ORDER

Ravish Sood, Judicial Member.- The captioned appeals filed by the assessee company are directed against the respective orders passed by the Assessing Officer (for short “A.O.”) u/s 143(3) r.w.s. 144C(13) r.w.s. 144B of the Income Tax Act, 1961 (for short “the Act”) dated 24.02.2020 and 20.01.2022 for A.Ys. 2018-19 and 2021-22, respectively. As common issues are involved in the present appeals, therefore, the same are being taken up and disposed off vide a consolidated order.

2. We shall first take up the appeal filed by the assessee company for A.Y. 2018-19 in ITA No.466/Hyd/2022, and the order therein passed shall apply mutatis mutandis for disposing off the other appeal i.e. ITA No.1301/Hyd/2024 for A.Y. 2021-22. The assessee company has assailed the impugned order on the following grounds of appeal before us:

“1. On the facts and in the circumstances of the case and in law, the final assessment order passed by Ld. Assessing officer (‘Ld. AO’) pursuant to directions of the Dispute Resolution Panel (‘Ld. Panel) under Section 143(3) read with Sections 144C(13) of the Act to the extent prejudicial to the Appellant, is bad in law and is liable to be quashed.

2. On the facts and in the circumstances of the case and in law, the Ld. Panel erred in upholding the action of the Ld. Transfer Pricing Officer (‘Ld. TPO’)/Ld. AO in proposing an adjustment of INR 19,43,26,338 to the specified domestic transactions (‘SDTs’) pertaining to inter-unit transfer of milk.

3. On the facts and circumstances of the case, and in law, the Ld. AO / Ld. TPO / Ld. Panel erred in rejecting the economic analysis carried out in TP documentation which was maintained in good faith and with due diligence.

4. On the facts and circumstances of the case, and in law, the Ld. TPO/Ld. AO/Ld. Panel erred in disregarding the fact that the Appellant has determined the overhead rate/inter-unit transfer rate on the basis of weighted average overhead rate paid to the third parties by the processing units.

5. On the facts and circumstances of the case, and in law, the Ld. TPO /Ld. AO/Ld. Panel erred in disregarding the fact that determining the ALP at cost contradicts to the legislative intent of registering the eligible units under Section 801B of the Act, which is profit linked incentive benefit.

6. On the facts and circumstances of the case, and in law, the Ld. TPO/Ld. AO/Ld. Panel erred in contending that the Appellant has shifted profits to eligible units / created artificial profits in eligible units.

7. On the facts and circumstances of the case, and in law, the LA. TPO/Ld. AO/Ld. Panel erred in disregarding the fact that Form 10CCBs issued by an independent Chartered Accountant acts an a complete set of audited financial statements as prescribed under Section Bo-1B(A) read with Section 80-IB(13), Section 80-IA(7) of the Act and Rule 18BB (1) of the Rules.

8. On the facts and circumstances of the case, and in law, the Ld. TPO erred in not following a consistent approach for SDT’s on a year-on-year basis.

9. On the facts and circumstances of the case and in law, the Ld. AO/Ld. Panel erred in appreciating that deduction under section 80JJAA of the Act is to be claimed over a period of 3 years @ 30% for each year and the 80JJAA deduction claimed during the year comprises of 30% of the eligible claim for AY 2018-19 (being the 1st year of claim) and 30% of the eligible claim pertaining to AY 2017-18 (being the second year of such claim) and thereby erred in not granting the deduction under section 80JJAA amounting to INR 35,67,060 as per the Form 10DA filed by the Appellant for Assessment Year (‘A.Y’) 2017-18 in accordance with provisions of section 80JJAA of the Act.

10. On the facts and circumstances of the case and in law, the Ld. AO/Ld. Panel erred in disallowing expenditure of INR 66,96,000 under Section 144 of the Act without considering and verifying the fact that entire borrowed funds were utilized for purchase of plant and machinery and not for the purpose of investment capable of generating the exempt income.

11 Without prejudice to the above Ground No 10, on the facts and circumstances of the case and in law, the Ld. AO/Ld. Panel erred in not restricting the disallowance of the expenditure under section 14A of the Act to the proportionate salary cost incurred for the Key Managerial Personnel (‘KMP’) being administrative expenses amounting to INR 12,16,740.

12. Without prejudice to the above Ground No. 10 and 11, on the facts and circumstances of the case and in law, the Ld. AO/Ld. Panel erred in not restricting the disallowance under section 14A of the Act to the extent of exempt income earned by the Appellant amounting to INR 39.04.165.

13. On the facts and in the circumstances of the case and in law, the Ld. AO/Ld. Panel erred in disallowing interest expenditure of INR 208,333 under section 37 of the Act disregarding the fact that the differential interest amount (market value of interest income v. interest charged from employee) was already taxed as perquisite in the hands of the Managing Director.

14. On the facts and in the circumstances of the case and in law, the LA. AO/LA. Panel erred in initiating the penalty proceedings under section 270A of the Act by alleging that there is under reporting of income by the Appellant.”

3. Apart from that the assessee company has filed before us letters dated 14.07.2023, 21.09.2023 and 22.04.2025, wherein it has raised additional grounds of appeal, which reads as under:

Filed on 14.07.2023:

“1. On the facts and circumstances of the case and in law, the Ld. DRP has erred in issuing DRP directions without a valid Documentation Identification Number (“DIN”) and in contravention of the CBDT Circular No. 19/2019 dated August 14, 2019.

2. On the facts and circumstances of the case and in law, the final assessment order dated July 15, 2022 under section 143(3) read with section 144C(13) read with section 1448 of the Act passed by the Ld. AO, pursuant to the invalid and non-est directions passed by the Ld. DRP under section 144C(5) of the Act, is illegal, thus, making the final assessment order bad in law, null and void and thus, liable to be quashed.

Filed on 21/09/2023:

1. On the facts and in the circumstances of the case and in law, the final assessment order dated July 15, 2022, passed by the Ld. Assessing Officer under Section 143(3) read with Sections 144C(13) and 144B of the Act, having been passed beyond the time limitation prescribed under Section 153(1) read with Section 153(4) of the Act, is barred by limitation and, therefore, is void ab initio, bad in law, and liable to be quashed.

Filed on 22/04/2025 :

1 Without prejudice, the lower authorities erred in proposing a TP adjustment of INR 19,43,26,338, without appreciating that the TP adjustment with respect to the deduction claimed under section 801B(11A) of the Act to the extent of INR 2,05,64,816 pertains to the transfer of processed milk/milk products from processing units to the end customers wherein the Appellant has earned actual profits on such sale to end customers.”

4. Succinctly stated, the assessee company is engaged in the business of procuring, processing and selling milk and milk products across 11 states in India. The assessee company has 11 processing plants, 61 chilling centers and a wide distribution network across India. The asseessee company offers its products and services through 27 sales offices. The assessee company had e-filed its return of income for A.Y. 2018-19 on 29.11.2018, declaring an income of Rs. 35,30,28,430/-. Subsequently, the case of the assessee company was selected for complete scrutiny (CASS) under Section 143(2) of the Act.

5. During the course of the assessment proceedings, the A.O. made a reference u/s 92CA of the Act to the DCIT, T.P.-1, Hyderabad, for determination of the “Arm’s Length Price” (for short, “ALP”) of the specified domestic transactions reported by the assessee company for the subject year.

6. The Transfer Pricing Officer (for short “TPO”), vide his order passed under Section 92CA(3) of the Act, dated 31.07.2021 determined the ALP of the gain obtained on account of excess charging of overhead expenses by the Chilling Units of the assessee company by following “Other Method” at Rs. Nil. Accordingly, the TPO suggested an adjustment u/s 92CA(3) of the Act of Rs.19,43,26,338/- being the deduction claimed by the assessee company u/s 80IB on account of the excess charging of overhead costs by the chilling units.

7. Thereafter, the A.O. vide his draft assessment order passed under Section 143(3) r.w.s 144C of the Act, dated 16.09.2021, inter alia, gave effect to the directions of the TPO. u/s 92CA(3) of the Act and declined its claim for deduction u/s 80IB of the Act of Rs.19.43 crores (approx.). Apart from that, the A.O. proposed certain other additions/disallowances, viz. (i) disallowance u/s 14A of the Act: Rs.66,96,066/-; (ii). part disallowance of the assessee’s claim for deduction u/s 80JJAA: Rs.48,32,390/-; and (iii). disallowance of the interest expenditure on the amount advanced by the assessee company at a discounted rate of interest to its director: Rs.2,50,000/

8. The assessee objected to the proposed adjustments before the Dispute Resolution Panel-1, Bangalore (for short, “DRP”). However, the DRP found no infirmity in the view taken by the A.O./TPO, and upheld the declining of the assessee’s claim for deduction u/s 80IB(11A) r.w. Rule 18BBB(2) of the Income Tax Rules, 1962. Also, the declining of the assessee’s claim for deduction u/s 80JJAA of the Act was upheld by the DRP. Further, the DRP concurred with the disallowance worked out by the A.O. u/s 14A r.w. Rule 8D, and sustained the same. At the same time, the DRP though principally concurred with the disallowance of the assessee’s claim for deduction of the interest corresponding to the loan of Rs.1.25 crore that was advanced by the assessee company at a discounted rate of interest to its managing director, but taking cognizance of the fact that the said loan was repaid by the managing director in the month of January, 2018, directed the A.O. to restrict the disallowance upto the date of re-payment.

