ORDER

C.N. Prasad, Judicial Member. – All these appeals are filed by the assessee as well as revenue for the A.Ys 2016-17, 2020-21 and 2021-22 against different orders of the Ld. CIT(A)/NFAC, Delhi since all these appeals involve common issues, therefore, all of them were heard together and are disposed of by this common order for the sake of convenience.

2. First we take up the appeals for A.Y.2020-21 of assessee and revenue for A.Y. 2020-21 are also covers the issues in appeal of the assessee for the A.Y. 2021-22 in ITA No. 624/Del/2024 and Revenue’s appeal in ITA No. 4868/Del/2024 for the A.Y. 2016-17. The assessee and the revenue raised the following grounds of appeal for A.Y. 2020-21 : –

4960/Del/2024 A.Y. 2020-21 (Assessee’s appeal)

| 1) | | That the learned Commissioner of Income tax (Appeals) [“CIT (Appeals)”] erred on facts and in law in confirming the disallowance of variable license fee paid to Ministry of Information and Broadcasting (MIB) under section 35ABB of the Income Tax Act, 1961 [“Act”] which is applicable on companies providing telecommunication services while appellant is engage in providing Direct to Home (DTH) services. |

| 2) | | The appellant craves leave to add to, alter, amend, or vary the above grounds of appeal at or before the time of hearing. |

4966/Del/2024 A.Y. 2020-21 (Revenue’s appeal)

| 1. | | Whether Ld. CIT(A) has erred in deleting the disallowance of provision for interest on outstanding license fee of Rs. 119,01,19,717/- for AY 2020-21 and mentioning it as ascertained liability. Rs. 404640704. |

| 2. | | Without prejudice to the G.O.A. at S., No. 1 on provision for interest on outstanding license fee whether Ld. CIT(A) has grossly erred in considering interest on license fee (Provision) as 2 revenue expense even when the same has come into existence on the basis of license fee which has been considered to be a capital receipt by Hon’ble Supreme Court in the case of VIT v. Bharti Hexacom Ltd. (sc). |

| 3. | | Whether Ld. CIT(A) has erred in upholding that the variable license fee paid by the assessee is deductible as revenue expenditure and thereby deleting the addition of Rs. 159,38,43,254/- without considering the fact that it is capital in nature and has to be amortized as per the provision of section 35ABB of the Act. |

| 4. | | The appellant craves leave to add, alter or amend any/all of the grounds of appeal before or during the course of the hearing of the appeal. |

3. The brief facts of the case are that the assessee had entered into a contract with the Ministry of Information and Broadcasting, Government of India (“MIB”) for providing DTH services vide agreement dated 10.09.2007 (pages 168 to 182 of the paperbook) in terms of section 4 of the Indian Telegraph Act, 1885 (‘the Telegraph Act’) and Indian Wireless Telegraphy Act, 1933. In terms of the said licence agreement as clarified/ amended vide Order No. 8/12/2006-BP&L dated 6th November 2007 issued by MIB (pages 183 to 184 of the paperbook), the licencee (assessee) is required to pay licence fee; the terms related to such licence fee are as under:

“ARTICLE-3 “LICENCE FEE

3.1 The Licencee shall pay an initial non-refundable entry fee of Rs.10 crores before the issue of letter of intent to him by Licensor, and, after the issue of the Wireless Operational licence by the Wireless Planning and Coordination (WPC) Wing of the Ministry of Communications, an annual fee equivalent to 10% of its gross revenue in that particular financial year in the manner detailed hereunder.

Provided that the annual fee so payable by the licencee shall be paid in advance on a six monthly basis and on account payments made on this basis will be adjusted/reconciled when the annual audited accounts of the Company for that particular financial year are made available at the end of the financial year.

3.1.1 Gross Revenue for this purpose would the gross inflow of cash, receivable or other consideration arising in the course of ordinary activities of the Direct to Home [0TH] enterprise from rendering of services and from the use by others of the enterprise resources yielding rent, interest, dividend, royalties, commissions etc. Gross revenue shall, therefore, be calculated, without deduction of taxes and agency commission, on the basis of billing rates, net of discounts to advertisers. Barter advertising contracts shall also be included in the gross revenues on the basis of relevant billing rates. In the case of licencee providing or receiving goods and service from other companies that are owned or controlled by the owners of the licencee, all such transactions shall be valued at normal commercial rates and included in the profit and toss accounts of the licencee to calculate its gross revenue.

3.1.2 Every licencee shall maintain separate financial accounts for the channel, which shall be audited by the Statutory Auditors. At the end of each financial year, the company shall provide the statement of gross revenue forming part of the final accounts of the licencee as per the format in Form D, duly certified by the Statutory Auditors. It may be noted that the income heads specified in Form D are only indicative and illustrative and the Auditor would include all the relevant heads qualifying for gross revenue whether or not specifically included in the said format In addition, the income from the Related Parties shall have to tally with the Related Parties schedule as per Accounting Standards no. 18. Besides, the company shall disclose the following information at the end of each financial year, duly certified by the Statutory Auditor.

(i) Total trade and other discounts

(ii) Total agency commission

(iii) Total Related party transaction

3.1.3 So as to verify that the Gross Revenue is correctly disclosed to it, the Government of India shall have the right to get the accounts of any licencee audited by CAG or any other professional auditors at its discretion. In case of difference between the Gross Revenue determined by the Statutory Auditors and the Government appointed auditors, the views of the government appointed auditor, subject to opportunity of hearing to the licencee shall prevail and the expenses on such audit shall be borne by the licencee.

3.1A.1 The First payment of Annual licence fee for the financial year (FY) shall be made on the basis of provisional accounts for the FY certified by the Statutory Auditors, within one month of the end of that FY.

3.1A.2 Annual Licence fee for the FY shall be finally determined on the basis of final annual accounts of the FY audited by the Statutory Auditors, which shall not be later than 30th September of the following FY. If the amount so determined is found to be higher than the amount already deposited as per clause 3.1A.1, the difference amount along with simple interest @ 1% per month on the difference for the period of delay calculated from 1st of May of the following FY upto and including the date of such payment shall be paid in one lumpsum within a period of 15 days from the date of finalization of audited accounts, or 15th October of the following FY whichever is earlier.

3.1.A.3 Where the total annual fee deposited as per clause 3.1A.1 is more than the amount determined on the basis of audited accounts of the FY, the difference may at the request of the licencee be adjustable against the annual licence fee due for the following FY.

3.1A.4 In case any amount is to be deposited by the licencee as per provisions of clause 3.1.3 it shall be deposited within 15 days of such determination along with simple interest at the rate of 1% per month for the period from Ist May following the FY for which such determination has been made, upto and including the date of payment.”

4. In terms of the aforesaid Licence Agreement, the assessee was/ is required to pay: -One time non-refundable entry fee of Rs.10 crores prior to issuance of letter of intent from licensor.

– Annual licence fee @ 10% of the gross revenue earned during the period. It may be noted that such annual licence fee is to be paid on the basis of gross revenue as per the prescribed formula stated above (Adjusted Gross Revenue (AGR)]. Further, in terms of the contract, MIB is authorized to scrutinize the audited accounts of the assessee for a specified period to verify if the licence fee deposited by the assessee is in accordance with the formula as prescribed in the agreement and in case there is any difference in the amount so deposited by the assessee and the amount as computed by MIB, the same was payable by the assessee along with simple interest @ 1% per month on the difference for the period of delay.

5. In terms of the aforesaid contract, the assessee paid the initial non-refundable entry fee of Rs. 10 crore in financial year 2007-08; the said one-time non-refundable fees was debited to the profit and loss account by the assessee and was claimed as a revenue expenditure under section 37 of the Act in previous year relevant to assessment year 2008-09. The return filed for the said year has been duly accepted by the Revenue without any modification. Copy of the audited financial statements of the assessee for the year ending on 31.03.2008 and copy of acknowledgement of return of income alongwith computation of income of the assessee for the assessment year 2008-09 are placed at pages 672 to 697 of the paperbook. The assessee, in accordance with the terms of the agreement, has been paying Annual Licence Fee @ 10% of the gross revenue earned over the years.

