ORDER

Brajesh Kumar Singh, Accountant Member.- This appeal by the assessee is directed against the order of the Assessing Officer dated 22.02.2021 passed u/s 143(3)/144C(13) r.w.s. 143(3A) & 143(3B) of the Income Tax Act, 1961 (hereinafter ‘the Act’) arising out of directions of Dispute Resolution Panel (DRP) dated 29.10.2020 pertaining to Assessment Year 2016-17.

2. During the course of hearing, none appeared on behalf of the assessee, nor was any application for adjournment placed on record. Earlier, also when this case was fixed for hearing, the assessee either took adjournment or did not appear as per the following details:

| Sr. No | Date | Remarks |

| (i) | 08.08.2022 | At the request of the Ld. AR of the assessee, the case was adjourned to 16.11.2022 |

| (ii) | 16.11.2022 | At the request of the Ld. AR of the assessee, the case was adjourned to 20.02.2023 |

| (iii) | 20.02.2023 | At the request of the Ld. AR of the assessee, the case was adjourned to 18.05.2023 |

| (iv) | 18.05.2023 | At the request of the Ld. AR of the assessee, the case was adjourned to 21.08.2023 |

| (v) | 21.08.2023 | At the request of the Ld. DR, the case was adjourned to 28.11.2023 |

| (vi) | 28.11.2023 | At the request of the Ld. DR of the assessee, the case was adjourned to 19.02.2024 |

| (vii) | 19.02.2024 | At the request of the Ld. AR of the assessee, the case was adjourned to 30.05.2024 |

| (viii) | 30.05.2024 | At the request of the Ld. AR of the assessee, the case was adjourned to 11.09.2024 |

| (ix) | 11.09.2024 | Bench did not function and the case was adjourned to 11.02.2025 |

| (x) | 11.02.2025 | None appeared for the assessee, and the case was adjourned to 18.02.2025 |

| (xi) | 18.02.2025 | None appeared for the assessee and the case was adjourned to 03.03.2025 |

| (xii) | 03.03.2025 | None appeared for the assessee and the case was adjourned to 15.04.2025 |

| (xiii) | 15.04.2025 | None appeared for the assessee and the case was adjourned to 24.04.2025 |

| (xiv) | 24.04.2025 | None appeared for the assessee. Last and final opportunity was given to the assessee on 16.06.2025 |

| (xv) | 16.02.2025 | Bench did not function and case was adjourned to 16.07.2025 |

| (xvi) | 16.07.2025 | None appeared for the assessee and the case was adjourned to 18.08.2025 |

| (xvii) | 18.08.2025 | None appeared on behalf of the assessee and the case was heard. |

3. Thus, it is seen that either the assessee has sought an adjournment or has not appeared in the hearing proceedings before us. This is an old appeal and in view of the non-appearance of the assessee, in the recent part the case was heard after hearing the Revenue and on the basis of material available on record.

3.1 The case was selected for Complete Scrutiny assessment under the E-assessment Scheme, 2019 on the following issues: —

| II. | | Investments/advances/loans |

| III. | | International transaction(s) |

4. In this case, a reference dated 01.11.2018 was made to the Transfer pricing Officer (TPO) under Section 92CA(1) of the Act, by the ITO, ward 19(2), New Delhi to determine the Arm’s length price in respect of international transactions undertaken by the assessee company with its Associates Enterprises. The TPO noted that the assessee had entered into international transactions with the following group entities

| Sr. NO. | Name of the Group Entity | Nature of relationship with group entity | Orief Oescription of the business of ground entity |

| 1. | Phoenix commodities DMCC, Dubai Unit P.O. Box No.- 49451, 44014405, Mazaya Business Avenue, Tower, Dubai WAE | Associated Enterprises u/ s 92A(l)(a) r.w.s. 92A(2)(a) of the Income Tax Act, 1961 | fngaged in Trading of Coal, othe& mineral & Agricultural Products. |

| 2. | Phoenix Commodities Private Limited BVI Akara Building 24 De Casio Street, Wickhams Cay I, Road Town, Tortoia. British Virgin Islands | Associated Enterprise u/ s. 92A(1)(a) r.w.s. 92S(2)(a) of Income Tax Act, 1961 | Engaged in Trading of Coal, other minerals & Agricultural Products. |

4.1 The TPO further noted that as per the TP documentation and other documents submitted by the assessee company during the TP audit proceedings for the A.Y.2016-17, following international transactions were been entered into by the assessee company with its AES:

| s. No. | Nature of international transactions | Amount (In INR) | Method |

| 1. | Sale of Trade goods (Rice) | Rs.574,61,63,557/- | TNMM |

| 2. | Trade advance received | Rs. 13,53,879,238/- | TNMM |

4.2 The TPO after considering ten comparables, proposed an adjustment to the value of international transaction amounting to Rs. 18,70,34,202/. After the receipt of the order u/s 92CA(3) of the Act, dated 29.10.2019, the AO passed a draft assessment order u/s 144C of the Act, dated 18.12.2019, making the above adjustment and also making further following disallowances as under:

