ORDER

Smt. Beena Billai, Judicial Member.- Present cross-appeals filed by the assessee as well as the revenue arises out of order dated 27/05/2025 passed by Ld. CIT(A)-51, Mumbai [hereinafter “the Ld. CIT(A)”] for assessment year 2019-20.

Grounds of appeal in r/o ITA No. 4260/Mum/2025:

1. Ground No. 1:- (New ground) On facts and circumstances of the case and in law, the learned Commissioner (Appeals), ought to have allowed deduction u/s 80-G in respect of the CSR donation expenditure of Rs. 3,00,000/- disallowed in the assessment

The said deduction u/s 80-G may please be allowed in the appeal.

2. Ground no. 2 -On facts and circumstances of the case and in law, the learned Commissioner (Appeals), erred in sustaining the action of the learned Assessing Officer in rejecting in his assessment order the Appellant’s computation of loss of Ra. 2,32,67,278/-under the head *Short Term Capital Gains/Loss’ and its claim for carry forward to the subsequent year

The Appellant’s claim for this loss and its carry forward may please be allowed in appeal.

3. The Appellant reserves the right to add to, alter or delete any of the above grounds of appeal.”

Grounds of appeal in r/o ITA No. 4845/Mum/2025:

1. “On the facts and in the circumstances of the case, the Ld CIT(A) erred in deleting the addition of Rs. 4,54,63,267/- made u/s 69A of the Income Tax Act on account of excess stock of 22Kt and 18Kt gold without considering the fact that assessee failed to discharge the initial onus to satisfactorily explain the excess stock found during survey proceedings.”

2. “On the facts and in the circumstances of the case, the Ld CIT(A) erred in deleting the addition of 2,12,52,000/- made by the AO u/s 69A of the Act without appreciating that the assessee failed to substantiate the claim of gold purchase and delivery with any credible evidence, and the employee’s voluntary statement, corroborated by CCTV footage, categorically disproved the assessee’s explanation. The addition made was fully justified under settled judicial principles.”

3. “On the facts and in the circumstances of the case, the Ld CIT(A) erred in deleting the addition of 82,12,52,000/- made by the AO u/s 69A of the Act ignoring the facts of the judgment of the Hon’ble Supreme Court in the case of Chuharmal v. CIT (1988) 172 /TR 250 (SC), wherein it was held that possession of assets not recorded in books of account creates a presumption of ownership and unexplained income under Section 69A, unless satisfactorily explained.”

4. “The appellant craves to leave, to add, to amend and / or to alter any of the ground of appeal, if need be.”

5. “The appellant, therefore, prays that on the ground stated above, the order of the Ld. GIT (A)-51, Mumbai, may be set aside and that of the Assessing Officer restored.”

2. Brief facts of the case are as under:-

Assessee is a company engaged in manufacturing of jewellery. It filed its return of income on 26/09/2019 declaring total income at Rs.8,03,96,224/-. Book profit of even amount was also declared by the assessee. The case was selected for scrutiny and notice u/s 143(2) alongwith notice u/s 142(1) and questionnaire was issued to the assessee. In response to the statutory notices, assessee filed its submissions.

2.1. The Ld.AO noted that, assessee claimed short term capital loss of Rs. 2,32,67,278/- in the return of income which was carried forwarded. The assessee was thus asked to furnish the details of working of the loss. Assessee in response, furnished letter dated 16/09/2021, wherein it was stated that assesse purchased a property being land and building in 2016 and the same was added to the block of building. It was submitted that, as per return of income for AY 2018-19, the closing stock WDV for Block of Buildings was shown at Rs.15,56,05,717/-. It was submitted that, subsequently the property was sold at Rs. 13,21,00,000/- and assessee claimed short-term capital loss of Rs. 2,32,67,278/-. In the financial statement the assessee thus declared the closing stock of the block of building at Rs. 3,36,934/-.

2.2. The Ld.AO noted that in the block of buildings, the assessee claimed depreciation of only Rs.37,437/- for the year under consideration. Thus, a show cause notice was issued in order to justify the short-term capital loss of Rs.2,32,67,278/- claimed by the assessee. In response to the notice, the assessee submitted that, loss of Rs.2,32,67,278/- on account of transaction of sale of property, was not claimed in profit and loss account, nor was it considered in the computation of total income. It was submitted that there were two properties under the block of assets of Rs.15,56,05,717/- as opening balance. The assessee submitted that one of the property, among this was sold for Rs.13,21,00,000/-and the other property continued to remain in the block of assets. The assessee during assessment proceedings revised the computation and the depreciation chart. In the revised depreciation chart, Ld.AO noted that block of Rs.2,12,77,484/- still remains after claiming current year depreciation amounting to Rs.23,64,165/-. The assessee revised total income at Rs. 8,13,42,630/- as against returned income of Rs.8,36,69,360/-. The assessee further requested the Ld.AO to ignore the claim of carry forward of short term capital loss of Rs. 2,32,67,278/-. The Ld.AO after considering the above submissions of the assessee, allowed the balance amount of depreciation of Rs.23,13,135/-.

2.3. The Ld.AO further observed that there was unaccounted stock of 22KT and 18KT gold based on survey conducted at the premises of the assessee u/s 133A dated 07/09/2018 by the DDIT, Investigation Wing, Mumbai. Based on the statements recorded, The Ld.AO came to the conclusion that the stock of 7000 grams of 24KT gold found from the premises of the assessee was unaccounted stock and the nature and source of the purchase was not satisfactorily explained by the assessee. The Ld.AO thus added the value of 7000 grams of 24KT gold at Rs. 2,12,52,000/- as on the date of survey u/s 69A of the Act as unexplained money.

