ORDER

Ravish Sood, Judicial Member.- The present appeal filed by the assessee company is directed against the order passed by the A.O under Section 143(3) r.w.s.144C(13) of the Income Tax Act, 1961 (“the Act”) dated 25.02.2024, which in turn arises from the directions issued by the Dispute Resolution Panel-1, Bengaluru (for short, “DRP”) for the assessment year 2020-21. The assessee company has assailed the impugned order on the following grounds of appeal before us:

“1. Erroneous transfer pricing adjustment of INR 10,58,23,162 in respect of international transaction of provision of software development and support services

1.1. The learned AO erred, on the facts and circumstances of the case and in law, in proposing a transfer pricing adjustment of INR 10.58,23,162/- to the income of the Appellant in relation to the international transection of provision of software development and support services (“SDS services”), vide Assessment Order under section 143(3) r.w 144C(13) read with section 144B of the Income-tax Ac, 1961 (“he Ac”

1.2. The learned AO/Transfer Pricing Officer (“TPO”) erred in law and in facts in rejecting the Appellant’s transfer pricing documentation without any cogent reasons.

1.3 The learned AO/TPO erred in law and in facts by inappropriately rejecting some of the comparability filters adopted by the Appellant in its TP study report and applying additional filters and proceeded to undertake a fresh search for benchmarking the said international transaction of SOS services.

1.4 The learned AO/TPO erred in law and in facts in rejecting the following comparable companies accepted by the Appellant in its transfer pricing study report for benchmarking the said international transaction of provision of SDS services:

| • | | Yudiz Solutions Pvt. Ltd |

| • | | R Systems International Ltd |

| • | | Sasken Technologies Ltd. |

| • | | Info Bears Technologies Ltd. |

1.5 The learned AO erred in law and in facts in rejecting the following additional comparable companies proposed by the Appellant for benchmarking the said international transaction of provision of SDS services:

| • | | Kireeti Soft Technologies |

| • | | Hurix System Private Limited |

1.6 The learned AO/TPO erred in law and in facts in selecting the following additional companies as comparable for benchmarking the said international transection of provision of SDS services:

| • | | Great Software Laboratory Pvt Ltd |

| • | | Robosoft Technologies Ltd |

| • | | Daffodil Software Pvt Ltd |

| • | | CC VAK Software & Exports Ltd |

| • | | Harbinger Systems Pvt Ltd |

1.7 The learned AO/TPO erred in not applying the upper limit turnover filter while selecting comparable companies for benchmarking the said international transaction of provision of SDS services.

1.8 The learned AO/TPO erred in including companies as comparable having significant revenue/expenses from onsite activities while benchmarking the said international transaction of provision of SDS services.

1.9 The learned AO/TPO erred in computing the net operating margins of certain companies accepted as comparable for benchmarking the said international transaction of provision of SDS services.

1.10 The learned AO/TPO erred in law and in facts, in not allowing adjustment for differences in the levels of working capital of the Appellant and the comparable companies proposed to be selected in determining the arm’s length prices of the international transaction of provision of SDS services.

1.11 The learned AO/TPO erred in law and in facts, in not allowing adjustment for differences in the levels of risks assumed by the Appellant and the comparable companies proposed to be selected in determining the arm’s length price of the international transaction of provision of SDS services.

2 Erroneously considering the total income of the Appellant in excess in terms of the Intimation” u/s. 143(1) of the Act.

2.1 The learned AO has erred in considering the total income of the Appellant under the normal provisions of the Act in excess in terms of the ‘Intimation’ u/s. 143(1) of the Act

2.2 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject, no intimation u/s. 143(1) of the Act has been received/served.

2.3 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject the disallowance made in terms of the Intimation u/s. 143(1) of the Act is misconceived, erroneous, illegal, and unwarranted.

2.4 The Appellant submits that the learned AO be directed to consider the correct total income of the Appellant and to re-compute the tax thereon accordingly.

3. Erroneous disallowance of INR 13,13,770 pertaining to leave encashment expenses claimed by the Appellant under section 43B of the Act

3.1 The learned AO has erred in not granting a deduction of INR 13,13,770/- /s.43B of the Act

3.2 The Appellant submits that considering the facts and circumstances of its case and the law prevailing on the subject, it is interalia eligible for claiming deduction u/s. 43B of the Act on account of leave encashment which has been paid on or before the due date of filing the return of income and the stand taken by the learned AO in this regard is illegal, incorrect, erroneous and misconceived.

3.3 The Appellant submits that the learned AO be directed to grant deduction w/s. 43B of the Act and to re-compute its total income and tax liability accordingly.

4. Others

4.1 The learned AO erred in initiating proceedings for penalty under section 274 read with section 270A of the Act, consequent to the above adjustment.

4.2 The Appellant submits that each ground of appeal are without prejudice to one another.

4.3 The Appellant desires to leave to amend, alter or to add, by deletion, substitution or otherwise, any or all of the above grounds of objections, at any time before or during the hearing of the Appeal.

2. Succinctly stated, the assessee company is a wholly-owned subsidiary of its overseas parent company and is engaged in the business of providing software development services exclusively to its associated enterprise (for short, “AE”), and is characterized as a captive service provider assuming limited risks.

3. The assessee company had filed its return of income for AY 2020-21 on 24.12.2020, declaring an income of Rs. 6,41,92,580/-. Subsequently, the case of the assessee company was selected for scrutiny assessment, and notice under Section 143(2) of the Act, dated 29.06.2021, was issued to the assessee company. Also, as observed by the AO the return of income filed by the assessee company was thereafter processed vide an intimation issued under Section 143(1)(a) of the Act, dated 30.11.2022, wherein after making an addition of Rs. 13,13,770/- under Section 43B of the Act the income of the assessee company was determined at Rs. 6,55,06,350/-.

4. During the course of the assessment proceedings, the AO made a reference to the Transfer Pricing Officer (for short, “TPO”) under section 92CA(1) of the Act for determining the Arm’s Length Price (for short, “ALP”) of the international transactions of software development services that were provided by the assessee company to its Associate Enterprise (for short, “AE”), viz. High Radius Corporation, USA.

5. The TPO, in the course of proceedings before him, rejected certain comparables included in the assessee’s transfer pricing study report, and selected a new set of comparables by applying filters, viz. (i). rejection of companies having R&D expenses in excess of 3% of sales; (ii). turnover filter of more than Rs. 1 crore; (iii). rejection of companies having export income of less than 75% of sales; (iv). employee cost filter of less than 25% of sales; (v). exclusion of companies having different financial year endings; and (vi). application of RPT filter of 25%. Thereafter, the TPO, based on the final set of comparables selected by him, determined the mean margin at 21.43% as against the assessee’s margin of 14.29%, resulting in an upward adjustment of Rs. 12,32,46,335/- to the arm’s length price of the international transactions of provision of software development services to its AE.

6. Aggrieved, the assessee company filed objections before the DRP, which, vide its order dated 30.01.2024, substantially upheld the action of the TPO, except for minor corrections.

7. Thereafter, the AO vide his final assessment order passed under Section 143(3) r.w.s 144C(13) r.w.s 144B of the Act, dated 25/02/2024 (after taking the income of the assessee company determined vide an impugned intimation issued u/s 143(1)(a) of the Act, dated 30.11.2021 at Rs. 6,55,06,350/-) made TP adjustment as directed by the DRP-1, Bengaluru of Rs. 10,58,23,162/-, and determined its income at Rs. 17,13,29,510/-.

8. The assessee company aggrieved with the order passed by the AO under Section 143(3) r.w.s 144C(13) r.w.s 144B of the Act, dated 25.02.2024, has carried the matter in appeal before us.

9. We have heard the Ld. Authorized Representatives of both parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that have been pressed into service by them to drive home their respective contentions.

10. The core dispute relates to the adjustment of Rs. 10,58,23,162/-made by the Transfer Pricing Officer (TPO), while giving effect to the directions of the DRP-1, Bengaluru, for determining the Arm’s Length Price (ALP) of the international transaction of software development and support services provided by the assessee company to its Associated Enterprise (AE).

