ORDER

1. Captioned ten appeals filed by the same assessee, pertaining to assessment years (A.Y.s) 2013-14, 2014-15, 2015-16 and 2016-17, all appeals directed against the separate orders passed by the National Faceless Appeal Centre (NFAC), Delhi/Commissioner of Income-tax (Appeals), which in turn arises out of separate orders passed by the Assessing Officer under Section 147/144 of the Income Tax Act, 1961 (in short ‘the Act’) and penalty orders passed by the assessing officer, u/s.271A, 271(1)(c) and 271F of the Act.

2. Since, the issue issues involved all thses appeals are common and identical; therefore, these appeals have been together and are being disposed by this consolidated order. For the sake of convenience, the grounds as well as the facts narrated in ITA No.515/Rjt/2025 for Assessment Year 2015-16, have been taken into consideration for deciding these appeals em-masse.

3. Grounds of appeal raised by the assessee in lead case i.e. ITA No.515/Rjt/2025 for A.Y. 2015-16 are as follows:

“1. The Ld. CIT(A) erred in law as well as on fact in adopting profit rate of 10% without any basis and disregarding comparative cases.

2. The Ld. CIT(A) erred in law as well as on fact in upholding an addition of Rs. 15,86,480/- out of Rs. 1,58,64,799/- made by Ld. AO u/s 69A of the Act.”

4. The brief facts qua the issue, as per lead case in ITA No.515/Rjt/2025 for A.Y. 2015-16 are as follows: The assessee, before us, is an individual and did not file his original return of income. As per the information available with the Jurisdictional Assessing officer (JAO), the assessee, during the year had credits of Rs. 1,58,64,799/- in his various bank accounts, with the assessee being nonfiler credits in his bank accounts remained unexplained. The relevant part of the information received by the Jurisdictional Assessing Officer (JAO), is reproduced below:

“Total credits of Rs. 1,58,64,799/- were observed during F.Y.2014-15 in the bank accounts of the assessee with the ICICI bank bearing nos. 072605000749, 072601504936 and 072605500333. During the course of Investigations before ADIT(Inv), Jamnagar, he provided opportunities to the assessee to explain sources of these credits in his bank accounts but the assessee didn’t respond. The assessee has not filed return of income for the relevant period i.e. AY 2015-16. Hence the credits found in these bank accounts of assessee, totaling to Rs. 1,58,64,799/-, remained unexplained.”

Based on the above information, a show-cause notice u/s 148A(b) of the Act was issued with the approval of the specified authority. In response, assessee made certain submission including objection against reopening of the assessment and the same was disposed-off by the Jurisdictional Assessing Officer after perusing the submission of the assessee. As the submission by the assessee could not satisfactorily explain the bank credits, the case was reopened for assessment and a notice u/s 148 of the Act was issued to assessee.

5. In response of the notice u/s 148, assessee filed return of income declaring income of Rs. 3,17,300/-. Further, notice u/s 143(2) of the Act, was issued to assessee. Furthermore, notice u/s 142(1) of the Act, was issued to assessee to produce the documentary evidence related to credit in his bank accounts. In response of notice, assessee submitted certain details on 25.02.2023 including computation of income, bank account statements and certain case laws. The assessee submitted the bank statements of all the bank accounts, confirming the cash deposits/credits in the bank accounts. The Assessee stated that he is engaged into the business of trading in brass items and the deposits in the bank accounts have been made by the customers from all over the country against the sales made to them. Based on the above, credits/deposits in the bank account should be taken as sales of the business. Further, assessee filed the return of income with net profit taken as 2% (percent) of the credits/deposits in the bank account of the assessee.

6. However, the assessing officer having gone through the documents and written submission of the assessee, notices that no documentary evidence, such as, books of accounts including balance sheet, and sample bills/invoice for sales/purchase made during the year have been submitted. Further, assessee has not submitted any books of account which further indicates that the assessee has not maintained the books of account as per section 44AA of the Income Tax Act, 1961. In the absence of the books of account, assessee contention to calculate net profit at 2% of credits/deposits in bank account, is immaterial. In view of the above discussion, the credits/deposits in the bank accounts of Rs. 1,58,64,799/-remains unexplained. Therefore, another show-cause notice, proposing to add the same as unexplained money u/s 69A of the Income Tax Act, 1961 was issued to assessee. In response, the assessee submitted its reply before the assessing officer. However, the assessing officer, rejected the reply and contention of the assessee and observed that in the absence of any satisfactory explanation in relation to credits/deposits in the bank account of the assessee, the credits of Rs. 1,58,64,799/- remains unexplained and the same was added back, as the income of the assessee u/s 69A of the Income Tax Act, 1961, as unexplained money. The assessing officer also clarified that tax payable will be as per provision u/s115BBE of the Act, at maximum marginal rate @30% for the A.Y.2015-16. Further, as the receipts in the bank accounts are not proved to be from business hence the income returned by the assessee (in Return of income filed in response of 148 notice) at approximate 2 percent of the bank credits was not accepted by the assessing officer and the same was taken as NIL for computation purpose.