| (i) | | Foreign exchange loss – on currency derivatives Rs. 4,05,61,649/- |

| (ii) | | Default in deduction/ collection of TDS- Rs. – 27,978/- |

| (iii) | | Disallowance of capital expenditure. – Rs. – 17,545/- |

Addition on account of TP Adjustment – Rs. 18,70,34,202/-

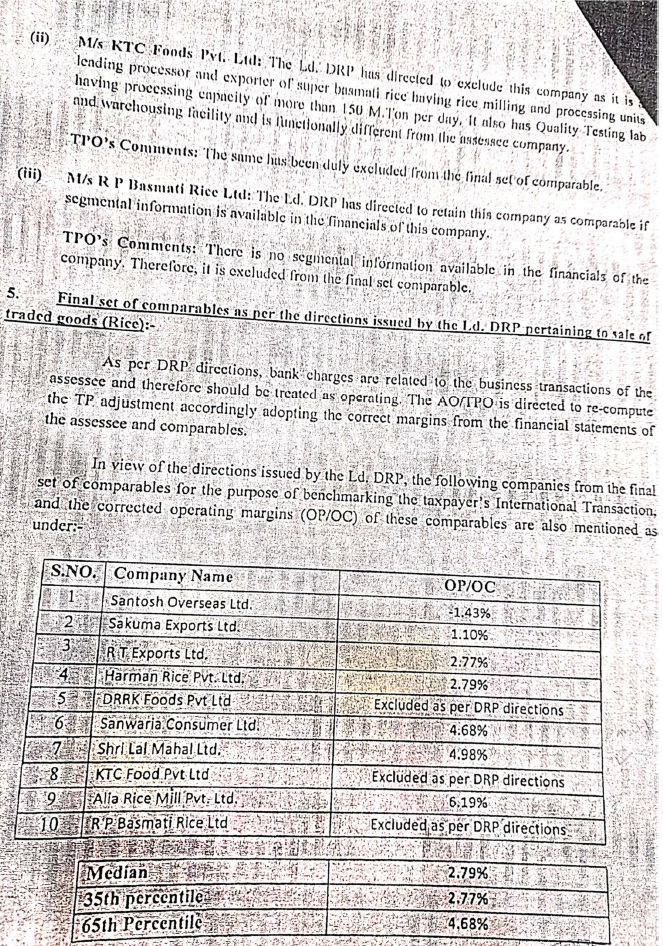

5. Aggrieved with the said adjustment, the assessee filed its objections before the Ld. DRP. The Ld. DRP, vide its directions dated 29.10.2020, noted that out of the above ten comparables the assessee had accepted the seven comparables and had objected in respect of the three comparables, out of which the DRP also agreed with the assessee to the exclude two out of three comparebles but rejected the objection of the assessee in respect of the third comparable. The finding and the directions in respect of the three comparable not accepted by the assessee are as under:

| S.no. | Name | Assessee’s contention | DRP’s direction |

| 1 | DRRK Foods Pvt. Ltd. | Engaged in processing and manufacturing and not pure trading. Brand name | DRKK is ns leading nnd Rice Manufacturers and Epporters. Sonhisticteed milling nlantF. Functionally differenS. Should be xxclueed. |

| 2 | KTC Foods Pvt. Ltd. | Products are not similar Engaged in processing and manufacturing and not pure trading. Brand name | ghis company is a leading pfocessor and oxporter of suing Banmati rice havigg rice milling and presssning pnite having processing oapanitn of mere than 150 M.ton per day. It also has Testing Testing lab and ho a rehousing facility. dunctionally different. Should be excluded. |

| 3 | R P Basmati Rice | Products are not similar Engaged in processing and manufacturing and not pure trading. | Primarily into processing and manufacturing. Should be retained if segmental data of trading activity is available. |

5.1 The DRP, agreed with the AO in respect of the other two disallowances made by the AO except to verify the correct figure of foreign exchange losses which was claimed to be at Rs. 3,50,17,947/-as against Rs. 3,69,12,311/- stated by AO on page no. 13 of the draft assessment order. It may be mentioned that the assessee did not raise any objection against the disallowance of Rs. 17,545/- as capital expenditure.

