No Addition for Explained Purchases Even if Suppliers are do not appear before AO :

If interest expenditure is disallowed under Section 40(a)(ia) for not furnishing Form 15G/15H, the matter can be remanded for verification of the forms.

Fact -1

- Section: 69C, read with section 145, of the Income-tax Act, 1961

- Title: No Addition for Explained Purchases Even if Suppliers are Unavailable

- Summary in Key Points:

- The Assessing Officer made a 100% addition for purchases from 10 suppliers who did not appear before him, suspecting bogus transactions.

- However, the assessee provided sufficient evidence to prove the genuineness of the purchases and the related export sales.

- The ITAT held that the mere non-appearance of suppliers does not automatically make the purchases bogus, especially when supported by documentary evidence.

- Decision:

- The ITAT ruled in favor of the assessee, deleting the addition made by the Assessing Officer, as there was no evidence to contradict the assessee’s documentation.

Facts -2

- Section: 40(a)(ia) of the Income-tax Act, 1961

- Title: Remand for Verification of Form 15G/15H for Interest Disallowance

- Summary in Key Points:

- The Assessing Officer disallowed interest expenditure claimed by the assessee for not furnishing Form 15G/15H.

- The assessee claimed to have furnished the forms.

- The ITAT remanded the case back to the Assessing Officer to verify the existence and validity of the forms.

- Decision:

- The ITAT did not give a final decision but sent the case back to the Assessing Officer for further fact-finding.

IN THE ITAT MUMBAI BENCH ‘G’

Suresh Kishinchand Changwani

v.

Deputy Commissioner of Income-tax

Ms. Kavitha Rajagopal, Judicial Member

and Girish Agrawal, Accountant Member

and Girish Agrawal, Accountant Member

IT Appeal No. 3336 (MUM) of 2024

[Assessment Year 2012-13]

[Assessment Year 2012-13]

NOVEMBER 11, 2024

Bhupendra Shah, CA for the Appellant. Shambhu Yadav, Sr. AR for the Respondent.

ORDER

Girish Agrawal, Accountant Member.- This appeal filed by the assessee is against the order of Ld. CIT(A), National Faceless Appeal Centre (NFAC), Delhi, vide order no. ITBA/NFAC/S/250/2024-25/1065549284(1), dated 11.06.2024 passed against the assessment order passed by the Deputy Commissioner of Income Tax – 23(3), Mumbai, u/s. 143(3) of the Income-tax Act (hereinafter referred to as the “Act”), dated 27.02.2015. for Assessment Year 2012-13.

2. In the grounds raised by the assessee, essentially two issues are involved, first relating to addition of Rs.3,71,36,606/- alleged as non-genuine purchase made from 10 parties and second for disallowance of Rs.13,36,294/- u/s.40(a)(ia) for interest expenditure dis-regarding Forms-15 G/H produced by the assessee during the remand proceedings.

3. Brief facts of the case are that assessee is engaged in the business of cloth merchant as a proprietor in the name and style of M/s. Suresh Synthetics. He filed his return on 29.09.2012 reporting total income at Rs.35,95,489/. Assessment was completed by making the aforesaid two additions mentioned in the grounds raised by the assessee for which ld. AO also rejected the books of account u/s. 145(3).

3.1. In respect of the first ground, ld. AO had noted that assessee had claimed purchases for which amounts remained outstanding during the year. In order to verify genuineness of purchase transaction, notices u/s.133(6) were issued to 17 parties from whom assessee had made purchases. Out of these, notices pertaining to 10 parties were returned back for which the value of purchases totalled to Rs.3,71,36,606/-. List of these 10 parties is as under:

| Sr. No | Name | Purchase | Outstanding |

| 1. | Vista Trading Co | 38,36020 | 38,36,020 |

| 2. | United Enterprise | 72,44,800 | 72,44,800 |

| 3. | M / s Swastik Textile | 18,41,424 | 18,41,424 |

| 4. | Shamuk Trading P. Ltd. | 22,86,875 | 22,86,875 |

| 5. | M / s. Royal Traders | 5081090 | 5081090 |

| 6. | M/s. Ritik Textiles | 69,92,500 | 69,92,500 |

| 7. | M / s Radhaswami Textiles | 18,81,320 | 18,81,320 |

| 8. | Paras Enterprises | 40,47,875 | 40,47,875 |

| 9. | M/s Neel Kamal Corporation | 24,75,150 | 24,75,150 |

| 10. | M/s. Nayana Fabrics | 14,49,552 | 14,49,552 |

| 3,71,36,606 |

3.2. Current/new addresses for these 10 parties were called for and assessee was also required to produce them in person, to establish their genuineness by the assessee. Notices u/s. 133(6) were once again issued on the new addresses provided by the assessee which also were returned unserved. Ld AO caused an enquiry conducted through inspectors, based on which it was noted that addresses given by the assessee were either fictitious or no such entities exist on those addresses. For the adverse view taken by the ld. AO, he also noted that assessee does not maintain stock register and confirmation letters produced by the assessee were incomplete. Ld. AO, though acknowledging furnishing of ledger accounts and bank statements, observed that reply filed by the assessee is not satisfactory and he has failed in discharging his onus of proving the genuineness of purchases made. Ld. AO rejected the book result shown by the assessee and thus made the addition as stated above.

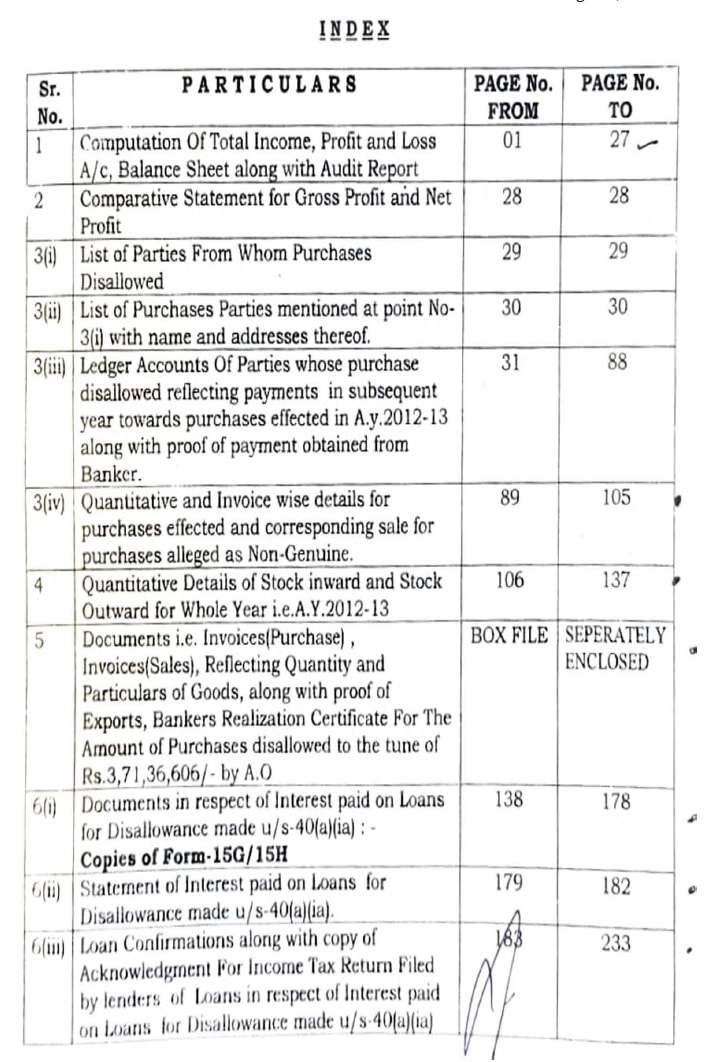

3.3. Aggrieved, assessee went in appeal before the ld. CIT(A). Assessee made all the submissions and explanations along with corroborative documentary evidences. In this respect, index of the paper book containing 233 pages furnished before the ld. CIT(A) under an acknowledged rubber stamp dated 06.04.2016 is extracted below, which is also placed in the paper book before us.

3.4. Assessee also made a detailed written submission in the first appellate proceedings which are reproduced by the ld. CIT(A). In the paper book furnished by the assessee, ld. CIT(A) observed that he has filed additional evidences and thus a remand report was called from the ld. AO by issuing a letter dated 07.06.2016. In this letter, ld. CIT(A) has observed that “The appellant has claimed that these documents were presented in paper compilation during the assessment proceedings. The appellant has also claimed that such documents were also submitted by him during the assessment proceedings for AY 2013-14 and the Assessing officer has accepted the book results after making due verifications.” Contrary to this observation, in para – 2 of the same letter, ld. CIT(A) noted that the documents were probably produced before the ld. AO but were not verified. He thus, asked the ld. AO to examine the additional evidences and submit a report to his office. Ld. AO furnished a remand report dated 04.09.2017, wherein he noted that “The assessee’s submission were duly considered by the ld. AO during the assessment proceedings, and as the assessee has not provided any fresh evidence, the views of the ld. AO are acceptable”.