7. The assessing officer, then framed the assessment, under section 147 read with section 143(3) read with section 144B of the Income Tax Act, 1961. The penalty proceedings u/s 271(1)(c) of the Income-tax Act, 1961, was initiated for concealment of the particulars of income by the assessing officer. The penalty proceedings u/s 271F of the Income-tax Act, 1961, was initiated for failure to furnish particulars of return of income. Further, Penalty proceedings u/s 271A of the Income-tax Act, 1961, was initiated for failure to maintain books of account as mandated by section 44AA of the Income Tax Act, 1961.

8. Aggrieved by the order of the assessing officer, in quantum proceedings, and penalty proceedings, [u/s 271(1)(c) of the Income-tax Act, 1961, u/s 271F of the Income-tax Act, 1961 and u/s 271A of the Income-tax Act, 1961], the assessee carried the matter in appeal before the Ld. CIT(A) who has partly allowed the appeal of the assessee on quantum proceedings. The ld.CIT(A), on merit, noticed that the assessee had been doing business of trading in brass items on commission basis. The assessee operated bank accounts nos. 072605000749, 072601504936 and 072605500333 in ICICI Bank for his business purposes. In the above bank accounts, the assessee has been getting cash deposits/credits from various locations across India such as Bareilly, Kanpur, Delhi, Coimbatore, Solapur, Surat etc. and immediately withdrawing cash for the purchase of brass items and selling the same. In response to notices issued during the re-assessment proceedings, the assessee filed his Return of Income on 18.10.2022 declaring income @ 2% on total cash deposits/credits which comes to Rs.3,17,300/-. During the course of appellate proceedings, the assessee filed sample invoices and other details authenticating existence of business. The assessee also gave some comparable instances of profitability in the same line of business. However, even though, the assessee had done such huge business transactions, but did not bother to maintain books of accounts / audit the books of accounts / file Return of Income which shows grave negligence. Even though, substantial cash deposits/credits in the bank accounts of ICICI Bank were from business transactions, it is not possible to make one-to-one correlation at this juncture. Therefore, to safeguard the interests of revenue, 10% of cash deposits/credits appearing in the bank accounts of the assessee were treated as from undisclosed sources and thereby treated as unexplained money u/s.69A of the Income Tax Act, 1961. Accordingly, addition to this extent of 10% of cash deposits/credits which comes to Rs.15,86,480/- was confirmed by ld.CIT(A) and balance addition was deleted.

9. During the appellate proceedings, before learned CIT(A), the assessee has raised additional technical/legal grounds, such as notice under section 147/148 of the Act, was not valid, and DIN number was not incorporated in the body of the notice. The learned CIT(A) dismissed these technical grounds of the assessee. Before this Tribunal also, the assessee has raised same technical grounds, which we have admitted.

10. The learned CIT(A), by way of passing separate penalty orders, confirmed the various penalties under section 271(1)(c) of the Income-tax Act, 1961, u/s 271F of the Income-tax Act, 1961 and u/s 271A of the Income-tax Act, 1961 for assessment year 2015-16, in the case of same assessee.

11. Aggrieved by the addition sustained by CIT(A), in quantum proceedings, and aggrieved by the various penalties confirmed by the learned CIT(A), the assessee is in further appeal before this Tribunal.

