ORDER

Udayan Dasgupta, Judicial Member.- Both the appeals have been filed by the assessee against the order of the ld. CIT(A) NFAC, Delhi even dated 06.09.2024 passed u/s 250 of the Income Tax Act, 1961 which has emanated from the order of the AO, ITD u/s 147 r.w.s. 144 of the Act, 1961 dated 19.10.2023 and 28.12.2023.

2. Grounds of appeal taken by the assessee in ITA No. 585/Asr/2024 for Asstt. Year: 2018-19 in Form No. 36 are as under:

“1. That the CIT(A) has erred in confirming the addition made by the AO vide order passed u/s 147 r.w.s 148 of Income Tax Act 1961, dated 06.09.2024 which is illegal, bad in law and void ab initio

2. That the CIT(A) has erred in Law in passing the order without adjudicating the case on merits particularly without adjudicating the factual grounds of appeal.

3. That on the facts and in the circumstances of the case and in law, the Id AO erred in making addition to the tune of Rs 3523500/- by passing the order u/s 147 r.w.s 144 r.w.s 148. That that assumption of jurisdiction u/s 148 by the Ld. AO is in violation of mandatory jurisdictional conditions as stipulated under the Act.

4. That the notice u/s 148A(b) dated 22.03.2024 requiring the assessee to furnish reply by 29.03.2024 is bad in law since the time allowed to furnish reply is less than 7 days as stipulated in the income tax act 1961. That the notice issued on 22.03.2024 is bad in law in view of judicial precedent in which it has been held that both, the day of issue of notice and the due date for furnishing of reply have to be excluded for calculating the time limit of 7 days.

5. That the assessment framed u/s 147 is bad in law as the jurisdictional notice issued u/s 148 and proceedings completed u/s 148A(d) were made by the jurisdictional AO which is in violation with the provisions of section 151A read with notification no S.O. 1466 (E) No 18/2022 dated 29.03.2022.

6. That the information uploaded on the insight portal is nowhere corroborated with any independent material. That the assessee was not supplied with the copy of reasons recorded, information or any document on the basis of which whole belief has been made that there is escapement of income to the tune of Rs. 3523500/-on the basis of information uploaded on insight portal.

7. That the CIT(A) has erred in confirming the action of the AO in estimating expenses at 20% without appreciating that the assessee is associated with Reliance retail limited as activation and recharge distributor of SIM cards and also engaged a subdistributor to meet the targets as fixed by reliance Retail limited.

8. That the CIT(A) has erred in confirming the addition made by the AO in estimating expenses at 20% without allowing the benefit of a major portion of expenses incurred in the shape of schemes, Trade discounts and sub-distributors margin.

9. That the CIT(A) has erred in confirming the action of the AO in estimating net profit margin @ 80% without appreciating that the net profit rate so estimated is not in conformity with the average industry net profit margin.

10. That the CIT(A) has erred in confirming the addition made by the AO without appreciating a major portion of expenses incurred in the shape of schemes, Trade discounts and sub-distributors margin.

11. That the Assessing craves and leave to add or amend the grounds of appeal before the appeal is finally heard or disposed off.”

3. Apart from the above, the assessee has also filed an application before the tribunal on 15th May, 2025, requesting for taking additional grounds of appeal for the assessment year 2018-19, which according to the assessee is a legal ground where no new facts are required to be investigated and the same goes to the very root of the proceedings for initiation of notice u/s 148 of the Act 61, and he prays for admitting the same as per the law laid down by the Hon’ble Apex court in the case of National Thermal Power Co. Ltd. v. CIT ITR 383 (SC):

4. The additional grounds taken by the assessee are as follows:

“That the notice issued u/s 148 on 04.04.2022 is bad in law, since the approval required u/s 151 was required to be obtained from Principal Chief Commissioner or Principal Director General or where there is no principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General instead of Pr. CIT, Srinagar obtained on 01.04.2022 vide Reference no. 100000029387810.”

