ORDER

Partha Sarathi Chaudhury, Judicial Member.- This appeal preferred by the assessee emanates from the order of the Ld. CIT(Appeals), Raipur-3 dated 30.06.2025 for the assessment year 2019-20 as per the grounds of appeal on record.

2. In this case, the assessee has filed both legal grounds as well as grounds on merits. The Ld. Counsel for the assessee submitted that he would assail the legal ground first and if the said legal ground is answered affirmative, then the grounds on merits shall become academic only.

3. In this regard, the legal ground assailed by the Ld. Counsel for the assessee is extracted as under:

“Ground No.1:

On the facts and circumstances of the case & in law, combined approval granted u/s.153D dt. 23-03-21 on presumption basis for 14 years without application of mind in routine manner for mere formality, without even recording any word of own satisfaction on the facts of the assessee’s case for A.Y.2019-20 i.e., each year for each assessee separately in the approval order u/s.153D; approval order u/s.153D is invalid and hence, assessment made u/s. 143(3) r.w.s. 153A dt. 31-3-21 would be invalid and is liable to be quashed.”

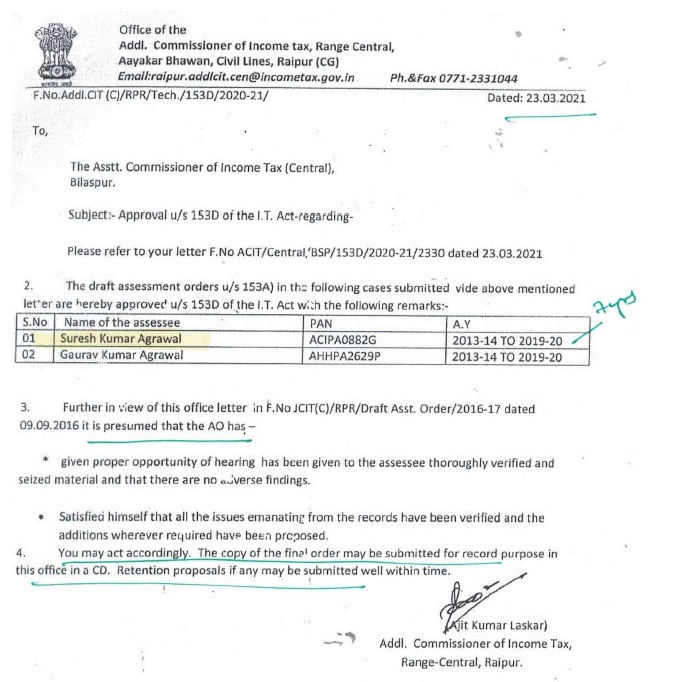

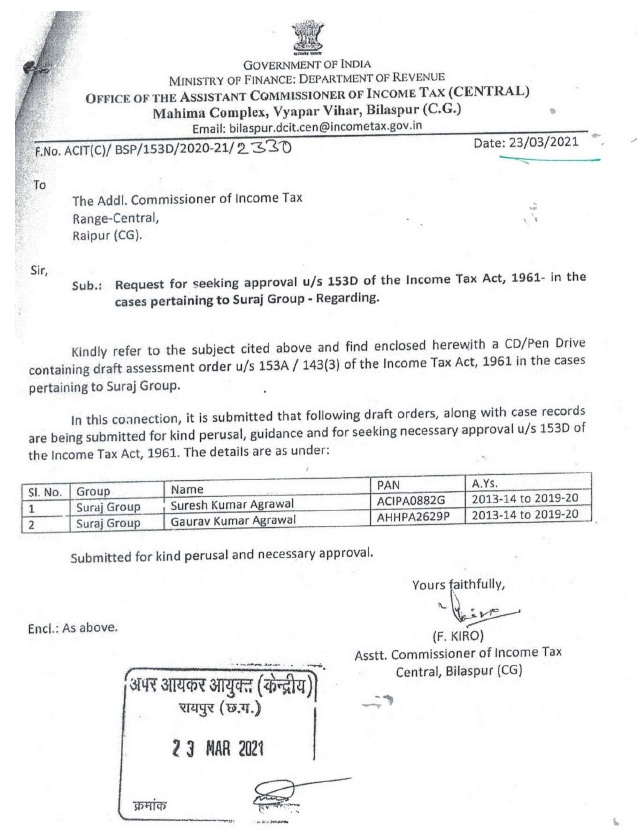

4. It is also relevant to extract the approval u/s.153D of the Income Tax Act, 1961 (for short ‘the Act’), dated 23.03.2021 a/w. request letter dated 23.03.2021 for the said approval which reads as follows:

