ORDER

Ravish Sood, Judicial Member.- The captioned appeal filed by the Revenue is directed against the order passed by the Commissioner of Income-Tax (Appeals), National Faceless Appeal Center (NFAC), Delhi, dated 05/09/2024, which in turn arises from the order passed by the Assessing Officer under Section 147 r.w.s 144 r.w.s 144B of the Income Tax Act, 1961 (for short, “Act”), dated 02/02/2024 for Assessment Year 2018-19. The Revenue has assailed the impugned order on the following grounds of appeal before us:

“1 The Order of the Ld.CIT(A), National Faceless Appeal Centre (NFAC), Delhi is erroneous in law and to the facts of the case.

2.1. The Ld CIT(A) erred in quashing the order passed under section 148A(d) and notice issued under section 148 by the jurisdictional Assessing Officer, as the Finance Act, 2021 introduced provisions for faceless assessment and the automated allocation of cases, and does not explicitly prohibit the JAO from issuing such notices as per provisions of section 148A of the Income Tax Act, 1961.

2.2. The Ld CIT(A) erred in quashing the order passed by the Jurisdictional Assessing Officer (JAO) under Section 148A(d) and the notice issued by the JAO under Section 148 which is inconsistent with the legislative intent when the powers to issue the notice under section 148 remained intact with the JAO even after bringing the Faceless Assessment Scheme

2.3. The Ld.CIT(A) is not correct in holding that the JAO cannot issue notice under section 148 of the Act, when both the JAO as well as units under NFAC have concurrent jurisdiction under the Income Tax Act.

2.4. The Ld.CIT(A)’s decision to quash the orders passed by the Jurisdictional Assessing Officer (JAO) under Section 148A(d) and the notices issued by the JAO under Section 148 is in alignment with the provisions of Section 1448 which comes into picture only after the process of issuance of notice under Section 148 of the Act has been completed.

2.5. The Ld.CIT(A) erred in quashing the orders passed under section 148A(d) and notice issued under section 148 by the JAO as per automated allocation and risk management strategies as per provisions of Section 151A read with section 144B of the Income Tax Act.

2.6 The Ld.CIT(A) erred in not appreciating the directions given by the Hon’ble Supreme Court in its order in the case of

UOI v.

Ashish Agarwal (2022) 444 ITR 1 (SC), wherein the “Assessing Officers were directed to conduct enquiry and pass orders in relation to the reopening of cases.

2.7. The Ld.CIT(A) erred in quashing the order passed u/s. 148A(

d) by the jurisdictional Assessing Officer when the Hon’ble Supreme Court in its order in the case of

UOI v.

Ashish Agarwal (2022) 444 ITR 1 (SC) had taken the stand that the “Assessing Officers are the Authorities specified in the said provisions of Section 148 of the IT. Act

2.8. The Ld.CIT(A) erred in not observing the fact that Section 151A of the IT Act, 1961 read with the CBDT notification dated 29.03.2022 clearly and unambiguously demarcate that pre-assessment action of issuing notice u/s 148 so as to trigger the subsequent assessment or reassessment or re-computation, is to be taken by the JAO only. The JAO has jurisdiction outside the purview of the faceless regime and is empowered to conduct enquiries u/s. 148A and thereafter issue notice u/s. 148.

2.9 The Ld CIT(A) erred in allowing the ground no. 2 of the assessee ie. the order uls. 148A(d) passed by the Jurisdictional AO is in violation of ‘e-Assessment of Income Escaping Assessment Scheme, 2022’ and therefore, the assessment order passed u/s. 147 is void ab initio. The judgement of Hon’ble Telangana High Court in the case of Kankanala Ravindra Reddy relied upon by the Ld CIT(A) is not that of the jurisdictional High Court and the above decision relied upon by the Ld. CIT(A) was appealed by the Department before the Hon’ble Supreme Court and presently, the proceedings are pending.

3.1 The Ld CIT(A) erred in adjudicating that the approval for passing order u/s 148A(d) was sought from authorities specified in clause (i) as against clause (ii) of section 151 of the Income-tax Act. 1961.

3.2 The Ld.CIT(A) erred in not observing the fact that approval u/s. 151 was sought from the Pr. Commissioner of Income Tax as per clause (i) of the section as the case falls within three years from the end of the relevant assessment year as per the provisos 5 and 6 to Section 149(1) of the Income-tax Act, 1961.

4.1 The Ld. CIT(A) erred in deleting the addition made by the AO of Rs.4,24,70,696/- as unexplained expenditure u/s 69C of the IT Act

42 The Ld.CIT(A) erred in not observing the fact that there is no actual sale-purchase of goods undertaken in the case and the whole transaction was created merely to adjust/reconcile the stock inventory and the goods were never physically transported

4.3 The Ld CIT(A) erred in not observing the fact that the assessee vide its submission dated 10.02.2023 clearly stated that “In relation to above transaction we have not incurred any labour or transportation expenses”. Hence CIT(A) ought to have treated this transaction as bogus purchase transaction.

4.4. The Ld. CIT(A) erred in not appreciating the fact that the assessee had fraudulently availed fake inward GST invoices and that the information shared by DGCI, Visakhapatnam and accordingly the reassessment was completed by treating the transaction as bogus purchase transaction.

