ORDER

Manish Agarwal, Accountant Member.- These are five appeals filed by the Revenue against the separate orders of Learned Commissioner of Income Tax (Appeals)-27, New Delhi. All are dated 12.06.2023 for Assessment Years as tabulated as under:

| ITA | Assessment Year | Remarks |

| 2442/Del/2023 | 2013-14 | Order u/s 143(3)/147 |

| 2443/Del/2023 | 2014-15 | Order u/s 143(3)/147 |

| 2444/Del/2023 | 2015-16 | Order u/s 143(3) |

| 2445/Del/2023 | 2016-17 | Order u/s 143(3) |

| 200/Del/2023 | 2019-20 | Order u/s 143(3) |

2. Since in all appeals, issues raised by the revenue are common and interlinked, therefore, all the appeals of the revenue are taken together and decided by a common order.

3. First we take up the Revenue’s appeal for Assessment Years 2013-14 in ITA No.2442/Del/2023.

ITA NO. 2442/DEL/2023 (Assessment Year 2013-14)(Revenue’s Appeal)

4. Before us, Ld. AR of the assessee filed an application under Rule 27 of the ITAT Rules, 1963, according to which the assessee can take any issues though he may not have appealed which was decided against him. In the prayer made under Rule 27, the assessee has challenged the action of the Ld. CIT(A) in rejecting the assessee’s legal issue with respect to initiation of reassessment proceedings u/s 148 of the Act. In support of prayer under Rule 27 of the Rules, the Ld. AR of the assessee has made following submissions in detail:

“Initiation of Reassessment proceedings wholly without jurisdiction

As stated above, the original assessment was completed vide order dated 29.03.2016 passed under section 143(3) of the Act/pages 119 to 128 of the paper book), assessing the income of the assessee at Rs. 38,50,02,139, after making disallowance of Rs.2.16.018 on account of alleged late deposit of EPF and ESI.

Subsequently, after the expiry of the limitation of four years, notice dated 31.03.2021 as issued under section 148 for initiating assessment under section 147 of the Act a page 42 of the paper book). The reasons recorded before initiating re-assessment proceedings under section 147 of the Act were provided by the assessing officer vide letter dated 09.12.2021 [@pages 43 to 55 of the paper book].

Objecting to the reasons so recorded and challenging the validity of the initiation of the reassessment proceedings, the assessee filed its detailed legal objections on 16.02.2022 /a pages 56 to 113 of the paper book. The objections so filed by the applicant were disposed off by the assessing officer vide a cryptic order dated 23.02.2022 a pages 114 to 118 of the paper book). While disposing the objections raised by the applicant, the assessing officer did not rebut to any specific objection raised by the applicant and passed a general order without considering the specific facts of the case.

It is respectfully submitted that the reassessment proceedings and the consequent reassessment order dated 30.12.2017 passed under section 147 r.w.s. 143(3) of the Act are without jurisdiction, bad in law and void ab initio, inter alia, for following reasons:

| (a) | | Reassessment proceedings barred as per proviso to section 147-No failure on part of the assessee to fully and truly disclose material facts; |

| (b) | | Impugned reassessment proceedings have been initiated on mere ‘change of opinion’; |

| (c) | | Reassessment proceedings initiated without any valid and legally sustainable “reasons to believe” of income having “escaped assessment”, without any fresh tangible material and without independent application of mind, is illegal and bad in law: |

| (d) | | Sanction under section 151 of the Act for initiation of reassessment proceedings accorded in a mechanical manner. |

The aforesaid contentions are elaborated hereunder:

Re (a): Reassessment proceedings barred as per provisions to section 147- No failure on part of the assessee to fully and truly disclose material facts

In terms of proviso to section 147 of the Act, the assessing officer can initiate reassessment proceedings beyond the period of four years from the end of the relevant assessment year, where the assessment has been previously undertaken under section 14303) of the Act, only on fulfilment of additional condition that the income has escaped assessment by reason of the “failure of the assessee to disclose fully and truly all material facts necessary for assessment”. The proviso to the section places fetters on the powers of the assessing officer to initiate reassessment proceedings beyond the period of four years from the end of the relevant assessment year, where the assessment has been previously undertaken under section 143(3) of the Act unless the income has escaped assessment by reason of the “failure of the assessee to disclose fully and truly all material facts necessary for assessment”

In the present case, during the course of original assessment proceedings, specific queries were raised by the assessing officer regarding the AMP expenses incurred by the assessee which were duly replied by the assessee to the satisfaction of the assessing officer (elaborated as under) and after such an exhaustive examination, the claim of the assessee was accepted by the assessing officer during original assessment, as demonstrated hereunder

Enquiry, made during original assessment proceeding for AY 2013-14.

– Vide notice dated 17.07.2015 issued under section 142(1) of the Act for assessment year 2013-14/6 pages 129 to 132 of the paper book, the assessing officer raised the following queries/ sought the following information:

“14. TDS (as deduced by the assessee) details both expense head wise and party wise for the year under consideration.

27. You are requested to produce all the books of accounts for verification at and when required.

30. Details to expenses debited to P & L A/c on which TDS is applicable showing separately expenses on which TDS deducted and expense on which TDS is not deducted with reasons thereof ”

Vide reply dated 24.09.2015/ page 133 of the paper book], the assessee furnished before the assessing officer, copies of audited balance sheet and profit and loss account, tax audit report as well as income tax return and computation for the relevant assessment year.

Vide reply dated 08.10.2015 [filed on 09.10.2015] @ pages 134 to 135 of the paper book], the assessee furnished “details of payments made u/s 40A(2)(b) including purchases made from Kanidi Cosmeceuticals and 1,otus Herbals Color Cosmetics.

– Vide reply dated 19.11.2015[(@pages 136 to 200 of the paper book, the assessee furnished the following details:

| • | | Vide Sr. No.1, the detail of various Marketing expenses recorded under different accounting heads for AY 2010-11 to AV 2013-14 Detailed comparative Table was also submitted as Annexure-A of this point. [page 137 of the paper book] |

| • | | Vide Sr. No.5, details of Advertisement Expenses under different accounting heads and its detailed Ledger accounts were also submitted as asked for. The detailed ledgers for all the following accounting heads were submitted: |

| a. | | Advertisement Expenses [pages 139 to 147 of the paper book]. |

| b. | | Point ofPurchase (POP) expense [pages 148 to 159 of the paper book] |

| c. | | Uniform expenses[page 160 of the paper book] |

| d. | | Window Display expenses [@ pages 161 to 200 of the paper book]. |

– Vide reply dated 10.12.2015 [pages 201 to 280 of the paper book), the assessee furnished “details of expenses debited to P&L A/c for FY 2012-13 as ‘ANNEXURE B’ thereto.

Upon consideration of the aforesaid details/ replies filed by the assessee, the assessing officer vide order dated 29.03.2016 passed under section 143(3) of the Act/pages 119 to 128 of the paper book/ proceeded to allow the AMP expense incurred by the assessee

Reliance in this regard is placed on the following decisions wherein the Courts have held that reopening of proceedings after the expiry offour years shall be invalid in terms of proviso to section 147 of the Act unless there is failure on the part of the assessee to disclose true and material facts.

| – | | CIT v. Foramer France: 264 ITR 566 (SC) |

| – | | D.T. & T.D.C. Ltd. v. ACTT: 232 CTR 260 (Del) |

| – | | CIT v. Fenner India Ltd.: 241 ITR 672 (Del) |

| – | | Haryana Acrylic Manufacturing Company: |

| – | | Purolator India Ltd: 343 ITR 155 (Del) 308 IIR 38 (Del.) |

| – | | Atma Ram Properties P. Ltd. v. DCIT: 343 ITR 141 (Del) 23 |

| – | | Avtee Ladi v, DCIT: 370 ITR 611 (Del) |

| – | | CIT v. Motor & General Finance: (Del.) |

In the case of Calcutta Discount Co. Ltd 15. ITO 41 ITR 191 (SC), the Hon’ble Apex Court, held that-(i) it is the assessee’s duty to disclose primary facts, including particular entries in account books, particular portions of documents and other evidence disclosed (6) once all primary facts are before the assessing authority, be requires no further assistance by way of disclosure, (in) it is for the assessing officer to decide what inferences of fact can be reasonably drawn and what legal inferences have ultimately to be drawn and (iv) it is not for the assessee to tell the assessing authority what inferences, whether of fact or law, should be drawn.

Case of AO and rebuttal thereto

The findings of the AO on true and full disclosure of material facts are set out in para 8 of reasons, which is reproduced hereunder.

