ORDER

Sudhir Kumar, Judicial Member.- This appeal by the revenue is directed against the order of the Commissioner of Income Tax (Appeals)-XX New Delhi [hereinafter referred to as “Ld. CIT(A)”] vide order dated 08.08.2014 pertaining to A.Y. 2005-06 arising out the assessment order dated 15-12-2008 u/s.143(3) of the Incometax Act, 1961, (in short ‘the Act’).

2. The revenue has raised the following grounds in appeal:

1.(i) Restricting the addition of Rs.9,53,92,316/- on account of interest expenses to Rs. 93,54,162/- when he himself had observed that the assessee had not submitted the rate at which short term loan was taken from banks and relied on prevailing bank rate.

(ii).Directing to take average of NYBOT price reported in the kingsman publication after converting into FOB vale as per CUP for determining ALP on the issue of import sugar when the assessee had failed to comply with the stipulation under Rule 10D

(iii). Directing the AO to take contracts under Bharat Mines & Minerals dt.03-06-2014 and contract with Patnayak Mineral Pvt.Ltd. dt.15-12-2014 as cup on the issue of export of ferrous and restricting the disallowance on the issue to Rs.3,83,367/-thereby allowing relief of Rs. 61,15,603/-.

2.The appellant craves leave for reserving the right to amend, modify, alter add or forego any ground(s) of appeal at any time before or during the hearing of this appeal.

3. The brief facts of the case are that the assessee company is a company incorporated as per the provisions of Companies Act, 1956. The Assessee Company is a wholly owned Indian Subsidiary of Cargil Mauritius Limited, which in turn is a wholly owned subsidiary of Cargil Inc.USA. The assessee company is engaged in the business of import, export and domestic trading in edible oils, fertilizers, grains oil seeds and other food products/processed food. The assessee company filed its return of income on 31-10-2005 declaring a loss of Rs.1,19,86,47,680/-. The return was processed u/s 143(1) of the Acton 31-10-2006. The case of assessee was selected for scrutiny and statutory notice u/s 143(2) dated 15-06-2006 was issued. Again notices u/s 143(2) and 142(1) of the Act with questionnaire were issued to the assessee. In the compliance of the notices filed their submission. The Assessing Officer assessed the loss of Rs. 61,69,58,580/- of the assessee as against the return loss of Rs.119,86,47,680/- with the following additions/ disallowances;

| (i) | | Discounting charges amounting to Rs.5,72,77,093/- |

| (ii) | | Deemed dividend amounting to Rs.40,89,99,750/- |

| (iii) | | Interest expenses amounting to Rs.9,5392,316/- |

| (iv) | | Depreciation on computer accessories amounting to Rs.75,580/- |

| (v) | | Transfer Pricing additions amounting to Rs.1,99,44,362/ |

4. Aggrieved the order of the AO the assessee filed the appeal before the Ld. CIT(A), who vide his order dated 08-08-2014 partly allowed the appeal and deleted the additions/disallowances relating to discounting charges amounting to Rs.5,72,77,093/-, deemed dividend amounting to Rs.40,89,99,750/- and addition on account of interest u/s 36(1)(iii) of the Act restricted to Rs.93,54,162/-instead of Rs. 95,392,316/- and granted relief of Rs.8,60,38,154/-. The Ld. CIT(A), also granted the relief on account of export of Rs.61,15,603/- and depreciation on computer peripherals and accessories @60% instead of @25%.

5. Being aggrieved the order of the Ld. CIT(A) the revenue is in appeal before the Tribunal.

6. Ld. CIT(DR) submitted that the assessee has not provided the details of loan taken, which was utilized for purchase of fixed assets during the year. During the proceedings of appeal Ld. CIT(A) called the remand report from the AO but the assessee has not provided the details of loan. Ld. CIT(A) had applied the interest of rate hypnotically and granted the relief to the assessee. He further submitted that the principle of res judicata is not applicable on the proceedings of the Act and the tax authorities are not estopped by their conduct from insisting on a different practice consistent with law. This view is supported by the Hon’ble High Court of Madras in the case of Commissioner of Income tax v. Thanthi Trust [1981] 23 CTR 155/[1982] 137 ITR 735 (Madras).

