JUDGMENT

Prathiba M. Singh, J.- This hearing has been done through hybrid mode.

2. The Petitioner-M/s Clyde Pumps Private Limited, a Delhi based company has filed the present petition under Article 226 of the Constitution of India, inter alia, seeking transferring of the CENVAT credit admissible as Input Tax Credit (hereinafter, ‘ITC’) of Rs.99,18,972/-.

3. The background of the present case is that the Petitioner is involved in the business of manufacturing general purpose machinery. Upon the advent of the GST regime, it obtained GST registration as an Input Service Distributor (hereinafter, ‘ISD’). The Petitioner has multiple business premises across the country where services are provided and CENVAT credit in the form of ITC becomes available to each of the sub-offices of the Petitioner.

4. For the period between March, 2017 to June, 2017, after the GST regime had been introduced, the Petitioner could file a form TRAN-1 to avail the transitional credit under Section 140 of the Central Goods and Services Tax Act, 2017 (hereinafter, ‘CGST Act’). The Petitioner had ITC to the tune of Rs.99,18,972/- as closing balance which ought to have been allowed to be carried forward under the GST regime.

5. However, the same could not be availed of in terms of Rule 39(1)(a) of the Central Goods and Services Tax Rules, 2017 (hereinafter, ‘the Rules’) due the fact that at the relevant point in time, the transition was not permitted on the GST portal. After the transition took place, the credit was not reflected on the portal of the Petitioner leading to repeated representations being made by the Petitioner for reflection of the credit on the portal. However, the same was not allowed by the Department which has led to the filing of the present petition. The prayer in the present petition is as under:

| “a. | | To issue writ of mandamus or any other appropriate writ, order or direction in the like nature to the Respondents and thereby direct Respondent No. 1 to 5 to allow the Petitioner to utilize the credit balance of INR 99,18,972/- (Rupees Ninety-Nine Lakhs Eighteen Thousand Nine Hundred and Seventy-Two Only) duly transited from old regime to new regime under the provision of Section 140 of the CGST Act, or; |

| b. | | To issue a writ of mandamus or of any other nature or direction in the like nature to the Respondents and thereby direct Respondent No.1 to 5 to formulate a procedure in accordance with Section 140 r.w. Rule 117 of the CGST Rules so as the credit transferred from previous regime to new regime may be utilized, or any rules contrary to the provision of Section 140 of the CGST Act be read over to the extent of utilisation and distribution of duly transited ITC, or; |

| c. | | To issue a writ of mandamus or of any other nature and thereby direct the Respondent No. 3 to modify, alter or adjust the GST Portal as per the requirements of Section 140 of the CGST Act, or; |

| d. | | Pass such other or further orders as this Hon’ble Court may deem fit and proper in the facts and circumstances of the case in the interest of justice and to meet the ends of justice.” |

6. Ld. Counsel for the Petitioner submits that this is an acknowledged difficulty that several ISDs’ have faced during the transitional period. By way of illustration, various orders passed in Siemens Ltd. v. UOI GSTL 253 (Bombay)/Writ Petition No. 986/2019 passed by the High Court of Bombay are relied upon by the Petitioner. On the strength of these judgments, it is submitted that the clear position that emerges is that the ITC transition and further distribution ought to have been permitted but the matter was referred to the GST Council vide order dated 29th February, 2024 in Siemens Ltd. (supra). However, no final decision has been taken in the matter and severe prejudice is being caused to the Petitioner.

7. Ld. Counsel for Respondent Nos. 2 to 5 submits that the matter has to be dealt with by the Delhi GST Department and not by the Central GST Department, as it is not the jurisdictional Commissionerate.

8. Insofar as the Delhi GST Department is concerned, its stand in the counter affidavit is as under:

“6. Therefore, it is mandatory that any ITC available with an ISD for distribution in a particular month ought to be distributed in the same month which clearly implies that no provision for carrying forward or transfer to electronic credit ledger in case of an ISD was even contemplated in the entire GST regime. The same was done keeping in mind the limited role of an ISD which was to distribute the lTC to the respective units. As already stated earlier, and at the cost of repetition, an ISD registered under the GST regime does not enjoy the same status of an assessee obtaining registration under GST for carrying out its business. The purpose of the ISD is facility based wherein the business, having a large share of common expenditure and billing or payment is done from centralized locations. The mechanism is aimed at simplifying the credit taking process for entities.

