ORDER

Madhusudan Sawdia, Accountant Member. –This appeal is filed by My Home Industries Private Limited, (“the assessee”), feeling aggrieved by the assessment order passed by the Learned Commissioner of Income Tax (Appeals)-10, Hyderabad (“Ld. CIT(A)”) dated 29.01.2024 for the A.Y 2018-19.

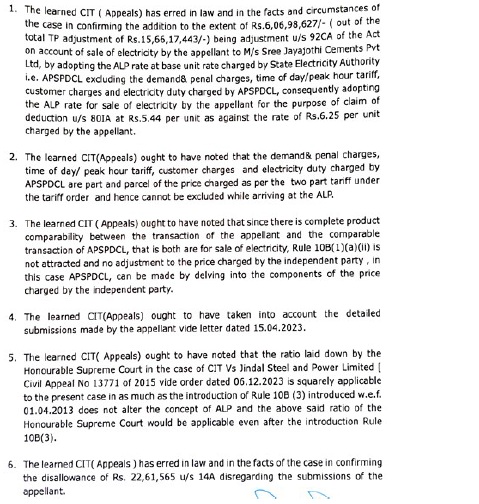

2. The assessee has raised the following grounds of appeal:

3. The brief facts of the case are that the assessee is a company engaged in the business of manufacturing Portland cement and generation of power. The assessee filed its return of income for the Assessment Year 2018-19 on 31.10.2018, declaring a total income of Rs.120,24,30,930/-. The case of the assessee was selected for complete scrutiny, and accordingly, a notice under section 143(2) of the Income Tax Act, 1961 (“the Act”) was issued by the Learned Assessing Officer (“Ld. AO”). Since the case involved specified domestic transactions, the Ld. AO referred the matter to the Learned Transfer Pricing Officer (“Ld. TPO”) under section 92CA(1) of the Act for determination of the Arm’s Length Price (“ALP”).

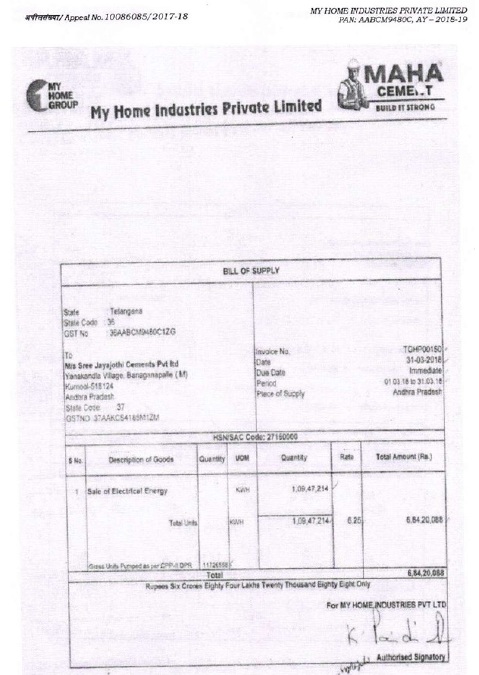

3.1 During the proceedings before the Ld. TPO, it was observed by the Ld. TPO that the assessee had made captive consumption of power as well as supplied power to M/s. Sree Jayajyothi Cements Pvt. Ltd., which is a 100% subsidiary of the assessee (“AE”). The Ld. TPO further observed that the assessee had taken three comparables including the AE for the purpose of benchmarking and calculated the ALP at Rs.5.26 per unit on the basis of the weighted average rate. The Ld. TPO, however, removed the AE from the list of comparables and recalculated the ALP based on the remaining two comparables by taking the arithmetic mean, arriving at an ALP of Rs.4.16 per unit. Accordingly, the Ld. TPO proposed an adjustment of Rs.21,46,15,742/- on account of captive consumption of power and Rs.15,66,17,443/- on account of supply of power to the AE. The Ld. TPO, vide order dated 31.07.2021 passed under section 92CA(3) of the Act, thus proposed a total adjustment of Rs.37,12,33,185/-.

