ORDER

Anadee Nath Misshra, Accountant Member.- These appeals and Cross Objections pertaining to Jeevan Jyoti Group of cases are being disposed of through this consolidated order. Grounds taken in appeals and Cross Objections are as under:

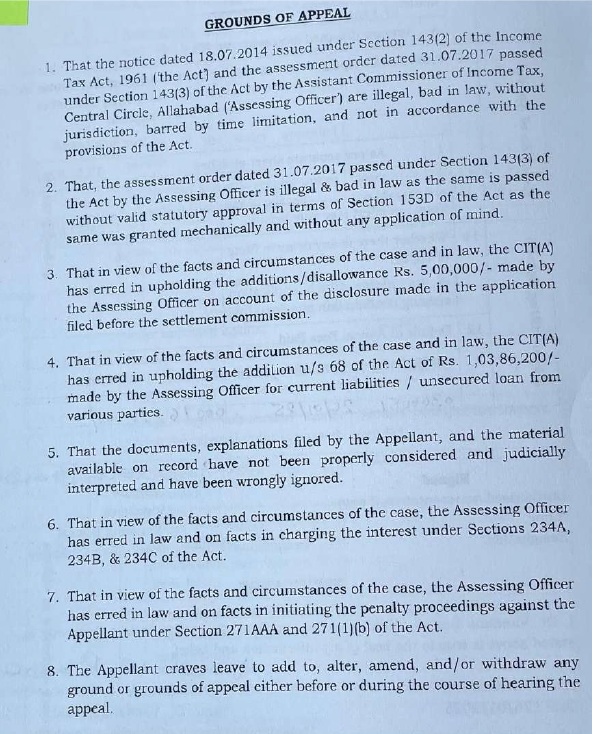

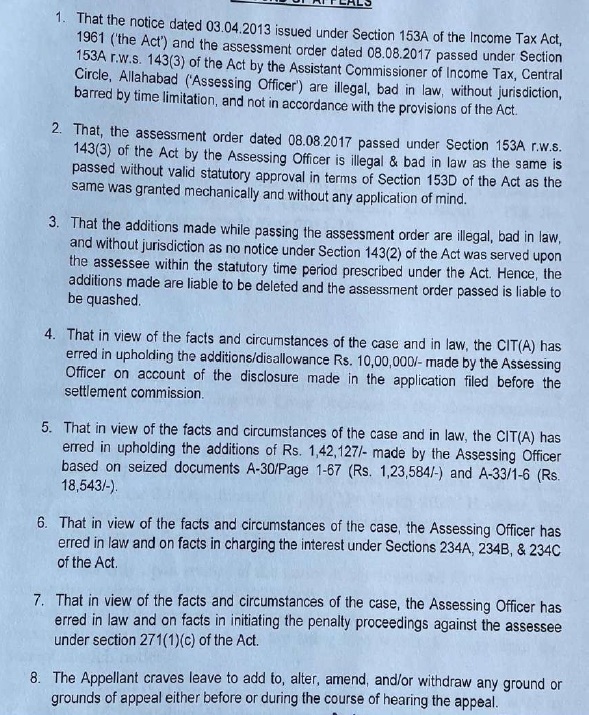

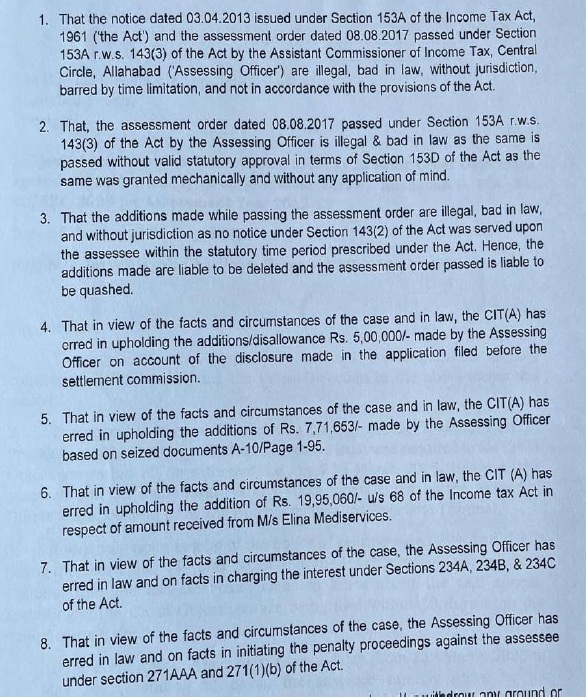

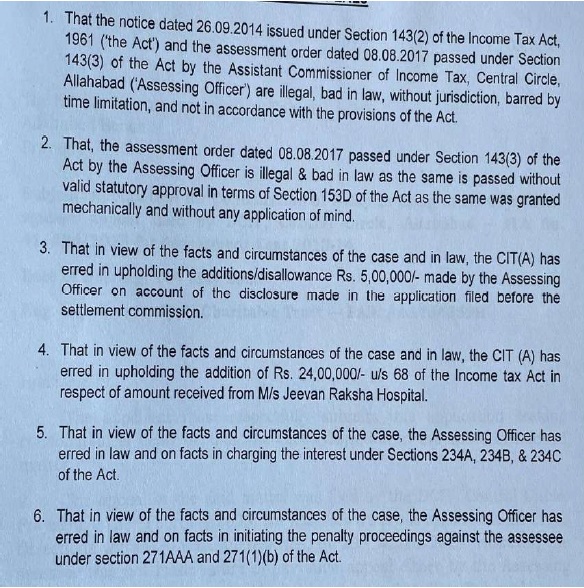

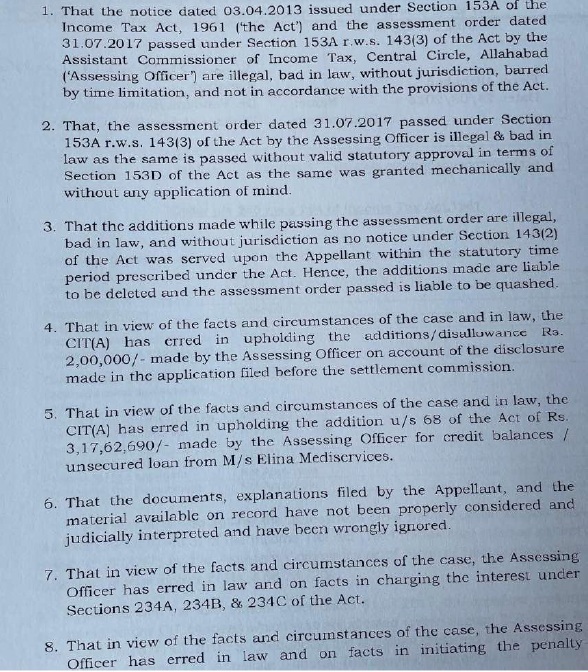

I.T.A. No.337/Alld/2018 (Assessment year 2009-10)

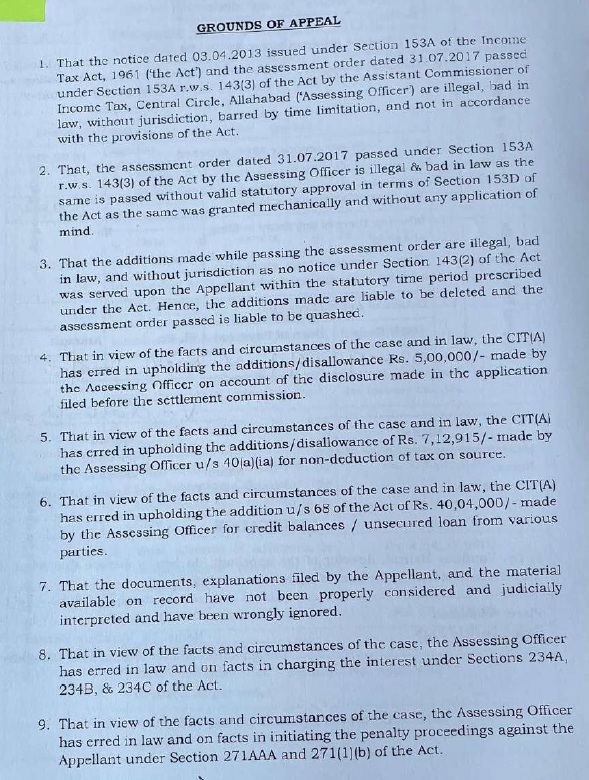

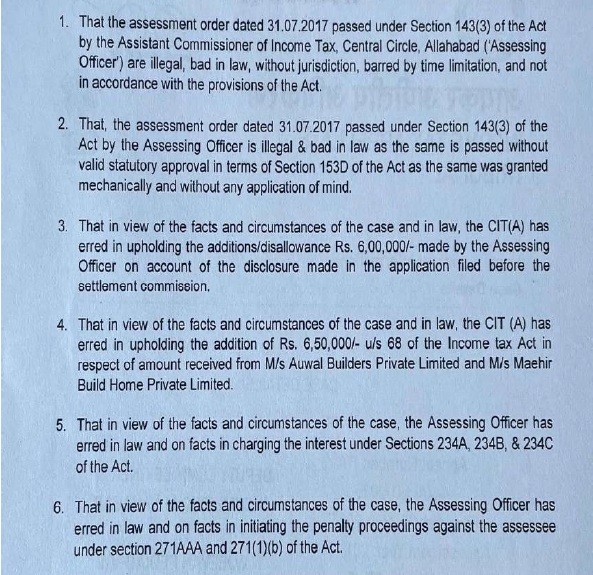

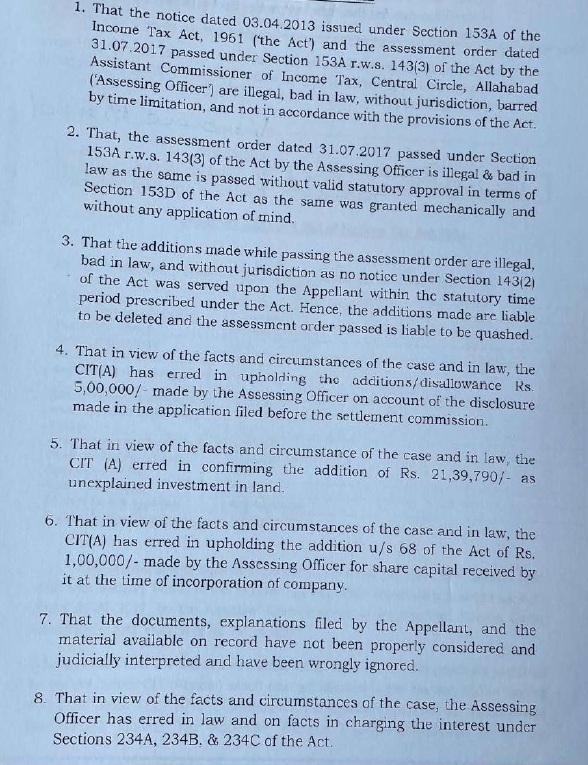

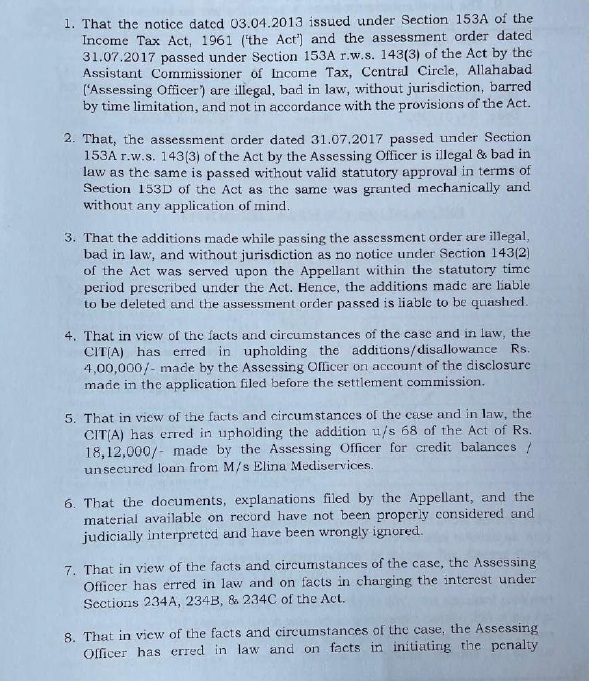

I.T.A. No.34/Alld/2019 (Assessment year 2007-08)

I.T.A. No.35/Alld/2019 (Assessment year 2008-09)

I.T.A. No.36/Alld/2019 (Assessment year 2009-10)

