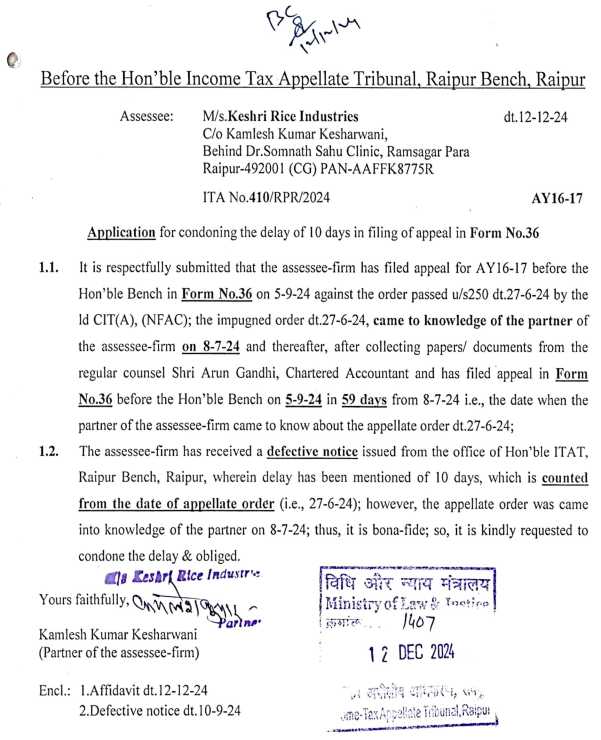

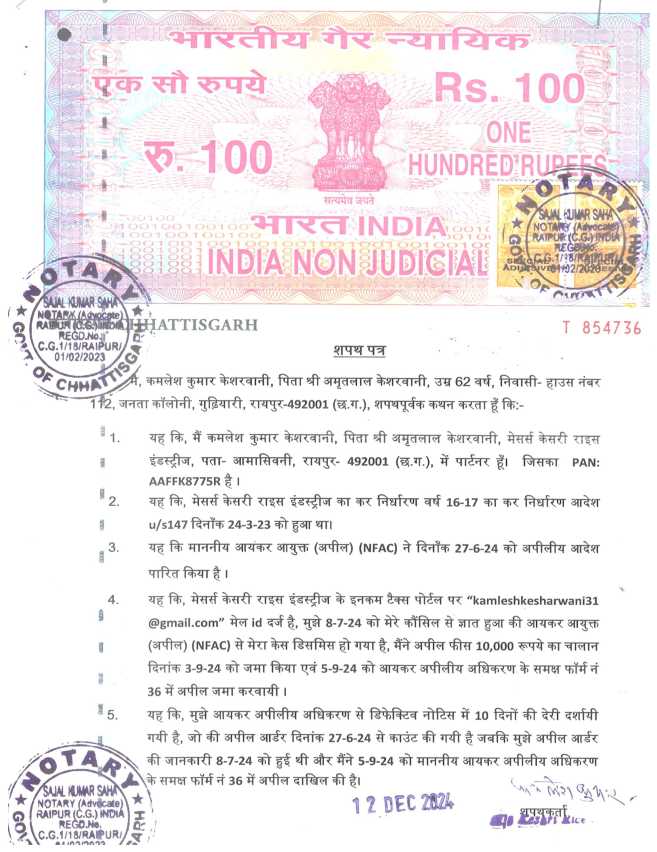

4. Based on aforesaid submission, it is requested by the Ld. AR that the appellate order by the First Appellate Authority passed on 27.06.2024, came to the knowledge of assessee firm on 08.07.2024, and, thereafter, in the process of collection of papers and documents from the regular counsel, the appeal could have been filed on 05.09.2024.

5. It was the submission that the information about passing, or order was come to the knowledge of the assessee through its counsel and, therefore, the moderate delay of 10 days was occurred in filing of the appeal. It is further clarified that the delay involved was on account of Bonafide reasons without any intentional or intended reasons on the part of assessee. Therefore, the delay may kindly be condoned.