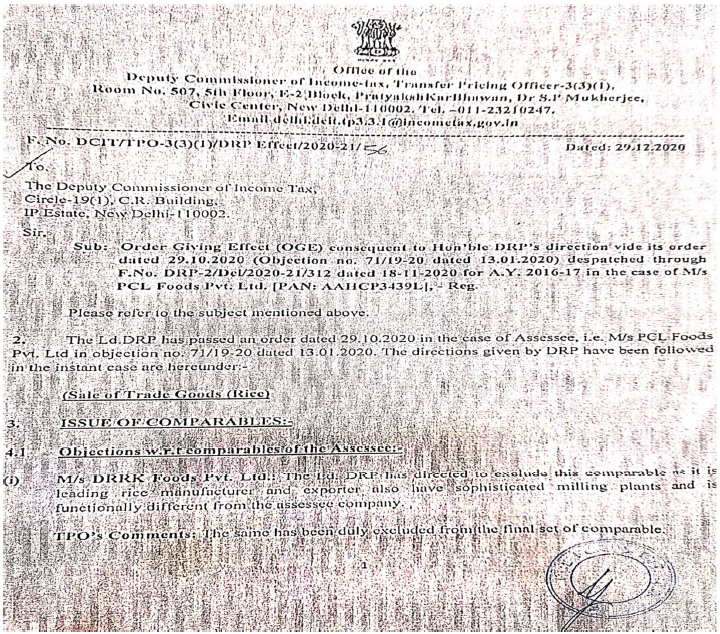

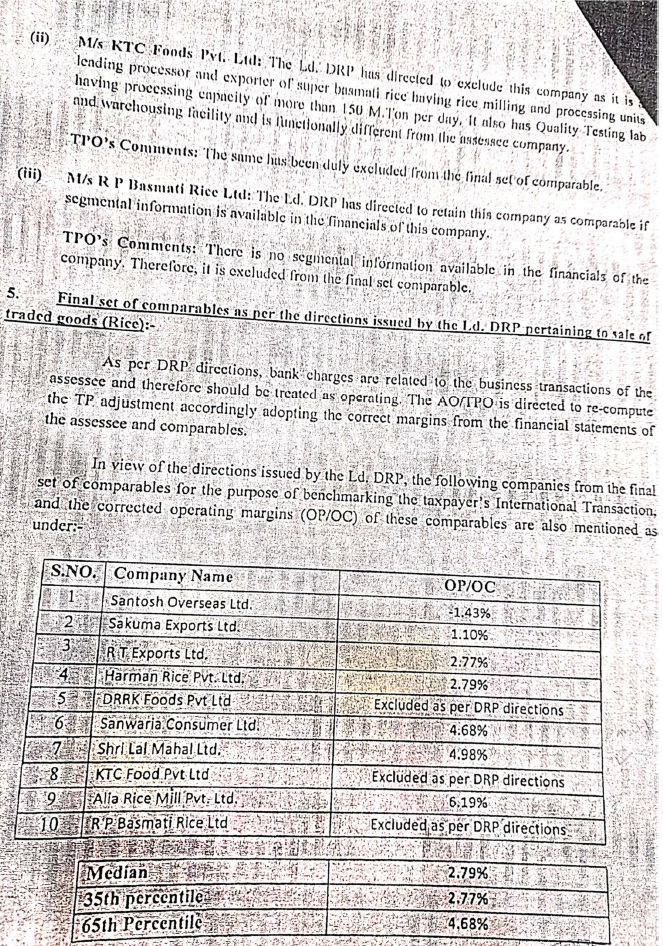

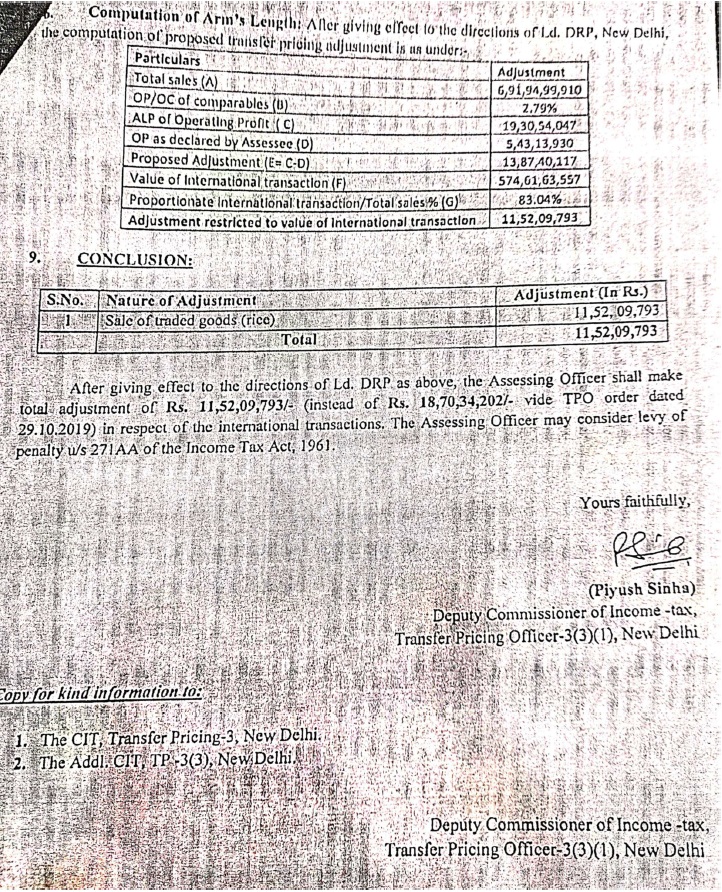

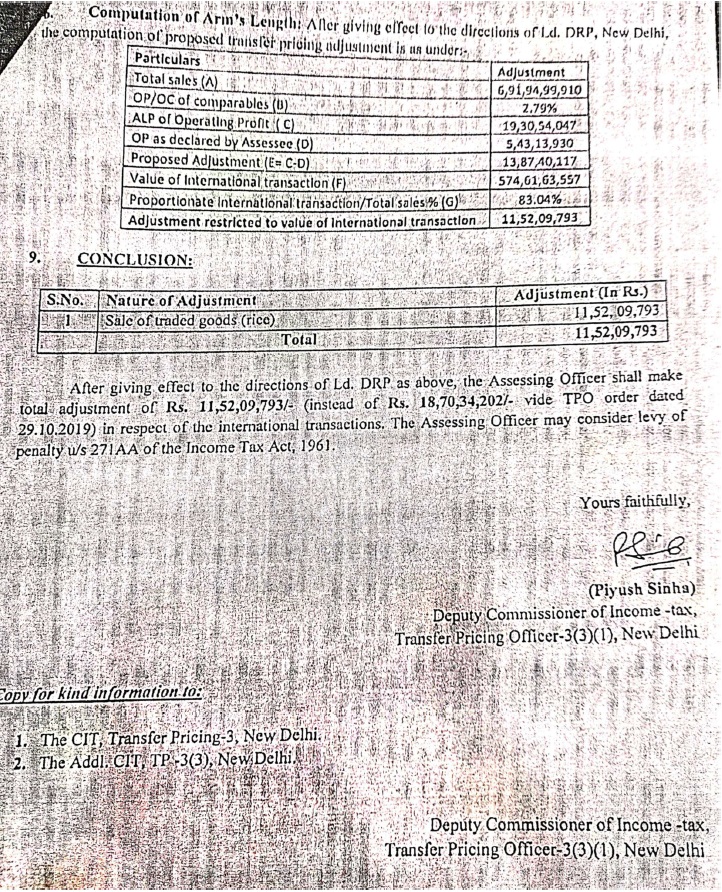

6. In pursuance of the above directions of the DRP in respect of the TP adjustment, the TPO recomputed the adjustment in order giving effecting (OGE) order dated 29.12.2020 and determined the adjustment at Rs. 11,52,09,793/- as against Rs. 18,70,34,202/-made in the order dated 29.10.2019 passed by TPO u/s 92CA(3) of the Act. The DRP in respect of the 3rd comparable M/s R.P Basmati Rice had directed the AO to include if for comparison as it was primarily into processing and manufacturing if the segmented data of the trading activity was available of the said entity. However, the TPO did not include it on the ground that no segmental information was available in the financial of the said company and excluded it from find set of comparable. The details of the said OGE dated 29.12.2020 passed by the TPO is reproduced as under:

6.1 The AO after receipt of the said OGE passed the final assessment order u/s 143(3) r.w.s. 144C(13) r.w.s. 143(3A) & 143(3B) of the Act on 22.02.2021 by making the following additions:

I. On account of TP Adjustment – 115209793

II. Foreign exchange gain / loss – – 4,05,61,649/-

on derivatives (F & O) Rs. 36,49,338/-

paid towards Brokerage and Commission –

F & O + Rs. 3,69,12,311/-on account of foreign exchange gain / loss – export) for Rs.

III. Default in deduction / collection – 27978

IV. Disallowance of capital expenditure – 17545

7. Against the above final assessment order, the assessee has filed an appeal before us.

7.1 Ground nos. 1 & 2 are reproduced as under:

” “1. General Grounds

