ORDER

S. Rifaur Rahman, Accountant Member. – This appeal is filed by the assessee against the order of ld. Commissioner of Income-tax (Appeals)-VIII, New Delhi [hereinafter referred to as ‘ld. CIT (A)] dated 21.03.2014for Assessment Year 2008-09.

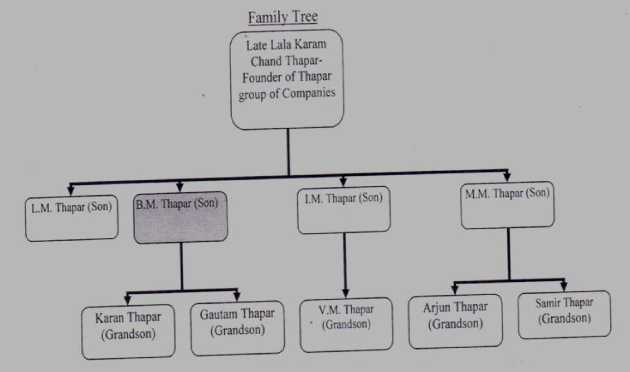

2. Brief facts of the case are, the assessee company belongs to the Thapar Group established by Late Lala Karam Chand Thapar. There was a family settlement between the various constituents of the Karam Chand Thapar family as a result of which Revenue-organization/restructuring of the group companies had taken place by virtue of Memorandum of family settlement dated 27th April, 2001. The re-organization of the Group Companies & Trusts was made into four groups, as under, each headed by the sons of Late Lala K.C. Thapar. The family tree of Karam Chand Thapar family is explained as under in the form of a diagrammatic chart:

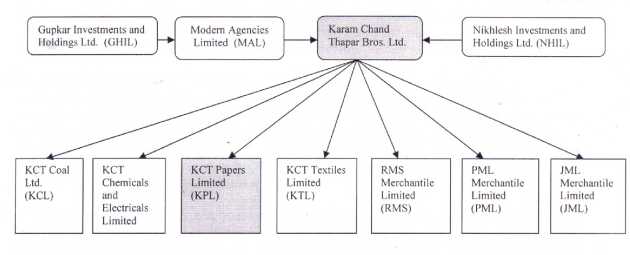

3. The aforesaid Memorandum of family settlement provided for the re structuring of the companies as under:

| i. | | Scheme 1- Amalgmation of Nikhlesh Investments and Holdings (NIHL) with Karam Chand Thapar and Bros. Limited (KCTBL) |

| ii. | | Scheme 2- It was comprised of two stages as under: |

Stage 1- Amalgamation of Modern Agencies Limited (MAL)&Gupkar Investments and Holdings Limited (GHIL) with KCTBL.

Stage 2- Demerger of KCTBL into 7 companies namely KCT Coal Limited (KCL), KCT Chemicals and Electricals Limited (KEL), KCT Papers Limited (KPL), KCT Textiles Limited (KTL), RMS Merchantile Limited (RMS), PML Merchantile Limited (PML) and JMK Merchantile Limited (JMK). Thus, the assessee company, M/s KCT Papers Ltd. is one of the resulting companies.

4. The various schemes of amalgamations and demergers have been duly approved and sanctioned by the Hon. High Court of Delhi and Bombay in terms of section 391 and 394 of the Companies Act. The effective date of all the aforesaid amalgamations and demergers was 15t April, 2006.

5. The assessee company belongs to the BMT group which comprises of Sh. B.M. Thapar s/o Late Lala Karam Chand Thapar and his two sons, Sh. Gautam Thapar and Sh. Karan Thapar.

6. The facts pertaining to the Long term capital gains on sale of rights, title and interest in commercial site are that Modem Agencies Ltd. and KCT Bros Ltd. (Both of which ultimately merged under amalgamation had together invested Rs.4,10,00,000/- in the past with M/s Energetic Construction Pvt. Ltd. which was supposed to develop World Trade Centre at Gurgoan and the above mentioned two companies were together entitled for 24261 sq ft. of built area @ 1640 per sq ft. when property would be built. After amalgamation of Modem Agencies Ltd. with KCT Bros Ltd, entire right become concentrated in KCT Bros. Ltd. and subsequently when the demerger took place in KCT Bros Ltd., this right was passed on to 4 (out of 7) of the resulting companies, assessee company being out of them. The aforesaid rights, title and interest were transferred to M/s TCG Urban Infrastructure Holding Ltd. for a total consideration of Rs.20,78,62,944/-. Thus, the assessee’s 1I4th share of consideration was Rs.5,19,65,736/-. Indexed cost of acquisition of such rights was Rs.1,83,39,832/-. Accordingly, assessee has offered Rs. 3,36,25,904/-being its 1/4th share of Long term capital gains.

7. The losses in respect of shares of Ballarpur Industries Ltd have resulted due to buyback of these shares made by the company. Initially, BILT had allotted shares of face value of Rs.10/-. Subsequently, these were split into 5 shares of Rs.2/- each. BILT had floated a scheme of buy back two shares out of every five shares held by shareholders. Assessee has exercised this option and a sum of Rs.49,40,64,800/- was received in this buyback transaction. Thus, Rs.1,97,62,592 shares were sold in buy-back out of total of Rs.4,94,06,480 shares. The shares of BILT were received by the assessee company as a result of the family settlement in the process of amalgamations and demergers. The shares of BILT were initially acquired by KCTBL, MAL and GHIL. Further, as a result of family settlement process, the entire shares had got concentrated in KCTBL, whereafter it became a property of the assessee company. During the entire process of amalgamation and demerger, these shares, alongwith other assets and liabilities were transferred at their cost to the previous owner/ Book value.

8. Issue under consideration: The main contentious issue before us is the calculation of cost of acquisition of shares of Ballarpur Industries Ltd. The appellant has claimed that the cost of acquisition of the shares acquired under family settlement, should be taken as the cost to the previous owner as indexed with reference to the period of holding in the hands of previous owner and after taking into account the Fair Market Value of the shares as on 1.04.1981 in respect of the shares acquired on or before the said date. The assessee has accordingly adopted the indexed cost of acquisition of such shares.

9. On the other hand, assessing officer has taken cost of acquisition of shares as cost to the previous owner or book value of the shares, i.e., the value as appearing in the books of KCT Papers on appointed date of 1.4.2006. He has reckoned the period of holding from 1.4.2006 only, instead of referring to the date when the shares were first acquired by the previous owner. Thus, he has not allowed the benefit of indexation to the and also not considered fair market value of shares as on 1.4.1981 in case of shares acquired by previous owners, prior to the said date. The A.O. had adopted the value of shares of BILT as on 01.04.2006 being the effective date of amalgamation and demerger of all companies as per High Court orders.

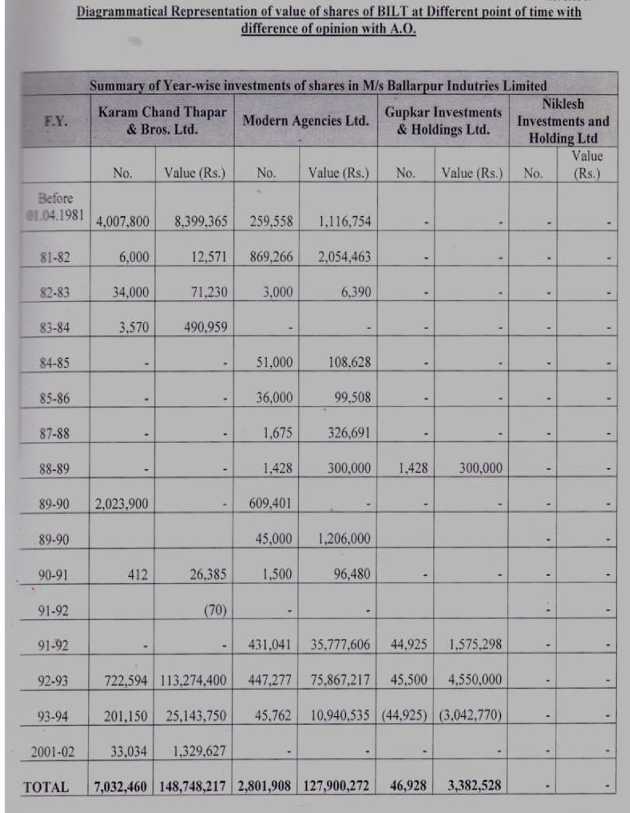

10. The calculation of long term capital gains on buy back of shares of BILT as per the Assessing Officer and as per the assessee is being summarized as under :-

| Particulars | As per A.O. Amount (Rs.) | As per assessee Amount (Rs.) |

| Sales consideration received on Buy Back of BILT shares. | 49,40,64,800 | 49,40,64,800 |

| Less : Cost of shares | | |

| -As per cost of shares | 11,20,12,407 | |

| -Indexed cost of Acquisition (with reference to period of holding of previous owner &FMV as on 01.04.1981) | | 72,79,22,871 |

