ORDER

Ravish Sood, Judicial Member.- The captioned appeals filed by the assessee are against the respective orders passed by the Commissioner of Income Tax (Appeals), Visakhapatnam-3, dated 21/03/2025, 24/03/2025 and 16/04/2025, which in turn arises from the respective orders passed by the Assessing Officer (for short, “AO”) under section 147 of the Income Tax Act, 1961 (for short, “the Act”), dated 27/03/2023; under section 271AAC(1) of the Act, dated 21/08/2023; and under section 270A of the Act, dated 21/08/2023 for Assessment year 2018-19. As the facts involved in the captioned appeals are inextricably interwoven, therefore, the same are being taken up and disposed of vide a consolidated order.

2. We shall first taken up the appeal filed by the assessee in ITA No.385/Viz/2025, wherein the assessee has assailed the impugned order passed by the CIT(A), Visakhapatnam-3, which in turn arises from the order passed by the AO under section 147 of the Act, dated 27/03/2023, on the following grounds of appeal before us:

| 1. | | The order of the learned Commissioner of Income Tax (Appeals) is contrary to the facts and also the law applicable to the facts of the case. |

| 2. | | The learned Commissioner of Income Tax (Appeals) is not justified in deciding the appeal ex-parte. |

| 3. | | Without prejudice to the above, the learned Commissioner of Income Tax (Appeals) is not justified in sustaining the addition of Rs.21,35,549 made by the assessing officer u/s 69 of the Act towards unexplained investment in flats. |

| 4. | | The learned Commissioner of Income Tax (Appeals) is not justified in sustaining the addition of Rs.2,52,520 of made by the assessing officer by estimating profit @ 8% of the turnover. |

| 5. | | Any other ground that may be urged at the time of appeal hearing.” |

Apart from that, the assessee has raised an additional ground of appeal, as under:

“The notice dated 30/03/2022 issued under section 148 of the Act is invalid as the same was issued by the JAO but not the FAO, in contravention of the provisions of section 151A of the Act and hence the notice is liable to be quashed as invalid.”

3. Succinctly stated, survey operations under section 133A of the Act were conducted on 11/02/2020 in the case of Sri GV Hari Krishna, husband of the assessee, viz. Smt. G. Lakshmi Madhavi. During the course of the survey proceedings, it was observed that the assessee had, during the subject year, acquired immovable properties and was engaged in the construction business under the name and style of M/s. Aakruthi Constructions.

4. As the assessee had not filed her return of income for the year under consideration, i.e., AY 2018-19, therefore, the AO issued a show cause notice (SCN) under section 148A(b) of the Act, dated 14/03/2022, wherein the assessee was called upon to explain as to why her investments and business transactions may not be assessed as her undisclosed income. In reply, the assessee admitted that she had taxable income and submitted a working as per which her total taxable income for the subject year was disclosed at Rs. 12,41,770/- with a consequential tax liability of Rs. 3,73,754/- (after claiming TDS credit of Rs. 5,000/-). Against the aforesaid tax liability, the assessee had paid self-assessment tax of Rs. 84,676/- on 07/03/2020 and arrived at the balance tax liability of Rs. 2,89,080/-.

5. Thereafter, the assessee, in response to notice under section 148 of the Act, dated 30/03/2022, had filed her return of income for the year under consideration, i.e., AY 2018-19, on 09/05/2022, disclosing an income of Rs. 12,50,870/-.

6. During the course of the assessment proceedings, the AO observed that the assessee had disclosed gross receipts/turnover from her construction business of Rs. 1,48,53,826/-, viz., (i) sale of semifurnished flats: Rs. 82,12,000/-; (ii) additional works receipts corresponding to sale of semi-finished flats: Rs. 6,12,000/-; and (iii) work contract receipts: Rs. 60,29,826/-. The AO observed that the assessee as against her gross receipts/turnover from construction activities of Rs. 1,48,53,826/-, had disclosed the net profit at Rs. 9,35,786/-, which worked out to 6.29%. However, the AO observed that the assessee in the computation of income that was filed before him had disclosed her business income as per the provisions of section 44AD of the Act. The AO observing that the presumptive income under section 44AB of the Act is to be worked out @ 8% of the turnover/gross receipts, therefore, applied the same to the gross receipts/turnover of Rs.1,48,53,826/- (as was disclosed by the assessee) and determined her business income at Rs. 11,88,306/- instead of Rs. 9,35,786/- that was admitted by her. Although it was the claim of the assessee that, as she had received the gross receipts through online mode, therefore, her income under section 44AD of the Act was to be computed @ 6% only, but the AO, in the absence of any material substantiating her said claim, had rejected the said claim.

7. Also, the AO observed that the assessee during the year under consideration had acquired two immovable properties (shown as personal assets), i.e., (A) Flat No.406, Srinivasa Sankalp, Yendada Village, Visakhapatnam for a purchase consideration of Rs. 17,86,830/, viz. (i). purchase consideration vide a registered document No.2612/2017, dated 12/06/2017: Rs. 13,41,000/-; (ii). registration expenses: Rs. 1,00,830/-; and (iii). payment towards the execution of construction works: Rs. 3,45,000/-; AND (B). Flat No. 402, Roshini Residency, Bakkannapalem, Visakhapatnam for a purchase consideration of RS. 17,54,030/-, viz. (i). purchase consideration vide a registered document No.2888/2017, dated 21/06/2017: Rs. 13,03,000/-; (ii). registration expenses: Rs. 98,030/-; and (iii). payment towards execution of construction works: Rs. 3,53,000/-.

