ORDER

Waseem Ahmed, Accountant Member.- The present appeal has been instituted by the assessee against the order of the Ld. CIT(A) passed u/s 250 of the Act dt. 20.06.2025

2. The assessee in the memo of appeal raised multiple grounds numbered 1 to 7 and sub-grounds thereunder, which we, for the sake of brevity and convenience, are not inclined to reproduce here.

3. The issues raised by the assessee are that the ld. CIT-A erred affirming the AO’s view regarding the year of acquisition as 1998-99 instead of year 1996-97 and the disallowance of cost improvement. All the other issues are interconnected.

4. The brief facts of the case are that the assessee did not file her ROI u/s 139(1) of the Act. The case of assessee was selected under Non-filers Monitoring System (NMS) category on account of sale of immovable property and receipt of professional income. In view of nonfiling of return of income u/s 139(1) of the Act, the assessee’s case was selected for reassessment proceedings under section 147 of the Act on the allegation of income escaping assessment.

5. The assessee filed ITR in response to the notice issued u/s 148 of the Act for the captioned AY and offered an income for taxation to the tune of Rs. 14,44,910/- only.

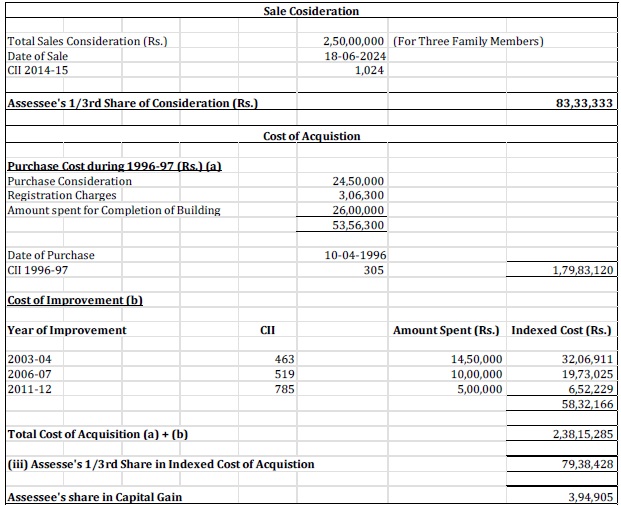

5.1 In response to the notice issued u/s 142(1) of the Act, the assessee submitted that assessee had an immovable property which was sold for a total consideration of Rs. 2.5 crore, in which the assessee held a 1/3rd share. The Capital gain arising from such transaction was calculated by the assessee as follows:

6. The learned Assessing Officer accepted the assessee’s contention with respect to ownership of one-third share in the property. However, in relation to the cost inflation index adopted by the assessee, the AO observed that the assessee had taken the date of purchase of the impugned property as 10.04.1996, falling in the financial year 1996-97, for which the applicable CII was 305. The AO, however, noted that the purchase deed reflected the date of purchase as 12.06.1997 and that the deed was registered on 24.04.1998, which pertains to the financial year 1998-99, for which the applicable CII was 351.

7. With regard to construction cost of Rs. 26 lacs incurred during the year 1996-97, the assessee submitted that at the time of purchase of the immovable property, it was a semi-finished building. However, at the time of sale, it was a fully completed building which is evident from the purchase & sales deed. Therefore, it can be reasonably contended that the construction activity was carried out by the assessee.

8. With respect to the indexed cost of improvement of Rs. 58,32,166/-claimed by the assessee over different FY, the Assessing Officer held that, in the absence of any supporting documentary evidence, the claim could not be verified. Accordingly, the AO disallowed the entire construction cost and improvement cost and restricted the deduction to the assessee’s one-third share of the purchase cost along with registration charges of Rs. 3,06,300 for the purpose of computing capital gains. The AO re-computed the capital gain of assessee as follows:

| Sales Consideration | Rs. 2,50,00,0000/- |

| Less: Indexed Cost of Purchase (CII =351) (27,56,300 X 1024/351) | Rs. 80,47,171/- |

| Total Taxable Long Term Capital Gain | Rs. 1,69,58,829/- |

| 1/3rd Share ofAssessee | Rs. 56,52,943/- |

9. Therefore, the AO added the sum of Rs. 52,58,038 to the total income of the assessee under the head capital gains to the income returned by assessee for an amount of Rs. 3,94,905/- only.

10. Aggrieved by the order of AO, the assessee preferred an appeal before the Ld. CIT(A).

11. Before the Ld. CIT(A), the assessee, more or less, reiterated the same contentions as advanced before the AO regarding the computation of capital gain.

12. Further, with regard to the absence of documentary evidence in support of the construction cost of Rs. 26 lakh and improvement cost of Rs.58,32,166, the assessee relied upon clause (5) of Rule 6F of the Income-tax Rules, 1962. It was submitted that the construction and improvement activities were carried out during the financial years 1996-97 to 2011-12, which were beyond the statutory period of six years as on 31.03.2016. It was further contended that the major construction had been completed more than ten years prior to 30.06.2016, whereas the notice under section 148 of the Act was issued only on 05.04.2022.

