ORDER

1. The present cross-appeals filed by revenue as well as assessee arise out of the following separate orders passed for assessment years 2013-14 to 2015-16 and 2017-18 to 2018-19:-

| Details of assessment order u/s 143(3) r.w.s. 144C(13) of the Act |

| Assessment Year | Assessing Officer | Date of order |

| 2013-14 | DCIT, Circle 8(3), Mumbai | 02/02/2017 |

| 2014-15 | DCIT, Circle 8(3), Mumbai | 07/02/2018 |

| 2015-16 | DCIT, Circle 8(3), Mumbai | 31/01/2019 |

| 2017-18 | Assistant Commissioner of Income tax, Central Circle 8(3), Mumbai | 18/09/2021 |

| 2018-19 | Assistant Commissioner of Income tax, Central Circle 8(3), Mumbai | 09/11/2021 |

2. In the cross-appeals the assesse is challenging validity of final assessment order passed u/s 143(3) r.w.s. 144C(3) of the Act being time barred as per the provisions of the Act. However, the Ld.AR submitted that, the issue may be kept open as the assessee wishes to primarily argue on merits.

3. Admittedly, all issues raised in the revenue’s appeals are common and on identical facts. They were thus heard together to be disposed of by way of a consolidated order. For the sake of convenience and brevity, we are referring to the facts for assessment year 2013-14.

The grounds of appeal raised by the revenue for assessment year 2013-14 are as under:-

“1. Whether on the facts and in the circumstances of the case, the CIT(A) was justified in deleting the adjustment of Rs. 10,62,65,292/- on account of interest receivable on loans given to Associated Enterprise?

2. Whether on the facts and in the circumstances of the case, the CIT(A) was justified in not considering that the loan was forwarded by the assessee to the Mauritius AE and not to the South African AE, hence the geographical search is relevant to Mauritius only?

3. Whether on the facts and in the circumstances of the case, the CIT(A) was justified in not considering that the credit rating of the AE is determined as BBB-, which is on the basis of consolidated financials of all the AEs, whereas the credit rating of the comparable companies are that of A-, BBB+ and BBB?

4. Whether on the facts and in the circumstances of the case, the CIT(A) was justified in accepting the floating rate of interest and not the fixed rate of interest of 8.113%, which was based on LIBOR + 600 basis points, since the assessee had charged interest but the same was not received for F.Y. 2012-13?

5. Whether on the facts and in the circumstances of the case, the CIT(A) was justified in deleting the adjustment of Rs. 5,81,315/- on account of interest on overdue receivables from AEs merely on the ground that the method used for benchmarking the transaction by the TPO was the same as that was used to calculate interest on loans given by assessee to AE, when outstanding receivables from AE have been treated as ‘loan’ advanced to the AE and hence the same method used for benchmarking interest receivable on loans given to the AE has correctly been applied by the TPO?

6. Whether on the facts and circumstances of the case, the Ld. CIT(A) was correct in ignoring the jurisdictional ITAT decision in the case of PARLE BISCUITS PVT. LTD. v/s AU in ITA No. 2484/Mum/2022, wherein it was held that interest on outstanding receivable are nothing but loan given by the assessee to its AE?

7. Whether on the facts and circumstances of the case and in law, the Ld. CIT(A) is justified in deleting the adjustment of Rs. 54,73,82,963/-on account of power conversion charges when the TPO has arrived at the real cost of power generation to be at Rs. 0.77 per unit based on actual figures submitted by the assessee?

8. Whether on the facts and circumstances of the case and in law, the Ld. CIT(A) is justified in deleting the adjustment of Rs. 54,73,82,963/-on account of power conversion charges made by the TPO without giving any plausible reason as to why the benchmarking analysis carried out by the TPO is incorrect?

9. Whether on the facts and circumstances of the case and in law, the Ld. CIT(A) is correct in not appreciating the fact and position of law that comparability of the specified domestic transaction (SDT), i.e. power conversion charges with uncontrolled transaction i.e., KERC (Karnataka Electricity Regulatory Commission) prices, has to be established in terms of parameters contained in Rule 10B(2), by which the price charged by a power generating company cannot be compared to the price charged by a power distributor, more so since the Functions performed, Assets employed and Risks assumed (FAR) are entirely different?

10. Whether on the facts and circumstances of the case and in law, the Ld. CIT(A) is correct in not appreciating the fact that the assessee has adopted the price charged by a power distributing company (as arrived at by KERC) as a comparable transaction and that the margin earned by the power distributor for functions performed, assets employed and risks assumed by it are embedded in the said price, against the same, the assessee does not perform any function on account of power distribution nor does it employ any huge asset relating to distribution nor does it assume any risk connected with distribution and therefore, adoption of the price charged by a distributor as comparable for the price charged by the assessee which is generator is not correct, as the assessee would be attributed with costs and profits on account of distribution activity, which it has not performed?

11. Whether on the facts and in the circumstances of the case the Ld. CIT(A) was justified in deleting the addition made on disallowance of deduction u/s 80IA of Rs. 469,81,46,793/- in respect of its SBU II?

12. Whether on the facts and in the circumstances of the case and in law, the Ld. CIT(A) was justified in deleting the disallowance made u/s 14A r.w. Rule 8D of the Act, by holding that no disallowance u/s 14A of the I.T. Act ignoring the clarifications issued by the CBDT vide Circular No. 5 of 2014 dated 11.02.2014 issued by the Central Board of Direct Taxes which clearly provides for disallowance of the expenditure even where taxpayer in a particular year has not earned any exempt income?

13. Whether on the facts and in the circumstances of the case and in law, the Ld. CIT(A) was justified in directing the AO to delete the addition worked out u/s 14A r.w. Rule 8D of the Act while computing the book profits u/s 115JB of the Act without considering that as per Explanation 1(d) to Section 115JB, the book profits have to be increased by the expenditure incurred for earning the exempt income?

14. Whether on the facts and in the circumstances of the case and in law, the Ld. CIT(A) erred in allowing the depreciation claim of Rs. 2,65,32,914/-, whereas no work executed by M/s. Grenach Infrastructure Equipments & Projects Ltd. (now known as Sancia Global Infraprojects Ltd.)?

15. The appellant craves leave to amend or alter any ground or add a new ground which may be necessary.”

Brief facts of the case are as under:-

4. Assessee filed its return of income on 30/11/2013 declaring total income of Rs.3,68,42,37,650/- under normal provisions of the Act and Rs.12,43,85,54,737/- under the provisions of Section 115JB(2) of the Act. The case was selected for scrutiny and notice u/s 143(2) of the Act was issued on 01/09/2014 along with notice u/s 142(1) and questionnaire. In response to the statutory notices representative of the assessee appeared before Ld.AO and filed details as called for.

4.1. The Ld.AO noted that assessee is a public company engaged in the business of generation of power and operation and maintenance of power plants. Assessee works on Power solutions in the states of Karnataka, Maharashtra, Rajasthan and Himachal Pradesh. The Ld.AO further noted that, the assessee entered into international transactions with its associated enterprises that exceeded the threshold limit and accordingly reference was made u/s 92CA(1) of the Act to Ld.TPO to determine the ALP of such international transactions.

4.2. On receipt of the reference, the Ld.TPO called for details of international transactions in Form 3CEB alongwith various other evidence and documents to support the computation of ALP in relation to the international transactions, assessee had with its AE along with other specified domestic transactions entered into with such AEs.

4.3. The Ld.TPO from the details furnished noted that, the assessee is a part of JSW group which is in the operation of steel, energy, minerals, mining and infrastructure. It was noted that, the assessee is engaged in the generation of power and has plants in Karnataka (Vijaynagar Unit) – SBU 1 and 2 and Maharashtra (Ratnagiri Unit) SBU-3. It was also noted that, for the year under consideration, the plants situated in Karnataka was claiming deduction u/s 80IA(10) of the Act.

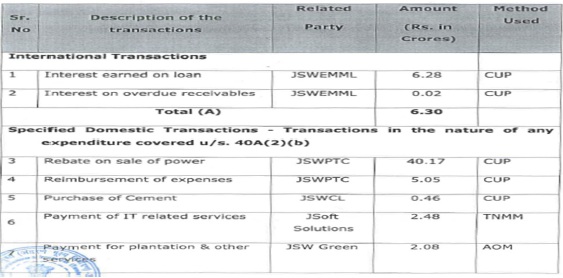

4.4. The Ld.TPO noted that for the year under consideration, assessee had entered into the following international transaction with its AE:-

4.5. The Ld.TPO noted that, the assessee during the year under consideration received interest of Rs.627.50 Lakhs from its AE in respect of loan granted. It was noted that, assessee had entered into a loan agreement dated 26/07/2010 with its Mauritius, AE on following terms:-

“5.1 The assessee during AY 13-14 has received an interest of Rs. 627.50 lakhs from its AE in respect of loans granted. The assessee had entered into a loan agreement dated 26 July 2010 with its Mauritius AE. As per the said agreement following are the relevant terms:

“3. INTEREST

3.1 The Borrower shall pay to the Lender interest at the rate of 3 month’s LABOR and it shall be computed on the basis of 360 days year.

3.2 Interest for the period commencing from the disbursement date till 31st December of each calendar year shall be payable every year on 31 December.

3.3 The Lender shall also have full right and discretion to charge penal interest at the rate of one (J) per cent per annum for the period for which any installment of repayment of loan thereof remains in arrears.

4. REPAYMENT

4.1 the Borrower shall repay the principal amount of loan along with the outstanding interest, if any at the end of three (3) years from, the date of disbursement of each tranche of the Loan.