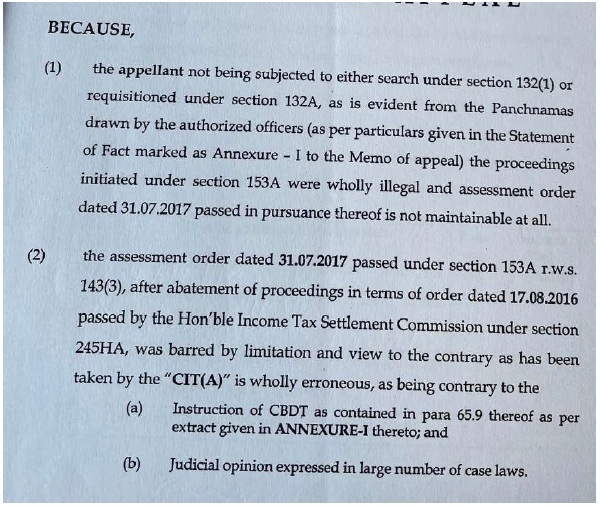

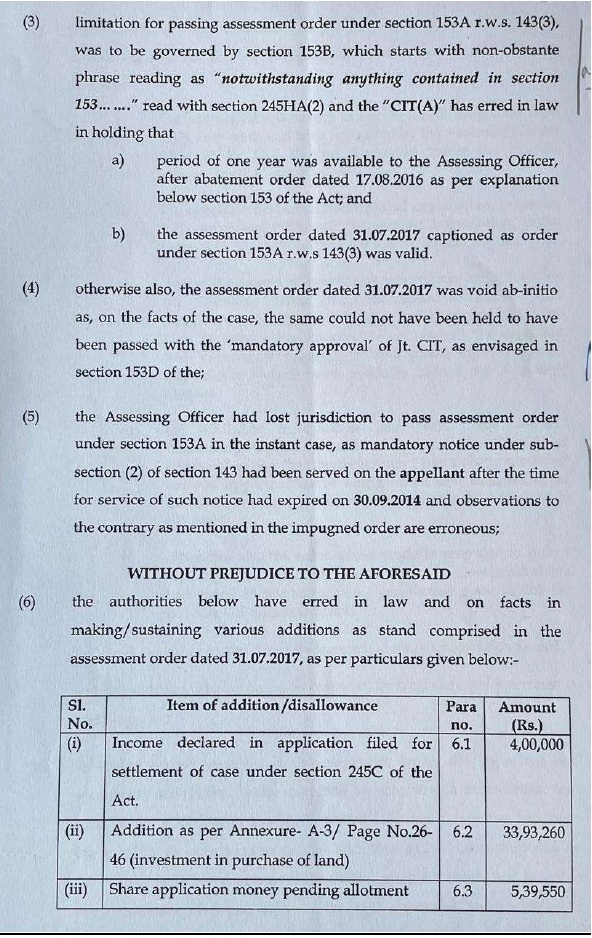

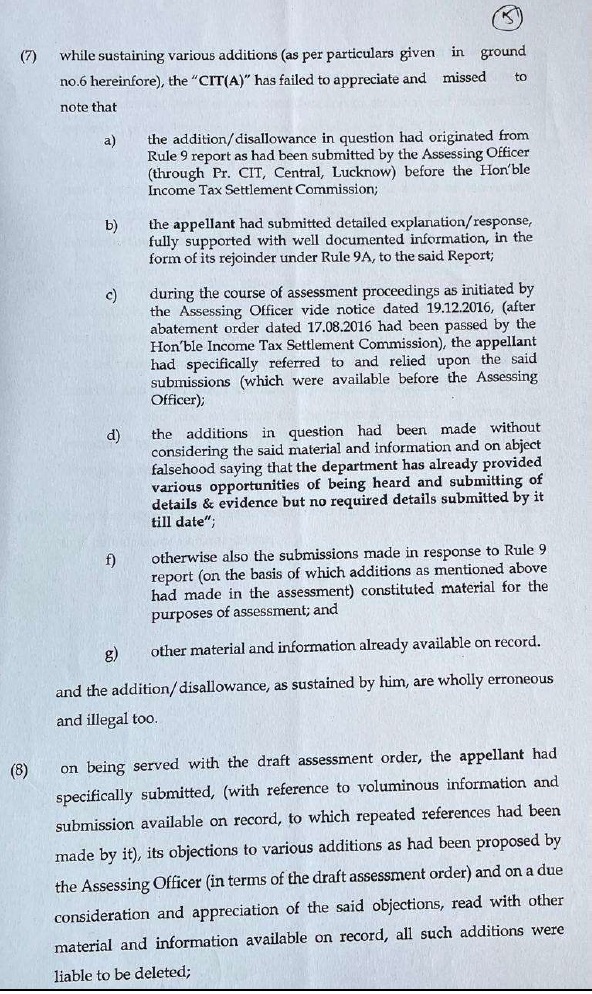

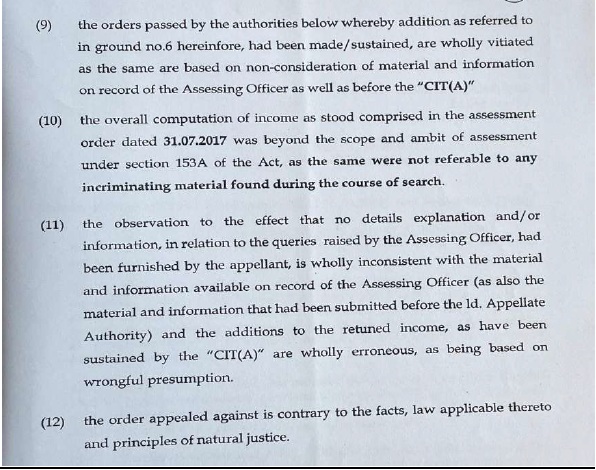

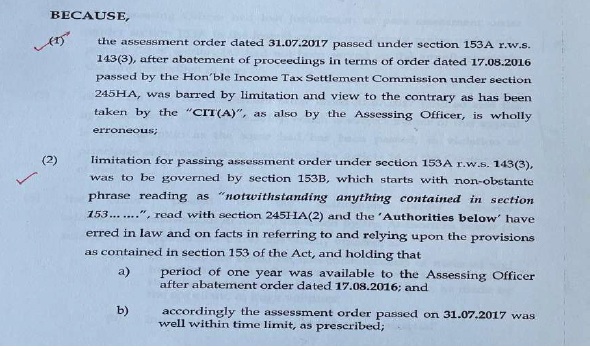

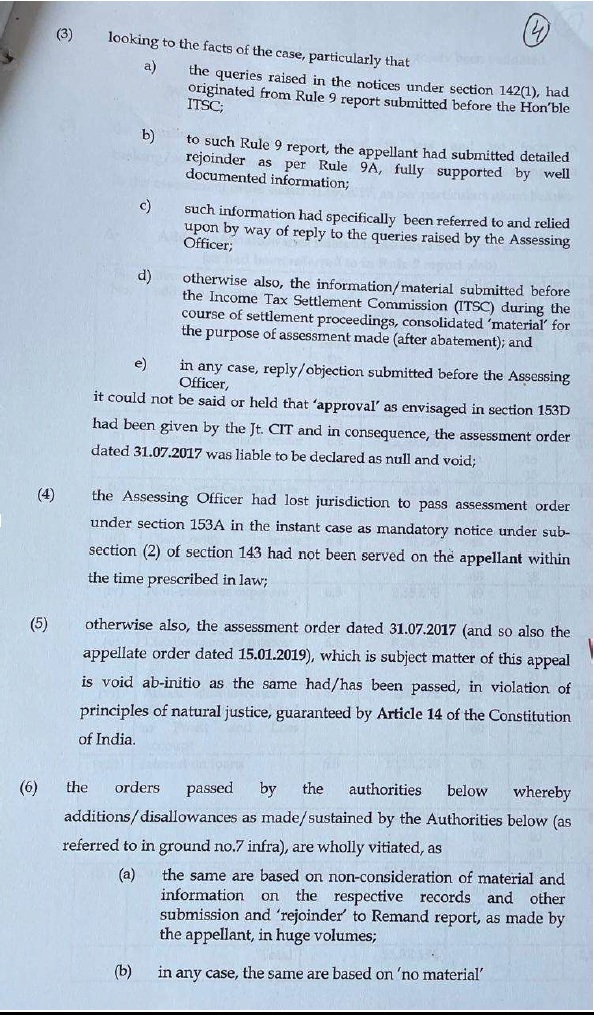

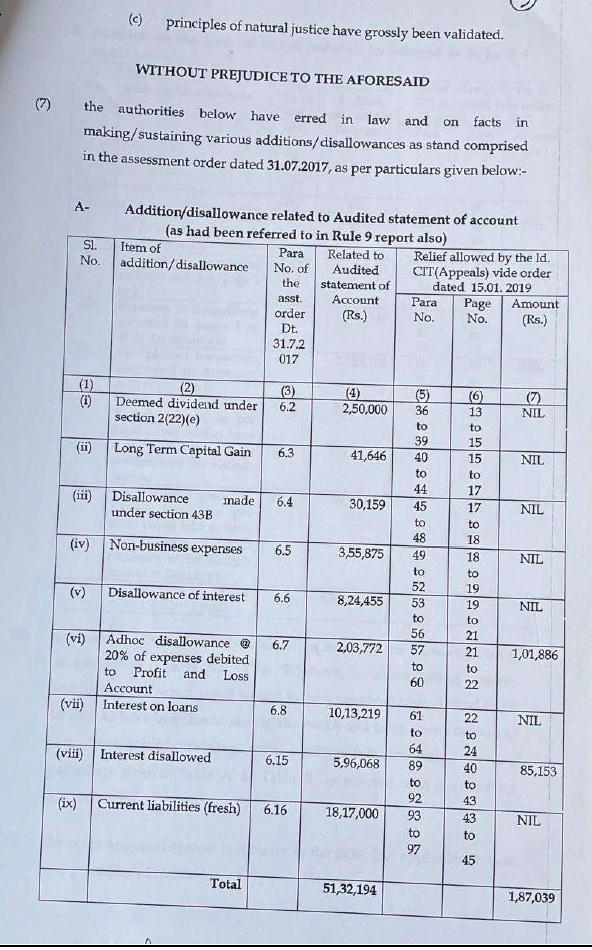

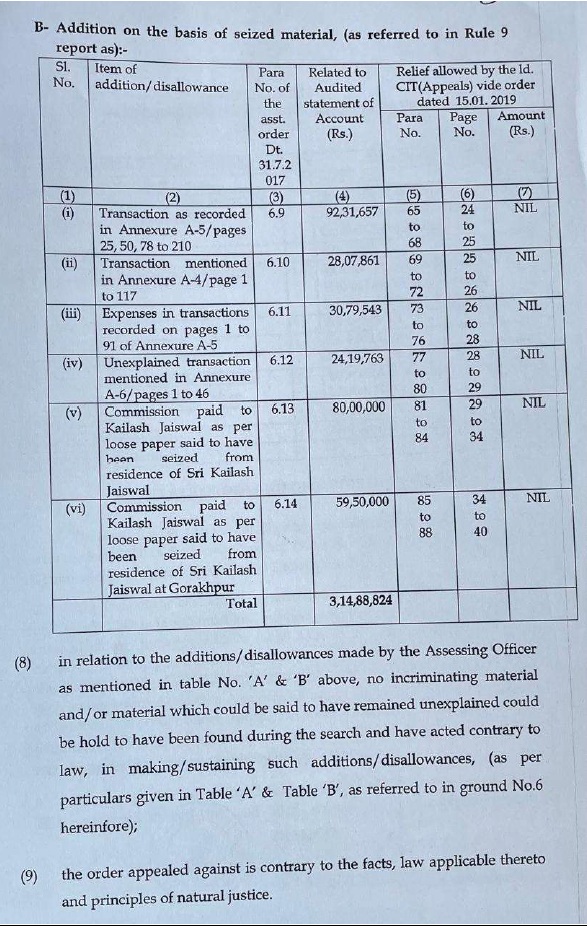

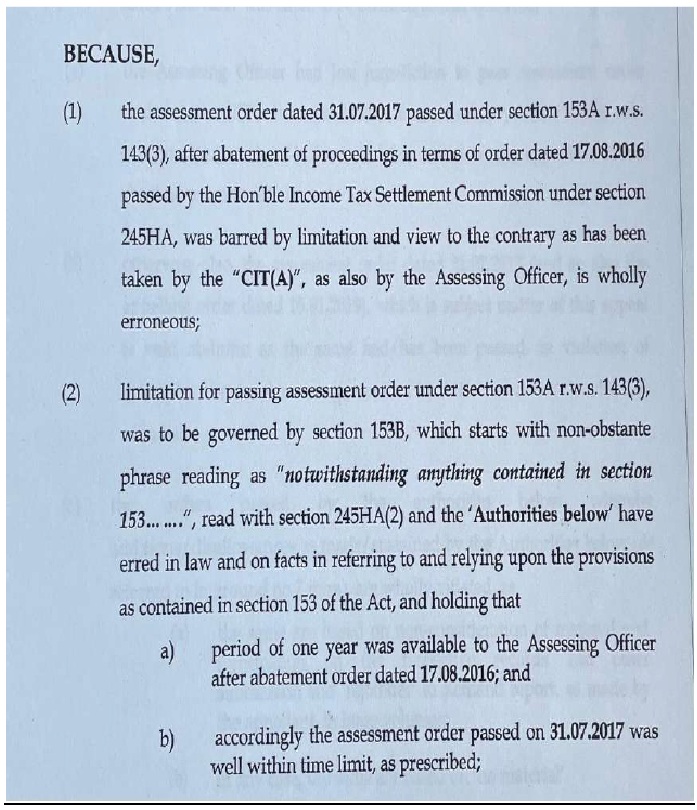

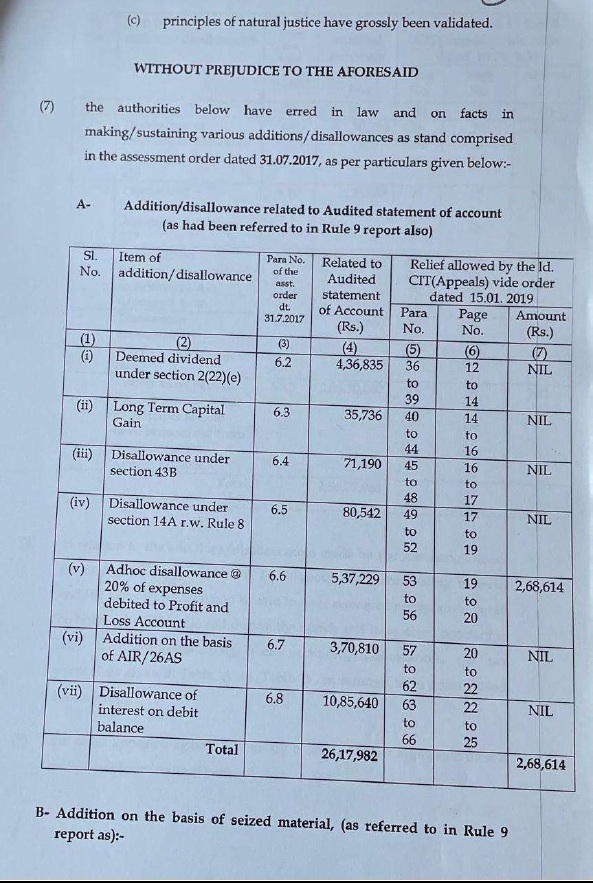

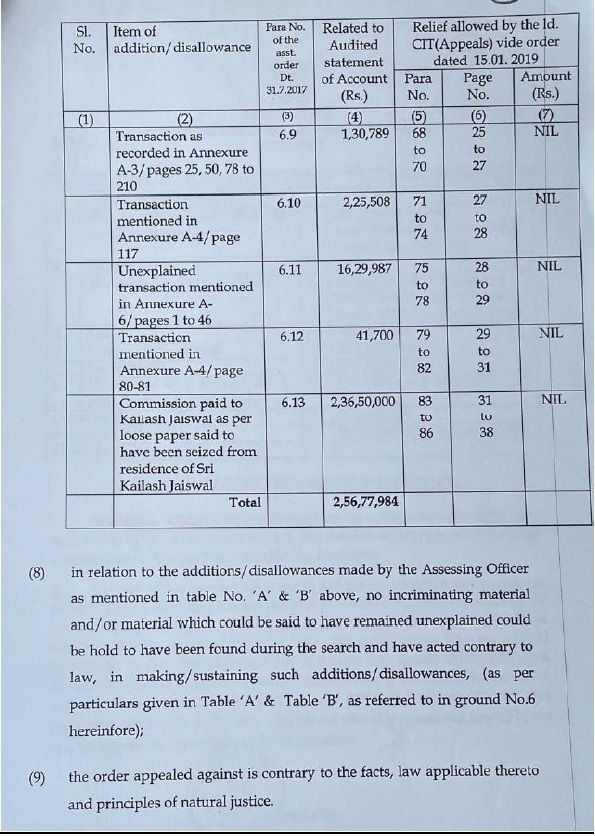

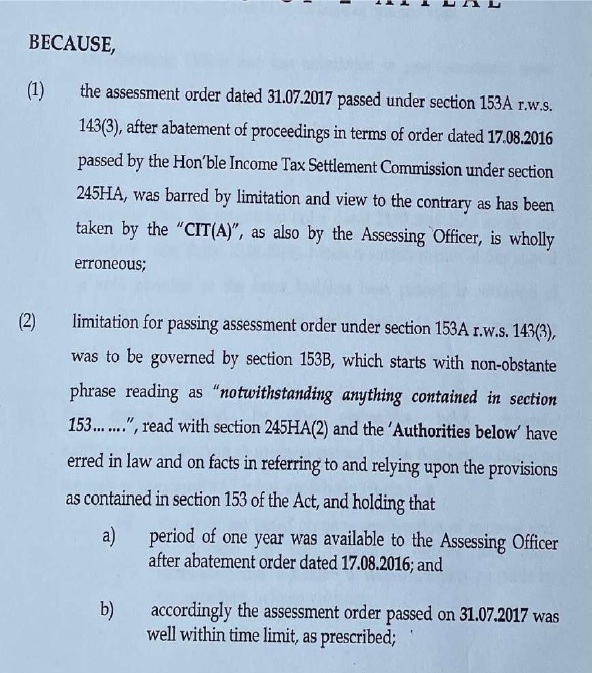

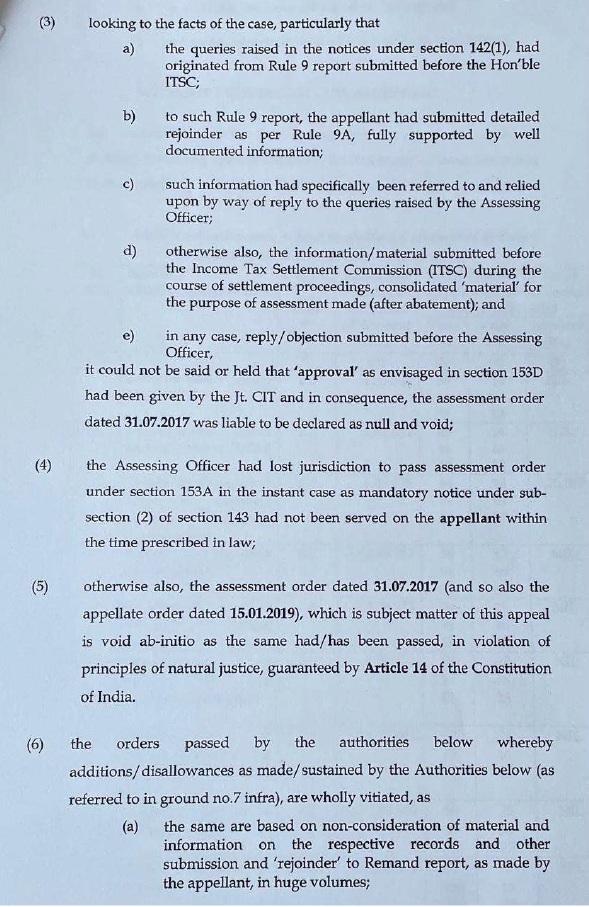

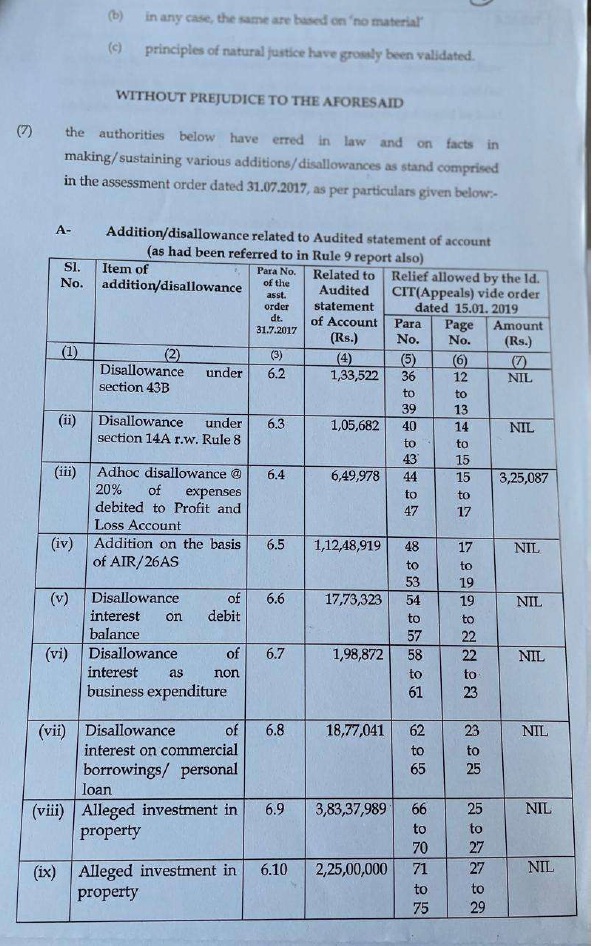

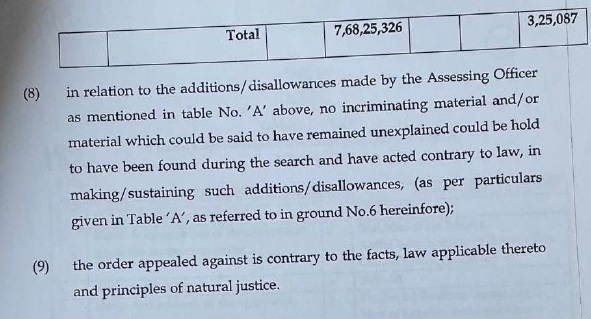

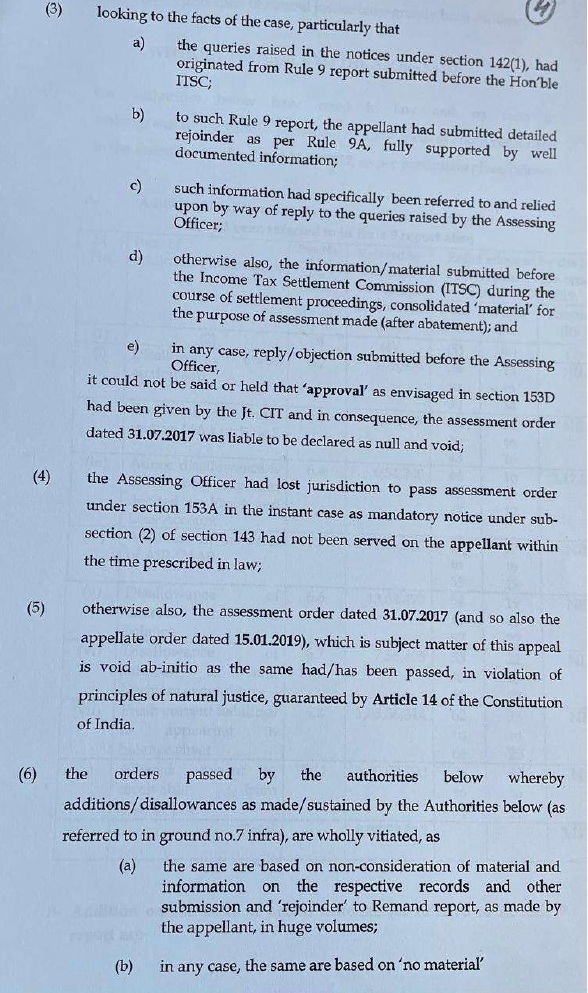

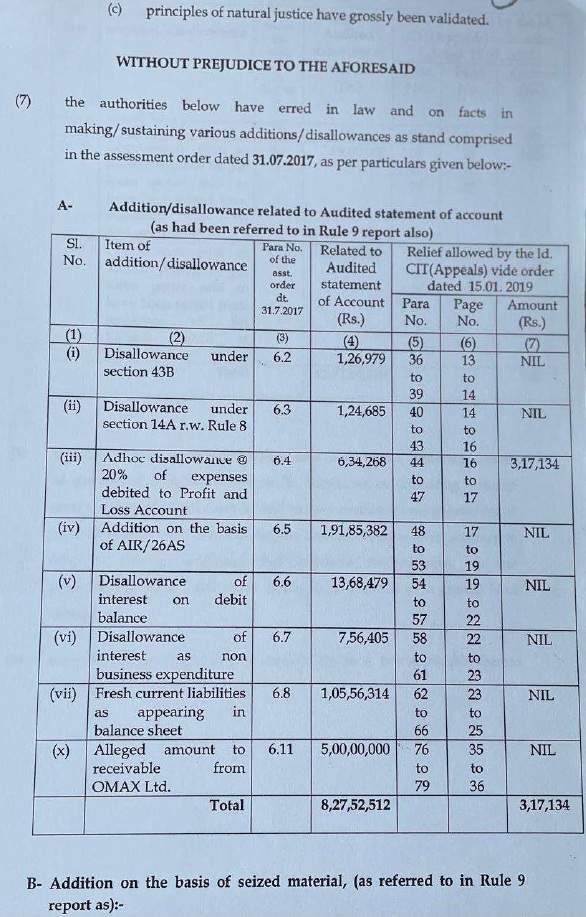

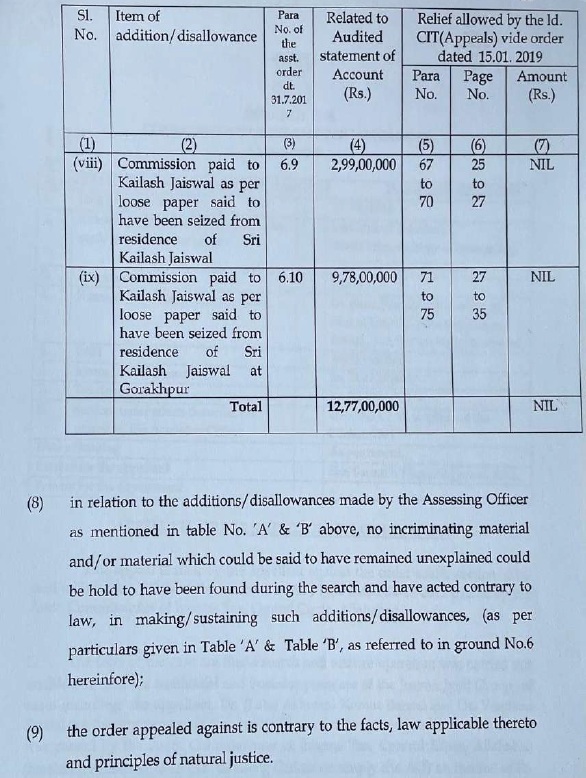

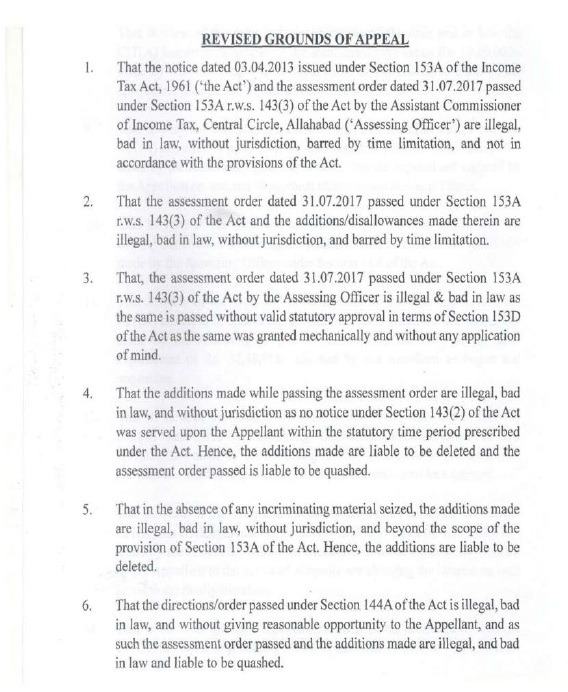

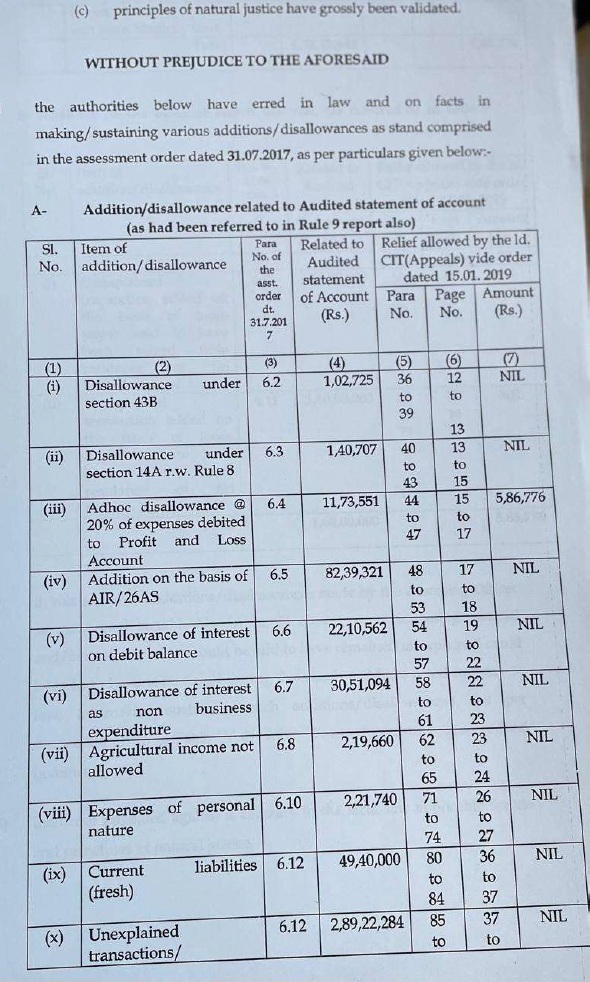

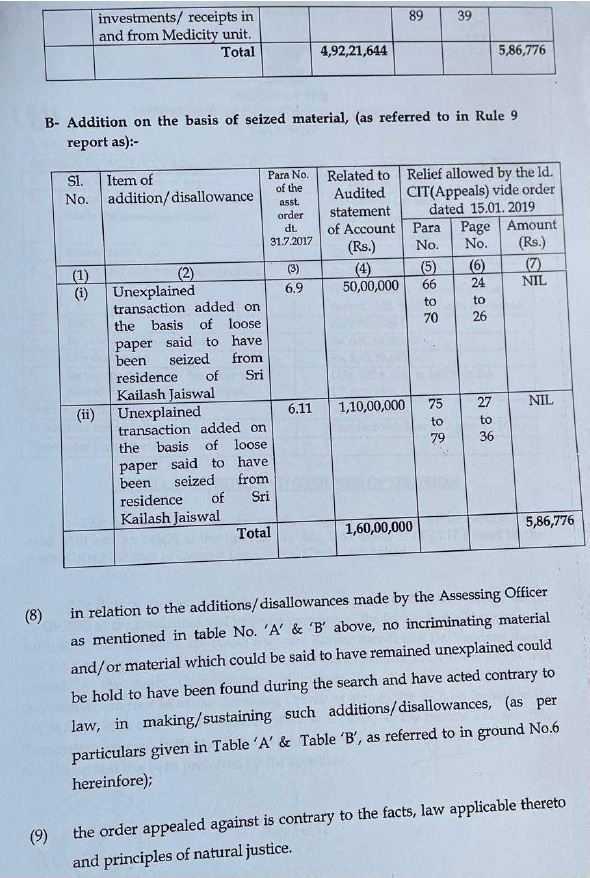

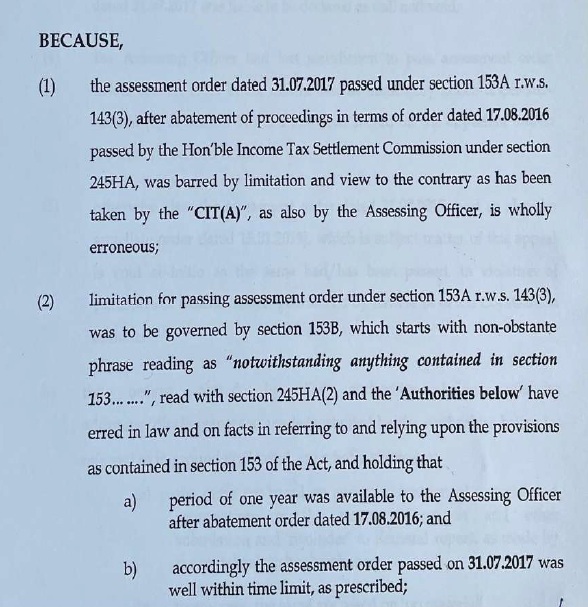

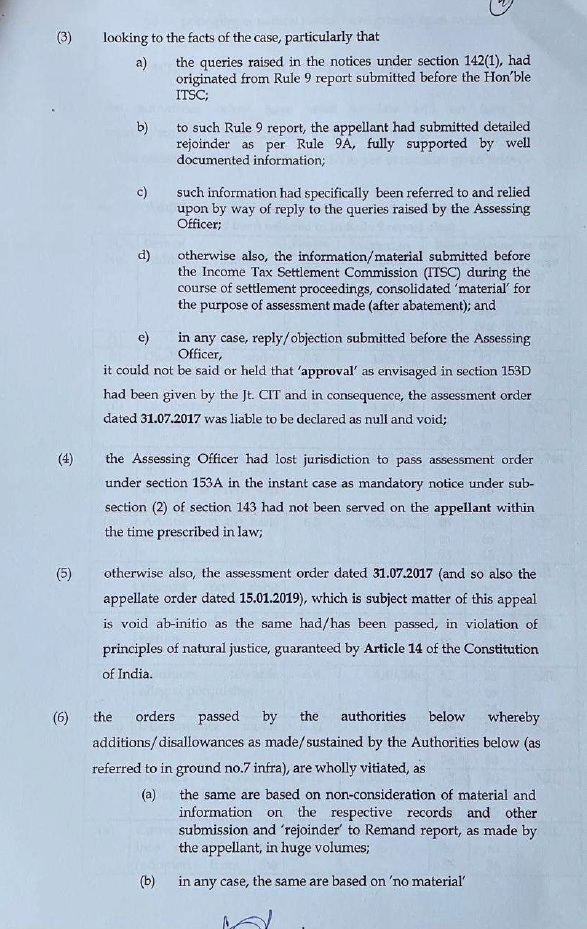

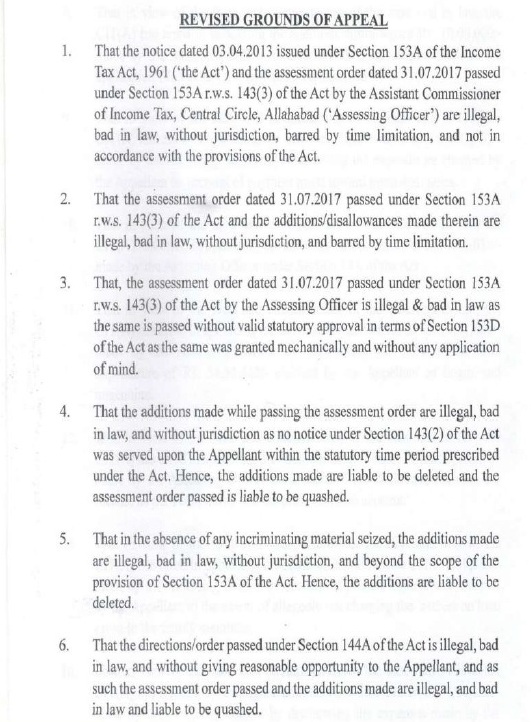

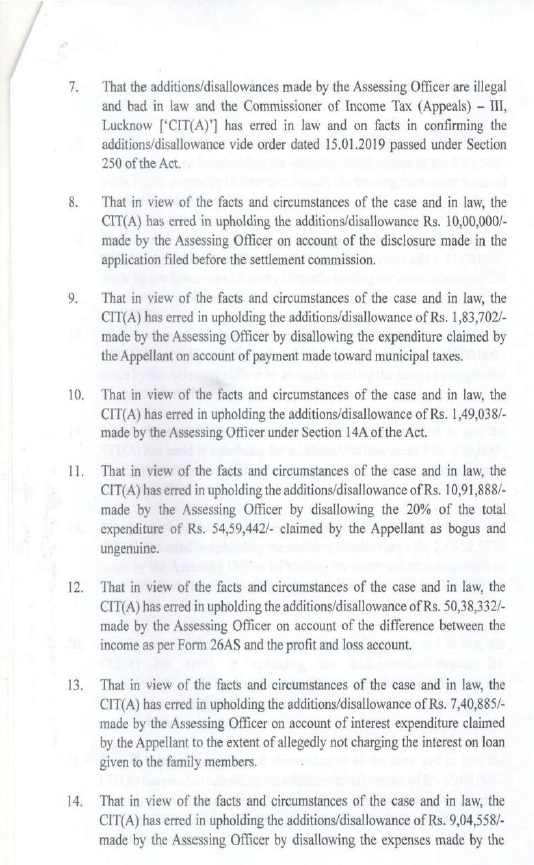

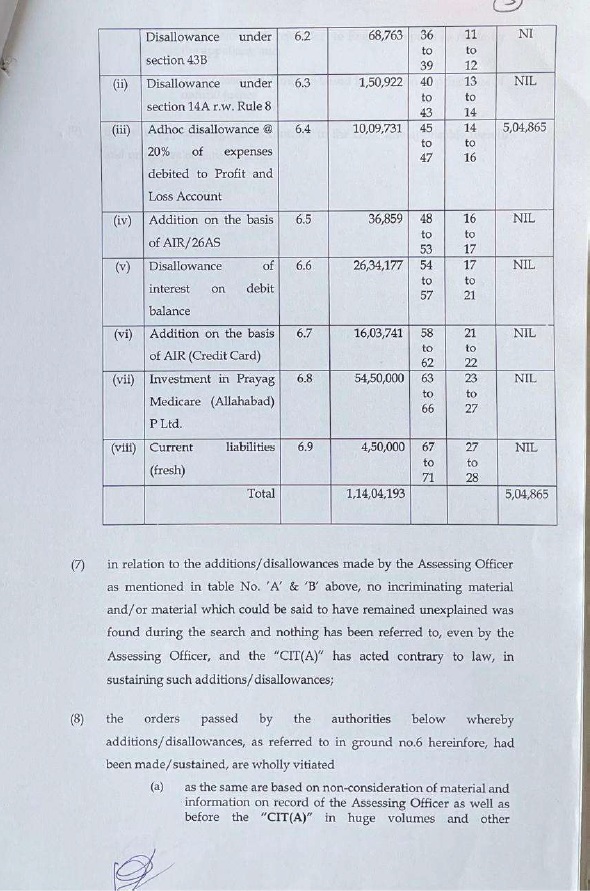

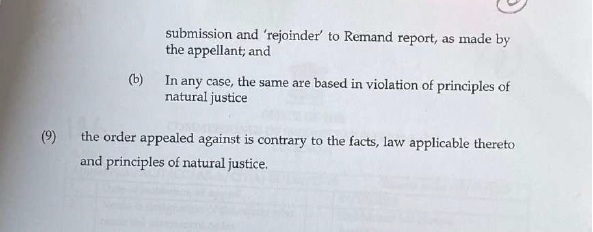

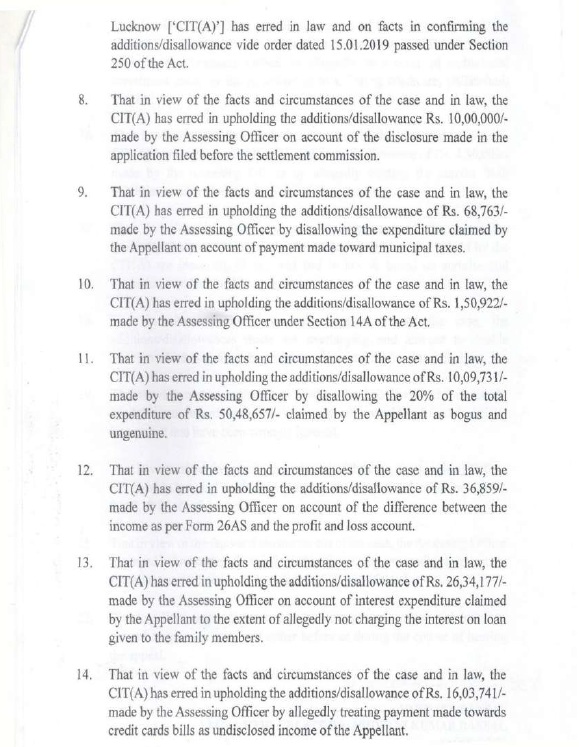

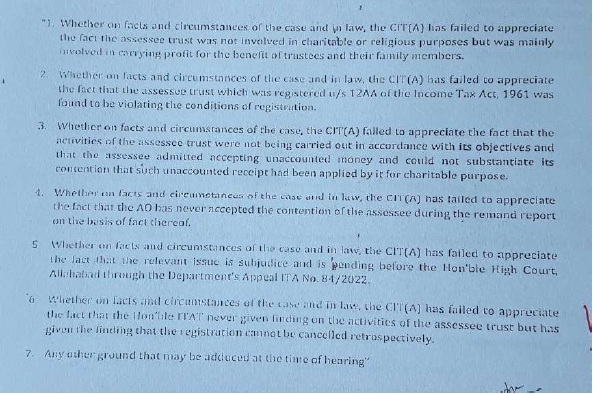

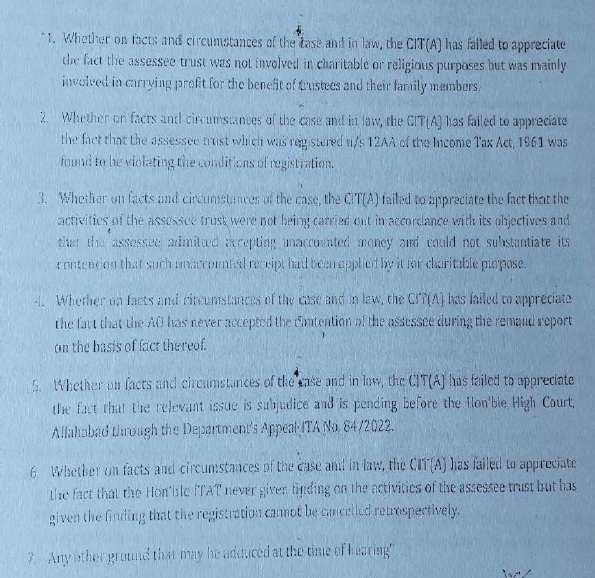

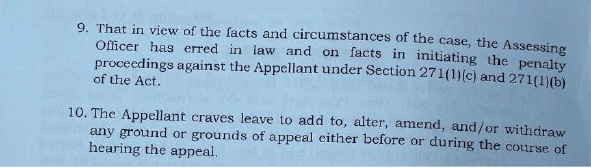

REVISED GROUNDS IN I.T.A. No.36/Allahabad/2019

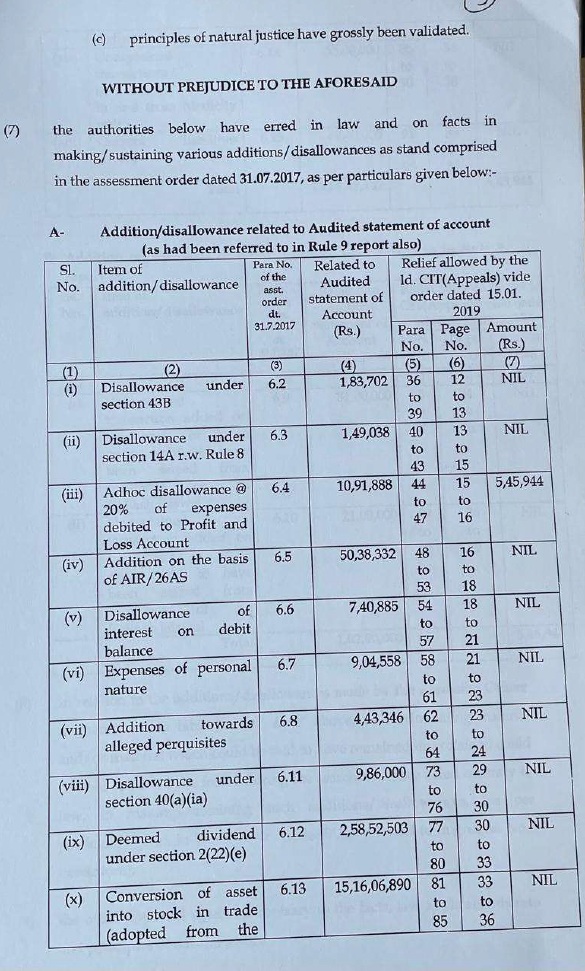

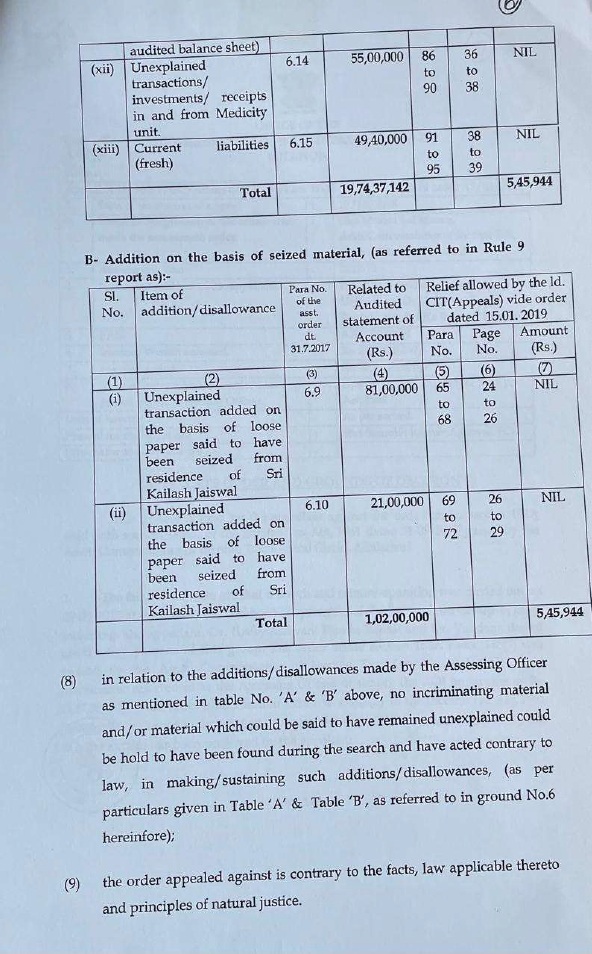

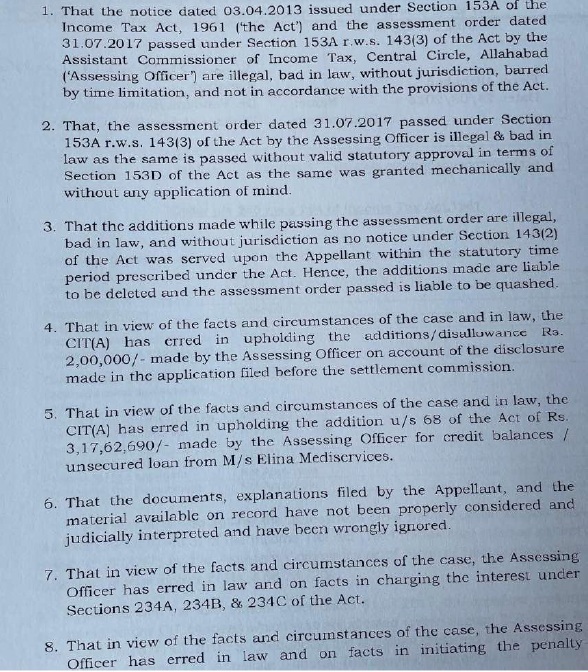

I.T.A. No.37/Alld/2019 (Assessment year 2010-11)

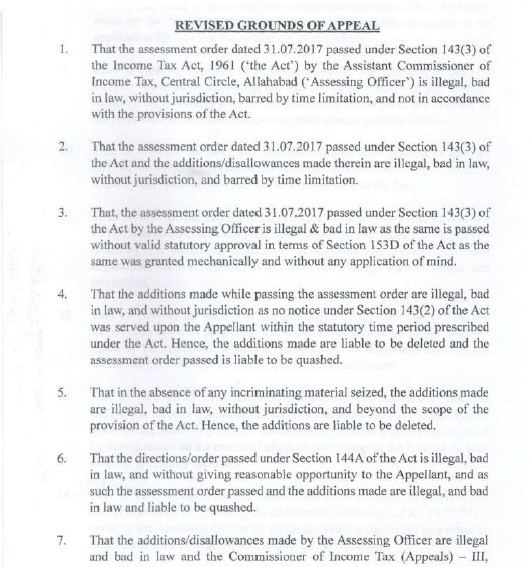

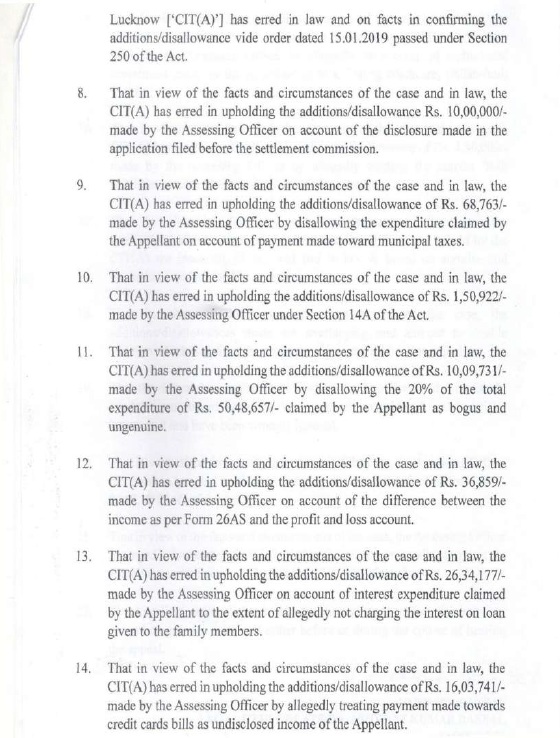

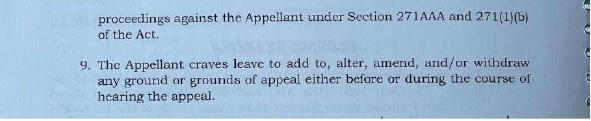

REVISED GROUNDS IN I.T.A. No.37/Alld/2019

I.T.A. No.38/Alld/2019 (Assessment year 2011-12)

I.T.A. No.39/Alld/2019 (Assessment year 2012-13)

REVISED GROUNDS IN I.T.A. No.39/Alld/2019

I.T.A. No.40/Alld/2019 (Assessment year 2013-14)

REVISED GROUNDS IN I.T.A. No.40/Alld/2019

I.T.A. No.13/Alld/2025 (Assessment year 2011-12)

I.T.A. No.14/Alld/2025 (Assessment year 2013-14)

I.T.A. No.39/Alld/2025 (Assessment year 2011-12)

I.T.A. No.40/Lkw/2025 (Assessment year 2012-13)

I.T.A. No.41/Alld/2025 (Assessment year 2013-14)

C.O. NO.02/Alld/2025 (in I.T.A. No.39/Alld/2025)

C.O.No.03/Alld/2025 (in I.T.A. No.40/Allahabad/2025)

C.O.No.04/Alld/2025 (in I.T.A. No.41/Alld/2025)

I.T.A. No.44/Alld/2025 (Assessment year 2013-14)

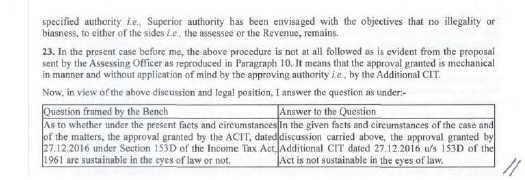

C.O.No.05/Alld/2025 (in I.T.A. No.44/Alld/2025)

I.T.A. No.54/Alld/2025 (Assessment year 2009-10)

I.T.A. No.55/Alld/2025 (Assessment year 2012-13)

