ORDER

Pawan Singh, Judicial Member.- This appeal by the assessee is directed against the order of NFAC/Learned Commissioner of Income Tax [Ld. CIT(A)] dated 22.09.2023 for A.Y. 2015-16.

The assessee in its appeal has raised following ground of appeal:-

“Based on the facts and circumstances of the case, the Appellant respectfully craves to prefer an appeal against the order dated 22 September 2023 passed under section 250 of the Income-tax Act, 1961 (the Act), by the Commissioner of Income-tax (Appeals), National Faceless Appeal Centre, Delhi [CIT(A)] in respect of the appeal filed against the assessment order dated 27 December 2017 passed under section 143(3) of the Act, on the following grounds, each of which are without prejudice to one another

1. Consideration received in respect of sale of shares taxed as business income:

1.1. On the facts and in the circumstances of the case and in law, the CIT(A) erred in upholding the action of the Assessing Officer (AO) in taxing the entire consideration received on sale of shares of Hyderabad Chemicals Lid (HCL) held as an investment since the last 35 years to Nihon Nohyaku Co. Ltd (NNCL) pursuant to a Share Purchase Agreement (SPA) under the head “Profits and Gains of Business or Profession” instead of the head “Capital Gains.”

1.2. On the facts and in the circumstances of the case and in law, the CIT(A) erred in upholding the action of the AO that the aforesaid sale of shares is an adventure in the nature of trade and taxable as business income.

1.3. On the facts and in the circumstances of the case and in law, the CIT(A) erred in summarizing, without any factual basis, that the difference between the duly negotiated share price and the value as per the valuation report was the price paid for management control.

1.4. On the facts and in the circumstances of the case and in law, the CIT(A) erred in upholding the action of the AO that the transfer of shares to NNCL pursuant to a SPA is a transfer of business and the provisions of section 28(va) were applicable to the aforesaid transfer of shares.

1.5. the facts and in the circumstances of the case and in law, the CIT(A) erred in not dealing with the Ground Nos. 1.3 (in respect of applicability of section 28(1), 1.4 (in respect of applying Rule 11UA for valuation of shares), 1.5. (v) (in respect of arriving at a separate value for non-compete fees), 1.6, 1.7, 1.8 and 19 of the appeal filed before him.

2. On the facts and in the circumstances of the case and in law, the CIT(A) erred in treating Ground No.2 of the appeal before him as infructuous, and thus erred in not giving any finding in respect of the non-set off of longterm capital loss on sale of UTI Units against the long-term capital gains on sale of shares of Shroff Engg. Limited

3. On the facts and in the circumstances of the case and in law, the CIT(A) erred in treating Ground No 3 of the appeal before him as infructuous, and thus erred in not giving any finding in respect of the non-granting of exemption under sections 54F and 54EC on the long-term capital gains on sale of shares of Shroff Engg Limited.

4. On the facts and in the circumstances of the case and in law, the CIT(A) erred in treating Ground No.4 of the appeal before him as infructuous, and thus erred in not giving any finding in respect of the correct amount of short term capital loss to be carried forward.

5. On the facts and in circumstances of the case and in law, the CIT(A) erred in upholding the action of the AO in levying interest under section 234B of the Act treating the same as compensatory, without considering the fact that self-assessment tax amounting to Rs.9,25,000/- paid by the Appellant was not considered while levying the said interest.

6. On the facts and in circumstances of the case and in law, the CIT(A) erred in upholding the action of the AO in levying interest under section 234C of the Act treating the same as compensatory, without appreciating the fact that interest under section 234C ought to be levied only on the basis of the income as per the return of income.

7. The Appellant craves leave to add, alter, amend, delete or withdraw any or all of the grounds of appeal at or before hearing of the appeal so as to enable the Income-tax Appellate Tribunal to decide the appeal according to law.”

