ORDER

Ravish Sood, Judicial Member.- The present appeal filed by the assessee company is directed against the order passed by the Commissioner of Income-Tax (Appeals), National Faceless Appeal Centre (NFAC), Delhi, dated 11.07.2024, which in turn arises from the order passed by the Assessing Officer (for short “A.O.”) under Section 143(3) of the Income Tax Act, 1961 (for short, “the Act”) dated 30.12.2016 for A.Y. 2014-15. The assessee company has assailed the impugned order on the following grounds of appeal before us:

“1. The order of the learned Commissioner of Income Tax (Appeals) is contrary to the facts and also the law applicable to the facts of the case.

2. The learned Commissioner of Income Tax (Appeals) is not justified in sustaining the addition of Rs.66,67,806 made by the assessing officer towards profit on sale of asset by erroneous application of the provisions of S.50C of the Act.

3. The learned Commissioner of Income Tax (Appeals) is not justified in sustaining the addition of Rs.20,67,000 made by the assessing officer towards unexplained investment in property.

4. Any other ground that may be urged at the time of appeal hearing.”

2. Succinctly stated, the assessee company that is engaged in the business of chit funds had filed its return of income on 30.09.2014, declaring an income of Rs. 78,88,127/-. The return of income was initially processed as such under Section 143(1) of the Act, on 29.12.2014. Subsequently, the case of the assessee company was selected for scrutiny assessment under Section 143(2) of the Act.

3. During the course of assessment proceedings, it was observed by the A.O. that the assessee company had purchased land admeasuring 967.32 sq. yards, situated at Door No. 5-87-126, Main Road, Lakshmipuram, Guntur, vide an agreement to sell cum General Power of Attorney dated 07.08.2009 for a total consideration of Rs. 2,11,80,000/-. Out of 967.32 sq. yards (supra), the assessee company had sold 82.28 sq. yards of land to M/s. Vishesh Engineering Company (for short “M/s. VEC”) on 16.04.2010, vide a registered sale deed no. 3628/2010 for a total sale consideration of Rs. 17,57,775/-.

4. The A.O. observed that the assessee company had thereafter entered into a “Memorandum of Understanding” (MOU) with M/s. Pawan Constructions on 27.11.2010 for development of the landed property admeasuring 885.04 sq. yards [9672.32 sq. yards (-) 82.28 sq. yards], situated at Door No. 5-87-126, Main Road, Lakshmipuram, Guntur.

5. The A.O. observed that, as per the terms of the “MOU”, the Builder/Developer was to construct a commercial complex, viz. “Chandralok Complex”, consisting of a cellar, ground floor, first floor, second floor, third floor, and fourth floor, along with all its amenities, with its own funds within a period of 12 months (with a grace period of 4 months). It was further observed that, as per the Memorandum of Understanding dated 27.11.2010, out of the total land of 885.04 sq. yards, the assessee company would be vested with an unspecified and undivided share in land admeasuring 619.528 sq. yards and 55% of the total built-up area of the commercial complex. On the other hand, the Builder/Developer, viz. M/s. Pawan Constructions would have an unspecified and undivided share of land ad-measuring 265.512 sq. yards and 40% of the total built-up area of the commercial complex. Thereby, the assessee company and the Builder/Developer had agreed to share the sale proceeds of the property in the ratio of 55:45.

6. Thereafter, the A.O. observed that the assessee company along with the aforementioned Builder/Developer, viz. M/s. Pawan Constructions (supra) had sold the entire property consisting of 967.32 sq. yards and 27,794 sq. ft. of built-up area to five different buyers. On being queried, it was the claim of the assessee company that the 82.28 sq. yards of land that was transferred to M/s. VEC (supra), vide registered sale deed No. 3628/2010 dated 16.04.2010, was cancelled as the sale consideration was not received from the said purchaser. Accordingly, the assessee company explained that the total land admeasuring 967.32 sq. yards (885.04 sq. yards + 82.28 sq. yards) was developed and sold to five different buyers.

