty u/s.271(1)(c) of the Act. The relevant extract of the judgment is reproduced hereunder for ready reference:

“16. Thus, despite the fact that there is no requirement of proving mens rea specifically, it is clear that the word “conceal” inherently carries with it the requirement of establishing that there was a conscious act or omission on the part of the assessee to hide his true income. This was also the conclusion of the Supreme Court in the case of Dilip N. Shroff v. Jt. CIT . In a later decision in Union of India v. Dharmendra Textile Processors [2008] 13 SCC 369, the Supreme Court overruled its decision in Dilip N. Shroff (supra). Thereafter, in CIT v. Reliance Petroproducts (P.) Ltd. (SC) the Court clarified that Dilip N. Shroff (supra) stood overruled only to the extent that it imposed the requirement of mens rea in Section 271(1)(c); however, no fault was found with the meaning of “conceal” laid down in Dilip N. Shroff’s case (supra). Thus, as the law stands, the word “conceal” in Section 271(1)(c), would require the A.O. to prove that specifically there was some conduct on part of the assessee which would show that the assessee consciously intended to hide his income.

17. In this case, the A.O. in his order noted that the disclosure of higher income in the return filed by the assessee was a consequence of the search conducted and hence, such disclosure cannot be said to be “voluntary”. Hence, in the A.O.’s opinion, the assessee had “concealed” his income. However, the mere fact that the assessee has filed revised returns disclosing higher income than in the original return, in the absence of any other incriminating evidence, does not show that the assessee has “concealed” his income for the relevant assessment years. On this point, several High Courts have also opined that the mere increase in the amount of income shown in the revised return is not sufficient to justify a levy of penalty.

18. The Punjab & Haryana High Court in CIT v. Suraj Bhan , held that when an assessee files a revised return showing higher income, penalty cannot be imposed merely on account of such higher income filed in the revised return. Similarly, the Karnataka High Court in the case of Bhadra Advancing (P.) Ltd v. Asstt. CIT , held that merely because the assessee has filed a revised return and withdrawn some claim of depreciation penalty is not leviable. The additions in assessment proceedings will not automatically lead to inference of levying penalty. The Calcutta High Court in the case of CIT v. Suresh Chand Bansal [2010] 329 ITR 330 held that where there was an offer of additional income in the revised return filed by the assessee and such offer is in consequence of a search action, then if the assessment order accepts the offer of the assessee, levy of penalty on such offer is not justified without detailed discussion of the documents and their explanation which compelled the offer of additional income. The Madras High Court in the case of S.M.J. Housing v. CIT held that where after a search was conducted, the assessee filed the return of his income and the Department had accepted such return, then levy of penalty under Section 271(1)(c) was not justified. From the above cases it would be clear that when an assessee has filed revised returns after search has been conducted, and such revised return has been accepted by the A.O., then merely by virtue of the fact that such return showed a higher income, penalty under Section 271(1)(c) cannot be automatically imposed.

19. The whole matter can be examined from a different perspective as well. Section 153A provides the procedure for completion of assessment where a search is initiated under Section 132 or books of account, or other documents or any assets are requisitioned under Section 132A after 31.05.2003. In such cases, the Assessing Officer shall issue notice to such person requiring him to furnish, within such period as may be specified in the notice, return of income in respect of six assessment years immediately preceding the assessment year relevant to the previous year in which the search was conducted under Section 132 or requisition was made under

Section 132A. The Assessing Officer shall assess or reassess the total income of each of these six assessment years. Assessment or reassessment, if any, relating to any assessment year falling within the period of six assessment years pending on the date of initiation of the search under Section 132 or requisition under Section 132A, as the case may be, shall abate. [Ref to Memorandum accompanying the Finance Bill, 2003] Section 153A opens with a non-obstante clause relating to normal assessment procedure covered by Sections 139, 147, 148, 149, 151 and 153 in respect of searches made after May 31, 2003. The sections, so excluded, relate to returns, assessment and reassessment provisions. However, the provisions that are saved are those under Section 153B and 153C, so that these three Sections 153A, 153B and 153C are intended to be a complete code for post- search assessments. Considering that the non-obstante clause under Section 153A excludes the application of, inter alia, Section 139, it is clear that the revised return filed under Section 153A takes the place of the original return under Section 139, for the purposes of all other provisions of the Act. This is further buttressed by Section 153A (1)(a) which reads:

“Notwithstanding anything contained in section 139, section 147, section 148, section 149, section 151 and section 153, in the case of a person where a search is initiated under section 132 or books of account, other documents or any assets are requisitioned under section 132A after the 31st day of May, 2003, the Assessing Officer shall

(a) issue notice to such person requiring him to furnish within such period, as may be specified in the notice, the return of income in respect of each assessment year falling within six assessment years referred to in clause (b), in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed and the provisions of this Act shall, so far as may be, apply accordingly as if such return were a return required to be furnished under section 139.”

20. Therefore, the position that emerges from the above-mentioned provision is that once the assessee files a revised return under Section 153A, for all other provisions of the Act, the revised return will be treated as the original return filed under Section 139. On similar lines, the Gujarat High Court in the case of Kirit Dahyabhai Patel v. Asstt. CIT [2015] 280 CTR 216, held that: “In view of specific provision of s. 153A of the I.T. Act. the return of income filed in response to notice under s. 153A of the I.T. Act is to be considered as return filed under s. 139 of the Act, as the AO has made assessment on the said return and therefore, the return is to be considered for the purpose of penalty under s. 271(1)(c) of the I.T. Act and the penalty is to be levied on the income assessed over and above the income returned under s. 153A, if any.”