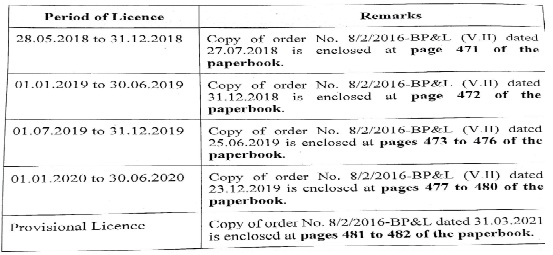

6. It is pertinent to note that, initially, MIB had granted the licence to the assessee for a period of 10 years, which was valid upto 10.09.2017. Thereafter, MIB vide order No.8/2/2016-BP&L dated 06.09.2017 had extended the validity of the said licence upto 27.05.2018. However, after 27.05.2018, the licence was extended for a period of 6 months at a time thereafter. The details of validity of the licence are tabulated as under.

7. For the relevant assessment year i.e. A.Y. 2020-21, the assessee filed its revised return of income on 31.03.2021 declaring total income of Rs.550,36,16,740/-. During the relevant year, the assessee incurred expenditure amounting to Rs.294,80,00,000 towards variable annual licence fees being 10% on AGR for renewal of the licence. The same being revenue expenditure was debited to the profit and loss account and has been claimed as deduction by the assessee while computing the business income.

8. Apart from the aforesaid, the assessee has a long-standing dispute with MIB regarding computation of AGR (qua inclusion/ exclusion of certain receipts while computing AGR); consequentially, quantification of variable licence fee is also a subject matter of dispute between the DTH companies (including appellant) and MIB since its inception. The issue was first considered by Telecom Disputes Settlement and Appellate Tribunal (TDSAT) and is presently pending before the Supreme Court, Considering that the assessee is required to pay interest @ 1% on delayed payment of variable licence fee as per the aforesaid agreement, the assessee has computed interest for period ending 31 March, 2020, payable as per terms of licence condition and in terms of the demand made by MIB vide various notices. The assessee has provided an incremental liability of Rs.119,01,19,717 for such interest, which has been claimed as deduction (refer page 266 of the paperbook).

9. Summarily, the assessee has, inter alia, claimed the following amounts as deduction in the return of income:

| (a) | | Rs.294,80,00,000 towards payment of variable annual licence fees, and |

| (b) | | Rs.119,01,19,717 as provision of interest on delayed payment of licence fee as per agreement owning to dispute in computation of AGR with MIB. |

Case of the assessing officer:

10. The case of the assessee was picked up for scrutiny assessment which culminated into order dated 28.09.2022 passed under section 143(3) of the Income Tax Act, 1961 (‘the Act’), In the assessment order, the income of the assessee was assessed at Rs.834,08,54,720/- inter alia, after making disallowance on account of the following:

| (i) | | Amortization of licence fee under section 35ABB |

Despite the specific submissions of the assessee that provisions of section 35ABB of the Act are not applicable to the assessee, the assessing officer proceeded to hold that the variable annual licence fee of Rs.294,80,00,000/- is required to be amortized over the period of licence under the said section. The assessing officer accordingly made the following disallowance:

| Variable Licence Fee Paid | : Rs.294,80,00,000 |

| Less: Amortization to be allowed | : Rs.135.41.56,746 |

| Net amount to be disallowed | : Rs.159,38,42,254 |

For making the aforesaid disallowance at pages 13 and 15 of assessment order, the assessing officer has referred to the stand of the Revenue in the case of Bharti Hexacom Ltd. (assessee’s sister concern – a telecom operator).

Disallowance of provision of interest qua delayed licence fee

(ii) The assessing officer has disallowed the sum of Rs.119,01,19,717/- towards provision of interest on delayed payment of licence fee recognized during the year. The assessing officer has held that the liability had not yet crystallized and hence was required to be disallowed, for the following reasons as stated at pages 14-15 of Assessment Order:

| (a) | | No payment for the said interest had been made during the year; |

| (b) | | No provision was created for the interest right from assessment year 2008-09 but only from assessment year 2015-16 when assessee received order for payment of outstanding licence fee from MIB on 19.04.2014; and |

| (c) | | Issue of quantification of AGR is subject matter of litigation before the Supreme Court and hence the amount of interest payable is not an accrued and ascertained liability. |

11. The sum and substance of the case of the assessing officer is that since the issue of AGR and consequential licence fee is pending before the apex Court, the liability of interest cannot be considered to have been crystallized to be allowed as deduction during the relevant year.

Decision of the CIT(A):

12. Against the aforesaid assessment order, the assessee filed an appeal before the National Faceless Appeal Centre [NFAC’ or ‘CIT(A)’] which was disposed off by the Ld.CIT(A) vide impugned order dated 27.08.2024, whereby the appeal of the assessee was partly allowed. The Ld. CIT(A) held as under:

| (i) | | Re: Amortization of licence fee under section 35ABB |

The CIT(A) upheld the applicability of section 35ABB of the Act holding that the issue is covered by the decision of the Hon’ble Supreme Court in the batch of cases titled as Commissioner of Income-tax v. Bharti Hexacom Ltd.ITR 593 (SC) [16-102023]. wherein the case of the assessee for earlier year (AY 2010-11) was tagged [para 69 of CIT(A) order].

The CIT(A) however held that since post expiry of original licence granted for 10 years (expired on 10.09.2017) the licence was periodically extended for period of six months (tabulated above), the licence fee was for the short-extended period and not for 10 years (as alleged by the AO). The assessee placed on record working of amortization of licence fee under section 35ABB of the Act considering licence period of six months taking into account fee for financial years 2018-19 and 2019-20 and computed amount of Rs.323,72,50,000 to be allowed. The CIT(A) however held that no amount in excess of amount charged in books would be allowed and hence restricted/ allowed the claim of Rs.294,80,00,000/- [Page 70 of CIT(A) order).

| (ii) | | Re: Disallowance of provision of interest qua delayed licence fee |

| (a) | | The obligation of interest payment @ 1% for delay in payment of licence fee was as per the agreement with MIB. |

| (b)While | | computing licence fee liability, the assessee claims certain deduction in calculating AGR which MIB did not accept, resulting in dispute between the assessee and MIB for quantification of licence fee. |

| (c) | | The issue was decided by TDSAT in favour of the assessee, relying on earlier order for telecom companies. The dispute in respect of such licence fee computation is now pending before the Apex Court for DTH industry. |

| (d)In | | case of telecom companies, the issue of computation of AGR has been decided against by the apex Court. |

| (e) | | Notices for enhanced liability were received by the assessee from MIB from time to time which included interest liability. |

In the aforesaid facts, the CIT(A), especially considering the obligation under the licence agreement, demand notices from MIB, and issue of AGR being decided against by the Apex Court judgment in case of telecom companies, held that the liability must be considered to be an ascertained liability notwithstanding that the issue is subject matter of challenge (pending) before the apex Court. Thus, the CIT(A) deleted the disallowance of interest made by the assessing officer.

Appeals before this Hon’ble Tribunal:

13. Against the aforesaid order passed by the CIT(A), the assessee as well as the Revenue has filed the captioned appeal. In the appeals filed by the assessee, the applicability of section 35ABB of the Act has been challenged. In the Revenue’s appeal, deletion of disallowance of licence fee on amortization for short period of licence (Ground No.3) and deletion of disallowance of provision of interest has been challenged (Ground No.1 & 2).

14. The Learned Counsel for the assessee inviting our attention to provision of Section 35ABB of the Act submitted that this provision shall apply only to the telecom operators and not for the assessee whose business is different since it is engaged in the business of DTH which is merely distribution platform that uses satellite services to broad cast television signals directly to subscriber’s homes via satellite dishes and set-top boxes.

15. The Ld. Counsel for the assessee further submitted that there is no definition for telecomm services in the Act but the provisions of section 80-IA has a reference to telecom services wherein deductions in respect of profit and gains from industrial undertakings or enterprises engaged in infrastructure development are allowed. Further Sub section (4) of 80-IA has a reference to infrastructure facilities and clause-(ii) of subsection (4) includes the undertaking which started or starts providing telecommunications services, whether basic or cellular, including radio paging, domestic satellite service, network of trunking, broadband network and internet services etc.