| Long term capital gain | 38,20,52,393 | (23,38,58,071) |

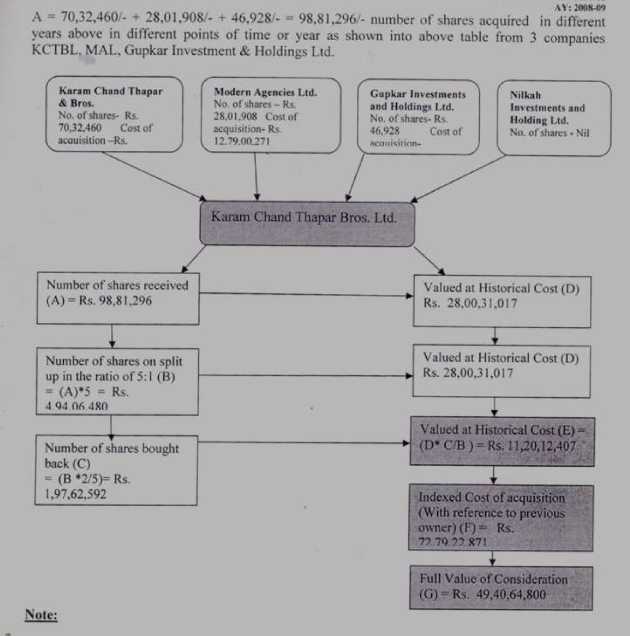

11. A diagrammatic representation of number and value of shares of BILT at different points of time with difference of opinion with A.O. summarizing the facts of the case and entire issue under consideration is being summarized as under:-

| (i) | | A represents total number of shares of Billarur Industries Ltd. received by Assessee Company under the family settlement =. 98,81,296/- |

| (ii) | | B represents total number of shares of Billarpur Industries Ltd on split up in the ratio of 5 share for one share held. =5 x 98,81,296/- =4,94,06,480/- |

| (iii) | | C represents total number of shares of Billarpur Industries Ltd. bought back in the ratio of two for every five shares held =4,94,06,480/- x 2/5 =1,97,62,592/-. |

| (iv) | | D represents the historical cost of shares of Billarpur Industries Ltd. received under family settlement =Rs. 28,00,31,017/- |

| (v) | | On split up of shares of Billarpur Industries Ltd., the historical cost of shares remain same at Rs.28,00,31,017/-. |

| (vi) | | E represents the historical cost of shares of Billarpur Industries Ltd. transferred by KCT Papers Ltd. under buy back scheme received under family settlement =Rs.28,00,31,017/- *1,97,62,592/- =Rs. 11,20,12,407/4,94,06,480/- |

| (vii) | | F represents the Indexed cost of acquisition of shares of Billarpur Industries Ltd. with reference to the period of holding of previous owners =Rs.72,79,22,871/- |

| (viii) | | G represents the full value consideration received on buy back of shares of Billarpur Industries Ltd. =Rs.49,40,64,800/- |

| (ix) | | Long Term Capital gains as per assessee =(G) – (F) =Rs. 49,40,64,800/- (-) Rs.72,79,22,871/- =(Rs. 23,38,58,071) |

| (x) | | Long Term Capital gains as per A.O. =G) – (E) =Rs. 49,40,64,8001(-) Rs. 11,20,12,407/- =Rs.38,20,52,393/ |

12. Thus, the main issue for consideration is adoption of cost of acquisition of shares in computing the capital gains on sale thereof. The assessee has adopted indexed cost of acquisition with reference to the period of holding of previous owner (E), whereas the A.O. has adopted historical cost (D) for the purpose of calculation of Long Term Capital Gain.

| 3. | | Aggrieved, assessee preferred an appeal before the ld. CIT (A) and raised grounds of appeal and also filed detailed written submissions which are reproduced by the ld. CIT (A) at pages 7 to 15 of the impugned order. After considering the above submissions, ld. CIT (A) allowed the appeal of the assessee with regard to Ground Nos.1 to 3 raised by the assessee with the following observations :- |

“12. Ground of Appeal No.1, 2 and 3: I have gone through the order of the Assessing Officer and perused the written submissions of the appellant and the other material on record. I have observed that the appellant company was incorporated on 28thSeptember, 2004 to execute the Memorandum of family settlement. The Memorandum of family settlement is basically an arrangement entered between the members of a family with a view to resolve the disputes as to their claims and entitlement over the ancestral family property. The shares of BILT were acquired by the appellant company as a result of the family settlement. As per the principle laid down by the Hon. Supreme Court in the case of “Kale v. Deputy Director of Consolidation, AIR 1976 SC 807″, a family settlement is of wider import and it can run across companies, firms and between more than one families. In case a family settlement is to be carried across the companies, then complete rearrangement and reallocation of the shareholding pattern has to be made. And no arrangement in the case of companies can be made except through the approval of High Court. Accordingly, in order to resolve the disputes in Thapar Group of Companies, the two schemes of Amalgamation, Arrangement and Reconstruction approved by the Delhi High Court vide its orders dated 27thJuly, 2007 and 8th October, 2007 and by Bombay High Court Orders dated 27th April, 2007 and were carried out with a view to implement the Memorandum of family settlement or Thapar Family Settlement Agreement. The schemes of Amalgamation, Arrangement and Reconstruction were notwithstanding but part and parcel of the Memorandum of Family Settlement. This is evident from the subclause (ii) & (iii) of clause 2 of Annexure IV, on proposed steps for implementation of the Memorandum of Family Settlement contained on page no. 40 of the separate compiler submitted during the course of appellate proceedings and clause 2.3 of part D of Amalgamation, Arrangement and Reconstruction contained on page no.32 of the said compiler. It has been observed that there has been no change in the valuation of shares since initial purchase by previous owner till the date of their acquisition by appellant company. These shares have been valued at historical cost only. No change in the value of shares has taken place under the family settlement. For this purpose, the valuation of cost of shares as adopted by the assessee and the relevant extract of investment schedule in the Financial statement of appellant company as on appointed date i.e. 1.4.2006 has been made part of this order as annexure – 1. From the perusal of the same, it is clear that the appellant has recorded shares of BIL T at their historical cost of Rs.11,20,12,407/- in its balance sheet. Further, I am satisfied with the contention of the Ld. AR that family settlement is analogous to partition and does not amount to transfer in terms of section 47(i) of Income Tax Act, 1961. Accordingly, the cost of acquisition of shares of Ballarpur Industries Ltd. acquired under family settlement has to be taken in terms of section 49(1)(i) of the Act. This view is fortified by the plethora rulings of Madras High court in the case of Commissioner of Income Tax v. A.L. Ramanathan, [2003) (Mad), Commissioner of Income Tax v. Shanthi Chandran, (2003) 241 ITR 371 (Mad), Commissioner of Income Tax v. Kay Arr Enterprises, (2008) 299 ITR 348 and Hon. Delhi High Court in the case of Assistant Commissioner of Income Tax v. Baldev Raj Charla, (2009) 121 TN 366 (Delhi). Moreover, the period of holding of the shares has to be taken with reference to the year in which shares were first acquired by the previous owner and accordingly the benefit of indexation has to be allowed to the appellant. Reliance is placed on the ruling of Deputy.Commissioner of Income-tax, 12(2) v. Manjula J Shah, [2010) 35 SOT 105 (MUM)(SB) and Commissioner of Income Tax v. Arun Shungloo Trust, [2012), (Delhi) cited by the appellant. Further, fair market value of shares as on 1.4.1981 in case of shares acquired prior to that date has to be allowed. The AR has argued that in a case no family settlement would have taken place, and the shares would have been transferred by the original owners only, then in that case indexed cost of acquisition of shares in their hands including their fair market value as on 1.4.1981, would have been allowed to them for the purpose of computing capital gain. Now, in the present case when as a result of family settlement, no transfer of asset has actually taken place, then also the same indexed cost of acquisition after considering the fair market value as on 1.4.1981 in the hands of previous owner should be allowed to the appellant company. I am completely in agreement with the said argument of the AR. Accordingly, the computation of indexed cost of acquisition of shares at Rs.72,79,22,871/- made by appellant is hereby upheld.

13. I do not find any merit in the contention of the Assessing Officer that Capital Gains was attracted at two points i.e. one at the time of amalgamation and other at the time of demerger. There was no transfer at the time of amalgamation or demerger. As held above the scheme of Amalgamation, Arrangement and Reconstruction was only part and parcel of family settlement. Further, it is a settled law that no transfer takes place in the case of family settlement. The contention of the Assessing officer that case laws relied upon by the assessee are distinguishable on facts is misplaced. In holding so, the A.O. has erred in getting biased by the fact that in the given case family settlement is facing place by way of amalgamation and demerger. This is truly not the intention of law. It has been held by the Hon. Supreme Court that a family settlement is of wider import and it can run across companies. Benefit of family settlement has to be allowed to the assessee even if the conditions of amalgamation and demerger are not satisfied. Another contention of the A.O. that since statutory dues like stamp duty have been discharged by the assessee, and has not claimed waiver thereof, seems totally absurd and arbitrary.

As rightly pointed out by the assessee that the stamp duty is governed by different Act, thereof, no adverse inference could be drawn therefrom. Further, the allegation at no immunity from taxes has been granted under the Memorandum of Family Settlement is also devoid of any merits. Moreover, he has grossly erred in adopting two different approaches for calculation of cost of acquisition of two different capital assets in the same assessment order. On one hand, he has upheld the adoption of indexed cost of acquisition in the case of sale of rights, title and interest in commercial site made by the appellant during the relevant year wherein the assessee had declared capital gains. However, on the other hand he has not allowed the benefit of indexation in the case of capital asset being shares of Billarpur Industries Ltd. This action of the A.O. is grossly arbitrary, absurd and not maintainable at law.

