ORDER

Dr. A. L. Saini, Accountant Member. – By way of this appeal, the assessee has challenged the correctness of the order dated 20.03.2025 passed by the Learned Principal Commissioner of Income-tax (in short “Ld PCIT”) under section 263 of the Income-tax Act, 1961 (hereinafter referred to as ‘the Act’), for the assessment year 2020-21. Grievances raised by the assessee, which, being interconnected, will be taken up together, are as follows:

| (1). | | The Order passed by the Ld. PCIT dated 20.03.2025 is bad and illegal to the extent that no proper opportunity of being herd was granted. The same is prayed for being struck down. |

| (2). | | The Order passed by Ld. PCIT dated 20.03.2025 is prayed for quashing since it is not prejudicial to the interest of the revenue and none of the conditions laid down in Explanation-2 of section 263 are fulfilled. |

| (3). | | The Ld. PCIT has erred in passing the order u/s 263 without verifying the records submitted during the course of proceedings under section 263. |

| (4). | | The appellant reserves its right to add, amend, alter or modify any of the grounds at or before the time of final hearing. |

2. The facts of the case which can be stated quite shortly are as follows: the assessee before us is hindu undivided family (HUF). The assessee had filed his return of income for assessment year (A.Y.) 2020-21, on 25.08.2020, declaring total income of Rs.19,29,090/- and agricultural income of Rs.60,87,400/-. This assessee’s case was selected for limited scrutiny under in CASS on the issue of “Large Agricultural Income”. The Assessment was finalised u/s 143(3) r.w.s. 144B of the Income-tax Act, 1961, on 08.09.2022, accepting returned income.

3. Later on, the Learned Principal Commissioner of Income-tax (in short “Ld PCIT”) exercised his jurisdiction under section 263 of the Income-tax Act, 1961. The ld.PCIT noted that during the course of assessment proceedings, the assessing officer verified the issues under reference and after considering the submissions submitted by the assessee, no addition was made. The ld. PCIT noted that on perusal of materials available on record, it has been noticed that assessee has shown gross agriculture income of Rs.91,08,490/- and incurred expenses of Rs.30,21,090/- and declared net agriculture income of Rs.60,87,400/- which was shown as exempt income. The ld. PCIT noticed that during the course of assessment proceedings, the assessee has submitted agricultural income and expenditure ledger with copies of sale bills of agricultural produces and invoices of expenses incurred in relation to agricultural activities. On perusal of agricultural expenses, ledger as well as bills/vouchers, etc. submitted by the assessee, it was noticed by ld. PCIT that out of total expenses incurred of Rs.30,21,090/-, as per ledger, the supporting documentary evidences in form of actual bills/vouchers submitted are only for Rs.42,531/-. The ld. PCIT also observed that during the course of assessment proceedings, it was noticed that the assessee has made sales of various agricultural products of more than Rs.91 lakhs, during the year under consideration. However, to verify the genuineness of such sales made during the year, the assessing officer has not issued a single notice u/s 133(6) of the Act and has just accepted the assessee’s version and that too without the required documentary evidences. Considering such facts, notice u/s 263 of the Income-tax Act, 1961, dated 25.01.2025, was issued by ld. PCIT and duly served upon the assessee.

4. In response to such notice, the assessee has filed its reply dated 05.02.2025. The assessee submitted before the learned PCIT that assessee furnished all the invoices, vouchers etc, for Labor, Seeds, Fertilizers, and Pesticides etc before the assessing officer. The assessing officer wanted to verify the vouchers and bills on test check basis, accordingly, assessing officer has examined the vouchers and evidences on test, check basis and allowed the expenses. The assessee could not be uploaded entire vouchers/bills during the course of Faceless Assessment proceedings on account of technical glitches, viz more than 5 MB file. However, the assessee submitted all the vouchers/bills before the ld. PCIT. The assessee has been showing agriculture income and claiming agriculture expenses for all the past years and subsequent years around 35% of the Gross Agriculture income as against which for the current year is around 33%. These facts are verifiable from the records. The declared Gross Agriculture income and Agriculture Expenses have been accepted for all these years, since inception, and have not been disputed by department. Besides, agricultural income is exempt from tax and even if revenue expenses associated with agricultural income is disallowed, then agricultural income would increase and consequently, it would be exempt from tax, hence, there is no loss of revenue.

