Inadvertent Filing of Wrong Form (10-IB) is a Curable Defect Not Fatal to 115BAA Claim.

Issue

Whether a domestic company can be denied the benefit of the concessional tax rate under Section 115BAA due to an inadvertent error of filing Form 10-IB instead of the mandatory Form 10-IC, especially when the assessee has otherwise complied with the substantive conditions and rectified the error upon direction.

Facts

- The assessee-company filed its return for Assessment Year 2023-24, clearly opting for the 22% concessional tax rate under Section 115BAA.

- However, the company inadvertently filed Form 10-IB instead of the correct Form 10-IC, which is the prescribed form for opting into the 115BAA regime.

- Due to this incorrect form, the Centralized Processing Centre (CPC) processed the return at the normal 30% tax rate and raised a demand.

- The Commissioner (Appeals) held that filing the form was a procedural requirement and directed the Assessing Officer to provide the assessee with an opportunity to file the correct Form 10-IC.

- Pursuant to these directions, the assessee subsequently filed the correct Form 10-IC (electronically and manually) with the Assessing Officer.

Decision

- The High Court ruled decisively in favour of the assessee.

- It held that the assessee had fully complied with the substantive conditions prescribed under Section 115BAA (i.e., opting for the rate in its return and forgoing the specified deductions).

- The initial filing of Form 10-IB instead of Form 10-IC was a “purely technical lapse” and a bona fide error.

- Since the assessee had duly rectified this procedural defect by filing the correct Form 10-IC in compliance with the appellate directions, they were entitled to the benefit of the concessional tax rate under Section 115BAA.

Key Takeaways

- Substance Over Form: The court prioritized the assessee’s clear intent and substantive compliance with the law over a clerical, procedural error in selecting the correct form.

- Curable Defect: Filing the wrong form, when done inadvertently, is treated as a curable technical lapse, not a fatal error that extinguishes a statutory right.

- Procedural vs. Mandatory: While filing the intent form is mandatory, an error in which form was filed is a procedural issue that can be corrected, especially before the assessment is finalized.

- Equitable Justice: The decision ensures that a taxpayer is not subjected to a significantly higher tax rate due to a simple, non-malicious mistake that has since been corrected.

IN THE ITAT MUMBAI BENCH ‘D’

ACIT

v.

Magik Kraft (P.) Ltd.

Sandeep Gosain, Judicial Member

and Prabhash Shankar, Accountant Member

and Prabhash Shankar, Accountant Member

IT Appeal Nos. 4327 & 4338 (Mum.) OF 2025

CO. Nos. 242 & 257 (Mum.) OF 2025

[Assessment year 2023-24]

CO. Nos. 242 & 257 (Mum.) OF 2025

[Assessment year 2023-24]

OCTOBER 13, 2025

Annavaran Kosuri, Sr. AR for the Appellant. Vimal Punmiya for the Respondent.

ORDER

Sandeep Gosain, Judicial Member. – These two appeals have been filed by the revenue and COs filed by the assessee challenging the impugned order dt. 30.06.2025 passed under section 250 of the Income Tax Act, 1961 (‘the Act’), by the National Faceless Appeal Centre (NFAC) / CIT(A) for the assessment year 2023-24.

ITA No. 4338/Mum/2025, & CO. 257/Mum/2025 A.Y 202324

2. At the outset Ld DR appearing on behalf of the revenue submitted that “in advertently two appeals for the same assessment years have been filed by the revenue”. Therefore he wants to withdraw appeal bearing No. 4338/Mum/2025, A.Y 2023-24. Considering the request of Ld. DR the same stands dismissed as withdrawn consequently the CO filed by the assessee becomes infructuous in view the statement of Ld. DR.

ITA No. 4327/Mum/2025, A.Y 2023-24

3. The revenue has raised the following grounds of appeal:

(a) On the facts and in circumstances of the case and in law, the Ld. CIT(A) has erred in deleting the addition by not appreciating the fact that as per Rule 21AE of the I. T. Rules it is mandatory to file Form 10-IC avail the benefit Of Section 1I5BAA of the Act while the assessee has failed to file Form 10-IC, therefore not liable to be assessed under concessional rate of tax.

(b) On the facts and in circumstances of-the Case and in law, the Ld. CIT(A) has erred in deleting the addition by not appreciating the fact that the assessee Was duty bound opt for-the lower rate of tax as per Section

115BAA of the Act by filing the mandatory Form 10-1C and by not doing so there was no alternative left to the A.0. who disallowed the claim of the assessee.