16. The Ld. Counsel further referring to section 72A(7)(iiia), submitted that the section defines what is an industrial undertaking and business of providing telecommunication services which would fall within the industrial undertaking but the DTH services are not defined anywhere in the provisions of the Act. Therefore, the Ld. Counsel submits that in the absence of definition for DTH services, the same will not fall within the ambit of the provisions of section 35ABB of the Act since the DTH services are not akin to telecommunication services.

17. The Ld. Counsel for the assessee further referring to clause (k) of section-2 i.e. “Definitions” in The Telecom Regulatory Authority of India Act, 1997 (TRAI) submitted that while defining telecommunication services in clause (k) the broadcasting services are excluded from telecommunication services. The Ld. Counsel further submitted that though in the TRAI Regulations it was provided that Central Government may notify other services / telecommunication services including broadcasting services, till now no notification has been issued by TRAI. The Ld. Counsel for the assessee further submitted that even regulatory wise also, the regulatory authorities are different for telecommunication services and DTH services. The Ld. Counsel for the assessee submitted that the telecommunication services are governed by Telecom Regulatory Authority of India and whereas the DTH services are governed by the Ministry of Information and Broadcasting Corporation.

18. The Ld. Counsel for the assessee further submitted that the Ld. CIT(A) placing reliance on the decision of the Hon’ble Supreme Court in the case of Bharti Hexacom Ltd. (supra) ruled that the variable license fee paid to Ministry of Information and Broadcasting is not allowable as revenue expenditure but is governed by provisions of section 35ABB of the Act. The Ld. Counsel for the assessee submitted that the issue before the Hon’ble Supreme Court in the case of Bharti Hexacom Ltd. (supra), though was related to variable license fee paid by the assessee but it was in connection with telecommunication services vis-a-vis the provisions of Section 35ABB of the Act, which are governed under TRAI Act and the Hon’ble Supreme Court did not deal with the variable license fee paid by the assessee to Ministry of Information and Broadcasting Corporation for the DTH services which are not akin to DTH services and do not fall under the ambit of provisions of the section 35ABB of the Act. The Ld. Counsel further submitted that the Ld. CIT(A) has simply followed the decision in the case of Bharti Hexacom Ltd. (supra) and did not deal with the applicability of provision of section 35ABB of the Act to the facts of the Assessee’s case.

19. The Ld. Counsel for the assessee further submitted that initially the license fee was granted from the year 2007 to 2017 and post the year 2017 the license fee was extended from time to time for every 6 months as per the guidelines issued from time to time, therefore, the variable license fee paid by the assessee to MIB for every 6 months has to be allowed as revenue expenditure as there is no enduring benefit so as to treat such payments as capital expenditure and apply the provisions of section 35ABB of the Act.

20. Coming to the appeal of the revenue the Ld. Counsel for the assessee submitted that ground No.1 and 2 are in respect of interest on outstanding license fee and the same was allowed consistently and, therefore, there is no reason to deviate for the assessment year under consideration and make disallowance of such provision of interest on outstanding license fee. The Ld. Counsel for the assessee further stated that the AO himself while completing the assessment years for the A.Y’s 2013-14, 2014-15, 2017-18 and 2019-20 allowed interest on outstanding license fee as deduction and, therefore, there is no reason for not allowing the same during the assessment year under consideration. Ld. Counsel placed reliance on the decision of the Hon’ble Supreme Court in the case of Bharat Earth Movers v. CIT (SC)/[2000] 245 ITR 428 (SC).

21. The Ld. Counsel for the assessee also made detailed submissions which are as under :-

“SUBMISSIONS OF THE ASSESSEE:

14. Brief submissions of the assessee in respect to the aforesaid appeals are as under:

Re: GoA No.1 (Assessee’s Appeal) & GoA.3 (Revenue’s Appeal): Licence fee u/s 35ABB

15. In this regard, it is respectfully submitted that the fundamental case of the assessing officer and CIT(A) in applying provisions of section 35ABB of the Act is patently erroneous, incorrect and not sustainable. For the said reason alone, the disallowance of licence fee could not have been made.

Re: Section 35ABB of the Act per se not applicable to the present case

16. The provision of section 35ABB of the Act reads as follows:

“Expenditure for obtaining licence to operate telecommunication services.

35ABB. (1) In respect of any expenditure, being in the nature of capital expenditure, incurred for acquiring any right to operate telecommunication services either before the commencement of the business to operate telecommunication services or thereafter at any time during any previous year and for which payment has actually been made to obtain a licence, there shall, subject to and in accordance with the provisions of this section, be allowed for each of the relevant previous years, a deduction equal to the appropriate fraction of the amount of such expenditure.

Explanation. For the purposes of this section,-

(i) “relevant previous years” means,-

(A) in a case where the licence fee is actually paid before the commencement of the business to operate telecommunication services, the previous years beginning with the previous year in which such business commenced;

(B) in any other case, the previous years beginning with the previous year in which the licence fee is actually paid,

and the subsequent previous year or years during which the licence, for which the fee is paid, shall be in force:

(ii) “appropriate fraction” means the fraction the numerator of which is one and the denominator of which is the total number of the relevant previous years;

(ii) “payment has actually been made” means the actual payment of expenditure irrespective of the previous year in which the liability for the expenditure was incurred according to the method of accounting regularly employed by the assessee.” (emphasis supplied)

17. Section 35ABB of the Act, thus, applies only where an assessee incurs a capital expenditure for obtaining/ acquiring any right to operate TELECOMMUNICATION SERVICES), and for which payment has actually been made for obtaining licence (to operate TELECOMMUNICATION SERVICES) Therefore, if the expenditure is not for obtaining or acquiring any right to operate telecommunication services under section 35ABB of the Act is not applicable.

18. The assessee, in the present case, is engaged in the business of providing direct-to-home (DTH) services which is BROADCASTING service; the said DTH/broadcasting services is clearly distinct from telecommunication service. The same is evident from the following illustrative facts, provisions and precedents:

18.1 Functional and technological distinction: The licensing regimes for the two industries are structured differently to reflect distinct communication models – telecom licenses are designed for interactive, bidirectional services, while broadcasting licenses focus on content delivery with no direct feedback from the audience.

Telecom service providers invest heavily in building and maintaining their own infrastructure relying on a network of cellular towers, fiber-optic cables, and satellites to offer voice, data, and broadband services; telecom operators build and maintain extensive terrestrial networks, including 4G/5G towers and data centers. Essentially, they manage end-to-end communication services.

In contrast, DTH is merely a distribution platform that uses satellites service to broadcast television signals directly to subscribers’ homes via satellite dishes and set-top boxes. DTH providers do not operate these satellites, nor do they own or create the content they deliver.

Thus, DTH service/ companies are distinguished from telecom service/companies as they focus exclusively on distribution aspect of broadcasting, merely facilitating content delivery rather than being extensively involved in setting up infrastructure for the provision of these services unlike telecom service providers.

Technologically also, DTH uses a satellite dish and a set-top box to receive and decode signals, while telecommunication includes various technologies like fiber optics, cellular networks, and broadband connections.

It is pertinent to note that DTH services are covered within the scope of broadcasting services as has been held by the apex Court recently in the case of State of Kerala v. Asianet Satellite Communications Ltd. State of Kerala v. Asianet Satellite Communications Ltd. (SC) dated 22.05.2025 in the context of excise/ service tax/Vat laws:

“12.4 In the year 2005, the Finance Act, 1994 was again amended to define “broadcasting” to include abroad casting agency or an organization collecting the broadcasting charges for transmission of electromagnetic waves through space or through cables, direct to home signals or by any other means to cable operator including multisystem operator or any other person on behalf of the said agency or an organization through any representative or agent appointed in India. Thus, service tax was levied on direct to home (DTH) broadcasting services.

Modus Operandi of the Assessees and their aspects:

13. As regards the business of the assessees herein, they are DTH broadcasting service providers licenced by the Central Government in terms of the provisions of Section 4 of the Indian Telegraph Act, 1885 and Sections of the Indian Wireless Telegraphy Act, 1933. Their modus operandi is that they set up a hub which enables them to downlink signals from the satellites of various broadcasters of TV channels (Star, BBC, etc.), then they uplink those signals to their own Ku Band (such as INSAT 4CR satellite) designated transponders for transmission of the signals in Ku band. These signals are received by the dish antennae which are installed at the subscribers’ premises. Since these signals are in encrypted form they are decrypted by the Set-Top Boxes and the viewing cards inside these boxes enable subscribers to view the various TV channels on their TV sets. Invariably, the set-top boxes are installed without any consideration and remain the property of the assessees.