8. Apart from that, the AO observed that the assessee during the subject year had sold two immovable properties (stock-in-trade), i.e., (i) Flat No.301, Aakruti Sree Madhava Sadan, Resapuvanipalem, Visakhapatnam: Rs. 30,00,000/-; and (ii) Flat No.102, Aakruti Sree Madhava Sadan, Resapuvanipalem, Visakhapatnam: Rs. 30,00,000/-. The assessee submitted before the AO that the aforementioned immovable properties, i.e., two flats (shown as personal assets), were sourced out of the sale proceeds of the aforesaid flats (stock-in-trade). Also, it was submitted by her that the corresponding expenditure for such stock-in-trade was incurred in the preceding year, and thus, the entire sale proceeds of stock-in-trade were utilised for the acquisition of two immovable properties, which were shown as assets.

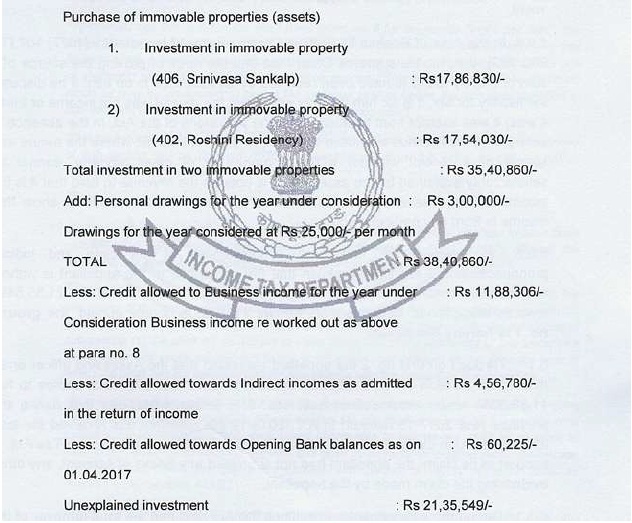

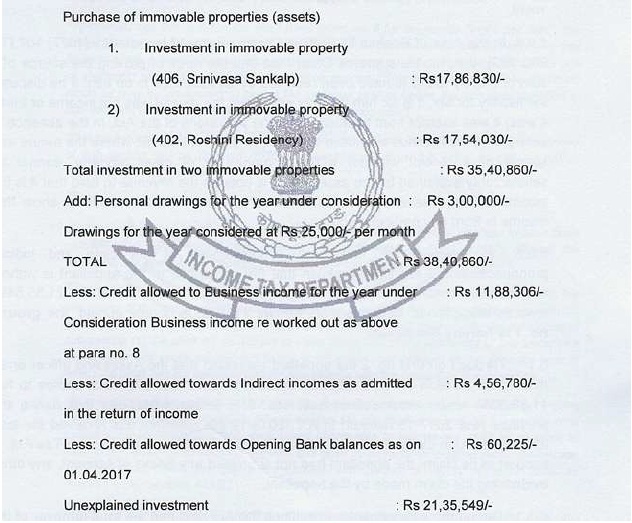

9. However, the aforesaid explanation of the assessee did not find favour with the AO. Although, the AO observed that the sale consideration of the above mentioned two flats (stock-in-trade) was diverted/utilized towards purchase of two immovable properties (shown as personal assets) in the same period, i.e., June, 2017, but taking cognizance of the fact that the “balance sheet” of the assessee for the preceding year, i.e., as on 31/03/2017 disclosed the “closing stock” at Rs. NIL, thus, concluded that the assessee had no explanation regarding the source of acquisition of the said two immovable properties (assets). Accordingly, the AO worked out the unexplained investment made by the assessee during the subject year at Rs. 21,35,549/-, as under:

10. Thereafter, the AO vide his order under section 147 of the Act, dated 27/03/2023, determined the income of the assessee at Rs. 36,38,936/-. Also, the AO while culminating the assessment, initiated penalty proceedings, viz., (i) under section 270A of the Act for underreporting of income, in consequence of misreporting of income, in respect of business income assessed at Rs.11,88,306/-; and (ii) penalty proceedings under section 271AAC of the Act in respect of addition towards unexplained investment made under section 69 of Rs.21,35,549/-.

11. Aggrieved, the assessee carried the matter in appeal before the CIT(A) but without success.

12. The assessee, being aggrieved with the order of the CIT(A), has carried the matter in appeal before us.

13. We have heard the Learned Authorised Representatives of both parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that have been pressed into service by them to drive home their respective contentions.

14. Sri GVN Hari, Advocate, the Learned Authorised Representative (for short, “Ld. AR”) for the assessee, at the threshold of hearing of the appeal submitted that the AO had wrongly assumed jurisdiction and framed the assessment vide the impugned order of assessment passed by him under section 147 of the Act, dated 27/03/2023. Elaborating on his contention, the Ld. AR submitted that as the notice under section 148 of the Act, dated 30/03/2022 was issued by the Jurisdictional Assessing Officer (JAO) and not the Faceless Assessing Officer (FAO), therefore, the assumption of jurisdiction by the AO for framing of the assessment being in contravention of the provisions of section 151A of the Act, cannot be sustained and is liable to be quashed on the said count itself.