7. In view of this clear position of law which emanates from the GST regime, the only option which was available was for the Petitioner-ISD to distribute the ISD credit to its different units/offices before 1.07.2017 and thereafter the transferee unit/offices ought to have filed TRAN-1 to transition the said credit distributed to it by ISD, into their respective ECL. Filing of the TRAN-1 by the Petitioner-ISD is neither contemplated under the provisions of the CGST Act read with the CGST Rules and the same is, therefore, clearly prohibited under the said GST regime.

8. Therefore, when the Petitioner filed its representation regarding its inability in utilisation of transited CENVAT credit, the same was duly responded to vide email dated 05.01.2022 clarifying the aforesaid position of law which clearly prohibited fling of TRAN-I by ISDs. The relevant portion of the said reply, which has been annexed by the Petitioner, is reproduced below for the reference of this Hon’ble Court:

“This is in reference to the stated query related to GSTR6. Kindly note that there is no Electronic Credit Ledger maintained for ISD Registrants. Law neither envisages ITC Electronic Ledger to be maintained for JSDs nor required distribution of ITC through TRAN-1”.

9. Therefore, there is no room for any doubt that the answering respondent has never, arbitrarily and without recording of any proper reasons, denied the utilisation of credit transferred from the Pre-GST Regime to GST regime under the Transitional provision in terms of Section 140 of the CGST Act to the Petitioner. Since the present GST regime does not envisage the filing of TRAN-1 by ISDs for crediting their ITC in ECL, the relief claimed by the Petitioner cannot be granted. That apart, and without prejudice, issue of Electronic Credit Ledger not maintained for ISD Registrants resultant to which the Petitioner, allegedly, is not able to avail the CENVAT credit, is a subject matter of Policy/GSTN module formulation authority is not under the jurisdiction of State GST Department, who, as is evincible, has performed its duty and functions in abidance and in conformity to the provisions of the CGST Act And its corresponding Rules.

In light of the facts, circumstances and various submissions made hereinabove, it is most humbly and respectfully prayed that the present petition lacks merit and the same may be dismissed in limine.”

9. Heard and perused the record. ISD is defined under Section 2(61) of the CGST Act, as under:

“2.(61) “Input Service Distributor ” means an office of the supplier of goods or services or both which receives tax invoices towards the receipt of input services, including invoices in respect of services liable to tax under sub-section (3) or sub-section (4) of section 9 [of this Act or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017)], for or on behalf of distinct persons referred to in section 25, and liable to distribute the input tax credit in respect of such invoices in the manner provided in section 20″

10. The provisions relating to ISD are captured in Sections 20 to 25 of the CGST Act. The procedure for registration of an ISD is prescribed under Sections 22 to 25 of the Act and the manner in which credit can be distributed is stipulated under Section 20 the CGST Act, as under:

“20. Manner of distribution of credit by Input Service Distributor:

(1) The Input Service Distributor shall distribute the credit of central tax as central tax or integrated tax and integrated tax as integrated tax or central tax, by way of issue of a document containing the amount of input tax credit being distributed in such manner as may be prescribed.

(2) The Input Service Distributor may distribute the credit subject to the following conditions, namely:— (a) the credit can be distributed to the recipients of credit against a document containing such details as may be prescribed;

(b) the amount of the credit distributed shall not exceed the amount of credit available for distribution;

(c) the credit of tax paid on input services attributable to a recipient of credit shall be distributed only to that recipient;

(d) the credit of tax paid on input services attributable to more than one recipient of credit shall be distributed amongst such recipients to whom the input service is attributable and such distribution shall be pro rata on the basis of the turnover in a State or turnover in a Union territory of such recipient, during the relevant period, to the aggregate of the turnover of all such recipients to whom such input service is attributable and which are operational in the current year, during the said relevant period;

(e) the credit of tax paid on input services attributable to all recipients of credit shall be distributed amongst such recipients and such distribution shall be pro rata on the basis of the turnover in a State or turnover in a Union territory of such recipient, during the relevant period, to the aggregate of the turnover of all recipients and which are operational in the current year, during the said relevant period.

Explanation: For the purposes of this section,—

(a) the “relevant period” shall be

(i) if the recipients of credit have turnover in their States or Union territories in the financial year preceding the year during which credit is to be distributed, the said financial year; or (ii) if some or all recipients of the credit do not have any turnover in their States or Union territories in the financial year preceding the year during which the credit is to be distributed, the last quarter for which details of such turnover of all the recipients are available, previous to the month during which credit is to be distributed;

(b) the expression “recipient of credit” means the supplier of goods or services or both having the same Permanent Account Number as that of the input Service Distributor;

(c) the term “turnover”, in relation to any registered person engaged in the supply of taxable goods as well as goods not taxable under this Act, means the value of turnover, reduced by the amount of any duty or tax levied under entries 84 and 92A of List I of the Seventh Schedule to the Constitution and entries 51 and 54 of List II of the said Schedule.”