2. Brief facts of the case are that the assessee is an individual, filed his return of income for A.Y. 2015-16 on 29.08.2015 declaring his total income of Rs. 3.14 crore. In the computation of income, the assessee has shown income from salary of Rs. 31,47,555/- income from other sources of Rs. 9,70,278/- and long-term capital gain of Rs. 2.75 crore. Case was selected for scrutiny. During assessment the assessing officer (AO) noted that the assessee has claimed long term capital gain of Rs. 8.48 crore on sale of shares of Hyderabad Chemicals Limited (HCL). The assessee made investment for acquiring house property at Rs. 6.69 crore and claim exemption under section 54F. The assessee has shown sale consideration of 10500 share of Hyderabad Chemicals Limited (HCL) for a total consideration of Rs. 15.64 crore and claimed the expenditure on transfer of such claim at Rs.42,42,430/-. The assessee has also shown to have acquired 1189 share of Hyderabad Chemicals Limited as gift from his family member Hrishit Shroff on different states. The assessee has also dealt with script of different shares like Hyderabad Chemicals Limited and Tech Mahindra Limited which is not the subject matter of present appeal. The dispute in the present appeal relates to capital gain show from shares of Hyderabad Chemicals Limited. The assessing officer recorded background to acquisition of shares by assessee and in para 4 of assessment order. The AO recorded that Hyderabad Chemicals Limited was in incorporated in 2013 after taking over pesticide business of demerged company Vibrant Green Tech India Pvt Ltd (which was formerly known as Hyderabad Chemicals Limited). The company and its director are shareholder decided to sale 74% of stake to a foreign (Japans Company) Nihon Nohyaku Company Ltd and prepare share purchase agreement. Such work was assigned to Desai and Dewangi Advocates of Linten Chambers Dalal Street, Fort Mumbai. Board of Directors of Hyderabad Chemicals Limited, the company appointed Raju and Prasad Chartered Accountant for valuation of its shares, who valued the equity shares of company at Rs. 7845.23/- per equity share as on 31.12.2014. Nihon Nohyaku Company Ltd, a Japan based company which acquired 74% of stake in HCL. HCL paid various charges for preparation of share purchase agreement and share valuation report and has shown to have incurred total of Rs. 14.64 crore. Such expenses were initially borne Vibrant Greentech (India) Pvt Ltd. The expenditure incurred was recovered from each shareholder through their contribution of an amount of Rs. 1067.40 per share of HCL. The expenses were distributed as per share holding pattern. On the basis of aforesaid background, the assessing officer was of the view that the assessee along with other shareholder sold the majority shareholding in HCL through single transaction by way of share purchase agreement. The AO issued show cause notice dated 06.12.2027. In the show cause notice the AO recorded that out of total sale proceed of Rs. 15.64 Crore on shares of HCL the assessee offered net capital gain at Rs. 2.74 crore and also claimed exemption under section 54F of Rs. 6.69 crore. was claimed. No documentary evidence for investment in property was furnished. As per sale purchase agreement share price was fixed at Rs. 15401/- and sale receipt should be of Rs. 19.08 crore but as per bank statement the assessee has received only Rs. 18.45 crore. As per computation of capital gain the assessee officer Rs. 15.64 crore as full value of consideration. As per share purchase agreement remaining block amount and indemnity escrow account will be paid after completion of 100% share transfer. The AO asked the assessee has to why entire sale consideration accrued to assessee on transfer of sale of share be added to the income of assessee in view of section 28((ii) and CBDT Circular dated 02.05.2017.

