ORDER

B.M. Biyani, Accountant Member.- Feeling aggrieved by order of first appeal dated 09.12.2024 passed by learned Commissioner of Income-Tax (Appeals)-Addl/JCIT(A)-1, Delhi [“CIT(A)”] which in turn arises out of intimation of assessment dated 29.01.2024 passed by learned CPC, Bengaluru [“AO”] u/s 143(1) of Income-tax Act, 1961 [“the Act”] for Assessment-Year [“AY”] 2023-24, the assessee has filed this appeal.

2. The registry has informed that the present appeal is delayed by 23 days and therefore time-barred. Ld. AR for assessee submitted that the assessee has filed an application for condonation of delay supported by an affidavit of Divyanshi Rathore, an intern working under him. On perusal of the application/affidavit, we observe that the delay is attributed to the time taken in preparing case with accuracy. Ld. AR very humbly submitted that there is no lethargy, negligence, mala fide intention or ulterior motive of assessee in making delay and the assessee does not stand to derive any benefit because of delay. He further submitted that the sole reason of delay is as mentioned in the application/affidavit. He submitted that there is “sufficient cause” for delay and hence the small delay should be condoned. Ld. DR for Revenue left the matter to the wisdom of Bench without raising any objection. We have considered the explanation advanced by assessee and in absence of any contrary fact or material on record, the assessee is found to have a “sufficient cause” for delay in filing present appeal. We find that section 253(5) of the Act empowers the ITAT to admit an appeal after expiry of prescribed time, if there is a “sufficient cause” for not presenting appeal within prescribed time. It is also a settled position by Hon’ble Supreme Court in Collector Land Acquisition v. Mst. Katiji (SC)/1987 AIR 1353/1987 2 SCC 107 that whenever substantial justice and technical considerations are opposed to each other, the cause of substantial justice must be preferred by adopting a justice-oriented approach. Thus, taking into account the facts of case, the provision of section 253(5) and the decision of Hon’ble Supreme Court, we take a judicious view, condone the small delay of 23 days, admit appeal and proceed with hearing.

3. The background facts leading to present appeal are such that the assessee-individual filed his return of income of AY 2023-24 on 30.10.2023 u/s 139(1) before due date of 31.10.2023 declaring a total income of Rs. 40,17,574/-. The AO processed assessee’s return through an intimation u/s 143(1) after making certain additions/disallowances and determining total income at Rs. 53,93,910/-. Aggrieved, the assessee carried matter in first-appeal but could not make representation. The CIT(A), therefore, dismissed first-appeal on account of non-prosecution. Now, the assessee has come before us in next appeal.

4. The grounds raised by assessee are as under:

“1. BECAUSE, the order passed by the learned Commissioner of 1 Income tax (Appeals) U/s 250 of the Income tax Act is bad in law and is liable to be quashed.

2. BECAUSE, the no proper communication to the Appellant amount to violation of Principles of Natural Justice and thus the impugned order dated 09.12.2024 is liable to be set aside at the very threshold.

3. BECAUSE, the impugned order dated 09.12.2024 has been passed merely on the ground of’want to prosecution’, and hence in view of the same, due to the non-communication and thence no opportunity to file a detailed reply along with the proof, the said impugned order dated 09.12.2024 is liable to be set-aside.

4. BECAUSE, the Appellant is non-operational since October 2023, and the email IDs on record were not regularly monitored by employees, resulting in non-compliance with notices issued 4 by the Income Tax Department. Additionally, the accountant handling of the company left the company during the proceedings, further contributing to the lack of timely responses to the department’s communications.

5. BECAUSE, the learned Respondent erred in considering the fact that as per the Section 43B of the Act the payment actually made before the due date of furnishing return is the date for consideration of deductions under the Section. In the instant case, the Appellant after consideration of the observations in the Tax Audit Report made actual payment of the Bonus before the due date of filing ITR and hence the aforesaid is liable to deduction under Section 43B of the Act. Therefore, the payment of Rs. 10,00,000/- ought to be allowed as deduction and the addition may kindly be dropped accordingly.

6. BECAUSE, the inconsistency in amount mentioned in return at SI No. 5(d) of Part A OI “Any other item of income” as compared to amount mentioned in clause 16(d) of audit report of Rs. 86,682/- is illegal and bad in law, as the aforesaid is merely an error in the presentation and there is no prejudice caused to the Revenue.

7. BECAUSE, the various Other Income to the tune of Rs. 86,682/-was duly reflected in the Income Tax Return under the SCHEDULE OS -INCOME FROM OTHER SOURCES and the Income Tax on the same has duly been paid, hence there is no prejudice caused to the Revenue Department. Further, an amount of Rs. 30,507/- was inclusive in the Capital Gain head, which is exempt from tax.

8. BECAUSE, the order passed by the learned Commissioner of Income tax (Appeals) has erred in computing and confirming the charging interest U/s 234B Rs.86,182/- & 234C Rs. 46,258/-respectively.