5. Brief facts emerging from records are that the assessee individual, is a distributor of Reliance Retail Limited engaged in the business of selling SIM cards and dongles under trade name of ” Dreamz Communication” and the entire operations are carried out under agreement executed with the parent company (RIL), where the nature of activity, procedure, terms and conditions and the mode under which the same is to be carried out are clearly spelt out, which involves three channel partners in the business activity, namely the “zonal distributor “, “Distributor” (assessee in this case) and “Retailer outlet”, and the parent company has also determined and fixed the commission for each of the channel partners, the assessee (distributor) margin being fixed at 2% (two percentage) on recharge balance of total sales, as per written communication from the company (placed in pb page 37).

6. The total turnover of the assessee (as declared in the profit and loss A/c – page 38 of PB) during the year under appeal was Rs. 3,27,73,560/- and the gross profit is worked out at Rs. 12.74 lakhs (which is 3.88% approx.), arrived at after payments of retailer margins, trade discount and expenditure incurred under various schemes as framed by the parent company.

7. However, on account of unfortunate demise of the authorized CA of the assessee (one late Kapil Aggarwal, due to brain surgery), no return of income could be filed by the assessee in absence of all particulars and books of accounts which remained in custody of the deceased CA, prompting the department to issue notice u/s 148A(b) of the Act on 22nd March, 2022, and in absence of any response from the assessee, order was passed u/s 148A(d) on 2nd April, 2022, followed by notice u/s 148 dated 4th April, 2022, initiating the reassessment proceedings and further in absence of any response from the assessee to various subsequent notices issued by the department, the assessment was completed on a total income of Rs. 35.23 lakhs on the basis of information gathered u/s 133(6) of the Act, @ 80% of total commission Rs.44.04 lakhs as reflected in form 26AS alleged to have been earned by the assessee.

8. The matter carried in appeal has been dismissed by the Ld first appellate authority without considering the submissions uploaded by the assessee in the appeal portal on 4th July, 2024 consisting of financial statements, profit and loss A/c and balance sheet, ledger accounts of assessee in books of parent company (RIL), ledgers of various distributor schemes, retailer schemes, copies of agreement with parent company under which the business activity is carried out, details of other indirect expenses, along with application under Rule 46A of the IT Rules ‘ 62, praying for consideration of fresh evidences.

9. Now the assessee is before the tribunal on the grounds contained in the memorandum of appeal in form 36.

10. Though the assessee has taken eleven grounds in the memorandum of appeal, at the very outset the Ld. AR of the assessee, requested for taking up ground no 12, (the additional ground), and considering the jurisdictional issues involved therein, which goes to the very root of the proceedings, we admit the additional ground for hearing on merits.