Approval u/s. 153D of the Act, dated 23.03.2021

Request letter dated 23.03.2021

5. The Ld. Counsel for the assessee submitted that the approval granted u/s. 153D of the Income Tax Act, 1961 (for short ‘the Act’) by the competent authority has been done in a mechanical manner without any independent satisfaction and reasoning of the said authority. It was submitted by the Ld. Counsel that the date for request for seeking approval u/s. 153D of the Act by the Assistant Commissioner of Income Tax, Range-Central, Raipur was dated 23.03.2021 and it is on the same date i.e. 23.03.2021 the said approval was granted by the competent authority as is evident from the aforesaid letter. Referring to the aforesaid letter, the Ld. Counsel submitted that the said approval u/s. 153D of the Act was granted in the case of the assessee for A.Ys. 2013-14 to 2019-20 i.e. for 7 years.

6. The second contention raised by the Ld. Counsel is that as evident from Para 3 and 4 of the said approval, there is no satisfaction arrived at independently by the competent authority for issuing such approval u/s.153D of the Act. In this case, the approval has been granted for two assesses viz. (i) Sr. No. 1: Suresh Kumar Agrawal; and (ii) Sr. No. 2: Gaurav Kumar Agrawal and Sr.No.1 is the appellant assessee before this Bench. That on one hand, there is no independent satisfaction of the competent authority in issuing such approval and on the other hand, it is only borrowed satisfaction from the A.O, based on which, such approval u/s.153D of the Act has been granted summarily in the case of the assessee which vitiates such approval in the eyes of law.

7. Per contra, the Ld. Sr. DR submitted that the approval u/s.153D of the Act has been granted by the competent authority after due application of mind and there is no infirmity in the said approval. The Ld. Sr. DR further submitted that as a matter of fact, there are discussions on various occasions between the ACIT, Central and the Addl. CIT, Central before such approval is accorded. However, he could not place on record any evidence on facts supporting his submissions.

8. I find that exactly identical situation in so far as this legal parameter is concerned, had arisen in the case of Mamta Agrawal v. ACIT (Raipur – Trib.)/ ITA No. 240/RPR/2025, dated 21.05.2025. In that case, approval was sought for by the ACIT (Central), Bilaspur by Mr. F. Kiro and the competent authority granting such approval i.e. Addl. CIT, Range-Central, Raipur was Mr. Ajit Kumar Laskar. These are the same officers who had also functioned regarding the present case of the assessee. That again, it is noted that the format of granting approval u/s.153D of the Act is absolutely same and identical as if it is copied and pasted. It would therefore be relevant to refer to the judgment of the said case (supra) and the relevant observation of the Tribunal are culled out as follows:

“3. In this regard, the legal ground assailed by the Ld. Counsel for the assessee is extracted as under:

“Ground No.1:

On the facts and circumstances of the case & in law, combined approval granted u/s.153D dt. 16-03-21 on presumption basis for 14 years without application of mind in routine manner for mere formality, without even recording any word of own satisfaction on the facts of the assessee’s case for A.Y.2019-20 i.e., each year for each assessee separately in the approval order u/s.153D; approval order u/s.153D is invalid and hence, assessment made u/s. 143(3) r.w.s. 153A dt. 25-3-21 would be invalid and is liable to be quashed.”