5. However, ld. PCIT rejected the above contention of the assessee and observed that during the year under consideration, the assessee has shown gross agriculture income of Rs.91,08,490/- and incurred expenses of Rs.30,21,090/- thereby declaring net agricultural income of Rs.60,87,400/- in income tax return (ITR) filed and the same has been shown as exempt income. The assessee has claimed agricultural expenses of Rs.30,21,090/-, however, on verification of the documentary evidences submitted, it was noticed that the submitted evidences were only for Rs.42,531/-. Hence, it was noted by ld. PCIT that the assessee has not submitted any documentary evidences regarding expenses claimed. Therefore, it was held by ld.PCIT that the assessment order passed by the assessing officer (A.O.) u/s 143(3) r.w.s. 144B of the Income-tax Act, 1961, on 08.09.2022, was erroneous and prejudicial to the interest of the revenue, therefore, ld.PCIT set-aside the order u/s 143(3) r.w.s. 144B of the Income-tax Act, 1961 on 08.09.2022, on the issue discussed above and directed the Assessing Officer to pass a fresh assessment order after making necessary enquiries relating to assessee’s claim of agricultural income.

6. Aggrieved by the order of the Ld. PCIT, the assessee is in appeal before us.

7. Shri Samir Jani, Learned Counsel of the assessee, vehemently argued that during the assessment proceedings, the assessee has submitted bills, vouchers of the agricultural expenses before the assessing officer, in response to the notices issued u/s 142(1) of the Act. (vide paper-book page no.89). The assessee submitted reply before the assessing officer alongwith documents evidences which is placed in paper-book page no. 92. All these bills, vouchers were examined by the assessing officer on test check basis, therefore, order passed by the assessing officer is neither erroneous nor prejudicial to the interest of the revenue, hence, jurisdiction exercised by the learned PCIT under section 263 of the Act, may be quashed.

8. On the other hand, the Ld. DR for the Revenue has primarily reiterated the stand taken by the Assessing Officer, which we have already noted in our earlier para and is not being repeated for the sake of brevity.