2.4. The Ld.AO noted that, there was difference in the stock of 24K gold weighing 1900 gms and 400 gms as per Annexure B, page 1-3. The assessee submitted that, this gold was purchased by M/s. Classic Solitaires Pvt. Ltd. from S.K. Gold and was delivered to the assessee for further job work i.e., processing/manufacturing into the jewellery. The assessee submitted that the job work was to be carried out by the assessee on behalf of M/s. Classic Solitaires Pvt. Ltd. The Ld.AO was not satisfied with the reply of the assessee and made addition of Rs.4,53,63,627/- as unexplained money u/s 69A of the Act.

2.5. Further, the Ld.AO also disallowed the claim of deduction u/s 80G in respect of CSR donation amounting to Rs.3,00,000/-.

Aggrieved by the additions made by Ld.AO, assessee preferred appeal before the Ld.CIT(A).

3. The Ld.CIT(A) after verifying the details furnished by the assessee allowed the claim of the assessee by deleting the addition on account of excess stock of 24KT gold by 7000 gms observing as under:-

“7.4.3 I have carefully perused the order of the AO. The AO has based his addition solely on the statement of the peon, Shri Devaram Kumawat. It is seen that Shri Kumawat had earlier stated that he along with another employee had picked up 7 kg of gold from M/s Abhushan Creations Pvt Ltd and deposited at the cash counter of the appellant. However, when Shri Kumawat was shown the CCTV footage of the cash counter and it was pointed out that no delivery of gold is visible in the footage and that he has made a false statement and that there has been no purchase of gold from M/s Abhushan Creations Pvt Ltd, he stated that he cannot explain and that he did not take any such delivery from Mis Abhushan Creations Pvt Ltd. The AO has rebutted the submission of the appellant that the statement of Shri Kumawat cannot be relied upon since it was given under duress by referring to the statement again wherein Shri Kumawat states that he has given the statement without any external influence or duress.

7.4.41 have perused the relevant question and the reply that forms the basis of the addition. The same has been reproduced by the AO in the assessment order in para 7.2 of his order. The translated version of the same is as under:

Ques: Please tell as to whether you had collected 7 Kg of gold from M/s Abhushan Creation Pvt Ltd and deposited at the cash counter of M/s Royal Chains Pvt Ltd on 07.09.2018 at 1:30 PM?

Ans: Yes, I have deposited 7 Kg of gold, collected from M/s Abhushan Creations Pt Ltd at the cash counter of M/s Royal Chains Pvt Ltd at the cash counter on 07.09.2018 at around 1:30 PM.

Ques: Upon perusal of your statement in response to the question above it is clear that you have given a false statement earlier that you had delivered 7 Kg of gold purchased from M/s Abhushan Creation Pvt Ltd at the cash counter on 07.09.2018 at 1:30 PM and it proves that M/s Royal Chains Pvt Ltd has not purchased any gold from M/s Abhushan Creations Pt Ltd. Please clarify.

Ans: I cannot clarify the above, I wish to state that have not collected any gold from M/s Abhushan Creations Pt Ltd and not delivered 7 Kg of gold at the cash counter of the company.

It is my considered view that the above question is in the nature of a leading question and is implying or presuming facts that Shri Kumawat merely needs to agree with, rather than supplying the facts himself. Considering the limited role that Shri Kumawat has in the company, being a peon, I do not attach much significance to the statement of Shri Kumawat that no such purchase has taken place. I further see that even Shri Kumawat has earlier stated that the gold was duly collected from M/s Abhushan Creations Pvt Ltd and even the Director of the appellant, Shri Suresh Jain stated that the excess gold found was purchased from M/s Abhushan Creations Pvt Ltd with payment duly made just a day before. I find that there is enough consistency in the statements recorded during the survey and that the version of excess stock of 7 Kg of gold given by the peon and the Director is the same. Therefore, the status of excess stock of gold found at the premises will have to be ascertained by way of documentary evidences and not merely the statement of Shri Kumawat.

7.4.5 As regards the finding of the AO that the excess 7000 gms of gold was unexplained and unrelated to purchase from Abhushan Creations Pvt. Ltd, I find that the purchase from Abhushan Creations Pvt. Ltd. is supported by Tax Invoice dated 07.09.2018, bank payment made through normal banking channels and stock register and purchase register of Abhushan Creations Pvt. Ltd. Moreover, the said M/s Abhushan Creations Pvt Ltd confirmed the sale in response to notice u/s 131 issued by the DDIT (Inv). The transaction is reflected in the audited books of both the appellant and the supplier and there is no case of bogus or fictitious purchase. The only reason for the stock mismatch during survey was that entries of the invoice had not been made yet pending purity and quantity checks, which is standard business practice and fully explained in the reconciliation. An elaborate reconciliation was submitted on 16.05.2019, and again during assessment proceedings.

The reconciliation included names of parties (Abhushan Creations, Classic Solitaires, etc.), to whom notices u/s 133(6) were issued and all responded with confirmations, books of accounts, bank statements, and delivery records, fully corroborating the appellant’s version. Moreover, the survey was conducted on 07.09.2018 ie middle of the financial year and therefore it is fairly acceptable that the books of accounts are not updated on a real time basis and there is some lag.

7.4.61 therefor hold that the appellant has maintained proper records and has reconciled the stock difference by way of proper documentation. Further, the transactions have also been confirmed by the counter parties and accordingly the appellant has been able to explain the stock discrepancy satisfactorily. The addition of Rs.2,12,52,000/- on account of excess stock of 24 KT gold is deleted and the ground of appeal is allowed.”

3.1. In respect of addition of Rs.4,53,63,627/-, the Ld.AO observed and held as under:-

“6.4.1 The facts of the case, submissions of the appellant and the findings of the AO have been considered. The instant ground pertains to the addition of Rs.4,53,63,627/- made under section 69A on account of alleged unexplained stock of 22KT and 18KT gold discovered during the survey conducted under section 133A on 07.09.2018 at the business premises of the appellant. During the course of survey proceedings, a statement was recorded u/s 131 from Shri Suresh Jain, Director of the appellant company, wherein he acknowledged the existence of excess stock and stated that he was unable to immediately recall the party names from whom purchases were made with respect to 22KT and 18KT gold. The AO has inferred from this that the excess stock amounting to 16,313.237 grams of 22KT and 18KT gold, valued at Rs.4,53,63,627/-, was not recorded in the books of accounts and represented unexplained money liable to be added under section 69A. The AO’s findings were broadly based on the following contentions:

(i) Shri Suresh Jain, Director, did not provide an explanation for the 22KT and 18KT gold stock at the time of survey.

