ORDER

Sandeep Gosain, Judicial Member.- The present appeals have been filed by the assessee challenging the impugned order dt. 28.01.2025 passed under section 250 of the Income Tax Act, 1961 (‘the Act’), by the National Faceless Appeal Centre (NFAC) / CIT(A) for the assessment year 2015-16.

2. The solitary ground raised by the assessee relates to challenging the order of Ld. CIT(A) in confirming the addition made u/s 68 of the Act. In this regard Ld. AR relied upon his written synopsis and the same are reproduced herein below:

A) BACKGROUND DETAILS OF APPELLANT ASSESSEE

Appellant Assessee is currently 58 years old resident individual. For the AY 2015-16 appellant assessee has earned Business Income from trading in equity shares of listed entities. Retuned income was Rs. 3,09,240/-

B) FACTS OF THE CASE

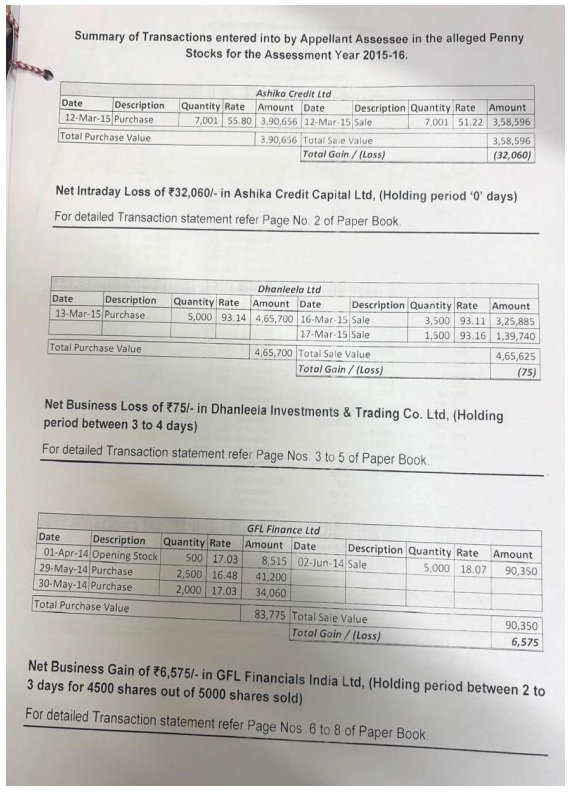

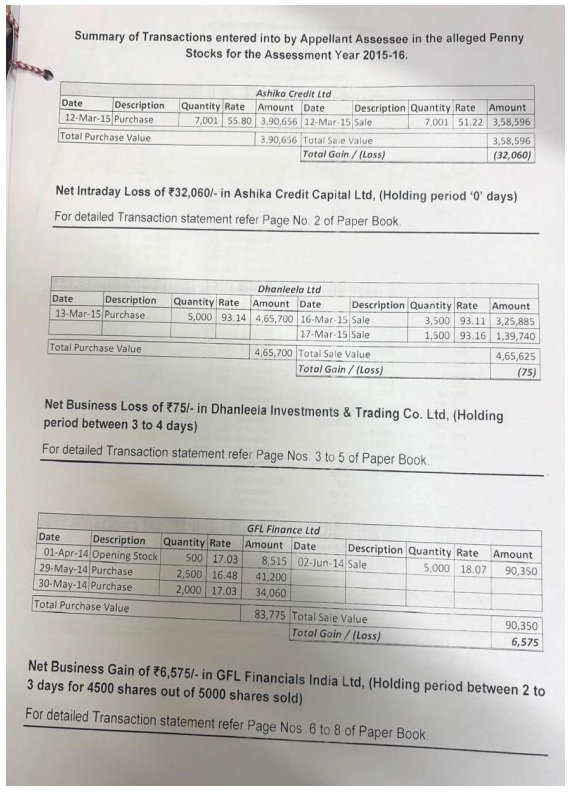

Amongst others, appellant assessee has engaged in trading in three selected listed equity shares namely Ashika Credit Capital Ltd, Dhanleela Investments & Trading Co. Ltd and GFL Financials India Ltd during the Financial Year 2014-15 On the basis of information received from Investigation Wing, Kolkata, Ld AO considered it as “bogus entry ” and total sale value of 11,49,008/- was considered as Unexplained Cash Credit u/s 68 without carrying out any independent investigation

Total actual Sale value of these shares aggregate to 9,14,571/-whereas Ld. AO has erroneously considered it to be ? 11,49,008/- without considering purchase value of the same shares amounting to 9,40,131/-, resulting into Net Loss of? 25,560/- Obviously, Appellant Assessee has not claimed any exemption of long term capital gains u/s 1 0(38).