The appellant craves to leave to add, alter, amend and modify any of the above grounds of appeal either before or at the time of hearing of the appeal if considered necessary

4. As per the facts of the present case, the assessee company is engaged in the business of trading and had filed return of income by taking tax rate u/s 115BAA of the Act @ 22%+ surcharge + Education Cess and paid tax of Rs. 1,99,16,614/-. However, the assessee received an intimation order along with demand notice from CPC thereby raising demand of Rs. 77,96,140/- u/s 143(1) of the Act. Against this intimation assessee preferred appeal before Ld. CIT(A), who partly allowed the appeal. Against this order of Ld. CIT(A) the revenue has filed an appeal and assessee has also preferred cross objection. First of all we take up appeal filed by the revenue.

5. All the grounds raised by the revenue are interrelated and relates to challenging the order of Ld. CIT(A) in deleting the addition made by CPC therefore we have decided to adjudicate the same through the present consolidated order.

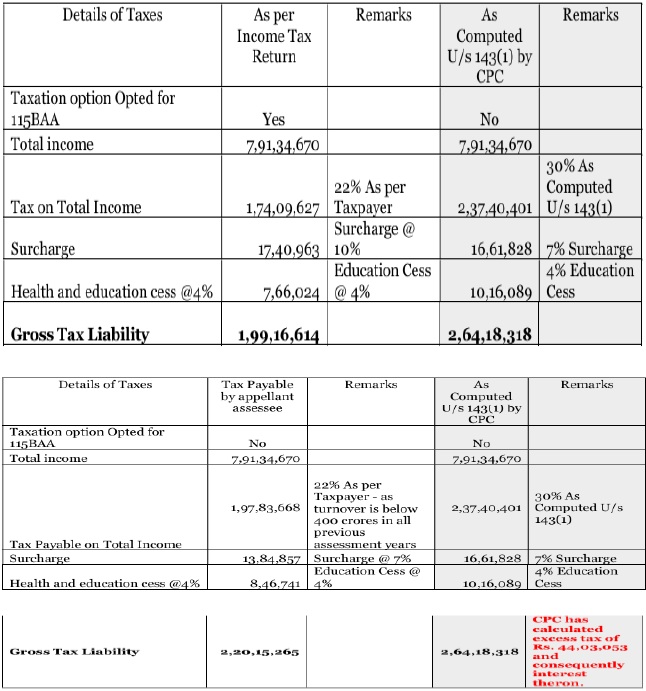

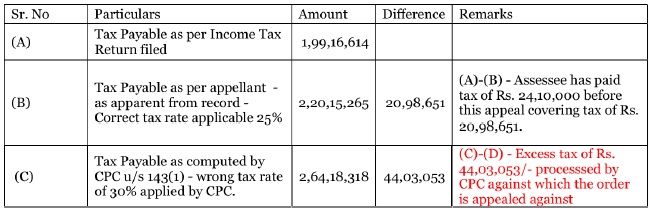

6. We have heard the counsels for both the parties, perused the material placed on record, judgments cited before us and also the orders passed by the revenue authorities. From the records we noticed that the return filed by the assessee was processed by CPC taking tax rate of 30% with tax demand of Rs. 2,64,18,318/-. The CPC while processing the income tax return applied wrong tax rate of 30%. Whereas according to assessee the CPC should have applied the tax rate of 25% which is applicable on the assessee, which has resulted in excess tax demand including interest. As per the assessee the correct tax rate applicable to the assessee company should be 25% corporate tax rate as the total turnover or gross receipts during the previous year does not exceed Rs. 400 crores. Although assessee has filed the tax return taking tax rate of 22% u/s 115BAA of the Act but has filed Form -10IB instead to 10IC and due to this mistake the CPC had disallowed the tax rate of 22% u/s 115BAA of the Act. The difference in tax computed as per income tax return filed Vs

7. Although the afore mentioned order was appealed against before Ld. CIT(A) and the Ld. CIT(A) while acknowledging the submissions of the assessee had reached the conclusion that benefit available to a tax payer shall not be denied due to failure of fulfilling the procedural requirements. As per the Ld. CIT(A) filing of Form -10IC is also procedural requirement and could be condoned if filed belatedly. Therefore it was mentioned by Ld. CIT(A) that since assessee had inadvertently filed incorrect form i.e Form -10IB, thus directions were granted to AO to grant opportunity to the assessee to correct its mistake and to file a correct form required for claiming the rate of tax u/s 1 15BBA of the Act.

8. Ld. CIT(A) while principally allowing relief to the assessee had categorically directed the JAO (Jurisdictional Assessing Officer) that in case of compliance is being made, then the AO shall grant benefit to the assessee.