(ii) He admitted the stock was not recorded in the books of accounts.

(iii) No indication was given during the survey that a reconciliation would be submitted later.

(iv) The reconciliation letter dated 16.05.2019 was filed nine months later and did not bear an income-tax office stamp, rendering its authenticity unverifiable.

(v) No reconciliation was filed before the DDIT (Inv.) in post-survey proceedings.

(vi) No retraction of the alleged admission made during the survey was filed.

(vii) As per judicial precedents, an un-retracted admission under oath is a strong

piece of evidence and sufficient for sustaining additions.

6.4.2 The appellant on the other hand has vehemently contested the basis of the addition and has made detailed submissions, which are summarized as under:

(i) No admission of undisclosed income: It was submitted that Shri Suresh Jain never admitted that the excess stock constituted undisclosed income. He merely stated during the survey that he could not recall the party names and that certain entries were pending in the books due to verification of quality and weight. Therefore, there was no occasion to file a retraction of a non-existent confession.

(ii) Reconciliation filed with evidence: The Appellant submitted a detailed reconciliation vide letter dated 16.05.2019 to the DCIT, Circle 8(1)(1), Mumbai. The reconciliation explained that the stock differences arose due to:

Purchase invoices received prior to survey but not yet entered (from Rishabh Jewellers, Abhushan Ornaments Pvt. Ltd., and Abhushan Creations Pvt. Ltd.);

Gold received for job work but not recorded at the time of survey (from Penta Gold Ltd. and Classic Solitaires Pvt. Ltd.);

Gold dispatched for export for which sales invoices were not entered (to Viva Jewellery FZCO, Vaama Gold Jewellery LLC, and Guru Trading Co. Inc.).

(iii) Confirmation from third parties: During assessment proceedings, the AO issued notices under section 133(6) to the same parties mentioned in the reconciliation. All parties confirmed their transactions with the appellant by submitting ledger copies, ITRs, stock records, and bank statements. These confirmations substantiate that the gold found during survey was not unaccounted.

(iv) Books of accounts and GST records updated: The appellant clarified that all transactions were subsequently recorded in the books of accounts, which were audited. Further, the same purchases and exports were declared in the GST returns and covered by GST audit, which was also submitted to the AO.

(v) Legal right to explain during assessment: It was argued that the AO erred in dismissing the reconciliation merely because it was not submitted during the survey or to the DDIT (Inv.). Reliance was placed on the decision of the Hon’ble Bombay High Court in CIT v. Rakesh Ramani (Bom)], wherein it was held that there is no requirement that evidence should be filed only at the time of search/survey and not during assessment. The appellant has a legal right to explain discrepancies during the assessment proceedings.

(vi) No rejection of third-party confirmations: The AO has not rejected or even commented on the confirmations obtained u/s 133(6). There is no allegation that these parties were bogus or that the transactions were not genuine. In fact, no effort has been made by the AO to rebut the evidentiary value of these confirmations.

(vii) No basis for invoking section 69A: The AO has made the addition solely on the assumption that the stock was unaccounted, overlooking the reconciliatory evidence, confirmations, and audit trail. The appellant has demonstrated that the transactions are duly supported by invoices, job work records, and bank payments through proper channels.

6.4.3 On careful examination of the material on record and submissions made, I find the reasoning adopted by the AO to be factually and legally untenable. Firstly, it is not in dispute that Shri Suresh Jain did not admit that the stock difference represented undisclosed income and this fact is clear from the extract of his statement that has been reproduced by the AO in his assessment order. He merely acknowledged the presence of a difference in stock, attributing it to pending entries and inability to recall specific party names. The AO’s inference that such acknowledgment amounted to admission of undisclosed income is a mischaracterization of the statement. Further, there was no confession or voluntary disclosure of income under survey, and hence, the question of retraction does not arise. Secondly, the appellant, vide letter dated 16.05.2019, submitted a detailed reconciliation of the stock difference to the DCIT, Circle 8(1)(1), Mumbai. The said reconciliation explained the difference in stock on three grounds: (a) purchase invoices received but not recorded prior to the survey date; (b) job work gold received from third parties pending entry; and (c) goods dispatched for export for which sales invoices were yet to be entered. These included transactions with Rishabh Jewellers, Abhushan Ornaments Pvt. Ltd., Abhushan Creations Pvt. Ltd., Penta Gold Ltd., Classic Solitaires Pvt. Ltd., and export consignments to Viva Jewellery FZCO, Vaama Gold Jewellery LLC, and Guru Trading Co. Inc. These explanations were further corroborated during assessment proceedings when the AO issued notices under section 133(6) to the concerned parties. All such parties responded and submitted requisite details, including ledger accounts of the Appellant, copies of ITRs, bank statements, and stock movement registers. These responses confirm the genuineness of the transactions and fully support the reconciliation submitted by the appellant. Moreover, the survey has been conducted in the middle of the financial year and it is an accepted business practise that the books of accounts are not updated on a real time basis. The important thing is that the appellant should be able to properly reconcile the difference with bills, invoices etc. In the instant case, the appellant has been able to duly reconcile the difference and hence it is my considered view that the difference in stock arose because certain entries were yet to be entered in the books of accounts. Further, the fact of these transactions has been confirmed by the counter parties also in the course of assessment proceedings. The AO, however, failed to consider these confirmations in the assessment order and proceeded to draw adverse inference merely because the reconciliation letter was not acknowledged with an office stamp. I am also in agreement with the submissions of the appellant that merely because reconciliation was not submitted before the DDIT (Inv), the same cannot be filed before the AO. The Hon’ble Bombay High Court in the case of CIT v. Rakesh Ramani (Bom)] held that evidence submitted during assessment proceedings cannot be rejected merely because it was not produced at the time of search or survey. The important thing is that such evidence should be verifiable and acceptable. In the instant case the reconciliation statement submitted by the appellant is duly vouched by bank entries, invoices and confirmation from the counter parties.

