ORDER

Rakesh Mishra, Accountant Member.- This appeal filed by the assessee is against the order of the Assessing Officer (hereinafter referred to as Ld. ‘AO’) passed u/s 143(3) r.w.s. 144C(13) r.w.s. 144B of the Income Tax Act, 1961 (hereinafter referred to as ‘the Act’) for AY 2020-21 dated 24.07.2024, which has been passed as per the directions of the Dispute Resolution Panel-2, New Delhi u/s 144C(5) of the Act, dated 11.06.2024.

2. The assessee is in appeal raising the following grounds of appeal:

“1. Order bad in law and on facts

1.1. That the assessment order passed by the Ld. Assessing Officer (‘Ld. AO’) under Section 143(3) r.w.s. 144C(13) read with Section 1448 of the Act and read with the order passed by the Ld. Transfer Pricing Officer (‘TPO’), under section 92CA(3) read with section 144C(5) of the Act is bad in law and void ab-initio.

1.2. That the Hon’ble DRP erred in not holding that the order of Ld. TPO and the draft order of the Ld. AO (in so far it relates to transfer pricing proceedings) are void-ab-Initio as the conditions of section 92C(3) of the Act have not been satisfied.

2. Determination of arm’s length price by the Ld. TPO, Ld. AO and Hon’ble DRP for Corporate guarantee commission received by the Appellant

2.1. That the Ld. TPO /Ld. AO/ Hon’ble DRP erred in not appreciating the fact that the issuance of corporate guarantee is not an international transaction as per section 92B of the Act without individually appreciating the facts in each case.

2.2. On the facts and circumstances of the case and in law, the Ld. TPO, Ld. AO and Hon’ble DRP erred in making an adjustment of INR 12,00,057/- in relation to issuance of corporate guarantee on behalf of Tega Holdings Pte. Ltd (‘Tega Singapore’), and in doing so, have grossly erred by amongst other things:

2.2.1. Not appreciating the fact that the provision of guarantee is essentially in the nature of shareholder activity and should be construed as passive support to its associated enterprises (‘AEs’) in the ordinary course of its business.

2.2.2. Not giving due cognizance to the order pronounced by the Hon’ble Kolkata ITAT in the Appellant’s own case for AY 2008-09 to AY 2013-14, wherein the jurisdictional ITAT has held that if the expectation of the Appellant from provision of guarantee is not of a guarantor, but of a shareholder then the provision of guarantee cannot be treated as providing service and should be regarded as shareholder activity.

2.2.3. Not giving due cognizance to the order passed by the Ld. Commissioner of Income Tax Appeals [Ld. CIT(A)) for AY 2011-12, wherein the Ld. CIT(A) had perused the facts of the said transaction and concluded the same as shareholder function which was later upheld by the Hon’ble Kolkata ITAT in Appellant’s own case (ITA NO. 1047,1048 & 1049/Kol/2017).

2.2.4. Applying an arbitrary approach to benchmark the corporate guarantee transaction by erroneously using Comparable Uncontrolled Price (“CUP”) method as the most appropriate transfer pricing method, although the said method applied is not in accordance with the first proviso to section 92C (2) of Act and Rule 10B (1) (a) of the Income-tax Rules, 1962 (“the Rules”);

2.3. On the facts and circumstances of the case and in law, the Ld. TPO, Ld. AO and Hon’ble DRP erred in making an adjustment of INR 9,88,849/- in relation to issuance of corporate guarantee on behalf of Tega Industries Chile SpA (Tega Chile’), and in doing so, have grossly erred by amongst other things:

2.3.1. Applying an arbitrary approach to benchmark the corporate guarantee transaction by erroneously using Comparable Uncontrolled Price (“CUP”) method as the most appropriate transfer pricing method, although the said method applied is not in accordance with the first proviso to section 92C (2) of Act and Rule 10B (1) (a) of the Rules;

2.4. Without prejudice to above, the rate of guarantee commission recovered by the Appellant in the instant case is more than the rate being upheld by Hon’ble ITAT in plethora of judicial pronouncements wherein, the arm’s length rate ranges from 0.20% to 0.53%.

3. Rule of Consistency

3.1. The Ld. TPO, Ld. AO and Hon’ble DRP erred in making an adjustment of INR 12,00,057/- in relation to issuance of corporate guarantee on behalf of Tega Singapore in the year under appeal without appreciating that the facts of the transaction have remained same and that the transaction has been accepted as shareholder function by the Ld. Commission of Income Tax Appeals [Ld. CIT(A)] in Appellant’s own case for AY 2011-12 and by the Hon’ble Income Tax Appellate Tribunal (ITA No. 1047,1048 & 1049/Kol/2017).

3.2. The Ld. TPO, Ld. AO and Hon’ble DRP erred in not applying the rule of consistency to transfer pricing proceedings when the facts of the case including the underlying arguments have not altered.

4. Non-grant of deduction under section 80G of the Act.

4.1. That on the facts and in the circumstances of the case and in law, The Ld. AO and Hon’ble DRP erred in not granting the deduction claimed by the Appellant under section 80G of the Act amounting to Rs. 52,91,000 on the contention that since donation paid was part of the CSR expenditure, it cannot be considered as voluntary payment and thus not eligible for deduction u/s 80G of the Act.

4.2. That on the facts and in the circumstances of the case and in law, The Ld. AO and Hon’ble DRP erred in not considering the decision of the Hon’ble Kolkata Tribunal in the case of JMS Mining (P.) Ltd. v. Pr. CIT ITD 702 (Kolkata – Trib.) and Hon’ble Bangalore Tribunal in the case of Goldman Sachs Services (P.) Ltd. v. Jt. CIT (Bangalore – Trib.) wherein held that CSR made under section 135(5) of the Companies Act are also eligible for deduction under section 80G of Income-tax Act subject to assessee satisfying the requisite conditions prescribed for deduction under section 80G of the Act, which is squarely applicable to the facts of the instant case.

5. Disallowance of deduction claimed under section 80-IA of the Act

5.1 That on the facts and in the circumstances of the case and in law, The Ld. AO and Hon’ble DRP erred in not granting the deduction claimed by the Assessee under section 80-IA of the Act amounting to Rs. 4,88,57,264 on the contention that generation of power or generation and distribution of power for the purpose of section 80-1A(iv) means electrical power which is distributed and uses network and transmission lines and hence assessee’s claim of 80-IA deduction on steam generation for captive consumption is not in accordance with the intent of the Act.

5.2 That on the facts and in the circumstances of the case and in law, The Ld. AO and Hon’ble DRP erred in not considering the judicial precedents wherein it was held that steam is a form of ‘power’ and ought to be eligible for deduction under section. 801A(4)(iv) of the Act.

5.3 That on the facts and in the circumstances of the case and in law, The Ld. AO and Hon’ble DRP erred in not granting the deduction claimed by the Assessee under section 80-IA of the Act amounting to Rs. 4,88,57,264 without appreciating the fact that where deduction under section 80-IA had been granted to the appellant in the first year of the claim, it is not open for the Ld. AO to challenge the same in subsequent years.

