Prior deposit of Rs. 2.01 Cr to be considered; Appeal to Tribunal allowed without further pre-deposit

Issue

Whether the Adjudicating and Appellate Authorities erred in confirming penalties for fraudulent ITC availment against the company and its directors without considering a substantial pre-notice deposit of Rs. 2.01 crore made during earlier registration restoration proceedings, and whether the petitioner can pursue a statutory appeal before the newly constituted GST Appellate Tribunal without additional pre-deposit.

Facts

Background: The petitioner (A And T Security Services Pvt Ltd), engaged in security services, had its GST registration cancelled in 2019 for non-filing of returns.

Restoration & Deposit: To restore registration, the petitioner appealed and subsequently deposited approximately Rs. 2.01 crore. The registration was restored in August 2021.

The New Demand: In July 2024, a fresh Show Cause Notice (SCN) was issued alleging fraudulent availment of Input Tax Credit (ITC).

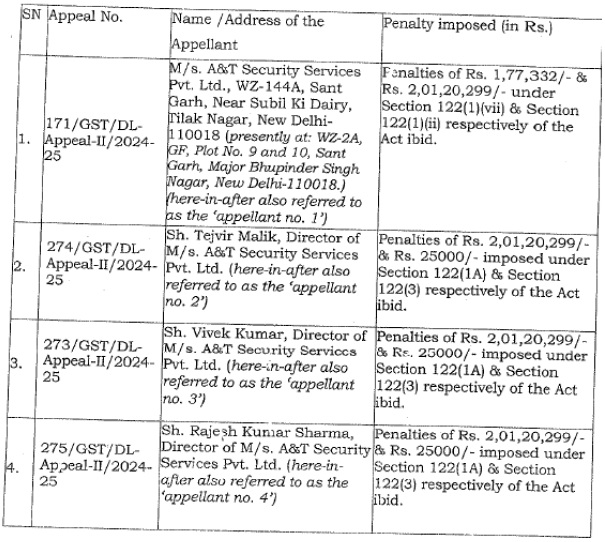

The Impugned Order: The Adjudicating Authority imposed penalties on the company and its directors under Section 122. The Appellate Authority affirmed this in an order dated 16 May 2025, ignoring the petitioner’s submission regarding the Rs. 2.01 crore already deposited.

Petitioner’s Plea: The penalties were maintained due to a complete non-application of mind regarding the pre-existing deposit, which covered the alleged liability.

Decision

Lapse in Adjudication: The Delhi High Court held that the failure of both authorities to consider the substantial deposit of Rs. 2.01 crore—despite it being disclosed in the reply to the SCN—constituted a significant lapse in adjudication.

Relegation to Tribunal: Since the GST Appellate Tribunal (GSTAT) has now been constituted, the Court directed the petitioner to pursue their statutory appeal there.

Directions to Tribunal:

The Tribunal must verify and consider the documents evidencing the deposit of Rs. 2.01 crore.

Director Penalty: Under the statutory scheme, if tax and interest are paid pre-notice, the penalty on directors may not sustain.

Company Penalty: The penalty on the company warrants reconsideration subject to linking the earlier payment with the current allegations.

Waiver of Pre-deposit: Recognizing the substantial amount already with the Department, the Court permitted the petitioner to file the appeal without any further pre-deposit.

Ruling: The writ petition was disposed of with directions to file the appeal before the Tribunal, which is to be decided on merits without dismissing it for delay.

Key Takeaways

Pre-SCN Payments Count: Payments made during earlier proceedings (like revocation of cancellation) must be accounted for in subsequent demand proceedings. Ignoring such deposits vitiates the penalty order.

Director Immunity: If the primary tax liability is discharged before the SCN (Section 73/74 closure), separate penalties on directors under Section 122 are often legally unsustainable.

Tribunal Access: With the GSTAT becoming functional, High Courts are increasingly relegating writ petitioners to the Tribunal. However, in cases of prior substantial deposits, Courts may grant a specific waiver from the mandatory 20% pre-deposit required for Tribunal appeals.

CM APPL. Nos. 69009,69024.69532, 69533, 69537 and 69538 of 2025