9. Thereafter, the A.O. framed the assessment vide his order passed u/s 143(3) r.w.s. 144C(13) r.w.s. 144B of the Act, dated 15.07.2022, wherein he had after making the aforementioned additions/disallowances, determined the income of the assessee company at Rs.56,38,41,020/-, viz. (i) adjustment u/s 92CA(3) of the Act as suggested by the TPO: Rs.19,43,26,338/-; (ii). declining of the assessee’s claim for deduction u/s 80JJAA of the Act: Rs.48,32,390/-; (iii). disallowance u/s 14A r.w. Rule 8D: Rs.66,96,066/-; and (iv). disallowance of the claim of the assessee company for deduction of interest expenditure on the amount that was advanced at a discounted rate of interest to its managing director: Rs.2,08,333/-.

10. The assessee company being aggrieved with the order passed by the A.O. u/s 143(3) r.w.s. 144C(13) r.w.s. 144B of the Act, dated 15.07.2022 has carried the matter in appeal before us.

11. We have heard the learned Authorized Representatives of both parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that were pressed into service by them to drive home their respective contentions.

12. Shri Aashik Shah, C.A. the learned Authorized Representative (for short, “ld. AR”) for the assessee company, at the threshold of hearing of the appeal, submitted that as per instructions he seeks not to press some of the additional grounds, viz. (i). the additional grounds nos. 1 and 2 raised vide application dated 14.07.2023; and (ii). the additional ground of appeal no. 1 raised vide application dated 21.09.2023. Considering the aforesaid concession of the Ld. AR, the aforeentioned additional grounds of appeal raised by the appellant company vide its applications dated 14.07.2023 and 21.09.2023 are dismissed as not pressed.

13. Controversy involved in the present appeal lies in a narrow compass, i.e., whether or not the A.O/T.P.O. are right in law and facts of the case in rejecting the assessee’s claim for deduction of the profit derived from its chilling units on inter-unit transfer of milk u/s 80IB(11A) of the Act. Apart from that, the declining of the assessee’s claim for deduction u/s 80JJAA; disallowance u/s 14A r.w. Rule 8D; and disallowance of the interest corresponding to the amount advanced to the Managing Director are the other issues for which our indulgence has been sought for by the assessee/appellant.

14. As observed hereinabove, the assessee company is engaged in the processing/production and sale of milk and milk products in India, Singapore, Uganda and Kenya. The assessee company has in-house chilling and processing units to process the raw milk for manufacturing of milk and various milk products i.e. full cream, standardized, toned and double toned milk, ghee, curd, butter, paneer, flavored milk, butter milk, ice-creams, skimmed milk powder etc.

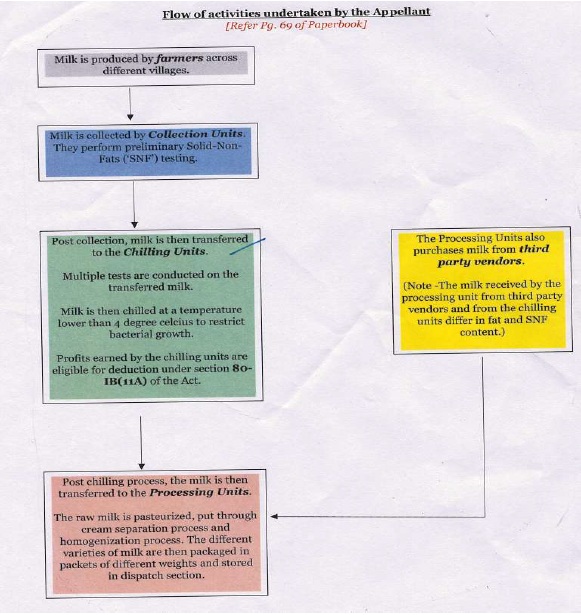

15. Before proceeding any further, we deem it fit to cull out the business model of the assessee company based on a “Chart” as had been placed on our record by the assessee/appellant, as under:

16. During the subject year, the assessee company had transferred chilled milk from its eligible units i.e. “Chilling Units” to the processing units and charged inter-unit transfer price on the same. On a perusal of the record, it transpires that the pricing mechanism adopted by the “Chilling units” for the transfer of chilled milk to the processing units is based on the aggregation of the following costs:

| “a. | | Cost of raw milk: The cost of raw milk is at actuals. |

| b. | | Indirect cost of production: The assessee company incurs cost in respect of stores, administrative & other expenses, salaries of the employees, transportation cost of the eligible unit. The cost per litre of the indirect cost is determined based on the quantity of milk chilled/processed. |

| c. | | Market price of overhead costs: The assessee company also procures chilled milk from third party vendors and pays for (a) raw milk price; and (b) overheads at a negotiated fixed rate per litre. There are multiple vendors with which this price is negotiated. The Appellant has computed the weighted average overhead cost paid to the multiple vendors and compared it with the indirect cost incurred by its chilling units (ie., eligible units). |

| d. | | Any difference between the weighted average cost and eligible unit cost, relating to overheads, is considered as gain/loss, and is accordingly treated under Section 80IB of the Act.” |

17. The issue involved in the present appeal hinges around the solitary aspect, i.e., the difference between the weighted average overhead cost (of the third party vendors) and the actual overhead costs (of the “chilling units” i.e. the eligible units of the assessee company), being included by the chilling units in the sale price of the milk transferred to its processing units and thus, considered as gain/loss by the said chilling units on which deduction is claimed u/s 80IB of the Act.

18. The A.O during the course of the draft assessment proceedings had made a reference u/s 92CA(3) of the Act to the TPO for the determination of the ALP of the Specified Domestic Transactions (SDT) of the asseseee company, viz. “transfer of chilled milk” by its “Chilling Units” to the “Processing Units”.

19. The TPO observed that as per the business model of the assessee company, as stated in the TP documentation i.e TP Study Report (TPSR), the collection units of the assessee company would collect milk from the farmers. Thereafter, the “Chilling Units” would procure raw milk from the collection units and would subject the same to filtration, testing for adulteration, antibiotic residue, acidity, and fat content in the chilling units. It was further observed by him that the milk is chilled at a temperature of about 4 degrees celsius to restrict bacterial growth. Post chilling process, the milk is stored in insulated storage tank and then sent to processing plants through insulated vans. The TPO observed that the processing plants after receiving the chilled milk from the chilling units would carry out sample testing to check whether there are any deviations from the tests done in the chilling units. Thereafter, the milk is subjected to pasteurization process during which it is separated into cream and skimmed milk. After that, the milk is segregated into standardized milk, toned milk, double toned milk and full cream milk. Finally, the different variety of milk are then packaged in packets of different weights and stored in the dispatch sections.

20. The TPO observed, that the chilling units of the assessee company had claimed deduction u/s 80IB(11A) of the Act. It was observed by him that the assessee company had in its TP study report, reported the transfer of chilled milk amounting to Rs. 844.40 crores by its chilling units to the processing units as Specified Domestic Transactions (SDT’s). The TPO after referring to the pricing mechanism that was adopted by the chilling units for transferring chilled milk to the processing units, i.e., inter-unit transfers, observed that the same was reported by the assessee company to be at “arms length” by following the “Other method”.

21. The TPO analyzed the inter-unit transfer by the assessee company of chilled milk by its 48 chilling units to the processing units as reported in “Form 3CEB”. The TPO referring to Section 80IB(11A) of the Act r.w Rule 18BBB(2) of the I.T Rules, 1962, observed that the assessee company was obligated to have furnished an audit report of the accounts of each eligible unit that was claiming deduction u/s 80IB(11A) of the Act in “Form 10CCB”, along with the profit & loss account and balance sheet of each such eligible unit as if it was a distinct entity. However, it was observed by him that the assessee company had not furnished the audited financial statements, i.e., Profit & loss account, Balance sheets of the 48 eligible units reported in “Form 3CEB”. The TPO observed, that the assessee company had furnished a consolidated statement said to be the profit & loss accounts of the eligible units.

22. The TPO, referring to the pricing mechanism that was adopted by the chilling units for transferring the chilled milk to the processing units, observed that after claiming certain expenses towards converting the raw milk into chilled milk, i.e., overhead costs incurred by the chilling unit, the assessee company had further added certain artificial cost, i.e., the difference between the overhead costs actually incurred by the chilling units towards converting the raw milk into chilled milk vis-a-vis the weighted average cost of overheads that was charged by the third party chilling units from whom the processing units of the assessee company had during the subject year procured chilled milk. It was, thus, observed by the TPO that the assessee company had computed the profit & loss in respect of each chilling unit based on the difference between the average overhead cost billed by third party chilling units and the actual overhead cost incurred by the chilling units. The TPO, based on the aforesaid pricing mechanism adopted by the chilling units for transferring the chilled milk to the processing units, observed that the profit on account of transfer of chilled milk from the chilling units to the processing units was based on the average overhead cost paid by the processing units to the third party vendors of chilled milk.