11. As observed hereinabove, the assessee company is a captive service provider remunerated by its AE on a cost-plus basis. Ostensibly, a perusal of the record reveals that the assessee company neither owns any intellectual property (IP) nor undertakes research and development (R&D) and bears only limited operational risks.

12. During the subject year, the assessee company had earned an operating margin (OP/TC) of 14.29 %. It had applied the Transactional Net Margin Method (TNMM) with Operating Profit/Total Cost (OP/TC) as the Profit Level Indicator (PLI). The arm’s-length range determined by the assessee company in its Transfer Pricing Study Report (TPSR) (after working-capital adjustment), considering 8 comparables selected by it was 11.36% to 16.80%, with a median of 14.27%. Accordingly, the assessee company had claimed its international transactions with its AE as being at arm’s length

13. However, we find that the TPO rejected certain comparable and had,interalia, included seven new companies, viz. (i). L&T Infotech Ltd.; (ii). Tata Elxsi Ltd. (iii). Infosys Ltd.; (iv). Wipro Ltd.; (v). Nihilent Ltd.; (vi); Great Software Laboratory Pvt. Ltd.; and (vii). Cybage Software Pvt. Ltd. Also, the TPO had excluded R Systems International Ltd.,i.e. , one of the comparable that was selected by the assessee company. Accordingly, the TPO vide his order passed u/s 92CA(3) of the Act, dated 27/03/2023, suggested an upward adjustment of Rs. 12,32,46,335/-.

14. Thereafter, the Dispute Resolution Panel-1, Bengaluru,vide its order dated 30.01.2024, directed the TPO to exclude certain comparables from the software development segment for comparability analysis. Accordingly, the TPO, in view of the directions of the DRP-1, Bengaluru, made the final adjustment of Rs. 10,58,23,162/-.

15. We have heard the Ld. Authorized Representatives of both parties in the backdrop of the orders of the authorities below.

16. Shri. Ketan Ved, Ld. Authorized Representative (for short, “AR”) for the assessee company has assailed the orders of the authorities below on the limited extent that they had erred in including/excluding certain comparables in the final list of comparables for benchmarking the international transaction of provision of software development services by the assessee company to its Associate Enterprise (for short, “AE”), viz. High Radius Corporation, USA. As the Ld. AR has confined his contentions to the extent of sustainability of the inclusion/exclusion of certain comparable in the final list of comparables, therefore, we shall confine our adjudication only to the said limited extent.

17. Before dealing with the respective comparables in question, we deem it apposite to cull out the functional, asset, and risk (FAR) profile of the assessee company before us. The FAR analysis of the assessee company as per its TP study report and other documents, reveals as under:

| • | | Functions: The assessee company performs software development, testing, and maintenance for its AE. It works strictly as per the specifications provided by the AE and does not carry out any independent research or marketing. |

| • | | Assets: The assessee company owns computers, servers, and software tools required for its work and does not possess any proprietary software or intellectual property. |

| • | | Risks: The assessee company as a captive service provider, bears only the operational risks, viz. employee-related or delivery-related risks, while the market, credit, and product risks are borne entirely by its AE. |

Accordingly, based on the FAR analysis of the assessee company, it can safely be characterized as a low-risk captive software development service provider.

18. We shall now deal with the respective comparables, whose inclusion/exclusion by the TPO/DRP has been assailed by the Ld. AR before us in the backdrop of the observations arrived at by the DRP after considering the objections of the assessee company, as under:

(A). Larsen & Toubro Infotech Ltd.

19. We have thoughtfully considered the contentions advanced by the Learned Authorized Representatives of both parties in context of the aforesaid comparable viz., Larsen & Turbo Infotech Ltd (for short, “LTI”) which had been included by the Transfer Pricing Officer (in short, “TPO”) in the list of comparables for benchmarking the international transactions of the assessee company with the Associated Enterprise (for short, “AE”). Before proceeding further, we deem it apposite to cull out the observations of the DRP, which had upheld the inclusion of LTI in the final list of comparables by the TPO, as under:

“2.5.6.1 Having considered the submissions, we note, the company is engaged in providing application maintenance and Development, Enterprise Resource Planning and Testing. For the period ended March 31, 2018, March 31, 2019 and March 31, 2020, as per the information in the annual reports, 100 percent of the operating revenues respectively were derived from software development services. The activities IT services like Application maintenance and Development, Enterprise Resource Planning and Testing are all software development activities and fall within the umbrella IT services, as per NASSCOM. As per the annual report information for the year ended 31.03.2020, the main object of the Assessee company is to carry on the business of designing software development, software maintenance and support services the areas of computer networks, computer software and hardware, data communication equipment, ectronic equipment, radio and wireless communication product and equipment wireless telecommunication equipment of every description. Thus, the activities of L&T are functionally comparable to the Assessee company, as evident from the nature of services rendered by it. Therefore, the plea that this company performs different functions has no basis. The nature of activity performed by this company is given at page 83 of the annual report, as under:

“Larsen & Toubro infotech Limited (‘Company’) together with its subsidiaries shall mean Larsen and Toubro infotech Limited (“Group’). The Group offers extensive range of IT services like application development, maintenance and outsourcing, enterprise solutions, infrastructure management services, testing, digital solutions, and platform-based solutions to the clients in diverse Industries.”

2.5.6.2 In view of the above information, it is very clear that this company is engaged in software development services only and hence functionally comparable. The plea that it has diversified activities has no basis, as could be seen from the above information and discussion in the annual report of this company. The financial statements do not mention about any product sale or Inventory. As there is no revenue stream on account of product sales, we do not find any ment in the argument that the company is engaged in product sales. Accordingly, we hold that this company is functionally comparable to the Assessee.

2.5.6.3 It was argued that during the year under consideration, L&T Infotech has acquired Lymbyc Solutions Private Limited and Powerupcloud Technologies Private Limited (F.Y.2019-20). Accordingly, the company has experienced in organic growth owing to which, financial year 2019-20 has been a year with extraordinary events. The Assessee has not furnished any information to demonstrate the said plea. Having examined the plea, we note that with the acquisition of M/s Lymbyc Solutions Private Limited and with regards to M/s. Powerupcloud Technologies Private Limited, it had become wholly owned subsidiary operating in the same field of rendering software services. The method of accounting to give effect to the amalgamation into the accounts is discussed at pages 206 & 207 of the annual report.

2.5.6.4 As per the Annual report, pursuant to scheme of acquisition of the abovementioned entities during the FY 2019-20 and there is no impact as such on comparability, as the transferor company is also in the same line of business activity- namely software development services. Thus, there is no functional difference so as to affect comparability on account of the said acquisition. On further perusal of the financial reports for the three years, we note that there is no impact on the profitability of the transferee company on account of such acquisition, as could be seen from the following information extracted from the annual report:

| Financial Year | Operating profit |

| 2012-13 | 22.7% |

| 2013-14 | 21.19% |

| 2014-15 | 21.6% |

| 2015-16 | 21.7% |

| 2016-17 | 19.15% |

| 2017-18 | 18.11% |

| 2018-19 | 20.15% |

| 2019-20 | 18.15% |

2.5.6.5. The above information clearly shows that the amalgamation has not impacted in increasing the profitability of the transferee company. Besides, it is also seen that the company has not reported amalgamation as a significant factor affecting its revenue growth or profitability. In view of these, we reject the plea that this company has to be excluded on account of amalgamation.

2.5.6.6 The Assessee has also argued that this company derives a significant amount of revenue from its onsite activities as well as incurring onsite branch office expenses. Although the Assessee has argued for the exclusion of the company also on this ground but, has not given any reasons or justification as to how this affect comparability.

2.5.6.7 At the outset, we note that in many cases, the expenditure incurred in foreign currency has been assumed to represent onsite expenses which are totally incorrect. All expenses incurred in foreign currency cannot be assumed to relate to expenditure incurred for onsite activity. There will be many situations, that for the offshore activity, the enterprise may have to incur expenses in foreign currency, such as towards commission payment, consultancy payment, travel expenses etc., Therefore, the percentage working of onsite expenses given, in all are found to be erroneous and unreliable. Only in the case of some comparables there is clear mention of onsite activity and onsite expenses. As to the incurrence of onsite expenses, we note that the Assessee has not given any reasons or justification as to how these affects functional comparability as such.