13. However, the learned CIT(A) upheld the action of the Assessing Officer in adopting the Cost Inflation Index of 351 for FY 1998-99 instead of 305 for FY 1996-97. The ld. CIT(A) observed that the purchase deed of the impugned property was registered on 24.04.1998 and, therefore, the year of acquisition was correctly taken as FY 199899.

13.1 The ld. CIT(A) further noted that no additional evidence under Rule 46A was filed to establish that possession was given or full consideration was paid in FY 1996-97. In the absence of independent corroborative evidence such as bank statements or utility bills to prove earlier possession or payment, the finding of the AO was confirmed.

13.2 The learned CIT(A) sustained the disallowance of cost of construction of Rs.26,00,000 and indexed cost of improvement of Rs.19,44,055 (being one-third of Rs.58,32,166). The Id. CIT(A) held that the appellant failed to furnish any documentary evidence or details to substantiate the expenditure claimed towards construction and improvement of the property during the relevant financial years.

13.3 The plea regarding non-maintenance of records under Rule 6F was rejected in view of the proviso to Rule 6F(5), particularly since the assessment was reopened under section 147 of the Act. It was further noted that the assessee had not filed the original return under section 139(1) of the Act disclosing the capital gains but offered the same only in response to notice issued under section 148 of the Act. In the absence of supporting evidence, the disallowances made by the AO were confirmed.

14. Aggrieved by the order of the Ld. CIT(A), the assessee filed an appeal before us.

15. The Ld. AR before us has submitted a paper book running from pages 01 to 76 containing the written submissions before us, orders of lower authorities, sales & purchase deeds.

15.1 The Ld. AR submitted that the registered purchase deed itself records that the entire consideration was paid by 10.04.1996 and possession of the property was handed over to the assessee on 20.04.1996, as evident from pages 53 and 54 of the paper-book.

15.2 The learned AR further submitted that the provisions of section 2(47)(v) of the Act provide that transfer includes any transaction involving allowing of possession of immovable property in part performance of a contract as referred to in section 53A of the Transfer of Property Act, 1882. Since both payment of consideration and handing over of possession took place during FY 1996-97, the said year ought to be treated as the year of acquisition for indexation purposes.

15.3 It was further contended that the learned CIT(A) erred in doubting the evidentiary value of the registered purchase deed by observing that the factual recitals therein required independent verification from third-party documents. According to the learned AR, the contents of a duly registered document cannot be brushed aside without any contrary material on record, and therefore the Cost Inflation Index applicable to FY 1996-97 was required to be adopted.

16. On the other hand, the Ld. DR before us submitted that mere recitals in the purchase deed cannot be conclusive for determining the year of acquisition for the purposes of indexation. He contended that for invoking the provisions of section 2(47)(v) of the Act read with section 53A of the Transfer of Property Act, 1882, all the conditions prescribed therein must be cumulatively satisfied. According to the Ld. DR, the assessee failed to bring on record any independent evidence to conclusively establish that possession was in fact handed over during FY 1996-97 and that the contract was acted upon in the manner contemplated under section 53A of the Transfer of Property Act, 1882. The Ld. DR therefore prayed that the order of the learned CIT(A) be upheld, and the appeal of the assessee be dismissed.

17. We have heard the rival submissions of both the parties and carefully perused the materials available on record. The controversy before us is confined to the determination of the correct year of acquisition of the impugned immovable property for the purpose of adopting the applicable Cost Inflation Index.

17.1 On examination of the registered purchase deed placed in the paper book, we find that the document clearly records that the entire sale consideration of Rs. 24,50,000/-was paid by 10.04.1996 and possession of the property was handed over to the assessee on 20.04.1996. These recitals have not been controverted by the Revenue authorities by bringing any material on record to show otherwise. Merely because the deed was registered at a later point of time on 24.04.1998, the date of acquisition cannot be shifted to the year of registration when the substantial rights in the property stood transferred earlier.

17.2 Section 2(47)(v) of the Act specifically provides that transfer includes any transaction involving allowing possession of immovable property to be taken or retained in part performance of a contract in the nature referred to in section 53A of the Transfer of Property Act, 1882. Once the possession is handed over in part performance of the contract and the consideration is paid, the transfer is complete for the purposes of the Act, irrespective of the date of registration of the document.

17.3 We are unable to agree with the observation of the learned CIT(A) that the recitals contained in the registered purchase deed require independent corroboration from third-party documents. In the absence of any adverse material brought on record by the Revenue, the contents of a duly registered document cannot be brushed aside merely on suspicion. In view of the above facts and the legal position, we hold that the year of acquisition of the impugned property is FY 1996-97 and, accordingly, the Cost Inflation Index applicable to that year is to be adopted for the purpose of computing the indexed cost of acquisition. Hence, the ground raised by the assessee is therefore allowed.