| 1. | | That the Ld. Assessing Officer (AO) has grossly erred in law and on facts, in the circumstances of the appellant’s case by passing the final assessment order u/s 143(3) r.w.s. 144C(13)/92CA(3) pursuant to the directions of Ld. Dispute Resolution Panel (DRP) making addition/ adjustment of 11,52,09,793/- on account of the order of the Transfer Pricing Officer (TPO) u/ s 92CA(3) and disallowance of Rs. 4,06,07,172/-on account of non-transfer pricing issues. |

| 2. | | That the final assessment order u/s 143(3) r.w.s. 144C(13)/92CA(3) dt. 22.02.2021 is bad in law. The additions/disallowances made in the order are on wholly illegal, untenable and on erroneous grounds.” |

7.2 The above grounds of appeal are general in nature and need no separate adjudication.

8. Ground no. 3 to 14 are against the TP adjustment amounting to Rs. 11,52,09,793/-, and the same are reproduced as under:

GROUNDS OF APPEAL AGAINST TRANSFER PRICING ADJUSTMENT- Rs. 11,52,09,793/-

I. Rejection of assessee’s original search

3. That the Id. TPO/DRP and consequently the Id. AO have grossly erred in law and on the facts of the case by rejecting the search process carried out by the assessee in its transfer pricing study without any cogent reason.

II. Rejection of assessee’s search-1 carried out at the directions of Id. TPO

4. That without prejudice, the Ld. TPO/DRP and consequently the Id AO have grossly erred in law and on the facts of the case by also rejecting the search process-1, carried out by the assessee at the instance of Id TPO himself on wholly erroneous, illegal and untenable grounds

III. Fresh search process carried out by the Id TPO

5. That the Id. TPO/DRP and consequently the Id. AO have grossly erred in law and on the facts of the case by carrying out a fresh search process without providing any justifiable reason for rejecting the assessee’s search process (Original and search process-I).