7. He further submitted that the rule of res judicata as regards assessment orders and assessment for one year are not binding the officer for the next year. In this regard, he relied upon the decision of the Hon’ble High Court of Delhi in the case of Krishak Bharati Cooperative Ltd. v. Deputy Commissioner of Income-tax (Delhi), wherein, the Hon’ble High Court held that there cannot be a wide application of the rule of consistency. In the case of Radhasomi Satsang v. CIT (SC)/[1992] 193 ITR 321 (SC), itself, the Hon’ble Supreme Court acknowledged that fact that there is no res judicata as regards assessment orders, and assessment for one year may not bind the officer for the next year.

8. Ld. AR of the assessee submitted that assessee has not taken any foreign currency loan during the year for purchase of fixed assets. He further submitted that in the previous year assessment order the AO did not disallowance the interest, therefore the consistency should have maintained. In the case of Commissioner of Income tax v. Sridev Enterprises (Karnataka)/[1991] 192 ITR 165 (Karnataka) Hon’ble Karnataka held as under:-

“4. We are in agreement with the view expressed by the tribunal. The status of the amount standing as outstanding due from Nalanda on the first day of the accounting year is that the amount that stood outstanding on the last day of the previous accounting year; its nature and status cannot be different on the 1st day of the current accounting year, from its nature and status as on the last day of the previous accounting year. Regarding the past years, the assessee claims for deductions were allowed in respect of sums advanced during those years; this could be, only on the assumption that those advances were not out of borrowed funds of the assessee. This finding during the previous years is the very basis of the deductions permitted during the past years, whether a specific finding was recorded or not. A departure from that finding in respect of the said amounts advanced during the previous year, would result in a contradictory finding; it will not be equitable to permit the revenue to take a different stand now, in respect of the amounts which were the subject-matter of previous years’ assessments; consistency and definiteness of approach by the revenue is necessary in the matter of recognizing the nature of an account maintained by the assessee so that the basis of a concluded assessment would not be ignored without actually reopening the assessment. The principle is similar to the cases where it has been held that a debt which had been treated by the revenue as good debt in a particular year cannot subsequently be held that a debt which had been treated by the revenue as a good debt in a particular year cannot subsequently beheld by it to have become bad prior to that year.”

8.1 Ld. AR also submitted that assessee had initiated the set-up of two oil refineries unit Kandala and Paradeep in March 2003, and over the period, it has incurred the cost for acquiring capital assets along with various incidental expenses. These cost were added in the Capital Work In progress till the time it was put to use in the relevant year in July 2004 and June 2004 respectively. It is also submitted that all the cost relating to the setting up of refineries, which have been incurred during the relevant year and prior years were routed through Capital Work in Progress. It is also submitted that assessee has been settled the issue in Direct Tax Vivad se Vishwas Scheme, 2020. The increase in fixed assets of the assessee was only because of the fact that Capital Work in Progress of Rs.1,58,63,87,994/- has been capitalized during the year and no substantial purchase of fixed assets were made. The assessee ECB loan was utilized during the A.Y.2004-05 which was not objected by the Ld. AO.

8.2 From the perusal of the order of the Ld. CIT(A), reveals that in the remand report the AO has reported that assessee could not prove the correctness of its claim. The assessee did not furnish the rate of interest, but as per Audit Report the assessee has used short term loan for long term investment. The projects were completed and put to use in July, 2004 and the interest cost capitalized for four months only. The Ld. AO has not disputed the Capital work in progress. The Ld. CIT(A) has rightly applied the rate of interest for four months on the short term loan of Rs.20,45,26,795/- and the internal accrual of Rs.6,25,57,646/-. We do not find any reason to interfere with the findings of the Ld. CIT(A), hence, we uphold the same and reject the ground no. 1(i) raised by the Revenue.