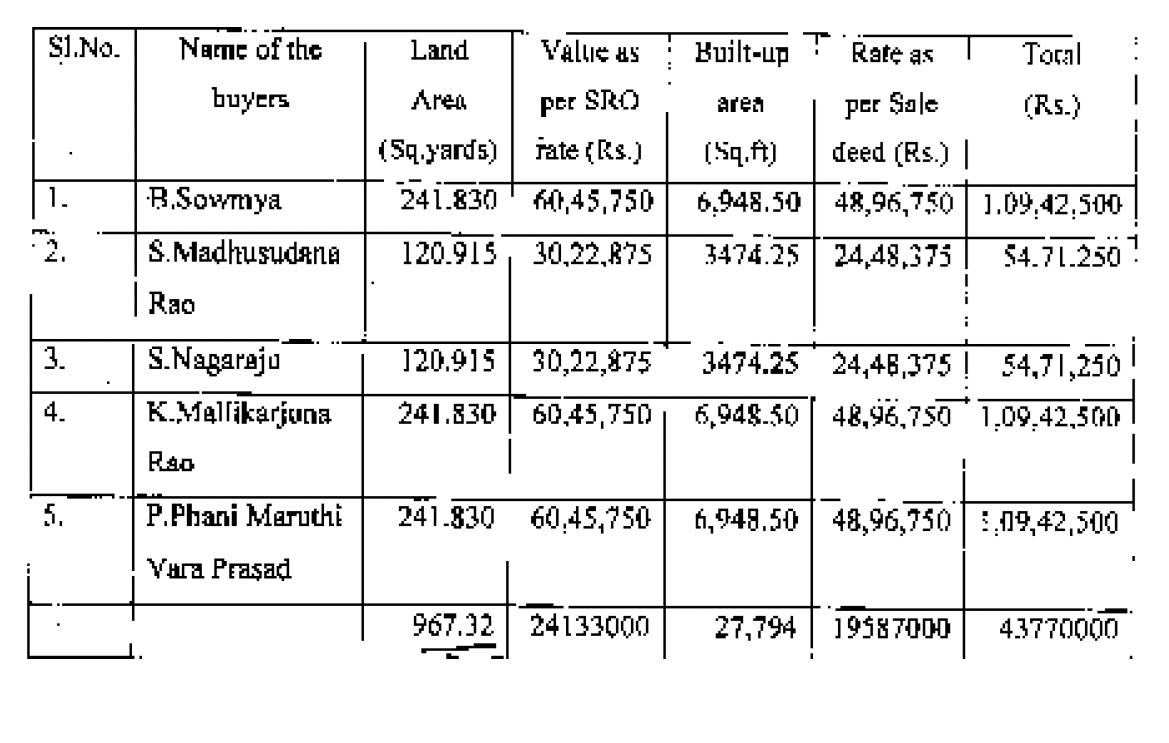

7. The A.O., based on the aforesaid facts, observed that the total value of the developed property sold by the assessee company, along with the aforementioned Builder/Developer, viz, M/s. Pawan Constructions, as per the SRO rates worked out at Rs. 44,37,70,000/-, as under :

8. The A.O., for computing the sale consideration of the property sold by the assessee company along with the Builder/Developer, adopted the value of the land as per SRO/segment rate i.e. @ 25,000/- per square yard. Accordingly, the A.O. computed the profit/gain on the sale of the subject property developed by the assessee company along with the Builder/Developer, viz. M/s. Pawan Constructions at Rs. 66,77,806/-as under.

9. Also, the A.O. observed that the land admeasuring 82.28 sq. yards that was earlier sold by the assessee company to M/s. VEC (supra), vide registered sale deed No. 3682/2010 dated 16.04.2010, was transferred back in its name. The A.O., considering the value of the said property as per the SRO records, determined the same at Rs. 20.57 lacs and called upon the assessee company to explain as to why an addition towards unexplained investment made for acquiring the said property during the subject year may not be made in its case. In reply, the assessee company expressed its inability to produce any evidence or offer any explanation and agreed to the proposed addition. Accordingly, the A.O. treated the investment made by the assessee company in the aforementioned property as unexplained and made an addition of Rs. 20.57 lacs in its hands. The A.O., based on his aforesaid deliberations, vide his order passed under Section 143(3) of the Act, dated 30.12.2016, determined the income of the assessee company at Rs. 1,66,12,933/-.