8. Findings of the AD on true and full disclosure of the material facts necessary for assessment under proviso to section 147

The enquiries establish that Mix Loner Herbal Pvt. Ltd. has claimed bogus AMP expenses of Rs. 36,56,43,885 and expenditure of Rx 35, 42,857/- in the form of salary given to its employees in the form of credit notes to reduce its profit during the year under consideration, thereby bringing its undisclosed income in the books of account without paying taxes on such income. After the perusal of the records available with this office, I have the reason to believe that taxable income to the extent of Rs. 36.91,86,742-has escaped assessment within the meaning of section 147 of the IT Act, 1961. Further, this escapement was due to failure on part of the assessee to disclose true and correct facts relating to its income. There is clear failure on the part of the assessee to fully and truly disclose all material facts which were necessary for correct assessment of its income.

In substance, it is the case of the AO that the result of enquiries in the course of survey establish that the assessee claimed bogus expenses and this escapement is on account of assessee’s failure to disclose true and correct facts.

Most importantly, AO has failed to clearly specify which material fact the assessee was required to disclose but has not been disclosed by the assessee. In fact, AO, while recording the reasons under section 148(2) of the Act has, in fact, categorically stated that the assessee “has produced books of accounts, annual report, audited P&L Account and balance sheet or other evidence as mentioned above, but still proceeded to repeat the language of proviso and allege that there has he failure to disclose relevant facts.

Thus, even as per the admission of AO, complete/ correct facts were placed on record by the assessee. It is, however, the case of the AO that the facts were embedded in the manner that the same could not have been discovered with due diligence. The said observation, too, is apart from being general, legally and factually flawed/ perverse,

It is emphatically reiterated that no specific allegation whatsoever, has been made out in the reasons recorded to point out whether there was any failure on the part of the assessee to disclose fully and truly all material facts in relation to its assessment of income for the relevant year. In the reasons recorded, the AO has merely repeated the language of proviso to section 147 of the Act that there was failure on the part of the assessee to disclose material facts, without specifically spelling out any such actual failure, except making vague and bald observations.

In the absence of specific charge in the reasons recorded pointing out any failure on the part of the assessee to disclose fully and truly all material facts necessary for assessment and mere mention in the reasons that the assessee has failed to furnish material facts, without spelling out such material facts, is not sufficient compliance, which is a pre-requisite for valid initiation of the reassessment proceedings and therefore, the notice for reassessment issued under section 148 of the Act, after the expiry of four years from the end of the relevant assessment year is invalid.

It is further respectfully submitted that mere charge that the expenses claimed is bogus is not sufficient to justify the fulfillment of condition set out in first proviso to section 147 of the Act, as has been held in the following decisions:

| – | | Chhugamal Rajpal v. S.P. Chaliha 79 ITR 603 (SC) |

| – | | Ganga Saran & Sons (P) Ltd v. ITO: 130 ITR 1 (SC) |

| – | | ITO v. Lakhmani Mewal Das: 103 ITR 437 (SC) |

| – | | CIT v. Foramer France: 264 ITR 566 (SC) |

| – | | Rita Rajkumar Singh v. ACIT. (Bom) |

| – | | Sunil Hanskrishna Khanna v. ACIT; (Bom) |

| – | | Gateway Leasing (P.) Ltd. v. ACIT 426 ITR 228 (Bom.) |

| – | | Priti Paras Savla v. ITO (Guj) |

Considering that in the present case since there is: (a) no failure on the part of the assessee to disclose any material facts; and/or (b) no specific finding, in reasons that there was any such failure on the part of the assessee. On this ground alone, the reassessment proceedings is invalid and bad in law,

Re (b): Initiation of reassessment proceedings on mere change of opinion invalid

In the present case, undisputedly no new material information came to the possession of the assessing officer subsequent to the completion of the original assessment and the reassessment proceedings were reopened merely to re-examine the aforesaid issues. The information relied upon is, as explained supra, not a valid fresh tangible information [appraisal report is merely an inference and nowhere contains live and vital link with the transaction of the assessee), considering the fact that claim of AMP expense/ expenditure incurred on marketing and sales promotion was specifically examined and accepted in the course of original assessment; thus, the initiation of Impugned reassessment proceedings suffers from the vice of ‘change of opinion’, which is not permissible in law

In this regard, it is a trite law that the reassessment proceedings under section 147 cannot be initiated on a mere change of opinion. The Full Bench of the jurisdictional Delhi High Court in CIT v. Kelvinator of India Ltd.: 256 ITR I held that “Section 147 of the Act does not postulate conferment of power upon the assessing officer to initiate reassessment proceedings upon his mere change of opinion.” The aforesaid decision of the Delhi High Court has Court has been affirmed by the Supreme Court in CIT v. Kelvinator of India Ltd: 320 ITR 561 (SC).

Reliance is also placed on the decision of the Full Bench of the Delhi High Court in the case of Usha International Limited: 348 ITR 485 wherein the Court held that re-assessinent proceedings will be invalid in case an issue or query is raised but thereafter the assessing officer does not make any addition in the assessment order

On perusal of the aforesaid, it will kindly be appreciated that the Court clearly held that in case where query is raised by the assessing officer in the original assessment but thereafter the assessing officer does not make any addition in the assessment order, in such situations it should be accepted that the issue was examined but the assessing officer did not find any ground or reason to make addition or reject the stand of the assessee. In such a situation, the Court held that reassessment will be invalid because the Assessing Officer had formed an opinion in the original assessment, though he had not recorded his reasons

Further reliance is placed on the following decisions:

| – | | CIT v. Foramer France: 264 ITR 567 (SC) affirming Foramer France v CIT: 247 ITR 463 (All) |

| – | | ACIT v. ICICI Securities Primary Dealership Ltd.: 348 ITR 299 (SC) 26 |

| – | | Jindal Photofilms Lid. v. DCIT 234 ITR 170 (Del) |

| – | | CIT v. Feather Foam Enterprises (P.) Ltd. : 296 ITR 342 (Del) |

| – | | Satnam Overseas Limited and Anr. v. ACTT: 329 ITR 237 (Del) |

| – | | Jal Hotels Co. Ltd. v. ADIT: (Del) |

| – | | CIT v. Prima Paper and Engineering Industry: 364 ITR 222 (Bom.) |

| – | | PMC Fincorp Ltd. v. ACIT: (Del)S.B. Packagings Ltd. v. ACIT (Del) |

| – | | Chandra Global Finance Lid. v. ITO.W.P.(C) 359/2023 (Del)) |

| – | | Infinity.com Financial Securities Lul. v. ACIT: (Bom) -SLP dismissed by SC in 290 Taman 126 (SC) |

Thus, the impugned reopening of assessment on the very same set of facts, without any fresh tangible information being referred to in the reasons recorded and also without any fresh tangible information being received, is devoid of jurisdiction

Re: (c) Reassessment proceedings initiated without any valid and legally sustainable “reasons to believe” of income having “escaped assessment”, without any fresh tangible material and without independent application of mind, is illegal and bad in law

It is further respectfully submitted that in order to initiate proceedings under section 147 of the Act, it is incumbent on the part of the assessing officer to first possess some fresh “tangible material”, on the basis of which prima facie casel belief of any escapement of income on the part of the assessee is made out after completion of the original assessment proceedings.

The Courts have repeatedly held that proceedings u/s 147 of the Act cannot be initiated on the basis of general/ vague information of any bogus/accommodation transaction, without any link/ nexus with the specific transaction of the assessee.[Refer, ITO v. Lakhmami Mewal Dax: 103 ITR 437 (SC), CIT v. United Electrical Co. Pvt. Ltd 258 ITR 317 (Del), CIT 1. Vineeta Jain and Atul Jain: 299 ITR 383 (Del), Signature Hotels P. Ltd v. ITO. 338 ITR 51 (Del), CIT v. Insecticides (India) Ltd. 357 ITR 330 (Del), Revolution Forver Marketing (P) Lad. v. ITO 413 ITR 400 (Del) and CIT v. And Jain 299 ITR 383 (Del)

In the reasons recorded, no tangible information/ material has been highlighted that may even throw any doubt on the genuineness of the transactions undertaken by the assessee.

Further, the reasons recorded do not reflect any independent application of mind to the information received and the basis and material of the information has not been examined and simply relied upon in a mechanical manner without arriving at an independent belief whether or not any income had escaped assessment.