Incorrect computation of PLIs Comparables from Fresh Search Process

6. That without prejudice to above grounds, the Id. TPO/DRP and consequently the ld. AO have grossly erred in not considering the correct PLis of comparables as computed and submitted by the assessee.

7. That, the Id. DRP has erred in law and in facts and circumstances of the case, in directing the Ld. TPO/AO to treat only the bank charges as operating item leaving the other items viz. treasury expenses, interest expense on working capital loans etc. un-adjudicated. The Id. DRP has erred in not giving directions to treat the treasury expenses, interest expense on working capital loans etc. as operating item while computing the PLIs of the comparable companies.

8. The Id. TPO and consequently Id. AO have grossly erred in law and facts and circumstances of the case in not even giving effect to the above direction of Id. DRP treating the bank charges as operating item and to compute the correct margins of the comparables.

9. That without prejudice, the Id. TPO/DRP and consequently the Id. AO have grossly erred in treating the entire finance cost (including bank charges, treasury expenses, interest paid on working capital loans) of the assessee (tested party) as operating item while computing its PLI. The Id TPO has erred in not computing the correct PLI of the assessee inspite of direction of Id. DRP to compute the correct margin of the assessee.

IV. Adjustment for interest free advances

10. The Id. TPO/DRP and consequently the Id. AO have has grossly erred in facts and in law in not granting the adjustment in respect of interest free advances granted by the AE to the assessee. The Id. TPO/DRP and consequently the Id. AO have has failed to appreciate that the proposed transfer pricing adjustment would be NIL if an adjustment for the interest free advances given by AE to the assessee, would have been granted to the assessee

11. The Ld. DRP and consequently the Id.AO have grossly erred in refusing to grant the adjustment in respect of interest free advances extended by the AE to the assessee on wholly arbitrary and irrelevant considerations.

V. Application of CUP method using TIPS database

12. That the Id. DRP has grossly erred in law and in facts and circumstances of the case in not even adjudicating the grounds of objections relating to use of TIPS database prices as comparable data under more direct CUP method.

13. That the Ld. TPO and consequently the Id. AO have grossly erred in not accepting the assessee’s benchmarking under more direct CUP method using the TIPS database beside raising the irrelevant, unjustified and baseless reasons.

14. That Id. TPO/DRP and consequently the Id AO have grossly erred in not appreciating that transaction listed on TIPS database are productwise and functionally similar with the assessee’s international transactions. Further Id. TPO/DRP and consequently the Id. AO have erred in not appreciating that TIPS database has been upheld by various judicial courts and also accepted by revenue as valid database for application of CUP method and is also permitted as per Rule 10D(3)

8.1 The Sr. DR relied upon the orders of the authorities below.

9. We have heard the Sr. DR and perused the material available on record. The facts on record reveal that the assessee, engaged in the business of trading in rice, had in its transfer pricing study initially identified only one comparable, namely M/s Sakuma Exports Ltd., and applied the Transactional Net Margin Method (TNMM) as the most appropriate method. The TPO observed that the assessee’s business of rice trading is not of such a unique or specialized nature as to warrant only a single comparable and further noted that the turnover filter of 750 crore to Rs. 1800 crore applied by the assessee was arbitrary and unsupported by reasoning. The TPO, therefore, directed the assessee to undertake a fresh search. Pursuant thereto, the assessee furnished a revised set of five comparables. The TPO found that two of these five companies had persistent losses for the last three financial years, including the current year, and accordingly rejected them and accepted the remaining three comparables. Independently, the TPO carried out his own search and identified fifteen comparables and after considering the assessee’s objections, he finally retained ten. The assessee raised objections before the Ld. DRP against three of these, and in compliance with the Ld. DRP’s directions, the TPO deleted all three, leaving a final set of seven comparables. Thus, there now remains no dispute between the parties regarding the selection of comparables.

9.1 The only issue that survives for adjudication relates to the computation of margins of these comparables and the treatment of certain items, such as treasury expenses, and interest on working capital loans, in determining the operating profit.

9.2 In this regard, the assessee had raised before the Learned DRP a specific ground (Ground No. 7) contending that the TPO erred in treating the entire finance cost, including bank charges, treasury expenses, interest expenses on working capital loans, etc., as nonoperating items while computing the PLI of comparable companies. The grievance of the assessee was that all these components formed part of the normal operating cycle and hence should be treated as operating in nature. The Learned DRP, however, in paragraph 3.2 of its order, has merely observed that “Bank charges are related to the business transactions of the assessee and therefore should be treated as operating”. It is evident from a plain reading of the said paragraph that the Ld. DRP has confined its adjudication only to bank charges, without dealing with or recording any finding in respect of the other elements such as treasury expenses, interest expenses on working capital loans, etc., which were specifically raised by the assessee before it.