4.2 In the event of any default in payment of principal amount of Loan and/or any interest, postponement, if any, allowed by the Lender shall be at the rate of interest as may be stipulated by the Lender at the time of postponement.”

4.6. The Ld.TPO called upon assesse to submit details in respect of loans with the Mauritius AE. Assessee vide letter dated 14/06/2016 submitted following details:-

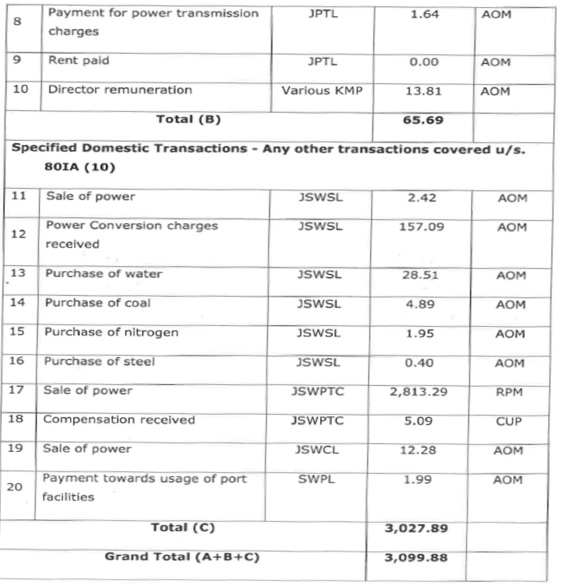

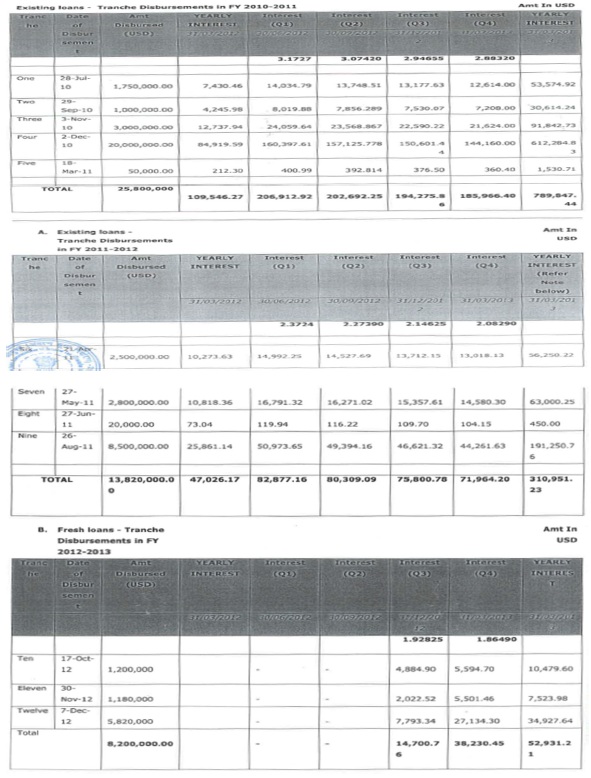

(a) Assessee vide letter dated 14/06/2016 submitted that there were existing loans amounting to Rs.1,78,18,64,100/-and fresh loans amounting to Rs.44,59,92,260/- was disposed off during the financial year relevant to assessment year under consideration.

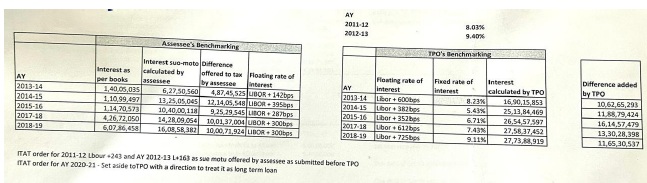

(b) It was submitted that, on these loans, interest was charged at LIBOR plus 142 basis point and thus, the total interest was determined at Rs.6,27,50,560/-, details of which were submitted as under:-

4.7. The Ld.TPO noted that assessee benchmarked the international transactions of interest payment on the basis of External Comparable Uncontrolled Price (CUP) method. No internal CUP was available with the assessee as AE was treated as the tested party. The method of determining the ALP of the transactions by assessee in the TP study was as under:-

“1. The credit rating of the AE (entity using loan to acquire assets in South Africa) was determined.

2. Comparable loans in respect of those companies which have credit rating that of the AE were searched. The average at which comparable companies have taken loan is arm length price.

3. The AE was treated as tested party.”

4.8. Assessee had also provided details in the TP study report regarding the credit rating of the borrower (Mauritius AE):-

“2.1 Creditworthiness of the borrower

There is no formal or informal credit rating available for the borrower. It is pertinent to note that, although the intra-group loans have been granted by JSWEL to JSWEMML, the intra- group loans have been utilised by SACMH-South Africa, which is the operating entity, for the acquisition of coal mines. In order to estimate the credit estimate of SACMH, we had relied on Moody’s Rating Methodology (‘MRM’) for Global Mining Industry.

For FY 2012-13, in estimating the creditworthiness of the borrowing subsidiary it was thought prudent by JSWEL to continue the credit estimation done in FY 2010-2011. The reason for this was that the underlying facts based on which the credit estimation was carried out in FY 2010- 11 still hold good for the current financial year. This is especially pertinent considering the credit estimation of the borrowing entity was carried out using projected fire year financial Statements. Furthermore, SACMH-South Africa continues to be in its nascent stage of operations.

The credit estimate of the global mining industry is dependent on six primary factors: Reserves; Cost Efficiency & Profitability,’ Financial Policies; Financial Strength; Business Diversity & Size; and ‘Other’ Liabilities Adjustments. Each of the above factors is further divided into sub- factors, with a total of eleven sub-factors. A different weight is assigned to each factor depending on the exhaustive survey / analysis performed by the rating agency.

Based on the financial analysis and the qualitative analysis, the numeric score under each factor is determined for each Company. In the next step, each sub- factor’s numeric score is multiplied by the assigned weight and the results are aggregated. Finally, the numeric score under each subfactor is aggregated and the credit estimate is derived. The detailed application of the rating is provided in appendix below.

Using the above mentioned methodology, SACMH”s implied credit rating is estimated Lo be Baa1 (see Appendix A). The S&P’s equivalent credit rating to a Moody’s Baa1 rating is BBB +4. In brief, the estimated credit rating falls in the ‘lower medium investment grade”.

Based on the implied credit quality for SACMH and the terms of the intragroup debt, a search for comparable loans was undertaken.

Thomson Reuters’ LoanConnector is a convenient, internet-based distribution platform. DealScan database (‘DealScanB), which is part of the LoanConnector product, provides information on the global commercial loan market.

DealScan provides users with access to LPC’s robust database of detailed terms and conditions on over 155,000 loan and bond transactions. The database provides information about current deals in the market and offers a historical perspective on deal pricing or market trends. DealScan is used by financial institutions and businesses worldwide, including syndicators, lenders, institutional investors, traders, risk managers, treasurers, and other market participants.

Search for comparable loan deals

Based on the implied credit quality for the borrower and the terms of the intra-group debt, a search for comparable loans was undertaken on Reuter’s DealScan database (‘DealScan’)”

Table 3: Search Strategy used on DealScan to obtain external comparables

| Ratings (Moody’s) | A3, Baa1, Baa2 |

| Borrower (country) | USA, Mauritius, South Africa |

| Currency | United States Dollar |

| Deal Active Date | 28 July 2010 to 27 July 2011 |

| Date – Tenor/Maturity | 2 -4 Years |

| Collateral | Unsecured |

| Status/ Phase | Mandated, Completed |

4.9. The assessee thus computed the mean interest rate of the comparable loan after necessary risk adjustment at LIBOR plus 142 Basis points for the year under consideration. Assessee also considered an additional spread of basis point of LIBOR and computed the interest at Rs.6,27,50,560/-. Assessee provided following working in respect of same:-

5. The Ld.TPO was not convinced with the assessee’s methodology to compute interest on floating rate. He also rejected the comparables selected by assessee which was located in South African geography i.e., the country in which the loan was ultimately utilised instead of selecting comparables in Mauritius, the country to which the loan was given. The Ld.TPO was of the view that the transaction must be compared with comparables in respect of interest on loan data applicable for borrowers in Mauritius geography from an appropriate database.

5.1. The Ld.TPO thus, benchmarked the transactions by considering the rates as per Bloomberg database and considered the comparable rates in case of Mauritius borrowers by treating the tenure of loan to be four years. The Ld.TPO also considered the fact that no interest was paid up till now by the Mauritius AE. The Ld.TPO also noted that assessee did not determine the ALP rate of interest receivable from the AE in accordance with the provisions of section 92C(1) and 92C(2) and also the information or data used by the assessee not being reliable, he rejected the comparison analysis made by the assessee.

5.1.1. The Ld.TPO referred to the loans taken by the assessee in earlier years and proposed to compare Bloomberg database’ rate keeping in mind currency of loan, geography of borrower, terms and conditions of tenor of loan, security given, repayment of loan etc. The Ld. TPO recorded categorical finding that, in earlier AYs 2012-13, 2013-14, 2014-15, 2015-16, 2016-17, 2017-18 and 2018-19 the assessee has not received any interest from the AE, therefore, the floating rate of interest would not be applicable in the case of assessee, instead fixed rate of interest was to be ascertained from Bloomberg database’ using ‘Swap Manager’ tool. The Ld.TPO accordingly held that the, interest rates should be charged at the rate applicable for fixed rates loan. He considered the Mauritius entity as the borrower and also considered loans issued in different tranches, taking into consideration the fact that, no interest payment was made by the AE. The Ld.TPO concluded that facts and circumstances for the year under consideration being same from AYs 2012-13 to 2018-19, fixed rate should be applied for these years on the loan advanced to Mauritius AE.