3.2 Based on the findings of the Ld. TPO, the Ld. AO passed a draft assessment order under section 144C of the Act on 27.09.2021, proposing an addition of Rs.37,12,33,185/- on account of specified domestic transactions as suggested by the Ld. TPO, and a further disallowance under section 14A of the Act amounting to Rs.37,33,334/-. Accordingly, the Ld. AO proposed a total addition of Rs.37,49,66,519/- in the draft assessment order. The assessee did not file any objection before the Learned Dispute Resolution Panel (“Ld. DRP”) against the draft assessment order passed by the Ld. AO. Consequently, the Ld. AO passed the final assessment order under section 143(3) read with sections 144C(3) and 144B of the Act on 12.11.2021, making the same additions of Rs.37,49,66,519/- as proposed in the draft assessment order. Thus, the total income of the assessee was assessed at Rs.157,73,97,449/-.

4. Aggrieved by the final assessment order passed by the Ld. AO, the assessee filed an appeal before the Ld. CIT(A). The Ld. CIT(A), after considering the submissions of the assessee and the remand report of the Ld. AO, concluded that in respect of captive consumption of power, the benchmarking rate should be the base rate charged by the State Electricity Authority, excluding other additional charges such as demand and penal charges, time of day/peak hour tariff, customer charges and electricity duty (“miscellaneous charges”) levied by the State Authority. At para no. 6.4.2 of the order, the Ld. CIT(A) recorded a factual finding that the rates adopted by the Ld. TPO were less than the base rate charged by the State Electricity Authority, and therefore, no adjustment was required under section 92CA of the Act. Accordingly, the Ld. CIT(A) deleted the adjustment made by the Ld. TPO on account of captive consumption of power by the assessee.

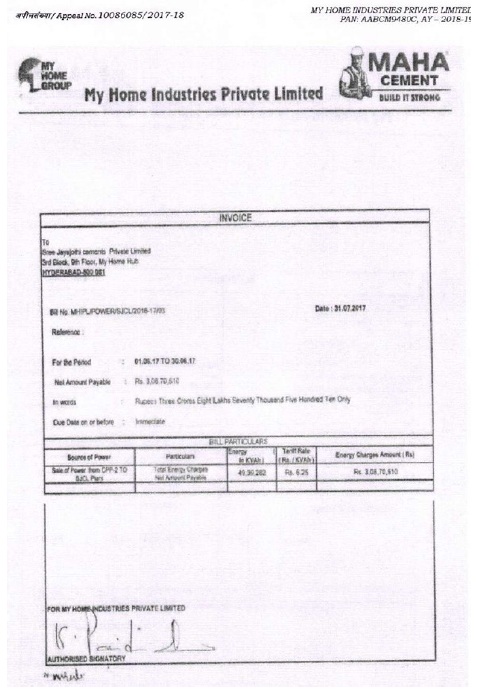

4.1 As far as the supply of power to the AE is concerned, the Ld. CIT(A), holding the same view as taken for captive consumption, was of the opinion that the benchmarking rate for determining ALP should be the base rate charged by the State Electricity Authority, excluding Miscellaneous Charges. Since the base rate charged by the State Electricity Authority was Rs.5.44 per unit, the Ld. CIT(A) considered the same as the ALP. However, as the assessee had charged Rs.6.25 per unit from its AE, the Ld. CIT(A) recalculated the adjustment under section 92CA at Rs.6,06,98,627/-, instead of the adjustment of Rs.15,66,17,443/-proposed by the Ld. TPO. Thus, the Ld. CIT(A) upheld the adjustment to the extent of Rs.6,06,98,627/- and deleted the balance of Rs.9,59,18,816/-. Finally, the appeal of the assessee was partly allowed by the Ld. CIT(A).

