HC Quashes GST Demand on Corporate Guarantee for Non-Consideration of Binding CBIC Circulars.

Issue

Whether an assessment order levying GST on a corporate guarantee is legally sustainable if the assessing authority passes the order without applying their mind to, or even considering, the taxpayer’s primary defense, which is based on specific, binding CBIC circulars that clarify the valuation of such transactions.

Facts

- The assessee-company provided a corporate guarantee to a related party without any consideration.

- The GST department issued a Show Cause Notice (SCN) proposing to treat this as a taxable supply and levy GST at 1% of the guarantee amount.

- The assessee filed a detailed reply, asserting that the transaction value was zero and no GST was payable.

- This defense was based on the second proviso to Rule 28 and was supported by two specific CBIC Circulars (No. 199/11/2023-GST and No. 210/4/2024-GST). These circulars clarify that if the recipient (the related party) is eligible for full Input Tax Credit (ITC), the invoice value (or zero, in this case) can be deemed the open market value.

- The Assessing Officer passed the final order confirming the 1% tax demand but completely failed to examine, discuss, or even refer to the assessee’s main contention regarding the circulars and the full ITC eligibility of the recipient.

- The assessee filed a writ petition challenging the order for this fundamental breach.

Decision

- The High Court quashed and set aside the impugned assessment order.

- It held that the authority’s failure to deal with a material defense (which was based on binding circulars) is a clear case of non-application of mind and renders the adjudication “vulnerable in law.”

- The order was deemed to be vitiated due to this breach of natural justice.

- The matter was remanded back to the authority for a fresh adjudication, with a specific direction to consider all of the assessee’s contentions (especially the circulars) and pass a fresh, reasoned order on merits.

Key Takeaways

- Orders Must Be “Speaking”: An adjudicating authority is legally bound to consider and provide reasoned findings on the material defenses raised by a taxpayer. An order that ignores the primary defense is a “non-speaking order” and is invalid.

- Binding Nature of CBIC Circulars: Tax authorities are bound by circulars issued by the CBIC. An order passed in ignorance of a binding circular (that the assessee has cited) is a fatal flaw.

- Violation of Natural Justice: Passing an order without considering the taxpayer’s reply is a clear violation of the principles of natural justice, as the right to be heard includes the right to have one’s submissions considered.

- Remand is the Remedy: When an order is quashed for a procedural failure or non-application of mind, the standard judicial remedy is to remand the case, forcing the authority to re-adjudge the matter correctly and in accordance with the law.

HIGH COURT OF MADRAS

Amman Try Trading Company (P.) Ltd.

v.

State Tax Officer – V (RS)

G.R. Swaminathan, J.

W.P(MD)No. 20109 of 2025

W.M.P(MD)Nos. 15509, 15510 & 18212 of 2025

W.M.P(MD)Nos. 15509, 15510 & 18212 of 2025

OCTOBER 6, 2025

M. Karthikeyan and S. Jai Kumar for the Petitioner. R.Suresh Kumar, Additional Government Pleader for the Respondent.

ORDER

1. Heard both sides.

2.The writ petitioner furnished corporate guarantee in favour of a related party, namely, M/s.Amman Try Trading Company Private Limited.

3.The specific stand of the writ petitioner is that they did not receive any consideration for furnishing such corporate guarantee. However, the assessing officer held that supply of such service of corporate guarantee by the petitioner to their related entity attracts the levy of GST and tax was levied at 1% of the corporate guarantee amount. Challenging the said order, this writ petition has been filed.

4. It is true that the respondent had issued show cause notice to the writ petitioner before passing the impugned order.

5. The writ petitioner submitted their reply. In their reply, the petitioner placed reliance on 2 circulars i.e., Circular No.199/11/2023-GST dated 17.07.2023 and Circular No.210/4/2024-GST dated 26.06.2024. Rule 28 of CGST Rules, 2017 reads as follows:

“28.Value of supply of goods or services or both between distinct or related persons, other than through an agent.

(1) The value of the supply of goods or services or both between distinct persons as specified in sub-section (4) and (5) of section 25 or where the supplier and recipient are related, other than where the supply is made through an agent, shall-

(a) be the open market value of such supply;

(b) if the open market value is not available, be the value of supply of goods or services of like kind and quality;

(c) if the value is not determinable under clause (a) or (b), be the value as determined by the application of rule 30 or rule 31, in that order:

Provided that where the goods are intended for further supply as such by the recipient, the value shall, at the option of the supplier, be an amount equivalent to ninety percent of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person.

Provided further that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of the goods or services.

[(2) Notwithstanding anything contained in sub-rule (1), the value of supply of services by a supplier to a recipient who is a related person [located in India], by way of providing corporate guarantee to any banking company or financial institution on behalf of the said recipient, shall be deemed to be one per cent of the amount of such guarantee offered [per annum], or the actual consideration, whichever is higher.]

[Provided that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the value of said supply of services.”

