The condition to invest corpus donations in specified modes is not retrospective.

Issue

Can the tax exemption for a corpus donation under Section 11(1)(d) of the Income-tax Act, 1961, for the Assessment Year 2017-18 be denied on the ground that the donation was not invested in the specific modes prescribed under Section 11(5) of the Act?

Facts

- An assessee, a charitable trust, received corpus donations during the financial year relevant to the Assessment Year 2017-18. These were voluntary contributions that came with a specific direction from the donors that they should form part of the trust’s permanent corpus fund.

- The trust claimed this amount as fully exempt from tax under Section 11(1)(d).

- The Assessing Officer (AO) and the Commissioner (Appeals) both disallowed this exemption. The sole reason given by the Commissioner (Appeals) for confirming the addition was that the assessee had failed to prove that it had invested or deposited the corpus donation in the forms or modes that are specified in Section 11(5) of the Act.

Decision

The court ruled decisively in favour of the assessee.

- It held that the requirement for a trust to invest its corpus donations in the modes specified under Section 11(5) was a new condition that was introduced into the law by amendments made by the Finance Act, 2021, and the Finance Act, 2022.

- The court noted that these amendments were explicitly made effective from April 1, 2022, and are therefore prospective in nature; they do not apply to past years.

- Since the assessment year in question was 2017-18, these new conditions were simply not applicable. The law as it stood in AY 2017-18 did not contain this requirement for corpus donations.

- Therefore, the Commissioner (Appeals)’s entire basis for confirming the addition was legally incorrect. The addition was unjustified and was directed to be set aside.

Key Takeways

- You Must Apply the Law of the Correct Year: A taxpayer’s tax liability for any assessment year must always be determined based on the specific provisions of the law as they existed in that particular year. You cannot apply a future law to a past year.

- Amendments are Generally Prospective: New conditions or liabilities that are introduced into the tax law through an amendment are almost always presumed to be prospective (applying to future periods only), unless the legislature has explicitly and clearly stated that they should be applied retrospectively.

- The Law for Corpus Donations Before the Amendment: For assessment years prior to the 2021/2022 amendments, a corpus donation was exempt from tax under Section 11(1)(d) as long as it was a voluntary contribution and came with a specific direction from the donor to be treated as corpus. There was no further condition regarding how it had to be invested.

- Authorities Must Apply the Correct Law: An adjudicating or appellate authority has a duty to apply the law that was in force for the relevant assessment year. Applying a future law to a past year is a fundamental legal error that will be overturned by a higher court.

[Assessment year 2017-18]

(i) investment in savings certificates as defined in clause (c) of section 2 of the Government Savings Certificates Act, 1959 (46 of 1959), and any other securities or or certificates issued by the Central Government under the Small Savings Schemes of that Government;

(ii) deposit in any account with the Post Office Savings Bank;

(iii) deposit in any account with a scheduled bank or a co-operative society engaged in carrying on the business of banking (including a co-operative land mortgage bank or a co-operative land development bank). Explanation.—In this clause, “scheduled bank ” means the State Bank of India constituted under the State Bank of India Act, 1955 (23 of 1955), a subsidiary bank as defined in the State Bank of India (Subsidiary Banks) Act, 1959 (38 of 1959), a corresponding new bank constituted under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 (5 of 1970), or under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 (40 of 1980), or any other bank being a bank included in the Second Schedule to the Reserve Bank of India Act, 1934 (2 of 1934);

(iv) investment in units of the Unit Trust of India established under the Unit Trust of India Act, 1963 (52 of 1963);

(v) investment in any security for money created and issued by the Central Government or a State Government;

(vi) investment in debentures issued by, or on behalf of, any company or corporation both the principal whereof and the interest whereon are fully and unconditionally guaranteed by the Central Government or by a State Government;

(vii) investment or deposit in any public sector company : Provided that where an investment or deposit in any public sector company has been made and such public sector company ceases to be a public sector company, ?

(A) such investment made in the shares of such company shall be deemed to be an investment made under this clause for a period of three years from the date on which such public sector company ceases to be a public sector company;

(B) such other investment or deposit shall be deemed to be an investment or deposit made under this clause for the period up to the date on which such investment or deposit becomes repayable by such company;

(viii) deposits with or investment in any bonds issued by a financial corporation which is engaged in providing long-term finance for industrial development in India and which is eligible for deduction under clause (viii) of sub-section (1) of section 36;

(ix) deposits with or investment in any bonds issued by a public company formed and registered in India with the main object of carrying on the business of providing long-term finance for construction or purchase of houses in India for residential purposes and which is eligible for deduction under clause (viii) of sub-section (1) of section 36;

(ixa) deposits with or investment in any bonds issued by a public company formed and registered in India with the main object of carrying on the business of providing long-term finance for urban infrastructure in India.

Explanation.—For the purposes of this clause, — (a) “long-term finance” means any loan or advance where the terms under which moneys are loaned or advanced provide for repayment along with interest thereof during a period of not less than five years;

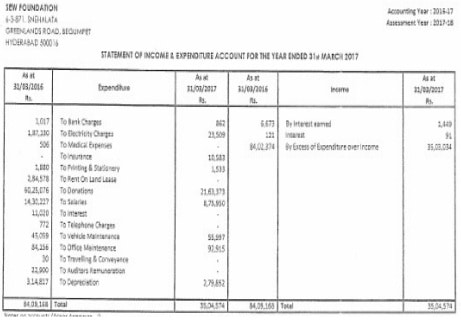

(b) “public company” shall have the meaning assigned to it in section 3 of the Companies Act, 1956 (1 of 1956); (c) “urban infrastructure” means a project for providing potable water supply, sanitation and sewerage, drainage, solid waste management, roads, bridges and flyovers or urban transport; (x) investment in immovable property. Explanation.—”Immovable property ” does not include any machinery or plant (other than machinery or plant installed in a building for the convenient occupation of the building) even though attached to, or permanently fastened to, anything attached to the earth; (xi) deposits with the Industrial Development Bank of India established under the Industrial Development Bank of India Act, 1964 (18 of 1964); (xii) any other form or mode of investment or deposit as may be prescribed. 5.6 The balance sheet/statement of affairs filed along with the audit report does not have any investment in the modes prescribed u/ s 11(5).