2.5.6.8 In this regard, we also note profit margins for onsite work is normally low as compared to offshore work and average rate per hour differs for onsite and offshore work; the salary structure in case of onsite project is governed by the economic conditions prevailing in the resident country where work is actually performed, whereas in offshore projects, Indian conditions govern the salary structure which is much lower as compared to the country where associated enterprise is located. Further, the employees if sent overseas have certain dead hours, which cannot be properly utilized as can be done in the home country. These facts are favorable to the Assessee on which, there should be no grievances to the Assessee. Accordingly, there is no need to reject a functionally comparable company on account of onsite activity. In this regard reliance is placed on the order of ITAT, Mumbai in the case of Capgemini in Para 5.3.7 wherein it was held that “The Id. Sr. Counsel has also pointed out that Infosys and Wipro have substantial revenue, 51.7% in case of 33 Infosys, and 45.3% in case of Wipro from on-site work done overseas at the site of clients whereas the onsite work in the case of the Assessee is just 5%. It has been pointed out that the employees if sent overseas have certain dead hours, which cannot be properly utilized as can be done in the home country. But this argument as rightly pointed out by the Id, CIT-DR does not support the case of higher margin in case of onsite work because dead hours would mean less output with the same employee cost, which would in fact reduce the margin. No material has also been placed before us to show that the margin in case of on-site work is higher. Therefore, we do not find merit in the objection for exclusion of companies merely on account of onsite expenditure.” In view of the above, the argument made by the Assessee is rejected on onsite activity

2.5.6.9 A plea was also raised that this company has incurred substantial expenditure towards R&D and hence not to be taken as comparable. However, perusal of the information in the annual report shows that there is an expenditure of Rs.302 million as against total revenue of Rs.69,064 million which comes to 0.43% of total revenue. This percentage of expenditure is below the threshold limit of 3% adopted in case of R&D expenditure. There is no indication in the annual report to show that the R&D had resulted in any distinct product development giving rise to source of separate revenue stream. The information on technology absorption on which the Assessee has relied on states that R&D activities are integrated with software development process with objective of ensuring efficiency and quality. Therefore, they are to be taken as routine activities in enhancing the quality of delivery of services. In view of the above these pleas are rejected.

2.5.6.10 The plea of the turnover range will not affect the comparability as discussed in paras 2.4.3.1 & 2.4.12.1 to 2.4.12.12 above.

2.5.6.11 In view of the above, we uphold the selection of this comparable.”

20. At the threshold, we may herein observe that LTI is engaged in diversified activities, wherein it is offering an extensive range of IT services, viz., application development, maintenance and outsourcing, enterprise solutions, infrastructure management services, testing, digital solutions, and platform-based solutions to its clients in diverse industries, which, thus, renders it functionally dissimilar to the assessee company which is a low-end captive service provider of software development services to its AE. Apart from that, we find that there is no segment-wise breakup regarding the software development services provided by the aforementioned comparable. Also, we find that during the year under consideration, the aforementioned comparable, viz., LTI had acquired Lymbyc Solutions Pvt. Ltd. on 01.08.2019, a specialist in AI, machine learning, and an advanced analytics company with their proprietary product, viz. “Leni”; and Powerupcloud Technologies Pvt Ltd. on 01.10.2019, a born-in-cloud company with cloud consulting capability across all three leading cloud platforms – AWS, Microsoft Azure, and Google Cloud. Although the DRP had observed that pursuant to the acquisition of the aforementioned companies, there was no impact regarding the comparability as the transferor company was also in the same line of business activity, i.e., software development services, but we are unable to persuade ourselves to concur with the same. Further, we find that the operation of the LTI for the subject year is significantly higher in comparison to the assessee company before us. On perusal of the “annual return” of the comparable for the year under consideration,i.e., Financial Year ending 31/03/2020, we find that its revenue from operations was Rs. 10184.20 crores as against the revenue of Rs. 195.39 crores of the assessee company. Further, we find that the said comparable owns proprietary platforms, viz. “Mosaic” and “Canvass”, spend significantly on R&D and operate on a global scale.

21. We find that the issue of inclusion of LTI as a comparable company in the case of software development services (SDS) had come up before the ITAT, Hyderabad in the case of ADP (P.) Ltd. v. Dy. CIT The Tribunal had, after exhaustive deliberations, concluded that the said company cannot be considered as a comparable for benchmarking the transactions in the software development segment for the reason that there was an extraordinary event during the subject year,i.e. , amalgamation. Also, we find that the ITAT, Bangalore in the case of EMC Software and Services India (P.) Ltd. v. Asstt. CIT (Bang-Trib.)/in IT(TP)A No. 191/Bang/2022 had observed that LTI could not have been considered as a comparable for benchmarking the transactions of software development segment in the case before them for the reason that it was functionally dissimilar, and also that no segmental information etc. of its software development segment was available. We find that the ITAT, Bangalore in the case of AMD India (P) Ltd v. Asstt. CIT [IT (TP) Appeal No. 775 (Bang) of 2022, dated 11-9-2023], while disposing of the case of the assessee before them for AY 2018-19, had held that the aforementioned company could not be selected for benchmarking the transactions in the software development segment for the reason that the same was functionally dissimilar and was involved in diversified activities. For the sake of clarity, the observations of the Tribunal wherein it had held that the LTI could not be selected as a comparable for benchmarking the transactions of software development services are culled out as under:

“15. The Id. AR submitted that this company is functionally different as it is engaged in diversified business activities like infrastructure management services, digital consultation, data and analytics and is not a pure software development company. The services are provided under two segments, namely Services cluster and Industrial cluster. Software service segmental data is not available in the AR. The Company has global brand value and has business spread across borders. AugmentIQ Data Sciences Private Limited amalgamated with L&T in FY 2017-18. This company has substantial onsite operations for all 3 FY’s i.e., FY2017-18 (54.17%), FY 2016-17 (53.32%) & FY 2015-16 (57.20%). Thus, business model is different from Appellant. Reliance is placed on the decision of this Tribunal in assessee’s own case for AYs 2016-17 & 2017-18 in IT(TP)A Nos. 238 & 262 /Bang/2021 dated 26.06.2023 and other decisions in M/s. Huawei Technologies India Pvt. Ltd. (TS-855-ITAT-2022 Bang-TP) for AY 2018-19 and M/s. Yahoo Software Development India Pvt. Ltd. in IT(TP)A No. 178/Bang/2022 for AY 2017-18.”

22. Apart from that, we find that as the turnover of the comparable for the subject yeari.e., Financial Year 2019-20 is Rs. 10184.20 crores as against the turnover of the assessee company of Rs 195.39 crores, therefore, on the said count itself it cannot be selected as a comparable for benchmarking the software development services provided by the assessee company as a captive service provider to its AE.

23. Also, we may herein observe that the aforementioned comparable, viz., LTI provides end-to-end digital transformation services and consulting across multiple industries, incurs significantly on R&D, and operates on a global scale with a substantial turnover generated from consulting and IP-based solutions, while for the assessee company, on the other hand provides only captive software development services and neither owns any IP nor bears any market risk.

24. Accordingly, in terms of our aforesaid observations, we are of a firm conviction that the aforementioned company,i.e. , LTI, for the reasons stated hereinabove, could not have been picked up as a comparable for benchmarking the international transactions of the assessee company, and accordingly direct the AO/TPO to exclude the same from the final list of comparables.

(B) Tata Elxsi Ltd.