15. Per contra, Dr. Aparna Villuri, the Learned Senior Departmental Representative (for short, “Ld. Sr. DR”) submitted that as the assessee had not called in question the assumption of jurisdiction by the JAO within the prescribed time period contemplated under section 124(3) of the Act, therefore, he is precluded from challenging the same for the first time in the course of the present proceedings before the Tribunal. The Ld. Sr. DR to support her aforesaid contention had relied upon the judgment of the Hon’ble Supreme Court in Dy. CIT (Exemption) v. Kalinga Institute of Industrial Technology (SC)/[2023] 454 ITR 582 (SC). Elaborating further on her contention, the Ld. Sr. DR submitted that the Hon’ble Apex Court in clear and unequivocal terms in its aforesaid order had observed that Section 124(3)(a) precludes the assessee from questioning the jurisdiction of the AO, if he does not do so within 30 days of receipt of notice. Accordingly, the Ld. Sr. DR submitted that the assessee in the present case, in the absence of having questioned the jurisdiction of the JAO as per the strict mandate of section 124(3) of the Act, cannot now be permitted to challenge the same in the course of the proceedings before us.

15.1. Rebutting the Ld. CIT-DR’s contention, Shri. GVN Hari, Ld. AR submitted that, as in the present case, the assessee was challenging the inherent lack of jurisdiction with the JAO to initiate the impugned proceedings under Section 148A of the Act, and also issue notice under Section 148 of the Act, and was not questioning the jurisdiction as provided in Section 120(3) of the Act, which was the subject matter before the Hon’ble Apex Court in the case of Commissioner of Incometax (Exemption) v. Kalinga Institute of Industrial Technology (supra), therefore, the said judgment being distinguishable both on facts and the issue therein involved will not carry the case of the revenue any further.

15.2. We have thoughtfully considered the contentions advanced by the Ld. Authorized Representatives of both parties regarding the validity of the jurisdiction assumed by the FAO for framing the assessment vide his order passed under Section 147 of the Act, dated 27/03/2023 based on the order passed under Section 148A(d) of the Act, dated 30/03/2022 and Notice issued under Section 148 of the Act, dated 30/03/2022 by the ACIT, Central Circle 1, Visakhapatnam.

15.3. We shall first deal with the Ld. DR’s contention that as the assessee had within the specified time period contemplated under subsection (3) of Section 124 of the Act, i.e. within a period of one month from the date on which the said notice was served upon him not called in question the jurisdiction of the ACIT, Central Circle-1, Visakhapatnam i.e., the JAO, who had issued Notice u/s 148 of the Act, dated 30/03/2022, therefore, he was precluded from assailing the same for the first time before the Tribunal.

16. Before proceeding further, it would be relevant to cull out Section 124(3) of the Act, which reads as under:

“124 (1) xxxxxxxx

(2) xxxxxxx

(3) No person shall be entitled to call in question the jurisdiction of an Assessing Officer—

(a) where he has made a return under sub-section (1) of section 115WD or under sub-section (1) of section 139, after the expiry of one month from the date on which he was served with a notice under subsection (1) of section 142 or sub-section (2) of section 115WE or subsection (2) of section 143 or after the completion of the assessment, whichever is earlier;

(b) where he has made no such return, after the expiry of the time allowed by the notice under sub-section (2) of section 115WD or subsection (1) of section 142 or under sub-section (1) of section 115WH or under section 148 for the making of the return or by the notice under the first proviso to section 115WF or under the first proviso to section 144 to show cause why the assessment should not be completed to the best of the judgment of the Assessing Officer, whichever is earlier;

(c) where an action has been taken under section 132 or section 132A, after the expiry of one month from the date on which he was served with a notice under sub-section (1) of section 153A or sub-section (2) of section 153C or after the completion of the assessment, whichever is earlier.”

17. Having given a thoughtful consideration to the aforesaid claim of the ld. DR in the backdrop of the mandate of Sub-section (3) of Section 124 of the Act, we are unable to fathom that as to how the restriction therein contemplated, which is confined to questioning the jurisdiction of an Assessing Officer, can have any bearing on the claim of the present assessee before us, who has assailed the validity of the assessment order passed under Section 147 of the Act, dated 27/03/2023 by the ACIT, Central Circle-1, Visakhapatnam, i.e., JAO, based on the Notice u/s 148 of the Act, dated 30/03/2022 issued by him despite lack of inherent jurisdiction for initiating the proceedings u/s 148A of the Act; issuing Notice u/s 148 of the Act and framing the impugned assessment vide order passed by him under Section 147 of the Act, dated 27/03/2023.

18. Before dealing with the subject issue, we deem it apposite to look into the fabric of Section 124 of the Act. On a careful perusal of Section 124 of the Act, it transpires that the same apparently deals with the issue of “territorial jurisdiction” of an Assessing Officer. Ostensibly, sub-section (1) of Section 124 contemplates vesting with the AO of jurisdiction over a specified area by virtue of any direction or order issued under subsection (1) and sub-section (2) of Section 120 of the Act. Sub-section (2) of Section 124 contemplates the manner in which any controversy regarding the territorial jurisdiction of an AO is to be resolved. Apropos sub-section (3) of Section 124 of the Act, the same places a restriction upon an assessee to call in question the jurisdiction of the A.O where he had initially not raised such objection within a period of one month from the date on which he was served with a notice under sub-section (1) of Section 142 or sub-section (2) of Section 143 or Section 148 or subsection (1) of Section 153A or sub-section (2) of Section 153C. To sum up, the obligation cast upon an assessee to call in question the jurisdiction of the A.O as per the mandate of sub-section (3) of Section 124 is confined to a case where he objects to the assumption of jurisdiction by the A.O, and not otherwise.