In light of the above, the grounds of appeal no. I to 3 of the appellant are allowed.”

| 4. | | Aggrieved Revenue is in appeal before us raising following grounds of appeal :- |

| “1. | | Whether on the facts and circumstances of the case and in law, the ld. CIT (A) erred in deleting Long Term Capital Gain on shares of Ballarpur Industries Ltd. of Rs.382052393/- as computed by the A.O. |

| 2. | | Whether on the facts and circumstances of the case and in law, the Ld. CIT (A) erred in accepting the incorrect computation of Long Term Capital Loss by the assessee in regards to cost of acquisition of shares of the Ballarpur Industries Pvt. Ltd. at Rs.727922870/-. |

| 3. | | That the order of Ld. CIT (A) is erroneous and is not tenable on the facts and in law. |

| 4. | | That the grounds of appeal are without prejudice to each other.” |

| 5. | | At the time of hearing, ld. DR of the revenue submitted as under :- |

” The only issue involved in this case is the computation of indexed cost of acquisition in respect of shares of Bal1arpur Industries P.Ltd. bought back by the company. These shares were acquired by the assessee company in a scheme of demerger w.e.f. 01.04.2006 at the book value of these shares in the books of demerging company. The AO has taken the cost of acquisition of these shares at book value of these shares in the books of demerging company and the benefit of indexation has been given from 01.04.2006 to the date of buy back of shares. On the other hand the assessee has claimed that the demerger has taken place to give effect to a family settlement of Thapar family and therefore, the indexation benefit is to be given with respect to the date of acquisition of these shares in the hands of previous owner(s).

2. In this background the AO rejected the claim of long term capital loss of Rs.23,38,58,071/- of the assessee and computed long term capital gain at Rs.38,20,52,393/ -. However, the CIT(A), in para 12 & 13 of the appellate order accepted the assessee’s contention by referring to several decision of various Courts with reference to family settlement and also referred to Sec.47(i) of the I.T. Act. The CIT(A) gave a finding on Pg.16 of the appellate order holding that the transfer of shares to the assessee consequent to family settlement is analogous to partition of family assets and does not amount to transfer u/s 47(i) of the I.T. Act and therefore, the cost of acquisition is to be computed as per sec.49(1)(i) of the I.T.Act wherein the cost is to be taken at the cost to the previous owner(s) and indexation is to be provided from 01.04.1981 or the actual date of acquisition of shares by previous owner(s).

3. In para 13 of the order the CIT(A) also rejected the findings of the AO that the transfer of assets and the incident of capital gain arose at two points earlier i.e. at the time of amalgamation and at the time of demerger. The AO’s findings were on the basis of facts that the requirement of Sec.2(1B) & 2(19AA) were not met as specifically admitted by assessee and recorded on Pg.5 of the assessment order and therefore the transactions at the time of amalgamation and demerger did amount to transfer as Sec.47 (vi) & Sec.47(vib) apply only when the scheme of amalgamation and demerger meets the requirement ofSec.2(1B) and 2(19M).

4. As evident from Pg.5 of the order of CIT(A) the shares of Ballarpur Industries Ltd. were acquired over a period of time starting from prior to 01. 04. 1981 to F. Y. 2001-02 by following three parties:

| a. | | Karamchand Thapar & Bros. Ltd. (KCTBL) |

| b. | | Modem Agencies Ltd. (MAL) |

| c. | | Gupkar Investments & Holding Ltd. (GIHL) |

4.1 These three companies and one more company namely Nikhlesh Investment & Holding Ltd. merged into one company by a scheme of amalgamation and the resultant company was again named as Karamchand Thapar & Brothers Ltd. This company was then demerged into 7 companies, the assessee company being one of them. Both the amalgamation and demerger have been approved by the Hon’ble High Courts w.e.f. 01.04.2006 under the relevant provisions of the Companies Act. All the shares of Ballarpur Industries Ltd. were transferred to the assessee company in the above scheme of demerger. It needs to be mentioned here that the assessee company was incorporated on 28.09.2004. This scheme is shown on Pg.3 of the order of CIT(A). The family tree of Thapar group has been shown on Pg.2 of the order of CIT(A).

5. Since the I.T. Act defines amalgamation in Sec.2(1B) and demerger in Sec.2(19AA) any amalgamation or demerger which does not meet the requirements of these sections is not an amalgamation or demerger for the purpose of Section 47 (vi) & 47(vib) of the I.T.Act, notwithstanding the corresponding provisions in the Companies Act and the orders of Hon’ble High Courts. Therefore, the transfer of shares of Ballarpur Industries Ltd. did take place from GIHL, MAL & KCTBL (old) to KCTBL (new amalgamated company) and these shares were again transferred to the assessee company on demerger and both these transfers have taken place on 01.04.2006. However, since these transactions were recorded at the cost value (book value) of these shares and there has been no provision in the I.T.Act to substitute the market value of shares transferred for the agreement value of transfer of shares similar to Sec.SOC, no capital gains arose in the hands of any person. Though it could have resulted in some loss due to indexation in the hands of GIHL, MAL & KCTBL (erstwhile amalgamating company), as far as assessee company is concerned it acquired the shares on 01.04.2006 at the book value of shares and being incorporated entity on 28.09.2004, it is a different entity from the amalgamating companies i.e. GIHL, MAL, KCTBL (old) & NIHL and also form the demerging company KCTBL(new). The assessee company is also a different entity from various family members of the Thapar group and the share holders of the seven demerged companies including the assessee company.

6. The family settlement has taken place between the family members of the Thapar group who were the share holders of GIHL, MAL KCTBL (old) & NIHL. Consequent to family settlement they became share holders of seven demerged companies including the assessee company. The provisions of Sec.47(i) and 49(I)(i) may only apply in relation to transfer of shares of seven demerged companies including assessee company by its share holders i.e. the members of Thapar family. All the decisions relies upon by the assessee and the CIT(A) have been given in that context. They do not deal with the situation in the present appeal. The interpretation of CIT(A) makes the provisions of Sec.2(IB) and 2(19AA) redundant the Apex Court in the case of Surat Art Silk Cloth manufacturer Association, reported in 121 ITR 01 dated 19.11.1979 (5 Member Bench decision) has observed as under:

“The construction contended for the Revenue would have the effect of rendering s.11(4) totally redundant after the enactment of section 13(1)(bb). A construction which renders a provision of the Act superfluous and reduces it to silence cannot be accepted.”

6.1 The assessee company was not a part of family settlement, it was a result of family settlement.

7. The family settlement is arrived at for the purpose of distribution of total family wealth on the basis of its market value. For example if the assets acquired for Rs.70 crs. have market value of Rs.140 crs. and those assets are to be distributed in 7 members equally, the each member will get a property having market value of Rs.20 crs. Though on the basis of cost of assets, it may not be a equitable distribution. In the present case apparently the assets of GIHL, MAL KCTBL & NIHL were valued to arrive at the net market value of their assets/liabilities which determined the intrinsic market value of the share of amalgamated company KCTBL(new). In a scheme of demerger those assets and liabilities were distributed in seven companies and intrinsic value of shares of each of those seven companies were determined on the basis of the same. Then the share holding of those seven companies was distributed amongst the family members of Thapar family in such a manner that the intrinsic value of shares of each family members is equal to his share in the market value of family wealth, as agreed during the family settlement. The surrender of shares of GIHL, MAL, KCTBL & NIHL and subsequent allotment of shares of seven demerged companies would be treated as transfer related to family settlement, though it is not clear whether the Thapar family constituted the Hindu Undivided Family for the purpose of Sec.47(i) & 49(1)(i) of the I.T. Act.

8. The shares in dispute in the present appeal is an asset of the assessee company which has its own independent existence from its share holders. These shares are distinct from the shares of demerged companies which are held by the Thapar family. The sale or transfer of any asset of assessee company is to be treated as the transfer of asset by itself, as a distinct entity for which the cost of acquisition would be the cost at which it acquired the asset. The Thapar family members never acquired that asset. They acquired shares of demerged companies. The CIT(A) has failed to appreciate this distinction. As regards the reference of CIT(A) to another transfer of asset by the assessee company regarding transfer of rights, titles & interest in commercial land the same is not relevant for this appeal for two reasons:

| (i) | | The full facts of that transaction are not available and |

| (ii) | | one wrong can not make another wrong right.” |

| 6. | | On the other hand, ld. AR of the assessee brought to our notice relevant facts of the case and filed detailed submissions on the issue of family arrangement and conditions of amalgamation / demerger satisfied by the assessee in this arrangement. However, they did not press the issue of family arrangement, however filed detailed submissions on the issue of amalgamation/demerger in terms of conditions satisfied as per section 2(1B) and section 2 (19AA) of the Income-tax Act, 1961 (for short ‘the Act’) and also made detailed submissions on tax neutrality. For the sake of brevity, it is reproduced below:- |

| 17. | | It is respectfully submitted that the aforesaid action of the assessing officer in recomputing capital gains is totally unwarranted and has rightly been reversed by the CIT(A) for the reasons elaborated hereunder: |

| 18. | | Pursuant to composite scheme of amalgamation and demerger, the assessee company was vested with 98,81,296 shares of BIL at historical cost of Rs.28,00,31,017. Thereafter, there was splitting-up of shares of BIL in the ratio of 5:1 as a result of which the assessee held 4,94,06,840 shares of BIL. |

| 19. | | Out of the aforesaid 4,94,06,840 shares, the assessee, during the assessment year 2008-09, sold 1,97,62,592 shares of BIL under buy-back scheme, for a total consideration of Rs.49,40,64,800. |

| 20. | | In the return of income filed for the assessment year 2008-09, the assessee returned long-term capital loss of Rs.23,38,58,071,after taking into consideration historical cost of shares to previous owner as its cost of acquisition and including the period for which such shares were held by previous owners in its period of holding in accordance with the provisions of section 49(1)(e) and section 2(42A) of the Act. |

| 21. | | The aforesaid facts were also duly submitted before the assessing officer during the course of assessment proceedings along with copy of scheme of arrangement. Further, without prejudice to the above, it was also submitted that since shares of BIL stood vested in the assessee pursuant to the family settlement agreement among the members of Thapar family, there was, even otherwise, no ‘transfer ‘and consequently, the assessee had rightly considered the cost of acquisition and period of holding of the previous owner. |