25. We have thoughtfully deliberated upon the contentions advanced by the Learned Authorized Representatives of both parties in the context of inclusion of the aforementioned comparable, viz., Tata Elxsi Ltd., in the final list of comparables by the TPO for benchmarking the transactions of providing software development services by the assessee company to its AE. Before proceeding further, we deem it apposite to cull out the observations of the DRP, which had upheld the inclusion of Tata Elxsi Ltd. in the final list of comparables by the TPO, as under:

“2.5.10.1 Having considered the submissions, on perusal of the annual report of this company, the operations of the company are into Design and Development of Computer Hardware and Software as its principal business activity. On further perusal of the Annual report (page no. 79) of the company, the Panel has noticed that the company provides product design and engineering services to the consumer electronics, communications & transportation industries and systems integration and support services for enterprise customers. The software development of the company provides design and engineering services to the consumer electronics, communications and transportation industries. The principal business activity of the company as per the Form MGT-9 (page 40 of the annual report) is design and development of computer hardware and software which contributes 97.08% of the total revenue of the company. This is supported by the breakup of revenue from operations given at Note 21 of financial statements wherein the revenue of Rs.1562.78 crores as against total revenue of Rs.1609.86 crores constituting 97.07% of the total revenue. Therefore, the software development and services segment of this company is functionally comparable to the Assessee and passes the filters of the TPO. We also note that the revenue streams from this segment are on account of rendition of services and not on account of product sales. Thus, the Software Development and Services segment of this company can be characterised as a software development & design service provider and functionally comparable to the Assessee’s activities. Therefore, the plea that this company is functionally different is rejected.

2.5.10.2 it was argued that the company is functionally different as it involved in content management which is classified as KPO. In this case as we have pointed out earlier that difference in various segmentsi.e. low end to high end in IT services is mainly on account of differences in the skill/qualification and pay structure of employees and, therefore, the main point to be considered is whether such differences between employees is going to materially affect the margin of the comparables. On the basis of billing rates/skills no conclusion could be drawn that margins in different segments of IT services are also different. This is because if the billing rate is high in the high-end services, the cost of the employees who are highly qualified/skilled also goes up steeply and, therefore, the margins are not much affected. In fact, no evidence has been produced before us to show that margins in the high-end segments of IT services is high compared to low end services. Therefore, we are unable to accept the argument that the comparable belonging to high end segments such as KPO etc. should be excluded from the comparability list on this ground alone. In fact, KPO is a term given to a branch of BPO in which apart from processing data, knowledge is also applied. In view of the above, IT services cannot be further classified as BPO and KPO services for the purpose of comparability analysis. Under the TNMM, functional similarity is more relevant than product similarity. Accordingly, we reject this plea of the Assessee. In view of the above, the company is involved in diversified activities is not acceptable.

2.5.10.3 The plea of the turnover range will not affect the comparability as discussed in paras 2.4.3.1 & 2.4.12.1 to 2.4.12.12 above.

2.5.10.4 With regard to the plea that the company has significant intangibles, we note that the value of intangibles assets shown in the balance sheet (Note 3.(ii) -Page 74) represent the computer software. The value of intangible assets as on 31-3-2020 was only Rs. 3462.77/-lakhs (page no 90 of AR) as against total revenue of Rs. 1,60,986.04 lakhs constituting 2.15% of total revenue. There is no reference to any IPR or patent owned or developed by the company, in the stand-alone qual report. There is also no acquisition of IPR during the year. The Assessee se did not point to any information in the annual report to indicate that the intangibles have materially affected the profitability of the company as required in clause (i) of sub-rule (3) of Rule 108. Taking into account all these aspects, we do not find any material difference so as to affect comparability. Hence, these pleas of the Assessee for exclusion of the company are hereby rejected.

2.5.10.5 It was plead that this company is engaged in R&D activities and has significant intangibles. However, perusal of the information in the annual report (ref p. 27) that the expenses incurred towards R&D was only 1.42% of total revenue, and quiet less to the generally acceptable tolerable limit of 3%. There is no indication in the annual report to show that the R&D had resulted in any distinct product development giving rise to source of separate revenue stream. On the other hand, the information in the annual report indicates, that the R&D activities are undertaken towards continuous training, human resource development and to facilitate the engineering teams in upcoming projects in terms of delivery capability and capacity. Therefore, the R&D activities are to be considered as routine and towards enhancing the development capability of the employees for efficient delivery. In view of the above these pleas are rejected.

2.5.10.6 Regarding the Assessee’s assertion that the company owns the brand and produced an exception from the Annual report from page no. 109. The Panel finds this argument of the Assessee without any ground as the Assessee has failed to establish that which all brands are owned by the Assessee. Even if it is assurned that the company owns any brand or brand, the Assessee could not demonstrate that how this fact could possibly impact the margin of the company which is otherwise comparable to the Assessee. Therefore, the Assessee’s plea on this ground is hereby rejected.

2.5.10.7 Regarding the plea to exclude the company from the comparable since the selection of the company is in conflict with the contemporaneous requirement, the Panel concurs with the TPO’s view of rejecting comparables with financial years outside the period of April to March is well-founded and aligns with sound Transfer Pricing principles. By applying this filter, the Assessee aims to ensure a more accurate and meaningful comparison between its financials and those of selected comparables. The decision to focus on companies with financial years ending in March is logical, as it maintains consistency and facilitates a genuine comparison profit level indicators. Comparing companies with different financial year periods could lead to distorted results, as their financials correspond to different timeframes. This approach is not only in accordance with the taxpayer’s accounting practices but also enhances the reliability of the Transfer Pricing analysis by promoting a more robust and relevant set of comparables for determining the arm’s length price of international transactions entered into by the Assessee. Thus, the Panel finds no infirmity with TPO’s findings and accordingly the objection raised by the Assessee are hereby rejected.

2.5.10.8 In view of the above, we uphold the selection of this comparable.”

26. Having given thoughtful consideration, we concur with the Ld. AR that, as the aforementioned company, viz., Tata Elxsi Ltd., is engaged in diversified activities, viz., provision of high-end services like embedded product design and engineering services to its consumers in electronics, communications & transport industries and systems integration and support services for enterprise customers, and works with leading OEM’s and suppliers in the automotive and transportation industries for R&D design and product engineering services from architecture to launch and beyond, and further works with leading car manufacturers and suppliers, in developing electronics and software for powertrain, infotainment, connectivity, active safety and comfort and convenience, which cannot be compared to a routine provider of software development services, therefore, the same renders it functionally dissimilar in comparison to the assessee company before us. Also, we find that Tata Elxsi Ltd (supra) is engaged in the provision of digital content creation for the media and entertainment industry. Also, the revenue from software development services of the aforesaid company, viz. Tata Elxsi during the financial year ending 31.03.2020 is significantly high at Rs. 1562.78 crores (approx.) as against that of the assessee company of Rs. 195.39 crores.

27. Further, we find that Tata Elxsi Ltd (supra) also makes use of highly innovative and IP led technology and undertakes various learning and development initiatives to build critical organizational capabilities to its employees in the course of its services rendered to its customers. As the said comparable owns intellectual property (IP) in the form of technology and brand, thus, the same, in our view, cannot be picked up as a comparable to benchmark the ALP of the SDS provided by the assessee company to its AE. Also, we find that on perusal of the annual report of the aforementioned company reveals that it had invested an amount of Rs. 22.83 crores,i.e. , 1.42% of its revenue, towards in-house R&D projects, i.e. , investment in technology IP development, especially those related to automotive, broadcast, and communication.

28. We, thus, in terms of our aforementioned observations are of the view that Tata Elxsi Ltd (supra) operates in the fields of product design, engineering, and R&D, providing solutions for automotive broadcast, healthcare sectors, and further owns intellectual property (IP) in the form of embedded software design and simulation tools and operates multiple R&D centers, which all factors renders it functionally incomparable to the assessee company which neither carries out any R&D nor owns any intellectual property.