C) ORDER OF Ld. AO and Hon’ble CIT(A), NFAC

Ld. AO and Hon’ble CIT(A), NFAC have based their observations upon information as received from report of the Investigation Wing. Kolkata. Investigation report alleges that above penny stocks are used by various beneficiaries to launder money and give accommodation entries in the form of exempted LTCG or STCL. Department has questioned the creditworthiness of listed entities CIT(A) states that the preponderance of probabilities is against the assessee.

However, Ld. CIT(A) has ignored the fact that shares traded in Ashika Ltd are merely Intraday, the maximum holding period of Dhanleela Ltd is 4 Days only and for GFL Finance Ltd is only 3 days for 4500 shares out of 5000 sold.

(Refer Summary of Transactions as Annexure – ‘A’ on Pg No. 1 of PB)

It is also important to note that assessee has shown Income from trading in shares as Business Income and hence, benefit of exemption of LTCG is not applicable to the appellant assessee. As a result, the question of accommodation entries is baseless and purely based on surmises. Also, since taxable total income of appellant assessee is only ?3,09,240/-, a loss of ?25,560/- would only reduce the tax by 2,560/- and as such application of modus operandi here is unwarranted.

D) ISSUE INVOLVED IS DIRECTLY COVERED BY FOLLOWING JUDGEMENTS

(i) Amrita Abhishek Doshi v. Deputy Commissioner of Income-tax Amrita Abhishek Doshi v. Deputy Commissioner of Income-tax (Mumbai – Trib.). Concluding para reads as follows:-

“8. We heard the rival submission and considered the documents available in the record. On perusal of the records, we find that the assessee, herself never involved in price rigging of the scrips. The Ld. AO has not conducted independent investigation and fully relied on the observation of the investigating authority of Kolkata. But no separate verification was conducted. The assessee has discharged her onus by submitting documents before the revenue authorities. There is no information of entry/exit provider in appeal and assessment stage. The share was duly opened by the SEBI but later on the same was revoked. The co-ordinate bench in the case of assessee’s husband Shri Abhishek Tejraj Doshi (supra) & Shri Abhishek Doshi (supra) has taken a view in favour of the assessee and against the revenue. For our observations and to arrive at the findings, we respectfully relied on the decisions of Hon’ble High Court of Bombay being a jurisdictional High Court: Pr. CIT v. Ziauddin A. Siddique [IT Appeal No. 2012 of 201 7, dated 4-3-2022]”

(ii) Pr. CIT v. Ziauddin A. Siddique [IT Appeal No. 2012 of 201 7 (Mumbai HC)] Concluding para reads as follows:-

“2. We have considered the impugned order with the assistance of the learned Counsels and we have no reason to interfere. There is a finding of fact by the Tribunal that the transaction of purchase and sale of the shares of the alleged penny stock of shares of Ramkrishna Fincap Ltd. (“RFL “) is done through stock exchange and through the registered Stockbrokers. The payments have been made through banking channels and even Security Transaction Tax (“STT”) has also been paid. The Assessing Officer also has not criticized the documentation involving the sale and purchase of shares. The Tribunal has also come to a finding that there is no allegation against assessee that it has participated in any price rigging in the market on the shares of RFL.

3. Therefore, we find nothing perverse in the order of the Tribunal. “

(iii) Vipul Patel v. Income Tax Officer, Ward- 45(4), Kolkata Vipul Patel v. Income Tax Officer, Ward-45(4), Kolkata (Kolkata – Trib.)) along with a plethora of cases in favour of the appellant assessee as discussed in the this order.

“9. I note that shares of M/s. KAFL were sold by assessee through recognized broker in a recognized Stock Exchange. The details of such sale and contract note have been submitted before AO/Ld. CIT(A). I take note that when the transactions happened in the Stock exchange, the seller who sells his shares on the stock exchange does not know who purchases shares. It is noted that the shares are sold and bought in an electronic mode on the computers on-line by the brokers and there is also no direct contact at any level even between the brokers. It is noted that as and when any shares are offered for sale in the stock exchange platform, any one of the thousands of brokers registered with the stock exchange is at liberty to purchase it. As far as our understanding the selling broker does not even know who is the purchasing broker. This is how the SEBI keeps a strict control over the transactions taken place in recognized stock exchanges. Unless there is a evidence to show that there is a breach in the aforesaid process which fact has been unearthed by meticulous investigation, I am of the opinion that the unscrupulous actions of few players exploiting the loopholes of the Stock Exchange, if any, cannot be the basis to paint the entire sale/purchase of a scrip like that of M/s. KAFL as bogus without bringing out adverse material specifically against the assessee.