6. Erroneous Levy of Interest under section 234A of the Act

6.1 The Ld. AO has erred in levying erroneous interest under section 234A of the Act to the tune of Rs. 3,83,625.

7. Erroneous Levy of Interest under section 234B of the Act

7.1 The Ld. AO has erred in levying erroneous interest under section 234B of the Act to the tune of Rs. 47,617.

Prayer

| i. | | That the Appellant craves leave to add to and/or amend, alter, modify or rescind the grounds of appeal stated herein above before or at any time of hearing of the appeal. |

| ii. | | The Appellant submits that the above grounds are independent and without prejudice to one another.” |

3. Brief facts of the case are that the return of income for the A.Y. 2020-21 was filed by the assessee company on 18.02.2021 declaring total income of Rs.39,52,07.070/-. The assessee is engaged in providing customized solutions to mining, mineral beneficiation, bulk material handling, environment and slurry transportation industry. The Company specializes in manufacturing, distribution and life cycle management of wear resistant lining components required for grinding, sizing and beneficiation of minerals, and downstream equipment used in the aforesaid industries. The case was selected for complete scrutiny assessment through Computer Aided Scrutiny Selection System (CASS). Accordingly, notice u/s 143(2) dated 29.06.2021 was issued to the assessee for compliance on or before 14.07.2021. In response to the said notice the assessee submitted its reply on 13.07.2021. As one of the reasons for selection of the case for scrutiny assessment was the transfer pricing parameter, the case was referred to the Transfer Pricing Officer (“the TPO”) with the approval of the Competent Authority. A detailed questionnaire was issued to the assessee and its response was incorporated in the draft assessment order under section 144C(1) issued to the assessee. The assessee filed a petition before the Dispute Resolution Panel (“the DRP”), and the DRP issued directions to the Assessing Officer (“the Ld. AO”) and the assessment was made at the total income of Rs.47,73,28,802/- by the Ld. AO. Aggrieved with the assessment order, the assessee has filed the appeal before the Tribunal.

4. Rival submissions were heard and the record and the submissions made and the details filed have been examined. The assessee’s written submissions filed before the Ld. AO as well as before the Ld. DRP have also been considered along with the submissions made in the course of the hearing before the Tribunal.

5. Ground No. 1 is general in nature and does not require any separate adjudication.

6. Ground Nos. 2 and 3 relate to the adjustment on account of corporate guarantee. It was argued before the Bench that the Ld. TPO, the Ld. DRP and the Ld. AO had all erred in making an adjustment of Rs.12,00,057/- in relation to issuance of corporate guarantee on behalf of Tega Holdings Pvt. Ltd. (“Tega Singapore”) and not appreciating the fact that the provision of guarantee is essentially in the nature of shareholder activity and should not be considered as passive support to its Associate Enterprises (‘AE’). It is further stated that no cognizance had been given to the order of the Hon’ble ITAT, Kolkata in the assessee’s own case for AY 2008-09 to AY 2013-14 and no cognizance had been given to the order of the Ld. CIT(A) for AY 2011-12 wherein the Ld. CIT(A) had concluded the same as shareholder’s function which was later upheld by the Hon’ble ITAT, Kolkata in the assessee’s own case Dy. CIT v. Tega Industries Ltd. (Kolkata–Trib.)/ITA No. 1047 to 1049/KOL/2017. He submitted that an arbitrary benchmark for corporate guarantee transaction has been taken up using Comparable Uncontrolled Pricing (‘CUP’) method as the most appropriate transfer pricing method not in accordance with the first proviso to section 92C(2) of the Act and Rule 10B(1)(a) of the Income Tax Rules, 1962. It was also submitted that the Ld. TPO/AO/DRP erred in making adjustment of INR 9,88,849/- on account of corporate guarantee on behalf of Tega Industries Chile SpA (‘Tega Chile’) by applying CUP method.

6.1 A perusal of the assessment order shows that in respect of the corporate guarantee for Tega Chile, the Ld. TPO made the total Arm’s Length Price adjustment towards guarantee commission by applying the Arm’s Length Price rate of interest @6.385% on the amount of loan of USD 20 Lakh and the total corporate guarantee fee has been worked out at Rs.24,88,849/- by applying the interest saving method, out of which an amount offered as corporate guarantee fee of Rs.15,00,000/-has been reduced and the transfer pricing adjustment has been worked out at Rs.9,88,849/-. In the case of ALP for corporate guarantee in the case of Tega Singapore, the effective interest rate of 7.25% was adopted and total corporate guarantee fee of Rs.12,00,057/- had been worked out making the total adjustment on account of both the corporate guarantees of Rs.21,88,906/-. Accordingly, the proposal of adjustment of Rs.21,88,906/- was made in the draft assessment order. The DRP finding in this regard is as under:

“4.4 The Panel observes that the issue involved is identical to that in the case of the assessee for AY 2018-19. In the AY 2018-19, the Panel upheld the benchmarking methodology and the conclusion of the AO by observing as under:

“The DRP notes that the findings of the AO are consistent with law and the facts of the case The TPO has selected the comparables on Bloomsberg data base, made adjustments for tenor of loan based on yield approach. A detailed showcause notice has been issued to the assessee and the contention of the assessee have been discussed in the body of the order. As the agreement between the assessee and its Als have been revised in year 2014 hence the order of ITAT for AY 2011-12 will not apply for the year under reference because the agreement has been modified. In view of the above, the DRP finds no reason to interfere with the findings of the TPO. The objection of the assessee is rejected.”

4.5 Since, there is no change in the factual and legal matrix, the arguments of the AO and the submissions of the assessee, the Panel finds no ground to deal with from its decisions on the issue in AY 2018-19. Following the same, the objections of the assessee are rejected. “

6.2 Therefore, rejecting the objections of the assessee on this issue the Ld. Assessing Officer made an addition of Rs. 21,88,906/-.

6.3 The Ld. AR contended that consistency should be followed and relied upon the findings in the past years. We have considered the submissions made, gone through the facts of the case and perused the record and the order of the Ld. CIT(A). Similar issue arose in the case of Tata Consumer Products Ltd. v. Dy. CIT [IT Appeal No. 372/KOL/2021] for AY 2014-15 order dated 17.09.2024 wherein the finding of the Hon’ble ITAT is as under:

“This issue also came up before the Tribunal in the case of the assessee in AYs 2012-13 and AY 2013-14, the relevant extract of the order in the case of M/s Tata Global Beverages Limited in I.T.A. No.: 1854/Kol/2016 Assessment Year: 2012-13 I.T.A. No.: 1899/Kol/2017 Assessment Year: 2013-14 is as under:

“10. A regards the first contention is concerned, we observe that international transaction has been defined in Section 92B(1) of the Act and the same reads as follows:

“92B. (1) For the purposes of this section and sections 92, 92C, 92D and 92E, “international transaction” means a transaction between two or more associated enterprises, either or both of whom are nonresidents, in the nature of purchase, sale or lease of tangible or intangible property, or provision of services, or lending or borrowing money, or any other transaction having a bearing on the profits, income, losses or assets of such enterprises, and shall include a mutual agreement or arrangement between two or more associated enterprises for the allocation or apportionment of, or any contribution to, any cost or expense incurred or to be incurred in connection with a benefit, service or facility provided or to be provided to any one or more of such enterprises. ”

11. Now, on examining the facts and circumstances of the case under the above extracted definition, we observe that the assessee company is located in India and its wholly-owned subsidiary is located at U.K. and its step-down subsidiaries are located in other parts of the world. Since the assessee company has given a corporate guarantee for one of its step-down subsidiaries i.e. an associate enterprises there is prima facie an international transaction and now to complete the same it has been contended that there has to be a bearing on the profits, income, losses or assets of such enterprise. In our considered view, the counter guarantee taken by the assessee company to cover up the possible cost of giving the guarantee seems to mere formality because ‘TGBIL’, U.K. is a wholly-owned subsidiary of the assessee company and any cost which may arise for the default in the repayment of loan by ‘KHL’ to RABO Bank will ultimately affect the assessee company only. In case of any default by ‘KHL’ regarding repayment of loan to RABO Bank the first/direct impact will be on the assessee and that can end up a cost on the assessee and similarly if there is a gain arising out of the said corporate guarantee by way of deduction in interest rates, which will thus, increase the profits of the step-down subsidiaries, will have a positive impact on the profits of the assessee company and therefore, in our considered view there is a direct bearing on the profits/losses of the assessee company for the said transaction entered on behalf of its associate enterprises. So far as the effect of counter guarantee by ‘TGBIL’ to ‘TGBL’ is concerned, the same can be examined only after the first impact comes to the assessee and one cannot ignore the fact that ‘TGBIL’ is wholly owned subsidiary of ‘TGBL’. We, therefore, are of the considered view that the said transaction comes under the purview of international transaction and which thus calls for the calculation of upward adjustment towards corporate guarantee fee.