29. We find that the ITAT, Hyderabad Bench in the case of ADP (P.) Ltd. (supra) had observed that Tata Elxsi Ltd (supra) cannot be considered as a comparable for benchmarking the transaction in the software development segment for the reasons that it being engaged in diversified activities was functionally dissimilar. For the sake of clarity, we deem it apposite to cull out the observations of the Tribunal, as under:

“28. In the case of Tata Elxsi, the assessee has taken the following objections:

(a) It is not functionally comparable to the assessee. In the financial statements of the company, the nature of business carried out by Tata Elxsi is given below:

(1) Corpoprate Information “Tata Elxsi Ltd was incorporated in 1989. The Company provides product design and engineering services to the consumer electronics, communications and transportation industries and systems integration and support services for enterprise customers. It also provides digital content creation for media and entertainment industry

29. We find that in the case of Infor (India) (P) Lad. v. ACIT in ITA No. 2307/Hyd/2018, the Co-ordinate Bench of the Tribunal has considered similar objections of the assessee therein and has held that these two companies along with Thirdware Solutions Ltd is not comparable to the software development company like the assessee before us. The relevant portions has been reproduced by us in the above paras. Respectfully following the same, these two companies are also directed to be excluded from the final list of ITA No 2233 of 2018 ADP Private Ltd.”

30. Further, we find that a similar view had been taken by the ITAT, Hyderabad Bench in the case of Indeed India Operations (P.) Ltd. v. Dy. CIT (Hyd-Trib.), wherein it was once again observed that as the aforementioned comparable was functionally dissimilar and was involved in the diversified activities, etc., therefore, the same could not be considered as a comparable for benchmarking the transactions in software development segment. Further, we find that the ITAT, Hyderabad in the case of Infor India (P) Ltd v. Dy. CIT [IT(TP) Appeal No. 198 (Hyd) of 2021, dated 6-10-2021], had also, on account of functional dissimilarity, i.e., the provision of product design services and trading etc., directed the exclusion of the aforementioned company from the final list of comparables. Also, the ITAT, Bangalore in the case of AMD India (P) Ltd (supra) had taken a similar view and had concluded that as the aforementioned company, viz., Tata Elxsi Ltd., was functionally dissimilar and into diversified activities, i.e., engaged in product design and engineering services, digital content creation for media and entertainment industries etc., therefore, the same could not have been picked up as a comparable for benchmarking the international transactions of the software development segment of the assessee company before them.

31. We thus, in terms of our aforesaid observations, are of a firm conviction that the aforementioned company,i.e. , Tata Elxsi, for the reasons stated hereinabove, could not have been picked up as a comparable for benchmarking the international transactions of the assessee company, and accordingly direct the AO/TPO to exclude the same from the final list of comparables.

(C). Infosys Ltd.

32. We shall now deal with the Ld. AR’s contention that the TPO/DRP had erred in including Infosys Limited as a comparable for benchmarking the software development services rendered by the assessee company to its AE. Before proceeding further, we deem it apposite to cull out the observations of the DRP, which had upheld the inclusion of Infosys Ltd. in the final list of comparables by the TPO, as under:

“2.5.11.1 Having considered the submissions, and on perusal of the annual report of the company, we note that this company provides business IT services (comprising software application development, integration, maintenance, validation, enterprise system implementation, product engineering, infrastructure management and business process management); consulting and systems integration services (comprising consulting, enterprise solutions, systems Integration and advanced technologies); products, business platforms and solutions to accelerate intellectual property-led innovation. All these activities fall within the gamut of ‘software services. The mere reason that these services are rendered in regard to different industries such Financial, Manufacturing, Life Science, Energy, Retall does not make it functionally dissimilar. As per information in the stand-alone P&L account of this company (available at page 172 of the annual report), it has reported revenue from ‘software services’ of Rs. 78,809 crores and from ‘software products of Rs. 238 crores, and thus it could be seen that the product revenue constitute meagre 0.30% of total operating revenue. Therefore, the contention of the Assessee that it is involved in licensing of Software products and hence functionally dissimilar is not acceptable. Taking into consideration, the information available in the annual report and the fact that the ???n ?y is predominantly having revenue from software services. (1.e. more than its operating revenue) we are of the considered view that this company can be considered as functionally comparable to the Assessee. The pleas that it has diversified activities, rendering services to various industries, and licensing software products and hence it is functionally dissimilar, are hereby rejected.

2.5.11.2 The perusal of the details in the annual report show that the company has incurred R & D expenditure to the tune of Rs.458 crores (page 182 of the AR), which constitute meagre 0.58% of its total operating revenue, and which is much less than the generally acceptable tolerable limit of 3% of the total revenue. Hence, this plea is hereby rejected.

2.5.11.3 It was plead that this company has a huge brand which has contributed to its growth in revenue and hence not comparable. A perusal of the annual report shows that the growth in revenue was on account of various business initiatives taken to accelerate growth such as ability to keep pace with ever-changing technology, ability to increase scale and breadth of service offerings to provide one stop solutions for customer needs, high quality management technology professionals and sales personnel, providing high-quality cost-effective services, high ethical and corporate governance standards and recognized brand.

2.5.11.4 As the company is primarily engaged in software development services and earns the revenue majorly from this activity, there is no need of providing segmental information as per AS 17. Accordingly, the plea of the Assessee to exclude the company as there is no segmental information is available in the Annual Report, is hereby rejected.

2.5.11.5 The plea of the turnover range will not affect the comparability as discussed in paras 2.4.3.1 & 2.4.12.1 to 2.4.12.12 above.

2.5.11.6 In view of the above, we uphold this company as comparable to the Assessee.”

33. We may herein observe that Infosys Limited is admittedly a leading provider of consulting, technology, outsourcing, and next-generation digital services, wherein it enables its clients to execute strategies for their digital transformation. Apart from that, Infosys Limited is also engaged in the development of software products. Also, no segment-wise breakup regarding software development services of the aforementioned company can be gathered from its annual report. We are of the considered view that, in the backdrop of the diversified business transactions of Infosys Limited, it could not have been picked up as a comparable for benchmarking the software development segment of the assessee company, i.e., a low-risk captive software development service provider to its AE. Apart from that, we find that Infosys Limited has a huge brand value and continues to own and create significant intangible assets. Further, we find that the scale of operation of Infosys Limited is significantly higher than that of the assessee company before us. On a perusal of the annual report of the Infosys Limited, we find that it had during the subject year i.e., Financial Year 2019-20 revenue generation of Rs. 79,047 crores primarily from the IT services comprising of software application development, integration, maintenance, validation, consulting and technology implementation and from licensing of the software products (referred to as software related services) aggregating to Rs. 79,047 crores as in comparison to the revenue of the assessee company of Rs 195.39 crores.

34. We find that the issue of inclusion of Infosys Limited as a comparable company in the case of software development segment for AY 2016-17 had come up before the ITAT, Hyderabad in the case of ADP (P.) Ltd. (supra) The Tribunal had observed that as the said company was functionally dissimilar and was into diversified activities like artificial intelligence, product services, platforms, consulting etc., and had no segmental, therefore, it could be considered as a comparable for benchmarking the software development segment of the assessee company before them. For the sake of clarity, the observations of the Tribunal in the case of ADP (P.) Ltd. (supra) are culled out as under:

“9. Infosys Ltd: The AR submitted referring to the Rule 10B of the IT Rules, which expressly lay down the preconditions for comparability of uncontrolled transactions with international transactions as under:

| 1. | | The specific characteristics of the property transferred or services provided in either transaction |

| 2. | | The functions performed taking into account assets employed or to be employed and the risks assumed, by the respective parties to the transactions |

| 3. | | The contractual terms of the transactions which lay down explicitly or implicitly how the responsibilities, risks and benefits are to be divided between the respective parties to the transactions. |

| 4. | | Conditions prevailing in the markets in which the respective parties to the transactions operate, including the geographical location and size of the markets the laws and govt orders in force, cost of labour and capital in the markets, the laws and government orders in force, costs of labour and capital in the markets, overall economic development and level of competition and whether the markets are wholesale or retail. |

9.1 He further submitted that this company offers end to end business solutions including product support, product engineering and lifecycle solutions, artificial intelligence, software products, business platforms and solutions. Further, he submitted that it crores and the turnover of this company is 123 times more than assessee. He, therefore, submitted that this it has a turnover of Rs. 53,983 crores whereas assessee’s turnover is Rs. 437 company cannot be compared as the different in its size and scale of operations have a direct impact on their profitability. He relied on various decisions of ITAT including the decision in ADP (P) Ltd. (supra) wherein this company is excluded as comparable.