3.5. Assessee was given an opportunity to file his rebuttal in which he strongly submitted that assessee had furnished all the documentary evidences and has been rightfully accepted by the ld. AO that these are not additional evidences. However, in respect of non-filing of Form 15-G/H, assessee re-presented the said forms. These assertions made by the assessee have been acknowledged by the ld.CIT(A) in his para 6.3.1. which is reproduced as under:

“6.3.1 In the Report submitted by the Assessing Officer vide his letter dated 18.02.2020, the Assessing Officer stated that the appellant had not furnished any new / additional evidence during the appellate proceedings, the documents furnished were already available in the file of the assessing officer while completing the assessment u/s 143(3) of the Act. In the rejoinder to the remand report, the appellant had stated that default of suppliers should not be harshly penalized to the extent of 100% since there was genuine export of goods. With regard to the disallowance u/s 40(a)(ia), the appellant had submitted that Form 15 G/H have been submitted.”

4. On the first issue relating to alleged bogus purchases, ld. CIT(A) held these entries as in the nature of arranged accommodation entries and agreed with the ld. AO on rejecting the books of accounts and bringing this amount to tax as unexplained purchases. He held so on account of non-filing of details asked for, non-production of purchasers, so as to conclusively prove the genuineness of the purchases made. In respect of the second issue relating to disallowance u/s. 40(a)(ia), he sustained the same in absence of production of any documentary evidences. Thus, the appeal was dismissed. Aggrieved, assessee is in appeal before the Tribunal.

5. Before us, ld. Counsel for the assessee asserted that assessee is a 100% exporter and all of its sales are subjected to scrutiny by the customs authority when goods cross the boundaries of the country. According to him, movement of goods are under bill of entry along with export invoice, packing list, delivery challan and shipping bills. He also referred to mapping of bill to bill purchase with the export sales made by the assessee as well as bill to bill stock of input and output from all the suppliers reconciling them with opening and closing stock. Statement for this mapping for each of the suppliers is placed in the paper book at page No. 28 to 41, wherein item to item purchased is mapped with the export sales done by the assessee. Ld. Counsel also referred on a sample basis to the other corresponding documentary evidences which includes sales invoice, custom shipping bill for export, bank realisation certificate, bill of lading to demonstrate the genuineness of purchase transactions claimed by the assessee. Ld. Counsel also referred to the ledger accounts of each of the suppliers placed in the paper book as well as RBI RTGS settlement report for the payments made to these suppliers through banking channel which also establishes genuineness of the purchases made.

5.1. He also contended that in the subsequent year AY 2013-14, similar purchase transactions were made from the same parties. This Assessment Year was subjected to scrutiny assessment u/s. 143(3) wherein certain disallowances were made but not relating to the purchases from the same parties as in the present case. Matter went in appeal before the ld. CIT(A) for the disallowances made and were allowed. Thus, Department has accepted the purchases from the same parties in the subsequent year which in itself establishes the case of the assessee for genuineness of the purchases so made.

5.2. The ld. Counsel placed reliance on judicial precedents of Hon’ble Jurisdictional High Court of Bombay in the case of CIT v. Nikunj Eximp Enterprises Pvt. Ltd., [2013] 372 ITR 619 (Bombay)(Bom) wherein it was held that sales supported by purchase and payment made through bank, merely because suppliers had not appeared before the ld. AO, purchase could not be rejected as bogus. He also placed reliance on the decision of the Hon’ble Jurisdictional High Court of Bombay in the case of Mohommad Haji Adam & Co. (Bombay), wherein it was held as under:

“8 In the present case, as noted above, the assessee was a trader of fabrics. The A.O. found three entities who were indulging in bogus billing activities. A.O. found that the purchases made by the assessee from these entities were bogus. This being a finding of fact, we have proceeded on such basis. Despite this, the question arises whether the Revenue is correct in contending that the entire purchase amount should be added by way of assessee’s additional income or the assessee is correct in contending that such logic cannot be applied. The finding of the CIT(A) and the Tribunal would suggest that the department had not disputed the assessee’s sales. There was no discrepancy between the purchases shown by the assessee and the sales declared. That being the position, the Tribunal was correct in coming to the conclusion that the purchases cannot be rejected without disturbing the sales in case of a trader. The Tribunal, therefore, correctly restricted the additions limited to the extent of bringing the G.P. rate on purchases at the same rate of other genuine purchases.”