12. Now, so far as the computation of corporate guarantee fee is concerned, Id. Transfer Pricing Officer applied 2% rate and on the other hand, the assessee has given an alternate submission applying 0.25% rate. We, however, find that under similar set of facts and circumstances of the case, we have sustained the addition for corporate guarantee fee applying 0.5% rate. We draw support from the decision of coordinate Bench, Guwahati in the case of Greenply Industries Limited v. ACIT in ITA No. 232/GAU/2019 order dated 21.06.2022 wherein the issue has been examined at length and Arm’s Length fee has been restricted @ 0.5%.”

After reproducing the relevant extract from the order, it is concluded in para 13 as under:

“13. We, therefore, taking a consistent view as has been taken by the Coordinate Bench of Guwahati in the case of Greenply Industries Limited (supra) direct Id. AO to compute the corporate guarantee fee @ 0.5% of the outstanding loan at the year end as against 2% charged in the assessment proceedings. Thus, ground no. 2 raised by the assessee is partly allowed. 13. We, therefore, taking a consistent view as has been taken by the Coordinate Bench of Guwahati in the case of Greenply Industries Limited (supra) direct Id. AO to compute the corporate guarantee fee @ 0.5% of the outstanding loan at the year end as against 2% charged in the assessment proceedings. Thus, ground no. 2 raised by the assessee is partly allowed. 13. We, therefore, taking a consistent view as has been taken by the Coordinate Bench of Guwahati in the case of Greenply Industries Limited (supra) direct Id. AO to compute the corporate guarantee fee 0.5% of the outstanding loan at the year end as against 2% charged in the assessment proceedings. Thus, ground no. 2 raised by the assessee is partly allowed.”

6.5 Although the Ld. TPO as well as the Ld. CIT(A) have highlighted the higher risks were involved in the case of the assessee which required application of corporate guarantee fee @2%, however, since in the assessee’s own case in the earlier year, corporate guarantee fee @0.5% has been applied on the same guarantee, hence, respectfully following the order of the coordinate Bench of the Tribunal in the assessee’s own case for AY 2012-13, we direct the Ld. AO to apply corporate guarantee fee @0.5% of the loan outstanding at the year end as against 2% charged during the assessment proceedings. Hence, Ground Nos. 2.0 to 2.7 in relation to corporate guarantee fee are partly allowed.”

6.4 Our attention was also drawn to page 445 of the paper book in the assessee’s own case Tega Industries Ltd. v. Assessment Unit, ITD, (NCAC), Delhi (Kolkata–Trib.)/ITA No. 539/Kol/2022, A.Y. 2018-19 in which corporate guarantee with the AE has been treated as an international transaction in view of the Explanation to section 92B and 0.5% of the loan has been directed to be computed as corporate guarantee fee. Further, in the assessee’s own case in Tega Industries Ltd. v. Dy. CIT [IT Appeal No. 2597/KOL/2024, dated 16-6-2025], Assessment Year: 2021-22, order dated 16.06.2025 a similar finding has been given, relying upon the decision in ITA No. 539/Kol/2022 and the relevant portion of the order is extracted as under:

“8. We have heard rival contentions and perused the material placed before us. So far as the first issue as to whether the alleged transaction of providing corporate guarantee to its associate enterprise i.e., Tega Singapore and Tega Chile will fall into the category of international transactions or not, we find that Section 92B of the Act provides for the meaning of international transactions and the same is reproduced below:-

“92B. (1) For the purposes of this section and sections 92, 92C, 92D and 92E, “international transaction” means a transaction between two or more associated enterprises, either or both of whom are non-residents, in the nature of purchase, sale or lease of tangible or intangible property, or provision of services, or lending or borrowing money, or any other transaction having a bearing on the profits, income, losses or assets of such enterprises, and shall include a mutual agreement or arrangement between two or more associated enterprises for the allocation or apportionment of, or any contribution to, any cost or expense incurred or to be incurred in connection with a benefit, service or facility provided or to be provided to any one or more of such enterprises.

(2) A transaction entered into by an enterprise with a person other than an associated enterprise shall, for the purposes of sub-section (1), be 95[deemed to be an international transaction] entered into between two associated enterprises, if there exists a prior agreement in relation to the relevant transaction between such other person and the associated enterprise, or the terms of the relevant transaction are determined in substance between such other person and the associated enterprise 96[where the enterprise or the associated enterprise or both of them are non-residents irrespective of whether such other person is a non-resident or not].

Explanation.—For the removal of doubts, it is hereby clarified that—

| (i) | | the expression “international transaction”98 shall include — |

| (a) | | the purchase, sale, transfer, lease or use of tangible property including building, transportation vehicle, machinery, equipment, tools, plant, furniture, commodity or any other article, product or thing; |

| (b) | | the purchase, sale, transfer, lease or use of intangible property, including the transfer of ownership or the provision of use of rights regarding land use, copyrights, patents, trademarks, licences, franchises, customer list, marketing channel, brand, commercial secret, know-how, industrial property right, exterior design or practical and new design or any other business or commercial rights of similar nature; |

| (c) | | capital financing, including any type of long-term or short-term borrowing, lending or guarantee, purchase or sale of marketable securities or any type of advance, payments or deferred payment or receivable or any other 99debt arising during the course of business; |

| (d) | | provision of services, including provision of market research, market development, marketing management, administration, technical service, repairs, design, consultation, agency, scientific research, legal or accounting service; |

| (e) | | a transaction of business restructuring or reorganisation, entered into by an enterprise with an associated enterprise, irrespective of the fact that it has bearing on the profit, income, losses or assets of such enterprises at the time of the transaction or at any future date;” |

9. Now, from perusal of the explanation to sub-Section (2) of Section 92B, the expression international transaction includes capital financing, include any type of long-term or short-term borrowings, purchase or sale of marketable securities or any type of advance, payments or deferred payment or receivable or any other debt arising during the course of business. Since inclusive definition of international transaction includes the activities relating to capital financing and borrowings, in our view now corporate guarantee transaction also falls under the category of international transactions. In the instant case, undisputedly, the assessee has given corporate guarantee for loan borrowed by its subsidiary/SPV after acquiring the business. Certainly, with the help of such corporate guarantee interest burden of the AE has been lowered. Though, it is contended by the assessee that it had saved immediate use of it(s) own funds and the interest on the said borrowings has also been paid by the AE but this plea will not apply in the said transactions because, we are dealing specifically with the transactions of corporate guarantee and that with the help of such corporate guarantee, the AE has gained and then as per the TP provisions, the assessee is required to offer the corporate guarantee fee as income. Therefore, in view of the provisions of Section 92B of the Act, the alleged transactions of corporate guarantee with the AE falls in the category of international transactions. Our view is further supported by the judgment of the Hon’ble Madras High Court in the case of Principal Commissioner of Income Tax 5 v. M/s. Redington (India) Limited in T.C.A.Nos.590 & 591 of 2019 judgment dt.: 10.12.2020. Accordingly, ground raised by the assessee that the alleged transactions is not an international transactions, is hereby dismissed.