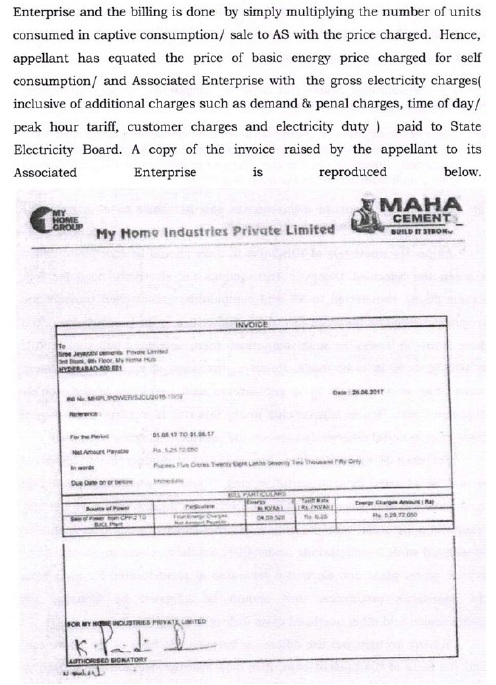

5. Aggrieved by the order of the Ld. CIT(A), the assessee is now in appeal before this Tribunal. The Learned Authorized Representative (“Ld. AR”) submitted that the ground nos. 1 to 5 of the assessee is related the benchmarking of supply of electricity by the assessee to its AE at base rate by the Ld. CIT (A) instead of gross rate charged by the State Electricity Authorities. He further submitted that, the Ld. CIT(A) erred in adopting the base rate instead of the gross rate charged by the State Electricity Authority for determining the ALP. It was contended that the Ld. CIT(A) has misconstrued the provisions of Rule 10B(3)(i) and (ii) of the Income Tax Rules, 1962, which provides for making reasonable adjustments to eliminate material differences between the tested party and the comparables. The Ld. AR explained that such adjustments are required only when there are actual differences in the situations affecting the price charged by the comparables and the tested party. It was further submitted that the Ld. CIT(A) failed to appreciate that if the assessee had not supplied power to its AE, the AE would have purchased the same power from the State Electricity Authority at the gross rate, which includes not only the base rate, but also Miscellaneous Charges. Therefore, for the purpose of benchmarking, the rate at which the AE actually receives power from the assessee should be compared with the gross rate at which the State Electricity Authority would have supplied power to the AE, and not merely with the base rate. Accordingly, the Ld. AR contended that the Ld. CIT(A) has committed an error in comparing the final rate charged by the assessee to the AE with only the base rate charged by the State Electricity Authority, ignoring the composite nature of the actual rate structure applicable to similar consumers. In support of the above proposition, the Ld. AR relied upon the decision of this Tribunal in the case of Bharathi Cement Corporation (P.) Ltd. v. Deputy Commissioner of Income-tax (Hyderabad – Trib.)/ITA No. 159/Hyd/2022, order dated 17.02.2023, which has been affirmed by the Hon’ble High Court in ITTA No.119/2023, vide order dated 31.07.2025 wherein this Tribunal held that for benchmarking captive power transactions, the gross rate charged by the State Electricity Board constitutes the appropriate comparable rate for the purpose of computing ALP, and not merely the base rate. Therefore, relying on the above judicial precedent and factual parity, the Ld. AR submitted that the Ld. CIT(A) should have adopted the gross rate charged by the State Electricity Authority for determining the ALP. The Ld. AR thus prayed that the adjustment sustained by the Ld. CIT(A) may be deleted, and suitable directions be issued to the Ld. AO/TPO to recompute the ALP by considering the gross rate charged by the State Electricity Authority to the AE.

6. Per contra, the Learned Departmental Representative (“Ld. DR”) relied upon the findings of the Ld. CIT(A). The Ld. DR submitted that the Ld. CIT(A) has rightly adopted the base rate of the State Electricity Authority, as it reflects the core energy charge exclusively of other elements like demand and penal charges, which are consumer-specific and not comparable across different categories of consumers. It was thus submitted that the order of the Ld. CIT(A) does not warrant any interference.