10. The fact of holding the shares in the D-mat account cannot be disputed. Further, the Assessing Officer has not even disputed the existence of the D-mat account and shares credited in the D-mat account of the assessee. Therefore, once, the holding of shares is D-mat account cannot be disputed, then the transaction cannot be held as bogus. The AO has not disputed the sale of shares from the D-mat account of the assessee and the sale consideration was directly credited to the bank account of the assessee, therefore, once the assessee produced all relevant evidence to substantiate the transaction of purchase, dematerialization and sale of shares then, in the absence of any contrary material brought on record the same cannot be held as bogus transaction merely on the basis of report of Investigation Wing, Kolkata wherein there is a general statement of providing bogus long term capital gain transaction to the clients without stating anything about the transaction of allotment of shares by the company to the assessee. “

(iv) Vijayrattan Balkrishan Mittal v. Deputy Commissioner of Income Tax, Central Circle- 8(1), Mumbai Vijayrattan Balkrishan Mittal v. Deputy Commissioner of Income Tax, Central Circle-8(1), Mumbai (Mumbai – Trib.))

Refer Para 31 to 35 on page 18 & 19 of the order.

(v) Tejash Ramesh Shah, HUF v. Income-tax Officer, (Mumbai – Trib.)

“7. After hearing the rival submissions and carefully considering the documents available on record, we note that the assessee earned LTCG related to the scrip MPL through transactions conducted on the BSE. No adverse findings or comments have been issued by SEBI regarding this scrip, and the Ld. DR was unable to submit any such directions or allegations by SEBI related to the scrip in question. The Ld. AO did not reject any of these primary pieces of evidence during assessment proceeding. In this context, the Hon’ble Bombay High Court in CIT v. Shyam R. Pawar (Bombay) held that when details of share transactions are substantiated by DEMAT account statements and contract notes, and the Assessing Officer fails to prove such transactions as bogus, the capital gains cannot be treated as unaccounted income under Section 68 of the Act.

The Ld. AR respectfully relied on the order of the coordinate bench of ITAT, Mumbai, D-Bench in the case of Ramesh Rikhavdas Shah, HUF (supra) where the assessee earned LTCG on same scrip MPL after detailed observation the bench allowed the appeal of the assessee and directed the Assessing Officer to allow the exemption on LTCG. The said order was followed by the ruling of the Hon’ble Bombay High Court in case Indravadan Jain (HUF) (supra). The coordinate bench of ITAT Delhi-F in the case Puja Gupta (supra)allowed the appeal of the assessee related to the same scrip& allowed the exemption claimed U/s 10(38) of the Act. We find no evidence of any irregularities or price rigging concerning the scrip MPL. We find no basis to conclude that the assessee was involved in any price rigging or circulation of black money to generate LTCG. The evidence and documents submitted during the assessment proceedings were neither denied nor challenged in terms of their authenticity.

Accordingly, we hold that the appeal order is flawed and perverse. The addition under Section 68 of the Act amounting to Rs. 61,79,355/- is hereby deleted.

3. It was submitted that the revenue authorities have mechanically applied general findings of the Investment Wing, Kolkata against the assessee, therefore the entire additions are liable to be quashed.

4. On the other hand, Ld. DR relied upon the orders passed by the revenue authorities and argued for dismissal of appeal.