10. Now, so far as the Ground relating to calculation of corporate guarantee fee is concerned, we find that this issue has come up before various judicial forums and corporate guarantee fee range of 0.2% to 0.5% has been found to be justified. We find support from the judgment of the Hon’ble Bombay High Court in the case of CIT v. Everest Kento Cylinders reported in (2015) 378 ITR 57 (Bom), and are inclined to give part relief to the assessee directing the TPO to compute corporate guarantee fee @ 0.5% and delete excess amount added in the hands of the assessee. Accordingly, Ground Nos. 2 & 3 raised by the assessee are partly allowed.

11. Ground Nos. 11 & 12 are relating to levy of interest u/s 234B/C of the Act which are consequential in nature and need no adjudication.

12. In the result, appeal of the assessee is partly allowed for statistical purposes.”

6.5 In view of the directions issued by the Tribunal in the assessee’s own case for AY 2018-19, the decision in the case of Tata Consumer Products Limited (supra) and in view of the alternate argument and the statutory provisions in this regard, the corporate guarantee is now held to be an international transaction. However, considering the fact that in the assessee’s own case, the corporate guarantee fee at the rate of 0.5% has been upheld for A.Y. 2018-19 by the Coordinate Bench, we are also inclined to give part relief to the assessee and direct the Ld. TPO/AO to compute the adjustment on account of corporate guarantee fee at the rate of 0.5% of the loan outstanding in the beginning of the year as adjusted by addition and subtractions and delete the excess amount added in the hands of the assessee. The adjustment is over and above the amount already admitted by the assessee in the case of Tega Chile as well besides that in the case of Tega Singapore. The Ld. AO is directed to recompute the Arm’s Length Price adjustment on account of corporate guarantee fee and grant consequential relief to the assessee. Hence Ground Nos. 2 and 3 of the appeal are partly allowed.

7. Ground no. 4 relates to non-grant of deduction of Rs. 52,91,000/-u/s 80G of the Act. The Ld. AO did not allow the deduction holding as under:

“4.5.5 The submission of the assessee has been considered. However, assessee’s contention is not found to be tenable. There is no doubt about the fact that the CSR expenses are statutory obligations. These expenses clearly lack the element of voluntary donation whereas for the deduction u/s 80G the element of charity and thus the voluntary nature of donation is a must. Therefore, the expenses towards CSR can not again be utilized for claiming deduction u/s 80G. In effect it would be using the same expenditure for two purposes at a time. Further, the CSR expenditure has the underlining intention to supplement the Government efforts and resources towards certain specific areas of work relating to social and developmental interests of the society. If the CSR expenses are then again claimed for deduction u/s 80G, it would be mean that considerable part of the expenditure towards CSR is funded by the Government by foregoing the Tax and hence to some extent it will nullify the basic intent behind CSR. To reiterate, it is a mandatory obligation on the part of the certain companies. The donation under 80G on the other hand has the underlying intent of charity behind it. Further, the contention of the assessee that CSR expenses towards only two schemes are specifically barred from being used for the purpose of 80G and so it implies that there is no prohibition for other CSR expenses to be used for 80G, is also misplaced. It is to be underlined that the two schemes mentioned above are specifically barred, but, it does not automatically imply that other CSR expenses are allowed to be used for 80G. The issue has to be seen in the context of the basic intent and purpose of the CSR expenses and the donations for 80G. As discussed above, the one is a mandatory expense whereas the other is a voluntary donation with the basic intent of charity. Therefore, assessee’s contention in this regard is found to be untenable.

4.5.6 In view of the above, the deduction u/s 80G amounting to Rs. 52,91,000/- is not allowable as the corresponding donations having been made under the mandatory obligation of CSR. Therefore, in the Draft Assessment Order u/s 144C(1) dated 27.09.2023 this amount of deduction claimed u/s 80G on account of CSR expenses was disallowed and added back to the total income. Also, penalty proceeding u/s 270A was initiated for underreporting of income. Aggrieved by this addition, the assessee raised its objection on this issue before the Hon’ble DRP. The Hon’ble DRP-2, New Delhi vide order u/s 144C(5) dated 11.06.2024 as aforesaid has rejected the objections of the assessee and upheld the addition made on this issue.

The relevant part of the DRP’s direction is as below”

7.1. Before us the assessee has relied upon the decision of the Hon’ble Kolkata Tribunal in the case of JMS Mining (P.) Ltd. v. Pr. CIT ITD 702 (Kolkata – Trib.) and Hon’ble Bangalore Tribunal in the case of Goldman Sachs Services (P.) Ltd. v. Jt. CIT (Bangalore – Trib.) wherein it has been held that “CSR made under section 135(5) of the Companies Act are also eligible for deduction under section 80G of Income-tax Act subject to assessee satisfying the requisite conditions prescribed for deduction under section 80G of the Act, which is squarely applicable to the facts of the instant case.”. Further reliance has been made in the case of Cheil India (P.) Ltd. v. Dy. CIT (Delhi – Trib.)[28-10-2024] as also the decision of the Coordinate Bench of the ITAT, Kolkata in the case of Britannia Industries Ltd. v. Dy. CIT. (Kolkata – Trib.)[14-12-2023]. Recently, the coordinate Bench of the Tribunal in the case of Dy. CIT v. Phillips Carbon Black Ltd. (Kolkata – Trib.)[10-06-2025] have held as under:

“■ It is submitted that the reason given by the Assessing Officer for disallowing the deduction claimed under section 80G in respect of CSR donations to registered charitable trusts is unjustified as nowhere do the provisions of section 80G provide that the sums paid to charitable trusts have to be ‘voluntary’ in nature so as to become eligible for deduction under the said provision. It is further submitted that, it was the assessee’s sole prerogative to decide as to the manner in which it proposes to contribute towards CSR activities. It was not a case that the assessee has contributed to the registered charitable trust in question under any specific mandate or compulsion. Instead, the appellant has voluntarily decided to contribute to the registered charitable trust(s). Hence, the Assessing Officer’s action that the donation was not made at the assessee’s own volition was untenable. It is imperative to mention that the Legislature was well aware that the companies may spend on CSR activities by contributing to charitable trusts recognized under section 80G and therefore wherever the Legislature intended that CSR contributions to any specific charitable trusts should be denied deduction, necessary provisions were incorporated in the specified sub-clauses. It shall be noted that section 80G contains certain restrictions in respect of deduction to only two projects [sub-clauses (iiihk) and (iiihi)). The Parliament has clearly expressed its intention by debarring claim of deduction under section 80G in respect of CSR expenditure spent by an assessee appellant to Swachh Bharat Kosh and Clean Ganga Fund. No such restriction has otherwise been set out for any other donations made by an assessee. Meaning thereby, if CSR expenses are incurred by way of donation given to any other eligible charitable trusts (except Swachh Bharat Kosh and Clean Ganga Fund), then the same shall be eligible for deduction under section 80G. In the facts of the present case, the assessee has made donations to registered charitable trusts which have been approved under section 80G(6)(vi) and unlike sub-clauses (iiihk) and (iiihi), there is no restriction or prohibition set out in the said sub-clause denying deduction under section 80G for CSR contributions. [Para 13]”

7.2. It is further noticed that CSR expenditure is an obligation of the company specified in section 135 of the Companies Act, 2013 and the activities which may be included by the company in the CSR policies are mentioned in the schedule VII of the Companies Act, 2013. Incidentally, contribution to the Swatch Bharat Kosh set-up by the Central Government for the promotion of sanitation, contribution to the Clean Ganga Fund set-up by the Central Government for rejuvenation of river Ganga, contribution to the Prime Minister’s National Relief Fund or Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund) are mentioned in schedule VII besides several other activities. However, sub-section (2) of section 80G allows deduction in respect of Swachh Bharat Kosh and Clean Ganga Fund only for the donation other than the sums spent for CSR as under:

86[(iiihk) the Swachh Bharat Kosh, set up by the Central Government, other than the sum spent by the assessee in pursuance of Corporate Social Responsibility under sub-section (5) of section 13587 of the Companies Act, 2013 (18 of 2013); or

(iiihl) the Clean Ganga Fund, set up by the Central Government, where such assessee is a resident and such sum is other than the sum spent by the assessee in pursuance of Corporate Social Responsibility under sub-section (5) of section 135 of the Companies Act, 2013 (18 of 2013);.”