19. At this stage, we may herein refer to certain judicial pronouncements that had in the past held the field on the aforesaid issue. The Hon’ble High Court of Bombay in the case of Peter Vaz v. CIT Central Circle, Bangalore (Bombay)/[2021] 436 ITR 616 (Bombay) and the Hon’ble High Court of Gujarat in the case of Commissioner of Income-tax v. Ramesh D. Patel (Gujarat)/[2014] 362 ITR 492 (Gujarat), had held that as Section 124 of the Act pertains to territorial jurisdiction vested with an AO under sub-section (1) or subsection (2) of Section 120, therefore, the provisions of sub-section (3) of Section 124 which puts a restriction on an assessee to object to the validity of the jurisdiction of an A.O would get triggered only in a case where the dispute of the assessee is with respect to the territorial jurisdiction and have no relevance in so far his inherent jurisdiction for framing the assessment is concerned. Further, the Hon’ble High Court of Bombay in the case of Bansilal B. Raisoni & Sons v. Assistant Commissioner of Income Tax (Bombay) had, inter alia, observed that the time limit for objecting to the jurisdiction of the Assessing Officer prescribed under sub-section (3) of Section 124 has a relation to the Assessing Officer’s territorial jurisdiction. It was further observed that the time limit prescribed would not apply to a case where the assessee contends that the action of the Assessing Officer is without authority of law and, therefore, wholly without jurisdiction. Also, the Hon’ble High Court of Bombay in the case of Commissioner of Income tax v. Lalitkumar Bardia (Bombay)/[2018] 404 ITR 63 (Bombay) had addressed the contention of the department that where the assessee had not objected to the jurisdiction within the time prescribed under subsection (3) of Section 124 of the Act, then, having waived its said right, it was barred from raising the issue of jurisdiction after having participated in the assessment proceedings. The Hon’ble High Court had observed that the waiver can only be of one’s right or privilege, but nonexercise of the same will not bestow jurisdiction on a person who inherently lacks jurisdiction. Therefore, the principle of waiver cannot be invoked to confer jurisdiction on an Officer who is acting under the Act when he does not have jurisdiction. The Hon’ble High Court, while concluding as hereinabove, had relied on the judgment of the Hon’ble Supreme Court in the case of Kanwar Singh Saini v. High Court of Delhi (2012) 4 SCC 307. The Hon’ble Apex Court in its aforesaid judgment, had held that it is the settled legal proposition that conferment of jurisdiction is a legislative function and it can neither be conferred with the consent of the parties nor by a superior court. The Hon’ble Apex Court further observed that if the court passes an order or decree having no jurisdiction over the matter, it would amount to a nullity as the matter goes to the roots of the cause. Also, the Hon’ble Apex Court clarified that an issue can be raised at any belated stage of the proceedings, including in appeal or execution. Elaborating further, it was observed by the Hon’ble Apex Court that the finding of a court or tribunal becomes irrelevant and unenforceable and inexecutable once the forum is found to have no jurisdiction. It was further observed by the Hon’ble Apex Court that the acquiescence of a party equally should not be permitted to defeat the legislative animation, and the court cannot derive jurisdiction apart from the statute. For the sake of clarity, the observations of the Hon’ble Apex Court in the case of Kanwar Singh Saini (supra) are culled out as under:

“22. There can be no dispute regarding the settled legal proposition that conferment of jurisdiction is a legislative function and it can neither be conferred with the consent of the parties nor by a superior court, and if the court passes order/decree having no jurisdiction over the matter, it would amount to a nullity as the matter goes to the roots of the cause. Such an issue can be raised at any belated stage of the proceedings including in appeal or execution. The finding of a court or tribunal becomes irrelevant and unenforceable/inexecutable once the forum is found to have no jurisdiction. Acquiescence of a party equally should not be permitted to defeat the legislative animation. The court cannot derive jurisdiction apart from the statute. (Vide United Commercial Bank Ltd v. Workmen, Nai Bahu v. Lala Ramnarayan, Natraj Studios (P) Ltd. v. Navrang Studios, Sardar Hasan Siddiqui v. STAT, A.R. Antulay v. R.S. Nayak, Union of India v. Deoki Nandan Aggarwal, Karnal Improvement Trust v. Parkash Wanti, U.P. Rajkiya Nirman Nigam Ltd. v. Indure (P) Ltd., State of Gujarat v. Rajesh Kumar Chimanlal Barot, Kesar Singh v. Sadhu, Kondiba Dagadu Kadam v. Savitribai Sopan Gujar and CCE v. Flock (India) (P) Ltd.)”

(emphasis supplied by us)

20. We further find that the Hon’ble Supreme Court in its recent order passed in the case of Union of India v. Rajeev Bansal (SC)/[2024] 469 ITR 46 (SC) had, inter alia, observed that the order passed without jurisdiction is nullity. It was further observed that if a statute expressly confers a power or imposes a duty on a particular authority, then such power or duty must be exercised or performed by that authority itself. The Hon’ble Apex Court had further observed that any exercise of power by statutory authorities inconsistent with the statutory prescription is invalid. Apart from that, it was observed that as there cannot be any waiver of a statutory requirement or provision that goes to the root of the jurisdiction of assessment, therefore, any consequential order passed or action taken will be invalid and without jurisdiction. For the sake of clarity, the observations of the Hon’ble Apex Court are culled out as under:

“30. If a statute expressly confers a power or imposes a duty on a particular authority, then such power or duty must be exercised or performed by that authority itself. (Dr. Premachandran Keezhoth v. Chancellor, Kannur University). Further, when a statute vests certain power in an authority to be exercised in a particular manner, then that authority has to exercise its power following the prescribed manner (CIT v. Anjum M.H. Ghaswala; State of Uttar Pradesh v. Singhara Singh). Any exercise of power by statutory authorities inconsistent with the statutory prescription is invalid..