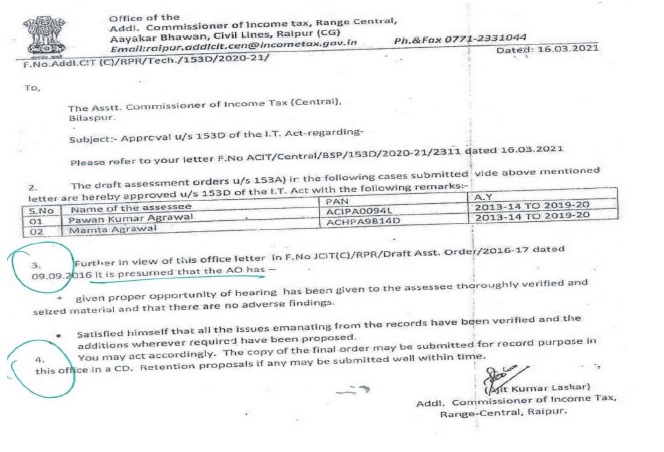

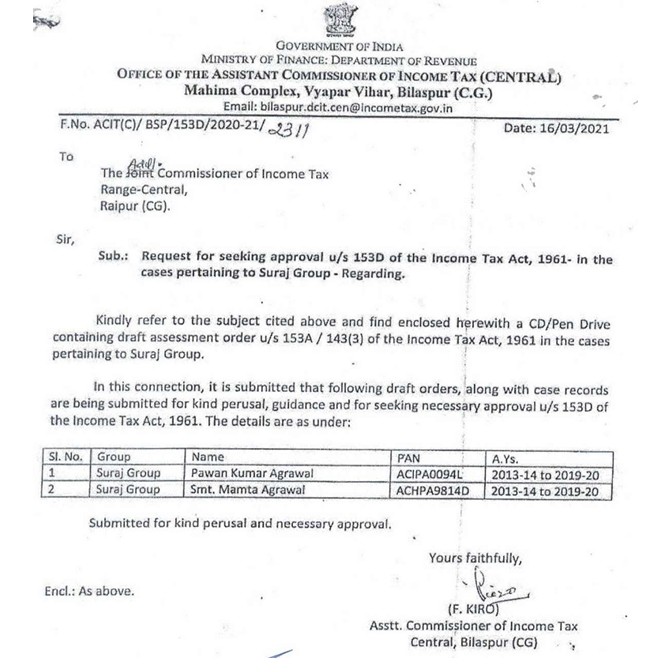

4. It is also relevant to extract the approval u/s.153D of the Income Tax Act, 1961 (for short ‘the Act’), dated 16.03.2021 a/w. request letter dated 16.03.2021 for the said approval which reads as follows:

Approval u/s. 153D of the Act, dated 16.03.2021

Request letter dated 16.03.2021

5. That the first contention raised by the Ld.Counsel is that date for request for seeking approval u/s.153D of the Act by the ACIT was dated 16.03.2021 and it is on the same date i.e. 16.03.2021, the said approval was granted by the competent authority as is evident from the aforesaid letter and that too for A.Y. 2013-14 to 2019-20 i.e. for 7 years. The second contention raised by the Ld. Counsel is that as evident from Para 3 and 4 of the said approval, there is no satisfaction arrived at independently by the competent authority for issuing such approval u/s.153D of the Act. The approval has been granted for two assesses viz. (i) Sr. No. 1: Pawan Kumar Agrawal; and (ii) Sr. No. 2: Smt. Mamta Agrawal and Sr.No.2 is the appellant assessee before this Bench. Rather, it is only borrowed satisfaction from the A.O due to which the approval u/s.153D of the Act was granted summarily in the case of the assessee which vitiates such approval in the eyes of law.

6. Per contra, the Ld. Sr. DR submitted that the approval u/s.153D of the Act has been granted by the competent authority after due application of mind and there is no infirmity in the said approval.

7. I have heard the parties herein, carefully perused the material available on record as well as analyzed the facts and circumstances in this case. That so far as the legal ground raised by the assessee is concerned, it has been contended that the approval granted u/s.153D of the Act by the competent authority is without application of mind. I have examined the approval of the competent authority as well as request letter from the A.O requesting for grant of such approval before the competent authority. It is clearly evidenced that the approval u/s. 153D of the Act was granted by the competent authority on the same date, on which, the request application has been made by the concerned A.O. The said approval has been given for A.Ys. 2013-14 to 2019-20 i.e. 7 years. On a careful reading of the said approval granted on 16.03.202, not even a word has been written by the competent authority which shows any independent application of mind. It is evident from Para 3 and 4 wherein the competent authority presumes that the A.O had given appropriate opportunity of hearing to the assessee and thoroughly verified seized material and that the A.O has satisfied himself that all the issues emanating from records have been verified and the additions wherever required have been proposed. Thereafter, the competent authority writes at Para 4 that “you may act accordingly”. That when the competent authority is issuing approval u/s. 153D of the Act for 7 years, he is not writing any findings regarding the fact or for that matter he is not providing any reasons so to understand his reasoning for granting of such approval. It is obvious that the approval is granted in a mechanical and summary manner and that too on the same date, on which, the request letter has been furnished before the competent authority. That further, the entire action has been taken on the basis of borrowed satisfaction from the A.O.