9 In this regard it has been submitted that the assessee has already filed and had made full compliance by filing Form No. 10IC on 20.09.2024 vide acknowledgement No. 472671630200924 for previous year 20.09.2024 itself as the income tax e-filing website does not allow to filing of Form-10IC for earlier years. It is further submitted that direction be given to the AO to accept separate Form 10-IC for previous year i.e 2022-23. More particularly when the assessee they had already submitted Form -10IC to the AO manually on 05.04.2025 for previous year 2022-23 so as to giving effect to the order of Ld. CIT(A) u/s 250 of the Act. It was further submitted by Ld. AR that although AO has passed the appeal effect order but has not given tax calculation sheet & not considered request for manual Form 10IC. Ld. AR further drawn our attention to the fact that:

| – | For AY 2021-22-retuen filed – tax paid @25% – not opted for section 115BAA- IT WAS ACCEPTED BY DEPARTMENT |

| – | For AY 2022-23-retuen filed – tax paid @25% – not opted for section 115BAA- IT WAS ACCEPTED BY DEPARTMENT |

| – | For AY 2023-24-retuen filed – tax paid @22% – opted for section 115BAA- NOT ACCEPTED BY DEPARTMENT |

| – | For AY 2024-25-retuen filed – tax paid @22% – opted for section 115BAA – IT WAS ACCEPTED BY DEPARTMENT |

10. After having gone through the entire facts and circumstances of the present case and also hearing the parties at length, we find that principally Ld. CIT(A) had recorded the findings to the effect that assessee had inadvertently filed Form 10IB instead of prescribed Form 10IC and assessee has right to be taxed at concessional rate of 22% provided if satisfy the prescribed condition of filing Form 10IC. At the same time Ld.CIT(A) also recorded a specific finding that filing of Form -10IC is a procedural requirement meant to operationalize the substantive right and mere non-filing or incorrect filing of such form cannot by itself extinguish or deny the substantive benefit of concessional tax rate, if otherwise permissible under law. Therefore in compliance of direction of Ld. CIT(A) the assessee had rightly filed Form No. 10IC on 20.09.2024 for previous year 2023-24 and since the income tax e-filing website does not allow filing of Form 10IC of earlier years, therefore separate Form 10IC was filed manually for the previous year i.e 2022-23 on 05.04.2024 with the AO for giving effect to the order of Ld. CIT(A).

11. After having gone through the following details:

| • | For A.Y. 2021-22, the assessee filed return and paid tax @25% without opting for section 115BAA – accepted by the Department. |

| • | For A.Y. 2022-23, return filed and tax paid @25% without opting for section 1 15BAA – accepted by the Department. |

| • | For A.Y. 2023-24 (year under consideration), return filed @22% opting for section 1 1 5BAA – not accepted by CPC due to wrong form. |

| • | For A.Y. 2024-25, return filed @22% opting for section 115BAA – accepted by the Department. |

Which clearly shows that except for technical error in filing Form 10IB instead of Form 10IC in the year under consideration, the department had consistently accepted the assessee’s tax position in earlier and subsequent years.

13. It is a settled position in law that substantive benefits conferred by the statute cannot be denied merely on account of technical or procedural lapses. Section 115BAA of the Act is a substantive provision granting eligible companies the right to be taxed at a concessional rate of 22%. The requirement to file Form 10-IC under Rule 21AE is a procedural formality intended to operationalize the substantive right. Where the assessee satisfies all substantive conditions under section 115BAA, the mere fact of filing an incorrect form (Form 10-IB instead of 10-IC) cannot disentitle it from the benefit.

14. On this preposition of law, reliance is being placed upon the following decisions:

|

SUPREME COURT OF INDIA CIT v. G. M. Knitting Industries (P.) Ltd. A.K. SIKRI AND ROHINTON FALI NARIMAN, JJ. CIVIL APPEAL NOS. 10782 OF 2013 & 4048 OF 2014+ JULY 24, 2015 | Section 32 of the Income-tax Act, 1961 – Depreciation -Additional depreciation -Assessment year 2005-06 -Even if form 3AA was not filed along with return of income but same was filed during assessment proceedings before final order of assessment was made, assessee was entitled for additional depreciation [In favour of assessee] Even if form 3AA was not filed along with the return of income but same was filed during assessment proceedings before final order of assessment was made, the assessee was entitled for the additional depreciation. Section 80-IB of the Incometax Act, 1961 – Deductions -Profits and gains from industrial undertakings (Condition as to number of workers) – Assessment year 2005-06 – Even though necessary certificate in Form 10CCB along with return of income had not been filed but same was filed before final order of assessment was made, assessee was entitled to claim deduction under section 80-IB [In favour of assessee] Even though necessary certificate in Form 10CCB along with return of income had not been filed but same was filed before final order of the assessment was made, the assessee was entitled to claim deduction under section 80-IB. |

15. Even otherwise the CBDT in its own circular supports the assessee’s case as the CBDT itself recognized that delay or defects in filing Form 10-IC are procedural and condonable in nature:

Circular No. 06/2022 dated 17.03.2022 – specifically provided for condonation of delay in filing Form 10-IC for A.Y. 2020-21. The circular makes it clear that where the assessee is otherwise eligible for the concessional regime under section 1 1 5BAA, the benefit should not be denied merely due to delay or technical lapse in filing the prescribed form.

