ORDER

Anadee Nath Misshra, Accountant Member.- (A) For the sake of convenience and brevity these appeals and Cross Objections (“COs” for short) pertaining to the same assessee are hereby disposed of through this consolidated order. Grounds taken in these appeals and COs are as under:

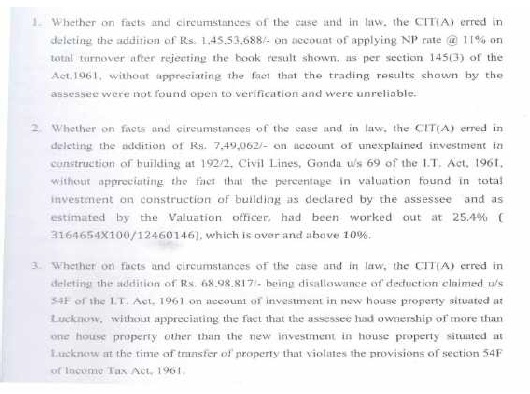

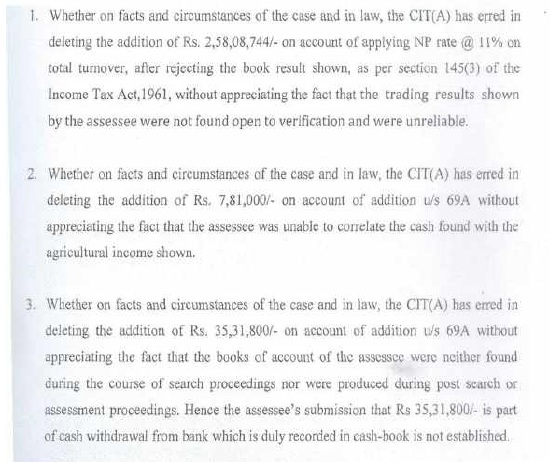

I.T.A. No.557/Lkw/2024, A.Y. 2021-22 (Revenue’s Appeal)

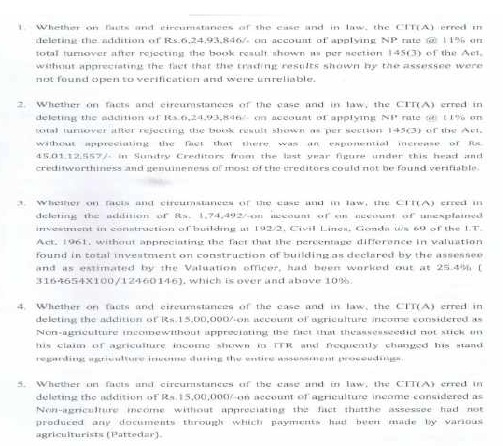

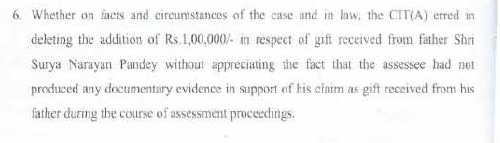

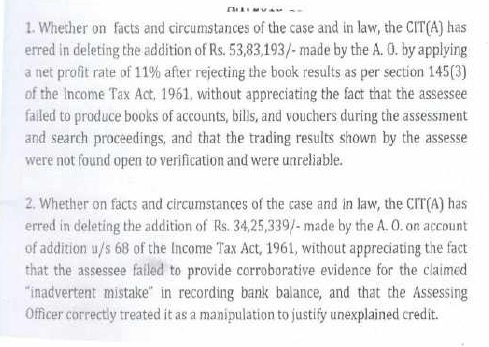

I.T.A. No.608/Lkw/2024, A.Y. 2020-21 (Revenue’s Appeal)

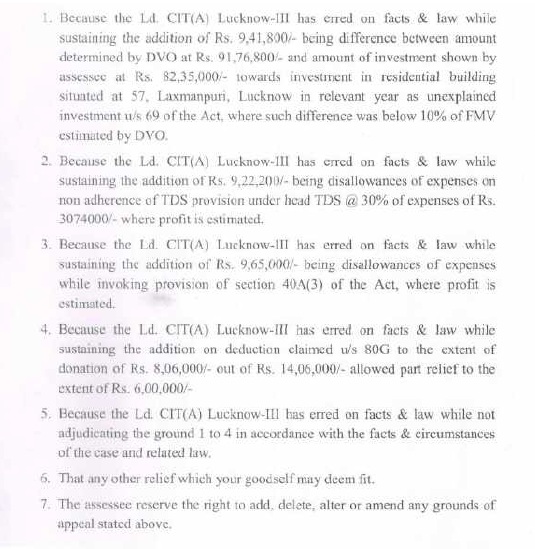

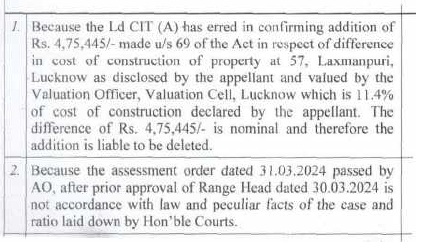

C.O.No.27/Lkw/2024, A.Y. 2021-22 (Assessee’s C.O.)

C.O.No.28/Lkw/2024, A.Y. 2020-21 (Assessee’s C.O.)

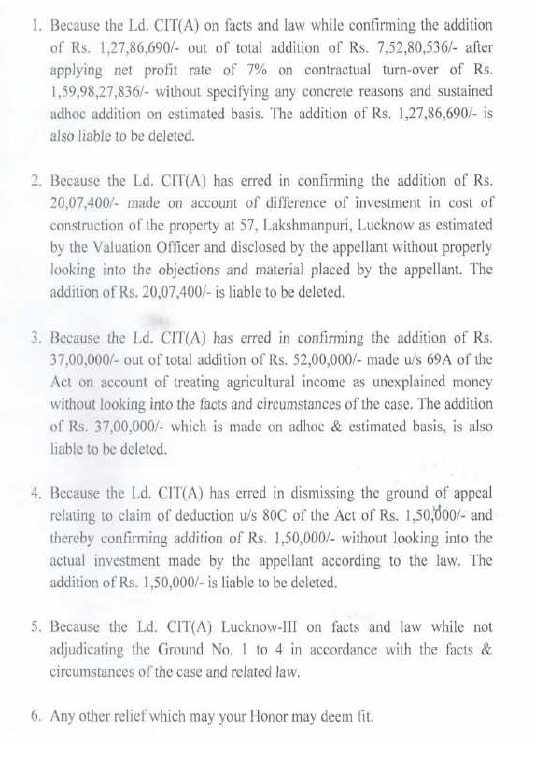

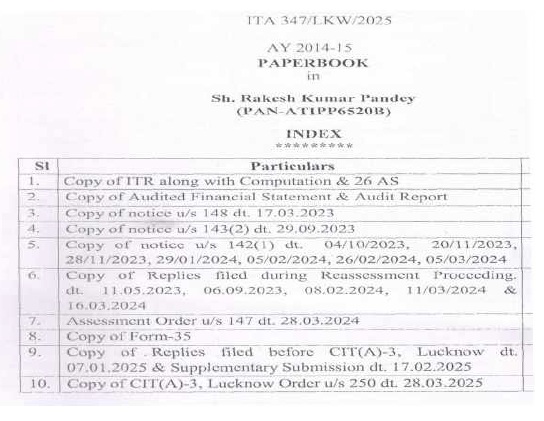

I.T.A. No.347/Lkw/2025, A.Y. 2014-15 (Assessee’s Appeal)

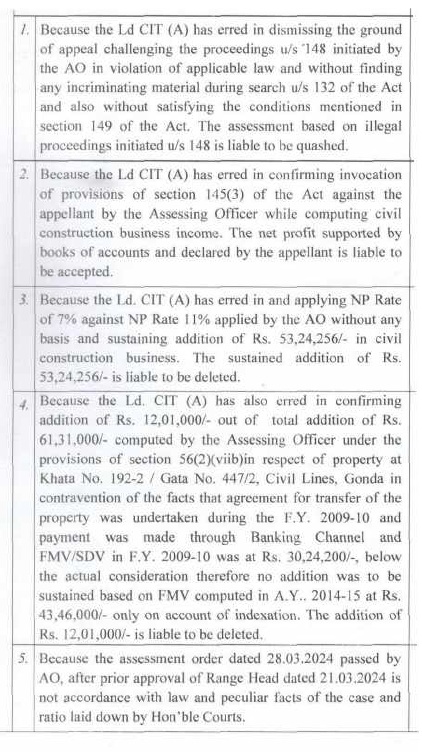

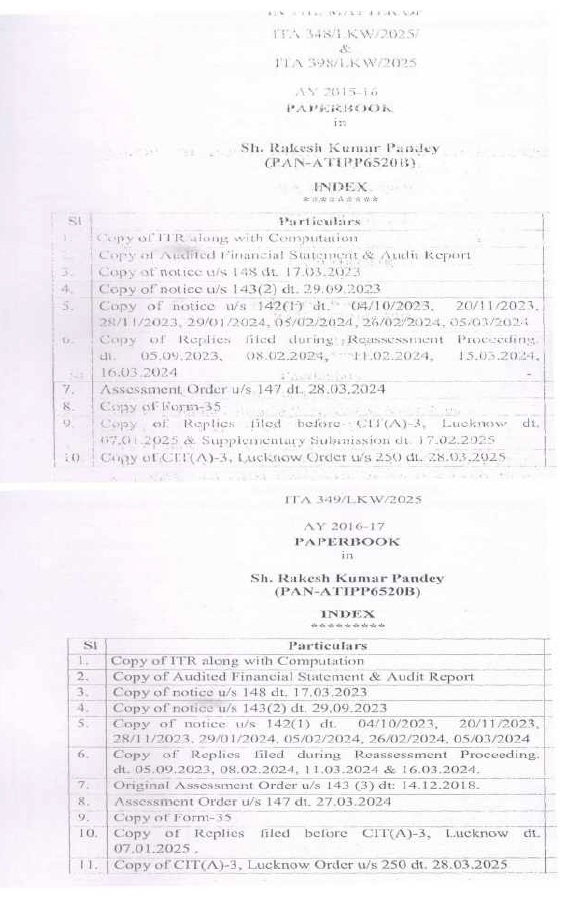

I.T.A. No.348/Lkw/2025, A.Y. 2015-16 (Assessee’s Appeal)

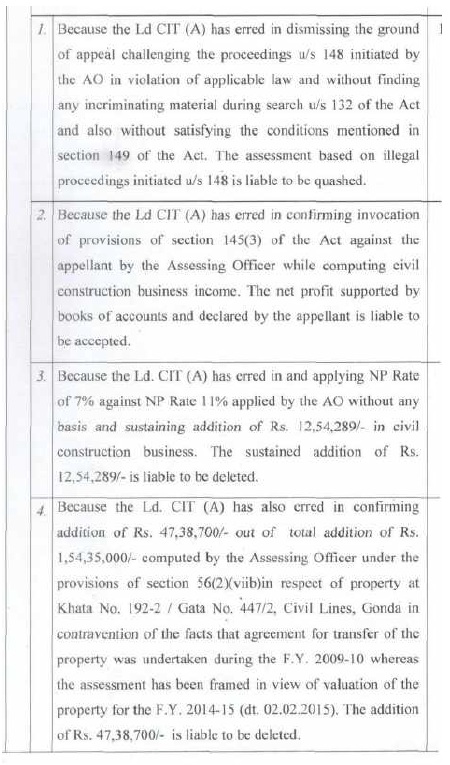

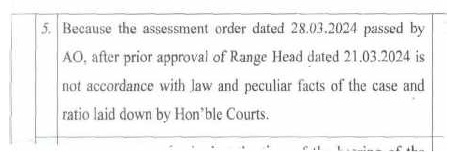

I.T.A. No.349/Lkw/2025, A.Y. 2016-17 (Assessee’s Appeal)

I.T.A. No.350/Lkw/2025, A.Y. 2017-18 (Assessee’s Appeal)

I.T.A. No.351/Lkw/2025, A.Y. 2018-19 (Assessee’s Appeal)

I.T.A. No.352/Lkw/2025, A.Y. 2019-20 (Assessee’s Appeal)

I.T.A. No.353/Lkw/2025, A.Y. 2022-23 (Assessee’s Appeal)

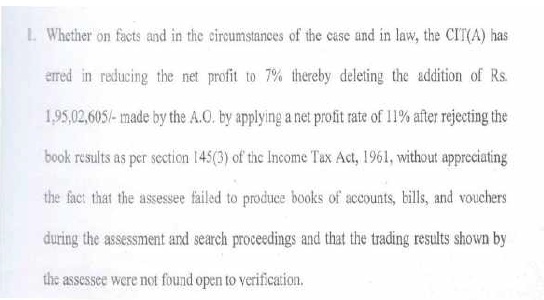

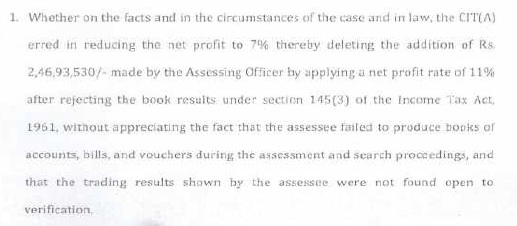

I.T.A. No.398/Lkw/2025, A.Y. 2015-16 (Revenue’s Appeal)

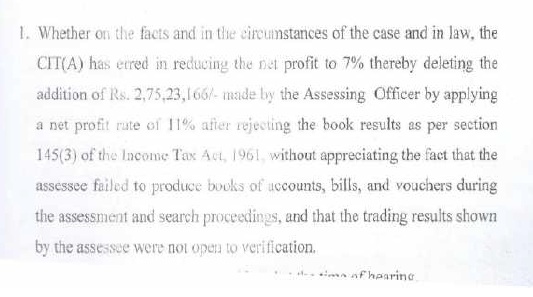

I.T.A. No.399/Lkw/2025, A.Y. 2016-17 (Revenue’s Appeal)

I.T.A. No.402/Lkw/2025, A.Y. 2019-20 (Revenue’s Appeal)

I.T.A. No.405/Lkw/2025, A.Y. 2022-23 (Revenue’s Appeal)

I.T.(SS)A. No.460 /Lkw/2025, A.Y. 17-18 (Revenue’s Appeal)

(A.1) The Cross Objection vide C.O.No.28/Lkw/2024 has been filed by the assessee, beyond time limit prescribed under section 253(3) of IT Act. The assessee has submitted application for condonation of delay in filing of the Cross Objection; pleading that the delay was unintentional and beyond the control of the assessee and has requested to admit the Cross Objection for hearing. The learned Departmental Representative for Revenue did not express any objection to assessee’s application for condonation of delay in filing of the Cross Objection. In view of the foregoing, and in specific facts and circumstances of the present Cross Objection before us, the delay in filing of this Cross Objection is condoned; and the Cross Objection is admitted for hearing, on merits.