| 22. | | The assessing officer, however, proceeded on the erroneous premise that the assessee had conceded that conditions of tax neutral amalgamation and demerger in terms of the provisions of the Act were not satisfied, and recomputed the capital gains on sale of shares of BIL by considering book value of shares on the date of demerger (i.e., as on 01.04.2006) as cost of acquisition of shares and reckoning the period of holding from the said date, thereby denying the benefit of indexation to the assessee from the date of acquisition of shares of the previous owner. |

| 23. | | The stand of the assessing officer is, in fact, self-contradictory inasmuch as: |

| (a) | | the assessing officer accepted another transaction of long-term capital gain of Rs.3,36,25,904 declared by the assessee on transfer of rights/interest in M/s. Energetic Construction Pvt. Ltd., which too stood vested in the assessee pursuant to the same scheme of arrangement, by considering the period of holding of previous owner for the purpose of computation of the said capital gains; |

| (b) | | the transaction of amalgamation/ demerger has not at all been disputed by the Revenue as tax neutral in the hands of the amalgamated company and/ or the demerged company and/ or the shareholders of the companies part of restructuring; |

| (c) | | the transaction of sale of shares of BIL have been accepted as “long-term capital gain”, while disputing the benefit of indexation, which is, in fact, consequential to the acceptance of period of holding. |

| 24. | | It may be noted that the aforesaid order passed by the assessing officer was challenged before the CIT(A) primarily on following two grounds: |

| (a) | | That the shares of BIL were received by the assessee as a result of family arrangement between members of Thapar family which did not amount to ‘transfer’ and therefore, period of holding and cost of acquisition in the hands of the assessee are to be considered after taking into account cost of acquisition and period of holding of the previous owners. |

| (b) | | That the conditions of amalgamation as prescribed under section 2(1B) and conditions of demerger as prescribed under section 2(19AA) were duly satisfied by the assessee and therefore, in view of the provisions of section 49(1)(e) and 2(42A) of the Act, the assessee had rightly considered cost to previous owner as its cost of acquisition and also included period for which such shares were held by previous owner in its period of holding. |

| 25. | | The assessee’s appeal was allowed by the CIT(A) vide order dated 21.03.2014, holding that the shares of BIL were received by the assessee pursuant to family arrangement/settlement which is analogous to partition and therefore, it cannot be treated as ‘transfer’. Accordingly, it was held that the assessee had rightly considered cost to previous owner as its cost of acquisition and period of holding was also to be reckoned from the year in which such shares were acquired by the previous owner. However, it is important to mention here that since the appeal of the assessee was allowed by the CIT(A) on the first legal ground itself, therefore, no specific finding was rendered by the CIT(A)on the aspect of whether the assessee had satisfied conditions stipulated in sections 2(1B) and 2(19AA) of the Act. |

| 26. | | In this regard, it is respectfully submitted that the conditions of amalgamation and demerger as provided in section 2(1B) and section 2(19AA) of the Act stood satisfied in the case of the assessee and thereby provisions of section 47(vi) and 47(vib) of the Act was applicable in the case of the assessee. |

Re: Conditions of Amalgamation/ Demerger satisfied

| 27. | | Clauses (vi) and (vib) of the section 47 provides that transfer of a capital asset pursuant to a scheme of amalgamation and/ or demerger satisfying the definition in sections 2(1B) and 2(19AA) of the Act respectively, is exempt from capital gains. |

| 28. | | The said section 47 of the Act reads as under: |

“47. Nothing contained in section 45 shall apply to the following transfers:

……………………

| (vi) | | any transfer, in a scheme of amalgamation, of a capital asset by the amalgamating company to the amalgamated company if the amalgamated company is an Indian company. |

| (vib) | | any transfer, in a demerger, of a capital asset by the demerged company to the resulting company, if the resulting company is an Indian company”(emphasis supplied) |

| 29. | | For purposes of the Act, in order that merger of two or more companies satisfies the definition of amalgamation contained in section 2(1B) of the Act, the following conditions are required to be satisfied: |

| (i) | | All the properties of the amalgamating company immediately before the amalgamation become the properties of the amalgamated company by virtue of the amalgamation; |

| (ii) | | All the liabilities of the amalgamating company immediately before the amalgamation become the liabilities of the amalgamated company by virtue of the amalgamation; and |

| (iii) | | Shareholders holding not less than three-fourths in value of the shares in the amalgamating company become shareholders of the amalgamated company by virtue of the amalgamation. |

| Each | | of the aforesaid conditions are undisputedly satisfied inasmuch as the tax neutrality was not at all questioned in the hands of the amalgamated entity [refer detailed note on tax neutrality attached as Annexure – 2]. |

| 30. | | Thus, in view of the aforesaid section, since all the conditions of amalgamation provided in section 2(1B) of the Act were duly satisfied, therefore, transfer of capital assets from NIHL, MAL and GIHL to KCTBL was exempt from capital gains tax. |

| 31. | | Similarly, section 47(vib) of the Act exempts any transfer of capital asset by the demerged company to the resulting company pursuant to demerger. Thus, in view of the above, subsequent transfer of capital assets made by KCTBL(after merger) to the resulting companies (including the assessee company) was also exempt from tax. |

| 32. | | In other words, there was no transfer attracting capital gains at the time of amalgamation and subsequent demerger in the present case. Thus, the shares of BIL received by the assessee from KCTBL at the time of tax neutral demerger was also exempt from tax and the said transaction was not considered as ‘transfer’. |

| 33. | | It is submitted that section 49(1)(e)of the Act specifically provides that where the asset has been acquired by the assessee under the provisions of section 47(vi) or 47(vib) of the Act, in such cases, the cost of acquisition of such asset will be the cost in the hands of the previous owner. |

| 34. | | Further, similarly, for the purpose of determining the period of holding of assets in the hands of the assessee (who acquired the asset in pursuance of section 47(vi) or 47(vib) of the Act), the period of holding of the asset by the “previous owner” is also to be taken into account, as mandated by clause (b) of Explanation 1 to section 2(42A) of the Act. Such complete period will be taken into account for the purpose of calculating the indexed cost of acquisition [Refer Arun Shungloo Trust v. CIT: 249 CTR 294 (Del.)]. |

| 35. | | Therefore, applying the aforesaid provisions to the facts of the present case, it is submitted that the assessee company had rightly computed long-term capital loss on sale of shares of BIL by considering cost of previous owner as its cost of acquisition and including the period of holding of shares held by ‘previous owner’ in its period of holding. |

| 36. | | Further, it is also important to note that in the assessment of KCTBL for the assessment year 2007-08 made by DCIT, Circle- 4, Kolkata, no addition on account of transfer of assets pursuant to amalgamation and demerger was made by the assessing officer. In other words, it was accepted by the assessing officer that the conditions for amalgamation and demerger as provided in section 2(1B) and section 2(19AA) of the Act respectively, were duly satisfied by the assessing officer. Copy of assessment order dated 08.12.2009 in case of KCTBL is attached at pages 01 to 02 of the caselaws paperbook. |

| 37. | | In view of the aforesaid, it is respectfully submitted that the long-term capital loss of Rs.23,38,58,071 returned by the assessee company was in accordance with the provisions of the Act and the action of the assessing officer in re-computing the capital gains on such shares was unwarranted and unjustified. |

Re: Computation of long term capital gains on sale of rights in M/s. Energetic Construction Pvt. Ltd. accepted

| 38. | | Further, it is also submitted that during the assessment years 1997-98 and 1998-99, MAL and KCTBL had, in aggregate, jointly invested a sum of Rs.4.10 crores in M/s. Energetic Construction Pvt. Ltd., against which they were entitled to 24,261 sq. ft of built up area in World Trade Centre, Gurgaon. Thereafter, pursuant to amalgamation and demerger, the said right devolved upon 4 resulting companies, which also included the assessee company (i.e. KCT Papers Ltd.) also. |

| 39. | | During the relevant assessment year, such right, title and interest in property were sold by all the 4 companies together to M/s. TCG Urban Infrastructure Holding Ltd. for a total sale consideration of Rs.20.78 crores. On such sale, the assessee has computed long term capital gains as under: |

| Particulars | Amount (in Rs.) |

| Sale Consideration [l/4th of total sale consideration of Rs.20.78 crores] | 5,19,65,736 |

| Less: Proportionate indexed cost of acquisition (l/4th of total indexed cost of Rs.7,33,59,328) | (1,83,39,832) |

| Long term capital gains offered to tax | 3,36,25,904 |

| 40. | | In this regard, it is respectfully submitted that aforesaid long-term capital gains were computed by the assessee by taking cost to MAL & KCTBL as its cost of acquisition as per section 49(1)(e) of the Act and including the period of holding of MAL & KCTBL in its period of holding while calculating its indexed cost of acquisition. |

| 41. | | It is submitted that the aforesaid computation of capital gains were duly accepted by the assessing officer. It is respectfully submitted that once the assessing officer has himself accepted cost to previous owner pursuant to demerger as cost of acquisition of the assessee in case of sale of rights in M/s. Energetic Construction Pvt. Ltd., there was no reason for re-computing long term capital gains in case of sale of shares of BIL. The stand of the assessing officer is therefore, itself, self-contradictory and is liable to be reversed. |