8. The Hon’ble High Court of Delhi in the case of PCIT v. Shiv Kumar Nayyar (Delhi)(HC) had an occasion to deal with an almost identical issue i.e. grant of approval u/s. 153D of the Act in a mechanical manner and without application of mind. For the sake of completeness, the relevant discussions of the said decision are extracted as follows:

“10. Before embarking upon the analysis of the factual scenario of the instant appeal, we deem it apposite to examine the underlying intent of the relevant provision of the Act i.e., Section 153D, which is culled out as under:-

“153-D. Prior approval necessary for assessment in cases or requisition.–No order of assessment or reassessment shall be passed by an Assessing Officer below the rank of Joint Commissioner in respect of each assessment year referred to in clause (b) of [sub-section (1) of Section 153-A] or the assessment year referred to in clause (b) of sub-section (1) of Section 153-B, except with the prior approval of the Joint Commissioner :

Provided that nothing contained in this section shall apply where the assessment or reassessment order, as the case may be, is required to be passed by the Assessing Officer with the prior approval of the [Principal Commissioner or Commissioner] under sub-section (12) of Section 144-BA.”

11. A plain reading of the aforesaid provision evinces an uncontrived position of law that the approval under Section 153D of the Act has to be granted for “each assessment year” referred to in clause (b) of sub-section (1) of Section 153A of the Act. It is beneficial to refer to the decision of the High Court of Judicature at Allahabad in the case of PCIT v. Sapna Gupta [2022 SCC OnLine All 1294] which captures with precision the scope of the concerned provision and more significantly, the import of the phrase- “each assessment year” used in the language of Section 153D of the Act. The relevant paragraphs of the said decision are reproduced as under:-

“13. It was held therein that if an approval has been granted by the Approving Authority in a mechanical manner without application of mind then the very purpose of obtaining approval under Section 153D of the Act and mandate of the enactment by the legislature will be defeated. For granting approval under Section 153D of the Act, the Approving Authority shall have to apply independent mind to the material on record for “each assessment year” in respect of “each assessee” separately. The words ‘each assessment year’ used in Section 153D and 153A have been considered to hold that effective and proper meaning has to be given so that underlying legislative intent as per scheme of assessment of Section 153A to 153D is fulfilled. It was held that the “approval” as contemplated under 153D of the Act, requires the approving authority, i.e. Joint Commissioner to verify the issues raised by the Assessing Officer in the draft assessment order and apply his mind to ascertain as to whether the required procedure has been followed by the Assessing Officer or not in framing the assessment. The approval, thus, cannot be a mere formality and, in any case, cannot be a mechanical exercise of power.

***

19. The careful and conjoint reading of Section 153A(1) and Section 153D leave no room for doubt that approval with respect to “each assessment year” is to be obtained by the Assessing Officer on the draft assessment order before passing the assessment order under Section 153A.”

[Emphasis supplied]

12. It is observed that the Court in the case of Sapna Gupta (supra) refused to interdict the order of the ITAT, which had held that the approval under Section 153D of the Act therein was granted without any independent application of mind. The Court took a view that the approving authority had wielded the power to accord approval mechanically, inasmuch as, it was humanly impossible for the said authority to have perused and appraised the records of 85 cases in a single day. It was explicitly held that the authority granting approval has to apply its mind for “each assessment year” for “each assessee” separately.