5. I have heard the counsels for both the parties, perused the material placed on record, judgments cited before me and also the orders passed by the revenue authorities. From the records, I noticed that assessee traded in 3 listed equity shares namely Ashika Credit Capital Ltd, Dhanleela Investments & Trading Co. Ltd and GFL Financials Ltd during the year under consideration. However, on the basis of information received from Investment Wing Kolkata, the AO considered the said scrip as penny stock was under the impression that assessee had obtained bogus entry thus the total sale value of Rs. 11,49,008/- was considered as ‘unexplained cash credit’ u/s 68 of the Act. On going through the records I noticed that actual total sale value of these shares aggregate to 9,14,571/- only but the AO had erroneously considered it to be Rs. 11,49,008/-. From the records I also noticed that ld. CIT(A) while upholding the addition has based his findings solely upon the information received from the Investigation Wing, Kolkata, wherein the said scrip was termed as penny stock and therefore it was concluded mechanically by Ld. CIT(A) that assessee being the beneficiary is liable for additions. However, the said findings of Ld. CIT(A) are mechanical in nature as none of the revenue authorities have carried independent verifications or investigations. Moreover an important aspect has also been ignored by the revenue authorities that the shares traded in Ashika Ltd are merely Intraday and the maximum holding period of Dhanleela Ltd is 4 days and for GFL Finance Ltd is only 3 days for 4500 shares out of 5000 shares which have been sold by the assessee. The transaction summary is contained at Anx-A which is at paper book page No.1 and the same is reproduced herein below:

6. Although assessee has shown income from trading in shares as ‘business income’ and thus the benefit of exemption of LTCG is not applicable to the assessee. Even otherwise the question of availing accommodation entries seems to be baseless and merely based on surmises because of the fact that since the taxable total income of the assessee is only Rs. 3,09,240/- and he sustained loss of Rs. 25,560/-. In this way the said loss only leads to reduce the tax by Rs. 25,650/-, therefore in such a scenario making additions by holding that assessee is part of modus operandi is unwarranted.

7. From the records, it is nowhere proved that assessee himself was involved in price rigging of any of the scrips and AO have also not conducted any independent investigations on this aspect and had fully relied upon the observations of the Investigation Authorities of Kolkata. Whereas the assessee has discharged his onus by submitting all the documentary evidences in the shape of purchase and sale of the said scrips and a certificate from the broker regarding confirmation thereby confirming transaction of equity shares which goes to prove the genuineness of transactions under taken by the assessee for the year under consideration through BSE/NSE stock exchange. I also noticed that the entire payments have been made through banking channel and AO has not criticized or found fault in any of documentation involving the share purchases and share sales, no allegation has been found against the assessee to the effect that he had participated in any price rigging in the market on these shares, reliance in this regard has been placed upon the following decisions.

(i) Amrita Abhishek Doshi v. Deputy Commissioner of Income-tax(Mumbai – Trib.). Concluding para reads as follows:-

“8. We heard the rival submission and considered the documents available in the record. On perusal of the records, we find that the assessee, herself never involved in price rigging of the scrips. The Ld. AO has not conducted independent investigation and fully relied on the observation of the investigating authority of Kolkata. But no separate verification was conducted. The assessee has discharged her onus by submitting documents before the revenue authorities. There is no information of entry/exit provider in appeal and assessment stage. The share was duly opened by the SEBI but later on the same was revoked. The co-ordinate bench in the case of assessee’s husband Shri Abhishek Tejraj Doshi (supra) & Shri Abhishek Doshi (supra) has taken a view in favour of the assessee and against the revenue. For our observations and to arrive at the findings, we respectfully relied on the decisions of Hon’ble High Court of Bombay being a jurisdictional High Court: Pr. CIT v. Ziauddin A. Siddique [IT Appeal No. 2012 of 2017, dated 4-3-2022]”

(ii) Pr. CIT v. Ziauddin A. Siddique [IT Appeal No. 2012 of 2017 (Mumbai HC)] Concluding para reads as follows:-

“2. We have considered the impugned order with the assistance of the learned Counsels and we have no reason to interfere. There is a finding of fact by the Tribunal that the transaction of purchase and sale of the shares of the alleged penny stock of shares of Ramkrishna Fincap Ltd. (“RFL “) is done through stock exchange and through the registered Stockbrokers. The payments have been made through banking channels and even Security Transaction Tax (“STT”) has also been paid. The Assessing Officer also has not criticized the documentation involving the sale and purchase of shares. The Tribunal has also come to a finding that there is no allegation against assessee that it has participated in any price rigging in the market on the shares of RFL.

3. Therefore, we find nothing perverse in the order of the Tribunal. “

(iii) Vipul Patel v. Income Tax Officer (Kolkata – Trib.)) along with a plethora of cases in favour of the appellant assessee as discussed in the this order.