9. As regards Ground No.1(ii) raised by the Revenue, Ld. DR submitted that Ld. CIT (A) has erred in directing to take the average of NYBOT price and price reported in Kingsman Publication after converting FOB value as per CUP for determining ALP on the issue of Sugar when the assessee has failed to comply with the Stipulation under Rule 10D.

9.1 Ld. AR of the assessee submitted that the purchase to import of sugar were made on cost, Insurance, and Freight (“CIF”) basis. The assessee used New York Board of Trade (“NYBOT”) quotes as a valid external comparable uncontrolled price (“CUP”) for the purpose of benchmarking the subject transaction under CUP method. NYBOT quotes were inherently Free on Board (“FOB”) in nature. NYBOT prices on any given date are available only for four delivery months in a year. The price is under taken based on price quotes available on NYBOT as on entering into contract but for the relevant month of shipment. The price quote provided by exchange is cents/pounds which are converted into USD/MT based on standard conversion factor of 0.2204621. The assessee made the following adjustment to the quotes to make comparable to CIPL’s CIF contract prices. The assessee has considered the average of the highest and lowest prices for the first month in which the delivery of sugar is expected as per the terms of the contract. The international market prices relied upon by CIPL can be accepted to be the price at which various purchase/sale transaction would take place. Accordingly, the mean of high and low prices quoted by NYBOT is representative of multiple independent third-party transactions that would take place for import of sugar.