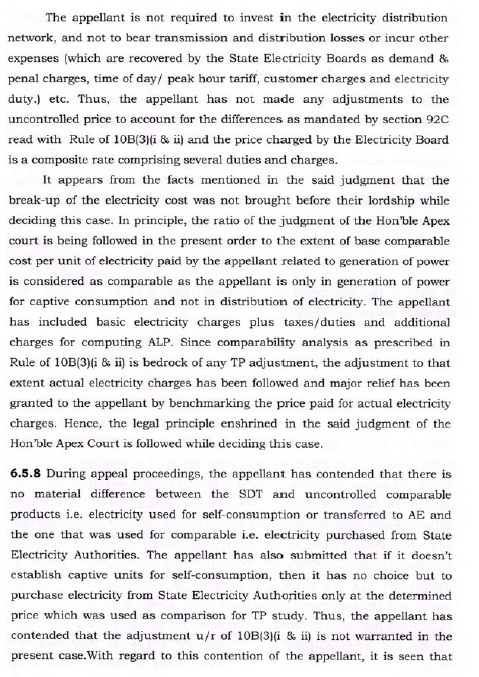

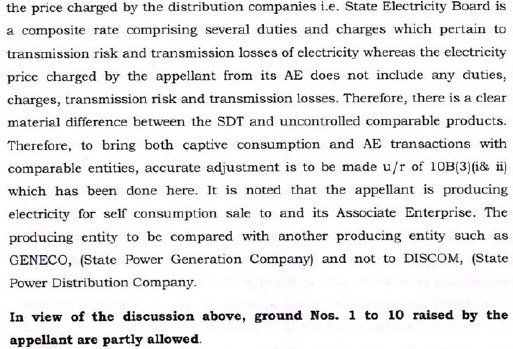

7. We have considered the rival submissions of both parties and perused the material available on record. The issue for adjudication before us relates to determination of the appropriate rate to be adopted for benchmarking the transfer of electricity by the assessee to its AE. In this regard, we have gone through para nos.6.5.7 and 6.5.8 of the order of the Ld. CIT (A) which is to the following effect:

8. On perusal of the above, it is evident that the Ld. CIT(A) has adopted the base rate charged by the State Electricity Authority, excluding Miscellaneous Charges, while the Ld. AR contends that the gross rate should be adopted since that represents the actual rate at which a similar consumer would procure power from the State Electricity Authority. Further, we have gone through Rule 10B(3)(i) and (ii) of the Rules, which is to the following effect:

“10B. (1) For the purposes of sub-section (2) of section 92C, the arm’s length price in relation to an international transaction or a specified domestic transaction shall be determined by any of the following methods, being the most appropriate method, in the following manner, namely :—

(i) the price charged or paid for property transferred or services provided in a comparable uncontrolled transaction, or a number of such transactions, is identified;

(ii) such price is adjusted to account for differences, if any, between the international transaction or the specified domestic transaction and the comparable uncontrolled transactions or between the enterprises entering into such transactions which could materially affect the price in the open market.”

9. On perusal of above, it is evident that adjustments are to be made for differences which materially affect the price in the open market. In the present case, the difference between base rate and gross rate represents mandatory charges applicable to all consumers under the tariff schedule of the State Electricity Authority. Therefore, such charges form part of the composite price payable by an independent consumer and excluding them would not reflect the true arm’s length condition. We also find merit in the reliance placed by the Ld. AR on the decision of the coordinate bench of this Tribunal in Bharathi Cement Corporation Limited (supra), which has since been upheld by the Hon’ble High Court in ITTA No.119/2023 dated 31.07.2025. We have gone through the para no. 13 the decision of the coordinate bench of this Tribunal in Bharathi Cement Corporation Limited (supra), which is to the following effect:

“13. We have heard the rival submissions and perused the material on record. In the present case, the sole dispute before us is whether the lower authorities were erred in disallowing taking the rate of Rs.6.29 per unit Charged by the Southern Power company as comparable instance instead of base rate of Rs.5.25 per unit as held by Assessing Officer /DRP. It was the contention before us that Andhra Pradesh Southern Power Distribution Corporation Limited (APSPDCL) is charging Rs.6.29 per unit for the electricity supplied by it to its industrial consumers, hence discharging the similar functions as that of assessee. In the said rate of Rs.6.29 per unit, the APSPDCL had included various charges towards ToD rate, Electricity duty, customer charges and fixed demand while arriving at the said figure. In the present case, the TPO had adopted the CUP method to determine the ALP of the electricity supplied by the assessee to it’s A.E. to bench mark by comparing the charges charged by the APSPDCL Board with that of the charges charged by assessee. However, while doing so, it had reduced the ToD rates, Electricity duty, customer charges and fixed demand and arrived at the figure of Rs.5.25 per unit. In our view, the above said reduction of the charges by the TPO were without any basis, more particularly, when the electricity was received by the assessee/sister concerns from the Electricity Board at the same rate. Further the electricity tariff charged by the Board can not be segregated into various components as done by the TPO, as all components will collectively constitute the electricity charges as had been decided by the Regulatory Commission while exercising its power under section 61 of Electricity Act 2003. APTE (APPELLATE TRIBUNAL FOR ELECTRICITY) had examined the issue of ToD (time of day) tariff, fixed charges etc in various decisions including in Udyog Nagar Association case wherein it had held that charges of electricity will consist of Fixed charges, customers charges etc.”