6. Dr. Priyanka Patel, Ld. Sr. DR on the other hand objected to the delay, but since the delay involved is not for inordinate period, thus, have requested to decide the same as permissible under the law.

7. We have considered the reasons of delay submitted by the assessee and found substance that the delay was not on account of any careless, casual or lackadaisical approach on the part of assessee, whereas the delay was on account of sufficient cause with no intentional laps on the part of assessee, also since, the period of delay is moderate, we, therefore, are of the opinion that the delay in present case needs to be condoned, in the interest of justice.

8. Consequently, the delay involved in present appeal is condoned and the registry is directed to put up the matter for regular hearing.

9. The brief facts of the case culled out from the order of Ld. CIT(A), are as under:

In this case, an information was received from ADIT (Inv) Raipur that the appellant had routed its funds amounting to Rs.1,22,40,000/- through the facility and the bank account in the name of M/s. Shri Shyamji Rice Agrotech (Prop. Shri Shushil Kumar Maurya), the concern which during the enquiry conducted by the Inv. Wing was found doing -no real business and indulged only in entry providing activities in lieu of commission. The appellant did not file return of income for A.Y. 2016-17. As the appellant failed to reply to the notices issued, the A.O added Rs. 1,22,40,000/- as unexplained income of the appellant u/s. 69A of the Act and Rs. 3,64,334/- being net profit as per audit report as the appellant had not filed ITR. Order u/s. 147 r.w.s 144 dated 24.03.2023 was passed accordingly. Aggrieved appellant filed this appeal.

10. Aggrieved with the aforesaid addition u/s 69A by the Ld. AO, assessee preferred an appeal before the Ld. CIT(A), but with no success. Therefore, the assessee had preferred the present appeal, which is under consideration before us.

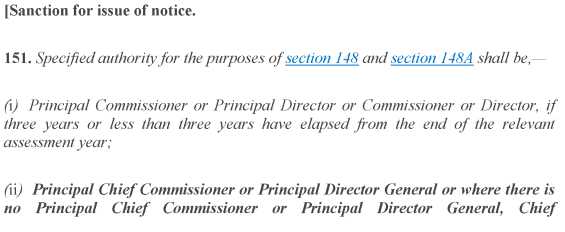

11. At the outset, Ld. AR on behalf of the assessee, referring to ground no. 1 of the present appeal have assailed the assessment, challenging the validity of approval granted by the competent / sanctioning authority u/s 151 of the Act. It was the submission that in absence of valid approval u/s 151 which is without application of mind and in mechanical manner by the PCIT-1, Raipur, who is not the specified authority to grant approval u/s 151 of the present case, the order u/s 148A(d) and notice u/s 148 issued, become invalid on account of approval by a non-specified authority, having no jurisdiction to grant the approval as prescribed under the law. To substantiate this fact, Ld. AR submitted that the year under consideration is assessment year 2016-17 and as per provisions of section 148. The assessment in the present case is permitted to be reopened maximum within 6 years from the end of relevant assessment year. Accordingly, the date of 6 year came to be culminated on 31 March 2023, accordingly, the notice u/s 148 was issued on 02.07.2022, which is within the prescribed time frame, thus, there was no dispute by the assessee regarding the time limitation for reopening of assessment. However, the dispute has been raised qua the validity of sanction u/s 151, as in the present case the reopening proceedings are initiated by issuance of notice u/s 148 dated 02.07.2022, on which the relevant provisions of section 151(ii) under new regime are applicable, since the proceedings are initiated after 3 years from the end of the relevant AY.

12. Ld. AR drew our attention to the relevant provisions of section 151 under new regime effective from 01.04.2021 specifying the specified authority for the purpose of section 148 / 148A, for the sake of better interpretation the relevant provisions are extracted as under:

13. It is further submitted by the Ld. AR that by virtue of direction by the Hon’ble Apex Court in the case of Union of India v. Ashish Agrawal dated 03.10.2024, wherein the Hon’ble Apex Court had explain the analogy drawn in the case of Ashish Agrawal (supra), extending the limitation under TOLA read with provisions of section 151 under new regime, the same is extracted as under:

b. Interplay of Ashish Agarwal with TOLA

108. The Income-tax Act read with TOLA extended the time limit for issuing reassessment notices under section 148, which fell for completion from 20 March 2020 to 31 March 2021, till 30 June 2021. All the reassessment notices under challenge in the present appeals were issued from J April 2021 to 30 June 2021 under the old regime. Ashish Agarwal (supra) deemed these reassessment notices under the old regime as show cause notices under the new regime with effect from the date of issuance of the reassessment notices. The effect of creating the legal fiction is that this Court has to imagine as real all the consequences and incidents that will inevitably flow from the fiction. East End Dwellings Co. Ltd. v. Finsbury’ Borough Council [1952] AC 109. [Lord Asquith, in his concurring opinion, observed: “If you are bidden to treat an imaginary state of affairs as real, you must surely, unless prohibited from doing so, also imagine as real the consequences and incidents which, if the putative state of affairs had in fact existed, must inevitably have flowed from or accompanied it.”] Therefore, the logical effect of the creation of the legal fiction by Ashish Agarwal (supra) is that the time surviving under the Income-tax Act read with TOLA will be available to the Revenue to complete the remaining proceedings in furtherance of the deemed notices, including issuance of reassessment notices under section 148 of the new regime. The surviving or balance time limit can be calculated by computing the number of days between the date of issuance of the deemed notice and 30 June 2021.

109. If this Court had not created the legal fiction and the original reassessment notices were validly issued according to the provisions of the new regime, the notices under section 148 of the new regime would have to be issued within the time limits extended by TOLA. As a corollary, the reassessment notices to be issued in pursuance of the deemed notices must also be within the time limit surviving under the Income-tax Act read with TOLA. This construction gives full effect to the legal fiction created in Ashish Agarwal (supra) and enables both the assesses and the Revenue to obtain the benefit of all consequences flowing from the fiction. See State of A P v. A P Pensioners Association 13 SCC 161. [This Court observed that the “legal fiction undoubtedly is to be construed in such a manner so as to enable a person, for whose benefit such legal fiction has been created, to obtain all consequences flowing therefrom.”]

110. The effect of the creation of the legal fiction in Ashish Agarwal (supra) was that it stopped the clock of limitation with effect from the date of issuance of Section 148 notices under the old regime I which is also the date of issuance of the deemed notices]. As discussed in the preceding segments of this judgment, the period from the date of the issuance of the deemed notices till the supply of relevant information and material by the assessing officers to the assesses in terms of the directions issued by this Court in Ashish Agarwal (supra) has to be excluded from the computation of the period of limitation. Moreover, the period of two weeks granted to the assesses to reply to the show cause notices must also be excluded in terms of the third proviso to Section 149.

111. The clock started ticking for the Revenue only after it received the response of the assesses to the show causes notices. After the receipt of the reply, the assessing officer had to perform the following responsibilities: (i) consider the reply of the assessee under section 149A(c); (ii) take a decision under section 149A(d) based on the available material and the reply of the assessee; and (iii) issue a notice under section 148 if it was a fit case for reassessment. Once the clock started ticking, the assessing officer was required to complete these procedures within the surviving time limit. The surviving time limit, as prescribed under the Income-tax Act read with TOLA, was available to the assessing officers to issue the reassessment notices under section 148 of the new regime.

112. Let us take the instance of a notice issued on I May 2021 under the old regime for a relevant assessment year. Because of the legal fiction, the deemed show cause notices will also come into effect from 1 May 2021. After accounting for all the exclusions, the assessing officer will have sixty-one days [days between I May 2021 and 30 June 2021] to issue a notice under section 148 of the new regime. This time starts ticking for the assessing officer after receiving the response of the assessee. In this instance, if the assessee submits the response on 18 June 2022, the assessing officer will have sixty-one days from 18 June 2022 to issue a reassessment notice under section 148 of the new regime. Thus, in this illustration, the time limit for issuance of a notice under section 148 of the new regime will end on 1 8 August 2022.