5.2. Assessee objected for adopting fixed rate for following reasons:-

| (a) | | for assessment year 2012-13, this Tribunal already rejected the fixed rate of interest applied by Ld.TPO and justified the floating at of interest. |

| (b) | | While making search of comparables over the database like, country of risk, country of incorporation tests were applied. |

| (c) | | The criteria used to arrive at comparable was very broad and did not consider parameters like country of borrower, tenor/maturity of loan etc. |

| (d) | | The rate of loan was applied on which loan/tranch basis on the year on which the loan/tranch was first advanced to the AE disregarding the fact that the loan agreement had been amended to retrospectively from the date of issuance of such respective tranch. |

5. 2.1. In support of the above objection, the assessee placed reliance on the decision of the Hon’ble Delhi High Court in the case of Cotton Natural India Pvt. Ltd. v. Dy.CIT [ITA No.5855/DeI/2O13 TS-33-ITAT-2013(DEL)-TP, wherein necessary parameters to be considered for pricing any company, loans were emphasized. The assessee also placed reliance on the decision of Hon’ble Delhi Tribunal in the case of Aithent Technologies (P.) Ltd. v. ITO ITD 521 (Delhi)/ ITA No. 3647/DeI/2007, wherein Hon’ble Tribunal noted that, there are several relevant factors to be considered including the credit quality of the borrower and an estimation of credit rating, evaluation of the terms of the loan such as period of loan, amount, currency, interest rate basis and additional inputs such as convertibility of the loan etc.

5.3-5.4. The Ld.TPO rejected the objections of assessee by observing as under:-

“a) The assessee’s claim that since the loan given to the Mauritius AE was ultimately utilized by the South African AE, the benchmarking search for comparables in South Africa did not yield any results is not correct method of benchmarking.

(b) Ideally, the assessee should have searched for comparable interest on loan data applicable for borrowers in Mauritius geography from appropriate databases like Bloomberg. This is because the repayments has to be done by the entity in Mauritius and it is in the cash flow of this entity which will repay the assessee’s loan and not that of the entity in South Africa.

(c) Since, the assessee had not determined the arms’ length rate of interest receivable from the AE in accordance with the provisions of section 92C(1) and 92C(2), and also since the information or data used by the assessee in computation of the arms’ length price is not reliable or correct, hence the same deserves to be rejected and provisions of section 92C(3)(a) and 92C(3)(c) are invoked to determine the ALP.

(d) External CUP has been correctly applied by searching for appropriate interest rates prevailing in the borrower geography(Mauritius)

(e) Bloomberg database has been used to determine the appropriate comparable ALP interest rate.”

5.5. The Ld.TPO, thus made an upward adjustment of Rs.10,62,65,292/- towards the receipt of interest from AE against the loan granted. The Ld.TPO also computed interest on overdue receivable @8.113% at Rs.5,81,315/-.

5.6. The Ld.TPO further determined ALP of specified domestic transactions in respect of power generated by adopting the rate of conversion charge of power at Rs.0.75/- per unit to its captive entities as against Rs.1.3/- per unit charged by assessee. The adjustment thus proposed was Rs. 54,73,82,963/-.

6. The Ld.AO upon receipt of the transfer pricing, incorporated the adjustment proposed by Ld.TPO. In furtherance, the Ld.AO also computed;

| • | | Restricted the disallowance under section 80IA at Rs.200,22,69,287/- |

| • | | disallowance u/s 14A r.w.s. 8D amounting to Rs. 14,85,775/- and; |

| • | | disallowed depreciation claimed on capitalisation expenses for the work done by M/s. Gremach Infrastructure Equipments & Projects Ltd. [known as Sancia Global Infraprojects Limited (SGIL)] amounting to Rs.2,65,32,914/- |

The Ld.AO computed the Net total Income at Rs.917,29,45,155/-

6.1. On receipt of the draft assessment order, the assessee did not respond. The Ld.AO thus passed final assessment order making addition.

7. The assessee then filed appeal before Ld.CIT(A) against final assessment order dated 02/02/2017

7.1. The Ld.CIT(A) vide order dated 03/02/2025, upheld the additions made in the assessment order.

Aggrieved by the order of Ld.CIT(A), assessee is in appeal before this Tribunal.

8. Ground Nos. 1 to 4 raised by assessee is on the issue of interest receivable on loans advanced to AE.

8.1. At the outset, the Ld.AR submitted that this issue stand covered by order of this Tribunal in assessee’s own case for assessment year 2011-12 & 2012-13 in Dy.CIT v. JSW Energy Ltd. (Mum. – Trib.)/ITA no. IT(TP) No.2452&2316/Mum/2017 vide order dated 07/11/2019. In all fairness, he brought to our notice, order dated 26/03/2025 passed by this Tribunal for assessment year 2020-21 in Asstt.CIT v. JSW Energy Ltd. [ITA Nos. 3713 and 3714 (Mum) of 2024] where in this Tribunal took contrary view. He submitted that, this Tribunal after considering various arguments by both sides and based on subsequent development, remanded this issue back to the Ld.TPO/Ld.AO by observing and holding as under:-

“8. We have heard rival submissions of the parties and perused the relevant materials on record. The issue in dispute involved in the grounds raised is regarding adjustment made by the Ld. TPO to the international transaction of the interest to be received from the associated enterprises applying fixed rate of interest as against the floating rate of interest i.e. LIBOR applied by the assessee. The primary contention of the assessee is that identical issue of applying floating rate of the interest applying floating rate of interest vis-a-vis fixed has been decided by the Tribunal in assessment year 2011-12 2011 and 2012-13 in ITA No. 2452 & 2316/Mum/2017 in favour of assessee assessee.

8.1 The Tribunal(supra), (supra), in assessment year 2011-12 12 noted that the assessee advanced unsecured loans of Z 115.19 crore crores to associated enterprise namely M/s JSW Energy Minerals Mauritius limited and received interest of the 13.82 lakhs. The said loan was in the nature of unsecured loan having tenure of three years. The currency of JSW Energy Ltd 22 ITA Nos. 3714 & 3713/MUM/2024 interest payment as well as principal repayment was said to be in US dollars. The interest rate was stated to be floating interest rate LIBOR. The loan was advanced in five to be computed as per LIBOR trenches during the year and accordingly, the interest was charged at three months average LIBOR rate ranging between 0.29% to 0.30% for actual number of days for which loan was used by the AE. The relevant facts for AY 2010-11, 2010 11, reproduced by the Tribunal (supra), are extracted as under:

“2.9.2 The assessee explained that non residents who wished nonresidents to invest in South Africa by means of loan capital needs approval from South African Reserve Bank particularly with reference to intended repayment dates and interest rates. The agree to interest rates in excess of prime Reserve Bank will not agree rate being charged by non resident shareholders on loans to non-resident the South African subsidiaries but loans from non non-residents residents other than shareholder may be allowed to carry interest at prime +2%. The relevant extracts of the regulations were provided to Learned TPO. It was submitted that intra-group intra loan advanced to Mauritius Entity was ultimately utilized in South Africa since JSWEMML further advanced the said loan to JSW Energy South Africa Ltd. [JSWENRSAL] and in view of o the South African Reserve Bank regulation, the Mauritius entity would not be able to charge any interest more than LIBOR from South African Entity. In the aforesaid background, it was submitted that the intra group transaction was to acquire the asset is South Africa and therefore, transaction was at Arm’s Length Price as prescribed in the Indian Regulations. In nutshell, it was submitted that due to regulatory restraints of South Africa, the interest rate could not borrowings from any group be more than LIBOR rate for any borrowings companies outside South Africa.

2.9.3 Without prejudice to the above submissions, the assessee benchmarked the loan transaction on the basis of External Comparable Uncontrolled Price [CUP] Method by comparing the interest rates at which the independent parties with similar credit ratings would be able to obtain intra-group intra loans. The AE was selected as the tested party and its credit rating was determined to be Baa1 (Moody; equivalent to S&P BBB+) which fall in the lower medium investment grade. Selecting the borrower country to be Mauritius/South Africa/USA, the assessee arrived at mean ALP margin of 243.83 basis points over LIBOR. Applying the spread of 243.83 basis point to LIBOR, the ALP interest was computed to be US Dollars 367598 (INR (INR Equivalent Rs.164.13 Lacs) as against Rs.13.82 Lacs charged by the assessee from its AE. The assessee, in support of LIBOR, also submitted that the loans were advanced from internal accruals and it did not have any foreign borrowings. The weighted average of domestic borrowings was computed as 10.14% as per the workings submitted by the assessee.

2.9.4 However, upon due consideration, the Ld. TPO opined that the regulatory restriction imposed under South African Regulations would not be determinative since the loan was since advanced to Mauritius entity and not to South African entity. Further, the regulatory authority of any country would not take into account the transfer pricing provisions to determine the appropriate rates which could be considered as Arm’ Length Price for interest payment. Drawing analogy from the decision rendered in Coca Coca-Cola India Inc. v. Asstt. CIT (Punj & Har.) that the royalty rates represent ALP of any international permitted by RBI would not represent transactions, Ld. TPO opined that determination of ALP was to be examined from the point of view of Transfer Pricing Provisions under the Income Tax Act.

