ORDER

C.N. Prasad, Judicial Member.- This appeal is filed by the assessee against final assessment order dated 29.10.2024 for the A.Y.2021-22 passed u/s.143(3) r.w.s. 144C (13) in pursuance to the directions of the DRP dated 13.09.2024 passed u/s.144C(5) of the IT Act. The assessee in its appeal raised the following grounds :-

“1. That on the facts, law and in the circumstances of the case, the orders passed by the Assessing Officer (AO) [Draft Assessment Order and Final Assessment Order), Transfer Pricing Officer (TPO) as well as the Dispute Resolution Panel (DRP) are bad in law, violative of principles of natural justice and thus, void-ab-initio.

2. That on the facts, law and in the circumstances of the case, the Ld. Assessing Officer (AO) and the Ld. Members of the DRP have erred in law in determining the total income of the appellant at Rs. 3,53,43,56,141/- vide order u/s 143(3) r.w.s. 144C(13) of the Income Tax Act, 1961 dated 29.10.2024 as against the returned loss of Rs. 98,71,60,760/- and thereby making erroneous additions of Rs. 4,44,75,24,909/-.

3. That on the facts, law and in the circumstances of the case, the orders so framed u/s 143(3) r.w.s. 144C(13) of the Income Tax Act, 1961 dated 29.10.2024 as well as enabling orders (which are culminated in the said order dated 29.10.2024) are barred by, limitation in view of Sec. 153 r.w.s. 144C of the Act and hence, void-ab-initio, therefore, needs to be quashed/ annulled.

4. That on the facts, law and in the circumstances of the case, the Ld. AO, Ld. TPO as well as the Ld. DRP have erred in law in framing a high-pitched assessment u/s 143(3) r.w.s. 144C(13) of the Act by making erroneous, arbitrary and ad-hoc additions based on mere to Rs. and surmises amounting conjectures, suspicions 4,44,75,24,909/- without considering the submissions made by the appellant.

5. That on the facts, law and in the circumstances of the case, the orders of the Ld. AO, Ld. TPO as well as the Ld. DRP are devoid of the legal principles of audi alteram partem as the statements recorded of third parties(persons) or third party information have been used against the appellant without affording the reasonable opportunity of cross examination to the appellant to rebut the said testimony of the third parties and for confronting the said parties/rebutting the alleged third party information before passing the orders u/s 143(3) r.w.s. 144C(13) of the Act and 144C(1) of the Act despite of the fact that cross-examination is the sine qua non of due process of taking evidences and no adverse inference can be drawn against a party unless the party put on a notice of the case made out against him and therefore, the impugned orders u/s 143(3) r.w.s. 144C(13) of the Act and 144C(1) of the Act needs to be quashed.

6. That on the facts, law and in the circumstances of the case, the statutory approval so granted by Ld. Addi. CIT, Central Range-8, New Delhi is merely mechanical/statistical, without application of mind, without considering and perusing the material on record, facts of the case, applicable legal position and thus, bad in law thereby making the assessment proceedings u/s 143(3) r.w.s. 144C(13) of the Act and 144C(1) of the Act, void ab initio.

7. That on the facts, law and in the circumstances of the case, the Ld. AO, Ld. TPO as well as the Ld. DRP have erred in law in framing a high-pitched assessment u/s 143(3) r.w.s. 144C(13) of the Act by making erroneous, arbitrary and ad-hoc additions based on mere conjectures, suspicions and surmises amounting to 4,44,75,24,909/- without providing the statements so recorded and the material so seized during the course of search operation and thus, the orders passed are against the natural law of justice. Rs.4,44,75,24,909/- without providing the statements so recorded and he material so seized during the course of search operation and thus, the orders passed are against the natural law of justice.

8. That on the facts, law and in the circumstances of the case, the Ld. Assessing Officer has erred in law and on facts in initiating assessment proceedings on the appellant particularly when no independent search action has been conducted based on an Independent warrant of authorization in the name of the appellant and thus the assessment so framed u/s 143(3) r.w.s 144C(13) of the act is void ab initio and deserves to be vitiated.

9. That on the facts, law and in the circumstances of the case, the assessment so framed u/s 143(3) r.w.s. 144C(13) of the Act suffers from statutory legal jurisdictional defect as the alleged information based on which the assessment has been initiated was found during the course of search action conducted u/s 132 of the Act and accordingly, the assessment should have been framed under the specified provisions of income tax law, i.e., u/s 148 r.w.s. 147 of the Act and therefore, the order so passed u/s 143(3) r.w.s. 144C(13) of the Act needs to be annulled or quashed on the basis of this ground alone.

10. 10. That on the facts, law and in the circumstances of the case, the Ld. DRP has erred in law in not entirely deleting the proposed erroneous additions amounting to Rs. 4,68,86,17,357/-while framing order u/s 144C(5) of the Act.

11. That on the facts, law and in the circumstances of the case, the Ld. AO, Ld. TPO as well as the Ld. DRP has erred in law in making arbitrary transfer pricing adjustment on account of purchase of raw material of Rs. 3,73,94,73,776/- without considering the Transfer Pricing Study of the assessee company and by wrongly computing the Arm’s Length Price by adopting incorrect comparable as against the genuine comparable adopted by the assessee company in its Transfer Pricing Study and hence, the said erroneous addition needs to be deleted.

12. That on the facts, law and in the circumstances of the case, the Ld. AO as well as the Ld. DRP has erred in law in not allowing the claim of depreciation of Rs. 9,14,57,036/- following the arbitrary transfer pricing adjustment particularly when all the requisite details & documents were placed before the authorities with regard to purchase of capital assets and hence, the entire erroneous addition needs to be deleted.

13. That on the facts, law and in the circumstances of the case, the Ld. AO as well as the Ld. DRP has erred in law in making addition on account of alleged stock difference of Rs. 60,84,60,395/-particularly when there is no difference in the stock records maintained and hence, the entire erroneous addition needs to be deleted.

14. That on the facts, law and in the circumstances of the case, the Ld. AO as well as the Ld. DRP has erred in law in making addition by wrongly invoking provisions of Sec. 69C of the Act amounting to Rs. 81,33,702/- particularly when all the relevant details & documents were furnished and nothing was unexplained with regard to the genuineness of the expenditure claimed and hence, the entire erroneous addition needs to be deleted.

15. That on the facts, law and in the circumstances of the case, the Ld. AO, Ld. TPO as well as the Ld. DRP has erred in law in wrongly invoking and applying the provisions of Sec. 115BBE of the Act.

16. That on the facts, law and in the circumstances of the case, the Lo A.O. has erred in law in arbitrarily levying the interest u/s 234B 234C of the Act.

17. That on the facts, law and in the circumstances of the case, the orders of the Ld. DRP as well as Ld. AO needs to be quashed (to the extent stated above) and accordingly, the wrongful additions need to be deleted in entirety and the consequent arbitrary demands.

18. That on the facts, law and in the circumstances of the case, the Ld. Assessing Officer has erred in law and on facts in initiating penalty proceedings under various sections wrongly particularly based on an erroneous assessment order passed u/s 143(3) r.w.s. 144C(13) of the Act.

19. That the appellant craves to add, amend, alter or withdraw any Ground or Grounds of Appeal.”

2. The Ld. Counsel for the assessee at the outset submitted that the assessee is not willing to press ground No.3 of grounds of appeal which is on limitation in passing assessment order. In view of the submissions of the Ld. Counsel for the assessee ground No.3 of grounds of the assessee is dismissed as not pressed.

3. The Ld. Counsel for the assessee further submitted that assessee had raised additional grounds of appeal by way of a petition filed on 04.08.2025. Referring to the additional ground, Ld. Counsel for the assessee submitted that the assessee is challenging the jurisdiction of Ld.PCIT in transferring the case of the assessee from one range to another range by passing 127 order and consequential assessment order passed by the AO, since the Ld.PCIT who transferred the case of the assessee, had no jurisdiction to do so.

4. The Ld. Counsel for the assessee thus submitted that the additional ground raised is purely a legal ground and goes to the root of the matter and facts relating to additional ground had ready been on record, therefore, in view of the decision of the Hon’ble Supreme Court in the case of National Thermal Power Co. Ltd. v. CIT ITR 383 (SC), the additional ground be admitted and adjudicated upon.

5. Heard rival submissions and perused the following additional ground raised by the assessee :-

“That on the facts and in the circumstances of the case, the order u/s.127 of the Act dated 27.05.2022 passed by the Ld. PCIT, Delhi-10 is invalid, non-est and void-ab-initio as the same has been passed by a non-jurisdictional income tax authority and therefore, following the principles of Sublato Fundamento Cadit Opus (i.e., once the foundation is removed, the superstructure must fall), all the subsequent orders (including the final assessment order dated 29.10.2024) passed pursuant to the aforesaid order u/s.127 are also null & void being without jurisdiction and thus, deserves to be quashed.”

6. The Ld. DR in his submissions objected for admission of additional ground stating that the assessee never objected legality of the order of Ld.PCIT passed u/s. 127 before the AO, DRP or High Court. It is further submitted by the Ld. DR that facts relating to issue of legality of order u/s.127 are not on the record of the AO or DRP and they are available only in the records of Ld.PCIT and, therefore, it requires investigation into final facts and, therefore, not purely legal issue raised in the additional ground. Therefore, the DR requested to reject for admission of additional grounds raised by the assessee.

7. In our view the additional ground raised by the assessee is purely a legal ground going to the very jurisdiction of AO in making assessment and, therefore, respectfully following the decision of the Hon’ble Supreme Court in the case of National Thermal Power Co. Ltd. (supra) the same is admitted for adjudication. We also find that no new facts have to be investigated on the jurisdiction of the Ld.PCIT since the jurisdiction of the Ld.PCIT on the assessee’s is always in the public domain.