13. Reliance can also be placed upon the decision of the Orissa High Court in the case of Asst. CIT v. Serajuddin and Co. [2023 SCC OnLine Ori 992] to understand the exposition of law on the issue at hand. Paragraph no.22 of the said decision reads as under:-

“22. As rightly pointed out by learned counsel for the assessee there is not even a token mention of the draft orders having been perused by the Additional Commissioner of Income-tax. The letter simply grants an approval. In other words, even the bare minimum requirement of the approving authority having to indicate what the thought process involved was is missing in the aforementioned approval order. While elaborate reasons need not be given, there has to be some indication that the approving authority has examined the draft orders and finds that it meets the requirement of the law. As explained in the above cases, the mere repeating of the words of the statute, or mere “rubber stamping” of the letter seeking sanction by using similar words like “seen” or “approved” will not satisfy the requirement of the law. This is where the Technical Manual of Office Procedure becomes important. Although, it was in the context of section 158BG of the Act, it would equally apply to section 153D of the Act. There are three or four requirements that are mandated therein, (i) the Assessing Officer should submit the draft assessment order “well in time”. Here it was submitted just two days prior to the deadline thereby putting the approving authority under great pressure and not giving him sufficient time to apply his mind; (ii) the final approval must be in writing; (iii) the fact that approval has been obtained, should be mentioned in the body of the assessment order.”

[Emphasis supplied]

14. During the course of arguments, learned counsel for the assessee apprised this Court that the Special Leave Petition preferred by the Revenue against the decision in the case of Serajuddin (supra), came to be dismissed by the Supreme Court vide order dated 28.11.2023 in SLP (C) Diary no. 44989/2023.

15. A similar view was taken by this Court in the case of Anuj Bansal (supra), whereby, it was reiterated that the exercise of powers under Section 153D cannot be done mechanically. Thus, the salient aspect which emerges from the abovementioned decisions is that grant of approval under Section 15 3D of the Act cannot be merely a ritualistic formality or rubber stamping by the authority, rather it must reflect an appropriate application of mind.”

9. Further, the Hon’ble High Court of Delhi in the case of Pr. CIT v. MDLR Hotels (P) Ltd. (Delhi) has held that where competent authority accorded approval u/s. 153D of the Act as many as 246 proposed assessments mechanically by way of a single letter of approval without application of mind, the impugned assessment is liable to be quashed. For the sake of clarity, the relevant observations of the Hon’ble High Court are culled out as follows:

“3. It is the aforesaid facts which appear to have constrained the Tribunal to observe as follows:

“13. We have given thoughtful consideration to the orders of the authorities below and have carefully perused all the relevant documentary evidences brought on record. We have also gone through each and every approval granted by the Additional Commissioner of Income tax, Central Range – 2, New Delhi vis- a -vis, each and every proposal made by the DCIT, Central Circle -15, New Delhi.

14. The issue which we have to decide is, can these approvals be treated as fulfilling the mandate of provisions of section 153 D of the Act vis- a-vis legislative intent of the said section in the statute. Section 153 D of the Act reads as under :

“No order of assessment or reassessment shall be passed by an Assessing Officer below the rank of Joint Commissioner in respect of each assessment year referred to in clause (b) of section 153A or the assessment year referred to in clause (b) of sub – section (1) of section 153B, except with the prior approval of the Joint Commissioner. Provided that nothing contained in this section shall apply where the assessment or reassessment order, as the case may be, is required to be passed by the Assessing Officer with the prior approval of the Commissioner under sub- section (12) of section 144BA.”

15. The Legislative intent can be gathered from the CBDT Circular No.3 of 2008 dated 12.3.2008 which reads as under:

“50. Assessment of search cases Orders of assessment and reassessment to be approved by the Joint Commissioner.

50.1 The existing provisions of making assessment and reassessment in cases where search has been conducted under section 132 or requisition is made under section 132 A does not provide for any approval for such assessment.

50.2 A new section 153D has been inserted to provide that no order of assessment or reassessment shall be passed by an Assessing Officer below the rank of Joint Commissioner except with the previous approval of the Joint Commissioner. Such provision has been made applicable to orders of assessment or reassessment passed under clause (b) of section 153A in respect of each assessment year falling within six assessment years immediately preceding the assessment year relevant to the previous year in which search is conducted under section 132 or requisition is made under section 132A. The provision has also been made applicable to orders of assessment passed under clause (b) of section 153B in respect of the assessment year relevant to the previous year in which search is conducted under section 132 or requisitioned is made under section 132A.