Circular No. 07/2023 dated 31.05.2023 – lays down monetary limits and authority-wise powers for condonation under section 1 19(2)(b). Importantly, it reiterates that claims relating to Form 10-IC can be condoned by the appropriate authority.

16. Reliance in this regard is also being placed upon the following decisions:

| S. N. | CITATION | CASE LAW |

| 1. |

SUPREME COURT OF INDIA G. M. Knitting Industries (P.) Ltd. (supra) CIVIL APPEAL NOS. 10782 OF 2013 & 4048 OF 2014 | Section 32 of the Income-tax Act, 1961 – Depreciation – Additional depreciation – Assessment year 2005-06 – Even if form 3AA was not filed along with return of income but same was filed during assessment proceedings before final order of assessment was made, assessee was entitled for additional depreciation [In favour of assessee] Even if form 3AA was not filed along with the return of income but same was filed during assessment proceedings before final order of assessment was made, the assessee was entitled for the additional depreciation. Section 80-IB of the Income-tax Act, 1961 – Deductions – Profits and gains from industrial undertakings (Condition as to number of workers) – Assessment year 2005-06 – Even though necessary certificate in Form 10CCB along with return of income had not been filed but same was filed before final order of assessment was made, assessee was entitled to claim deduction under section 80-IB [In favour of assessee] Even though necessary certificate in Form 10CCB along with return of income had not been filed but same was filed before final order of the assessment was made, the assessee was entitled to claim deduction under section 80-IB. |

| 2. |

HIGH COURT OF GUJARAT V M Procon (P.) Ltd. v. Asstt. DIT R/SPECIAL CIVIL APPLICATION NO. 9707 OF 2024 | INCOME TAX : Where assessee-company in substance had exercised option for lower rate of tax under section 115BAA, assessee could not be deprived of lower rate of tax and delay in filing Form 10-IC ought to have been condoned as per CBDT Circular No. 19/2023 Section 115BAA read with section 119 of the Income-tax Act, 1961 – Domestic companies Tax on – Assessment year 202122 – Due to oversight, petitioner/assessee could not file Form 10 IC electronically under section 115BBA(5) on or before due date for furnishing return of income as per Rule 21AE of Rules due to which its return was processed without giving benefit of lower rate of tax -Assessee relying upon CBDT Circular No. 19/2023 filed application under section 119(2)(b) before respondent to condone delay in filing Form 1 0-IC and to permit it to file same electronically – However, respondent rejected application holding that assessee did not put any remark against Column (e) meant for giving option for taxation under section 115BAA and therefore, condition of CBDT Circular No. 19 of 2023 was not satisfied – Whether in absence of any provision to opt for taxation under section 115BAA item (e) ‘Filing Status’ in ‘Part A-GEN’ of Form of Return of Income ITR-6, same could not have been complied with by assessee -Held, yes – Whether when assessee had exercised option for lower rate of tax under section 115BAA which was clear from computation of income, assessee could not be deprived of lower rate of tax and delay in filing Form 10-IC ought to have been condoned – Held, yes [Para 25] [In favour of assessee] Circulars and Notifications : CBDT Circular No. 6/2022 dated 17-3-2023 and CBDT Circular No. 19/2023 dated 23-10-2023 |

| 3. |

HIGH COURT OF CALCUTTA Pr. CIT v. Fastner Commodeal (P.) Ltd. ITAT NO. 267 OF 2024 IA GA NO. 2 OF 2024 | INCOME TAX : Where assessee-company opted for taxation under section 115BAA but failed to file Form 10-IC along with return within extended period, since delay in filing Form 10-IC was due to certain difficulties faced by assessee in uploading form in income tax portal during Covid, matter was to be restored to Assessing Officer to permit assessee to file Form 10-IC Section 115BAA of the Incometax Act, 1961 – Tax on income of certain domestic companies (Filing of Form 10-IC) – Assessment year 2020-21 – Assessee-company opted for taxation under section 115BAA -However, assessee did not file Form 10-IC along with return within extended period, as extended by Circular No. 6 of 2022, dated 17-3-2022 – Assessing Officer rejected claim of assessee for benefit under section 115BAA on ground that Form 10-IC was not filed within prescribed time – It was noted that assessee had filed return on or before due dates specified under section 139(1) – It was also noted that assessee had specifically stated that they had certain difficulties in uploading form in Income tax portal during Covid Whether since conduct of assessee clearly showed that it had opted for taxation under section 115BAA and delay in filing Form 10-IC was due to an inadvertent procedural error, matter was to be restored back to Assessing Officer to permit assessee to file report in Form 10-IC and consider as to what relief assessee would be entitled to subject to conditions that assessee fulfils all other requisite conditions as per law -Held, yes [Para 4] [Matter remanded] Circulars and Notifications : CBDT Circular No.6/2022, dated 17-03-2022 |