2.9.5 Proceeding further, finding defects in the assessee’s methodology to benchmark the same by External CUP in view of the fact that comparable entities were based in USA whereas the loans was advanced to Mauritius entity and further, the credit rating of Mauritius AE would be much lower than BBB+ as adopted by the assessee for benchmarking, Ld. TPO concluded that the search process was not proper and was required to be rejected. The argument that the loans were advanced from internal accruals was also rejected since the assessee, in the opinion of Ld. TPO, failed to prove nexus between interest free funds available with the assessee vis-a- vis loans advanced to its AE.

2.9.6 The Ld. TPO also came to a conclusion that interest on outbound loan was not to be benchmarked with LIBOR since no company would like to advance loans outside e India without security as the interest rate in India would be higher than those prevailing in the developed country. Therefore, the rates prevailing in India would be an appropriate benchmark to determine the ALP of loans advanced by Indian entities. Although the assessee placed reliance on certain judicial pronouncements for the submission that LIBOR would be appropriate benchmark rate, however Ld. TPO opined that certain vital aspects remained to be considered in the cited decisions. Rather reliance was placed on the decision of Tribunal rendered in Aurionpro Solutions Ltd. v. Addl. CI (Mum. – Trib.) for the conclusion that lending should not be below the cost of the borrowings of the assessee and the assessee should earn income which it would have earned by advancing loans to third parties.

2.9.7 Finally, Ld. TPO proceeded to work out the mean ALP rate on the basis of above factors. The assessee was taken as the tested party and External CUP method was used for benchmarking the aforesaid transaction. External CUP, as per Ld. TPO, could be the Bank Prime Lending Rate [PLR], Corporate Bond Rates or the cost of borrowings in the domestic market. Applying the average spread of 2.89% to assessee’s cost of borrowing i.e. 10.14%, cost of domestic borrowings was worked out to be 13.03%. Relying upon safe harbor rules, Prime Lending Rate was worked out to be 10.50%, which was nothing but 3% spread over State Bank of India base rate of 7.5%. The ALP based on Corporate Bond Rates was worked out to be 15%. Finally, the most conservative rate i.e. 10.5%, out of three rates, was adopted to benchmark the stated transactions. The ALP interest, thus, worked out to be Rs.441.61 Lacs as per computations made in para 5.8 of learned TPO’s order. Adjusting the interest of Rs.13.82 Lacs as charged by the assessee from its AE, the net TP adjustment, thus proposed, worked out to be Rs.427.78 Lacs.

2.9.8. The aforesaid TP adjustment was incorporated in assessment order dated 17/04/2014. The assessee submitted that it did not want to pursue the matter before Ld. Dispute Resolution Panel and expressed its intention to contest the same through normal appellate channel of Ld. CIT(A). Accordingly, the assessment order was passed by Ld. AO on 17/04/2014 which was subjected to further appeal before Ld. first appellate authority.

2.10 Before Ld. first appellate authority, the assessee, inter inter alia, drew attention to the fact that similar benchmarking, in immediately succeeding year i.e. AY assessee’s own case for immediately 2012-13, 13, has been done by Ld. TPO himself in its subsequent order dated 29/01/2016 adopting LIBOR rates as the base rates and ruled out the application of Corporate Bond Rate, SBI PLR Rate or Cost of Borrowing rate etc. RelianReliance was placed, inter-alia, alia, on the decision of Hon’ble Delhi High Court rendered in CIT v. Cotton Naturals (I) (P.) Ltd. to support the benchmarking submissions that LIBOR would be appropriate benchmarking rate on such outbound loan transactions. The list of other decisions which has also affirmed the said view, as relied upon by assessee during appellate proceedings, has also been tabulated on page nos. 18 19 of the appellate order.

18-19 with assessee’s submissions, Ld. CIT(A) allowed Concurring with assessee’s ground by observing as under: –

I have considered the submissions of the assessee, the views of the AO in the assessment order and the material on record.

use of intra-group It is apparent from the above that the end use intra loan was to acquire the asset company in South Africa and it is clearly evident that the JSWEMML was not able to charge the interest more than LIBOR from JSW South Africa Ltd. (JSWENRSAL), which had a direct impact on the interest repayment nt capability of JSWEMML to JSWEL of not more than LIBOR.

Further, the assessee submitted that with respect to cross border transactions, the interest rate is determined by using foreign currency rate (LIBOR/EURIBOR) and the same has JSW Energy Ltd 26 ITA Nos. 3714 & 3713/MUM/2024 been upheld as an appropriate benchmarking rate in various judicial decisions which have been mentioned above.

Thus, considering the above view taken by the appellant and the view taken by the TPO in appellant’s own case for later years i.e. AY 12-13 12 & AY 13-14, the transaction on of interest on loan has been benchmarked using the LIBOR Rate and also it is a well settled law that with respect to the cross border transactions, LIBOR has been considered as an appropriate benchmarking and thus, this ground of appeal raised by the assessee is allowed.

Aggrieved as aforesaid, the revenue is in further appeal before us.”

8.2 The Tribunal(supra) rejected the benchmarking applying fixed rate, of interest for the reason that in succeeding assessment years the learned TPO himself carried out benchmarking on the basis of LIBOR plus some spread over of basis points. But the Ld. CIT(A) benchmarked the transaction applying only the LIBOR. Though, the Tribunal supported the finding of the Ld. CIT(A) relying on the decision of the Hon’ble Delhi High Court in the case of CIT v. Cotton Naturals (I) P Ltd(supra), but directed to determine the ALP on the basis of LIBOR plus some spread over points, because the LIBOR represents interbank rates which are applicable in case of entities having highest credit cre ribunal noted that the rating. The Tribunal assessee itself has assigned a rating of Baa1 /BBB+ to its AE, while benchmarking the international transaction. The sai said rating being of ‘lower lower medium investment ribunal directed to investmentgrade’ rating, the Tribunal adopt certain spread over the LIBOR. The relevant finding of the Tribunal is reproduced as under:

“2.14 Now the only question that survives for our determination of ALP rate keeping in view consideration is the determination the facts and circumstances of the case. The Ld. first appellate authority has confirmed the determination of ALP on the basis of LIBOR only without any spread-over. However, the said rate, in our opinion, represent inter-bank in bank rates which are applicable in case of entities having highest credit rating. The same is also fortified by the fact that the assessee, itself, has assigned a rating of Baa1/BBB+ to its AE while benchmarking the transactions. The said rating represents ‘lower medium investment grade rating. Therefore, the determination of ALP merely on the basis of LIBOR, in our considered opinion, would not be justified. During the course of proceedings before Ld. TPO, the assessee had arrived at mean spread of 243.83 243 basis points over LIBOR which is evident from page nos. 5-65 of Ld. TPO’s order. The computation of the same has nowhere been disputed by the revenue. Applying LIBOR + spread-over, spread ALP interest has been worked out to be Rs.1,64,13,241/-. We considered opinion that this spread over as are of the considered computed by the assessee was undisputed, quite fair and reasonable and the same was to be accepted. Accordingly, we confirm the ALP rate of LIBOR + 2.4383% as computed by the assessee in the alternative submissions made before Ld. TPO.

The impugned order stand modified to that extent. The Ld. TPO/Ld. AO is directed to recompute the income of the assessee in terms of our direction. Accordingly, Ground Nos. 1 & 2 stands dismissed. Ground No.3 stand allowed. Ground No. 4 stands partly allowed.”

8.3 Based on the above finding for assessment year 2011-12, the Tribunal in assessment year 2012-13 also accepted the floating rate of interest i.e. LIBOR with certain spread over of basis points as interest adopted by the learned TPO. The against the fixed rate of interest relevant finding of the Tribunal 2012 Tribunal for assessment year 201213 is reproduced as under:

“3.7.4 Upon careful consideration, we find that the facts of this year are pari-materia with the facts of AY 2011-12.12. The loan transactions arise out of same contractual terms and conditions. We also find force in the submissions that learned TPO proceeded on the basis of wrong parameters as pointed out by the assessee before lower authorities, completely disregarding the contractual terms. It is settled position that the contractual terms agreed to between the parties could not be rewritten or obliterated and reclassification or substitution of the transaction was not permitted. Nothing on record rebut the facts that as per the terms of the contract, the borrower had agreed to pay the lender interest at rates equal to 3 months’ LIBOR prevailing on the date of each interest payment up to 31/03/2012. The said fact has also been noted by Ld. DRP at para 2.29 of its directions. The only allegation is that the original agreement dated 26/07/2010 was not produced before Ld. DRP. However, the same would not make much difference since we have already confirmed the application of 2011 12. Since in AY 2011-12, floating rates of interest for AY 2011-12. 2011 we have upheld the working made by assessee, taking the same view, we upheld the workings made by the assessee during proceedings before learned TPO. Accordingly, we direct lower authorities to accept alternative TP adjustment of Rs.491.07 Lacs as worked out by the assessee during proceedings before Ld. TPO based on LIBOR + spread of 243.88 bps/163.8 bps for AYs 2011-12 2011 12 & 2012-13 respectively. The interest already charged by the assessee would be adjusted from the same and the net amount shall be the amount of TP adjustment for the impugned AY. Ground No.1 stand partly allowed.”

8.4 Thus, Tribunal (supra) has mainly applied the floating rate of the interest in assessment year 2012 2012-13 13 for the reason that there was no change in the contractual terms in AY 2012–13 as compared to assessment year 2011-12.