I.T.A. No.56/Allahabad/2025 (Assessment year 2012-13)

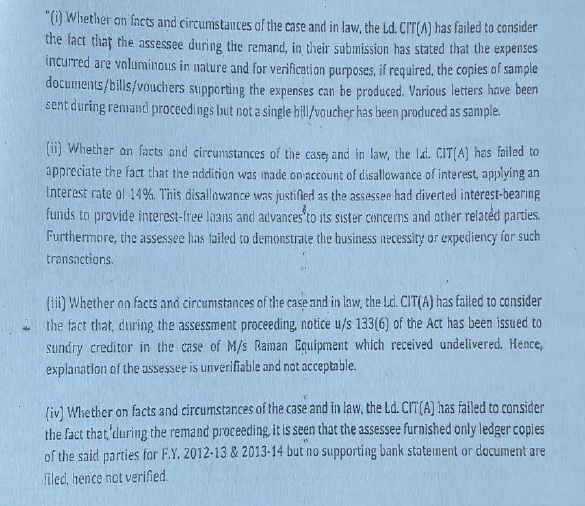

(B) In the case of aforesaid appeals/Cross Objections, pertaining to Arpit Hospital Pvt. Ltd., Jeevan Jyoti Charitable Trust, Navjeevan Pediatrics Pvt. Ltd., Minto Developers Pvt. Ltd. and Jeevan Jyoti Infrastructure Company Private Limited, this is the second round of appeal in Income Tax Appellate Tribunal. In first round of appeal, a consolidated order dated 21/12/2018 was passed by Coordinate Bench of the Income Tax Appellate Tribunal, Allahabad Bench, Allahabad for the aforesaid along with other cases of Jeevan Jyoti Group. In the aforesaid order dated 21/12/2018 of the Tribunal, all the appeals of all the assessees were remitted back to the learned CIT(A), to be decided afresh in accordance with law, on affording due and adequate opportunity of hearing to the assessees and on taking into consideration all the materials filed or to be filed by the assessees. It was further held in the aforesaid order dated 21/12/2018 that all pleas available under the law shall remain so available to the assessees. The appeals of the assessees in Income Tax Appellate Tribunal were remitted back to the learned CIT(A) vide the aforesaid order dated 21/12/2018 on the ground that a few issues were not decided by the learned CIT(A). For the ease of reference, the relevant part of the aforesaid order dated 21/12/2018 of the Income Tax Appellate Tribunal, is reproduced as under:

“4. Apropos grounds No.1 and 2, the assessee contended before the ld. CIT(A) that for the purpose of time limit for framing of assessment order in its case, section 153B of the Income Tax Act, 1961 is the governing provision. The assessee filed written submissions before the ld. CIT(A). These written submissions have been reproduced by the ld. CIT(A) in para 13, at pages 7 to 9 of the impugned order, as follows:-

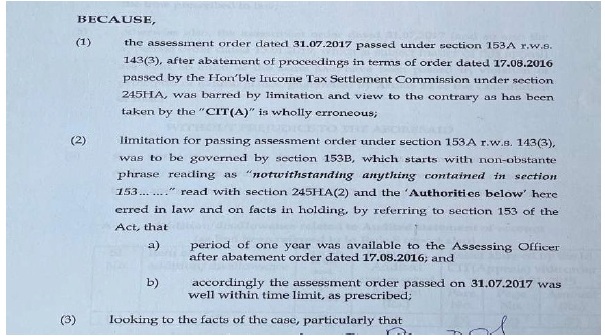

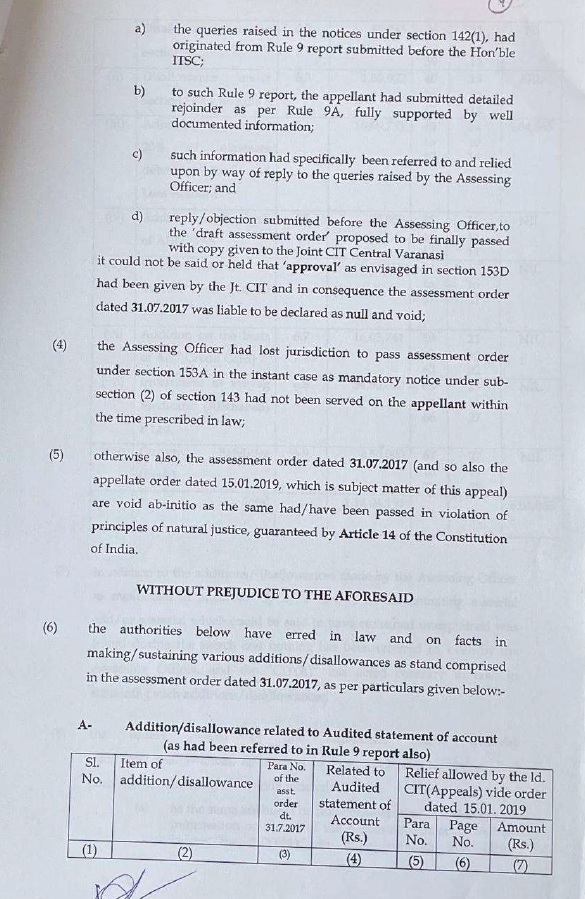

“4. Coming to the ground relating to assessment being barred by limitation, the appellant begs to state that the assessment orders dated 31.07.2017 which are subject matter of appeals before your honour, are barred by limitation. The said objection had been raised before the Assessing Officer and to take the same to a logical conclusion the appellant had filed a petition under section 144A also before the Jt. CIT, Central, Varanasi. The Id. Assessing Officer has discussed the issue in paras 4, 4.2 and 4.3 of the assessment order.

5. Crux of the said discussion of the Assessing Officer is that after the case was abated under section 245HA(1)(iiia) of the Act vide order dated 17.08.2016 (it is wrong at the part of the Assessing Officer to say that the application of the assessee was rejected by the Hon’ble Settlement Commission, in opening line of para 4), copy appearing in the paper book nomenclatured as ‘papers filed before Hon’ble Settlement Commission’, that is being submitted before your honour; the time limit for completion of assessment will have to be reckoned as per section 153 of the Act.

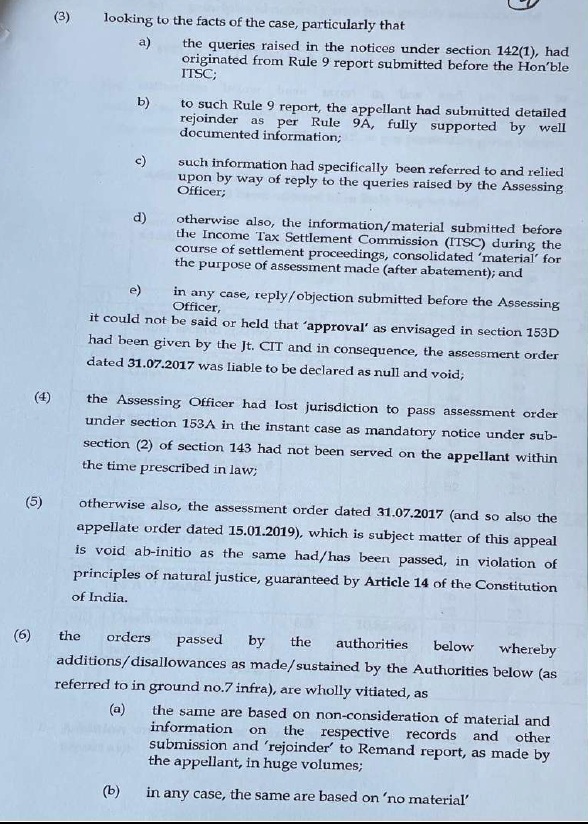

6. As against this the appellant’s contention is that time limit for completion of assessment would be governed by the provisions contained in sub-section (2) of section 274HA with section 153B which starts with non-obstante phrase “(i) Notwithstanding anything contained in section 153….” To elaborate this issue, it is submitted that by virtue of abatement under clause (iiia) of sub-section (1) of ‘section 245HA the appellant got relegated to the stage at which it was at the time of filing the application for settlement of case on 11.02.2015 as per specific provision contained in sub-section (2). On the date of filing the application 48 days were available to the Assessing Officer for completion of assessment (31st March 2015 being the date of time barring). Therefore, as per sub-section (2) only 48 days were available to the Assessing Officer to complete the assessment under section 153A, after abatement. Such period of 48 days had expired on 04.10.2016. It means that latest by 04.10.2016, the assessment should have been completed (after abatement). It is a matter of record that even proceedings for assessment (after abatement) had not been initiated by that date and first notice under section 142(1) was served on the appellant was 19.12.2016. Therefore, the assessment orders dated 31.07.2017 are barred by limitation.

7. The authorities below differed on this issue by relying on the following proviso below section 153:-

Provided further that where a proceeding before the Settlement Commission abates under section 245HA, the period of limitation available under this section to the Assessing Officer for making an order of assessment, reassessment or re-computation, as the case may be, shall, after the exclusion of the period under sub-section (4) of section 245HA, be not less than one year; and where such period or limitation is less than one year, it shall be deemed to have been extended to one year; and for the purposes of determining the period of limitation under sections 149, 153B, 154, 155, 158BE and 231 and for the purposes of payment of interest under section 243 or section 244 or, as the case may be, section 244A, this-proviso shall also apply accordingly.

8. It is submitted with great respect that the non-obstante clause as appearing in section 153B as referred to above shall prevail over section 153 and “time limit of one year would not become available to the Assessing Officer for completion of assessment after abatement under clause (iiia) of section 245HA. Further, in support of appellant’s contention the appellant begs to refer and rely upon legal opinion (as has been submitted before the authorities below also) copy of which appears in the paper book which are being filed separately along with this written submission, description of which is appearing at the end of this submission.

9. In short, the appellant’s submission is that fallacy in rejection is evident by the fact that the same was based on the provision contained in section 153 of the Act and it bus been very conveniently ignored (by the Assessing Officer as well as by your Ld. joint CIT, Central Varanasi) that sections 153A, 153B, 153C and 153D represented ‘complete code’ to deal with search related assessments and, therefore, limitation for completion of assessment as has been specifically provided in section 153B read with section 245HA(2), was liable to be strictly adhered to. it is evident from a plain reading of section 153B itself, which starts with non-obstante phrase reading as “(i) notwithstanding anything contained in section 153”. Thus, there was no ambiguity in the Act for computing time limit for completion of assessment and the only provision contained in section 153B was required to be looked into and nothing beyond this.”

5. The ld. CIT(A) has held as follows:-

“16. In this ground the appellant has contended that once the case got abated in terms of order under section 245HA dated 17/08/2016, passed by Hon’ble ITSC, New Delhi, assessment under section 153A was liable to be completed within the period of 48 days which has expired on 04/10/2016, hence the assessment order dated 31/07/2017 u/s 153A was barred by limitation.

17. On examination, I find that the appellant along with 12 Group cases of “jeevan Jyoti Group” has filed an application before the ITSC, New Delhi in Feb, 2015. After considering the submission of the appellant and the reports of the department, Hon’ble ITSC, New Delhi has passed order u/s 245D(4) of the Act, dated 17/08/201.6. In the said order, Hon’ble ITSC has given finding in Para 30, as under-

“It is clean in this background that the mandate cast upon the commission u/s. 245HA(1)(iiia.) for providing terms of settlement, cannot be discharged. We accordingly allow proceedings pending before us to abate. The matters stand restored to the file of the AO.”

18. On bare reading the provisions of section 153 of the Act, relating to limitation of assessment in cases abated before Settlement Commission, it is clearly evident that The period available to me AO for making assessment, reassessment or re-computation shall be one year from the date of receipt of order passed by the Settlement Commission. The proviso to Explanation 1 of section 153 of the Act is reproduced as under:-

“Provided also that where a proceeding before the Settlement Commission abates under section 245HA, the period of limitation available under this section to the Assessing Officer for making an order of assessment, reassessment or re-computation, as the case may be, shall, after the exclusion of the period under sub-section (4) of section 245HA, be not less than one year; and where such period of limitation is less than one year, it shall be deemed to have been extended to one year; and or the purpose of determining the period of limitation under sections 149, 153B, 154, 155 and 158BE and for the purposes of payment of interest under section 144A, this proviso shall also apply accordingly.”

“19. In view of proviso to Explanation 1 of section 153 of the Act, the period of limitation for assessment, reassessment or re-computation in cases abated before the Commission shall not be less than one year after excluding period under sub-section (4) of section 245HA of the Act, i.e. the period, commencing on and from the dale of the application to the Settlement Commission u/s 245C and ending on the specified date referred in sub-section (1). The instant case falls within the ambit of section 245HA(1)(iiia) of the Act. Hence, specified date shall be the date on which the order under sub-section (4) of section 245D was passed for not providing for the terms of the settlement.

20. Therefore on examining the provisions as hereinabove, relating to the limitation of assessment in cases abated before Settlement Commission, it is clearly evident that the period available to the AO for making assessment, reassessment or re-computation shall be one year from the date of receipt of order of passed by the Settlement Commission. Since the order u/s 245D(4) was passed by the Settlement Commission on 17/08/2016 therefore the case shall not be barred by limitation before 16/08/2017, i.e. one year from the date of order of the Settlement Commission not providing for the settlement.

21. In view of the above, Appellant’s contention that the assessment made by the AO u/s 153A of the Act on 31/07/2017 was barred by limitation is found to be totally unjustitied, Hence Ground no. 3 raised by the appellant are hereby rejected.”

6. The assessee’s grievance is that its contention of applicability of section 153B of the Act as the only provision governing limitation for framing of assessment order, has not been considered, much less decided by the ld. CIT(A).

7. The Department, on the other hand, contends as follows:-

| (i) | | As per second proviso of section 153(4) the Assessing Officer has passed the order as per the time and this proviso was inserted from 01.06.2007. The order has been passed by the commission u/s 245D(4) after considering the application of the applicant and it is very speaking order. The applicant has submitted that the settlement application was filed much earlier therefore settlement commission cannot apply the section 245H(A)(iiia) and the time limit for the exclusion clause will not be applicable in this case. The issue has been argued in length wherein it has been shown to the Bench that the exclusion clause is available from 01.06.2007 although section 245(h)(iiia) came in the statute from 01.06.2015. |

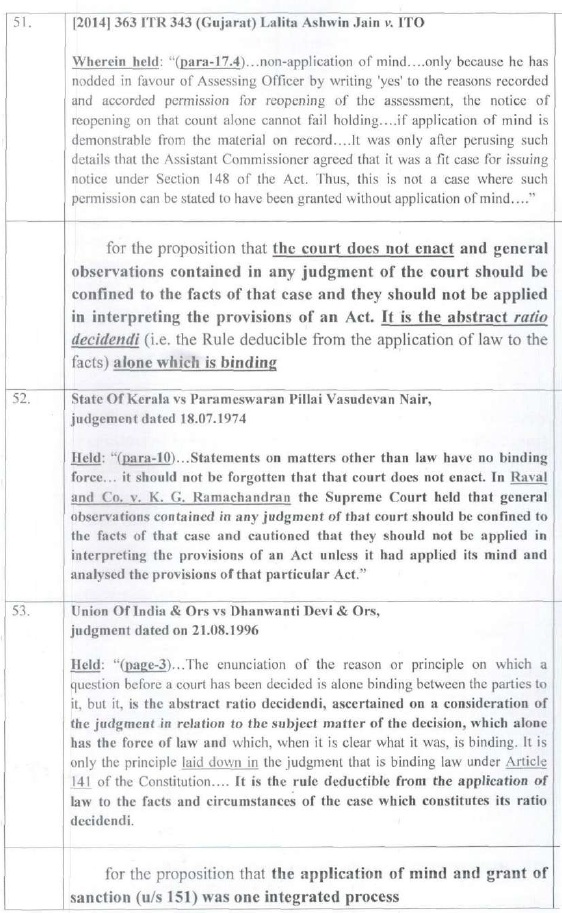

| (ii) | | The argument of the appellant is that the notwithstanding clause of section 153(B) debar the assessing officer to take the shelter of the second proviso of section 153(4) and the order has been time barred. Section 153 is explaining of the exclusion clause and if the notwithstanding as argued by the appellant may be accepted then whole section 153 may become redundant. |

| (iii) | | The appellant has tried to submit before the Bench to persuade that sections 148 and 153 are perimaterial’. But the fact of the matter is that the language of the sections 148 and 153A are not the same and even the purposes of both the sections are different to assess the income of assessee. The appellant has read the case law of Rajiv Sharma of Allahabad High Court 336 ITR 678 and relied on para 19 of the order where it has been held that While computing escaped assessment, return filed in response to notice under section 148, shall be deemed to be furnished under section 139 of the Act. Meaning thereby, procedure of section 139 of the Act shall be followed while dealing with the case of escaped assessment under section 148 of the Act. This para itself speaking about escaped income and written filed in response to notice u/s 148 shall be deemed to furnish u/s 139 of the Act and section 139 of the act shall be followed while dealing with the case u/s 148. 153A has nothing to do with escaped income described in section 147. The purpose of both the sections are altogether are different and this case pertains to A.Yrs. 1994, 1995 and 1996 when the concept of 153A was not in the statute. The section 153A starts with “Notwithstanding anything contained in sections 139, 147, 148…….. it means 153A has a separate jurisdiction and separate concept to assessment in the case of search action.” |

8. Section 153 concerns time limit for completion of assessment and re-assessment under sections 143 and 144 of the Act. Section 153A of the Act deals with the assessment in case of search or requisition. Section 153B of the Act relates to time limit for completion of assessment under section 153A of the Act. The assessment order in the present case is dated 31/7/2017. It has been passed under section 153A read with 143(3) of the Act. The Assessing Officer has applied the provisions of section 153 to compute the limitation for passing of the assessment order. The assessee’s plea that it is the provisions of section 153B of the Act and not those of 153 thereof, has, evidently, not been taken into consideration, or decided. Therefore, indeed, the grievance of the assessee that its such contention has not been dealt with by the ld. CIT(A), is correct. The impugned order in this regard is, therefore, non-speaking and has caused prejudice to the assessee. Accordingly, this matter is remitted to the file of the ld. CIT(A), to be decided afresh in accordance with law, on affording due and adequate opportunity of hearing to the assessee and on considering the material filed/to be filed by the assessee before the ld. CIT(A). The assessee, no doubt, shall co-operate in the fresh proceedings before the ld. CIT(A).

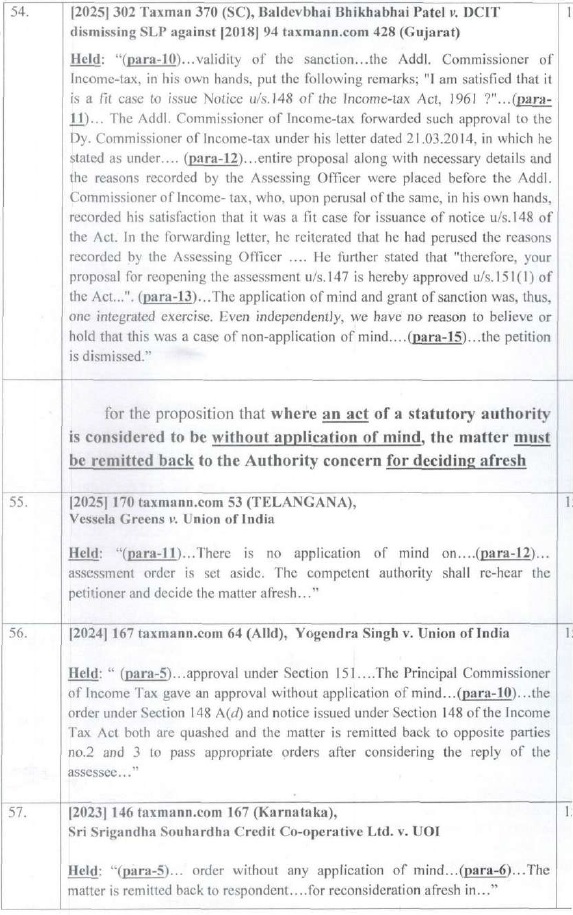

9. As per ground No.3, the assessment order is void ab-initio, since no mandatory approval of the JCIT, within the meaning of section 153B of the Act, was obtained. In this regard, the Department contends that “The appellant without any material having in its possession submitted before the Bench that the Joint CIT/Addl.CIT has not applied its mind while according approval u/s 153(B). This issue was raised first time before the tribunal therefore at outset it is being submitted here that it need not to be entertained and Hon’ble Bench may consider to reject it. The assessment order is very speaking and approval of the Joint CIT is with full application of mind.”

10. The Assessing Officer, in the last para of the assessment order, states as follows:-

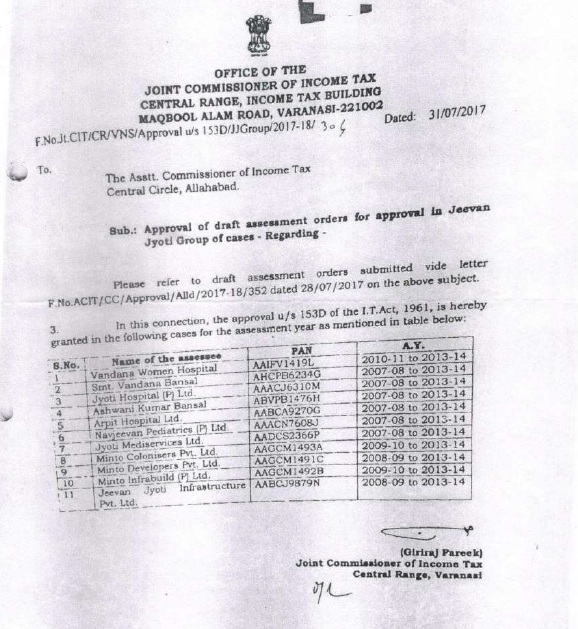

“This order is passed with the prior approval of the Joint Commissioner of Income Tax, Central Range, Varanasi. (Vide F.No.JtCIT/CR/VNS/Approval u/s 153D/JJGroup/2017-18/304 dated 31.07.2017.”

11. Since the issue concerning ground Nos.1 and 2 has been remitted to the file of the ld. CIT(A) as above, this matter is also remitted to the file of the ld. CIT(A), to be decided in accordance with law, on ascertaining the facts with regard to the approval under section 153D of the Act.”

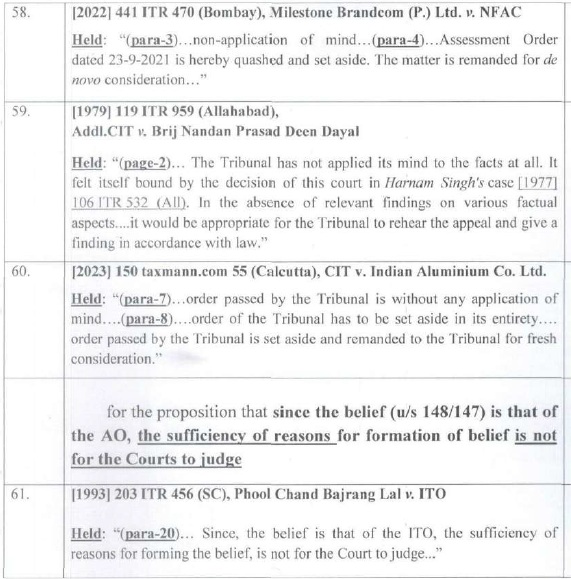

On perusal of the aforesaid order dated 21/12/2018 of the ITAT, it is obvious that therein, the assessees had raised the issue in appeals that the assessment orders were barred by limitation. Further, the assessees had also taken the ground that the assessments were void ab initio as the assessments had been passed without valid approval of Jt. Commissioner of Income Tax (“JCIT” for short) within the meaning of section 153D of the Act.

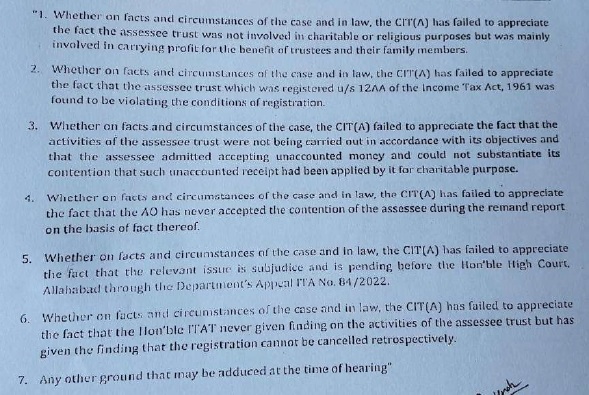

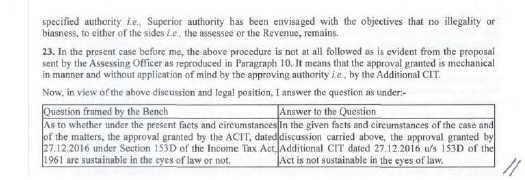

(B.1) The learned CIT(A) passed consequential orders in pursuance of the aforesaid order dated 21/12/2018 of the ITAT in the case of Arpit Hospital Pvt. Ltd., Jeevan Jyoti Charitable Trust, Navjeevan Pediatrics Pvt. Ltd., Minto Developers Pvt. Ltd. and Jeevan Jyoti Infrastructure Company Private Limited. In the consequential appellate order, the learned CIT(A) took the view that the assessments were not barred by limitation. She further took a view, agreeing with her predecessor, that the JCIT had given prior approval to the assessment order after due application of mind and examining facts of the case and records. The predecessor CIT(A) had observed, holding that the assessees’ contention to the effect that approval was done in mechanical manner, was totally unjustified: “I find that the JCIT has given prior approval to the order passed u/s 153A read with section 143(3) of the Act by the Assessing Officer after due application of mind and examining the facts of the case and records. Therefore, appellant’s contention that the approval was done in a mechanical manner is found to be totally unjustified and is hereby rejected” (Quoted). Aggrieved, Arpit Hospital Pvt. Ltd. (for assessment years 2012-13 and 2013-14), Minto Developers Pvt. Ltd. (for assessment years 2009-10 and 2012-13) and Jeevan Jyoti Infrastructure Company Private Limited (for assessment year 2012-13) are in appeal against the consequential appellate order of learned CIT(A). Revenue is in appeal in the case of Jeevan Jyoti Charitable Trust (for assessment years 2011-12 to 2013-14) and Navjeevan Pediatrics Pvt. Ltd. (for assessment year 2013-14) against the consequential appellate orders of the learned CIT(A) in respect of relief granted by the learned CIT(A).

(C) There was search & seizure operation u/s 132 of the Act conducted in Jeevan Jyoti Group of cases on 29/05/2012. During the subsequent assessment proceedings, the assessees filed applications u/s 245C of the Act in Income Tax Settlement Commission (“ITSC” for short). The applications of the assessees were admitted vide orders dated 01/05/2015 passed u/s 245D of the Act. Reports of the Pr.CIT, Kanpur under Rule 9 of Income Tax Settlement Commission (Procedure) Rules, 1997 [”ITSC(P) Rules” for short] were obtained by ITSC. The response of the assessees under Rule 9A of ITSC(P) Rules were also obtained by ITSC. Later, ITSC passed orders dated 17/08/2016 u/s 245HA(iiia) of the Act, allowing proceedings before the ITSC to abate. The ITSC restored the matters to the file of the Assessing Officer. Therefore, the Assessing Officer passed assessment orders, the validity of which are under challenge in the appeals/Cross Objections filed by the respective assessees in the present set of appeals.

(D) During appellate proceedings in Income Tax Appellate Tribunal, the learned D.R. for Revenue adduced additional evidence in the paper books filed by them, such as an affidavit of the Assessing Officer and also personal testimony of Mr. Agrahari, Inspector working in Income Tax Department, who was produced in person before us. The learned Counsel for the assessees expressed no objection to admission of the same. In view of the foregoing, the additional evidences adduced by Revenue are admitted.

(D.1) In the common paper book (Volume-I); the learned Departmental Representatives objected to the admission of additional grounds filed by the assessee. Although, no serious objection was expressed by them against admission of additional grounds, at the time of oral hearing before us; we deem it fit to decide the admissibility of additional grounds. The assessees relied on the Supreme Court order in the case of National Thermal Power Co. Ltd. v. CIT ITR 383 (SC) and Jute Corpn. of India Ltd. v. CIT ITR 688 (SC). Further as discussed earlier, while passing the aforesaid order dated 21/12/2018, Coordinate Bench of the ITAT, Allahabad had already decided grounds pertaining to whether the assessment was barred by limitation and whether the approvals given by the JCIT u/s 153D of the Act were valid. These issues permeate through all the cases in the appeals before us. On identical facts, the learned CIT(A) has already passed two rounds of orders in impugned group cases [as discussed in foregoing paragraphs (B) and (B.1) of this order] wherein the issue regarding validity of approval u/s 153D of the I.T. Act has been decided. No fresh investigation of facts is required as the issues have been examined by learned CIT(A) in the appellate proceedings in the group cases in earlier rounds of appellate orders passed by the learned CIT(A). Further, perusal of grounds of Cross Objections filed by the assessee, show that specific ground has been taken with regard to approval of the JCIT u/s 153D of the Act. Furthermore, in the aforesaid consolidated order dated 21/12/2018 of Coordinate Bench of the Tribunal, it is seen that the assessees had raised the issue regarding the approval u/s 153D of the Act, which were also adjudicated in the aforesaid order dated 21/12/2018 and the matter was set aside to the file of the Ld. CIT(A). Moreover, on perusal of the original and the consequential orders passed by the learned CIT(A), as referred to in foregoing paragraphs No. (B) and (B.1) of this order, it is found that the issue regarding approval of JCIT u/s 153D of the Act was specifically adjudicated in both the orders by the learned CIT(A). In view of the foregoing, the grounds taken in the present appeals/Cross Objections of the assessees are not strictly in the nature of “additional grounds”, as alleged by the learned D.R. The issue regarding the approval given by learned JCIT u/s 153D of the Act, thus specifically arises from the orders passed by the learned CIT(A). Moreover, Rule 11 of Income Tax (Appellate Tribunal) Rules, 1963 (“ITAT Rules” for short) authorizes the ITAT to admit additional grounds of appeal.