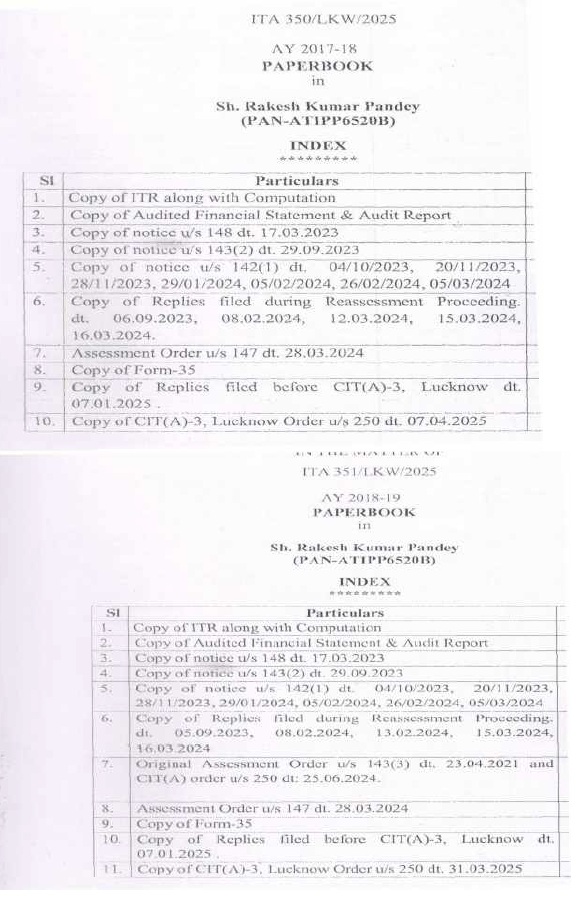

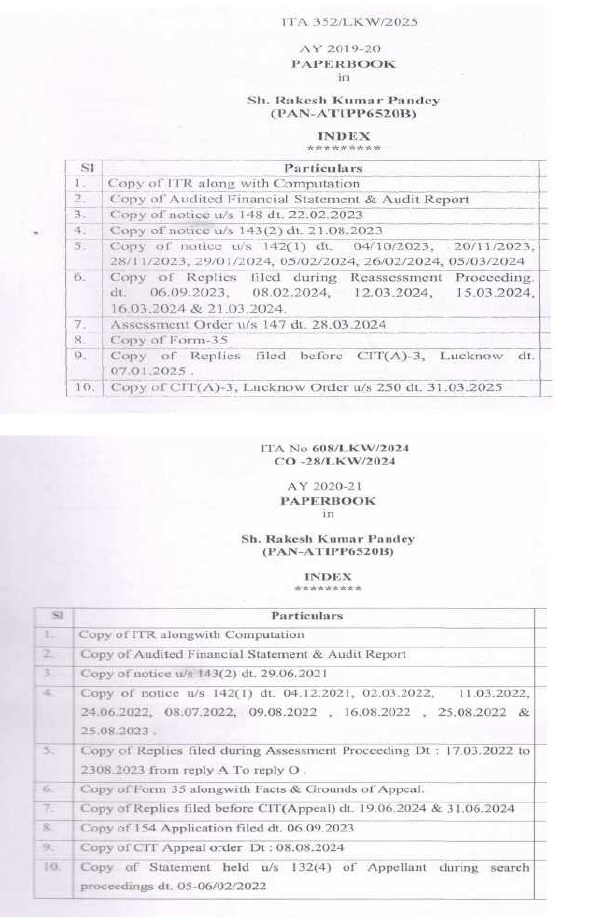

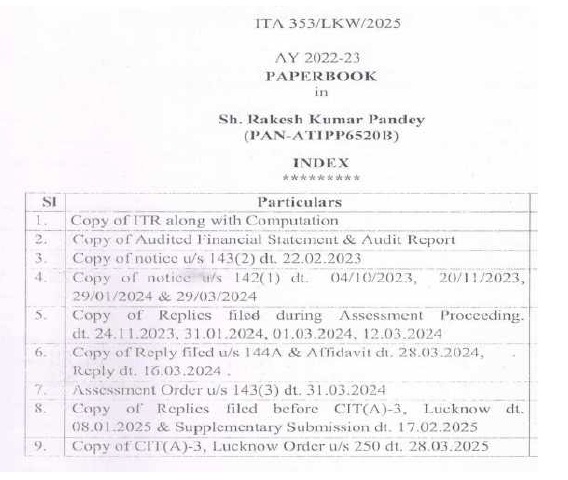

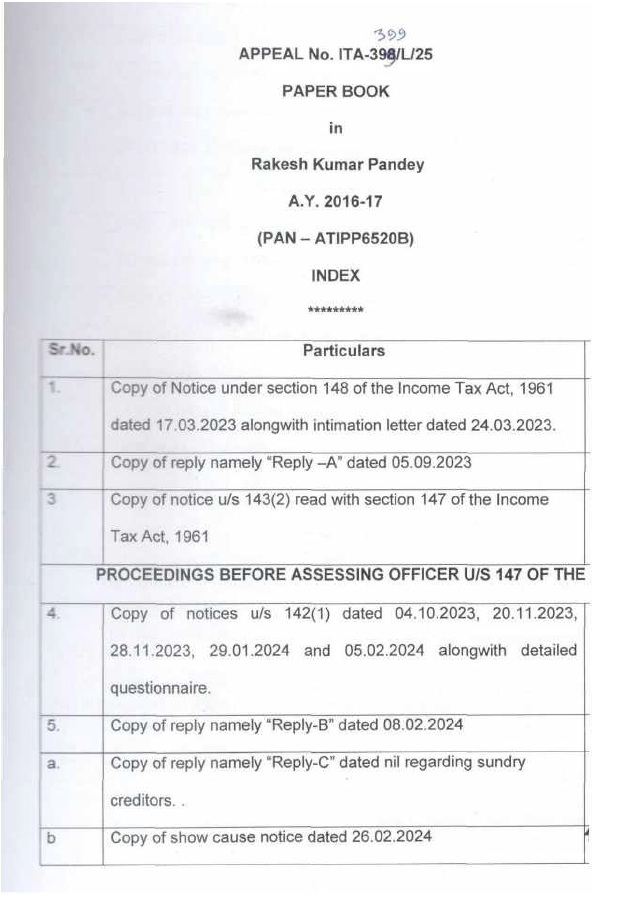

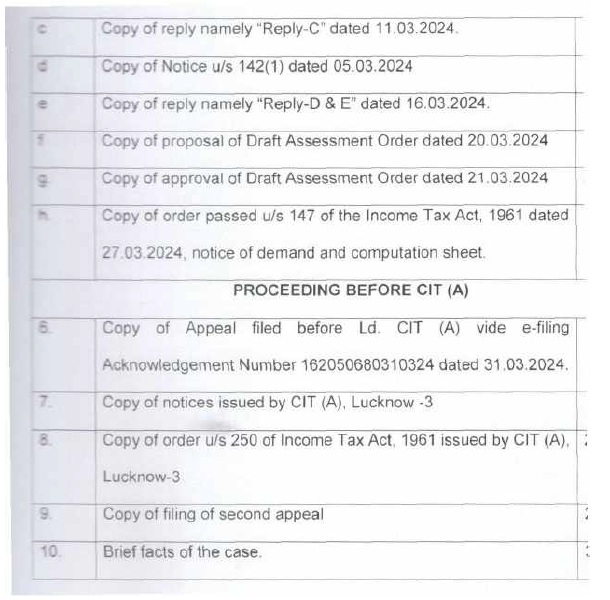

(B) In the course of appellate proceedings in Income Tax Appellate Tribunal, (“ITAT” for short), following paper book were filed from the assessee’s side:

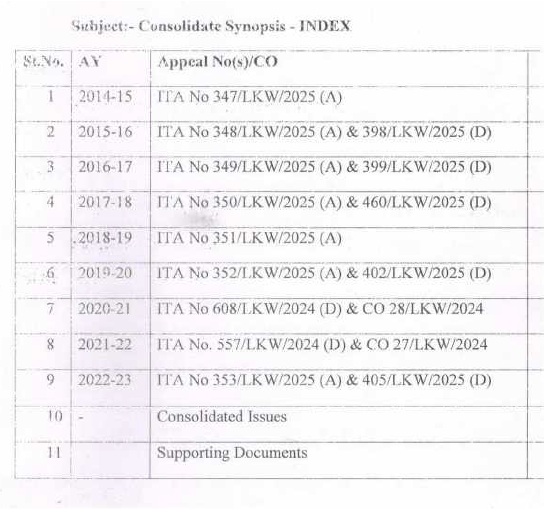

(B.1) Further, a consolidated synopsis, common for all the appeals and COs before us, was filed from assessee’s side; which is reproduced below for the ease of reference:

“Before,

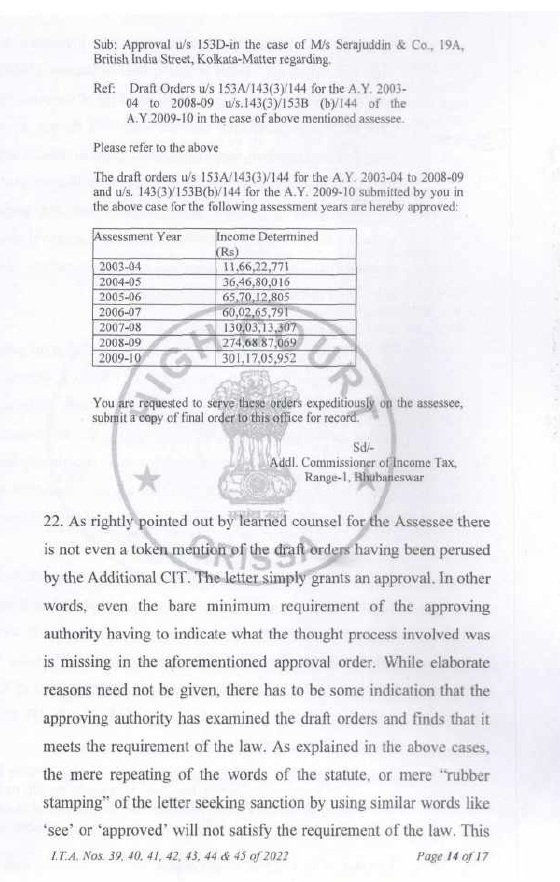

The Hon’ble ITAT, Lucknow Bench ‘A’, Lucknow

Hon’ble Members,

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

Subject:-Consolidate Synopsis:

| 1. | | ITA No 347/LKW/2025 (A) AY 2014-15 |

| 2. | | ITA No 348/LKW/2025(A) & 398/LKW/2025 (D) AY 2015-16 |

| 3. | | ITA No 349/LKW/2025 (A) & 399/LKW/2025 (D) AY 2016-17 |

| 4. | | ITA No 350/LKW/2025 (A) & 460/LKW/2025 (D) AY 2017-18 |

| 5. | | ITA No 351/LKW/2025 (A) AY 2018-19 |

| 6. | | ITA No 352/LKW/2025 (A) & 402/LKW/2025 (D) AY 2019-20 |

| 7. | | ITA No 608/LKW/2024 (D) & CO 28/LKW/2024 AY 2020-21 |

| 8. | | ITA No. 557/LKW/2024 (D) & CO 27/LKW/2024 AY 2021-22 |

| 9. | | ITA No 353/LKW/2025 (A) & 405/LKW/2025 (D) AY 2022-23 |

In above said pending appeals filed by Appellant and Revenue substantially issues are common, therefore, consolidated synopsis are prepared based on issues involved w.r.t. respective year.

Issue No. 1 – AY 2014-15 TO AY2022-23

| 1. | | That a search and seizure operation u/s 132 of the Income Tax Act was carried out on 05.02.2022 on the business and residential premises of M/s Alok Construction being proprietary concern of Appellant. The assessee is Government Contractor and during the relevant period, the assessee engaged in proprietorship business of construction of road etc. in semi urban area from contract work provided by the UPPWD, under the name and style of M/s Alok Construction. |

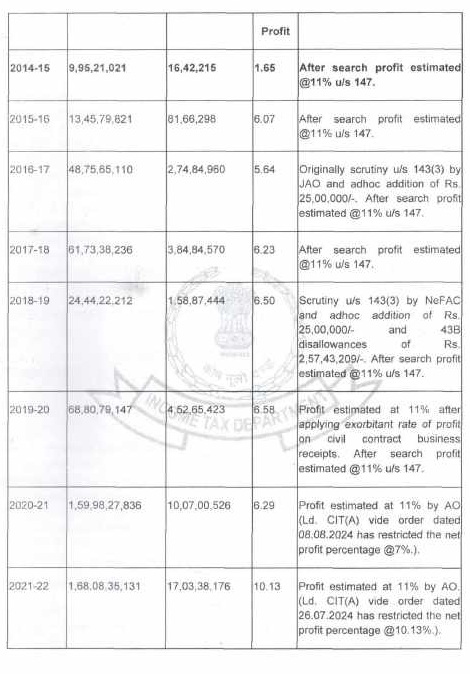

| 2. | | The books of accounts for relevant year were regularly maintained and audited and ITRs alongwith TAR. were filed within due date in respective years with following financial details:- |

| AY | Turnover | Profit | Assessee % of Profit | AO % of Profit | CIT(A) % of Profit | Remark |

| 2014-15 | 9,95,21,021 | 16,42,215 | 1.65 | 11% | 7% | Year of inception of proprietary business. |

| 2015-16 | 13,45,79,821 | 81,66,298 | 6.07 | 11% | 7% | |

| 2016-17 | 48,75,65,110 | 2,74,84,960 | 5.64 | 11% | 7% | Erstwhile Scrutiny u/s 143(3) dated 14.12.2011 by JAO and adhoc addition of Rs. 25,00,000/- |

| 2017-18 | 61,73,38,236 | 3,84,84,570 | 6.23 | 11% | 7% | |

| 2018-19 | 24,44,22,212 | 1,58,87,444 | 6.50 | 11% | 7% | Erstwhile Scrutiny u/s 143(3) dt. 23.04.2021 by NeFAC and adhoc addition of Rs. 25,00,000/- and 43B disallowances of Rs. 2,57,43,209/-, Ld. CIT(A) allowed the appeal against original order. |

| 2019-20 | 68,80,79,147 | 4,52,65,423 | 6.58 | 11% | 7% | |

| 2020-21 | 1,59,98,27,836 | 10,07,00,526 | 6.29 | 11% | 7% | |

| 2021-22 | 1,68,08,35,131 | 17,03,38,176 | 10.13 | 11% | 10.13% | Addition on extra profit deleted. |

| 2022-23 | 2,82,59,71,973 | 28,50,48,173 | | 11% | 9.68% | Addition on extra profit deleted. |

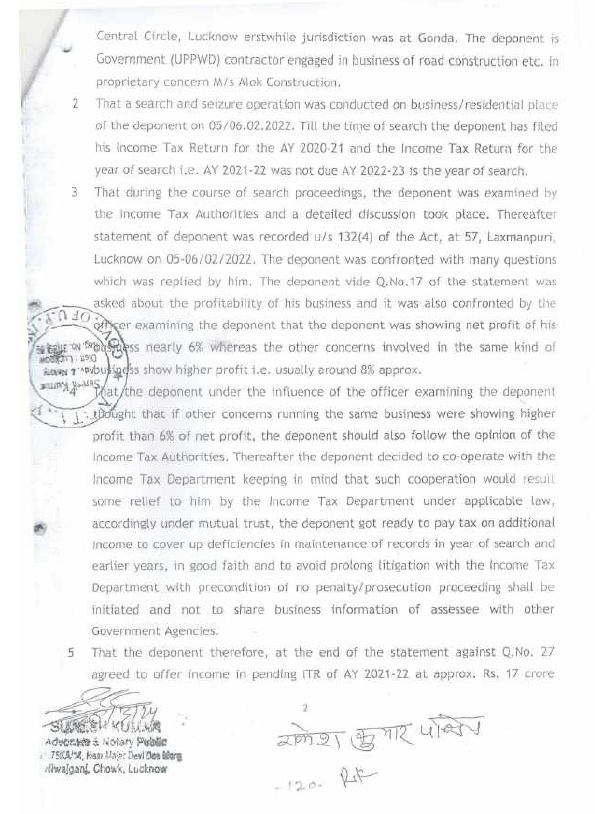

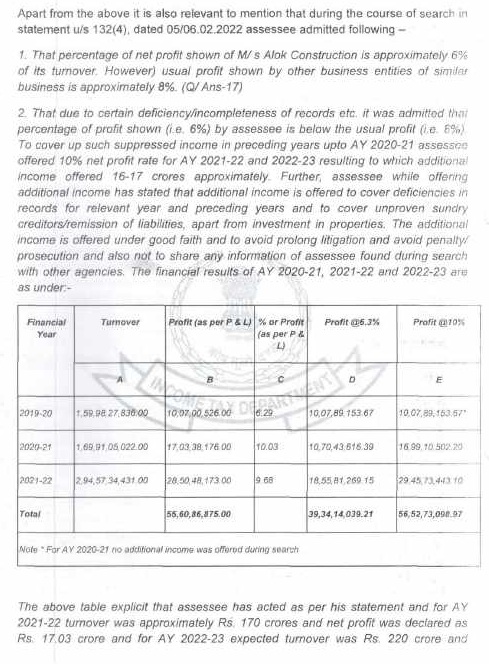

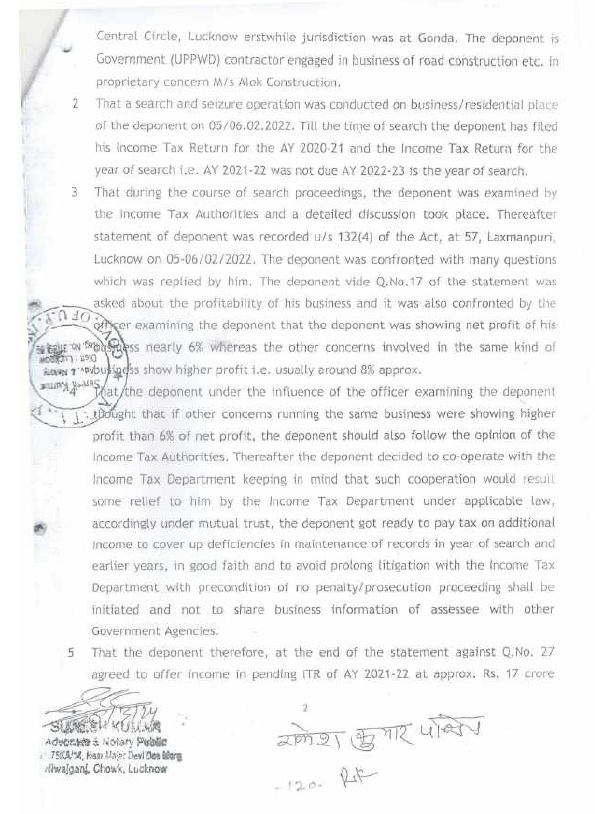

That during the course of search proceeding in statement recorded u/s 132(4), dated 05/06.02.2022 assessee admitted following –