18. Coming to Ground No. 3, The learned AR before us submitted that the property was only semi-finished at the time of acquisition and that the assessee completed the construction of the ground floor and first floor, which is clearly borne out from the registered purchase deed and the registered sale deed.

19. The Ld. AR drew attention to the schedule of property in the registered purchase deed (page 56 of the paper book), wherein the property is described as a semi-finished building measuring 28 squares, purchased in “as is where is” condition along with all appurtenances. He further referred to the schedule of property in the registered sale deed (pages 60 and 70 of the paper book), which describes the property as a residential building consisting of a ground floor measuring 1,404.25 sq. ft. and a first floor measuring 1,404.25 sq. ft.

19.1 It was therefore contended that the property was under construction at the time of acquisition and that the assessee subsequently completed the construction of the residential building comprising ground floor and first floor, which was ultimately sold during FY 2014-15. Accordingly, the learned AR submitted that the assessee is entitled to deduction of such cost of construction from the full value of consideration while computing income chargeable under the head “Capital Gains” in accordance with the provisions of section 48 of the Income-tax Act, 1961.

20. Per contra, the Ld. DR submitted that the assessee has failed to substantiate the claim of having incurred any cost of construction with cogent and reliable evidence. He contended that except for the description in the sale deed, no independent material such as approved building plans, completion certificate, bills, vouchers, or proof of payments to contractors has been placed on record to establish that the alleged construction was carried out by the assessee after acquisition of the property. The Ld. DR therefore supported the orders of the lower authorities and prayed that the disallowance of the claimed cost of construction while computing long-term capital gains be sustained.

21. We have heard the rival submissions of both the parties and carefully perused the materials available on record. The issue before us is whether the assessee is entitled to deduction of cost incurred for completion of construction of the building while computing capital gains. From the perusal of the registered purchase deed, we find that the schedule property acquired by the assessee was described as a semifinished building purchased in “as is where is” condition. On the other hand, the registered sale deed describes the same property as a fully constructed residential building consisting of a ground floor and a first floor with specified built-up area. The difference in the description of the property in the purchase deed and the sale deed clearly establishes that the construction of the building was completed by the assessee after acquisition of the property.

21.1 It is also noted that the assessee is a co-owner along with two other owners, and the department has not disputed or raised any issue in respect of construction costs claimed by the other co-owners. This reinforces the genuineness of the assessee’s expenditure attributable to his share of the property.

21.2 The authorities below have disallowed the claim solely on the ground that the assessee failed to furnish documentary evidence such as bills or vouchers in support of the construction expenditure. In our considered view, once it is undisputed that the property was semifinished at the time of purchase and fully constructed at the time of sale, the construction expenditure incurred by the assessee cannot be doubted. The fact of construction stands established from the registered documents themselves.

21.3 While the exact quantification of expenditure may require verification, the claim cannot be rejected entirely merely for want of bills, particularly when the construction relates to a period far back in time and the existence of construction activity is otherwise evident from the record. The Assessing Officer was therefore not justified in making a blanket disallowance of the cost of construction.

21.4 It is an undisputed fact that the assessee is a co-owner of the impugned immovable property holding a one-third share therein, along with two other co-owners. It is also not in dispute that the Assessing Officer has accepted the computation of capital gains, including the year of acquisition, adoption of Cost Inflation Index, and allowance of cost of construction and improvement, in the cases of the other two co-owners.

21.5 We find that the impugned additions and disallowances have been made only in the hands of the present assessee, despite the fact that the property is the same, the period of acquisition is identical, the nature of construction and improvement is common, and the mode of computation of capital gains arises out of the same transaction. The Revenue has not brought on record any distinguishing features or adverse material to justify a different treatment in the case of the assessee as compared to the other co-owners.

21.6 It is a settled principle where co-owners of the same property are similarly placed and the facts are identical; the Revenue cannot adopt inconsistent stands in the cases of different co-owners without any cogent reason. In the absence of any material difference in facts, parity and consistency demand that the assessee be treated on the same footing as the other co-owners.

21.7 Accordingly, following the principle of consistency and in the interest of judicial discipline, we hold that the assessee is entitled to the same treatment as adopted by the other co-owners. The year of acquisition, adoption of Cost Inflation Index, and allowance of cost of construction and improvement as accepted in the cases of the other co-owners are directed to be applied mutatis mutandis in the case of the present assessee. In view of the above, we hold that the assessee is entitled to deduction of cost incurred for completion of construction while computing capital gains under section 48 of the Act. Hence, the ground raised by the assessee is therefore allowed.

22. With respect to Ground Nos. 4 to 7, we note that the issues on hand have been decided favouring assessee in the preceding paragraphs. Accordingly, we are not inclined to deal with the issue of impugned ground of appeal, treating them infructuous. Hence, we dismiss the same accordingly.

23. In the result, the appeal of the assessee is partly allowed.