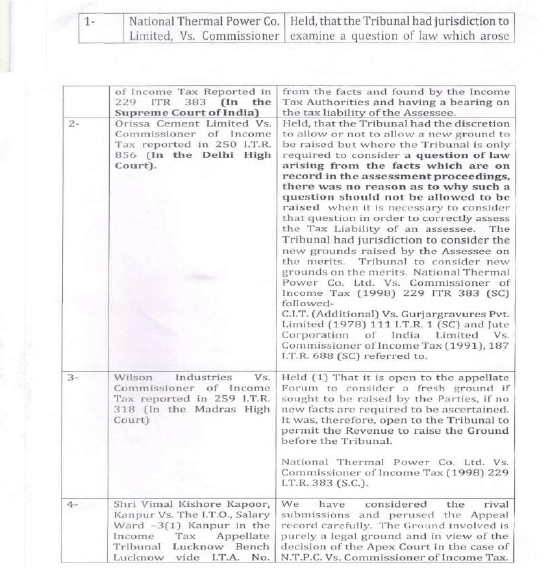

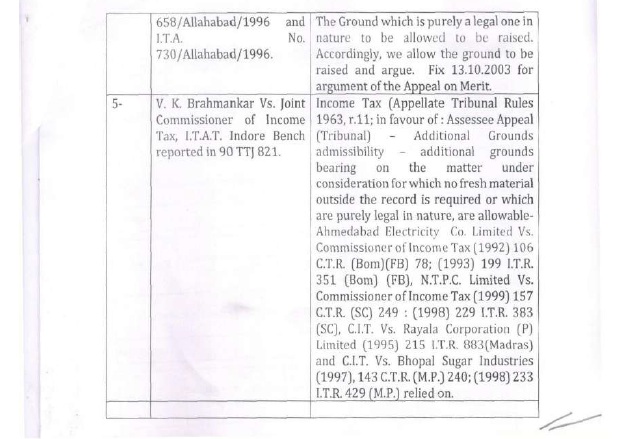

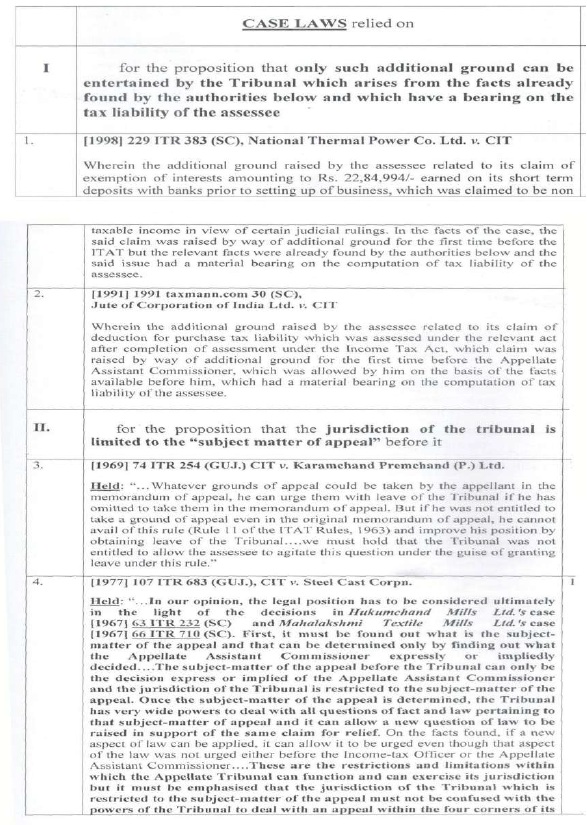

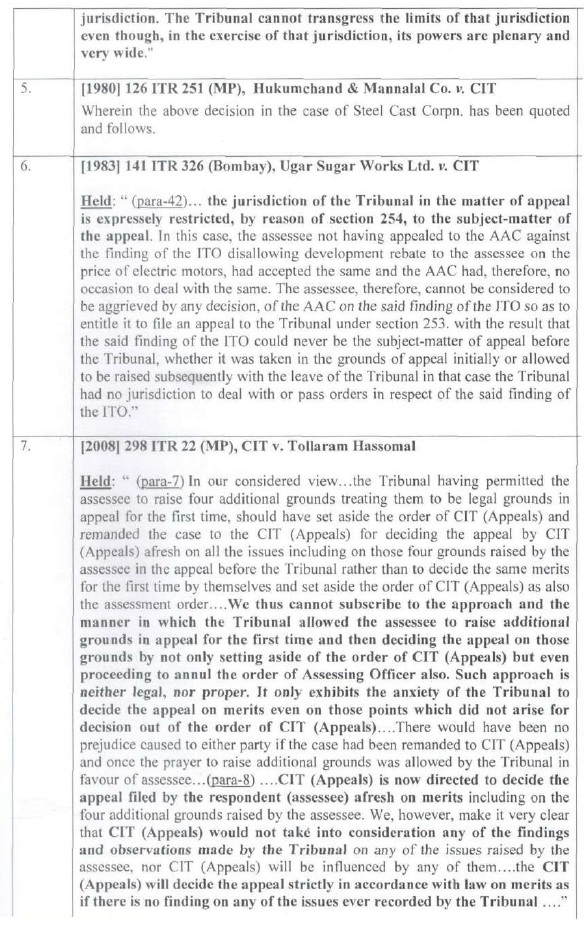

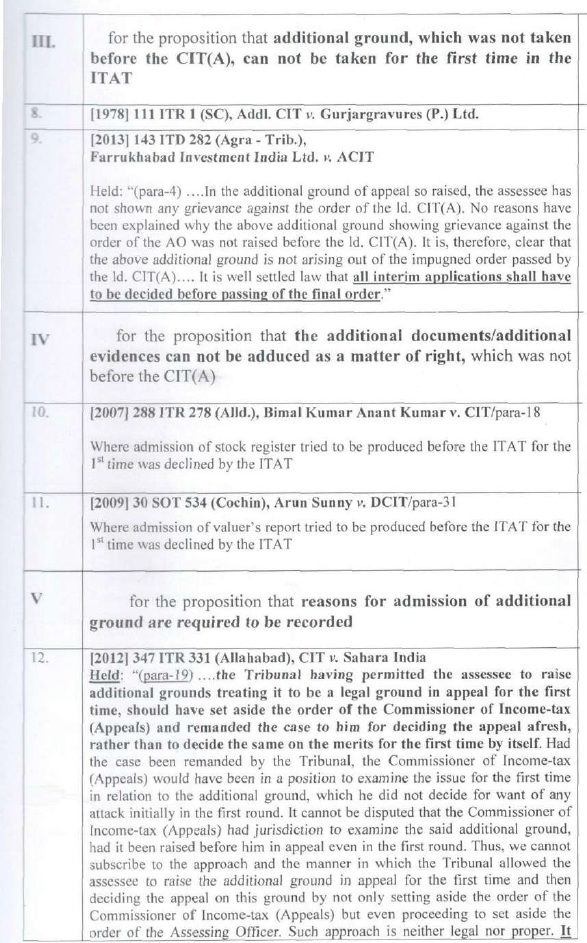

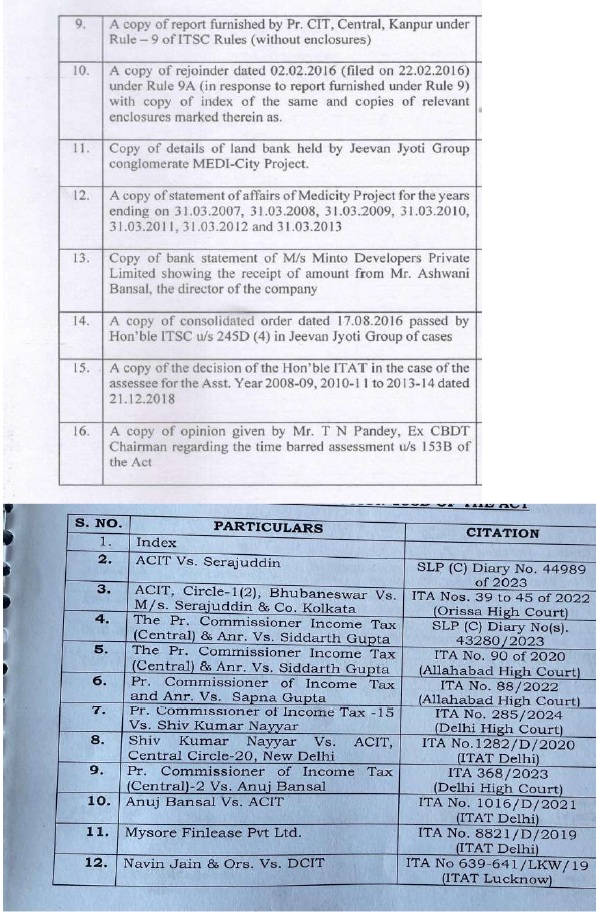

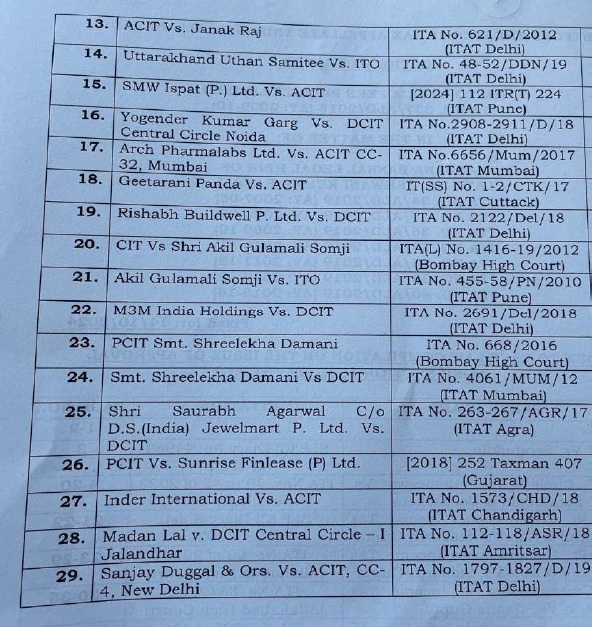

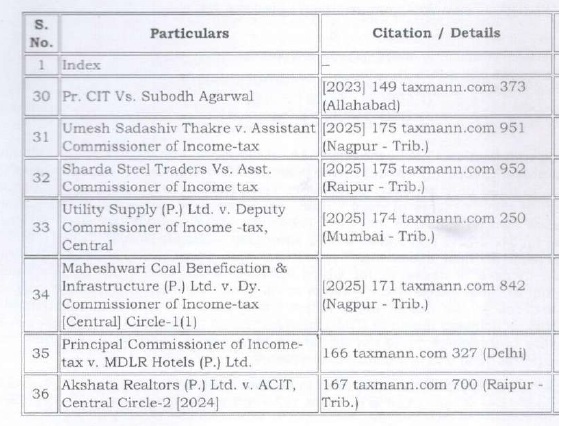

(D.2) Moreover, it is well settled in numerous precedents that the Tribunal can admit additional grounds of appeal. Some such decision are as under:

(D.2.1) In view of the foregoing, the grounds of the assessees, taken in appeals/Cross Objections regarding validity of approval granted u/s 153D of the I.T. Act, are being admitted.