10. Aggrieved, the assessee company carried the matter in appeal before the CIT(A) but without success. For the sake of clarity, the observations of the CIT(A) are culled out as under :

11. The assessee company, being aggrieved with the order of the CIT(A), has carried the matter in appeal before us.

12. We have heard the learned Authorized Representatives of both parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that have been pressed into service by them to drive home their respective contentions.

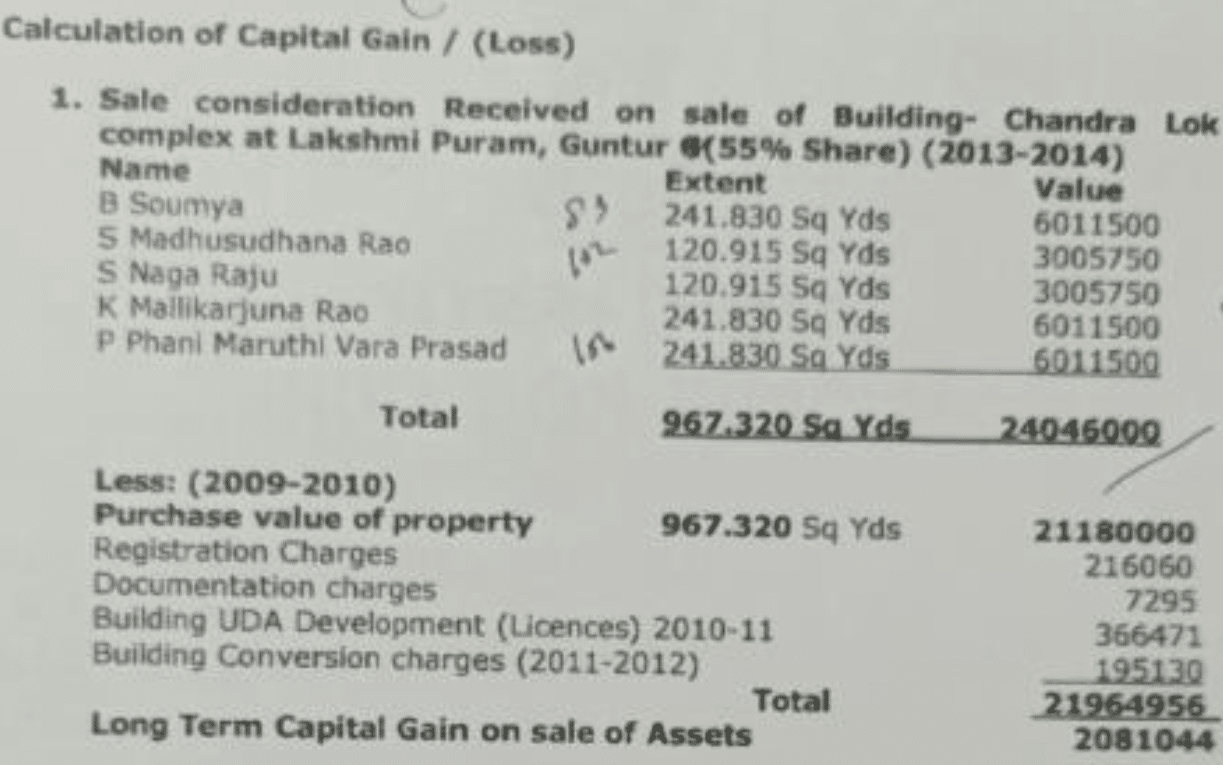

13. Shri GVN Hari, Advocate, the learned Authorized Representative (for short “Ld.AR”) for the assessee company, at the threshold of hearing of the appeal, submitted that the A.O. had grossly erred in law and on facts of the case in substituting the profit/gain falling to the share of the assessee company on sale of the developed property of Rs. 20,81,044/- by an amount of Rs. 66,67,806/-. Elaborating on his contention, the Ld. AR submitted that the A.O. had grossly erred in substituting the actual sale consideration of the subject property by the SRO rates under Section 50C of the Act. Apart from that, the Ld. AR submitted that the A.O. had, without giving any cogent reason, declined the assessee company’s claim for deductions, viz. (i) Building UDA Development (license charges) (2010-11): Rs. 3,66,471/- and (ii) Building conversion charges (2011-12): Rs. 1,95,130/-. Apart from that, the Ld. AR submitted that the A.O. had most arbitrarily made an addition under Section 69 of the Act of Rs. 20,57,000/-. Elaborating further on his contention, the Ld. AR submitted that the assessee company had proposed to sell 82.28 sq. yards (out of 967.32 sq. yards) of the subject land) to M/s. VEC (supra) and had executed a registered sale deed dated 16.04.2010. The Ld. AR submitted that as the assessee company owed certain amounts to M/s. VEC (supra), therefore, the latter had initially sought for adjustment of the said amount against the sale consideration for the subject property. The Ld. AR submitted that in the sale deed, there was no mention of any cash having been received at the time of registration, and it was only mentioned that the amount was already given. Carrying his contention further, the Ld. AR submitted that as the subject property was a corner plot (triangular shape), therefore, the purchaser, i.e. M/s. VEC (supra), had rejected the land and backed out of the adjustment of the sale consideration against the amount that was receivable by it from the assessee company. Carrying his contention further, the Ld. AR submitted that the assessee company had thereafter agreed to take back the land and had cancelled the registered sale deed vide a cancellation deed dated 15.04.2013 (Pages 65-78 of APB). The Ld. AR submitted that as the sale transaction of 82.28 sq. yards (supra) to M/s. VEC (supra) did not involve any payment of consideration, but was initially executed based on a mutual understanding that the amount owed by the assessee company to M/s. VEC would be adjusted against the sale consideration, which, however, did not materialize and, resultantly, the said sale transaction was cancelled, therefore, there was no justification for the A.O. to have arbitrarily concluded without any basis that the assessee company had made an unexplained investment of Rs. 20.57 lacs (supra) for getting the subject land transferred back in its name.