13.1 If we closely examine the modus operandi of the activity undertaken by the assessees, it would be evident that their activity involves at least two aspects: the first, is the act of relaying the signals from the satellites of various broadcasters of TV channels, and the second, is the object of such relaying of the signals, which is the effect of the content delivered to the subscriber. This effect is nothing but the entertainment of the subscribers. In other words, the activity of the assessees involves at least two aspects which correspond to the subject-matter of the levy under the Central Finance Act, 1994, namely, broadcasting service and the respective State enactments as providing entertainment to the subscribers.”

18.2 Regulatory Authority: Broadcasting and telecommunications are subject to distinct regulatory frameworks and licenses due to the fundamental differences in the services they provide. DTH industry is under Ministry of Information and Broadcasting (“MIB”) while Telecom Industry is under Department of Telecommunications (“DoT”).

For telecommunications, the DoT issues an access service license, which governs the two-way communication between service providers and users. This enables telecom companies to offer a range of services, such as voice calls, text messaging, internet access, and other data-driven communication, where both parties can interact with each other in real-time.

In contrast, MIB is the nodal ministry for broadcasting which involves a one-way communication system, where content is transmitted from the broadcaster to the users through various distribution platforms such as DTH, IPTV, HITS, MSOS, LCOs, etc. Viewers consume the content but cannot directly communicate back with the broadcaster during the transmission.

18.3 Definitions under the Act:

The term ‘telecommunication services’ is not defined under section 35ABB of the Act. However, reference for the meaning of the term ‘telecommunication services’ can be drawn from the provisions of section 72A(7)(iiia) and 801A(4)(ii) of the Act, relevant extracts of which are reproduced hereunder:

“72A. (7) For the purposes of this section,

…………

(aa) “industrial undertaking” means any undertaking which is engaged in-

(i) the manufacture or processing of goods; or

(ii) the manufacture of computer software; or

(iii) the business of generation or distribution of electricity or any other form of power; or

(iiia) the business of providing telecommunication services, whether basic or cellular, including radio paging, domestic satellite service, network of trunking, broadband network and internet services, or

(iv) mining; or

(v) the construction of ships, aircrafts or rail systems;

“80-IA. (4) This section applies to-

…………..

(ii) any undertaking which has started or starts providing telecommunication services, whether basic or cellular, including radio paging, domestic satellite service, network of trunking, broadband network and internet services on or after the 1st day of April, 1995, but on or before the 31st day of March, 2005.

Explanation. For the purposes of this clause, “domestic satellite” means a satellite owned and operated by an Indian company for providing telecommunication service; “

From the perusal of the aforesaid provisions which inclusively define telecommunication services to include pager, internet, broadband, internet, network, and domestic satellite services (like ISRO) etc., it is evident that the Legislature does not intend to include DTH services within the scope of telecommunication services.

The same is supported by the fact that (i) DTH services providers, including the assessee have not claimed nor has the Revenue allowed deduction under section 801A under the Act; and (ii) benefit of carry forward of losses is also not allowed on amalgamation of companies providing DTH business.

The Memorandum Explaining provisions of Finance Act, 2002 which sought to provide benefit of section 72A of the Act qua accumulated losses on amalgamation to telecommunication service sector read as under :

“Incentive for amalgamation in telecom sector

Under the existing provisions contained in section 724 of the Income-tax Act, the benefit of curry forward of losses and unabsorbed depreciation is allowed in cases of amalgamation of a company owning an industrial undertaking or a ship, with another company. Industrial undertaking is defined to mean any undertaking which is engaged in the manufacture or processing of goods or computer software, the business of generation or distribution of electricity or any other form of power, mining or the construction of ships, aircrafts and railway systems.

With a view to encourage rapid consolidation and growth in an important infrastructural area it is proposed to extend the benefit under this section to an industrial undertaking engaged in the business of providing telecommunication services, related to infrastructure. This amendment will take effect from 1st April, 2003 and will, accordingly, apply in relation to the assessment year 2003-2004, and subsequent years.

Further, if DTH services were to be included within the scope of telecommunication services, the assessee would have been claiming the benefit of section 80LA of the Act. (clause 27)”

Thus, the law intended to provide benefit under section 72A to telecom sector and not to broadcast/ DTH service providers.

18.4 Most importantly, even The Telecom Regulatory Authority of India Act, 1997 expressly excludes broadcasting services from the definition of ‘telecommunication service provided under section 2(k) of the said Act, which reads as under.

“(k) “telecommunication service” means service of any description (including electronic mail, voice mail, data services, audio tex services, video tex services, radio paging and cellular mobile telephone services) which is made available to users by means of any transmission or reception of signs, signals, writing, images and sounds or intelligence of any nature, by wire, radio, visual or other electro-magnetic means but shall not include broadcasting services.

It may be noted that following proviso was inserted to the aforesaid definition w.e.f 24.01.2000:

“Provided that the Central Government may notify other service to be telecommunication service including broadcasting services.” However, till date, there has been no notification notifying broadcasting services to be considered/included as telecommunication service.

18.5 Insertion of section 35ABB much prior to DTH industry coming into existence Section 35ABB of the Act was inserted vide Finance Act, 1997 stating that capital expenditure incurred for acquiring any right to operate telecommunication services, shall be amortized over the unexpired period of licence, starting from the year of actual payment. The relevant extracts of Memorandum explaining provisions of Finance Bill 1997 are reproduced below: “Amortisation of telecom licence fees

In order to give fillip to this sector in addition to tax holiday, the Bill proposes to insert a new section 35ABB in the Income-tax Act. The section seeks to provide that any capital expenditure incurred and actually paid by an assessee on the acquisition of any right to operate telecom services by obtaining licence will be allowed as a deduction in equal instalments over the period for which the licence remains in force.

It further seeks to provide that where the licence is transferred and proceeds of the transfer are less than the expenditure remaining unallowed, a deduction equal to the expenditure remaining unallowed as reduced by the proceeds of transfer, shall be allowed in the previous year in which the licence has been transferred. It also seeks to provide that if the licence is transferred and proceeds of the transfer exceed the amount of expenditure remaining unallowed, the excess amount shall be chargeable to tax as profits and gains of business in the previous year in which the licence has been transferred. It also seeks to provide for amortisation of unallowed expenses in a case where a part of the licence is transferred. The restrictive provisions of this section shall not apply in relation to a transfer in a scheme of amalgamation whereby the licence is transferred by the amalgamating company to the amalgamated company, the latter being an Indian company.

The proposed amendment will take effect from 1st April, 1998 and will. accordingly, apply in relation to assessment year 1998-99 and subsequent years. [Clause 6]”

DTH services, however, were launched in India in early 2000s i.e., much later than insertion of section 35ABB in the statute, which establishes that it was never the intent of law to include broadcasting services within the scope of the said section. If the Legislature intended to cover broadcasting services within the purview of section 35ABB of the Act, the provision would have been suitably amended.

18.6 The assessee further understands that the provisions of section 35ABB of the Act has not been invoked in the case of any major DTH player in the Indian industry.

19. Considering the aforesaid legal position, it can be concluded that the provisions of section 35ABB of the Act are not applicable in the case of the assessee, as there is a clear distinction between telecommunication services and broadcasting services with the assessee being engaged in the latter business.

20. It is submitted that the aforesaid fundamental and pivotal fact that the assessee is not engaged in providing telecommunication services and hence provisions of section 35ABB of the Act are per se not applicable have been glossed over by the lower authorities in ignorance of specific averment made by the assessee.

21. The judgement in the case of CIT v. Bharti Hexacom Ltd. [2023] Commissioner of Income-tax v. Bharti Hexacom Ltd. ITR 593 (SC) has been relied by the CIT(A) to consider the impugned license fee as capital expenditure to be amortized under section 35ABB of the Act. In this regard, it is submitted that in the said case, the controversy related to the assessees/ companies engaged in the business of telecommunication services and had procured licences in different telecom circles. In the present case, as clearly explained above, the assessee is not engaged in telecommunication business but broadcasting/ DTH business, which is completely separate from the former (telecommunication) industry and to which provisions of section 35ABB of the Act do not apply. Being so, the aforesaid judgment of the apex Court has no application in the facts of the present case.