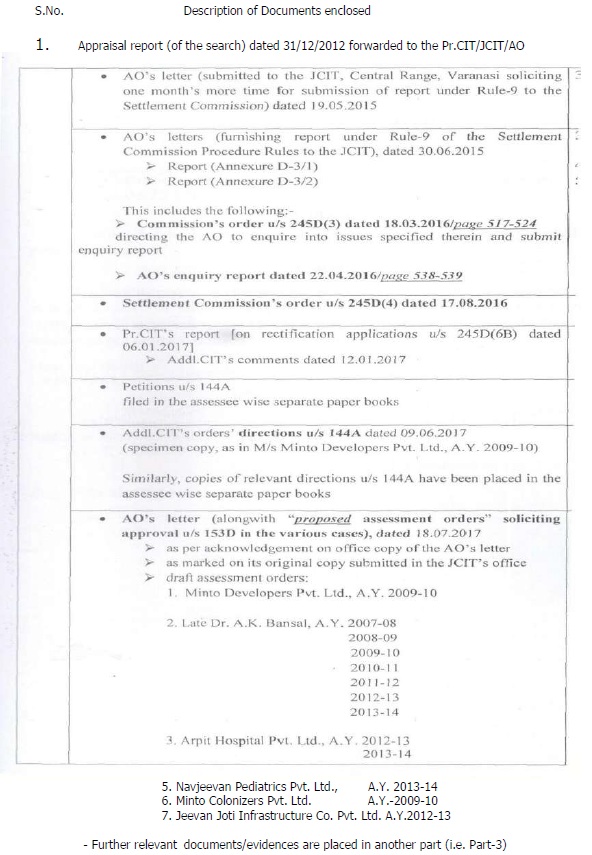

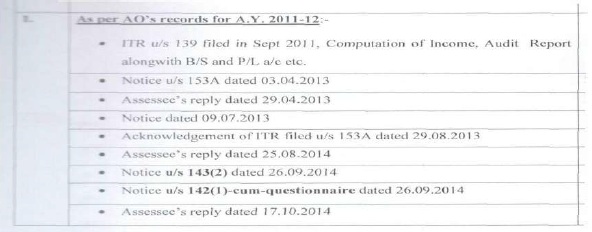

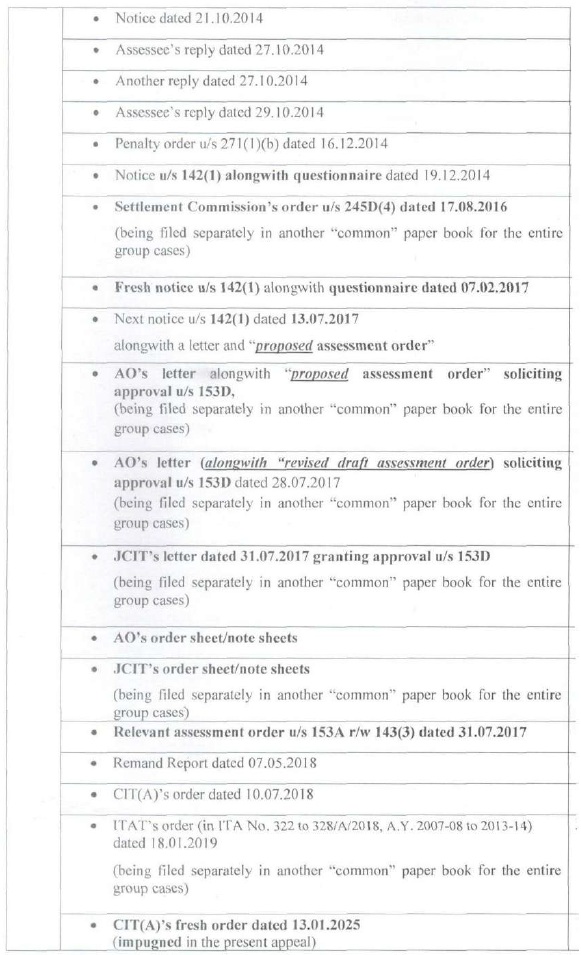

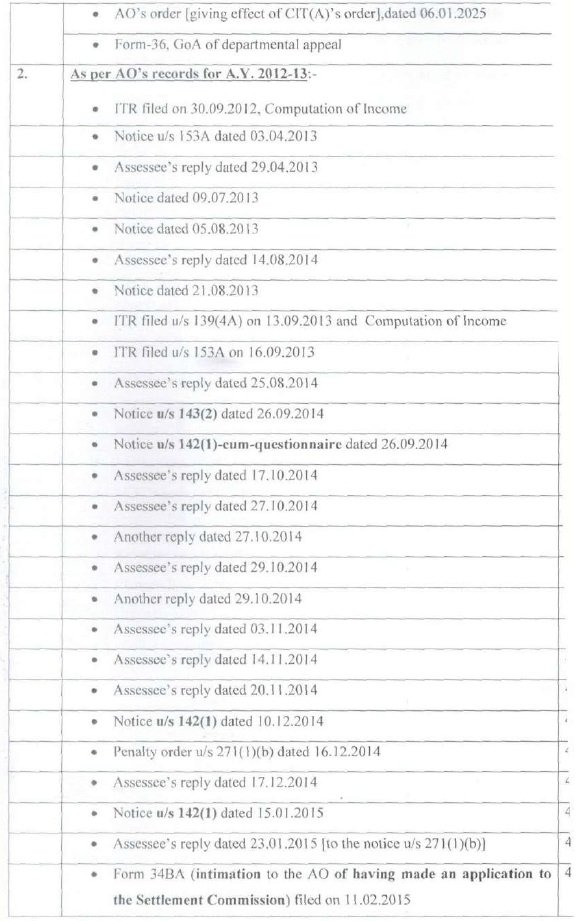

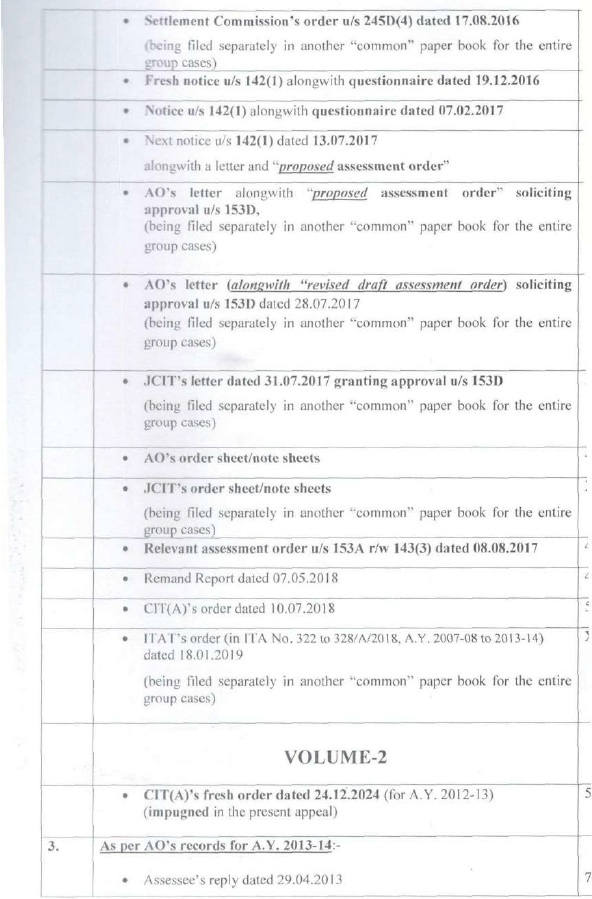

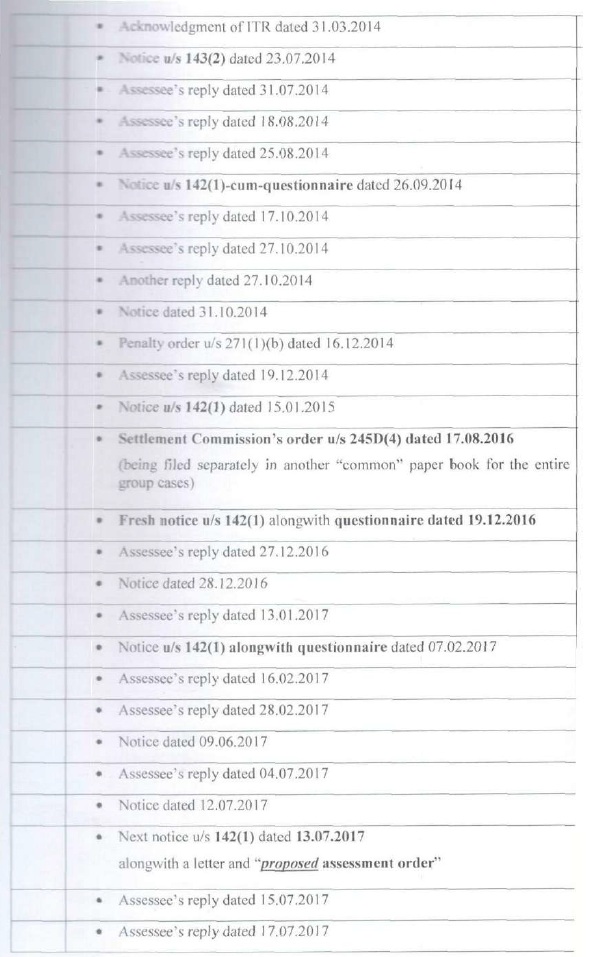

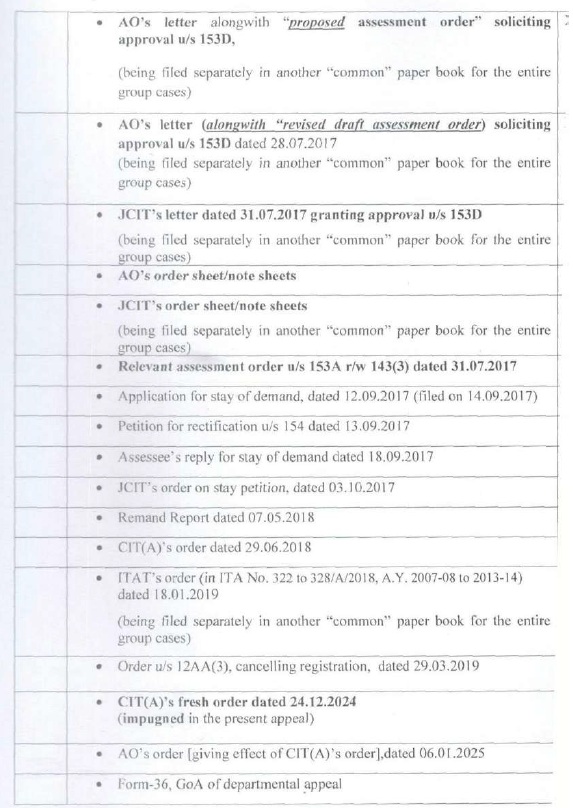

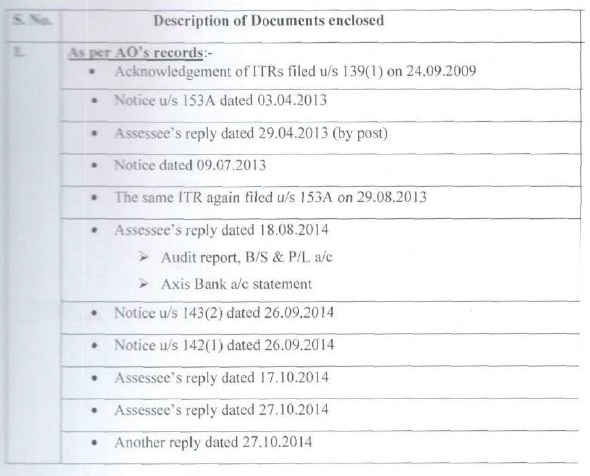

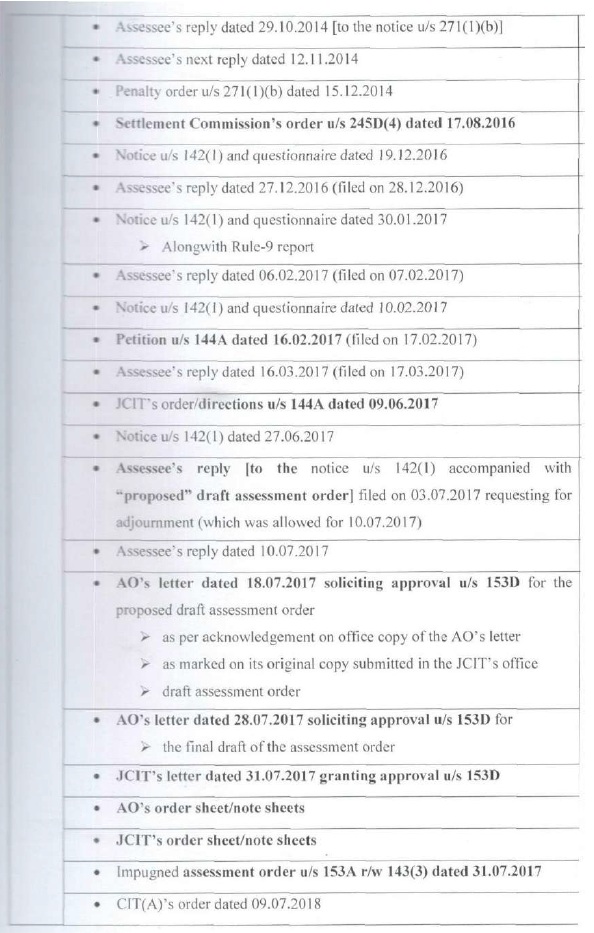

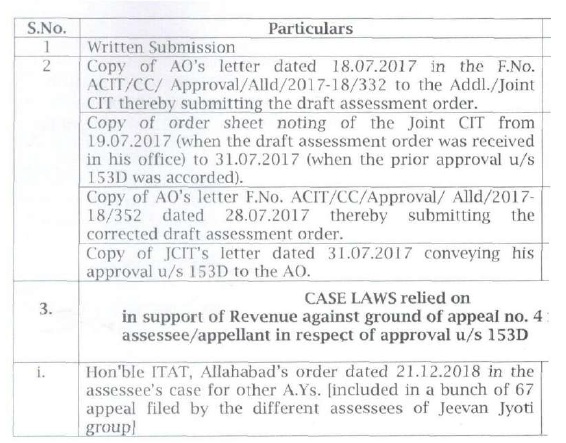

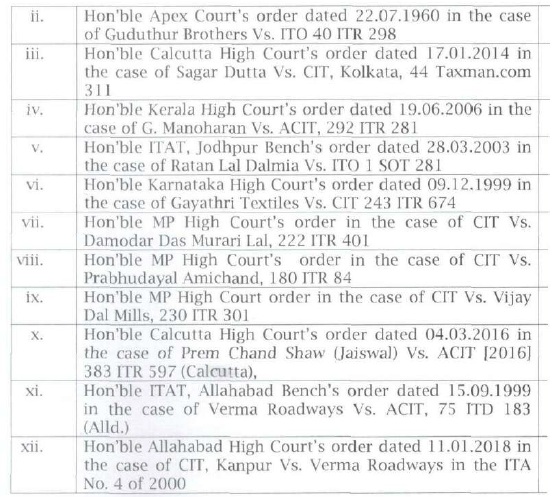

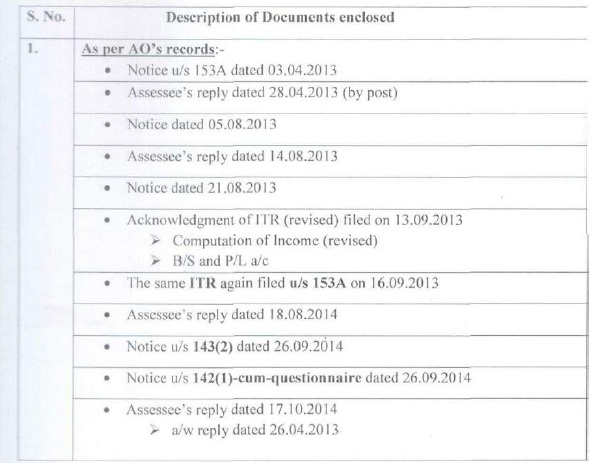

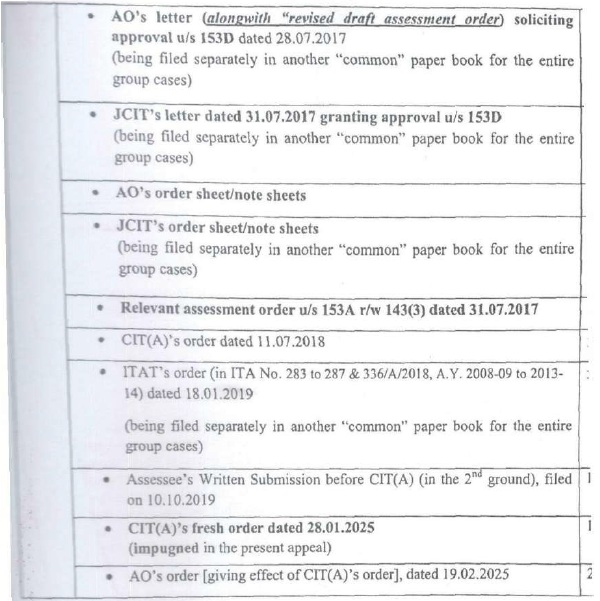

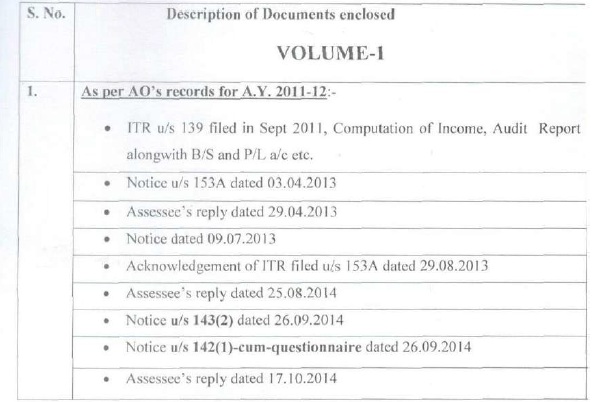

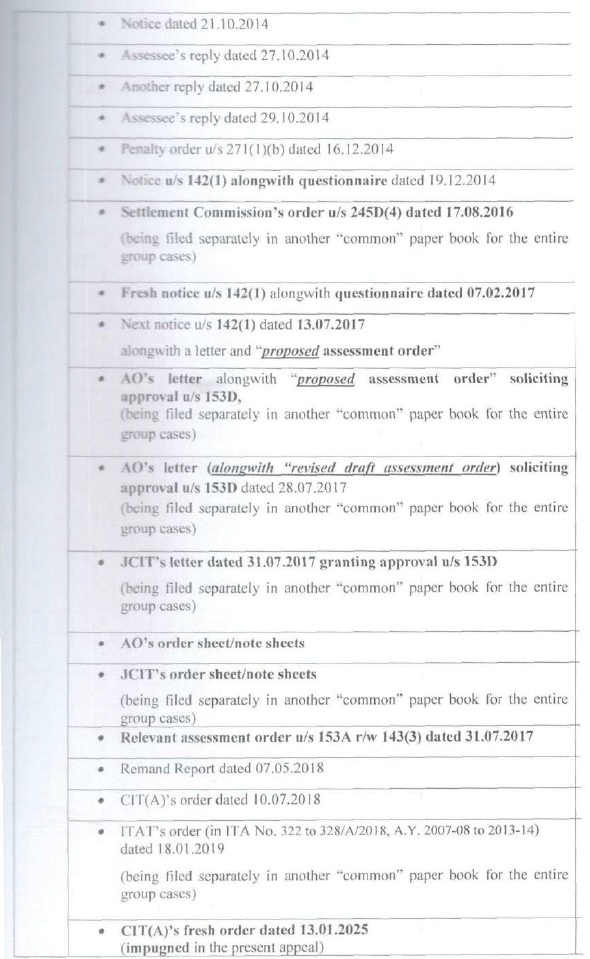

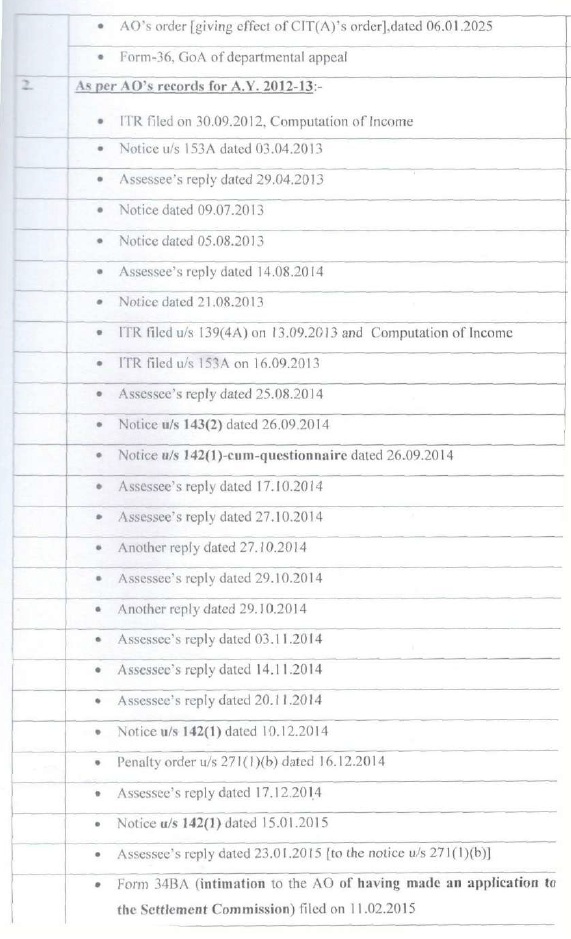

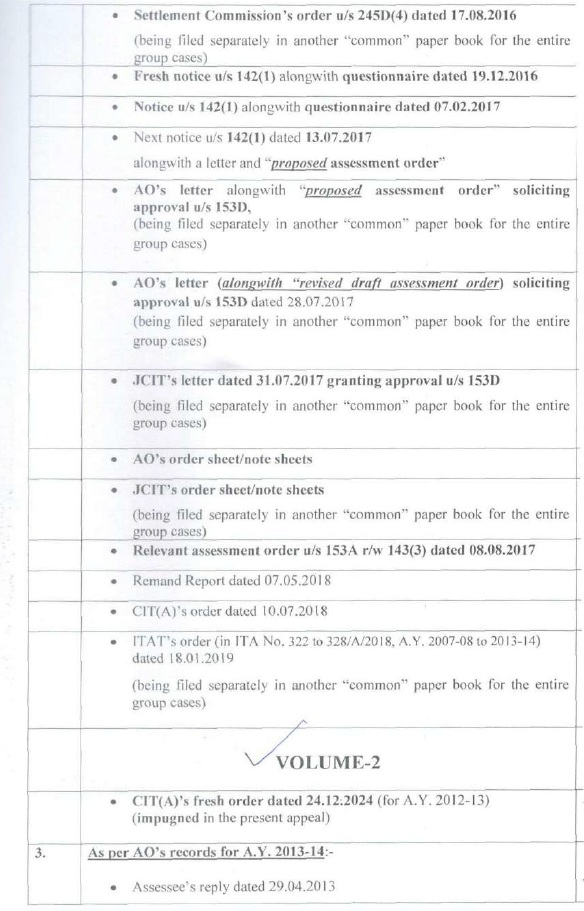

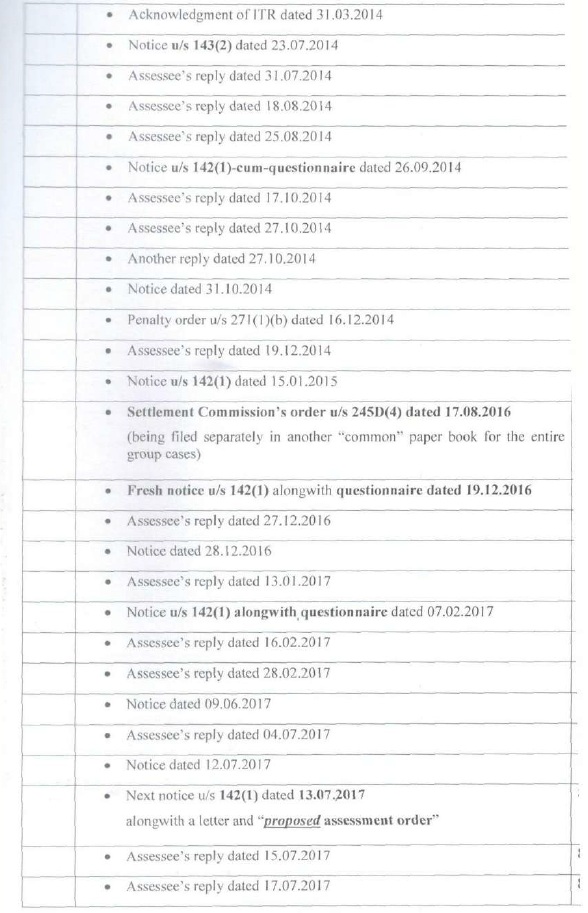

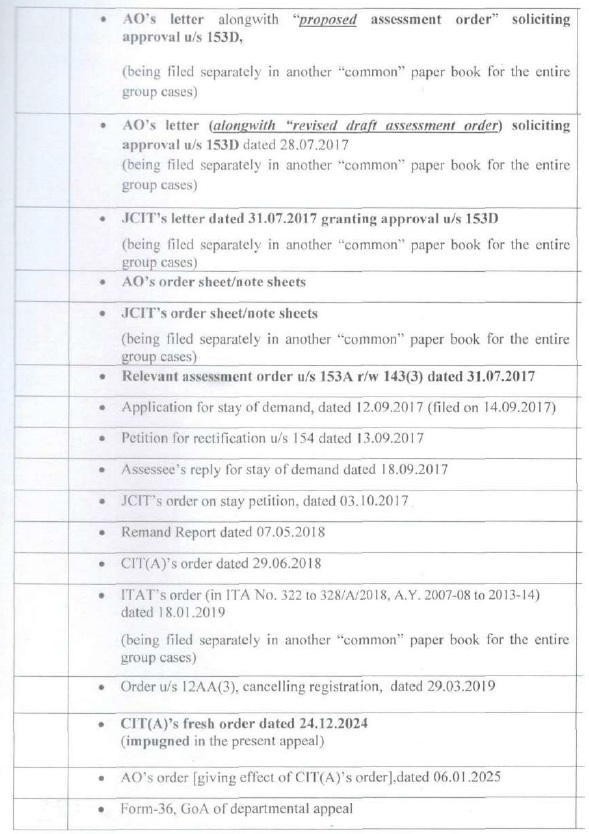

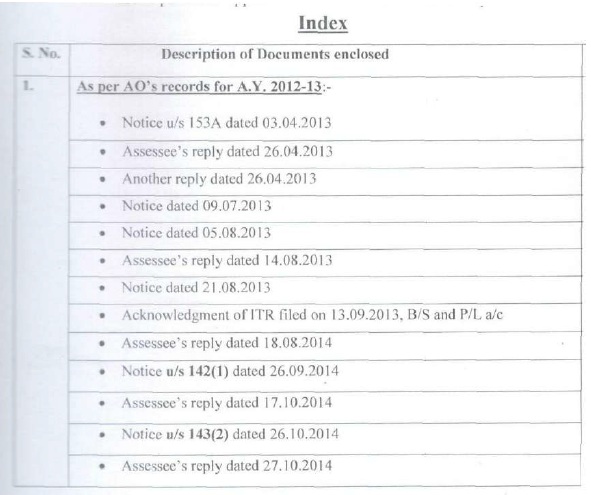

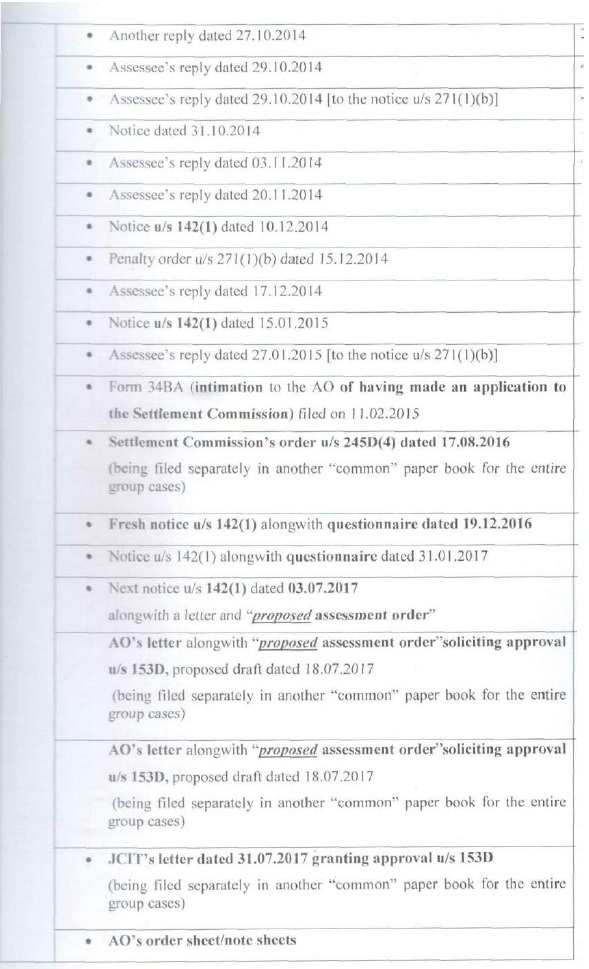

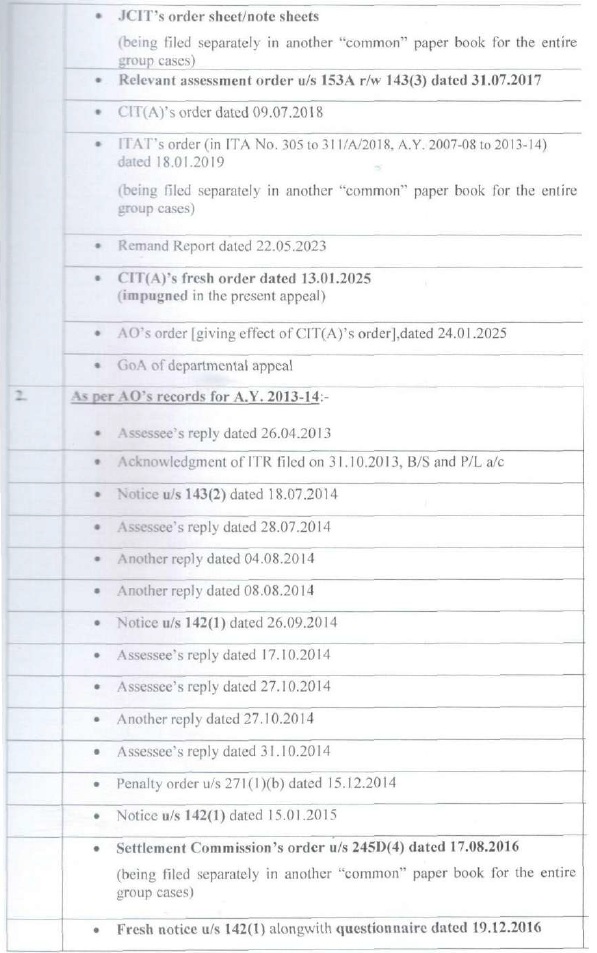

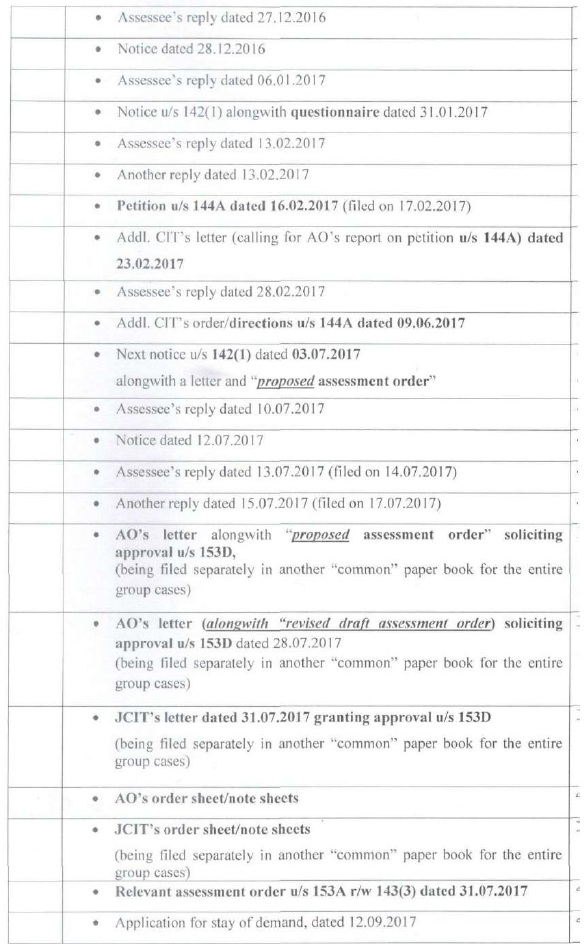

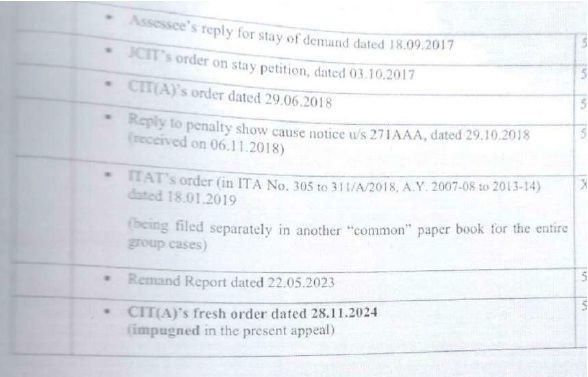

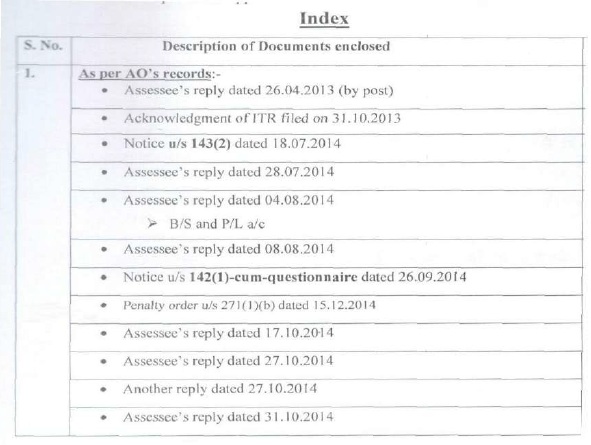

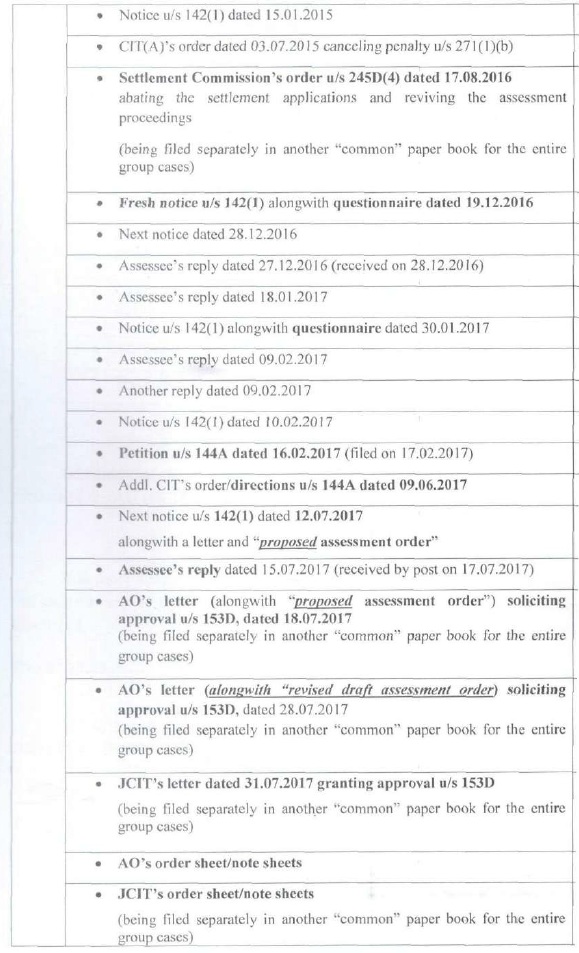

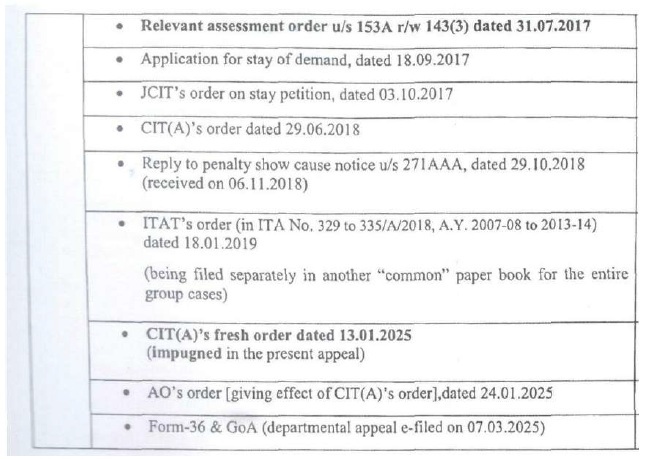

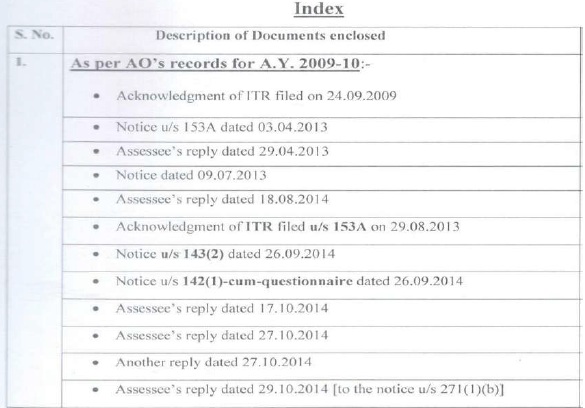

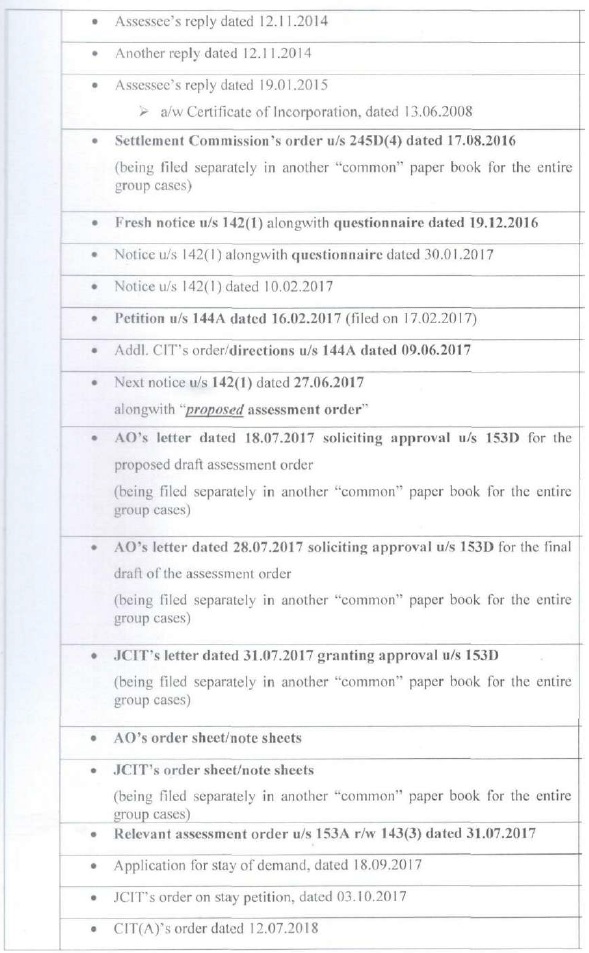

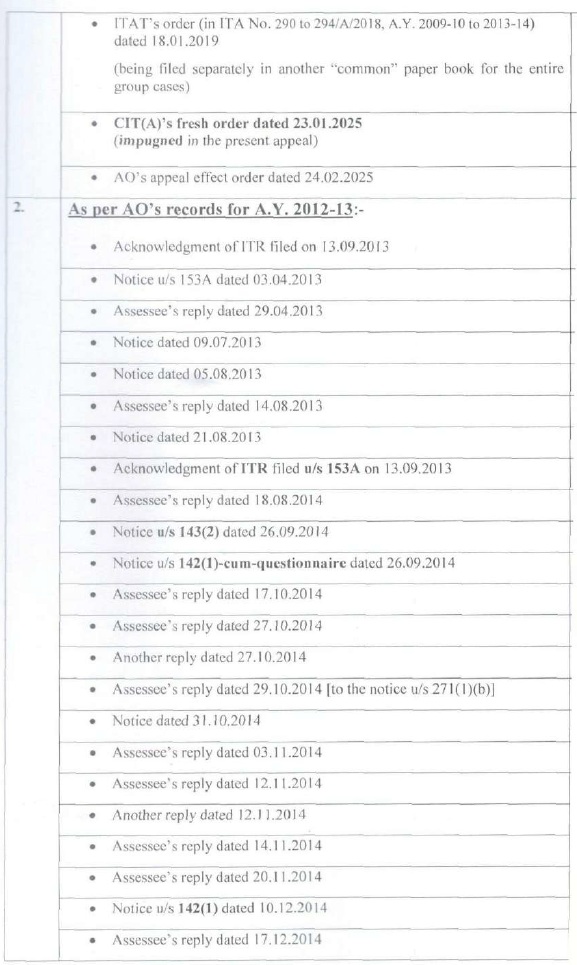

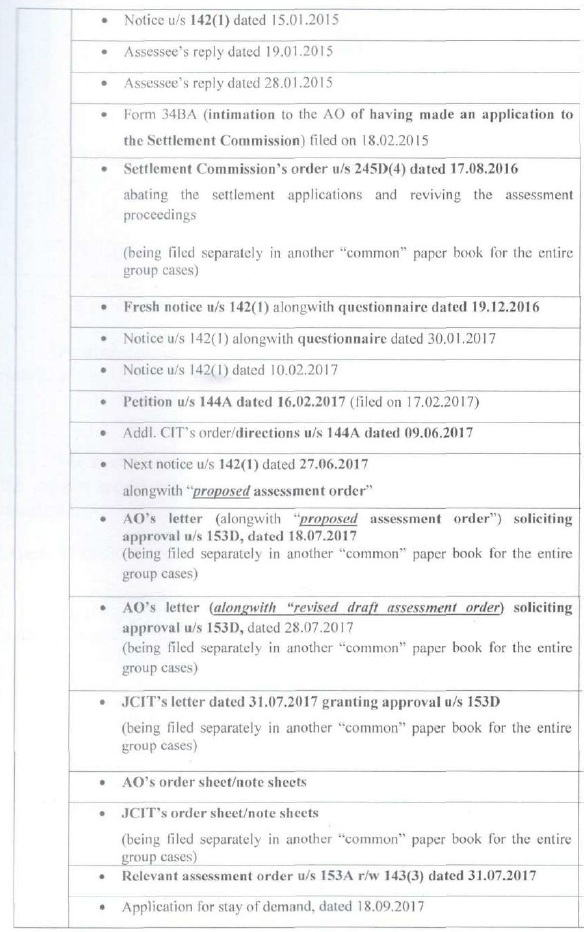

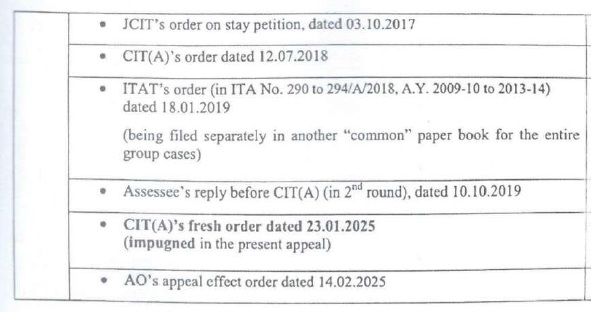

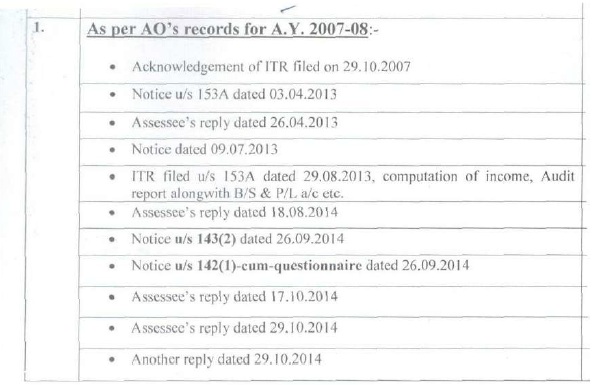

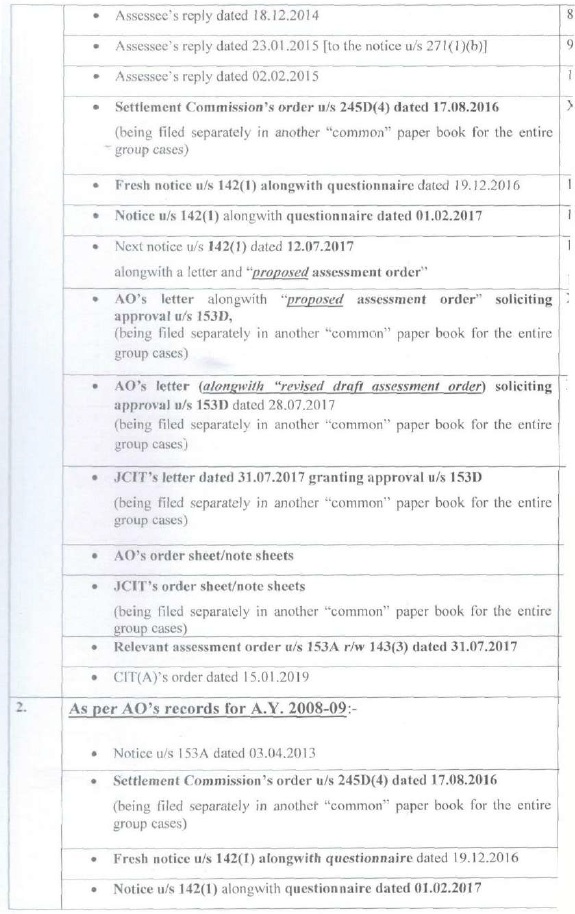

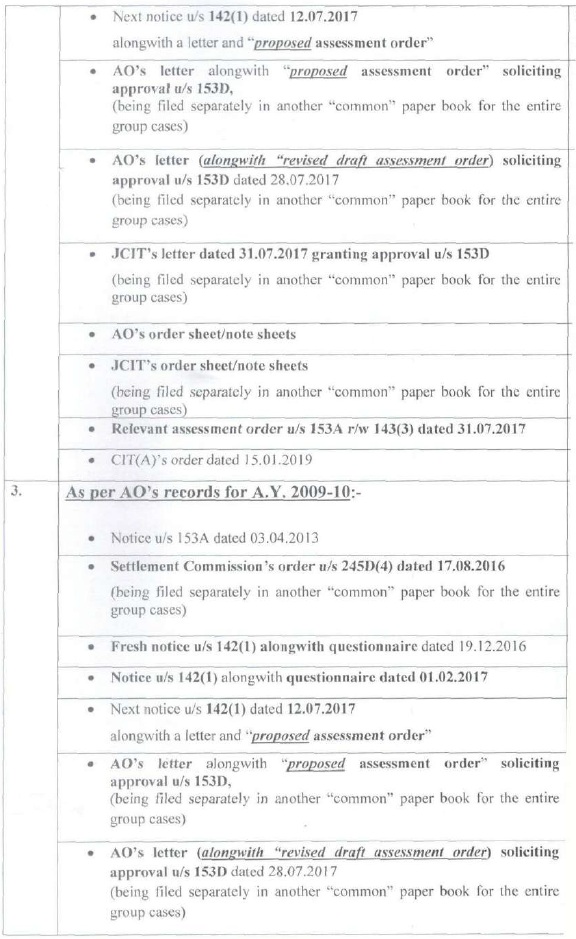

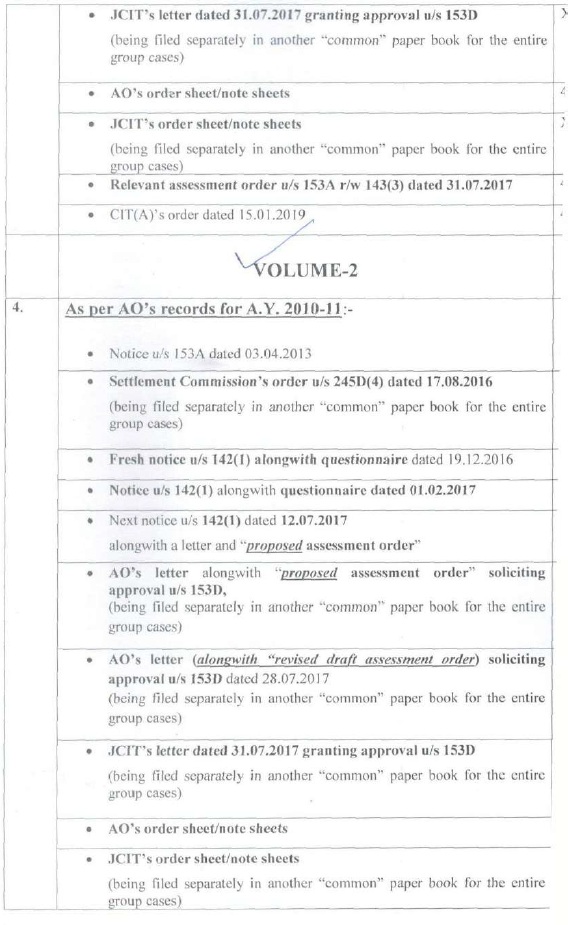

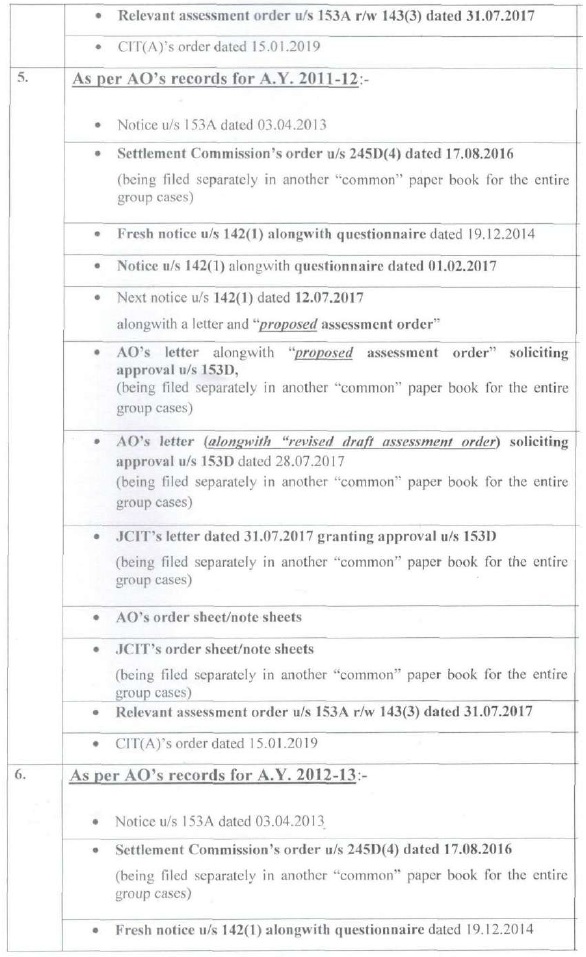

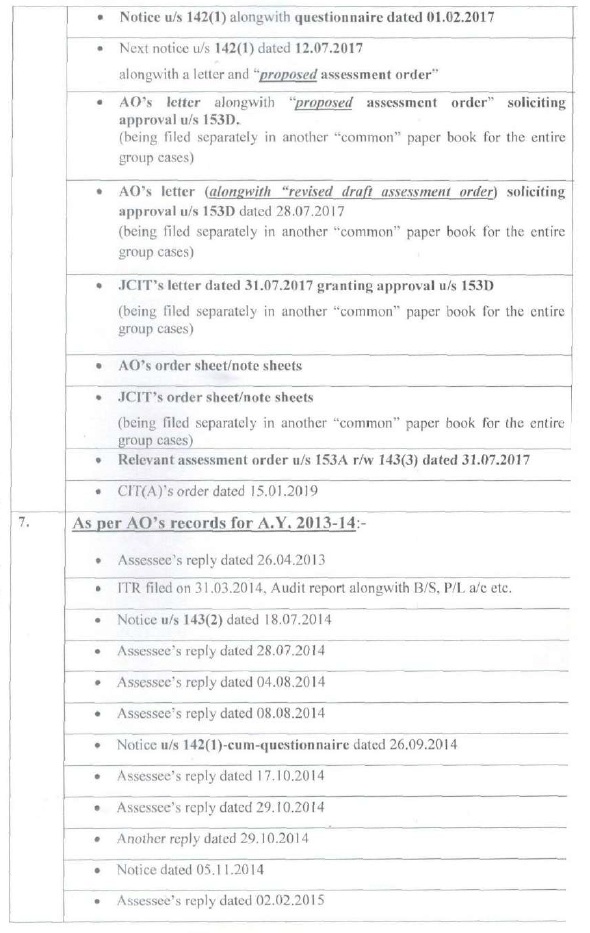

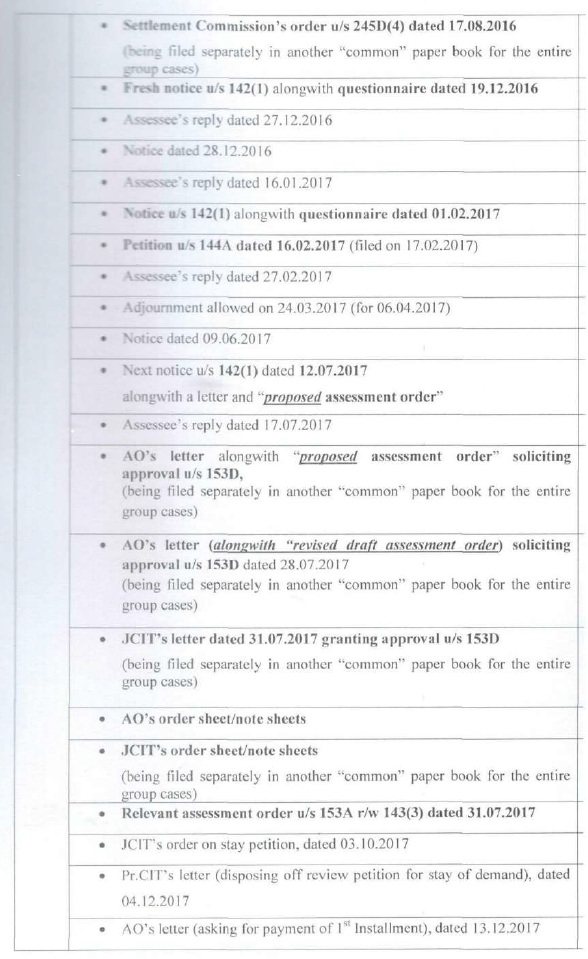

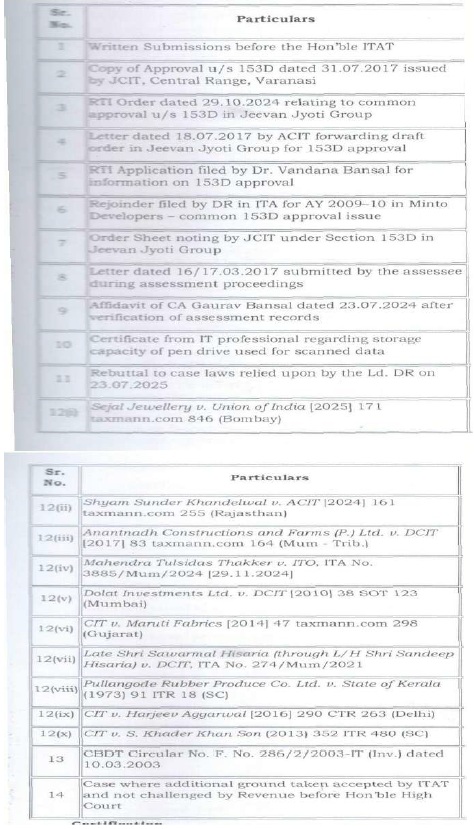

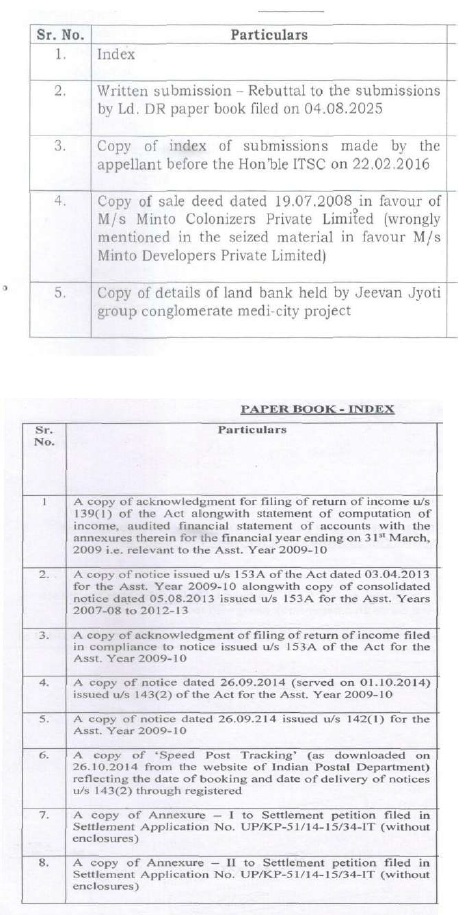

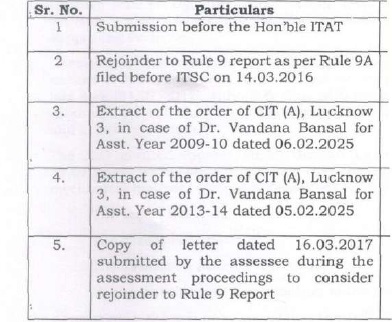

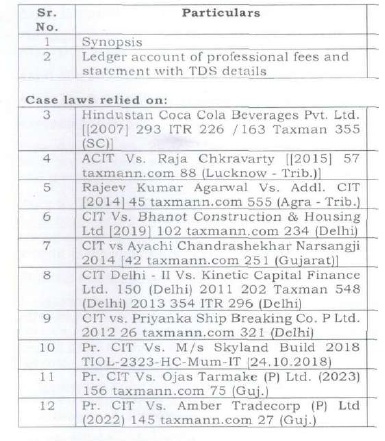

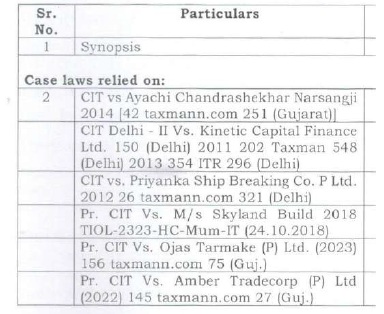

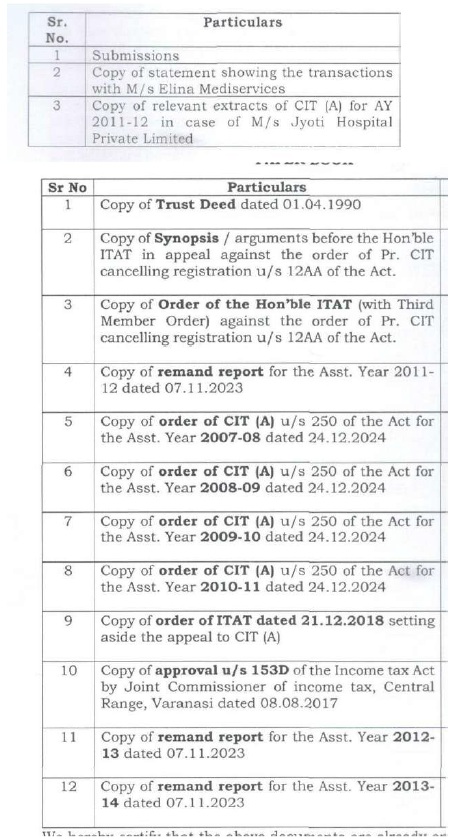

(E) In the course of appellate proceedings in Income Tax Appellate Tribunal, written submissions/paper books were filed by Revenue and by the assessees as per following details:

COMMON PAPER BOOK – PART-I

COMMON PAPER BOOK – PART-2

COMMON PAPER BOOK – PART-3

COMMON PAPER BOOK – PART4

Revenue’s Appeal I.T.A. Nos. 39 to 41/All/2025 & assessee’s C.O. Nos. 2 to 4/All/2025 (paper book filed by Revenue)

Revenue’s paper book in I.T.A. No.337/All/2018

Revenue’s paper book in respect of I.T.A. No.56/All/2025

Revenue’s paper book in I.T.A. Nos. 39 to 41/All/2025 & Assessee’s C.O. Nos. 2 to 4/All/2025

Revenue’s paper book in I.T.A. Nos. 13 & 14/All/2025

Revenue’s paper book in I.T.A. No.44/All/2025 & in assessee’s C.O. No.5/All/2025

Revenue’s paper book in I.T.A. Nos. 54 & 55/All/2025

Revenue’s paper book in I.T.A. Nos. 34 to 40/All/2019

Assessee’s paper book in I.T.A. No.337/All/2018

Assessee’s paper book in I.T.A. Nos. 34 to 40/All/2018

Assessee’s paper book in I.T.A. No.13/All/2025

Assessee’s appeal in I.T.A. No.14/Allahabad/2025

Assessee’s paper book in I.T.A. Nos. 39 to 41/All/2025

(F) At the time of hearing, representatives of both sides agreed that appeals of Minto Developers Pvt. Ltd. (I.T.A. No.337/Lkw/2018 for A.Y. 2009-10) may be taken as the lead case as regards the legal issue whether the assessments were passed by the Assessing Officer after obtaining valid approval of JCIT. They submitted that the facts and circumstances for all the other appeals on this issue were in pari materia and the decision in the case of Minto Developers Pvt. Ltd. would apply mutatis mutandis to remaining cases also. Accordingly, we first take up the appeal of Minto Developers Pvt. Ltd. (I.T.A. No.337/Alld/2018 for A.Y.2009-10).

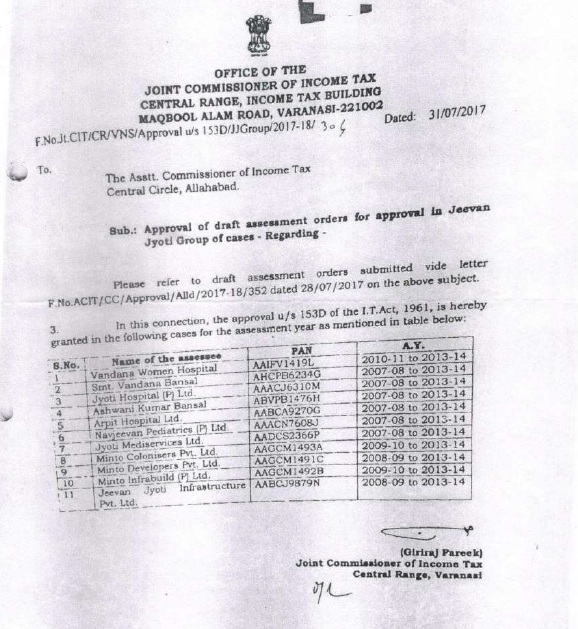

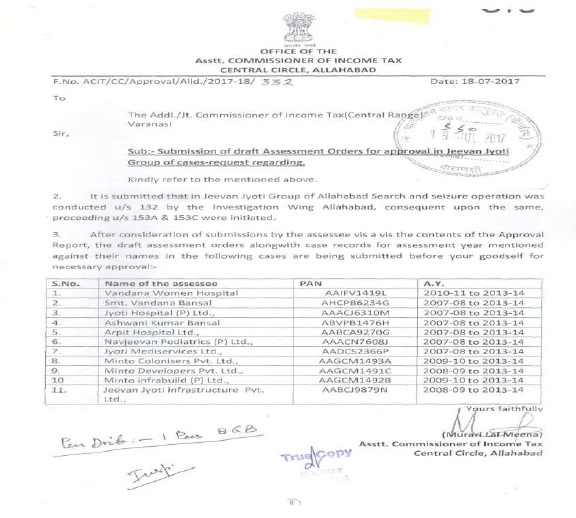

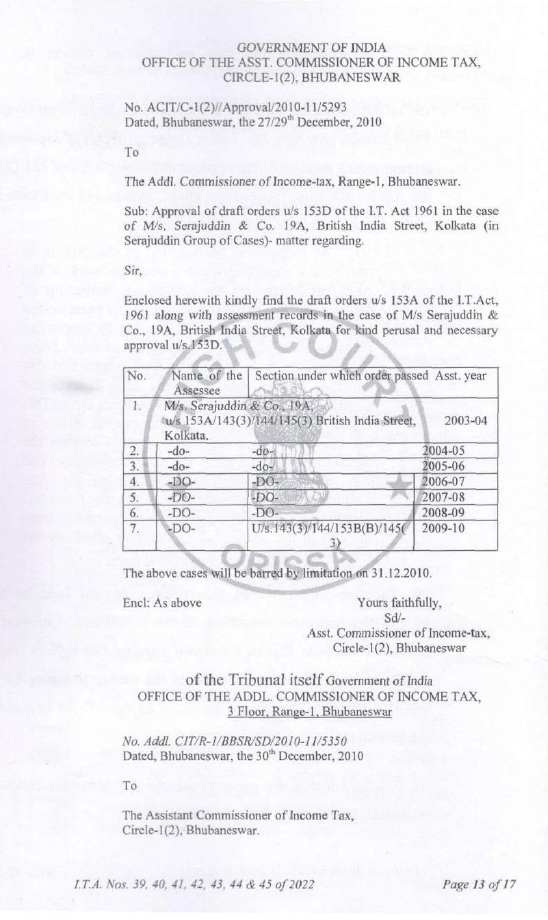

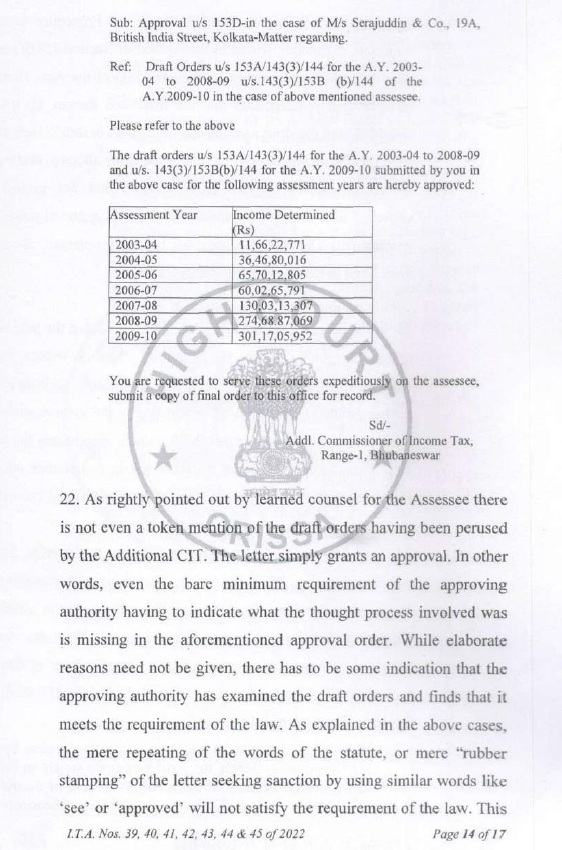

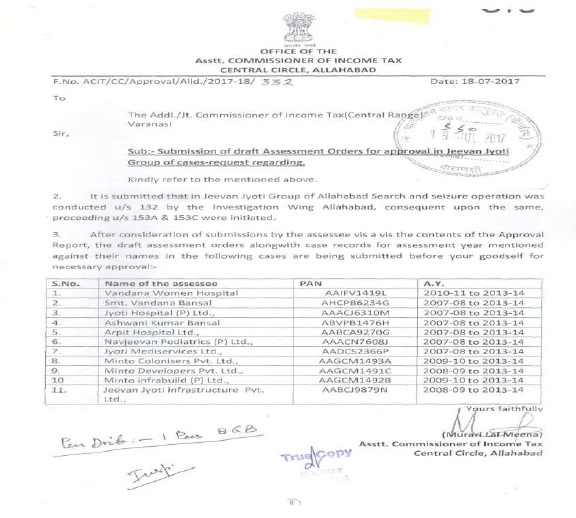

(F.1) As regards validity of approval given by JCIT u/s 153D of the Act, the learned Counsel for the assessee drew our attention to approval letter No.Jt.CIT/CR/VNS/Approval u/s 153D/JJGroup/2017-18/304 dated 31/07/2017 whereby approvals were given for 11 different assessees for a total of 63 assessments pertaining to numerous assessment years. The aforesaid letter is reproduced below for the ease of reference:

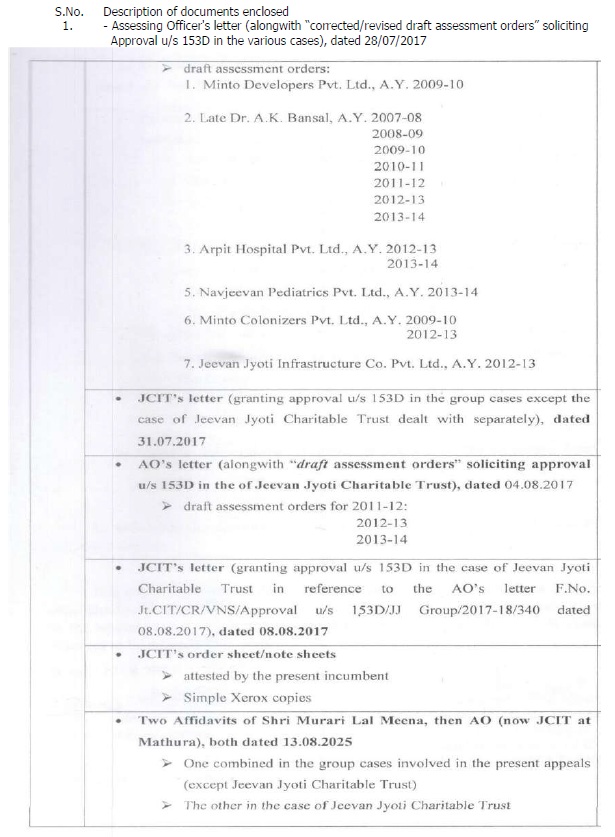

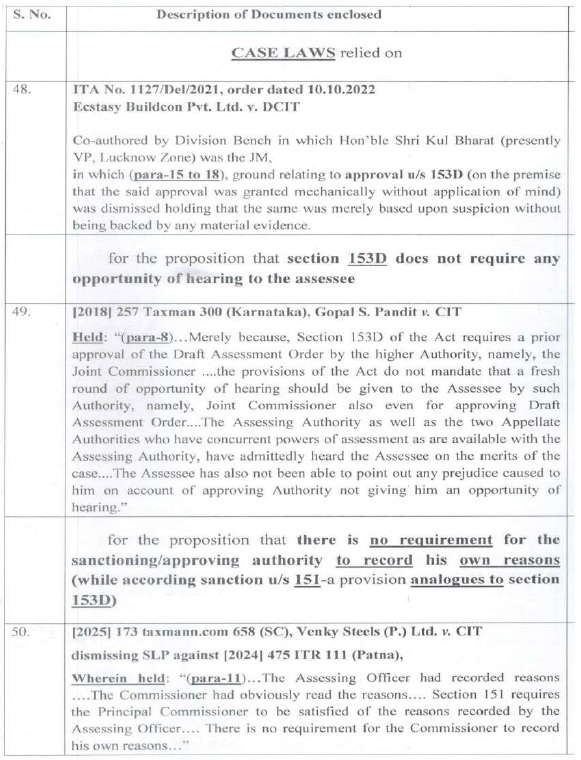

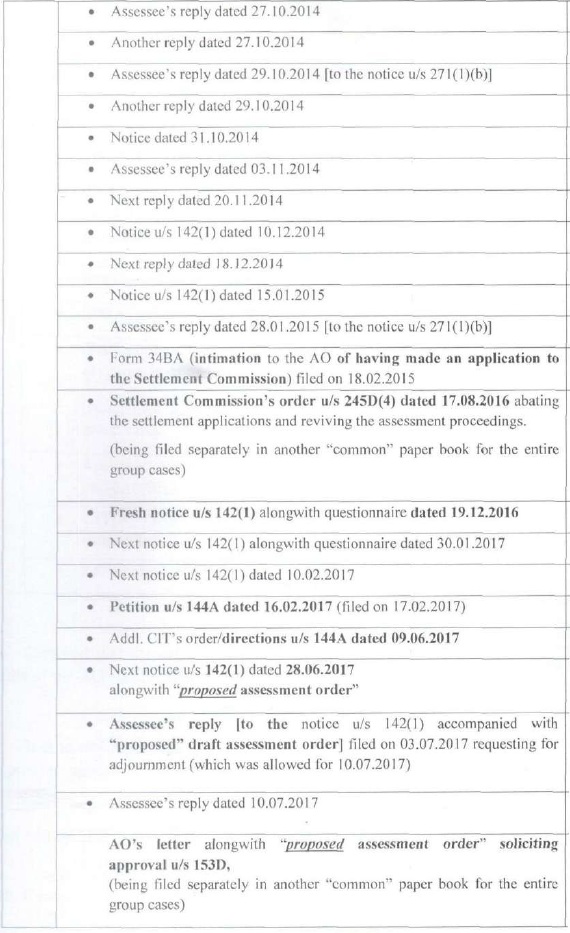

(F.1.1) The learned Counsel for the assessee challenged the validity of approval granted u/s 153D of the Act on many grounds. To begin with, he contended that the approvals were given without due application of mind. In this regard he drew our attention to the fact that the draft assessment orders were sent to the JCIT by the Assessing Officer vide letter F.No.ACIT/CC/Approval/Alld/2017-18/352 dated 28/07/2017. He further drew our attention to the fact that the next two days, i.e. 29th & 30th July, 2017 were closed holidays on account of Saturday and Sunday. Thereafter, the JCIT gave approval u/s 153D of the Act vide aforesaid letter dated 31/07/2017 in the case of aforesaid 11 assessees for a total of 63 assessments pertaining to different assessment years in the cases of the aforesaid 11 different assessees. It was the contention of the learned Counsel for the assessee that considering the enormity of seized materials, digital data, submissions of the assessees, appraisal report provided by the Investigation Wing of Income Tax Department, reports under Rules 9 and 9A of ITSC(P) Rules, and other materials including assessment records, it was humanly impossible for the JCIT to exercise due application of mind before granting approval to the Assessing Officer for 63 assessments pertaining to 11 different assessees for various assessment year; vide aforesaid common approval letter dated 31/07/2017, sufficiently in time on 31/07/2017 for the letter of approval to reach the Assessing Officer along with seized materials, digital data, submissions of the assessees, appraisal report provided by the Investigation Wing of Income Tax Department, reports under Rules 9 & 9A of ITSC(P) Rules and other materials including assessment records to reach the Assessing Officer on 31st July 2017 itself from Varanasi (where JCIT was stationed) to Allahabad (where the Assessing Officer was stationed) in order to also enable the Assessing Officer to pass the assessment order on 31/07/2017 itself, which was the last date for passing assessment order (after which the assessments would have been barred by limitation).

(F.1.2) The learned Counsel for the assessee then challenged the aforesaid approval given u/s 153D of the Act on the basis that the JCIT did not grant approvals u/s 153D of the Act through separate approval letters for separate assessment years for each assessment orders pertaining to each of the aforesaid assessees. He contended that the JCIT was required to issue separate letters of approval for each assessment year for each assessee. The approvals granted u/s 153D for the aforesaid assessments pertaining to different assessment years for the aforesaid 11 assessees through a common letter do not meet this requirement, the learned Counsel for the assessee submitted.

(F.1.3) Next, the learned Counsel for the assessee challenged the validity of the approval granted u/s 153D of the Act, contending that the approvals were granted by JCIT vide aforesaid common letter dated 31/07/2017 in a non speaking manner. The letter did not contain any writeup of JCIT himself indicating that the approvals were granted for the aforesaid 63 assessments after proper application of mind. He contended that contents of the approval letter should include discussion to show that the JCIT had considered all the issues in the proposed draft assessment order, and had applied his mind independently before granting approval instead of giving approval in a summary and non speaking way, in the manner of rubber stamping whatever draft assessment order was sent by the Assessing Officer. He further submitted that this showed that the approvals were granted in a summary, routine, perfunctory and mechanical manner, as an idle formality; and that approvals were not based on independent application of mind by the JCIT.

(F.1.4) The learned Counsel for the assessee also submitted that the JCIT was required, u/s. 153D of the Act, to approve not only the additions proposed by the Assessing Officer; but was also required to approve the assessment order in entirety, contending that the assessment order proposed by the Assessing Officer was required to be approved word by word. In the present case, the learned Counsel for the assessee submitted, the JCIT, vide order sheet dated 25/07/2017, had observed that certain corrections were needed in the draft orders and had directed the Assessing Officer to resubmit the draft orders after making necessary corrections, as discussed with him, latest by 28/07/2017. The JCIT had further directed the Assessing Officer to resubmit the draft orders after corrections, through official e-mail address. Therefore, learned Counsel for the assessee submitted even till 25/07/2017, there was no finality to the assessment order. The state of affairs was conditioned and tentative.

(F.1.4.1) Moreover, the learned Counsel for the assessee submitted, there was common order sheet for all the cases of Jeevan Jyoti Group which consisted of several assessees and the assessments pertained to seven assessment years in the case of each assessee. However, the learned Counsel for the assessee submitted, there was no record, either in the order sheet or elsewhere, as to what corrections were directed to be made by JCIT in the draft assessment orders sent by the Assessing Officer vide aforesaid letter dated 18/07/2017 which was received in the office of the JCIT on 19/07/2017. He contended that considering large number of assessees and multiple assessments for different assessment years; it was impossible for the JCIT to remember what corrections were directed by him in the absence of any record and therefore, it was impossible for him to satisfy himself whether the second draft assessment orders were prepared after carrying out the corrections as per the directions given on 25/07/2017. In the absence of such satisfaction, the approval given u/s 153D of the Act were in the nature of rubber stamping and suffered from infirmity on the ground of having been given without due application of mind.

(F.1.5) The learned Counsel for the assessee further submitted in this connection that the direction of the JCIT to send the second draft of the proposed assessment order by e-mail by 28/07/2017, was not complied with by the Assessing Officer and instead only physical copies were submitted by the Assessing Officer. In the absence of compliance of the directions of the JCIT, the learned Counsel for the assessee submitted, the approvals granted by the JCIT vide aforesaid common approval letter dated 31/07/2017 were vitiated. The learned Counsel for the assessee also contended that the omission to send the second draft of the proposed assessment order by e-mail, pointed to the likelihood that the proposed second drafts of the assessment orders were not even ready by 28/07/2017 and hard copies of the second drafts of the assessment order may have been sent to the JCIT later, possibly on 31/07/2017, which was the next working day; leaving the JCIT with no time to exercise due application of mind before giving approvals u/s 153D of the Act, on 31/07/2017 itself.

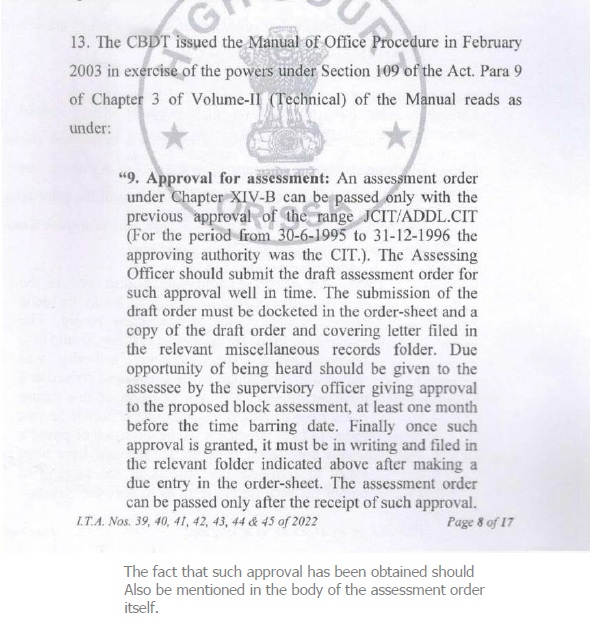

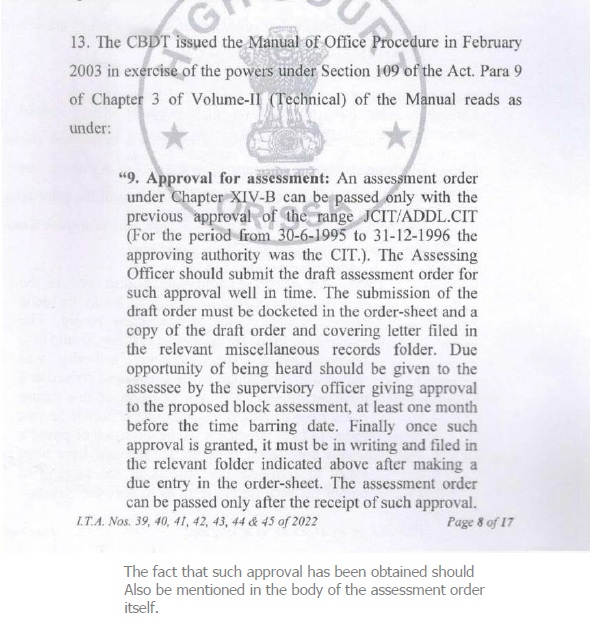

(F.6) The learned Counsel for the assessee further submitted that CBDT has directed the Assessing Officers, in Search Manual, to seek the approval from the approving authority at least one month before the time barring date. In this connection, he drew our attention to order of Lucknow Bench of ITAT in the case of Navin Jain v. DCIT [IT (SS) Appeal No. 639-641 (Lkw) of 2019, dated 3-8-2021] in which, at paragraph 7 of the order, this direction of CBDT is noted. For the ease of reference; para 7 of the aforesaid order dated 03/08/2021 of ITAT is reproduced below:

“7…………Learned counsel for the assessee submitted that granting of approval u/s 153D is a huge task which involves the verification by the approving authority to examine as to which year is unabated and which year is abated and the relevance vis-a-vis seized material. Learned counsel for the assessee further invited our attention to CBDT manual of Office Procedure Volume-II (Technical) placed at pages 995 and 996 of paper book wherein the CBDT has directed that Assessing Officer should submit the draft assessment order for approval from the approving authority well in time. Such manual says that the Assessing Officer should seek approval from the approving authority at least one month before the time barring date. While going through CBDT manual placed at paper book pages 995 & 996, it was observed that this manual was printed in February 2003 and therefore, Learned counsel for the assessee was asked as to how it is applicable to the provisions of section 153D of the Act which came into existence w.e.f. 01/06/2007. Learned counsel for the assessee in this respect submitted that this manual is applicable to the provisions of section 158BG of the Act and which are pari materia to the provisions of section 153D of the Act. It was further submitted that Mumbai Tribunal in the case of Shreelekha Damani, vide order dated 19/08/2015, while deciding similar issue u/s 153D, has relied on the case laws relied for deciding the issue of approval u/s 158BG of the Act and therefore this manual is applicable to provisions of Section 153D also………………..”

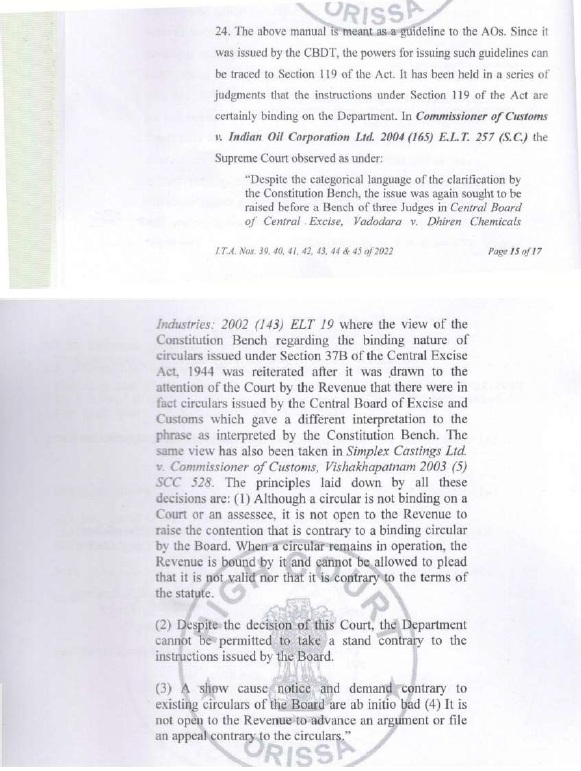

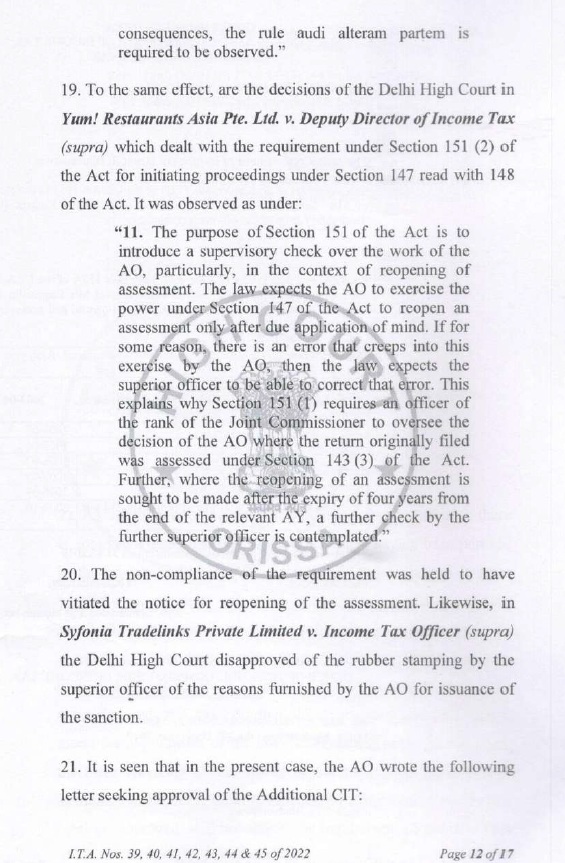

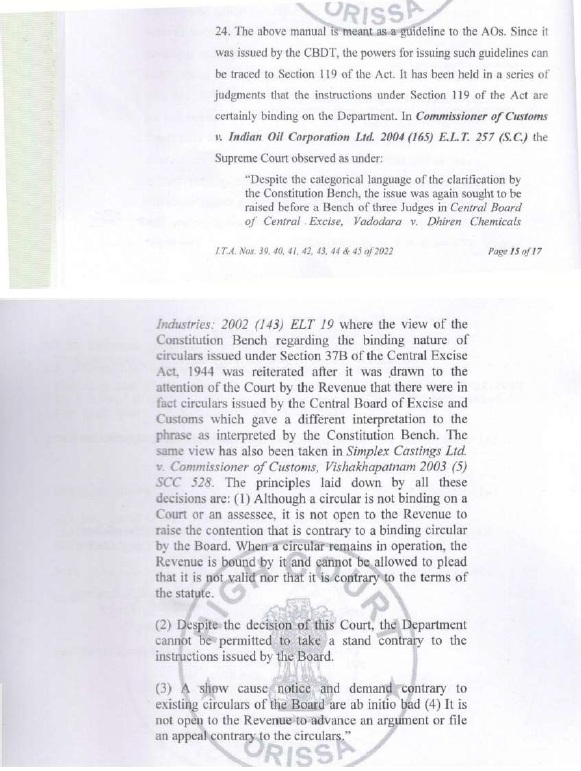

The learned Counsel for the assessee further submitted that the aforesaid order dated 03/08/2021 of ITAT has been referred to and approval by Hon’ble Allahabad High Court in the case of order dated 12/12/2022 in Income Tax Appeal No. 88 of 2022) Pr. CIT v. Sapna Gupta (Allahabad) and also in the case of (order dated 12/12/2022 in Income Tax Appeal No. 90 of 2022) Pr. CIT v. Siddarth Gupta (Allahabad)/[2023] 450 ITR 534 (Allahabad). The learned Counsel for the assessee submitted that the Hon’ble Orissa High Court also, in the case of (in order dated 15/03/2023 in I.T.A. Nos. 39 – 45 of 2022) ACIT v. Serajuddin and Co. (SC) has in paragraphs 13 and 24 of the order; took the aforesaid direction of CBDT into consideration and held that since CBDT, has powers for issuing such guidelines u/s 119 of I.T. Act; the same was certainly binding on the Department. The learned Counsel for the assessee further submitted that the aforesaid orders of Hon’ble Allahabad High Court in the case of Siddarth Gupta (supra) and Hon’ble Orissa High Court in the case of Serajuddin & Co. (supra) were challenged by Revenue in Hon’ble Supreme Court through separate SLPs; but both SLPs were dismissed by Hon’ble Supreme Court vide order dated 09/08/2024 (in the case of Pr.CIT v. Siddharth Gupta) in SLP(C) Diary No. 43280/2023 and order dated 28/11/2023 in SLP(C) Diary No.44989 of 2023 respectively. He drew our particular attention to paragraphs 13 and 24 of the aforesaid order of Hon’ble Orissa High Court in the case of Serajuddin & Co. (supra) which are reproduced below for the ease of reference:

In the present case, the learned Counsel for the assessee submitted, the first draft of proposed assessment order was sent by the Assessing Officer to the JCIT vide letter dated 18/07/2017 which was received in the office of JCIT on 19/07/2017. The limitation date, after which assessment would become time barred was 31/07/2017; therefore, the Assessing Officer was required to seek the approval of JCIT by 30/06/2017. The second draft of the proposed assessment order was sent by the Assessing Officer to the JCIT vide letter dated 28/07/2017. Both the draft orders were sent by the Assessing Officer to JCIT after 30/06/2017; in violation of the aforesaid direction of CBDT, the learned Counsel for the assessee submitted.

