A company that owns its own Intellectual Property (IP) and conducts high-end Research and Development (R&D) is not functionally comparable to a routine software development service provider.

Issue

Can a diversified company that is engaged in engineering services, conducts its own R&D, and owns valuable intellectual property be considered a valid comparable in a transfer pricing analysis for a company that provides routine software development services?

Facts

- The assessee was a company that provided software development services, typically operating as a low-risk service provider.

- In the transfer pricing study, the tax department sought to use a certain company as a comparable for benchmarking the assessee’s profit margin.

- However, this selected company was functionally very different. It was engaged in diversified engineering services, conducted its own R&D activities, and, most importantly, owned its own valuable IP in the form of its technology and brand.

Decision

The court ruled in favour of the assessee.

- It held that the selected company could not be compared with the assessee.

- The functional profile of a high-end, IP-owning company that invests in R&D is significantly different and carries a much higher risk profile than that of a routine contract software service provider. Therefore, they are not comparable.

Key Takeways

- Functional Similarity is the Cornerstone of TP: The cornerstone of any transfer pricing comparability analysis is the “FAR” analysis (Functions performed, Assets employed, Risks assumed). A company with significant functions (like R&D), valuable assets (like IP), and high risks (like product development) cannot be compared to a low-risk service provider.

- IP Ownership is a Key Differentiator: A company that owns its own valuable intangible assets (such as brands, patents, or proprietary technology) is expected to earn a different and typically higher level of profit than a contract service provider that does not own any such IP. They are not functionally comparable.

A company that has its own R&D functions and owns intangible assets is not a valid comparable for a simple service provider.

Issue

Can a company that engages in its own Research and Development (R&D) and owns its own intangible properties be used as a valid comparable for a simple service provider that does not have these complex functions or valuable assets?

Facts

- The assessee was a provider of software development services, operating as a captive service provider without owning any significant intangibles of its own.

- The tax department selected a company as a comparable in the transfer pricing analysis. This selected company was found to be engaged in its own R&D activities and also owned valuable intangible properties.

Decision

The court ruled in favour of the assessee.

- It held that the selected company was not functionally comparable to the assessee due to the significant and fundamental differences in their business models, assets, and risk profiles.

Key Takeways

- Comparing “Apples and Oranges”: Comparing a company that invests in, develops, and owns its own IP with one that simply provides services using its human capital is a classic example of comparing “apples and oranges” in transfer pricing analysis and is not permissible.

- Different Risk Profiles: An R&D-focused, IP-owning company has a high-risk, high-return business profile. In contrast, a contract service provider typically has a low-risk, low-return profile. Their profit margins are not comparable.

A pharmaceutical drug discovery R&D company is not functionally comparable to a contract R&D service provider in the medical device sector.

Issue

Can a company whose R&D activities are focused on the discovery of new pharmaceutical drugs and the licensing of its own IP be considered a valid comparable for a company that provides contract R&D services for medical devices?

Facts

- The assessee was a company that provided contract research and development services specifically for the medical device industry.

- The tax department sought to use another company as a comparable for benchmarking.

- However, this selected company was engaged in a completely different field. Its activities were purely related to the manufacturing of drugs, specifically the discovery of new drugs through its own research, and it also earned income from licensing its own intellectual property.

Decision

The court ruled in favour of the assessee.

- It held that the selected company was not a valid comparable.

- The functions, risks, and the specific industry of a pharmaceutical drug discovery company are significantly different from those of a contract R&D service provider that operates in the medical device sector.

Key Takeways

- The Industry and Niche are Important: Even within a broad sector like “life sciences R&D,” there are very significant differences between sub-sectors like pharmaceuticals and medical devices. These differences in R&D cycles, regulatory pathways, risk profiles, and typical profit margins make them non-comparable for transfer pricing purposes.

- Contract Service Provider vs. IP Owner: The assessee in this case was a contract R&D service provider, meaning it worked on projects for its clients. The selected company was an IP owner and licensor, which is a fundamentally different business model with a much higher risk and reward structure.

A double disallowance of the same item of expenditure, once by the AO and once by the assessee, is a clear error that needs to be corrected.