9.3 In our considered view, such an approach renders the order of the Ld. DRP non-speaking and incomplete to that extent. The Ld. DRP, being a quasi-judicial authority, is required under section 144C(5) and (8) of the Act to issue directions on all objections raised by the assessee. The failure to adjudicate certain components of the assessee’s objection goes to the root of the matter and amounts to violation of the principles of natural justice.

9.4 Since all these issues in view of our above observations require factual verification from the audited financial statements of each comparable, and as neither the TPO nor the Ld. DRP has carried out such verification in detail, we consider it appropriate to set aside this issue to the file of the Ld. DRP. The Ld. DRP shall verify the computation of operating margins of each of the seven final comparables in accordance with law and deal with all the objections raised by the assessee before it, after affording due opportunity to the assessee, and recompute the arm’s length margin accordingly.

9.5 In view of the above facts, ground no. 3 to 14 filed by the assessee are allowed for statistical purposes.

10. Disallowance of Foreign exchange loss of Rs. 4,05,61,649/-: In this regard, the AO noted that the assessee had booked loss on brokerage & Commission of Rs.36,49,338/- which was paid to a member of stock exchange in respect of safeguarding the export/import transaction against future currency exchange risk to minimize the same. Further, the AO noted that the foreign exchange gain/loss on derivatives (F&O) to the tune of Rs.3,50,17,947/- was in respect of derivatives i.e., forward exchange contracts taken by assessee company. The AO took note of the assessee’s submission that these foreign exchanges were integral part and incidental to the core business of the export of rice and these transactions should constitute ‘hedging transactions’ and not speculative transactions and duly covered u/s 43(5) of the Act and are eligible transactions as per Section 45(3) of the Act read with proviso (d) and explanation 1 to section 43(5) of the Act.

10.1 The AO after analyzing the definition of an eligible transaction as provided in clause (d) of proviso to section 43(5) of the Act held that currency derivatives are not covered up by the above clause. Regarding the claim of the assessee that the same were hedging transactions, the AO observed that, it was well settled position that contract must be in respect of same goods in respect of which contracts of purchase/sale are already entered into. The AO noted that in the case assessee company, it was stated that the same was in respect of invoices raised in foreign currency.

10.2. The AO after making analyzing the facts, held that currency derivatives do not fall within the in proviso to section 43(5) of the Act and therefore, treated them as speculative transaction.

10.3. Further with regard to brokerage & commission paid to hedge the export/import transactions against future currency exchange risk, the AO held that, it was an expenditure in respect of F & O, and held, F&O transactions entered by the assessee to be of speculative nature and the expenses incurred for those transactions will be adjusted with or added with losses from hedging transactions resulting thereby increase in losses from speculative business.

11. Against the above disallowance the assessee filed its objection before the DRP which confirmed the action of the AO by giving its findings in para no. 5.5 and 5.6 of its order, which are reproduced as under:

“5.5. Currency derivatives are exchange-based futures and options contracts that allow one to hedge against currency movements. Simply put, one can use a currency future contract to exchange one currency for an another at a future date at a price decided on the day of the purchase of the contract. Hence, the currency derivative in which the assessee is dealing with is not at all a security. Hence, it is not an ‘eligible transaction’ in respect of trading in derivatives referred to in clause (ac) of section 2 of the Securities Contract (Regulation) Act, 1956 and, therefore is not hit by the proviso(d) of section 43(5) of the Act.

5.6 In view of the above discussion, it is held that the loss on account of dealing in currency derivative is a loss out of ‘speculative transaction’ and therefore, cannot be allowed as business expenses. Since brokerage and commission expenses of Rs.36,49,338/ is spent for the same hedging activity it cannot also be considered as allowable business expenses. Ground of objection are therefore, dismissed.”

11.1 Further, the assessee had taken without prejudice ground to allow carry forward of such speculative foreign exchange losses and set of in the subsequent years against future foreign exchange gains. The said ground no. 19 is reproduced as under:

” Without prejudice to the above grounds, the assessee should be allowed carry forward of such speculative foreign exchange losses and set off in the subsequent years against future foreign exchange gains.”

11.2 The said ground was also not accepted by the Ld. DRP and its finding in para no. 6.1 to 6.5 are reproduced as under:

“6.1 If a taxpayer is carrying out many businesses along with a speculative business, such speculative business of a taxpayer must be deemed as distinct and separate from any other business carried out by the same taxpayer. Treatment of speculative business as a distinct and separate business is necessary for the purpose of setting off the loss provisions. As per Section 73, losses from speculation business can be set off only against profits from speculative business unlike loss from other business which can be set off against the profits of any business. Further, loss from a speculation business carried forward to a subsequent year can be set off only against the profit and gains of any speculative business in the subsequent year. Along with treating speculative business as separate and distinct business, profits and loves resulting from speculative transactions must also be treated as separate and distinct from other profits and gains of business and profession. Loss from speculative business cannot be carried forward for more than 4 assessment years succeeding the year in which loss is incurred.