Re: Indexed cost of acquisition

| 42. | | On perusal of second proviso to section 48 of the Act, it would be noticed that while computing capital gains in case of long term capital assets, reduction of ‘indexed cost of acquisition’ is allowable to the assessee instead of cost of acquisition. Indexed cost of acquisition is defined to be an amount which bears to the cost of acquisition the same proportion as Cost Inflation Index (CII) for the year in which the asset is transferred bears to the CII for the first year in which the asset was held by the assessee or for the year beginning on the 1st day of April, 1981, whichever is later. |

| 43. | | It is submitted that in the context of assets acquired by an assessee by way of a partition, family transfer, gift or will, though the assets is first held by the assessee in the year of receipt of asset; however, it well settled that in such cases, benefit of indexation if allowable to the assessee taxpayer from the year in which the asset was first held/ acquired by the previous owner or the base year (i.e. 1981), whichever is later. |

| 44. | | Reliance, in this regard, is placed on the decision of Bombay High Court in the case of CIT v. Manjula J. Shah: 355 ITR 474, where in the Court held that while computing the capital gains arising on transfer of a capital asset acquired by way of a gift or will, indexed cost of acquisition has to be computed with reference to year in which previous owner first held asset and not year in which assessee became owner of asset. |

| 45. | | Further reliance is also placed on the judgment of Calcutta High Court in the case of CIT v. Smt. Mina Deogun: 375 ITR 586, whereinit has been held that where property was purchased by predecessor in 1958, in terms of section 55(2)(1), cost inflation index was to be applied with effect from 1-4-1981 instead of the year of acquisition by the assessee. |

| 46. | | The Punjab & Haryana High Court in the case of DCIT v. Sushil Kumar: held that where capital asset was property of HUF prior to 1.4.1981 and assessee acquired absolute ownership on 19.5.1998 by way of partition, assessee was entitled to calculate capital gains tax by taking CII for financial year 1981-82. |

| 47. | | To the similar effect are the following judgements: |

| (a) | | Arun Shungloo Trust v. CIT: (Del.) |

| (b) | | CIT v. Raman Kumar Suri: 255 CTR 257 (Bombay) |

| (c) | | CIT v. Smt. Nita Kamlesh Tanna:(Mag) (Bombay) |

| (d) | | CIT v. Gautam Manubhai Amin:(Guj.) |

| (e) | | CIT v. ShanthiChandran- 241 ITR 371 (Mad) |

| (f) | | CIT v. Smt. Asha Machaiah:(Kar.) |

| (g) | | CIT v. Smt. Daisy Devaiah:(Mag) (Karnataka) |

| (h) | | CIT v. Smt. Kaveri Thimmaiah: 369 ITR 81 (Karnataka) |

| (i) | | Income Tax Officer v. Nandlal R. Mishra: 155 ITD 306 (Mum) |

| (j) | | Income-tax Officer v. Ms. Noella P. Perry: 56 SOT 495 (Mum) |

| (k) | | ITO v. Padarti Venkata Rama Chandra Rao: (Vizg.) |

| (l) | | ITO v. Sudip Roy: 161 ITD 709 (Kolkata – Trib.) |

| (m) | | Meher R. Surti v. Income-tax Officer: 61 SOT 5 (Mum) |

| (n) | | Smt. Pramila R. Wadhawan v. ACIT: ITA Nos. 798 & 1901 of 2011(Mum) |

| (o) | | Sujan Azad Parikh v. DCIT: (Mum) |

| (p) | | Vishwanath Sharma v. ACIT: 58 SOT 267 (Chd.) |

| 48. | | In view of the aforesaid settled legal position, it is submitted that the benefit of indexation would be available to the assessee, even if the property was first held by the assessee pursuant to the scheme of demerger.” |

7. The ld. AR of the assessee further submitted supplementary submissions reproduced as under :-

During the course of hearing in the captioned matter on 28.04.2025, your Honour’s had directed the assessee/ respondent to furnish certain information/ documents. In this regard, in continuation/ supplement to our earlier submission dated 28.03.2023, the requisite information/ details are submitted as under:

| I. | | Fair Market Value (FMV) of 98,81,296 shares of Ballarpur Industries Ltd. which vested in the assessee (resulting company) as part of demerger of Paper Undertaking/ Business w.e.f. 01.04.2006 (appointed date) |

| 1. | | As elaborately explained in the earlier submissions and during the course of hearing, it is reiterated that 98,81,296 shares of Ballarpur Industries Ltd. (“BIL”) [listed entity] vested in the assesseeas a result of the demerger of Paper and related Products Undertaking of KCTBL. The said share included shares which vested in KCTBL as a result of amalgamation of NIHL, MAL and GIHL. |

| 2. | | For the sake of convenience, the total value of shares of BIL received by the assessee as on 01.04.2006 (appointed date) is tabulated below for reference: |

| S.No. | Particulars | Number/ Amt (INR) |

| 1. | Number of shares of BIL which vested in KCT Papers pursuant to demerger w.e.f. 01.04.2006 | 98,81,296 |

| 2. | Quoted value (FMV) of each share of BIL as on 01.04.2006 [closing price of share as on 31.03.2006] [Screenshot of BSE India website is attached @ page 341 of paperbook – II] | Rs.138 |

| 3. | FMV of 98,81,296 shares of BIL as on 1.04.2006 [1*2] | Rs.136,36,18,848 |

| 3. | | For completeness it may be highlighted that subsequently on 28.02.2008, the shares of BIL were split in the ratio of 1:5, thereby resulting in assessee/ respondent holding 4,94,06,480 shares of BIL. |

| 4. | | Out of the aforesaid shareholding of 4,94,06,480, the assessee transferred 1,97,62,592 shares as part of the buyback scheme of BIL during the captioned financial year2007-08, relevant to assessment year 2008-09, for total consideration of Rs.49,40,64,800. |

| 5. | | In this regard, it is pertinent to note the following: |

| (a) | | There is no dispute with regard to the fundamental facts that the assessee had, as part of the buyback scheme of BIL, transferred 1,97,62,592 shares for total consideration of Rs.49,40,64,800 [refer para 10/ pg.11 of assessment order]; |

| (b) | | The actual cost of 1,97,62,592 shares so transferred amounted to Rs.11,20,12,407 [refer para 10/ pg.11 of assessment order]; |

| (c) | | The dispute is limited to the eligibility of the assessee to claim benefit of indexation – the assessing officer has not allowed the benefit of indexation. |

| 6. | | As elaborately explained in the detailed submissions already filed and duly explained at the time of hearing, since the shares vested in the assessee pursuant to tax-complaint scheme of amalgamation [first step] followed by tax-complaint demerger [second step], which corporate schemes had been undertaken to give effect to the family settlement agreement dated 27.04.2001, the assessee was entitled to benefit of period of holding as well as consequential benefit of indexation [refer detailed submissions, section 49(1)(e) read with section 2(42A) read with section 49(2) for amalgamation and section 49(1)(e) read with section 49(2C)) read with section 2(42A) in the context of demerger]. |

| 7. | | As explained in our earlier submissions, two schemes of amalgamation and demerger under section 391 to 394 of the Companies Act, 1956 were filed before Hon’ble Delhi High Court and Bombay High Court which was duly approved and sanctioned as under: |

| (a) | | Scheme I- The first scheme was in respect of amalgamation of Nilkash Investments and Holdings Ltd. (hereinafter referred to as ‘NIHL’) with Karam Chand Thapar and Bros. Ltd. (hereinafter referred to as ‘KCTBL’) which was approved and sanctioned by Bombay High Court vide order dated 27.04.2007 and thereafter, by Delhi High Court vide order dated 27.07.2007. [Refer pages 222 to 237 of the paperbook] |

| (b) | | Scheme II- A composite scheme of amalgamation as well as demerger was approved and sanctioned by Delhi High Court vide order dated 08.10.2007 [Refer pages 62 to 221 of the paperbook], which involved the following two stages: |

| i. | | Stage 1-Firstly, two companies of the group viz., Modern Agencies Ltd. (hereinafter referred to as ‘MAL’) and Gupkar Investments and Holdings Ltd. (hereinafter referred to as ‘GIHL’) were merged/amalgamated with KCTBL. |

| ii | | . Stage 2-The merged KCTBL, i.e., after amalgamation with NIHL, MAL and GIHL, was thereafter demerged into seven resulting companies, out of which the assessee (i.e. KCT Papers Limited) was one of the resulting company in which paper and related undertaking was demerged. |

The appointed date for the aforesaid stages/ schemes was 1.04.2006.

| 8. | | Further, as elaborately explained vide Annexure 2 to the written submissions, the assessee satisfies all the conditions for the transaction to qualify as tax neutral amalgamation and demerger, which is not repeated here for the sake of brevity. |

II. Compliance of conditions stipulated in section clause (v) of section 2(19AA)

9. As regards the specific issue raised by the Hon’ble Bench to demonstrate compliance of condition stipulated in clause (v) of section 2(19AA) of the Income tax Act, 1961 (‘the Act’), the relevant provisions are set out hereunder for ready reference:

“demerger”, in relation to companies, means the transfer, pursuant to a scheme of arrangement under sections 391 to 394 of the Companies Act, 1956 (1 of 1956), by a demerged company of its one or more undertakings to any resulting company in such a manner that—

………….