50.3 Applicability- These amendments will take effect from the 1st day of June, 2007.”

16. The Legislative intent is clear from the above, in as much as, prior to the insertion of Sec.153D of the Act, there was no provision for taking approval in cases of assessment and reassessment in cases where search has been conducted. Thus, the legislature wanted the assessments/reassessments of search and seizure cases should be made with the prior approval of superior authorities which also means that the superior authorities should apply their minds on the material on the basis of which the officer is making the assessment and after due application of mind and on the basis of seized materials, the superior authorities have to approve the assessment order.

xxxx xxxx xxxx

18. In light of the afore-stated relevant provisions and legislative intent, approval dated 08.03.7.013 is in respect of 62 assessment orders as exhibited at pages 136 and 137 of the Index to Convenience Compilation furnished by the ld. counsel for the assessee. Approval dated 15.03.2013 is in respect of 37 assessment orders as exhibited at pages 138 and 139. Approval dated 18.03.2013 is in respect of 54 assessment orders as exhibited at pages 140 and 141. Approval dated 21.03.2013 is in respect of 24 assessment orders as exhibited at pages 142 and 143 and approval dated 25.02.2013 is in respect of 69 assessment orders as per exhibits in the Convenient Compilation.

19. Thus, the worthy Additional Commissioner of Income tax, Central Range – 2, New Delhi gave approval to 246 assessment order by a single approval letter u/s.153 D of the Act by mentioning as under:

“The above draft orders, as proposed, are hereby accorded approval with the direction to ensure that the orders are passed well before limitation period. Further, copies of final orders so passed be sent to this office for record.”

20. In our considered opinion, there is no whisper of any seized material sent by the Assessing Officer with his proposal requesting the approval u/s.153D of the Act. All the requests for approval are exhibited at pages 123 to 135 of the Convenience Compilation.

21. Even the approval granted by the Additional Commissioner of Income tax, Central Range – 2, New Delhi does not refer to any seized material/assessment records or any other documents which could suggest that the Additional Commissioner of Income tax, Central Range – 2, New Delhi has duly applied his mind before granting approvals.

xxxxx

5. In view of the aforesaid, we find no justification to interfere with the view expressed by the Tribunal. No substantial question of law arises. The appeals fail and shall stand dismissed.”

10. It has been well established through the various judicial pronouncements wherein it has been laid down the purpose for which, such approval u/s.153D of the Act is taken and what are the process which have to be complied with by the competent authority before issuing such approval. The Hon’ble Courts have held that if there is any approval given in mechanical and summary manner that itself defeats the purpose of Section 153D of the Act. The competent authority shall examine the case records for each of the assessment years and though it is not mandatory to give exhaustive reasons for such approval but at least requirement of law shall be complied if such authority pronounces few words in the said approval given which shall reflect his independent application of mind.

11. Reverting to the present case, on a perusal of entire approval order and as examined hereinabove, no such exercise has been done by the competent authority which itself vitiates such approval in the eyes of law and any proceedings thereafter shall have to be declared non-est as per law.

12. After giving thoughtful consideration to the matter on record and various decisions of the Hon’ble High Courts, I am of the considered view that the law is no more res-integra and the approval if granted in a mechanical manner wherein the approval letter itself does not disclose the reasons nor show any application of mind such an approval shall have to be held as void ab initio since it vitiates the very intent of the legislature enshrined u/s.153D of the Act. Therefore any proceedings on basis of such void approval thereafter shall become non-est in the eyes of law. I hold accordingly. Resultantly, the assessment order looses legal validity to sustain itself, hence quashed.

13. As per the aforesaid terms even without going into the merits of the matter on this legal premise itself the appeal of the assessee stands allowed. Since this legal ground is answered in affirmative, therefore, all other grounds on merits including any other legal grounds if any, becomes academic only.

14. In the result, appeal of the assessee is allowed.”

9. Respectfully following the aforesaid judicial pronouncements, on the same parity of reasoning, this legal ground is answered in favour of the assessee against the revenue. Since this legal ground is answered in affirmative, therefore, all other grounds on merits including any other legal grounds if any, becomes academic only.

10. In the result, appeal of the assessee is allowed.