Reassessment initiated merely on the basis of vague report of the investigation wing/appraisal report, without any independent application of of mind, is beyond jurisdiction, bad in law and void ab initio, as has been held in the following legal decisions:

| • | | ACTT v. Dhariya Construction Company 328 ITR 515 (SC) |

| • | | Pr. CIT v. Meenakshi Overseas (P.) Ltd. 395 ITR 677 (Del) |

| • | | Well Trans Logistics India (P.) Lad. v. ACTT (Del) |

| • | | CIT v. SFIL Stock Broking Ltd: 325 ITR 285 (Del) |

| • | | Pr. CIT v. RMG Polyvinyl (1) Ltd. 396 ITR 5 (Del) |

| • | | PCIT v. G & G Pharma India Ltd. 384 ITR 147 (Del.) |

| • | | CIT v. Gulati Industrial Fabrication (P) Limited 217 CTR 494 (Del) [SLP Dismissed by SC in 1134/2009] |

| • | | CIT v. Fair Finvest L: 357 ITR 146 (Del) |

| • | | CIT v. Viniyas Finance & Investment Pvt Ltd. 357 ITR 646 (Del) |

In view of the aforesaid, the reassessment proceedings having been initiated on the basis of documents already available on record, are invalid and bad in law.

Re (d): Sanction under section 151 of the Act for initiation of reassessment proceedings accorded in a mechanical manner

In the present case, in terms of sub-section (1) of section 151, sanction for issuance of the impugned notice dated 31.03.2021/(@) page 44 of the paper book), it may be noticed that PCIT (Central)-2 has accorded sanction in the following terms:

“I have perused the reasons recorded by the AO. In view of the facts and details stated therein, I am satisfied that it is a fit case for issue of notice under section 148 of the Income Tax Act. 1961. Approval as per section 151(1) is granted.”

The aforesaid could not be regarded as valid satisfaction inasmuch the aforesaid note: (a) clearly indicate that the sanctioning authority simply perused the reasons, with looking into the records; and (b) does not show any application of mind which, it is submitted, is sine qua non for issuance of notice under section 148 of the Act.

In terms of section 151, recording of proper and legally sustainable sanction under section 151 is a sine qua non for initiating reassessment proceedings under sections 147/148 of the Act, however, as evident from the noting of PCIT (Central)-2, sanction is accorded in the present case by way of a cryptic noting which only leads to the inescapable conclusion that there was, in reality, no perusal of assessment record and independent application of mind by the sanctioning authority (les) for according approval.

The Orissa High Court in the case of ACTT v. Serajuddin & Co. (2023) 454 ITR 312 (Ori), while disapproving of sanction granted without looking into the records, observed as under:

“16. That such an approval of a superior officer cannot be a mechanical exercise has been emphasized in several decisions. Illustratively, in the context of section 142 (2-4) which empowers on AO to direct a special audit. The obtaining of the prior approval was held to be mandatory. The Supreme Court in Rajesh Kumar (supra) observed as under.

“58. An order of approval is also not to be mechanically granted. The same should be done having regard to the materials on record. The explanation given by the assessee, if any, would be a relevant factor. The approving authority was required to go through it. He could have arrived at a different opinion. He in a situation of this nature could have corrected the assessing officer if he was found to have adopted a wrong approach or posed a wrong question unto himself. He could have been asked to complete the process of the assessment within the specified time so as to save the Revenue from suffering any lass. The same purpose might have been achieved upon production of some materials for understanding the books of accounts and/or the entries made therein. While exercising its power, the assessing officer has to form an opinion. It is final so far he is concerned albeit subject to approval of the Chief Commissioner or the Commissioner, as the case may be. It is only at that stage he is required to consider the matter and not at a subsequent stage, viz., after the approval is given.

……………………………………………………………..

22. As rightly pointed out by learned counsel for the Assessee there is not even a token mention of the draft orders having been perused by the Additional CIT. The letter simply grants un approval. In other words, even the bare minimum requirement of the approving authority having to indicate what the thought process involved was is missing in the aforementioned approval order. While elaborate reasons need not be given, there has to be some indication that the approving authority has examined the draft orders and finds that it meets the requirement of the law. As explained in the above cases, the mere repeating of the words of the statute, or mere “rubber stamping” of the letter seeking sanction by using similar words like ‘see’ or ‘approved’ will not satisfy the requirement of the law. This is where the Technical Manual of Office Procedure becomes important, Although, it was in the context of section 158BG of the Act, it would equally apply to section 153D of the Act. There are three or four requirements that are mandated therein, (1) the AD should submit the draft assessment order “well in time” Here it was submitted just two days prior to the deadline thereby putting the approving authority under great pressure and no giving him sufficient time to apply his mind; (ii) the final approval must be in writing; (iii) The fact that approval has been obtained, should be mentioned in the body of the assessment order.”

The aforesaid decision has attained finality inasmuch as the Hon’ble Supreme Court has vide order dated 28.11.2023 dismissed the SLP (C) D. Nos. 44989 of 2023 and upheld the judgment in Serajuddin (supra)

Reliance in this regard is placed on the following decisions:

| – | | PCIT v. Shiv Kumar Nayyar: (Delhi), -Pr. CIT v. Pioneer Town Planners (P.) Lul. (2024) 465 ITR 356(Del), -CIT v. United Electrical Co. Pvt. Ltd. 258 ITR 317 (Del), |

| – | | Capital Broadways (P) Ltd. v. ITO (Delhi). –The Saraswati Co-operative Bank Ltd v. ACIT (WP No. 1910/2022; decided on 26.08.2024) (Bom) |

| – | | SABH Infrastructure Lid. v. ACIT (2017) 398 ITR 198 (Del) (Dept. SL dismissed in (2024) 461 ITR 339 (SC) ) |

| – | | Yum! Restaurants Asia Pte. Restaurants Asia Pte. Ltd. v. DDIT [2017] 397 ITR 665 (Del) |

| – | | Central India Electric Supply Co. Ltd. v. ITO [2011] 333 ITR 237 (Del) |

| – | | Kartik Sureshchandra Gandhi v. ACIT [2023] 295 Tasman 442 (Bom) |

| – | | PCIT v. Subodh Agarwal (All) |

| – | | SMW Ispat (P.) Lad. v. ACIT: [2024] 163 laxmann.com 119 (Pune – Trib.) |

In that view of the matter, the approval/sanction u/s 151, having been granted in a mechanical manner, the same stands vitiated in law and the consequent impugned proceedings initiated u/s 147/148 of the Act, are liable to be quashed:

For the aforesaid cumulative reasons, it is submitted that the appeal filed by the Revenue deserves to be dismissed.

5. The Ld. AR further submits that the reassessment proceedings are merely changed of opinion and, therefore, the same deserves to held bad in law and the consequent order be quashed.

6. On the other hand, Ld. CIT-DR submits that Ld. CIT(A) has not decided the issue of reopening of assessment taken by the assessee and therefore, Rule 27 cannot be invoked. He drew our attention to the observations made by Ld. CIT(A) in para 10.1 of the order where it has been stated that Grounds No.1 to 1.8 taken by the assessee challenging the validity of reassessment proceedings are not adjudicated as appellant has got full relief on merits. Therefore, he prayed that petition filed by the assessee U/R 27 of ITAT Rules,1963 not be admitted and decided at this stage.

7. Heard both the parties and perused the materials available on record. Rule 27 of the ITAT Rules provides that responded can support the order appeal against on any ground decided against him. In the judgment relied upon by assessee in case of Sanjay Sawhney v. Pr. CIT (Delhi), the Hon’ble Delhi High Court held that in absence of any written request provisions of Rule 27 of the ITAT Rules can be invoked, however in none of the case relied upon by the assessee, it is held by the hon’ble Courts that where the First Appellate Authority has not decided the legal issue and expressed the opinion against the assessee for the reason that the appeal already been allowed on the merits, Tribunal cannot decide that issue in the terms of Rule 27 of the ITAT Rules 1963. In the instant case, since the ld. CIT(A) has not decided the legal issue regarding the validity of reopening of assessment thus, we are not agreed with the contention raised by the assessee that legal issues taken before us as per Rule 27 of the ITAT Rules be admitted at this stage for adjudication. In view of these facts, we dismissed the prayer made by the assessee under Rule 27 of ITAT Rules, 1962 and proceed to decide the appeal of the revenue.

8. Brief facts of the case are that the assessee company was incorporated on 20.09.1993 and since inception is engaged in the business of trading of cosmetic and skin care products under the brand name ‘LOTUS’. The return of income for the year under appeal was filed on 28.09.2023 u/s 139(1) of the Act declaring total income of Rs.38,47,86,120/-. Thereafter, the assessment u/s 143(3) was completed vide order dt. /s 29.03.2016 at a total income of Rs.38,50,02,139/- after making disallowance of Rs.2,16,018/- towards the delayed payment of EPF and ESI. Subsequently, the proceedings u/s 147 were initiated in terms of the notice issued on 31.03.2021 u/s 148 of the Act and consequently, the reassessment order was passed u/s 147 r.w.s. 143(3) dated 31.03.2022 wherein the total income of the assessee was assessed by making additions of Rs.10,96,92,546/- after disallowing various expenses claimed.