(F.6.1) The learned Counsel for the assessee submitted that Hon’ble Delhi High Court, in the case of Pr. CIT v. Shiv Kumar Nayyar (Delhi)/[2024] 467 ITR 186 (Delhi)(order dated 15/05/2024 in I.T.A. No.285/2024 and CM Appeal 28994/2024) considered the aforesaid order of Hon’ble Allahabad High Court in the case of Sapna Gupta (supra) and order of Hon’ble Orissa High Court in the case of Serajuddin & Co. (supra); and expressing agreement with the Hon’ble Allahabad High Court and Hon’ble Orissa High Court; upheld the order of Delhi Bench of ITAT quashing the assessment order.

(F.7) In view of the foregoing, the learned Counsel for the assessee submitted that the assessment should be quashed in the present appeal also.

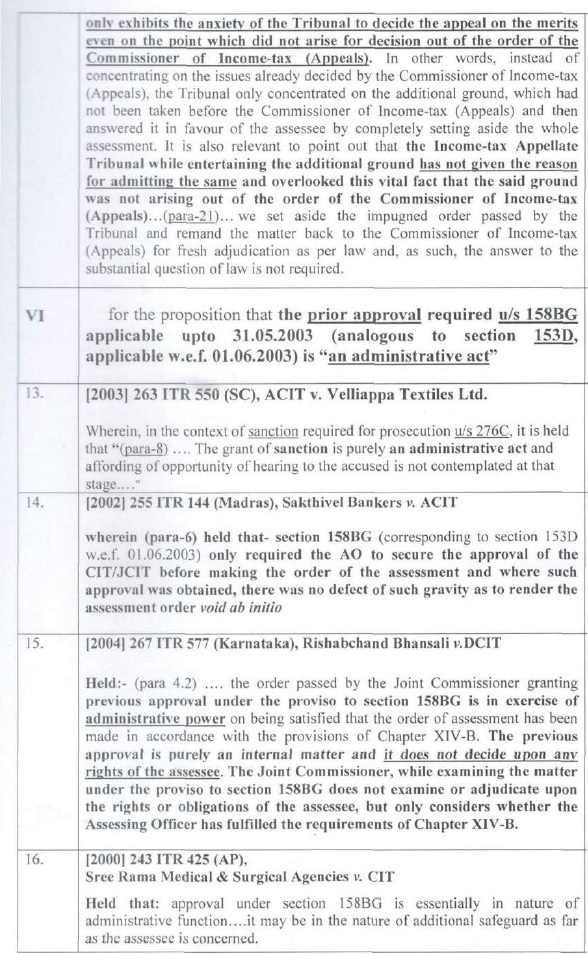

(G) Learned Departmental Representatives contended that it was not required on the part of the JCIT to issue separate letters for giving approval to different assessment years. They submitted that the assessees also, from time to time, provided their written submissions through common letter. They further submitted that it was permitted under law to issue common notice and to pass common assessment orders for several assessment years in the case of a particular assessee. They further submitted that logically therefore, it should also be permissible to give approval u/s 153D of the Act for several assessments pertaining to an assessee. In this regard they drew our attention to the provisions under section 158BG of the Act (which were applicable upto 31/05/2007) and relied on the following case laws:

| (i) | | Asstt. Commissioner v. Velliappa Textiles Ltd. (SC)/[2003] 263 ITR 550 (SC). |

| (ii) | | Sakthivel Bankers v. Asstt. Commissioner (Madras)/[2002] 255 ITR 144 (Madras) |

| (iii) | | Rishabchand Bhansali v. Dy. CIT (Karnataka)/[2004] 267 ITR 577 (Karnataka) |

| (iv) | | Sree Rama Medical & Surgical Agencies v. CIT (Andhra Pradesh)/[2000] 243 ITR 425 (Andhra Pradesh) |

| (v) | | Lakshmi Jewellery v. Dy. CIT (Madras)/[2001] 252 ITR 712 (Madras) |

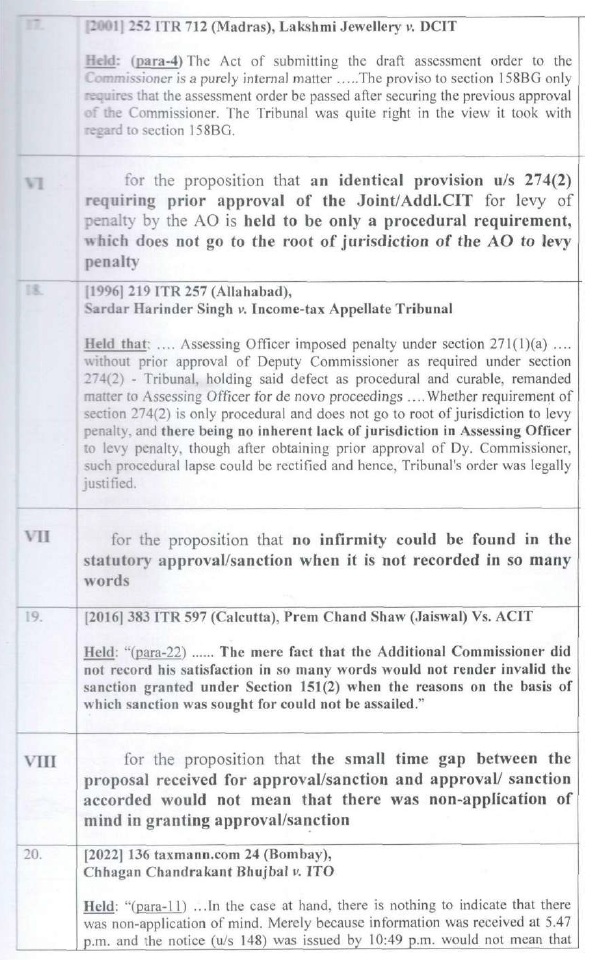

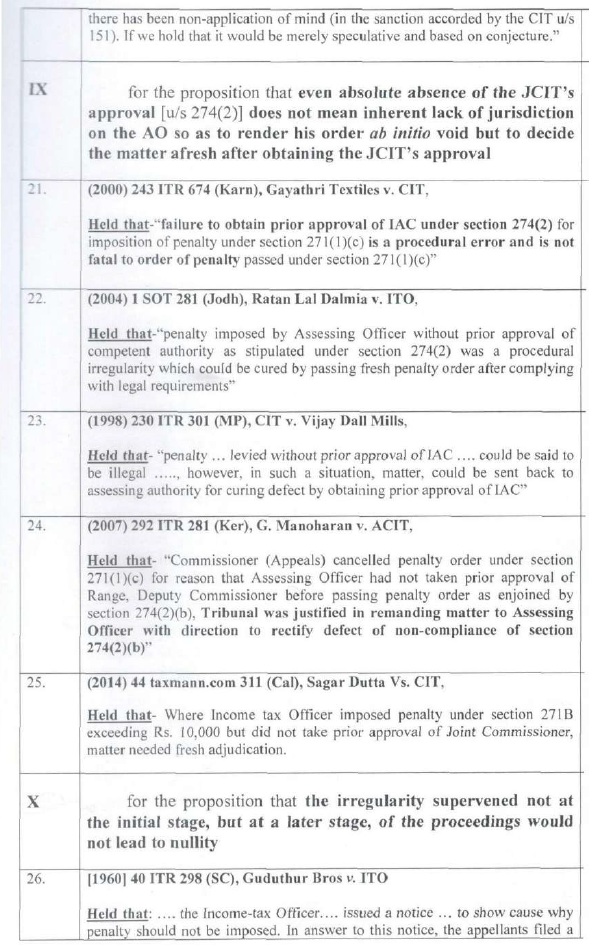

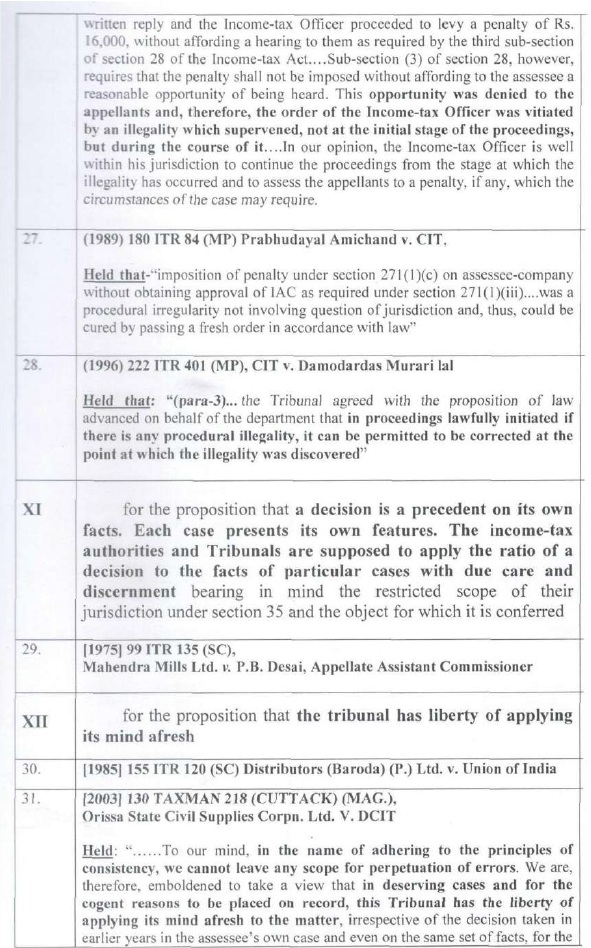

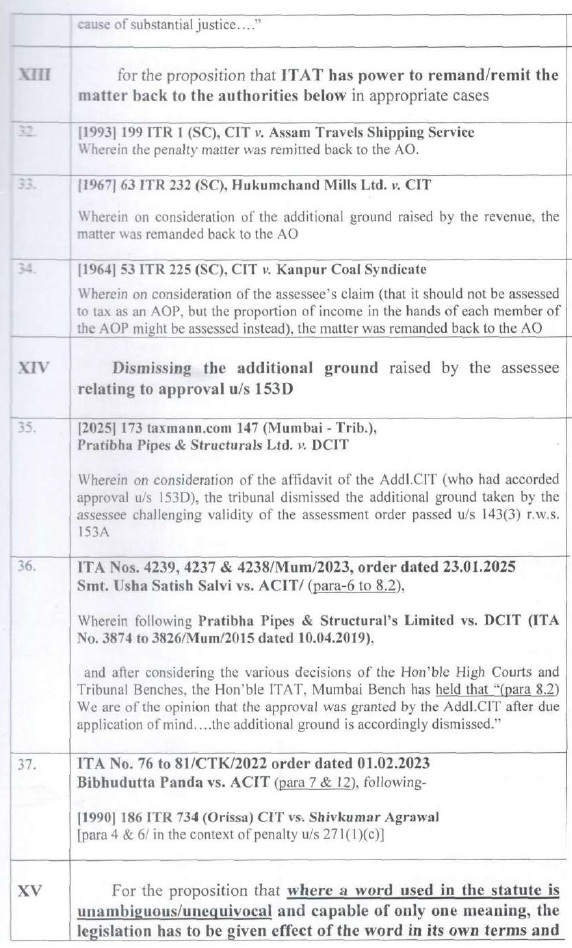

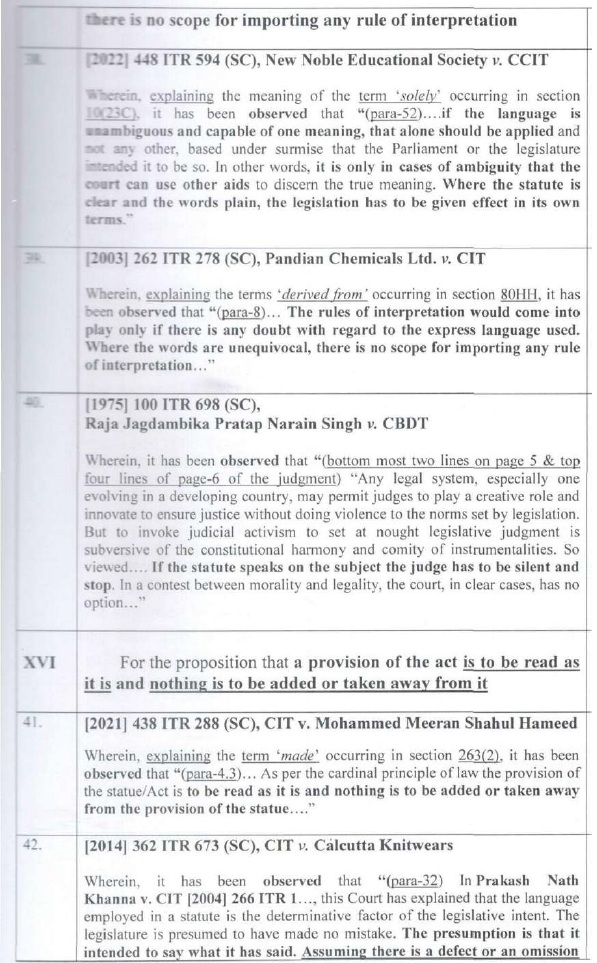

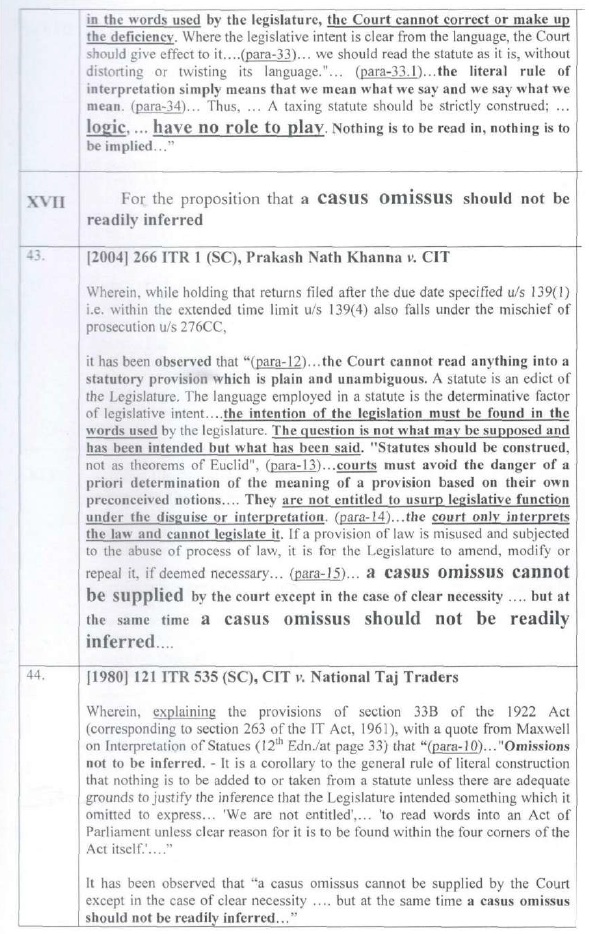

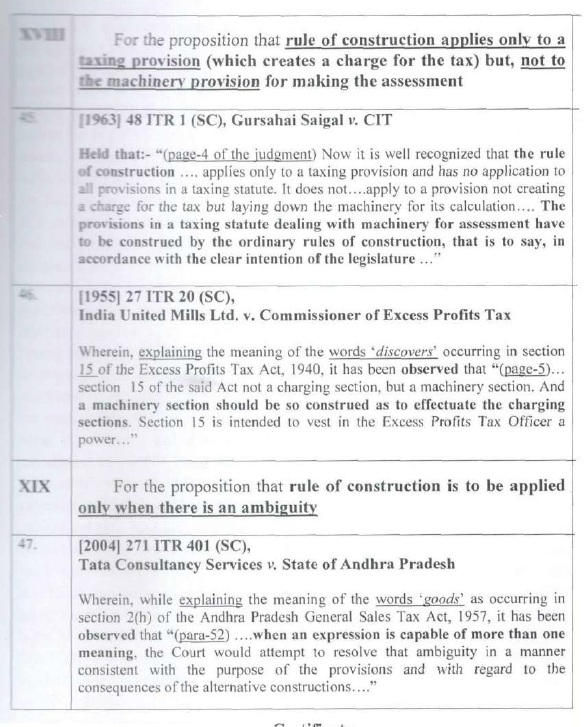

(H) Learned Departmental Representatives further contended that the approval u/s 153D of the Act was akin to approval u/s 274(2) of the Act and further that the approval u/s 274(2) of the Act was held to be a procedural requirement which did not go to the root of the jurisdiction of the Assessing Officer to levy penalty. In this regard they placed reliance on the case of Sardar Harinder Singh v. Income-tax Appellate Tribunal (Allahabad)/[1996] 219 ITR 257 (Allahabad). They also contended that no infirmity can be attributed in the statutory approvals even when it was not recorded in so many words. They placed reliance on the case of Prem Chand Shaw (Jaiswal) v. Asstt. Commissioner (Calcutta)/[2016] 383 ITR 597 (Calcutta) and contended that mere fact that the additional Commissioner did not record his satisfaction in so many words, would not render invalid the sanction granted under section 151(2) when the reasons on the basis of which sanction was sought for could not be assailed. They relied on the order in the case of Chhagan Chandrakant Bhujbal v. ITO (Bombay) (Bombay)/[2022] 440 ITR 359 (Bombay) for the proposition that the small time gap between the proposal received for approval/sanction and approval/sanction accorded would not mean that there was non-application of mind in granting approval/sanction. Learned Departmental Representatives also relied on the case laws Gayathri Textiles v. CIT (Karnataka)/[2000] 243 ITR 674 (Karnataka), Ratan Lal Dalmia v. ITO [2004] 1 SOT 281 (Jodhpur); CIT v. Vijay Dal Mills [1998] 230 ITR 301 (Madhya Pradesh), G. Manoharan v. Asstt. CIT (Kerala)/[2007] 292 ITR 281 (Kerala)andSagar Dutta v. CIT (Calcutta)for the proposition that even absolute absence of the JCIT’s approval u/s 274(2) did not mean inherent lack of jurisdiction on the Assessing Officer so as to render his order ab initio void but to decide the matter afresh after obtaining the JCIT’s approval. Learned Departmental Representatives also placed reliance on the case laws in Guduthur Bros v. ITO [1960] 40 ITR 298 (SC), Prabhudayal Amichand v. CIT ITR 84 (Madhya Pradesh) andCIT v. Damodardas Murarilal ITR 401 (Madhya Pradesh) for the proposition that the irregularity supervened not at the initial stage, but at a later stage of the proceedings would not lead to nullity. Learned Departmental Representatives further placed reliance on the case law in Mahendra Mills Ltd. v. P.B. Desai, Appellate Asstt. Commissioner [1975] 99 ITR 135 (SC) for the proposition that a decision is a precedent on its own facts; that each case presents its own features; and that Income Tax authorities and Tribunals are supposed to apply the ratio of a decision to the facts of particular cases with due care and discernment. They also placed reliance on the case laws in the cases of Distributors (Baroda) (P.) Ltd. v. Union of India (SC)/[1985] 155 ITR 120 (SC)and Orissa State Civil Supplies Corpn. Ltd. v. Dy. CIT (Cuttack)for the proposition that the Tribunal has liberty of applying its mind afresh. Learned Departmental Representatives also placed reliance on the cases of CIT v. Assam Travels Shipping Service (SC)/[1993] 199 ITR 1 (SC), Hukumchand Mills Ltd. v. CIT [1967] 63 ITR 232 (SC)andCIT v. Kanpur Coal Syndicate [1964] 53 ITR 225 (SC); for the proposition that ITAT has power to remand/remit the matter back to the authorities below in appropriate cases. They further placed reliance on the case laws in the cases of New Noble Educational Society v. Chief CIT (SC)/[2022] 448 ITR 594 (SC); Pandian Chemicals Ltd. v. CIT ITR 278 (SC) andRaja Jagdambika Pratap Narain Singh v. CBDT [1975] 100 ITR 698 (SC) for the proposition that where a word used in the statute is unambiguous/unequivocal and capable of only one meaning, the legislation has to be given effect of the word in its own terms and there is no scope for importing any rule of interpretation. Learned Departmental Representatives also placed reliance on the precedents in the cases of CIT v. Mohammed Meeran Shahul Hameed (SC)/[2021] 438 ITR 288 (SC)and CIT v. Calcutta Knitwears (SC)/[2014] 362 ITR 673 (SC) for the proposition that a provision of the Act is to be read as it is and nothing is to be added or taken away from it. Learned Departmental Representatives placed further reliance on Prakash Nath Khanna v. CIT (SC)/[2004] 266 ITR 1 (SC)andCIT v. National Taj Traders (SC)/[1980] 121 ITR 535 (SC) for the proposition that casus omissus should not be readily inferred. Learned Departmental Representatives also relied on the case laws in Gursahai Saigal v. CIT [1963] 48 ITR 1 (SC) andIndia United Mills Ltd. v. Commissioner of Excess Profits Tax [1955] 27 ITR 20 (SC) for the proposition that rule of construction applies only to a taxing provision (which creates a charge for the tax) but, not to the machinery provision for making the assessment. They also relied on the Tata Consultancy Services v. State of Andhra Pradesh (SC)/[2004] 271 ITR 401 (SC) for the proposition that rule of construction is to be applied only when there is an ambiguity. Learned Departmental Representatives also relied on orders of Mumbai Bench of ITAT in the cases of Pratibha Pipes & Structurals Ltd. v. Dy. CIT (Mumbai – Trib.)andUsha Satish Salvi v. ACIT [IT Appeal No. 4237-4239 (mum) of 2023, dated 23-10-2025] and also on order of Cuttack Bench of ITAT in the case of Bibhudutta Panda v. ACIT [IT Appeal Nos. 76 to 81 (CTK.) of 2022, dated 1-2-2023] in which grounds raised by the assessee against validity of approval granted u/s 153D of the I.T. Act were dismissed.

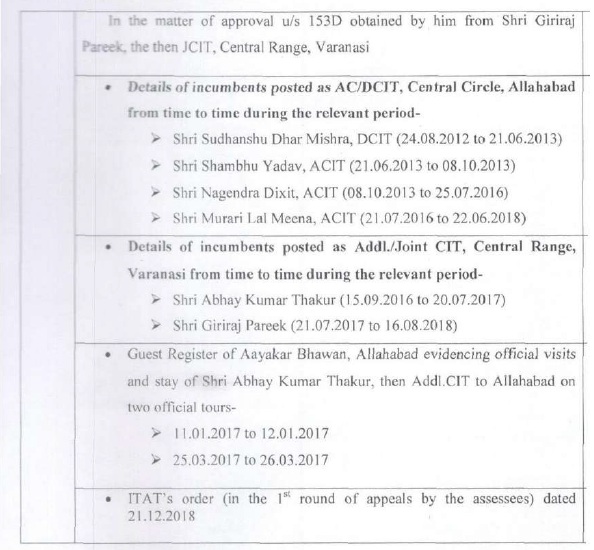

(H.1) Learned Departmental Representatives also submitted that procedural irregularity was not fatal if jurisdictional issue was established. Further, learned Departmental Representatives submitted that fiscal acts should be interpreted in a way which enables functioning of the Act and does not frustrate the Act. Learned Departmental Representatives submitted furthermore, that there was no statutory form prescribed for granting approval u/s 153D of the Act and therefore, the approval given u/s 153D of the Act in the present case did not suffer from any infirmity. Learned Departmental Representatives moreover submitted that the draft assessment order sent by the Assessing Officer to the JCIT vide aforesaid letter dated 28/07/2017 was the second draft order; that the first draft order was sent by the Assessing Officer along with the letter dated 18/07/2017, which was received by the then JCIT (Shri Abhay Kumar Thakur) on 19/07/2017; that the earlier JCIT, who held charge from 15/09/2016 to 20/07/2017 (who received the original draft assessment orders) did not give approval u/s 153D of the Act; but the approval u/s 153D of the I.T. Act was given by the new incumbent (Shri Giriraj Parikh) who took charge on 21/07/2017. They submitted that the new incumbent called the Assessing Officer for discussion, that the discussion between the JCIT and the Assessing Officer took place on 25/07/2017; that after the discussion, the JCIT gave certain directions to the Assessing Officer and the Assessing Officer forwarded the second draft assessment order along with the aforesaid letter dated 28/07/2017, which was approved by the JCIT u/s 153D of the I.T. Act, on 31/07/2017. They also submitted that the Assessing Officer had sent, along with the aforesaid letter dated 18/07/2017, the assessment records and a pen drive (of 8GB capacity) containing seized materials, digital data, submissions of the assessees, appraisal report provided by the Investigation Wing of Income Tax Department and other materials of assessment records; which remained in the office of the JCIT till 31/07/2017 when the JCIT gave approvals u/s 153D of the Act vide aforesaid common letter dated 31/07/2017. They submitted that although the new incumbent, in the office of JCIT (Shri Giriraj Parikh) took charge on 20/07/2017, he immediately came into action regarding the matter of giving approvals u/s 153D of the Act immediately and the approval was given vide aforesaid letter dated 31/07/2017 after due application of mind. Learned Departmental Representatives also submitted that the earlier incumbent in the office of the JCIT (Shri Abhay Kumar Thakur) had visited Allahabad for discussion with the Assessing Officer on multiple occasions and had also stayed in the guest house of the Income Tax department a couple of times. Learned Departmental Representatives also submitted that although the second draft of the proposed assessment orders were not sent to the JCIT by e-mail, the physical copies were indeed sent to the JCIT on 28/07/2017 itself along with the aforesaid letter dated 28/07/2017 with an Inspector of the income tax department, named Mr. Agrahari. Learned Departmental Representatives produced the concerned Inspector, Mr. Agrahari, in person before us, who stated in his oral testimony that the second drafts of the proposed assessment orders were physically carried by him from Allahabad to Varanasi and were handed over to the JCIT on 28/07/2017 itself.

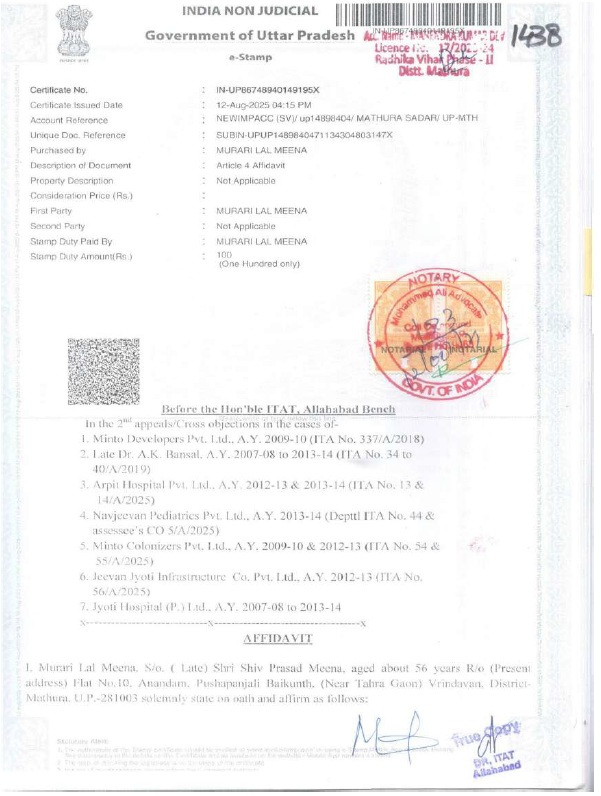

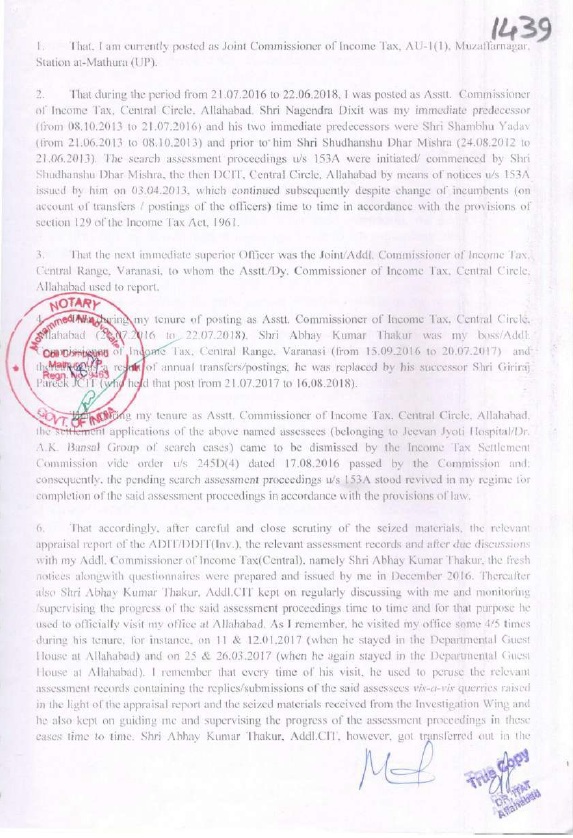

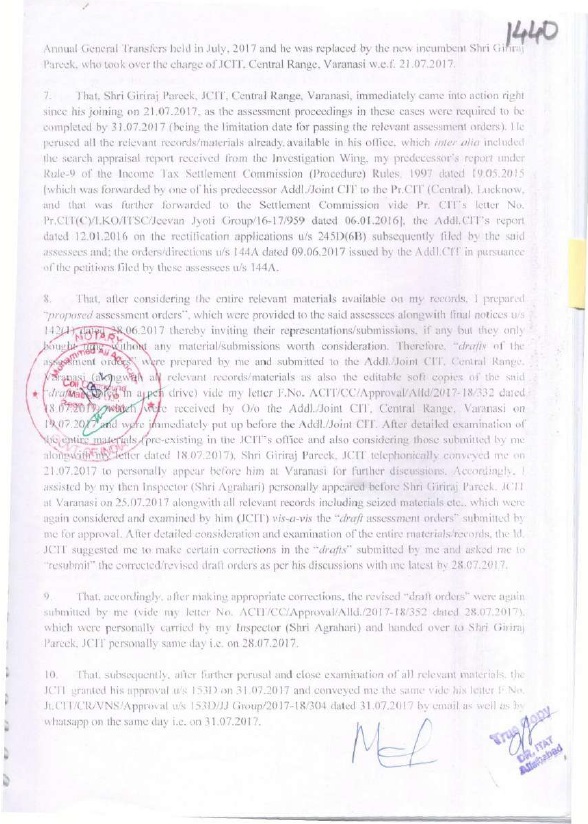

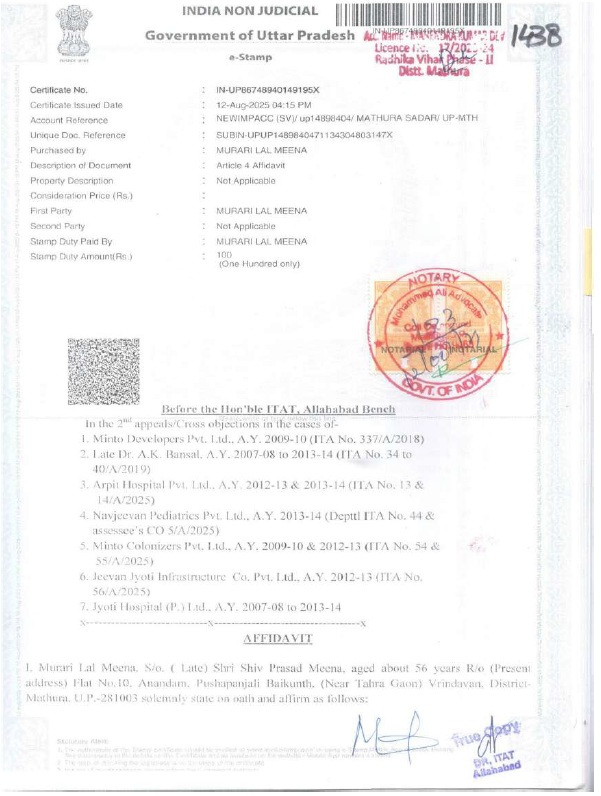

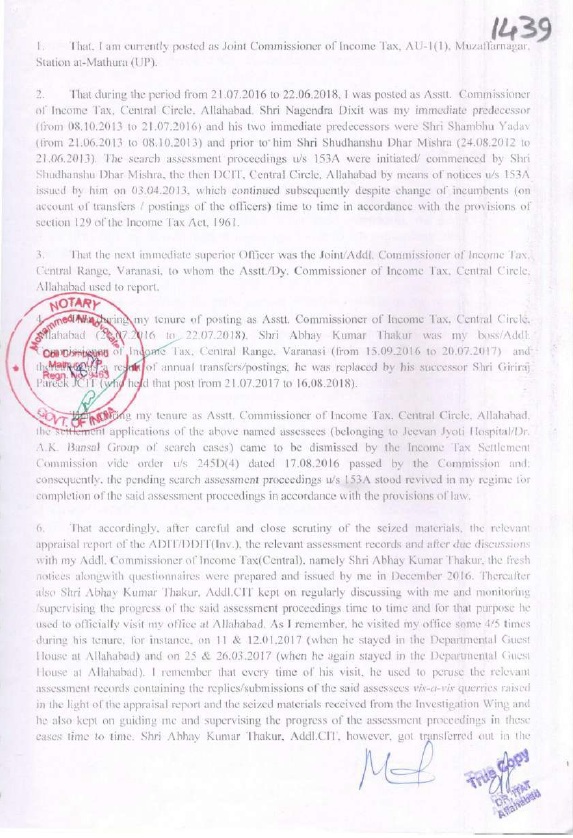

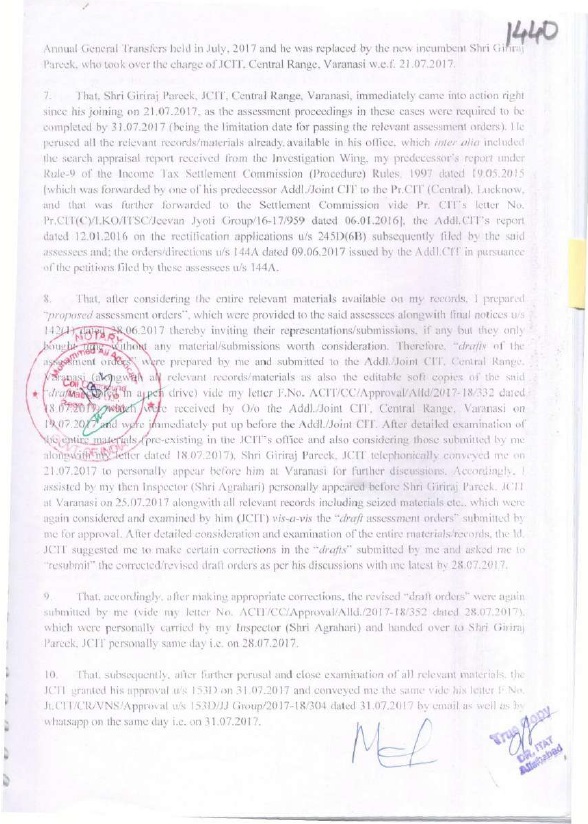

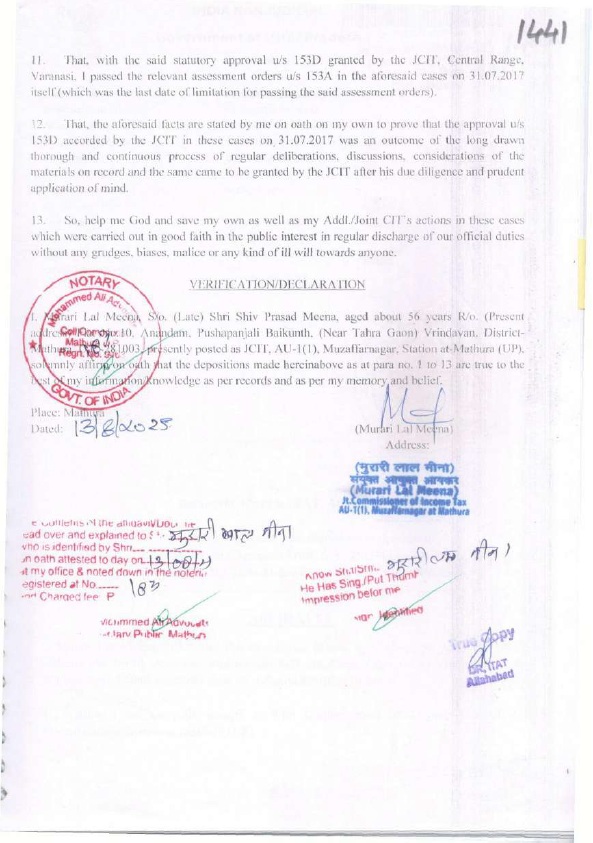

(H.1.1) Learned Departmental Representatives contended emphatically that whether the JCIT had given approval u/s 153D of the Act after due application of mind, was a question of fact and the answer would depend on facts and circumstances of each case. They contended that a conclusion arrived at in a particular case that the approvals were given u/s 153D of the Act without application of mind, did not act as a precedent (being a question of fact) in another case; and conclusion as to whether there was due application of mind in a particular case was to be decided for each case, based on the specific facts of the particular case; and the conclusion was to be arrived at independent of conclusion arrived at in any other case. Learned Departmental Representatives also submitted that the earlier incumbent in the office of JCIT (Mr. Abhay Kumar Thakur) had issued directions u/s 144A of the Act in June 2017, which also enabled him to develop familiarity with the case. Moreover, they contended that the limited time available with the Assessing Officer and the JCIT for the process of approval u/s 153D of the Act was partly attributable to the assessees, as the assessees had sought adjournment of hearing till 12/07/2017. Moreover, they contended that the direction of CBDT to Assessing Officer to seek approval of the approving authority at least one month before the time barring date was directory and not mandatory. They also submitted that although the JCIT, who gave approval, took charge of office on 20/07/2017 which may have been just a few days before limitation date for passing assessment order, the association of the predecessor JCIT (Shri Abhay Kumar Thakur) with the Assessing Officer was part of institutional memory which was reflected in the final approval given vide aforesaid common approval letter dated 31/07/2017 by the next incumbent in the office of JCIT who succeeded him. In view of the submissions made, Learned Departmental Representatives pleaded that the validity of approval given u/s 153D of the Act by the JCIT should be upheld. In their alternate submissions, Learned Departmental Representatives pleaded that the matter regarding approval u/s 153D of the I.T. Act should be restored back to the file of the approving authority (i.e. Addl. CIT/JCIT) for fresh view to be taken; in case it was found that the approval granted u/s 153D of the I.T. Act suffered from infirmities or were invalid. In order to support their submissions, Learned Departmental Representatives drew our attention to the affidavit of Shri M. L. Meena, ACIT, the Assessing Officer. The affidavit of Shri M. L. Meena dated 13/08/2025 is reproduced below for the ease of reference:

(I) The learned Counsel for the assessee, in his rejoinder, countered the submissions made by learned Departmental Representatives emphatically. He submitted that affidavit of the Assessing Officer and the Departmental Inspector are de void of any credibility. He submitted that it was an important and material fact to be noted that the JCIT who gave approval u/s 153D of the IT Act, and who had since superannuated, did not file any affidavit/statement in support of Revenue’s contentions. Since it was the JCIT who gave approval, and he did not support Revenue’s stand; the version of Assessing Officer and Inspector, who still working in the Department and were under the control and discipline of Department; must be rejected. In this regard he contended that the affidavit and personal testimony of Departmental Inspector were self-serving documents and it was aimed at covering omissions and mistakes of Departmental authorities. He also contended that the affidavit and personal testimony of the Departmental Inspector are not supported by any documentary evidence. Further he submitted that the Assessing Officer was not competent to state on oath about the conduct of some other officer specially his senior officer. In particular he referred to paragraph-7 of the affidavit of the Assessing Officer wherein he has stated that Shri Giriraj Parikh, JCIT, came into action right since his joining on 21/07/2017. The deponent Assessing Officer has further stated that the JCIT perused all the relevant records/materials already available in his office, which included appraisal report, the report under Rule 9 of Income Tax Settlement Commission (Procedure) Rules, 1997 [“ITSC(P) Rules” for short], the report of the Addl. CIT dated 12/01/2016, the orders and directions u/s 144A of the I.T. Act etc. The learned Counsel for the assessee also drew our attention to paragraph 8 of the affidavit wherein the deponent Assessing Officer has stated that the JCIT, examined the entire materials (pre existing in the JCIT’s office and also considering those submitted along with letter dated 18/07/2017). The learned Counsel for the assessee further drew our attention to para 10 of the affidavit of the deponent Assessing Officer wherein he has stated that the JCIT granted approval u/s 153D of the Act after further perusal and close examination of all the relevant materials. The learned Counsel for the assessee contended that the deponent Assessing Officer has made statements in the affidavit regarding these materials about which only the JCIT had personal knowledge and the deponent Assessing Officer could not have personal knowledge, information and belief. Further he submitted that in paragraph-9 of the affidavit of the deponent Assessing Officer and in the personal testimony of the Departmental Inspector, it has been stated that the Inspector handed over draft orders to Shri Giriraj Parikh, JCIT on 28/07/2017 along with letter No.ACIT/CC/Approval/All./2017/18/352 dated 28/07/2017. However, no documentary evidence, such as acknowledgement from the office of the JCIT is available on record and no such documentary evidence has been produced by Revenue. The learned Counsel for the assessee also contended that the affidavit of the deponent Assessing Officer has been made on 13/08/2025 after more than 8 years since 31/07/2017 on which approval was given by the JCIT u/s 153D of the Act. He contended that it was impossible for the deponent Assessing Officer to remember the facts of the case including specific dates and specific letter numbers; which are found in the affidavit; after such substantial lapse of time; and similarly, it was impossible for the Inspector to remember things in such specific details after such a long time. In view of these facts and circumstances, the learned Counsel for the assessee submitted that the affidavit of the deponent Assessing Officer and the personal testimony of the Departmental Inspector should be rejected being completely de void of any credibility.

(I.1) Learned Counsel for the assessee also submitted that the contention of Revenue that the Assessing Officer was in regular supervision of the earlier incumbent in the office of the JCIT (Shri Abhay Kumar Thakur) and that Shri Abhay Kumar Thakur regularly discussed with the Assessing Officer, monitored/supervised the progress of the assessment proceedings and extended guidance to the Assessing Officer was entirely irrelevant because it was not Shri Abhay Kumar Thakur who gave approval u/s 153D of the Act. He submitted that it was Shri Giriraj Parikh, JCIT, who took charge on 21/07/2017 who, on 31/07/2017 gave approval u/s 153D of the Act and the validity of the approval u/s 153D of the Act is to be examined regardless of whatever was done and whatever happened when Shri Abhay Kumar Thakur, the earlier incumbent before Shri Giriraj Parikh, held office. He also submitted that 21/07/2017 was Friday and before 31st July 2017 (on which approval was given u/s 153D of the Act) there were only five working days (excluding Saturdays and Sundays which were closed holidays). The learned Counsel for the assessee also submitted that although it is contended by Revenue that the letter dated 18/07/2017 containing initial draft of the assessment order was accompanied with a pen drive (8GB capacity), the note and order sheet of the office of the JCIT dated 19/07/2017, does not make a mention of any pen drive accompanying the aforesaid letter. The notes and order sheet merely mentioned the receipt of letter of the Assessing Officer, and makes no mention of pen drive. Further he submitted that the letter dated 18/07/2017 of the Assessing Officer also does not contain any description of the contents of the pen drive and merely mentions at the bottom of the letter, in hand writing “Pen Drib 1 pees. 8GB”. He also drew our attention to the report of an expert (included in the paper book, filed by the assessee) in which it has been mentioned that there were approximately 40,434 seized documents, 7 CPUs, 26 HDDs and one laptop seized during the search u/s 132 of the Act. The expert has opined that the storage of this data would require a memory of 200GB and that it was impossible to store it on a pen drive of 8GB capacity. The learned Counsel for the assessee also submitted that in any case there was no evidence from record that the JCIT did even examine the contents of the pen drive and also that the letter dated 18/07/2017 did not in any case provide any description of the contents of the pen drive. In the absence of any description of the contents of the pen drive in letter dated 18/07/2017 of the Assessing Officer and in the absence of any reference to pen drive in the notes and order sheet of the office of the JCIT, the claim of Revenue that a pen drive was sent along with letter dated 18/07/2017 carried no value or relevance for the issue at hand, the learned Counsel for the assessee contended. For the ease of reference, the aforesaid letter dated 18/07/2017 of the Assessing Officer is reproduced below:

(I.2) The learned Counsel for the assessee submitted further that the reliance of the learned Departmental Representatives on precedents of Hon’ble Courts, pertaining to section 158BG of the Act to draw equivalence with section 153D of the Act deserved to be rejected outrightly because section 158BG pertained to block assessment order in which, under the mandate of law the Assessing Officer was required to pass one assessment order for the block period consisting of multiple years; whereas under section 153D of the Act, separate approvals are to be given by the approving authority for separate assessment orders pertaining to different assessment years for each assessee. The learned Counsel for the assessee stated that the contention of the learned Departmental Representatives that there was no statutory form prescribed for granting approval u/s 153D of the Act also deserved to be rejected because in any case the approval is to be granted u/s 153D of the Act after due application of mind of the approval authority and the approval given by the approving authority should be done in a speaking manner and not in a summary manner. The learned Counsel for the assessee submitted that the contention of the learned Departmental Representatives that the assessee had sought adjournment of hearing till 20/07/2017 is misleading. He pointed out that the reports under Rules 9 and 9A of ITSC(P) Rules were already on the record of the Assessing Officer, which contained all the information sought for by the Assessing Officer. Moreover, in any case, whether the assessee delayed the assessment proceedings or not is wholly irrelevant for the purpose of examining the validity of approval of the proposed draft assessment order, under section 153D of the Act. He contended that the Assessing Officer was at liberty to proceed with ex parte order if he considered that there was default on the part of the assessee in providing information or in making compliance with the notices. The learned Counsel for the assessee also submitted that direction of CBDT to Assessing Officer to seek approval of the approving authority at least one month before the time barring date was mandatory on the Assessing Officer. He also contended that the association of the JCIT/Addl CIT with the Assessing Officer till the time of preparation of the draft assessment order has no significance for considering the validity of the approval given u/s 153D of the Act because the statutory requirement of approval u/s 153D of the Act cast a separate duty upon the approving authority which was de hors any other role and responsibility of the approving authority. He also submitted that the contention of the learned Departmental Representatives that the association of the predecessor JCIT (Shri Abhay Kumar Thakur) with the Assessing Officer was part of institutional memory, deserved to be rejected for the aforesaid reason. In view of the submissions and contentions presented before us by learned Counsel for the assessee, he submitted that the approval granted by the JCIT was invalid and suffered from the infirmity, because it was humanly impossible for the JCIT to apply his independent mind to total of 63 assessments pertaining to 11 different assessees for different assessment years having regard to enormity of the seized materials, digital data, submissions of the assessees, appraisal report provided by the Investigation Wing of Income Tax Department, reports under Rules 9 & 9A of ITSC(P) Rules, and other materials including assessment records. The learned Counsel for the assessee submitted that although it has been contended in the affidavit of the Assessing Officer and in the submissions of the learned Departmental Representatives that the JCIT sent approvals u/s 153D of the Act to the Assessing Officer on 31/07/2017 through e-mail and Whatsapp, there was no evidence on record that any such e-mail or Whatsapp was sent by the JCIT; and also no print out of such e-mail/Whatsapp communication has been adduced from the side of the Revenue at any stage. In this regard, he also relied on the various paper books, referred to in foregoing paragraph (E) of this order, and on the compilation of the case laws/decisions referred to in foregoing paragraph (E) of this order.

(J) We have heard both sides, patiently; we have also diligently perused the materials on record. We have been presented many precedents/case laws; and many propositions; which are either of general nature, or which pertain to specific issues other than the specific matter of validity of approval u/s 153D of the IT Act. It is settled position of law that specific principles and provisions of law prevail over general principles/provisions of law. It is also settled position of law that principles and provisions of a particular matter or issue, prevail over principles and provisions of another matter or issue; for taking a decision on the former matter or issue. Therefore, the specific propositions, precedents and case laws in the context of validity of approval u/s 153D of the Act have stronger force than those propositions and precedents pertaining to general propositions or pertaining to specific issues other than validity of approval u/s 153D of the IT Act. Moreover, although the learned Departmental Representatives have placed reliance on some orders of ITAT (Bombay Bench and Cuttack Bench), orders of Hon’ble Supreme Court, Hon’ble Allahabad High Court which is the jurisdictional High Court, and orders of other Hon’ble High Courts, such as Hon’ble Orissa High Court and Hon’ble Delhi High Court; prevail over orders of Bombay Bench and Cuttack Bench of the Tribunal.

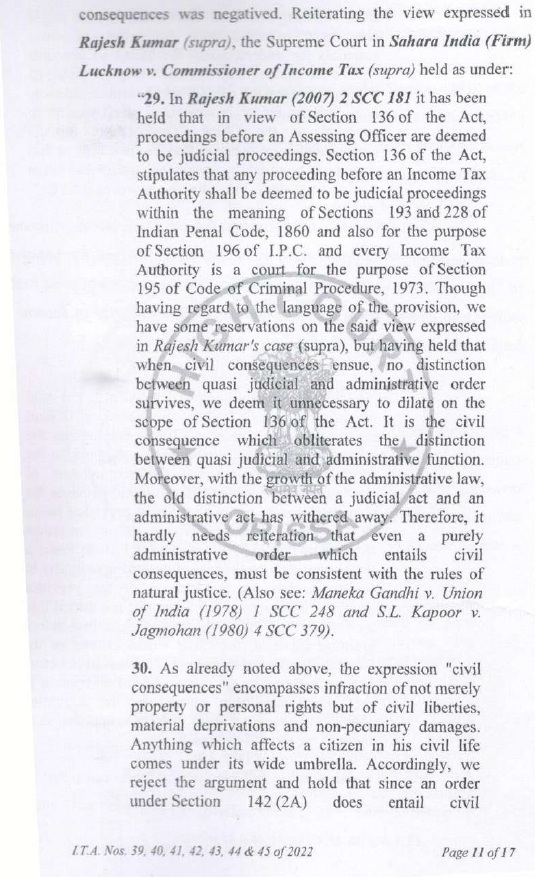

(J.1) In the case of ACIT, Circle-1(2), Bhubaneswar v. Serajuddin & Co. (supra), it was held as under:

(J.1.1) Further, in the case of Pr.CIT (Central) & Anr. v. Siddarth Gupta (supra), Hon’ble Allahabad High Court held as under:

(J.1.1.1) SLPs filed by Revenue against aforesaid order of Hon’ble Orissa High Court in the case of ACIT v. Serajuddin & Co. [2023] (Orissa)/[2023] 454 ITR 312 (Orissa) and aforesaid order of Hon’ble Allahabad High Court in the case of Siddharth Gupta (supra) ; have been dismissed by Hon’ble Supreme Court in decisions at Serajuddin and Co. (supra) and vide order dated 09/08/2024 in SLP(C) Diary No.43280/2023 in the case of Pr.CIT v. Siddharth Gupta, respectively.

(J.1.2) Similarly, in the case of Sapna Gupta (supra), Hon’ble Allahabad High Court held as under:

(J.1.3) Moreover, in the case of Shiv Kumar Nayyar (supra), Hon’ble Delhi High Court held as under:

10. Before embarking upon the analysis of the factual scenario of the instant appeal, we deem it apposite to examine the underlying.

(J.1.3.1) In the case Pr. CIT (Central) v. Anuj Bansal (Delhi)/[2024] 466 ITR 251 (Delhi) also, Hon’ble Delhi High Court upheld the order of ITAT quashing assessment order on the ground that there was absence of application of mind by the approving authority in granting approval u/s 153D of IT Act. The SLP filed by Revenue against this order of Hon’ble Delhi High Court has been dismissed by Hon’ble Supreme Court in Anuj Bansal (supra). Similar view has also been taken by Hon’ble Delhi High Court in the cases CIT v. Pioneer Town Planners (P.) Ltd. (Delhi)/[2024] 465 ITR 356 (Delhi) and in Pr. CIT v. MDLR Hotels (P.) Ltd. (Delhi).

(J.1.4) In the case of Pr. CIT v. Subodh Agarwal (Allahabad) ; Hon’ble Allahabad High Court held as under:

(J.1.5) We are also cognizant of the order of Lucknow Bench of ITAT in the case of Standard Frozen Foods Exports Pvt. Ltd. v. DCIT [IT(SS)A No.41 & 41/Lkw/2022], which has been authored by us and order of Lucknow Bench of the ITAT in Quality Structures Pvt. ltd. v. DCIT [IT(SS)A No.679 & 680/Lkw/2019], which is co-authored by one of us (the Judicial Member). In these orders, we have already taken view regarding validity of approval u/s 153A of the Act and relevant portions are reproduced as under:

Standard Frozen Foods Exports Pvt. Ltd. (supra)

“(D) We have heard representatives of both sides. We have also perused the materials on record carefully.

(D.1) The first limb of the contention raised by the learned Counsel for the assessee is on the legal ground that statutory approval given to the Assessing Officer for the assessment orders was not based on application of mind. It was the case of the learned Counsel for the assessee that approval was given by Addl. CIT in a mechanical manner within a short period of time during which it was humanly impossible for the Addl. CIT to go through exhaustive assessment records, search & seizure materials and to thereafter give approval after due application of mind. The learned Counsel for the assessee submitted that the Addl. CIT gave approval to 110 cases in two days which included; 48 cases on 27/12/2019 and 62 cases on 28/12/2019. These cases included approvals given for assessment orders which are subject matters of the present batch of appeals before us. The learned Counsel for the assessee further drew our attention to the fact that approval No. 1490 was requested by the Assessing Officer for 16 cases on 28/12/2019 and approval was given by the Addl. CIT on the same day i.e. on 28/12/2019. He further drew our attention to the fact that approval No. 1488 was requested by the Assessing Officer for 15 cases on 26/12/2019 and approval was given by the Addl. CIT on the very next day i.e. on 27/12/2019. He also drew our attention to the fact that draft assessment orders were sent by the Assessing Officer for approval to the Addl. CIT at the fag end of the assessment proceedings on 26/12/2019 and 28/12/2019 though the assessments were going to be barred by limitation barely a few days later, on 31/12/2019. Placing reliance on the order of Hon’ble Allahabad High Court in the case of Pr. CIT v. Subodh Agarwal, I.T.A. No. 86 of 2022, dated 12/12/2022 and order of Hon’ble Orissa High Court in the case of ACIT v. Serajuddin & Co. (supra) and further on the order of Hon’ble Delhi High Court in the case of Pr. Commissioner of Income Tax v. Shiv Kumar Nayyar (supra), learned Counsel for the assessee submitted that the assessment orders passed by the Assessing Officer, based on mechanical approval given by the Addl. CIT, without due application of mind, lacked legal validity and deserved to be quashed. He also placed reliance on the orders of Income Tax Appellate Tribunal in the case of Khoday Ehshwarsa and Sons v. DCIT, I.T.A. No.1079 & 1080/Bang/2024 dated 20/09/2024 and in the case of Sanjay Duggal and Others, I.T.A. No.1813/Del/2019 and in the case of Quality Structure Pvt. Ltd. v. DCIT, IT (SS)A Nos. 679 & 680/Lkw/2019. The learned CIT, D.R. for Revenue submitted that it was the normal practice that the Assessing Officer and the Addl. CIT/Jt. CIT engage in periodical discussion over a long period of time. Therefore, it was possible for the Addl. CIT to grant approval to draft assessment order after application of mind even though time available was short. In his rejoinder, learned Counsel for the assessee submitted that there is nothing on record to show that there was discussion between the Assessing Officer and Addl. CIT. In response to specific query from Bench whether the assessees were responsible for the delay on the part of the Assessing Officer in submission of draft assessment orders to the Addl. CIT at the fag end of the limitation period; and if so, whether the submissions made by the assessee would still be good on merits, learned Counsel for the assessee submitted that the delay on the part of the Assessing Officer in submission of the draft assessment orders to the Addl. CIT was due to the fact that assessment proceedings were taken up in haste by the Assessing Officer after lapse of substantial duration of time available during the limitation period. He further submitted that the assessees made compliance with the notices of the Assessing Officer even though sufficient time was not given by the Assessing Officer. Therefore, he contended that the delay on the part of the Assessing Officer in submission of the draft assessment order to the Addl. CIT was entirely attributable to Revenue and to the Assessing Officer in particular; and further, that the assessees were in no way responsible for the delay. After hearing both sides, we are of the view that the issue in dispute is squarely covered by the order of the Hon’ble Allahabad High Court in the case of Pr. CIT v. Subodh Agarwal, I.T.A. No. 86 of 2022, dated 12/12/2022, order of Hon’ble Orissa High Court in the case of ACIT v. Serajuddin & Co. (supra) and order of Hon’ble Delhi High Court in the case of Pr. Commissioner of Income Tax v. Shiv Kumar Nayyar (supra), in favour of the assessee. Further the issue in dispute is also squarely covered in favour of the assessee by the orders of the Income Tax Appellate Tribunal in the case of Khoday Ehshwarsa and Sons v. DCIT, I.T.A. No.1079 & 1080/Bang/2024 dated 20/09/2024 and in the case of Sanjay Duggal and Others, I.T.A. No.1813/Del/2019 and in the case of Quality Structure Pvt. Ltd. v. DCIT, IT (SS)A No. 679 & 680/Lkw/2019 (supra). In view of the foregoing, we set aside the impugned appellate orders of learned CIT(A) deserve to be set aside; and the assessment orders passed by the Assessing Officer deserve to be annulled.

(D.2) The second limb of the contentions made by the learned Counsel for the assessee on behalf of the appellant assessees was that in the following cases, no incriminating material was found in the course of search conducted u/s 132 ofthe IT Act:

| Appeal Number | Assessment year | Appellant |

| IT(SS)A No.41/Lkw/2022 | 2012-13 | Standard Frozen Foods Exports Pvt. Ltd. |

| IT(SS)A No.42/Lkw/2022 | 2013-14 | Standard Frozen Foods Exports Pvt. Ltd. |

| IT(SS)A No.43/Lkw/2022 | 2016-17 | Standard Frozen Foods Exports Pvt. Ltd. |

| IT(SS)A No.44/Lkw/2022 | 2017-18 | Standard Frozen Foods Exports Pvt. Ltd. |

| IT(SS)A No.46/Lkw/2022 | 2012-13 | Standard Agro Vet Pvt. Ltd. |

| IT(SS)A No.47/Lkw/2022 | 2013-14 | Standard Agro Vet Pvt. Ltd. |

| IT(SS)A No.48/Lkw/2022 | 2014-15 | Standard Agro Vet Pvt. Ltd. |

| IT(SS)A No.49/Lkw/2022 | 2015-16 | Standard Agro Vet Pvt. Ltd. |

| IT(SS)A No.55/Lkw/2022 | 2014-15 | Sachin Verma |

| IT(SS)A No.57/Lkw/2022 | 2016-17 | Sachin Verma |

| IT(SS)A No.54/Lkw/2022 | 2012-13 | Sachin Verma |

| IT(SS)A No.56/Lkw/2022 | 2015-16 | Sachin Verma |

| IT(SS)A No.58/Lkw/2022 | 2017-18 | Sachin Verma |

| IT(SS)A No.50/Lkw/2022 | 2015-16 | Kamal Kant Verma |

| IT(SS)A No.51/Lkw/2022 | 2016-17 | Kamal Kant Verma |

| IT(SS)A No.52/Lkw/2022 | 2017-18 | Kamal Kant Verma |

Further, he submitted that in the aforesaid cases, the assessments were unabated. Therefore, he contended, following the order of Hon’ble Supreme Court in the case of Pr. CIT v. Abhisar Buildwell (P) Ltd. (supra), no additions could be made in the assessment orders passed by the Assessing Officer in the aforesaid assessment orders. The learned CIT D.R. for Revenue placed reliance on the orders ofthe Assessing Officer and the impugned appellate orders of the learned CIT(A) on this issue. After hearing both sides, we are of the view that the issue is squarely covered in favour of the assessees as far as aforesaid assessments are concerned, by order of Hon’ble Supreme Court in the case of Pr. CIT v. Abhisar Buildwell (P) Ltd. (supra). Accordingly, the additions made in the aforesaid assessment orders deserve to be deleted.

(D.2.1) In view of the foregoing, we are of the view that the additions made in the assessment orders pertaining to the present bunch of 19 appeals cannot be upheld. In the light of the discussion in foregoing paragraph (D.1) and (D.2) of this order, we are also of the view that the assessment orders passed by the Assessing Officer in the present batch of 19 appeals lack validity in law; and that the additions made cannot be upheld. In view of the foregoing, we set aside the impugned appellate orders passed by the learned CIT(A) and we annul corresponding assessment orders for various assessment years pertaining to various assessees in present batch of 19 appeals being disposed ofthrough this consolidated order.”

Quality Structures Pvt. Ltd. v. DCIT (supra)

“10. We have heard the rival parties and have gone through the material on record. We find that in this case, in view of a search carried out on the Sigma Group, the assessments of various assessees were reopened and various assessees were required to file income tax returns as required under the provisions of section 153A of the Act. The search was started on 23.8.2016 and it continued upto 25.8.2016, and therefore, the assessment year 2017-18 became the search year and the years preceding the search year became the subject matter of reopening under section 153A of the Act. Since the controversy involved herein is with regard to the approval under section 153D of the Act, it would be appropriate to first visit the provisions of section 153D of the Act, which, for the sake of completeness are reproduced below:

Prior approval necessary for assessment in cases of search or requisition.

153D. No order of assessment or reassessment shall be passed by an Assessing Officer below the rank of Joint Commissioner in respect of each assessment year referred to in clause (b) of sub-section (1) of section 153A or the assessment year referred to in clause (b) of sub-section (1) of section 153B, except with the prior approval of the Joint Commissioner.

Provided that nothing contained in this section shall apply where the assessment or reassessment order, as the case may be, is required to be passed by the Assessing Officer with the prior approval of the Principal Commissioner or Commissioner under sub-section (12) of section 144BA.

11. The above provisions of section 153D of the Act were inserted by the Finance Act, 2007 with effect from 1.6.2007. In our meek understanding of the said provisions, we are of the considered opinion that the Legislature wanted that the assessment/re-assessment of the search cases should be made and the order should be passed with the prior approval of the superior authority.

12. In the group of cases of Shri Navin Jain and others in I.T.(SS)A. Nos.639 to 641/Lkw/2019, etc., vide order dated 3.8.2021, for Assessment Years 2015-16 to 2017-18, on which reliance has been placed by the ld. counsel for the assessee, a similar issue has been considered by the Lucknow Bench of the Tribunal, wherein also, the approval under section 153D of the Act was given through the same letter dated 30.12.2018 by the ACIT, Central, Kanpur and the Ground raised in this regard by the assessee was allowed, and the assessment orders were annulled by us. While allowing the Ground raised by the assessee, the Tribunal had also considered various cases laws, including that of the Hon’ble Supreme Court. For the sake of ready reference, the findings of the Tribunal in that case are reproduced as under:

“9. We have heard the rival parties and have gone through the material placed on record. We find that in these cases, in view of a search carried out on the Sigma Group, the assessments of various assessees were reopened and various assessees were required to file income tax returns as required under the provisions of section 153A of the Act. The search was conducted on 23/08/2016 which continued upto 25/08/2016 and therefore, assessment year 2017-18 became the search year and the years preceding the search year became the subject matter of reopening u/s 153A of the Act. The issue raised by Learned counsel for the assessee is that the approval granted by the Addl. CIT is bad in law as it is humanly impossible to go through documents exceeding 17,800 in a single day and then grant approval on the same day. Since the controversy involved here is with respect to approval u/s 153D of the Act, it would be appropriate to first visit the provisions of section 153D of the Act, which for the sake of completeness are reproduced below:

“SECTION 153D.

Prior approval necessary for assessment in cases of search or requisition [No order of assessment or reassessment shall be passed by an Assessing Officer below the rank of Joint Commissioner in respect of each assessment year referred to in clause (b) of [sub-section (1) of section 153A] or the assessment year referred to in clause (b) of subsection (1) of section 153B, except with the prior approval of the Joint Commissioner.] [Provided that nothing contained in this section shall apply where the assessment or reassessment order, as the case may be, is required to be passed by the Assessing Officer with the prior approval of the [Principal Commissioner or Commissioner] under sub-section (12) of section 144BA.]”