That percentage of net profit shown of M/s Alok Construction is approximately 6% of its turnover. However, usual profit shown by other business entities of similar business is approximately 8%. (Q/Ans-17)

That due to certain deficiency/incompleteness of records etc. it was admitted that percentage ofprofit shown (i.e. 6%) by assessee is below the usual profit (i.e. 8%). To cover up such suppressed income in preceding yearsupto AY 2020-21 assessee offered 10% net profit rate for AY 2021-22 and 2022-23 resulting to which additional income offered 16-17 crores approximately. Further, assessee while offering additional income has stated that additional income is offered to cover deficiencies in records for relevant year and preceding years and to cover unproven sundry creditors/remission of liabilities, apart from investment in properties. Further, no adverse inference may be drawn w.r.t. extra profits and seized documents for years prior to AY 2021-22.

Further, at the time of the search proceeding for AY 2020-21 was under progress and issues arising from the search operation was also covered by Ld. AO in assessment proceedings.

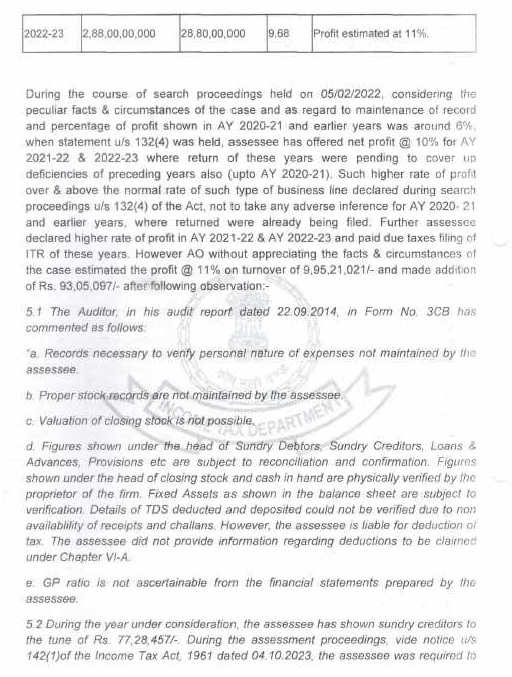

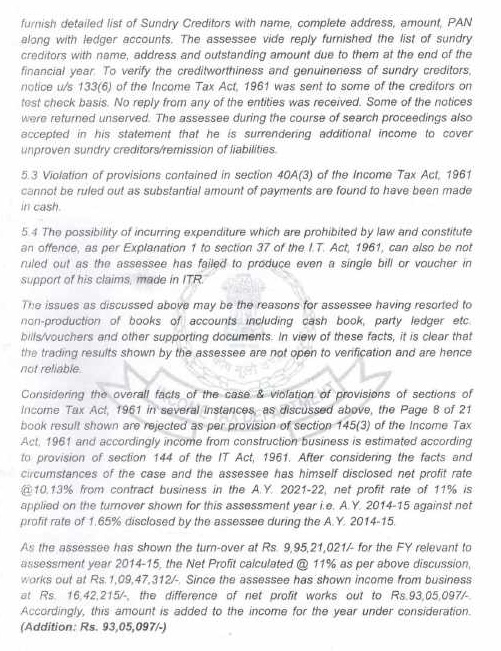

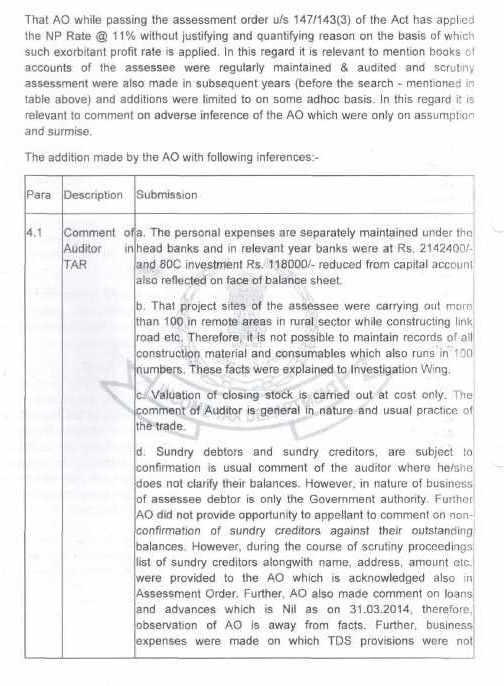

During the course of the assessment proceeding, assessee has provided all relevant information as required time to time with regard to purchase of material, business expenses and reconciliation of sales with VAT/GST return. However, AO only on usual observation of Tax Auditor in form 3CB has invoked provision of section 145(3) of the Act and estimated income according to provision of sec. 144 of the Act. It is relevant to mention that these are the general observation made by Auditor in TAR without adverse finding on particular transactions and figures, which are year wise reproduced for ready reference.

Observation of Auditor in TAR

| AY | Para/ Page of Assessment Order | Observation of AO | Remarks |

| 2014-15 | 5.1 / 2 & 3 | 5.1 The Auditor, in his audit report dated 22.09.2014, in Form No. 3CB has commented as follows:

“a. Records necessary to verify personal nature of expenses not maintained by the assessee.

b. Proper stock records are not maintained by the assessee.

c. Valuation of closing stock is not possible.

d. Figures shown under the head of Sundry Debtors, Sundry Creditors, Loans & Advances, Provisionsetc are subject to reconciliation and confirmation. Figures shown under the head of closing stock and cash in hand are physically verified by the proprietor of the firm. Fixed Assets as shown in the balance sheet are subject to verification. Details of TDS deducted and deposited could not be verified due to nonavailability of receipts and challans. However, the assessee is liable for deduction of tax. The assessee did not provide information regarding deductions to be claimed under Chapter VI-A.

e. GP ratio is not ascertainable from the financial statements prepared by the assessee. | |

| 2015-16 | 5.1 / 2 & 3 | 5.1 The Auditor, in his audit report dated 22.09.2015, in Form No. 3CB has commented as follows:

“a. GP ratio is not ascertainable in such type of business.

b. We have not found any documentary records available with the assessee to verify payments through account payee cheque.

c. We have not found any record to verify personal nature expenses incurred by the management.

d. We have not been provided with the stock records by the assessee.

e. Valuation of closing stock is not possible as no proper records of stock has been maintained by the assessee and the value of the closing stock has been certified by the assessee himself.

f. Balances of Sundry debtors and Sundry creditors are subject to verification. | |

| 2016-17 | 5.1 / 2 & 3 | 5.1 The Auditor, in his audit report dated 25.05.2016, in Form No. 3CB has commented as follows:

“a. GP ratio is not ascertainable in such type of business.

b. We have not found any documentary records available with the assessee to verify payments through account payee cheque.

c. We have not found any record to verify personal nature expenses incurred by the management.

d. We have not been provided with the stock records by the assessee.

e. Valuation of closing stock is not possible as no proper records of stock has been maintained by the assessee and the value of the closing stock has been certified by the assessee himself.

f. Balances of Sundry debtors and Sundry creditors are subject to verification. | |

| 2017-18 | 5.1 / 2 & 3 | 5.1 The Auditor, in his audit report dated 28.09.2017, in Form No. 3CB has commented as follows:

“a. GP ratio is not ascertainable in such type of business.

b. We have not found any documentary records available with the assessee to verify payments through account payee cheque.

c. We have not found any record to verify personal nature expenses incurred by the management.

d. We have not been provided with the stock records by the assessee.

e. Valuation of closing stock is not possible as no proper records of stock hasbeen maintained by the assessee and the value of the closing stock has been certified by the assessee himself.

f. Balances of Sundry debtors and Sundry creditors are subject to verification. | |

| 2018-19 | 5.1 / 2 & 3 | 5.1 The Auditor, in his audit report dated 22.09.2018, in Form No. 3CB has commented as follows:

“a. GP ratio is not ascertainable in such type of business.

b. We have not found any documentary records available with the assessee to verify payments through account payee cheque.

c. We have not found any record to verify personal nature expenses incurred by the management.

d. We have not been provided with the stock records by the assessee.

e. Valuation of closing stock is not possible as no proper records of stock has been maintained by the assessee and the value of the closing stock has been certified by the assessee himself.

f. Balances of Sundry debtors and Sundry creditors are subject to verification. | |

| 2019-20 | 5.1 / 2 & 3 | 5.1 The Auditor, in his audit report dated 28.10.2019, in Form No. 3CB has commented as follows:

“a. GP ratio is not ascertainable in such type of business.

b. We have not found any documentary records available with the assessee to verify payments through account payee cheque.

c. Expenditure by way of personal nature was Nil as explained by the Assessee. However, the extent of personal use in case of cacr running and maintenance, Telephone Expenses etc. if any could not be ascertained for want of record.

d. We have not been provided with the stock records by the assessee. Item wise Quantitative details of stock could not be furnished due to nature of business and large number of items. So, we are unable to give item wise quantitative details of stock in Para 35(b) of Form 3D.

e. Valuation of closing stock is not possible as no proper records of stock hasbeen maintained by the assessee and the value of the closing stock has been certified by the assessee himself.

f. Balances of Sundry debtors and Sundry creditors are subject to verification. | |

| 2020-21 | 4.1 / 2 | 4.1 follows: The Auditor, in his audit report dated 21.12.2020, in Form No. 3CB has commented as

“a. GP ratio is not ascertainable in such type of business.

b. Balances of Sundry Debtors and Sundry Creditors are subject to verification.

c. The assessee has not obtained TAN, thus, we, are unable to comment on TDS provisions.

d. We have not been provided with the stock records by the assessee. Item wise Quantitative details of stock could not be furnished due to nature of business and large number of items. So, we are unable to give the item wise quantitative details of stock in Para no. 35(b) of Form 3D.

e. Valuation of closing assessee stock is not possible as no proper records has been maintained by the assessee and the value of the closing stock has been certified by the itself.” | |

| 2021-22 | 4.1 / 2 | 4.1 follows: The Auditor, in his audit report dated 08.03.2022, in Form No. 3CB has commented as

a. It is not possible to ascertain GP ratio in such type of business.

b. As explained to us, entity has not maintained quantity wise reconciliation of stock.

c. Sundry debtor, creditors and loans & advances are as per books of account only and are subject to reconciliation and confirmation. | |

| 2022-23 | 6.1 / 2 & 3 | 6.1 The Auditor, in his audit report dated 30.09.2022, in Form No. 3CB has commented as follows:

“a. It is not possible to ascertain GP ratio in such type of business.

b. Expenditure related to personal nature could not be ascertained for want of record.

c. It is not possible for us to verify whether all loans and deposit taken or accepted u/s 269SS and the payments in excess the specified limit in section 269T have been made otherwise than by account payee cheque or account payee bankdraft, as the necessary evidence are not in possession of the assessee. The management certifies that all payments in excess of limit prescribed were made through account payee cheque/drafts or RTGS/NEFT.

d. As explained to us, entity has not maintained quantity wise reconciliation of stock, however physical verification of stock has been conducted at the year end. | |

In this regard, it is relevant to mention that prior to date of search for AY 2016-17 & 2018-19 case of the appellant was completed under scrutiny by JAO & FAO respectively where assessment was completed u/s 143(3) after due verification of record. It is also relevant to mention that during the course of the search no incriminating material was found w.r.t. justification of enhancement of profit percentage. On the other side documents found and seized for differentyears of above said period were duly reconciled with either recorded in books of account relates to business of assessee or personal investments relates to investment in construction of house properties. In the assessment order of above said period the Ld. AO has not brought any single instance of incriminating material on the basis of which addition could have been made w.r.t. business income of assessee in support to justify increase profit percentile. In the assessment order the observation of the AO while estimating net profit @ 11% of Gross Receipt was simply based on Net Profit occurred by assessee @ 10.13% for AY 2021-22 in compliance of statement u/s 132(4) held during the search, higher percentage of profit for AY 2021-22 to AY 2022-23 only.

The Ld. AO was highly unjustified while increasing the profit percentage and making the addition for AY 2014-15 to AY 2020-21 where no incriminating material was found w.r.t. addition made in these years.

Reliance is placed on AbhisarBuildwell (P.) Ltd. Pr. CIT v. Abhisar Buildwell (P.) Ltd. (SC) (SC)/[2023] 454 ITR 212 (SC)(For AY 2014-15 to AY 2019-20)

Further, while estimating the profit percentile at 11% AO made reliance on profit estimated @11% in AY 2021-22 which is highly unjustified. In AY 2021-22 assessee himself offered profit percentile around 10% as per statement held u/s 132(4) for AY 2021-22 & AY 2022-23, with prior condition no adverse inference is drawn in years prior to AY 2021-22. Therefore, the whole additions on account of increase in profit percentile was made based on the statement of assessee which is not sustainable in the peculiar circumstances and in the eyes of law.

Reliance is placed on the followings:-

| • | | Principal Commissioner of Income-tax, (Central)-1 v. Forum Sales (P.) Ltd.*Principal Commissioner of Income-tax, (Central)-1 v. Forum Sales (P.) Ltd. (Delhi) HIGH COURT OF DELHI |

“24. The series of judgments referred to hereinabove clearly allude to the settled position of law that the books of account have to be necessarily rejected before the AO proceeds to the best judgment assessment upon fulfillment of conditions mentioned in the Act. The underlying rationale behind such an action is to meet the standards of correct computation of accounts for the purpose of a more transparent and precise assessment of income. Therefore, any pick and choose method of rejecting certain entries from the books of account while accepting other, without an appropriate justification, is arbitrary and may lead to an incomplete, unreasonable and erroneous computation of income of an assessee.

29. Admittedly, the addition of income as discussed in questions (B), (C) and (D) on estimate basis has been done without rejecting the books of account. In view of the aforesaid, we find that no substantial question of law arises in the present appeals.