9. Against the said order, the assessee has preferred the appeal before the Ld. CIT(A) who after considering the merits of the submissions made, had deleted the disallowances made by the AO. Aggrieved by the said order, the Revenue is in appeal before the Tribunal by taking the following grounds of appeal:

| “1 | | . The Ld. CIT(A) has erred on facts and in law, in deleting the disallowance of Rs. 1,76,17,395/- made u/s 37 of the Income Tax Act, 1961, on account of bogus Advertisement, Marketing & Promotion (AMP) Expenses, by ignoring the facts that the genuineness of the expenses could not be verified since the assessee failed to provide the complete details of these entities and their bills/vouchers & confirmation from the parties. The details of parties provided by the assessee did not respond to the notices issued to them during the course of assessment proceedings. |

| 2 | | The Ld. CIT(A) has erred on facts and in law, in deleting the disallowance of Rs. 35,42.857/- made u/s 37 of the Income Tax Act, 1961, on account of Salary paid through Credit Notes, by ignoring the facts and circumstances of the case. Also in the statement of Sh. Prabhat, Sales Operation Manager recorded on oath during search operation failed to provided any details/data regarding salaries paid through credit notes. |

| 3. | | The Ld. CIT(A) has erred on facts and in law, in deleting the disallowance of Rs.8,85,32,294/- made u/s 37 of the Income Tax Act, 1961, on account of disproportionate AMP Expenses, by ignoring the facts the these expenses were incurred in the building of the brand name ‘Lotus’ and all the sister concerns were benefitting from the goodwill of the brand. |

| 4. | | The Ld. CIT(A) has erred on facts and in law by ignoring the fact that the assessee failed to apportion the AMP expenses between itself and its sisterly concerns namely Lotus Herbal Color Cosmetics and Kanidi Cosmeceuticals based upon the common expenses with regards to building of brand name ‘Lotus’. |

| 5. | | The Ld. CIT(A) has erred on facts and in law by not appreciating the fact that the entire AMP expenses has been claimed by assessee only to artificially depress its taxable profit in order to accumulate tax free income and evade taxes. |

| 6. | | The Ld. CIT(A) has erred on facts and in law by ignoring the fact that the assessee deliberately did not apportion the AMP expenses in the hands of its two sisterly concerns because these were enjoying tax holidays under the provisions of section 80IC(7) r.w.s. 801A(10) of the Income Tax Act, 1961. |

| 7. | | The Ld. CIT (A) has erred on facts and in law, giving the opinion that the Assessing Officer was wrong in apportioning the AMP expenses amongst the assessee and its two sisterly concerns, since the assessee is a marketing entity while the latter two are purely manufacturing concerns without considering the fact that these concerned are also enjoying the benefits of the common and sharing expenses. |

| 8. | | The Ld. CIT(A) has erred on facts and in law by not appreciating the fact that the premium charged by the other two entities on their products is due to the brand name built by the advertisement/marketing and promotion budget wholly claimed by assessee in its books without sharing with its two sister concerns. |

| 9. | | The Ld. CIT(A) has erred on facts and in law by not appreciating the fact that there was nothing to discriminate between the product lines sold by assessee visa-vis its other sisterly concerns to an average discerning customer and the entire product line is only sold under “Lotus” Brand. |

| 10. | | (a) The Order of the Ld. CIT(A) is erroneous and not tenable in law and on facts. |

| (b) | | The appellant craves to add, alter or amend any/all of the grounds of appeal before or during the course of the hearing of the appeal.” |

10. Ground of Appeal No.1 is with respect to the deletion of disallowance made by the AO out of Advertisement, Marketing & Promotion (AMP) Expenses mounting to Rs.1,76,17,a395/- by holding the same as non-genuine expenses.

11. Before us, Ld. CIT-DR vehemently supported the order of the AO on this issue and submits that a survey was carried out at the business premises of the assessee on 31.03.2018, and based on the findings of the survey, the AO observed that assessee has got manufactured its goods from two firms namely M/s Kanidi Cosmeceutical (hereinafter referred to as’KC’) and M/s Lotus Herbals Color Cosmetics (herein after referred to as ‘LHCC’). During post survey enquiries, it was found that assessee has claimed certain expenses which are not verifiable. Ld. CIT-DR submits that the AO has made independent verification of the AMP expenses by issue of summons u/s 133(6) and concluded that the expenses to the tune of Rs.1,76,17,395/- paid to four parties were not verifiable as they have not filed any details in response to the summons issued. Accordingly, the same were disallowed by the AO. The Ld. CIT-DR submits that these parties have failed to respond to the notice issued to them u/s 133(6), therefore, the services rendered by them are doubtful and, he requested for the confirmation of the disallowance made by the AO.

12. On the other hand, the Ld. AR of the assessee, at the outset submits that in the remand report dated 22.05.2023, the AO has accepted that during the remand proceedings all the documents were filed by these four parties and it is observed by the AO that they are showing more turnover than the payments were made to them by the assessee. The Ld. AR further submits that similar disallowance was made in AY 2019-20 which stood deleted by Ld. CIT(A) and no further appeal is preferred by the revenue. Further in AY 2020-21 expenses of similar nature were incurred and were accepted, therefore as a principle of consistency also the expenses claimed by holding the parties as non-genuine is incorrect and consequent disallowance has rightly been deleted by the ld. CIT(A) which orders deserves to be upheld. Ld. AR also filed the detailed written submission which reads as under:

“It is respectfully submitted that the disallowance made by the AO is wholly erroneous, contrary to facts on record and was correctly deleted by the CIT(A) for following reasons.

Re (i): Complete supporting documents furnished before the AO which was also accepted by the AO in Remand Report

It is, at the outset, respectfully submitted that complete supporting documents pertaining payment made to all the aforesaid 4 parties were duly submitted by the assessee during the course of assessment proceedings. The list of such supporting documents along with a brief description of nature of transaction entered into by the assessee with each of the aforesaid parties is enclosed herewith as Annexure1.

On a perusal of the aforesaid Annexure, it would be appreciated that complete relevant supporting documents in order to establish the identity, genuineness of the said parties and payment of AMP Expenses to the said parties to the said parties was furnished before the AO and by no stretch of imagination it could have been alleged that the genuineness of these AMP expenses remained unsubstantiated for lack of documentary evidences.

Pertinently, the AO, in remand report dated 22.05.2023 [@ pages 512 to 518 of the paper book, relevant ja 512 to 5131, has also categorically accepted that the required supporting documents qua all the aforesaid parties were submitted by the assessee vide replie(s) dated 11.03.2022 and 28.03.2022 furnished during assessment, proceedings. Further, the AO had also sent notices u/s 133(6) of the Act to the parties and after reconciling the accounts and records submitted by these parties, the AO was satisfied about the genuineness of the parties and genuineness of the transactions.

In view of above, considering that the AD has categorically admitted that evidences in support of the said payments were duly furnished by the assessee, the allegations basis which disallowance of AMP expense was made to the AO stands obliterated and no appeal by be Revenue is maintainable on this issue.

Reliance in this regard is placed on the following decisions wherein the Courts/Tribunal have held that appeal before the Tribunal is not maintainable where assessing officer has accepted the issue in remand report furnished before CIT(A)

| • | | Jivallal Purtapshi v. CIT: 65 TTR 261 (Bom.) |

| • | | Smt. B. Jayalakshmi v. ACIT: 407 ITR 212 Mad.) |

| • | | ACIT v. R. P. G.Credit & Capital Lad: ITA. Nos.- 4688-4690/Del/2012 (Del. Trib.) |

| • | | ACIT v. Ansal Housing and Construction Lad ITA No. 3171/Del/2019 (Del. Trib.) |

No appeal by Department in A V2019-20 on this issue

Further, similar disallowance on account of payment to suspicious parties, involving some common parties, was made by the AO in AY 2019-20, which was deleted by CITEA) on same reasoning; however, the Revenue has not filed appeal on that issue in that year.