9. That, with respect to the disallowance of Rs. 12,218/- under Section 43B of the Act pertaining to the payment of Professional Tax for the FY 2022-23, the same is rightfully disallowed in the Tax Audit Report and wrongfully allowed in the Income Tax Report, and therefore we admit the disallowance of the same in the AY 2023-24.

10. The Appellant craves, leave to add, amend, alter, modify or withdraw any of the above grounds of appeal at the time of hearing.”

5. During hearing before us, Ld. AR for assessee submitted that the assessee wants adjudication of only three Grounds i.e. Ground No. 5, 6 & 7. Other grounds raised by assessee are either general in nature or not being pressed. The submission of Ld. AR is accepted and accordingly Ground No. 1 to 4 & 8 to 10 are dismissed.

Ground No. 5:

6. This ground relates to the disallowance of Rs. 10,00,000/- made by AO u/s 43B and confirmed by CIT(A).

7. The necessary facts relevant to this issue ground are such that the AO made a total disallowance of Rs. 10,12,218/- u/s 43B which has two components, viz. (i) disallowance of outstanding bonus expenditure payable to employees – Rs. 10,00,000/-, and (ii) disallowance of outstanding professional tax – Rs. 12,218/-. The assessee has contested the second component of outstanding professional tax of Rs. 12,218/- in Ground No. 9 but since the Ld. AR is not pressing that ground, the same stands already dismissed in earlier part of this order. Now, we are concerned only with the first component of outstanding bonus of Rs. 10,00,000/- payable to employees.

8. The assessee has claimed a deduction of Rs. 10,00,000/- on account of provision for bonus expenditure payable to employees in P&L A/c and shown the same as liability in Balance-Sheet as on 31.03.2023. In terms of clause (c) Section 43B r.w.s. 36(1)(ii) of the Act, the assessee would get deduction of bonus expenditure only if the same was paid upto due date for filing of return u/s 139(1) which was 31.10.2023 in present case. However, what has happened in present case is that the auditors of assessee prepared Tax Audit Report in Form No. 3CD much earlier on 30.09.2023 and reported ‘Provision for bonus – Rs. 10,00,000/-‘ against Clause No. 26(B)(b) [Copy of Tax Audit Report is filed and relevant page is shown during hearing] since the bonus was not paid by then. However, the assessee subsequently made payment of bonus to concerned employees on various dates during the period 04.10.2023 to 07.10.2023 before due date u/s 139(1) [i.e. 31.10.2023]. Therefore, in this situation, we agree in principle that disallowance u/s 43B is not attracted when the assessee has already made payment upto due date u/s 139(1) as per section 43B. However, the assessee has filed additional evidences in the form of (i) Statement of working of bonus payable at Pages 225 to 226 of Paper-Book, (ii) Statement of datewise payments made to employees at Pages 70 to 72 of Paper-Book, (iii) Payment-Vouchers duly acknowledged by respective employees at Pages 73 to 202 of Paper-Book, and (iv) a Confirmatory affidavit of auditors dated 20.02.2025 at Page 229 of Paper-Book. Since these are additional evidences required to be verified by AO, we remand this ground to the file of AO for the limited purpose of verification of assessee’s evidences. The AO is directed to verify the evidences of assessee and delete the impugned disallowance as may be after carrying out the exercise of verification. Accordingly, Ground No. 5 is allowed for statistical purpose.

Ground No. 6 & 7:

9. These grounds relate to the addition of Rs. 86,682/- made by AO on account of other incomes and confirmed by CIT(A).

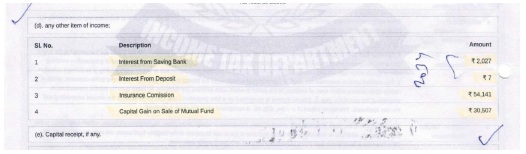

10. Ld. AR for assessee firstly carried us to Clause No. 16(d) / Page No. 6 of Tax Audit Report (Form No. 3CD) where the auditors have reported that the assessee did not credit following incomes to P&L A/c:

11. Ld. AR next carried us to following pages of ITR filed by assessee to demonstrate that the assessee has already offered those incomes at respective places under respective heads in ITR and paid tax:

| Page No. of Paper-Book | Income offered in ITR |

| Where offered | How offered | Amount |

| 38 | Schedule CG – Capital Gain – Entry No. B(4)(i) | Full value of consideration | 30,507 |

| 44 | Schedule OS – Income from other sources – Entry No. 1(b) | Interest income | 2,034 |

| 45 | Schedule OS – Income from other sources – Entry No. 1(e) | Any other income | 54,141 |

| | Total | 86,682 |

12. Thus, Ld. AR has successfully shown that the assessee has already offered the income of Rs. 86,682/- in ITR and paid tax. The Ld. DR for revenue could not have any objection against submission of Ld. AR. Being so, we direct the AO to delete the addition of Rs. 86,682/- made by AO. Accordingly, Ground No. 6 & 7 are allowed.

13. Resultantly, this appeal is partly allowed.