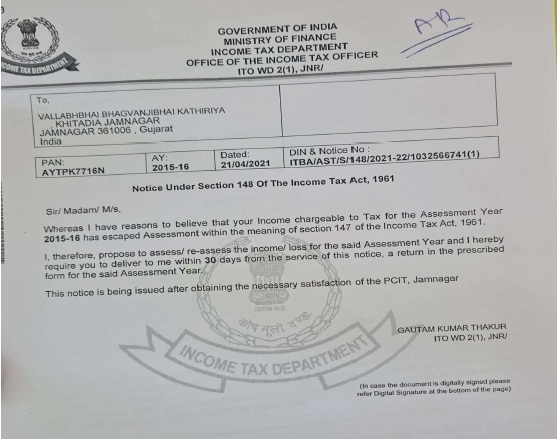

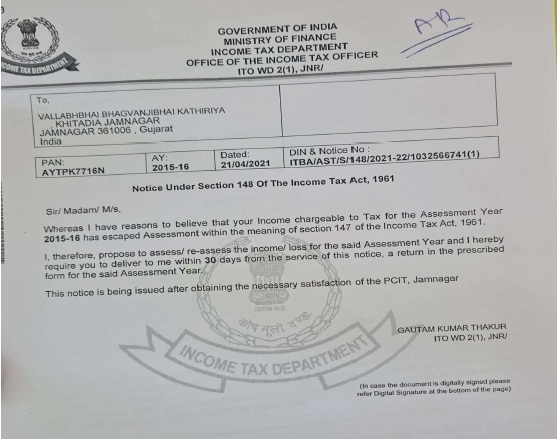

12. Learned Counsel for the assessee, argued on the technical/legal ground raised by the assessee stating that in the assessee’s case under consideration, the notice u/s. 148 of the Act for assessment year (A.Y.) 2015-16, was issued by the assessing officer on 21.04.2021. The Ld. Counsel submitted that for the assessment year (A.Y.) 2015-16, the notice under section 148 of the Act, should have been issued on or before 31st March, 2019. After amendment in the Act, w.e.f. 1st April, 2021, for assessment year (A.Y.) 2015-16, the notice issued after 1st April, 2021 would be time barred and, therefore, the assessment order itself should be quashed. For that Ld. Counsel for the assessee relied on the judgment of the Jurisdictional High Court of Gujarat in the case of Gordhanbhai Devjibhai Kapadia v. ITO , wherein it was held that when the assessing officer issued notice u/s 148 of the Act for A.Y. 2015-16, after 31st March, 2021, on pretext that due to operation of TOLA, time limit of issuance of notice would extended up to 30th June, 2021, therefore, the impugned notice was invalid. Therefore, Ld. Counsel for the assessee submitted that in the assessee’s case, the notice u/s 148 of the Act was issued on 21st April 2021, which is time barred and invalid and hence, the assessment order itself should be quashed.

13. On the other hand, the Ld. DR for the Revenue stated that assessee had participated in the assessment proceedings. Therefore, this legal ground should not be taken at this stage. Apart from this, ld DR has primarily reiterated the stand taken by the Assessing Officer, which we have already noted in our earlier para and is not being repeated for the sake of brevity.

14. We have heard the rival parties and have gone through the material placed on record. For the sake of clarity and also being pertinent, we reproduce, the notice issued by the assessing officer under section 148 of the Act dated 21.04.2021, as follows:

15. We have gone through the above notice issued by the assessing officer under section 148 of the Act and noticed that the date of issuance of the notice is 21.04.2021. The assessment year, involved in the assessee’s case, under consideration is the assessment year 2015-16. For the assessment year (A.Y.) 2015-16, the notice under section 148 of the Act, should have been issued, by the assessing officer, on or before 31st March, 2019. After amendment in the Act, (for assessment year 2015-16), the notice issued after 1st April, 2021 would be time barred and invalid therefore, the assessment order itself should be quashed. For that reliance is placed on the judgment of the Jurisdictional High Court of Gujarat in the case of Gordhanbhai Devjibhai Kapadia (supra), wherein it was held as follows

“2. The petitioner has challenged notices issued under section 148 of the Income Tax Act, 1961 (for short “the Act”) for the Assessment Year 2015-2016 under the old regime in view of TOLA without issuing notice under section 148A(b) as required to be issued with effect from 01.04.2021.

3. Notice under section 148 under Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 [(2020) 422 ITR (St.) 116] (For short “TOLA”) was issued on 04.06.2021 whereas notice under section 148A(b) of the Act after judgment in case of Union of India v Ashish Agarwal ITR 1 (SC) was issued on 31.05.2022.

4. The respondent Assessing Officer has issued notice under section 148 of the Act after 31.03.2021 on the pretext that due to operation of TOLA, time limit for issuance of notice would be extended upto 30.06.2021.

5. Thereafter, considering the decision of Hon’ble Apex Court in case of Ashish Agarwal (supra), notice issued under section 148 between 01.04.2021 and 30.06.2021 for Assessment Year 2015-2016 was deemed to be notice under section 148A(b) of the Act which has come into operation with effect from 01.04.2021 and thereafter as per the direction issued by the Hon’ble Apex Court in case of Ashish Agarwal(supra) department has issued the notices under section 148 of the Act between the month of July,2022 and August, 2022 after following the procedure of inviting reply and passing order under section 148A(d) of the Act.

6. The petitioners challenged such notices issued by the respondent Assessing Officer for Assessment Year 2015-2016 pursuant to the order of Hon’ble Apex Court in case of Ashish Agarwal(supra).

7. During the pendency of these petitions, similar notices which were issued for Assessment Years 2013-2014 to 2017-2018 came up for consideration on the ground of delay as well as on the ground of getting valid sanction before this Court and other High Courts. This Court in case of Keenara Industries (P.) Ltd v. ITO [2023] 147 taxamann.com 585 (Guj) allowed such petitions.

8. The matter was carried to Hon’ble Supreme Court. Hon’ble Supreme Court in case of Union of India v Rajeev Bansal ITR 46 (SC) decided the issues raised with regard to delay as per the provisions of section 149 of the Act which has come into operation after 01.04.2021 as well as validity of sanction granted under section 155 of the Act.

9. During the course of hearing before the Hon’ble Apex Court, Revenue conceded to the effect that so far as Assessment Year 2015-2016 is concerned, Revenue could not have issued the notices under section 3(1) of TOLA as considering the time period as prescribed under section 149 of the Act with effect from 01.04.2021, three years would be over on 31.03.2019 which is prior to coming into force of TOLA and six years would be completed on 31.03.2022 which is after operation of TOLA. In such circumstances, notices for Assessment Year 2015-2016 are held to be invalid by Hon’ble Apex Court in case of Rajeev Bansal(supra).