| 4. |

HIGH COURT OF GUJARAT Colosperse (P.) Ltd. v. Pr. CIT R/SPECIAL CIVIL APPLICATION NO. 21800 OF 2023 | INCOME TAX : Where assessee-company inadvertently failed to electronically file Form 10-IC within time limit specified in Circular No. 6 of 2022 dated 1 73-2022, since assessee had exercised option under section 115BAA while filing its return and it was a case of genuine mistake of assessee’s Chartered Accountant that he bonafidely believed that he had already filed Form 10-IC, Principal Commissioner was required to permit assessee to file a fresh Form 10-IC by condoning delay in filing such Form Section 115BAA, read with section 119, of the Income-tax Act, 1961 – Certain domestic companies, tax on (Form 10-IC, filing of) – Assessment year 2020-21 – Assessee-company filed its return of income for assessment year 2020-21 declaring certain taxable income – It opted for taxation under section 115BAA and computed tax payable at rate of 22 per cent However, assessee inadvertently failed to electronically file Form 10-IC along with return of income within time limit specified in Circular No. 6 of 2022 dated 1 73-2022 – Thereafter, assessee filed an application under section 119(2)(b) to condone delay in filing Form 10-IC However, same was rejected on ground that authority was not empowered to condone delay in view of Circular No. 6 of 2022 – It was noted that it was bonafide belief of Chartered Accountant being statutory auditor of assessee that he had already filed Form 10-IC However, after having realised fact of its nonfiling, Chartered Accountant had filed filed Form 10-IC belatedly -Whether since assessee had exercised option under section 115BAA while filing its return and it was a case of genuine mistake of assessee’s Chartered Accountant that Form 10-IC was not filed within time, Principal Commissioner was required to consider facts of case by permitting assessee to file a fresh Form 10-IC and condoning delay in filing such Form – Held, yes [Paras 12 and 16] [In favour of assessee] |

| 5. | ITD 774 (Mumbai – Trib.) IN THE ITAT MUMBAI BENCH ‘D’ Madison Communications (P.) Ltd. v. ACIT IT APPEAL NO. 4000 (MUM.) OF 2023 [ASSESSMENT YEAR 2020-21] | INCOME TAX : Where assessee, a domestic company, had uploaded Form 10-IC electronically on 2-5-2021 i.e. before cut-off date mentioned in CBDT circular No. 6/2022, dated 17-3-2022, i.e. 30-6-2022, assessee was entitled to benefit of section 115BAA(1) for purpose of computation of income at rate mentioned thereunder Section 115BAA of the Incometax Act, 1961 – Domestic companies – Tax on (Filing of Form 10-IC) – Assessment year 2020-21 – Assessee, a domestic company, had filed its return of income on 5-2-2021 i.e. before last date of filling return under section 139(1) – Whether since Form 10-IC was electronically uploaded by assessee on 2-52021 i.e. before cut-off date mentioned in CBDT circular No. 6/2022, dated 17-3-2022, i.e. 30-6-2022, assessee was entitled to benefit of section 115BAA(1) for purpose of computation of income at rate mentioned thereunder – Held, yes [Paras 11 and 13] [In favour of assessee] Circulars & Notifications : Circular No. 6/2022, dated 1 7-3-2022 |

| 6. | HIGH COURT OF DELHI A. C. Surgipharma (P.) Ltd. v. Dy. CIT W.P.(C) NO. 17057 OF 2022 | INCOME TAX : Where assessee was not taxed at rate of 22 per cent as provided under section 115BAA on account of fact that it failed to file Form 10-IC, since assessee had filed a fresh Form 10-IC electonically, delay in filing Form 10-IC was to be condoned and a direction was to be issued to CBDT to process assessee’s request contained in Form 10-IC Section 115BAA of the Incometax Act, 1961 – Domestic companies – Tax on (Filing of Form 10-IC) – Assessment year 2021-22 – Assessee had filed its return for relevant year 2021-22 and opted for being taxed at 22 per cent as provided under section 115BAA – However assessee was not taxed at 22 per cent only on account of fact that assessee had failed to file Form No. 10-IC and impugned order was passed raising demand on assessee – Whether fact that in view of Circular No. 19/2023, dated 23-10-2023, a fresh Form 10-IC had been filed by assessee electronically, delay in filling Form 10-IC was to be condoned – Held, yes – Whether therefore, a direction was to be issued to CBDT to process assessee’s request contained in Form 10-IC – Held, yes [Paras 2, 3 and 6] [In favour of assessee] Circulars and Notifications: Circular No. 19/2023, dated 2310-2023 |