*** ** *** *** ** *** *** ** ***

32. A statutory authority may lack jurisdiction if it does not fulfil the preliminary conditions laid down under the statute, which are necessary to the exercise of its jurisdiction. (Chhotobhai Jethabhai Patel and Co. V. Industrial Court, Maharashtra Nagpur Bench).There cannot be any waiver of a statutory requirement or provision that goes to the root of the jurisdiction of assessment. (Superintendent of Taxes v. Onkarmal Nathmal Trust). An order passed without jurisdiction is a nullity. Any consequential order passed or action taken will also be invalid and without jurisdiction. (Dwarka Prasad Agrawal V. B.D. Agrawal). Thus, the power of assessing officers to reassess is limited and based on the fulfilment of certain preconditions. (CIT v. Kelvinator of India Ltd.)”

(emphasis supplied by us)

21. We shall now advert to the judgment of the Hon’ble Supreme Court, in the case of Kalinga Institute of Industrial Technology (supra), that has been relied upon by the Ld. DR to impress upon us that as the assessee in the present case before us, had, within the time allowed by the notice issued u/s 148 of the Act, dated 30/03/2022, i.e., period of 30 days, not called in question the jurisdiction of the ACIT, Central Circle-1, Visakhapatnam, i.e., JAO, based on which he had thereafter framed the assessment vide his order passed under Section 147 of the Act, dated 27/03/2023, therefore, as per the mandate of subsection (3) of Section 124 of the Act, she cannot in the course of present proceedings before us object to the validity of the jurisdiction so assumed.

22. It would be relevant to cull out the facts that were involved in the case of Kalinga Institute of Industrial Technology (supra), as under:

| (i) | | . assessee had in the aforesaid case challenged the notice issued u/s.143(2) of the Act by the ACIT, Corporate Circle-1(2), Bhuwaneshwar, as being without jurisdiction; |

| (ii) | | . jurisdiction over the case of the assessee that was vested with ACIT, Corporate Circle-1(2), Bhuwaneshwar, was, after the filing of the return of income by the assessee, changed, and got vested with the Jt. CIT(OSD) (Exemption), Bhuwaneshwar; |

| (iii) | | . it was the assessee’s case that, as the jurisdiction to issue notice under Section 143(2) of the Act in its case was with the Jt. CIT (OSD)(Exemption), Bhuwaneshwar, therefore, the impugned notice issued u/s. 143(2) of the Act by the ACIT, Corporate Circle-1(2), Bhuwaneshwar was without jurisdiction and, thus, liable to be quashed; |

| (iv) | | . Hon’ble High Court of Orissa, observing that the jurisdiction to issue notice u/s. 143(2) of the Act in the case of the assessee remained with the Jt. CIT(OSD)(Exemption), Bhuwaneshwar, therefore, held the impugned notice issued u/s. 143(2) of the Act by the ACIT, Corporate Circle-1(2), Bhuwaneshwar, as having been issued without jurisdiction and quashed the same. |

23. On Special Leave Petition (SLP) filed by the revenue, the Hon’ble Apex Court had, inter alia, observed that as the record revealed that the assessee had, participated in the assessment proceedings and not questioned the jurisdiction of the AO, there was no justification for the High Court to have set-aside the notice issued u/s.143(2) of the Act by the ACIT, Corporate Circle-1(2), Bhuwaneshwar. Elaborating on the scope of Section 124(3)(a) of the Act, the Hon’ble Apex Court observed that the same precluded the assessee from questioning the jurisdiction of the AO if he does not do so within 30 days of receipt of notice u/s. 142(1) of the Act.

24. Before proceeding further, it would be relevant to point out that a plain reading of sub-section (3) of Section 120 of the Act reveals that the “Jurisdiction” vested with the Income-tax Authorities is classified into four categories, viz. (i) territorial area; (ii) persons or classes of persons; (iii) income or classes of income; or (iv) cases or classes of cases. The assessee in the present case before us, has not assailed the vesting of jurisdiction with the ACIT, Central Circle-1, Visakhapatnam,, i.e., JAO based on either of the aforesaid four categories, but has rather challenged the lack of inherent jurisdiction with the Jurisdictional Assessing Officer (JAO), for initiating the impugned proceedings under Section 148A of the Act, issuing the consequential notice under Section 148 of the Act, and framing the assessment vide his order passed under Section 147 of the Act, dated 27/03/2023. In our view, as after the introduction of the “Faceless Jurisdiction of the Income Tax Authorities Scheme, 2022” and the “e-Assessment of Income Escaping Assessment Scheme, 2022”, it is only the FAO which can issue the notice under Section 148 of the Act and frame the assessment and not the JAO, and the assessments are statutorily required to be as per the prescribed faceless mechanism provided under the provisions of Section 144(b) r.w Section 151A of the Act, therefore, the challenge by the assessee to the inherent lack of jurisdiction with the JAO to initiate the impugned proceedings under Section 148A of the Act, issue the notice under Section 148 of the Act, and frame the assesseement vide the impugned assessment order passed under Section 147 of the Act, dated 27/03/2023 will not be saved by the judgment of the Hon’ble Supreme Court in Kalinga Institute of Industrial Technology (supra), which being distinguishable on facts will not assist the case of the revenue before us.