9.2 We note that Ld.CIT(A) has observed in his order as under:-

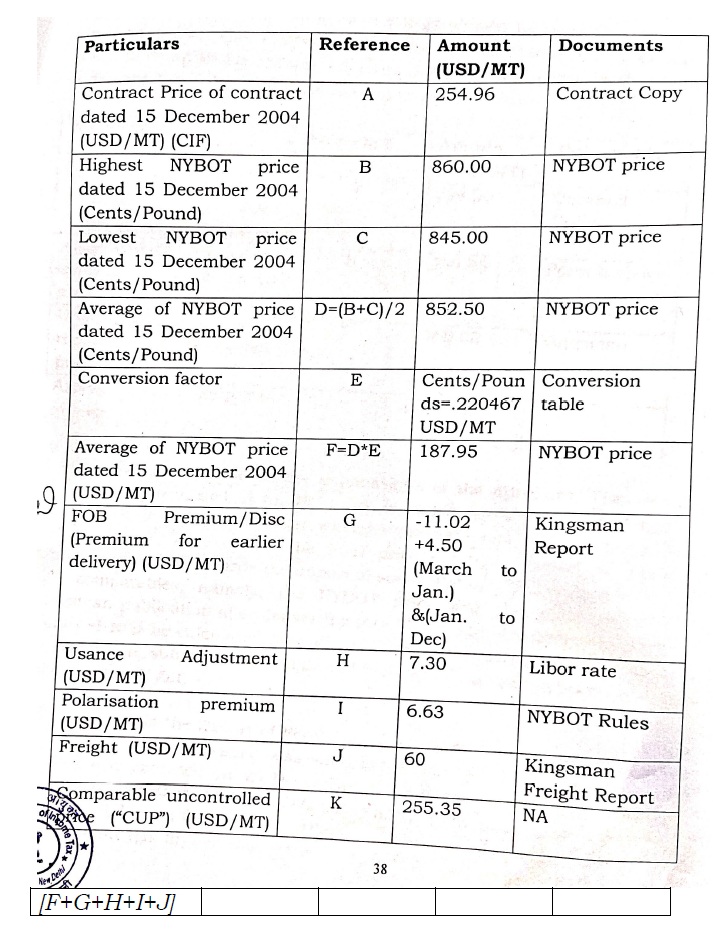

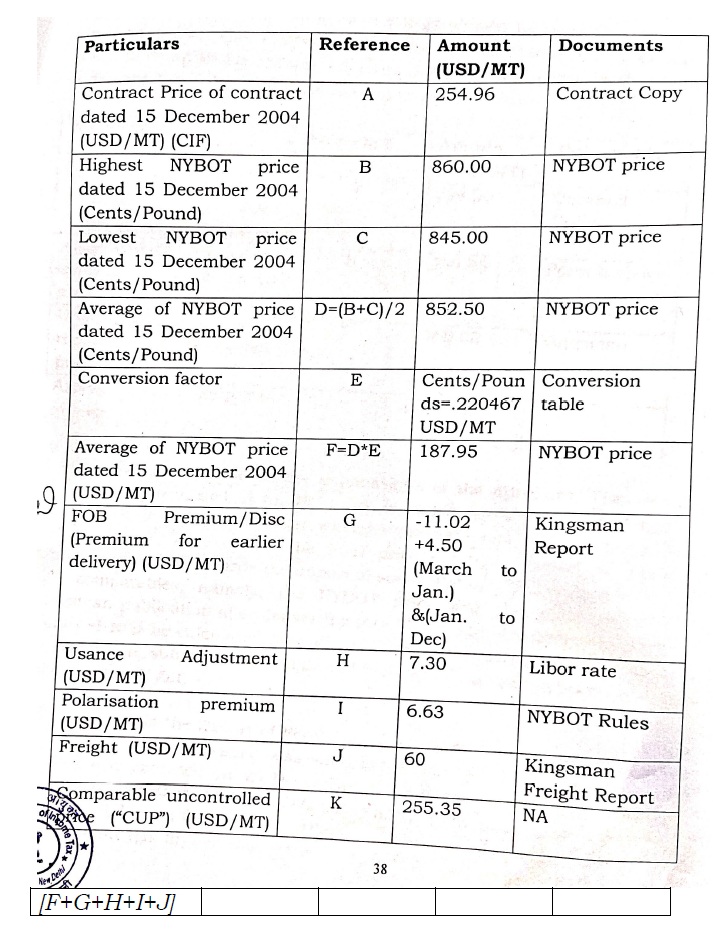

“7.3 As regards the CIF price and FOB price the TPO has observed that if the two prices are to be compared, there are two methods of neutralizing before actual comparison can be done. One method is to convert the FOB price to the CIF price or vice versa. If the difference in the delivery terms is adjusted correctly and accurately, there would be no difference in either of the two methods. The TPO has held that both the methods of neutralizing the difference would give the same result. The TPO has further observed that as far as possible, for the purposes of establishing the comparability for the application of the CUP method, the FOB prices should be used. In the present case the CIF price was converted into FOB prices by the TPO. For the purposes of freight, the TPO has relied on Kingsman Freight Report submitted by the appellant on sugar. The TPO has also observed that Kingsman Freight Report is an internationally renowned freight report from an independent broker. With respect to import of sugar, the TPO has converted the CIF price to the FOB price and determined the adjustment in respect of the imports of sugar at Rs.69,48,422/-. During the appellate proceedings the appellant contended that the approach formulated by the TPO of making an adjustment in the transfer price instead of comparable uncontrolled price is in contrary to the provisions of the Act. The appellant has drawn reference to Para 2.19 of the Transfer Pricing Guidelines on ‘Review of Comparability and of Profit Methods’ issued by the OECD and also “Guidance note on report on international transactions under section 92E of the Income-Tax Act, 1961 (Transfer Pricing)” issued by Institute of Chartered Accountants of India (ICAI). The appellant has argued that the appellant company should be given the range benefit on transaction relating to import of sugar on the ground that that price reported at NYBOT in itself is a mean/average of different prices. The appellant has placed reliance on the decision in the case of the Deputy Director of Income tax v. The Development Bank of Singapore (ITA No. 6631/Mum/2006). In this regard the appellant has submitted the following chart:

Accordingly, the appellant has claimed that the Contract Price of contract dated 15th December 2004 falls within the range of +/- 5% of the adjusted NYBOT price.

7.4 In addition to the above, the appellant has made an alternative submission that the arithmetical mean computed on the basis of price reported at NYBOT and Kingsman report should be used for comparing the contract price. The appellant has also clarified that the TPO has used Kingsman report for making adjustments to NYBOT price. In this regard the appellant has submitted the following chart:

| Particulars | Reference | Amount (USD/MT) | Documents |

| Contract Price dated 15 December 2004 (USD/MT) (at Indian Port) | A | 254.96 | Contract copy |

| Adjusted NYBOT price (as computed as point b above) | B | 250.85 | Point b above |

| Unadjusted price reported in Kingsman publication | C | 360.00 | Kingsman report |

| Average comparable price of sugar | | 30.5.42 | |

I have carefully considered the submissions of the appellant. The appellant has used unadjusted domestic price of sugar as reported in Kingsman publication in the above chart whereas the TPO has used FOB value for benchmarking. In my view the FOB price of sugar should be used for benchmarking. As regards the import of sugar, the AO/TPO is directed to take two companies, namely the NYBOT price and the price reported in Kingsman publication after converting into FOB value. The difference of arm’s length should be calculated accordingly. The adjustment to the international transaction is subject applicability of +/-5% as per proviso to section 92CA(2) of the I.T. Act.”

9.3 We noted that the assessee has not put any such allegations in any of the orders passed so far for the relevant assessment year. The Ld. CIT(A) affirmed the approach of the TPO in relation to adjustments done by converting CIF price into FOB prices. The Ld. CIT(A) also directed the TPO to consider the average of prices reported in Kingsman publication report and NYBOT for the purpose of computing of ALP after converting into FOB value. The Ld. CIT(A) also allowed the benefit of adjustment to the international transaction is subject to the applicability of +/- 5% as per the proviso to the section 92C(2) of the Act. We do not find any reason to interfere with the findings of the Ld. CIT(A), hence, this ground raised by the Revenue is dismissed accordingly.

10. As regards Grounds No.1(iii), Ld. DR submitted that the Ld. CIT(A) erred to direct the AO to take contract under Bharat Mines & Minerals dt.03-06-2014 and contract with Patanyak Mineral Pvt. Ltd. dt.15-12-2014 as CUP on the issue of export of Ferrous. He further submitted that the quotes from independent third party traders are not of the same day as the date of contract and single quote on different date is not representative of the market prices of the day of the contract. According to TPO for an appropriate comparison an average of the two quotes can be taken as representative of the market prices prevailing during the period.

10.1 Ld. AR of the assessee submitted that the TPO ignored the fact that the contract under consideration was amended by the entities and an amended contracts was executed on 16.12.2004. He further submitted that while computing the ALP of the impugned transaction, the TPO erred in ignoring the fact that the date of third party quotations significantly varied from the contract date of the respondent and hence, could not be used for comparison under CUP. He further submitted that contract under consideration was amended by the entities and an amended the approach formulated by the TPO of making an adjustment in the transfer price instead of comparable uncontrolled price is in contrary to the provisions of the Act. We note that CIT(A) upheld the benchmarking methodology followed by the assessee in its transfer pricing documentation and rightly directed the TPO to consider the amended contract for the purpose of computation of ALP. It was further noted that CIT(A) accepted the authenticity of the additional evidence submitted the assessee, he however, concluded that International Business Information System (IBIS) quotes cannot be used for comparison as the specifications mentioned as AEs are not available in the price quotes provided by IBIS. We may gainfully refer here the findings of the Ld. CIT(A) as under:-

“7.5 As regards the Export of Ferrous, the assessee has submitted that the contract under consideration was amended by the entities and an amended contract was executed on 16th December, 2004. For the amendment contract dated 16th December, 2004, the TPO has considered an average of trader’s and broker’s publication for 3rd June, 2004 and 15th December, 2004 respectively. The assessee has argued that for benchmarking such trade, the TPO should have considered the broker’s or trader’s quote dated 15 December, 2004. During the course of the appellate proceedings the appellant has submitted the price information obtained from International Business Information Services (IBIS) in respect of iron ore as additional evidence. It was forwarded to the TPO on 12.06.2012. In the remand report dated 13.06.2012 the TPO has objected to it on the ground that IBIS is a private party and price quotes provided by IBIS are not covered within the provisions of Rules 10D(3) of the Rules. In respect of the TPO’s remand report, the appellant has submitted that IBIS is an institute of national repute and price quotes provided by it are covered by Rules 10D(3)(b) and 10D(3)(c). The specifications mentioned for the AE are not available in the price quote provided by IBIS. Accordingly, the price quotes provided by IBIS are not acceptable in the present case. In my view, the contract dated 03-May-04 should be compared with CUP as per Bharat Mines & Minerals dated 03.06.04 and the contr4act dated 16.Dec-04 should be compared with CUP as per Patnaik Minerals Pvt. Ltd. Dated 15.12.04. Thus the difference is computed as under:-

| S.No. | Contract Date | Quantity | FOB contra ct price (us D/MT) | CUP | CUP Price | Assessee raises | Difference |

| 1 | 03-May-04 | 5,437 | 58.40 | CUP as per Bharat Mines and Minera ls dated 3.6.04 FOB Price USD/ MT 60.00 | 1,43,38,763 | 1,39,56,396 | 3,82,367 |

| 2 | 16-Dec- 04 | 24,639 | 58 | CUP as per Patnai k Minera ls Pvt Ltd. Dt. 15.12. 04 FOB Price USD/ MT 48.00 | 5,84,81,726 | 5,84,71,726 | |

The appellant is not eligible for benefits of +/-5% range under the provisions of the proviso to Section 92C as there is only a single quotation for the contract dated 03.05.2004. Accordingly, the adjustment on account of the export of ferrous to AE is restricted to Rs. 3,82,367/- instead of Rs. 64,97,970/-. Thus, the appellant gets a relief of Rs. 61,15,603/- [64,97,970 -3,82,367] in respect of the TP adjustment for export of ferrous to AE.”

10.2 We note that Rule 10 B(1) of the Income tax Rules not only permits but also make it obligatory for the respondents to make adjustments to the comparable prices wherever necessary. The relevant extract of the provision is reproduced below :

“For the purpose of sub-section (2) of section 92C, the arm’s length price in relation to an international transaction shall be determined by any of the following methods being the most appropriate method, in the following manner, namely:

| (a) | | Comparable uncontrolled price method, by which ; |

| (i) | | The price charged or paid for property transferred or services provided in a comparable uncontrolled transaction or a number of such transactions is identified; |

| (ii) | | Such price is adjusted to account for differences, if any between the international transaction and the comparable uncontrolled transaction or between the enterprises entering into such transactions, which could materially affect the price in the open market; |

| (iii) | | The adjustment price arrived at under sub-clause (ii) is taken to be an arm’s length price in respect of the property transferred or services provided in the international transaction;” |

10.3 We note that in the instant case the assessee has taken the price quotes provided by IBIS which is an institute of national repute. The specification mentioned for the AE are not available in the price quoted provided by IBIS. The Ld. CIT(A) rejecting the quotes provided by IBIS compared the contract dated 03-05-2004 with CUP as per Bharat Mines & Minerals dt. 03-06-2004 and the contract dated 15-12-2004 of Patnaik Minerals Pvt. Ltd. and adjustment on account of the export of ferrous to AE is restricted the amount to Rs.3,82,367/- without the benefits of +/-5 % range under the proviso to section 92C of the Act. It was further submitted due to the price fluctuations, the taxpayer adopted a transaction-by-transaction approach and further the adjustment sustained by the CIT(A) is Rs. 3,82,367/- was accepted by the taxpayer through Vivad Se Vishwas Scheme 2020. In view of above, we do not find any infirmity in the findings of the Ld. CIT(A), hence, we uphold the same, and accordingly, reject the instant ground raised by the Revenue.

11. In the result the appeal of the Revenue is dismissed.