9. We have heard both the parties and carefully gone through the submission put forth on behalf of the assessee along with the documents furnished and the case laws relied upon, and perused the fact of the case including the findings of the ld PCIT and other materials brought on record. We note that Assessing Officer has through his notice u/s 143 (2) of the Act, dated 29.06.2021 and notice u/s 142 (1) of the Act, dated 12.11.2021, made specific inquires for Agriculture Income and Agriculture Expenses along with other relevant details for agriculture income. The details called for by the assessing officer, were submitted on portal by the assessee, during the assessment proceedings. On account of technical inability to upload PDF files in excess of 5 MB data, instead of entire supporting for agriculture expenses, random supporting for such expenses was uploaded. However, the physical set of entire agriculture expenses were produced before the ld. PCIT. It would also be found from the quantum of agriculture expense that the quantum for the year under consideration is below that of last 6 to7 years. Therefore, in assessee’s case, the assessment order passed under section 143(3) read with Section 144B is neither erroneous nor prejudicial to the interests of revenue. The order was passed after a detailed and thorough examination of the relevant facts and submissions, and there is no demonstrable error in the application of law or process. The alleged insufficiency of inquiry, even if presumed for argument’s sake, cannot by itself constitute an error under Section 263 of the Act, unless coupled with specific and quantifiable prejudice to revenue, which is conspicuously absent in the assessee’s case, under consideration. We note that the assessing officer conducted a detailed examination of the documents and explanations provided, including a verification of the agricultural income and expenses when matched with earlier year’s income and expenses. The assessing officer found the evidence sufficient and reasonable in supporting the assessee’s claims, after examining them on test, check bases. Thus, the assessing officer, after due verification, framed an order under section 143(3) read with Section 144B, dated 08-09-2022. This reflects the assessing officer’s satisfaction with the evidences provided by the assessee on test check basis, and demonstrates that the claims were supported by credible evidence. It is the prerogative of the assessing officer in the scrutiny assessment that he may conduct and examine the vouchers and bills on test check basis, if the assessing officer think fit that volume of vouchers and bills are huge, and it is not practical or feasible to examine all the bills and vouchers. What a prudent, judicious, and responsible Assessing Officer is to do in the course of his assessment proceedings. Is he to doubt or test every proposition put forward by the assessee and investigate all the claims made in the income tax return as deep as he can? The answer has to be emphatically in negative because, if he is to do so, the line of demarcation between scrutiny and investigation will get blurred, and, on a more practical note, it will be practically impossible to complete all the assessments allotted to him within no matter how liberal a time limit is framed. In scrutiny assessment proceedings, all that is required to be done is to examine the income tax return and claims made therein as to whether these are prima facie in accordance with the law and where one has any reasons to doubt the correctness of a claim made in the income tax return, probe into the matter deeper in detail. He need not look at everything with suspicion and investigate each and every claim made in the income tax return; a reasonable prima facie scrutiny of all the claims will be in order, and then take a call, in the light of his expert knowledge and experience, which are as, if at all any, required to be critically examined by a thorough probe. While it is true that an Assessing Officer is not only an adjudicator but also an investigator and he cannot remain passive in the face of a return which is apparently in order but calls for further inquiry but, as observed by Delhi High Court in the case of Gee Vee Enterprises v. Addl CIT [1975] 99 ITR 375 (Delhi), “it is his duty to ascertain the truth of the facts stated in the return when the circumstances of the case are such as to provoke an inquiry. It is, therefore, obvious that when the circumstances are not such as to provoke an inquiry, he need not put every proposition to the test and probe everything stated in the income tax return. In a way, his role in the scrutiny assessment proceedings is somewhat akin to a conventional statutory auditor in real life situations. Of course, an Assessing Officer cannot remain passive on the facts which, in his fair opinion, need to be probed further, but then an Assessing Officer, unless he has specific reasons to do so after a look at the details, is not required to prove to the hilt everything coming to his notice in the course of the assessment proceedings. When the facts as emerging out of the scrutiny are apparently in order, and no further inquiry is warranted in his bona fide opinion, he need not conduct further inquiries just because it is lawful to make further inquiries in the matter. A degree of reasonable faith in the assessee and not doubting everything coming to the Assessing Officer’s notice in the assessment proceedings cannot be said to be lacking bona fide, and as long as the path adopted by the Assessing Officer is taken bona fide and he has adopted a course permissible in law, he cannot be faulted which is a sine qua non for invoking the powers under section 263 of the Act. The test for what is the least expected of a prudent, judicious and responsible Assessing Officer in the normal course of his assessment work, or what constitutes a permissible course of action for the Assessing Officer, is not what he should have done in the ideal circumstances, but what an Assessing Officer, in the course of his performance of his duties as an Assessing Officer should, as a prudent, judicious or reasonable public servant, reasonably do bona fide in a real life situation. It is also important to bear in mind the fact that lack of bona fides or unreasonableness in conduct cannot be inferred on mere suspicion; there have to be some strong indicators in direction, or there has to be a specific failure in doing what a prudent, judicious and responsible officer would have done in the normal course of his work in the similar circumstances.