25. Coming back to the core issue involved in the present appeal, i.e., the validity of the assessment order passed under Section 147 of the Act, dated 27/03/2023 by the ACIT, Central Circle-1, Visakhapatnam, i.e., Jurisdictional Assessing Officer (FAO), based on the order passed u/s 148A(d), dated 30/03/2022 and Notice u/s 148 of the Act, dated 30/03/2022, issued by him, we find that the same as on date is squarely covered by the Judgment of the Hon’ble Jurisdictional High Court of Andhra Pradesh in the case of Kishan Kumar Thotakura v. Asstt. CIT [Writ Petition No. 14681 of 2023, dated 28-10-2025]. The Hon’ble High Court in its aforesaid order had held that after the formulation of the “e-Assessment of Income Escaping Assessment Scheme, 2022”, the notice under Section 148 of the Act can only be issued by the FAO and not by the JAO. For the sake of clarity, the observations of the Hon’ble High Court are culled out as under:

“7. Discussion and findings:

(A). The Division Bench of the Bombay High Court in the case of Prakash Pandurang Patil v. Income Tax Officer, Ward 5, Panvel & Others by following the judgment of a Division Bench of the High Court of Bombay, in the case of Hexaware Technologies Limited v. Assistant Commissioner of Income Tax & 4 Ors 1 had considered the effect and interpretation of the Section 151 (A) of the Income Tax as extracted herein under:

“3. It is apparent that the impugned notice dated 5 April, 2022 issued under Section 148 of the Act and the order of the same date under Section 148A(d) of the Act are issued by the Jurisdictional Assessing Officer (“JAO”) and not under the mandatory faceless mechanism as per the provisions of Section 151A of the Act. For a notice to be validly issued under Section 148 of the Act, the respondent No.2 would be required to comply with the provisions of Section 151A of the Act, so as to adhere to the faceless mechanism, as notified by the Central Government by notification dated 29 March 2022. A Division Bench of this Court in the case of Hexaware Technologies Limited v. Assistant Commissioner of Income Tax & 4 Ors 2 had considered the effect and interpretation of the said provision. The relevant extract of the said decision reads thus:-

35. Further, in our view, there is no question of concurrent jurisdiction of the JAO and the FAO for issuance of notice under Section 148 of the Act or even for passing assessment or reassessment order. When specific jurisdiction has been assigned to either the JAO or the FAO in the scheme dated 29.03.2022, then it is to the exclusion of the other.

To take any other view in the matter, would not only result in chaos but also render the whole faceless proceedings redundant. If the argument of Revenue is to be accepted, then even when notices are issued by the FAO, it would be open to an assessee to make submission before the JAO and vice versa, which is clearly not contemplated in the Act.

Therefore, there is no question of concurrent jurisdiction of both FAO or the JAO with respect to the issuance of notice under Section 148 of the Act. The Scheme dated 29th March 2022 in paragraph 3 clearly provides that the issuance of notice “shall be through automated allocation” which means that the same is mandatory and is required to be followed by the Department and does not give any discretion to the Department to choose whether to follow it or not. That automated allocation is defined in paragraph 2

(b) of the Scheme to mean an algorithm for randomised allocation of cases by using suitable technological tools including artificial intelligence and machine learning with a view to optimise the use of resources. Therefore, it means that the case can be allocated randomly to any officer who would then have jurisdiction to issue the notice under Section 148 of the Act, It is not the case of respondent No.1 that respondent No.1 was the random officer who had been allocated jurisdiction.

36. With respect to the argument of the Revenue, i.e., the notification dated 29th March, 2022 provides that the Scheme so framed is applicable only ‘to the extent’ provided in Section 144B of the Act and Section 144B of the Act does not refer to issuance of notice under Section 148 of the Act and hence, the notice cannot be issued by the FAO as per the said Scheme, we express our view as follows:-

Section 151A of the Act itself contemplates formulation of Scheme for both assessment, reassessment or re-computation under Section 147 as well as for issuance of notice under Section 148 of the Act. Therefore, the Scheme framed by the CBDT, which covers both the aforesaid aspect of the provisions of Section 151A of the Act cannot be said to be applicable only for one aspect, i.e., proceedings post the issue of notice under Section 148 of the Act being assessment, reassessment or recomputation under Section 147 of the Act and inapplicable to the issuance of notice under Section 148 of the Act. The Scheme is clearly applicable for issuance of notice under Section 148 of the Act and accordingly, it is only the FAO which can issue the notice under Section 148 of the Act and not the JAO. The argument advanced by respondent would render clause 3(b) of the Scheme otiose and to be ignored or contravened, as according to respondent, even though the Scheme specifically provides for issuance of notice under Section 148 of the Act in a faceless manner, no notice is required to be issued under Section 148 of the Act in a faceless manner. In such a situation, not only clause 3(b) but also the first two lines below clause 3(b) would be otiose, as it deals with the aspect of issuance of notice under Section 148 of the Act. Respondents, being an authority subordinate to the CBDT, and which has been laid before both House of Parliament is partly otiose and inapplicable.”