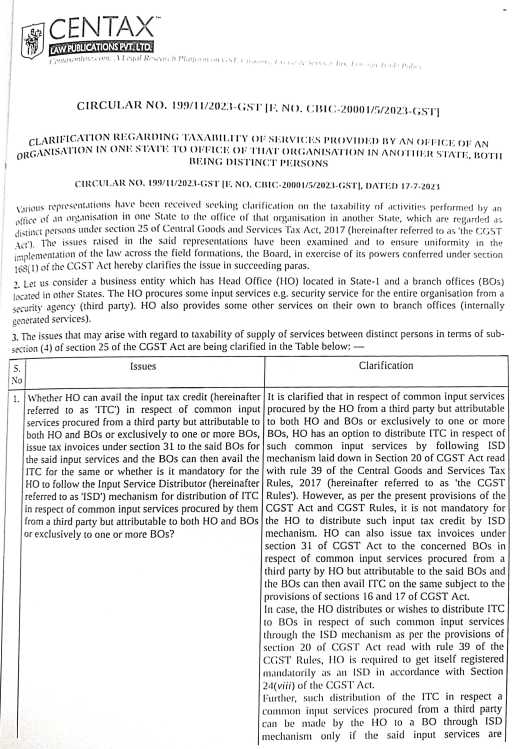

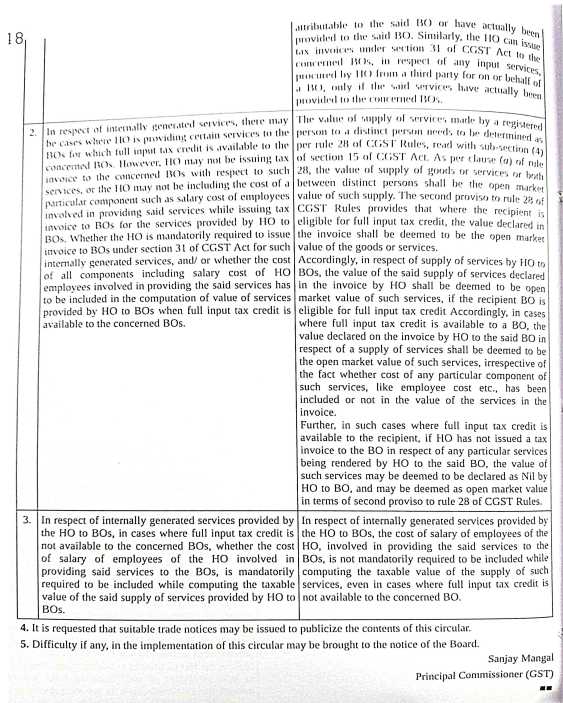

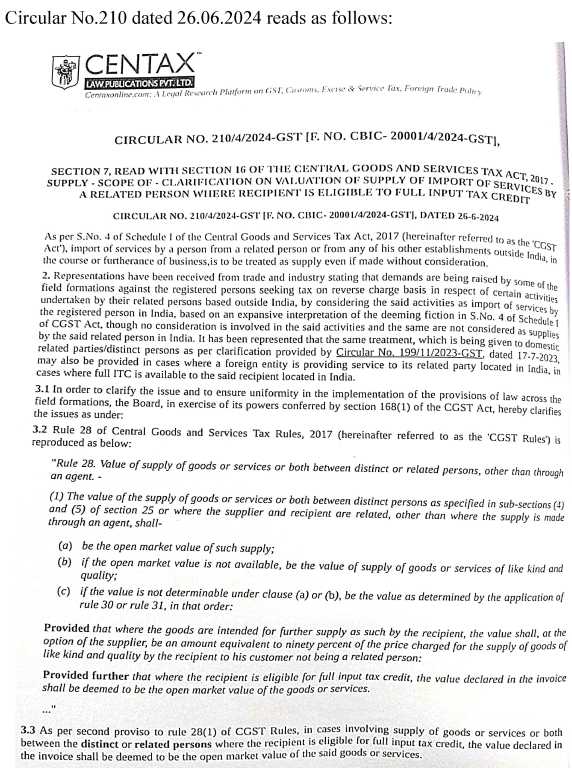

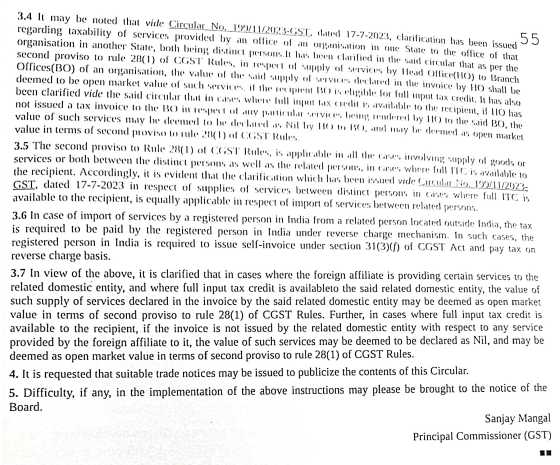

Circular No.199/11/2023-GST dated 17.07.2023 reads as follows:

6. The assessee / writ petitioner herein had contended that since the recipient is eligible for full ITC and the writ petitioner did not issue any invoice, and value of transaction has been taken as zero, the aforesaid circulars are applicable to the transactions in question. However, the assessing officer did not consider the applicability of these 2 circulars at all. It is a well settled principle of administrative law that when a defense raised by the noticee is not considered in the final order, the order is vulnerable on that ground. On the ground of non-consideration of the contentions raised by the assessee, the impugned order is set aside. The matter is remitted to the respondent. The respondent is directed to consider all the contentions raised by the assessee in the reply and pass order afresh on merits and in accordance with law. I have not gone into the merits of the matter.

7 . This Writ Petition is allowed on these terms. No costs. Consequently, connected miscellaneous petitions are closed.