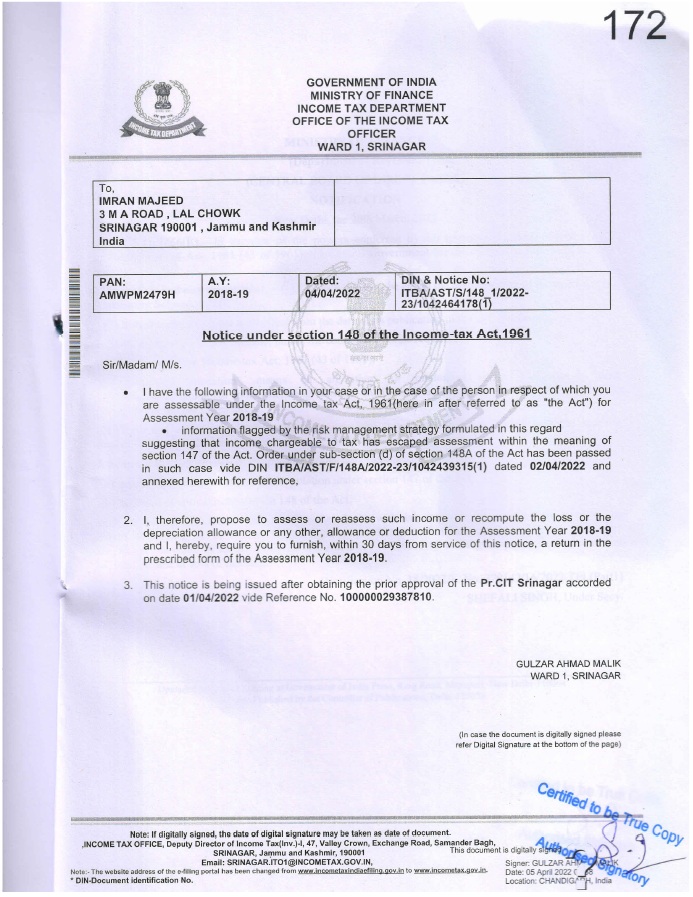

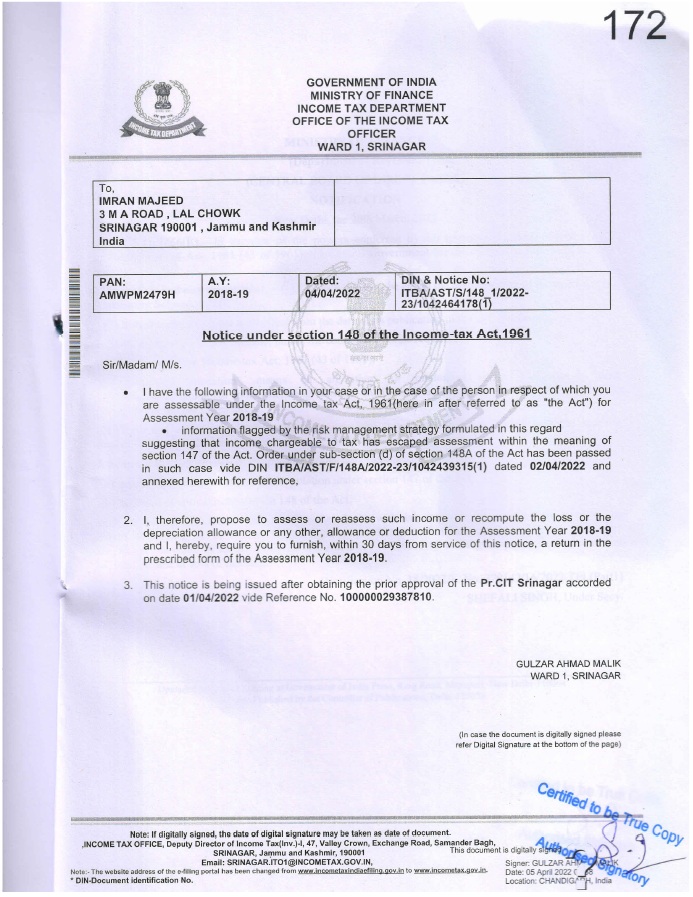

11. The argument of the Ld. AR is that in the instant case, more than three years has expired from the end of the assessment year 2018-19, and the sanctioning authority u/s 151(ii) of the Act 61, (as per amended finance Act 2022) should have been ” Principal Chief Commissioner of Income Tax” (and not the Principal Commissioner of Income Tax), and in the instant case the notice u/s 148 dated 4th April, 2024 has been issued with approval of the Principal Commissioner of Income Tax, Srinagar, along with the order u/s 148A(d) of the Act dated 2nd April, 2022, with approval from the same authority (PCIT Srinagar) (as per copies of order and the notice placed in page 170 to 172 of the pb), and since it is not in accordance with the provisions of section 151(ii) of the Act, the sanction obtained on 02/04/2022, is itself invalid and the consequential notice u/s 148 dated 04/04/2022 is also invalid and the entire proceedings is liable to be quashed.

12. In support of his arguments the assessee relied upon the decision of the Hon’ble Bombay High Court involving the same Asst year 2018-19, on identical facts, in the case of Holiday Developers (P.) Ltd. v. ITO (Bombay) where the Hon’ble court has held as follows:

“1. Petitioner is impugning an order under Section 148A(d) and the notice, both dated 7th April, 2022 passed under Section 148 of the Income Tax Act, 1961 (“Act”). Of-course Petitioner has also Impugned the notice dated 17th March, 2022 issued under Section 148A(b) of the Act. Various grounds have been raised but one of the primary grounds for challenging the notice under Section 148A(d) and the notice under Section 148 of the Act both dated 7th April 2022 is that order as well as the notice both mention the authority that has granted approval, is the Principal Commissioner of Income Tax (“PCIT”), Mumbai 5 and the approval has been granted on 7th April 2022.