2011 The Tribunal(supra) has particularly noted the terms of the contract that borrower had agreed to pay the lender interest rates equal to 3 months LIBOR prevailing on the date of the interest payment of two 31/03/2012.

8.5 Before us, the Ld. DR however submitted that facts and circumstances in the year under consideration has under gone substantial change as compared to the assessment year 2011-12 and 2012-13. We find that in the beginning, the assessee and its associated enterprises agreed for a quarterly and six monthly associated interest payments with limited tenure of loan. Thereafter, assessee as amended agreement at least 10 times and extended the first has installment of payment of the interest from six months to 31.03.2019. The ld DR submitted that the floating rate of the interest i.e. LIBOR is charged in case of loan of small tenure like the case of assessee in earlier years, where parties agreed for tenure up to three years at the time of entering the loan agreement for the first time. However in the current assessment year under consideration, the loan amount has consistently increased and the tenure of the loan has got substantially changed and first installment has been made payable only on 31.03.2019 i.e. almost nine year after the first tranche of the loan agreement dated 26.07.2010. Therefore, all practical purposes, the loan extended to the associated enterprises is in the nature of long term loan.

8.6 Therefore, the facts and circumstances of the year under consideration being altered as compared to the facts and circumstances in asses 12 and 2012-13, assessment year 2011-12 2012 the ratio of the decision of the Tribunal (supra) is not applicable over the facts of the instant case. Accordingly, we reject the first contention of the assessee.

8.7 The next objection of the assessee is considering the Mauritius entity as the country of the loan borrower, the Ld. TPO has held that loan was availed by the AE in Mauritus even though it was used in South Africa. We are of the opinion that the Ld. TPO has correctly considered the Mauritius entity and the country of the borrower as Mauritius as the loan has been availed as part of the agreement between the assessee and the Mauritius entity. Accordingly, we reject the contention of the assessee in this regard

8.8 Next contention of the assessee is against application of the fixed rate of the interest by the Ld. TPO, Bloomberg’ data TPO using ‘Bloomberg base applying ‘Swap Manager M tool’, converting the floating rate into fixed rate of the interest. In our opinion, the loans granted by the assessee to its associated enterprises might be temporary or short term period loan in the beginning years, but in view of subsequent amendments adding of the further loans, by amendments from time to time and way of conduct of the parties, the loans have become long term nature Further, non payment of the interest or delay period loans in nature. being in the in repayment of installments has made the loan. In such circumstances, comparability of nature of high risk loan transaction under CUP method invoking only assessee’s loan transactions LIBOR rate i.e. floating rate of the interest, may not be correct as the LIBOR interest rate is applied in interbank loan transactions of short term nature, where party’s credit score is very high. In the case, the assessee itself has mentioned credit score of the Mauritius Baa1/BBB which is a ‘lower medium investment AE as below Baa1/BBB+, grade’. The assessee itself has also accepted the change in facts and stances as compared to the assessment year 2011 circumstances 2011-12 and itself has included 300 basis points to the LIBOR along with certain additional spread over points to compensate high risk nature of the loan.

8.9 But, no instance of any loan transaction of long term nature between two independent parties where floating rate of interest has been applied was brought to our notice by the assessee Thus, the question is whether the assessee has relied on any of the CUP nature of loan where transaction from database of long term nature floating rate with appropriate spread has been applied by parties in an independent transaction. The answer is in negative. The ld TPO has also not compared transactions of assessee with any transaction of long term loan between two independent parties relying on CUP method. The ld AO/TPO is bound to follow the methods prescribed under the law for determination of arms length price and can’t adopt arbitrary method of converting floating rate of interest into fixed rate of interest.

8.10 In above, we feel it appropriate to restore the matter in view of above back to the file of the ld AO/TPO for benchmarking of the loan transaction of the assessee using appropriate method provided under the law treating ng the transaction of the assessee as long term loan transaction with appropriate risk involved. Accordingly, we the ground No. 1 of the appeal is allowed for statistical purposes.”

8.2. He submitted that a miscellaneous application filed on this issue has been decided against assessee and, thus, this order in the present scenario has attained finality.

8.3. The Ld. AR, however, submitted that, although the assessee does not agree with the application of fixed rate of interest, without prejudice to the observations of this Tribunal in its order for assessment year 2020-21 (supra), following chart was filed to demonstrate that, in all assessment years under consideration, the assessee offered interest at a higher rate than that computed by the Ld. TPO.

8.4. The Ld. AR further submitted that, in order to bring finality to the issue, the assessee proposes a working based on interest at 5.43%, which could be charged to treat the transactions at arm’s length, considering that the last amendment to the loan agreement occurred in Financial Year 2013-14, relevant to assessment year 2014-15.

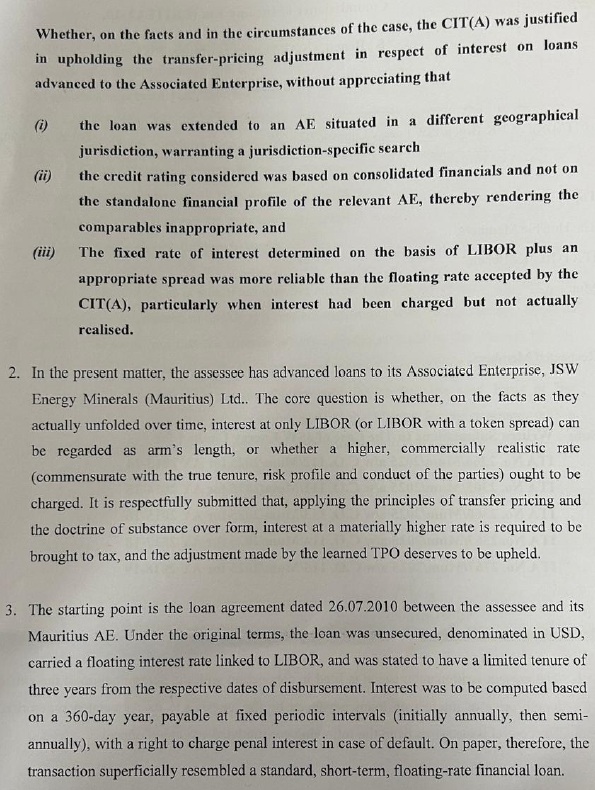

8.5. Per contra, the Ld. DR vehemently opposed the submissions of the assessee and submitted that the assessee had advanced loans to its Mauritius AE. She contended that the crucial issue for consideration was whether such transactions, having unfolded over a prolonged period through repeated modifications, could still be regarded as being at arm’s length when interest was charged merely at the LIBOR rate. The Ld.DR has filed her written submissions dated 18/11/2025 considering various terms and conditions in the loan argument between the assessee and its AE. The same is scanned and reproduced as under:-

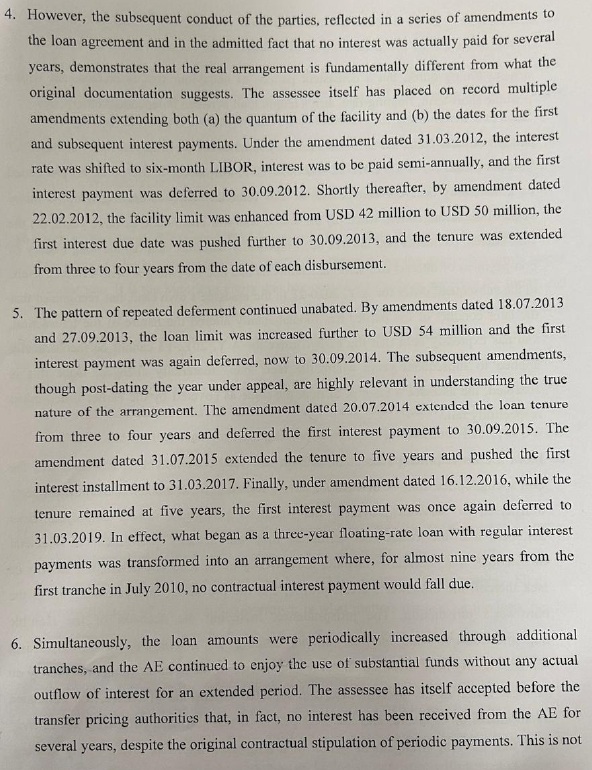

8.6. She submitted that, although on paper the arrangement superficially resembled a short-term capital raising at a floating rate of interest, the actual conduct of the parties clearly demonstrated otherwise. According to her, a series of amendments to the loan agreements showed that no interest was, in fact, paid, thereby revealing that the real agreement between the parties was fundamentally different from what was formally documented.