11. This provision has been subsequently amended w.e.f. 1st April, 2025. However, insofar as the present case is concerned what would be relevant would be the unamended provision.

12. Section 140(7) of the CGST Act would also be relevant and is extracted below:

“140. (7) Notwithstanding anything to the contrary contained in this Act, the input tax credit on account of any services received prior to the appointed day by an Input Service Distributor shall be eligible for distribution as [credit under this Act, within such time and in such manner as may be prescribed, [whether the invoices relating to such services are received prior to, on or after, the appointed day”

13. A perusal of Section 140(7) of the CGST Act would show that the ITC which was available on account of any services received prior to the appointed date by the ISD shall be eligible for distribution as credit within the time and manner as may be prescribed. It is not in dispute that after the GST regime came into effect, no specific timeline has been prescribed till date for distribution of this credit.

14. Insofar as Rule 39(1)(a) of the CGST Rules is concerned, the same would permit distribution of the credit within a period of one month. The said Rule reads as under:

“Rule 39. Procedure for distribution of input tax credit

by Input Service Distributor.-

(1) An Input Service Distributor shall distribute input tax credit in the manner and subject to the following conditions, namely:-

(a) the input tax credit available for distribution in a month shall be distributed in the same month and the details thereof shall be furnished in FORM GSTR-6 in accordance with the provisions of Chapter VIII of these rules;”

15. Insofar as Section 39(1)(a) of the CGST Rules is concerned, the said provision of distribution within one month came into effect from 1st April, 2025. However, the unamended Rule 39(1)(a) of the CGST Rules also required distribution within a month.

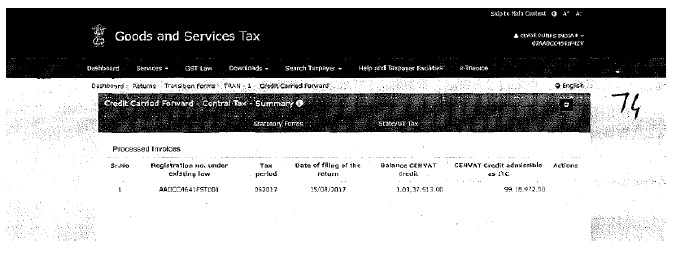

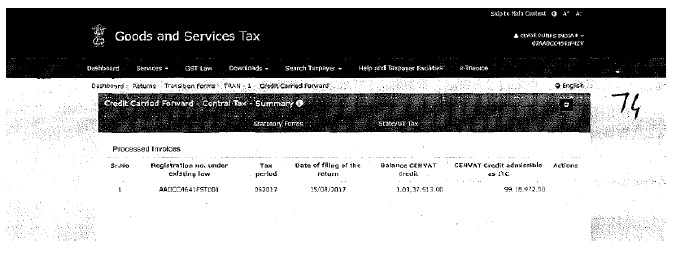

16. In the present case, the period for which the credit is to be distributed is between March, 2017 to June, 2017 and from 1st July, 2017, the GST regime came into effect. At the relevant point in time, as per ld. Counsel for the Petitioner, the portal did not permit ISD to file form TRAN-1. In the present case, TRAN-1 had been filed on 15th August, 2017 and the same is reflected below:

17. The only difficulty which the Petitioner faces is that the credit was not distributed in the same month in terms of Rule 39(1)(a) of the CGST Rules. The High Court of Bombay in Siemens Ltd. (supra) has passed several orders. The relevant two orders are order dated 24th August, 2023 and order dated 29th February, 2024. A perusal of the said orders would show that the benefit would be liable to be passed on to ISDs and the modalities therein have not been prescribed under Section 140(7) of the CGST Act, though the provision contemplates prescription of such a modality. The relevant portions of the said orders are extracted below:

Order dated 24th August, 2023

“4. Having considered the submissions as advanced before us, we may prima facie observe that there can hardly be any lis and/or a contrary assertion on the part of the revenue, against the provisions of subsection (7) of Section 140, in denying input tax credit, to the bonafide Input Service Distributors when such provision as also the Act itself recognizes such benefit, being part of the transitional arrangement created under Section 140 of the CGST Act. Thus, in our prima facie opinion, the Revenue is required to take a holistic view of such impasse, as also, considering the provisions of the CGST Act it needs to take a stand which would not defeat the substantive provisions of the Act, which permits the benefit of the credit to be taken by the assessee under Section 140(7) read with other provisions of the Act.