4.5 The Ld. CIT(A) erred in not appreciating the fact that the assessee has contradicting itself on the issue of bogus purchase transaction. On one hand, the assessee has stated that the transaction were solely aimed at receiving inventory back from Steel Exchange India Limited due to non-payment of sale proceeds by Hero Wiretex Private Limited while on the other hand, it submitted copies of invoices reflecting levying of GST on sale of MS Bars by M/s. Hero Wiretex Pvt. Ltd. This GST levied by M/s. Hero Wiretex Pvt Ltd. has been claimed as input tax credit by the assessee. Claiming Input Tax Credit for the transactions in question itself contradicts the assessee’s claim that no actual business has taken place between assessee and M/s. Hero Wiretex Pvt. Ltd.

5 The appellant craves leave to add or delete or amend or substitute any ground of appeal before and/or at the time of hearing of appeal.

6. For these and other grounds that may be urged at the time of appeal hearing, it is prayed that the above addition be restored.”

2. Also, the assessee company is before us as a Cross Objector on the following grounds:

“1. The learned Commissioner of Income-Tax (Appeals) is justified in quashing the order passed u/s 148A(d) by the JAO contrary the stipulations of S.151A of the Act and E-Assessment of Income Escaping Assessment scheme, 2022.

2. The learned Commissioner of Income-Tax (Appeals) is justified quashing the notice u/s 148 on the ground that the assessing officer did not take approval from specified authority in terms of S.151 of the Act.

3. The learned Commissioner of Income Tax (Appeals) is justified in deleting the addition of Rs.4,24,70,696/- made by the assessing officer u/s 69C of the Act towards alleged bogus purchases from M/s Hero Wiretex Private Limited.

4. Any other grounds of Cross-Objection that may the raised at the time of hearing.”

3. Succinctly stated, the assessee company had filed its return of income for AY 2018-19 on 15/09/2018, declaring an income of Rs. NIL. Subsequently, the Jurisdictional Assessing Officer (for short, “JAO”) based on information that the assessee company which was engaged in the business of trading of steel had fraudulently availed Input Tax Credit (ITC) based on the fake inward GST invoices issued by M/s. Hero Wiretex Ltd., on bogus purchases of Rs.4,24,70,696/-, reopened its case and passed an order under clause(d) of section 148A of the Act, dated 01/04/2022. Therefore, the JAO i.e., Income Tax Officer, Ward-2(1), Visakhapatnam issued notice under section 148 of the Act, dated 01/04/2022, which was served upon the assessee company through ITBA system via e-mail. In response, the assessee company filed its return of income for the subject year i.e., AY 2018-19 on 23/04/2022, which however as per the assessment order is held to be invalid as it is pending for e-verification.

Thereafter, the AO issued notice under section 142(1) of the Act in response to which the assessee company filed its replies. On being queried, as to why the purchases of Rs. 4,24,70,696/- that the assessee company had claimed to have made from M/s. Hero Wiretex Private Limited (supra) may not be treated as bogus purchases, the assessee company vide its reply dated 08/01/2024 rebutted the same. It was submitted by the assessee company that during the Financial Year 2017-18, M/s. Steel Exchange India Limited (SEIL) had sold 998.870 mts of MS bars to M/s. Hero Wiretex Private Limited but had not taken the delivery of inventory due to non-payment of sale proceeds as per the terms and the material remained in SEIL yard. Later, SEIL requested M/s. Hero Wiretex Private Limited to sell the said quantity of material to the assessee company wherein the latter had in turn again sold the same material to SEIL, which, thereafter was sold to outside parties. Accordingly, it was the assessee’s claim that the subject transaction was undertaken only to receive the inventory back to SEIL due to nonpayment of sale proceeds by M/s. Hero Wiretex Private Limited and it had in relation to the said transaction not incurred any labour or transportation expenses.

4. However, we find that the AO did not find favour with the explanation of the assessee company for the reason that it had failed to substantiate the same based on any documentary evidence. Accordingly, the AO concluded that the assessee company had availed Input Tax Credit based on fake inward GST invoices of Rs. 4,24,70,696/-that were issued by M/s. Hero Wiretex Private Limited. Thereafter, the AO vide his order passed under section 147 r.w.s. 144 r.w.s 144B of the Act, dated 02/02/2024 made an addition of Rs. 4,24,70,696/- by treating the same as unexplained expenditure under section 69C of the Act.

5. Aggrieved, the assessee company carried the matter in appeal before the CIT(A), who rejected the assessee’s contention that the order passed by the AO under section 148A(d) of the Act, dated 01/04/2022 was contrary to the grounds based on which the show cause notice (SCN) was issued by him under section 148A(d) of the Act, dated 22/03/2022. At the same time, the CIT(A) concurred with the assessee regarding the invalid assumption of jurisdiction by the AO for issuing notice under section 148 of the Act, viz., (i) that the notice under section 148 of the Act, dated 01/04/2022 should have been issued in a faceless manner and not by the JAO; and (ii) that the AO had grossly erred in law and facts of the case by passing the order under section 148A(d) of the Act, dated 28/04/2022 without the approval of the specified authority as contemplated under section 151 of the Act. Also, we find that the CIT(A) found favour with the contentions advanced by the assessee company regarding the merits of the addition of Rs.4.24 crores (approx.) and deleted the same.

6. The revenue being aggrieved by the order of the CIT(A) has carried the matter in appeal before us. Also, the assessee is before us as a Cross Objector.