23. Thereafter, the TPO had referred to the inter-play between Section 92 and Sections 80IA/IB of the Act. It was observed by him that, as per the provisions of Section 92CA of the Act, any allowance for an expenditure or interest or allocation of any cost in relation to a specified domestic transaction shall be computed having regard to the arm’s length price. It was further observed by him, that as per the provisions of Section 80IA(8) of the Act, which was also applicable to the deduction allowable under Section 80IB, where any goods held for the purpose of eligible business are transferred to any other business carried on by the assessee company and the consideration for such transfer as recorded in the accounts of the eligible business does not correspond to the market value of such goods as on the date of transfer, then for the purposes of deduction u/ss. 80IB or 80IA of the Act, the profits and gains of the eligible business shall be computed as if the transfer has been made at the market value of such goods.

24. The TPO, referring to the facts of the present case, observed that the actual overhead cost per liter incurred by the chilling units was less than the market value of overhead cost i.e., the weighted average overhead cost of Rs. 3.53 per liter that was incurred by the processing units with respect to third party vendors. The TPO observed, that if the chilling units would have transferred the chilled milk to the processing units by charging the actual overhead cost (per liter) incurred by them, then the transactions would not have required any benchmarking, as the price at which the goods would have been transferred would have been less than the market value. The TPO, was of the view that since the assessee company had artificially increased the price of overhead cost incurred by the chilling units to the level of the market price, i.e., the price charged by the third party vendors, thus, such artificially increased price is to be benchmarked having regard to the provisions of section 92 and Section 80IB r.w.s 80IA(8) of the Act.

25. Thereafter, the TPO vide his “SCN”, dated 30.07.2021, inter alia, observed that the chilling units, i.e., the eligible units were not making any actual profit if the chilled milk was transferred by them to the processing plants at rates comprising of actual cost of milk and actual overhead cost incurred by the respective units. Elaborating further on his conviction, the TPO observed that the assessee company by artificially increasing the actual overhead cost per liter to the weighted average overhead cost of Rs. 3.53 (per liter) which was charged by the third party vendors, had artificially increased the profits of the chilling units. Rather, the TPO was of the view that the overhead cost actually incurred by the chilling units should have been charged to the processing units for supplying chilled milk to them. Accordingly, the TPO was of the view that the artificial profits were created in the books of the chilling units (eligible units) by overcharging the overhead cost per liter from the processing units, which, thus, had increased the profits of the eligible units and decreased the profits of the non-eligible units. The TPO, held a firm conviction that the taxable profits/income was being shifted from the non-eligible units, i.e., the processing units to the eligible units, i.e., chilling units by inflating the actual overhead cost incurred by the eligible units under the guise of adhering to the Arm’s Length Price principles. The TPO, observed that though Section 92CA(2) contemplated that any allowance for an expenditure or allocation of any cost or expense in relation to a specified domestic transaction shall be computed having regard to the ALP, but, the same does not mean that in a case where the actual expenditure or cost incurred by an assessee in relation to a specified domestic transaction was less than the market price, the assessee is entitled to enhance the expenditure or cost incurred by him/it to the levels of the market price and book artificial exempt income. Accordingly, the TPO based on his aforesaid observations called upon the assessee company to explain that why the per liter overhead cost of Rs. 3.53 (supra) (i.e. the weighted average overhead cost charged by the third party vendors of chilled milk on the processing units of the assessee company) that was adopted by the chilling units of the assessee company may not be restricted to the actual overhead cost per liter incurred by the said chilling units as otherwise, it would amount to allowing the chilling units to claim deduction u/s 80IB on unearned income with a consequential effect of reduction in the taxable income of the eligible units.

26. As the reply filed by the assessee company to the SCN, dated 30.07.2021 did not find favour with the TPO, therefore, he rejected the same, for reasons culled out as under:

| (i). | | that the assessee company had not furnished the information mentioned in Rule 10D(1), i.e., by not furnishing the complete set of audited financial statements and copies of “Form 10CCB” of all the eligible units. Also, the TPO, observed that the audited financial statements of the chilling units, i.e., the eligible units were never produced before him, but, only a consolidated statement containing the profit & loss accounts of the said eligible units was produced before him; |

| (ii). | | that though Section 92CA(2) contemplated that any allowance for an expenditure or allocation of any cost or expense in relation to a specified domestic transaction shall be computed having regard to the ALP, but, the same did not mean that in a case where the actual expenditure or cost incurred by an assessee in relation to a specified domestic transaction was less than the market price, the assessee is entitled to enhance the expenditure or cost incurred by him/it to the levels of the market price and book artificial exempt income; |

| (iii). | | that the assessee company by taking recourse to the weighted average overhead cost charged by the third party vendors supplying chilled milk to its processing unit had created artificial/notional profits in the hands of its chilling units; |

| (iv). | | that as the actual overhead cost per liter incurred by the chilling units was less than the market value of overhead cost, i.e., the weighted average overhead cost of Rs. 3.53/- per liter that was charged by the third party vendors of chilled milk on the processing units of the assessee company, therefore, the chilling units by adopting Rs. 3.53/- per liter (supra) as a benchmark for its overhead costs had created artificial/unearned profits. It was further observed, that if the chilling units would had transferred the chilled milk to the processing units by charging the actual overhead cost (per liter) incurred by them, then they would not have earned any profits. Also, the TPO observed that as the chilling units were not performing much functions which would have resulted to any value addition to the raw milk chilled in its units, therefore, there was sufficient justification for it to have transferred the chilled milk to the processing units at cost; |

| (v). | | the TPO further rebutted the claim of the assessee company and observed that he had not disallowed its profits but only determined the ALP of the gain obtained on account of excess charging of overhead costs by the chilling units at the stage of transfer of the chilled milk to the processing units. |

27. Accordingly, the TPO, vide his order passed u/s 92CA(3) of the Act, determined the arms length price (ALP) of the gain obtained on account of excess charging of overhead costs by the chilling units of the assessee company at Rs. Nil by following “Other Method”, and suggested a transfer pricing adjustment u/s 92CA(3) of te Act of Rs. 19,43,26,338/-, i.e., the deduction claimed by the assessee company u/s 80IB on account of excess charging of overhead costs by the chilling units.

28. Shri. Ashik Shah, Ld. AR for the assess company, at the threshold of hearing of the appeal, had referred to the “written submissions” filed before us. The Ld. AR submitted that the A.O/TPO had grossly erred in law and facts of the case in suggesting/making an adjustment u/s 92CA(3) of the Act of Rs. 19,43,26,338/- by dislodging the pricing mechanism adopted by the chilling units for transferring the chilled milk to the processing units. Elaborating further on his contention, the Ld. AR submitted that the assessee company had in all fairness charged the overhead expenses on the chilled milk transferred to the processing units after considering the weighted average overhead costs of Rs. 3.53/- per liter that was charged by the third party vendors on the processing units of the assessee company. The Ld. AR submitted that as the overhead costs charged by the chilling units on the processing units was based on the weighted average overhead costs of Rs. 3.53/-per liter (supra) that was charged by multiple third party vendors on the assessee company, therefore, the same being at arm’s length was not liable to be dislodged. The Ld. A.R submitted that based on the aforesaid pricing mechanism adopted by the assessee company for the inter-unit transfer of milk from the chilling units to its processing units, the difference between the actual overhead cost incurred by the chilling units and the weighted average overhead cost incurred by the third party vendors who had supplied chilled milk to the processing units of the assessee company was taken as the profit earned by the chilling units. The Ld. AR submitted that keeping in view the nature of transaction and degree of comparability, wherein the amount of overhead costs paid by the assessee company to third parties were compared with the overhead costs paid in the inter-unit transfers, the “Other method” was considered as the most appropriate method (MAM) in the TP study report. The Ld. AR submitted that the AO/TPO had grossly erred in law and facts of the case in concluding that the assessee company which is involved in inter-unit transfer of milk from the chilling units to the processing units, had based on the comparison of the overhead costs incurred by the chilling units with the weighted average overhead cost of Rs. 3.53/- per liter that was charged by the third party vendors, artificially increased the profits of its chilling units. Elaborating further on his contention, the Ld. AR submitted that the TPO had wrongly observed that the transaction between a chilling unit and a processing unit of the same entity cannot have any profit element embedded in it as the assessee company cannot earn profit from itself. Also, the Ld. AR averred that the TPO had erroneously observed that the chilling units does not perform any worthwhile functions that would make any value addition to the milk which is transferred to the processing plants and hence, a profit margin for the chilling units is not required. The Ld. AR rebutting the observation of the TPO that the chilling units do not make any value addition to the milk transferred to the processing units, submitted that the chilling units after procuring the raw milk from the collection units, would after subjecting the same to filtration, testing for adulteration, antibiotic residue, acidity, and fat content, thereafter chill it at a temperature of about 4 degrees celsius to restrict bacterial growth. The Ld. AR submitted that post chilling process the milk is stored in insulated storage tanks and then sent to the processing plants through insulated vans. The Ld. AR, submitted that considering the multiple processes carried out by the chilling units, there was no justification for the TPO to observe that no worthwhile functions and value addition was carried out by the chilling units. The Ld. AR further submitted that the AO/TPO had based on their misconceived view observed that there could be no profit element embedded in the transfer of the milk by the chilling unit to the processing unit. The Ld. AR to buttress his claim had relied on the judgment of the Hon’ble Supreme Court in the case of CIT v. Jindal Steel & Power Ltd.(SC)/Civil Appeal No. 13771 of 2015 & Ors., dated 06.12.2023. The Ld. AR submitted that the Hon’ble Apex Court in its aforesaid order had observed that the eligible units of the assessee company before them were eligible to claim deduction under Section 80IA of the Act, even in case where the eligible unit transfers its finished products or services to the non-eligible units of the assessee (i.e., for captive consumption). The Ld. AR to fortify his contention had taken us through the judgment of the Hon’ble Apex Court in the case of Jindal Steel & Power Limited (supra). Also, the Ld. AR had pressed into service the judgments of the Hon’ble High Court of Madras in the case of Tamilnadu Petro Products Ltd. v. Asstt. CIT ITR 643 (Madras) and CIT v. Cethar Ltd. (Madras). The Ld. AR further submitted that as Section 80IA(8) of the Act [applicable to the assessee company which has claimed deduction u/s 80IB(11A) of the Act] postulates that where any goods held for the purpose of eligible business are transferred to any other business carried on by the assessee company, and if the consideration for such transfer recorded in the books of account does not correspond to the market value of such goods as on the date of transfer, then for the purpose of computing deduction u/s 80IB(11A) of the Act, the relevant profits from the eligible business shall be computed as if the transfer had been made at the market value of such goods as on the date of transfer.