7.3 Incidentally, no such restriction has been placed in respect of donations to the Prime Minister’s National Relief Fund or Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund), even though both these funds are also mentioned in clause (viii) of schedule VII relating to section 135 of the Companies Act, 2013 thereby implying that there is no such limitation as regards claim of deduction u/s 80G of the Act in respect of these two funds. Therefore, the assessee’s contention in this regard is accepted in view of the decision of the coordinate Bench in the case of Phillips Carbon Black Ltd. (supra) and other decisions mentioned in the preceding paras and the Ld. AO is directed to allow deduction u/s 80G of the Act as per law. Hence, Ground no. 4 of the appeal is allowed.

8. Ground no. 5 relates to disallowance of deduction claimed u/s 80-IA of the Act. The Ld. AO in the assessment order has held as under:

“4.4.4 The assessee has also enclosed a note on deduction u/s 80-IA along with the submission. In this note it has been contended that the generation of high-pressure steam will also qualify as being power for the purpose of section 80-IA and hence the assessee is eligible for such deduction in respect of generation of high-power steam for captive consumption used for running its other machines. However, the contention made in the notes is totally misplaced and without any basis. The provisions of section 80-IA(iv) are very much clear on this issue. The generation of power or generation and distribution of power for the purpose of section 80-IA(iv) means electrical power as has been discussed in the Show Cause Notice. The assessee is producing high pressure steam for running its own machines and claiming that it is generation of power for the purpose of section 80-IA. This is totally untenable. Clearly, the assessee is not eligible for deduction u/s 80-IA(iv). Hence, the deduction claimed under this section amounting to Rs. 4,88,57,264/- is liable to be disallowed.

4.4.5 Accordingly, in the Draft Assessment Order u/s 144C(1) dated 27.09.2023 the deduction claimed by the assessee u/s 80-IA amounting to Rs. 4,88,57,264/- was disallowed and added back to the total income of the assessee. Aggrieved by this addition, the assessee raised its objection on this issue before the Hon’ble DRP. The Hon’ble DRP-2, New Delhi vide order u/s 144C(5) dated 11.06.2024 as aforesaid has rejected the objections of the assessee and upheld the addition made on this issue. The relevant part of the DRP’s direction is as below”

8.1. Before us the assessee has relied upon the decision of Hon’ble Gujarat High Court in the case of Pr. CIT v. Jay Chemical Industries Ltd. ITR 449 (Gujarat)[17-02-2020] wherein it has been held as under:

“12. We now proceed to look into the third question as proposed by the Revenue with regard to section 80IA(4) of the Act.

13. It appears that during the year under consideration, the assessee had claimed deduction of Rs. 32,51,080/- under section 80IA(4) of the Act. This claim was on account of the operation of the Captive Power Plant. The assessee showed income from sale of Power to the tune of Rs. 1,23,10,500/-and the sale of vapour of Rs. 6,59,77,170/-. The Assessing Officer took the view that “Vapour” would not fall within the meaning of “Power”. The case of the assessee is that “steam” is also a form of “power”.

14. The case of the Revenue is that “steam” is only an intermediate raw material for the manufacturing process. In other words, the production of “steam” is only a byproduct, which is used by the assessee for its manufacturing activity.

15. In this regard, the CIT (A) recorded the following findings:

“2. The appellant has also claimed deduction under section 80 I-A on account of sale of steam to the chemical plant. “The steam was generated by the power plant in the boiler and part of it was also utilised for the chemical process of the non-eligible unit. The AO has held that the appellant was not entitled to the deduction on account of sale of steam to the power plant. It has been held by her that steam does not fall within the meaning of “power”. In this reference she has made reliance on the judgment of honourable ITAT Ahmedabad in the case of N R Agrawal Industries Ltd v. DCIT dated 26/07/2013. The appellant on the other hand has submitted that the value of steam should be considered for arriving the profit as the scheme is being generated for generation of electricity and after utilising the same for electricity generation the balance steam is used for the chemical process. Therefore, it is a byproduct and therefore, the deduction was admissible.

On a careful consideration of the facts related to the issue, it is noted that that appellant is generating steam at high-pressure and temperature and the steam is being fed into turbine and the steam which is coming out from turbine is utilised for the chemical process. The details on record to show that the turbine utilised by the appellant for generation of the power is a back pressure turbine. In back pressure turbine the intake is of high-pressure steam which is used for generation of power and the exhaust steam is also at certain pressure so that it can utilised for some other purpose. The design of the turbine is done in such a manner so that all energy of the steam is not utilised by the turbine for generation of power but certain part of it is released in the exhaust steam also. Therefore, the design of the turbine used by the appellant is in such a manner that the exhaust steam is at a certain pressure so that it can be utilised for some other work. Accordingly, this steam cannot be consider as a by product but it is intentionally being produced or generated for a specific purpose. Further the intention of the legislature was to provide deduction for generation of electricity and not for generation of steam. The intention is clearly evident from the perusal of the speech of the honourable Finance Minister while introducing the provisions for deduction in the budget. The use of word ‘power’ is intended for ‘electricity’ as the other relevant sections clearly mentioned the word ‘electricity’. The honourable Bench of ITAT Ahmedabad while deciding the issue in N.R.Agrawal Industries Private Limited has discussed these aspects in detail and accordingly relying on the judgment it is held that the appellant is not entitled for deduction under section 80 I-A on sale of such steam to its chemical plant. Accordingly, the decision of the AO in this regard is upheld.