7. Sri G.V.N. Hari, the learned Authorized Representative (for short “Ld.AR”) for the assessee company at the threshold of hearing of the appeal, supported the CIT(A) order, and submitted that the A.O. had grossly erred in law and on facts of the case in assuming jurisdiction and framing the impugned assessment vide his order passed u/s 147 r.w.s 144 r.w.s 144B of the Act, dated 02.02.2024. Elaborating on his contention, the Ld. AR submitted that as notice u/s 148 of the Act, dated 01.04.2022 for the subject year i.e. A.Y. 2018-19 had been issued by the Jurisdictional Assessing Officer (JAO) i.e., Income Tax Officer, Ward-2(1), Visakhapatnam. beyond a period of three years from the end of the relevant assessment year, i.e., on 01.04.2022, therefore, as per the mandate of Section 151 of the Act, as was made available on the statute vide the Finance Act, 2021 w.e.f. 01.04.2021, the said notice could have been issued only after obtaining the prior approval of the authorities contemplated in sub-section (ii) of Section 151 of the Act, viz. Principal Chief Commissioner/principal Director General/Chief Commissioner /Director General. The Ld. AR submitted that the notice under Section 148 of the Act, dated 01.04.2022, had been issued in the present case after obtaining the prior approval of the Principal Commissioner of Income-tax on 01.04.2022. The Ld. AR to fortify his contention had drawn our attention to the notice u/s 148 of the Act, dated 01.04.2022, which revealed that the same was issued after obtaining the prior approval of Pr. CIT accorded on 01.04.2022 vide reference No.100000028783629 (Page 47 of APB). Carrying his contention further, the Ld. AR submitted that as the impugned notice under Section 148 of the Act, dated 01.04.2022 had been issued by the A.O. without obtaining the approval of the prescribed authority, therefore the said notice and the consequential assessment framed by him vide his order passed under Section 147 r.w.s 144B of the Act, dated 02.02.2024 cannot be sustained and is liable to be quashed on the said count itself. Apart from that, the Ld. AR supported the CIT(A) order. The Ld. AR submitted that the CIT(A) by rightly relying on the judgment of the Hon’ble High Court of Telangana in Kankanala Ravindra Reddy v. ITO (TELANGANA), had rightly observed that after introduction of faceless jurisdiction of Income-tax Authorities Scheme 2022 and e-assessment of Income Escaping Assessment Scheme 2022, it became mandatory for revenue to conduct/initiate proceedings pertaining to reassessment under sections 147, 148 and 148A in a faceless manner.

8. Per contra, Sri Badicala Yadagiri, Commissioner of Income Tax-Departmental Representative (for short “Ld. CIT-DR”), on being confronted with the aforesaid contentions as were canvassed before us, failed to rebut the same. However, the Ld. DR submitted that as the A.O., after validly assuming jurisdiction, had issued notice u/s 148 of the Act, dated 01.04.2022, therefore, no infirmity emerges from the assessment order passed by him. The Ld. CIT-DR, submitted that on a conjoint reading of Section 151 and the “5th proviso” to Section 149(1) of the Act, for reckoning the period of three years from the end of the relevant assessment year as envisaged in Section 151 of he Act, based on which the specified authority whose sanction is required to be obtained for issuing notice under Section 148 of the Act is to be determined, the period allowed to the assessee as per the “Show Cause Notice” (SCN) issued under clause (b) of Section 148A of the Act has to be excluded. The Ld. CIT-DR to support his contention had drawn our attention to the “5th Proviso” of Section 149 of the Act. Also, the Ld. DR had relied on the order of the ITAT, Mumbai in the case of Albert Joseph Rozario v. ITO, (Int. Tax) (Mumbai – Trib.)/ITA No. 1168/Mum/2025, dated 22.07.2025.

9. The Ld. A.R. rebutted the contentions advanced by the revenue’s counsel. The Ld. AR supported the CIT(A) order to the extent he had by relying on the judgment of the Hon’ble High Court of Telangana in Kankanala Ravindra Reddy (supra), had quashed the notice issued by the Jurisdictional Assessing Officer (JAO) instead of the Faceless Assessing Officer (FAO). Apart from that the Ld. AR submitted that the “Proviso” to Section 151 of the Act, which, inter alia, contemplates exclusion of the time period provided in the “5th proviso” of Section 149 of the Act for computing the period of three years had been made available on the statute vide the Finance Act, 2023, w.e.f 01.04.2023 and thus, cannot be applied retroactively to the subject year involved in the present appeal, i.e., AY 2018-19. The Ld. AR further submitted that the subject issue is squarely covered by the recent judgment of the Hon’ble High Court of Telangana in the case of Deloittee Consulting India (P.) Ltd. v. Assessment Unit, ITD, NFAC, New Delhi (Telangana)/CWP No. 4061 of 2024, dated 25.09.2025.

10. We have heard the Ld. Authorized Representatives of both parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that have been pressed into service by the Ld. Authorized Representatives of both parties to drive home their respective contentions.

11. As the Ld. AR has assailed the validity of the jurisdiction assumed by the A.O. for issuing notice u/s 148 dated 01.04.2022 without obtaining of approval from any of the authorities specified u/s 151 of the Act (as was applicable at the relevant point of time), therefore, we shall first deal with the same.