2. Mr. Gandhi is correct in saying that the Assessment Year (“AY”) is 2018-19 and, therefore, since more than three years have expired from the end of the assessment year, Sanctioning Authority under Section 151(i) of the Act should be the Principal Chief Commissioner of Income Tax (“PCCIT”) and not the PCIT. Mr. Gandhi says, as held in Siemens Financial Services Private Limited v. Deputy Commissioner of Income Tax and Others [2023] 457 ITR 647 (Bom.), the sanction is invalid and consequently, the order and the consequent notice under Section 148A(d) and Section 148, respectively, of the Act should be quashed and set aside.

3. In view of these facts and circumstances, we do not see any reason to just grant Rule and keep the matter pending.

4. As held in Siemens (supra), the order passed under Section 148A(d) and notice issued under Section 148 of the Act both are quashed and set aside.

5. Petition disposed. No order as to costs.

6. All rights and contentions are kept open.”

13. Thereafter, the assessee relied on the decision of the Bombay High Court in the case ofPrakash Pandurang Patil v. ITO (Bombay)/WRIT PETITION NO. 10749 OF 2024 DATE 12 August 2024, on the issue of sanction obtained u/s 151 of the Act 61, where the Hon’ble court has also considered the decision of Siemens Financial Services (P.) Ltd. v. Dy. CIT ITR 647 (Bombay):

14. The relevant paragraph – 6 of the order is reproduced:

“6. Apart from the petitioner’s contention that the proceedings would stand covered by the decision of this Court in Hexaware Technologies Limited (supra), another contention as raised by the petitioner is in regard to the impugned notice also being contrary to the decision of this Court in Siemens Financial Services Pvt. Ltd. v. Deputy Commissioner of Income Tax, Circle 8(2)(1), Mumbai & Ors.2, for the reason that the proceedings were initiated well after the expiry of three years from the end of the relevant assessment year. If this be so, the contention as urged on behalf of the petitioner is that the sanction for initiating the reassessment ought to have been granted by the authorities of the rank referred to in Section 151(ii) of the Act and not by the authorities of the relatively lower rank under Section 151(i) of the Act. It is submitted that the issue in this regard is no more res integra in view of the pronouncement of this Court in Siemens Financial Services Pvt. Ltd. (supra) as relied on behalf of the petitioner.

7. In Siemens Financial Services Pvt. Ltd., this Court held that the sanction as granted by the authority would be rendered invalid in the case it is not issued by the authorities specified in Clause (ii) in the event reassessment proceedings were initiated well after the expiry of three years from the end of the relevant assessment year. The following observations as made in Siemens Financial Services Pvt. Ltd. are required to be noted, which reads thus: “24. As per section 151 of the Act, the ‘specified authority’ who has to grant his sanction for the purposes of section 148 and section 148A is the Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General, the Chief Commissioner or Director General if more than three years have elapsed from the end of the relevant assessment year. The present petition relates to the AY 2016-17, and as the impugned order and impugned notice are issued beyond the period of three years which elapsed on 31 st March, 2020 the approval as contemplated in section 151(ii) of the Act would have to be obtained which has not been done by the Assessing Officer. The impugned notice mentions that the prior approval has been taken of the ‘Principal Commissioner of Incometax – 8’ (‘PCIT-8’) which is bad in law as the approval should have been obtained in terms of section 151(ii) and not section 151(i) of the Act and the PCIT-8 cannot be the specified authority as per section 151 of the Act. Further, even in the affidavit-in-reply, the department has accepted that the approval obtained is of the ‘Principal Commissioner of Income- tax – 8’ and, hence, such an approval would be bad in law.”