9.1 On perusal of the above, it is evident that the Tribunal in that case held that, for the purpose of benchmarking captive power transactions, the gross rate charged by the State Electricity Board constitutes the appropriate comparable rate for computing ALP. The facts of the present case being identical, the said ratio squarely applies. Respectfully following the above judicial precedent and considering the factual matrix, we hold that the benchmarking of electricity transactions between the assessee and its AE should be done by taking the gross rate charged by the State Electricity Authority as the comparable rate. Accordingly, the order of the Ld. CIT(A) is set aside to this extent, and the Ld. AO/TPO is directed to recompute the ALP by adopting the gross rate charged by the State Electricity Authority for similar category consumers, instead of the base rate adopted by the Ld. CIT(A).

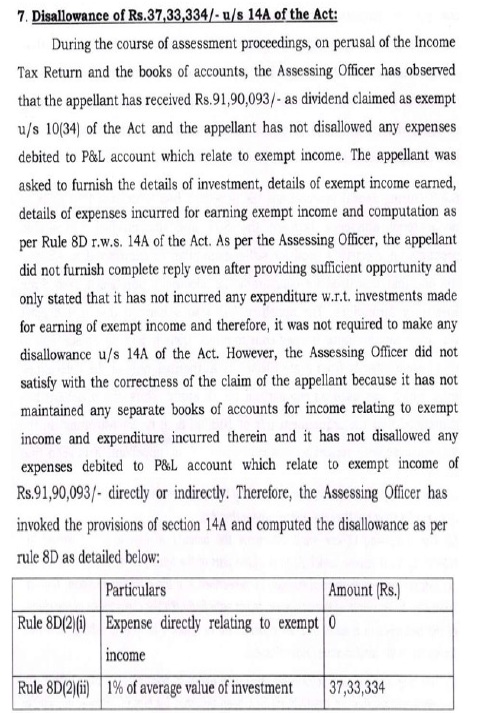

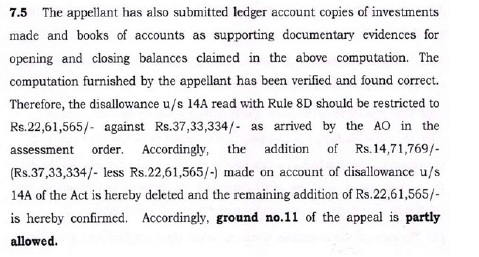

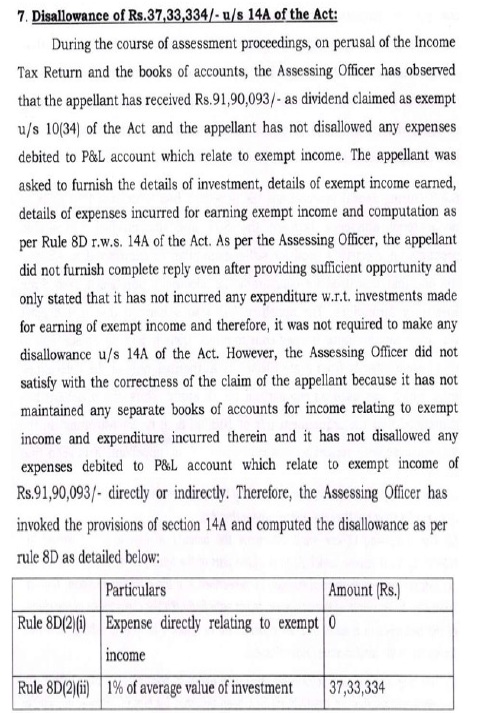

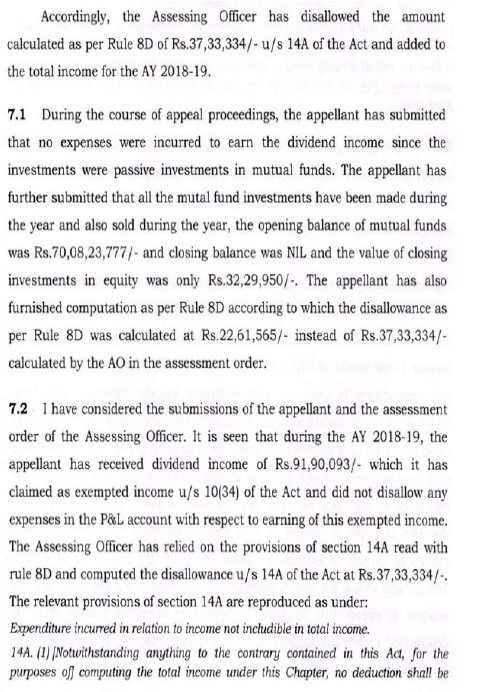

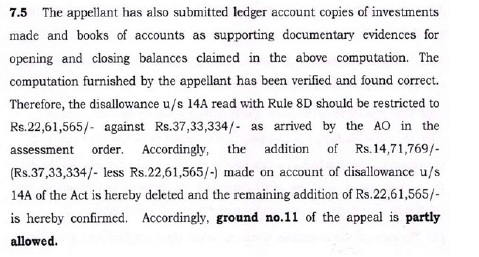

10. Ground No.6 of the assessee’s appeal relates to the disallowance made under section 14A of the Act. In this regard, the Ld. AR submitted that the Ld. AO had made a disallowance of Rs.37,33,334/- under section 14A of the Act, which was subsequently reduced by the Ld. CIT(A) to Rs.22,61,565/-. The Ld. AR contended that the assessee had not incurred any expenditure in relation to earning of exempt income, and therefore, no disallowance under section 14A of the Act was warranted. Accordingly, it was prayed that the disallowance sustained by the Ld. CIT(A) of Rs.22,61,565/- be deleted in full.