9.2 On the other hand, Id. DR submitted that under TNMM comparable transactions needs to be broadly similar with this company and significant product diversity and some functional diversity between the controlled and uncontrolled parties are acceptable.

9.3 We have considered the rival submissions and perused the material on record as well as gone through the orders of revenue authorities. The co-ordinate bench in assessee’s own case in ADP (P) Ltd. (supra), directed the AO/TPO to exclude this company from the list of comparables for determining ALP by observing as under:

25. Having regard to the rival contentions and the material on record, we find that in a number of decisions including the assessee’s own case, Infosys Lid has been held to be not comparable with any other software development company such as the assessee due to its huge turnover and high profit margin and also as it is into software products and owns intangible intellectual property rights. In the case of Agnity India Technologies Ltd, (Del), the Hon’ble Delhi High Court has held that Infosys Ltd is not comparable to other software development company. Relevant paragraphs are reproduced hereunder:

“8. It is a common case that Satyam Computer Services Ltd. should not be taken into consideration. The Tribunal for valid and good reasons has pointed out that Infosys Technologies Ltd. cannot be taken as a comparable in the present case. This leaves L&T Infotech Ltd. which gives us the figure of 11.11%, which is less than the figure of 17% margin as declared by the respondent-assessee. This is the finding recorded by the Tribunal. The Tribunal in the impugned order has also observed that the assessee had furnished details of workables in respect of 23 companies and the mean of the comparables worked out to 10%, as against the margin of 17% shown by the assessee. Details of these companies are mentioned in para 5 of the impugned order”.

26. Respectfully following the same, we direct the exclusion of this company from the final list of comparables.

9.4 On perusal of the entire financial statements, we observe that the company is functionally not comparable and selling and marketing expenses are 5% of revenue and there were extraordinary events also noted ie. transfer of product financial & edge services as well as diversified activities like artificial intelligence, products services, platforms, consulting etc. Also onsite revenue was 52.7% and no segmental details like services, consulting products are available. In view of the above observations the coordinate bench in assessee’s own case for AY 2014-15 directed to exclude this company as comparable. Respectfully following the said decision, we direct the AO/TPO to exclude this company as comparable from the list of comparables.”

35. Also, we find that a similar view was taken by the ITAT, Hyderabad in the case of Indeed India Operations (P.) Ltd. (supra), wherein the aforementioned comparable was excluded from the final list of comparables for benchmarking the software development segment for the reason that it was found to be functionally dissimilar and into diversified activities, owns intangibles etc. Also, we find that the ITAT, Bangalore in the case of AMD India (P) Ltd (supra), while disposing of the appeal of the assessee company for the AY 2018-19, had held that the aforementioned company could not be considered as a comparable for benchmarking the software development segment for the reason that it was functionally dissimilar and into diversified activities. Also, we find that the ITAT, Hyderabad in the case of SSNC Fin Tech Services India (P.) Ltd. v. Dy. CIT (Hyd-Trib.)/ITA No. 916/Hyd/2024, dated 03/07/2025, had directed the exclusion of Infosys Limited as a comparable for benchmarking the software development services provided by the assessee company before them, by observing as under:

“7. We have heard both the parties, perused the material on record and the orders of the authorities below. The appellant-company is a captive service provider to it’s AEs on cost plus basis as per the agreement entered into by it with it’s AEs. The appellant-company provides software development services to it’s AEs on cost plus basis, whereas, Infosys Limited being a giant software developer provides software development services to multidimensional industries including banks, manufacturing etc. Further, Infosys Limited is having huge brand value which is definitely impacts the operating margins of any company. Further, the Company has incurred substantial expenditure for marketing and R & D, whereas, the said expenditure is absent in the case of the appellant-company. Therefore, in our considered view, Infosys Limited cannot be a good comparable to the appellant-company which is engaged in software development services to it’s AEs on cost plus basis. Further, Infosys Limited has been considered to be not comparable to the appellant-company in appellantcompany’s own case for the assessment year 2014-2015 in ITA.No.2234/Hyd./2018 (supra), where under identical set of facts, Infosys Limited has been excluded from the list of final set of comparables. The relevant findings of the Tribunal are as under :

“4.4. Coming to ground no.4, the companies which the assessee is seeking exclusion are:

| ii. | | ii. Persistent Systems Ltd. |

| iv. | | Infobeans Technologies Ltd. |

| v. | | Thirdware Solutions Limited |

The Ld. Counsel for the assessee submitted that in the case of Kony India P Ltd. v. DCIT for the very same AY 2014-15, the above companies have been held to be functionally not comparable to the Kony India Pvt.Ltd. which is also engaged in the business of providing Software Development Services to it’s A.E. like assessee company. He, therefore, placed reliance on the decision of the Coordinate Bench of this Tribunal in the case of :

| i. | | M/s Kony India Private Ltd. v. DCIT (ITA No. 2305/H/18 -AY 2014-15); and |

| ii. | | ii. Kony IT Services P Ltd. v. DCIT (ITA 2304/H/2018 – AY 2014-15) and prayed for exclusion of the above 5 companies from the final list of comparables. |

5. Ld. DR on the other hand supported the orders of the authorities below.

6. Having regard to rival contentions and material placed on record, we find that the assessee is into providing Software Development Services and M/s Kony India Private Ltd. was also into similar business of providing Software Development Services to it’s AE, we also find that the TPO has taken the very same 12 companies as comparables in the case of Kony India Ltd. Since the relevant AY is also 2014-15, the facts and circumstances under which those companies have been held to be not comparable to M/s. Kony India Private Limited are also the same, the said decision is also applicable to the case before us.

6.1. In view of the same, respectfully following the decision of Coordinate Bench of this Tribunal to which one of us (i.e. J.M.) is a signatory, we direct the exclusion of above mentioned companies from the final list of comparables. For the sake of ready reference, the relevant paragraphs from the order of this Tribunal are reproduced hereunder:-

“9. We have heard the rival submissions and carefully perused the materials on record. From the paper book furnished by the assessee as well as the arguments advanced by the Ld.AR, we find merit in his contention because of the following reasons:-

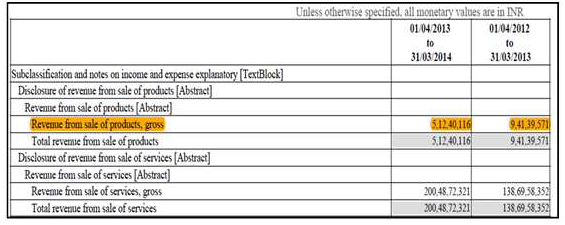

(i) E-Infochips Limited:-

(a) As per the annual report of M/s. E-Infochips Limited for the period 1/4/2013 to 31/3/2014 (Page No.98 of the paper book-Volume-II) it is evident that the company is primarily engaged in software development, IT Enables Services and product-based company. Further, no segmental details are available in the Annual Report. While as the assessee’s company’s only activity is Captive Software Development Services.

Extraction from page-98 of PB-II

“The company is primarily engaged in Software Development and IT Enable Services and products which is considered the only reportable business segment as per Accounting Standard-AS 17 Segment Reporting prescribed in Companies Accounting standards notified under Section 211(3C) (Which continues to be applicable in terms of General Circular 15/2013 dated September 13, 2013 of the Ministry of Corporate affairs in respect of Section 133 of the companies Act, 1961.”

(b) The company also manufactures products such as electronic boards and printer circuits by importing raw materials and holding inventory, as apparent from Page No. 119 of the PB-II. The assessee company is not engaged into any activity of producing physical goods.