37. When an authority acts contrary to law, the said act of the Authority is required to be quashed and set aside as invalid and bad in law and the person seeking to quash such an action is not required to establish prejudice from the said Act. An act which is done by an authority contrary to the provisions of the statue, itself causes prejudice to assessee. All assessees are entitled to be assessed as per law and by following the procedure prescribed by law.

Therefore, when the Income Tax Authority proposes to take action against an assessee without following the due process of law, the said action itself results in a prejudice to assessee. Therefore, there is no question of petitioner having to prove further prejudice before arguing the invalidity of the notice.

4. It is hence apparent that in the present case, the impugned order and the notices issued by respondent no.1 are not in compliance with the Scheme notified by the Central Government implementing the provisions of Section 151A of the Act. The Scheme, as tabled before the Parliament as per the requirements of the said provision, is in the nature of a subordinate legislation, which governs the conduct of proceedings under Section 148A as well as Section 148 of the Act. Thus, in view of the explicit declaration of the law in Hexaware Technologies Limited (supra), the grievance of the petitioner- assessee insofar as it relates to an invalid issuance of the impugned order and the notice is required to be accepted.

5. Learned Counsel for the parties agree that in this view of the matter, the proceedings initiated under Section 148 of the Act would not be sustainable and are rendered invalid in view of the judgment rendered in Hexaware Technologies Limited (supra).” (B). Further, it is very apt to refer the judgment of the High Court of Telangana in the case of Kanakanala Ravindra Reddy v. Income Tax Officer 3, decided on 14.09.2023 whereby a batch of Writ Petitions were allowed and the proceedings initiated under Section 148A as also under Section 148 of the Act were held to be bad with consequential reliefs on the ground of it being in violation of the provisions of Section 151A of the Act read with Notification 18/2022 dated 29.03.2022.

(C). It is also to be noted that the same issue had also been decided by various High Courts in India i.e., Gauhati High Court in the case of Ram Narayan Sah v. Union of India 4, Punjab and Haryana High Court in the case of Jatinder Singh Banngu v. Union of India 5 and Telangana High Court in the case of Sri Venkataramana Reddy Patloola v. Deputy Commissioner of Income Tax 6. Some views have been taken by the Division Bench of Calcutta High Court in the case of Giridhar Gopal Dalmia Vs.Union of India v. Ors 7,

(Telangana) (Telangana) M.A.T. 1690 of 2023 decided on 25.09.2024. In these decisions, the various High Courts allowed the Writ Petitions in favour of the assessee in so far as the issue of jurisdiction is concerned.

(D). Admittedly, the Supreme Court has upheld the decision of the Bombay High Court in the case of Prakash Pandurang Patil v. Income Tax Officer, Ward 5 Panvel & Ors in S.L.P.(Civil) Diary No.39689/2025, dated 18.08.2025, wherein, the Bombay High Court has allowed the said Writ Petition by following the judgment of the Division Bench of the Bombay High Court in the case of Hexaware Technologies Limited v. Assistant Commissioner of Income Tax & 4 Ors. In view of the above factual position, we are of the considered view that the issue involved in the present batch of Writ Petitions is no more res integra.

(E). Considering the background in notifying the (E-Assessment Scheme of Income Escaping Assessment Scheme, 2022) notified by the Government of India on 29.03.2022, and in the light of the decisions of various High Courts stated supra and upon careful consideration of the contentions raised by the learned counsel appearing on either side, we hold that the impugned notices and orders which have been issued by the Jurisdictional Assessing Officer, or outside the faceless mechanism as provided under the provisions of Section 144 (b) read with Section 151 A and the “E-Assessment Scheme of Income Escaping Assessment Scheme, 2022” notified by the Government of India on 29.03.2022 under Section 151 A, is bad and illegal. It is made clear that the Jurisdictional Assessing Officer (“JAO”) had no jurisdiction to issue the impugned orders/notices.

(F). In view of the foregoing reasons, all these Writ Petitions are to be allowed in favour of the petitioners, by setting aside the impugned notices/orders.

8. Accordingly, these Writ Petitions are allowed.

(i) Consequently, the impugned notices/orders issued under Sections 148-A(b), 148-A(d) and 148 of the Income Tax Act, 1961, in all these Writ Petitions, are hereby set-aside.

(ii) The consequential orders, if any, shall stand set-aside.

9. There shall be no order as to costs.

As a sequel, miscellaneous petitions pending, if any, shall stand closed.”

We, thus, respectfully follow the judgment of the Hon’ble Jurisdictional High Court in the case of Mr. Kishan Kumar Thotakura & Ors. v. The Assistant Commissioner of Income-tax (supra), and on the same terms hold the impugned orders and notices issued by the Jurisdictional Assessing Officer (JAO), i.e., outside the faceless mechanism as provided in Section 144(b) r.w Section 151A and the “E-Assessment Scheme of Income Escaping Assessment Scheme, 2022” notified by the Government of India on 29.03.2022 under Section 151A of the Act, as bad and illegal. Consequent thereto, we herein set aside the order passed by the CIT(A), and quash the impugned assessment order passed by the ACIT, Central Circle-1, Visakhapatnam, i.e., JAO under Section 147 of the Act, dated 27/03/2023, for want of a valid assumption of jurisdiction on his part.