6.4.4 Moreover, it is evident that the relevant transactions were duly accounted for in the audited books of account post-survey. The appellant has also furnished its GST audit report, further substantiating that all sales and purchases were duly recorded and reported. Payments for the purchases and job work were made through banking channels, and no discrepancy in pricing, valuation, or arm’s length basis was pointed out by the AO.

6.4.5 In view of the above, it is clear that the appellant has satisfactorily explained the stock difference in the 22KT and 18KT gold with credible documentary evidence. There is no material on record to rebut these submissions or demonstrate that the excess stock represented unaccounted money. Accordingly, the addition of Rs.4,53,63,627/- made under section 69A of the Act is directed to be deleted. This ground of appeal is allowed.”

3.2. In respect of disallowance of short-term capital loss, the Ld.CIT(A) confirmed the addition made by Ld.AO by observing as under:-

“8.4.1 This ground pertains to the disallowance of a claim of short-term capital loss of Rs.2,32,67,278/- made by the appellant in its return of income for Assessment Year 2019-20, which arose from the sale of a factory building located at MIDC, Andheri, Mumbai. The AO disallowed the loss on the grounds that the said building was part of the block of assets that was still existing and therefore the question of having deemed short term capital gain did not arise at all. The appellant thereafter filed a revised computation of income and withdrew the claim of short term capital loss. The AO thereafter initiated penalty proceedings on the issue. The appellant has submitted that in view of the penalty being initiated, it retracts its earlier stand and wishes that the short term capital loss is restored. The appellant has raised a legal issue that the building which has been sold, resulting in short term capital loss, was never put to business use and no depreciation was claimed on it and therefore it should not form a part of the block of asset and should be treated as an individual asset.

8.4.2 I have considered the submissions of the appellant. It is an undisputed fact that the building that has been sold now was forming a part of the block of asset. Merely not claiming depreciation does not result in exclusion from the block, especially when the asset has not been discarded, destroyed, or otherwise removed from the business context. Therefore, I am of the view that once the asset was acquired and grouped within the block of assets eligible for depreciation at the rate of 10%, its usage status alone did not determine exclusion from the block and therefore under the scheme of the Act, especially Section 50 read with the Explanation thereto, any subsequent sale must be factored into the computation of the written down value (WDV) of the block, rather than as an isolated capital asset. Moreover, the revised computation filed by the appellant during the assessment clearly acknowledges the inclusion of the asset in the block, and the resultant depreciation of Rs.23,50,572l-has been partly claimed and allowed. This reinforces the position that the block remained in existence and the asset was within its fold. Accordingly, the action of the AO in disallowing the short-term capital loss of Rs.2,32,67,278/- is confirmed and the ground raised by the appellant is dismissed.”

3.3. The Ld.CIT(A) also confirmed the disallowance of deduction u/s 80G claimed on account CSR donation.

Aggrieved by the order of Ld.CIT(A), the assessee as well as the revenue are in appeal before this Tribunal.

We shall first take up the assessee’s appeal.

4. Ground No.1, raised by the assessee is in respect of disallowance of deduction u/s 80G of the Act on account of CSR donation amounting to Rs.3,00,000/-. The Ld.AR submitted that, assessee made donation of Rs. 3,00,000/- on 30/08/2018 to a NGO called Association for Voluntary Action. As it was in the nature of CSR, the assessee disallowed the same u/s 37 Explanation (1). However, claimed it as deduction u/s 80G as relevant criteria u/s 80G stood satisfied in respect of the donation of Rs. 3,00,000/- to the NGO.

4.1. He submitted that, entitlement u/s 80G could be verified from the certificate issued by the NGO. The authorities below disallowed the claim of assesse by holding that payment was not voluntary and, therefore, deduction u/s 80G could not be allowed. It was also held that the payment so made was actually as a part of CSR expenditure which is not an allowable expenditure in the hands of assessee and, therefore, what is not allowed directly cannot be claimed indirectly.

We have perused the submissions advanced by both the sides in light of the records placed before us.

5. It is the claim of assessee that, donation paid towards CSR obligation under the Companies Act, 2013 by assessee are also eligible for deduction u/s 80G of the Act. He submitted that payment made towards CSR obligation is supported by necessary certificates issued that clearly mention the allowability of the respective amounts u/s 80G of the Act. As submitted by Ld.AR, this issue is no longer res integra. Assessee has filed all relevant details in respect of the documents to support the CSR expenditure as well as the certificate that allows the amount to be claimed as deduction u/s 80G of the Act.

5.1. We place reliance on the following decisions passed by other Co-ordinate Benches of this Tribunal :

| (i)Synergia | | Lifesciences (P.) Ltd. v. Dy. CIT [IT Appeal No. 938(Mum) of 2023, dated 20-6-2023] |

| (ii) | | Sling Media (P.) Ltd. v. Dy. CIT ITD 1 (Bangalore – Trib.) |

| (iii) | | Infinera India (P.) Ltd. v. Jt. CIT ITD 463 (Bangalore – Trib.) |

| (iv) | | FNF India (P.) Ltd. v. Asstt. CIT (Bangalore – Trib.) |

| (v) | | JMS Mining (P.) Ltd. v. Pr. CIT, Kolkata-2 ITD 702/91 ITR(T) 80 (Kolkata – Trib.) |

5.2. It is an admitted fact that CSR expenditure has to be mandatorily incurred by certain specified companies as per the provisions of Section 135 of the Companies Act, 2013. It is a statutory obligation cast upon certain companies to share certain portion of profits to the activities towards social responsibilities. In other words, it is part of profit appropriation to the society at large which, in the new scenario of CSR regime, is one of the strategic stake holders of the company. It is for this reason that this expenditure was clarified to be an expenditure not incurred fully and wholly for the purpose of business through Explanation (2) u/s 37 (1) of the Act.

