ORDER

Vijay Pal Rao, Vice President. – This appeal by the Revenue is directed against the order dated 16/01/2025 of the learned CIT (A)-10, Hyderabad, for the A.Y.2017-18.

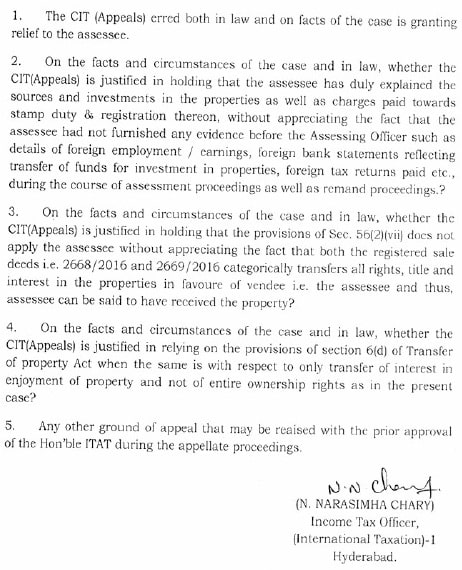

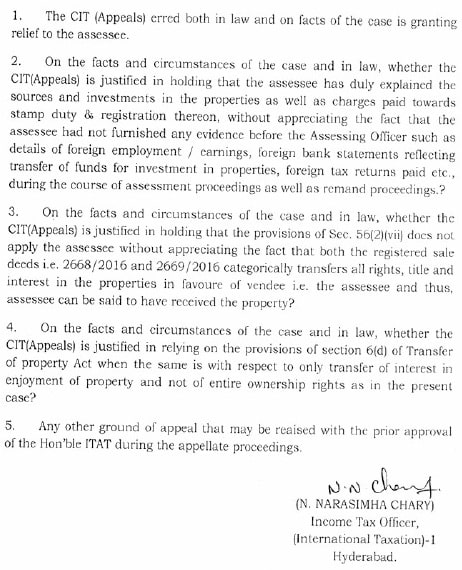

2. The Revenue has raised the following grounds of appeal:

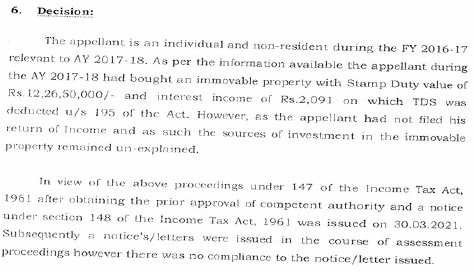

3. The respondent assessee has also filed a petition under Rule 27 of ITAT Rules, 1963 and raised the issue of validity of reopening of the assessment on the basis of the documents executed between the parties i.e. MOU dated 21/06/2016, agreements of sale cum GPA dated 21/03/2016 in respect of the land measuring 2 acres and 18 guntas in Survey No.303 as well as agreement of sale cum GPA dated 21/03/2016 in respect of land measuring 7 acres 22 guntas in Survey No.294 in the Revenue State of Manchirevula Village, because these transactions falls in the financial year 2015-16 relevant to the A.Y 2016-17 and not in the A.Y 2017-18 as reopened by the Assessing Officer and assessed to tax as unexplained investment as well as the income by applying the provisions of section 50C of the I.T. Act. The learned Counsel for the assessee has submitted that this issue of validity of the reopening of the assessment as well as consequential assessment order passed by the Assessing Officer was raised by the assessee before the learned CIT (A) in Ground Nos.1 to 4 but the same was decided against the assessee. Thus, the learned Counsel for the assessee has submitted that if this issue of validity of reopening of the assessment as well as the impugned assessment order is decided in favour of the assessee, then the appeal of the Revenue is liable to be dismissed on this ground only. He has submitted that the Income Tax Officer Manchirevula, Karimnagar District, issued notice u/s 148 of the Act on 30/03/2021 and thereafter, the assessment was completed by the Assessing Officer, NFAC on 29/03/2022 determining the total income of Rs.12,26,52,090/-. The said order was challenged by the assessee before the learned CIT (A) and also raised the grounds against the validity of the reopening of the assessment as well as the consequential assessment order passed by the Assessing Officer. The learned Counsel for the assessee has submitted that the assessee along with his father Sri Pochaiah Patel Ingu, entered into an MOU on 21/03/2016 with Shri G. Narasimha Chary and 11 other persons for clearing of pending litigation in respect of agricultural land admeasuring 122 acres and 18 guntas situated at Manchirevula Village, Rajendranagar Mandal, Ranga Reddy District. Shri G. Narasimha Chary and others claimed as land owners being the Inamdar and occupant/possessor of the land by virtue of will dated 13/06/1950. However, the Revenue authorities did not give Occupancy Rights Certificate (ORC) in favour of these persons and land is shown in the revenue record as Endowment land and these other persons are shown as encroachers of the land. These persons claiming themselves as owners of the land in question filed a Writ Petition against the order of the Revenue Authorities before the Hon’ble jurisdictional High Court which is pending adjudication. Apart from the MOU dated 23/03/2016, the assessee and his father entered into 2 agreements of sale cum GPA both dated 21/03/2016 that these persons in respect of 2 parcels of land measuring 2.18 acres in Survey No.303 and 7.24 acres in Survey No.294 against the consideration which were paid through banking channels as recorded in these agreements of sale cum GPOA both dated 21/03/2016. He has further submitted that all these documents were presented before the Jt. Registrar, Balanagar and were duly registered on 24/03/2016 as document No.2668 of 2016 and 2669 of 2016 respectively. Thus, the learned Counsel for the assessee has submitted that these documents were executed on 24/03/2016 and also registered on 24/03/2016, then the transactions under these 2 set of agreements of sale cum GPA were completed on 24/03/2016 and falls in the financial year 2015-16 relevant to the A.Y 2016-17 and not in the financial year 20916-17 and relevant to the A.Y 201718 as considered by the Assessing Officer as well as the learned CIT (A). The learned Counsel for the assessee has referred to the findings of the learned CIT (A) and submitted that the learned CIT (A) has rejected these grounds of the assessee only on the basis of the date of scanning of these registered documents in the Office of Registrar for uploading in the digital mode on 18th April, 2016. He has thus, submitted that when the transaction of transfer of immovable property was completed when the documents were executed and were registered on 24/03/2016 respectively, then the reopening of the assessment for the A.Y 2017-18 is invalid and liable to be quashed. Once the transaction was completed in the financial year 2015-16, then the reopening as well as consequential assessment order is not valid and liable to be quashed. The learned Counsel for the assessee has referred to section 47 of Registration Act,1908 and submitted that a registered document operates from the time from which it would have commenced to operate if in the registration thereof had been required or made and not from the time of its registration. Thus, he has contended that even if the registration is made on a subsequent date, the document operates on the date when it is executed by the parties. In support of his contention, he has relied upon the decision of the Delhi Bench of the Tribunal in case of Smt. Madhu Gangwani v. Assistant Commissioner of Income-tax 179 ITD 673 (Delhi – Trib.). The learned Counsel for the assessee has further submitted that the reopening is also not valid as the Assessing Officer as the Assessing Officer has not followed the procedure before issuing notice u/s 148 of the Act on 30/03/2021 as prescribed in the CBDT Instruction No.14/2013 dated 23/09/2013. Thus, the learned Counsel for the assessee has submitted that once the reopening of the assessment is not valid and liable to be quashed, then the appeal of the Revenue is also liable to be dismissed.

4. On the other hand, the learned DR has submitted that the assessee has not filed any return of income u/s 139 and even no return was filed in response se to notice u/s 148 of the I.T. Act. Therefore, when there is no compliance on behalf of the assessee to the notice issued by the Assessing Officer and no return of income was filed then, the objections raised by the assessee against the validity of the reopening of the assessment cannot be entertained and accepted. He has further submitted that the notice u/s 148 was issued by the Assessing Officer having geographical jurisdiction over the PAN of the assessee and thereafter, when it was found that the assessee is a Non-Resident-Indian, the matter was transferred to the concerned Assessing Officer and Faceless Assessment Centre. In support of his contention, he has relied upon the judgment of the Hon’ble Supreme Court in the case of Dy.CIT v. Kalinga Institute of Industrial Technology 493 (SC)/ dated 01/03/2023 in Special Leave Petition No.29304 of 2019 and submitted that the Hon’ble Supreme Court has reversed the order of the Hon’ble High Court whereby the assessment order was quashed on the ground that the jurisdictional Assessing Officer has not adjudicated upon the return. The jurisdiction has been changed after the return was filed. Therefore, once the assessee has not disputed the jurisdiction of the Assessing Officer, then the time limit as prescribed u/s 124(3) of the Act, the assessee cannot question the jurisdiction of the Assessing Officer. He has also relied upon the judgment of the Hon’ble Delhi High Court in case of Abhishek Jain v. ITO 405 ITR 1 (Delhi). The learned DR has pointed out that the learned CIT (A) has considered the relevant facts regarding the registration of the document and reporting of these documents by the Sub Registrar and given a factual finding that these documents were registered on 18th April 2016 and not on 24/03/2016 as claimed by the assessee. He has relied upon the impugned order of the authorities below.

5. We have considered the rival contentions as well as the relevant material available on record. The assessee is an NRI and did not file any return of income u/s 139 of the Act. On the basis of the reporting of the transactions vide agreements of sale cum GPA dated 16/03/2016, the Assessing Officer reopened the assessment by issuing notice u/s 148 dated 30/03/2021. In response to the said notice, the assessee did not file any return of income. The Assessing Officer has completed the assessment u/s 147 r.w.s. 144 of the I.T. Act on 29/03/2022 whereby the total income of the assessee was assessed at Rs.12,26,52,091/-. The assessee challenged the action of the Assessing Officer before the learned CIT (A). The learned CIT (A) has granted relief to the assessee by holding that there is no transfer of immovable property by way of these documents namely agreement of sale cum GPA dated 21/03/2016 because the vendors in these documents were not having a valid possession of the said property and therefore, due to lack of handing over of physical possession of the land, there was no transfer of immovable property. The impugned order of the learned CIT (A) is challenged by the Revenue by filing the present appeal. The assessee has raised an issue of validity of reopening by invoking the Rule 27 of the ITAT Rules, 1963 which reads as under:

“Respondent may support order on grounds decided against him.

27. The respondent, though he may not have appealed, may support the order appealed against on any of the grounds decided against him.”

6. Thus, Rule 27 of the ITAT Rules, 1963 contemplates that the respondent can support the order of the learned CIT (A) against which the other party has filed the appeal on any of the ground decided against him. The scope of raising a plea under Rule 27 of the ITAT Rules to defend against the appeal filed by the other party and thereby if the issue raised by the respondent is decided in favour of the respondent may lead to failure of the appeal filed by the other party. Therefore, even if the issue which is raised by the respondent assessee is decided in favour of the assessee holding that the reopening of the assessment is not valid and liable to be quashed, the impugned order of the learned CIT (A) would stand and will have full effect in so far as it is against the Revenue, but the assessee will succeed only to the extent that the appeal filed by the Revenue would fail. The Hon’ble Bombay High Court in the case of

B.R. Bamasi v.

CIT [1972] 83 ITR 223 (Bombay) has discussed the scope of Rule 27 of the ITAT Rules, 1963 as under:

“But even if the assessee had not made such a statement, the above judgment shows that the assessee would be entitled to raise a new ground, provided it is a ground of law and does not necessitate any other evidence to be recorded, the nature of which would not only be a defence to the appeal itself, but may also affect the validity of the entire assessment proceedings. If the ground succeeds, the only result would be that the appeal would fail. The acceptance of the ground would show that the entire assessment proceedings were invalid, but yet the Tribunal which hears that appeal would have no power to disturb or to set aside the order in favour of the appellant against which the appeal has been filed. The ground would serve only as a weapon of defence against the appeal. If the respondent has not himself taken any proceedings to challenge the order in appeal, the Tribunal cannot set aside the order appealed against. That order would stand and would have full effect in so far as it is against the respondent. The Tribunal refused to allow the assessee to take up this ground under an incorrect impression of law that if the point was allowed to be urged and succeeded, the Tribunal would have not only to dismiss the appeal, but also to set aside the entire assessment. The point would have served as a weapon of defence against the appeal, but it could not be made into a weapon of attack against the order in so far as it was against the assessee.”

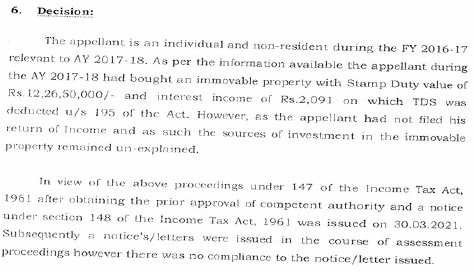

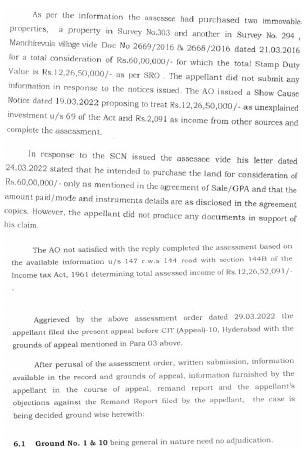

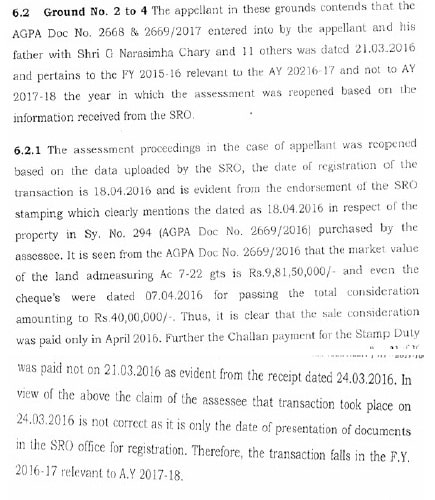

7. Thus, the Hon’ble High Court has held that if the respondent has not himself taken any proceedings to challenge the order in appeal, the Tribunal cannot set aside the order appealed against. However, if the ground raised by the assessee is accepted that the initiation of the re-assessment itself is invalid and consequential re-assessment order is liable to be set aside, the effect would be that the appeal filed by the Revenue would fail. The point raised under Rule 27 of the ITAT Rules serves as a weapon of attack against the appeal, but it could not be made into a weapon of defence against the order. In the case in hand, the learned CIT (A) has decided the issue raised by the assessee regarding the validity of the initiation of the proceedings u/s 147 and 148 of the Act in para 6.2 to 6.2.2 as under:

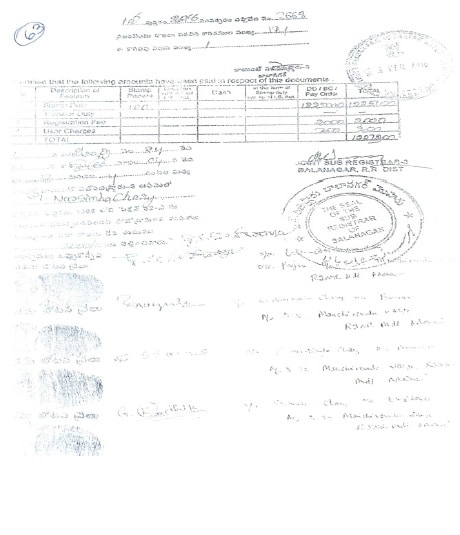

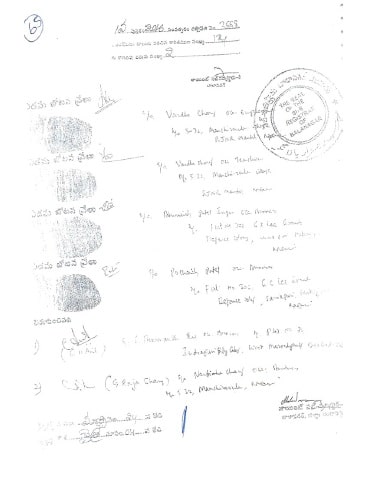

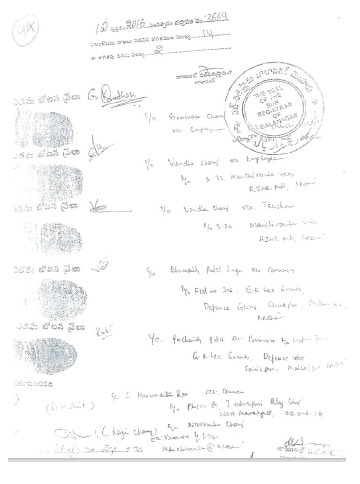

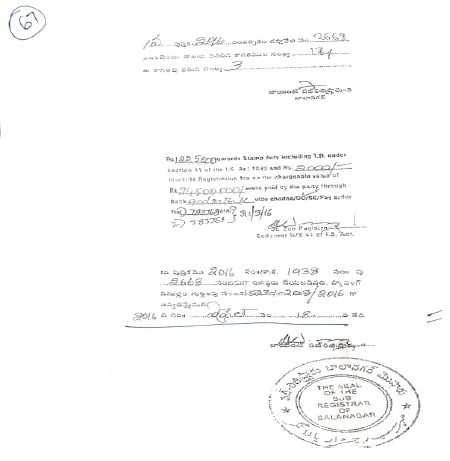

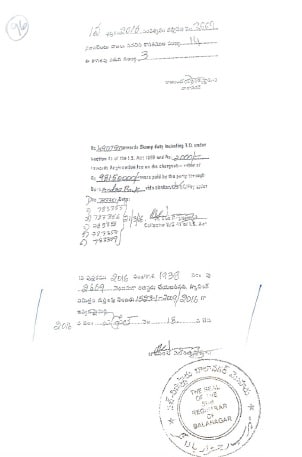

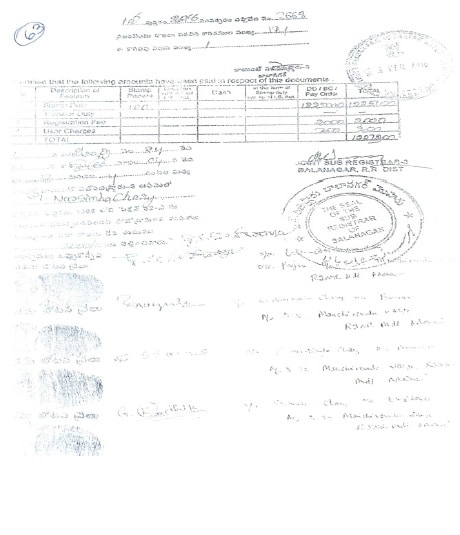

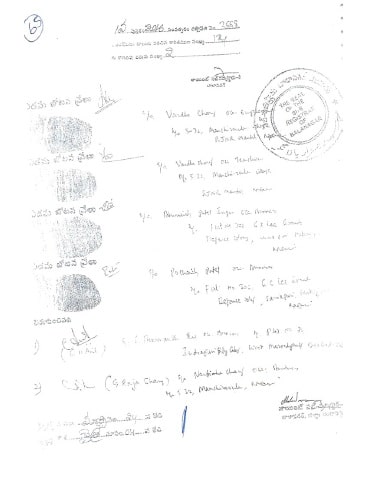

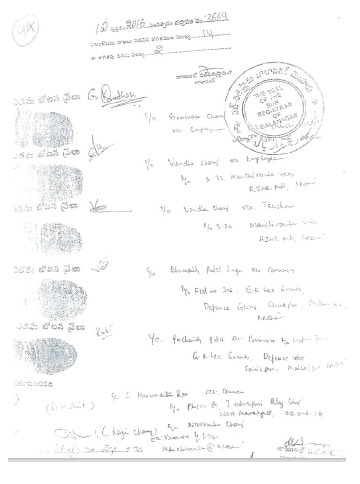

8. The learned CIT (A) has not disputed that these 2 documents being agreements of sale cum GPA were registered by the Registrar as document Nos. 2668 and 2669 of 2016 respectively. However, the learned CIT (A) has not accepted the fact that these documents were got registered on 24/03/2016 but it is held that these were registered on 18/04/2016. It is pertinent to note that as per the endorsement of the Jt. Sub Registrar, Balanagar, Ranga Reddy District, giving the details of registration at the back side of the first page of the document, these 2 documents were presented before the Jt. Sub Registrar on 21/03/2016 and were registered on 24/03/2016. The relevant details of registration of document Book No. as well as the date of registration are appearing at page Nos. 63, 65, 92 and 94 as under:

9. Thus, there is no dispute regarding the presentation of these documents before the Jt. Sub Registrar and the registration thereof on 24/03/2016 as manifest from the record of registration details. The learned CIT (A) has taken the date of scanning of these documents for uploading as a digital documents on 18/04/2016 as date of registration. These details are also appearing at page Nos. 67 and 96 of the paper book as under:

10. It is also pertinent to note that the documents as considered to be executed on the date when the parties have signed the documents and presented the same before the Registrar for registration and not on the date when the registration is done by the Sub Registrar. This position is clarified under section 47 of the Registration Act, 1908 as under:

“47. Time from which registered documents operates. A registered documents shall operate from the time from which it would have commenced to operate if no registration thereof had been required or made, and not from the time of its registration”.

11. We find from the record that these documents were duly signed by the parties and presented for registration on 24/03/2016 and thereupon these documents were registered as document Nos. 2668 and 2669 of 2016 both dated 24/03/2016. Thus, in view of section 47 of the Registration Act, 1908, the document is considered as executed on the date when it is signed and presented for registration. However, in the case in hand, the registration itself was completed on 24/04/2016, therefore, the transactions as per these documents would be considered on 24/03/2016. The learned CIT (A) has misdirected itself by taking the date of scanning as the date of registration as date of transaction. Accordingly, we accept this plea raised by the assessee that the reopening of the assessment for the year under consideration is not valid as the transaction as contemplated in the 2 agreements of sale cum GPA both dated 21/03/2016 were completed on the date when these documents were presented before the Jt. Sub Registrar and thereafter, registered on 24/03/2016 which falls in the financial year 2015-16 relevant to the A.Y 2016-17 and not in the financial year 2016-17 relevant to the A.Y 2017-18. Having held that the reopening of the assessment is not valid, the effect of it would be failure of the appeal filed by the Revenue. Accordingly, the order of the learned CIT (A) to the extent of deciding the issue in favour of the assessee and against the revenue stands confirmed and the appeal filed by the Revenue stands dismissed. Since the appeal filed by the Revenue is dismissed on the point raised by the assessee under Rule 27 of the ITAT Rules, 1963, we do not propose to go into the merits of the grounds raised in the appeal filed by the Revenue.

12. In the result, appeal filed by the Revenue is dismissed.