14. Per contra, Dr. Aparna Villuri, learned Senior Departmental Representative (for short, “Ld. DR”) relied upon the orders of the lower authorities.

15. The Ld. DR submitted that no infirmity did emanate from the order of the A.O. who had in the absence of any objection from the assessee company, rightly adopted the SRO rates, and based on the same determined the capital gain on the sale of the subject property falling to the share of the assessee company at Rs. 66.67 lacs (approx.). The Ld. DR submitted that as there was a clear mention in the registered sale deed dated 16.04.2010 that 82.28 sq. yards of land was transferred to M/s. VEC (supra) for a consideration, which was already paid, therefore, the A.O., in the absence of any explanation about the source of the investment that was thereafter made by the assessee company for getting back the subject land registered in its name, had rightly held that the assessee company had made an unexplained investment under Section 69 of the Act of Rs. 20.57 lacs.

16. We have given thoughtful consideration to the contentions advanced by the learned Authorized Representatives of both parties in the backdrop of the orders of the lower authorities.

17. Ostensibly, as the assessee company, in the course of the assessment proceedings, had not objected to the adoption of the SRO value of the subject land by the A.O. for determining the capital gain arising on the transfer of the same to the five parties, therefore, we find no infirmity in the determining of the same under Section 50C of the Act by the A.O at Rs.66,67,806/-. However, we find substance in the Ld. AR’s claim that the A.O., without giving any cogent reason, had declined the specific claims for deduction of certain expenses that were considered by the assessee company while computing the capital gain on the transfer of 967.32 sq. yards of the subject property, viz. (i) building UDA development (licence charges) – 2010-11: Rs.3,66,471/-and (ii) building conversion charges (2011-12): Rs.1,95,130/-.

18. At this stage, we deem it apposite to cull out the calculation of the capital gain on the transfer of the subject property as was disclosed by the assessee company in its return of income at Rs. 20,81,044/-(supra), as under:

19. We thus, in terms of our aforesaid observations, set aside the matter to the file of the A.O. with a specific direction to re-adjudicate the claim of the assessee company for deduction of the aforementioned expenses. Needless to say, the A.O. shall, in the course of the set-aside proceedings, afford a reasonable opportunity of being heard to the assessee company, which shall remain at liberty to substantiate its claim based on fresh documentary evidence, if any.