5.3. The legislative intent of introduction of this Explanation is elaborated in the Explanatory Notes to the Finance Bill 2014which is reproduced below:

“CSR expenditure, being an application of income, is not incurred wholly and exclusively for the purposes of carrying on business. As the application of income is not allowed deduction for the purposes of computing taxable income of a company, amount spent on CSR cannot be allowed as deduction for computing the taxable income of the company. Moreover, the objective of CSR is to share burden of the Government in providing social services by companies having net worth/turnover/profit above a threshold. If such expenses are allowed as tax deduction, this would result in subsidizing of around one-third of such expenses by the Government by way of tax expenditure.”

5.4. Section 135 of Companies Act, 2013 requires companies with CSR obligations, with effect from 01/04/2014. Finance (No.2) Act, 2014 inserted new Explanation 2 to sub-section (1) of section 37, so as to clarify that for purposes of sub-section (1) of section 37, any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2013 shall not be deemed to be an expenditure incurred by the assessee for the purposes of the business or profession. This amendment took effect from 1/04/2015 and was, accordingly, applied from assessment year 2015-16 and subsequent years. Thus, CSR expenditure is to be disallowed by new Explanation 2 to section 37(1), while computing Income under the Head ‘Income form Business and Profession’. Further, clarification regarding impact of Explanation 2 to section 37(1) of the Income Tax Act in Explanatory Memorandum to The Finance (No.2) Bill, 2014 is as under:

“The existing provisions of section 37(1) of the Act provide that deduction for any expenditure, which is not mentioned specifically in section 30 to section 36 of the Act, shall be allowed if the same is incurred wholly and exclusively for the purposes of carrying on business or profession. As the CSR expenditure (being an application of income) is not incurred for the purposes of carrying on business, such expenditure cannot be allowed under the existing provisions of section 37 of the Income-tax Act. Therefore, in order to provide certainty on this issue, it is proposed to clarify that for the purposes of section 37(1) any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2013 shall not be deemed to have been incurred for the purpose of business and, hence, shall not be allowed as deduction under section 37. However, the CSR expenditure which is of the nature described in section 30 to section 36 of the Act shall be allowed deduction under those sections subject to fulfilment of conditions, if any, specified therein.”

5.5. From the above it is clear that under Income tax Act, certain provisions explicitly state that deductions for expenditure would be allowed while computing income under the head, ‘Income from Business and Profession” to those, who pursue corporate social responsibility projects under following sections.

| • | | Section 30 provides deduction on repairs, municipal tax and insurance premiums. |

| • | | Section 31, provides deduction on repairs and insurance of plant, machinery and furniture |

| • | | Section 32 provides for depreciation on tangible assets like building, machinery, plant, furniture and also on intangible assets like know-how, patents, trademarks, licenses. |

| • | | Section 33 allows development rebate on machinery, plants and ships. |

| • | | Section 34 states conditions for depreciation and development rebate. |

| • | | Section 35 grants deduction on expenditure for scientific research and knowledge extension in natural and applied sciences under agriculture, animal husbandry and fisheries. Payment to approved universities/research institutions or company also qualifies for deduction. In-house R&D is eligible for deduction, under this section. |

| • | | Section 35CCD provides deduction for skill development projects, which constitute the flagship mission of the present Government. |

| • | | Section 36 provides deduction regarding insurance premium on stock, health of employees, loans or commission for employees, interest on borrowed capital, employer contribution to provident fund, gratuity and payment of security transaction tax. |

| | Income Tax Act, under section 80G, forming part of Chapter VIA, provides for deductions for computing taxable income as under: |

| • | | Section 80G(2) provides for sums expended by an assessee as donations against which deduction is available. |

| (a) | | Certain donations, give 100% deduction, without any qualifying limit like Prime Minister’s National Relief Fund, National Defence Fund, National Illness Assistance Fund etc., specified under section 80G(1)(i) |

| (b) | | Donations with 50% deduction are also available under Section 80G for all those sums that do not fall under section 80G(1)(i). |

| | Under Section 80G(2) (iiihk) and (iiihl) there are specific exclusion of certain payments, that are part of CSR responsibility, not eligible for deduction u/s80G. |

5.6. In our view, expenditure incurred under section 30 to 36 are claimed while computing income under the head, ‘Income form Business and Profession”, whereas monies spent under section 80G are claimed while computing “Total Taxable income” in the hands of assessee. The point of claim under these provisions are different.

5.7. Further, intention of legislature is very clear and unambiguous, since expenditure incurred under section 30 to 36 are excluded from Explanation 2 to section 37(1) of the Act, they are specifically excluded in clarification issued. There is no restriction on an expenditure being claimed under above sections to be exempt, as long as it satisfies necessary conditions under section 30 to 36 of the Act, for computing income under the head, “Income from Business and Profession”.

5.8. For claiming benefit under section 80G, deductions are considered at the stage of computing “Total taxable income”. Even if any payments under section 80G forms part of CSR payments (keeping in mind ineligible deduction expressly provided u/s.80G), the same would already stand excluded while computing, Income under the head, “Income form Business and Profession”. The effect of such disallowance would lead to increase in Business income. Thereafter benefit accruing to assessee under Chapter VIA for computing “Total Taxable Income” cannot be denied to assessee, subject to fulfilment of necessary conditions therein.

We therefore do not agree with arguments advanced by Ld.DR.