30. Consequently, we do not find any merit in the case of the Revenue and have no reason to interfere with the view taken by the ITAT. Therefore, the appeals stand dismissed. Pending application(s), if any are also disposed of.”

| • | | The Division Bench of the High Court of Bombay in the case of Pr. CIT v. Swananda Properties (P.) Ltd. 429/2019 SCC OnLineBom 13359, had an occasion to consider the said question and the same was accordingly answered as under:- |

| “11. | | We note that the books of account of the respondent were rejected by the Commissioner of Income-tax (Appeals) under section 145(3) of the Act. However, the Tribunal found in the impugned order that the invocation of section 145(3) of the Act is unjustified as no defect was noted in the books of account to disregard the same. We note that the Commissioner of Income-tax (Appeals) in his order while rejecting the books of account does not specify the defect in the record. The basis of the rejection appears to be best judgment of assessment done by him. The rejection of the books should precede the best judgment assessment. On facts, the Revenue has not been able to show any defect in the respondent’s records which would warrant rejection of the books and making a best judgment assessment. Thus, on facts the view taken by the Tribunal is a possible view. Therefore, no substantial question of law arises. Thus not entertained.” |

| • | | Commissioner of Income-tax – I v. Sahu Construction (P.) Ltd. (Allahabad) |

“21. In the case of CIT v. Gian Chand Labour Contractors(Punj. &Har.)], it was observed that no further separate deduction is allowable as per Sections 29, 144 and 145 of the Act. Relevant portion of the judgment reads as under:—

“Section 145 of the Income-tax Act, 1961 provides for computation of income under section 29 on the basis of books of account and methods of accounting regularly followed by the assessee. However, where the Assessing Officer is not satisfied with the correctness or completeness of the books, he may reject them and estimate the income to the best of his judgment in accordance with the provisions of Section 144 of the Act. When an estimate is made to the best judgment of an Assessing Officer, he substitutes the income that is to be computed under section 29 of the Act. Once best judgment assessment is made by fixing a rate of net profit, the assessee’s claim for deduction on account of expenses cannot be deemed to have been ignored. The net profit rate is applied after taking into consideration all factors and it accounts for all the deductions which are referred to under section 29 and are deemed to have been taken consideration while making such estimate.”

| • | | Commissioner of Income-tax, Allahabad v. Target Construction Co. Ltd. (Allahabad) |

IT: Where in case of government contractor engaged in construction of roads books of account was rejected, Tribunal, relying upon profit rates of preceding three years, was justified in estimating profits earned by assessee during relevantyears at 5 percent ofgross receipts

Section 145 of the Income-tax Act, 1961 – Method of accounting -Estimation of income (GP rate) – Assessment years 2004-05 and 2005-06 -Assessee-company was carrying out contract of construction of roads awarded by Government – Due to various discrepancies in books of account, Assessing Officer rejected same and estimated profit at 10 per cent ofgross receipts – Tribunal relying upon profit rates of preceding three years, reduced profit earned during relevant year to 5 per cent of gross receipts -Where since assessee had not done any private construction work during assessment years in question, impugned order passed by Tribunal did not require any interference – Held, yes. [Paras 5 and 6] [In favour of assessee]

| • | | M/s Omshree Agrotech Private Ltd. IT(SS)A No. 45 to 50/ PUN/2022 |

Held that book of accounts cannot be rejected only on surmise and lower profit declared by assessee.

| • | | Shri Ramesh Singh Ranavs DCIT Range-4, Lucknow ITA No.717/LKW/2019 |

Held that the action of the Ld. CIT(A) is justified for restricting the addition @ 6.5% of the net profit. As he has also considered the past history and also the reason as to why the net profit was estimated at 5%. It is pointed out that gross business receipts were high in that year comparing to the year under appeal. The assessee did not point out any infirmity in adopting such rate by filing credible evidence. The grounds raised in this appeal of the assessee lack merit, hence dismissed.

| • | | Manoj Gupta v. ACIT, Range- 3, Lucknow ITA No. 355/LKW/2020 |

Held where sales and purchase are verified books of account cannot be rejected and profit cannot be estimated. Further estimation of profit may be made only on the basis ofalways on past history only. It is also relevant to mention that in identical facts of AY 2020-21, AO estimated the net profit at 11% and at first appellate level vide order u/s 250 dated 08.08.2024 vide DIN ITBA/APL/S/250/2024-25/1067435183(1) profit was estimated at 70% after following observation:-

7.12 Considering the aforementioned discussion, case laws specially the judgment of Hon’ble HIGH COURT OF ALLAHABAD in the case of Commissioner of Income-tax, Allahabad v. Target Construction Co. Ltd and the fact that depreciation of Rs. 14,99,267/- has already been disallowed, the net profit rate of 11% applied by the Assessing Officer is too high when appellant has shown comparatively higher profit margin of 10.13% and 9.68% in subsequent years i.e. A.Y. 2021-22 and A.Y. 202223 to cover up the deficiencies of unproved sundry creditors/remission of liabilities found during search proceeding. Therefore, I am of the considered view that it would be justified to apply net profit rate of 7% on the total turnover of Rs. 1,59,98,27,836/- which works out at Rs. 11,19,87,949/-. Since the appellant has shown income from business at Rs. 10,07,00,526/-, thus, the difference in profit works out at Rs. 1,12,87,423/-. Thus, the addition to the tune of Rs. 1,27,86,690/- (Rs. 1,12,87,423 + Rs. 14,99,267/-) deserved to be confirmed. Therefore, the addition to the extent of Rs. 1,27,86,690/- is confirmed and remaining addition of Rs.6,24,93,846/- (7,52,80,536-1,27,86,690) made by the Assessing Officer is hereby deleted. Thus, these grounds of appeal are partly allowed.

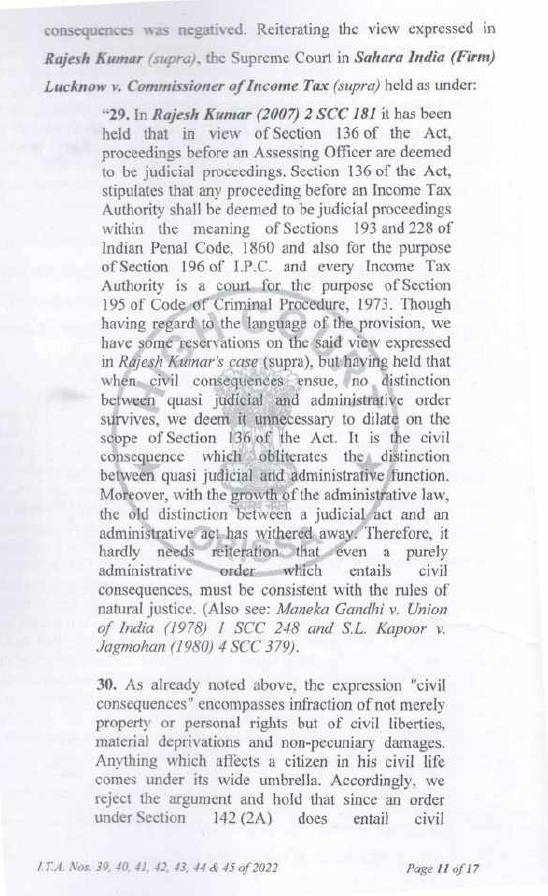

Issue No. 2 – A Y 2014-15

Ld. CIT(A)-3 sustained the addition Rs. 1201000/- (Rs. 43460003135000)

That assessee has acquired lease hold plot measuring at 781.40 sqm. situated at Khata no. 192/2,Gata no. 447/2, (Part) Civil line, Gonda purchased by assessee for consideration was Rs. 31,45,000/- from Smt. Pushplata Saran, Shri. Saurabh Saran, Shri. Shobhit Saran and

Shri. Shresh Saran on 04/10/2013 against stamp duty value at Rs. 92,76,000/-. Thereafter, the said lease property was converted into freehold through registered deed on 24/10/2017. During the assessment proceeding of AY 201415, AO has referred the valuation of said property u/s 50C/142A in response to which Valuation Officer, Allahabad has estimated the FMV of lease property as on 04/10/2013 at Rs. 43,46,000/- against actual consideration of Rs. 31,45,000/- vide valuation report dt. 14/06/2024.

In this regard it is relevant to mention that assessee has already made payment of Rs. 31,45,000/- through banking channel in FY 2009-10, therefore, stamp duty value in 2009 was to be applied as per provision of sec. 56(2) of the Act. However, Valuation Officer erred on facts and law while applying the stamp duty value of 2009 and indexing thereafter. Resulting to which FMV is over valued. Further, in 2009 stamp duty value of said property was at Rs. 3000 per sq.mts. The said fact is overlooked by VO. Therefore if rate 2009 may be applied than the FMV of the land will be at Rs. 2344200/- (3000 X 781.4 sq. mtr) and cost of boundary wall Rs. 680000/- aggregating Rs. 3024200/- against the consideration of Rs. 3145000/-therefore the actual sale consideration is over & above the value of property being FMV as per provision of 56(vi)(2) without any revenue effect.

Therefore, addition sustained to the extent of Rs. 12,01,000/- u/s 56(2)(vii)(b) may kindly be deleted.

Issue No. 3- A Y 2015-16

Ld. CIT(A)-3 sustained the addition Rs. 4738700/- (Rs. 77387003000000)

That assessee has acquired lease hold plot measuring at 1279.06 sqm. situated at Khata no. 192/2,Gata no. 447/2, (Part) Civil line, Gonda for consideration of Rs. 30,00,000/- against value for stamp duty of Rs. 1,84,26,000/- from Smt. Pushplata Saran, Shri. Saurabh Saran, Shri. Shobhit Saran and Shri.Shresh Saran on 02/02/2015. The said property was in continuation of property transaction held with same seller in AY 2014-15, where advance are given for adjacent of property of same Gata. However whole advance given in FY 2009-10 was absorbed in property acquired in AY 2014-15. During the assessment proceeding of AY 2015-16, AO has referred the valuation of said property u/s 142A in response to which Valuation duty value of said property was at Rs. 3000 per sq.mts. The said fact is overlooked by VO and estimated the FMV at Rs. 77,38,700/-. Therefore if rate 2009 may be applied than the FMV of the land will be at Rs. 32,61,603/- [2,550 (3,000+300750) X 1279.06 sq. mtr] and cost of boundary wall Rs. 3,67,500/- aggregating Rs. 36,29,103/- against the consideration of Rs. 30,00,000/-. Therefore difference between FMV of property and actual sale consideration is of Rs. 6,29,103/- only. However, Ld. CIT(A) sustained the addition to the extent of Rs. 47,38,700/- being difference between FMV estimated by VO at Rs. 77,38,700/-(-) Rs. 30,00,000/-.

Therefore, addition sustained by ld. CIT(A) at Rs. 47,38,700/- on such footing may be restricted to Rs. 6,29,103/-.

Issue No. 4 – AY 2015-16

Addition u/s 68 source of introduction of Capital in Firm M/s Alok Construction Rs. 34,25,339/-

That AO made addition of Rs. 34,25,339/- amount added in capital a/c inadvertently and bank balance was also increased by Rs. 34,25,339/- being contra entry on debit side. The said mistake was rectified in immediately following year on 1st April, 2015 when mistake came into the knowledge of appellant while finalizing the books/ audit. The Ld. AO ignoring the documents placed on record made addition only on surmise and against the CBDT circular no. 14 of 1955 dated 11.04.1955.

The Ld. CIT(A) considering the peculiar facts of the case of relevant year when mistake occurred of AY 2016-17 when mistake was rectified both the cases were completed under scrutiny and no adverse inference was drawn by AO on rectification of such transaction in AY 2016-17 and deleted the addition.

Issue No. 5 – AY 2020-21, 2021-22 & 2022-23

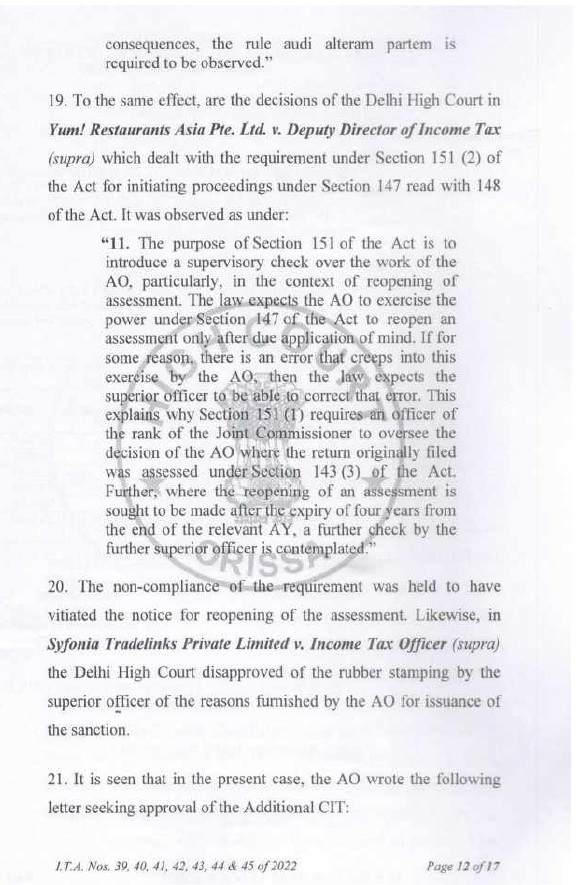

3. That assessee has acquired residential property situated at 57, Laxmanpuri, Lucknow on 17.08.2015 in which residential house was constructed by assessee and such construction was carried out in the period of AY 2020-21 to till the date of search 05.02.2022 (AY 2022-23) and made investment of Rs. 2,99,44,455/-. During the assessment proceeding investment in construction of house property was referred to Valuation Cell, Income Tax office, Lucknow, the Ld. VO estimated the cost at Rs. 3,33,69,100/- against investment made by assessee at Rs. 2,99,44,455/-, the year wise breakup is as under:-

| AY | Amount of Investment (Assessee) | Estimated cost (Valuation Officer) | Difference | Difference in percentile based on estimation by Valuation Office | Difference in percentile based on Investment by Assessee |

| A | B | C | D | E | F |

| 2020-21 | 17552000 | 19559400 | 2007400 | 10.26% | 11.43% |

| 2021-22 | 8235000 | 9176800 | 941800 | 10.26% | 11.43% |

| 2022-23 | 4157455 | 4632900 | 475445 | 10.26% | 11.43% |

| Total | 29944455 | 33369100 | 3424645 | 10.26% | 11.43% |

4. The Valuation Officer has allowed deduction on account of self supervision, purchase of bulk material and being state government registered contractor only 7.5% instead of 10% which usually allowed by Valuation Department. Further on site existing old house was situated carrying area of 260.223 i.e. 2800sqft which is dismantled and use in new building value considered for old building material at Rs. 5,53,042/- by Valuation Officer was on very lower site.

5. The Ld. CIT(A) while sustaining the addition in respective years being difference between amount of investment made towards construction of house and estimation made by Valuation Officer has considered difference in percentile on the basis of investment made by Appellant. On the other side the difference in percentile liable to be computed on the basis of estimation made by Valuation Officer. Further, assessee himself is a Civil Contractor &Engineer, therefore, difference is of 10.26% which is near to 10% liable to be ignored. Reliance is placed on:

| i. | | Hon’ble Allahabad High Court in case of Tulsiani Constructions & Developers Ltd (Allahabad)has discussed the decision of Hon’ble Madhya Pradesh High Court in case of CIT v. Abeeson Hotels (P) Ltd 2004 191 CTR (MP) 263 and allowed difference upto 10%of estimated FMV by Valuation Department is within tolerance limit, no addition is warranted. In said case difference in percentile @ 10.47% was computed on the basis of estimation made by VO and Hon’ble MP High Court has dismissed the appeal of Revenue. |

| ii. | | That Jurisdictional Hon’ble ITAT in case of M/s Dr. Bhim Rao Ambedkar Educational Society ITA No. 658/LKW/2012. In said case difference in percentile @ 6.58% was computed on the basis of estimation made by VO and Hon’ble ITAT Lucknow Bench has rejected the appeal of Revenue. |

Issue No. 6 – AY 2020-21 & 2021-22

6. That assessee has acquired residential property situated at 192/2, Civil Lines, Gonda on 24.10.2017 in which residential house was constructed by assessee and such construction was carried out in the period of AY 2020-21 to AY 2022-23. Further at the time of search construction activities were under progress and as on date of search on 05.02.2022 investment in said property was at Rs. 12460146/- however investment in construction during 07.02.2022 to 31.03.2022 was at Rs. 2035960/- therefore aggregate investment till 31.03.2022 was Rs. 14496106/- against said investment VO estimated value at Rs. 15624800/-. These facts and details were submitted to VO. Initially VO in his report considered investment of assessee at Rs. 12460146/-. Considering the glaring mistake assessee filed rectification in Valuation Report to VO and sent copy to the AO also on 09.08.2023.Thereafter VO in Valuation Report (Rectified) on 25.08.2023 has correctly considered investment of assessee at Rs. 14496104/-. The yearwise detail of investment in property is as under:

| FY | AY | Amount of Investment (Assessee) | Estimated cost (Valuation Cell) | Difference | Difference in percentile based on estimation by Valuation Office | Difference in percentile based on Investment by Assessee |

| A | B | C | D | E | F | G |

| 2019-20 | 2020-21 | 2241054 | 2415546 | 174492 | 7.22% | 7.78% |

| 2020-21 | 2021-22 | 9620392 | 10369454 | 749062 | 7.22% | 7.78% |

| 2021-22 Till date of Search 05.02.2022 Rs. 598700 From 07.02.2022 to 31.03.2022 Rs. 2035960 | 2022-23 | 2634660 | 2839800 | 205140 | 7.22% | 7.78% |

| Total | 14496106 | 15624800 | 1128694 | 7.22% | 7.78% |

In AY 2022-23 Ld. AO vide Scrutiny Order vide DIN ITBA/AST/S/143(3)/2023-24/1063757561(1), dt31.03.2024 did not draw adverse inference on investment in above said property however on identical facts in AY 2020-21 & AY 2021-22, he made addition of Rs.174492/- and Rs.749062/- which itself is below 10% of value estimated by VO in respective years, which is against the facts of the case and related law. Further Ld. CIT(A) has deleted the addition on this issue in AY 2020-21 & AY 2021-22.