15. Thereafter in Paragraph -8 of the order it has been observed as follows:

“8. The decision in Siemens Financial Services Pvt. Ltd. (supra) was subsequently followed in Vodafone Idea Ltd. v. Deputy Commissioner of Income Tax, Circle-5(2)(1), Mumbai & Ors. 3 where the Court made the following observations: “3. The impugned order and the impugned notice both dated 7 th April, 2022 state that the Authority has accorded the sanction is the PCIT, Mumbai-5, The matter pertains to Assessment Year (AY) 2018-19 and since the impugned order as well as the notice are issued on 7 th April, 2022, both have been issued beyond a period of three years. Therefore, the sanctioning authority has to be the PCIT as provided under Section 151(ii) of the Act. The proviso to Section 151 has been inserted only with effect from 1st April, 2023 and therefore, shall not be applicable to the matter at hand. 4. In these circumstances, as held by this Court in Siemens Financial Services Private Ltd. v. Deputy Commissioner of Income Tax & Ors., the sanction is invalid and consequently, the impugned order and impugned notice both dated 7th April, 2022 under section 148A(d) and 148 of the Act are hereby quashed and set aside.”

16. Thereafter, the assessee placed reliance on the decision of the Hon’ble Supreme Court in the case of ITO v. Prakash Pandurang Patil(SC)/SLP Civil Diary No 39869 of 2025 dated 18/08/2025, Asstt. Year 2018-19, where the SLP filed by the revenue against the order of the High Court has been dismissed on the grounds of delay in filing the SLP as well as on merits.

“II. Section 151 of the Income Tax Act, 1961-Income escaping assessment – Sanction for issue of notice (General) Assessment year 2018-19 High Court held that where reassessment in case of assessee was initiated after expiry of three years from end of relevant assessment year, sanction for issue of notice under section 148 ought to have been granted by authorities of rank referred to in section 151 (ii) and not by authorities of relatively lower rank under section 151 (i) Whether there was a gross delay of 248 days in filing SLP and same had not been satisfactorily explained by revenue – Held, yes Whether even otherwise instant court see no reason to interfere with impugned order passed by High Court, thus, SLP filed by revenue was to be dismissed-Held, yes [Paras1 and 3] [In favour of assessee]

SLP dismissed against Prokash Pandurang Patil v. Income Tax Officer (Bombay) (Para 3)

N. Venkatarman, A.S.G., Ms. Madhulika Upadhyay, AOR, V. Chandrashekhara Bharathi, Udit Dedhiya, Ms. Seema Bengani, Mrs. Gargi Khanna and Jagdish Chandra, Advs. for the Petitioner,

ORDER

| 1. | | There is a gross delay of 248 days in filing the Special Leave Petition which has not been satisfactorily explained by the petitioner. |

| 2. | | Even otherwise, we see no reason to interfere with the impugned order passed by the High Court. |

| 3. | | The Special Leave Petition is, therefore, dismissed on the ground of delay as well as merits. |

| 4. | | Pending application(s), if any, stands disposed of.” |

17. The Ld. AR relying on the above decisions, submitted that in the instant case since it is evident from record that the sanction has not been obtained by the AO from the specified authority (Ld. Principal Chief Commissioner of Income Tax) as per provisions of section 151(ii) of the Act 61, in respect of the notice of reopening dated 4th April, 2024, which is clearly after the period of three years from the end of the assessment year 2018-19, the notice issued as per approval of the Ld. PCIT, as per provisions of section 151(i) of the Act 61, is legally not proper and as observed by the Hon’ble Apex court in the case of Prakash Pandurang Patil (supra), the Hon’ble court has dismissed the SLP, but has observed that that the SLP is dismissed on the ground of delay as well as merits.

18. As such he prayed that the observation of the Hon’ble Apex court is binding on all authorities and the facts of the above case of Prakash Pandurang Patil (supra) was identical and also related to the same Asst year 2018-19, and the same needs to be followed.

19. He prayed for quashing the assessment on this legal ground itself before proceeding to argue on the merits of the case based on documentary evidences contained in the paper book.