11. Per contra, the Ld. DR supported the findings of the Ld. CIT(A) and relied upon the order passed under section 250 of the Act.

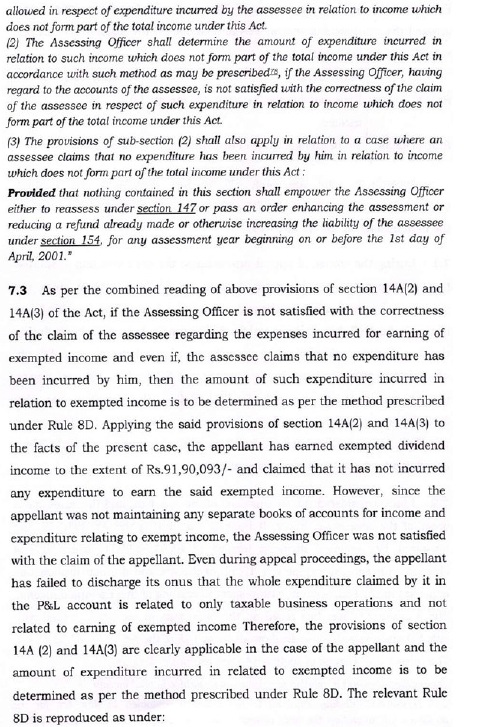

12. We have considered the submissions of both sides and perused the material available on record. We have also gone through the para nos. 7 to 7.5 of the order of the Ld. CIT(A) which is to the following effect:

13. On perusal of the above, we find that the Ld. CIT(A), after detailed examination, restricted the disallowance made by the Ld. AO under section 14A of the Act from Rs.37,33,334/- to Rs.22,61,565/-. The claim of the Ld. AR that no expenditure was incurred in relation to exempt income without any supporting evidence is not acceptable. The assessee has neither substantiated nor produced any documentary evidence to demonstrate that no expenditure, direct or indirect, was incurred in relation to the earning of exempt income. In the absence of any cogent material to controvert the findings of the Ld. CIT(A), we see no reason to interfere with the well-reasoned conclusion drawn therein. The Ld. CIT(A) has already granted partial relief to the assessee by restricting the disallowance to Rs.22,61,565/-, which in our considered view is fair and reasonable. Accordingly, we uphold the order of the Ld. CIT(A) and dismiss Ground No.6 raised by the assessee.

14. In the result, the appeal of the assessee is partly allowed for statistical purposes.