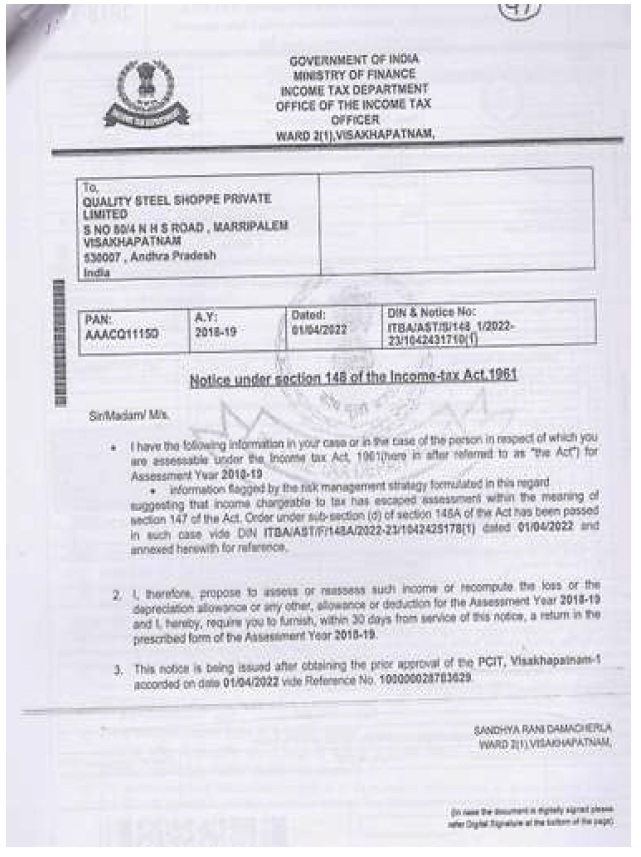

12. Admittedly, it is a matter of fact discernible from the record that the notice u/s 148 of the Act, dated 01.04.2022, had been issued by the ITO, Ward-2(1), Visakhapatnam after obtaining the prior approval of the Pr. Commissioner of Income-Tax dated 01.04.2022 vide reference No.100000028783629. For the sake of clarity, we deem it fit to cull out the notice u/s 148 dated 01.04.2022.

13. At this stage, it would be relevant to point out that nothing has been placed on our record by the Ld. CIT-DR to rebut the aforesaid factual position as had been brought to our notice.

14. Apropos the challenge thrown by the Ld. AR regarding the validity of the jurisdiction assumed by the A.O. for initiating proceedings u/s. 147 of the Act, i.e., without obtaining the approval of the specified authority u/s. 151(ii) of the Act, we find substance in the same. Admittedly, the reassessment proceedings u/s. 147 of the Act had been revamped vide the Finance Act, 2021 w.e.f. 01.04.2021. The substituted Sections 147 to 149 and Section 151 of the Act, applicable w.e.f. 01.04.2021 are culled out as under:

“Income escaping assessment-

147. If any income chargeable to tax, in the case of an assessee, has escaped assessment for any assessment year, the Assessing Officer may, subject to the provisions of sections 148 to 153, assess or reassess such income or recompute the loss or the depreciation allowance or any other allowance or deduction for such assessment year (hereafter in this section and in sections 148 to 153 referred to as the relevant assessment year).

Explanation.—For the purposes of assessment or reassessment or recomputation under this section, the Assessing Officer may assess or reassess the income in respect of any issue, which has escaped assessment, and such issue comes to his notice subsequently in the course of the proceedings under this section, irrespective of the fact that the provisions of section 148A have not been complied with.”.

Issue of notice where income has escaped assessment

148. Before making the assessment, reassessment or recomputation under section 147, and subject to the provisions of section 148A, the Assessing Officer shall serve on the assessee a notice, along with a copy of the order passed, if required, under clause (d) of section 148A, requiring him to furnish within such period, as may be specified in such notice, a return of his income or the income of any other person in respect of which he is assessable under this Act during the previous year corresponding to the relevant assessment year, in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed; and the provisions of this Act shall, so far as may be, apply accordingly as if such return were a return required to be furnished under section 139:

Provided that no notice under this section shall be issued unless there is information with the Assessing Officer which suggests that the income chargeable to tax has escaped assessment in the case of the assessee for the relevant assessment year and the Assessing Officer has obtained prior approval of the specified authority to issue such notice.

Explanation 1.—For the purposes of this section and section 148A, the information with the Assessing Officer which suggests that the income chargeable to tax has escaped assessment means,—

(i) any information flagged in the case of the assessee for the relevant assessment year in accordance with the risk management strategy formulated by the Board from time to time;

(ii) any final objection raised by the Comptroller and Auditor General of India to the effect that the assessment in the case of the assessee for the relevant assessment year has not been made in accordance with the provisions of this Act.

Explanation 2.—For the purposes of this section, where,—

(i) a search is initiated under section 132 or books of account, other documents or any assets are requisitioned under section 132A, on or after the 1st day of April, 2021, in the case of the assessee; or

(ii) a survey is conducted under section 133A, other than under subsection (2A) or subsection (5) of that section, on or after the 1st day of April, 2021, in the case of the assessee; or

(iii) the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner, that any money, bullion, jewellery or other valuable article or thing, seized or requisitioned under section 132 or under section 132A in case of any other person on or after the 1st day of April, 2021, belongs to the assessee; or

(iv) the Assessing Officer is satisfied, with the prior approval of Principal Commissioner or Commissioner, that any books of account or documents, seized or requisitioned under section 132 or section 132A in case of any other person on or after the 1 st day of April, 2021, pertains or pertain to, or any information contained therein, relate to, the assessee, the Assessing Officer shall be deemed to have information which suggests that the income chargeable to tax has escaped assessment in the case of the assessee for the three assessment years immediately preceding the assessment year relevant to the previous year in which the search is initiated or books of account, other documents or any assets are requisitioned or survey is conducted in the case of the assessee or money, bullion, jewellery or other valuable article or thing or books of account or documents are seized or requisitioned in case of any other person. Explanation 3.—For the purposes of this section, specified authority means the specified authority referred to in section 151.”