Reliance is placed on

| iii. | | Hon’ble Allahabad High Court in case of Tulsiani Constructions & Developers Ltd (Allahabad)has discussed the decision of Hon’ble Madhya Pradesh High Court in case of CIT v. Abeeson Hotels (P) Ltd 2004 191 CTR (MP) 263 and allowed difference upto 10%of estimated FMV by Valuation Department is within tolerance limit, no addition is warranted. In said case difference in percentile @ 10.47% was computed on the basis of estimation made by VO and Hon’ble MP High Court has dismissed the appeal of Revenue. |

| iv. | | That Jurisdictional Hon’ble ITAT in case of M/s Dr. BhimRaoAmbedkar Educational Society ITA No. 658/LKW/2012. In said case difference in percentile @ 6.58% was computed on the basis of estimation made by VO and Hon’ble ITAT Lucknow Bench has rejected the appeal of Revenue. |

Issue No. 7—AY 2020-21

Disallowances of Agriculture Income in tune of Rs. 37,00,000/-

That in the relevant assessee and his family earned agricultural income in tune of Rs. 52,00,000/-. Further, during the course of assessment proceedings detail of agricultural income was submitted as under:-

| 1. | | That as regard to gross agriculture income of Rs.52 Lacs earned by assessee along with his family members, it is relevant to mention, relevantyear while filing of ITR, assessee has incorporated inadvertently agricultural income of rest of his family members who were non-filer of ITR for relevantyear in absence of any other taxable income. Income of the all family members are under: |

| S.N. | Name & PAN | Agriculture Income | Land Holding |

| (a) | Shri Surya Narayan Pandey (PAN-BWPPP5138L) (Father) | Rs. 8,90,000/- | 5.3815 Hect. |

| (b) | Smt. Rajkumari w/o Surya Narayan Pandey (PAN/Aadhar-243864686286) (Mother) | Rs. 2,30,000/- | 1.3597 Hect. |

| (c) | Smt. LalitaPandey (PAN-BWPPP5188L) (Spouse) | Rs. 1,10,000/- | 0.6340 Hect. |

| (d) | Rakesh Kumar Pandey (PAN: ATIPP6520B) | Rs. 34,30,000/- | 20.176 Hect. |

| Total | Rs. 46,60,000/- | |

Further, while declaring agricultural income for relevant year of whole family, assessee offered the same on its Gross Value could not deduct agricultural expenses which was around Rs. 5,40,000/- incorporated in drawings, therefore, net agricultural income was at Rs. 46,60,000/- of assessee as well as other family members. Hence it is relevant to mention while assessing the agriculture income pertaining to assessee only may kindly be incorporated in total income for rate purposes.

That as regard to agriculture income it is reiterated that such income was earned on sharing basis through many agriculturist (labour basis) who performed agriculture activities on agriculture land of assessee and also sold seasonal agriculture crop in open market and thereafter shared the revenue in cash mode as per terms with assessee periodically, confirmation of all these parties are already placed on record along with their address & identity proof which are open for verification. Further these are small agriculturist are not assessed to tax because of their agriculture income exempt from tax however such queries may be raised directly from them and they are ready to appear before your good self, if required. Hence agriculture income net of agriculture expenses pertaining to assessee at Rs. 34,30,000/- may kindly be accepted.

However, the Assessing Officer made addition of Rs. 52,00,000/-being gross agricultural income of appellant as well as his family members ignoring the confirmation alongwith supporting documents provided related to person who carried out agricultural activities and shared agricultural income with assessee and confirmation of other family members for their agricultural income incorporate in the hands of appellant. Further, this bonafide mistake occurred during Covid period when assessee could not properly coordinate his consultant and reconcile agricultural income which was not part of audited financial statement and books of account and reported separately. The agricultural income of relevant year and preceding and sub sequent year assessed by revenue is as under:-

| AY | Agricultural income as per ITR | Disallowances | Remarks |

| 2022-23 | 22,12,500 | – | Assessment completed u/s 144 of the Act |

| 2021-22 | 12,60,000 | – | Assessment completed u/s 144 of the Act |

| 2020-21 | 52,00,000 | 52,00,000 | Assessment completed u/s 144 of the Act |

| 2019-20 | 15,42,683 | – | Assessment completed u/s 147 of the Act |

| 2018-19 | 16,52,848 | – | Assessment completed u/s 147 of the Act |

The ld. CIT(A) considered allowed the agricultural income at Rs. 15,00,000/- and sustained the addition of Rs. 37,00,000/- only on adhoc basis considering the agricultural income of other years, without considering the peculiar facts of the case and documents placed on record.

Since, additions sustained by Ld. CIT(A) is purely on estimated basis of Rs. 37,00,000/- may kindly be deleted.

Issue No. 8- A Y2020-21

Disallowances of deduction claimed u/s 80C of Rs. 1,50,000/- on repayment of housing loan

That in the relevant year assessee has repaid housing loan (ICICI Bank loan a/c no. LBLUC00004351237) etc. for the house self occupied at 57, laxmanpuri, Lucknow which was eligible for deduction u/s 80C. However, CIT(A) did not allow such deduction and sustained the disallowances of Rs. 1,50,000/- which liable to be deleted considering the peculiar facts of the case and related law.

Issue No. 9 – AY 2020-21

Addition u/s 68 Gift from father Sh. S.N. PandeyRs. 1,00,000/-

The Ld. AO made addition of Rs. 1,00,000/- being gift received by Appellant from his father Shri Surya Narayan Pandey only on assumption and surmise ignoring the documents placed on record.

The Ld. CIT(A) has deleted the addition of Rs. 1,00,000/- being bonafide gift received from his father Shri Surya Narayan Pandey (PAN-BWPPP5138L)who is agriculturist and given such gift on the occasion of construction of residential house under construction and native place Gonda considering the supporting documents placed on record and genuineness of transaction.

Issue No. 10 – AY 2021-22

Disallowance of claimed deduction u/s 54F of the Act – Rs. 68,98,817/-

That in the relevant year assessee has sold residential land measuring 300 sq. mtr. on 20.05.2020, part of 447/2, Chawni Bazar (Civil Lines), Pargana-Tehsil, Gonda for consideration of Rs. 9,00,000/- Stamp Duty value Rs. 82,35,000/- to his son AlokPandey (PAN-CZZPP5325B).

Considering the provision of Sec. 50C, the liability of Long Term Capital Gain was computed amounting to Rs.68,98,817/- and claimed deduction u/s 54F of the Income Tax Act against the investment made in house property situated at 57, Laxmanpuri, Indira Nagar, Lucknow. However, Ld. AO rejected the claim of assessee on following ground being details filed in ITR in AL schedule:-

| i. | | opp. VikasBhawan, Pant Nagar, Civil Lines, Gonda |

| iii. | | Poly opp. VikasBhawan, Pant Nagar, Civil Lines, Gonda |

| iv. | | 57, Laxmanpuri, Indira Nagar, Lucknow |

Ignoring the submission of assessee and details furnished in AL schedule were having duplicate entry at Sl. No. iii w.r.t. Sl. No. i. Further, property mentioned at Sl. No. i was under construction in AY 2021-22 and reference to Valuation Cell was also made and also part of assessment order where such property was completed in AY 2022-23. Further, property mentioned at Sl. No. ii relates to joint property in which only temporary erection only (teen shed) is on portion of assessee not habitable. Therefore, assessee was eligible to claim deduction u/s 54F of the Act. The Ld. CIT(A) considering the facts and circumstances of the case and in accordance with law has allowed the appeal.

Issue No. 11 – AY2021-22

Addition due to Non deduction of TDS on payment of Rs. 3074000 @ 30% i.e. 922200/- in violation of the provision of section 40a(ia)

In relevant year Ld. AO made addition of Rs. 9,22,200/- on account of payment of such expenses on which tax was not deducted aggregating Rs. 30,74,000/- as reported by Auditor in TAR and on other side estimated the profit @11%.

The ld. CIT(A) on one side deleted the estimated profit addition but sustained the addition on account of expenses on which tax was not deducted in tune of Rs. 9,22,200/-.

That since the Ld. AO rejected the books of accounts after invoking the provision of sec. 145(3) and made assessment u/s 144 of the Act, there may not be in scope for such technical disallowances. Hence, addition of Rs. 9,22,200/- may not be sustained.

Issue No. 12 – AY 2021-22

Addition due to violate the provision of section 40A(3) Rs. 9,65,000/-

In relevant year Ld. AO made addition of Rs. 9,65,000/- after invoking the provision of section 40A(3) being cash payment exceeding Rs. 10,000/-against certain head of expenses and on other side estimated the profit @11%.

The ld. CIT(A) on one side deleted the estimated profit addition but sustained the addition on account of expenses on which tax was not deducted in tune of Rs. 9,65,000/-.

That since the Ld. AO rejected the books of accounts after invoking the provision of sec. 145(3) and made assessment u/s 144 of the Act, there may not be in scope for such technical disallowances. Hence, addition of Rs. 9,65,000/- may not be sustained. Reliance is placed on Commissioner of Income-tax v. BanwariLalBanshidhar [1998] 229 ITR 229 (ALL.)

Issue No. 13-AY2021-22

Disallowances of deduction claimed u/s 80G Rs. 7,03,000/- on donation of Rs. 14,06,000/-, being donation given to UP Wrestling Association Rs. 6,00,000/- and Ram JanamBhumiRs. 8,06,000/-

That the Ld. CIT(A) has allowed the deduction of Rs. 3,00,000/- against the donation in tune of Rs. 6,00,000/-. However, sustained the disallowances of Rs. 4,03,000/- against donation of Rs. 8,06,000/- paid to Ram JanamBhumi. The said donation is eligible u/s 80G and may kindly be allowed as deduction claimed.

Issue No. 14 – AY2022-23

Addition u/s 69A – Cash found Rs. 43,12,800/-

That during the course of search cash amounting Rs. 35,31,800/- from business/residential place at 57, Laxmanpuri, Lucknow and cash amounting Rs. 7,81,000/- at Village Devarda, Belsar, Gondawere found and out of which Rs. 34,00,000/- and Rs. 7,00,000/- were seized. During the course of search as well as assessment proceedings assessee informed nature and source of eligibility of cash. During the assessment proceeding assessee has submitted cash found at Lucknow were out of bank withdrawal immediately before the date of search from SBI (a/c no. 34788366126) and relates to business of assessee and cash found in Village were out of agricultural income. Further, cash found and seized in tune of Rs. 41,00,000/- were duly recorded in books of account and part of Audited Financial Statement. The assessment is being completed u/s 143(3) of the Act and no adverse finding is given by AO on such transaction w.r.t. source of availability of fund of cash seized on contra heads. Therefore, addition made was deleted by Ld. CIT(A).

Issue No. 15 – AY 2014-15 to AY 2019-20Identical Legal Grounds

AY 2014-15 (GOA-1 & 5)

AY 2015-16 (GOA-1 & 5)

AY 2016-17 (GOA-1 & 4)

AY 2017-18 (GOA-1 & 4)

AY 2018-19 (GOA-1 & 4)

AY 2019-20 (GOA-1 & 4)

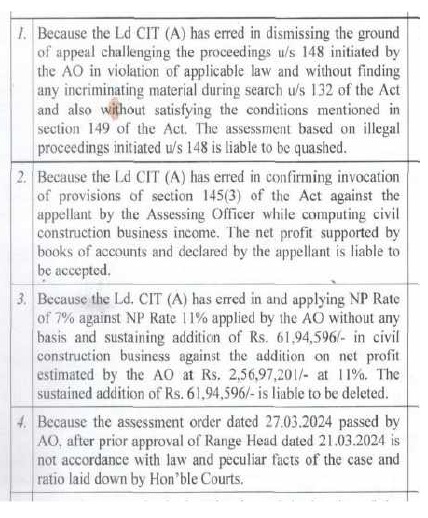

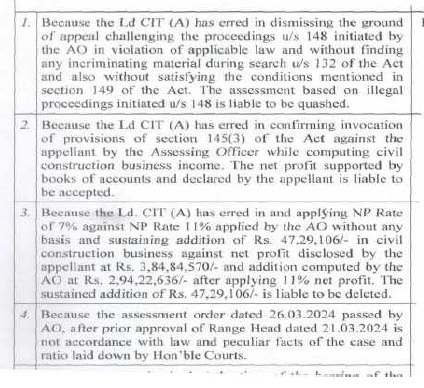

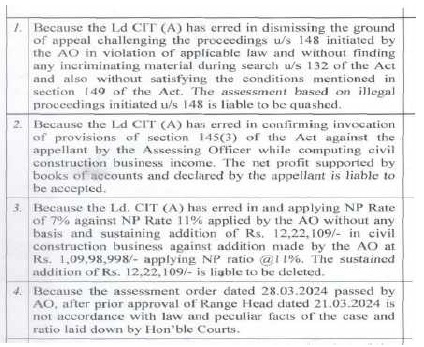

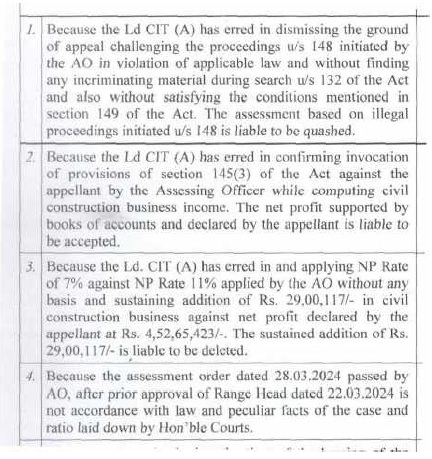

| 1. | | Because the Ld CIT (A) has erred in dismissing the ground of appeal challenging the proceedings u/s 148 initiated by the AO in violation of applicable law and without finding any incriminating material during search u/s 132 of the Act and also without satisfying the conditions mentioned in section 149 of the Act. The assessment based on illegal proceedings initiated u/s 148 is liable to be quashed. |

| 2. | | Because the assessment order passed by AO, after prior approval of Range Head dated 21.03.2024 (AY2019-20 – 22.03.2024) is not accordance with law and peculiar facts of the case and ratio laid down by Hon’ble Courts. |

That appellant has filed applications for above years on 03.10.2025 alongwith requisite fees (copy enclosed before Ld. AO (DCIT/AC, Central Circle-2, Lucknow) for inspection of case record and certified copy of order sheet including approval copy while initiating reassessment proceeding. In response to which department has provided copy of order sheet on 24.10.2025. In which reasons are not recorded while issuing notice u/s 148 and approval taken from specified authority were also not provided. Though the case was selected for income escaping assessment of assessee covered by sec. 132 and Assessing Officer while issuing notice u/s 148, shall be deemed to have information. However, no material is available on record how income is being quantified alleging escaped assessment amount to or is likely to amount Rs. 50 lakhs or more where three years have been elapsed from end of relevant assessment year in compliance of provision section 149(1)(b) of the Act, while issuing notice u/s 148 the Act. Further during the course of search no incriminating material was found with reference to above said years which could suggest income escaping assessment in assessment order AO has also not discussed/demonstrated about any seized document found during search while drawing any adverse inference. Therefore proceeding initiated u/s 148 of the Act is not accordance with Law.