22.In view of the aforesaid, since provisions of section 35ABB of the Act are not applicable to the assessee, not engaged in telecommunication services, the question of any amortization of the variable licence fee does not arise; thus, the disallowance made by the assessing officer is erroneous. The variable licence fee is thus allowable revenue deduction under section 37 of the Act.

Assessee’s case for assessment year 2010-11 tagged with Bharti Hexacom batch

23. Furthermore, as regards averment that the case of the assessee was also tagged in the aforesaid judgement of the Supreme Court, it is submitted that the case appearing vide Civil Appeal No. 6897/2018 [SLP (C) No. 019426/2018] in the list of cases is the appeal of Revenue Department before the apex Court in the case of the assessee for AY 2010-11 which was tagged and disposed with Bharti Hexacom (supra) batch. In this regard, it may be noted that the assessee company had already (prior to the decision of the apex Court) settled the appeal pertaining to assessment year 2010-11 under Direct Tax Vivad se Vishwas Scheme, 2020 (DTVSV), Copy of Form 5 issued under the DTVSV in this regard is placed at page 671 of the paperbook. The Revenue, however, failed to withdraw the appeal for reason best known to the Revenue and hence the name of the assessee continues to appear in the batch of cases. Since the appeal had already been settled before the decision by the apex Court, it cannot, in our submissions, be averred that the appeal is decided against the assessee by the apex Court. In that view of the matter, no adverse inference could be drawn against the assessee.

24. Be that as it may, it is submitted that the assessee makes payment of variable licence fee annually; the said payment is computed with reference to the annual gross revenues; the licence fee is for the recurring permission to operate to provide DTH services to the customers; the benefit available by making the payment of annual licence fee lasts for that particular year only, and the subsequent year is a standalone year for which the assessee has to again make payment towards licence fee, as percentage of gross revenue; non-payment of licence fees could result in cancellation/ revocation in terms of the licence agreement (refer Article 15 of Licence Agreement for Termination). In the said facts, the annual variable licence fee is, in our submissions, clearly revenue in nature and incurred wholly and solely for business purposes and hence allowable deduction under section 37 of the Act.

25. Support in respect of license fee being revenue in nature can also be drawn from operating guidelines of 30th December 2020 issued by the MIB (handed during course of hearing), which provides that the no entry fee shall be charged for renewal of DTH licence, such operators are liable to pay only variable license fees based on revenue earned on a yearly basis at the specified percentage. Thus, on renewal, the obligation to pay licence fee pertains only to the year in which revenue is earned. As there is no enduring benefit being achieved through the payment of license fees on a yearly basis, the same is allowable under section 37 of the Act.

26.

It is settled law that recurring consideration paid for use cannot be equated to price paid for acquisition of any asset and thus, the fees paid will be treated as revenue expenditure [refer Mewar Sugar Mills Ltd. v.

CIT, [1973] 3 SCC 143,

Empire Jute Co. Ltd v.

CIT (SC), Gotan Lime Syndicate v.

CIT 59 ITR 718 (SC)].

27. In view of the aforesaid, the annual variable licence fee paid by the assessee with reference to adjusted gross revenue for the year is clearly allowable revenue expenditure.

Without prejudice- full amortization under section 35ABB in same year

28. Strictly without prejudice to the aforesaid and in the alternative, if one is to assume that section 35ABB of the Act is applicable to the present case and the licence fee/ expenditure is to be amortized thereunder, even then, for the year under consideration, the entire licence fee deserves to be amortized over the period of licence (6 months):

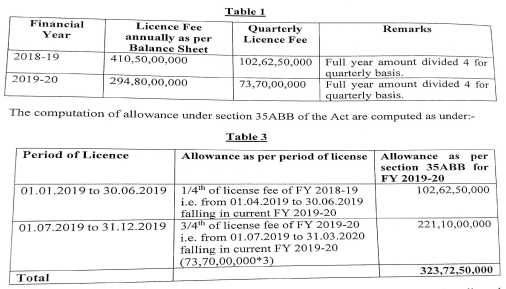

29. In terms of section 35ABB of the Act read with the Explanation thereto, expenditure is required to be amortized in appropriate fraction over the period in which licence is paid till the licence is in force. In the present case, since the validity of licence for the relevant year is for six months at one time (discussed supra), the annual licence fee is required to be amortized over the period of licence. The working of the same is given as under:

Details of licence fee as per the Audited Financial Statements are as under:-

30. Considering the aforesaid, on without prejudice basis, the appellant must be allowed deduction of Rs.323,72,50,000 if section 35ABB of the Act is held to be applicable; the action of the CIT(A) in restricting the claim to Rs.294,80,00,000 is incorrect.

Re: GoA.1 & 2 (Revenue’s Appeal): Interest on licence fee-ascertained liability

31. As explained supra, the DTH industry (including the assessee) has a long-standing dispute with MIB regarding computation of AGR (qua inclusion/ exclusion of certain receipts/amounts from AGR); consequentially, quantification of variable licence fee is also a subject matter of dispute between the DTH companies and MIB since its inception. The said dispute is presently pending before the Supreme Court. Considering that the assessee is required to pay interest @ 1% on delayed payment of variable licence fee as per the Licence Agreement, the assessee has computed interest for period ending 31″ March 2020, payable as per terms of licence condition and as determined by MIB; consequently, the assessee has provided an incremental liability of Rs.119,01,19,717 for such interest, which has been claimed as deduction [refer page 266 of paperbook).

32. The assessing officer has disallowed the aforesaid claim holding that since the issue of AGR and consequential licence fee is pending before the apex Court, the liability of interest cannot be considered to have been crystallized/ ascertained and hence is not allowable.

33. Appreciating the factual matrix in detail and applying the settled legal position, the CIT(A) has rightly allowed deduction of the interest provided for deleting the disallowance made by the assessing officer. The Revenue has accordingly filed the captioned appeal.

34. In this regard, it is respectfully submitted that the action of the CIT(A) in treating the provision for interest on delayed payment of licence fee as an ascertained liability deserves to be upheld and Revenue’s appeal is liable to be dismissed for the reasons explained in detail infra:

35. The relevant facts in relation to the issue under consideration, which clearly demonstrate that incremental provision of Rs. 119,01,19,717, towards interest obligation for delayed payment of licence fee, is an ascertained liability, are as under:

35.1 It is emphatically reiterated that in terms of the Licence Agreement, the assessee was/is required to pay annual licence fee @10% of the gross revenue earned during the period. Such annual licence fee is to be paid on the basis of gross revenue as per the prescribed formulae. Further, in terms of the contract, MIB is authorized to scrutinize the audited accounts of the assessee for a specified period to verify if the licence fee deposited by the assessee is in accordance with the formula as prescribed in the agreement and in case there is any difference in the amount so deposited by the assessee and the amount as computed by MIB, the same was payable by the assessee along with simple interest @ 1% per month on the difference for the period of delay [refer Article 3 of the License Agreement).

Thus, the obligation of payment of interest is expressly arising from the binding license agreement entered into between the assessee and the ministry. The said Licence Agreement unambiguously lays down all the factors for interest obligation including – the principal, i.c., the amount of license fee, the rate i.e., 1% per month, and the period, i.e., days by which payment of licence fee is delayed. The provision recognized and claimed by the assessee is undisputedly computed as per terms defined in the Licence Agreement -computation of provision is placed at page 266 of the paperbook.

35.2 The assessee has been computing and paying the variable licence fee @ 10% of Adjusted Gross Revenues as per its own computation after making certain exclusions/ deduction. Initially, the dispute was decided by TDSAT vide order dated 28.05.2010 (copy of the order is placed at pages 243 to 265 of the paperbook, which allowed certain deductions claimed by the appellant. The dispute is now pending before the Supreme Court.

It may be noted that the TDSAT decided the issue basis its earlier order dated 07.07.2006 in the case of Association of Unified Telecom Service Providers of India (AUSPI) v. Uol. The said order of TDSAT was, however, later reversed by the apex Court in Civil Appeal No.5059 of 2007 in the case of Uol v. AUTSPI holding that the Tribunal did not have jurisdiction to decide validity of definition of Adjusted Gross revenues in the licence agreement.