5.9. In present facts of case, Ld.AR submitted that all payments forming part of CSR does not form part of profit and loss account for computing Income under the head, “Income from Business and Profession”. It has been submitted that some payments forming part of CSR were claimed as deduction under section 80G of the Act, for computing “Total taxable income”, which has been disallowed by authorities below. In our view, assessee cannot be denied the benefit of claim under Chapter VI A, which is considered for computing ‘Total Taxable Income”. If assessee is denied this benefit, merely because such payment forms part of CSR, would lead to double disallowance, which is not the intention of Legislature.

5.10. On the basis of above discussion, in our view, authorities below have erred in denying claim of assessee under section 80G of the Act. We also note that authorities below have not verified nature of payments qualifying exemption under section 80G of the Act and quantum of eligibility as per section 80G(1) of the Act.

Under such circumstances, we are remitting the issue back to Ld.AO for verifying the quantum in respect of which deduction under section 80G of the Act could be claimed. Assessee is directed to file all requisite details in order to substantiate its claim before Ld.AO. Ld.AO is then directed to grant deduction to the extent of eligibility.

Accordingly, Ground No. 1 raised by assessee stands allowed.

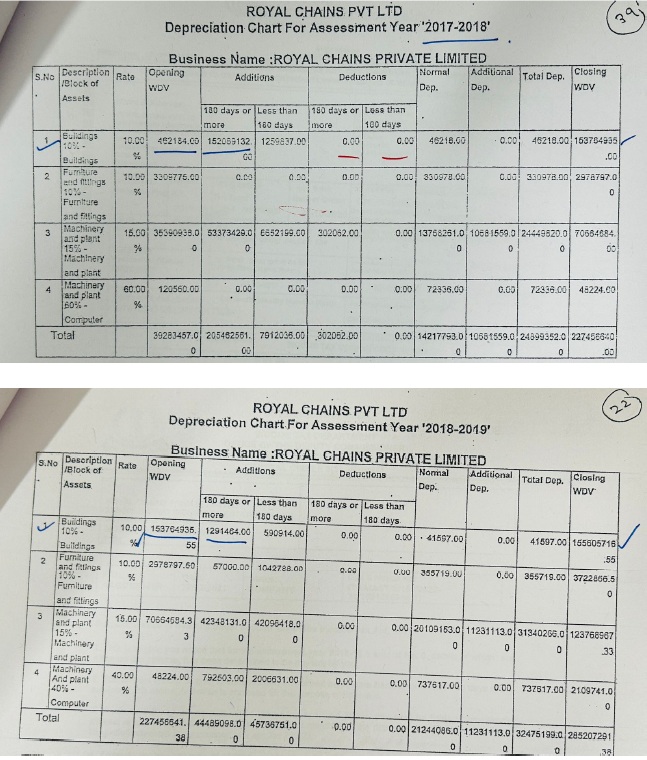

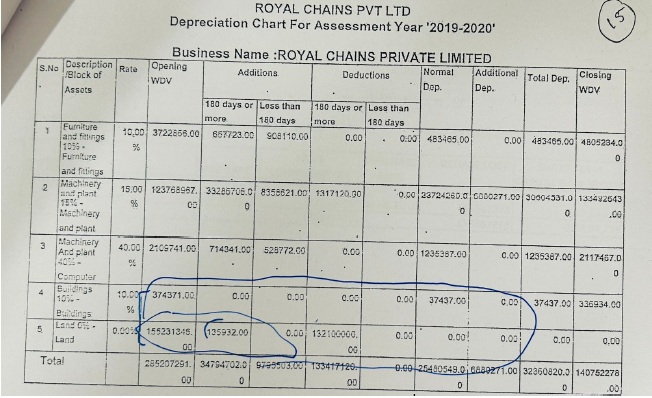

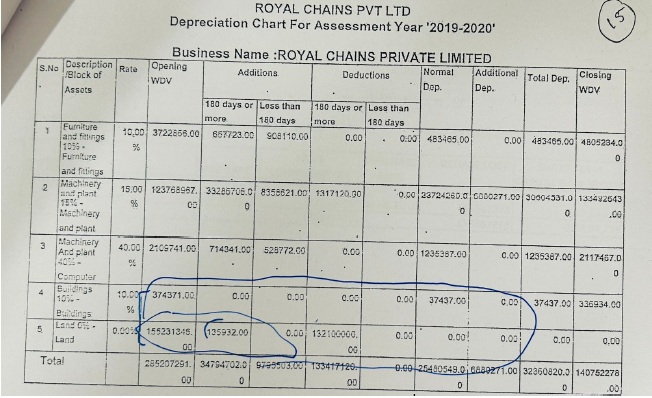

6. Ground No. 2 argued by the Ld.AR is in respect of the disallowance of the computation of short-term capital loss claimed by the assessee to be carried forward to subsequent year. The Ld.AR submitted that till financial year 2015-16, assessee had one land and factory building in the block of asset whose WDV as on 31/03/2016 was Rs. 4,62,184/-. He submitted that during financial year 2016-17, the assessee purchased another factory land and building at MIDC Andheri, Mumbai. However, the assessee did not put this second factory to use in the year relevant to financial year 2016-17. The Ld.AR the submitted that, therefore, in computing its income for AY 2018-19, the assessee claimed depreciation only on the first building and not on the second building. In support, he placed reliance on the computation of income as well as the financial statements of the assessee for assessment year 2017-18.

6.1. The Ld.AR submitted that this position was not disturbed by the revenue authorities and the return of income filed by the assessee was accepted. The Ld.AR further submitted that similar was the situation for assessment year 2018-19. However, during the financial year relevant to the assessment year under consideration, the second factory building along with land appurtenant were sold by the assessee. He submitted that unless the assessee has put it to use, the same cannot be subjected to depreciation u/s 32 of the Act. The Ld.AR submitted that assessee had not put to use the second factory building and, therefore, it cannot be added in the working of block of asset nor it can be reduced when it is sold. The Ld.AR submitted that based on this understanding of the law, assessee worked out the capital gains on the sale of the second building on a stand-alone basis that resulted in a short-term capital loss of Rs.2,32,67,278/-.