Reliance is also placed on Principal Commissioner of Income-tax, Central-3 v. AbhisarBuildwell (P.) Ltd. Pr. CIT v. Abhisar Buildwell (P.) Ltd. (SC)/[2023] 454 ITR 212 (SC).

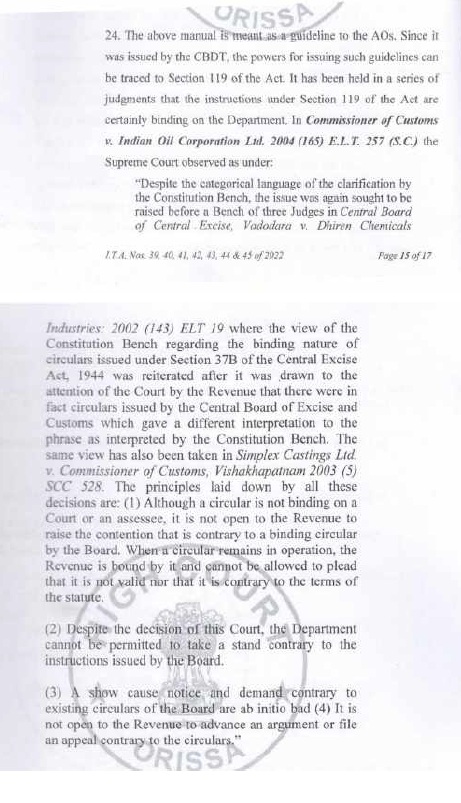

Further in above cases notices u/s 148 were issued on 17.03.2023 by ACIT/DCIT (CC-II), Lucknow however which is not accordance with law after the amendment made u/s 151A of the Act. Central Board of Direct Taxes vide NOTIFICATION New Delhi, the 29th March, 2022 18/2022/F. No. 370142/16/2022-TPL(Part1)has notified, notice u/s 148 from such date was liable to be issued through automated allocation in accordance with RMS formulated by Board Faceless manner. Therefore notice issued by JAO was not accordance with law after such notification hence whole assessment is liable to be quashed.

Recently, Hon’ble Mumbai High Court in case of PrakashPandurangPatil (Bombay) after following the Division bench judgment of Hon’ble Mumbai high Court in case of Hexaware Technologies Limited held as under:-

“9. In the light of the above discussion, and when there is no dispute that the Jurisdictional Assessing Officer (JAO) had no jurisdiction to issue the impugned order and the impugned notices, the writ petition is required to be allowed. It is accordingly allowed in terms of prayer clause (b) and (d), which reads thus:-

“(b) To issue a writ of Mandamus or direction or order in the nature of Mandamus or writ of Certiorari or any other writ under Article 226 of the Constitution of India, setting aside the impugned order under section 148A(d) dated 05.04.2022.

(d) To issue a writ of Mandamus or direction or order in the nature of Mandamus or writ of Certiorari or any other writ under Article 226 of the Constitution of India, declaring that the consequential notice dated 05.04.2022 issued under section 148 as invalid.”

10. We make it clear that having disposed of this petition on the ground of non-compliance with Section 151A of the Act, we have not expressed any opinion on the other issues as raised in the Writ Petition, which are expressly kept open.”

Further, SLP of Revenue Diary No. 39689 / 2025 (dated 18.08.2025) in case of PrakashPandurangPatil are dismissed by Hon’ble Supreme Court on ground of delay as well as merits.

Recently Apex Court in case of Deepanjan Roy SLP Civil Diary No. 33956/2025 (dated 16.07.2025) has dismissed the SLP of Revenue.

Issue No. 16 – A Y2020-21

That for the relevant year case was picked for scrutiny vide notice u/s 143(2) dated 29.06.2021 before the date of search and search was conducted on 05.02.2022 when scrutiny assessment was under progress. The Ld. AO suomoto converted normal scrutiny assessment against into search assessment which is against the spirit of Guidelines issued on 10.06.2021vide F. No. 225/61/2021/ITA-II and also against the specific law relating to search assessment u/s 147 where search is conducted on or after 01.04.2021 to 31.08.2024. Hence, the assessment order passed u/s 144 dated 25.08.2023 for relevant not accordance with law and facts of the case liable to be quashed.

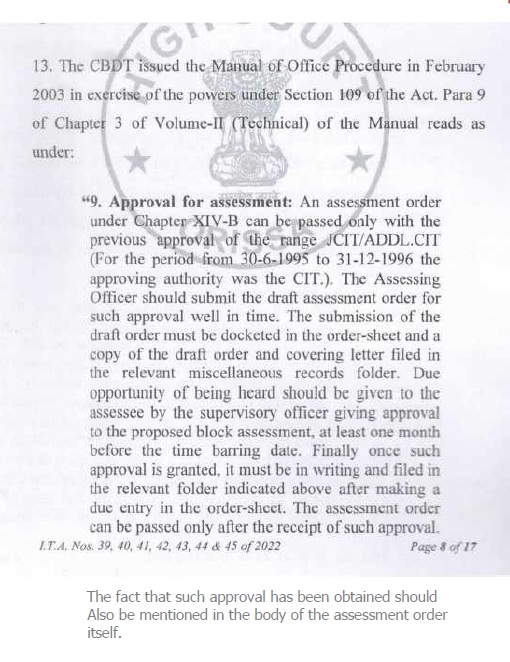

Further, AO while passing the assessment order has not taken approval from Range Head u/s 148B of the Act which is mandatory for search assessment resulting to which assessment order passed not accordance with law liable to be quashed.

Issue No. 17 – A Y2021-22

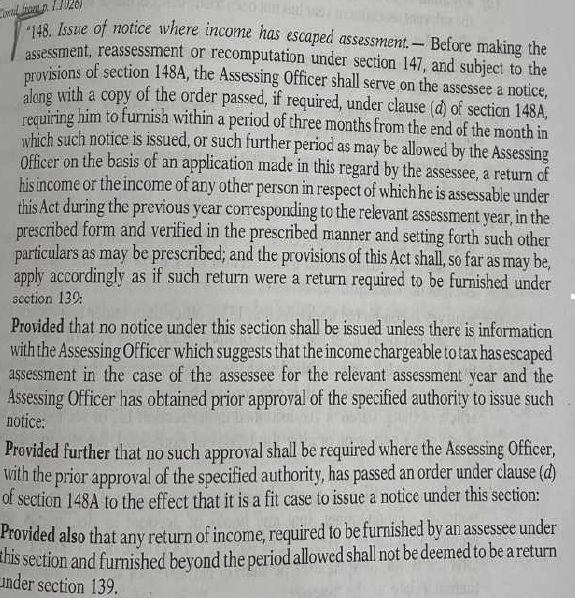

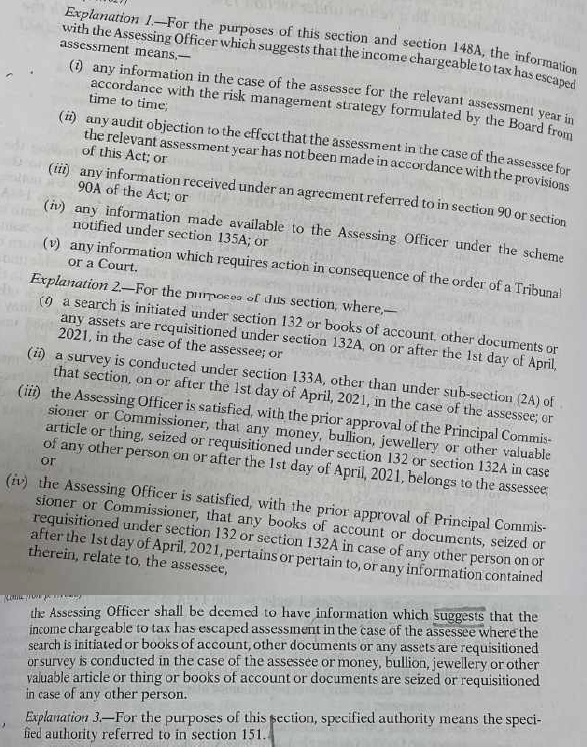

| 1. | | That it is relevant to mention since the search was conducted on or after 01/04/2021, while framing the assessment order, the provisions of section 147 to 151 was required to be followed as per law amendment took place by Finance Act, 2021. Erstwhile assessment in case of search cases were covered by 153A/ 153C of the Act, where search conducted till 31/03/2021. Therefore the Ld. AO was under obligation to follow provisions of section 147 to 151 while making assessment of appellant considering search case. By Finance Act, 2024 procedure of search assessment has again been changed where search conducted on or after 01/09/2024 and NOW covered by block assessment u/s 158BC/BD of the Act, accordingly following sub-section-3 has been inserted in section 152 by Finance Act, 2024:- |

[(3) Where a search has been initiated under section 132 or requisition is made under section 132A, or a survey is conducted under section 133A [other than under sub-section (2A) of the said section], on or after the 1st day of April, 2021 but before the 1st day of September, 2024, the provisions of sections 147 to 151 shall apply as they stood immediately before the commencement of the Finance (No. 2) Act, 2024.

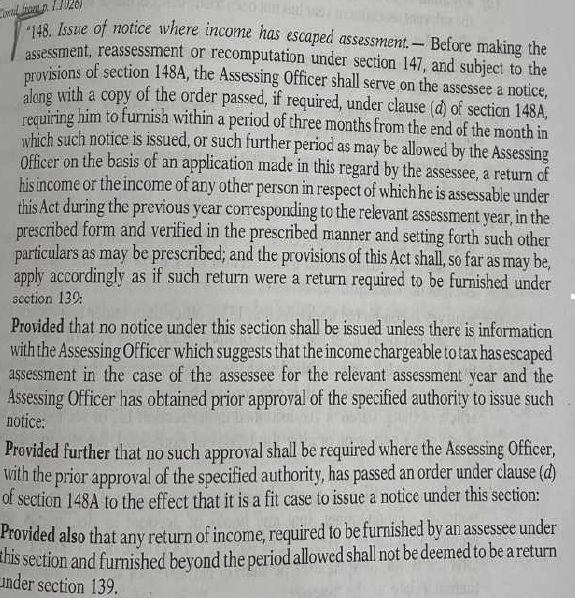

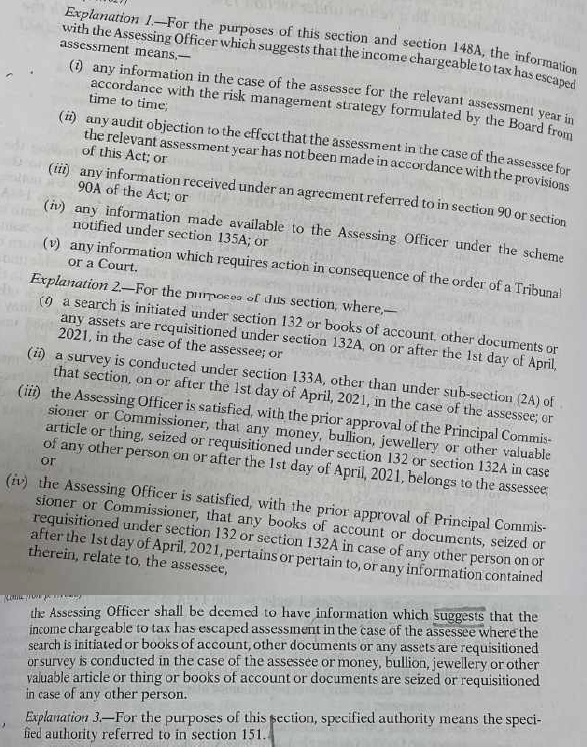

| 2. | | That AO has not issued the notice u/s 148 of the Act for relevant year alike he issued for AY 2019-20 &AY 2020-21. Since the case of assessee was transferred to Central Circle because of search in the case of other person u/s 132 of the Act, therefore while assessing the income of appellant notice u/s 148 of the Act was directly issued without conducting enquiry, providing opportunity as provided u/s 148A, of the Act, which provides:- |

Provided that the provisions of this section shall not apply in a case where,—

| (a) | | a search is initiated under section 132 or books of account, other documents or any assets are requisitioned under section 132A in the case of the assessee on or after the 1st day of April, 2021; or (not the case of appellant) |

| (b) | | the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any money, bullion, jewellery or other valuable article or thing, seized in a search under section 132 or requisitioned under section 132, in the case of any other person on or after the 1st day of April, 2021, belongs to the assessee; or (not the case of appellant nothing is mentioned in assessment order about money etc.) |

| (c) | | the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any books of account or documents, seized in a search under section 132 or requisitioned under section 132, in case of any other person on or after the 1st day of April, 2021, pertains or pertain to, or any information contained therein,262[relate to, the assessee; or (Covered by said clause in A Y 2019-20 & A Y 2020-21) |

| (d) | | the Assessing Officer has received any information under the scheme notified under section 135A pertaining to income chargeable to tax escaping assessment for any assessment year in the case of the assessee.] (NA) |

Explanation.—For the purposes of this section, specified authority means the specified authority referred to in section 15.]

The above applicable provision was obligatory on the part of AO to record satisfaction with prior approval of PCIT/CIT while issuing the notice u/s 148 of the Act which is safeguard to appellant because such assessee is deprived of enquiry/opportunity as provided u/s 148A of the Act. It transpires AO without issuing notice u/s 148 directly selected the case for scrutiny only misinterpreting Board Circular No. F.NO. 225/81/2022/ITA-II, dt. 03.06.2022:-

| S.No. | Parameter | Procedure for compulsory selection |

| 2 | Cases pertaining to search & seizure/requisition |

| 2.2 | Search & seizure/requisition on or after 01.04.2021: Assessments in cases arising from search & seizure actions/requisitions u/s 132/132A conducted on or after 01.04.2021, for returns pertaining to A. Y 2021-22. | The cases shall be selected for scrutiny with prior administrative approval of Pr. CIT/pr. DIT/Crr/DIT concerned, who shall ensure that such cases are transferred to Central Charges u/s 127 of the Act within 15 days of service of notice u/s 143(2)/142(1) of the Act by the Assessing Officer concerned. |

The above guidelines was issued after detailed (Master) guidelines for compulsory scrutiny of cases during FY 2022-23 on 11-05-2022 vide FNo. 225/81/2022/ITA-II. However para-2 of Sl. No-2 being cases pertaining to search & seizure, substituted guidelines were issued on 03.06.2022 discussed above, since erstwhile guidelines at para-2, covers only search cases, where conducted upto 31-03-2021. Therefore guidelines issued on 03.06.2022 covers in para-2 as under:-

2.1 Search & seizure/requisition prior to 01.04.2021 (Not Our Case)

2.2 Search & seizure/requisition on or after 01.04.2021 (discussed above)

It is relevant to mention the detailed (Master) guidelines dt. 11.05.2022 at Para-4 of Sl. No.-2 also covers search cases where search conducted on or after 01.04.2021 under the heading cases in which notice have been issued u/s 148 ofthe Act with following details:-

| S.No. | Parameter | Procedure for compulsory selection |

| 4 | Cases in which notices u/s 148 of the Act have been issued |

| Cases where return is either furnished or not furnished in response to notice u/s 148 of the Act. | (i) Cases, where notices u/s 148 of the Act have been issued pursuant to search & seizure/survey actions conducted on or after the 1st day of April, 2021: These cases shall be selected for compulsory scrutiny with prior administrative approval of Pr. CIT/pr.DIT/CIT/DIT concerned who shall ensure that such cases, if lying outside Central Charges, are transferred to Central Charges u/s 127 of the Act within 15 days of service of notice u/s 143(2)/142(1) of the Act calling for information by the Assessing Officer concerned. |

Therefore the above guidelines itself proves that search cases where search conducted on or after 01.04.2021 liable to be covered by 147 to 151 provisions. Since for relevant year AY 2021-22 notice was not issued u/s 148 of the Act, therefore Ld. AO was liable to first issue notice u/s 148 after recording the satisfaction on documents/information available with him found during the search of other person with prior approval of PCIT/CIT. The issuance of notice u/s 148 is not tantamount to selection of case of scrutiny for making regular assessment but being a pre-condition for search assessment where search held in case of other person on or after 01.04.2021.