3. For the purpose of calculation the quantum of deduction and allocation of expenditure incurred for production of steam the appellant had given certain information-related to the heat value of steam (Enthalpy). The details given by the appellant were also forwarded to the AO and she has also given her comments on the same. In order to arrive at a logical conclusion it would be useful to understand the process involved. The appellant has installed a boiler which generates high-pressure steam at a very high temperature. The steam is first fed in the turbine where part of the heat energy of the steam is utilized in generating the electricity and the balance energy available in the steam coming out from the turbine is utilised in the chemical process. The appellant is incurring expenses such as coal consumption, boiler running, depreciation of boilder and other machinery and the building in which the whole generation plant is housed. The expenditure for the steam which is utilised in generation of power and the balance steam which is utilised by the chemical plant can be determined by distributing the same in proportion to the heat value (Enthalpy) of the inlet steam and the outlet steam of the turbine. As per the details available on record the heat value of the inlet steam at 65.5 KG/cm2 is 793 kcal per KG whereas the heat value of the output steam at 3.5 KG/cm2 is 653.7 kcal per KG. The quantity of input and output steam remains the same and only the calorific value of the heat value goes down as part of the energy is utilised for generation of power. Accordingly, the expenses can be apportioned in the ratio of enthalpy of the inlet and output steam. The same is worked out as under:—

| Totalenthalpy of the steam coming out of the boiler | 793 kcal per KG | |

| The enthalpy of the steam coming out of the turbine | 653 kcal per KG | |

| The enthalpy utilised by the turbine for generation of electricity | 139 kcal per KG | |

| Percentage of energy utilised in the generation of electricity | 17.66% | |

| Total expenses for | Boiler | 1800000 |

| Generation of steam to be allocated on a percentage basis | expenses | |

| Boiler maint | 1728903 |

| Coal expenses | 38733894 |

| Depreciation otherthan turbine | 10522945 |

| Total expenses | 52785832 |

| Expenses for steam utilised for | 17.66% of52785832 | |

| Generation of electricity | 9321977 | |

In addition to above expenses for generation of steam, the expenses of head office of the appellant company which looks after the management or the affairs of-the Company and also the power plant are also to be disallowed on proportionate basis. It is also noted that the appellant has taken loan from financial institutions for installing the power plant. The appellant is also paying huge amount of interest on the loan. Proportionate allocation of the interest expenditure should also be done and added to the cost of generation of steam. Since the details related to the expenses of head office as well as interest expenditures are not available before me, the AO is directed to work out the proportionate allocation of the interest expenditure should also be done and added to the cost of generation of steam. Since the details related to the expenses of head office as well as interest expenditure are not available before me, the AO is directed to work out the proportionate allocation of these expenses by obtaining suitable details from the AO. The details of following expenses are readily available from record:—

| Expenses for generation of steam | 9321977 |

| Depreciation on turbine | 1289189 |

| Electricity duty | 787872 |

The AO is also directed to verity the above figures. Accordingly the AO is directed to rework the deduction under section 80I-A claimed by the appellant as indicated in the preceding discussion.”

16. The Tribunal, concurred with the aforesaid findings recorded by the CIT (A), by taking support of the decision of a Co-ordinate Bench of the ITAT, Mumbai, in the case of West Cost Paper Mills (P.) Ltd. v. CIT, . As regards section 80IA of the Act, strong reliance has been placed on behalf of the Revenue on the decision of this Court in the case of CIT v. Atul Ltd. . In Atul Ltd. (supra), the assessee had established a new power plant by expending a sum of Rs. 14.62 Crore and claimed deduction under section 80IA. The Assessing Officer upon examination of such claim, arrived at the conclusion that the production of power would require boiler and also a turbine since the boiler would manufacture steam which would be a raw material for the production of power with the aid of turbine and such a plant would be a new industrial undertaking capable of generating electricity. The case of the assessee was that in the existing power plant the assessee had excess steam production capacity which was to be utilised by the turbine installed in the new plant. The Assessing Officer ultimately rejected the case of the assessee on the ground that the turbine should be treated as an independent power generating unit and thereby disallowed the claim of deduction under section 80IA of the Act.

17. The assessee carried the matter in appeal. The CIT (A) held that no industrial undertaking would come into existence within the meaning of the provisions contained in section 80IA of the Act by transferring the boiler or by installing new machinery for the purpose of generation of the power. The appeal came to be dismissed and the assessee carried the matter before the Tribunal. The Tribunal dismissed the appeal.

18. It appears that the assessee preferred an application for rectification before the Tribunal contending that after the judgment was delivered by the Tribunal, the High Court, in the case of Gujarat Alkalines and Chemicals Ltd. v. CIT (Guj.) has delivered a judgment which would have a bearing on the issue decided by the Tribunal. The said application was opposed by the Revenue. However, the Tribunal allowed the application for rectification and recalled its earlier judgment. The Revenue came before this Court in appeal. This Court took the view while allowing the appeal of the Revenue that the claim of the assessee for deduction under section 80IA of the Act was not tenable in law.

19. This Court took notice of the fact that the assessee had installed turbine for power generation which relied on the excess steam production capacity of the plant. This Court ultimately took the view that the installation of turbine for power generation could be said to setting up of a new industrial unit and therefore, the assessee would not be entitled for deduction of sum under section 80IA of the Act.

20. In our view, the facts in the case of Atul Ltd. (supra) are quite different and the ratio, as propounded in the same, will have no applicability to the case on hand, more particularly, the question No. 3 with which we are dealing with.

21. It is difficult for us to take the view as suggested by the learned standing counsel appearing for the Revenue that “steam” would not amount to power. The word “Power” used in Section 80IA(4) has not been defined under the Income-tax Act.

22. The word “Power” should be understood in common parlance as “Energy”. “Energy” can be in any form being mechanical, electricity, wind or thermal. In such circumstances, the “steam” produced by the assessee can be termed as power and would qualify for the benefits available under section 80IA(4) of the Act.”

8.2. The assessee has also relied upon the decision of the ITAT, Jaipur Bench in the case of Dy. CIT v. Maharaja Shree Umaid Mills Ltd. [2009] 29 SOT 278/120 TTJ 711 (Jaipur)[30-06-2008].

8.3. In this respect it is required to examine the provision of subsection (4) of section 80-IA of the Act which are as under:

8.4. A perusal of the above subsection shows that the intention and the purpose of the legislature for introducing section 80-IA(4) is to develop infrastructure facility in the country. The assessee emphatically relied upon the decision of Hon’ble Gujarat High Court in the case of Jay Chemical Industries Ltd. (supra)[17-02-2020] specifically para 22 thereof in which the hon’ble High Court has stated that the steam produced by the assessee can be termed as power and would qualify for the benefits available u/s 80-IA(4) of the Act.

8.5 Recently, the Courts have emphasised upon the contextual interpretation of the provisions in place of literal interpretation. For the purpose of section 80-IA(4) of the Act, it is also imperative to consider purposive interpretation of the provisions. The provisions were incorporated for development of infrastructure facility in the country and were introduced with effect from 01.04.1991 when the Indian economy had been opened up on account of liberalisation and it was considered imperative to grant tax concessions by introducing incentive provisions so that the infrastructure development could be accelerated in the country. As per sub-section (1) of section 80-IA, the deduction was available for business of an industrial undertaking or a hotel or operation of ship or developing, maintaining or operating any infrastructure facility or scientific and industrial research and development of providing various telecommunication services etc. The conditions for claiming the deduction were specified in sub-section (2) and other sub-sections. The sunset period was amended and was continued up to 31.03.2017. The section 80-IA underwent substitution by the Finance Act, 1999 with effect from 01.04.2000 and clause (iv) of sub-section (4) which relates to an undertaking inserted is as under:

“80-IA(4) This section applies to-

| (i) | | any enterprise carrying on the business [of (i) developing or (ii) operating and maintaining or (iii) developing, operating and maintaining] any infrastructure facility which fulfils all the following conditions, namely:- |

| (a) | | it is owned by a company registered in India or by a consortium of such companies [or by an authority or a board or a corporation or any other body established or constituted under any Central or State Act;] |

| [(b) | | it has entered into an agreement with the Central Government or a State Government or a local authority or any other statutory body for (i) developing or (ii) operating and maintaining or (iii) developing, operating and maintaining a new infrastructure facility;] |

| (c) | | it has started or starts operating and maintaining the infrastructure facility on or after the 1st day of April, 1995: |

Provided that where an infrastructure facility is transferred on or after the 1st day of April, 1999 by an enterprise which de-veloped such infrastructure facility (hereafter referred to in this section as the transferor enterprise) to another enterprise (hereafter in this section referred to as the transferee enter-prise) for the purpose of operating and maintaining the infra-structure facility on its behalf in accordance with the agreement with the Central Government, State Government, local authority or statutory body, the provisions of this section shall apply to the transferee enterprise as if it were the enterprise to which this clause applies and the deduction from profits and gains would be available to such transferee enterprise for the unexpired period during which the transferor enterprise would have been entitled to the deduction, if the transfer had not taken place:

[Provided further that nothing contained in this section shall apply to any enterprise which starts the development or operation and maintenance of the infrastructure facility on or after the 1st day of April, 2017.]