Issue

What is the appropriate legal remedy when a single item of expenditure has been disallowed twice—once by the Assessing Officer in the intimation order and a second time by the assessee themselves in their return of income?

Facts

- The Assessing Officer (AO), in the intimation order that was passed under Section 143(1), made a disallowance for interest that the assessee had paid to entities covered under the MSMED Act.

- At the same time, the assessee, likely taking a conservative position, had also disallowed the same amount of interest suo moto while filing its return of income.

- This led to a situation where the same item of expenditure was effectively disallowed twice, resulting in an incorrect and inflated computation of the assessee’s taxable income.

Decision

The court remanded the matter back to the Assessing Officer.

- It held that this issue of a clear double disallowance was a mistake that needed to be looked into and corrected by the AO.

- The AO was directed to decide the issue afresh after reviewing the facts of the case and giving the assessee a reasonable opportunity of being heard, with the clear implication that the double disallowance should be removed.

Key Takeways

- No Double Disallowance: It is a fundamental principle of tax computation that the same expense cannot be disallowed twice. A double disallowance is a mistake that is apparent from the record and must be rectified.

- Remand for Correction of Obvious Errors: When a clear computational or factual error like a double disallowance is brought to the attention of an appellate authority, the standard procedure is to remand the case back to the AO with a specific direction to correct the error.

In a leasing transaction, the owner of the asset is entitled to claim depreciation, while the user of the asset is entitled to claim the rent they pay as an expense.

Issue

In a transaction involving a leased asset, who is legally entitled to claim the deduction for depreciation, and who is entitled to claim the deduction for the rental payments?

Facts

The specific facts of the dispute are not detailed in the summary, but the legal issue revolved around which party—the owner or the user of a leased asset—could claim the deductions associated with that asset.

Decision

The court ruled in favour of the assessee by clarifying the fundamental legal principle governing this issue.

- It held that it is the owner of the asset (the lessor) who is entitled to the deduction for depreciation on that asset.

- The user of the asset (the lessee), who pays rent for the right to use the asset, is entitled to the deduction for the rent that they pay.

Key Takeways

- A Clear Division of Deductions: The Income-tax Act makes a very clear and logical distinction between the deductions that are available to the owner (the lessor) and the user (the lessee) of an asset.

- Ownership is the Test for Depreciation: The primary and non-negotiable condition for claiming depreciation on an asset under Section 32 of the Act is that the assessee must be the legal and/or beneficial owner of that asset.

- “Use for Business” is the Test for Rent: The primary condition for claiming lease rent as a business expenditure under Section 37(1) of the Act is that the asset must be used by the taxpayer for the purpose of their business.

and Rajesh Kumar, Accountant Member

[Assessment year 2021-22]

| i. | Wipro GE Healthcare (P.) Ltd. v. ACIT 97 (Bangalore – Trib.)[17-05-2023] |

| ii. | Infineon Technologies India (P.) Ltd. v. Deputy Commissioner of Income-tax 245 (Bangalore – Trib.)[10-01-2024] |

| iii. | Mavenir Systems (P.) Ltd. v. Deputy Commissioner of Income Tax 655 (Bangalore – Trib.)[23-03-2023] |

| iv. | Infor (India) (P.) Ltd. v. Assistant Commissioner of Income-tax 68 (Hyderabad – Trib.)[25-08-2022] |

“4.4 Sasken Communication Technologies Ltd.

4. 4.1 It is submitted that this comparable has been excluded by the Ld.TPO as it is involved in R&D activities and owns huge patents. We have hereinabove excluded Infosys Ltd., L&T Infotech Ltd. for the reason that they are into research and development activities and owns huge intangibles which is not akin to a captive service provider. Applying the same principle, we do not find any infirmity in exclusion of Sasken Communication Technologies Ltd. by the Ld.TPO.

Accordingly, we reject this comparable sought for exclusion by assessee.

Accordingly ground no. 1.6 raised by assessee stands partly allowed.

