Unsigned Assessment Order is Void Ab Initio; Section 282A Mandates Signature for Validity.

Issue

Whether an assessment order communicated electronically but bearing no signature (neither physical nor digital) is valid under the Income-tax Act, particularly in light of the authentication requirements under Section 282A(1).

Facts

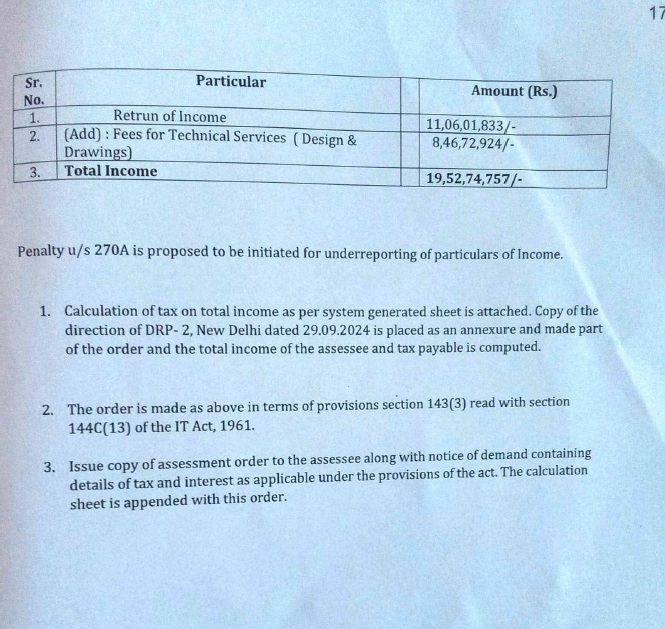

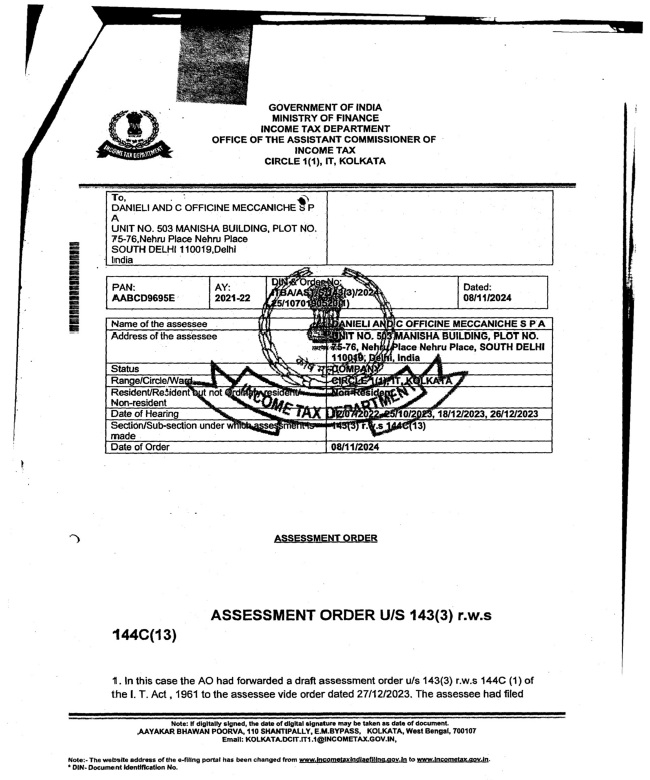

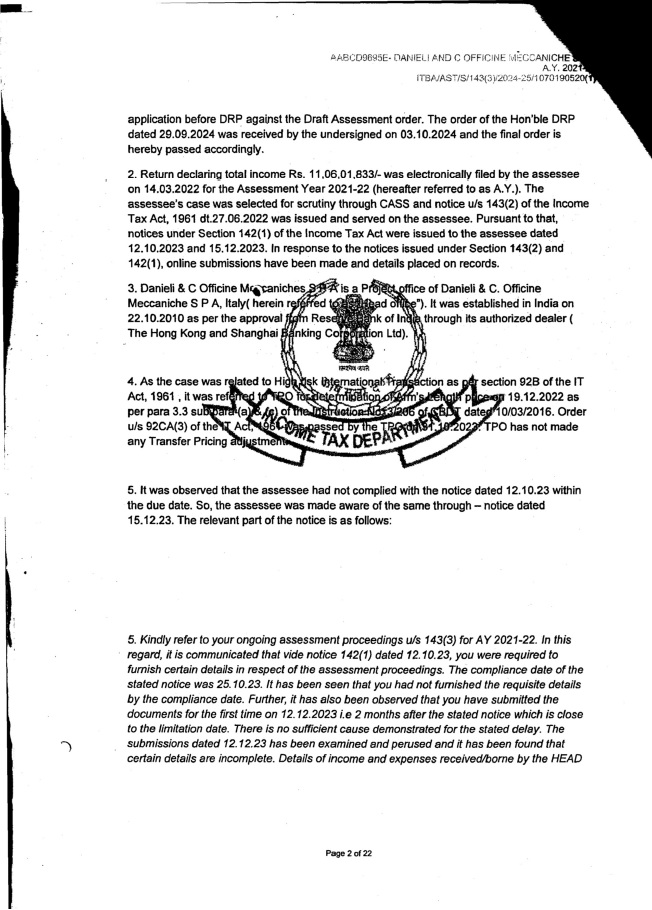

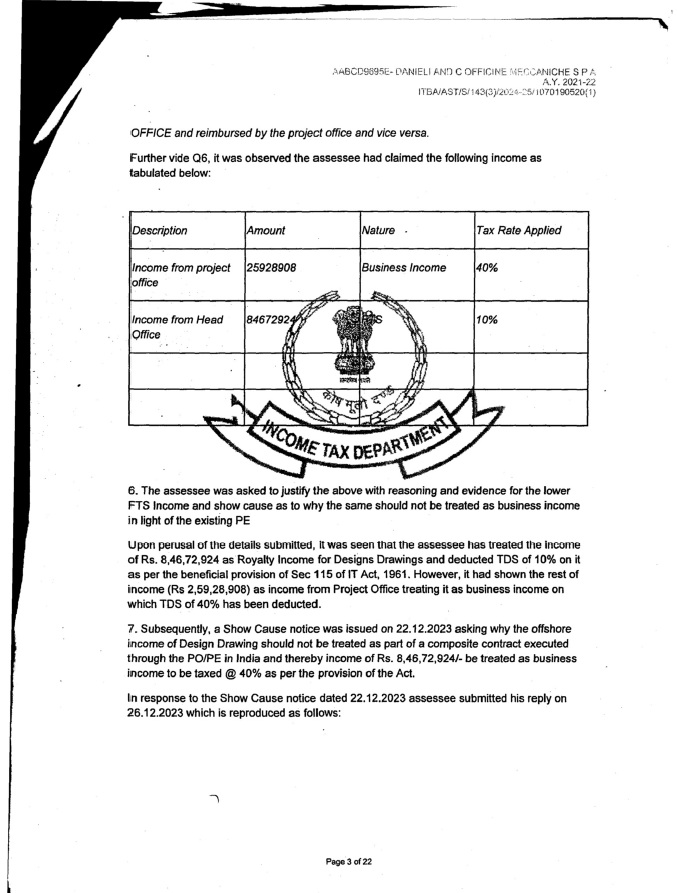

Assessment Year: 2021-22.

The Order: The Assessing Officer (AO) passed a final assessment order (likely following directions from the Dispute Resolution Panel under Section 144C).

The Defect: The order served on the assessee was not signed in any manner whatsoever. It neither bore a manual signature nor a digital signature (DSC) of the AO.

The Defense: The Department likely argued that the order was valid as it was issued through the ITBA portal or that the defect was curable under Section 292B.

Decision

The Tribunal/Court ruled in favour of the assessee and quashed the assessment order.

Mandatory Requirement: The Court held that Section 282A(1) of the Income-tax Act creates a mandatory obligation: every notice or other document issued by an income-tax authority “shall be signed”.

Electronic vs. Paper: The Court clarified that the term “signed” cannot be restricted to paper documents. Even if a document is communicated in electronic form, it must be authenticated (digitally signed) in accordance with the prescribed procedure.

Fatal Defect: An unsigned order is legally non-existent. The lack of a signature is not a mere procedural irregularity curable under Section 292B; it goes to the root of the document’s validity and authenticity.

Outcome: Since the assessment order lacked any signature, it was declared null and void and was annulled.

Key Takeaways

Signature is the Soul: A judicial or quasi-judicial order has no legal force unless it is signed by the authority passing it. An unsigned draft or text file is not an “order.”

Digital Signature Mandatory: In the e-assessment regime, the Digital Signature Certificate (DSC) of the AO serves the same purpose as a handwritten signature. Its absence vitiates the proceedings.

