I. SECTION 80G APPROVAL REMANDED TO CONSIDER RESOLUTION ON DISSOLUTION CLAUSE

SUITABLE TITLE

Rejection of Final 80G Approval Set Aside; Remanded to Verify Dissolution Clause Resolution

ISSUE

Whether the Commissioner (Exemption) was justified in rejecting the assessee’s application for final approval under Section 80G(5) on the ground that the trust deed lacked a “Dissolution Clause” (specifying how assets would be transferred upon winding up), even though the trustees had passed a specific resolution curing this defect which was accepted for a subsequent year.

FACTS

The Assessee: A trust registered under Section 12A with provisional Section 80G approval.

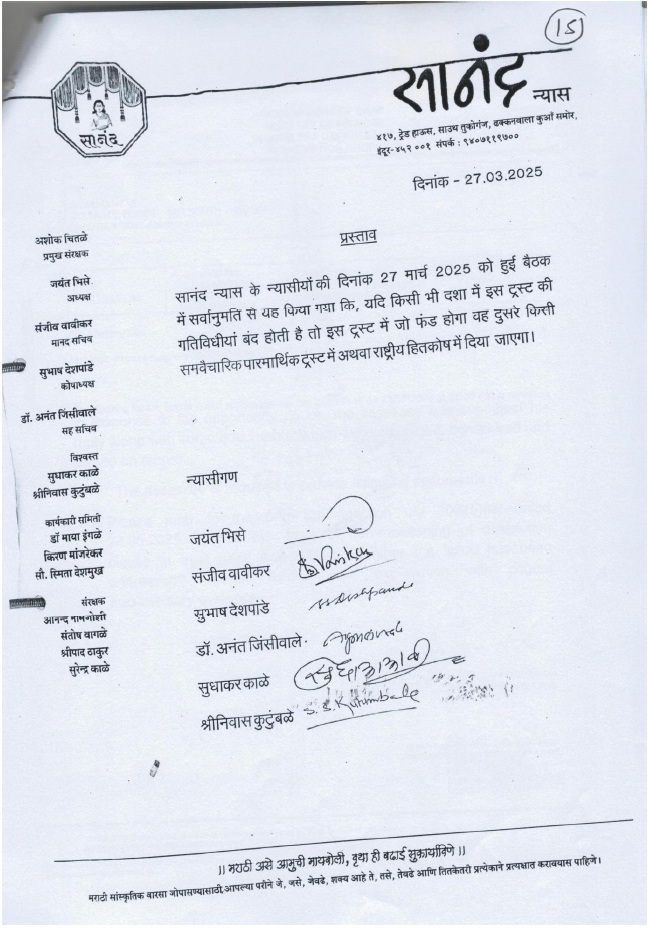

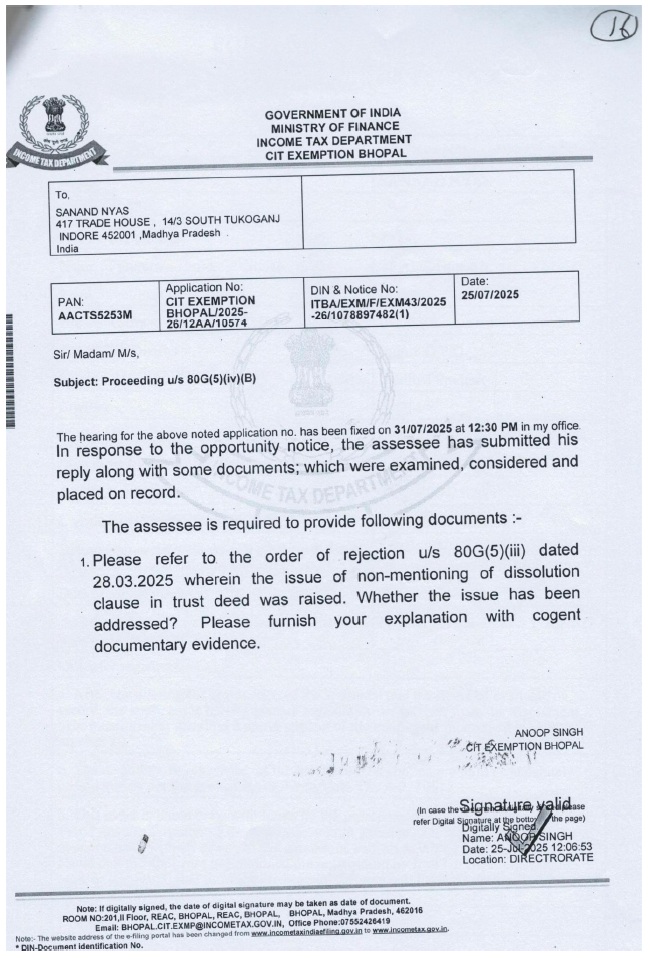

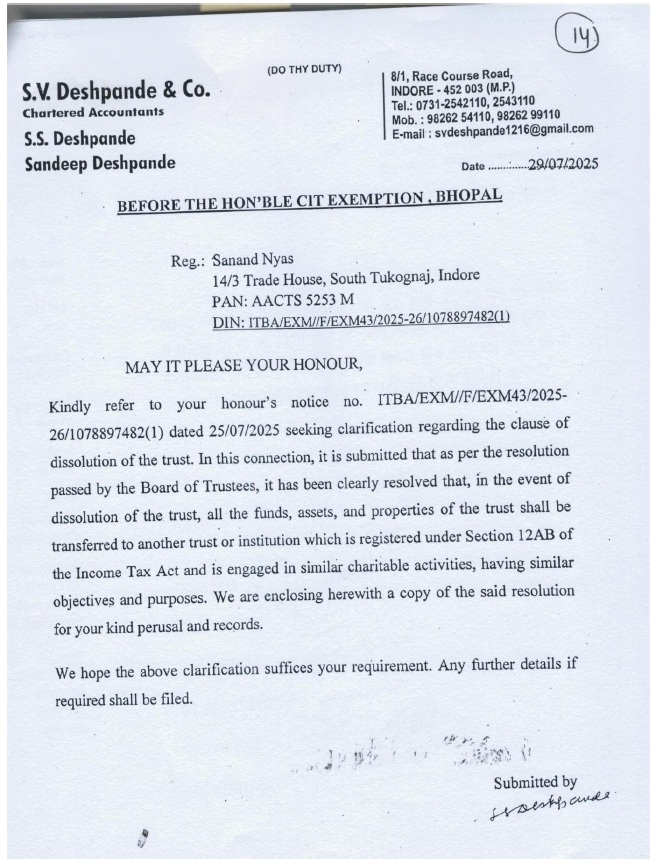

The Rejection: The CIT(E) rejected the application for final approval because the trust deed did not contain a Dissolution Clause (mandating transfer of assets to a similar trust upon dissolution).

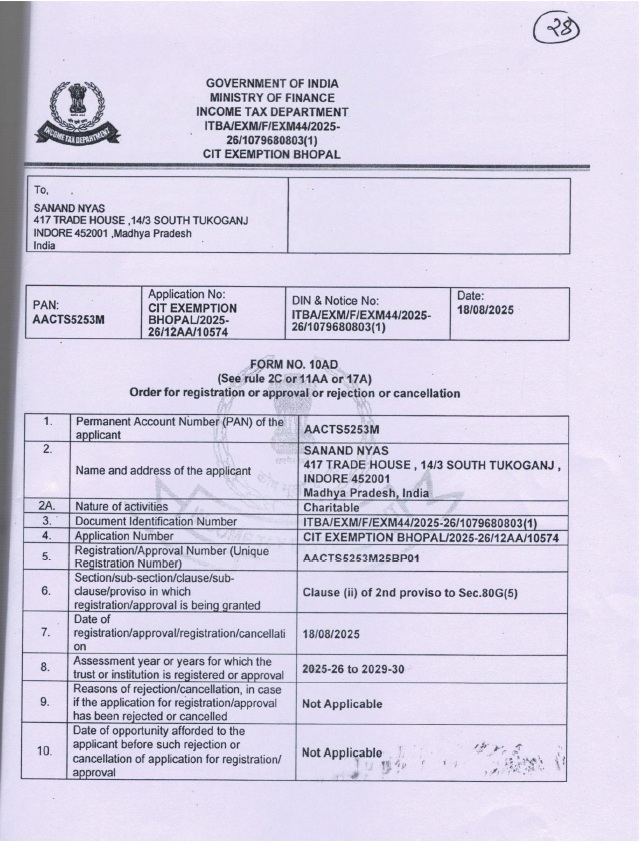

The Resolution: It was found that the trustees had actually passed a resolution adopting such a clause. Interestingly, the CIT(E) had accepted this very resolution while granting approval for a later period (AY 2025-26 to 2029).