21. Thus, it is clear that when the A.O. has accepted the revised return filed by the assessee under Section 153A, no occasion arises to refer to the previous return filed under Section 139 of the Act. For all purposes, including for the purpose of levying penalty under Section 271(1)(c) of the Act, the return that has to be looked at is the one filed under Section 153A. In fact, the second proviso to Section 153A(1) provides that “assessment or reassessment, if any, relating to any assessment year falling within the period of six assessment years referred to in this subsection pending on the date of initiation of the search under Section 132 or making of requisition under Section 132A, as the case may be, shall abate.” What is clear from this is that Section 153A is in the nature of a second chance given to the assessee, which incidentally gives him an opportunity to make good omission, if any, in the original return. Once the A.O. accepts the revised return filed under Section 153A, the original return under Section 139 abates and becomes non-est. Now, it is trite to say that the “concealment” has to be seen with reference to the return that it is filed by the assessee. Thus, for the purpose of levying penalty under Section 271(1)(c), what has to be seen is whether there is any concealment in the return filed by the assessee under Section 153A, and not vis-a vis the original return under Section 139.”

37. The ratio of the above judgment of the Hon’ble Delhi High Court has been accepted by the Hon’ble Madras High Court in the case of R.P. Darrmalingam v. ACIT (Madras)/CRL.O.P.No.28572 of 2018 and Crl.M.P.No.16630 of 2018 dated 09.11.2023, wherein their Lordships have observed as under:

“14. The learned counsel appearing for the petitioner also cited the judgment of the Hon’ble High Court of Delhi in the case of Principal Commissioner of Income Tax-19 v. Neeraj Jindal reported in (Delhi), in which it is held that once the assessee files a revised return under Section 153A, for all other provisions of the Act, the revised return will be treated as the original return filed under Section 139. Further held that when the assessment officer has accepted the revised return filed by the assessee under Section 153A, no occasion arises to refer to the previous return filed under Section 139 of the Act for all purposes, including for the purpose of levying penalty under Section 271(1)(c) of the Act, the return that has to be looked at is the one filed under Section 153A. In fact, the second proviso to Section 153A(1) provides that “assessment or reassessment, if any, relating to any assessment year falling within the period of six assessment years referred to in this sub-section pending on the date of initiation of the search under Section 132 or making of requisition under Section 132A, as the case may be, shall abate.” Therefore, Section 153A is in the nature of a second chance given to the assessee, which incidentally gives him an opportunity to make good omission, if any, in the original return. Once the assessment officer accepts the revised return filed under Section 153A, the original return under Section 139 abates and becomes non-est. Now, it is trite to say that the “concealment” has to be seen with reference to the return that it is filed by the assessee. Thus, for the purpose of levying penalty under Section 271(1)(c), what has to be seen is whether there is any concealment in the return filed by the assessee under Section 153A, and not vis-a vis the original return under Section 139.

15. No quarrel that once the assessment officer accepts the revised return filed under Section 153A, the original return filed under Section 139 abates and becomes non est. Therefore, no penalty can be levied under Section 271(1)(c) of the Income Tax Act. Whereas in the case on hand, there was concealment by the petitioner while filing his first return of income for the assessment year 2012-2013. In fact, the levying of penalty was already dropped in view of the order passed by the tribunal. However, the petitioner is now facing prosecution under Section 276CC of Income Tax Act. That apart, the mens rea of the petitioner is clearly established by the respondent and as such, the above judgment is also not helpful to the case on hand.”

38. We are of the considered opinion that the ratio laid down by the Hon’ble Supreme Court in MAK Data (P.) Ltd. v. CIT (SC) is clearly distinguishable on facts and, therefore, does not govern the present case of the assessee. In MAK Data (P.) Ltd. (supra), the Hon’ble Supreme Court categorically noted that the surrender of income by the assessee therein was not voluntary in nature, but was made only after detection by the Department, on the basis of incriminating documents and material seized during a search conducted in the premises of a sister concern. The Court, in that context, held that such a surrender, made under compulsion of adverse material, could not absolve the assessee from the charge of concealment of income. In contradistinction, the factual matrix of the present case is materially different. In the assessee’s case, there is no discovery or seizure of incriminating material that evidence or suggests concealment of income. The proceedings do not reveal any adverse documents or findings which could attribute suppression or misrepresentation of income to the assessee. Consequently, the element of compulsion or discovery of concealed material, which formed the foundation of the Hon’ble Supreme Court’s decision in MAK Data Pvt. Ltd., is entirely absent in the present matter. Accordingly, the principle laid down in MAK Data (P.) Ltd. (supra) cannot be applied to the facts and circumstances of the instant case.

39. We also concur with the finding of the CIT(A) that the judgment of the Hon’ble Kerala High Court in P. Rajaswamy, Raja Jewellery (supra), as relied upon by the AO, pertains to a period prior to the insertion of Explanation 5A to section 271(1)(c) of the Act, which came into effect from 01.06.2007. Accordingly, the said judgment has no application to the present case of the assessee, since the penalty proceedings arising out of search operations subsequent to the aforesaid date are squarely governed by Explanation 5A.