113. In Ashish Agarwal (supra), this Court allowed the assesses to avail all the defenses, including the defence of expiry of the time limit specified under section 149(1). In the instant appeals, the reassessment notices pertain to the assessment years 2013-2014, 2014-2015, 2015-2()16, 2016-2017, and 2017-2018. To assume jurisdiction to issue notices section 148 with respect to the relevant assessment years, an assessing officer has to: (i) issue the notices within the period prescribed under section 149(1) of the new regime read with TOLA; and (ii) obtain the previous approval of the authority specified under section 151. A notice issued without complying with the preconditions is invalid as it affects the jurisdiction of the assessing officer. Therefore, the reassessment notices issued under section 148 of the new regime, which are in pursuance of the deemed notices, ought to be issued within the time limit surviving under the Income-tax Act read with TOLA. A reassessment notice issued beyond the surviving time limit will be time-barred.

G. Conclusions

114. In view of the above discussion, we conclude that:

(a) After I April 2021, the Income-tax Act has to be read along with the substituted provisions;

(b) TOLA will continue to apply to the Income-tax Act after I April 2021 if any action or proceeding specified under the substituted provisions of the Income-tax Act falls for completion between 20 March 2020 and 31 March 2021;

(c) Section 3(1) of TOLA overrides Section 149 of the Income-tax Act only to the extent of relaxing the time limit for issuance of a reassessment notice under section 148;

(d) TOLA will extend the time limit for the grant of sanction by the authority specified under section 151. The test to determine whether TOLA will apply to Section 151 of the new regime is this: if the time limit of three years from the end of an assessment year falls between 20 March 2020 and 31 March 2021, then the specified authority under section 151(i) has extended time till 30 June 2021 to grant approval:

(e) In the case of Section 151 of the old regime, the test is: if the time limit of four years from the end of an assessment year falls between 20 March 2020 and 31 March 2021, then the specified authority under section 151(2) has extended time till 31 March 2021 to grant approval;

(f) The directions in Ashish Agarwal (supra) will extend to all the ninety thousand reassessment notices issued under the old regime during the period I April 2021 and 30 June 2021;

(g) The time during which the show cause notices were deemed to be stayed is from the date of issuance of the deemed notice between 1 April 2021 and 30 June 2021 till the supply of relevant information and material by the assessing officers to the assesses in terms of the directions issued by this Court in Ashish Agarwal (supra), and the period of two weeks allowed to the assesses to respond to the show cause notices; and

(h) The assessing officers were required to issue the reassessment notice under section 148 of the new regime within the time limit surviving under the Income-tax Act read with ‘TOLA. All notices issued beyond the surviving period are time barred and liable to be set aside;

14. Based on aforesaid submission, Ld. AR submitted that since the order u/s 148A(d) along with notice u/s 148 was issued to the assessee dated 02.07.2022 i.e., after 3 years from the last date of assessment year 2016-17 i.e., 31.03.2017. In such case, an approval u/s 151(ii) granted by the Ld. PCIT stands invalid as the specified authority in the case of assessee is Principal Chief Commissioner or Principal Director General or Where there is no Principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General will be the specified authority.

15. To fortify the aforesaid contentions, Ld. AR further placed his reliance on the following case laws:

(i) ACIT v. Manish Financial in ITA No. 5055 & 5050/Mum/2024, vide order dated 02.12.2024

14. We heard the parties and perused the material on record. In assessee’s case for AY 2016-17 pursuant to the directions of the Hon’ble Supreme Court in the case of Ashish Agrawal, the AO passed an order under section 148(d) of the Act and issued a notice under section 148 on 30.07.2022. From the above observations of the Hon’ble Supreme Court it is clear that the though the prior approval under section 148A(b) and 148(d) were waived in terms of the decision of Ashish Agarwal (supra), for issue of notice under section 148A(a) and under section 148 on or after 1 April 2021, the prior approval should be obtained from the appropriate authorities specified under Section 151 of the new regime. The provisions of section 151 of the Act under the new regime read as under:

Sanction for issue of notice.

151. Specified authority for the purposes of section 148 and section 148A shall be,—

I. Principal Commissioner or Principal Director or Commissioner or Director, if three years or less than three years have elapsed from the end of the relevant assessment year;

II. Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General, if more than three years have elapsed from the end of the relevant assessment year.