10. Therefore, we note that in assessee’s case under consideration, the assessing officer has examined the agricultural expenses with help of supporting bills and vouchers on test check basis. The assessee also submitted entire bills and vouchers of agricultural expenses before the learned PCIT. Besides, we also note that the power conferred under section 263 of the Income Tax Act, 1961, is premised on two essential conditions that must be satisfied concurrently, that is, the assessment order must be both erroneous and prejudicial to the interests of revenue. Even if, the inquiry conducted by the Assessing Officer is alleged to be inadequate, this alone does not justify revision unless there is clear and demonstrable prejudice to the revenue. In the present case, no such prejudice exists, as agricultural income is exempt from tax, hence, there is no tangible or quantifiable revenue loss, as the agricultural income declared by the assessee, amounting to Rs.60,87,400/- (net of expenses), is exempt from tax under section 10(1) of the Income Tax Act. This exemption is unequivocal and governed by statutory provisions that recognize agricultural income as beyond the taxable ambit. Consequently, any associated agricultural expenses, such as those amounting to Rs.30,21,090/-, do not influence the taxable income and thus have no impact on revenue. Even if, the agricultural expenses were re-evaluated or disallowed, it would not alter the assessee’s taxable income since the agricultural income itself remains exempt. Therefore, there is no measurable loss to the exchequer arising from the assessment order.

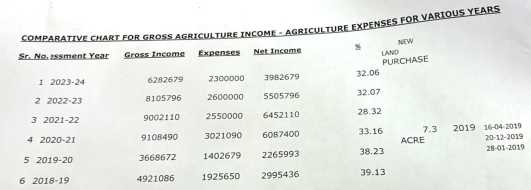

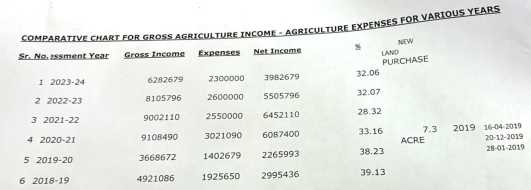

11. We note that the assessee has shown agricultural income, which is reproduced below, by way of chart:

We note that the main grievance of the Ld.PCIT was that the expenses claimed by the assessee were partly examined by the assessing officer and assessing officer has not examined entire agricultural expenses. However, we note that assessing officer has examined the agricultural expenses on test, check basis and if the agricultural expenses are increased then the corresponding agricultural income will be decreased, and in the reverse/ opposite position case, the assessee, let say, shown less agriculture expenses then agricultural income would be more, and in both the cases agricultural income is exempt from tax, therefore, it does not have impact on revenue, that is, there is no loss of revenue. Hence, in the assessee’s case, the order passed by the assessing officer is neither erroneous nor prejudicial to the interest of revenue, as there is no loss of revenue, for that we rely on the judgement of the Hon’ble Supreme Court in the case Pr.CIT v. V-Con Integrated Solutions Pvt. Ltd. [Special Leave Petition (Civil) Diary No. 13205 of 2025, dated 12.-9-2024], wherein it was held as follows:

“In our opinion, the order passed by the High Court, which upheld the decision of the Tribunal, is correct on facts and in law. This case does not involve a failure by the assessing officer to conduct an investigation. Instead, according to the Revenue, it be the case where the assessing officer having made inquiries erred by not making additions. The assessee does not have control over the pen of the Assessing Officer. Once the Assessing officer carries out the investigation but does not make any addition, it can be taken that he accepts the plea and stand of the assessee.

In such cases, it would be wrong to say that the Revenue is remediless. The power under Section 263 of the Income Tax Act, 1961, can be exercised by the Commissioner of Income Tax, but by going into the merits and making an addition, and not by way of a remand, recording that there was failure to investigate. There is a distinction between the failure or absence of investigation and a decision/conclusion. A wrong decision/conclusion can be corrected by the Commissioner of Income Tax with a decision on merits and by making an addition or disallowance. There may be cases where the Assessing Officer undertakes a superficial and random investigation that may justify a remit, albeit the Commissioner of Income Tax must record the abject failure and lapse on the part of the Assessing Officer to establish both the error and the prejudice caused to the Revenue. Recording the aforesaid, the special leave petition is dismissed.”

12. In light of the above, discussion, it is abundantly clear that the assessment order dated 08-09-2022 does not meet the statutory threshold of being prejudicial to the interests of revenue under Section 263 of the Act. In the absence of tangible revenue loss, the revision proceedings initiated by ld. PCIT, are without merit and should be quashed. Accordingly, we quash the order of learned PCIT and allow the appeal of the assessee.

13. In the result, the appeal of the assessee is allowed.