| 7. |

HIGH COURT OF GUJARAT Camino Herbal Remedies (P.) Ltd. v. Pr. CIT R/SPECIAL CIVIL APPLICATION NO. 20564 OF 2023 | INCOME TAX : Where assessee-company inadvertently failed to electronically file Form 10-IC within due date and filed belated Form and made an application under section 119(2)(b) to condone delay in filing such Form, since provisions of section 115BAA are in a way granting relief to assessee-companies to enable them to pay reduced rate of tax at 22 per cent, Principal Commissioner was required to consider facts of case and permit assessee to file a fresh Form 1 0-IC and condone delay in filing such Form Section 115BAA, read with section 119, of the Income-tax Act, 1961 – Certain domestic companies, tax on (Condonation of delay) – Assessment year 2020-21 – Assessee-company filed its return of income for relevant assessment year declaring certain taxable income – It exercised option under section 115BAA to pay tax at reduced rate of 22 per cent -However, assessee inadvertently failed to electronically file Form 10-IC along with return of income because of genuine mistake of Chartered Accountant – Assessee filed belated Form 10-IC and made an application under section 119(2)(b) to condone delay in filing such Form – Same was rejected by Principal Commissioner on ground that he was not empowered to condone delay in view of Circular No. 6 of 2022 – It was noted that as per Circular No. 6/2022, CBDT had exercised powers under section 119(2)(b) to avoid genuine hardships to domestic companies in exercise of option under section 115BAA – Whether since provisions of section 115BAA are in a way granting relief to assessee-companies to enable them to pay reduced rate of 22 per cent tax and provisions of section 119(2)(b) are meant for redressal of grievance and hardships caused to assessee, Principal Commissioner was required to consider facts of case and permit assessee to file a fresh Form 10-IC and condone delay in filing such Form – Held, yes [Paras 15 and 16] [In favour of assessee] |

| 8. |

HIGH COURT OF GUJARAT Royal Led Equipments (P.) Ltd. v. Chief CIT R/SPECIAL CIVIL APPLICATION NO. 14786 OF 2024 | INCOME TAX : Where assessee-company availed benefit of lower tax rate under section 115BAB, however, due to technical difficulty it failed to file Form 10-ID within prescribed time-limit, delay in filing said form was to be condoned and same was to treated as legal and valid Section 115BAB, read with sections 119, 139 and 143, of the Income-tax Act, 1961 and Rule 21AF of the Income-tax Rules, 1962 – Tax on income of new manufacturing domestic companies (Scope of provision) -Assessment year 2021-22 – For relevant assessment year assessee-company filed return under section 139(1) and availed benefit lower tax rate under section 115BAB – It made attempts to file Form 10-ID but could not filed same within prescribed time-limit – Thereafter, CBDT issued Circular No. 06 of 2022 providing a standing instruction to condone delay that occurred to assessee in filing of Form 10-ID Subsequently assessee was able to file Form 10-ID on online portal – Assessee thereafter filed an application under section 119(2)(b) to condone delay that occurred in filing Form 10 ID -Competent Authority rejected application – Whether since a series of Circulars namely Circular Nos. 6/2022, 19/2023 and recently 17/2024 had been issued by CBDT which goes to show that there has been a problem in large number of cases which assessee has faced in respect of filing Form 10-IC and 10-ID in time, given acknowledgment of problem by Department, it must be said that assessee had shown sufficient cause – Held, yes – Held, yes-Whether Competent Authority was to be directed to accept Form 10-ID filed by assessee to be legal and valid – Held, yes [Para 9] [In favour of assessee] Circulars and Notifications: Circular No. 6 of 2022, dated 173-2022; Circular No. 19 of 2023, dated 23-10-2023 and Circular No. 17 of 2024, dated 18-112024. |