15. In assessee’s case from the perusal of para 3 of the notice issued under section 148 for AY 2016-17 we notice that the same is issued with the prior approval of Pr. CIT-19 Mumbai accorded on 29.07.2022 vide reference No. Pr. Cit and this fact is not contravened by the ld DR. For AY 2016-17, the period of three years have elapsed as of 31.03.2020 and the notice is issued beyond three years on 30.07.2022. Therefore as per the decision of the Hon’ble Supreme Court, the approval should have been obtained under the amended provisions of section 151(ii) of the Act i.e. the approval should have been obtained from the Principal Chief Commissioner whereas the approval has been obtained from Pr.CIT as stated in the notice under section 148 itself. Therefore we see merit in the contention of the assessee that the notice under section 148 for AY 2016-17 isissued without obtaining the prior approval from the appropriate authority. Accordingly, we hold that the notice under section 148 is invalid and the consequent assessment under section 147 is liable to be quashed.

(ii) Manoj Rajput v. DCIT- 1(1) in ITA No. 360/RPR/2023, vide order dated 22.10.2024. 15. We, thus, in terms of our aforesaid observation concur with the Ld. AR that in the present case before us for A.Y.2017-18, wherein notice u/s.148 of the Act was issued on 30.06.2022, i.e. beyond a period of three years from the end of the assessment year, the A.O. was statutorily obligated to have obtained the approval from either of the authorities specified u/s. 151(ii) of the extant law, viz. Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General. However, as the A.O. had obtained the approval from the Pr. Commissioner of Income Tax, i.e. an authority who was not vested with any jurisdiction as per the mandate of Section 151 of the Act (as made available on the statute w.e.f 01.04.2021), therefore, the assessment so framed by him u/s.147 r.w.s. 144 r.w.s. 144B of the Act, dated 11.05.2023 being devoid and bereft of valid assumption of jurisdiction is liable to be quashed. Accordingly, we quash the assessment framed by the A.O u/s.147 r.w.s. 144 r.w.s. 144B of the Act, dated 11.05.2023 in terms of our aforesaid observations.

(iii) Gigantic Mercantile (P) Ltd v. Assistant Commissioner of Income Tax in Writ Petition No. 1498 of 2023, dated 26.07.2024 (Bom HC). 8. It is apparent that the sanction accorded in the instant case was required to be granted under Section 151(ii) of the Act since more than three years had lapsed from the end of the relevant Assessment Year. The period of three years would expire on 3 1 st March, 2020 while the first notice (which now was purported to be a notice under Section 148A), came to be issued on 30t June, 2021 i.e. one year and three months after the lapse of three years. The sanction in the instant case has been granted by the Principal Commissioner of Income-tax-3. For cases where the reassessment is sought to be undertaken more than three years after the end of the relevant Assessment Year, the specified authorities who may sanction the reassessment are of a more senior and higher rank. Section 151 of the Act contains an inherent check and balance – when the reopening is sought to be initiated after a longer period, application of mind by the specific authorities who are even more senior (as compared with the authorities who are relatively subordinate, who are listed in Section 15 1 (i) to sanction reassessments initiated within three years) would have to be involved.

9. It is an admitted position that the sanction in the instant case had not been granted by any authority empowered under Section 15 1 (ii). Consequently, indeed, the matter at hand would be covered by the decision in Cipla, which inherently deals with the findings in Siemens. The following extracts would be relevant: –

9. The record clearly indicates that the sanction in the present case was issued by the Principal Commissioner which can only be in respect of cases if three years or less than three years have elapsed from the end of the relevant assessment year, as would fall under the provisions of clause (i) of Section 151 of the Act. As in the present case the assessment year in question is 20 16-17 and the impugned notice itself has been issued on 30 July. 2022, it is issued after a period more than 3 years having elapsed from the end of the said assessment year. hence, clause (ii) of Section 151 of the Act was applicable, which required the sanction to be issued by either Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General. Chief Commissioner or Director General for issuance of notice under Section 148 of the Act.