29. Elaborating further on his contention, the Ld. AR submitted that as per Section 80IA(8) of the Act an eligible undertaking can rightly undertake business transactions with the other business units of the same assessee in the form of input/purchases or in the form of output/sales. The Ld. AR submitted that there would have been no need to prescribe and incorporate Section 80IA(8) of the Act in case, an assessee company could not have transacted and sold goods and services manufactured/produced by its eligible undertakings to another unit or business of the same assessee company. The Ld. AR had drawn our attention to the “Explanation” to Section 80IA(8) of the Act, which contemplates that the “market value” in relation to goods or services means the price that such goods or services would ordinarily fetch in the open market. The Ld. AR based on his aforesaid contentions vehemently submitted that the TPO’s conclusion that the assessee company could not have generated actual profits in case of inter-unit transactions as the transactions were only artificial (i.e. not from real business activity) was completely erroneous and totally misplaced. The Ld. AR in support of his contentions had relied on the judgment of the Hon’ble High Court of Delhi in the case of CIT v. Orient Abrassive Ltd. (Delhi).

30. The Ld. AR further submitted that the entitlement of the assessee company for claim of deduction u/s 80IB(11A) of the profits of its chilling units on the transfer of milk to its processing units was squarely covered by the order passed by the A.O. in the assessee company’s case for the preceding years i.e., A.Y. 2012-13 to A.Y. 2017-18. Elaborating on his contention, the Ld. AR submitted that in the said preceding years, though the A.O. had not drawn any adverse inference regarding the claim of deduction u/s 80IB(11A) of the Act, that was raised by the chilling units on the profits derived from the transfer of milk to the processing units, but had declined the same for the reason that the assessee company was not engaged in the business of preservation, processing and packaging of dairy products. The Ld. AR submitted that the aforesaid view taken by the A.O. was thereafter dislodged by the CIT(A), wherein the latter had concluded that the chilling units, i.e., eligible units were engaged in the preservation, packaging and processing of dairy products and satisfied all the conditions contemplated u/s 80IB(11A) of the Act.

31. The Ld. AR further submitted that the TPO in the case of the assessee company had traversed beyond the scope of his jurisdiction. Elaborating on his contention, the Ld. AR submitted that though the jurisdiction of the TPO was statutorily confined to the determination of Arm’s Length Price of the Specified Domestic Transactions (SDT) carried out by the assessee company, i.e., determination of ALP of the transactions of milk transferred by its chilling units to the processing units, but he had grossly erred in traversing beyond the scope of his jurisdiction and drawing adverse inferences regarding the assessee company’s claim for deduction u/s 80IB(11A) of the Act. The Ld. AR submitted that the examination of the issue, i.e., commercial expediency, genuineness or economic rationale of the transactions as well as the eligibility of the assessee company’s claim of deduction u/s 80IB(11A) of the Act fell within the exclusive domain of the jurisdiction vested with the A.O. Carrying his contention further, the Ld. AR submitted that as the TPO vide his “Show Cause Notice”, dated 22.07.2021 had accepted the Arm’s Length Price adopted by the assessee company to benchmark the transactions of transfer of milk by the chilling units to the processing units, inter alia, based on the weighted average overhead costs adopted by the third party vendors, therefore, he had satisfied the obligation that was cast upon him for verifying whether or not the ALP adopted by the assessee company was accurate and the impugned transactions were at arm’s length. Also, the Ld. AR submitted that now when the TPO in the assessee company’s own case of the preceding year, i.e., A.Y. 2017-18 had accepted the similar specified domestic transactions, i.e., transfer of milk by the chilling units to the processing units to be at arm’s length as per the Indian Transfer Pricing Regulations, therefore, in absence of any deviation of the facts in the year under consideration, there was no justification for him to have taken a view to the contrary. The Ld. AR in support of his contention that a consistent approach ought to have been adopted by the A.O/TPO in the backdrop of the view taken by them while framing the assessment in its case in the preceding years had relied upon the judgment of the Hon’ble Supreme Court in the case of Radhasoami Satsang v. CIT ITR 321 (SC).

32. The Ld. AR further submitted that the TPO had grossly erred in law and on facts of the case by wrongly observing that the assessee company had failed to submit the audited financial statements and also the copies of “Form 10CCB” for each of the chilling units, i.e., eligible units. The Ld. AR had drawn our attention to the observation of the TPO, wherein he had observed that the assessee company has not furnished the audited financial statements, i.e., profit and loss account, balance-sheet of the 48 eligible units reported in “Form 3CEB”. It was observed by him that the assessee company had not furnished the audited financial statements of the chilling units, and what was furnished was only a consolidated statement said to be containing profit & loss accounts of the various units. The Ld. AR rebutted the aforesaid observation of the TPO and submitted that the Rule 18BBB of the Income Tax Rules, 1962 prescribes that a separate report i.e. report in Form 10CCB is to be furnished by each undertaking of the assessee company claiming deduction u/s 80IB of the Act and the same shall be accompanied by the profit & loss account and balance-sheet of the undertaking, as if the undertaking were a distinct entity. Elaborating on his contention, the Ld. AR submitted that the assessee company had already submitted the complete set of copies of “Form 10CCB’s” and audited financial statements for each of its 31 eligible units that had claimed deduction u/s 80IB of the Act, as Annexure 1 and Annexure 2 & 3 to its submission dated 14.07.2021 with the TPO (Pages 270 to 384 of APB). Accordingly, the Ld. AR submitted that the TPO had wrongly observed that the assessee company had failed to comply with the statutory requirement contemplated u/s 80IA(7) of the Act r.w Rule 18BBB of the IT Rules, 1962.

33. The Ld. AR submitted that the method adopted by the assessee company of comparing the difference between the actual overhead costs incurred by its chilling units and the weighted average overhead costs charged by the third party vendors (i.e. market rate) regarding the chilled milk transferred by them to the processing unit i.e. Rs.3.53/- per liter was the Most Appropriate Method (MAM) for computing the ALP of the inter unit transactions of transfer of chilled milk by the chilling units of the assessee company. The Ld. AR to buttress his claim, submitted that the said method of benchmarking the market value, i.e., the price at which the third party sells the goods to the non-eligible units of the assessee company, had been upheld by the Hon’ble Apex Court in the case of Jindal Steel Power Ltd. (supra), and by the ITAT, Chennai in the case of Eveready Spinning Mills (P.) Ltd. v. ACIT [IT (TP) A No. 2/Chny/2022, dated 30-8-2023]/(2023) (9) TMI 324. The Ld. AR further submitted that the TPO vide his Show Cause Notice, dated 22.07.2021, had accepted that the processing units of the assessee company had incurred a weighted average cost of Rs.3.53/- per liter on the milk procured from the third party vendors.