3. The assessee filed details reply along with relevant part of sale purchase agreement of share, report of valuation Desai and Dewangi Advocates. The contents of reply of assessee is recorded in para 7.1 of assessment order. In the reply, the assessee stated that he was a shareholder of HCL (HCL was a pioneer in manufacturing pesticide formulation for over three decades and was ISO 9001-2008 certified company). The assessee was holding 12389 share which were 3.78% of total shares. The assessee has been holding this share as investment for more than 25 years. Nihon Nohyaku Company Ltd the company (NNCL) is a Japan based company engaged in manufacturing and development of chemicals and sale of HCL in Japan and worldwide. Finding opportunity in Indian market entered into share purchase agreement in Nov 2024 to purchase 74% share of HCL at the price of 15401 per share. The said price was subjected to pre and post closing net working capital and net adjustment and final sale price was 14896.17 per share. Further as per share purchased agreement the shareholder agree to comply with non-compete agreement as per clause 10 of said agreement. However, no consideration was taken by the assessee from NNCL for non-complete clauses. During the year under consideration the assessee sold 12389 shares held in HCL to NNCL. In the return of income, the assessee has shown profit from transfer of said share and offered it as long-term capital gain. The assessee further stated that provisions of section 28(va) are applicable only to the person, who are engaged in the business and received any consideration towards non complete fees. The assessee was merely shareholder. He was not a director and nor involving in carrying of business. He has received consideration only for transfer of shares. No consideration towards not complete fees as per agreement is received. Thus, provision of section 28(va) cannot be made applicable. In alternative and without prejudice contention with was submitted that even if any consideration is allocated to a non-complete fee, then a same ought to be tax under the head ‘capital gain’. The assessee was merely shareholder and was not carrying out any business. Business was carried out by HCL, if the assessee has given his right by agreeing to non complete clauses contained in agreement, then the same ought to be computed as per the provision of section 55(2)(a) of the Act. The provision of section 28(va) is attracted only where a person was carried on business and not merely person only had right to carry in the business in the form of capital asset. The assessee also relied on CBDT Circular No 8 dated 27.08.20.22, wherein it was clarified that receipt for transfer of right in manufacture, produce or process any article or thing or right to carry on a business which is chargeable in head ‘capital gain’ would not be taxable as profit or gain of business. The assessee also relied on CBDT No. 225 of 2016 dated 02.05.2016.

4. The reply of assessee was not accepted by assessing officer. The AO in para 8.1 of the assessment order recorded the shareholder pattern of different family or directors and held that as per share purchase agreement all shareholders sold their respective share in a single go. All shareholders had signed the share purchase agreement with NNCL, certain part of agreement was extracted in the assessment order. The AO in para 8.3 on assessment order recorded that as per share purchase agreement all shareholder are divided into five groups namely Ashwin Shroff, Dipesh Shroff and family, Atul Shroff and family, N. Sukumar and family and others. The total share held by this group was 3,27,900 and out of the same they have sold Rs. 2,42,464 by way of share purchase agreement. The share purchase agreement indicates that all shareholder have come together at one single go to perform sale of their share and agreed to all the clause referred in such agreement and transferred the control and management of the company. Such act is a color of adventure in nature of trade having different shareholding come together and negotiate with other party to get the best value of their share which were valued at Rs. 7845.23/- per equity share by the valuer and sold at Rs. 15,401 per equity share. Unless all shareholder come together and agree to the term and condition, barring power with the purchaser party want to be there and they all decided to sale the share for better advantage to follow up them which look like advantage in the nature of trade and the business receipt through the transaction as business income. The consultant was paid professional fees for executing the deal. The AO held that the assessee has sold share of 12389 shares at the rate of 15401 of Rs. 19.180 crore. The assessing officer treating such receipt as business receipt under section 28(va). The AO in para 11 of assessment order noted that the assessee claimed exemption under section 54EC of Rs. 50.00 lakhs and 54F of Rs. 6.69 crore for investment in property. Since sale consideration was treated as business receipt, resultantly exemption under section 54EC and 54F was disallowed. Similarly, short term capital loss on share of Hyderabad Chemicals Limited and Tech Mahindra and shroff family trade amounting to Rs. 5.10 crore was also not allowed against business income of current assessment however; it was allowed to be carry forward for future years.

5. Aggrieved by addition in the assessment order and denial of exemption under section 54F and 54EC and denial of short-term capital loss. The assessee has filed the appeal before the Ld. CIT(A). Before Ld. CIT(A) the assessee filed his detailed written submission as recorded in para 5.4 of impugned order. The contents of such written submissions are not reproduced in the impugned order. The Ld. CIT(A) held that assessing officer has perused various clause of the agreement and transfer of business from assessee group to NNC group with a complete exclusion of assessee group and held that on identical facts Punjab and Haryana High Court in the case of Sumeet Taneja v. CIT examined the similar issue and treated the similar transaction as business receipt and upheld the action of assessing office. The other disallowances were being a consequential was also upheld. Further, aggrieved the assessee has filed present appeal before Tribunal.