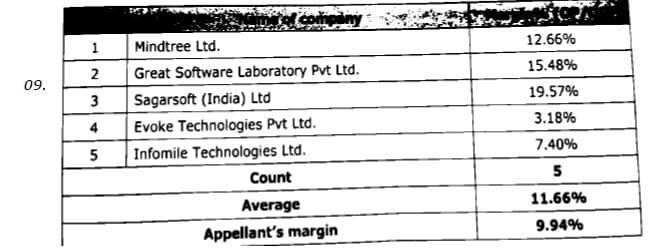

5. Ground no. 1.7 has been raised by assessee seeking the correction in the margins of the comparable companies. It is submitted that assessee has filed all the relevant details in respect of the comparables that needs to be verified by the Ld.TPO/AO.

We thus direct the Ld.AO/TPO to recompute the margins in accordance with law.

Accordingly this ground stands allowed for statistical purposes.

6. Ground no. 2 is related to the transfer pricing adjustment with respect to outstanding receivables. Primarily the Ld.AR has objected by submitting that no interest is attributable as the same was not charged by the AEs on any delayed payment by the assessee. However, assessee submitted that only two invoices payment were delayed to be paid by the AE with respect to 15 days and one day. In any event, if at all any interest is to be computed, LIBOR rate is to be applied as submitted by the Ld.AR. The Ld.DR relied on the order passed by authorities below.

We have perused the submissions advanced by both sides in the light of records placed before us.

Admittedly attributing interest to the delayed payment is an international transaction.

6.1 The Ld.AR submitted that the Ld.TPO proposed transfer pricing adjustment in respect of outstanding receivables in respect of trade creditors being the AEs by using 6 months LIBOR rate and CUP as the most appropriate method. The Ld.TPO thus proposed adjustment at 5.8749% amounting to Rs. 3,37,183/-.

6.2 The Assessee wishes to submit that the delayed/outstanding receivables should not be considered as a separate international transaction. Further, it is humbly submitted that determination of ALP in respect of delayed receivables from inter-company transactions is not required since ALP of inter-company transactions of provision of services has been already determined and no separate adjustment is necessary in this regard.

6.3 The Ld.AR placed reliance on decision of Hon’ble Delhi Tribunal in Kusum Healthcare (P). Ltd v. Asstt. CIT 79 deleted addition by considering the above principle, and subsequently Hon’ble Delhi High Court in Pr. CIT v. Kusum Health Care (P.) Ltd 431/[2017] 398 ITR 66, held that, no interest could have been charged as it cannot be considered as international transaction. He also placed reliance upon decision of Hon’ble Delhi Tribunal in case of Bechtel India (P.) Ltd. v. Dy. CIT 6 which subsequently upheld by Hon’ble Delhi High Court vide order dated 21/07/16 in ITA No. 379/2016, also upheld by Hon’ble Supreme Court vide order dated 21/07/17, in CC No. 4956/2017.”

“3. Issue raised in ground no. 2 is against the direction of DRP on determination of arms’ length price in respect thereof for intra group services received by the appellant assessee.

4. The Ld. Counsel for the assessee at the outset submitted that the issue is recurring one right from A.Y.2009-10 to 2015-16 and is covered in favour of the assessee by the decisions of the Co-ordinate Benches of the Tribunal deciding the issue in favour of the assessee in all the assessment years. The Ld. A.R took the Bench through the decisions attached in the Paper book and prayed that the ground may be allowed following the said decisions of the Co-ordinate Bench in the assessee’s own case.

5. The Ld. D.R. on the other hand fairly agreed that the issue is squarely covered by the decisions of Co-ordinate Benches in assessee’s own case however relied on the order of DRP.

6. Having heard rival submissions and perusing the material on record including the decisions of the coordinate benches in assessee’s own case in the earlier assessment years, we find that the issue is squarely covered in favour of the assessee. Therefore, taking a consistent view, we allow ground no. 2 by setting aside the direction of the DRP and directing the TPO/AO to delete the adjustment/addition.”

“7. Issue raised in ground no. 3 is in respect of determination of arm’s length price and an adjustment made on account thereof towards advertisement, marketing and promotion expenses.

8. Having heard rival submission and perusing the material on record we find that issue is squarely covered by the decisions of the Co-ordinate Benches in earlier assessment years in assessee’s own case from AY 2010-11 to 2015-16. Accordingly we set aside the DRP direction on this issue and direct the AO/TPO to delete the adjustment made and consequently ground no. 3 is allowed.”