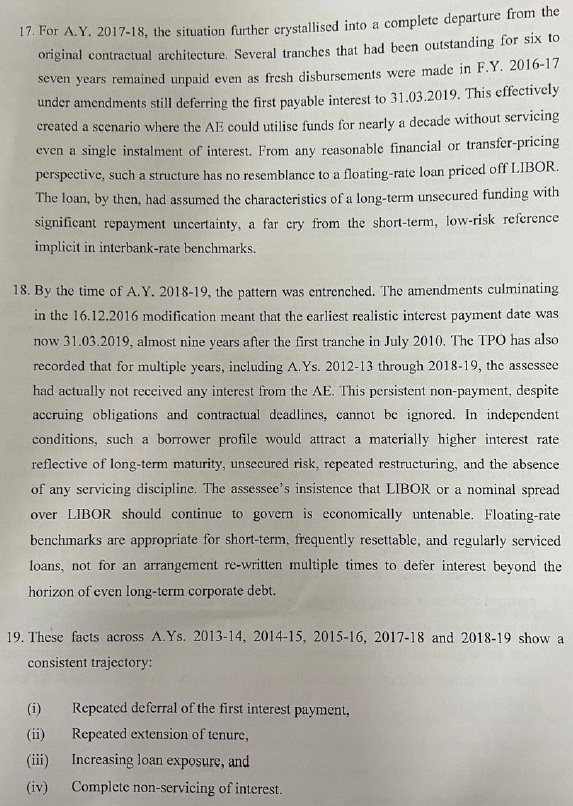

8.7. The Ld. DR pointed out that the original loan agreement dated 26.07.2010 underwent multiple amendments, whereby the loan amount was enhanced on several occasions up to the year 2013, and thereafter the due dates for payment of interest were repeatedly extended from time to time, ultimately up to 31.03.2020. Referring to the chart of amendments to the loan agreement filed by the Ld. AR and reproduced hereinabove, she submitted that both the quantum of the loan facility and the dates for the first and subsequent interest payments were consistently deferred. In particular, vide amendment dated 31.03.2012, the payment of interest was postponed to 30.09.2012, and by a subsequent amendment dated 22.02.2013, the loan limit was enhanced from USD 42 million to USD 50 million, with the first interest due date being pushed further to 30.09.2013.

8.8. She further submitted that the tenor of each such enhancement of the loan was effectively extended to three to four years from the date of each respective disbursement. The Ld. DR emphasised that the loan amounts were increased through successive tranches, enabling the Mauritius AE to continue enjoying the use of substantial funds without any actual payment of interest for an extended period. She pointed out that the assessee itself had admitted that no interest had been received from the AE till date, despite the original contractual stipulation providing for periodic interest payments.

8.9. According to the Ld. DR, in such circumstances, the arrangement could not be treated as a simple short-term loan. She submitted that interest ought to have been computed on a 360-day basis and made payable at fixed periodic intervals, with an enforceable right to levy penal interest in the event of default.

8.10. In this factual backdrop, she contended that the reliance placed by the assessee on the orders of this Tribunal for assessment years 2011-12 and 2012-13 was factually distinguishable, as the aforesaid factual matrix and the prolonged conduct of the parties were neither examined nor considered in those years. She placed heavy reliance on the observations of this Tribunal in its order for assessment year 2020-21 (supra), wherein the conduct of the parties was specifically taken into consideration and the issue was remitted to the Ld. AO with a direction to compute the interest at a fixed rate, having due regard to the various circumstances and factors governing such transactions.

We have perused the submissions advanced by both the sides in light of the records placed before us.

9. A perusal of the loan agreement chart (reproduced hereinbelow) and its successive amendments, reveals that, the assessee’s intragroup loan to the Mauritius AE was repeatedly enhanced from USD 3 million in July 2010 to USD 50 million by November 2012. Each tranche was granted with a 3-month LIBOR reference rate and an initial repayment tenor of three years; however, the interest due dates were consistently deferred through multiple amendments, with the first interest installment ultimately pushed to March 2017.

This pattern demonstrates that the AE enjoyed the use of substantial funds for extended periods without actually paying interest, making the floating LIBOR-based rate unworkable in substance in view of these facts and in line with the principles of section 92CB and Rules 10TA-10TG.

9.1. In the present facts of the case, the conduct of the parties also clearly indicates that there was no real intention on the part of the Mauritius AE to pay any interest to the assessee. Consequently, the primary contention of the Ld. AR that the issue deserves to be decided by following the orders of this Tribunal for assessment years 2011-12 and 2012-13 (supra) therefore cannot be accepted. It is thus held that reliance on the earlier Tribunal orders for assessment years 2011-12 and 2012-13 (supra) is misplaced, as the critical aspect of the parties conduct and prolonged nonpayment of interest could not have been examined in those years.

9.2. While the intra-group loans to the Mauritius AE were denominated in foreign currency and, in principle, a floating LIBOR-based rate could have been applied however, application of such a rate became untenable in the present facts. As noted, the creditworthiness of the South African AE to whom the loan was extended by the Mauritius AE was based on “Risk call” tool, and the references provided in the TP study are unverifiable. Further the spread-over of the rate is without any basis and not supported by the credit risk of the Mauritius AE being the borrower. Further, the agreed repayment schedules were repeatedly breached without any enforcement, rendering the floating rate mechanism ineffective and administratively impractical.

9.3. Upon a holistic examination of the records from assessment year 2010-11 onwards and based on the conduct of the parties, we hold that the intra-group loan advanced by the assessee to its Mauritius AE cannot be benchmarked by applying a floating LIBOR-based rate. The repeated amendments to the loan agreements, prolonged deferment of interest payments, absence of any penal consequences, and the admitted fact that no interest was actually received for more than a decade clearly demonstrate that the contractual terms were not adhered to in substance. Where the conduct of the parties demonstrates prolonged non-adherence to contractual terms relating to interest servicing, repayment schedules, and enforcement mechanisms, the real nature of the transaction must be determined on the basis of substance rather than the documented form.

9.4. We also observe that the floating rate mechanism becomes unworkable, since the agreed payment timelines were consistently breached without any enforcement. Once it is established that the floating rate mechanism cannot be applied since the parties have admittedly not adhered to the contractual terms relating to payment timelines the very foundation for applying a floating rate of interest collapses.

9.5. We have considered the chart and submissions of the Ld. AR proposing interest at 5.43% at fixed rate to treat the intra-group loan transactions at arm’s length. While the assessee contends that this rate could be applied, the cumulative conduct of the parties, the repeated amendments to the loan agreements, and prolonged deferment of interest payments indicate that the floating rate mechanism is unworkable. The last amendment of the loan agreement in Financial Year 2013-14 is relevant for determining the arm’s length interest, and the assessee’s unilateral proposal of 5.43% does not reflect the credit and default risks inherent in the transaction, nor does it adequately consider the statutory principles under section 92CB and Rules 10TA-10TG. Accordingly, the assessee’s proposal of 5.43% is rejected.

9.6. In such circumstances, adopting LIBOR-based benchmark with an appropriate spread provides a neutral, market-aligned reference rate that reflects the cost of funds in international financial markets. This approach ensures that the interest rate applied to the intra-group loans is consistent with arm’s length principles, even where the AE’s credit risk could not be independently verified and the floating rate mechanism could not be reliably enforced.

9.7. Be that as it may, from the manner in which both the assessee and the Revenue have determined the arm’s length price of the loan transaction with the Mauritius AE, it is evident that several obligations mandated under Chapter X of the Act have not been duly followed. It is also an admitted fact that the assessee did not levy any penal interest for the continued non-payment of interest by the Mauritius AE for more than a decade. We, therefore, concur with the view adopted by the Coordinate Bench of this Tribunal for assessment year 2020-21 (supra), that a default fixed interest rate, and not a floating rate.

9.8. At this stage, we deem it appropriate to clarify that no useful purpose would be served by remanding the issue to the Ld.TPO/Ld.AO for fresh determination. In the present facts, remand would merely result in a mechanical re-examination of the same material already available on record, without any likelihood of altering the substantive outcome, and would only prolong the litigation without advancing the cause of justice. We therefore consider it appropriate to finally determine the arm’s length interest rate ourselves, in exercise of our appellate jurisdiction, by drawing guidance from the Safe Harbour Rules, rather than restoring the matter for reconsideration.

9.9. In such circumstances, it is appropriate to adopt a fixed default rate of interest by drawing guidance from the OECD Transfer Pricing Guidelines, 2017, and the Safe Harbour Rules framed under section 92CB read with Rules 10TA to 10TG of the Income-tax Rules, 1962. Even though the assessee has not formally exercised the safe harbour option under Rule 10TG, the principles embodied in section 92CB read with Rules 10TA-10TG may be relied upon as guiding benchmarks for determining a reasonable arm’s length outcome. Rule 10TD prescribes specific safe harbour conditions for intra-group loans, including:

| (i) | | that the interest rate declared must not be lower than a prescribed reference rate plus spread determined with reference to the credit rating of the associated enterprise; |

| (ii) | | the assessee must have made a formal safe harbour opt-in; and |

| (iii) | | the use of reference rates, replacing LIBOR, with spreads varying according to the AE’s credit rating and loan size. |

These conditions ensure that safe harbour interest rates reflect economically relevant benchmarks, providing certainty and reducing transfer pricing disputes where the criteria are satisfied.

9.10. In view of the guiding benchmarks discussed hereinabove, and having regard to the fact that the creditworthiness of the borrower AE remains indeterminate in the absence of any reliable or independent credit rating, coupled with the undisputed position that the AE has enjoyed the use of substantial funds for an extended period without incurring any interest servicing costs, the adoption of a conservative fixed interest rate emerges as the most fair, reasonable, and arm’s length determination. Taking into consideration the totality of the undisputed facts, the prolonged and consistent conduct of the parties, and the statutory framework under Rule 10TD read with section 92CB, we determine the arm’s length interest rate at LIBOR plus 600 basis points as reference point. In our view 6.5% fixed rate will be reasonable approximation of an arm’s length outcome by drawing guidance from the Safe Harbour principles, considering the facts of the present case.

9.11. This determination is based on the undisputed factual matrix and the consistent conduct of the parties as emerging from the materials available on record for the relevant period. It is clarified that, so long as these material facts and contractual arrangements remain substantially unchanged and no fresh evidence is brought on record, the benchmarking of the interest rate on the said intra-group loan shall ordinarily not warrant reconsideration on the same grounds in subsequent assessment years under consideration.