Re (ii): Notice(s) under section 133(6) were duly responded by the parties

In this regard, contrary allegation by the assessing officer that these 4 parties failed to respond to notice(s) issued under section 133(6) the Act, it is respectfully submitted that all the aforesaid parties, except Krishna Attire, duly responded to the notice(s) issued to them and furnished the required documentary evidences in order to establish the genuineness of the transaction(s) entered into by them with the assessee during the relevant assessment year 2013-14. The screenshots of ITBA portal/ emails qua replies furnished by the parties in response to notice(s) under section 133(6), along with relevant pages of the paper book, are specified in Annexure 1

Further, as far as non-filing of required reply to notice under section 133(6) by Krishna Attire is concerned, it is respectfully submitted that the sole reason for non-furnishing of the said response was that Krishna Attire was never served with such notice issued by the assessing officer. The said fact was duly brought to the notice of the assessing officer vide reply dated 28.03.2022 filed by the assessee during the assessment proceedings. [Refer, pages 309 to 348 of the paper book, relevant @ page 328]

On a perusal of the aforesaid Annexure, it may be appreciated, that the allegation levelled by the assessing officer that no aforesaid parties responded to notice(s) under section 133(6) in factually incorrect and levelled without judicious appreciation of facts and evidences furnished by such parties

Further, without prejudice to the fact that the required response(s) to notice(s) under section 133(6) were furnished by the aforesaid parties, it is respectfully submitted that it has been repeatedly held by the Courts that the mere fact that a third party does not respond to the notice and or appear before the assessing officer to confirm a transaction cannot transaction Reliance in this regard is placed on the following decisions:

| – | | CTT v. Fancy International: (Delhi) |

| – | | CIT v. Haresh D. Mehta: (Bombay) |

| – | | CIT v Nikunj Eximp Enterprises P. Lad: 372 ITR 619 (Bom.) |

| – | | Diagnostics v. CIT: 334 ITR 111 (Cal)Gudwala& Sons v. ACFT: (Delhi-Tob.) |

| – | | M/s. Kesha Appliances Pvt. Ltd. v. ITO: ITA No. 2715/Del/2016 DCIT v. Bhaijee Commodities (P.) Ltd. : ITA No.5323/Del/2015 |

| – | | Umbrella Project Pvt. Ltd. v. ITO, ITA. No. 5955/Del/2014 |

| – | | Phool Singh v. ACIT: ITA No. 2901/Del/2014 |

| – | | Cheil India (P.) Ltd. v. ITO: (Delhi–Trib.) |

| – | | M/s LalsonsJewellers Ltd. v. ACTT ITA No. 5241/Del/2004 (Del) |

In view of above, the assesse had discharged its onus establishing genuineness of AMP expenses and even the parties to whom notice(s) were served under section 133(6) had also furnished its reply and the AO has failed to point out discrepancy in the documents and explanation furnished by the assesse.

Re (in): Genuineness of the parties stood accepted by AO during assessment proceedings for AY 2020-21

It is further respectfully submitted that, during the assessment proceedings for assessment year 2020-21, the assessing officer, vide Question No.9 of Notice dated 14.02.2022 issued under section 142(1) of the Act (@) pages 613 to 615 of the paper book (Refer page 614), directed the assessee to furnish party-wise details of Advertisement and Business Promotion expenses.

In response to the aforesaid, the assessee, vide reply dated 10.03.2022 (filed on 14.03.2022) (Refer, pages 617 to 6.39 of the paper hook, relevant in, 634 to 639), furnished detailed explanation along with documentary evidences such as ledger accounts, PAN and GST registration numbers of the parties through which such expenses were incurred by the assessee during assessment year 2020-21 It is pertinent to note that, in the said reply, explanation and documentary evidences qua all the aforesaid 4 parties Le. (1) Krishna Attire, (2) Brand Vision, (3) Symmetrix Prints and (4) Shan Creations were furnished by the assessee.

Being satisfied with the assessee’s response, subsequently, assessment proceedings culminated into assessment order dated 29.09.2022 pages 640 to 653 of the paper book) being passed by the assessing officer under section 143(3) of the Act wherein no disallowance of AMP Expenses paid to these parties was made by the assessing officer.

In that view of the matter, considering that the AO has also allowed AMP expenses made to the parties in AY 2020-21, it could not have been alleged in assessment year 2013-14 that the genuineness of such parties remained unsubstantiated.

For the aforesaid cumulative reasons, the disallowance of AMP expenses made by the AO was correctly deleted by the CIT(A) and the ground of appeal raised by the Department ought to be dismissed.

13. Heard the parties and perused the materials available on record. It is seen that during the course of reassessment proceedings, the Assessing Officer has issues summons u/s 133(6) of the Act to various parties, out of which four parties namely (i) M/s Krishna Attire & Hospitality Services (Krishna Attire) Rs.7,46,697/- (ii) M/s Shan Creations – Rs.25,69,331/- (iii) M/s Brand Vision – Rs.8,00,000/- and (iv) Symmetrix Prints Pvt. Ltd. (‘Symmetrix Prints)- Rs.1,35,01,367/- had not filed any response to the notice issued, therefore, the identity and genuineness of the transactions with these parties remained unproved. Accordingly, the AO had made the disallowance of the payment made to them. It is further seen that before the Ld. CIT(A) during the course of appellate proceedings, assessee has filed all the relevant details as additional evidences and remand report was obtained from the Assessing Officer. In the remand report as available at pages 19 to 24 of the CIT(A)’s order, the AO has accepted that the parties have filed all the details and their identity and services rendered were not doubted. The remand report so filed is reproduced as below:

To,

The Commissioner of Income Tax (Appeals),

Appeals-27, Delhi.

(Through Proper Channel)

Sir,

Sub: Verification of details in the case of M/s Lotus Herbal Private Limited, PAN: AAACL0198F for AYs 2013-14 to 2016-17-reg.

Kindly refer to your office letter bearing F. No. CIT(A)-27LHPL/2023-24/35 dated 02.05.2023 vide which this office as directed to verify whether the supporting documents to establish genuineness, identity of various parties against which AMP expenses were claimed by the assessee in various assessment year were filed by the assessee or not during the course of assessment proceedings.

2. In pursuance to the same, a verification exercise was done, and upon perusal and analysis of the submissions made by the assessee vide his letters dated 11.03.2022 and 28.03.2022, it is submitted that the assessee submitted following documents to establish genuineness and identity of the parties.

AY 2013-14

| Name of the party | PAN | Details of documents submitted by the assessee vide letters dated 11.03.2022 and 28.03.2022 |

| Krishna Attire & Hospitality Service | AIRPMI515H | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers |

|

| Shan Creations | ACSPG7894A | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers |

|

| Brand Vision | BGUPS2304A | | b. | | Copy of Ledger Account in the books of assessee company |

| c. | | Copy of PAN and GST registration |

| d. | | Copies of journal vouchers and invoice |

| f. | | Screenshot of compliance |

|

| Symmetrix Prints Private Limited | AALCS7753A | | b. | | Copy of Ledger Account in the books of M/s Symmetrix Prints Private Limited |

| c. | | Copy of PAN and GST registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Sample copies of purchase order and journal voucher |

| g. | | Screenshot of compliance to notice u/s 133(6) |

| h. | | Certificate of turnover |

|

AY 2014-15

| Name of the party | PAN | Details of documents submitted by the assessee vide letters dated 11.03.2022 and 28.03.2022 |

| Krishna Attire & Hospitality Service | AIRPMI515H | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers |

|

| Shan Creations | ACSPG7894A | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers |

|

| Brand Vision | BGUPS2304A | | b. | | Copy of Ledger Account in the books of assessee company |

| c. | | Copy of PAN and GST registration |

| d. | | Copies of journal vouchers and invoice |

| f. | | Screenshot of compliance |

|

| Symmetrix Prints Private Limited | AALCS7753A | | b. | | Copy of Ledger Account in the books of M/s Symmetrix Prints Private Limited |

| c. | | Copy of PAN and GST registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Sample copies of purchase order and journal voucher |

| g. | | Screenshot of compliance to notice u/s 133(6) |

| h. | | Certificate of turnover |

|

AY 2015-16

| Name of the party | PAN | Details of documents submitted by the assessee vide letters dated 11.03.2022 and 28.03.2022 |

| Iqra Display Private Limited | AACC19015L | | b. | | Confirmation of Ledger account |

| c. | | Copy of PAN and GST/VAT registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Sample copies of purchase order and journal voucher |

| g. | | Screenshot of compliance to notice u/s 133(6) |

| h. | | Certificate of tunrover |

|

| Kreo Packaging | ANWPA1677N | | b. | | Confirmation of Ledger account |

| c. | | Copy of PAN and GST/VAT registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Sample copies of purchase order and journal voucher |

| g. | | Screenshot of compliance to notice u/s 133(6) |

| h. | | Certificate of turnover |

|

| Krishna Artire & Hospitality Service | AIRPM1515H | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers. |

|

| Shan Creation | ACSPG7894A | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers. |

|

| Brand Vision | BGUPS2304A | | b. | | Confirmation of Ledger account |

| c. | | Copy of PAN and GST/VAT registration |

| d. | | Copies of journal vouchers and invoice |

| f. | | Screenshot of compliance to notice u/s 133(6) |

|

| Symmetrix Prints Private Limited | AALC97753A | | b. | | Confirmation of Ledger account |

| c. | | Copy of PAN and GST/VA T registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Sample copies of purchase order and journal voucher |

| g. | | Screenshot of compliance to notice u/s 133(6) |

| h. | | Certificate of turnover |

|

AY 2016-17

| Name of the party | PAN | Details of documents submitted by the assessee vide letters dated 11.03.2022 and 28.03.2022 |