5. It is on such prima facie opinion, before we hear the parties further, we would request the learned ASG, who is representing the revenue in the present batch of petitions, to consider whether in reality any serious dispute would arise on the modalities of giving effect to sub-section (7) of Section 140. It may also be observed that this would not mean, that a credit would be permissible in cases when the same is not recognized by law or is not permissible in any individual case. The cases of assessee’s on that count can certainly be considered, which would be by a scrutiny on a case-to-case basis, and accordingly whether in a given case, the benefit of credit is available or not would certainly be decided, as the provision itself would envisage

6. We are also surprised to note that the situation as canvassed by the petitioners is quite anomalous inasmuch as although the Act has Pan-India effect, as also the electronic portal is supposed to operate uniformly throughout the country, issues are stated to have arisen, in respect of ‘input service distributors’ in Maharashtra and in Goa only. This would be an additional facet, which would be required to be considered. This would have significance inasmuch as the assessees which were similarly placed elsewhere are already granted benefit, however, such a benefit is denied to the petitioners and therefore, there would be a discriminatory approach, is the case of the petitioners, on the touchstone of Article 14 of the Constitution. In fact we are informed that in the case of one of the petitioners – Siemens Ltd. in other States benefit of the input tax credit has already been granted except in the States of Maharashtra and Goa”

Order dated 29th February, 2024

“10. Today we would have closed the proceedings for judgment on Mr. Venkatraman concluding his rejoinder arguments. However, as a result of a significant discussion having taken place on the issues as involved, presently, we need to alter such course, by deferring further arguments of Mr. Venkatraman. Such discussion leads us to form an opinion that before we proceed to adjudicate such issues, it would be appropriate that the GST Council considers the issues inter alia the effect that Sub-Section (7) of Section 140 would bring about, on the transition of the input tax credit, being permitted under such provision. More particularly, as it is urged on behalf of the Petitioners, that it is ill-conceivable that the input tax credit which was legitimately available with the petitioners before the appointed day, cannot be permanently lost or lapsed, merely because the GST, machinery does not create an effective procedural mechanism, for such credit to be transferred to the Electronic Credit Ledger (ECL) to be utilized, thereby, creating a situation of such credit being permanently lost. It is also their submission that this can never be the intention of the legislation even on a plain reading of sub-section (7) of Section 140

11. We are thus of the considered opinion that, an appropriate examination of such issues by the GST Council shall assist the Court in taking an appropriate view of the matter. “

18. In the order dated 29th February, 2024 passed by the High Court of Bombay, the matter has been referred to the GST Council. However, no decision by the GST Council in this regard has been shown. Both the counter affidavits are also silent in this regard.

19. Similar cases involving non-grant of credit have also been considered by various Courts. One of the early cases was a decision of the Co-ordinate Bench of this Court in Vision Distribution (P.) Ltd. v. Commissioner, State Goods & Services Tax GSTL 90 (Delhi)/2019: DHC:6949-DB. In the said case, an exporter was unable to avail of ITC as the amount was not reflected in the ITC ledger. The Co-ordinate Bench of this Court held as under:

“7. Having heard learned counsels, we are inclined to direct partial refund of the amount claimed by the Petitioner. We are of the view that the Petitioner cannot be made to suffer on account of failure on the part of the Respondents in devising smooth transition to GST regime w.e.f. 01.07.2017, from the erstwhile indirect taxation structure. The Petitioner, being an exporter under the GST regime is entitled to undertake zero rated supplies. The Petitioner claims to have undertaken exports in the months of July and August, 2017 and since its unutilized Input Tax Credit – to the tune of Rs. 3,13,06,050/-, which was accumulated up to June, 2017, was not reflected in its ITC ledger as on 01.07.2017, it could not utilize the same w.e.f. 01.07.2017. The same resulted in the Petitioner having to shell out, in cash, Rs. 1,37,37,029/- which would not have been required, had the Respondents taken care to ensure that the Petitioner was able to utilize its accumulated Input Tax Credit in the said months. Even the Form GST TRAN-1 was made available on the portal of the Respondents only from 25.08.2017. The business activity in the country could not be expected to come to a standstill, only to await the Respondents making the GST system workable. The failure of the Respondents in first putting a workable system in place, before implementing the GST regime, reflects poorly on the concern that the Respondents have shown to the difficulties that the trade faced throughout the length and breadth of the country. Unfortunately, even after passage of over two years, the Respondents have not remedied their omissions and failures by taking corrective steps. They continue to take shelter of the limitations in, and the inability of their software systems to grant refund, despite the same being justified. The rights of the parties cannot be subjugated to the poor and inefficient software systems adopted by the Respondents. The software systems adopted by the Respondents have to be in tune with the law, and not vice versa. The system limitations cannot be a justification to deny the relief, to which the Petitioner is legally entitled. We, therefore, reject the hyper technical objections sought to be raised by the Respondents – to the effect, that no refund can be granted, because the system did not reflect any credit lying in the ITC ledger of the Petitioner for the months of July and August, 2017. If that is so, it is entirely the Respondents making. In fact, to permit the Respondents to get away with such an argument would be putting premium on inefficiency. We therefore, reject the submission”

20. The Special Leave Petition (hereinafter, ‘SLP’) against the said decision was also dismissed as withdrawn being SLP (Civil) Diary No 16998/2020 vide order dated 15th February, 2021.

21. In the case of Dell International Services India (P.) Ltd. v. UO (Madras)/2025: MHC:251, the Madras High Court observed that since the GST system was not fully operational, parties cannot be put to a disadvantage. The observations of the Madras High Court are as under:

“52. The GST was implemented w.e.f. 01.07.2017. However, the system to implement the GST fully was not operational on 01.07.2017. Thus, the petitioner was unable to transition ITC of Rs.74,61,65,427/-out of Rs.82,91,19,712/- which was available to the petitioner under the previous regime.

53. Under Section 54(3)(ii) of the CGST Act, 2017, though the petitioner is entitled to refund of credit accumulated on account of rate of tax on input supplies higher than the rate of tax on output supplies, the petitioner would have been unable to liquidate its credit of ITC in its electronic credit ledger.

54. There will also be no scope for claiming refund of ITC under Section 54(3)(ii) of the CGST Act, 2017 on the aforesaid sum of Rs.74,61,65,427/- out of Rs.82,91,19,712/- which was debited by the petitioner from its electronic credit ledger as the aforesaid amount of Rs.74,61,65,427/- out of Rs.82,91,19,712/- was not transitioned in time.

55. If the aforesaid ITC was seamlessly made available to the petitioner, the petitioner could have discharged the bulk of its tax liability of Rs.3,06,54,81,564/- of ITC availed and out of transitional ITC and would have been required to pay only the difference of Rs.4,05,58,690/-(Rs.86,96,78,402 – Rs.82,91,19,712) in cash, instead of Rs.86,96,78,402/-.

56. The petitioner cannot be burdened with accumulation of ITC as the petitioner is unable to liquidate the same as it is under inverted duty structure.

57. If the system was enabled then and there, the petitioner would have discharged part of its tax liability also from the input that ought to have been allowed to be transitioned in the system “

22. In the present case, due to a glitch in the GST portal, the Petitioner could not file the form TRAN-01 and since the form could not be filed in time, the distribution could not take place as per Rule 39(1)(a) of the CGST Rules within one month. Hence, the Petitioner cannot be deprived of the benefit of the ITC due to mere technical glitches or transitional creases which were ironed out subsequently.

23. Under these circumstances, the Court is of the opinion that the legitimate ITC which the Petitioner is entitled to distribute to its sub-offices cannot be held back due to such technical objections. The ITC which is clearly reflected in TRAN-1 would be liable to be reflected on the Electronic Credit Ledger (hereinafter, ‘ECL’) of the Petitioner for distribution within a period of three months.

24. Accordingly, let the Delhi GST Department reflect the amount of Rs.99,18,972/- on the ECL of the Petitioner. If the same is to be done with the co-operation of the GST Network (hereinafter, ‘GSTN’), the GSTN shall also give effect to this order within a period of three months. From the date when the ECL reflects the said amount, upon intimation to the Petitioner, the Petitioner would have one month to distribute the credit to its sub-offices.

25. Mr. Beriwal, ld. Counsel for Respondents Nos. 2-5 shall communicate this order to the concerned official at GSTN so that the credit can be duly reflected.

26. The writ petition is disposed of in the aforesaid terms. Pending applications, if any, are also disposed of.