35.3 The appellant thereafter received demand notices dated 19.03.2014 for enhanced licence fee as well as interest on outstanding licence fee which quantified outstanding licence fee of Rs.243.78 crores and interest of Rs.54.72 crores upto 19.03.2014. On application by the assessee, the TDSAT, vide order dated 04.04.2014, granted an interim protection and directed that “the UOI shall not take any coercive measure against the Petitioner for realization of the impugned demand” (copy of the order is placed at pages 459 to 460 of the paperbook).

35.4 In pursuance of the said dispute(s)/ demand notices, the assessee has created provision for interest on delayed payments of licence fee as per terms of the Licence Agreement; the provision has consistently been created with effect from financial year 2012-13 and onwards.

35.5 It is pertinent to note that similar issue relating to computation of AGR with respect to deduction/ exclusion of certain items was raised in the case of telecom companies. During the year under consideration, the apex Court has, vide order dated 24.10.2019, decided the issue against the telecom companies qua exclusion of various items while computing AGR and consequential licence fee (copy of the order is placed at pages 267 to 419 of the paperbook). As the matter pertaining to AGR dispute in respect of both telecom and DTH companies is similar in nature, the said findings of the Hon’ble Supreme Court shall have a strong bearing on the similar matter pending regarding the DTH companies

Most importantly, the Hon’ble Supreme Court in the aforesaid judgement specifically ruled on the issue pertaining to liability of interest in case of delayed payment of licence fee, holding that the interest can be levied and compounded in case there is a contractual obligation (refer pages 267 to 419 @398-418 (para 197) of the paperbook).

Considering the said unfavorable judgment for telecom industry, the ongoing litigation for DTH industry, including the assessee, is likely to result in outflow of enhanced licence fee and interest thereon.

35.6 The MIB has, from time to time, issued fresh letter demanding licence fee and interest as under:

– dated 19.03.2014 for enhanced licence fee of Rs.243.78 crores and interest of Rs.54.72 crores upto 19.03.2014;

dated 21.12.2020 for enhanced licence fee of Rs.1642.37 crores for period 2006-07 to 2018-19 alongwith interest (not quantified)- refer pages 491 to 494 of paperbook;

– dated 26.10.2022 for enhanced licence fee of Rs.483.59 crores for period 2019-20 to 2020-21 alongwith interest (not quantified)- refer pages 489 to 490 of paperbook;

– dated 31.03.2023 demanding the outstanding licence fee of Rs. 1657.71 crores and interest for various years aggregating to Rs.1074.31 crores including Rs.116.20 crores for financial year 2019-20- refer pages 486 to 488 of paperbook.

35.7 It is most important to note that enhanced license fee computed as per AGR calculation by the Ministry, though disputed by the assessee, has been considered for allowance by the assessing officer, albeit in terms of section 35ABB of the Act. Being so, the interest thereon arising out of the same contractual license between the assessee and MIB could not be considered as uncertained.

36. In the aforesaid facts, particularly that – (i) obligation to pay interest is arising out of the binding contract/ licence agreement between the assessee with MIB; (ii) the disputed principal amount of licence fee is considered allowable by the assessing officer; (iii) similar issue in respect of computation of AGR and consequential licence fee is decided against the telecom services providers by the Supreme Court; (iv) demand notices consistently issued by MIB for enhanced licence fee and interest from time to time; and (iv) provision for interest is computed strictly in line with the licence agreement, the same is, in our submissions, clearly an ascertained liabilityallowable deduction notwithstanding that issue is pending before the Supreme Court for final determination.

37. The aforesaid provision for interest is recognized in accordance with the terms of applicable Ind AS and binding accounting guidelines mandated as per the Companies Act.

38. Reference, in this regard, may also be made to the judgment of the Supreme Court in the case of

Rotork Controls India (P) Ltd. v.

CIT: 314 ITR 62 wherein, in context of allowability of provision for warranty expenses, it has been held that “17. At this stage, we once again reiterate that a liability is a present obligation arising from past events, the settlement of which is expected to result in an outflow of resources and in respect of which a reliable estimate is possible of the amount of obligation.

39. The assessee duly satisfies all the conditions laid down by the Hon’ble Supreme Court in the case of Rotork Controls India P. Ltd (supra), as demonstrated hereunder:-

i. an enterprise has a present obligation as a result of past event;

The assessee entered into agreement with MIB on 10.09.2007 as per which it has a contractual obligation to pay interest on license fee to MIB (refer Para No.3.1.A.4). Thus, there is a past event and as a result of which the assessee has created a provision for interest on license fee, which is a present obligation.

ii. it is probable that an outflow of resources will be required to settle the obligation;

As per terms of agreement with the MIB, the interest is due and payable, hence the same is provided in the Profit & Loss Account. However, due to pendency of AGR litigation before the Hon’ble Supreme Court, as stated earlier, the TDSAT had directed the MIB to not take any coercive action to enforce recovery of the financial demand payable, consequent to its order. Further, considering the judicial landscape, particularly the fact that similar issue is decided against the telecom operators by the apex Court, the probability of outflow in future is likely.

iii. reliable estimate can be made out of the amount of the obligation.

The assessee has made provision of interest @ 1% per month as prescribed under the Licence Agreement; hence accurate calculation, as per agreed terms in the contract, was made for determining the interest liability.

The aforesaid provision for interest cannot, in the stated facts, be considered as unascertained as alleged by the assessing officer.

40. It is now a settled position that provisions for liabilities made on scientific and rational basis are allowable as deduction while following mercantile accrual system of accounting even though its actual quantification and discharge is deferred to a future date [refer Calcutta Discount Co. Ltd.

37 ITR 1 (SC), Metal Box (P) Limited (1969): 73 ITR 53

(SC), United Commercial Bank v.

CIT 240 ITR 355 (SC), Bharat Earth Movers: (SC)/[2000] 245 ITR 428 (SC) (SC)].

41. As regards the allegation of the assessing officer that since the issue of quantification of AGR and consequential licence fee is pending/ disputed before the apex Court, the provision for interest for delay in payment of such licence fee made is an unascertained liability is erroneous and completely devoid of merits.

42. It is submitted that merely because the demands raised/ issue of enhanced licence fee is subject matter of challenge before the higher forum/ apex Cesart, the same cannot, in our submissions, be a reason to hold that the same is an ascertained liability.

43. It is reiterated that interest, in the present case, is for delay in payment of license fee; since the obligatory event, i.e., liability to pay annual licence fee had already occurred, the quantification of such interest is made on basis provided in the licence agreement and there are reasonable chances of outflow of resources in future, the provision created is towards an ascertained liability and thus calls for being allowed, notwithstanding that final quantification is disputed before the apex Court.

44. The case of the assessee is squarely covered by the decision of the

Delhi High Court in the case of Aggarwal and Modi Enterprises (Cinema Project) Co. (P.) Ltd. v. CIT

[2016] 381 ITR 469 (Del.). In that case, the assessee company had entered into an agreement with New

Delhi Municipal Council (NDMC”) to operate licence for running a cinema hall for a period of 10 years. Litigation ensued between the assessee and NDMC regarding increase in the annual licence fee payable by the licensee. Further, as per terms of agreement, the assessee was also required to pay interest on delayed payment of annual licence fee. The dispute/ litigation qua additional licence fee reached the Hon’ble Supreme Court. As the matter was pending, the assessee had created provision for interest on non-payment of increased annual licence fee. The AO had disallowed the provision of interest holding that since the dispute was pending adjudication before the Courts, the interest as demanded by NDMC was a contingent liability and hence could not be allowed. The disallowance was upheld by the Tribunal.

On appeal before the High Court, the Court held that whether a liability is ascertained or contingent is dependent on the facts of each case. The Court held that merely because a liability may be contractual or non-statutory would not make it incapable of being ascertained; where an assessee follows the mercantile system of accounting, it is not necessary that the liability must have actually been incurred during the assessment year in question to enable the assessee to claim it as an expense or deduction, as the case may be. The Court held that challenge of liability before the High Court cannot result in the same being unascertained; the crux of the matter is the reasonable certainty with which the liability can be ascertained. The relevant findings of the Court are reproduced below:

“47. A conspectus of the above decisions reveals that whether a liability is ascertained or contingent is dependent on the facts of each case. Merely because a liability may be contractual or non-statutory would not make it incapable of being ascertained. Where an Assessee follows the mercantile system of accounting it is not necessary that the liability must have actually been incurred during the Al in question to enable the Assessee to claim it as an expense or deduction as the case may be. The crux of the matter is the reasonable certainty with which the liability can be ascertained.