[Explanation.-For the purposes of this clause, “infrastructure facility” means-

| (a) | | a road including toll road, a bridge or a rail system; |

| (b) | | a highway project including housing or other activities being an integral part of the highway project; |

| (c) | | a water supply project, water treatment system, irriga-tion project, sanitation and sewerage system or solid waste management system; |

| (d) | | a port, airport, inland waterway [, inland port or navigational channel in the sea];] |

| [(ii) | | any undertaking which has started or starts providing telecommunication services, whether basic or cellular, including radio paging, domestic satellite service, network of trunking, broadband network and internet services on or after the 1st day of April, 1995, but on or before the 31st day of March, [2005].] |

Explanation.-For the purposes of this clause, “domestic satel-lite” means a satellite owned and operated by an Indian company for providing telecommunication service;

| (iii) | | any undertaking which develops, develops and operates or maintains and operates an industrial park [or special economic zone]notified by the Central Government in accordance with the scheme framed and notified by that Government for the period beginning on the 1st day of April, 1997 and ending on the 31st day of March, [2006] : |

[Provided that in a case where an undertaking develops an indus-trial park on or after the 1st day of April, 1999 or a special economic zone on or after the 1st day of April, 2001 and trans-fers the operation and maintenance of such industrial park or such special economic zone, as the case may be, to another under-taking (hereafter in this section referred to as the transferee undertaking), the deduction under sub-section (1) shall be al-lowed to such transferee undertaking for the remaining period in the ten consecutive assessment years as if the operation and maintenance were not so transferred to the transferee undertak-ing :

[Provided further that in the case of any undertaking which develops, develops and operates or maintains and operates an industrial park, the provisions of this clause shall have effect as if for the figures, letters and words “31st day of March, 2006″, the figures, letters and words “31st day of March, [2011]” had been substituted;]

| (iv) | | an [undertaking] which,- |

| (a) | | is set up in any part of India for the generation or generation and distribution of power if it begins to generate power at any time during the period beginning on the 1st day of April, 1993 and ending on the 31st day of March, [2017]; |

| (b) | | starts transmission or distribution by laying a network of new transmission or distribution lines at any time during the period beginning on the 1st day of April, 1999 and ending on the 31st day of March, [2017]: |

Provided that the deduction under this section to an [undertaking] under sub-clause (b) shall be allowed only in relation to the profits derived from laying of such network of new lines for transmission or distribution;

| [(c) | | undertakes substantial renovation and modernisation of the existing network of transmission or distribution lines at any time during the period beginning on the 1st day of April, 2004 and ending on the 31st day of March, 90 [2017]. |

Explanation.-For the purposes of this sub-clause, “substantial renovation and modernisation” means an increase in the plant and machinery in the network of transmission or distribution lines by at least fifty per cent of the book value of such plant and machinery as on the 1st day of April, 2004;]

| [(v) | | an undertaking owned by an Indian company and set up for reconstruction or revival of a power generating plant, if- |

| (a) | | such Indian company is formed before the 30th day of November, 2005 with majority equity participation by public sector companies for the purposes of enforcing the security interest of the lenders to the company owning the power generat-ing plant and such Indian company is notified before the 31st day of December, 2005 by the Central Government for the purposes of this clause; |

| (b) | | such undertaking begins to generate or transmit or distribute power before the 31st day of March, [2011];] |

8.6 Clause (v) was inserted with effect from 01.04.2006. It is relevant to refer to the to the Budget speech of the then Finance Minister for the Budget 2004-2005, which is extracted as under:

“V. THRUST AREAS

20. Before I deal with other areas of concern on which the Budget will have an impact, let me give you a snapshot of the goals that I have set for myself :

| • | | Doubling agricultural credit in three years, accelerating the completion of irrigation projects and investing in rural infrastructure; |

| • | | Providing farm insurance and livestock insurance; |

| • | | Improving agricultural product markets, and promoting agri-businesses; |

| • | | Expanding water harvesting, watershed development and minor- irrigation and micro-irrigation schemes; |

| • | | Enhancing investment in industry – public and private, domestic and foreign – to create new jobs; |

| • | | Creating space for small-scale industry to thrive and grow; |

| • | | Universal access to telecommunication facilities; |

| • | | More housing for the poor; |

| • | | Access to medical care through health insurance; and |

| • | | Encouraging savings, and protecting the savings of senior citizens. |

106. The power sector also deserves tax concessions. The Electricity Act 2003 envisages unbundling of generation, transmission and distribution. In order to promote renovation and modernization of existing transmission and distribution lines, I propose to extend the benefit under Section 80 IA to projects undertaken during the period April 1, 2004 to March 31, 2006.”

8.7 Clause (v) was also inserted for reconstruction or revival of a power generating plant. Thus, clause (iv) which related to generation or generation and distribution of power, transmission or distribution by laying a network of transmission or distribution lines and substantial renovation and modernization of existing transmission or distribution lines was expanded and the benefit was extended to an undertaking setup for reconstruction or revival of a power generating plant. Thus, clause (iv) of sub-section (4) of section 80-IA is in the context of electrical power and not any other type of power like steam or mechanical power etc. Since, it is an incentive provision, the provision has to be construed strictly and not liberally for doing otherwise would defeat the intention of the legislature behind introduction of such incentive provisions. Even though power is not defined in the Act, but a reference can be made to the Electricity Act, 2003, which is an Act to consolidate the laws relating to generation, transmission, distribution, trading and use of electricity and generally for taking measures conducive to development of electricity industry, promoting competition therein, protecting interest of consumers and supply of electricity to all areas, rationalization of electricity tariff, ensuring transparent policies regarding subsidies, promotion of efficient and environmentally benign policies, constitution of Central Electricity Authority, Regulatory Commissions and establishment of Appellate Tribunal and for matters connected therewith or incidental thereto, where several such terms have been defined. Some of them are as under:

“(8) “Captive generating plant” means a power plant set up by any person to generate electricity primarily for his own use and includes a power plant set up by any co-operative society or association of persons for generating electricity primarily for use of members of such cooperative society or association;

(16) “dedicated transmission lines” means any electric supply-line for point to point transmission which are required for the purpose of connecting electric lines or electric plants of a captive generating plant referred to in section 9 or generating station referred to in section 10 to any transmission lines or substations or generating stations, or the load centre, as the case may be;

(19) “distribution system” means the system of wires and associated facilities between the delivery points on the transmission lines or the generating station connection and the point of connection to the installation of the consumers;

(25) “electricity system” means a system under the control of a generating company or licensee, as the case may be, having one or more – (a) generating stations; or

| (b) | | transmission lines; or |

| (c) | | electric lines and sub-stations; |

and when used in the context of a State or the Union, the entire electricity system within the territories thereof;

(29) “generate” means to produce electricity from a generating station for the purpose of giving supply to any premises or enabling a supply to be so given;