9.12. Accordingly, the Ld.AO is directed to adopt fixed interest rate of 6.5% on the loan advanced by the assessee to its Mauritius AE for assessment year 2013-14 and to grant due credit for the interest already offered to tax by the assessee for the year under consideration. In respect of other years under consideration, considering the fact that there has been no change in the facts, the fixed interest rate at 6.5% is reasonable.

Accordingly, Grounds 1-4 raised by revenue stands partly allowed.

10. Ground Nos. 5-6, raised by the revenue is on the interest overdue on receivables from AE.

10.1. It is noted that, this issue is consequential to the issue considered in Ground No. 1-4 hereinabove. As we have already considered the default interest by applying Safe Harbour Rule @ 6.5%, no further interest is to be imputed on the same. Accordingly, these grounds raised by assessee stand dismissed.

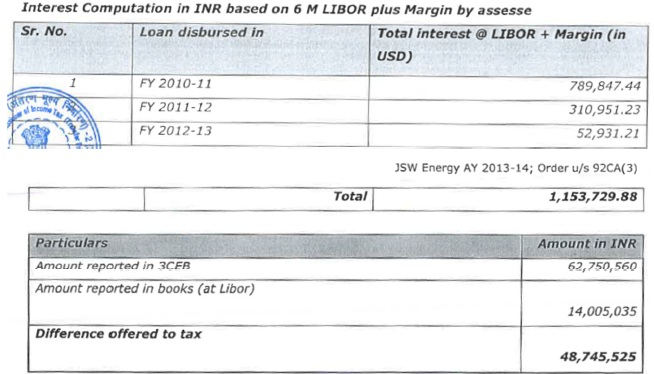

11. Ground Nos. 7-10, raised by revenue is against the deduction granted by Ld.CIT(A) in respect of assessee’s claim u/s 80IA of the Act. The Ld.AR relied on the categorical observation by Ld.CIT(A) in para 6.3.5. to 6.3.7. of the impugned order. He also placed reliance on the decision of Hon’ble Third Member in case of Aditya BirlaNuvo Ltd. v. Deputy Commissioner of Income-tax (Mumbai – Trib.)/ITA No. 563/Mum/2018 & 1885/Mum/2018 vide order dated 18.09.2025.

11.1. On the contrary, the Ld.DR relied on the decision of Hon’ble Hyderabad Tribunal in the case of Sanghi Industries Ltd. v. Dy. CIT (Hyd – Trib.)/ITA (TP) No.104/Hyd/2022 Assessment Year: 2017-18, vide order dated 23/01/2025.

We have perused the submission advanced by both sides in light of the records placed before us.

12. It is noted that assessee benchmarked the transaction by using other method as MAM. It is an admitted fact that, assessee supplies power to JSW group entities and functions merely as a job-work for JSW, wherein JSW provides gases required for power generation. The Ld.CIT(A) while considering the issue categorically considered the agreement between JSW Steel Limited and assessee pursuant to which JSW Steel Limited supplies Corex gas, mixed gas, nitrogen, and coal fines (collectively called ‘supplied fuel’) to assessee. The Ld.CIT(A) has noted that these supplied fuels are used by assesse to convert it into power which is used by JSW Steel Ltd., for its steel manufacturing activity. It is thus noted that, assesse used its facility to convert supplied fuel provided by JSW Steel Ltd. into power for which assessee charged fixed rate conversion charge of Rs.1.3/- per unit of power to JSW Steel Ltd.

12.1. The Ld.CIT(A) observed that owing to the fact that fuel required for producing such power is provided to assessee by JSW Steel Limited, the conversion charges for converting such fuel into power has been charged by assessee. It is noted that, the Ld.CIT(A) compared the cost conversion charged by assessee with the cost that is charged by a full-fledged power manufacturer which is JSW PTC, and observed as under:-

“6.3.2 Thus, once the fuel cost for producing one unit of power is recognized, the residuary amount would relate to the fuel conversion cost along with the profit element for the sale of power. During the year under consideration, JSWEL charged an average rate of Rs. 4.86/kWh for power supplied to JSWPTC. The estimated fuel cost per unit of such power generated is Rs. 2.93. Thus, it can be concluded that the residuary amount of Rs. 1.93/kWh (4.86-2.93) would be the cost of conversion of fuel into power, including the profit element for the sale of power.

6.3.3 Thus, the rate charged to JSWSL of Rs. 1.30/kWh as a conversion charge for converting the fuel supplied by JSWSL into power consists of JSWEL’s cost of rendering service plus the profit element. Hence as can be seen that the rate of Rs. 1.30/kWh is lower than the derived conversion price arrived at in the case of sale of power by JSWEL to JSWPTC and has not earned any more than ordinary profits owing to its close connection with JSWSL. Hence the receipt of conversion charges by JSWEL is in accordance with the arm’s length principle under the Indian Regulations.

6.3.4 However, the TPO rejected the method adopted by the appellant and stated that appellant cannot determine the conversion charges paid on the market price of the power. In stating so, the TPO calculated an average processing cost of Rs 0.77 per unit stating that the same should be conversion cost to be received from JSWSL instead of Rs 1.30 which is actually received by the appellant. The working of the same is tabulated as under:

| Particulars | Amount (In million) |

| Total operating cost of SBU 1 | 4,148.64 |

| Less: Cost pertaining to fuel purchased for Generated Units in SBU 1 | (2,559.02) |

| Total processing cost for SBU 1 | 1,589.62 |

| Total Units Sold from SBU 1(MU) (Excluding units generated on account of UI Charges) | 2,061.93 |

| Processing cost per unit | 0.7 |

6.3.5 I have gone through the working of the TPO, however I find his contention untenable. As mentioned earlier JSWSL has entered into an arrangement with the appellant wherein various waste gases are supplied to the appellant which can be used to generate power from its gas/coal based power plant at SBU 1. This power generated is sold back to JSWSL for which a conversion charge would be recovered by the appellant. Given this, it can be concluded that in effect the appellant adds value to the supplied fuel received, to convert it into power which can be consumed by JSWSL and accordingly, the appellant may be characterized as a “value added manufacturer”, who should earn a return to adequately compensate it for its value added function undertaken which give effect to “conversion” of fuel into power. Considering the above, it is safe to mention that the appellant is entitled to earn a margin on the value added functions undertaken by it.

6.3.6 Further, as far as the benchmarking methodology adopted by the appellant, the rate of 4.86/kWH is lower than the market rate prescribed by KERC (the rate at which JSWSL could procure power from the market – i.e. Rs 5.40 per unit). Thus, since the appellant has considered a price which is the lower than the price determined as per KERC (i.e. Rs. 4.86 per unit) in respect of the power conversion charges, the transaction can be treated as Arm’s length Price.

6.3.7 With reference to above, judicial precedents rendered by various Tribunals while examining ‘market price’ in the context of power supplied by power plants to manufacturing units has held that the rate at which the State Electricity Board supplies power to its consumers is to be considered to be the market value:

• M/s Hero Motocorp Limited (ITA No. 5130/Del/2010) wherein the Tribunal held the following:

” 40. In our opinion, the rate at which power is being supplied by the Haryana State Electricity Board, to each and every industrial unit situated in the area, in which assessee’s manufacturing unit is situated, is the market rate at which power is available.”

• Jindal Steel & Power Limited (16 SOT 509 ) wherein the Tribunal held the following:

“The assessee as an industrial consumer was also buying power from the Board and the Board supplied such power at the rate of Rs. 3.72 per unit to its consumers. This was the price at which the consumers were able to procure the power. Had the assessee not been saddled with restrictions of supplying surplus power to the State Electricity Board, it would have supplied power to the ultimate consumers at rates similar to those of the Board or such other competitive rates, meaning thereby that price received by the assessee would be in the vicinity of Rs. 3.72 per unit i.e. charged by the Board from its industrial consumers/users. Thus, the consideration recorded by the assessee’s undertaking generating electric power for transfer of power for captive consumption at the rate of Rs. 3.72 per unit corresponded to the market value of power.”

• West Coast Paper Mills Ltd. v. Additional Commissioner of Income-tax (2014) (supra)- It was held that

“The transfer of the price as contemplated in section 80-IA(8) has to be seen having regard to the arm’s length condition, i.e., what would be the price under uncontrolled transactions in the open market. If the paper division has been purchasing the electricity form the Karnataka Electricity Board at an average cost of Rs. 5.80, which fact is not in dispute, then the same price should be considered as market value for benchmarking the price at which power units are supplying the electricity to the paper division.”

6.3.8 Thus, in view of the above, I am of a considered opinion the appellant has not earned more than ordinary profits and that the addition made by the TPO is hereby deleted. Accordingly, this ground of the appeal No. 4 is allowed.”

12.2. Be that as it may, the Ld.DR submitted that, all the decisions relied on by this Tribunal as well as Ld.CIT(A) is prior to the date of amendment brought in Finance Act, 2012 w.e.f. 01/04/2013 whereby Clause (ii) to Explanation to sub-Section 8 of Section 80IA of the Act was inserted linking the market value to Arm’s Length Price for specified domestic transactions.