(v) the shareholders holding not less than three-fourths in value of the shares in the demerged company (other than shares already held therein immediately before the demerger, or by a nominee for, the resulting company or, its subsidiary) become shareholders of the resulting company or companies by virtue of the demerger, otherwise than as a result of the acquisition of the property or assets of the demerged company or any undertaking thereof by the resulting company;”

| 10. | | Clause (v) provides that the shareholders holding at least 75% of value of shares in the demerged company must become shareholder of the resulting company. In simple words, pursuant to demerger the resulting company must issue shares to at least 75% of the shareholders (in value)of the demerged company. |

| 11. | | In the present case, the aforesaid condition is duly satisfied inasmuch as the assessee (resulting company) had issued shares to all (and not just 75%) shareholders of the demerged company, as can easily be gauged from the following: |

| • | | As explained earlier, as per Stage 2, the paper and related business of the merged KCTBL [i.e., after amalgamation of NIHL, MAL and GIHL] was demerged into the assessee (i.e., KCT Papers Limited), with 1.04.2006 as the appointed date; |

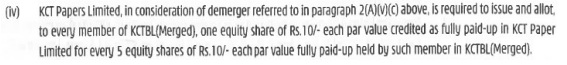

| • | | In terms of the scheme of demerger, the assessee(resulting company) issued 1 share to every shareholder of KCTBL (merged entity) against every 5 equity share held in the merged company; the relevant clause of the scheme is reproduced hereunder for ready reference (@page 91of paperbook): |

Section – 5

Capital Structure and Accounting Treatment

Upon Demerger of the KCTBL (Merged) – Paper and Related Products Undertaking to KCT Paper Limited pursuant to the scheme, KCT Paper Limited shall in consideration of such demerger, issue and allot, without further application, to every member of KCTBL (Merged) one equity share of Rs. 10/- each par value, credited as fully paid up in KCT Paper Limited for every 5 equity shares of Rs. 10/- each par value fully paid up held by such member in KCTBL (Merged) pursuant to clause 4.1.1 of clause B of this scheme on a record date to be determined by the Board of Directors or a committee of the Board of Directors of KCTBL (Merged).”

| • | | The assessee has duly complied with the aforesaid statutory mandate and had issued shares accordingly. The factum of issuance of shares by the assessee (resulting company) to all the shareholders of the demerged company (merged KCTBL) is evident from the following: |

| • | | Audited financials of the assessee for the nine-month period ending 31stDecember 2007alongwith corresponding figures for the financial year 2006-07 captures the factum of issuance of shares as under: |

| (B) | | Capital Structure arising from aforesaid Schemes: |

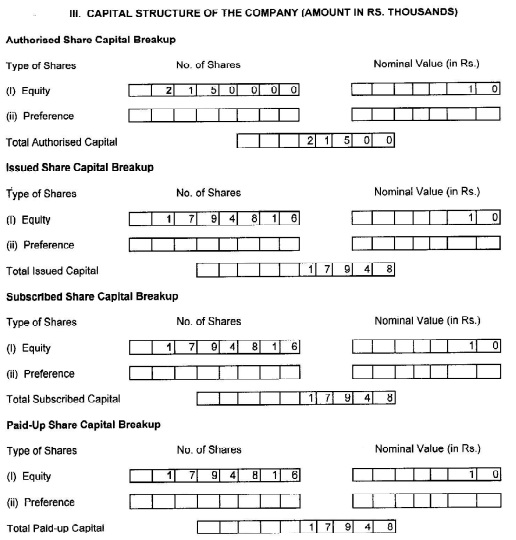

KCT Papers Limited, in consideration of demerger referred to in paragraph l(A)(v) above, is required to issue and allot, to every member of KCTBL (Merged), one equity share of Rs. 10 each par value credited as fully paid-up in KCT Papers Limited for every 5 equity shares of Rs. 10 each par value fully paid-up held by such member in KCTBL (Merged). Accordingly, KCT Papers Limited has issued and allotted at par 17,44,816 equity shares of Rs. 10 each to the shareholders of KCTBL (Merged) on January 22, 2008. For the purpose of these financial statements as at 31″ December, 2007, these shares have been shown under “Share Capital Suspense” in the Balance Sheet. The authorised capital of the Company has been increased by Rs. 2,10,00,000 divided into 21,00,000 equity shares of Rs. 10 each on payment of requisite fees and stamp duty.

Refer Note 1(B) in Schedule J of the aforesaid financials is attached @ page 342 – 360of paperbook – II.

Further, necessary disclosure in this regard was also made in Schedule J -‘Significant accounting policies and notes to accounts’ in the audited financials of the assessee for year ending 31stDecember 2008 as under (refer page 10 of paperbook]:

“B Capital Structure arisingfrom aforesaid Schemes

KCT Paper Limited in consideration of demerger referred to in paragraph 1(A)(v) above, is required to issue and allot to every member of KCTBL (Merged), one equity share of Rs. 10 each par value credited as fully paid-up held by such members in KCTBL (Merged). Accordingly, KCT Paper Limited has issued and allotted at par 17,44,816 equity shares of Rs. 10 each to the shareholders of KCTBL (Merged) on January 22, 2008. The authorized capital of the company has been increased by Rs. 2,10,00,000 divided into 21,00,000 equity shares of Rs. 10 each on payment of requisite fees and stamp duty”

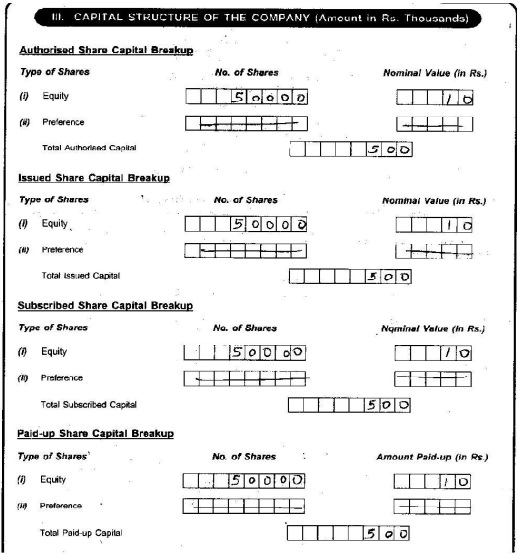

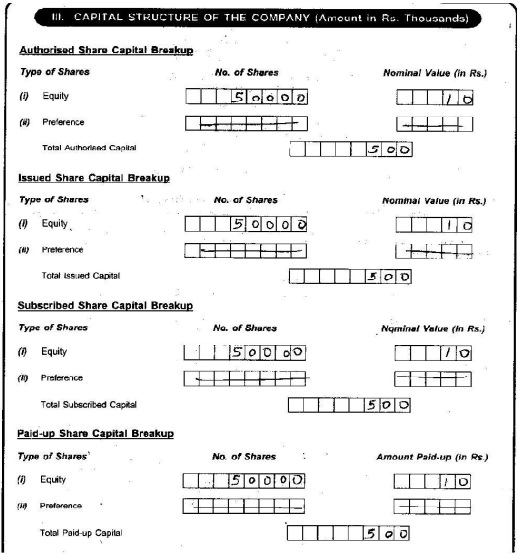

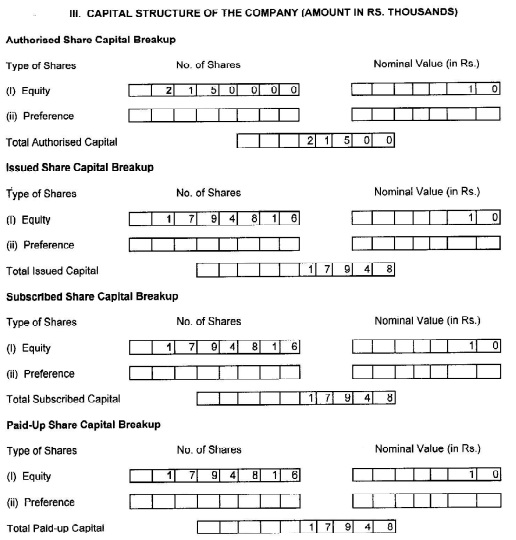

| • | | Prior to the demerger, assessee had a paid-up share capital of Rs. 500,000, represented by 50,000 equity shares of ? 10 each; relevant extract of the annual return filed by the assessee under Schedule V, Part-II of the Companies Act, 1956 prior to effectuation of demerger is attached @ page 361 – 371 of paperbook -II. The following is the relevant extract of the same: |

| • | | Post implementation of the Court approved demerger, the assessee had issued 1 new equity share of Rs. 10 each to every shareholder of KCTBL for every five shares they held in KCTBL. This resulted in the issuance of 17,44,816 new equity shares by the assessee on January 22, 2008. Consequently, the total paid-up share capital of the assessee had increased significantly to Rs.1,79,48,160, comprising 1,794,816 equity shares of Rs. 10 each. In this regard, copy annual return filed by the assessee under Schedule V, Part-II of the Companies Act, 1956 post AGM on 09.06.2008 is attached @ page 372 – 388of paperbook -II. Relevant extract of the said annual return of the assessee depicting the shareholding post demerger is reproduced below: |

Moreover, the aforesaid annual return also captures the details of all the shareholders of the assessee (post demerger). The list of shareholders as on 09.06.2008 alongwith their name, address and number of shares is attached as Annexure 1 to the said annual return.