Page No. 119 of the PB-II

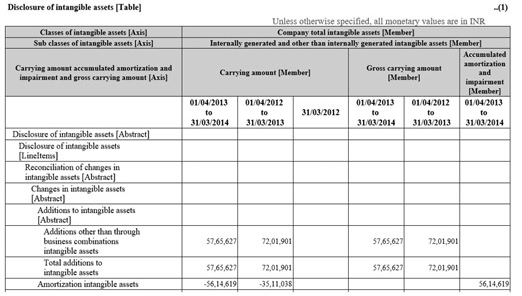

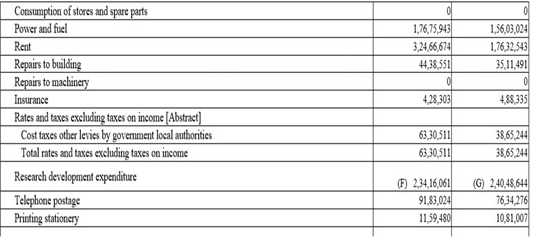

(c) The company has also incurred expenses in R & D and therefore generated intangible assets as apparent from page no. 65 & 121 of PB-II, while as the assessee company is not involved in any R & D activity. In the case of the assessee company neither such expenses are incurred, or any intangibles are acquired during the relevant period.

Extraction from page no. 65 of PB-II

Extraction from page No. 121, PB-II

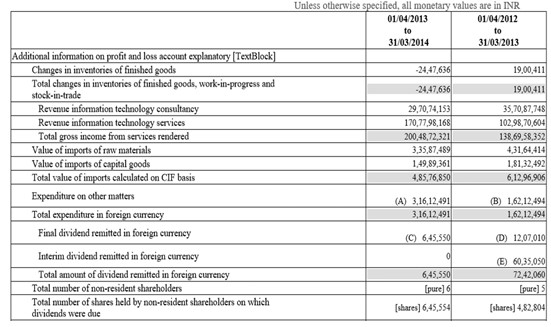

(d) The company has also earned revenue from Information Technology consultancy of Rs. 29.07 Crs as apparent from page no.123 of PB-II. However, the assessee company have not earned any income from information technology consultancy activities.

Extraction from page No.123 of PB-II :

10. Considering the nature of activities carried out by M/s. E infochips Limited discussed hereinabove and since the assessee company is primarily engaged in custom-built mobile platform, applications and software support and maintenance related services to M/s. Kony Group of Companies, we are of the view that M/s. E infochips Limited cannot be considered as a comparable company because of the reasons stated hereinabove.”

36. We, thus, in terms of our aforesaid observations which reveal that the subject company, viz., Infosys Limited is functionally dissimilar and into diversified business operations with a significantly higher revenue generation from operations, and owns huge brand value and continues to own and create intangible assets, therefore, it could not have been picked up as a comparable for benchmarking the software development segment of the assessee company before us.

37. Accordingly, in terms of our aforesaid observations, we are of a firm conviction that the aforementioned company, i.e. , Infosys Limited, for the reasons stated hereinabove, could not have been picked up as a comparable for benchmarking the international transactions of the assessee company, thus, direct the AO/TPO to exclude the same from the final list of comparables.

(D). Wipro Ltd.

38. We shall now deal with the Ld. AR’s contention that the TPO/DRP had erred in including Wipro Limited as a comparable for benchmarking the software development services rendered by the assessee company to its AE. Before proceeding further, we deem it apposite to cull out the observations of the DRP, which had upheld the inclusion of Wipro Ltd. in the final list of comparables by the TPO, as under:

“2.5.4.1 Having considered the submissions, we ascertained that the TPO has considered the IT services segment on standalone basis. The segment of ‘Global IT services and products’ finds place in consolidated accounts and not in standalone financials. The IT services of the segment the company is into software development services and such segmental details are available. The above facts have been confirmed by the company in its response to notice u/s 133(6) of the Act in earlier years. The principal business activity of the company as given page 107 of the annual report is IT Software Services and related activities deriving 90% of income. As per the Note 22 forming part of standalone financial statements (page 199 of the annual report) the revenue of Rs.494.47.1 crores is derived from sale of services and the revenue from sale of product is only Rs.940.8 crores as against total revenue of Rs.50387.7 crores. The segmental information given in the consolidated financial statements also reflects that the substantial revenue is derived from IT services only. Therefore, the IT service segment of the company being the major revenue earning segment is very much comparable to the Assessee on functional aspect. The company’s IT services segment is considered as a comparable on standalone basis. This segment is into software services development. Therefore, the plea of the Assessee that it is into diversified activities and no segmental details are not acceptable.

2.5.4.2 At the outset, it is pertinent to note, that the assessee has challenged the selection of some comparables, relying on some decisions of Hon’ble ITAT either in assessee’s own case or in some other case, holding that certain companies are to be excluded as comparable for some other years. We are of the humble view that the comparability of a company cannot be determined with regard to decisions of the appellate bodies rendered for some other year, as the business and economic factors are dynamic and different in each year both in the case of tested party and comparables.

2.5.4.3 The issue is well settled that simply because a comparable has been. included or excluded in some year that action or inaction by itself in transfer pricing issues on comparability cannot constitute a precedent to be blindly followed ad infinitum. Whether a particular company is a comparable or not is an exercise which has to be carried out every year in the case of an Assessee considering the facts of that specific year and not blindly following the precedent which has been laid down in earlier or subsequent year. A comparable is a comparable on facts and not because a precedent makes it so. Neither can the tax payer insist that a comparable be included nor can it be insisted that it be excluded only on the ground of it having been included or excluded in some other a previous assessment year.

2.5.4.4 In case of Agnity India Technologies Pvt. Ltd v. Assessee, Hon’ble ITAT, New Delhi in I.T.A.No.6485/Del/2012 for assessment year 2008-09 observed that precedents cannot be blindly followed. The relevant observations made are extracted as under: –

“Para 7.33. Having heard the rival submissions and perused the material available on record we find that in the peculiar facts and circumstances of the case where the Hon’ble High Court has not approved of the approach of the ITAT in relying upon the precedent available in assessee’s see’s own case for the immediately preceding assessment year which precedent stood approved by the Hon’ble High Court itself, we find that the prayer of the Ld. DR that decision be made first on facts on record and thereafter precedence be considered is not only a settled legal position but in the facts of the present case following this settled position the issue has been remanded despite the fact that the Coordinate Bench had followed the precedence in assessee’s own case.

Para 13. We find on facts that the prayer of the tax payer for exclusion of the said comparable cannot be ousted on the ground that it was not objected to in the previous assessment year. Whether a particular comparable is accepted or rejected in a previous assessment year consciously or inadvertently by the Assessee or the authorities is not the basis on which the issues can be decided. As and when challenge is posed to the inclusion or exclusion of a comparable the challenge has to be considered on the basis of facts and evidence on record for that year. It is only after the facts and evidences are taken into consideration that the relevance of applying a precedent would come into play. In the facts of the present case, we find that the revenues from the software development segment of this comparable constituted 96% and this finding of fact has not been assailed by the Assessee.”

2.5.4.5 Therefore, inclusion or exclusion of a comparable has to be necessarily justified on the basis of facts available on record, the FAR analysis and the information in the annual reports submitted for each year and not on the basis of judicial precedent.

2.5.4.6 It was also pleaded that the company has significant intangibles. However, on perusal of the information at page 177 of the annual report, we note that the value of intangible assets as on 31.03.2020 is Rs. 4571 millions which is insignificant (0.90%) considering its turnover of Rs. 503877 million. As per the information in page 144 the customer relationship is added to the company during the previous year under a contract with a group company. Therefore, this intangible does not pertain to year under consideration and there is no indication of any revenue generated on account of customer relationship. Other intangible assets like technical know-how and trade-marks are very meagre compare to the turnover of the company so as to affect the profitability significantly. We also note the Assessee has failed to establish that such differences, if any, on account of intangibles have material effect on the margin of the above company, in terms of clause (i) of sub-rule (3) of Rule 10B. Taking into account all these aspects, we do not find any material difference so as to affect comparability. Hence, these pleas are rejected.