10. The Hon’ble Apex Court followed the decision of Rajeev Bansal(supra) in case of Deepak Steel and Power Ltd v Central Board of Direct Taxes ITR 369 (SC) and after recording the concession of the learned advocate for the department and in view of the concession given before the Apex Court by learned advocate appearing for the Revenue as recorded in para 19(f) of the judgment in case of Rajeev Bansal (supra), has quashed and set aside the notice issued after 31.03.2021 under TOLA for A.Y. 2015-16 as under:

“1. Leave granted.

2. These appeals arise from the order passed by the High Court of Orissa at Cuttack in Writ Petition (C) Nos. 2446 of 2023, 2543 of 2023 dated 1.2.2023 and 2544 of 2023 dated 10.02.2023 respectively by which the High Court disposed of the original writ petitions in the following terms:-

“1. The memo of appearance filed by Mr. S. S. Mohapatra, learned Senior Standing Counsel for Revenue Department on behalf of Opposite Parties is taken on record.

2. In view of the order passed by this Court on 1st December, 2022 in a batch of writ petitions of which W.P.(C) No.9191 of 2022 (Kailash Kedia v. Income Tax Officer) was a lead matter and the subsequent order dated 10th January, 2023 passed in W.P.(C) No.36314 of 2022 (Shiv Mettalicks Pvt. Ltd., Rourkela v. Principal Commissioner of Income Tax, Sambalpur), the Court declines to entertain the present writ petition, but leaves it open to the Petitioner to raise all grounds available to the Petitioner in accordance with law including the grounds urged in the present petition at the appropriate stage as explained by the Court in those orders.

3. The writ petition is disposed of in the above terms.”

3. We heard Mr. Saswat Kumar Acharya, the learned counsel appearing for the appellants(assessee) and Mr. Chandrashekhar, the learned counsel appearing for the revenue.

4. The learned counsel appearing for the revenue with his usual fairness invited the attention of this Court to a three judge bench decision of this Court in Union of India and Ors. v. Rajeev Bansal, reported in 2024 SCC OnLine SC 2693, more particularly, paragraph 19(f) which reads thus:-

“19. (f) The Revenue concedes that for the assessment year 2015- 2016, all notices issued on or after April 1, 2021 will have to be dropped as they will not fall for completion during the period prescribed under the Taxation and other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020.”

5. As the revenue made a concession in the aforesaid decision that is for the assessment year 2015-2016, all notices issued on or after 1st April, 2021 will have to be dropped as they would not fall for completion during the period prescribed under the taxation and other laws (Relaxation and Amendment of certain Provisions Act, 2020). Nothing further is required to be adjudicated in this matter as the notices so far as the present litigation is concerned is dated 25.6.2021.

6. In view of the aforesaid, in such circumstances referred to above the original writ petition nos.2446 of 2023, 2543 of 2023 and 2544 of 2023 respectively filed before the High Court of Orissa at Cuttack stands allowed.

7. The impugned notice therein stands quashed and set aside.

8. The relief in terms of prayer (a) is granted.

9. The appeals stand disposed of in the above terms.

10. Pending application(s), if any, stand disposed of.”

11. Similar orders are also passed by the Apex Court in the following cases:

1) Asstt. CIT v. Nehal Ashit Shah [SLP(Civil) Diary No. 57209 of 2024, dated 4-4-2025];

2) ITO v. R.K.Build Creations Private Limited [SLP (Civil) Diary No.59625 OF 2024, dated 17-1-2025].

12. The Delhi High Court has also passed the similar order in following cases:

1) Bhagwan Sahai Sharma v. Dy. CIT 25] (Delhi)

2) Lalit Gulati v. Asstt. C 4T (Delhi);

13. The Punjab and Haryana High Court has taken similar decision in case of Jay Jay Agro Industries v. ITO [CWP 7405 of 2025, dated 19-3-2025]

14. Rajasthan High Court has also taken similar decision in case of Shreyansh Mehta v. ITO [Civil Writ Petition No. 3299 of 2023, dated 12-2-2025].

15. Karnataka High Court has also taken similar decision in case of Siddaiah Gurappaji v. Asstt. CIT [Writ Petition No. 20292 of 2023, dated 17-4-2025].

16. This Court also in case of Mayurkumar Babubhai Patel v. Assistant Commissioner of Income Tax (Gujarat)/Special Civil Application No.3154 of 2022 and allied matters) has held as under:

“15. Considering the facts of the case, it is not in dispute that the respondent-Assessing Officer has issued the notice under section 148A(b) of the Act after the period of six years were over on 31.03.2022. As observed by the Hon’ble Apex Court in case of Deepak Steel and Power Ltd(supra) and in view of the concession made by the Revenue before the Apex Court for the Assessment Year 2015-16, all the notices issued on or after 01.04.2021 will have to be dropped as they would not fall for completion during the period prescribed under the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 and therefore, nothing further is required to be adjudicated in the matters as the notice so far as the present petitions are concerned, though dated 31.03.2021, admittedly have been issued after 01.04.2021.

16. It is also not in dispute that the notices under section 148A(b) have been issued pursuant to the decision of the Hon’ble Apex Court in Ashish Agarwal (supra) dated 04.05.2022 admittedly after 31.03.2022. Therefore, on both counts, the notices issued under section 148 of the Act dated 27/28/29.07.2022 would be time barred.”