| 9. |

IN THE ITAT AHMEDABAD BENCH ‘C’ Sunpack Barrier Films (P.) Ltd. v. A. DIT IT APPEAL NO. 593 (AHD.) OF 2023 [ASSESSMENT YEAR 2021-22] | INCOME TAX : Where assessee-company filed its income tax return for assessment year 202122 on 30-12-2021, opting for reduced taxation under section 115BAA, but Commissioner (Appeals) dismissed it due to late filing of Form 10-IC, since Circular No. 19/2023 issued by CBDT allowed for condonation of delay in filing Form No. 10 IC for AY 2021-22, and assessee fulfilled all conditions laid in said circular including timely return filing and electronic submission of Form 10-IC, it would be eligible for concessional tax rate under section 115BAA Section 115BAA of the Incometax Act, 1961 – Certain domestic companies, tax on (Form 10 IC) -Assessment year 2021-22 – Assessee-company engaged in the manufacturing of flexible films, filed its income-tax return for assessment year 2021-22 on 30-12-2021, and opted for reduced taxation under section 115BAA – However, CPC calculated the tax liability without considering this provision, resulting in an additional tax demand -Commissioner (Appeals) dismissed appeal, citing assessee’s failure to file Form 10-IC within stipulated deadline as per Circular No. 06/2022 dated 17-3-2022 – assessee argued that Circular No. 19/2023 issued by CBDT allowed for condonation of delay in filing Form No. 10-IC for AY 2021-22, and it had met all conditions specified in Circular, including timely filing of income tax return, selection of taxation under section 115BAA, and electronic filing of Form No. 10 IC before deadline – Whether since assessee had fulfilled all conditions specified in said circular and had filed Form No. 1 0-IC within stipulated timelines, it would be eligibile to claim concessional tax rate under section 11 5BAA – Held, yes [Para 9] [In favour of assessee] Circulars and Notifications : Circular No. 06/2022 dated 173-2022 and Circular No. 19/2023 [F.NO. 173/32/2022-ITA-I], DATED 23-10-2023 |

| 10. |

IN THE ITAT AHMEDABAD BENCH ‘C’ Sunpack Barrier Films (P.) Ltd. (supra) IT APPEAL NO. 593 (AHD.) OF 2023 [ASSESSMENT YEAR 2021-22] | INCOME TAX : Where assessee-company filed its income tax return for assessment year 202122 on 30-12-2021, opting for reduced taxation under section 115BAA, but Commissioner (Appeals) dismissed it due to late filing of Form 10-IC, since Circular No. 19/2023 issued by CBDT allowed for condonation of delay in filing Form No. 10 IC for AY 2021-22, and assessee fulfilled all conditions laid in said circular including timely return filing and electronic submission of Form 10-IC, it would be eligible for concessional tax rate under section 115BAA Section 115BAA of the Incometax Act, 1961 – Certain domestic companies, tax on (Form 10 IC) -Assessment year 2021-22 – Assessee-company engaged in the manufacturing of flexible films, filed its income-tax return for assessment year 2021-22 on 30-12-2021, and opted for reduced taxation under section 115BAA – However, CPC calculated the tax liability without considering this provision, resulting in an additional tax demand -Commissioner (Appeals) dismissed appeal, citing assessee’s failure to file Form 10-IC within stipulated deadline as per Circular No. 06/2022 dated 17-3-2022 – assessee argued that Circular No. 19/2023 issued by CBDT allowed for condonation of delay in filing Form No. 10-IC for AY 2021-22, and it had met all conditions specified in Circular, including timely filing of income tax return, selection of taxation under section 115BAA, and electronic filing of Form No. 10 IC before deadline – Whether since assessee had fulfilled all conditions specified in said circular and had filed Form No. 1 0-IC within stipulated timelines, it would be eligibile to claim concessional tax rate under section 11 5BAA – Held, yes [Para 9] [In favour of assessee] |

| 11. |

IN THE ITAT MUMBAI BENCH ‘E’ Konti Infrapower & Multiventures (P.) Ltd. v. ITO. Income-tax Officer I T APPEAL NO. 3172 (MUM.) OF 2023 [ASSESSMENT YEAR 2021-22] | INCOME TAX : Where assessee filed return within extended due date under section 139(1) opting provisions of section 115BAA and filed Form No. 10-IC before time prescribed in Circular No. 19/2023, dated 23-10-2023, however, these details of filling of Form No. 10-IC and CBDT Circular were not available at time of processing of return of income under section 143(1) with Assessing Officer, issue was to be restored to Assessing Officer to examine and consider applicability of provisions under section 115BAA opted by assessee Section 115BAA, read with section 115JB, of the Income-tax Act, 1961 – Certain domestic companies, tax on (Scope of provision) – Assessment year 2021-22 – Assessee filed return of income within extended due date under section 139(1) opting provisions of section 115BAA and filed Form No. 10-IC before time prescribed in Circular No. 19/2023, dated 23-10-2013 Assessing Officer passed order prior to filing of Form No. 10-IC by assessee and issue of aforesaid Circular and determined tax liability as per provisions of section 115JB -Whether since assessee had complied with conditions as per CBDT Circular No. 19/2023, dated 23-10 2023 and details of filing of Form No. 10-IC and CBDT Circular were not available at time of passing of return of income with Assessing Officer, issue was to be restored to Assessing Officer to verify and examine claim and consider applicability of provisions under section 115BAA opted by assessee – Held, yes [Para 7] [Matter remanded] Circulars and Notifications : Circular No. 19/2023, dated 23-10-2023 and CBDT Press Release dated 11-12022 |

