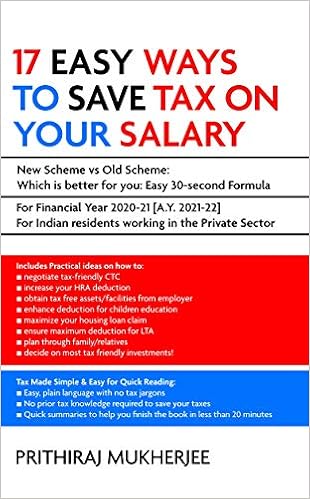

17 Easy Ways to Save Tax on Your Salary

Buy Online Rs 299 Click here

This is a jargon-free book which will tell you exactly how to save taxes on your salary income. It lays out in an extra simplified manner some of the hidden deductions and great tax-free benefits which will drastically bring down your taxes.

You will also be able to effortlessly understand the new scheme of taxation so that you may enhance your tax savings using the same. It includes few quick formulas using which you will readily know whether you should opt for the new scheme or continue with the old scheme of taxation. Also is included a table which will instantly show you how much deduction under the old scheme of taxation will result in greater tax savings as compared to the new scheme.

The book facilitates a clear understanding of how modern salary packages are drafted and how you should calculate your take-home salary from your CTC. It will guide you on how to negotiate the most optimum tax-friendly salary packages/CTC so that it enhances your net earnings and results in greater wealth generation.

Since this book is written specifically for Indian citizens/residents working in the private sector who are below 60 years, it is crisp, clear and without any confusing and irrelevant discussions.

About the Author: Prithiraj is a Chartered Accountant from India as well as a Charter Holder from Ireland specializing in taxation. He also holds a Master’s Degree in Finance by graduating cum laude from the University of Leiden, Netherlands. He has over 20 years of experience in taxation/finance, having worked in several countries of Europe and in India in Big 4 consultancy firms as well as heading the tax function of large corporates. Prithiraj is an incessant problem solver and is passionate about simplifying the complexities faced by his clients. He is also an avid reader, traveler, history enthusiast and a spiritual adventurer.