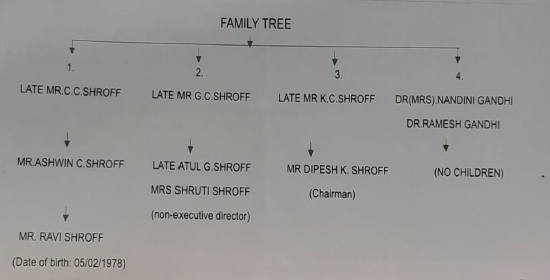

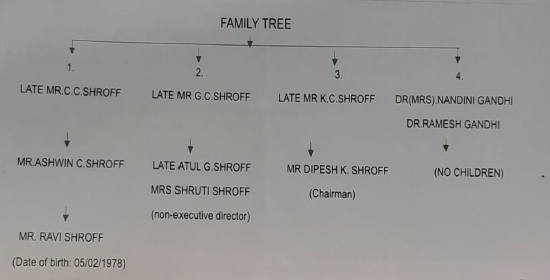

6. We have heard the submission of Sh. Nitesh Joshi Advocate/authorized representative, hereinafter recorded as (Ld.AR) of the assessee and Sh. Umashankar Prasad learned Commissioner of Income Tax-departmental representative hereinafter referred as (ld. CIT-DR) for the revenue. Ground No. 1 of the appeal relates to treating the sale price of shares as business income in place of capital gain. The ld.AR of the assessee submits that the assessee is son of Ashwin Shroff and Usha Shroff who were part of Shroff family and were promoters of Excel Industries Limited. The assessee originally acquired 3500 shares of Hyderabad Chemicals Limited (HCL) on 11.10.1980. The assessee was born on 05/02/1978. These shares were purchased on behalf of assessee when assessee was minor. Subsequently, the assessee received 8889 as bonus and gift from his relatives. The average holding period of shares held by assessee as investment for more than twenty years. Further, the assessee was allotted equivalent no. of share in Vibrant Greentech Limited (VGT) the resulting company, whose name was subsequently change to HCL, pursuant to scheme of demerging. Thus, the assessee was holding 12,389 shares in HCL, being 3.78% of total share capital of HCL. HCL and its subsidiaries were promoted by late Dr Ramesh Gandhi and Dr Nandini Gandhi. Dr Nandini Gandhi was sister of grandfather of assessee. HCL was in the business of manufacturing and sale of pesticide formulation. Dr Nandini Gandhi died in October 2003. Dr Nandini Gandhi has no children. The Gandhi’s along with Sukumar Nellore (MD) were directors and were in control of management of HCL and subsidiaries. On the demise of Dr Nandini Gandhi share held by Gandhi family bequeath to Shroff family and thereafter Dipesh Shroff acted as chairman and non executive director and Shruti Shroff was another non executive director. The ld. AR of the assessee also submitted tree of Shroff family. Dipesh Shroff is grandson of brother of assesses grandfather. Fact remains the same that business of HCL and its subsidiaries continue to be managed by Sukumar being Managing Director, the assessee was never a part of HCL Company. At the time of sale of sale of share he was the executive director of Excel Industries Ltd, which is in the business of industrial chemical and not connected with the business of HCL. The assessee joined Excel Industries Ltd on 26th March 2010 as Senior Vice President (Business Development), later on appointed as Executive Director. The ld AR for assessee while explaining the facts submits that during the year under consideration NNCL entered into agreement for purchase of 74% shares of HCL on 27th November 2014 at share price of Rs. 15,401/- per share. The said price was subject to Pre and Post Closing Net Working Capital and Net Debt Adjustment as per clause 3.1, 3.3 & 3.6 of agreement. Finally, price of shares of HCL was agreed at Rs. 14,869/- per share. The assessee received total consideration of Rs. 18.45 Crore, details of which are available at page No. 119 & 120 of PB.