| 12. |

SUPREME COURT OF INDIA G. M. Knitting Industries (P.) Ltd. (supra) CIVIL APPEAL NOS. 10782 OF 2013 & 4048 OF 2014/ JULY 24, 2015 | Section 32 of the Income-tax Act, 1961 – Depreciation – Additional depreciation – Assessment year 2005-06 – Even if form 3AA was not filed along with return of income but same was filed during assessment proceedings before final order of assessment was made, assessee was entitled for additional depreciation [In favour of assessee] Even if form 3AA was not filed along with the return of income but same was filed during assessment proceedings before final order of assessment was made, the assessee was entitled for the additional depreciation. Section 80-IB of the Income-tax Act, 1961 – Deductions – Profits and gains from industrial undertakings (Condition as to number of workers) – Assessment year 2005-06 – Even though necessary certificate in Form 10CCB along with return of income had not been filed but same was filed before final order of assessment was made, assessee was entitled to claim deduction under section 80-IB [In favour of assessee] Even though necessary certificate in Form 10CCB along with return of income had not been filed but same was filed before final order of the assessment was made, the assessee was entitled to claim deduction under section 80-IB. |

| 13. | SUPREME COURT OF INDIA Civil Appeal No. 10782 of 2013 and 4048 of 2014. D/d. 24.7.2015. G.M. Knitting Industries (P.) Ltd. (supra) | JUDGMENT It would be suffice to reproduce paragraph 2 of the impugned order whereby action of the Income-tax Appellate Tribunal was held to be justified in allowing the additional depreciation as claimed by the respondent-assessee herein : “Additional depreciation is denied to the assessee on the ground that the assessee has failed to furnish form 3AA along with the return of income. Admittedly, form 3AA was submitted during the course of assessment proceedings and it is not in dispute that the assessee is entitled to the additional depreciation. In these circumstances, in the light of the judgment of this court in the case of CIT v. Shivanand Electronics ITR 63 (Bombay), we see no merit in this appeal. The appeal is, accordingly, dismissed with no order as to costs.” 2. We concur with the aforesaid view of the High Court and hold that even if form 3AA was not filed along with return of income but the same was filed during the assessment proceedings and before the final order of the assessment was made that would amount to sufficient compliance. These appeals are, accordingly, dismissed. |

| 14. | Kworks Technologies (P.) Ltd. v. Dy. CIT (Delhi – Trib.) | The concessional corporate tax regime under Section 115BAA of the Income-tax Act, 1961, introduced by the Finance Act, 2019, provides eligible domestic companies the option to be taxed at a reduced rate of 22% (plus applicable surcharge and cess). This option, however, comes with specific conditions—most importantly, the company must exercise its option by filing Form 10-IC electronically under Rule 21AE of the Income-tax Rules, 1 962, on or before the due date |

17. Therefore considering the totality of the facts and circumstance of the case we are of the view that assessee has fully complied with the substantive conditions prescribed under section 115BAA of the Income-tax Act, 1961. The inadvertent filing of Form 10-IB in place of Form 10-IC is a purely technical lapse, which has since been duly rectified by filing the correct Form 10-IC electronically and manually before the jurisdictional Assessing Officer in compliance with the directions of the Learned CIT(A). The principle of law, consistently upheld by the Hon’ble Supreme Court, Hon’ble High Courts, and the Coordinate Benches Tribunals, is that the procedural defects should not defeat substantive rights when all eligibility conditions stand satisfied. Further, the CBDT itself, through various circulars, has recognized that such defects in the filing of Form 10-IC are condonable in nature, and taxpayers should not be denied the lawful benefit of the concessional regime merely due to technical or inadvertent errors. It is also significant that the Department has consistently accepted the assessee’s tax position in earlier and subsequent years, thereby reinforcing the principle of consistency in tax administration. In our view, the order of the Learned CIT(A) is reasoned, balanced, and based on settled principles of law, granting the assessee an opportunity to rectify the procedural lapse while safeguarding the interest of the Revenue

18. Since assessee has already compiled with the directions of the Ld. CIT(A) therefore is entitled for grant of benefit u/s 115BBA of the Act and according we dismissed the revenue’s appeal.

CO No. 242/Mum/2025, A.Y 2023-24

19. Since we have already quashed the revenue’s appeal, the CO filed by the assessee becomes infructuous and is dismissed.