17. In view of above, for the foregoing reasons, the petition is allowed. The impugned notice issued under section 148 of the Act for Assessment Year 2015-2016 is held to be invalid as same was issued during the extended period from 01.04.2021 to 30.06.2021 under TOLA.

18. Petition is accordingly disposed off.”

16. We have considered the submissions of both the parties, and we find merit in the submission of the Ld. Counsel for the assessee to the effect that for assessment year (A.Y.) 2015-16, the notice u/s. 148 of the Act was issued after 1st April, 2021, which is time barred and, therefore, assessment should be quashed on this score only, by relying on the judgment of the Jurisdictional High Court in the case of Gordhanbhai Devjibhai Kapadia (supra). Therefore, we hold that impugned notice issued by the assessing officer, u/s 148 of the Act for A.Y. 2015-16, after 31st March, 2021, is invalid. Since the notice u/s 148 of the Act was issued on 21st April 2021, which is time barred and invalid and hence, the assessment order passed by the assessing officer under section 147 r.w.s. 144B of the Act dated 27.05.2023, should be quashed and accordingly, we quash the same, being void, ab-initio.

17. As the reassessment order of assessing officer framed under section 147 r.w.s. 144B of the Act dated 27.05.2023, itself is quashed, therefore all other issues on merits of the additions, in the impugned assessment proceedings, are rendered academic and infructuous.

18. In the result, the appeal filed by the assessee, in ITA No.515/RJT/2025, for assessment year 2015-16, is allowed.

19. Since the order of the Assessing Officer has been quashed by us in ITA No.515/RJT/2025, for assessment year 2015-16, therefore, various penalties imposed by the assessing officer on the assessee for assessment year 2015-16, such as, under section 271(1)(c) of the Income-tax Act, 1961, u/s 271F of the Income-tax Act, 1961 and u/s 271A of the Income-tax Act, 1961 for assessment year 2015-16, in the case of same assessee, should also be deleted, as, now, there is no base to impose these penalties once the assessment order itself has been quashed by us. In this regard, we rely on the legal maxim “Sublato fundamento cadit opus” (meaning thereby that foundation being removed, structure/work falls). Hence the initial action of the assessing officer in framing the reassessment under section 147 of the Act, itself is not in consonance with law, then all the subsequent and consequential proceedings would fall through for the reason that illegality strikes at the root of the order. Therefore, we quash the following penalties imposed by the assessing officer, for assessment year 2015-16, being ab initio void:

| (i) | | Penalty order-ITA No.518/Rjt/2025 – A.Y. 2015-16 – Penalty u/s.271(1)(c) of the Act. |

| (ii) | | Penalty order-ITA No. 527/Rjt/2025 – A.Y. 2015-16 – Penalty u/s.271A of the Act. |

| (iii) | | Penalty order-ITA No.530/Rjt/2025 – A.Y. 2015-16 – Penalty u/s.271F of the Act |

Therefore, above penalties are deleted and above appeals of the assessee, are allowed.

20. Now, we shall take assessee’s remaining appeals for assessment year 201314 and for assessment year 2014-15, and for assessment year 2016-17, the details of these appeals, assessment year-wise, are as follows:

For Assessment Year – 2014-15, the assessee’s quantum appeal and Penalty appeal, are as under:

(a) Quantum appeal in ITA No.514/Rjt/2025 – A.Y. 2014-15

(b) Penalty appeal in ITA No.513/Rjt/2025 – A.Y. 2014-15 – penalty u/s. 271(1)(c) of the Act.

For Assessment Year – 2013-14, the assessee’s quantum appeal and Penalty appeal, are as under:

(a) Quantum appeal in ITA No.510/Rjt/2025 – A.Y. 2013-14

(b) ITA No. 511/Rjt/2025 – A.Y. 2013-14 – Penalty u/s. 271A – Non- maintenance of books of account

(c) ITA No. 512/Rjt/2025 – A.Y. 2013-14 – Penalty u/s. 271(1)(c)

For Assessment Year – 2016-17, the assessee’s quantum appeal, is as under:

(a) Quantum appeal in ITA No.525/Rjt/2025 – A.Y. 2016-17

21. In order to adjudicate the above quantum appeals of the assessee and penalty appeals of the assessee, we take lead case in ITA No.525/RJT/2025, to advert the facts of the assessee’s case. Brief facts of the case are that the assessee had not filed his Return of Income for the assessment year (AY.) 2016-17. The assessing officer had information that there were a total credits of Rs. 1,95,82,197/-, during the FY.2015-16, in the bank accounts of assessee, Sri. Vallabhbhai Bhagvanjibhai Kathiriya held with ICICI bank that is, accounts nos. 072605000749, 072601504936 & 072605500333. Further, during the course of investigation conducted by ADIT(Inv.), Jamnagar, even after multiple opportunities provided to the assessee, the assessee failed to respond. Thereby, the assessee’s case for the assessment year (AY.) 2016-17 was reopened by issue of notice u/s 148 of the Income Tax Act, 1961 dated 26.07.2022. During the assessment proceedings, notice u/s. 143(2) of the Income Tax Act, 1961 dated 25.01.2023, notices u/s.142(1) of the Income Tax Act, 1961 dated 15.02.20238 26.04.2023 and showcause notice dated 01.05.2023 were issued to the assessee. In response, the assessee filed a Return of Income for the assessment year (AY) 2016-17, declaring an income of Rs.3,91,640/-, on 18.10.2022, that is, at a net profit of 2% of total credits in bank accounts. The assessee submitted that he was engaged in the business of trading in brass items where sales were made at different places across India and cash thus received on sales was credited/deposited at different places and the credited/deposited amount was withdrawn from Jamnagar for purchases. The assessee further submitted that, in similar cases as of his business, the department had accepted an income @ 2% to 5% of credits/deposits made in the bank account, estimated by CIT(A) and ITAT. The assessee also submitted that he had not maintained any books of accounts and that he had sold goods out by making URD purchases and in similar cases of URD purchases, Hon’ble Rajkot Bench of ITAT had held that profit rate of 1.25% was reasonable. The assessee further submitted that he had actually incurred a loss but to conclude the matter had declared profit @ 2% of receipts/ deposits in bank account.

22. The assessing officer rejected the above submissions/contentions of the assessee, concluding that the assessee had not furnished any satisfactory documentary evidence, such as, purchase/sale details, expenses details, financials in proof of claim that he was involved in the business activity. Thereby, the assessing officer completed the assessment treating 25% of total credits of Rs. 1,95,82, 197/-i.e., of Rs.48,95,549/- as unexplained money u/s.69A of the Income Tax Act, 1961.

23. Aggrieved by the order of the assessing officer, the assessee carried the matter in appeal before the Ld.CIT(A), who has partly allowed the appeal of the assessee. The ld.CIT(A) observed that the assessee had done such business transactions, but did not bother to maintain books of accounts / audit the books of accounts / file Return of Income which shows grave negligence. Even though, substantial cash deposits/credits in the bank accounts of ICICI Bank were from business transactions, it is not possible to make one-to-one correlation at this juncture. Therefore, to safeguard the interests of revenue, 10% of cash deposits/credits appearing in the bank accounts of the assessee, which comes to Rs. 19,58,220/-was confirmed by ld. CIT(A) and balance addition was deleted.

24. Aggrieved by the order of the learned CIT(A), the assessee is in further appeal before us.

25. Learned Counsel for the assessee argued that it is evident from bank statement itself that amount deposited in the said bank account was from various location in India, viz. Bareilly, Kanpur, Ferozpur, Lucknow, Rohini, Dehradun, Delhi Kandivali, Ranchi, Hissar, Bhopal, Agra, Meerut, Malad, Garegaun, Coimbotar, Tinsukhia, Soalpur, Jaipur, New Bombay, Surat and many other such places and has made sales to all these places and all amount was withdrawn at Jamnagar for making purchases. Along with sample bills for sales made during the year under consideration and detailed explanation of each and every deposit entry in bank statement having complete name of customers were submitted before assessing officer’s verification. The assessing officer himself made estimated addition, and on appeal, by the assessee, the learned CIT(A) has further reduced the estimated addition. The learned Counsel also submitted that assessee has suo-moto offered margin at the rate of 2% on turnover in the return of income filed by the assessee, therefore, the same may be upheld.

26. On the other hand, learned DR for the revenue submitted that since the assessing officer and learned CIT(A) had estimated the profit of the assessee, therefore, estimation made by the learned CIT(A) may be sustained and no further relief should be given to the assessee.

27. We have heard learned Counsel appearing for the assessee and learned DR appearing for the revenue. We find that there is no method to derive the profit percentage in this type of business, in which the assessee is engaged, and it varies from 0.5% to 5% as per brass part products and we note that assessee has not maintained records in relation to purchase of raw materials. We note that assessee is engaged in just providing materials as per requirement of customer and there is no such roll in production and it can considered that assessee had acted as an agent of their customers and as an agent in brass parts, it is hard to earn commission @ 2% on sale, as the prices of products are open in the market. The assessee submitted before the lower authorities a chart for average rate of net profit for the industries engaged in the similar nature of business to the extent available with the assessee, and after considering average rate of net profit declared by the similar industries in same line of business. The assessee also cited before the learned CIT(A), the decision of ITAT, Rajkot Bench, which was confirmed by Hon’ble High Court and Hon’ble Supreme Court, vide SLP Appeal (c) No. 4381 of 2022 having ITA no 651/RJT/2014 with C.O. No. 18/RJT/2015 AY 2003-04 & other in which Tribunal has observed as under for deposit in bank account and withdrawal from bank account.

“We have heard the rival contentions of the both the parties and perused the material available on records. This issue in the present case relates whether the amount deposited by the assesse, admittedly, there was huge deposit of cash/ cheque in the bank account of the assesse. But on perusal of the bank statement, it is revealed that there were simultaneously withdrawals from the bank account leaving the negligible balance in the bank account of the assesses. Now 1st of all we have to see whether such deposit and withdrawal from the bank is representing the trading activities of the assesse. In this regard we find that the assesse has filed the evidence.”