26. Before parting, we may herein observe that as the assessment in the case of the assessee was framed by the ACIT, Central Circle-1, Visakhapatnam, therefore, we remained under an impression that the initiation of proceedings under section 148A of the Act and using the notice under section 148 of the Act could have been carried out by the Jurisdictional Assessing Officer (JAO), but thereafter corrected ourselves on the said aspect. On a careful perusal of section 144B of the Act read with CBDT Order, dated 06/09/2021, we found that though the same gives an exemption from following the mandatory Faceless procedure, but the said exemption is limited only to the extent of passing of the assessment orders in two cases, viz., (i) central charge; and (ii) international tax charge. Our aforesaid view is fortified by the judgment of the Hon’ble High Court of Telangana in the case of Shri Venkataramana Reddy Patloola v. DCIT, Circle- 1(1), Hyderabad and

“21. In order to understand the provision in a better way, we deem it proper to split it as under:

“3. Scope of the Scheme- For the purpose of this Scheme:-

(a) assessment, reassessment of recomputation under Section 147 of the Act,

(b) issuance of notice under Section 148 of the Act,

shall be through automated allocation, in accordance with risk management strategy formulated by the Board as referred to in Section 148 of the Act for issuance of notice in a faceless manner, to the extent provided in Section 144B of the Act with reference to making assessment or reassessment of total income or loss of assessee.” (Scheme)

22. A careful reading of the scheme points out that law makers consciously provided two different sub clauses (a) and (b). Clause 3 ‘(a)’ specifically deals with assessment, reassessment and recomputation whereas sub-clause ‘(b)’ deals with notice under Section 148 of the Act and gives reference of Section 144B for providing ‘extent’ for the purpose of ‘assessment’ and ‘reassessment’. Putting it differently, sub-clause (b) of Clause 3 of the scheme, before use of word ‘and’ is complete in itself and makes it obligatory to issue notice under Section 148 as per automated allocation procedure envisaged in clause 2 (b) of the scheme. The sentence after use of word ‘and’ in sub-clause (b) of clause 3 talks about ‘extent’ provided in Section 144B with reference to assessment and reassessment. The second portion of sub-clause (b) of clause 3 after ‘and’ does not deal with issuance of notice under Section 148 of the Act. Therefore, subclause (b) of clause 3 is in two parts. First part is confined to notice under Section 148 of the Act, whereas, second part after the word ‘and’ is confined to ‘assessment’ and ‘reassessment’.

23. It is noteworthy that the order of CBDT dated 06.09.2021 deals with “assessment orders”. The said order is passed in exercise of power under Section 144B of the Act. The order of CBDT is clear that direction was issued about passing of “assessment orders” by the National Faceless Assessment Centre under Section 144B of the Act except in two situations, one of which is passing of assessment orders in cases assigned to International Tax Charges.

24. Thus, there is no cavil of doubt that Section 144B of the Act and order of CBDT dated 06.09.2021 give exemption from following the mandatory faceless procedure only in relation to passing of assessment orders in cases of central charges and international tax charges. Any other interpretation would amount to doing violence with the language employed in the scheme/notification dated 29.03.2022, Section 144B(2) of the Act and order dated 06.09.2021. Since in our view, the plain and unambiguous language used in the scheme and order dated 06.09.2021 shows that the notice under Section 148 does not fall within the ‘exception’, the judgments cited by the learned Senior Standing Counsel for Income Tax Department are of no assistance. The Taxpayer is nowhere distinguished between NRIs and Indian Citizens. The notice issued under Section 148 must comply with the requirement of the Scheme whether or not the Taxpayer is NRI/Indian Citizen. Thus, the second limb of argument of the learned Senior Standing Counsel for Income Tax Department deserves to be rejected.”

27. Accordingly, the passing of order under section 148A(d), dated 30/03/2022 and issuance of notice under section 148 of the Act, dated 30/03/2022 both by the ACIT, Central Circle-1, Visakhapatnam, i.e., JAO, i.e., outside the Faceless mechanism as provided in section 144(6) r.w.s 151A and the “E-assessment Scheme of Income Escaping Assessment Scheme, 2022 notified by the Government of India on 29/03/2022 under section 151A of the Act, being bad and illegal cannot be sustained and renders the consequential assessment as invalid and bad in law.

28. As we have quashed the assessment for want of valid assumption of jurisdiction by the ACIT, Central Circle-1, Visakhapatnam for framing the impugned assessment vide order passed under Section 147, dated 27/03/2023, based on the Notice u/s 148 of the Act, dated 30/03/2022 issued by the him, i.e., JAO, therefore, we refrain from adverting to the other grounds based on which the assessee has assailed the impugned order of the CIT(A) before us, which, thus, are left open.

29. Resultantly, the order passed by the ACIT, Central Circle-1, Visakhapatnam i.e., Jurisdictional Assessing Officer (JAO) under Section 147 of the Act, dated 27/03/2023, is quashed for lack of valid assumption of jurisdiction by him.

30. In the result, the appeal filed by the assessee in ITA No.385/Viz/2025 is allowed in terms of our aforesaid observations.

ITA No.386 & 387/Viz/2025 (AY: 2018-19)

31. We have quashed the order passed by the Assessing Officer under section 147 of the Act, dated 27/03/2023 for want of valid assumption of jurisdiction on his part, therefore, the impugned penalties imposed by him, viz., (i) 271AAC(1) of the Act, dated 21/08/2023; and (ii) under section 270A of the Act, dated 21/08/2023, which have their foundation in the impugned assessment order cannot survive on a stand alone basis and is to meet the same fate. Accordingly, the subject penalties imposed by the AO are in terms of our aforesaid observations quashed.

32. Resultantly, ITA No. 386 and 387/Viz/2025 filed by the assessee are in terms of our aforesaid observations allowed.