The Error: For the impugned order (AY 2022-23), this resolution was not considered, likely because the assessee failed to furnish it during those specific proceedings.

DECISION

Consistency: Since the Department had already accepted the resolution as valid compliance for a future period, it should ideally be accepted for the current period as well.

Remand: The Tribunal set aside the rejection and restored the matter to the CIT(E).

Direction: The assessee was directed to file the resolution formally. The CIT(E) was directed to verify it and pass a fresh order considering the dissolution clause as compliant.

Verdict: [Matter Remanded]

II. APPLICATION FOR FINAL 80G APPROVAL FILED WITHIN CBDT EXTENDED DEADLINE IS VALID

SUITABLE TITLE

Final 80G Approval Granted: Application Filed Within CBDT Extended Deadline (30-09-2023) Valid

ISSUE

Whether an application for converting provisional approval into final approval under Section 80G(5)(iii) can be rejected as “time-barred” if it was filed on 25-09-2023, considering the CBDT Circulars extending the deadlines for such compliance.

FACTS

Registration History: The assessee obtained provisional registration under Section 12AB (Sept 2021) and Section 80G (Jan 2023).

The Application: The assessee applied for final approval (conversion) on 25-09-2023.

The Rejection: The CIT(E) treated the application as time-barred under the statutory timelines (which generally require filing 6 months prior to expiry or within 6 months of commencement).

The Extension: The CBDT had issued circulars (specifically Circular No. 10/2023) extending the due date for filing Form 10AB for Section 80G approval up to 30-09-2023.

DECISION

CBDT Relief Applies: The Tribunal noted that the application filed on 25-09-2023 was well within the extended deadline of 30-09-2023 provided by the Board.

Refusal Unjustified: Therefore, the CIT(E)’s dismissal on limitation grounds was incorrect.

Outcome: The CIT(E) was directed to grant final approval to the assessee, subject to verifying other eligibility conditions (genuineness of activities).

Verdict: [In Favour of Assessee]

KEY TAKEAWAYS

The “Dissolution Clause” Trap: This is the #1 reason for 80G rejection today. Your trust deed must say: “Upon dissolution, assets shall be transferred to another trust with similar objects.” If your deed is old and misses this, pass a Trustee Resolution immediately and submit it. As seen in Case I, this resolution cures the defect.

Circular 10/2023 is a Lifesaver: Many trusts missed the strict “6-month” window for filing Form 10AB. CBDT Circular 10/2023 (dated 24.05.2023) extended this generally to 30th September 2023. Any rejection of an application filed before this date is legally invalid (Case II).

Provisional to Final: Remember, Provisional Approval is valid only for 3 years. You must apply for Final Approval (Form 10AB) at least 6 months before it expires OR within 6 months of starting activities, whichever is earlier. Missing this deadline (without a CBDT extension) kills your exemption.

and B.M. Biyani, Accountant Member

| (i) | The assessee is a public charitable trust established in the year 1993 by a Trust-Deed dated 26.09.1993. The assessee got registration under the M.P. Public Trust Act, 1951 w.e.f. 29.09.2003. |

| (ii) | The assessee was also granted registration by Income-tax Department u/s 12A w.e.f. 18.07.1994 and approval u/s 80G w.e.f. 31.03.1995 (the renewal of approval u/s 80G was also granted by Income-tax Department from time to time). |

| (iii) | After introduction of new provisions in Income-tax Act, 1961 for registration/approval u/s 12A/80G [“new regime”] w.e.f. 01.04.2021, the assessee re-applied to Income-tax Department for grant of registration/approval under new regime. The authorities granted provisional registration u/s 12A vide Order dated 24.09.2021 for AY 2022-23 to 2026-27 and provisional approval u/s 80G vide Order dated 20.01.2023 for the period 20.01.2023 to AY 2025-26. |