Conducting inquiry, providing opportunity before issue of notice under section 148-

“148A. The Assessing Officer shall, before issuing any notice under section 148,—

(a) conduct any enquiry, if required, with the prior approval of specified authority, with respect to the information which suggests that the income chargeable to tax has escaped assessment;

(b) provide an opportunity of being heard to the assessee, with the prior approval of specified authority, by serving upon him a notice to show cause within such time, as may be specified in the notice, being not less than seven days and but not exceeding thirty days from the date on which such notice is issued, or such time, as may be extended by him on the basis of an application in this behalf, as to why a notice under section 148 should not be issued on the basis of information which suggests that income chargeable to tax has escaped assessment in his case for the relevant assessment year and results of enquiry conducted, if any, as per clause (a);

(c) consider the reply of assessee furnished, if any, in response to the show cause notice referred to in clause (b);

(d) decide, on the basis of material available on record including reply of the assessee, whether or not it is a fit case to issue a notice under section 148, by passing an order, with the prior approval of specified authority, within one month from the end of the month in which the reply referred to in clause (c) is received by him, or where no such reply is furnished, within one month from the end of the month in which time or extended time allowed to furnish a reply as per clause (b) expires:

Provided that the provisions of this section shall not apply in a case where,—

(a) a search is initiated under section 132 or books of account, other documents or any assets are requisitioned under section 132A in the case of the assessee on or after the 1st day of April, 2021; or

(b) the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any money, bullion, jewellery or other valuable article or thing, seized in a search under section 132 or requisitioned under section 132A, in the case of any other person on or after the 1st day of April, 2021, belongs to the assessee; or

(c) the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any books of account or documents, seized in a search under section 132 or requisitioned under section 132A, in case of any other person on or after the 1st day of April, 2021, pertains or pertain to, or any information contained therein, relate to, the assessee.

Explanation.—For the purposes of this section, specified authority means the specified authority referred to in section 151.”

Time limit for notice-

“149. (1) No notice under section 148 shall be issued for the relevant assessment year,—

(a) if three years have elapsed from the end of the relevant assessment year, unless the case falls under clause (b);

(b) if three years, but not more than ten years, have elapsed from the end of the relevant assessment year unless the Assessing Officer has in his possession books of account or other documents or evidence which reveal that the income chargeable to tax, represented in the form of asset, which has escaped assessment amounts to or is likely to amount to fifty lakh rupees or more for that year:

Provided that no notice under section 148 shall be issued at any time in a case for the relevant assessment year beginning on or before 1st day of April, 2021, if such notice could not have been issued at that time on account of being beyond the time limit specified under the provisions of clause (b) of subsection (1) of this section, as they stood immediately before the commencement of the Finance Act, 2021:

Provided further that the provisions of this subsection shall not apply in a case, where a notice under section 153A, or section 153C read with section 153A, is required to be issued in relation to a search initiated under section 132 or books of account, other documents or any assets requisitioned under section 132A, on or before the 31st day of March, 2021:

Provided also that for the purposes of computing the period of limitation as per this section, the time or extended time allowed to the assessee, as per show cause notice issued under clause (b) of section 148Aor the period during which the proceeding under section 148A is stayed by an order or injunction of any court, shall be excluded:

Provided also that where immediately after the exclusion of the period referred to in the immediately preceding proviso, the period of limitation available to the Assessing Officer for passing an order under clause (d) of section 148A is less than seven days, such remaining period shall be extended to seven days and the period of limitation under this subsection shall be deemed to be extended accordingly.

Explanation.—For the purposes of clause (b) of this subsection, “asset” shall include immovable property, being land or building or both, shares and securities, loans and advances, deposits in bank account.

(2) The provisions of subsection (1) as to the issue of notice shall be subject to the provisions of section 151.’

Sanction for issue of notice-

“151. Specified authority for the purposes of section 148 and section 148A shall be—

(i) Principal Commissioner or Principal Director or Commissioner or Director, if three years or less than three years have elapsed from the end of the relevant assessment year;

(ii) Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General, if more than three years have elapsed from the end of the relevant assessment year.”

15. The Hon’ble Apex Court in the case of UOI v. Ashish Agarwal (SC), after deliberating at length on the aforesaid amended provisions had, inter alia, observed as under:

“5. We have heard Shri N. Venkataraman, learned ASG appearing on behalf of the Revenue and Shri C.A. Sundaram and Shri S. Ganesh, learned Senior Advocates and other learned counsel appearing on behalf of the respective assessee.

6. It cannot be disputed that by substitution of sections 147 to 151 of the Income Tax Act (IT Act) by the Finance Act, 2021, radical and reformative changes are made governing the procedure for reassessment proceedings. Amended sections 147 to 149 and section 151 of the IT Act prescribe the procedure governing initiation of reassessment proceedings. However, for several reasons, the same gave rise to numerous litigations and the reopening were challenged inter alia, on the grounds such as (1) no valid “reason to believe” (2) no tangible/reliable material /information in possession of the assessing officer leading to formation of belief that income has escaped assessment, (3) no enquiry being conducted by the assessing officer prior to the issuance of notice; and reopening is based on change of opinion of the assessing officer and (4) lastly the mandatory procedure laid down by this Court in the case of GKN Driveshafts (India) Ltd. v. Income Tax Officer and ors; (2003) 1 SCC 72, has not been followed.