40. Therefore, we are of the considered view that even the provisions of Explanation 5A to Section 271(1)(c) of the Act are not attracted to the present case of the assessee. This is for the reason that the additional income has been offered by the assessee voluntarily, and such disclosure is not founded upon or traceable to any incriminating material discovered or seized during the course of search proceedings. It is a well-settled principle, fortified by several pronouncements of the Coordinate Benches of this Tribunal, that the deeming fiction embedded in Explanation 5A to Section 271(1)(c) of the Act can be invoked only when the addition or disclosure of income is directly relatable to incriminating evidence unearthed during the course of search. In the absence of such incriminating material, the provisions of Explanation 5A cannot be pressed into service for the imposition of penalty u/s.271(1)(c) of the Act. Thus, in view of the judicial precedents and the legislative scheme, it follows that in the present case, where the assessee’s voluntary disclosure of additional income is not supported by any seized or incriminating document, the penalty provisions u/s.271(1)(c) of the Act stand inapplicable. In support of this proposition, we place reliance on the following judicial pronouncements.

| (i) | | The Jaipur Bench of this Tribunal in Ajay Traders v. Dy. CIT (Jaipur-Trib.)/[ITA No.296/JP/2014, dated 06.05.2016] has held as under: |

“4.3. We have heard rival contentions and perused the material on record. It is undisputed fact that during the course of search, no incriminating documents were found and seized. The assessee surrendered the additional income under section 132(4) at Rs. 15 lacs and requested not to impose penalty u/s 271(1)(c) of the IT Act. The ld. AO imposed the penalty by invoking the Explanation 5A to section 271(1)(c) of the Act, which has been confirmed by ld. CIT (A) by considering the judgment of Hon’ble Supreme Court in the case of MAK Data Pvt. Ltd. (supra). But for imposing the penalty under Explanation 5A on the basis of statement recorded during the course of search, it is necessary to be found incriminating documents and is to be considered at the time of assessment framed under section 153A of the Act. The issue has been considered by various High Courts as well as by ITAT as relied upon by the assessee, which are squarely applicable to the case of the assessee. As no incriminating documents were found during the course of search, therefore, Explanation 5A to section 271(1)(c) is not applicable. Accordingly, we delete the penalty confirmed by ld. CIT (A).”

| (ii) | | The Mumbai Bench of this Tribunal in Financial Technologies (I) Ltd. v. Asstt. CIT (Mumbai) has held as under: |

“23. When we analyse the expressions used in clause (i) to Explanation 5A, we find that the expressions used are definite to use the words “any money, bullion, jewellery or other valuable article or thing (hereafter in this Explanation referred to as assets) and the assessee claims that such assets have been acquired by him by utilising (wholly or in part) his income for any previous year”. In the instant cases, no addition/disallowance had been made on any money, bullion, jewellery or other article or thing found in the search. Factually, it is not the case of the Revenue as well, because none of the above expressions was a result of the search or have been pointed out by the Revenue authorities.

24. Even when we analyse expressions used in clause (ii) to Explanation, “any income based on any entry in any books of account or other documents or transactions and he claims that such entry in the books of account or other documents or transactions represents his income (wholly or in part) for any previous year”,…, we find that even this shall not apply for the following reasons. ”

41. In view of the aforesaid judicial precedents, and further taking into consideration the fact that the assessee, in compliance with the notice issued u/s.153A of the Act, had offered an additional income of Rs.3,25,88,900/- and since such additional income was not offered on the basis of any incriminating material found during the course of search conducted at the premises of the assessee but rather represents a voluntary disclosure by the assessee, we find no reason to interfere with the findings of the CIT(A) in deleting the penalty of Rs.1,11,89,533/- levied by the AO u/s.271(1)(c) of the Act for the A.Y.2015-16.

42. Since we have affirmed the order of the CIT(A) on multiple substantive grounds, we are of the considered view that the technical issue relating to the issuance of the show cause notice u/s.274 r.w.s 271(1)(c) of the Act, subsequent to the date of the assessment order, is merely of academic relevance. Accordingly, we refrain from rendering any finding thereon.

43. Furthermore, it is pertinent to observe that the Revenue has failed to raise a specific ground of appeal challenging the finding of the CIT(A) that the show cause notice dated 27.03.2022 was invalid, having been issued after the assessment order. Such omission, in our view, renders the entire appeal filed by the Revenue infructuous and devoid of any merit. Accordingly, the grounds of appeal raised by the Revenue for the A.Y.2015-16 are dismissed. In the result, the appeal filed by the Revenue in ITA No.1650/Chny/2025 stands dismissed.

ITA Nos.1651 to 1654/Chny/2025 (AYs.2017-18 to 2020-21)

44. These four appeals of the Revenue are directed against the common order of the CIT(A) dated 12.03.2025, wherein he deleted the penalty imposed by the AO u/s.270A of the Act on account of under-reporting of income consequent to misreporting.

45. The assessee was subjected to a search action u/s.132 of the Act on 25.03.2021. Consequent thereto, the AO issued notices u/s.153A of the Act for the assessment years under consideration. The material facts emerging from the record, relevant for our adjudication, are as under:

| Particulars | AY 2017-18 | AY 2018-19 | AY 2019-20 | AY 2020-21 |

| Date of filing of ROI u/s.139 of the Act | 31.10.2017 | 31.10.2018 | 26.09.2019 | 12.02.2021 |

| Total Income returned originally (Rs.) | 98,53,470 | 1,17,64,060 | 19,29,180 | 20,90,670 |

| Date of issuance of notice u/s.153A of the Act | 10.12.2021 | 10.12.2021 | 10.12.2021 | 10.12.2021 |

| Date of filing of ROI u/s.153A of the Act | 07.03.2022 | 07.03.2022 | 07.03.2022 | 07.03.2022 |

| Total Income returned in the ROI filed u/s.153Aof the Act (Rs.) | 1,76,52,420 | 2,47,74,950 | 1,70,35,810 | 2,07,91,320 |

| Additional Income offered in the ROI filed u/s.153A of the Act (Rs.) | 77,98,950 | 1,30,10,890 | 1,51,06,630 | 1,87,00,650 |

| Basis for offering of additional income by the assessee | Offered voluntarily without the existence of any incriminating material found for the assessment years under consideration |

| Date of completion of the | 24.03.2022 | 24.03.2022 | 24.03.2022 | 24.03.2022 |

| assessment u/s. 143(3) r.w.s 153Aof the Act | | | | |

| Assessed Income (Rs.) | 1,76,52,420 | 2,47,74,950 | 1,70,35,810 | 2,07,91,320 |

| Outcome of quantum assessment | Returned Income by the assessee including the additional income offered has been accepted by the AO without any variation |

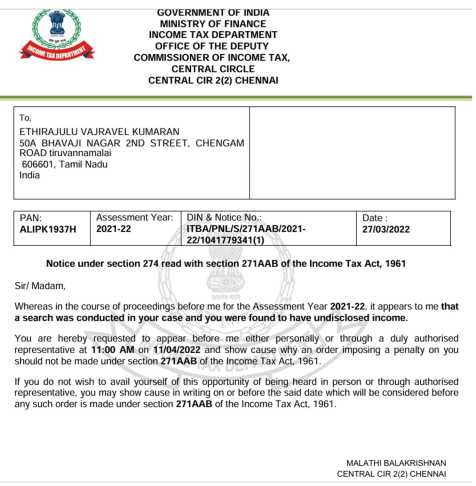

| Penalty initiated by the AO | 270A of the Act |

| Nature of charge/default recorded by the AO in the assessment order relating to initiation of penalty u/s.270A of the Act | Under Reporting of Income |

| Date of issuance of first show cause notice by the AO u/s.274 r.w.s 270A of the Act | 27.03.2022 |

| Nature of charge/default specified by the AO in the show cause supra | Under Reporting of Income |

| Dates of issuance of subsequent show cause notices u/s.274 r.w.s 270A of the Act by the AO | 29.07.2022 & 26.08.2022 |

| Nature of charge/default specified by the AO in the subsequent show cause notices | Under Reporting of Income |

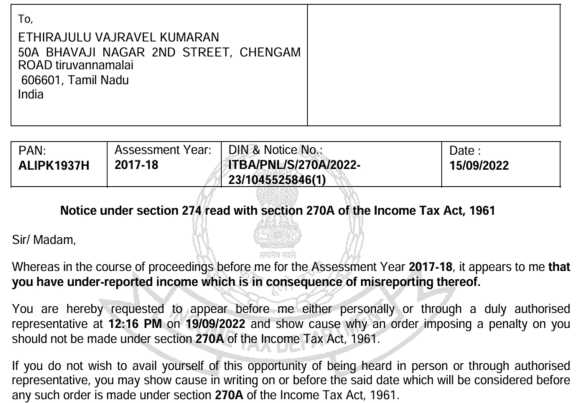

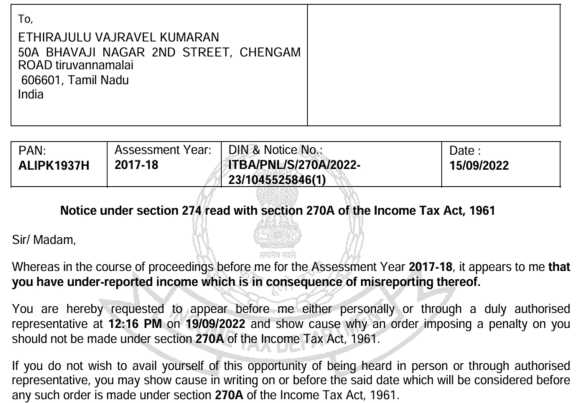

| Date of issuance of final show cause notice u/s.274 r.w.s 270A of the Act by the AO | 15.09.2022 |

| Nature of charge/default specified by the AO in the final show cause notice | Under Reporting of Income in consequence of misreporting thereof |

| Date of passing of penalty order u/s.270A of the Act by the AO | 28.09.2022 | 28.09.2022 | 27.09.2022 | 28.09.2022 |

| Amount of penalty levied (Rs.) | 62,74,154 | 92,46,838 | 1,09,97,688 | 1,46,69,968 |

| Conclusion of the AO and basis for levying penalty u/s.270A of the Act | Under Reporting of Income in consequence of misreporting thereof in view of the additional income offered by the assessee in the return of income filed u/s.153A of the Act. Penalty levied was 200% of the tax sought to be evaded being the difference between the tax on assessed and returned income |

46. Aggrieved by the above penalty orders levying penalty u/s.270A of the Act, assessee preferred appeals before the CIT(A). The CIT(A) vide common order dated 12.03.2025 deleted the penalty imposed by the AO for the impugned assessment years. With the consent of both the parties, A.Y.2017-18 is taken as the lead case, as the facts and issues involved in all the assessment years under consideration are identical. Accordingly, our findings rendered in respect of A.Y.2017-18 shall, mutatis mutandis, apply to the other assessment years.

47. The relevant findings of the CIT(A) in deleting the penalty levied by the AO u/s.270A of the Act are as under:

“6.5. 2 It can be seen from the above that as per subsection (2) of section 270A of the Act, a person is considered to have under-reported his income under six different situations. One among them is that the income assessed is greater than the income tax return processed under clause (a) of sub section (1) of section 143(1) of the Act. In simple term, the clause deals with the situation that result in addition in assessments.

6.5.3 The question of misreporting will arise only when the underreporting of income has been established. The under-reporting and misreporting of income are mutually inextricably linked. It may be appreciated that in the instant case the AO has accepted the return of income and assessment has not resulted in determination of an income greater than the income returned by the appellant.

6.5.4 As the income returned was accepted in total, obviously, there is no transgression of the provisions of section 270A(2) of the Act. In the absence of any such transgression arriving at a conclusion that the Appellant has under-reported income is erroneous. Further the AO in the assessment order has not made any findings as to how the Appellant has misrepresented or suppressed the facts.

6.5.5 In fact, the AO in the assessment order has simply narrated that “Penalty proceedings u/s 270A will be initiated separately for underreporting of income” for all the years under consideration. In the instant case, when the return of income was accepted in total by the AO there can be no case for under-reporting of income and there exists no case of any mis-representation.

6.5.6 Further, to support the above findings, the following judicial decisions are relied upon viz.

In the case of Enrica Enterprises Pvt Ltd v. DCIT (Chennai – Trib.) the Hon’ble Jurisdictional Tribunal had observed as follows:

It could be seen from the assessment order that there is no observation of ‘under reporting of income and under reporting as a consequence of misreporting of income’ either in the assessment order or in the show cause notice u/s.274 r.w.s.270A of the Act specifying the limb of misreporting of income. The addition in the assessment is purely based on sworn statement u/s.132(4) of the Act, but nothing else. Form the above, it is undisputedly clear that the AO has not made out a case of ‘under reporting of income and under reporting as a consequence of misreporting of income’, which falls under Clauses (c) & (d) of sub-section 9 of sec.270A of the Act.

it is undisputedly clear that the appellant has not misrepresented facts with regard to marketing expenditure. Therefore, we are of the considered view that it is not a case of misrepresentation or suppression of facts based on any evidences, but admission of additional income is purely on the basis of statement recorded u/s.134 of the Act, without any reference to incriminating material found as a result of search. Therefore, in our considered view, Clause-(C) of sub-sec.9 to sec.270A, is not applicable.

As regards Clause-(d) of sub-section 9 of section 270A of the Act, which speaks about failure to record investment in the books of accounts. In our considered view, it is not a case of any investment which is not recorded in the books of accounts. Therefore, said Clause is not applicable. In our considered view, the AO is completely erred in invoking said section and levied penalty u/s.270A of the Act. As regards sub Clause (e) to section 270A(9) of the Act, invoked by the Ld.CIT(A), in our considered view, there is no allegation from the AO regarding failure to record any receipt in books of accounts of the assessee having a bearing on total income in so far as estimated disallowance of proportionate marketing expenses. The additional income has been quantified by the Revenue on the basis of estimated disallowance of marketing expenses and such estimation is ad hoc without there being any specific findings with regard to year for which the assessee has inflated expenditure. In absence of any findings as to quantification of inflated expenditure qua each assessment year with reference to total purchase from each party, amount of inflated expenditure, actual cash received back by the assessee. in our considered view, merely because addition was made on the basis of voluntary surrender of income by the assessee, penalty for ‘under reporting of income’ or ‘misreporting of income’ cannot be fastened on the assessee. Therefore, we are of the considered view that even on merits, penalty levied by the AO u/s 270A of the Act, cannot be sustained. Therefore the Tribunal finally held that In our considered view, income voluntarily admitted by the assessee does not constitute ‘under reporting of income’ or ‘misreporting of income’, and thus, in our considered view, penalty levied u/s.270A of the Act is unsustainable in law on merits, and thus, we quashed the order passed by the AO imposing penalty u/s.270A(9) of the Act

In the case on hand the survey took place before the income tax returns were filed by the appellant and there is no case for even a voluntary surrender as the appellant had during the survey informed about his source of income which was subsequently disclosed in his return of income.

In the case of Greenwoods Govt. Officers Welfare Society v. DCIT (Delhi – Trib.) the Hon’ble Delhi Tribunal had held that Where fact of earning interest income and miscellaneous income had been duly disclosed by assessee in its accounts and in original return with full details, it could not be alleged that assessee was guilty of under-reporting and/or misreporting of income penalty under section 270A was not exigible

In the case of Kavita Jasjit Singh v. CIT(A) (Mumbai – Trib.) the Honble Mumbai Tribunal had held that Where during scrutiny assessment proceedings, assessee suo moto furnished a revised computation and offered interest on income tax refund to tax, non-declaration of interest on income tax refund while filing return of income could not be said to be under-reporting of income by assessee within meaning of section270A and, thus, penalty levied under section 270A was to be deleted

In the case of PCIT v. Prafulbhai Vallabhdas Fuletran (Gujarat) the Honble Gujarat High Court had held that Where assessee had offered Long Term Capital Gain (LTCG) in his return of income filed under section 139 on basis of seized papers and Assessing Officer completed assessment by accepting said LTCG, since income assessed was not greater than income determined in return processed under section 143(1)(a),there was no case of under reporting of income as per provisions of section 270A(2)and (3) and, thus, penalty under section 270A was to be deleted.

In the case of Saltwater Studio LLP v. NFAC, Delhi the Hon’ble Mumbai Tribunal vide order dated 22.5.2023 in I.T.A. No.13/Mum/2023 had held that since AO failed to bring the addition/disallowance he made in quantum assessment, under the ken of (a) to (f) of the sub-section(9) of section 270A of the Act, the penalty levied for misreporting @ 200% cannot be sustained because it is trite law that penalty provisions have to be strictly interpreted. And therefore, taking into consideration, the facts and circumstances of the case, we find that the levy of penalty by the AO u/s 270A of the Act suffers from the vice of nonapplication of mind as well as violates principles of natural justice.

In the case of Schneider Electric South East Asia (HQ) Pte. Ltd. v. ACIT (Delhi) the Hon’ble Delhi High Court had held that Where in penalty notice, Assessing Officer failed to specify limb of’ underreporting’ or ‘misreporting’ of income, under which penalty proceedings had been initiated, penalty notice was erroneous and arbitrary and, thus, petitioner was to be granted immunity under section 270AA

6.5.7 The undersigned upon examination of the various decisions relied upon supra, the decision of the jurisdictional tribunal in the case of Enrica Enterprises Pvt Ltd v. DCIT (Chennai – Trib.) is more relevant and squarely applies to the case of the appellant. The jurisdictional tribunal in its order dated 30.05.2024 has categorically explained that ‘under reporting of income’ and ‘misreporting of income’ shall not be used interchangeably, nor are they synonymous, but each operates under strict definition and do not overlap each other, thus the department, before initiating penalty proceedings, should specifically arrive at a satisfaction to the effect that, for which charge, AO has initiated penalty proceedings u/s.270A;

6.5.8 While explaining the above the Hon’ble Tribunal relied upon the decision of the Hon’ble Apex Court in the case of SSA’s Emerald Meadows, Madras HC judgment in Babuji Jacob, Karnataka HC in Manjunatha Cotton & Ginning Factory, Delhi HC judgment in Prem Brothers Infrastructure wherein it was held that in view of vague notice without any whisper as to which limb of section 270A is attracted and how ingredients of Section 270A(9) is specified, initiation of penalty under Section 270A for ‘under-reporting of income’ is not only erroneous, but also arbitrary and bereft of any reason.

6.5.9 The undersigned also relies upon the recent decision of the Hon’ble ITAT Bengaluru rendered in the case of Nateshan Sampath v. DCIT in ITA No. 1779/Bang/2024, dated 22.1.2025 where in the Hon’ble Tribunal held as under.

“5.2 On plain reading of the same, we are of the opinion that when a notice u/s 270A of the Act is issued, the following step ladder should be followed by the AO while levying penalty u/s 270A of the Act.

| 1. | | Underreporting – First the onus is on the AO to establish whether any of the contingency spoken of in clauses (a) to (g) of Section 270A(2) in the case of the assessee are attracted or not. If Yes, under which clause (limb) the assessee has underreported the income? |

| 2. | | Now the onus shifted on the assessee to refute by establishing that the assessee falls within any of the clauses (a) to (e) of section 270A(6) of the Act & hence there is no underreporting of income & the proceedings end there. Section 270A(6) is a window given by the legislature to give a leave to the Assessee. |

| 3. | | If the assessee is not able to controvert the charge of under reporting, the under reporting gets confirmed. |

| 4. | | Once the charge of underreporting is confirmed, then the AO has to establish whether the underreporting is in consequence of any of the clauses (a) to (f) of Section 270A(9) of misreporting. If Yes, under which clause (limb) the assessee has misreported the income? |

5.3 Therefore, we are of the considered opinion that without the charge of under reporting of income, the AO cannot straightaway jump with the charge of misreporting of income. In the present case the AO without even a whisper as to how the ingredient of sub-section (2) of section 270A is satisfied, has also not specifically mentioned the exact limb of misreporting as per section 270A(9) of the Act. Further, the AO stated under reported income amounting to Rs.91,47,331/- in his penalty order but levied 200% penalty.

5.4 By respectfully following the judgment of Hon’ble High court of Delhi in the case of Schneider Electric South East Asia (HQ) PTE Ltd. V. Commissioner of Income Tax (International Taxation) & Ors. (2022) 443 ITR 186, we are of the considered view that failure on the part of the AO to show cause which of the specific action of the assessee company from clause (a) to (f) of Section 270A(9) was determinant before imposing penalty u/s 270A of the Act has rendered the proceedings invalid and thus untenable in the eyes of law.”

6.5.10 In the present case, on examination of the assessment order, it has been found that the AO has not specifically mentioned as to which limb of section 270A of the Act is attracted and how the ingredients of Section 270A(9) of the Act is specified. In view of this, the satisfaction arrived by the AO in initiating proceedings u/s 270A of the Act is only ambiguous. Further as evident in the records, the AO at the first instance initiated penalty proceedings u/s 270A of the Act for under reporting of income vide notice dated 27.03.2022 and continued in the subsequent show cause notice (s) issued on 29.07.2022 & 26.08.2022. However, the AO suddenly shifted the stand and issued show cause notice u/s 270A of the Act for underreporting in consequence of mis-reporting for the first time on 15.09.2022. This sudden shift in stand by the AO affirms the fact that the AO was not clear as to the right levy of charge in the case of the appellant. Therefore, the levy of penalty u/s 270A of the Act for under-reporting of income in consequence of mis-reporting of income is not legally tenable as per various judicial decision(s) discussed as supra.

6.5.11 In view of the above discussion and judicial precedents relied upon, the undersigned is of the considered view that there exists no prima facie case when the AO failed to bring on record of any findings that the appellant has under-reported income in consequence of mis-reporting of income, when the return of income was accepted in toto. Accordingly, all the grounds raised by the Appellant upon the levy of penalty u/s 270A of the Act are hereby treated as allowed and the AO is hereby directed to delete the penalty levied u/s. 270A of the Act amounting Rs.62,74,154/-, Rs.92,46,838/-, Rs.1,09,97,688/- & Rs.1,46,69,968/- for the AY(s) 2017-18, 2018-19, 2019-20 & 2020-21.”

48. Aggrieved of the above order of the CIT(A) in deleting the penalty levied u/s.270A of the Act, the Revenue is in appeal before us raising the following grounds of appeal:

| 1. | | “The order of the learned Commissioner of Income Tax (Appeals) is erroneous on facts of the case and in law. |

| 2. | | The Ld.CIT(A) erred in deleting the penalty without appreciating the assessee did not declare the additional income voluntarily but had declared the same only after the proceedings of the search unearthed the undisclosed income, thereby rendering it not voluntary to claim immunity from penalty proceedings. |

| 3. | | The Ld.CIT(A) failed to take cognizance of the decision of the Hon’ble Supreme Court in the case of MAK Data (P.) Ltd. (supra) wherein the Hon’ble Supreme Court held that where surrender of income not being voluntary in nature, authorities below were justified in levying penalty under section 271(1)(c). |

| 4. | | For these grounds and any other ground including amendment of grounds that may be raised during the course of the appeal proceedings, the order of learned CIT (Appeals) may be set aside and that of the Assessing Officer be restored.” |

49. The Ld.DR submitted that the additional income disclosed by the assessee during the course of post-search proceedings, and further admitted by way of inclusion in the Return of Income filed u/s.153A of the Act, is an admitted fact and remains undisputed. In such circumstances, the Ld.DR contended that irrespective of whether such income was declared voluntarily by the assessee in any return of income filed subsequent to the date of search, the legal consequence u/s.270A of the Act is that the assessee has misreported his income. Further, the Ld.DR placing reliance upon the judgment of the Hon’ble Supreme Court in the case of MAK Data (P.) Ltd. (supra) submitted that penalty proceedings are not dependent on the voluntary disclosure of income and that penalty is leviable notwithstanding the voluntary admission of concealed income by the assessee. Placing further reliance on the findings recorded in the penalty order, the Ld.DR vehemently contended that the AO has correctly and lawfully invoked the provisions of Section 270A(9) of the Act to levy penalty on account of underreporting of income consequent to misreporting. It was further argued that the Ld.CIT(A) has erred in law and on facts in deleting the penalty, without properly appreciating the nature of misreporting. In light of the above submissions, the Ld.DR prayed that the impugned order of the CIT(A) deleting the penalty be set aside, and the penalty levied by the AO u/s.270A of the Act be restored and confirmed in toto.

50. Per contra, the Ld.AR placed strong reliance upon the order of the CIT(A) and submitted that the said order is a reasoned and well-founded order. It was argued that the CIT(A), after duly considering and following various judicial precedents, has rightly deleted the penalty levied by the AO u/s.270A of the Act. According to the ld.AR, the act of the CIT(A) in deleting the penalty by relying upon binding judicial precedents cannot, by any stretch, be regarded as erroneous. Accordingly, the ld.AR urged that the order of the CIT(A) deserves to be sustained.

51. The Ld.AR further submitted that the CIT(A) has deleted the penalty on the legal ground holding that the preliminary as well as the final show cause notices issued by the AO are defective, as they fail to specify the precise charge/default in terms of section 270A(2)/(9) of the Act. It was further contended that the Revenue, in its memorandum of appeal, has not raised any ground challenging the aforesaid legal finding of the CIT(A). In such circumstances, according to the ld.AR, the present appeals preferred by the Revenue are rendered infructuous and liable to be dismissed in limine.