(40) “line” means any wire, cable, tube, pipe, insulator, conductor or other similar thing (including its casing or coating) which is designed or adapted for use in carrying electricity and includes any line which surrounds or supports, or is surrounded or supported by or is installed in close proximity to, or is supported, carried or suspended in association with, any such line;

(50) “power system” means all aspects of generation, transmission, distribution and supply of electricity and includes one or more of the following, namely:-

| (b) | | transmission or main transmission lines; |

| (e) | | load despatch activities; |

| (f) | | mains or distribution mains; |

| (g) | | electric supply-lines; |

(72) “transmission lines” means all high pressure cables and overhead lines (not being an essential part of the distribution system of a licensee) transmitting electricity from a generating station to another generating station or a substation, together with any step-up and step-down transformers, switch-gear and other works necessary to and used for the control of such cables or overhead lines, and such buildings or part thereof as may be required to accommodate such transformers, switch-gear and other works;

(74) “transmit” means conveyance of electricity by means of transmission lines and the expression “transmission” shall be construed accordingly”

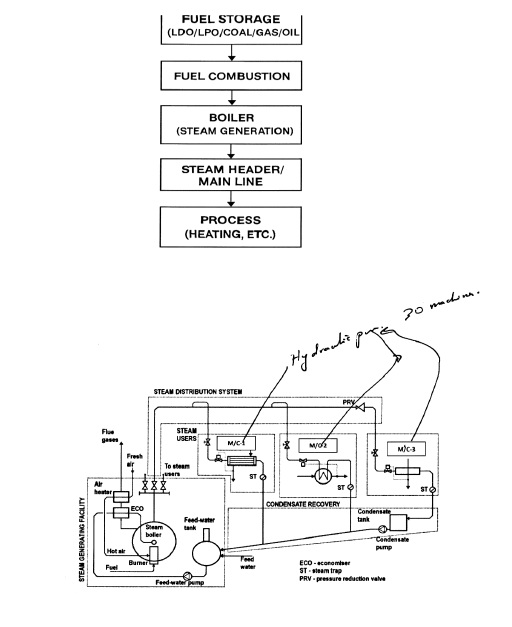

8.8 Thus, the terms used in clause (iv) find a reference and are defined in the Electricity Act, 2003 and therefore, coupled with the speech of the then Finance Minister, leave no doubt that the provision of clause (iv) of sub-section (4) of section 80-IA refer to only generation or generation and distribution of power i.e. electricity and no other form of power. This unbundling was part of the power sector reform. This is further fortified by the use of the term ‘power generating plant’ in clause (v). Steam on the other hand, is never transmitted through transmission and distribution lines but through pipelines. The assessee was specifically required to demonstrate the use of steam by sharing video recording and to explain the process involved and it was noted that the steam was used for operation of hydraulic presses in the manufacturing process and not for generation of electricity through any captive power plant. The schematic of the flow chart along with the transcript of the narration of the process is as under:

8.8.1 Transcript of the audio of the video recording:

“Visual plus process explained video

As you can see this is the fuel loading system that is happening. It is loading the fuel into the system. The boiler works on two inputs.

One is the fuel which we have to burn to produce energy. The other one is water which will be converted into steam and will be supplied. So what you see here is the fuel loading system.

The fuel is loaded from the tanker and into the fuel tanks. From there the fuel will move to the boiler. This section is where water treatment is happening.

We cannot use raw water into the boiler. It has to be treated and certain chemicals need to be added so that it adheres to certain specifications before we load it into the boiler. So this is the plant which treats the water.

The treated water gets into the boiler. So let’s move to the boiler where we can see exactly how the fuel burns and how it converts water to steam. As I said before, the fuel has to be burnt so that the energy is released to convert the water to steam.

Here what you see inside the boiler, that’s the fuel that is getting burnt. The pressure gauge shows the steam pressure that is being fed into our system. So if I just follow the line here, the steam is distributed to various parts of the plant.

Now the steam that is generated is coming right from the boiler, the header of the boiler, into the process. That means into the machinery that will be using steam for the process. All this is the machinery.

You can see the distribution of the steam lines here. The steam lines are tapped for each of these machines. If you see this corridor, you can see the steam lines being tapped for each of these machines and into the machine platens, where the machine heats the products and the complete process is done.

This is one of our finished products. This is called a lifter bar. It’s got reinforcement, it’s got rubber parts, it’s got other metallic parts inside.

And this is what a lifter bar, a typical one of our products looks like. This is what a lifter bar looks like.”

8.9 Therefore, the facts of the decisions relied upon by the assessee are different from the facts of the case of the assessee and therefore, the decisions are not applicable. In fact, the facts of the case of CIT v. Atul Ltd. (Gujarat)[01-08-2016] and the decision therein is applicable. In the case of Jay Chemical Industries Ltd. (supra) the assessee was operating a captive power plant and the issue related to the allowability of the deduction on the excess steam while in the case of the assessee there is no generation of electricity as there is no captive power plant.

8.10 Thus, the deduction under section 80-IA(4) of the Act being only for generation and distribution of electricity and not for generation of steam, even though the steam may be in the form of energy but the incentive is restricted to electricity generation and distribution and cannot be allowed to the assessee. Even though the term ‘power’ used in section 80-IA of the Act has not been defined in the Act but is extensively used in the Electricity Act, 2003, several times which coupled with the speech of the then Finance Minister, amply justifies the intention of the legislature that the term ‘power’ has been used in the context of ‘electrical power’ only. Electricity can also be generated using steam, wind, mechanical energy and hydel energy but the deduction would be available only for the final product of the electricity and not for any intermediate or initial product used. Further, a perusal of various clauses of sub-section (4) of section 80-IA of the Act would also show that the term ‘power’ relates to electrical power distribution and electrical power generation and not to mere generation of steam per se. Even though power could be understood in common parlance but the context in which it is used in sub-section (4) of section 80-IA of the Act is only for the purpose of generation and distribution of electrical power. However, the steam as such cannot be used by any domestic consumer while electrical power is to be utilized by the end user being both domestic consumer and industrial consumer. The assessee contends that the Ld. AO and the Hon’ble DRP erred in not granting the deduction claimed u/s 80-IA without appreciating the fact that where deduction u/s 80-IA had been granted to the assessee in the first year of claim, it is not opened for the Ld. AO to challenge the same in the subsequent years. This argument as appearing in Ground no. 5.3 is fallacious. It has been held in the case of Distributors (Baroda) (P.) Ltd. v. UOI ITR 120 (SC)[01-07-1985] that to perpetuate an error is no heroism. To rectify it is the compulsion of judicial conscience. In this we derive comfort and strength from the wise and inspiring words of Justice Bronson in Pierce v. A.M.Y. Delameter at page 18 :

“a Judge ought to be wise enough to know-that he is fallible and therefore everready to learn : great and honest enough to discard all mere pride of opinion and follow truth wherever it may lead : and courageous enough to acknowledge his errors.”

8.11 Hence, even if the claim has been allowed in the earlier year the same can be disallowed if it has erroneously allowed earlier as each A.Y. is different and estoppel and res judicata do not apply to the income tax proceedings and therefore, on appreciation of full facts of the case as the steam is used in manufacturing process for the hydraulic presses and is not used for generation of electricity, the claim of deduction under section 80-IA(4) of the Act for sale of steam is not acceptable and the direction of the Ld. DRP and the findings of the Ld. AO in this regard are hereby upheld and Ground no. 5 raised by the assessee is dismissed.

9. Ground nos. 6 and 7 relating to interest u/s 234A and 234B of the Act are consequential in nature and the Ld. AO shall recompute the same after the income is recomputed as directed above.

10. In the result, the appeal filed by the assessee is partly allowed.