6. In the present case, since assessee has placed on record all the corroborative documentary evidences which remain uncontroverted and no discrepancy has been found from the said material as well as no defects have been pointed out. Reliance was placed on the decision of the Hon’ble Supreme Court in the case of CIT v. Odeon Builders Pvt. Ltd. [2019] 315 (SC), wherein it was held that, where assessee had submitted purchase bills, transportation bills, confirmed copy of accounts and VAT registration of sellers as also their income tax return and payment was made through cheques, impugned purchases cannot be disallowed. According to the ld. Counsel in the present case, there are no VAT implications in the year under consideration since VAT was not applicable on textile.

6.1. On the first issue, we have considered the submissions made before us and perused the material on record along with judicial precedents relied upon. In the tax audit report placed on record, assessee has reported gross profit rate of 6.84% and net profit rate of 1.73%. Ld. AO made 100% addition on account of purchases from 10 parties which were not produced before him in the course of assessment. However, for the same, assessee has placed on record all the corroborative documentary material to establish the genuineness of purchases, mapping them to the export sales made by him, each item wise. In these documents placed in the course of assessment proceedings as well as remand proceedings taken up by ld. CIT(A), no defects or discrepancies have been pointed out. Assessee has claimed that default of suppliers who could not be produced should not have such a harsh implication on the assessee by making a 100% disallowance of the purchases made from them. In such circumstances, it has been held in various judicial precedents as already stated above that only a certain percentage of profit element on such alleged bogus purchases could be made for bringing the profit element to tax. We also take into consideration the fact that Revenue has accepted the purchases made from the same parties in the subsequent year which was subjected to scrutiny assessment u/s. 143(3).

6.2. The issue before us is in respect of establishing the genuineness of purchases made by the assessee from the ten parties who did not respond to notices issued u/s. 133(6) and could not be produced in the course of impugned assessment proceedings. In this respect, assessee had adequately demonstrated with all the corroborative documentary evidences about the genuineness of purchase transaction against which export sales have been undertaken and sales consideration realised through proper banking channels. Merely because the suppliers did not appear before the ld. AO or Ld. CIT(A), it cannot be concluded that the purchases were not made by the assessee.

6.3. For this, we find force from the decision of the Hon’ble High Court of Bombay in the case of Nikunj Eximp Enterprises Pvt Ltd. (supra). Further, Hon’ble Jurisdictional High Court of Bombay in the case of Mohommad Haji Adam & Co.(supra), it is observed that purchases cannot be rejected without disturbing the sales in case of a trader. The addition in such cases can be restricted to the extent of bringing GP rate of purchases at the same rate of other genuine purchases. Further, Hon’ble Supreme Court in the case of CIT v. Odeon Builders (P.) Ltd has held that once assessee has submitted all the necessary details in terms of purchase bills, transportation bills, confirmed copy of accounts and payment are made through cheques, then such purchases cannot be disallowed.

6.4. In the given set of facts as discussed above in detail and considering the judicial precedents referred above, we delete the addition made by the ld. AO in respect of purchases made from the 10 parties which were held as non-genuine purchases, since nothing cogent have been brought on record to controvert the corroborative documentary evidences placed on record and pointing out any discrepancies or defects in the same. Accordingly, ground no.1 taken by the assessee is allowed.

7. On the second issue, ld. Counsel asserted that interest was paid by the assessee on the unsecured loans obtained by him. The loan transactions are not in dispute. In fact, even the interest expense is also not in dispute. Disallowance has been made u/s. 40(a)(ia) for not furnishing Form-15G/H though according to the assessee, these have been furnished before the authorities below. Assessee has placed on record, loan confirmation letters from the parties to whom interest payments have been claimed. Assessee has placed on record Form -15G/H in the paper book before us along with details of loans and their confirmation letters.

7.1. Since authorities below have recorded non furnishing of these documents before them, we find it appropriate to remit this issue before the file of ld. Jurisdictional Assessing Officer (JAO) for the limited purpose of verification of Form – 15G/H in respect of the disallowance made u/s. 40(a)(ia). Ld. JAO is directed to verify and examine the same and if found proper in accordance to the provisions of the law, consider the claim of the assessee, accordingly. Thus, ground no.2 raised by the assessee is allowed for statistical purposes.

8. In the result, appeal of the assessee is allowed.