10. As rightly pointed out at the bar, such issue fell for consideration of the Division Bench of this Court in Siemens Financial Services Pvt. Ltd. (supra), wherein the Division Bench considered the provisions of Section 151 of the Act read with the provisions of Section 148A(b), the latter provision clearly providing that prior to issuance of any notice under Section 148 of the Act, the assessing officer shall provide an opportunity of being heard to the assessee only after considering the cumulative effect of Section 148A(b) read with Section 151 of the Act and as provided under sub-clause (d), the assessing officer shall decide on the basis of material available on record including reply of the assessee, whether or not it is a fit case to issue a notice under Section 148 by passing an order, with the prior approval of specified authority within one month from the end of the month in which the reply is received, It is held that the sanction of the specified authority has to be obtained in accordance with the law existing when the sanction is obtained and, therefore, the sanction is required to be obtained by applying the amended section 151(H) of the Act and since the sanction has been obtained in terms of section 15 1 (i) of the Act, the impugned order and impugned notice are bad in law and should be quashed and set aside.

[Emphasis Supplied]

10. In this view of the matter the Petition deserves to be allowed since the decision in Cipla indistinguishably a plies to the facts of the case involved in the matter at hand. In the instant case too, Assessment Year 2016 17 is involved and the sanction is accorded by the Principal Commissioner of Income-tax. Consequently, the Writ Petition deserves to be allows, which we hereby do in terms of prayer clause (a) which reads thus:-

a. that this Hon’ble Court be pleased to issue a Writ of Certiorari or any other writ order or clirection under Article 226 of the Constitution of India calling for the records of the case leading to the issue of the ilnpugned initial notice (Exhibit J) dated May 24, 2022, passing of the impugned order (Exhibit M) dated July 29, 2022 and the issue of the impugned notice (Exhibit N) dated July 29, 2022 and after going through the same and examining the question of legality thereof quash, cancel and set aside the impugned initial notice (Exhibit J) dated May 24, 2022, passing of the impugned order (Exhibit M) dated July 29, 2022 and the issue of the impugned notice (Exhibit N) dated July 29,2022;

(iv) Cipla Pharma and Life Sciences Ltd. v. DCIT in Writ Petition No. 149 of 2023 dated 02.07.2024, (Bom HC). 8. On a plain reading of Section 148A it is clear that the Assessing officer before issuing any notice under section 148 is required to follow the procedure as set out in clauses (a) to (d) ofSection 148A. One of the pre-conditions as ordained by clause (d) ofSection 148A is that an order under such provision can be passed by the Assessing ()fficer only with the approval of “Specified Authority”. Thus, necessarily when clause (d) ofSection 148A provides for prior approval specified authority, it relates to the provisions of Section 151 of the Act providing for ‘Specified authority for the purposes ofSection 148 and Section 148A ofthe Act’. In the present case, Section 151 as amended by the Finance Act, 2021 and Section 148A as also introduced by Finance Act, 2021 have become applicable, as although the assessment year in question is 2016-17 in respect of which the assessrnent is sought to be reopened by issuance ofnotice under section 148, which is dated 30 July, 2()22. Such amended provision would squarely become applicable the date of notice under section 148 itself being 30 July, 2()22.

9. The record clearly indicates that the sanction in the present case was issued by the Principal Commissioner which can only be in respect ofcases if three years or less than three years have elapsecl from the end of the relevant assessment year, as would fill] under the provisions of clause (i) of Section 151 of the Act. As in the present case the assessment year in question is 2016-17 and the impugned notice itself has been issued on 30 July, 2022, it is issued after a period more than 3 years having elapsed from the end of the said assessment year, hence, clause (ii) of Section ‘1 5 1 of the Act was applicable, which required the sanction to be issued by either Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General for issuance of notice under Section 148 of the Act.