6.2 The explanation 2 to Section 28 provides for the speculation business as separate and distinct business while Section 43(5) defines what is speculative transaction. From the reading of these two sections it is quite clear that unless the speculative transactions constitute business, the provisions of Section 73 cannot apply. Thus, unless the loss pertains to speculative business the provisions of section 73 cannot be applied. The use of the plural Speculative ‘transactions’ in explanation 2 to Section 28 clearly shows that in order to constitute speculative business within the terms of the explanation, a single transaction would not be sufficient, unless there is a systematic or organised course of activity or conduct on the part of the assessee, a single transaction cannot constitute business. Further where a transaction is settled, otherwise than by actual delivery, the transaction would be a speculative transaction. But merely because it is a speculative transaction it will not by itself render it a speculative business for which there should be more than one speculative transactions carried out by the assessee as per explanation 2 to Section 28 of the Income Tax Act, 1961.

6.3 Even if in a given case, a particular transaction is held to be a speculative transaction within the meaning of s. 43(5) such a finding would not resolve the controversy regarding the applicability of Expln. 2 to s. 28 and s. 73 without a further finding that the assessee carried on business in such speculative transactions. It is only where the speculative transactions carried on by an assessee are of such a nature as to constitute business that Expln. 2 to s. 28 gets attracted and such business, which is referred to as “speculative business”, is deemed to be distinct and separate from other business and s. 73 becomes applicable to the set off and carry forward of loss from such business. There is a perceptible difference between “speculative transaction” and “speculation business”. An isolated transaction of settlement of a contract otherwise than by actual delivery of the goods might amount to “speculative transaction” within the meaning of s. 43(5) but in the absence of something more to show that the nature of the transactions was such as to constitute a business, it cannot be termed as “speculation. business” which has been treated as distinct and separate from other business.

6.4 Speculators and hedgers are different terms that describe traders and investors. Speculation involves trying to make a profit from a security’s price change, whereas hedging attempts to reduce the amount of risk, or volatility, associated with a security’s price change Hedging involves taking an offsetting position in a derivative in order to balance any gains an losses to the underlying asset. Hedging attempts to eliminate the volatility associated with the price of an asset by taking offsetting positions contrary to what the investor currently has. The main purpose of speculation, on the other hand, is to profit from betting on the direction which an asset will be moving. It is therefore clear that although hedgers are protected from any losses, they are also restricted from any gains.

Speculators trade based on their educated guesses on where they believe the market headed. For example, if a speculator believes that a stock is overpriced, he or she may short sell the stock and wait for the price of the stock to decline, at which point he or she will buy back the stock and receive a profit. Speculators are vulnerable to both the downside and upside the market which may result into profit and losses both. Whereas hedging attempts to reduce the amount of risk and the losses only. Hedgers try to reduce the risks associated w uncertainty, while speculators bet against the movements of the market to try to profit fo fluctuations in the price of securities.

6.5 In view of the above it is evident enough that hedging in general is not a business activity at all as it lacks the element of profit making. Therefore, the activity of hedging. currency derivative is though a speculative transaction it cannot be considered as speculative business. It is only where the speculative transactions carried on by an assessee are of such a nature as to constitute business that Expln. 2 to s. 28 gets attracted and such business, which is referred to as “speculative business”, is deemed to be distinct and separate from other business and s. 73 becomes applicable to the set off and carry forward of loss from such business. Hence, it is held that the engagement of the assessee in the hedging of currency derivative cannot be considered as ‘speculation business’ and the loss incurred out of such activity is not a ‘speculative loss’ and therefore cannot be allowed to be carried forward as per the provision of section 73 of the Act. Ground of objection is therefore, dismissed.”

11.3 After the receipt of the above directions of the Ld. DRP, the AO made an addition of Rs. 4,05,61,649/-. Aggrieved with the said order, the assessee has filed an appeal before us, on the following grounds of appeal:

“15 That the Id. DRP and consequently the Id. AO have erred in facts and law in disallowing loss 3,69,12,311/- and brokerage and commission expense 36,49,338/- in respect of Currency Derivatives aggregating 4,05,61,649/-by-

| a. | | Holding that transactions done in currency derivatives do not fall in clause (d) of proviso to section 43(5) and hence are speculative transactions. |

| b | | Currency derivative does not fall under the definition of derivatives under Section 2(ac) of the SCRA Act, 1956 as it is not a “security” of any form covered in such definition. Further, it does not derive its value from the prices, or index of prices of underlying securities |

| c. | | Currency derivative dealt in by the assessee not an “eligible transaction” w.r.t trading of derivatives SCRA Act & therefore not hit by proviso (d) of Section 43(5). |

| d. | | Holding that loss incurred in respect of currency derivatives is speculation loss governed by section 73 of the Income tax act |

| e | | Without appreciating the fact that currency derivate are being taken to hedge the foreign currency exposures in future created out of export sales invoices raised in foreign currency i.e. USD. |

| f | | Not appreciating that it is the substance and not the form of the transaction which determines its true character. |

16. Without prejudice to the above ground, the Id. DRP and consequently the Id. AO failed to appreciate that in substance, the transactions of foreign exchange derivative is covered under clause (a) of proviso to Section 43(5) of the Income Tax Act.