7. The ld AR of the assessee further submits that similar capital gain has been accepted by department in case of Ashwin C Shroff (PAN: ALPS 6493H), Usha Ashwin Shroff (PAN: AAFPS 5029J), Vishwa Nellore (PAN: AKYPN 6486 H) and S. Kumar Nellore (PAN: AAHPR 8333 C). However, in case of Shruti Atul Shroff (PAN AACPS 7329 E) deduction of capital gain was claimed under section 54F on sale of similar share. Though, capital gain was accepted but deduction under section 54F was disallowed by AO, on the ground that she owned more than one residential house, but of appeal before CIT(A) she was allowed relief of deduction under section 54F and further appeal by revenue before Tribunal was dismissed in Laxmi Hydrocolloids v. ITO [IT Appeal No. 416 (Ahd) of 2019, dated 23-3-2022], facts remained the same that she was allowed capital gain. Thus, the assessee cannot be treated indifferently. The ratio of decision relied by the ld CIT(A) in his finding in case of Sumeet Taneja (supra) is not applicable on the facts of his case, as the facts of this case is at variance, the assessee in that case was major shareholder, promoter and managing director of the company, however, the assessee was admittedly having share holding of less than 4% and was not involved in the business of the company whose shares were sold in joint agreement. The ld AR of the assessee fairly submits that in cases of certain other family members, similar transaction was treated as business income, and their appeals are pending before CIT(A) level. To support his various contentions the ld AR of the assessee relied on the following case laws;

| ■ | | ? Venkatesh v. CIT (Mad), |

| ■ | | ? Smt. Maharani Ushadevi v. CIT (M. P.), |

| ■ | | ? CIT v. S. Chenniappa Mudaliar [1967] 64 ITR 213 (Mad), |

| ■ | | ? Gillanders Arbuthnot & Co. Ltd. v. CIT [1964] 53 ITR 283 (SC), |

| ■ | | ? CIT v. Best and Co. (P) Ltd. [1966] 60 ITR 11 (SC), |

| ■ | | ? Dy. CIT v. Dr. Sandeep Dave (Raipur-Trib.), |

| ■ | | ? Vodafone International Holdings B.V. v. Union of India (SC), |

| ■ | | ? Govindlal Mandhana v. Addl. CIT [IT Appeal Nos. 3095, 3877, 3881 and 3906 (Mum) of 2010, dated 15-2-2012], |

| ■ | | ? Mrs. Hami Aspi Balsara v. Asstt. CIT [2010] 126 ITD 100 (Mum.) |

8. On the other hand, the Id CIT-DR for the revenue supported the order of lower authorities. The ld CIT-DR for the revenue submits that the stand of the assessee that he was not associated with the business of HCL, are new facts, such facts were not brought to the notice of AO or ld. CIT(A). If it was share transfer or business transfer by way d sale of 74% holding in HCL can be interpreted in either of the way. Majority of shares were acquired by the Japans Company. Share transfer agreement is in fact business transfer agreement. The intention in the share purchase agreement was in fact to acquire entire business of HCL. The ld CIT-DR for the revenue read over various clauses of the share purchase agreement including the clause of noncompete fee and argued that the ratio of decision of Punjab & Haryana High Court in case Sumeet Taneja (supra) is clearly applicable on the facts of present case. The ratio of other decisions as relied by ld AR of the assessee is not squarely applicable on the facts of the present case as the facts of all such cases are at variance.

9. In short rejoinder submissions, the ld AR of the assessee submits that he has not raised any new plea, the stand of the assessee right from the beginning is that he was never associated with the business of HCL, the shares was acquired on his behalf when he was minor. The period of holding of shares are not disputed by AO, once similar transaction was accepted in case of four family members, thus, the assessee is also eligible for similar relief. Once, the assessee is allowed capital gain, all other grounds of appeal for allowing set off of losses or exemptions under section 54F or 54EC would be consequential and may be allowed after verification by AO.

10. We have considered the rival submissions of both the parties and have gone through the orders of lower authorities carefully. We have also deliberated on various case laws relied by the parties and the various evidence filed in the form of paper book by the assessee. We have also examined the assessment order in case of family members wherein similar gain of same transaction is accepted as capital gain in the assessment order passed under section 143(3) or though capital gain was accepted but disallowed exemption under section 54F. We find that on similar transaction capital gain in the hands of four family members were allowed by respective AOi.e. in respect of Ashwin C Shroff (PAN: ALPS 6493H), Usha Ashwin Shroff (PAN: AAFPS 5029J), Vishwa Nellore (PAN: AKYPN 6486 H), S. Kumar Nellore (PAN: AAHPR 8333 C) and Shruti Atul Shroff (PAN AACPS 7329 E). S. Kumar Nellore was Managing Director of HCL and was in control of the management of the company and similar receipt on sale of share under same agreement was accepted as capital gain.