Documents, pertaining to the demerged company

| • | | Reference may also be made to the list of shareholders of KCTBL as on 09.06.2008 (refer page 389 – 420 of paperbook – II). The comparative shareholding of the assessee and KCTBL demonstrates that shareholders of KCTBL were issued shares by the assessee and became shareholders of the assessee after demerger. |

| • | | The financial statements of KCTBL for nine months period ending 31.12.2007 also provide for the issuance of shares by assessee to shareholders of KCTBL on account of demerger: |

Copy of relevant extracts of the aforesaid financial statement(s) are attached @ page 421 – 459 of paperbook – II).

| 12. | | The aforesaid facts, in our respectful submission, clearly demonstrate that more than three fourth of the value of shareholders of KCTBL duly became shareholders of the assessee on account of demerger, thereby satisfying the requirement of the condition laid down in clause (v) of section 2(19AA) of the Act. In case any further detail/ document is required, the assessee shall be pleased to submit the same. |

| 13. | | Considering the aforesaid factual matrix and having regard to the legal and factual aspects placed on record vide earlier submissions, it is patently clear that schemes of amalgamation and demerger satisfied all the relevant conditions provided under the Act. |

| 14. | | Most importantly, the scheme of amalgamation and demerger involving KCTBL were affected in the financial year 2006-07, relevant to assessment year 2007-08, which stood accepted in the assessment order dated 8.12.2009 of the said company [refer copy placed at pages 1-2 of case law paper book]. |

| 15. | | Therefore, it was, in any case, not open to the assessing officer of the assessee, that too in the assessment year 2008-09, the year under consideration. |

| III. | | Family Settlement – Not “transfer” for tax purposes |

| 16. | | Further, as submitted earlier, shares of BIL vested in the assessee pursuant to the scheme of amalgamation and demerger undertaken to give effect to the Memorandum of Family Settlement dated 27.04.2001, which, inherently, does not amount to ‘transfer’ [refer detailed submissions vide paras 51 to 74 of Broad Propositions dated 28.03.2023] and consequently, not only cost of acquisition but also period of holding of the previous owner ought to be considered. |

| 17. | | Kind attention is invited to certain pertinent clauses of Family Settlement dated 27.04.2001 (refer pages 18-61), comprehensively capturing the family settlement and its implementation, which are highlighted hereunder: |

| (a) | | Preamble clauses 1 to 10 set out the background of the family settlement, including the fact that the Thappar group comprises of businesses undertaken in various group companies, which is now sought to be divided into four groups [refer clauses 1, 2, 7, and 10 on pages Pg. 18 to 21]; |

| (b) | | Article II containing general terms, clearly states that ” In consideration of the family settlement” the family businesses are being separated entailing separation of business interests and cess or of joint control and establishment of individual control of the Groups out of Thapar Group of Companies (refer clause 2.1-Article II @ page 21 of the paperbook); |

| (c) | | Clause 2.2 clearly provides that the Parties agree for division of the businesses into four parts in the manner set out Schedule 3, with the said schedule giving the proposed division of the Thapar Group Business among the four family groups (refer clause 2.2- Article II@ page 21 and Schedule 3 at pages 48-50 of the paperbook); |

| (d) | | Importantly, Schedule 3 captures the division of business amongst the four families of the Thapar group [refer page 48]; |

| (e) | | Clause 2.4 of Article II @ page 21 of the paperbook also provides that in case of purchase of shares by the allotted Thapar Group or their group companies for implementation of the terms of the Family Settlement Agreement, the companies would be required to sell or exchange shares at market rates where the shares are listed or at par in case of unlisted shares; |

| (f) | | Article XX of page 34-35 of paperbook allows for restructuring/ merger/ demerger to effectuate family settlement; |

| (g) | | Article V at page 22 of paperbook records confirmation and acceptance of the Groups to the valuation of business of the major manufacturing companies for the purpose of division of the Thapar Group Businesses. The valuation was done by Price Waterhouse as on 31.03.1998 which stands accepted; |

| (h) | | Article IIIat page 22 of the paperbook confirms the family agreement to be of binding nature; |

| (i) | | Consolidation of respective shares to each allotted group is captured in Article X at page 22 of paperbook; |

| (j) | | Article IV at page 22 of paperbook records acceptance of all the Groups to the groups for the division as per the family settlement agreement, which demonstrates equitable and fair distribution amongst the groups involved; |

| (k) | | Annexure IV (refer page 48-50 of paperbook) contains detailed steps for implementation of the family settlement; the same lays down all steps including consolidation of business and subsequent segregation (seven business) to be followed by inter-se transfer/ gift of shares of respective companies to allotted group. |

The aforesaid clearly demonstrates the comprehensive nature of settlement pursuant to multiple negotiations and mediations securing desired redistribution of business amongst the family groups.

| 18. | | As explained in our written propositions, it is settled law that a family arrangement merely realigns pre-existing rights and is not a “transfer” or “conveyance” in the traditional sense. The Courts have consistently held that such arrangements recognize and redistribute existing rights without triggering capital gains liability. |

| 19. | | Key judicial precedents settling the said view are as under: |

| • | | Ramcharan Das v. Girijanandini Devi: AIR 1966 SC 323 (SC) [Pg.43-53@52/ CLPB] |

| • | | Kale v. Deputy Director of Consolidation: 3 SCC 119 (SC) [Pg.54-77@60-63/ CLPB] |

| • | | Ziauddin Ahmed v. CGT: 102 ITR 253 (Gauhati) |

| 20. | | It is reiterated that legal position has been explained in detail in our earlier written submissions, which is not repeated here for the sake of brevity. |

Trust your Honour would find the above in order and to your Honours’ satisfaction.

Should your Honour require any further information/ detail/ clarification, the assessee would be pleased to submit the details and justification on being so intimated; in such a case, the matter may, it is respectfully submitted, also be refixed for hearing.”

| 8. | | With regard to tax neutrality, ld. AR submitted as under :- |

| “1. | | In this regard, it is respectfully submitted that the conditions of amalgamation and demerger as provided in section 2(1B) and section 2(19AA) of the Act respectively, were duly satisfied by the appellant as demonstrated hereunder: |

| 2. | | An “amalgamation” is regarded as tax neutral, both in the hands of the company(ies) as well as its shareholders, provided the conditions prescribed in relation thereto are complied with. |

| 3. | | Section 2(1B) of the Act defines the term “amalgamation” as under: |

| “2. | | In this Act, unless the context otherwise requires,— |

…………………………………..

(1B) “amalgamation”, in relation to companies, means the merger of one or more companies with another company or the merger of two or more companies to form one company (the company or companies which so merge being referred to as the amalgamating company or companies and the company with which they merge or which is formed as a result of the merger, as the amalgamated company) in such a manner that—

(i) all the property of the amalgamating company or companies immediately before the amalgamation becomes the property of the amalgamated company by virtue of the amalgamation ;

(ii) all the liabilities of the amalgamating company or companies immediately before the amalgamation become the liabilities of the amalgamated company by virtue of the amalgamation ;

(iii) shareholders holding not less than three-fourths in value of the shares in the amalgamating company or companies (other than shares already held therein immediately before the amalgamation by, or by a nominee for, the amalgamated company or its subsidiary) become shareholders of the amalgamated company by virtue of the amalgamation,

otherwise than as a result of the acquisition of the property of one company by another company pursuant to the purchase of such property by the other company or as a result of the distribution of such property to the other company after the winding up of the first-mentioned company ;” (emphasis supplied)

| 4. | | For purposes of the Act, in order that merger of two or more companies satisfies the aforesaid definition of amalgamation contained in section 2(1B) of the Act, the following conditions, inter alia, need to be satisfied: |

| (i) | | All the properties of the amalgamating company immediately before the amalgamation become the properties of the amalgamated company by virtue of the amalgamation; |

| (ii) | | All the liabilities of the amalgamating company immediately before the amalgamation become the liabilities of the amalgamated company by virtue of the amalgamation; and |

| (iii) | | Shareholders holding not less than three-fourths in value of the shares in the amalgamating company become shareholders of the amalgamated company by virtue of the amalgamation. |

| 5. | | Similarly, term “demerger” is defined in section 2(19AA) of the Act, which reads as under : |

“(19AA) ‘demerger’, in relation to companies, means the transfer, pursuant to a scheme of arrangement under section 391 to 394 of the Companies Act, 1956, (1 of 1956) by a demerged company of its one or more undertakings to the resulting company in such a manner that –

| (i) | | all the property of the undertaking, being transferred by the demerged company, immediately before the demerger, becomes the property of the resulting company by virtue of the demerger; |

| (ii) | | all the liabilities relatable to the undertaking, being transferred by the demerged company, immediately before the demerger, become the liabilities of the resulting company by virtue of the demerger; |

| (iii) | | the property and the liabilities of the undertaking or undertakings, being transferred by the demerged company are transferred at values appearing in its books of account immediately before the demerger;. |

| (iv) | | the resulting company issues, in consideration of the demerger, its shares to the shareholders of the demerged company on a proportionate basis; |

| (v) | | the shareholders holding not less than three-fourths in value of shares in the demerged company (other than shares already held therein immediately before the demerger, or by a nominee for, the resulting company or, its subsidiary) become shareholders of the resulting company or companies by virtue of the demerger; otherwise than as a result of the acquisition of the property or assets of the demerged or any undertaking thereof by the resulting company; |

| (vi) | | the transfer of the undertaking is on a going concern basis; |

| (vii) | | the demerger is in accordance with the conditions, if any, notified under sub-section (5) of section 72A by the Central Government in this behalf. |

Explanation 1: For the purpose of this clause, “undertaking” shall include any part of an undertaking, or a unit or division of an undertaking or a business activity taken as a whole, but does not include individual assets or liabilities or any combination thereof not constituting a business activity.

Explanation 2: For the purpose of this clause, the liabilities referred to in sub-clause (ii), shall include –

| (a) | | the liabilities which arise out of the activities/operations of the undertaking; |

| (b) | | the specific loans or borrowings (including debentures) raised, incurred and utilised solely for the activities or operation of the undertaking; and |

| (c) | | in cases other than those referred to in clause (a) or clause (b), so much of the amounts of general or multipurpose borrowings, if any, of the demerged company as stand in the same proportion which the value of assets transferred in a demerger bears to the total value of the assets of such demerged company immediately before the demerger. |

Explanation 3: For determining the value of the property referred to in subclause (iii), any change in the value of assets consequent to their revaluation shall be ignored.