34. Elaborating further, the Ld. AR had, come forth with an alternative contention. The Ld. AR submitted that though the A.O./TPO had drawn adverse inferences for dislodging the assessee’s claim for deduction u/s 80IB(11A) of the Act on the transfer of milk by its chilling units to the processing units, but there is no whisper in their respective orders regarding the claim for deduction u/s 80IB(11A) of Rs. 2,05,64,816/- that was raised by the processing unit of the assessee company situated at “Indragiri”. The Ld. AR submitted that the total claim of deduction u/s 80IB(11A) of Rs.19,43,26,338/- raised by the assessee company during the subject year comprised of, viz. (i) deduction u/s 80IB(11A) pertaining to chilling units: Rs.17,37,61,522/-; and (ii) deduction u/s 80IB(11A) pertaining to the processing unit at “Indragiri”: Rs.2,05,64,816/-.

35. Elaborating further on his contention, the Ld. AR submitted that the processing unit of the assessee company in the normal course would receive milk from the chilling units and converted it into final products such as buttermilk, peda, paneer, etc. The Ld. AR submitted that its aforesaid processing plant at “Indragiri” had during the subject year claimed deduction of Rs.2.05 crores under Section 80IB(11A) which had been summarily declined for no reason.

36. The Ld A.R submitted that though the TPO had observed that the arm’s length price of the profit computed on the amount of excess charging of overhead cost by the assessee’s chilling unit was to be determined at Rs. Nil, but at no point of time during the course of the proceedings or even in the TP order, he had ever observed that the profits earned by the assessee’s processing unit situated at “Indragiri” was also notional or artificial in nature, or had been claimed in the absence of any value added services being provided by the said processing plant. The Ld. DR submitted that as the profits earned by the aforesaid processing unit of the assessee company at “Indragiri” was eligible for claim of deduction under Section 80-IB(11A) of the Act, which neither the A.O. nor the TPO had ever questioned, therefore, there could be no justification for the A.O. to have declined the assessee’s claim for deduction to the said extent.

37. It was, thus, Ld. AR’s alternative claim that even if the observation of the TPO that the arm’s length price of the profits earned by the chilling units ought to be considered as nil is to be accepted, the disallowance of the assessee’s claim for deduction under Section 80IB(11A) of the Act, on the said basis could only be restricted to the profits earned by the chilling units, i.e., Rs. 17.38 crores. Accordingly, the Ld. AR submitted that, in absence of any basis or reason recorded by the authorities below, there could have been no justification for declining the assessee’s claim for deduction of Rs. 2.05 crore (supra) u/s 80-IB(11A) of the Act regarding its processing unit situated at “Indragiri”.

38. Apropos the disallowance of the assessee’s claim for deduction of expenses u/s 14A of the Act, the Ld. AR submitted that as the assessee company during the subject year, against the disallowance made by the A.O. u/s 14A of Rs. 66,96,066/-, had received exempt income of only Rs. 39,05,165/-, therefore the disallowance, if any, could have been restricted only to the extent of such exempt income received during the year. Apart from that, the Ld. AR submitted that as the assessee company during the subject year had sufficient own funds, therefore, there was no justification for the A.O. to have worked out the disallowance u/s 14A of the Act. The Ld. AR, to support his contention, had relied upon the judgment of Hon’ble Supreme Court in the case of Pr. CIT v. Sintex Industries Ltd. . The Ld. AR submitted that the Hon’ble High Court of Gujarat in the case of Pr. CIT v. Sintex Industries Ltd. (Gujarat), had observed that as the assessee company before them had surplus funds of Rs. 2319.75 crores against which investment was made of Rs.111.09 crores, there was no question of making any disallowance of expenditure in respect of interest and administrative expenses u/s 14A of the Act. The Ld. AR submitted that, by drawing an analogy from the judgment of the Hon’ble High Court of Gujarat in the case of Sintex Industries Ltd. (supra), which thereafter had been approved by the Hon’ble Supreme Court, now when in the present case the assessee company had sufficient self-owned funds available with it to make investment in the exempt income-yielding investments, therefore, no disallowance of any part of the administrative expenses could have been made by the A.O. u/s 14A of the Act.

39. Apropos the disallowance of the assessee’s claim for deduction of interest expenditure u/s 37 of the Act pertaining to the amount of Rs.1.25 crores that was advanced by the assessee company to its Managing Director @ 9% p.a, the Ld. AR submitted that the A.O., taking cognizance of the fact that the assessee company had raised interest-bearing loans from banks ranging from 10% to 11% per annum, had initially vide his “draft assessment order” passed u/s 144C of the Act, dated 16.09.2021 proposed a disallowance of Rs. 2.50 lac of the excess portion of interest of 2% [11% (minus) 9%] on the amount advanced. However, the DRP, had thereafter, considering the fact that the aforesaid loan was repaid by the Managing Director as on 21.04.2018, directed the A.O. to restrict the disallowance up to the date of repayment. The Ld. AR submitted that, based on the DRP’s directions, the disallowance of interest expenditure has been scaled down by the A.O. vide his order passed u/s 143(3) r.w.s 144C(3) r.w.s 144B of the Act, dated 15.07.2022 to an amount of Rs. 2,08,033/-. The Ld. AR assailed the disallowance of the aforesaid interest expenditure for two reasons, viz (i). that as the amount advanced by the assessee company to its Managing Director, i.e., an employee, at a discounted interest rate, was in the nature of a perquisite that was taxable in his hands, therefore, the A.O. was not justified in disallowing any part of the interest on the amount advanced by the assessee company at a discounted rate of interest in the hands of the assessee company; and (ii). that as the assessee company had sufficient interest-free funds available with it, therefore, there was no justification for the A.O. to have inferred that the interest-bearing funds that were borrowed by the assessee company from the banks for specific purposes were utilized for advancing the loan to the Managing Director. Accordingly, the Ld. AR submitted that, considering the availability of sufficient interest-free funds with the assessee company to source the loan advanced to the Managing Director, no disallowance of any part of the interest expenditure was called for in its case. The Ld. AR, to buttress his aforesaid claim, had relied upon the judgment of the Hon’ble High Court of Bombay in the case of CIT v. Reliance Utilities & Power Ltd. ITR 340 (Bombay).

40. Apropos the disallowance of the assessee’s claim of deduction u/s 80JJAA of the Act of Rs. 48,32,390/-, the Ld. AR submitted that the assessee company’s entitlement for deduction u/s 80JJAA of the Act amounted to Rs. 58,77,544/-, viz. (i). deduction pertaining to A.Y 2017-18 (being the second year of deduction): Rs. 35,67,060/-; and (ii). deduction for A.Y 2018-19: Rs. 23,10,484/-. Elaborating further on his contention, the Ld. AR submitted that, inadvertently, the assessee company had, in Form 10DA, certified its claim for deduction at Rs. 23,10,484/-, while for the same was claimed in the return of income at Rs. 35,75,814/-. The Ld. AR submitted that considering its entitlement for deduction for the immediately preceding year, i.e., AY 2017-18 of Rs. 35,67,060/- (being second year of claim) its total entitlement u/s 80JJAA worked out at Rs. 58,77,544/-. The Ld. AR, in support of his contention, had relied upon the order passed by the ITAT, Chennai in the case of Intimate Fashions India (P.) Ltd. v. Dy. CIT [IT(TP)A No.48/Chny/2019, dated 31.05.2023].

41. Per contra, Ms. U. Mini Chandran, Ld. CIT-Departmental Representative (for short, “Ld. CIT-D.R”), submitted that as the assessee company had, based on its artificial/notional profits on transfer of milk by its chilling units to the processing units, raised a claim for deduction u/s 80IB(11A) of the Act, therefore, the A.O./DRP had rightly declined the same. Apart from that, the Ld. CIT-DR submitted that, the claim for deduction u/s 80IB of the Act pre-supposes that the profits on which such claim is made are “derived from” the eligible units. Elaborating further on her contention, the Ld. CIT-DR submitted that the DRP had rightly observed that, as the assessee company had claimed deduction u/s 80IB(11A) of the Act on the artificial/notional profits, which by no means could be held to have been “derived from” the business of its eligible units, therefore, the same was not eligible for deduction under the said statutory provision.

42. Further, the Ld. CIT-DR submitted that, as the assessee company had failed to comply with the statutory obligation that was cast upon it u/s 80IA(7) of the Act read with Rule 18BBB(2) of the Income-tax Rules, 1962, which contemplates that a separate report in “Form 10CCB” accompanied by the Profit & Loss Account and Balance Sheet of each eligible undertaking was statutorily required to be furnished, therefore, the A.O. had, for the said reason, rightly held the assessee company as ineligible for claiming the deduction u/s 80IB(11A) of the Act. Apart from that, the Ld. CIT-DR submitted that the claim of the assessee company for deduction under section 80IB(11A) of the Act cannot be placed at par with claim of deduction under section 80IA(8) of the Act, as was the issue involved in the case before the Hon’ble Apex Court in CIT v. Jindal Steel & Power Ltd., CIT v. Jindal Steel & Power Ltd.(SC)/Civil Appeal No.13771 of 2015 & Ors, dated 06/12/2023.