Section 282A Interpretation: This section facilitates electronic communication but does not waive the requirement of authentication.

and Sanjay Awasthi, Accountant Member

[Assessment year 2021-22]

16. The Id. Departmental Representative referred to the provisions of Rule 127A i.e.the Rule framed in pursuance to the provisions of section 282(2) of the Act for service of notice, summons, requisition order and other communications. The Id. Departmental Representative has pointed that since the assessment order communicated to the assessee originated from the designated E-mail ID of the Assessing Officer, therefore, in terms of rule 127A, the said document shall be deemed to be authenticated. The said argument is desultory and not in unison with the provisions of section 282A of the Act. The relevant provisions of section 282A of the Act are reproduced herein below:

“282A: Authentication of notices and other documents:

(1) Where this Act requires a notice or other document to be issued by any income-tax authority, such notice or other document shall be signed and issued in paper form or communicated in electronic form by that authority in accordance with such procedure as may be prescribed.

(2) Every notice or other document to be issued, served or given for the purposes of this Act by any income-tax authority, shall be deemed to be authenticated if the name and office of a designated income-tax authority is printed, stamped or otherwise written thereon.

(3) For the purposes of this section, a designated incometax authority shall mean any income-tax authority authorised by the Board to issue, serve or give such notice”

The aforesaid section is with respect to authentication of notices and other documents le orders/summons requisitions/communications etc. Sub-section (1) makes it obligatory that where any notice or other document is required to be issued under the provisions of the Act, the same shall be signed and issued by the competent authority in accordance with the procedure prescribed. The section is unambiguous, specifies signing of notice or other documents mandatory and the manner of signing procedural. Therefore, the Board has issued instructions from time to time laying down the procedures inter alia for signing of the notices and the assessment orders. Sub-section (2) of section 282A of the Act explains the connotation of expression “authentication”. Thus, signing of document and authentication of document carry different meaning. Signing of document denotes committing to the document, whereas, authentication of document relates to genuineness of origin of document. If signing and authentication would mean the same, then there was no need for the Legislature to lay down the requirement of signing the documents viz, notices, orders etc. in sub-section (1) and explain the purpose of authentication in sub-section (2) of section 282A of the Act. If argument of the Revenue is accepted, then the provisions of sub-section (1) to section 282A would become redundant.

17. Lastly, the Revenue has tried to take shelter under section 2928 of the Act. The said section cures the procedural defects or omissions. The section does not grant immunity from noncompliance of statutory provisions, Non signing of an assessment order is not a procedural flaw that can be cured subsequently. The order is complete only when it is signed and released. The date on which the order is signed by the Assessing Officer is the date of order. If Revenue’s contention is accepted and the Assessing Officer is allowed to sign the assessment order now considering it to be procedural deficiency, still the order would suffer from the defect of limitation and would be without jurisdiction.

18. In the case of Vijay Corporation (supra), the Co-ordinate Bench in a case where the assessment order served on the assessee was not signed by the Assessing Officer, held that requirement of signature of the Assessing Officer is a legal requirement. The omission to sign the order of assessment cannot be cured by relying on the provisions of section 2928 of the Act and held the order invalid.

19. Ergo, in facts of the case and documents on record, we hold the unsigned impugned assessment order served on the assessee invalid and quash the same.

20. Since, we have granted relief to the assessee on the legal ground raised in ground no. I of appeal, the other grounds raised in appeal on merits have become academic, hence, not deliberated upon.

21. In the result, appeal of the assessee is allowed.

| (a) | in case of electronic mail or electronic mail message (hereinafter referred to as the e-mail), if the name and office of such income-tax authority- |

| (i) | is printed on the e-mail body, if the notice or other document is in the e-mail body itself; or |

| (ii) | is printed on the attachment to the e-mail, if the notice or other document is in the attachment, and the e-mail is issued from the designated e-mail address of such income-tax authority; |

| (b) | in case of an electronic record, if the name and office of the income-tax authority- |

| (i) | is displayed as a part of the electronic record, if the notice or other document is contained as text or remark in the electronic record itself; or |

| (ii) | is printed on the attachment in the electronic record, if the notice or other document is in the attachment, and such electronic record is displayed on the designated website. |

| (i)” | electronic mail” and “electronic mail message” shall have the same meanings respectively assigned to them in Explanation to section 66A of the Information Technology Act, 2000 (21 of2000); |

| (ii) | “electronic record” shall have the same meaning as assigned to it in clause (t) of sub-section (1) of section 2 of the Information Technology Act, 2000 (21 of2000).]” |