48. Coming to the facts of the present case it is not as if the Assessee has disputed its liability to pay licence fee. In other words during the AYs in question it continued to pay the annual licence fee to the NDMC and in those years it was protected in terms of an Interim order. What was being disputed by the Assessee in the suit initiated by it against the NDMC was the reasonableness of the enhancement of the licence fee at the stage of renewal of the licence. There is a distinction, therefore, to be drawn between disputing the liability as such and disputing the reasonableness of the enhancement of the licence fee.

49. What appears to have weighed with the CIT(A) as well as the ITAT in the impugned order in these cases is that in the suit filed by the Assessee an averment was made that it had not voluntarily signed on the Agreement dated 23rd September, 1980 and had averred that the Agreement having been “got signed by the NDMC authorities from the Directors under undue influence and coercion is illegal and not enforceable in law.” What also weighed with the ITAT is that the Assessee could not on the one hand challenge the validity of the said agreement and on the other urge the Department to act upon it because it is beneficial to the Assessee.

50. There appears to be a misconception on the question regarding an accrued liability in the hands of the Assessee in the above circumstances. In terms of the interim orders passed by the Court which were conditional upon the Assessee making a certain payment. what was being made clear was that the Assessee’s contention regarding legality of the renewed licence agreement was still to be determined. In other words, the Assessee could not, during the pendency of the suit, claim that it had no liability under the renewed licence agreement. It was granted interim protection on the express understanding that it would abide by the interim order of the Court which was in itself an acknowledgement that the liability under the renewed licence deeds continue as long as the suit is pending. However, the only concession was that the Assessee would pay the reduced licence fee for the renewed period which was 30 per cent over and above the original licence fee. In the circumstances, there was no question of there being no liability on the Assessee whatsoever for the renewal of the licence. Merely because the Assessee had chosen to challenge in Court the enhancement of the licence fee, which was permissible to be raised by it in accordance with law, did not preclude the Assessee, which was following the mercantile system of accounting, from claiming it as a liability during the AYs in question. The Court, therefore, does not, in view of the averments made by the Assessee in the pleadings in the suit filed by it against the NDMC, as a reason to preclude the Assessee from claiming the licence fee, the head office fee and the interest on arrears payable to the NDMC in terms of the renewed licence deed as a liability for the AYs concerned.

51. The ITAT also appears to have drawn a distinction between a statutory liability and a contractual liability and opined that a deduction in respect of the contractual liability would be permissible “only when the disputes are settled.” This is contrary to the legal position as explained in the above decisions of the Courts. Even where a challenge is laid to a liability arising under a contract, by a challenger initiating legal proceedings, such challenger can still for the purposes of its accounts and for the purposes of computation of its income tax liability claim the entire amount under challenge as an accrued liability as long as such amount is ascertainable. Corresponding adjustments would be made in the year in which the suit is finally decided or the disputes settled.

That, however, would not preclude the Assessee from claiming it as an ascertained liability.”

45. The Supreme Court in CIT v. Jagdish Prasad Gupta (SC) dismissed SLP filed against the decision of Hon’ble Delhi High Court (Del). which held that since assessee was following mercantile system of accounting, the liability to pay enhanced licence fee to the Railways for grant of license would arise in the year in which demand was made by the Railways irrespective of the fact when such enhanced fee was actually paid by assessee.

46. To the same effect is the decision of the

Delhi High Court in the case of

R.C. Gupta v.

CIT: 298 ITR 161, wherein it was held that contractual liability for purchases is allowable deduction in the year in which the assessee had incurred such liability and the payee files suit for recovery, dehors the fact that liability was disputed by the assessee.

47. In the case of

National Agricultural Cooperative Marketing Federation of India Ltd. v.

CIT: [2017] 393 ITR 666 (

Delhi), the assessee claimed deduction of interest determined to be payable under an arbitration award dated 28.01.2000. On appeal filed by the assessee. Division Bench (DB) of the High Court, by an order dated 28.02.2001, granted stay of the execution of the said decree. For tax purposes, claim of such interest payable by assessee on amount awarded was disallowed by assessing officer by holding that liability was contingent and not even acknowledged in the books of account. The Special Bench of Tribunal held that since the decree was stayed by the Division Bench, there was no liability on assessee to pay interest. On appeal, the High Court held that since award had been made rule of Court by a Single Judge of High Court, the mere fact that the said judgment and decree was stayed by the Division Bench would not relieve assessee of its obligation to pay interest in terms thereof and such liability commenced in previous year in which judgment and decree was passed by the Single Judge and, consequently, assessee incurred liability to pay interest and was entitled to deduction under section 37(1) of the Act.

48. The Gujarat High Court in the case of

Navjivan Roller Flour & Pulse Mills Ltd. v.

DCIT: 315 ITR 190 (Guj.) held that the liability to pay damages would arise on date of award for damages even if award was challenged by assessee in further appeal, which was pending. Accordingly, the damages were held allowable deduction under section 37(1) of the Act in the year of award.

49. Reliance in this regard is placed on the following decisions wherein it has been held that in the mercantile system of accounting, liability for amount accrued/ expenditure incurred is to be allowed as deduction, though the same is to be discharged at a future date:

The apex Court in the case of Bharat Earth Movers v. CIT: (SC)/[2000] 245 ITR 428 (SC) (SC) held as under:

“4. The law is settled: if a business liability has definitely arisen in the accounting year, the deduction should be allowed although the liability may have to be quantified and discharged at a future date. What should be certain is the incurring of the liability. It should also be capable of being estimated with reasonable certainty though the actual quantification may not be possible. If these requirements are satisfied, the liability is not a contingent one. The liability is in praesenti though it will be discharged at a future date. It does not make any difference if the future date on which the liability shall have to be discharged is not certain.

(

f)

Calcutta Company Ltd v.

CIT: 37 ITR 1 (SC)

(

g)

Metal Box Company of India Ltd v.

Their Workmen: 73 ITR 53 (SC)

(h) CIT v.

Woodward Governor India Pvt Ltd: 312 ITR 254 (SC)

(

i)

CIT v.

U.P. State Industrial Development Corporation: 225 ITR 703 (SC)

(

j)

CIT v.

Burhwal Sugar Mills Co Ltd: 82 ITR 784 (All)

(

k)

Madho Mahesh Sugar Mills Ltd v.

CIT: 92 ITR 503 (All)

(

l)

Delhi Flour Mills Co Ltd v.

CIT: 95 ITR 151 (Del)

(

m)

CIT v.

Laxmi Sugar & Oil Mills Ltd: 114 ITR 684 (All)

(

n)

Eddy Current Controls (India) Ltd v.

CIT: 198 ITR 491 (Ker)

50. In view of the aforesaid, it is submitted that, in the present case, the assessee had an obligation to pay interest, arising as a result of contract entered into with MIB; the liability to pay interest has crystallized in light of the attendant circumstances; the same is an ascertained liability quantified with reasonable certainty. Thus, the provision for interest created by the assessee is an allowable deduction under section 37(1) of the Act.

51. It may be reiterated that the assessee has also created provision for the enhanced licence fee (principal amount), which is disputed before the apex Court. The said licence fee is allowed by the Revenue albeit under section 35ABB of the Act there is no dispute as to the same delayed payment of such licence fee is unascertained is self-contradictory and not sustainable.

52. Be that as it may, it may kindly be appreciated that if the aforesaid liability of interest is ultimately, for any reason, not paid/charged by the assessee, the same shall be offered to tax in the year of cessation of such liability in terms of provisions of section 41(1) of the Act.

53. In view of the aforesaid, the disallowance of provision for interest made by the assessing officer treating the same as unascertained liability is not sustainable, the action of the CIT(A) in deleting the disallowance and allowing claim of interest provided for deserves to be upheld.

Principles of consistency

54. It may be noted that assessee has been consistently creating such provision for interest qua delayed payment of licence fee since assessment years 2013-14 and onwards. It is pertinent to note that the claim of deduction of such provision for interest has been accepted by the Revenue in completed scrutiny assessments for various past years, viz., assessment years 2013-14, 201415, 2017-18. Further, similar claim of interest also stood accepted in assessment year 2019-20, albeit under section 143(1) of the Act.