43. Apropos the disallowance made by the A.O. u/s 14A of the Act, the Ld. CIT-DR submitted that, as the assessee company during the subject year had invested in exempt income-yielding investments, therefore, the A.O. had rightly worked out the disallowance u/s 14Ar.w. Rule 8D(2)(iii) of the Income-tax Rules, 1962. The Ld. DR submitted that there was no substance in the Ld. AR’s claim that the disallowance u/s 14A was liable to be restricted to the extent of the exempt income received during the year. The Ld. DR, to support her claim, relied on the CBDT Circular No. 5/2014, dated 11.02.2014

44. The Ld. CIT-DR further submitted that, as the assessee company had diverted its interest-bearing funds for advancing loan at a discounted rate to its Managing Director, i.e., for a non-business purpose, therefore, the A.O. had rightly disallowed the corresponding discounted rate of interest element pertaining to the said loan, which, however, as per the directions of the DRP had already been restricted up to the date of repayment of the said loan.

45. The Ld. CIT-DR, on the issue of quantification of claim of deduction u/s 80JJAA of the Act, after arguing for some length, fairly submitted that the said aspect can be looked into by the A.O. in the backdrop of the extant law.

46. We have heard the learned Authorized Representatives of both parties, perused the orders of the lower authorities and the material available on record, as well as considered the judicial pronouncements that have been pressed into service by them to drive home their respective contentions.

47. We shall first deal with the issue as to whether or not the A.O. is justified in declining the assessee’s claim for deduction u/s 80IB(11A) of the Act of Rs. 19,43,26,338/-. For adjudicating the aforesaid issue, we have to deal with the following three material aspects, viz.

| (i). | | whether or not the TPO, vide his order passed u/s 92CA(3) of the Act dated 31.07.2021, had rightly observed that the assessee company’s profit obtained on account of excess charged overhead cost by its chilling units is to be determined at nil resulting to an adjustment of Rs. 19,43,26,338/- that was claimed as a deduction u/s 80IB of the Act; |

| (ii). | | whether or not the A.O. is right in law and on facts of the case in declining the assessee’s claim for deduction u/s 80IB(11A) of the Act; and |

| (iii). | | whether or not the DRP is right in law and on facts of the case in observing that the allocation of profits by the assessee company based on third-party comparables cannot be brought within the meaning of profits and gains “derived from” its eligible units i.e., chilling units. |

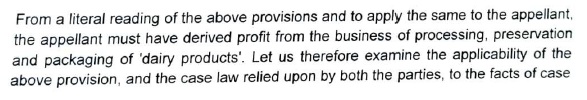

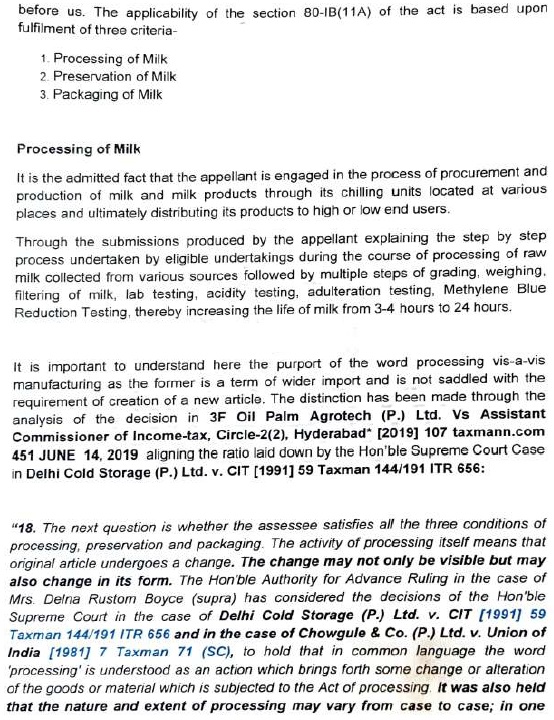

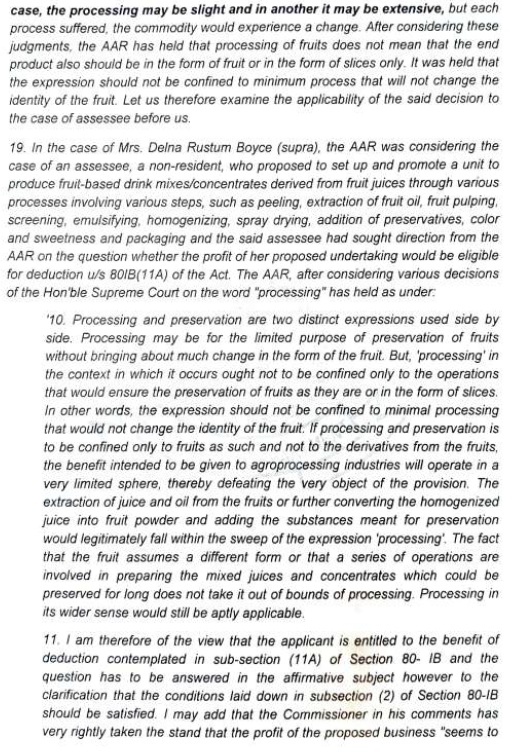

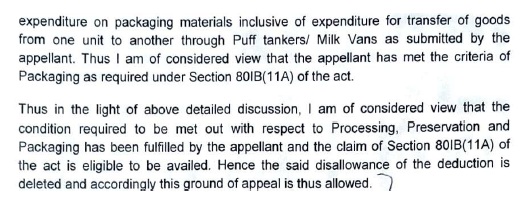

48. Before proceeding any further, we deem it apposite to cull out for the sake of clarity and better understanding of the issue in hand, that as to whether or not the eligible units of the assessee company, i.e., chilling units, were engaged in the business of processing, preservation, and packaging of dairy products as contemplated under Section 80IB(11A) of the Act. We find that the CIT(A), NFAC, Delhi, vide his order dated 25.03.2025, passed in the assessee’s own case for A.Y. 2012-13, had observed that the chilling units of the assessee company that were obligated to have cumulatively satisfied the carrying on of the aforementioned three activities, i.e., processing, preserving, and packaging of dairy products for claiming deduction under Section 80IB(11A) of the Act, had fulfilled the same, which, thus rendered it eligible for claiming deduction u/s 80IB(11A) of the Act, observing as under:

-left blank intentionally-

Accordingly, the CIT(A), in his aforesaid order, had observed, that the profits earned by eligible units of the assesseee company, i.e., chilling units, on transfer of milk to its processing units was eligible for deduction u/s 80-IB(11A) of the Act.

49. We shall now advert to the controversy involved in the present appeal before us, i.e., whether or not the assessee company had validly raised a claim for deduction u/s 80IB(11A) of the Act on the profit earned by its chilling units on the transfer of milk to its processing units.

50. As observed hereinabove, the primary reason that had weighed in the mind of the A.O/TPO for declining the assessee’s claim for deduction u/s 80IB(11A) of the Act, on the profit earned by its chilling units on transfer of milk to its processing units, was that the chilling units ought to have transferred the milk to the processing units at cost. In other words, the A.O/TPO had found it incomprehensible that the chilling units had transferred the milk to the processing units with a profit or markup.

51. We have given our thoughtful consideration and are unable to persuade ourselves to concur with the aforesaid observation of the A.O/TPO. Our aforesaid view that there is no restriction placed on the transfer of any goods held by the eligible units of the assessee to any other business carried on by the assessee company can safely be gathered on a bare reading of Section 80IA(8) of the Act. Section 80IA(8) of the Act postulates that where any goods held for the purpose of eligible business are transferred to any other business carried on by the assessee, and if the consideration for such transfer, as recorded in the books of account does not correspond to the market value of such goods as on the date of transfer, then, in such a situation, for the purpose of computing deduction under Section 80IB(11A) of the Act, the relevant profit from the eligible business shall be computed as if the transfer had been made at the market value as on the date of transfer. Accordingly, it can safely be concluded that Section 80IA(8) of the Act accepts that the eligible undertakings of an assessee company can rightly undertake business transactions with the other businesses or units of the same assessee company in the form of input/purchases or output/sales. In fact, the aforesaid section contemplates that the A.O., in case of transactions between the eligible undertakings and other business or units of the same assessee company, shall compute the profits of the eligible undertakings on the basis of the market value. We, thus, are of the firm conviction that if the view taken by the A.O/TPO, that the eligible units of the assessee company could not have transacted and sold goods to the other business units of the same assessee company is to be accepted, then there was no need to incorporate Section 80IA(8) of the Act.