From the above decision of ITAT which was also confirmed by Hon’ble Supreme court that the withdraw from the bank has been utilized by the assessee either in the form of some investment or the same has been incurred as an expense, the deposits cannot be treated as income on standalone basis without considering the withdrawal. Therefore, the assessee, has computed his profit @2% of deposits, which should be accepted.

28. Therefore, we note that neither the assessing officer nor the learned CIT(A) have accepted the genuine facts, submission of the assessee and also ignored average rate of net profit declared by similar entities engaged in the similar business. We are of the view that gross credits in bank accounts in any business cannot be considered as income and that too after giving all genuine explanation and submission up to the best endeavour of an assessee. From the assessee’s facts, it is understood that the assessee had been doing business of trading in brass items on commission basis. The assessee operated bank accounts nos. 072605000749, 072601504936 and 072605500333 in ICICI Bank for his business purposes. In the above bank accounts, the assessee has been getting cash deposits/credits from various locations across India such as Bareilly, Kanpur, Delhi, Coimbatore, Solapur, Surat etc. and immediately withdrawing cash for the purchase of brass items and selling the same. In response to notices issued during the re-assessment proceedings, the assessee filed his Return of Income on 18.10.2022 declaring income @ 2% on total cash deposits/credits which comes to Rs.3,91,640/-. During the course of appellate proceedings, the assessee filed sample invoices and other details authenticating existence of business. The assessee also gave some comparable instances of profitability in the same line of business.

29. At the cost of repetition, we state that during the assessment proceedings, the assessee submitted bank statements, copy of sample bills, detail of the transactions, name of parties, and the evidence that assessee is engaged at retail level, in selling the brass components, and the purchasers, are depositing the amount in the bank account of the assessee. The assessee withdraw the amount from the bank to make the payment to his suppliers of brass components. These facts were not denied by the assessing officer. Besides, the assessee, is getting only Commission on sale of brass components. During the assessment proceedings, the assessee has submitted before the assessing officer, relevant evidences and written submissions stating that he is doing business of sale of brass items on Commission basis for the assessment year under consideration. The assessee submitted the copy of the bank statement and stated that the cash have deposited from various locations of India and the withdrawals have been made at Jamnagar and assessee, therefore, requested the assessing officer to treat the credits in the bank account, as a total turnover of the assessee, in order to make a reasonable estimation of net profit. However, the assessing officer has not made reasonable estimated addition. However, on appeal by the assessee, the Id.CIT(A) estimated the profit at the rate of 5% for assessment year 2013-14 and estimated the profit at the rate of 10% in assessment year 2014-15 and other assessment years. The assessee is in appeal before us, raising the main grievance that addition sustained by the learned CIT(A) in various assessment years, varies from 5% to 10%, whereas the assessee is a commission agent and earning only commission at the rate of 2% of the amount deposited in the bank account/ turnover. Therefore, learned Counsel for the assessee, prayed the Bench that estimated addition should be sustained at the rate of 2% of the turnover, taking into account the trading activities of the assessee and the industry norms. Considering the above facts, we find that assessing officer has not denied this fact that assessee is not a commission agent. The assessing officer, as well as learned CIT(A) both accepted that assessee is a commission agent and doing business on commission basis. We note that assessee has raised factual objections before the lower authorities, that credit entries in the bank account, represents, sale proceeds in respect of his business, which were received from purchasers, and deposited at various stations/cities and all such amounts were withdrawn at Jamnagar for making payment of purchases. The assessee also submitted the relevant documents and evidences to demonstrate that these facts were correct. The assessee also argued before the learned CIT(A) that in similar cases, the learned CIT(A) himself estimated profit at the rate of 5% and Hon’ble ITAT has estimated income at the rate of 2% to 5% of all such bank credits. The learned CIT(A) accepted the above submissions of the assessee and therefore sustained the estimated addition at the rate of 5% in some years and at the rate of 10% of cash deposit/ credit in the bank account, in some other years. We also find that the assessing officer, had not specifically identified any specific defects in the purported evidences and also taking note of the fact that the assessing officer, has not held that these evidence filed by the assessee are bogus. Therefore, we find some merit in the contention of the Id. Counsel for the assessee. Therefore, we find that while the case of the assessee merits some relief, at the same time entire relief cannot be permitted to the assessee. In our view the ends of justice would be met, if a net profit rate of 3% is adopted on the amount of cash deposited in the bank accounts, since the same would take care of the inconsistencies, in the various documents and evidences submitted before the lower authorities. Therefore, we direct the assessing officer to adopt net profit rate of 3% of cash deposited/credits in bank accounts and should be taxable under the normal rate of Income-tax. It is also made clear that instant adjudication shall not be treated as a precedent in any preceding or succeeding assessment year.