6.1 Further pre Finance Act, 2021, the reopening was permissible for a maximum period up to six years and in some cases beyond even six years leading to uncertainty for a considerable time. Therefore, Parliament thought it fit to amend the Income Tax Act to simplify the tax administration, ease compliances and reduce litigation. Therefore, with a view to achieve the said object, by the Finance Act, 2021, sections 147 to 149 and section 151 have been substituted.

6.2 Under the substituted provisions of the IT Act vide Finance Act, 2021, no notice under section 148 of the IT Act can be issued without following the procedure prescribed under section 148A of the IT Act. Along with the notice under section 148 of the IT Act, the assessing officer (AO) is required to serve the order passed under section 148A of the IT Act. section 148A of the IT Act is a new provision which is in the nature of a condition precedent. Introduction of section 148A of the IT Act can thus be said to be a game changer with an aim to achieve the ultimate object of simplifying the tax administration, ease compliance and reduce litigation.

6.3 But prior to pre-Finance Act, 2021, while reopening an assessment, the procedure of giving the reasons for reopening and an opportunity to the assessee and the decision of the objectives were required to be followed as per the judgment of this Court in the case of GKN Driveshafts (India) Ltd. (supra).

6.4 However, by way of section 148A, the procedure has now been streamlined and simplified. It provides that before issuing any notice under section 148, the assessing officer shall (i) conduct any enquiry, if required, with the approval of specified authority, with respect to the information which suggests that the income chargeable to tax has escaped assessment; (ii) provide an opportunity of being heard to the assessee, with the prior approval of specified authority; (iii) consider the reply of the assessee furnished, if any, in response to the showcause notice referred to in clause (b); and (iv) decide, on the basis of material available on record including reply of the assessee, as to whether or not it is a fit case to issue a notice under section 148 of the IT Act and (v) the AO is required to pass a specific order within the time stipulated.

6.5 Therefore, all safeguards are provided before notice under section 148 of the IT Act is issued. At every stage, the prior approval of the specified authority is required, even for conducting the enquiry as per section 148A(a). Only in a case where, the assessing officer is of the opinion that before any notice is issued under section 148A(b) and an opportunity is to be given to the assessee, there is a requirement of conducting any enquiry, the assessing officer may do so and conduct any enquiry. Thus if the assessing officer is of the opinion that any enquiry is required, the assessing officer can do so, however, with the prior approval of the specified authority, with respect to the information which suggests that the income chargeable to tax has escaped assessment.

6.6 Substituted section 149 is the provision governing the time limit for issuance of notice under section 148 of the IT Act. The substituted section 149 of the IT Act has reduced the permissible time limit for issuance of such a notice to three years and only in exceptional cases ten years. It also provides further additional safeguards which were absent under the earlier regime pre Finance Act, 2021.

7. Thus, the new provisions substituted by the Finance Act, 2021 being remedial and benevolent in nature and substituted with a specific aim and object to protect the rights and interest of the assessee as well as and the same being in public interest, the respective High Courts have rightly held that the benefit of new provisions shall be made available even in respect of the proceedings relating to past assessment years, provided section 148 notice has been issued on or after 1st April, 2021. We are in complete agreement with the view taken by the various High Courts in holding so.

8. However, at the same time, the judgments of the several High Courts would result in no reassessment proceedings at all, even if the same are permissible under the Finance Act, 2021 and as per substituted sections 147 to 151 of the IT Act. The Revenue cannot be made remediless and the object and purpose of reassessment proceedings cannot be frustrated. It is true that due to a bonafide mistake and in view of subsequent extension of time vide various notifications, the Revenue issued the impugned notices under section 148 after the amendment was enforced w.e.f. 01.04.2021, under the unamended section 148. In our view the same ought not to have been issued under the unamended Act and ought to have been issued under the substituted provisions of sections 147 to 151 of the IT Act as per the Finance Act, 2021. There appears to be genuine nonapplication of the amendments as the officers of the Revenue may have been under a bonafide belief that the amendments may not yet have been enforced. Therefore, we are of the opinion that some leeway must be shown in that regard which the High Courts could have done so. Therefore, instead of quashing and setting aside the reassessment notices issued under the unamended provision of IT Act, the High Courts ought to have passed an order construing the notices issued under unamended Act/unamended provision of the IT Act as those deemed to have been issued under section 148A of the IT Act as per the new provision section 148A and the Revenue ought to have been permitted to proceed further with the reassessment proceedings as per the substituted provisions of sections 147 to 151 of the IT Act as per the Finance Act, 2021, subject to compliance of all the procedural requirements and the defences, which may be available to the assessee under the substituted provisions of sections 147 to 151 of the IT Act and which may be available under the Finance Act, 2021 and in law. Therefore, we propose to modify the judgments and orders passed by the respective High Courts as under:

(i) The respective impugned section 148 notices issued to the respective assessees shall be deemed to have been issued under section 148A of the IT Act as substituted by the Finance Act, 2021 and treated to be showcause notices in terms of section 148A(b). The respective assessing officers shall within thirty days from today provide to the assessees the information and material relied upon by the Revenue so that the assessees can reply to the notices within two weeks thereafter;

(ii) The requirement of conducting any enquiry with the prior approval of the specified authority under section 148A(a) be dispensed with as a onetime measure vis-a-vis those notices which have been issued under Section 148 of the unamended Act from 01.04.2021 till date, including those which have been quashed by the High Courts;

(iii) The assessing officers shall thereafter pass an order in terms of section 148A(d) after following the due procedure as required under section 148A(b) in respect of each of the concerned assessees;

(iv) All the defences which may be available to the assessee under section 149 and/or which may be available under the Finance Act, 2021 and in law and whatever rights are available to the Assessing Officer under the Finance Act, 2021 are kept open and/or shall continue to be available and;

(v) The present order shall substitute/modify respective judgments and orders passed by the respective High Courts quashing the similar notices issued under unamended section 148 of the IT Act irrespective of whether they have been assailed before this Court or not.