| Iqra Display Private Limited | AACC19015L | | b. | | Confirmation of Ledger account |

| c. | | Copy of PAN and GST/VAT registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Sample copies of purchase order and journal voucher |

| g. | | Screenshot of compliance to notice u/s 133(6) |

| h. | | Certificate of turnover |

|

| Kreo Packaging | ANWPA1677N | | b. | | Confirmation of Ledger account |

| c. | | Copy of PAN and GST/VAT registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Sample copies of purchase order and journal voucher |

| g. | | Screenshot of compliance to notice u/s 133(6) |

| h. | | Certificate of turnover |

> |

| Krishna Artire & Hospitality Service | AIRPM1515H | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers. |

|

| Shan Creation | ACSPG7894A | | b. | | Copy of GST registration |

| d. | | Sample copies of invoices |

| e. | | Sample copies of journal vouchers. |

|

| Brand Vision | BGUPS2304A | | b. | | Confirmation of Ledger account |

| c. | | Copy of PAN and GST/VAT registration |

| d. | | Sample Copies of journal vouchers and invoice |

| f. | | Screenshot of compliance to notice u/s 133(6) |

|

| Symmetrix Prints Private Limited | AALC9 7753A | | b. | | Copy of Ledger account in the books of M/s Symmetrix Prints Private Limited |

| i. | | Copy of PAN and GST/VAT registration |

| j. | | Sample Copies of journal vouchers and invoice |

| l. | | Sample copies of purchase order and journal voucher |

| m. | | Screenshot of compliance to notice u/s 133(6) |

| n. | | Certificate of turnover |

|

3. Accordingly, in light of facts and decision as above, your honor is most respectfully requested to decide the appeal as per the provisions of law, subject to your honor’s satisfaction.

Yours faithfully.

ANSHUL

Deputy Commissioner of Income Tax,

Central Circle-20, Delhi

14. Ld. CIT(A) after considering the replies of the assessee and remand report submitted by the AO, as reproduced above, has deleted the disallowances by making following observations:

5.3 Finding and Decision:

| i. | | From the remand report it has been observed that the appellant had actually filed all the relevant information to establish the genuineness of the business transaction. |

| ii. | | It has also been observed that all the, parties have declared higher turnover vis-s-vis amount received by them from the appellant. |

| iii. | | It is also observed that most of these parties are regular vendors of the appellant company year after year and the transactions with them are not one of its kind. |

| iv. | | In view of the above discussion, the addition of Rs.1,76,17,395/- on account of non-genuine Sales Promotion expenses u/s 37 of the IT Act is deleted and this ground of appeal is hereby allowed. |

15. It is a matter of fact that the Ld. CIT(A) based on the aforesaid remand report wherein column (3), the Ld. AO has observed that for AY 2013-14 all the parties have filed the relevant details such as their Copy of PAN, Copy of GST registration, Copy of Adhar Card, Sample copies of invoices, Sample copies of journal vouchers and ITR etc. and they have not been doubted by the AO in remand proceedings, therefore, the Ld. CIT(A) of the view that the expenses claimed were genuine and deleted the disallowance. The Ld. CIT(A) also observed that these parties have declared higher turnover viz-a-viz amount received by them for the appellant and are regular vendors. Before us, these facts have not been converted by the Revenue and in remand report the AO himself has not raised any doubt about the genuineness of the expenses claimed against the payments made to these parties, therefore, the order of Ld. CIT(A) on this issue is hereby upheld. In the result, the ground of appeal No.1 taken by the revenue is dismissed.

16. Ground No.2 taken by the revenue is with respect to the deletion of disallowance of Rs.35,42,857/- made out of the salary paid through credit notes under section 37 of the Act. The AO observed that during the course of survey in digital data impounded from the possession of one of the employee of the assessee wherein it was found that salary of Rs.35,42,857/- was paid through credit notes to 293 employees and was claimed as expenses. The assessee claimed that it relates to employees which were placed at the distributor / local retailer place where they worked as companies employees and demonstrate the products of the company to walk-in customers. The AO has made disallowance by holding that assessee has not submitted any agreements etc.in this regard. The Ld. CIT(A) has deleted the disallowance so made by appreciating the fact that the staff was working at the retailer show room. Against this Revenue is in appeal before the Tribunal.

17. Before us, Ld. CIT-DR supported the order of the AO and submits that the payments were made through credit notes and no details of the employees working under these arrangements were submitted nor found during the course of survey at the business premises of assessee. During the course of survey, the salary expenses booked through these credit notes were not found recorded in the tally records and were recorded thereafter. It is further submitted that the assessee has also failed to explain the nature of services rendered by these employees. He, therefore, requested for the restoration of the disallowance made by the AO.

18. On the other hand, the Ld. AR vehemently supported the order of the Ld. CIT(A) in deleting the disallowance and made the following submissions:

“It is respectfully submitted that the aforesaid allegations levelled by the AO are factually incorrect and without appreciation of the facts of the case. However, before furnishing rebuttal to such allegations, it is imperative to appreciate the nature of such salary payments which is succinctly explained as infra:

Salary payments through credit note is allowable business expenditure u/s 37(1)

The assessee is engaged in the business of trading of cosmetic and skincare products under the brand name “LOTUS’ and sells its products through a well-connected network of distributors, dealers and retailers across the country, explained hereunder.

Assessee- Retailer- Dealer- Distributor- End Customer

It may be appreciated that in the entire supply chain, it is ultimately the Retailer, who sells assessee’s products to the end customer and the assessee along with the distributors and dealers enter into only Business to Business transactions (828 transactions). The retailers, in order to sell the product have to employ certain sales personnel, commonly known as “beauty advisors’, who are trained in and aware of the specific products traded by the assessee and facilitate the customers to select the right product as per their skin and beauty requirements.

Such expenses are, it is submitted, normal selling expenses incurred by the assessee insofar as the assessee is selling its products through various dealers/distributors/retailers; furthermore, as a natural corollary, the payment of such salary expenses of beauty consultants is incurred/borne by the assessee by issuance of credit notes.

Since the assessee, generally, have no direct dealing with the retailers, the payment of beauty consultants then have to be made by the retailers which is deducted out of the payment made to dealer. Similarly, dealer deducts the payment out of amount payable to Distributor and distributor deducts the payments out of payment to the assessee. It is this amount of salary, for which the assessee has to issue credit notes to distributors/ dealers as the case may be.

It may be appreciated that bearing of salary expenses of such Beauty Advisors is nothing that a marketing and sales promotional exercise which is undertaken by the assessee, thus, the assessee books these expenses as AMP Expenses in its financial accounts. The said expenditure is incurred solely with the objective of increasing/boosting the sale of products of assessee and is accordingly, an allowable business expenditure in hands of the assessee

Rebuttal of allegations of AO

In the light of the aforesaid background, the allegations levelled by the assessing officer are rebutted as under.

Re(i): No rationale for making salary payments via credit notes

The detailed rationale for the same stands duly explained supra which has also been accepted by the CIT(A).

Re (ii): Absence of agreement, record of payments in accounting software and encashment of salary pavements by employees

It is pertinent to point out that there is no separate agreement is entered by the assessee with the distributors and dealers for such arrangement, the credit notes are issued by the assessee only upon receiving the necessary claim documents from the respective distributors/dealers. During the course of assessment proceedings, the assessee had furnished the following documents:

| S. No. | Particulars | Paper Book Page No. |

| 1. | Month-wise summary of credit notes issued by the assessee | 654 |

| 2. | Details of salespersons and distributors to whom credit notes were issued | 655-658 |

| 3. | Credit notes, on sample basis, along with claim documents submitted by the distributors | 659-848 |

The assessee has debited such expenses under the accounting head of Distributors Sales Persons Expense and clubbed the same in Marketing and Selling Expenses. The AO has failed to appreciate that for assessee such expenses are not Salary expenses as these persons were not employees of the assessee. Since they were hired by our Marketing channels, so correctly the assessee claimed such expenses under the grouping of Marketing and Sales Promotion expenses. The AO had misunderstood the entire explanation which lead to wrong conclusion.

Re (iii): Non-furnishing of data during post survey proceedings by Sh. Prabhat, Sales Operation Manager of Assessee.

The allegation of the AO that in his statement recorded during post-search/ survey proceedings. Sh. Prabhat, Sales Operation Manager of the assessee, failed to furnish data regarding payment of salary through credit notes is, it is submitted, wholly contrary to the record of the case inasmuch as Sh. Prabhathad had duly shown all transactions of salary paid to dealers/distributors/retailers staff deputed at showrooms and retail outlets to promote the sale of “Lotus” products; he also submitted the documentary chain of credit/ debit notes between the assessee and its Super stockists/dealers/ distributors/ retailers, and also clarified that the said expenses are not booked under the head of salary but are in fact in the nature of ‘marketing and sales promotion expenses’ and are recorded accordingly under the grouping of Advertisement, Marketing and sales Promotion.