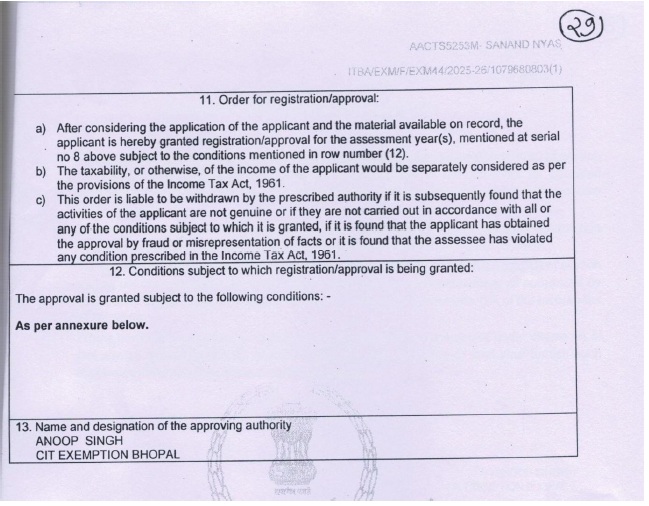

| (iv) | Thereafter, the assessee filed application dated 25.09.2024 [Form No. 10AB] under clause (iii) of first proviso to sub-section (5) of section 80G for conversion of provisional approval u/s 80G into final approval but the Ld. CIT(E) rejected assessee’s application vide Order dated 28.03.2025. The assessee is aggrieved by this Order dated 28.03.2025 of Ld. CIT(E) [“impugned order”] and has come in present appeal before us. |

| (i) | There is no ‘dissolution clause’ incorporated in the deed of assessee-trust and also nothing is mentioned/clarified about the transfer/ utilization of funds in case of dissolution of assessee-trust. |

| (ii) | The provisional approval u/s 80G under new regime was granted to assessee vide Order dated 20.01.2023 and the assessee was required to file application for conversion into final approval [Form No. 10AB] in terms of provision of clause (iii) of first proviso to section 80G(5), before six months prior to expiry of the provisional approval or within six months from the commencement of activities, whichever is earlier. Since the assessee’s activity was already started since long period of time, the assessee should have applied within 6 months of the commencement of activities but the same is not done. The Ld. CIT(E) has further observed that although the CBDT has extended date for filing of Form No. 10AB through its circulars but the extended date was also 30.06.2024 whereas the assessee has filed Form No. 10AB on 25.09.2024 after expiry of extended date. Therefore, the Form No. 10AB filed by assessee was time-barred and not valid. |

| (i) | where the institution or fund is approved under clause (vi) (as it stood immediately before its amendment by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020), within three months from the 1st day of April, 2021; |

| (ii) | where the institution or fund is approved and the period of such approval is due to expire, at least six months prior to expiry of the said period; |

| (iii) | where the institution or fund has been provisionally approved, at least six months prior to expiry of the period of the provisional approval or within six months of commencement of its activities, whichever is earlier; |

| (iv) | in any other case, at least one month prior to commencement of the previous year relevant to the assessment year from which the said approval is sought: |

| (i) | where the application is made under clause (i) of the said proviso, pass an order in writing granting it approval for a period of five years; |

| (ii) | where the application is made under clause (ii) or clause (iii) of the said proviso,– |

| (a) | call for such documents or information from it or make such inquiries as he thinks necessary in order to satisfy himself about– |

| (A) | the genuineness of activities of such institution or fund; and |

| (B) | the fulfilment of all the conditions laid down in clauses (i) to (v); |

| (b) | after satisfying himself about the genuineness of activities under item (A), and the fulfilment of all the conditions under item (B), of sub-clause (a), – |

| (A) | pass an order in writing granting it approval for a period of five years; or” |

XXX

| (a) | clause (i) of the first proviso, from the assessment year from which approval was earlier granted to such institution or fund; |

| (b) | clause (iii) of the first proviso, from the first of the assessment years for which such institution or fund was provisionally approved; |

| (c) | in any other case, from the assessment year immediately following the financial year in which such application is made. |

“6. So far as the observation of the ld. CIT(E) that the assessee had already commenced its activities since long and that as per Clause (iii) of 1st Proviso to section 80G(5) of the Act, the application for final registration was to be filed within six months from the commencement of its activities and therefore, the application of the assessee for final registration was time-barred, is concerned, we note that the issue has already been discussed and adjudicated by the Coordinate Bench of the Tribunal in the case of West Bengal Welfare Society v. CIT(Exemption), Kolkata vide order dated 13.09.23 [one of us i.e. the Judicial Member herein, being the author of the said order], wherein., it has been held that the assessee, who has been granted provisional registration, is eligible to apply for final registration irrespective of the fact that the assessee had already commenced its activity even prior to the date of grant of provisional approval. The relevant part of the order of the Coordinate Bench is reproduced as under:

6. We note that the ld. CIT(E) has misconstrued the aforesaid proviso to section 80G(5) of the Act. As per the provision, an application for final registration cannot be filed until and unless an assessee/trust has been given provisional approval u/s 80G(5)(iv) of the Act. The assessee was granted provisional approval on 30.11.2022 only, and within a few days i.e. on 03.12.2022, the assessee applied for final registration u/s Clause (iii) of 1st Proviso to section 80G(5) of the Act. Though the assessee might have commenced its activities prior to grant of provisional registration but that does not mean that the assessee in that event will be precluded from applying for final registration even after the grant of provisional registration. The assessee as per statutory provision could not have directly applied for final registration without grant of provisional registration. The aforesaid proviso, therefore, is to be read as that after the grant of provisional registration, if the assessee has not commenced its activities, he may apply for registration within six months of the commencement of its activities or within the six months prior to the expiry of the period of provisional approval, whichever is earlier. In any case, the assessee is eligible to apply for final registration only after the grant of provisional approval. Therefore, we hold that there is no delay on the part of the assessee in filing application in the prescribed form for grant of final registration under Clause (iii) of 1st Proviso to section 80G(5) of the Act.

In view of the above observations, the matter is restored the file of the CIT(E) for decision afresh in the light of the observations made above.”

5. It is to be further noted here that the Ld. CIT (Exemption) firstly misconstrued about the CBDT Circulars regarding the exemption of date for final applications for approval. The said Circular/time limits are applicable only for the institutions who stood already registered on the date of Amendment and have made application for renewal of the registration without any time break. However, the said last date which has been extended to 30.09.23 by CBDT Circular No.6 of 2023 is not applicable for making application under Clause (iii) to First Proviso to section 80G(5) of the Act.

5. 3 In our humble understanding, if the view of the ld. CIT(Exemption) is accepted to be correct, then no institution which has already been into charitable activities before seeking provisional approval under Clause (iv) to First Proviso to section 80G(5) of the Act would ever be entitled to grant of final registration under Clause (iii) to First Proviso to section 80G(5) of the Act even after grant of provisional approval, which would make the relevant provisions of section 80G(5) otiose and defeat the object and purpose of these statutory provisions.

6. In view of the above discussion, it is held that after grant of provisional approval, the application cannot be rejected on the ground that the institution had already commenced its activities even prior to grant of provisional registration. Under such circumstances, the date of commencement of activity will be counted when an activity is undertaken after the grant of provisional registration either under Clause (i) or Clause (iv) to First Proviso to section 80G(5) of the Act.

7. In the case in hand, the assessee admittedly has applied for final registration after grant of provisional registration under Clause (iv) to First Proviso to section 80G(5) of the Act and therefore, the application filed by the assessee is within limitation period. The issue is otherwise squarely covered by the decision of the Coordinate Bench of the Tribunal in the case of Vivekananda Mission Asram v. CIT (supra) and in the case of “West Bengal Welfare Society v. CIT(Exemption)” (supra) and further by the decision in the case of “Sri Aurobindo Bhawan Trust, Krishnagar v. CIT(Exemption)” order dated 20.02.2024 (Judicial Member herein being the author of the said orders). Therefore, the impugned order of the CIT(Exemption) is set aside and the ld. CIT(Exemption) is directed to grant provisional approval to the assessee under Clause (iii) to First Proviso to section 80G(5) of the Act, if the assessee is otherwise found eligible. The ld. CIT(A) will decide the application for final registration within three months of the receipt of copy of this order. ”

“4.1. It is further directed that, if the assessee is granted final approval by the ld. CIT(E) then, the benefit of approval u/s 80G of the Act, available to the assessee prior to the Amendment brought vide Amending Act of2020, will be deemed to be continued without any break. The assessee will not be deprived of the benefit during the time period falling between 31/03/2021 and the date of grant of provisional approval under clause (iv) i.e., 28/05/2021, due to technical errors occurred in making the application under the relevant provisions of the Act because of the confusion and misunderstanding on part of the assessee as well as on part of the ld. CIT(E) in properly interpreting the relevant provisions.”