ORDER

Amit Shukla, Judicial Member. – This appeal by the assessee arises from the order dated 15 July 2024 passed by the National Faceless Appeal Centre, Delhi, pertaining to the assessment framed under section 147 read with section 144 of the Income-tax Act, 1961 for Assessment Year 2015-16. The limited controversy before us concerns the addition of Rs.13,00,500 under section 69A representing cash deposits in the ICICI Bank account, which according to the assessee stood sourced entirely from the sale proceeds of an immovable property.

2. The relevant facts, briefly stated, indicate that information reflected in the AIMS module of ITBA suggested that the assessee had sold an immovable property during the year for a consideration of Rs.94,06,000 and had deposited cash of Rs.13,00,500 in her ICICI Bank account. Since no return of income had been filed under section 139, the Assessing Officer proceeded to reopen the assessment by issuing a notice under section 148 on 28 April 2022 after following the procedure prescribed under section 148A.

3. In response, the assessee filed her return of income on 17 May 2022 declaring a total income of Rs.6,95,000. The return, however, came to be flagged by the system as invalid. Proceeding on this technical ground alone, the Assessing Officer declined to recognise the return furnished under section 148 and treated the assessee as one who had not filed any return. Nevertheless, in the course of assessment proceedings, the assessee placed before the Assessing Officer the computation of income, copy of the purchase deed, registered sale deed, bank statement of ICICI Bank, and detailed replies dated 25 April 2023 and 19 May 2023. These replies, which contained a complete narration of the transaction including receipt of consideration through cheque and cash, were duly reproduced in the assessment order.

4. The Assessing Officer refused to consider these documents and proceeded to treat the entire amount of Rs.94,06,000 as unexplained income only because he regarded the return filed under section 148 as invalid. Before the Commissioner Appeals, the assessee succeeded in obtaining partial relief on the capital gains computation. The Commissioner Appeals duly noted the sale value of Rs.87,29,002, the purchase price of Rs.31,10,000, stamp duty of Rs.3,35,600, registration charges of Rs.30,000, cost of improvement aggregating Rs.12,00,000, and brokerage on sale of Rs.1,50,000. These aspects are not in dispute before us.

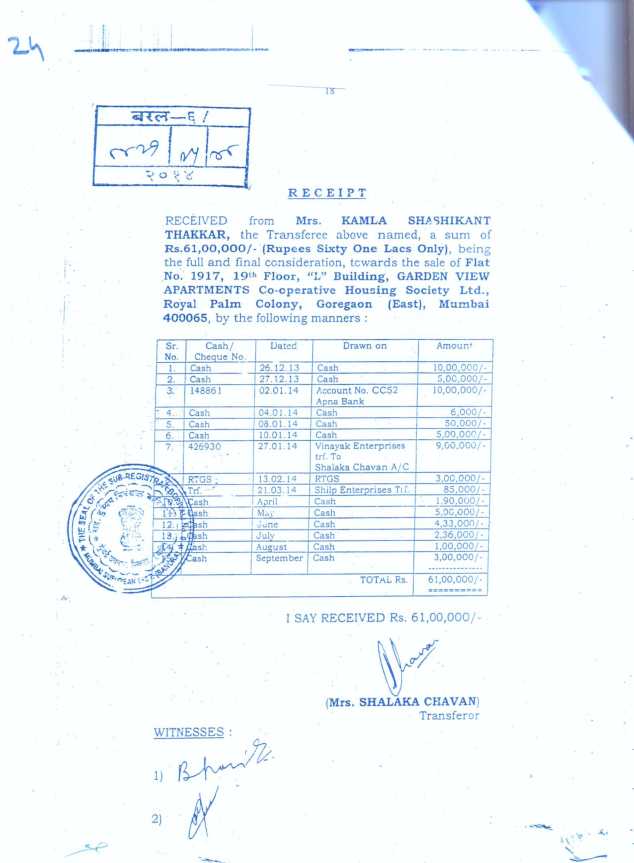

5. What survives for adjudication is the addition of Rs.13,00,500 treated as unexplained under section 69A. The assessee explained in unequivocal terms that out of the total consideration of Rs.61,00,000 received during the year from the purchaser, an amount of Rs.38,15,000 was received in cash and this very cash was deposited into the ICICI Bank account. The sale deed itself contains a clear recital acknowledging these cash receipts. The receipt annexed to the sale deed also sets out the precise amounts paid by the purchaser.

6. The Assessing Officer rejected this explanation solely on the ground that the return filed in response to section 148 was invalid and therefore he was not obliged to examine the source of the deposits. The Commissioner Appeals, instead of appreciating the factual foundation, merely extracted certain statutory provisions and judicial paragraphs without engaging with the core evidentiary substance. Neither authority has doubted the authenticity of the sale deed, the annexed receipt, nor the bank entries matching the cash receipts.

7. We have heard the rival submissions and perused the record. The learned counsel invited our attention to the receipt forming part of the annexure to the registered sale deed, placed at page 24 of the paper book, which records that the assessee received Rs.61,00,000 from the purchaser during the year, out of which Rs.38,15,000 was received in cash. This receipt corresponds exactly with the cash deposits made into the ICICI Bank account. The correctness of these documents has neither been challenged nor disproved by the revenue.

8. For ready reference, the scanned copy of the said receipt as forming part of the registered sale deed is reproduced herein below:-

9. Once the registered sale deed itself confirms the receipt of cash and the bank statement contemporaneously reflects the deposit of the same cash, there remains no basis in law or on fact to treat the sum of Rs.13,00,500 as unexplained. The statutory mandate under section 69A requires that where the explanation furnished by the assessee is supported by credible evidence and is not shown to be false, no addition is warranted. The explanation in the present case is not only consistent but stands fortified by primary documents which the revenue has not sought to impeach.

10. The non acceptance of the assessee’s return on account of a system generated technicality cannot eclipse the fundamental obligation of the Assessing Officer to examine the source of funds when tangible evidence is placed before him. Information obtained through automated modules such as AIMS may trigger enquiry but cannot override or supplant primary documentary evidence emanating from the registered instrument of transfer itself. The authorities below have thus erred in proceeding on peripheral considerations rather than adjudicating the factual merits.

11. In these circumstances, the addition of Rs.13,00,500 under section 69A is wholly unsustainable. There is no material on record to suggest that the assessee possessed any source of income other than the sale consideration in question. The factual matrix overwhelmingly supports the assessee’s explanation and therefore the impugned addition is directed to be deleted.

12. In the result, the appeal of the assessee stands allowed.