For the aforesaid cumulative reasons, the disallowance of salary paid through credit notes was correctly deleted by the CTT(A) and the ground of appeal raised by the Department ought to be dismissed.”

19. Heard both the parties and perused the materials available on record. Sole reason for making the disallowance is that there was no legal document available for making such arrangements for deploying the staff at retailer or distributor place. Further the AO observed that the said credit notes were not entered in tally records at the time of survey. However, from the perusal of the observations of Ld. CIT(A), we find that the Ld. CIT(A) in para 6.1 to 6.4 of the order has discussed this issue in detail and accepted the contention of the assessee that the staff of the assessee were deputed at various shops, malls, outlets show room where they were undersigned the duty of providing/demonstrating the product details marketed by the assessee company under the brand name “LOTUS” to the walk-in customers. It is a common practice of marketing and promoting goods and the companies are placing their employees at the place of retailer to demonstrate and promote their products directly to the customers. White goods companies, mobile companies are few examples which are following this model to promote their products. The AO has failed to appreciate this fact and made the disallowance. The existence of credit notes has not been denied and the payments to the respective parties / retailers on this account have been accepted. During the course of hearing, we have made specific query about the GP and NP ratio of the assessee and found that the assessee has declared better results despite of incurring these expenses. Further the assessee has filed the exhaustive list of the employees and the dealers/retailer to whom such credit notes were issued. Moreover, the services of the employees were reflected in the results of the assessee which as observed above, are better as compared to previous years and Ld. CIT(A) has deleted the disallowance after appreciating these facts. Before us, Revenue has failed to controvert such findings by placing any contrary material, therefore, we find no error in the order of Ld. CIT(A) in deleting the disallowance made on this account. Accordingly, ground of appeal No.2 taken by the Revenues is hereby dismissed.

20. Ground of appeal Nos. 3 to 9 of the Revenue are with respect to deletion of disallowance of AMP expenses made by AO by holding that these expenses were properly apportioned between the assessee and manufacturing units who are enjoying deductions u/s 80IC of the Act. Before us the Ld. CIT DR for the revenue submits that assessee is having two sister concerns which are wholly and exclusively the manufacturing cosmetic and skin care products which are traded by the assessee under the brand name ‘LOTUS’. These companies are KC and LHCC. The Ld. CIT DR submits that both these companies have enjoyed deductions u/s 80IC of the Act on the income earned by them and the assessee has not allocated any expenses AMP expenses to these manufacturing units solely declaring higher profits and claimed deduction u/s 80IC on the same. Accordingly, the AO has distributed the expenses in the ratio of their turnover and for the year under appeal a sum of Rs.8,85,32,294/-was disallowed as expenses as claimed by the assessee being allocable being burden to these units. Ld. CIT-DR further supports the observations made by the AO in para 12.4 of the order wherein the AO has observed that claiming entire expenses of advertisement, marketing and sales promotions by the assessee which is not making any value addition to the products, it is an attempt to deliberately keeping the profits of the KC and LHCC at a higher level to claim higher deduction u/s 80IC o the Act and to keep the profits of assessee company at a lower level to pay lower taxes. The ld. CIT-DR prayed for the confirmation of the order of the AO in this regard.

21. The ld. CIT DR further submits that these expenses were incurred by the assessee on the products manufactured by two sister concerns namely KC and LHCC. He submits that the entire products manufactured by them were traded and marketed by assessee company and the expenditure incurred on the marketing and sales promotions had direct relationship with their sales and had not added any value to the products. As these expenses are directly related to increase in demand of the products manufactured by the sister concerns for the assessee and benefited the manufacturing units to achieve better turnover. Accordingly, the action of the AO in allocating the AMP expense to the manufacturing units is in accordance with law and he requested for the restoration of the disallowance made by the AO.

22. On the other hand, the Ld. AR of the assessee submits that assessee is working in this line of business of last 20 years and created, nurtured and developed the brand ‘LOTUS’ in the field of cosmetic and skin care products. The brand ‘LOTUS’ is owned by the assessee and is renowned skin care product and belongs to the assessee only. The assessee is required to incur AMP expenses to maintain the demand of the lotus brand products. The assessee got manufacture the products from LHCC and KC and the sale price paid to them was at arm’s length price which fact has not been denied by the AO. The purchases from M/s LHCC were started in 2004 and from the year 2006, KC also started production and both of them are manufacturing the products for the assessee only. It is submitted that assessee is buying the products manufactured by these companies on contract basis. These companies manufacture the products only and are not concerned in any manner with their marketing which is the sole responsibility of the assessee who is trading the goods under the brand Lotus. Since the purchases price paid for these products was at arm’s length price which has not been doubted in any of the year since the assessee started these product manufactured from these two sister concerns. The Ld. AR submits that Ld. CIT(A) has deleted the disallowance by observing that the expenses were wholly and exclusively incurred for assessee business and allowable u/s 37(1) of the Act. He further submits that the nature of business of these two entities are different from assessee’s business who is trading its products and the main reason for the deletion of disallowance is that these expenditures were incurred by FMCG companies engaged in marketing and sale of product in order to penetrate highly competitive market consumer products. The contract manufacturers like LHCC and KC merely require manufacturing the products on contract basis for the marketing companies like the assessee who owned the brand name and also possesses the formula for manufacture such products. The Ld. AR thus submits that the order of the Ld. AR in this regard deserves to be upheld. He also filed a detailed written submission which reproduced as under:

“At the outset, the assessee seeks to respectfully submit/reiterate, with all emphasis at its command, the following important aspects/facts:

| (a) | | Brand name “LOTUS” and formula to prepare the products is owned by the assesse- AO also admits that brand pays an important role inasmuch as AO “In para 12.1 of the assessment order observed, “In cosmetics and skin care producing industries, the value of the finished. products is mainly due to its brand. On the similar lines, finished product of LIIPL are well known among the consumers due to its brandname-“Lotus”; |

| (b) | | It is not disputed by AO that to build a brand image, any company has to incur AMP expenditure (refer para 12.1); |

| (c) | | The entire AMP Expenses incurred by the assessee were undisputedly wholly and exclusively incurred for assessee business aspect has been disputed by the AO; |

| (d) | | The only case of the AO is that part of the AMP expenses ought to have been apportioned and borne by the two manufacturing entities, that too, simply on the ground that the said two entities were claiming tax holiday under section 80IC of the Act and the AO, on conjectures surmises, concluded that AMP expenses have not been apportioned to show higher profits in the said entities; |

| (e) | | It is, in fact, not even the case of the AO that the sale consideration received by the two entities for supply of products manufactured for to the assessee on a contract basis was not at arms’ length-in fact, AO has not disputed that the TNMN method followed for benchmarking the turnover of the two entities stood accepted to be at arms’ length under section 92C of the Act (1) At no stage, has it been alleged, much less demonstrated, by the AO that part of the AMP expenses on account of any business rationale and/or agreement between the parties, been partly borne by the two manufacturing entities. |

| (f) | | It is, in fact, not even the case of the AO that the sale consideration receive by the two entities for supply of products manufactured for/to the assessee on a contract basis was not at arms’ length-in fact, AO has not disputed that the TNMN method followed for benchmarking the turnover of the two entities stood accepted to be at arms’ length under section 92C of the Act. |

| (g) | | At no stage, has it been alleged, much less demonstrated, by the AO that part of the AMP expenses on account of any business rationale and/or agreement between the parties, been partly borne by the two manufacturing entities. |

In the aforesaid background, it is submitted that the disallowance made by the AO is not sustainable in law in view of the following:

Re (i): AMP Expenses incurred wholly and exclusively for assessee’s business and allowable under section 37(1) of the Act

The assessee is engaged in the FMCG industry, specifically cosmetic and skin care products, for the last more than 20 yrs., wherein, marketing and sales promotion and the resultant development of “brand name” plays a significant/ pivotal role in the business of an assessee.

It is pertinent to note that in the business segment in which the assessee operates, the main focus lies on market reputation and acceptability of the brand. In order to achieve this goal, the assessee is required to incur significant expenses on AMP in order to enhance as well as maintain the visibility and acceptance of its brand in the market. Without the existence of a well-known brand, any cosmetic product sold by the assessee would not fetch nearly as high a price as that charged by the assessee.