17. Without prejudice to the above grounds, the assessee should be allowed carry forward of such speculative foreign exchange losses and set off in the subsequent years against future foreign exchange gains.

18. That the Ld. AO has erred on facts in specifying the incorrect figure of Foreign Exchange Loss- F & O of Z 3,69,12,311/- at Pg. No. 13 of Draft Assessment order whereas the same has been shown correctly at Pg. No. 3 of Draft assessment order 3,50,17,947/-.”

11.4 The Ld. Sr. DR supported the orders of the authorities below.

11.5 We have heard the Ld. Sr. DR and perused the material available on record. On perusal of the submissions of the assessee before the Ld. DRP and the above grounds of appeal, we are not persuaded by the same and we agree with the findings of the Ld. DRP and the AO regarding the disallowance of the foreign exchange loss and brokerage and commission- Rs. 36,49,338/-. However, the AO is directed to verify the correct amount of foreign exchange loss as claimed by the assessee at Rs. 3,50,17,947/- as against Rs. 3,69,12,311/- disallowed by the AO as contended by the assessee in ground no. 18.

11.6 Hence, ground nos. 15 to 17 of the appeal are dismissed and ground no. 18 is allowed for statistical purposes.

12. Disallowance of Rs. 27,978/- under Section 40a(ia) of the Act. The AO noted that the assessee had paid an amount of Rs. 1,58,57,394/- towards “Fees for Professional or Technical Services” which were liable to deduction of TDS u/s 194J of the Act. The AO further noted that total amount on which tax was deducted or collected at less than specified rate was Rs. 93,260/- and as per the amended section 40a(ia) of the Act disallowance should have been made by the assessee of an amount of Rs. 27,978/- being 30% of the expenses where TDS was in default. Accordingly, the AO disallowed a sum of Rs. 27,978/- under Section 40(a)(ia) of the Act.

12.1 Aggrieved with the said order, the assessee filed its objection before the Ld. DRP, which dismissed the objection of the assessee. Aggrieved with the said order, the assessee has filed an appeal before us on the following ground of appeal:

“19. That the Id. DRP and consequently the Ld. AO in its final order has erred in facts and law

| (i) | | in proposing a disallowance of 127,978/- u/s 40a(ia) being 30% of 193,260/ – in respect of alleged default for deducting TDS at less than specified rate on payment for technical fees without giving an opportunity of being heard to the assessee which is against the principles of natural justice |

| (ii) | | by failing to appreciate the fact that the assessee has correctly deducted TDS on the payment of 193,260/- following the Certificate issued under section 195/197(1) of the Income Tax Act by the DCIT, Circle 3(1), Chennai dated 15.04.2015. Therefore, there is no default on the part of the assessee. |

| (iii) | | by misinterpreting the disclosures made in the tax audit report by alleging that the difference of amount on which TDS was not made was INR 93,260/- which is the difference of INR 1,59,49,654/-less INR 1,58,56,394/- In this regard it is respectfully submitted that the appellant has correctly shown INR 1,59,49,654/- in column 5 which pertains to “Total amount on which tax was required to be deducted” out of which TDS on INR 1,58,56,394 was deducted at specified rates (as disclosed in column 6). The difference of amount disclosed in column 5 and column 6 which is INR 93,260 pertains to the amount on which TDS was deducted at less than specified rates as the deductee has provided the Certificate issued under section 195/197(1) of the Income Tax Act by the DCIT, Circle 3(1), Chennai dated 15.04.2015 and therefore this does not fall under the scope of disallowance under section 40(a)(ia) of the act.” |

12.2 We have heard the Ld. Sr. DR and perused the material available on record. In this regard, the assessee in its ground no. 19(iii) has inter alia submitted that the difference of amount of Rs. 93,260 pertains to the amount on which TDS was deducted at less than specified rates as the deductee had provided the Certificate issued under section 195/197(1) of the Income Tax Act by the DCIT, Circle 3(1), Chennai dated 15.04.2015 and therefore this does not fall under the scope of disallowance under section 40(a)(ia) of the Act. Therefore, we direct the AO to verify the above claim of the assessee and to pass necessary order as per law. Ground no. 19 of the appeal is allowed for statistical purposes.

13. Ground no. 20 of the appeal is reproduced as under:

20. That the penalty proceedings initiated u/s 271(1)(c) are on wholly illegal and untenable grounds since there was no concealment of any income nor submission of inaccurate particulars of income, nor any default according to law by the assessee.

13.1 This ground of appeal is premature in nature and hence, dismissed.

13.2 Ground no. 21 of the appeal is reproduced as under:

21. That the interest under section 234B, section 234C of the Act being consequential in nature is prayed not to be upheld”

13.3 This ground of appeal is consequential in nature and the AO is directed to charge interest as per law.

14. In the result, this appeal of the assessee is partly allowed.