8. The Ld. Counsel for the assessee submitted that the assessee in the present case has been framed without jurisdiction as the order passed u/s 127 of the Act dated 27.05.2022 (which order conferred the jurisdiction upon the Ld. DCIT, Central Circle-30, New Delhi) was passed by a non-jurisdictional income tax authority, i.e., Ld. PCIT-10, Delhi. Thus, following the principles of Sublato Fundamento Cadit Opus (i.e., once the foundation is removed, the superstructure must fall), when the order conferring the jurisdiction upon the Ld. AO is itself invalid, vold-ab-initio and without jurisdiction then all the subsequent orders passed in pursuance of the aforesaid non-est order u/s 127 of the Act are also invalid, void-ab-initio and without jurisdiction. Copy of order u/s 127 of the Act dated 27.05.2022 is placed at Page Nos. 2122.

9. Therefore, it is submitted that the final assessment order passed u/s 143(3) r.w.s. 144C(13) of the Act dated 29.10.2024 so passed by the Ld. DCIT, Central Circle-30, New Delhi is bad in law, non-est and thus, void-ab-initio as the jurisdiction is assumed by Ld. DCIT, Central Circle-30, New Delhi based on an erroneous order passed u/s 127 of the Act by a non-jurisdictional authority, i.e., Ld. PCIT-10, Delhi and accordingly, the said order dated 29.10.2024 deserves to be quashed.

10. It is submitted that the Ld. PCIT-10, Delhi is a non-jurisdictional authority for the assessee company in view of the following submission (it is pertinent to mention here that the order u/s 127 of the Act dated 27.05.2022 has only been received on 02.01.2025 after the directions were given by the Hon’ble Bench during the course of hearing held on 13.12.2024, copy of the email dated 02.01.2025 is enclosed at Page no. 23):

“I. No Jurisdiction as per Sec. 124 of the Act

(i). That during the relevant AY 2021-22, the principal place of business of the assessee company was located at 3L, Udyog Vihar, Ecotech-11, Gautam Budh Nagar, Greater Noida UP 201306 as well as the books of accounts of the assessee company are also maintained at the said address, the copy of the factory license and GST Registration Certificate are enclosed herewith at Page Nos. 2427 of this written submission evidencing the said fact.

(ii) That it is vehemently submitted that as per the governing section which determines the jurisdiction of an Assessing Officer, i.e., Sec. 124 of the Income Tax Act, 1961, the Ld. PCIT-10, New Delhi cannot assume Jurisdiction of the assessee company as the principal place of business of the assessee company is situated only at Gautam Budh Nagar, Greater Noida and the said area is not covered under the jurisdiction of the Ld. PCIT-10, New Delhi and accordingly, the Ld. PCIT-10, New Delhi does not hold the valid jurisdiction over the assessee company. The relevant provision of the aforesaid Sec. 124 of the Act are reproduced hereunder: –

“Jurisdiction of Assessing Officers.

124. (1) Where by virtue of any direction or order issued under subsection (1) or sub-section (2) of section 120, the Assessing Officer has been vested with jurisdiction over any area, within the limits of such area, he shall have jurisdiction-

(a) in respect of any person carrying on a business or profession, if the place at which he carries on his business or profession is situate within the area, or where his business or profession is carried on in more places than one, if the principal place of his business or profession is situate within the area, and

(b) in respect of any other person residing within the area.”

(iii) To support the afore-stated facts & law, reliance is placed on the following landmark judgements wherein it has been held that the jurisdiction over the assessee company is determined on the basis of the principal place of business and not on the basis of registered address of the assessee company/ PAN history :-

a. Hon’ble Supreme Court of India in the case of Mansarovar Commercial (P.) Ltd. v. CIT (SC)

b. High Court of Calcutta in the case of India Gycols Ltd. v. CIT (CAL.)vide order dated 07.10.2004

c. Hon’ble ITAT Chandigarh in the case of Deluxe Enterprises v. ITO, Ward- 1 Solan (Chandigarh-Trib.)

d. Hon’ble Supreme court in the case of Bidi Supply Co. v. Union of India [1956] 29 ITR 717 (SC)

ii. Crux of the pronouncements -aforementioned well-settled judicial pronouncements –

It can be seen that the place of business has the crucial role to play in determining the jurisdiction of an assessee as the jurisdiction is also a matter of administrative convenience for both the assessee as well as the income tax authorities. Therefore, Sec. 124 of the Act specifically mandates that the Assessing Officer will assess the person who carries on his business or profession within his designated area. However, in the instant case of the assessee company, the said proposition of law has not been followed.

In view of the afore-stated facts and law, it is clearly evident that the order u/s 127 of the Act dated 27.05.2022 has been passed by a Non-Jurisdictional Income Tax Authority and therefore, the said order dated 27.05.2022 is a nullity as there is an inherent lack of jurisdiction and once a nullity is always a nullity, so therefore, all the subsequent orders passed pursuant to the said non-est order dated 27.05.2022 are also null, void & without jurisdiction and thus, the same deserves to be quashed.

II. No Jurisdiction as per the notification issued u/s 120 of the Act, even otherwise, inherent lack of jurisdiction with Ld. PCIT-10, Delhi as per notification issued

(i) That as per the jurisdiction notification issued u/s 120 of the Act, the jurisdiction of the corporate charges in Delhi is assigned on the basis of the alphabet with which name of the company begins with. Copy of the jurisdiction notification as obtained from the income tax website is enclosed herewith at Page Nos. 78-95 of this submission.

(ii) That the name of the company begins with the alphabet “K” and as per the jurisdiction notification, the jurisdiction of the corporate charges whose name begins with alphabet “K” falls under the charge of Ld. PCIT-5, Delhi, Range-14 and therefore, not with Ld. PCIT-10, Delhi,

(iii) Furthermore, as per the notification, the jurisdiction of the Ld. PCIT-10, Delhi falls under the “Non-Corporate Charges” and the assessee being a company comes under the “Corporate Charges”.

(iv) Therefore, as per the jurisdiction notification as well, the Ld. PCIT-10, Delhi cannot confer jurisdiction upon the assessee company which establishes the fact that there is an inherent lack of jurisdiction and the same cannot be cured under any provision of law. As held by a Division Bench of Bombay High Court in CIT v. Bharat kumar Modi wherein the well settled principle of law was discussed setting out the difference between lack of jurisdiction and irregular exercise of authority/jurisdiction, it was held that “Proceedings are a nullity when the authority taking it, has a no power to have seisin over the case”, therefore, in the instant case, the Ld. PCIT-10, Delhi has no power to exercise the right to transfer the jurisdiction of the assessee company as the Ld. PCIT-10, Delhi lacks the jurisdiction by virtue of provisions of Sec. 124 as well as Sec. 120 of the Act and accordingly, the order u/s 127 of the Act dated 27.05.2022 for AY 2021-22 passed by the Ld. PCIT-10, Delhi and all the orders passed subsequent to the said order dated 27.05.2022 are without a valid jurisdiction and accordingly, are all a nullity & deserves to be quashed on this count itself.

III. Jurisdiction cannot be assumed on the basis of PAN History

(i) No provision of law states that jurisdiction will be decided on the basis of the data available in PAN database. It is a settled law that jurisdiction cannot be assumed based on PAN History. In this regard, reliance is placed on the judgement delivered by the Hon’ble ITAT, Delhi in case of ACIT, Circle-27(1), Delhi v. M/s. UV Realtors Pvt. Ltd. in I.T.A. No.6033/DEL/2016 (Copy enclosed at Page Nos. 96-119) wherein after deep examination of the issue of jurisdiction & taking into account numerous judgments of the Hon’ble High Courts Including Hon’ble Jurisdictional Delhi High Court, vide order dated 17.03.2021 It was held as under:

“16. The entire case of the revenue hinges upon the interpretation that allotment of PAN is the criteria and foundation of deciding the jurisdiction of the Assessing Officer. However, nowhere in the statute it has been provided that PAN address will decide the territorial jurisdiction of the Assessing Officer. Section 139A merely provides who are the persons required to obtain PAN having regard to the nature of transaction of business and other conditions laid down that, Assessing Officer may allot a PAN and other procedure and mechanism of allotment of the PAN. The territorial jurisdiction is decided by the CBDT in terms of Section 120 only. Here, in this case, as discussed above, none of the parameters laid down for the territorial jurisdiction are applicable to the assessee. Even the Assessing Officer or the Ld. CIT(A) has not I.T.A. No.6033/DEL/2016 & CO No.11/DEL/2017 23 made out any case that assessee’s case falls in either of the given categories provided in sub Section (3) of Section 120, Allotment of a PAN from a particular place cannot provide jurisdiction to the Assessing Officer. The jurisdiction of the Assessing Officer over an assessee is decided by the CBDT on the basis of from where the assessee is either carrying the business in that area assigned to the Assessing Officer u/s.120 or the assessee is residing within that area. Admittedly, the assessee company does not only have registered office in New Delhi but also has been carrying out all its activities from which it has been earning income from New Delhi and has been filing the return of income from New Delhi. Even in the software of the Income Tax Department where return of income is uploaded online, the designation of the Assessing Officer as per the address has always been mentioned as Range-18, New Delhi. Had there been the allotment of jurisdiction by virtue of PAN, then the software of the Department would have assigned the jurisdiction as when assessee uploads the return of income electronically online. Be that as it may, nowhere in the statute it has been provided that allotment of a PAN would be the determinative factor for jurisdiction of the Assessing Officer. Thus, we hold that ITO, Ward-10(2)/DCIT, Circle-10(2), Kolkata did not have any jurisdiction over the assessee company and any order passed without jurisdiction is null and void.

Accordingly, we hold that the impugned assessment order passed by Assessing Officer of Kolkata is without jurisdiction and hence the same deserved to be quashed as per the provisions of law. Accordingly, Cross Objection of the assessee is allowed.”

(ii) Few other judgements, amongst many, taking the aforesaid similar view are cited herein below: –

a. Dr. Hari Singh Chandel v. ITO (Raipur – Trib.)

b. ITO v. NVS Builders (P.) Ltd. ITD 679 (Delhi – Trib.)

C Cosmat Traders (P.) Ltd. v. ITO ITD 504 (Kolkata – Trib.).

In view of the above, jurisdiction assumed on the basis of PAN data is not valid under law and thus, if the Ld. PCIT-10, Delhi has assumed the jurisdiction on the basis of PAN data, the same is also invalid, illegal, bad in law and void-ab-initio. Though it is pertinent to mention here that the assessee company has mentioned its principal place of business under the Address column while filing the return of income for AY 2021-22, copy of ITR Acknowledgement is enclosed at Page no. 120 of this submission evidencing the said fact.

IV. Bar of Sec. 124(3) is not applicable in case of inherent lack of Jurisdiction [Order u/s 127 of the Act dated 27.05.2022 has only been received on 02.01.25 after the directions were given by the Hon’ble Bench during the course of hearing held on 13.12.24, copy of email dt. 02.01.25 enclosed at Page No. 23]

(i) It is hereby again reiterated that the Ld. PCIT-10, Delhi lacks the inherent jurisdiction by virtue of provisions of Sec. 124 as well as Sec. 120 of the Act and accordingly, the order u/s 127 of the Act dated 27.05.2022 passed by the Ld. PCIT-10, Delhi and all the orders passed subsequent to the said order dated 27.05.2022 for AY 2021-22 are all without a valid jurisdiction.

(ii) It is important to note here that there is an inherent lack of jurisdiction on part of the Ld. PCIT-10, Delhi as the same is not covered under any provision of law or notification or order and thus, the bar of objection as envisages u/s 124(3) of the Act is not applicable in the instant case due to the presence of an inherent lack of jurisdiction. In this regard, reliance is placed on the judgement of the Hon’ble Delhi, ITAT in the case of Nasir Ali v. Additional Commissioner of Income-tax, Range- 23, New Delhi (Delhi –Trib.) (Copy enclosed at Page Nos. 121-128) wherein the Hon’ble Tribunal vide order dated 25.09.2019 held as under vide Para 7.2:-

“Considering the provisions of Section 2(7A) of the I.T. Act, 1961, which defines the definition of the Assessing Officer would make it clear that Addl. Commissioner of Income Tax could function as an Assessing Officer when jurisdiction have been assigned to him by virtue of the directions or orders issued under section 120(4)(b) of the I.T. Act, 1961. However, in the present case the Revenue Department has falled to produce any Order or Notification in favour of Addl. CIT, Range-23, New Delhi to act as an Assessing Officer, despite giving sufficient opportunities. No order or direction of the Board or any other Authority have been produced on record under section 120(1)(2) and (4) of the I.T. Act, 1961, empowering the Addl. CIT, Range-23, New Delhi, to act as an Assessing Officer in the present case to pass the impugned assessment order. The Id. D.R. contended that since it is mentioned in the assessment order that case was assigned to Addl. CIT, Range-23, New Delhi, vide Order of the CIT, Delhi-VIII, New Delhi, dated 09.12.2013, therefore, it is sufficient that Addl. CIT, Range-23, New Delhi, was having jurisdiction over the case of assessee. However, no Order or Notification in support of the above contention have been produced on record to satisfy the requirements of the Law. Mere mentioning of such order, dated 09.12.2013, may not serve the purposes. The Id. D.R. also relied upon Judgment of the Hon’ble Delhi High Court in the case of Mega Corpn. Ltd., (supra), in which it is mentioned in para-2 that on 01.08.2007, a Notification was issued under section 120(2) conferring power upon Addl. CIT. Therefore, this Judgment would not support the case of the Revenue. It maybe noted further that provisions of Section 124(3) of the I.T. Act would not be applicable in the case of the assessee because Addl. CIT, Range-23, New Delhi did not have jurisdiction over the case of the assessee. Therefore, there is no question of raising any objection before him. It may, however, noted that Section 124 of the I.T. Act, would come into play when there was a direction or order issued under section 120(1)(2) of the I.T. Act, and A.O. have been vested with the jurisdiction over the case of the assessee. In that event, if there is any dispute of the jurisdiction of the A.O, such question will be determined in accordance with the provisions of Section 124 of the Income Tax Act. However, in the present case, the Addl. CIT, Range-23, New Delhi lacks in jurisdiction over the case of assessee. In the absence of any Order or Notification issued by the Board or any other Income Tax Authority in this behalf, contentions of Id. D.R. are rejected. Considering the totality of the facts and circumstances of the case, we are of the view that Addi. CIT, Range-23, New Delhi do not have jurisdiction over the case of assessee and since he did not assume the jurisdiction legally and validly, therefore, the impugned assessment order framed by him is vitiated and illegal and without jurisdiction. In view of the above discussion, we set aside the Orders of the authorities below and quash the Impugned orders. Resultantly, all additions stand deleted. The Additional Ground No.1 of appeal of assessee is allowed.”

(iii) The aforesaid order of the Hon’ble Delhi ITAT has been duly affirmed by the Hon’ble Jurisdictional High Court of Delhi in ITA No. 133/2021 (Copy enclosed at Page Nos. 129-131) whereby the Hon’ble High Court vide order dated 20.03.2024 has dismissed the appeal of the Revenue by observing as under: –

“6. In our considered opinion, the provisions of Section 124(3) of the Act and the questions surrounding that provision would have warranted further consideration, provided the appellant had been able to establish that the Addl. CIT Range-23, New Delhi was duly empowered to act as the AO.

7. We note from the judgment rendered by the ITAT that the Addl. CIT Range-23 New Delhi is stated to have been assigned to be the AO by virtue of an order of the CIT dated 09 December 2013.

8. The ITAT however has noted that despite opportunity having been granted, the appellant had failed to place that authorisation for its perusal. It is the aforesaid aspect which has constrained the ITAT to observe that the mere mentioning of such an order in the assessment order which was framed would not suffice.

9. In view of the aforesaid, we find no ground to interfere with the views expressed by the ITAT. The appeal raises no substantial question of law and shall consequently stand dismissed.”

Reliance is also placed on M/s. Tata Communications Ltd. v. Additional commissioner of income tax range- 1(3) (MUM. TRIB.) ITA NO. 3972/MUM/2007 order dated 16.08.2019 and ITO (IT) TDS-2 v. Tata Steel Ltd. (MUMBAI TRIB.) order dated 07.06.2024.

(iv) Furthermore, it is also worthwhile to mention here that recently the Coordinate bench of Hon’ble ITAT, Delhi had an occasion to deal with the jurisdiction issue in case of Vishan Gunna v. ACIT (Delhi – Trib.). (Copy enclosed at Page Nos. 132-139) wherein the Hon’ble Tribunal vide order dated 25.07.2025 has observed & held as under:

“11. In the instant case, it is seen that the provision of section 127 of the Act, are not followed though the case has been transferred from one authority to another authority. Thus, without such order u/s 127 of the Act, jurisdiction cannot be conferred on the transferee AO. The Coordinate Bench of the Tribunal in the case of Raj Sheela Growth Fund (P.) Ltd. (supra) while dealing with this issue and also with the issue of objection u/s 124 has held the order as invalid by observing as under:

there is an assignment of the jurisdiction of an Assessing Officer. Sub section (1) of Section 124 assigns Assessing Officer’s jurisdiction linked with the territory. Sub Section (2) of Section 124 provides that assessee may raise objection regarding the correctness of the jurisdiction with respect to territorial jurisdiction u/s. 124(1). Sub Section (3) of section 124 provides for time limit for raising such objection. Here, it is not a case where assessee is challenging the territorial jurisdiction of the Assessing Officer albeit what has been challenged before us is that, Assessing Officer inherently lacked jurisdiction due to non passing of mandatory order u/s.127(2)(a) by the competent authority. It is now well-established principle of law that there is a distinction between lack of jurisdiction and irregular exercise of jurisdiction. The proceedings render void ab initio when the authority taking it has no power to have succinic over the cases.”

12. The said order of the Tribunal is further confirmed by the Hon’ble Delhi High Court in Raj Sheela Growth Fund (P.) Ltd. (supra) wherein Hon’ble Jurisdictional High Court vide its order dated 08.05.2024.

13. In view of the above facts and by respectfully following the judgement of Hon’ble Jurisdictional High Court of Delhi in the case of Raj Sheela Growth Fund (P.) Ltd. (supra), we are of the considered view that in the instant case, the jurisdiction has been transferred from one AO to another AO without there being any order passed u/s 127 of the Act. Thus, the jurisdiction assumed by the another AO i.e. ACIT, Circle International taxation 1(1)(1), Delhi without any authority and therefore, the order passed by him is without jurisdiction and the same is hereby quashed. The additional ground of appeal and Ground of appeal No.9 taken by the assessee are allowed.”

(v) Reliance is also placed on the judgement delivered by the Hon’ble ITAT, pur in case of ITO v. Bhagyaarna Gems & Jewellery (P.) Ltd. (Raipur Trib.) (Copy enclosed at Page Nos.140-168) wherein as well the Hon’ble Tribunal vide order 31.01.2025 has distinguished the applicability of objection u/s 124(3) of the Act in cases Involving transfer of jurisdiction u/s 127 of the Act by observing as under:

“48. We, thus, in terms of our aforesaid observations are of a firm conviction that as the assessee company had not called in question the jurisdiction assumed by the A.Q, based on, viz. (i) territorial area: (ii) persons or classes of persons; (iii) Income or classes of income; or (iv) cases or classes of cases. but had rather assailed the validity of the assessment order passed by the ITO-4(1), Raipur in absence of an order of transfer that was statutorily required to have been passed by the CIT-2. Kolkata u/s. 127 of the Act, therefore, it would not be circumscribed by the restriction contemplated under subsection (3) of Section 124 of the Act. Accordingly, we are of a firm conviction that the judgment of the Hon’ble Supreme Court in the case of Kalinga Institute of Industrial Technology (supra) is distinguishable qua the issue involved in the present case of the assessee company before us.

49. We, thus, in terms of our aforesaid observations read in the backdrop of the facts involved in the present case before us and the judicial pronouncements, are of a firm conviction that in absence of any order of transfer passed by the CIT, Kolkata-2, Kolkata u/s.127(2) of the Act, which was the very foundation for transferring the case of the assessee company from ITO-4(1), Kolkata to ITO-1(1), Raipur and finally to ITO 4(1), Raipur, the latter had invalidly assumed jurisdiction and framed the assessment vide his order u/s.143(3) of the Act, dated 31.03.2015. Accordingly, the assessment framed by the ITO-4(1), Ralpur vide his order passed u/s.143(3) of the Act, dated 31.03.2015 in absence of an order of transfer u/s. 127 of the Act having been passed by the CIT, Kolkata is quashed for want of valid assumption of jurisdiction.”

In view of the afore-stated facts and settled law, when there is an inherent lack of jurisdiction, i.e., the concerned income tax authority did not have jurisdiction over the case of the assessee legally & validly then there is no question of raising any objection before him u/s 124(3) of the Act. In the instant case, there is an inherent lack of jurisdiction on part of the Ld. PCIT-10, Delhi and thus, the provisions of Sec. 124(3) of the Act are not applicable in the case of the assessee company and therefore, the order passed u/s 127 of the Act as well as the subsequent orders so passed are all undisputedly without jurisdiction and accordingly, deserves to be quashed.

C. PRAYER:

In view of the above submission, following the principles of Sublato Fundamento Cadit Opus, when the order conferring the jurisdiction upon the Ld. DCIT, Central Circle-30, New Delhi so passed u/s 127 of the Act dated 27.05.2022 is itself invalid, nonest, bad in law, without jurisdiction and void-ab-initio THEN all the subsequent orders passed pursuant to the said order dated 27.05.2022 including the final assessment order passed u/s u/s 143(3) r.w.s. 144C(13) of the Act dated 29.10.2024 are also invalid, non-est, bad in law, without jurisdiction and void-ab-initio. Accordingly, it is hereby most humbly prayed before your honor that the final assessment order passed u/s u/s 143(3) r.w.s. 144C(13) of the Act dated 29.10.2024 may kindly be quashed being framed on the strength of erroneous order u/s 127 of the Act passed by a non-jurisdictional income tax authority and oblige.”

11. The Counsel for the assessee also submitted the following summary of arguments :-

“1) During the course of hearing held on 15.12.2025, the Ld. AR for the appellant placed the following written submissions before the Hon’ble Bench (advance copy already submitted to the Ld. DR on 12.09.2025 and again re-filed on 05.12.2025 which is a matter of record in this ITA no. 5356/DEL/2024) in respect of the grounds raised by the appellant towards the jurisdictional defects in the impugned assessment order framed u/s 143(3) r.w.s. 144C(13) of the Act dated 29.10.2024:

| S. No | Issue dealt up in the written submission (WS) Other Than Roca Bathroom barring 8s DIN issues | Written Submission (WS) No. | Pages |

| 1 | Order u/s. 127 of the Act dated 27.05.2022 has been passed by a Jurisdictional PCIT | 1 | 1-168 |

| 2. | DRP Order dated 30.09.2024 is barred by Limitation | 2 | 1-31 |

| 3. | Additions made based on third party information/ statements without providing (rather explicitly denying) the opportunity of Cross Examination | 3 | 1-84 |

| 4 | DRP erred in law in not deciding the jurisdictional and remanding back That same to the file of the Ld. AO and Ld. AO also ignored the directions of DRP which he is bound to follow. | 4 | 1-57 |

| 5 | Notice u/s. 143(2) issued by Non- Jurisdictional Assessing Officer | 5 | 1-30 |

| 6 | Wrong TP Adjustments made by adopting Dissimilar Comparables which d pass the FAR Test. | 6 | 1-80 |

| 7 | Non-Application of Mind by the Ld. AO while farming assessment and by th Addl. CIT while granting approval. | 7 | 1-57 |

| 8 | Notice u/s. 143(2) of the Act has not been issued as per Format prescribed b CBDT vide Circular dated 23.06.2017 (Refer Additional Ground no. II c 01.09.2025 | 8 | 1-61 |

2) Though the matter of the appellant is squarely covered by all the aforementioned eight submissions, however, during the course of hearing held on 15.12.2025, the matter was heard based on the arguments made in respect of the very first Written Submission -1 (WS-1) only as the matter is unambiguously covered in favour of the assessee on this very ground itself.

3) The Ld. AR for the appellant argued that the entire assessment framed in case of the appellant for AY 2021-22 is without jurisdiction and accordingly, the impugned assessment order dated 29.10.2024 deserves to be quashed and the consequent entire erroneous demand deserves to be quashed and thus, deleted being non-est, illegal and void-ab-initio.

4) The appellant company had raised an additional ground vide letter dated 01.08.2025 with regard to the fact that order u/s 127 of the Act has been passed by a Non-Jurisdictional PCIT as the said ground goes to the root of the matter and accordingly. can be raised at any stage before the appellate authorities [reliance placed on NTPC v. CIT (SC)], the additional ground so taken is reproduced hereunder (the copy of the additional ground along with copy of order u/s 127 of the Act have already been provided at Page Nos. 19-22 of WS-1):

“That on the facts and in the circumstances of the case, the order u/s 127 of the Act dated 27.05.2022 passed by the Ld. PCIT, Delhi-10 is invalid, non-est and void-ab-initio as the same has been passed by a non-jurisdictional income tax authority and therefore, following the principles of Sublato Fundamento Cadit Opus (i.e., once the foundation is removed, the superstructure must fall), all the subsequent orders (including the final assessment order dated 29.10.2024) passed pursuant to the aforesaid order u/s 127 are also null & void being without jurisdiction and thus, deserves to be quashed.”

5) The appellant has submitted the aforementioned WS-1 in respect of the afore-mentioned Additional Ground wherein it has been challenged by the appellant that order u/s 127 of the Act dated 27.05.2022 has been passed by a non-jurisdictional income tax authority, i.e., Ld. PCIT-10, Delhi (holding Non-Corporate charge) and therefore, following the principles of Sublato Fundamento Cadit Opus (i.e., once the foundation is removed, the superstructure must fall), when the order conferring the jurisdiction upon the Ld. AO (I.e. DCIT, Central Circle-30, Delhi) is itself invalid, void-ab-initio and without jurisdiction (i.e. order u/s 127 dated 27.05.2022) then all the subsequent orders including the final assessment order passed u/s u/s 143(3) r.w.s. 144C(13) of the Act dated 29.10.2024 so passed by the Ld. DCIT, Central Circle-30. New Delhi in pursuance of the aforesaid non-est order u/s 127 of the Act, are also invalid, void-ab-initio, unlawful & without jurisdiction and accordingly, deserves to be quashed along with the erroneous demand thereof. [EMPHASIS SUPPLIED]

6) That as per the jurisdiction notification for the corporate charges in Delhi, the jurisdiction is assigned on the basis of the alphabet with which name of the company begins with. Copy of the jurisdiction notification as obtained from the income tax website has already been provided at Page Nos. 78-95 of WS-1.

7) That the name of the company begins with the alphabet “K” and as per the jurisdiction notification, the jurisdiction of the corporate charges whose name begins with alphabet “K” falls under the charge of Ld. PCIT-5, Delhi, Range-14 and therefore, not with Ld. PCIT-10, Delhi holding “Non-Corporate Charge”.

8) That as per the notification, the jurisdiction of the Ld. PCIT-10, Delhi falls under the “Non-Corporate Charges” and the assessee being a company comes under the “Corporate Charges” and therefore, in no case, the Ld. PCIT-10, Delhi can assume jurisdiction over the appellant company being a corporate charge assessee.

9) In view of the aforesaid fact, the Ld. PCIT-10, Delhi cannot confer jurisdiction upon the assessee company which establishes the fact that there is an inherent lack of jurisdiction and the same cannot be cured under any provision of law. As held by a Division Bench of Bombay High Court in CIT v. Bharat kumar Modi (Bombay)/[2000] 246 ITR 693 (Bombay) wherein the well settled principle of law was discussed setting out the difference between lack of jurisdiction and irregular exercise of authority/ jurisdiction, it was held that “Proceedings are a nullity when the authority taking it, has no power to have seisin over the case”, therefore, in the instant case, the Ld. PCIT-10, Delhi has no power to exercise the right to transfer the jurisdiction of the assessee company as the Ld. PCIT-10, Delhi inherently lacks the jurisdiction as the said authority holds the charge of “Non-Corporate Assessees” and accordingly, the order u/s 127 of the Act dated 27.05.2022 for AY 2021-22 passed by the Ld. PCIT-10. Delhi and all the orders passed subsequent to the said order dated 27.05.2022 are without a valid jurisdiction and hence, a nullity and therefore, deserves to be quashed on this count itself.

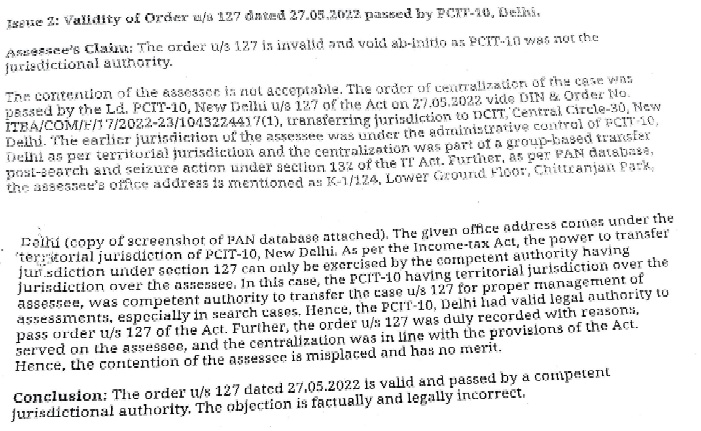

10) Against our aforesaid submissions, the Ld. DR submitted his reply during the course of hearing on 15.12.2025 (which is a report received from the Ld. DCIT, Central Circle-30, Delhi on 13.12.2025), the sum & substance of the Ld. DR submissions is that the Ld. PCIT-10, Delhi validly assumed jurisdiction and accordingly, passed the order u/s 127 of the Act dated 27.05.2022 empowering the Ld. DCIT, Central Circle-30, Delhi to act as the Assessing Officer in our case. The relevant portion of the aforesaid reply of the Ld. DR/Ld. AO is imaged hereunder :-

11) From the perusal of the aforesaid submission of the Ld. DR, it can be seen that the Ld. DR has purposefully ignored the fact that Ld. PCIT-10, Delhi holds non-corporate charge and not the corporate charge and thus, the Ld. PCIT-10, Delhi was not empowered to pass the order u/s 127 of the Act.

12) During the course of hearing, it was most vehemently submitted by us that the reply of the Ld. DR is only a smokescreen to cover up the erroneous order u/s 127 passed by the Non-Jurisdictional / Non-Corporate PCIT-10, Delhi which has no jurisdiction over the assessee as the assessee being a corporate assessee and thus, the order u/s 127 of the Act dated 27.05.2022 and the entire proceedings thereafter including the final assessment order passed u/s u/s 143(3) r.w.s. 144C(13) of the Act dated 29.10.2024 so passed by the Ld. DCIT, Central Circle-30, New Delhi in pursuance of the aforesaid non-est order u/s 127 of the Act. are also invalid, void-ab-initio, unlawful & without jurisdiction and accordingly, deserves to be quashed along with the erroneous demand thereof. [EMPHASIS SUPPLIED]

Prayer

In view of the afore-stated facts and settled law, when there is an Inherent lack of jurisdiction, i.e., the concerned income tax authority did not have jurisdiction over the case of the assessee legally & validly, the entire proceedings are a nullity. In the instant case, there is an inherent lack of jurisdiction on part of the Ld. PCIT-10, Delhi to pass order u/s 127 of the Act being a Non-Jurisdictional PCIT-10, Delhi (holding Non-Corporate charge) and therefore, following the principles of Sublato Fundamento Cadit Opus (i.e., once the foundation is removed, the superstructure must fall), when the order u/s 127 of the Act dated 27.05.2022 conferring the jurisdiction upon the Ld. AO (i.e., DCIT. Central Circle-30, Delhi) is itself invalid, void-ab-initio and without jurisdiction then all the subsequent orders including the final assessment order passed u/s u/s 143(3) r.w.s. 144C(13) of the Act dated 29.10.2024 so passed by the Ld. DCIT, Central Circle-30, New Delhi in pursuance of the aforesaid non-est order u/s 127 of the Act, are also invalid, void-ab-initio, unlawful & without jurisdiction and accordingly, deserves to be quashed along with the entire erroneous demand thereof and oblige.”

12. On the other hand the Ld. DR strongly objected to the submissions of the assessee that the PCIT, Delhi-10 did not have jurisdiction to transfer the case of the assessee and consequently the assessment made by the PCIT, CC-30 is not a valid assessment.

13. The Ld. DR further made submissions as under :-

“ii) Without prejudice to the above objection for admission of additional ground, it is submitted that an order u/s 127 of the Act is not appealable before the Hon’ble ITAT. It had been held to be an administrative order in number of judgments and the assessee did not challenge it before the Hon’ble High Court. Therefore, said order u/s 127 has attained finality and cannot be challenged indirectly before the Hon’ble ITAT in guise of challenging jurisdiction of the A.O. It is a settled preposition of law that what cannot be done directly as per law, cannot be permitted to be done indirectly too. Thus, assessee is precluded from questioning the validity of the transfer order u/s 127 in the guise of challenging the jurisdiction of the Assessing Officer before the Hon’ble ITAT. Further, if order under 127 of the Act cannot held to be as an invalid order at this stage, the jurisdiction conferred by said order on DCIT, CC-30 also can not be termed as invalid one.

(iii) As a matter of fact, the assessee has not called in question jurisdiction of the Assessing officer within the time limit prescribed under section 124(3) of the I.T. Act. 1961. No evidence regarding raising such question before A.O. has been filed by the Assessee Provisions of section 124(3) will squarely apply to such challenge being made by the assessee with regard to assumption of jurisdiction by AO before Hon’ble Tribunal. Relevant part of section 124(3)(a) of the Act is reproduced as under:

“124. (1) Where by virtue of any direction or order issued under subsection (1) or sub-section (2) of section 120, the Assessing Officer has been vested with jurisdiction over any area, within the limits of such area, he shall have jurisdiction-

(3) No person shall be entitled to call in question the jurisdiction of an Assessing Officer-

(a) where he has made a return under sub-section (1) of section 115WD or under sub-section (1) of section 139, after the expiry of one month from the date on which he was served with a notice under sub-section (1) of section 142 or sub-section (2) of section 115WE or sub-section (2) of section 143 or after the completion of the assessment, whichever is earlier;

……….”

Section 124(3)(a) of the Act clearly provides that no person shall be entitled to call in question the jurisdiction of an Assessing Officer after the expiry of the statutory time limit prescribed therein. It is an admitted fact that the assessee has not called in question the jurisdiction of Assessing Officer before the AO on the above ground within the time prescribed under section 124(3), i.e., within one month from the date of service of notice u/s 143(2)/142(1). Therefore, the assessee is barred to call in question the jurisdiction of AO before the Hon’ble ITAT after expiry of time limitation given in section 124(3) of IT Act.

(iv) The assessee argued that provisions of section 124(3) of the Act will not be applicable to challenge to jurisdiction on account of invalid order under section 127 of the Act. This argument is highly flawed and deserves to be rejected outrightly. Section 124(3) does not carve out any exception based on the mode of assumption of jurisdiction. The above section 124(3) does not make any distinguishment between different ways in which an AO has assumed jurisdiction. Such assumption of jurisdiction by AO can be on account of Board’s Notification/order in accordance with section 124(1) r.w. 120 of the Act or in accordance with order passed u/s 127 of LT. Act by the Ld. PCTT. Therefore, the contention of assessee that provisions of section 124(3) of the Act would not be applicable to issue of jurisdiction assumed consequent to order u/s 127 is without any merit and liable to be rejected. Such exception clause can not be read into above mentioned section in light of unambiguous language used. It is pertinent to emphasize that as stated earlier. before Hon’ble Tribunal, validity of order under section 127 of the Act can not be called in question now. Therefore, at this stage, the question which can be raised before this hon’ble Bench can be only about assumption of jurisdiction by the AO and the assessee is barred to raise such question about jurisdiction of the Assessing Officer in light of provision of section 124(3) of the Act.

(v) The Assessee also contended that PCIT, Delhi-10 did not have jurisdiction over its case and therefore, PCIT, Delhi-10 did not have legal competence to pass order under section 127 of the Act in its case. This argument can not be of any support to the case of the assessee. If order under section 127 can not be called in question at this stage, then definitely jurisdiction of the PCIT, Delhi-10 over the case of the assessee can also not be called in question at this stage. The issue of Jurisdiction of the Principal Commissioner passing order under section 127 cannot be adjudicated upon during course of appellate proceedings against instant assessment order. In fact, the Ld. PCIT, Delhi-10 is not made party to the instant appeal. No notice has been issued to the Ld. PCIT, Delhi-10, which is an entirely different jurisdictional income tax authority than the DCIT, CC-10 which passed the assessment order or PCIT, Central, which supervised function of the AO. The question of jurisdiction of PCIT-10, Delhi is at least two steps away from the issue of jurisdiction of the AO, which alone can be considered as part of issues of instant appeal which can be adjudicated upon. The reliance is placed by the assessee on the principle of Sublato Fundamento Cadit Opus without properly appreciating its ambit and import. The said principle would not apply to a situation where an earlier action (such as jurisdiction of PCIT, Delhi-10 and order under section 127 of the Act) cannot be questioned. and adjudicated upon during subsequent proceeding as earlier action had separate legal remedy available in this case, order u/s 127 of Act has attained legal finality due to separately availa judicial remedy not availed of by the assessee by no challenging said order u/s 127 before High Court.

(vi) It is not a case where there is no order under section 127 of the IT Act conferring Jurisdiction to assessing officer in central charge. There is an order under section 127 passed by the PCIT and the transfer of jurisdiction is within same city. Lack of order under section 127 of the Act is one thing and questioning merit of order under section 127 of the Act is entirely different thing. The issue of merit of order under section 127 of the Act can not be examined at this stage during present proceedings as proceeding under section 127 constitute separate proceeding undertaken by an income tax authority separate from the A.O. and had separate legal remedy available. If there was no order under section 127 of the Act in place, then situation would have been very different.

(vii) Further, centralization of the case of the assessee to central charge in the same station for coordinated investigation is an administrative exercise of the department and it does not cause any kind of prejudice to the assessee. The assessee could have challenged such an order by way of Writ Petition before Hon’ble High Court and assessee did not choose to do so, It implies that assessee was not aggrieved with the said transfer of jurisdiction within the same city. Now, by allowing the assessee to call in question order under section 127 of the Act before Hon’ble Tribunal, the assessee can not be allowed to avail new remedy, which it is not legally entitled to in such matters. Further, it important to note that in case, assessee’s contention is accepted, the end effect of the same will be to hold the jurisdiction of the Assessing officer as invalid/bad in law. This will be clearly in contravention to provision of section 124(3) of the Act as jurisdiction of AO can be held to be bad in law only if it is called in question within one month of issue of notice under 143(2)/142(1) of the Act. As stated earlier, the assessee did not raise any question to jurisdiction of the A.O. within prescribed period of one month.

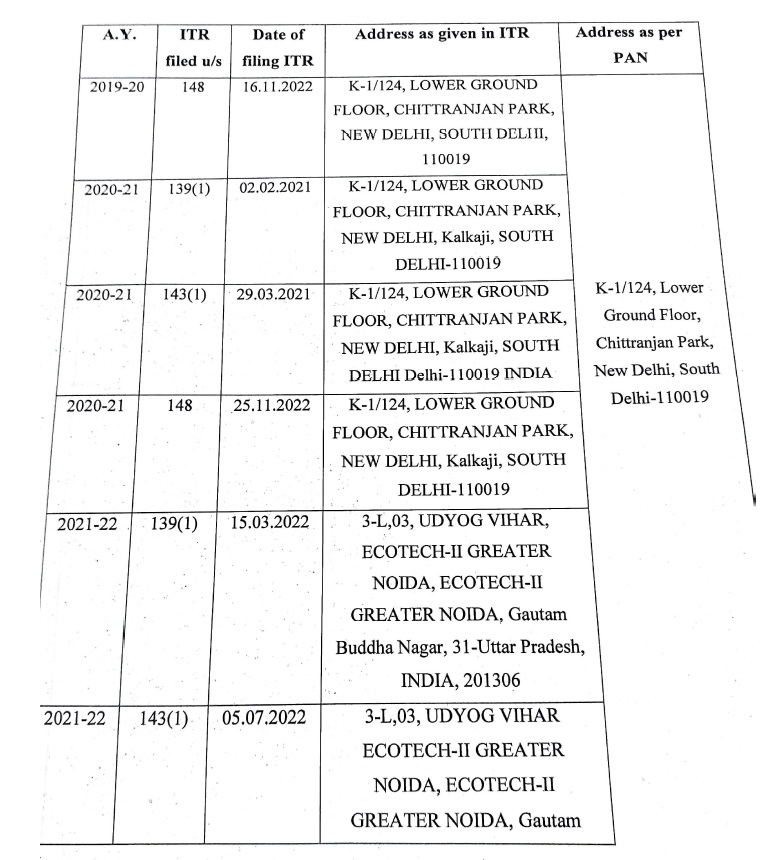

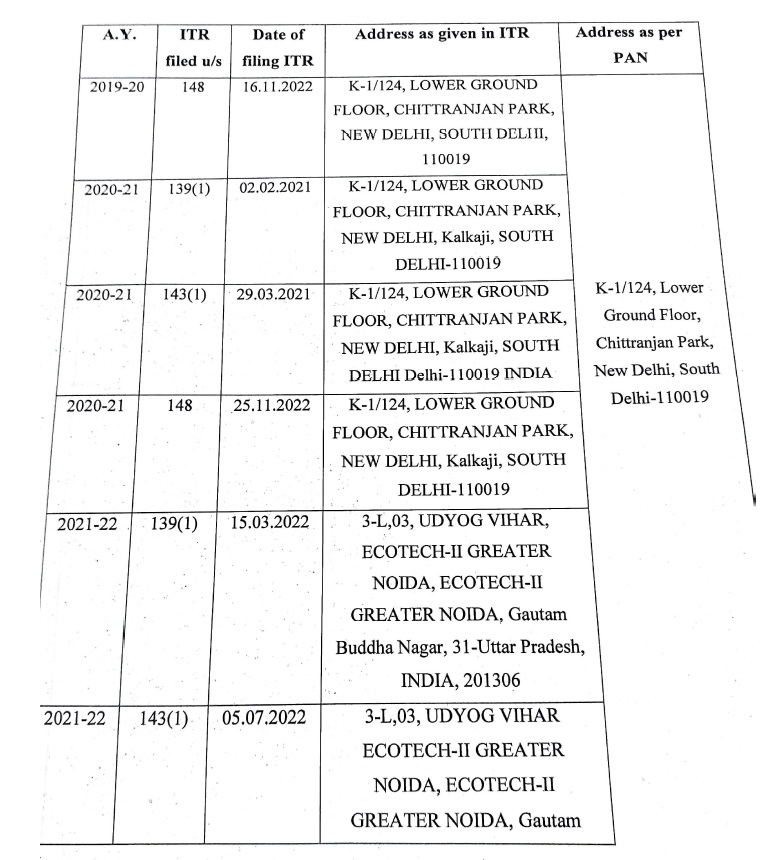

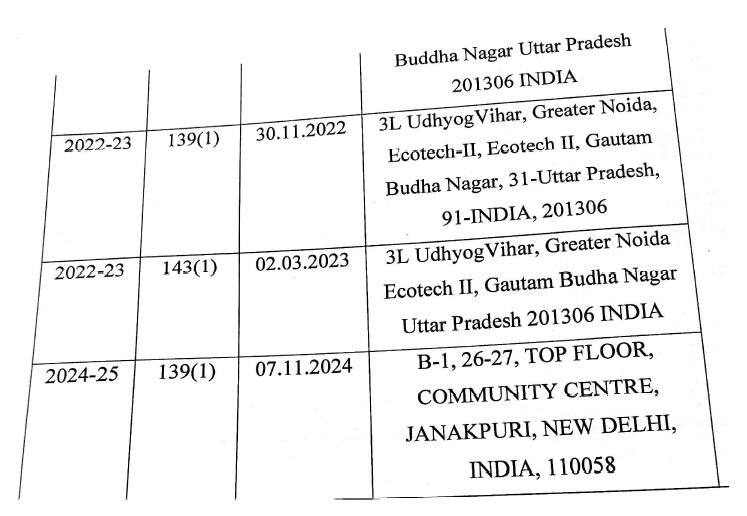

(viii) In addition to the points discussed above on strength of legal provisions, on merit of claim of the assessee that its jurisdiction did not lie in Delhi charge as its principal place of business was in Greater Noida, it is pertinent to highlight details of addresses given by the assessee in its Income Tax Return (ITR) and address as given in the PAN as under :

From the above table, it is evident that in the ITR filed from the AY 2019-20 to 2020-21, the address mentioned is K-1/124, Lower Ground Floor, Chittranjan Park, New Delhi, South Delhi-110019. It is pertinent to note that for the first time, in the ITR filed on 15.03.2022 for AY 2021-22, the assessee had mentioned the address of Greater Noida. But, again in the return of income filed for A.Y. 2020-21 under section 148 of the Act on 25.11.2022 after passing of order under section 127 of the Act, the address given by the assessee was of South Delhi. Thereafter, even in ITR filed for AY 2024-25 as late as on 07.11.2024, the assessee has again given its the address of Delhi i.e. B-1, 26-27, Top Floor, Community Centre, Janakpuri, New Delhi-110058. It is also required to be noted that as per PAN database, the address given by the assessee is mentioned as K-1/124, Lower Ground Floor, Chittranjan Park, New Delhi, South Delhi-110019. There has been no change made in this PAN address by the assessee. This goes to show that the assessee has been consistently maintaining its address in Delhi for commercial/business purposes and using the same for the purpose of filing returns of income for last many years and also using the said Delhi based address in its PAN records. There is no evidence brought on the record by the assessee that it mad any request to the Department for change of address in PAN from Delhi to Greater Noida prior to se passing of order under section 127 of the Act. Further, there is also no communication brought on record by the assessee which could have proved that at any time prior to issuing of order dated 27.05.2022 under section 127 of the Act, it made any request to the then jurisdictional Principal Commissioner i.e. Pr. CIT, Delhi-10 for transferring its jurisdiction from Delhi to Greater Noida in light of any change in address. Infact, as stated above, both prior to and after issue of order under section 127 of the Act, the assessee has been showing address based in Delhi in its return of income. In PAN records, address given is based in Delhi and same as given in the returns of income filed for A.Y. 2019-20 and 2020-21. Therefore, above records reveal that assessee has been maintaining its office for business purposes in Delhi over the years. Further, as per the business website ZAUBACORP.COM, the assessee company has been maintaining its registered address in Delhi. Relevant part of the information available on said website is reproduced as under:

“KUNSHAN QTECH MICROELECTRONICS (INDIA) PRIVATE LIMITED (CIN: U74999DL2019FTC344132) is a Private company incorporated on 10 Dec 2019. It is classified as subsidiary of company incorporated outside India and is registered at Registrar of Companies, Delhi.”

Infact, the fact that assessee company was having its registered office in Delhi at K-1/124, Lower Ground Floor, Chittranjan Park, New Delhi, South Delhi-110019 at the relevant point in time has not been denied by the Authorized Representative during the course of hearing. This address based in Delhi was the address given by the assessee on its own as registered address with ROC, in ITR and in PAN. The address given by assessee in such documents is not verified by the department by way of some physical inspection and is accepted in good faith. The assessee did not make any communication to the A.O. about its principal place of business being in Greater Noida and requesting for transfer of jurisdiction. Thus, there was no basis available with the A.O. or PCIT, Delhi-10 to consider that above address in Delhi was not a genuine one and had to be discarded.

It is also pertinent to mention that the Income-tax Department’s efiling portal provides facility titled “Know Your AO”, wherein the assessee can verify the jurisdictional Assessing Officer linked to the PAN at any point of time. Despite availability of such facility, no action was taken by the assessee to seek transfer of jurisdiction from the charge of PCIT, Delhi-10 to the charge, which is claimed to be having jurisdiction based on address in Greater Noida.

Therefore, now the assessee can not be allowed to get benefit out of the claim that its principal place of business was not in Delhi and was in Greater Noida, particularly when department acted in good faith based on address given by assessee itself in PAN, ITR and assessee did not bring any information to the knowledge of the Pr. CIT, Delhi-10 requesting for change in address to Greater Noida and for consequent change in jurisdiction. In other words, the interest of the Revenue can not be prejudiced by way of accepting contention of the assessee, when assessee itself had provided address based in Delhi in above mentioned legal documents submitted to the department and ROC. In view of above discussion, there is enough evidence on record, which indicate that assessee’s jurisdiction lied in Delhi charge.

In view of the above, contention of the assessee that its jurisdiction did not lie in Delhi charge is not tenable and deserves to be rejected.

(viii) The assessee also contended that its jurisdiction could not have been with PCIT, Delhi-10 as it was non corporate charge and whereas assessee is a corporate entity. In this regard, it is submitted that the assessee was allotted PAN on 10.01.2019, around three and half year before date of order under section 127 of the Act. During this period of three and half years, the assessee was well aware about its jurisdictional Assessing officer and yet, it did not make any request to the Assessing officer for transferring the jurisdiction to the correct jurisdictional assessing officer. As stated earlier, Income-tax Department’s e-filing portal provides a facility titled “Know Your AO”, wherein the assessee can see the jurisdictional Assessing Officer details linked to the PAN at any point of time. This utility has been created by the department specifically to make taxpayers aware about assessing officer who is linked to the PAN. Despite availability of such facility, no action was taken by the assessee to seek transfer of jurisdiction from the charge of PCIT, Delhi-10 to the charge, which is claimed to be having correct jurisdiction. The assessee is a large corporate person duly supported by well qualified professionals. Therefore, above contention of the assessee more than three years after the issues of order under 127 of the Act is just an afterthought without any bonafide and deserves to be rejected. Moreover, as submitted in earlier paragraphs, this plea of the assessee can not be raised now in light of expiry of limitation prescribed under section 124(3) of the I.T. Act.

(ix) During the course of hearing, the assessee contended that the notices were sent to it by the A.O. to an address in Greater Noida which is different from that in PAN database. The assessee tried to argue that it indicated that the A.O. was aware about its address in Greater Noida. In this regard, it is stated that the Assessing Officer functions through the ITBA platform, wherein different addresses of the assessee are auto populated from multiple sources, including but not limited to:

PAN database

Address mentioned in the Income-tax Return (ITR)

E-filing account profile of the assessee

Information available in the Insight/360-degree profile Other departmental databases

The system provides the Assessing Officer with multiple available addresses, and the AO is empowered to select one or more addresses for issuance of notices and communications, with the objective of ensuring effective service upon the assessee. Issuance of notice at an address located at Noida, even if different from the address mentioned in the PAN database, does not imply or amount to acceptance by the Department that the assessee was not under the jurisdiction of Delhi. It is merely a procedural step adopted to ensure service and cannot be construed as determinative of jurisdiction. Jurisdiction is determined strictly in accordance with statutory provisions and administrative orders, including the valid order passed u/s 127, and not on the basis of the address to which a particular notice is sent.

Hence, in view of the above facts, the objection raised by the assessee challenging the jurisdiction of the Assessing Officer, holds no merit and deserves to be rejected.

(x) The case laws relied upon by the assessee including the judgments of Hon’ble Supreme court in case of Mansarovar Commercial (P.) Ltd v. CIT (2023), (SC) and decision of Hon’ble ITAT, Delhi in case Vee Gee Industrial Enterprises Pvt. Ltd, ITAT 3550/Del/2024 are distinguishable on facts from the case of assessee as highlighted during the course of hearing. In case of Vee Gee Industrial, attention of Hon’ble Bench was drawn to Para 22 to 24 of the order which showed that change of jurisdiction was only for one intervening year and that too without any lawful order under section 127 of the Act. This is not in case of assessee. The case of Mansarovar Commercial too is distinguishable as in the instant case of assessee, the assessee itself had given address of Delhi in ITR, PAN and as registered office with ROC. The assessee company was recently formed and was never scrutinized earlier, prior to order under section 127 of the Act. The assessee did not submit any communication to the A.O. stating that its address based in Delhi is not used for purpose of business operations despite assessee very well knowing that its jurisdiction was lying in Delhi. Therefore, it was in light of such facts that there was no reason with the Department to believe that jurisdiction of assessee did not lie in Delhi. These were not the facts in above case decided by Hon’ble Supreme Court. Other case laws too forming part of submission of the assessee, even though not cited by the A.R. of the assessee during the course of hearing, are also found to be distinguishable on fact and hence, not applicable to case of assessee.

Moreover, none of the case laws relied by the assessee support the case of the assessee as they do not deal with the issue of bar imposed by the provision of section 124(3) of the Act to call in question jurisdiction of the A.O. in similar set of facts, which is the main basis of defense of the Revenue in present case.

(xi) Judicial decisions to support case of Revenue.:

Reliance is placed upon following decisions in support of the case of the Revenue in respect of the issue involved. The same may kindly be taken into consideration while adjudicating the issue involved.

1. Kashiram Agarwala v. Union of India (Supreme Court 1965 AIR 1028, 1965 SCR (1) 671, AIR 1965 SUPREME COURT 1028)

In Kashiram Agarwala (Aggarwalla) v. Union of India, the Supreme Court examined the scope of Section 127 of the Income-tax Act, 1961, which empowers tax authorities to transfer cases from one Assessing Officer to another. The Court clarified that although Section 127(1) generally requires that reasons for transfer be recorded and that the assessee be given a reasonable opportunity of being heard, these requirements are not absolute. The proviso to Section 127(1) creates an important exception: when a transfer is made within the same locality, such as between officers in the same city or jurisdiction, the obligation to record reasons and provide a hearing does not apply. The Supreme Court held that such intra-locality transfers are purely administrative in nature, undertaken for the administrative convenience of the department, such as workload distribution or internal efficiency. The Court emphasized that these transfers do not ordinarily cause prejudice or hardship to the assessee, since the place of assessment and overall jurisdiction remain substantially unchanged. Because no civil consequences are involved, principles of natural justice need not be strictly applied. The Court observed that insisting on a hearing or recorded reasons in such cases would unnecessarily hamper routine administrative functioning. Accordingly, it upheld the validity of the transfer order in that case, even though no reasons were recorded and no opportunity of hearing was granted. The judgment thus firmly establishes that Section 127 recognizes a distinction between substantive transfers affecting assessees an minor administrative transfers within the same locality, and that the latter an justified solely on grounds of administrative convenience.

The relevant portion of judgment is as follows:

“….. There is another consideration which is also relevant.

Section 124 of the Act de with the jurisdiction of Income-tax Officers. ‘S. 124(3) provides that within the limit the area assigned to him, the Income-tax Officer shall have jurisdiction-(a) in respect of any person carrying on a business or profession, if the place at which he carries on his business of profession is situate within the area, or where his business or profession is carried on in more places than one, if the principal place of his business or profession is situate within the area, and

(b) in respect of any other person residing within -the area.

This provision clearly indicates that where a transfer is made under the proviso to s 127(1) from one Income-tax Officer to another in the same locality, it merely means that instead of one Income-tax Officer who is competent to deal with the case, another Income-tax Officer has been asked to deal with it. Such an order is purely in the nature of an administrative order passed for considerations of convenience of the department and no possible prejudice can be involved in such a transfer. Where, as in the present proceedings, assessment cases pending against the appellant before an officer in one ward are transferred to an officer in another ward in the same place, there is hardly any occasion for mentioning any reasons as such, because such transfers are invariably made on grounds of administrative convenience, and that shows that on principle in such cases neither can the notice be said to be necessary, nor would it be necessary to record any reasons for the transfer.

2. Kanjimal & Sons v. Commissioner Of Income-Tax, Delhi High Court ( [1982]138ITR391 (DELHI)

Para 36. “We entirely agree with the assessed that if a case falls under s. 124(4) then the question of jurisdiction can be resolved only in the manner outlined in that section and it cannot be challenged before or decided by the appellate authorities. In fact this position cannot be challenged in view of the Supreme Court’s decision in Seth Teomal [1959] 36 ITR 9. Since the statute itself provides for a remedy in cases which fall under sub-s. (4), the assessed cannot bypass that remedy and seek to agitate the matter in appeals before the appellate authorities in a case where sub-s. (4) applies either where he has raised an objection within the time outlined by the Act and that objection had bee determined one way or the other or again where he has failed to raise an objection within the time outlined in the Act.” (Emphasis Supplied)

The passage above reiterates the settled legal position that where a case falls within the scope of section 124(4) of the Income-tax Act, the question of jurisdiction must be resolved strictly in the manner prescribed under that provision and cannot be examined or adjudicated by the appellate authorities. The statute itself provides a complete and specific mechanism for addressing jurisdictional objections, including the manner and time within which such objections are to be raised and decided. Consequently, once a case is governed by section 124(4), the assessee is confined to the statutory remedy available therein.

The position is fortified by the decision of the Supreme Court in Seth Teomal v. CIT [1959] 36 ITR 9, which conclusively held that where the Act prescribes a particular procedure for determination of jurisdiction, that procedure must be strictly followed. An assessee cannot circumvent or bypass the statutory scheme by raising jurisdictional issues for the first time before appellate authorities.

The passage further clarifies that this bar applies in both situations: first, where the assessee has raised an objection to jurisdiction within the time prescribed and such objection has been adjudicated; and second, where the assessee has failed to raise the objection within the stipulated period. In either case, the assessee cannot subsequently seek to agitate the issue in appeal proceedings.

Thus, the appellate authorities lack jurisdiction to entertain challenges to the Assessing Officer’s jurisdiction in cases covered by section 124(4). The legislative intent is to ensure certainty, procedural discipline, and finality in jurisdictional matters, preventing prolonged litigation by restricting such challenges to the specific statutory framework provided under the Act.

3. Sanjay Gandhi Memorial Trust v. Commissioner Of Income Tax (Exemption) (Delhi High Court W.P.(C) 3535/2021 & CM APPL. 10693/2021

The same position has been reiterated by Delhi High court as follows:

“Almost all the High Courts have held that transfer under Section 127 of the Act for the purpose of coordinated investigation is a sufficient reason for passing of such an administrative order. Consequently, it is settled law Neutral Citation Number: 2023:DHC:3707-DB that a transfer order under Section 127 of the Act does not affect any fundamental or legal right of an assessee

and the Courts ordinarily refrain from interfering with exercise of such power,”

In view of the above discussion, it is submitted that contention of the assessee questioning the jurisdiction of the DCIT, Central Circle-30 is without merit and deserves to be rejected. The appeal may kindly be fixed for hearing on merit.”

14. Heard rival submissions, perused the orders of the authorities below and the materials placed before us. The question here for adjudication is as to whether the order passed u/s.127 of the Act dated 27.05.2022 by the Ld. PCIT, Delhi-10 is invalid, non-est and void ab initio as the same has been passed by the non jurisdictional income tax authority and consequentially all the subsequent orders including the final assessment order passed pursuant to the order u/s.127 are null and void and being without jurisdiction.

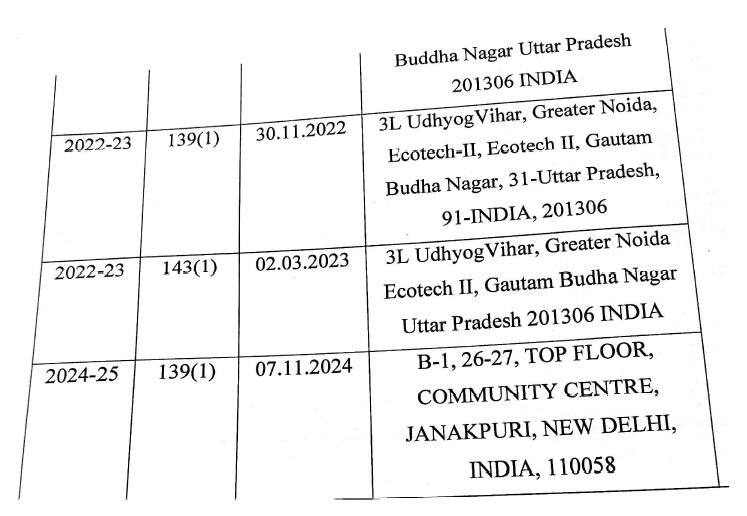

15. In this case the order u/s. 127 of the Act was passed on 27.05.2022 by Ld. PCIT, Delhi-10 transferring the jurisdiction of the AO to assess the assessee from Ward-31, New Delhi to Central Circle-30, Delhi which is as under :-

16. Pursuant to the said order the AO passed draft assessment order u/s.144C(1) dated 30.12.2023 on which the assessee filedobjections before the DRP and the DRP passed order on 13.09.2024 and the AO passed final assessment order u/s.143(3) r.w.s. 145C(13) on 23.10.2024 giving effect to the directions of the DRP.

17. By way of additional ground the assessee has challenged the jurisdiction of the Ld. PCIT, Delhi-10 in passing order u/s.127 as without jurisdiction and consequently all other proceedings / orders passed pursuant to the order u/s.127 are bad in law. It is observed from the pages 78 to 95 of the paper book furnished by the assessee, the jurisdiction of the Ld. PCIT the assessee’s in Delhi was listed according to which Ld. PCIT, Delhi-10 holds charge for non corporate assessee’s. The Ld. PCIT, Delhi-10 holds charge on non-corporate assessee’s. The assessee being a company and corporate assessee with alphabet-k, the Ld. PCIT, Delhi-5 holds charge over corporate assessee’s. In this scenario whether the Ld. PCIT, Delhi-10 who holds non corporate charge can assume jurisdiction to transfer a corporate assessee which was otherwise falling under the charge of Ld. PCIT, Delhi-5, for exercising jurisdiction of transfer from one range to another range.

18. We observe from pages 78 to 95 of the paper book which is the notification of the Revenue on jurisdiction of the Ld. PCIT/CIT, that the Ld. PCIT-10, Delhi holds the non corporate charge jurisdiction. The Ld. PCIT-10 who holds jurisdiction has jurisdiction only over non-corporate assessee’s cannot confer jurisdiction upon assessee company being a corporate assessee which establishes the fact that there is an inherent lack of jurisdiction and the same cannot be cured under any provision of law as held by the Hon’ble Bombay High Court in the case of CIT v. Bharatkumar Modi ITR 693 (Bombay), wherein it was held that proceedings are nullity when the authority taking it as no power to have over the case.

19. On the contrary the contention of the Ld. DR that there is no jurisdictional defect in the authority of Ld. PCIT-10, Delhi and the order u/s.127 of the Act dated 21.05.2022 is valid and the arguments of the assessee are wrong seems to be misplaced. The Ld. DR also contested that the assessee is barred to challenge jurisdiction of the AO in view of the provisions of section 124(3) of the Act. It is the contention of the assessee against this argument of the Ld. DR that with respect to section 124(3) of the Act, is totally misconceived and against settled legal position that bar of section 124(3) is applicable only when territorial jurisdiction of the AO is challenged and the said section 124(3) does not apply when there is inherent lack of jurisdiction on the part of the Ld. PCIT, u/s.127 of the Act. It was also contended that the assessee has not challenged the territorial jurisdiction of the AO rather challenged the assumption of jurisdiction of Ld. PCIT in view of invalid and non jurisdictional order passed u/s.127 of the Act dated 27.05.2022, which shows that there is inherent lack of jurisdiction on the part of the Ld. PCIT-10. Therefore, it is the contention that as per settled law the bar of Section 124(3) is not applicable on the objection raised by the assessee company against invalid order u/s.127 of the Act by Ld. PCIT. Reliance was placed on the following decisions :-

1. Vishan Gunna v. ACIT (Delhi – Trib.) dated 25.07.2025

2. Nasir Ali v. Addl. CIT ITD 30 (Delhi – Trib.) Delhi dated 25.09.2019 which was affirmed by the Hon’ble Delhi High Court in Pr. CIT v. Nasir Ali [IT Appeal No. 133 of 2021, dated 20-3-2024]

3. ITO v. Bhagyaarna Gems & Jewellery (P.) Ltd. (Raipur – Trib.) Raipur dated 31.01.2025

20. We find considerable merit in the contentions of the assessee that the order u/s.127 of the Act dated 27.05.2022 has been passed by non jurisdictional Ld. PCIT-10, Delhi. The assessee has brought on record the details of Delhi jurisdictional of Ld. PCIT-10 charges as available on the official Income Tax website. As said earlier, from the perusal of the said jurisdiction details it has been observed that Ld. PCIT-10, Delhi holds the non corporate charge and thus there is no iota of doubt that the Ld. PCIT-10 Delhi cannot confer jurisdiction upon the assessee company being a corporate assessee.

21. At the same time we do not see merit in the arguments of the Ld. DR as the bar of Section 124(3) of the Act is not applicable in the instant case due to the fact that the assessee has not challenged territorial jurisdiction of AO rather the jurisdiction assumed by the Ld. PCIT from a nonest order u/s.127 of the Act has been challenged as illegal and such transfer order did not confer jurisdiction to transfer the case from one range to another range. It is a settled law that once the nullity is always a nullity and, therefore, when the Ld. PCIT-10, Delhi inherently lacked the jurisdiction, then such order is nullity and cannot be cured.

22. We observe that recently the Raipur Bench of the Tribunal in the case of Bhagyaarna Gems & Jewellery (P.) Ltd. ( supra) held that sub section (3) of section 124 places an obligation upon assessee to call in question jurisdiction of AO within time period therein stipulated only in a case where objection pertains to territorial jurisdiction and not otherwise. It was further held that when assessee had not called in question jurisdiction assumed by the AO based on territorial area, persons or classes of persons; income or classes of income; or cases or classes of cases, but had rather assailed validity of assessment order passed by Assessing Officer in absence of an order of transfer that was statutorily required to have been passed by CIT u/s.127, it would be circumscribed by restriction contemplated under sub-section (3) of section 124 of the IT Act.

23. We also observe that in the case of Nasir Ali (supra) where the AO passed assessment order without having jurisdiction over the assessee and the Tribunal considering various decisions of jurisdiction High Courts held as under :-