9. There is a broad consensus on the aforesaid aspects amongst the learned ASG appearing on behalf of the Revenue and the learned Senior Advocates/learned counsel appearing on behalf of the respective assessees.

We are also of the opinion that if the aforesaid order is passed, it will strike a balance between the rights of the Revenue as well as the respective assessees as because of a bonafide belief of the officers of the Revenue in issuing approximately 90000 such notices, the Revenue may not suffer as ultimately it is the public exchequer which would suffer.

Therefore, we have proposed to pass the present order with a view avoiding filing of further appeals before this Court and burden this Court with approximately 9000 appeals against the similar judgments and orders passed by the various High Courts, the particulars of some of which are referred to hereinabove. We have also proposed to pass the aforesaid order in exercise of our powers under Article 142 of the Constitution of India by holding that the present order shall govern, not only the impugned judgments and orders passed by the High Court of Judicature at Allahabad, but shall also be made applicable in respect of the similar judgments and orders passed by various High Courts across the country and therefore the present order shall be applicable to PAN INDIA.

10. In view of the above and for the reasons stated above, the present Appeals are ALLOWED IN PART. The impugned common judgments and orders passed by the High Court of Judicature at Allahabad in W.T. No. 524/2021 and other allied tax appeals/petitions, is/are hereby modified and substituted as under:

(i) The impugned section 148 notices issued to the respective assessees which were issued under unamended section 148 of the IT Act, which were the subject matter of writ petitions before the various respective High Courts shall be deemed to have been issued under section 148Aof the IT Act as substituted by the Finance Act, 2021 and construed or treated to be show cause notices in terms of section 148A(b). The assessing officer shall, within thirty days from today provide to the respective assessees information and material relied upon by the Revenue, so that the assessees can reply to the show cause notices within two weeks thereafter;

(ii) The requirement of conducting any enquiry, if required, with the prior approval of specified authority under section 148A(a) is hereby dispensed with as a onetime measure visa-vis those notices which have been issued under section 148 of the unamended Act from 01.04.2021 till date, including those which have been quashed by the High Courts. Even otherwise as observed hereinabove holding any enquiry with the prior approval of specified authority is not mandatory but it is for the concerned Assessing Officers to hold any enquiry, if required;

(iii) The assessing officers shall thereafter pass orders in terms of section 148A(d) in respect of each of the concerned assessees; Thereafter after following the procedure as required under section 148A may issue notice under section 148 (as substituted);

(iv) All defences which may be available to the assesses including those available under section 149 of the IT Act and all rights and contentions which may be available to the concerned assessees and Revenue under the Finance Act, 2021 and in law shall continue to be available.

11. The present order shall be applicable PAN INDIA and all judgments and orders passed by different High Courts on the issue and under which similar notices which were issued after 01.04.2021 issued under section 148 of the Act are set aside and shall be governed by the present order and shall stand modified to the aforesaid extent. The present order is passed in exercise of powers under Article 142 of the Constitution of India so as to avoid any further appeals by the Revenue on the very issue by challenging similar judgments and orders, with a view not to burden this Court with approximately 9000 appeals. We also observe that present order shall also govern the pending writ petitions, pending before various High Courts in which similar notices under Section 148 of the Act issued after 01.04.2021 are under challenge.

12. The impugned common judgments and orders passed by the High Court of Allahabad and the similar judgments and orders passed by various High Courts, more particularly, the respective judgments and orders passed by the various High Courts particulars of which are mentioned hereinabove, shall stand modified/substituted to the aforesaid extent only.

All these appeals are accordingly partly allowed to the aforesaid extent.

In the facts of the case, there shall be no order as to costs.”

(emphasis supplied by us)

16. Apart from that, we find that the CBDT vide Instruction No.01/2022 while directing implementation of the judgment of the Hon’ble Supreme Court in the case of Ashish Agrawal (supra), while laying down the procedure that is required to be followed by the jurisdictional Assessing Officers/Assessing Officer had, inter alia, held that if it is a fit case to issue notice u/s. 148 of the Act, the Assessing Officer shall serve on the assessee a notice u/s 148 after obtaining approval of the specified authority u/s. 151 of the new law.

17. Apropos, the Learned CIT-DR’s contention that for the purpose of computing the period of three years from the end of the relevant Assessment Year as provided in section 151 of the Act, the period allowed to the assessee, as per show cause notice issued under clause (b) of section 148A of the Act, shall be excluded, we are unable to concur with the same. We say so, for the reason that as the “proviso” to section 151 of the Act (as was then available on the statute) inter alia, contemplating the exclusion of the time period allowed to the assessee, as per show cause notice issued under clause (b) of section 148A, as mentioned in the “fifth proviso” to section 149 of the Act, had been made available on the statute vide Finance Act, 2023, w.e.f. 01/04/2023, therefore, the same cannot be applied to the subject case before us.