11. We find that the AO treated the gain on transfer of shares as business income by taking view that share purchase agreement shows that all shareholder have come together at one single go to perform sale of their share and agreed to all the clause referred in such agreement and transferred the control and management of the company. The act of such share transfer is adventure in nature of trade as all shareholder come together and on agreeing the term and condition all decided to sale the share for better advantage and is taxable as business income under section 28(va). The action of AO was upheld by ld CIT(A) by refereeing the decision of Punjab & Haryana High Court in Sumeet Taneja (supra).

12. We find that the facts in case of Sumeet Taneja (supra) are at little variance as the assessee in that case was major shareholder, promoter and Managing Director of the company, however, the assessee in the case in hand was admittedly having share holding of less than 4.00% and was not involved in the business of the company whose shares were sold in joint agreement. The assessee was merely a share holder of less than 4.00% of shares. No evidence was brought on record that the assessee was involved in the day-today activities of HCL or was managing the affairs of the company. Initially the shares were purchased on behalf of assessee, when he was minor and thereafter received certain shares on gift and on account of bonus shares and finally on the death of Mrs Nandni Ghandhi, under will. Before us, the ld AR of the assessee furnished the family tree of Shroff family, for appreciation of facts such pedigree is reproduced below;

13. On careful perusal of the aforesaid family tree, we find that one the promoter of HCL was sister of grandfather of assessee and on her death assessee as well as other family members received shares of HCL and in case of four of shroff family similar transaction was accepted as capital gain. Thus, in our considered view the assessee cannot be treated differently as has been held in series of decisions by Higher Courts.

14. We further find that as per section 28(va) of Income Tax Act, any sum received or receivable in cash or kind under an agreement for not carrying business or profession is treated as profit or gain from business or profession, thereby taxable as business receipt. As noted earlier the assessee has received consideration only for transfer of shares held in HCL and no consideration was received toward non-compete clause in the share purchase agreement. Even, the share purchase agreement does not attribute any amount towards noncompete clause in the agreement. We further find that the assessee was never involved in the business affairs of HCL thus, for getting consideration for not to carry on any business activities will not arise to the assessee. Hence, the provisions of section 28(va) is not applicable on the transaction of shares by assessee, sale of shares is only gives rise to earning of capital gain and not of business receipt.

15. We find that Mumbai Tribunal in Mrs. Hami Aspi Balsara (supra) also held that where a shareholder sells their shares and the share purchase agreement includes a non-compete clause, the entire consideration received should be treated as capital gains from the transfer of shares, provided that no specific amount was assigned towards the non-compete fee in the agreement. Considering the aforesaid factual and legal discussions, the consideration received by assessee on sale of shares of HCL is not business receipt and to be taxed as capital gain.

16. We further find that the AO worked out business income on sale of impugned shares at Rs. 19.08 Crore (12389 x 15401), however, final sold price of shares of HCL was agreed at Rs. 14,869/- per share. The assessee received total consideration of Rs. 18.42 Crore (12389 x 14869), details of which are available at page No. 119 & 120 of PB. Thus, the AO is directed to consider the sale consideration of shares at Rs. 18.42 Crore for the purpose of computing long term capital gain. Thus, various sub-grounds of ground No. 1 of the appeal is allowed.

17. So far as other grounds of appeal which relates to deduction under section 54F, 54EC and allowing set off of capital loss, which was not verified after treating the gain on sale of share of HCL as business receipt, therefor, we direct the jurisdictional AO to verify the facts and allow relief to the assessee in accordance with law. Needless to direct that before passing the order the jurisdictional AO shall allow reasonable opportunity to the assessee. The assessee is also directed to provide required details to the AO. In the result, all remaining ground are allowed with the aforesaid directions.

18. In the result, the appeal of the assessee is allowed.