……………………………”

| 6. | | Section 2(19AA) of the Act prescribes the following conditions to be fulfilled to qualify as tax neutral “demerger”: |

| • | | All properties of the demerged undertaking are transferred to the resulting company, ignoring the revalued amounts; |

| • | | All liabilities relatable to the demerged undertaking are transferred to the resulting company; |

| • | | The properties and liabilities of the demerged undertaking should be transferred at values appearing in its books of account immediately before the demerger; |

| • | | Shares of the resulting company are issued to the shareholders of the demerged company on a proportionate basis; |

| • | | Shareholders holding not less than 75% in value of shares of the demerged company become shareholders of the resulting company; |

| • | | The demerged company transfers the unit, division or business activity on a going concern basis. |

| 7. | | In the present case, it is submitted that all the aforesaid conditions provided in section 2(1B) and section 2(19AA) of the Act were duly complied with as stated hereunder: |

| 8. | | Compliance of conditions stipulated in section 2(1B) of the Act in the amalgamation of MAL and GIHL with KCTBL |

| (a) | | All the properties of the amalgamating company immediately before the amalgamation become the properties of the amalgamated company by virtue of the amalgamation; |

It is submitted that pursuant to scheme of amalgamation approved and sanctioned by Hon’ble Delhi High Court vide order dated 08.10.2007, all the assets (both movable as well as immovable) of MAL and GIHL stood transferred to KCTBL.

The same is clearly evident from the ‘Scheme of amalgamation, arrangement and reconstruction’ approved and sanctioned by Hon’ble Delhi High Court, the relevant extracts of which are reproduced hereunder:

“2. Subject to the provisions of the Scheme in relation to the modalities of transfer and vesting, on occurrence of the Effective Date, the whole of the business, personnel, property and assets of the Transferor Companies shall stand transferred to and be vested in KCTBL, without any further act or deed, and by virtue of the Orders passed by the Hon’ble Delhi High Court in the following manner:

(a) With effect from the Appointed Date, the Transferor Companies’ Business and Undertaking shall stand transferred to and be vested in KCBL without any further deed or act, together with all their properties, assets, investments, rights, benefits and interest therein, subject to existing charges thereon in favour of banks and financial institutions, as the case may be. Without prejudice to the generality of the above, and in particular, the Transferor Companies’ Business & Undertaking shall stand transferred to be vested in KCTBL in the manner described in sub paragraphs (b) to (s) below:

(b) All the assets of the Transferor Companies as are movable in nature or incorporeal property or are otherwise capable of transfer by manual delivery or by endorsement and delivery, shall stand vested in KCTBL, with effect from the Appointed Date, and shall become the property and an integral part of KCTBL. The vesting pursuant to this sub-clause shall be deemed to have occurred by manual delivery or endorsement and delivery, as appropriate to the property being vested, and the title to such property shall be deemed to have transferred accordingly.

(c) With effect from the Appointed Date, all movable property of the Transferor Companies other than those specified in sub-clause (b) above, including sundry debts, obtaining loans and advances, if any, recoverable in cash or in kind or for value to be received, bank balances and deposits, if any, with Government, semi-Government, local and other authorities and bodies, customers and other persons shall without any act, instrument or deed become the property of KCTBL.

(d) With effect from the Appointed Date, all movable property (including land, buildings and any other immovable property) of the Transferor Companies, whether freehold or leasehold, and any documents of title, rights and easements in relation thereto including as more particularly described in Schedule 1 to this Scheme, shall stand transferred to and be vested in KCTBL, without any act or deed done by any of the Transferor Companies or KCTBL. With effect from the Appointed Date, KCTBL shall be entitled to exercise all rights and privileges and be liable to pay all taxes and charges including ground rent, and fulfill and obligations, in relation to or applicable to such immovable properties. The mutation/substitution of the title to such immovable properties shall be made and duly recorded in the name of KCTBL by the appropriate authorities pursuant to the sanction of the Scheme by the Hon’ble Delhi High Court and the Scheme becoming effective in accordance with the terms thereof………………..

(i) With effect from the Appointed Date, all permits, quotas, rights, entitlements, licenses including those relating to trademarks, tenancies, patents, copy rights, privileges, powers, facilities of every kind and description of whatsoever nature in relation to the Transferor Companies to which the Transferor Companies are party or to the benefit of which the Transferor Companies may be eligible and which are subsisting or having effect immediately before the Effective Date, shall be enforceable as fully and effectually as if, instead of the Transferor Companies, KCTBL had been a party or beneficiary or oblige thereto.”

| (b) | | All the liabilities of the amalgamating company immediately before the amalgamation become the liabilities ‘of the amalgamated company by virtue of the amalgamation. |

It is submitted that pursuant to scheme of amalgamation approved and sanctioned by Hon’ble Delhi High Court vide order dated 08.10.2007, all the debts, liabilities, contingent liabilities, duties and obligations (both secured and unsecured) of MAL and GIHL stood transferred to KCTBL.

The same is clearly evident from the ‘Scheme of amalgamation, arrangement and reconstruction’ approved and sanctioned by Hon’ble Delhi High Court, the relevant extracts of which are reproduced hereunder:

“(e) With effect from the Appointed Date, all debts, liabilities, contingent liabilities, duties and obligations, secured or unsecured whether provided for or not in the books of accounts or disclosed in the balance sheets of the Transferor Companies, shall become and be deemed to be the debts, liabilities, contingent liabilities, duties and obligations of KCTBL.

(f) With effect from the Appointed Date, the borrowing limits of the transferor companies approved by the respective shareholders of those companies under Section 293(1) (d) of the Act, shall be cumulatively added to the present borrowing limits of KCTBL and consequently, the borrowing limits of KCTBL shall stand increased to that extent.

(g) Without prejudice to the generally of the provisions contained herein, all loans raised after the Appointed Date but before the Effective Date operations shall be deemed to be the liabilities of KCTBL.

(l) With effect from the Appointed Date, KCTBL shall bear the burden and the benefits of any legal or other proceedings initiated or against the Transferor Companies.”

| (c) | | Shareholders holding not less than 3/4th in value of the shares in the amalgamating company become shareholders of the amalgamated company by virtue of the amalgamation. |

This condition was also satisfied in the present case as all the equity shareholders of MAL were allotted 72 equity shares of Rs.10/- each in KCTBL in lieu of every 1 equity share of Rs.100/- each held by them in MAL. Further, since GIHL was wholly owned subsidiary of MAL, therefore, all the relative shares were cancelled and extinguished and no allotment of shares of KCTBL was made.

The same is also evident from the ‘Scheme of amalgamation, arrangement and reconstruction’ approved and sanctioned by Hon’ble Delhi High Court, the relevant extracts of which are reproduced hereunder:

“4.1.1 The shareholders of the Transferor companies in consideration of such transfer shall, subject to the provisions of the Scheme, be entitled as follows:

| (i) | | Equity shareholder of MAL shall (without further application, act or deed) be entitled to equity shares in KCTBL (Merged) in the proportion of 72 equity shares of Rs. 10/- each in KCTBL (Merged) credited as fully paid for every 1 equity share of Rs. 100/- each held by them in MAL on a record date to be determined by the Board of Directors or a committee of the Board of Directors of KCTBL (“Record Date”) |

| (ii) | | Further, for the purposes of entitlements referred in (i) above, fractional entitlements shall be rounded-off to the next higher whole number. |

| (iii) | | However, no such entitlement referred to in (i) above shall arise in respect of shares of MAL held by KCTBL and the relative shares shall stand cancelled and extinguished. |

| (iv) | | Since GIHL is a wholly owned subsidiary of MAL, no entitlement shall arise in respect of equity and preference shall GIHL and the relative shares shall stand cancelled and extinguished.” |

9. In view of the aforesaid, it is submitted that in the amalgamation of MAL and GIHL with KCTBL pursuant to scheme of amalgamation approved and sanctioned by Delhi High Court, all the conditions as stated above, were duly satisfied, and therefore, the said merger was tax neutral in accordance with the provisions of section 2(1B) of the Act.

10. Compliance of conditions stipulated in section 2(1B) of the Act in the amalgamation of NIHL with KCTBLT

(a) All the properties of the amalgamating company immediately before the amalgamation become the properties of the amalgamated company by virtue of the amalgamation;

It is submitted that pursuant to scheme of amalgamation approved and sanctioned by Hon’ble Bombay and Delhi High Courts, all the assets (both movable as well as immovable) of NIHL stood transferred to KCTBL. The same is clearly evident from the ‘Scheme of arrangement and merger’ approved and sanctioned by Hon’ble High Court, the relevant extracts of which are reproduced hereunder:

“4.2 Subject to the provisions of the Scheme in relation to the modalities of transfer and vesting, on occurrence of the Effective Date, the whole of the business, personnel, property and assets of the Transferor Company shall stand transferred to and be vested in KCTBL, without any further act or deed, and by virtue of the Orders passed by the Hon’ble Delhi High Court, as also the Hon’ble Bombay High Court, as applicable, in the following manner:

‘a) With effect from the Appointed Date; the entire business and undertaking of the Transferor Company shall stand transferred to and be vested in KCTBL without any further deed or act together with all its properties, assets, investments, rights, benefits and interest therein, subject to existing charges thereon in favour of banks and financial institutions, as the case may be without prejudice to the generality of the above, and in particular, the Transferor Companies Business & Undertaking shall stand transferred to be vested in KCTBL in the manner described in sub paragraphs (b) to (s) below:

(b) An the assets of the Transferor Company as are movable in nature or incorporeal property or are otherwise capable of transfer by manual delivery or by endorsement and delivery or by vesting and recordal pursuant to this Scheme; shall stand vested in KCTBL with effect from the Appointed Date, and shall become the property and an integral part of KCTBL. The vesting of property under this sub-clause shall be deemed to have occurred by manual delivery or endorsement and delivery, as appropriate to the property being vested, and the title to such property shall be deemed to have transferred accordingly.