6.2. The Ld.AR submitted that during the assessment proceedings the assessee was issued show cause notice to explain transaction of sale and the loss not offered to tax by the assessee. The Ld.AO was of the view that the second factory building should be included in the block of asset even though it was not put to use for the purpose of business, at any time, since inception.

6.3. The Ld.AR before us submits that, the surrender of no carry forward of short-term capital loss by the assessee was under the circumstances to treat the asset to be part of block of asset. He submitted that, under no circumstances in the past assessee “put to use” the second asset that was purchased in the year 2016-17 and had also not claimed any depreciation on the same. It was submitted that, the assessee demolished the building and constructed a new one for which completion certificate was obtained on 17/04/2018. It was thus submitted that, there was no building or structure on the land during the interregnum period and, therefore, the submission that, it was not put to use, stands established. The Ld.AR submitted that, the assessee wrongly included the second asset into the block of asset in the revised return, however, assessee may be allowed to correct this mistake as originally assessee had not included the same in the block of asset. In support, Ld.AR placed reliance on the decision of the Hon’ble Supreme Court in the case of Pullangode Rubber Produce Co. Ltd. v. State of Kerala [1973] 91 ITR 18 (SC), wherein the Hon’ble Supreme Court has observed that, “.An admission is an extremely important piece of evidence but it cannot be said that it is conclusive. It is open to the person who made the admission to show that it is incorrect.”.

6.4. The Ld.AR submitted that the admissions made by the assessee before the Ld.AO cannot be treated as an estoppel in the eyes of law to deny the claim of the assessee.

6.5. On the contrary, Ld.DR submitted that there is a huge gap between the purchase date and the demolition date. Further there is gap between the date of completion certificate of the new building and the date of sale of the said land and building by the assessee. Under such circumstances, whether the asset was not put to use cannot be ascertained by the assessee. He also emphasised that, the electricity and water charges paid in respect of the already existing building on the land prior to its demolition establishes that the “put to use criteria” u/s 32 of the Act stands satisfied.

6.6. Further, the Ld.DR submitted that intention of the assessee to demolish the old building and to reconstruct a new one was to use it for its business purposes and, therefore, the Ld.AO has correctly considered the second asset in the block of asset. The Ld.DR emphasised that, once an asset enters block its individual identity is lost and thus, the claim of the assessee of short-term capital loss cannot be allowed. The Ld.DR thus, placed reliance on the orders passed by the authorities below.

6.6. In the rejoinder, Ld.AR submitted that the electricity bill paid in respect of the old premises prior to its demolition was very much meagre which also leads to the presumption that the assessee had put to use the said building for the purpose of business.

We have perused the submissions advanced by both the sides in light of the records placed before us.

7. It is noted that the assessee purchased the second asset vide agreement dated 03/05/2016 for a value of Rs. 15 Crores. Admittedly, during the relevant financial year, assessee did not include the said asset into the block of assets. However, during the subsequent assessment year 2017-18, additions were made into the block of asset (as per page 39 of the paperbook), but no depreciation was claimed on the same. This position continued in the subsequent assessment years, including the year under consideration. This makes it amply clear that the assessee intended to use the second asset for the purposes of business.

7.1. At this juncture it is very important to note that the assessee demolished the building and was in the process of constructing new building for which the commission certificate was received during the financial year relevant to assessment year under consideration. Therefore, in the assessment years between 2017-18 to 2019-20, there was no structure of the land on which assessee could have claimed depreciation.

7.2. During the year under consideration, the assessee sold the asset vide agreement dated 10/10/2018 for sale consideration of Rs.13,21,000/-. The Ld.AR submitted that the land and building could not have been used by the assessee and, therefore, it deemed it appropriate to sell the asset as early as possible. The assessee in the original return of income thus claimed the loss as short term capital loss and also claimed for a carry forward of the same. Subsequently, during the assessment proceedings, the assessee treated it as part of block of asset based on which the short-term capital loss claimed by the assessee was disallowed by Ld.AO.

7.3. On perusal of the entire factual aspect in respect of the treatment of the asset, we are of the view that both the assessee as well as the Ld.AO did not follow the due accounting principles applicable in this peculiar circumstance. It is noted from the audited financials for Ay 2017-18 placed at page 39 of the paperbook that the assessee included the second property being land and building in the Block as addition. Accordingly, the block contained two assets. However, did not claim depreciation.

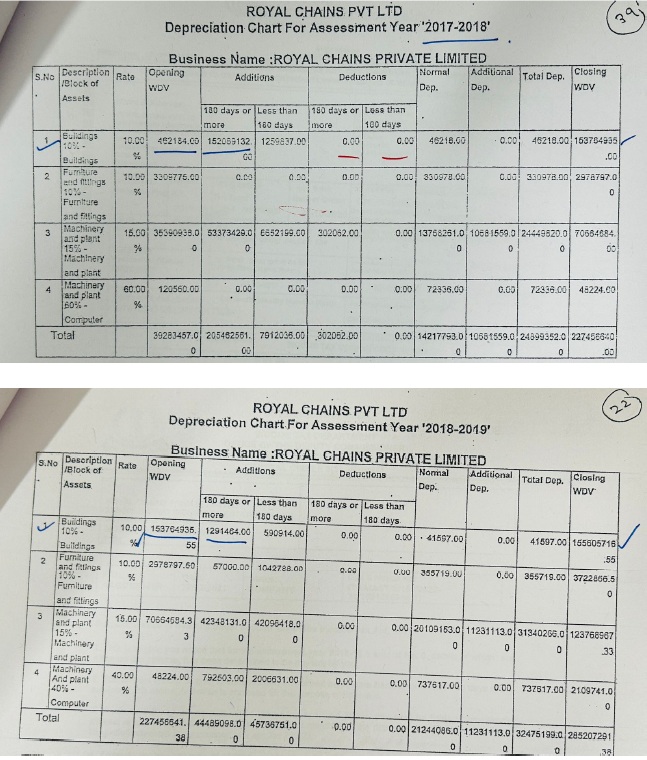

7.4. Subsequently, the building/structure that existed was demolished by the assessee in order to construct a new one. It is noted that the expenditure incurred to construct the same entered the block and shows as addition year on year. The assessee subsequently, in financial year relevant to assessment year under consideration sold one of the assets in the block that is the alleged property. On perusal of the depreciation chart for Income tax purposes from assessment year 2017-18 at page 39 of paperbook, assessment year 2018-19 at page 22 of the paperbook and for the year under consideration at page 15 at the paperbook, as extracted below:-