52. Rather, our aforesaid conviction is further fortified on a perusal of Section 80IA(8) of the Act, which provides that the market value in relation to goods or services would mean the price at which such goods or services would ordinarily be sold in the open market. Accordingly, we are unable to concur with the view taken by the AO/TPO that an eligible unit cannot generate actual profits in case of inter-unit transactions and that the profits created in such transactions will be nothing but artificial and notional. Our aforesaid view is fortified by the judgment of the Hon’ble High Court of Delhi in the case of CIT v. M/s. Orient Abrassive Ltd. (2014) 271 ITR 266 (Delhi). In the case before the Hon’ble High Court of Delhi, the assessee company had an abrasive grain division that manufactured fused aluminum oxide grains etc. Also, it had set up a power plant for captive supply only to its aluminum oxide grains unit. the assessee company had set up a power plant for captive supply only to its other units. The assessee company had claimed the profit earned from the power plant unit as deduction under Section 80IA, which, however, was declined by the AO. On appeal, the Hon’ble High Court observed that sub-section (8) of Section 80IA of the Act accepted and endorsed that the eligible undertakings could have transacted or have business transactions with other units of the same assessee in the form of input/purchases or in the form of output/sales. In either case, the A.O. was entitled to compute the profits of the business undertakings on the basis of the market value, i.e., by ignoring or accepting the value mentioned in the books of account. The Hon’ble High Court based on its aforesaid observations regarding sub-section (8) of Section 80IA of the Act, observed that there would have been no need to prescribe or incorporate sub-section (8) of Section 80IA in case the assessee company, i.e., the eligible unit could not have sold goods or services manufactured/ produced by the eligible undertaking to another unit or business of the same assessee company. Accordingly, the Hon’ble High Court approved the view taken by the Tribunal that the profit derived by the eligible unit of the assessee company was eligible for deduction as a separate undertaking under Section 80IA of the Act.

53. Also, our aforesaid view is supported by the judgment of the Hon’ble Supreme Court in the case of Jindal Steel and Power Ltd (supra). The Hon’ble Apex Court, in its order, had observed that there was no dispute that the captive power plants of the assessee company, i.e., the eligible units were entitled for deduction u/s 80IA of the Act. The Hon’ble Apex Court referring to the provisions of subsection (8) of Section 80IA of the Act, had observed, that the same contemplates that where any goods held for the purposes of the eligible business are transferred to any other business carried on by the assessee or where any goods held for the purposes of any other business carried on by the assessee are transferred to the eligible business but the consideration for such transfer as recorded in the accounts of the eligible business does not correspond to the market value of such goods as on the date of the transfer, then for the purpose of deduction under Section 80IA, the profits and gains of such eligible business shall be computed as if the transfer had been made at the market value of such goods as on that date. Also, the Hon’ble Apex Court had observed that the “Explanation” below the proviso to Section 80IA(8) defines the term “market value”, which means the price that such goods would ordinarily fetch on sale in the open market. Further, it was observed that in case the AO finds exceptional difficulties in computing the profits and gains of the eligible business in the manner specified in sub-section (8) of Secton 80IA of the Act, then in such a case, he may compute such profits and gains on such reasonable basis as he may deem fit. We, thus, are of the firm conviction that the Hon’ble Supreme Court had clarified that profits arising to an eligible unit of the assessee from its transactions with the other businesses carried on by the assessee are eligible for deduction under sub-section (8) of Section 80IA of the Act. Further, we find that the indulgence of the Hon’ble High Court of Madras in the case of Tamilnadu Petro Products Ltd. v. ACIT ITR 643 (Madras) was, inter alia, sought for adjudicating the following substantial question of law:

“Whether, on the facts and in the circumstances of the case, the Tribunal was right in holding that the assessee is entitled to deduction under Section 80-IA of the Act in respect of notional profits on account of power generated from its own power plants and utilized by it?

The Hon’ble High Court, while answering the aforesaid question, had observed that there was no difficulty in holding that the captive consumption of power generated by the assessee company from its own power plant would enable the respondent/assessee to derive profits and gains by working out the cost of such consumption of power inasmuch as the assessee is able to save to that extent which would certainly be covered by section 80IA(1). It was further observed, that when such will be the outcome out of own consumption of the power generated and gained by the assessee by setting up its own power plant, then, there was no lack of merit in the claim of the respondent/assessee when it claimed deduction of the value of such units of power consumed by its own plant by way of profits and gains for the relevant assessment years under Section 80IA(1) of the Act. Further, a similar view had been taken by the Hon’ble High Court of Madras in the case of CIT, Trichi v. Cethar Ltd. (Madras), wherein, the Hon’ble High Court had observed that the assessee company before them was entitled to claim deduction under Section 80-IA in respect of the power income generated by its own windmill that was captive consumed by the assessee. We, thus, in terms of our aforesaid observations and the settled position of law, are unable to persuade ourselves to concur with the view taken by the A.O/TPO that the chilling units, i.e., the eligible units of the assessee company ought to have transferred the milk to the processing units at cost.

54. We shall now deal with the pricing mechanism adopted by the chilling units of the assessee company for the inter-unit transfer of chilled milk to its processing units. As observed by us at length hereinabove, the assessee company had computed the profits earned by its chilling units, i.e., the eligible units, by comparing the actual overhead costs incurred by the chilling units with the weighted average overhead costs of Rs. 3.53/- per liter charged by third-party suppliers from whom the assessee company had during the subject year procured chilled milk.

55. We have given thoughtful consideration to the issue in hand and find no infirmity in the pricing mechanism that was adopted by the assessee company based on which its chilling units, i.e., the eligible units, had carried out inter-unit transfer of milk to the processing units. Ostensibly, the processing units of the assessee company had also procured milk from the third-party vendors and paid for, viz. (i). raw milk cost; and (ii). overhead costs at a negotiated fixed rate per liter. Admittedly, there is no dispute that the weighted overhead cost paid by the assessee company to the third party suppliers of chilled milk worked out at Rs. 3.53/- per liter. Now, the chilling units of the assessee company which were to supply the chilled milk to its processing units would raise a charge for the said transaction, which would include, viz. (i). the cost of milk; and (ii). overhead cost. We find that the chilling units, considering the weighted average cost of overhead at Rs. 3.53/- per liter that was paid by the assessee company to multiple third-party vendors of chilled milk, had adopted the same as a yardstick for costing the transactions of supply of chilled milk to the processing units, i.e., as per the market value/rates. We further find that Section 80-IA(8) of the Act itself contemplates that where any goods held for the purposes of the eligible business are transferred to any other business carried on by the assessee, or where any goods held for the purposes of any other business carried on by the assessee are transferred to the eligible business and, in either case, the consideration, if any, for such transfer as recorded in the accounts of the eligible business does not correspond to the market value of such goods as on the date of transfer, then, for the purposes of deduction under Section 80IA, the profits and gains of such eligible business shall be computed as if the transfer, in either case, has been made at the market value of such goods as on the date. Also, we find that as per the “Explanation 2” to Section 80IA(8) of the Act, the term market value means, viz. (i). the price that such goods or services would ordinarily fetch in the open market; or (ii). the arm’s length price as defined in sub-section (2) of Section 92F, where the goods or services are transferred in specified domestic transactions referred to in Section 92BA of the Act. We are of the firm conviction that now when the chilling units (i.e., eligible units) had carried out the inter-unit transfer of milk to the processing units considering the “market value” of the subject goods, which squarely fits within the meaning of sub-section (8) of Section 80IA of the Act, therefore, it is incomprehensible that on what basis the claim for deduction under Section 80IB(11A) of the Act raised by the chilling units could have been declined. Once again it may be reiterated that it is nobody’s case that the weighted average cost of overheads of the third party vendors of chilled milk of Rs. 3.53/- per liter (supra) suffers from any infirmity. Also, we would once again refer to the judgment of the Hon’ble Supreme Court in the case of Jindal Steel & Power Ltd (supra). It was observed by the Hon’ble Apex Court that the revenue had admitted that the profits derived by the assessee company, i.e., a captive power plant (eligible unit) from supplying electricity to its own industrial undertakings was eligible for deduction under Section 80IA of the Act. Rather, it was the profits & gains of the eligible unit that was computed by the assessee company by showing supply of power to its own industrial units for captive consumption at the rate of Rs. 3.72/- per unit that was disputed by the revenue on the ground that the same was inflated. The assessee company had recorded the supply of electricity to its own industrial undertakings @ Rs. 3.72/- per unit, which, in turn was based on the rate at which the State Electricity Board was supplying electricity to its industrial consumers i.e @ Rs. 3.72/- per unit. It was the revenue’s claim that as the assessee company was supplying electricity to the State Electricity Board @ Rs. 2.32/- per unit, therefore, it could not claim supply of electricity to its sister concerns @ Rs. 3.72/- per unit. The Hon’ble Apex Court, observed that if the A.O disputes the consideration for supply of goods as recorded in the books of account by the assessee, i.e., an eligible unit to its sister concern, on the ground that the same does not correspond to the market value of such goods as on the date of the transfer, then the A.O has to compute the sale price of such goods at the “market value” as per his determination. Thereafter, the Hon’ble Apex Court referred to the definition of the term “market value” as provided in the “Explanation” below the proviso to Section 80IA(8) of the Act, and observed, that the same would mean the price that such goods would ordinarily fetch on sale in the open market. Also, the Hon’ble Apex Court observed that if the industrial units of the assessee did not have the option of obtaining power from the captive power plants of the assessee, then in that case it would have had to purchase electricity from the State Electricity Board, i.e., @ Rs. 3.72/- per unit. Thus, the Hon’ble Apex Court observed that the Tribunal had rightly computed the “market value” of electricity supplied by the captive power plants of the assessee to its industrial units, i.e., @ Rs. 3.72/-per unit after comparing it with the rate of power available in the open market, i.e., the rate that was charged by the State Electricity Board while supplying electricity to the industrial consumers, i.e., at Rs. 3.72/- per unit at the relevant point of time. For the sake of clarity, we deem it apposite to cull out the observations of the Hon’ble Apex Court, as under:

“18. There is also no dispute that the assessee or rather, the captive power plants of the assessee are entitled to deduction under Section 80-IA of the Act. For the purpose of computing the profits and gains of the eligible business, which is necessary for quantifying the deduction under Section 80-IA, the assessee had recorded in its books of accounts that it had supplied power to its industrial units at the rate of Rs. 3.72 per unit which rate is disputed by the revenue as not being the market value of electricity.

19. While the assessing officer accepted the claim of the assessee for deduction under Section 80-IA, he, however, did not accept the profits and gains of the eligible business computed by the assessee on the ground that those were inflated by showing supply of power to its own industrial units for captive consumption at the rate of Rs. 3.72 per unit.

Assessing officer took the view that there was no justification on the part of the assessee to claim electricity charge at the rate of Rs. 3.72 for supply to its own industrial units when the assessee was supplying surplus power to the State Electricity Board at the rate of Rs 2.32 per unit. Finally, the assessing officer held that Rs. 2.32 per unit was the market value of electricity and on that basis, reduced the profits and gains of the assessee thereby restricting the claim of deduction of the assessee under Section 80-IA of the Act.

20. We have already analyzed Section 80-IA of the Act. There is no dispute that respondent-assessee is entitled to deduction under Section 80-IA of the Act for the relevant assessment year. The only issue is with regard to the quantum of profits and gains of the eligible business of the assessee and the resultant deduction under Section 80 IA of the Act.

The higher the profits and gains, the higher would be the quantum of deduction. Conversely, if the profits and gains of the eligible business of the assessee is determined at a lower figure, the deduction under Section 80-IA would be on the lower side. Assessee had computed the profits and gains by taking Rs. 3.72 as the price of electricity per unit supplied by its captive power plants to its industrial units. The basis for taking this figure was that it was the rate at which the State Electricity Board was supplying electricity to its industrial consumers.

Assessing officer repudiated such claim. According to him, the rate at which the assessee had supplied the surplus electricity to the State Electricity Board i.e., Rs. 2.32 per unit, should be the market value of electricity. Assessee cannot claim two rates for the same good i.e., electricity. When it supplies electricity to the State Electricity Board at the rate of Rs. 2.32 per unit, it cannot claim Rs. 3.72 per unit for supplying the same electricity to its sister concern i.e., the industrial units. This view of the assessing officer was confirmed by the CIT (A).

21. We have noticed that the Tribunal had rejected such contention of the revenue which has been affirmed by the High Court. In this proceeding, we are called upon to decide as to which of the two views is the correct one.

22. Reverting back to sub-section (8) of Section 80-IA, it is seen that if the assessing officer disputes the consideration for supply of any goods by the assessee as recorded in the accounts of the eligible business on the ground that it does not correspond to the market value of such goods as on the date of the transfer, then for the purpose of deduction under Section 80-IA, the profits and gains of such eligible business shall be computed by adopting arm’s length pricing.

In other words, if the assessing officer rejects the price as not corresponding to the market value of such good, then he has to compute the sale price of the good at the market value as per his determination. The explanation below the proviso defines market value in relation to any goods to mean the price that such goods would ordinarily fetch on sale in the open market. Thus, as per this definition, the market value of any goods would mean the price that such goods would ordinarily fetch on sale in the open market.

23. This brings to the fore as to what do we mean by the expression “open market” which is not a defined expression.

24. Black’s Law Dictionary, 10th Edition, defines the expression “open market” to mean a market in which any buyer or seller may trade and in which prices and product availability are determined by free competition. P. Ramanatha Aiyer’s Advanced Law Lexicon has also defined the expression “open market” to mean a market in which goods are available to be bought and sold by anyone who cares to. Prices in an open market are determined by the laws of supply and demand.

25. Therefore, the expression “market value” in relation to any goods as defined by the explanation below the proviso to subsection (8) of Section 80 IA would mean the price of such goods determined in an environment of free trade or competition. “Market value” is an expression which denotes the price of a good arrived at between a buyer and a seller in the open market i.e., where the transaction takes place in the normal course of trading. Such pricing is unfettered by any control or regulation; rather, it is determined by the economics of demand and supply.

26. Under the electricity regime in force, an industrial consumer could purchase electricity from the State Electricity Board or avail electricity produced by its own captive power generating unit. No other entity could supply electricity to any consumer. A private person could set up a power generating unit having restrictions on the use of power generated and at the same time, the tariff at which the said power plant could supply surplus power to the State Electricity Board was also liable to be determined in accordance with the statutory requirements.

In the present case, as the electricity from the State Electricity Board was inadequate to meet power requirements of the industrial units of the assessee, it set up captive power plants to supply electricity to its industrial units. However, the captive power plants of the assessee could sell or supply the surplus electricity (after supplying electricity to its industrial units) to the State Electricity Board only and not to any other authority or person.

Therefore, the surplus electricity had to be compulsorily supplied by the assessee to the State Electricity Board and in terms of Sections 43 and 43A of the 1948 Act, a contract was entered into between the assessee and the State Electricity Board for supply of the surplus electricity by the former to the latter. The price for supply of such electricity by the assessee to the State Electricity Board was fixed at Rs. 2.32 per unit as per the contract. This price is, therefore, a contracted price. Further, there was no room or any elbow space for negotiation on the part of the assessee.

Under the statutory regime in place, the assessee had no other alternative but to sell or supply the surplus electricity to the State Electricity Board. Being in a dominant position, the State Electricity Board could fix the price to which the assessee really had little or no scope to either oppose or negotiate. Therefore, it is evident that determination of tariff between the assessee and the State Electricity Board cannot be said to be an exercise between a buyer and a seller in a competitive environment or in the ordinary course of trade and business i.e., in the open market. Such a price cannot be said to be the price which is determined in the normal course of trade and competition.

27. Another way of looking at the issue is, if the industrial units of the assessee did not have the option of obtaining power from the captive power plants of the assessee, then in that case it would have had to purchase electricity from the State Electricity Board. In such a scenario, the industrial units of the assessee would have had to purchase power from the State Electricity Board at the same rate at which the State Electricity Board supplied to the industrial consumers i.e., Rs. 3.72 per unit.

28. Thus, market value of the power supplied by the assessee to its industrial units should be computed by considering the rate at which the State Electricity Board supplied power to the consumers in the open market and not comparing it with the rate of power when sold to a supplier i.e., sold by the assessee to the State Electricity Board as this was not the rate at which an industrial consumer could have purchased power in the open market.

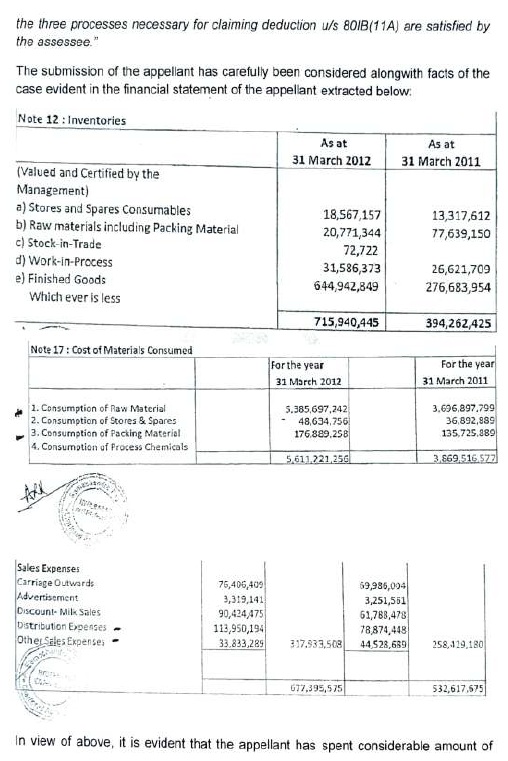

It is clear that the rate at which power was supplied to a supplier could not be the market rate of electricity purchased by a consumer in the open market. On the contrary, the rate at which the State Electricity Board supplied power to the industrial consumers has to be taken as the market value for computing deduction under Section 80 IA of the Act.