55. In this regard, it is submitted that once the facts permeating through the years are the same, there is no reasonable basis to take contrary stands in different years. Thus, no disallowance is called for even on principles of consistency. Reliance in this regard is placed on the following cases:

– Radhasoami Satsang v. CIT 193 ITR 321(SC)

– CIT v. Excel Industries (P) Limited: 358 ITR 295 (SC)

– Shasun Chemicals & Drugs Ltd. v. CIT: 388 ITR 1 (SC)

– DIT (E) v. Apparel Export Promotion Council: 244 ITR 734 (Del)

– CIT v. Neo Polypack (P) Ltd: 245 ITR 492 (Del.)

– CIT v. Girish Mohan Ganeriwala: 260 ITR 417 (P&H)

– CIT V. Dalmia Promoters Developers (P) Ltd: 200 CTR 426 (Del.)

– Escorts Cardiac Diseases Hospital: 300 ITR 75 (Del)

– CIT v. Rajasthan Breweries Limited.: ITA 889/2009 (Del.)-Revenue’s SLP dismissed (CC 1379/2014)

– PCIT v. Quest Investment Advicors Pvt. Ltd.: (Bom.)

56. For the aforesaid reason too, the disallowance made by the assessing officer treating the liability for interest as unascertained is, in our respectful submissions, not sustainable.

Alleged capital nature of interest

57. As regards the alternate contention raised by the Revenue, without prejudice, in ground of appeal no.2 that the interest expenditure is not deductible as revenue expenditure, as the same comes into existence on the basis of licence fee held to be capital in nature, in terms of judgement of the apex Court in the case of Bharti Hexacom (supra), it is submitted as under:

57.1 It is, at the outset, submitted that the averment made by the Revenue in the ground of appeal qua provision for interest to be considered as capital expenditure is neither the basis of disallowance nor was the case of

the Revenue before the lower authority. It is trite law that it is not open for the Revenue to change the complexion of the case for the first time before the Tribunal, the Tribunal is not vested with power of enhancement or to withdraw relief granted by the assessing authority [refer MCorp Global (P.) Ltd. v.

CIT: [2009] 309 ITR 434

(SC), Indian Steel & Wire Products Lid, v.

CIT: 208 ITR 740

(Cal.), Daimler India Commercial Vehicles (P.) Ltd. v.

DCIT: 416 ITR 343 (Mad)- Revenue’s SLP dismissed).

57.2 Be that as it may, interest is for delay in payment of annual licence fee as per the terms of the agreement entered into with MIB. The compensatory interest does not result in any capital asset or right coming into existence; the said interest is thus required to be expensed off in any case. The same is thus clearly a revenue expense; there cannot be any dispute whatsoever qua allowability of the same.

Reliance, in this regard, is placed on the following cases, wherein, the Courts have held that interest/damages paid for breach of contract, carried on in the normal course of business, is in the nature of expenditure incurred wholly and exclusively for purposes of business, allowable as deduction under section 37(1) of the Act:

(o) Prakash Cotton Mills Ltd. v. CIT: 201 ITR 684 (SC)

(p) CIT v. Desiccant Rotors International (P.) Ltd.: 347 ITR 32 (Del.)

(q) CIT v. Enchante Jewellery Ltd.: (Del.)

(r) New Mahalaxmi Silk Mills Pvt. Ltd.: 206 ITR 302 (Bom.)

(s) Golder v. Great Boulder Mines: 33 TC 75

(t) Sardar Prit Inder Singh v. CIT: (P&H)

(u) CIT v. Neo Structo Construction Ltd: (Gujarat)

(v) Huber Suhner Electronics (P.) Ltd. v. DCIT: 59 SOT 59 (Del ITAT)

(w) DCIT v. Hindustan Packaging Co. Ltd.: (Ahd.) (MAG.)

(x) G.L. Rexroth Industries Ltd. v. DCIT: 59 TTJ 757 (Ahd.)

(y) ITO v. Radiant Cables (P) Ltd.: 18 ITD (Hyd) 79

(z) Vodafone East Ltd. v. ACIT: 156 ITD 337 (Kol.)

57.3 As regards reference made to the decision of apex Court in the case of Bharti Hexacom (supra) is concerned, it is submitted that the said judgment of the Supreme Court (i) is not applicable to the case of the assessee as discussed supra; and (ii) does not deal with the issue of nature of interest; thus, such a reference made by the Revenue is misplaced.

57.4 In the present case, the licence fee is itself revenue in nature for reasons explained above and hence interest on delayed payment thereof, even as per the rationale of the assessing officer, deserves to be allowed as deduction and not be construed as capital expenditure.

58. Reliance in this regard is placed on the decision of the Delhi bench of the Tribunal in the case of Bharti Airtel Ltd v. PCIT vide ITA No. 1160/Del/2024 dated 21.02.2025. wherein levy of compensatory interest and penalty in terms of the licence agreement was considered to be revenue in nature dehors the fact that licence fee in context of telecom operators was held to be capital in nature by the apex Court Bharti Hexacom (supra). The relevant observations of the Tribunal are extracted hereunder for ready reference:

“10.5 At the same time, after taking into consideration the judgement of the Hon’ble Supreme Court in Bharti Hexacom’s case (supra), we are of the considered view that allowability of interest/penalty in the context of AGR issue was not in issue at all. The issue only revolved around the determination of validity of Hon’ble Delhi High Court holding a part of the license fee to be capital expenditure and part to be revenue expenditure.

……………..

10.8 After taking into consideration the aforesaid relevant clauses, we are of the considered view that the interest and penalty clauses are enshrined in the license agreement as compensatory mechanism for delayed payment of three components i.e entry fee, license fee and charges. Charges is not specifically defined but when we take into consideration the aforesaid clauses we find that apart from entry fee and license fee the Licensee was supposed to pay Radio Spectrum Charges and oyalty for the use of spectrum for point to point links and access links. These charges admittedly were considered as revenue expenditure. Thus sub clause 10.2 mentions that for delayed payment of fee and other charges due to this provision of clause of termination of license can be invoked. It is very much apparent from the clauses of license agreement that the interest is payable on the quantum of delayed payment of license fee determined as per the license agreement. Penalty is payable in case the total amount paid as quarterly License Fee for the 4 (four) quarters of the financial year, falls short by more than 10% of the payable License Fee. Delayed payment of penalty shall also be liable to interest.

………..

10.11 Then we are of the considered view that the nature of agreement giving rise to the payment of interest or penalty should have been examined by the PCIT. The reasoning given by the Id. PCIT as followed by the Id. AO in the effect giving order is that the interest and penalty will take the colour of license fee to hold that the same is capital expenditure. However, we consider the same to be not a justified manner of determining the taxability of an expenditure. Every expenditure or income giving rise to a tax incidence should be categorically defined either in the statute or be otherwise impliedly decipherable from the transaction. It is not justified to draw any inferences about the nature of an expenditure being revenue or capital on the basis of another expenditure without analyzing the surrounding circumstances and the context in which the liability of expenditure arises.

10.12 The fact that initially PCIT intended to question the payment of interest and penalty being hit by the provisions of section 37 of the Act, but, which was not ultimately done shows that as with regard to relationship of this expenditure with the business expediency of the assessee is not disputed. PCIT should have been cognizant of the fact that since there was a dispute between the assessee and the licensor Department of Telecommunication with regard to various heads of revenue, as part of AGR, on which the license fee was payable and which has been ultimately settled by the Hon’ble Supreme Court only, thus, for valid reasons there was delay on the part of the assessee to make payment of the license fee and it is only subsequent to the determination of the issue finally that the assessee had to revise its claim in the context of license fees which has been accepted. This shows that the interest and penalty have arisen not out of an act of voluntary nature or in the background of contractual obligation to pay interest and penalty as part of the principal liability, but this expenditure of interest and penalty as arisen out of a contingency due to attempt of the assessee to contest the issue of quantum of license fee itself. Therefore, the incidence of interest and penalty is outcome of a business decision to defend the license fee quantum and, thus, it cannot be considered to have submerged with the license fee and to be coloured in its nature similar to license fee as a capital expenditure.” (emphasis supplied).