“9. I note that shares of M/s. KAFL were sold by assessee through recognized broker in a recognized Stock Exchange. The details of such sale and contract note have been submitted before AO/Ld. CIT(A). I take note that when the transactions happened in the Stock exchange, the seller who sells his shares on the stock exchange does not know who purchases shares. It is noted that the shares are sold and bought in an electronic mode on the computers on-line by the brokers and there is also no direct contact at any level even between the brokers. It is noted that as and when any shares are offered for sale in the stock exchange platform, any one of the thousands of brokers registered with the stock exchange is at liberty to purchase it. As far as our understanding the selling broker does not even know who is the purchasing broker. This is how the SEBI keeps a strict control over the transactions taken place in recognized stock exchanges. Unless there is a evidence to show that there is a breach in the aforesaid process which fact has been unearthed by meticulous investigation, I am of the opinion that the unscrupulous actions of few players exploiting the loopholes of the Stock Exchange, if any, cannot be the basis to paint the entire sale/purchase of a scrip like that of M/s. KAFL as bogus without bringing out adverse material specifically against the assessee.

10. The fact of holding the shares in the D-mat account cannot be disputed. Further, the Assessing Officer has not even disputed the existence of the D-mat account and shares credited in the D-mat account of the assessee. Therefore, once, the holding of shares is D-mat account cannot be disputed, then the transaction cannot be held as bogus. The AO has not disputed the sale of shares from the D-mat account of the assessee and the sale consideration was directly credited to the bank account of the assessee, therefore, once the assessee produced all relevant evidence to substantiate the transaction of purchase, dematerialization and sale of shares then, in the absence of any contrary material brought on record the same cannot be held as bogus transaction merely on the basis of report of Investigation Wing, Kolkata wherein there is a general statement of providing bogus long term capital gain transaction to the clients without stating anything about the transaction of allotment of shares by the company to the assessee. “

(iv) Vijayrattan Balkrishan Mittal v. Deputy Commissioner of Income Tax (Mumbai – Trib.))

Refer Para 31 to 35 on page 18 & 19 of the order.

(v) Tejash Ramesh Shah, HUF v. Income-tax Officer (Mumbai – Trib.) (Mumbai – Trib.)

“7. After hearing the rival submissions and carefully considering the documents available on record, we note that the assessee earned LTCG related to the scrip MPL through transactions conducted on the BSE. No adverse findings or comments have been issued by SEBI regarding this scrip, and the Ld. DR was unable to submit any such directions or allegations by SEBI related to the scrip in question. The Ld. AO did not reject any of these primary pieces of evidence during assessment proceeding. In this context, the Hon’ble Bombay High Court in CIT v. Shyam R. Pawar (Bombay) held that when details of share transactions are substantiated by DEMAT account statements and contract notes, and the Assessing Officer fails to prove such transactions as bogus, the capital gains cannot be treated as unaccounted income under Section 68 of the Act.

The Ld. AR respectfully relied on the order of the coordinate bench of ITAT, Mumbai, D-Bench in the case of Ramesh Rikhavdas Shah, HUF (supra) where the assessee earned LTCG on same scrip MPL after detailed observation the bench allowed the appeal of the assessee and directed the Assessing Officer to allow the exemption on LTCG. The said order was followed by the ruling of the Hon’ble Bombay High Court in case Indravadan Jain (HUF) (supra). The coordinate bench of ITAT Delhi-F in the case Puja Gupta (supra)allowed the appeal of the assessee related to the same scrip& allowed the exemption claimed U/s 10(38) of the Act. We find no evidence of any irregularities or price rigging concerning the scrip MPL. We find no basis to conclude that the assessee was involved in any price rigging or circulation of black money to generate LTCG. The evidence and documents submitted during the assessment proceedings were neither denied nor challenged in terms of their authenticity.

Accordingly, we hold that the appeal order is flawed and perverse. The addition under Section 68 of the Act amounting to Rs. 61,79,355/- is hereby deleted.

8. Therefore considering the totality of the facts and circumstances as discussed by me above and also keeping in view the judgments relied upon by the assessee and more particularly the decision of the Jurisdicitonal Hon’ble Bombay High Court in the case of CIT v. Shyam R. Pawar (Bombay), wherein it has been held that “when details of share transactions are substantiated by DEMAT account statements and contract notes, and the AO fails to prove such transactions as bogus, the capital gains cannot be treated as unaccounted income u/s 68 of the Act” Thus considering the overall situation and legal preposition as discussed by me above, I direct the AO to delete the additions made u/s 68 of the Act, accordingly the grounds raised by the assessee stands allowed.

9. In the result, the appeal filed by the assessee stands allowed.