It is reiterated the case for the relevant year of appellant is neither normal scrutiny assessment where only notice u/s 143(2) was liable to be issued for making assessment u/s 143(3) nor it is normal reassessment proceeding covered by provision of section 147 to 151 where time for issuance of notice u/s 143(2) was left. Since the case of the assessee has already been considered as search case by Revenue in AY 2019-20 & AY 2020-21 while issuing notice u/s 148 directly without compliance of u/s 148A proceedings therefore for AY 2021-22 which is not a year of search notice could not have been issued directly u/s 143(2) with administrative approval depriving assessee legal safeguards provided u/s 148 of the Act. Further during the course of assessment proceeding vide reply dt. 20.12.2024 (Pg. no. 184 of paperbook filed on 09.05.2025) Appellant raised issue for not issuing notice u/s 148 for the relevant year which AO did not address in Assessment Order.

It is also relevant to mention if case of the appellant is considered as nonsearch case while selecting the case for scrutiny under procedure of compulsory selection, AO was liable to demonstrate in the Assessment Order, under which category case is selected as per scrutiny guidelines, which he failed to do so.

The intent of such guidelines to issue administrative order for selecting the case under scrutiny not to bypass legal obligation of AO to take approval from PCIT/CIT as defined in proviso of section 148 of the Act.

It is also pertinent to mention where search conducted on or after 01.04.2021 covered by section 147 to 151 are special provisions for search assessments which supersede the General provision of assessment and vice versa is not possible. Therefore the Ld. AO while issuing the notice u/s 143(2) without issuance of notice u/s 148 went against the well established principal of law “Gnerraiiaseeciaiibus non derogant’is a Latin legal maxim that means “gnnr&i provisions do not derogate from special provisions,” or “gnnr&i laws do not override specific laws” In essence, it dictates that when a general rule conflicts with a specific rule, the specific rule takes precedence. This principle is used in statutory interpretation to resolve conflicts between laws, ensuring that the more precise and relevant provision is applied.

The Board itself substituted the guidelines dt. 03.06.2022 para no-2.2 in which erstwhile only AY 2021-22 was mentioned after realising the mistake, deleted such assessment year in substituted guidelines dt. 26.09.2022 with following details:-

2. With reference to the above, I am directed to state that Sl No. 2.2 of para-2 of CBDT’s Guidelines dt. 03.06.2022 shall be substituted as under:-

| S.No. | Parameter | Procedure for compulsory selection |

| 2 | Cases pertaining to search & seizure/requisition |

| 2.2 | Search & seizure/requisition on or after 01.04.2021: Assessments in cases arising from search & seizure actions/requisitions u/s 132/132A conducted on or after 01.04.2021. | The cases shall be selected for scrutiny with prior administrative approval of Pr. CIT/pr. DIT/CIT/DIT concerned, who shall ensure that such cases are transferred to Central Charges u/s 127 of the Act within 15 days of service of notice u/s 143(2)/142(1) of the Act by the Assessing Officer concerned. |

After the above changes it transpires search cases for compulsory scrutiny where search conducted on or after 01.04.2021 in case of other eerson, are to be selected for scrutiny issuing notice u/s 143(2), only after issuing of notice u/s 148 of the Act, during the FY 2022-23 once assessee files the ITR in response to notice u/s 148 of the Act and thereafter to be transferred to Central Charge. The intent of substituted guidelines dt. 26.09.2022 to carry out process of selection of cases for scrutiny during whole year of FY 2022-23, which could be possible only after issuance of notice u/s 148 of the Act, where ITR filed in FY 2021-22 or earlier years for AY 2021-22 and preceding years, OTHERWISE in normal course notice u/s 143(2) could have been issued till 30.06.2022, where ITR filed during FY 2021-22. Thus directing the issuance of notice u/s 148 in scrutiny guidelines is not possible as it is a statutory provisions and cannot be override by any guidelines whatsoever.

| 3. | | That as a matter of fact the assessment of appellant/assessee company for two previous assessment years i.e. A.Y. 2019-20 & 2020-21 has been completed under the provisions of section 148/147 of the Act and after following due procedure which includes proper approval from Statutory Prescribed Authority before issuing notice u/s 148 of the Act and also Approval u/s 148B of the Act. Prescribed Procedure of recording satisfaction as per procedure u/s 148A of the Act has also not been followed by the Assessing Authority before framing a search assessment against the appellant/assessee company. |

| 4. | | That the search assessments framed by the Assessing Officer also lacks of proper approval u/s 148B of the Act behind the veil of framing assessment u/s 143(3) of the Act only. Had the Assessing Officer taken proper route to frame a search assessment he would have obtained to necessary approvals from the prescribed authorities, one at the time of issuing notice u/s 148 of the Act and second at the time of finalization for assessment u/s 148B of the Act which could entail proper justice to the appellant/assessee company. |

| 5. | | That it is therefore respectfully submitted that the appellant/assessee company has been deprived of its legal rights under the Income Tax Act while dragging it to search assessment and the present assessment framed u/s 143(3) of the Act is illegal and liable to be quashed. |

Issue No. 18 – A Y2022-23

That the relevant i.e. AY 2022-23 is being search year since search was conducted on 05.02.2022. However, assessment for relevant year was completed u/s 143(3) which is against the spirit of relevant provision of law where specific provisions of sec. 147 to 151 liable to be applied which is also proves from section 152(3) inserted by FA-2024 (w.e.f. 01.09.2024) [(3) Where a search has been initiated under section 132 or requisition is made under section 132A, or a survey is conducted under section 133A [other than under sub-section (2A) of the said section], on or after the 1st day of April, 2021 but before the 1st day of September, 2024, the provisions of sections 147 to 151 shall apply as they stood immediately before the commencement ofthe Finance (No. 2) Act, 2024.]

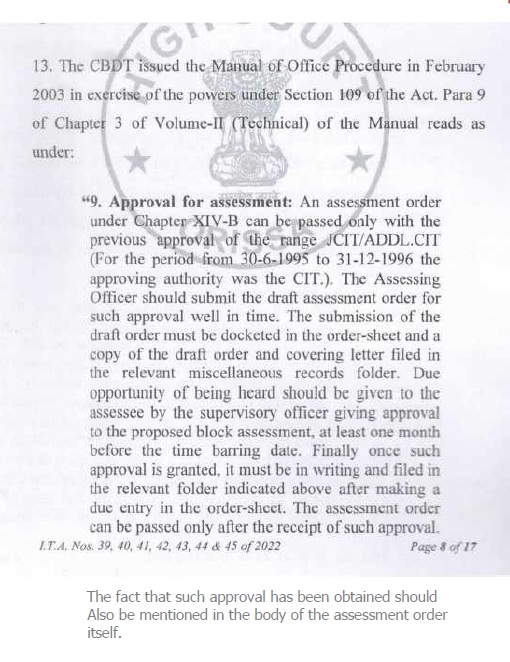

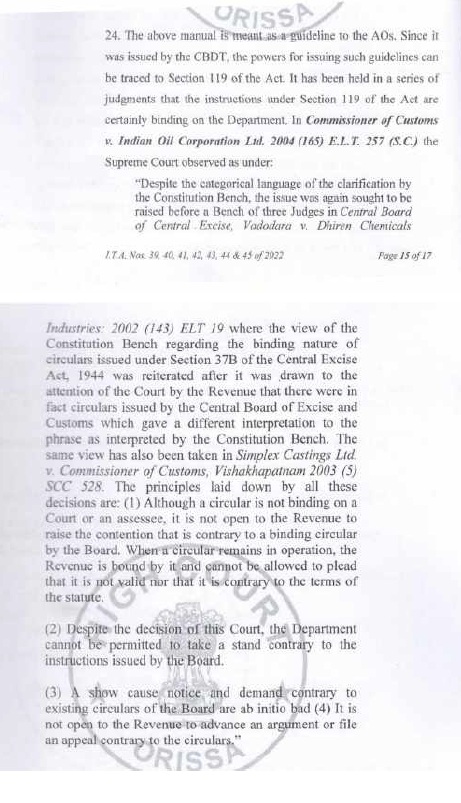

Further, AO while passing the order has not taken approval from Range Head as per the provision of sec. 148B being applicable provision on the other side took administrative approval from Range Head as per the Board order dated 15.07.2022 vide F. No. 299/36/2021-Dir(Inv-III)/577 which is also not accordance with law and facts of the case. Hence, the assessment order is liable to be quashed.”

CASE LAWS

| 1. | | CBDT Circular F.No.286/2/2003-IT(Inv) dated 10/03/2003 |

| 2. | | CBDT Circular F.No.286/98/2013-IT(Inv-II) dated 18/12/2014 |

| 3. | | CIT v. Dilbagh Rai Arora (Allahabad) |

| 4. | | CIT v. Mantri Share Brokers (P.) Ltd. (Rajasthan) |

| 5. | | CIT v. Smt. Malti Mishra (Allahabad) |

| 6. | | Pr. CIT v. Abhisar Buildwell (P.) Ltd. (SC)/[2023] 454 ITR 212 (SC) |

| 7. | | Pr. CIT v. Swananda Properties (P.) Ltd. (Bombay) |

| 8. | | CIT v. Naresh Kumar Agarwal (Andhra Pradesh)/[2014] 369 ITR 171 (Andhra Pradesh) |

| 9. | | Pr. CIT v. Rohit Karan Jain (Gauhati)ITA/ 5/2023 (Gauhati High Court) |

| 10. | | ACIT v. Kuber Khadyan Pvt. Ltd. (ITAT Delhi Bench) |

| 11. | | KC Raju Multi Specialty Hospital v. DCIT (ITAT ‘A’ Bench Bangalore) |

(B.2) Further, year-wise synopsis was also filed from the assessee’s side; containing narration of important papers in year-wise paper books referred to in foregoing paragraph (B) of this order; The same is reproduced below:

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

Date of Search: 05.02.2022

| 10. | | ITA No 347/LKW/2025 (A) AY 2014-15 |

| 11. | | ITA No 348/LKW/2025 (A) & 398/LKW/2025 (D) AY 2015-16 |

| 12. | | ITA No 349/LKW/2025 (A) & 399/LKW/2025 (D) AY 2016-17 |

| 13. | | ITA No 350/LKW/2025 (A) & 460/LKW/2025 (D) AY 2017-18 |

| 14. | | ITA No 351/LKW/2025 (A) AY 2018-19 |

| 15. | | ITA No 352/LKW/2025 (A) & 402/LKW/2025 (D) AY 2019-20 |

| 16. | | ITA No 608/LKW/2024 (D) & CO 28/LKW/2024 AY 2020-21 |

| 17. | | ITA No. 557/LKW/2024 (D) & CO 27/LKW/2024 AY 2021-22 |

| 18. | | ITA No 353/LKW/2025 (A) & 405/LKW/2025 (D) AY 2022-23 |

| AY | Notice u/s 148 | Order Passed | Remarks |

| 2013-14 | 17.03.2023 | 28.03.2024 | 1. Unabated Year, no incriminating material and all seized documents w.r.t. business were reconcile with regular books (nothing is mentioned in Assessment Order & no addition on the basis of seized document)

2. Three years elapsed from end of relevant year while issuing notice u/s 148, no information in possession of AO in document/evidence represented in form of asset, expenditure or entry which has escaped assessment amount of fifty lacs or more (Noting is mentioned in Assessment Order about reason of reopening of case and during inspection nothing found in case record about alleged escaped income of fifty lacs or more, addition made solely based on percentile of income declared in AY 2021-22 & AY 2022-23 only under statement u/s 132(4)) |

| 2014-15 | 17.03.2023 | 28.03.2024 | —do— |

| 2015-16 | 17.03.2023 | 28.03.2024 | —do— |

| 2016-17 | 17.03.2023 | 27.03.2024 | —do— |

| 2017-18 | 17.03.2023 | 26.03.2024 | —do— |

| 2018-19 | 17.03.2023 | 28.03.2024 | —do— |

| 2019-20 | 22.02.2023 | 28.03.2024 | 1. Unabated Year, no incriminating material and all seized documents w.r.t. business were reconcile with regular books (nothing is mentioned in Assessment Order & no addition on the basis seized document)

2. On the basis of deemed information for relevant year notice u/s 148 was issued within three years from end of relevant year. addition made solely based on percentile of income declared in AY 2021-22 & AY 2022-23 only under statement u/s 132(4) |

| 2020-21 | 143(2) issued on 29.06.2021 under progress as on date of search | 25.08.2023 | Regular scrutiny was converted into search case

SCN Not issued |

| 2021-22 | 143(2) issued on 28.06.2022 | 25.08.2023 | SCN Not issued |

| 2022-23 | 143(2) issued on 22.02.2023 | 31.03.2024 | SCN Not issued

144A Application not dealt in Assessment Order |

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2014-15

| Reply dt. | Page of PB | Description | Remarks |

| 11-05-2023 | 48 | General | |

| 05-09-2023 | 49 | General | |

| 08-02-2024 | 50-52 | General | Bank Statement, Turnover reconciliation |

| 26-02-2024 | | SCN issued | NP Rate applied @11% not mentioned in SCN |

| 11-03-2024 | 53-57 | General & Seized document with regular books | VAT, Seized document reconciliation with regular books |

| 16-03-2024 | 58 | Request for reference to VO | |

| 16-03-2024 | 59 | Bank statement summary | |

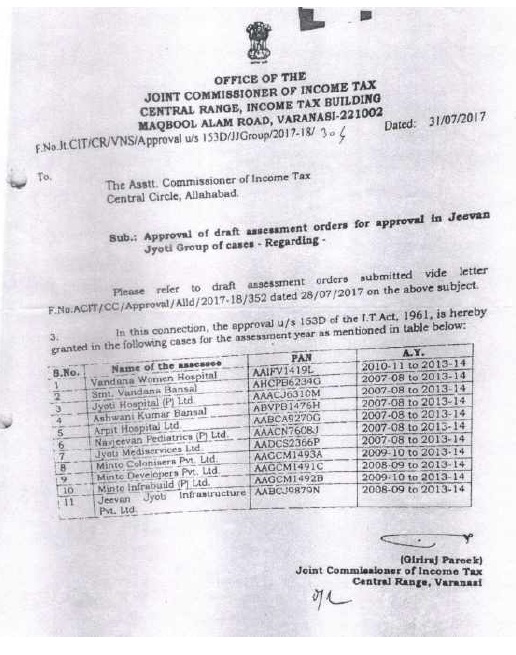

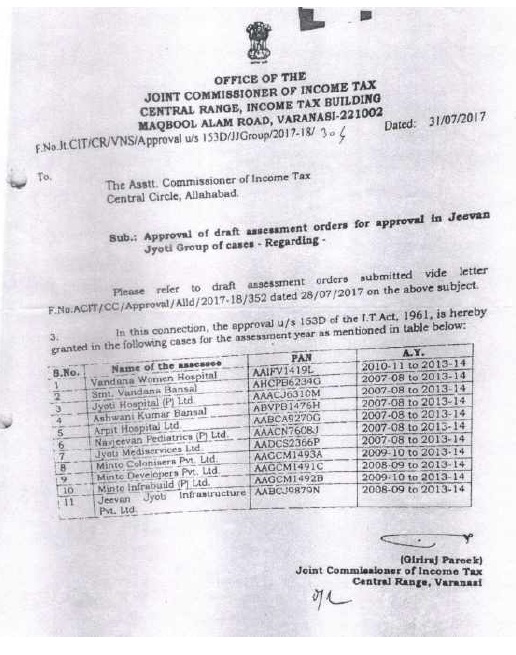

| 20-03-2024 | | Portal block for reply | Draft Order Sent to Range Head for approval (as per paper book of Revenue of AY 2016-17) |