10. As rightly pointed out at the bar, such issue fell for consideration of the Division Bench of this Court in Siemens Financial Services Pvt. Ltd. (supra), wherein the Division Bench considered the provisions of Section 151 of the Act read with the provisions of Section 148A(b), the latter provision clearly providing that prior to issuance of any notice under Section 148 of the Act, the assessing officer shall provide an opportunity of being heard to the assessee only after considering the cumulative effect of Section 148A(b) read with Section 151 of the Act and as provided under sub-clause (d), the assessing officer shall decide on the basis of material available on record including reply of the assessee, whether or not it is a fit case to issue a notice under Section 148 by passing an order, with the prior approval of specified authority within one month from the end of the month in which the reply is received. It is held that the sanction of the specified authority has to be obtained in accordance with the law existing when the sanction is obtained and, therefore, the sanction is required to be obtained by applying the amended section 15 1(ii) of the Act and since the sanction has been obtained in terms of section 15 1(i) of the Act, the impugned order and impugned notice are bad in law and should be quashed and set aside.

11. Insofar as the respondent’s case based on the notification dated 31 March, 202() issued under the Taxation and ()ther Laws (Relaxation and Amendment of Certain Provisions) Act, 202() (for short, ‘TOLA’) was concerned, the Court held that such notification was a subordinate legislation and it could not override the statute enacted by the Parliarnent and in that regard, the position in law was discussed by the Division Bench in paragraph 27 of the said decision.

12. In the present ease, it is not in dispute that an appropriate sanction of the specified authority as per the provisions of Section 151(ii) of the Act was not obtained and (Or such reason, certainly, as held by this Court in Siemens Financial Services Pvt. Ltd. (supra), the impugned notices would be rendered bad and illegal. The petition accordingly needs to succeed on such ground of the Court requiring to delve on such issues of challenge as raised by the petitioner as also prior procedure adopted in that regard.

16. Based on aforesaid submissions, it was the prayer by Ld. AR that the sanction by the specified authority u/s 151(ii) was not in accordance with law, therefore, order u/s 148A(d) and the notice u/s 148 issued beyond 3 years from the end of the relevant AY, are invalid for the want of approval from the specified authority. It was, therefore, the prayer that the reopening assessment order passed u/s 147 on the basis of order u/s 148A(d) and notice u/s 148 dated 30.06.2021 is invalid, bad in law and cannot sustained in the eyes of law, therefore, the same is liable to be quashed.

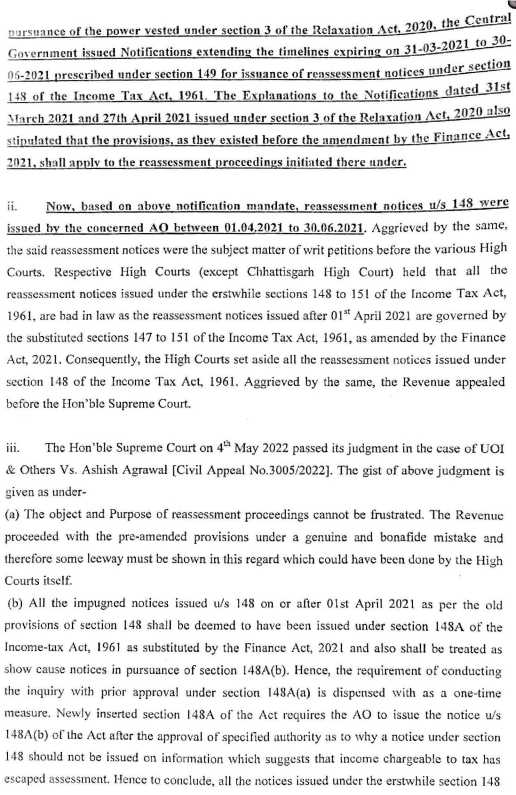

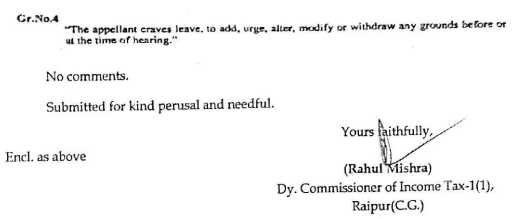

17. In response, on the aforesaid issue, Ld. Sr. DR on behalf of the revenue have obtained a report from the Ld. AO, which is furnished

before us for our consideration, the same is culled out as under: