Uploading SCN to ‘Additional Notices’ Tab Without Alert is Not Valid Service; Ex-Parte Order Remanded.

Issue

Whether the uploading of a Show Cause Notice (SCN) and subsequent order solely under the “View Additional Notices and Orders” tab on the GST portal—without sending an email/SMS alert or uploading it to the standard “Notices” tab—constitutes valid service under Section 169 of the CGST Act, satisfying the principles of natural justice.

Facts

Period: 2019-20.

The Defect: The GST department uploaded the SCN, reminder letters, and the final adjudication order under the “Additional Notices and Orders” tab on the GST portal.

Petitioner’s Stand: The petitioner contended that they were unaware of these proceedings because the “Additional Notices” tab was distinct from the regular “View Notices” tab and was not easily visible or monitored. Consequently, no reply was filed, and the order was passed ex-parte.

Judicial Context: This issue has been a subject of multiple recent writ petitions (e.g., M/s GMT Garments, Shri Ram Sharma in Delhi HC), where courts have acknowledged that the portal’s design (prior to updates in Jan 2024) made it difficult for taxpayers to notice communications in this specific tab.

Decision

The High Court (likely Delhi High Court based on similar recent judgments) ruled in favour of the assessee regarding the denial of natural justice.

Ineffective Service: The Court held that burying a notice in a secondary tab without a proactive alert does not grant the assessee a “proper opportunity to be heard.”

Remand: Since the order was passed without considering the assessee’s defense (due to non-service), the impugned order was set aside. The matter was remanded back to the Adjudicating Authority to decide afresh after giving the petitioner a chance to file a reply and be heard personally.

Key Takeaways

Portal Glitches vs. Rights: Courts are consistently protecting taxpayers from ex-parte demands arising solely because notices were uploaded to obscure sections of the GST portal (“Additional Notices” tab) without proper alerts.

Natural Justice: The right to be heard is substantive. If the mode of digital service fails to effectively communicate the notice, the resulting order is legally unsustainable.

Validity of Limitation Extension for FY 2019-20 (Notifications 9/2023 & 56/2023) is Sub Judice.

Issue

Whether Notification No. 9/2023-Central Tax and Notification No. 56/2023-Central Tax (and corresponding State notifications), which extended the time limit for passing orders under Section 73 for FY 2018-19 and 2019-20, are ultra vires the CGST Act, specifically regarding the powers under Section 168A.

Facts

The Notifications:

No. 9/2023-CT (31.03.2023): Extended time limit for FY 2017-18, 18-19, and 19-20.

No. 56/2023-CT (28.12.2023): Further extended time limit for FY 2018-19 and 19-20.

The Challenge: The assessee argued that these notifications were issued without the existence of “force majeure” circumstances (like COVID-19) at the time of issuance and thus violated Section 168A.

Current Status: The validity of these notifications has been challenged across various High Courts, with conflicting views (e.g., upheld by Allahabad/Kerala/Telangana, quashed by Gauhati/Madras). The matter is now pending before the Supreme Court (e.g., M/s HCC-SEW-MEIL-AAG JV case).

Decision

The High Court disposed of this specific ground by linking it to the higher court’s verdict.

Subject to Outcome: The Court directed that the petitioner’s challenge to the validity of these notifications shall survive and be subject to the final outcome of the pending Supreme Court and High Court decisions.

Partial Relief: While the matter was remanded on facts (Case I), the legal challenge regarding limitation (Case II) remains open. If the Supreme Court eventually strikes down the notifications, the demand for the extended period will automatically be quashed.

Key Takeaways

Protective Litigation: Taxpayers are raising the “validity of notification” ground in writ petitions to keep their rights alive. If the SC rules in favor of taxpayers later, those who challenged the notifications will benefit.

No Immediate Stay: Most High Courts are not staying the proceedings entirely but are allowing adjudication to continue, with the final liability being contingent on the Supreme Court’s ruling on the limitation issue.

CM APPL. 67705/2025

“1. The subject matter of challenge before the High Court was to the legality, validity and propriety of the Notification No.13/2022 dated 57-2022 & Notification Nos.9 and 56 of 2023 dated 31-3-2023 & 8-12-2023 respectively.

2. However, in the present petition, we are concerned with Notification Nos.9 & 56/2023 dated 31-3-2023 respectively.

3. These Notifications have been issued in the purported exercise of power under Section 168 (A) of the Central Goods and Services Tax Act. 2017 (for short, the “GST Act”).

4. We have heard Dr. S. Muralidhar, the learned Senior counsel appearing for the petitioner.

5. The issue that falls for the consideration of this Court is whether the time limit for adjudication of show cause notice and passing order under Section 73 of the GST Act and SGST Act (Telangana GST Act) for financial year 20192020 could have been extended by issuing the Notifications in question under Section 168-A of the GST Act.

6. There are many other issues also arising for consideration in this matter.

7. Dr. Muralidhar pointed out that there is a cleavage of opinion amongst different High Courts of the country. 8. Issue notice on the SLP as also on the prayer for interim relief, returnable on 7-3-2025.”

“65. Almost all the issues, which have been raised before us in these present connected cases and have been noticed hereinabove, are the subject matter of the Hon’ble Supreme Court in the aforesaid SLP.

66. Keeping in view the judicial discipline, we refrain from giving our opinion with respect to the vires of Section 168-A of the Act as well as the notifications issued in purported exercise of power under Section 168-A of the Act which have been challenged, and we direct that all these present connected cases shall be governed by the judgment passed by the Hon’ble Supreme Court and the decision thereto shall be binding on these cases too.

67. Since the matter is pending before the Hon’ble Supreme Court, the interim order passed in the present cases, would continue to operate and would be governed by the final adjudication by the Supreme Court on the issues in the aforesaid SLP-4240-2025.

68. In view of the aforesaid, all these connected cases are disposed of accordingly along with pending applications, if any.”

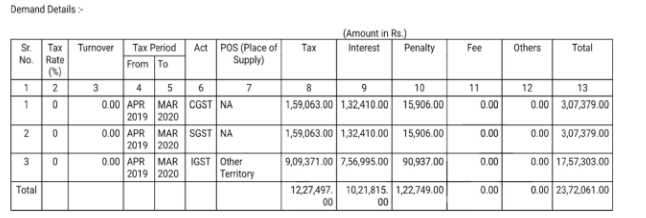

And whereas, the taxpayer had neither deposited the proposed demand nor filed their objections/ reply in DRC-06 within the stipulated period of time, therefore, following the Principle of Natural Justice, the taxpayer was granted opportunities of personal hearing for submission of their reply/objections against the proposed demand before passing any adverse order.

And whereas, neither the taxpayer filed objections/reply in DRC 06 nor appeared for personal hearing despite giving sufficient opportunities, therefore, the undersigned is left with no other option but to upheld the demand raised in SCN/DRC 01. DRC 07 is issued accordingly.