52. The Ld.AR further contended that, in terms of the provisions of Section 270A(1) of the Act, penalty proceedings u/s.270A of the Act can be initiated only “during the course of any proceedings” under the Act. It was argued that such initiation necessarily implies that the penalty show-cause notice u/s.274 r.w.s Section 270A of the Act ought to be issued and served simultaneously with the assessment order. According to the Ld.AR, any penalty show-cause notice issued subsequent to the passing of the assessment order cannot be regarded as a valid notice in the eyes of law, and consequently, no penalty can be sustained on the strength of such invalid initiation.

53. In support of the above argument, Ld.AR placed reliance on the judgment of the Hon’ble Delhi High Court in CIT v. Rajinder Kumar Somani (Delhi), as well as on the decision of the Coordinate Bench of this Tribunal in Srinivasan Chandrasekara Chandilya (supra).

54. Adverting to the facts of the present case, the ld.AR pointed out that the assessment orders for the assessment years under consideration were passed on 24.03.2022, whereas the first penalty show-cause notice u/s.274 r.w.s 270A of the Act was issued only on 27.03.2022, i.e., three days subsequent to the completion of the assessment. It was therefore emphasized that, as the initiation of penalty proceedings occurred after the conclusion of assessment proceedings, the statutory requirement of initiation “during the course of any proceedings” was not satisfied. Accordingly, the ld. AR submitted that the penalty proceedings are invalid in law and no penalty can survive against the assessee.

55. The ld.AR submitted that the first show cause notice issued by the AO on 27.03.2022 specified the charge for levy of penalty as “under-reporting of income” within the meaning of Section 270A of the Act. However, in the subsequent and final show cause notice dated 15.09.2022, which was issued merely 13 days prior to the passing of the penalty order, the AO materially altered the charge by stating the proposed default as “under-reporting of income in consequence of misreporting”, and thereafter proceeded to levy penalty on the said modified charge. It was contended by the Ld.AR that the jurisdiction to initiate penalty proceedings emanates only from the first show cause notice, and it is the charge specified therein which governs the scope of penalty proceedings. Any subsequent modification of such charge, as attempted by the AO in the final notice, is legally untenable and cannot confer jurisdiction upon the AO to levy penalty for a ground distinct from what was originally initiated.

56. The ld.AR further submitted that the initial notice dated 27.03.2022 initiated penalty proceedings exclusively for underreporting of income. However, the penalty has ultimately been levied on the ground of misreporting of income, which is a qualitatively different default u/s.270A of the Act and carries substantially higher consequences. This, according to the Ld.AR, vitiates the entire proceedings, as the assessee was never put to notice regarding the specific charge of misreporting at the stage of initiation. Such a course of action, where the penalty is initiated on one charge and levied on another, renders the show cause notice defective and invalid in law.

57. Consequently, it was submitted that the first show cause notice dated 27.03.2022, issued u/s.274 r.w.s 270A of the Act, being defective and lacking in jurisdiction, invalidates the entire penalty proceedings, and therefore the penalty order ultimately passed by the AO u/s.270A of the Act is liable to be quashed as null and void.

58. In support of the aforesaid propositions, the ld.AR placed reliance upon the decisions of the coordinate benches of this Tribunal in Landcraft Developers (P.) Ltd. v. ACIT [IT Appeal No. 1062/Del/2019, dated 08.01.2024], and Samiappagounder Dharmaraj v. Addl. CIT [ITA No. 1415/Chny/2023, dated 29.05.2024], wherein it has been consistently held that the charge specified in the initial show cause notice alone is relevant for conferring jurisdiction upon the AO, and any subsequent modification or substitution of the charge cannot sustain the penalty proceedings.

59. The Ld.AR further contended that even the final show cause notice dated 15.09.2022 suffers from a fundamental defect, inasmuch as it fails to specify the particular limb or clause of Section 270A(9) of the Act under which the penalty proceedings were sought to be initiated. It was argued that the omission to mention the relevant clause renders the notice inherently vague, invalid, and bad in law. Consequently, any penalty imposed pursuant to such a defective notice cannot be sustained in the eyes of law.

60. The Ld.AR emphasized that Section 270A(9) of the Act enumerates six distinct circumstances/limbs wherein misreporting of income attracts penal consequences. The AO, being statutorily bound, is under a legal obligation to clearly indicate in the notice the precise clause of sub-section (9) sought to be invoked. In the present case, however, the notice is wholly ambiguous and fails to apprise the assessee of the specific allegation of misreporting.

61. It was further submitted that the vagueness of the notice has caused serious prejudice to the assessee, as he was left in a state of uncertainty and confusion, unable to discern the exact default alleged and, consequently, deprived of an effective opportunity to defend himself. In other words, the assessee was kept in the dark as to the precise charge that necessitated a reply, thereby vitiating the very foundation of the penalty proceedings.

62. In light of the above, the Ld. AR submitted that the CIT(A) has correctly appreciated the legal infirmity and rightly deleted the penalty levied by the AO u/s.270A of the Act on the basis of an invalid and unsustainable show cause notice. Accordingly, the ld. AR prayed that the appeals filed by the Revenue be dismissed and the order of the Ld. CIT(A) be upheld in toto.