20. Apropos the Ld. AR’s claim that as the assessee company had got back 82.28 sq. yards of land transferred in its name from M/s. VEC (supra), we are of the view that the A.O. had failed to properly deal with the aforesaid claim of the assessee company and summarily concluded that it had made an unexplained investment for getting the land transferred back in its name. We say so, for the reason that the assessee company had supported its aforesaid claim vide a “cancellation deed” dated 15.04.2013 (Pages 65-72 of APB). As observed hereinabove, it has been the claim of the assessee company that the sale consideration of Rs. 16,29,500/- for the transfer of 82.28 sq. yards of land to M/s. VEC, vide sale deed dated 16.04.2010, was to be adjusted against the amount which the assessee company owed to the said purchaser. However, it is the claim of the assessee company that as the subject property, i.e. 83.28 sq. yards, was a corner plot (triangular shape), therefore, the purchaser i.e., M/s VEC (supra), had rejected the same and declined the adjustment of the sale consideration against the amount that was receivable by it from the assessee company. We find that it has been the claim of the assessee company that at the time of executing the sale deed dated 16-04-2010, there was no payment of sale consideration, but based on the mutual understanding that the sale consideration was to be adjusted against the amount owed by the assessee company to the purchaser, therefore, it was merely mentioned that the purchaser had paid the entire sale consideration. The Ld. AR submitted that as the aforesaid sale transaction did not get through, therefore, it was followed by a “cancellation deed” dated 15-04-2013, wherein the subject land admeasuring 82.28 sq. yards (supra) was transferred back in the name of the assessee company. Elaborating further on his contention, we find that it is the claim of the assessee company that as in the entire sequence of events, there was no payment of purchase consideration by the assessee company for getting back the subject property, i.e. 82.28 sq. yards, transferred back in its name, therefore, the A.O. was not justified in observing that it had made an unexplained investment for purchase of the said land for a consideration of Rs. 20.57 lacs. We further find that the assessee company, to support its aforesaid claim, had placed on record the confirmation/letter dated 09-01-2018 of M/s. VEC (supra) i.e., the transferor, wherein the latter had confirmed that it had not received any amount on cancellation of the registered sale deed dated 16-4-2010 (Page 205 of APB). The assessee company had filed on record a copy of its account appearing in the books of account of M/s. VEC (supra) for the F.Y 2010-11 to F.Y. 2012-13, wherein there was no mention of any amount having been received by the aforementioned concern, M/s. VEC (supra) from the assessee company.

21. We have deliberated at length on the aforesaid issue, and are of a firm conviction that the A.O. was not justified in summarily concluding that the assessee company had made an unexplained investment under Section 69 of Rs. 20.57 lacs for the purchase of the subject property. Insofar as the reference to the registered sale deed dated 16-04-2010, whereby 82.28 sq. yards of land was transferred by the assessee company to M/s VEC (supra), we are of the view that though the same makes a reference to the fact that M/s VEC (supra) had paid the entire sale consideration of Rs. 16.29 lacs to the assessee company, but the claim of the assessee company that the same was in lieu of the adjustment of the amount outstanding by it towards M/s VEC (supra) could not have been summarily discarded.

22. In fact, the aforesaid claim of the assessee company is supported by the confirmation letter dated 09-01-2018 of M/s. VEC (supra), wherein it had stated that it had not made any cash payment at the time of purchase of the subject property, vide registered purchase deed dated 16-04-2010. Also, the copy of the account of the assessee company in the books of account of M/s. VEC (supra) for the period from F.Y. 2010-11 to F.Y 2012-13 further supports the aforesaid claim as had been canvassed by the assessee company before us.

23. Be that as it may, we are of the considered view that in the totality of the facts involved in the present case, the matter in all fairness requires to be restored to the file of the A.O. The A.O. is directed to carry out necessary verifications by examining the concerned persons of M/s. VEC (supra), and also carry out any such verifications as he may deem necessary. We, thus, set aside the matter to the file of the A.O. for fresh adjudication.

24. Resultantly, the appeal filed by the assessee company is partly allowed for statistical purposes in terms of our aforesaid observations.