12.3. She has submitted that, it is mandatory that after 01/04/2013, the fair market value or the market value has to be determined under Chapter X of the Act i.e. under the TP provisions only. She vehemently submitted that prior to the amendment, the “market value” would be that the goods and services that would ordinarily fetch in the open market as provided in Clause (i). However, post amendment i.e., w.e.f. 01/04/2013, the market value has to be under Clause (ii). The Ld.DR emphasized that, the decision of Hon’ble Supreme Court in the case of Jindal Steel & Power Limited, therefore, cannot be applied as the facts therein pertain to assessment year prior to the insertion of the amendment brought in by Finance Act, 2012. She also took support from the explanatory memorandum to Finance Bill, 2012 to submit that, if there is any specified domestic transaction (SDT) then, ALP has to be determined as per provisions of Section 92BA/92CA.

12.4. The Ld.DR, thus, submitted that, the price of Rs.1.3 per Kw, which is the conversion charges for converting the fuel supplied by JSW Steel into power, cannot be considered to be the market price of such power that is transmitted by assessee to JSW Steel Ltd. She thus supported the computation adopted by Ld.TPO wherein the average processing cost of Rs.0.77/- per unit was computed which was treated as a conversion cost incurred by assessee in respect of the conversion of supplied fuels into energy.

12.5. On this identical issue, based on a difference of opinion that arose in case of Aditya BirlaNuvo Ltd. (supra), Hon’ble Vice President, Mumbai as Third Member observed and held as under:-

“44. It is noteworthy, in case of Star Paper Mills Limited v. DCIT(supra)identical view expressed by the Bench has been upheld by the Hon’ble Calcutta High Court. At this stage, we must observe, in case of Jindal Steel & Power Ltd. (supra), the Hon’ble Supreme Court while was on the issue of what should be the market value u/s. 80IA(8) of the Act prior to its amendment in 2013, had observed that in case the assessee had not obtained power from the captive power plant, it would have purchased power from the State Electricity Board and in such a scenario, it would have purchased power at the same rate at which the State Electricity Board supplies power to other consumers, hence such rate can be considered as the market value. The learned DR has forcefully submitted that the decision of Hon’ble Supreme Court having been rendered prior to the amendment to section 80IA(8) of the Act and having not been rendered in the context of Explanation u/s.80A(6) of the Act, will not apply. The learned DR has further submitted that the decision of Hon’ble Delhi High Court in case of DCM Shriram Ltd. (supra) and other decisions having not taken note of the overriding effect of section 80A(6) of the Act, are per incuriam and aresub-silentio on the issue of applicability of section 80IA(6) of the Act and hence, will not constitute binding precedents. In my considered opinion, such contention of learned DR is unacceptable for the simple reason that ITAT being at a lower level in the judicial hierarchy than High Courts, does not have the power or competence to question the correctness of a judgment rendered by Hon’ble High Court or declare it as per incuriam. The correctness or otherwise of a judgment of Hon’ble High Court can be tested by an aggrieved party before the highest court and not before the Tribunal.

45. At this stage, I must observe, learned DR has heavily relied upon a decision of ITAT, Hyderabad Bench in case of Sanghi Industries Ltd. v. DCIT (supra) to contend that the rate at which the generating company supplies power to the distribution licensee will be the ALP. Upon carefully going through the aforesaid decision of the coordinate Bench I found it to be factually distinguishable. The Bench has recorded a finding of fact that the CPP had sold surplus electricity to 14 individuals at an average rate of Rs. 2.97/- per unit. Whereas, in the TP study it has adopted the rate of Rs. 7.85/- per unit. In contrast, in the present case, CPP has sold power only to Rayon Plant for captive consumption at Rs. 6.62/- per unit and to no other party at any other rate. As against the aforesaid decision cited by learned DR, there are decisions of Hon’ble Delhi High Court in case of PCIT v. DCM Shriram Ltd.(supra) and that of Hon’ble Calcutta High Court in case of PCIT v. Rungta Mines Ltd. as well as plethora of other decisions of ITAT favourable to assessee, which are directly on the issue and have been rendered after considering all the relevant provisions of the Act, including, sections 80A(6), 80IA(8) with amended explanation, 92F(ii), Rule 10B etc. Therefore, these decisions carrying precedent value cannot be lightly brushed aside by branding them as per incuriam or having been rendered sub silentio of certain relevant provisions, merely because they are against the revenue.

46. Thus, upon considering the overall facts and circumstances of the case in the light of the judicial precedents cited before me, I am of the considered opinion that the price at which the assessee purchased power from the distribution licensee, GUVNL can be applied as a valid CUP for determining the ALP of sale/supply of power by the CPP to the Rayon Plant. In other words, the price of Rs.6.62 per unit charged by CPP to the Rayon Plant can be considered as ALP of the power supplied by the CPP to Rayon Plant. Thus, I agree with the view expressed by learned Judicial Member that the deduction claimed by the assessee u/s. 80IA of the Act should be allowed without making any downward adjustment.”

13. In the present facts of the case, assessee has charged only the conversion cost to arrive at the market value of power supplied to JSW Steel Ltd., that has been compared with the sale of power by assessee to JSW PTC, as has been observed by Ld.CIT(A) in para 6.3.2. and 6.3.3. reproduced hereinabove.

13.1. In the present fact, what is relevant is, whether the manufacturing unit (assessee), which is a selling power to JSW PTC at Rs.4.86 Kw per unit can be said to be the “market value” in relation to the power supplied by assessee to JSW Steel Ltd., wherein, only conversion cost was charged. It is also pertinent to mention here that, the bifurcation of the conversion cost and the rate applied by assessee towards the sale of power to JSW PTC is Rs.2.93/- per unit as against Rs.1.3/- per unit that is charged to JSW Steel Ltd., repeatedly.

13.2. For the sake of completeness, the relevant provisions of Section 80IA of the Act is reproduced as under:-

“8) Where any goods for services held for the purposes of the eligible business are transferred to any other business carried on by the assessee, or where any goods or services]held for the purposes of any other business carried on by the assessee are transferred to the eligible business and, in either case, the consideration, if any, for such transfer as recorded in the accounts of the eligible business does not correspond to the “market value of such goods “or services as on the date of the transfer, then, for the purposes of the deduction under this section, the profits and gains of such eligible business shall be computed as if the transfer, in either case, had been made at the “market value of such goods “or services” as on that date:

Provided that where, in the opinion of the Assessing Officer, the computation of the profits and gains of the eligible business in the manner hereinbefore specified presents exceptional difficulties, the Assessing Officer may compute such profits and gains on such reasonable basis as he may deem fit.

Explanation- For the purposes of this sub-section, “market value”, in relation to any goods or services, means-

(i) the price that such goods or services would ordinarily fetch in the open market; or

(ii) the arm’s length price as defined in clause (ii) of section 92F, where the transfer of such goods or services is a specified domestic transaction referred to in section 92BA.

12. Ergo, the aforesaid provision provides that goods and services provided by the eligible business which is being transferred to other business carried on by the assessee has to correspond to the market value of such goods as on the date of the transfer. The Explanation provides the scope and the meaning of the ‘market value’ in relation to any goods and services and has provided two manners to determine;

| ? | | Firstly, the price that such goods or services would ordinarily fetch in the open market; |

| and | | then the phrase “or” has been used; |

| ? | | Secondly, the arm’s length price as defined in clause (ii) of section 92F, where the transfer of such goods or services is a specified domestic transaction referred to section 92BA. |

The first clause gives the option of determining the market value for a goods or services which would ordinarily fetch in the open market, that is, the price of the similar goods and services available in the open market. If someone wants to purchase the goods and services from the open market then what is required to be seen is the price available for such goods in the open market, if it is available or ascertainable from the comparable market or transaction. Second option is the determination of arm’s length price determined as per transfer pricing principles. Section 92BA incorporates the determination of ALP under transfer pricing provision of sections 92,92C, 92D and 92E. It provides that any transfer of goods or services referred to in sub- section (8) of Section 80IA is also covered under the specified domestic transaction. Section 92F sub-clause (ii) defines the arm’s length price, which means the price which is applied or proposed to be applied in a transaction between the persons other than associated enterprises in uncontrolled conditions. Thus, the second option for determining the market value is the mechanism of transfer pricing provision for determining the arm’s length price.”

13.3. From the above it is clear that, the Explanation to Section 80IA defines the term “Market Value” in relation to any goods or services can be calculated in two ways or can be calculated by adopting two mechanisms:-

(i) The price that such goods or services would ordinarily fetch in the open market; or

(ii) The arm’s length price as defined in clause (ii) of section 92F, where the transfer of such goods or services is a specified domestic transaction referred to section 92BA.

13.4. From the above it is noted that, “or”, is dividing the two clauses under Explanation to Section 80IA which clearly indicates the intention of the legislature to give an option to the assessee entitled to claim deduction u/s 80IA(8) to choose either of the two mechanisms.

13.5. If in a scenario, the availability of the market value that one would ordinarily fetch in the open market is not possible to be determined then, the second option is always available with the assessee. For instance, if there are certain unique services which have been transferred or any unique goods or goods produced with patented IPR or intangibles where the market rate which can ordinarily fetch in the open market is not available, or where market value is not available in the open market, then market value has to be determined in terms of Sub-Clause (ii). If such option is not available then Ld.AO cannot ascertain the market value of goods and services. However, if market value is available on such goods and services which are available in the open market, then same can be adopted for the purpose of Section 80IA(8).

13.6. Further, the different manner of treatment for determination of “market value” becomes evident glaring when Explanation to section 80IA (8) is juxtaposed with section 80A(6). Explanation to Section 80A(6) does not provide the word “or” and all the 3 clauses therein used for situation specific have been made separate and disjunctive from other clauses. For the sake of ready reference Sub-Section (6) of Section 80A (6) alongwith Explanation reads as under:-