30. In the result, the appeal filed by the assessee, in ITA No.525/Rjt/2025 for A.Y. 2016-17, is partly allowed.

31. Since we have adjudicated the issue on merit, by taking the lead case in ITA No.525/Rjt/2025 for A.Y. 2016-17. The facts and issues involved, on merit, in other appeals of the assessee, are identical and similar, therefore, our observations made in ITA No.525/Rjt/2025 for A.Y. 2016-17, shall apply mutatis mutandis to the aforesaid other appeals of Assessee, namely, ITA No.514/Rjt/2025 for A.Y. 2014-15 and ITA No.510/Rjt/2025 for A.Y. 2013-14. For the parity of reasons, we allow the abovementioned appeals of the Assessee in terms of directions noted in ITA No.525/Rjt/2025 for A.Y. 2016-17.

32. In the result, appeals filed by the assessee, in ITA No.514/Rjt/2025 – A.Y. 2014-15, and in ITA No.510/Rjt/2025 – A.Y. 2013-14, are also partly allowed, in above terms.

33. Now we shall take penalty appeals of the assessee in ITA No. 512/Rjt/2025 for A.Y. 2013-14 – Penalty u/s. 271(1)(c) of the Act and in ITA No.513/Rjt/2025 for A.Y. 2014-15 – penalty u/s. 271(1)(c) of the Act. Learned Counsel for the assessee submitted that no penalty should be imposed on estimated addition. Learned Counsel pointed out that assessing officer made the estimation on turnover/ deposits in bank account, and on appeal by the assessee, the learned CIT(A) has further re-estimated the addition sustained by the assessing officer, at the rate of 5% and 10%. Therefore, there is no definite charge on account of concealment of income, on the part of the assessee, therefore, penalty under section 271 (1) (C) of the Act should not be imposed on the assessee, and the same should be deleted. On the other hand, learned DR for the revenue submitted that even on estimated addition, the penalty should be sustained under section 271 (1) (c) of the Act.

34. We have considered submissions of both the parties. The necessary facts of the assessee’s case have already been narrated by us in this order, therefore, we do not repeat them for the sake of brevity. We find merit, in the submissions of learned Counsel for the assessee to the effect that penalty on estimated addition under section 271 (1) (c) of the Act should not be levied. For that we rely on the judgment of the Co-ordinate Bench of ITAT Surat in the case of Gipilon Texturising Pvt. Ltd, ITA No. 293 & 294/AHD/2005, order dated 13.04.2021, wherein it was held as follows:

“On second appeal before the Tribunal in ITA No.186/Ahd/1998 dated 08.03.2004 the additions restricted the addition @ 5% of Gross Profit. Considering the fact that addition in the assessment order, on the basis of which the penalty was levied, is purely an estimated addition. It is settled position in law that no penalty under section 271(1)(c) can be levied on additions made on estimation. The similar view was taken by the Hon’ble Jurisdictional High Court in Manish Dhirajlal Mehta v. ACIT, Vijay Proteins Ltd., v. CIT (supra), in Vijay Proteins v. CIT (supra) and other case laws relied by ld. AR for the assessee. No contrary facts or law is brought to our notice. In the result, Ground No. 1 of appeal is allowed.”

35. Therefore, respectfully following the above binding precedent, in the case of Gipilon Texturising Pvt. Ltd (supra), we delete the penalty imposed by the assessing officer, under section 271(1) (c) of the Act.

36. In the result, appeals filed by the assessee in ITA No. 512/Rjt/2025 for A.Y. 2013-14 and in ITA No.513/Rjt/2025 for A.Y. 2014-15, are allowed.

37. Now we shall take, remaining penalty appeal of the assessee in ITA, No.511/Rjt/2025, for A.Y. 2013-14, Penalty u/s. 271A of the Act, on account of non-maintenance of books of accounts. We note that the above penalty was imposed by the assessing officer, on account of failure to keep, maintain or retain books of accounts, documents etc. If any person fails to keep and maintain any such books of account and other documents as required by section 44AA of the Act or rules made thereunder, then the assessing officer may direct that person to pay the penalty. The necessary facts of the assessee’s case have already been narrated by us in this order, therefore, we do not repeat them for the sake of brevity. Learned Counsel for the assessee submitted before us that assessee under consideration is a small category, assessee, who files the return of income, under section 44AD of the Act and therefore, the assessee need not to maintain books of accounts. On the other hand, learned DR for the revenue submitted that penalty should be imposed on the assessee, as there is credit in bank account, which is considered by the assessing officer, as a turnover of the assessee, and for such turnover assessee did not maintained Books of Accounts.

38. We have considered submissions of both the parties and noted that assessee falls in the category of a small pax-payer, who is not maintaining books of accounts, as he filed the return of income, under presumptive income scheme, under section 44AD of the Act, therefore, penalty should not be imposed on the assessee. We note that an eligible assessee opting for presumptive taxation under Section 44AD is not required to maintain books of accounts as prescribed under Section 44AA of the Act. When an assessee chooses to declare income under Section 44AD, income is computed at 8% (or 6% for digital receipts) of turnover, regardless of actual profits. Because the income is presumed, the law exempts the assessee from the obligation to maintain books of accounts under Section 44AA(2) of the Act. Considering these facts and circumstances, we delete the penalty u/s. 271A of the Act, imposed by the assessing officer.

39. In the result, appeal filed by the assessee, in ITA, No.511/Rjt/2025, for A.Y. 2013-14, is allowed.