| 21-03-2024 | | Approval Granted for Order u/s 147/143(3) | (as per paper book of Revenue of AY 2016-17) |

| 28-03-2024 | | Assessment Order u/s 147/144 | |

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2015-16

| Reply dt. | Page | Description | Remarks |

| 06-09-2023 | 54 | General | Turnover reconcile with 26 AS |

| 08-02-2024 | 55-57 | General | Bank accounts submitted |

| 26-02-2024 | 49 | SCN | NP Rate applied @11% not mentioned in SCN |

| 11-03-2024 | 58-67 | General & Seized document with regular books | Property transaction & reconciliation with sale with VAT Return |

| 15-03-2024 | 68 | General | Reconciliation of bank and drawings |

| 16-03-2024 | 69 | Request for reference to VO | |

| 20-03-2024 | | Portal block for reply | Draft Order Sent to Range Head for approval (as per paper book of Revenue of AY 2016-17) |

| 21-03-2024 | | Approval Granted for Order u/s 147/143(3) | (as per paper book of Revenue of AY 2016-17) |

| 28-03-2024 | 70 | Assessment Order u/s 147 | |

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2016-17

| Reply dt. | Page | Description | Remarks |

| 06.09.2023 | 49 | General | |

| 01.02.2024 | 50-52 | General | Bank Statement, Turnover reconciliation& copy of order u/s 143(3) |

| 26.02.2024 | 44-45 | SCN issued | NP Rate applied @11% not mentioned in SCN |

| 11.03.2024 | 53-54 | General& Property detail | VAT, Request for reference to VO |

| 16.03.2024 | 55 | General | |

| 16.03.2024 | 56 | General | |

| 20-03-2024 | | Portal blocked for reply | Draft Order Sent to Range Head for approval (as per paper book of Revenue of AY 2016-17) |

| 21-03-2024 | | Approval Granted for Order u/s 147/143(3) | (as per paper book of Revenue of AY 2016-17) |

| 27-03-2024 | | Assessment Order u/s 147/144 | |

SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2017-18

| Reply dt. | Page | Description | Remarks |

| 06.09.2023 | 53 | General | |

| 01.02.2024 | 54-56 | General | Bank Statement, Turnover reconciliation& copy of order u/s143(1) |

| 12.03.2024 | 57-63 | General & Property detail, Seized document detail | Request for reference to VO,insurance policy,VAT, Seized document reconciliation with regular books |

| 15.03.2024 | 64 | Capital Gain detail | |

| 16.03.2024 | 65 | General | |

| 20-03-2024 | | Portal blocked for reply | Draft Order Sent to Range Head for approval (as per paper book of Revenue of AY 2016-17) |

| 21-03-2024 | | Approval Granted for Order u/s 147/143(3) | (as per paper book of Revenue of AY 2016-17) |

| 26-03-2024 | | Assessment Order u/s 147/144 | |

Note: SCN Not issued

SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2018-19

| Reply dt. | Page | Description | Remarks |

| 06.09.2023 | 62 | General | |

| 08.02.2024 | 63-65 | General | Bank Statement, Turnover reconciliation |

| 26.02.2024 | 57-58 | SCN issued | NP Rate applied @11% not mentioned in SCN |

| 12.03.2024 | 66-70 | General & Property Detail,Seized document with regular books | GST, Request for reference to VO Seized document reconciliation with regular books |

| 15.03.2024 | 71-72 | General | Breakup of payable of FS |

| 16.03.2024 | 73 | General | |

| 20-03-2024 | | Portal blocked for reply | Draft Order Sent to Range Head for approval (as per paper book of Revenue of AY 2016-17) |

| 21-03-2024 | | Approval Granted for Order u/s 147/143(3) | (as per paper book of Revenue of AY 2016-17) |

| 28-03-2024 | | Assessment Order u/s 147/144 | |

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2019-20

| Reply dt. | Page | Description | Remarks |

| 06.09.2023 | 81 | General | |

| 08.02.2024 | 82-84 | General | Bank Statement, Turnover reconciliation |

| 26.02.2024 | 76-77 | SCN issued | NP Rate applied @11% not mentioned in SCN |

| 12.03.2024 | 85-92 | General, Property Detail, Seized document reconciliation | GST Turnover reconciliation, Request for reference to VO Seized document reconciliation with regular books |

| 15.03.2024 | 93 | General | Breakup of payable of FS |

| 16.03.2024 | 94 | General | Detail & confirmation of Unsecured loan |

| 21.03.2024 | 95 | General | GST& ITC reconciliation |

| 21-03-2024 | | Portal blocked for reply | |

| 28-03-2024 | | Assessment Order u/s 147/144 | |

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2020-21

| Reply dt. | Page | Description | Remarks |

| 17.03.2022 | 61-62 | General | |

| 22.03.2022 | 63 | General | |

| 26.08.2022 | 64-65 | General | GST & ITC reconciliation |

| 02.09.2022 | 66-68 | General | |

| 02.09.2022 | 69 | General | Detail & confirmation of Unsecured loan |

| 05.09.2022 | 70-71 | General &detail of Seized document | Seized document reconciled with regular books |

| 08.09.2022 | 72 | General | |

| 08.09.2022 | 73 | General | |

| 31.07.2023 | 74-77 | General | Sanctity of Additional income to AO and Range Head |

| 11.08.2023 | 78-82 | General | Bank Statement – Request for deviation note to Investigation Wing |

| 14.08.2023 | 83-84 | General | Agriculture income |

| 16.08.2023 | 85-86 | General | GST & ITC reconciliation |

| 17.08.2023 | 87 | General | List of sundry creditors of FS |

| 21.08.2023 | 88-89 | General | Agriculture income |

| 22.08.2023 | 90-92 | General & Property Detail | Details of unsecured loan of FS Request for reference to VO |

| 23.08.2023 | 93 | General | Details of unsecured loan of FS with confirmation |

| 25.08.2023 | | Assessment Order u/s 144 | |

Note: SCN Not issued

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2021-22

| Reply dt. | Page | Description | Remarks |

| 29.11.2022 | 60 | General | |

| 29.11.2022 | 61-65 | General | Bank statement, GST reconciliation Turnover reconcile with 26AS |

| 13.12.2022 | 66-70 | General & Seized document reconciliation with regular books | Seized document reconciliation with regular books |

| 13.12.2022 | 71-74 | General & Property detail | Gift, Request for reference to VO |

| 11.08.2023 | 75-77 | General | Bank accounts and submission on difference of property valuation |

| 14.08.2023 | 78-79 | General | Turnover reconcile, agricultural income, chapter VIA deduction |

| 16.08.2023 | 80-81 | General & Property detail | Request for reference to VO |

| 21.08.2023 | 82 | General | GST reconciliation, cash withdrawal details and detail of sundry creditors |

| 25.08.2023 | | Assessment Order u/s 144 | |

Note: SCN Not issued

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

AY 2022-23

| Reply dt. | Page | Description | Remarks |

| 24.11.2023 | 78 | General | Turnover reconcile with 26 AS |

| 31.01.2024 | 79-83 | General | GST reconciliation &Bank accounts submitted |

| 01.03.2024 | 84-86 | General | Detail of cash found and request for deviation note |

| 12.03.2024 | 87-114 | General & Seized document | Seized document reconciliation with regular books |

| 28.03.2024 | 115-116 | General | Request for direction u/s 144A to Range Head |

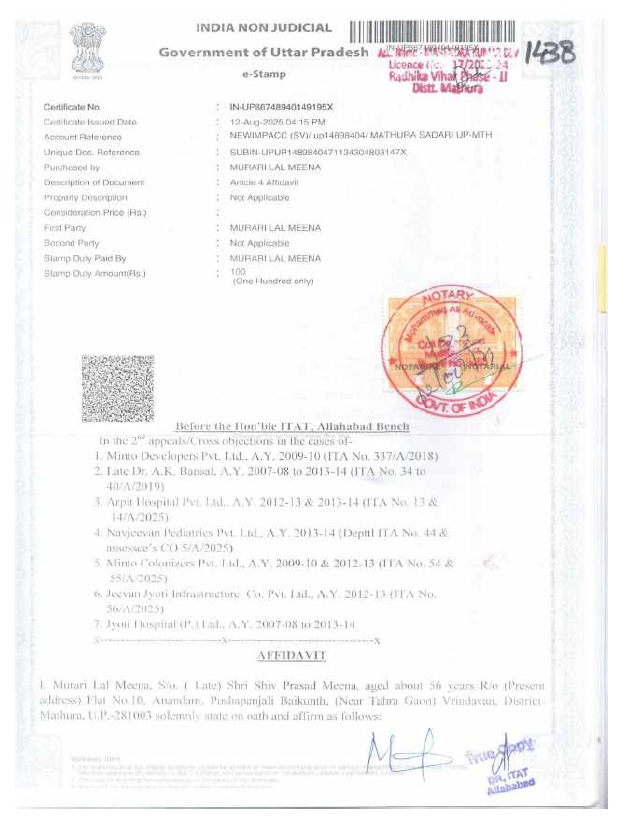

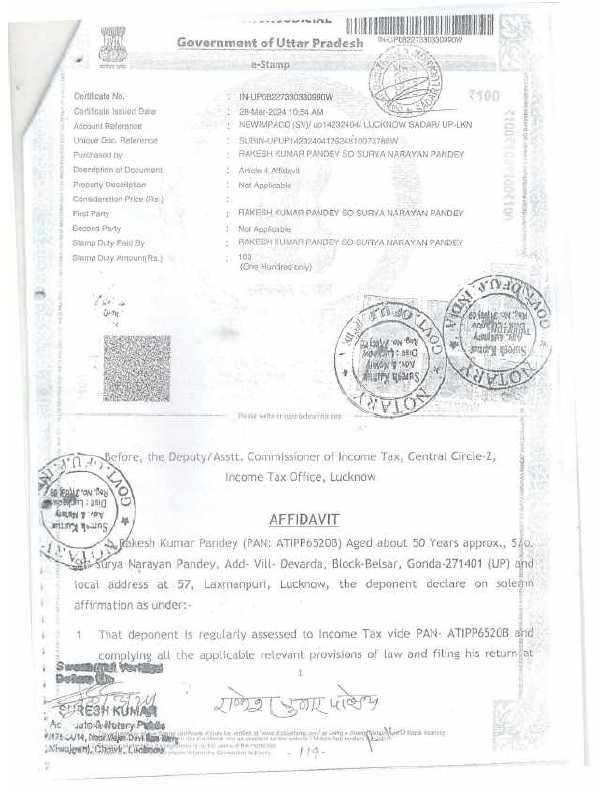

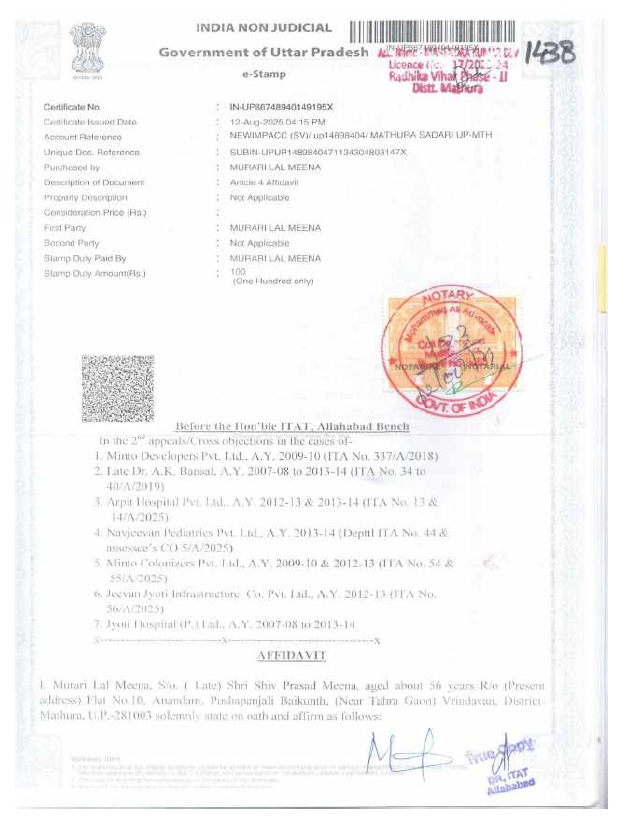

| 28.03.2024 | 117-127 | General | List of sundry creditors of FS and affidavit |

| 16.03.2024 | 128-135 | General & detail of property | Request for reference to VO |

| 31-03-2024 | 136-145 | Assessment Order u/s 143(3) | |

Note: SCN Not issued

(B.2.1) Moreover, revised consolidated synopsis was also filed from the assessee’s side, which is reproduced below for the ease of reference:

Before

The Hon’ble ITAT, Lucknow Bench ‘A’, Lucknow

Hon’ble Members,

Ref: SHRI RAKESH KUMAR PANDEY (PAN:ATIPP6520B)

Subject:-Consolidate Synopsis:

| 1. | | ITA No 347/LKW/2025 (A) AY 2014-15 |

| 2. | | ITA No 348/LKW/2025(A) & 398/LKW/2025 (D) AY 2015-16 |

| 3. | | ITA No 349/LKW/2025 (A) & 399/LKW/2025 (D) AY 2016-17 |

| 4. | | ITA No 350/LKW/2025 (A) & 460/LKW/2025 (D) AY 2017-18 |

| 5. | | ITA No 351/LKW/2025 (A) AY 2018-19 |

| 6. | | ITA No 352/LKW/2025 (A) & 402/LKW/2025 (D) AY 2019-20 |

| 7. | | ITA No 608/LKW/2024 (D) & CO 28/LKW/2024 AY 2020-21 |

| 8. | | ITA No. 557/LKW/2024 (D) & CO 27/LKW/2024 AY 2021-22 |

| 9. | | ITA No 353/LKW/2025 (A) & 405/LKW/2025 (D) AY 2022-23 |

In above said pending appeals filed by Appellant and Revenue substantially issues are common, therefore, consolidated synopsis are prepared based on issues involved w.r.t. respective year.

Issue No. 1 – AY 2014-15 TO AY 2022-23

| 7. | | That a search and seizure operation u/s 132 of the Income Tax Act was carried out on 05.02.2022 on the business and residential premises of M/s Alok Construction being proprietary concern of Appellant. The assessee is Government Contractor and during the relevant period, the assessee engaged in proprietorship business of construction of road etc. in semi urban area from contract work provided by the UPPWD, under the name and style of M/s Alok Construction. |

| 8. | | The books of accounts for relevant year were regularly maintained and audited and ITRs alongwith TAR. were filed within due date in respective years with following financial details:- |

| AY | Turnover | Profit | Assessee % of Profit | AO % of Profit | CIT(A) % of Profit | Remark |

| 2014-15 | 9,95,21,021 | 16,42,215 | 1.65 | 11% | 7% | Year of inception of proprietary business. |

| 2015-16 | 13,45,79,821 | 81,66,298 | 6.07 | 11% | 7% | |

| 2016-17 | 48,75,65,110 | 2,74,84,960 | 5.64 | 11% | 7% | Erstwhile Scrutiny u/s 143(3) dated 14.12.2011 by JAO and adhoc addition of Rs. 25,00,000/- |

| 2017-18 | 61,73,38,236 | 3,84,84,570 | 6.23 | 11% | 7% | |

| 2018-19 | 24,44,22,212 | 1,58,87,444 | 6.50 | 11% | 7% | Erstwhile Scrutiny u/s 143(3) dt. 23.04.2021 by NeFAC and adhoc addition of Rs. 25,00,000/- and 43B disallowances of Rs. 2,57,43,209/-, Ld. CIT(A) allowed the appeal against original order. |

| 2019-20 | 68,80,79,147 | 4,52,65,423 | 6.58 | 11% | 7% | |

| 2020-21 | 1,59,98,27,836 | 10,07,00,526 | 6.29 | 11% | 7% | |

| 2021-22 | 1,68,08,35,131 | 17,03,38,176 | 10.13 | 11% | 10.13% | Addition on extra profit deleted. |

| 2022-23 | 2,82,59,71,973 | 28,50,48,173 | | 11% | 9.68% | Addition on extra profit deleted. |