18. At this stage, we may herein observe that our aforesaid view that in a case where a period of more than three years have elapsed from the end of the relevant assessment year, then, approval for issuing the notice under section 148 of the Act has to be taken from the Principal Chief Commissioner or Principal Director General or Chief Commissioner or Director General for issuing the notice under section 148 of the Act is supported by the recent judgment of the Hon’ble High Court of Telangana in Deloitte Consulting India (P.) Ltd. (supra). For the sake of clarity, we deem it apposite to cull out the observations of the Hon’ble High Court in the case of Deloitte Consulting India (P.) Ltd. (supra), as under:

“48. The proviso to Section 151 has been introduced by the Finance Act, 2023 with effect from 01.04.2023. The relevant Section 151 with its proviso is applicable to the case of the petitioner is quoted hereunder:

151. Sanction for issue of notice:- Specified authority for the purposes of Section 148 and Section 148A shall be,-

(i) Principal Commissioner or Principal Director or Commissioner or Director, if three years or less than three years have elapsed from the end of the relevant assessment year;

(ii) Principal Chief Commissioner or Principal Director General or Chief Commissioner or Director General, if more than three years have elapsed from the end of the relevant assessment year:

Provided that the period of three years for the purposes of clause (i) shall be computed after taking into account the period of limitation as excluded by the third or fourth or fifth provisos or extended by the sixth proviso to sub-section (1) of Section 149.

49. In the present case, the order under Section 148A(d) and notice under Section 148 have been issued on 07.04.2022 relatable to the relevant Assessment Year 2018- 19 i.e., after more than three years from the end of the relevant assessment year. The approval before passing the order under Section 148A(d) of the Act and before issuing of notice under Section 148 of the Act has been taken from the Principal Commissioner of Income Tax by the respondent No.1, which is permissible only if three years or less than three years have lapsed from the end of the relevant assessment year. In the present case, the relevant three years lapsed on 31.03.2022. Therefore, the prior approval of the Principal Chief Commissioner or Principal Director General or the Chief Commissioner or the Director General was required to be obtained before passing of the order under Section 148A(d) or before issuance of the notice under Section 148 of the Act.

50. Learned counsel for the respondent has relied upon the proviso to Section 151 of the Act inserted by the Finance Act, 2023 with effect from 01.04.2023 quoted above to contend that the period of seven days furnished to the assessee to submit reply to the notice under Section 148A(b) issued on 23.03.2022 has to be excluded for counting the period of three years. It is submitted that the proviso is clarificatory in nature and as such, it would operate from the date when the amended Section 151 was brought into force i.e., 01.04.2021.

However, such a contention is fit to be rejected since the proviso to Section 151 has been inserted by the Finance Act, 2023 only with effect from 01.04.2023. It, therefore, cannot be applied retrospectively to exclude the period of seven days in furnishing the reply to the notice under Section 148A(b) of the Act by the assessee.

The Assessing Officer could not have assumed exclusion of such a period while passing the order under Section 148A(d) of the Act or issuing notice under Section 148 of the Act on 07.04.2022 that such a proviso excluding the period consumed in furnishing the reply is going to be brought into the statute book by amendment by the Finance Act, 2023 with effect from 01.04.2023. In taxing statutes, intendment cannot be assumed unless specifically expressed in the provision enacted by the legislature. Therefore, the reopening of assessment without sanction/approval of the specified authority in accordance with Section 151 of the Act was bad in law. Consequently, reassessment order dated 16.01.2024 also is bad in law.”

(emphasis supplied by us)

19. We find that the Hon’ble High Court in its aforesaid order had not only observed that in the case of the assessee before them i.e. , for AY 2018-19 the specified authority for granting approval under section 151 of the Act was the Principal Chief Commissioner or Principal Director General or Chief Commissioner or Director General as a period of more than three years had lapsed from the end of the relevant Assessment Year, but had also rejected the claim of the revenue that the “proviso” to section 151 of the Act as had been made available on the statute vide the Finance Act, 2023 w.e.f. 01/04/2023 was to be given a retrospective effect.

20. We, thus, in terms of our aforesaid observation, concur with the Ld. AR that in the present case before us for A.Y. 2018-19, wherein notice under Section 148 of the Act was issued on 01.04.2022, i.e., beyond a period of three years from the end of the assessment year, the A.O. was statutorily obligated to have obtained the approval from either of the authorities specified u/s. 151(ii) of the Act (as was then available on the statute), viz. Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General. However, as the A.O. had obtained the approval from the Pr. Commissioner of Income Tax, i.e. an authority who was not vested with any jurisdiction as per the mandate of Section 151 of the Act (as made available on the statute w.e.f 01.04.2021), therefore, the assessment so framed by him u/s.147 r.w.s 144 r.w.s 144B of the Act, dated 02.02.2024, being devoid and bereft of any valid assumption of jurisdiction, is liable to be quashed. Accordingly, we quash the assessment framed by the A.O. under Section 147 r.w.s. 144 r.w.s 144B of the Act, dated 02.02.2024, in terms of our aforesaid observations. The Grounds of Appeal No(s). 3.1 & 3.2 are dismissed in terms of our aforesaid observations.

21. As we have quashed the assessment for want of valid assumption of jurisdiction by the AO de hors obtaining of a valid approval from the specified authority as was required per the mandate of section 151(ii) of the Act (as was available on the statute at the relevant point of time), therefore, we refrain from adverting to the other contentions based on which the assumption of jurisdiction as well as the sustainability of the additions made by the AO have been assailed by the assessee before us, which, thus, are left open.

22. In the result, the Cross Objection No.2 filed by the assessee which is supportive of the order of the CIT(A) is allowed in terms of our aforesaid observations, while for the remaining grounds of Cross Objection and the grounds of appeal raised by the revenue having been rendered as academic in nature, being left open.