It is respectfully submitted that as per the business model being followed by the assessee, in order to maintain consistent quality, secrecy of formula of products and uninterrupted supply of goods, the promoters of Lotus group incorporated two separate partnership firms by the name of: (1) KC for manufacture of skin care products; and (ii) LHCC for manufacture of cosmetic products, while maintaining ownership of the brand trademarks/ trade secrets, etc. in the name of the assessee. The assessee purchases the products manufactured by KC and LHCC at arm’s length price, and thereafter, sells the same in the open market under its own brand name “Lotus”

The aforesaid business model has been consistently followed by the assessee for more than two decades and after incurring significant expenditure on advertisement and promotion of its brand “Lotus”, the assessee stands in a position to market and sell its products at significantly higher prices as opposed to the prices which such products would otherwise fetch without the brand name of Lotus attached to it.

It is further pertinent to note that LHCC and KC are manufacturing entities and assessee is the trading/ marketing entity which owns the brand “LOTUS”. LHCC and KC sell their products to the assessee only and do not make any sales to third parties, no AMP expenditure is required to be incurred by the said entities. The assessee owns the brand “LOTUS and thus, AMP expenses are incurred by the assessee in order to attract customers and to build its presence in the market.

The entire AMP expenses were, it is submitted, incurred wholly and exclusively for the purposes of creation and promotion of its brand, viz. Lotus and for marketing of cosmetic and skin care products in the regular course of its business of trading. The entire AMP expenses relates wholly and exclusively to the trading business of the assessee. In view of above, AMP expenses incurred by the assessee are allowable business expenditure under section 37(1) of the Act.

In fact, it is not even the case of AO that any part of AMP expenditure incurred and claimed by the assessee, was incurred for and on behalf of any other entity, much less the two related entities viz., LIICC and KC. Once expenditure is undisputedly found to have been incurred wholly and exclusively for the purposes of the business, then, no part of the expenditure incurred can be disallowed under section 37(1) of the Act.

In the assessment order, the primary allegation of the AO is that part of the AMP expense incurred by the assessee should have been apportioned to LHCC and KC since there is no value addition on the part of the assessee and the two entities were claiming tax holiday.

In making the aforesaid allegation, the assessing officer has failed to bring on record any corroborative evidence in the form of comparative study of AMP expense incurred by similar FMCG companies and how the expense incurred by the assessee is excessive. Further, the necessity of incurring an expenditure and reasonableness thereof has to be seen from the point of view of businessman and cannot be dictated by the Revenue authorities [Refer, CIT v. Walchand & Co.: 65 ITR 381 (SC), J.K. Woollen Manufacturers v. CIT: 72 ITR 612 (SC), CIT v. Birla Cotton Spg. and Wvg. Mills Ltd.: 82 ITR 166(SC), Madhav Prasad Jatia v. CIT UP: 118 ITR 200 (SC) and S.A. Builders Ltd. v. CIT: 288 ITR 1 (SC)]

That apart, in the instant case, there is no such incidental benefit, even remotely, flowing to KC and LHCC because the said entities have not sold any product in open market and it is only the assessee, which has sold the products in the open market. The assessee being exclusive seller of the licensed product in India, the benefit of advertisement of brand promotion expenses ensures to the assesscee in the form of higher sales and consequently higher profits.

Further, even if for the sake of argument, it is accepted that incurrence of such AMP Expenses indirectly benefitted assessee’s sister concerns, then also no disallowance of such AMP Expenses could have been made in the hands of the assessee. Reliance in this regard is placed on the following decisions:

| – | | Sassoon J. David and Co. P. Ltd. v. CIT: 118 ITR 261 (SC) |

| – | | CIT, Chandulal Keshavial & Co.: 38 ITR 601 (SC) |

| – | | Nestle India Ltd. v. DCTT: 111 TTJ 498 (Del) CIT v. Samsung India Electronics Ltd. : (Delhi) |

| – | | CIT v. Adidas India Marketing (P) Ltd. : (Del) |

| – | | CIT v. Agra Beverages Corporation (P) Ltd.: ITA No.966 of 2009 (Del HC) |

| – | | Sony Ericsson Mobile Communication India (P.) Ltd. v. CIT: 374 ITR 118 (Del) |

| – | | Sony India (1) Laf v. Dy. CIT: 114 ITD 448 (Del) |

| – | | Star India (P) LAL. 103 ITD 73 TM (Mum) |

| – | | National Panasonic (India) Lal. v. JCIT: ITA No. 3238/Del/2002 |

| – | | Samsung Indor: ITA Nos. 1360 & 3374/Del/2002 |

| – | | DCIT v. Manti Countrywide Auto Financial Services Pvt. Ltd.: ITA Nos. 2181 to 2183/Del/2010 |

For the aforesaid reasons, it is submitted that since the entire AMP expenses were incurred by the assessee wholly and exclusively for its business and in order to promote its brand “Lotus”, the disallowance of part of the expenditure on the ground that some expenditure should have been allocated to other entity(ies). The disallowance of part of the AMI expenses has rightly been deleted by the CITEA)

Re (ii): Allegation that by booking the entire AMP expense, the assessee has shifted profits to LHCC and KC which enjoy tax holiday u/s 80-IC, is devoid of any merit.

It is further respectfully submitted that the allegations levelled by the AO that by booking/ claiming the entire AMP expense in its hands, the assessee has shifted profits to group entities, viz., LHCC and KC, which are eligible for tax holiday under section 801C of the Act, is without any basis for following reasons:

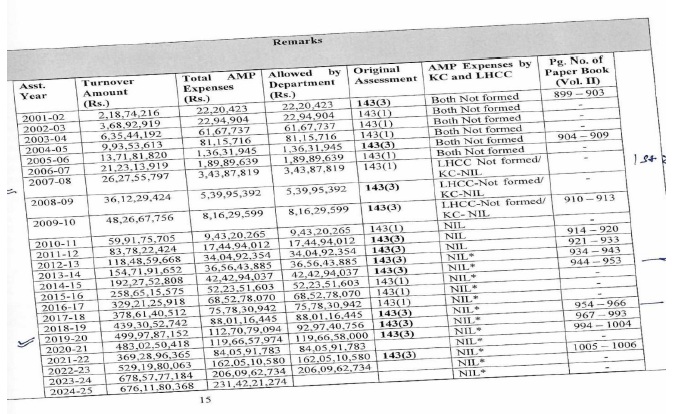

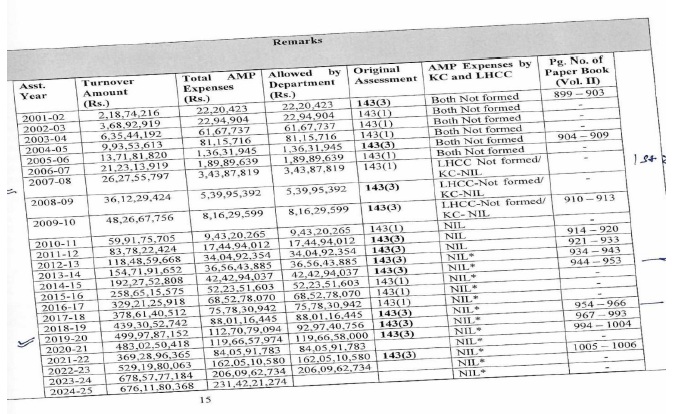

| (a) | | The assessee, even before the incorporation/ formation of aforesaid group entities and divesting its manufacturing activities in the hands of such entities, was incurring significant expenses on AMP which were always accepted and allowed in assessment, which is evident from the tabulation hereunder: |

| (b) | | As elaborated above, the assessee is the brand owner and benefit of AMP expenses ensures solely to the assessee. LICC and KC are mere contract manufacturers which were manufacturing the products for the assessee. The AMP expenditure has been unilaterally incurred by the assessee for the sales promotion and promotion of the brand name ‘LOTUS’ in the course of carrying on its trading business alone and thus the same cannot be attributed to the manufacturing concerns. AMP expenditure incurred is interlinked and interconnected activity/ function performed in connection to the main business of the assessee i.e., trading/selling of skincare products and thus, constitutes an essential part of the cost of sales. Without these expenses, the assessee would not be able to compete effectively. Further, even if deduction under section 80IC was not available to LIICC and KC, then too, the AMP expense would have been borne by the assessee only without any being apportionment being made to the said entities. |

| (c) | | The entire basis of the AO behind making the disallowance was that the NP ratios of LHCC and KC was significantly higher than that of the assessee. It is, at the outset, submitted that the aforesaid comparison of NP ratios, at the very threshold, is principally unfounded and 1 and illogical as there can no comparison of profits of manufacturing concern and trading concern. AMP expenditure is primarily a marketing expenditure incurred by any FMCG company engaged in marketing and sale of products in order to penetrate into highly competitive market of consumer products. A contract manufacturer, on the other hand, is merely required to manufacture and sell the products to a marketing/brand-owning company without undertaking any AMP expenditure. |