7.5. From the above charts, we notice that, the assessee was having only on block of building to which the construction cost to the new building is show as addition till AY 2018-19. However, in assessment year 2019-20, the assessee split the old building as a separate block and the new constructed building and land as a separate block as “land”. As per Schedule AL, the assessee cannot group land and building under a single block as “land”. Further the new building constructed by the assessee should be part of the buildings which is eligible for depreciation at 10%.

7.6. Under such factual circumstances, we are unable to ascertain if there is any other asset which still remains in the block. If there is any asset still existing in the block, assessee cannot claim short term capital loss since the sale value would go to reduce the WDV of the asset on which the assessee is eligible for depreciation as per the provision of Section 50 of the Act. However, the asset sold is the only asset in the block then assessee is right in contending that the net amount is a short term capital loss. The submissions advanced by the assessee regarding “put to use” to justify the claim to be a short term capital loss is, therefore, of no relevance. We remit the issue back to the Ld.AO to carry out necessary modifications in respect of block of assets as declared by the assessee for the purpose of computation of income and consider the claim in accordance with law.

Accordingly, Ground No. 2 raised by the assessee stands is partly allowed for statistical purposes.

8. In respect of the revenue’s appeal, the only issue raised is regarding the addition being deleted on account of excess stock found in the hands of assessee amounting to Rs. 4,54,63,267/- and discrepancy in stock of 24KT gold amounting to Rs. 2,12,52,000/-. The Ld.DR, at this juncture heavily relied on the observations of Ld.AO.

8.1. On the contrary, the Ld.AR relied on the factual analysis carried out by Ld.CIT(A) on this aspect.

9. We have perused the submissions advance by both the sides in the light of records placed before us.

10. It is noted that a survey action was undertaken at the premises of assessee u/s 133A of the Act alongwith manufacturing units at Sewri. A physical verification of gold and jewellery was taken at both places based on which it was found that there was excess stock as compared to the books of accounts as on the date of survey. The survey team also recorded statements of Shri Devaram Kumavat, Shri Suresh Jain (Director) and Shri Vinod Vora (Accountant), in order to establish the excess stock in the hands of assessee.

10.1. Based on survey proceedings, the DDIT issued notices u/s 131 of the Act to one M/s. Abhushan Creations Pvt. Ltd., from where it was stated that the assessee’s employee had picked up gold of 7000 grams against purchase order, on the very same date, which had not been entered into the books of accounts of assessee. M/s. Abhushan Creations Pvt. Ltd., subsequently responded to the notice and furnished all relevant documents like tax invoices of sales made to assessee for a period between 06/09/2018 till the date of survey, copies of bank statement highlighting transactions with the assessee, copies of stock book, purchase bill for the period 01/09/2018 to 08/09/2018. It was submitted that these details confirmed the dealing of assessee with M/s. Abhushan Creations Pvt. Ltd. It is noted that, the goods so purchased were received prior to the commencement of the survey action for which the invoices were not entered. Subsequently, the Ld.AO also issued notice u/s 133(6) of the Act various parties to reconciled the statement and stock of sales made by the to the assessee. It is noted that, the Ld.AO without cross verifying all these details below the statements furnished by the parties from whom the assessee stated to have purchased the gold and made an addition treating the excess stock in the hands of the assessee as undisclosed. The Ld.CIT(A) after considering all the details, observed as reproduced hereinabove.

11. There is nothing contrary to the observations of Ld.CIT(A) that has been brought on record by the revenue. We, therefore, do not find any infirmity in the view taken by the Ld.CIT(A) and the same is upheld. Further in respect of the discrepancy of stock in 24KT gold, the Ld.CIT(A) in para 7.4.1 to 7.4.6. has dealt with the issue in great detail by relying on the statements and details furnished by M/s. Abhushan Creations Pvt. Ltd., in response to notice u/s 133(6) issued by the Ld.AO. It has been observed that the transaction is reflected in the audited books of both the assessee as well as the supplier and, therefore, no case has been made out by the Ld.AO of any bogus or fictitious purchase stock. It is noted by the Ld.CIT(A) that the only reason for stock mismatched during the survey was that, the entries of the masses had not been made which were pending and the quantity checks were yet to be done. It is noted that, before the Ld.CIT(A) assessee submitted elaborate reconsideration on 16/05/2019 which was also punished before the Ld.AO which was confirmed by M/s. Abhushan Creations Pvt. Ltd. It has also been noted by Ld.CIT(A) that, the survey was conducted in the middle of the financial year and, therefore, one has to tally accept that the books of accounts could not have been updated on real-time basis. Based on these observations, and factual analysis, the Ld.CIT(A) deleted the addition on account of excess stock of 24KT gold from M/s. Abhushan Creations Pvt. Ltd.

12. Nothing contrary to the observations of the Ld.CIT(A) has been brought on record by the revenue. We, therefore, find no infirmity in the view adopted by the Ld.CIT(A) and the same is upheld.

Accordingly, the grounds raised by the revenue stand dismissed.

In the result, appeal filed by the assessee stands partly allowed and appeal filed by the revenue stands dismissed.

Order pronounced in the open court on 05/12/2025.