2.5.4.7 The perusal of the details in the annual report shows that the company has incurred R & D expenditure to the tune of Rs. 4619 millions, which constitute meagre 0.91% of its total operating revenue, and which is much less than the generally acceptable tolerable limit of 3% of the total revenue. It is also noted that the R&D initiatives are substantially routine for immediate business purposes for developing expertise and improved process execution to serve the clients in a much better manner. We also note that, the Assessee has failed to establish that such differences, if any, on account of R&D have material effect on the margin of the above company, in terms of clause (i) of sub-rule (3) of Rule 108. Taking into account all these aspects, we do not find any material difference so as to affect comparability. Hence, these pleas are rejected.

2.5.4.8 The plea of the turnover range will not affect the comparability as discussed in foregone paras 2.4.3.1 & 2.4.12.1 to 2.4.12.12.”

39. On a perusal of the annual report of Wipro Limited, we find that it is a global information technology (IT), consulting and business process services company, and also into the sale of IT and other products. It owns trademarks, patents, and software products. Also, we find that the said company bears fully entrepreneurial, market, and credit risks.

40. Considering the diversified business streams of the aforementioned company,i.e., global information technology, consulting, and business process services, we are of firm conviction that on account of the functional dissimilarity itself, the said company could not have been picked up as a comparable to the routine provider of software development services like the assessee company before us. Also, we find that as no separate segment-wise breakup regarding software development services of the aforementioned comparable can be gathered from its annual report, therefore, for the said reason also it could not have been selected as a comparable for benchmarking the software development services provided by the assessee company to its AE. Further, we find that as stated by the Ld. AR, and rightly so, the aforementioned company, viz., Wipro Limited, uses its highly innovative and IP led technology to provide its service offerings and solutions to its customers, which, thus, on the said count also renders it incomparable to the assessee company before us. Further, we find that the scale of operations of the aforementioned company for the subject year reveals that it had, during the subject year, i.e., Financial Year 2019-20, generated revenue from operations of Rs. 50,387.70 crores, which is significantly higher as in comparison to the revenue from operations of the assessee company of Rs 195.39 crores during the subject year.

41. We find that the ITAT, Bangalore in the case of AMD India (P) Ltd (supra), had observed that the aforementioned company, viz., Wipro Limited cannot be considered as a comparable for benchmarking the software development segment of the assessee company before them, inter alia, for the reason that it was functionally dissimilar and was into diversified activities, i.e., engaged in global information technology, consulting and business process solutions, etc. For the sake of clarity, the observations of the Tribunal are culled out as under:

“27. The Id. AR referred to the following written submissions for exclusion of this company which is as under:-

| Reasons for rejection | Reference & case laws |

Substantial related party transactions

1.The Company has substantial RPT for FY. 2017-18 (15.97%) and thus fails RPT filter of 15%. | 1.Submission at Pg 1422-1423 of PB l& Relevant extracts of AR at Pg 1935, PB 1942-1949 of ll(Computation of RPT is given at Pg 30 of the Note). |

Functionally Different

2. The Company is functionally different as it is not engaged in rendering of pure software development services. Wipro is engaged in diversified businesses like information technology, consulting and business process outsourcing.

3. The Company has global brand image and has high R&D Expenses.

4. There is vast difference between the profile of Wipro and the Appellant.

Substantial Onsite Operations

5. The Company has substantial onsite revenue for all 3 FYs i.e., FY 2017-1856.17%, FY 2016-17-56.24% & FY 2015-16-56.42%. Thus, Wipro has different business model, when compared Appellant. | 1. Submission at Pg 1423-1425 of PB I& Relevant extracts of AR at Pg 1951-1957 of PB II.

2. The TPO has himself not considered comparable in his list of Wipro as comparables for AY 2017-18. Further, the Appellant relies on decisions of the Honourable the following ITAT wherein, it was held that Wipro Ltd is functionally different:

ADP Pvt. Ltd., Hyderabad v. DCIT- 1(1), Hyderabad for AY 2016-17 [2022] (Hyderabad 44 Trib.) (Para 5.2 & 5.3 at Pg2252 of PB-III-Case law Compilation) Since, profile of this company remains same for all the 3 years, ratio of decision of earlier year is applicable.

1. Submission at Pg 1426- 1427 of PB I& Relevant extracts of AR at Pg 1955 of PB II. |

27.1 The Id. DR relied on the orders of lower authorities.

27.2 Considering the rival submissions, we note from the company’s overview that Wipro Ltd. is a leading global information technology (IT) consulting and business process services. It is clear that the company is engaged in diversified activities and not a pure software development company like the assessee and hence functional profile is different. Therefore, this company is directed to be excluded from comparables list.”

42. Also, we find that the ITAT, Bangalore in the case of Metricstream Infotech (India) (P) Ltd v. Dy. CIT [IT(TP) Appeal No. 827 (Bang) of 2022, dated 15-12-2023], had adopted a similar view and observed that the aforementioned company cannot be picked up as a comparable for benchmarking the software development segment of the assessee company before them, for the reason that it was found to be functionally dissimilar and into diversified activities, viz., engaged in global information technology, consulting and business process solutions, etc.

43. We thus, in terms of our aforesaid observations are of the view that, unlike the assessee company before us which is a captive service provider of software development services to its AE, the subject comparable i.e., Wipro Limited (supra) which is engaged in diversified business of global information technology, consulting and business process solutions, is functionally dissimilar with no separate segmentwise breakup available. Also, the said company owns intangible assets and undertakes R&D activities and has significantly higher scale of operations as in comparison to the assessee company before us. Accordingly, in the backdrop of our aforesaid observations and the view taken by the coordinate benches of the Tribunal as referred by us herein above, we direct the TPO/AO to exclude the said company, viz. Wipro Limited from the final list of comparables.

(E). Nihilent Ltd.

44. We shall now deal with the Ld. AR’s contention that the TPO/DRP had erred in including Nihilent Limited as a comparable for benchmarking the software development services rendered by the assessee company to its AE. Before proceeding further, we deem it apposite to cull out the observations of the DRP, which had upheld the inclusion of Nihilent Ltd. in the final list of comparables by the TPO, as under:

“2.5.5.1 Having considered the submissions, and on perusal of the annual report, we note that this company is engaged primarily in rendering IT Consultancy. Software development and related services. As per information at pages 24, the company is primarily rendering software services. Accordingly, it does not hold any physical inventories as can be seen on in the balance sheet of the company (page no.40). As per the background information given at page 232 of the annual report, the company is engaged in rendering software services, business consulting in the area of enterprise transformation, change and performance management and providing related IT Services. This fact is further supported by she information disclosed at page 24 of the annual report that the whole revenue of the company is derived from IT consultancy, software development and related services. Thus, it is functionally comparable to the Assessee which renders software development services and other allied services. Thus, the contentions of the Assessee that it is engaged in diverse activities and not functionally comparable are without merit. Besides, there is no information in the annual report to indicate that this company is engaged in product development or to indicate that it has revenue stream from product sales. The Assessee also could not point to any such information in the annual report. We also note at page 30 of the annual report, the independent auditor has certified, “the company is in the business of rendering services and consequently, does not hold any inventory.” There is no information in the annual report that the company is into diversified activities. In view of these, we hold that this company is functionally comparable to the Assessee and the pleas raised in this regard are rejected.

2.5.5.2 As the company is primarily engaged in software development services and earns the revenue from this activity there is no need of providing segmental information as per AS 17.

2.5.5.3 In view of the above discussion, the selection of this company is upheld.”

45. We may herein observe that a perusal of the “annual report” of the aforementioned company, it transpires, that it is a business consulting and enterprise transformation company which renders software services, business consulting in the area of enterprise transformation, change, and performance management and related IT services by using proprietary frameworks and methodologies. Also, the said company earns revenue mainly from online consulting assignments. Further, we may herein observe that no separate data of providing segment-wise breakup and revenue generation by the aforesaid comparable from its software development services is available.

46. We, thus, find substance in the Ld. AR’s claim that, as the aforementioned company, being into diversified activities, is not only functionally dissimilar vis-a-vis the assessee company before us, but also as no segmental information for its software development services is available in the public domain, therefore, it could not have been selected as a comparable for benchmarking the software development segment of the assessee company before us.