20. The Ld. DR relied on the order of the CIT(A) and objected to the additional ground being raised before the tribunal for the first time, even though it is a legal ground, and has also pointed out that the first notice u/s 148A(b) in this instant case, has been issued within three years timeframe on 22nd March, 2022 and approval has been rightly obtained from the Ld. Principal Commissioner of income tax as per provisions of section 151(i) of the Act 61, but has not countered the fact that the notice u/s 148 has been issued on 4th April, 2022, (after three years from the end of the assessment year 2018-19) and the necessary sanction should have been obtained from the Ld. Principal Chief Commissioner of Income Tax as per provisions of section 151(ii) of the act 61.

21. We have heard the rival counsels and considered the materials on record and the various judicial pronouncement on the issue of sanction obtained in the instant case, which we find has been obtained as per provisions of section 151(i) of the Act 61 from the Ld. Principal Commissioner of Income Tax, Srinagar in respect of the order being passed u/s 148A(d) dated 2nd April, 2022 and the subsequent notice u/s 148 dated 4th April, 2022.

22. Respectfully, following the law laid down by the Hon’ble Bombay High court in the case of ” Holiday Developers (P) Ltd. (supra)“, which relates to the same assessment year 2018-19, and are identical on facts we are of the opinion that the approval in the instant case should have been obtained from the sanctioning authority as per provisions of section 151(ii) of the Act 61, for the purpose of issue of notice u/s 148 and also for the purpose of issue of order u/s 148A(d) of the Act 61.

23. Moreover, we are also bound by the observation of the Hon’ble Apex court in the case of Prakash Pandurang Patil (supra),where the Hon’ble court has upheld the decision of the Hon’ble Bombay High court in the case of Prakash Pandurang Patil (supra), which also relates to the Asst year 2018-19, and on similar facts, where the Hon’ble Apex court while dismissing the revenue SLP on the ground of delay has also observed that the revenue has no case on merits.

24. As such, following the law laid down by the Hon’ble Apex court, we hold that in the instant case the notice u/s 148 dated 4th April, 2022, being issued after three years from the end of the relevant assessment year and not being approved by the appropriate authority as per provisions of section 151(ii) of the Act 61, is legally invalid and the consequential reassessment proceedings are also vitiated and quashed.

25. Since the appeal is allowed on this legal ground all other grounds on merits are not adjudicated upon.

26. In the result, the appeal of the assessee for Asstt. Year 2018-19 is allowed.

Grounds of appeal in ITA No. 586/Asr/2024 Asstt. Year: 2019-20:

“1. That the CIT(A) has erred in confirming the addition made by the AO vide order passed u/s 147 r.w.s 148 of Income Tax Act 1961, dated 06.09.2024 which is illegal, bad in law and void ab initio.

2. That the CIT(A) has erred in Law in passing the order without adjudicating the case on merits particularly without adjudicating the factual grounds of appeal.

3. That on the facts and in the circumstances of the case and in law, the Id AO erred in making addition to the tune of Rs 4036821/- by passing the order u/s 147 r.w.s 144 r.w.s 148. That that assumption of jurisdiction u/s 148 by the Ld. AO is in violation of mandatory jurisdictional conditions as stipulated under the Act.

4. That the assessment framed u/s 147 is bad in law as the jurisdictional notice issued u/s 148 and proceedings completed u/s 148A(d) were made by the jurisdictional AO which is in violation with the provisions of section 151A read with notification no S.O. 1466 (E) No 18/2022 dated 29.03.2022.

5. That the information uploaded on the insight portal is nowhere corroborated with any independent material. That the assessee was not supplied with the copy of reasons recorded, information or any document on the basis of which whole belief has been made that there is escapement of income to the tune of Rs. 4036821/-on the basis of information uploaded on insight portal.

6. That the CIT(A) has erred in confirming the action of the AO in estimating expenses at 20% without appreciating that the assessee is associated with Reliance retail limited as activation and recharge distributor of SIM cards and also engaged a subdistributor to meet the targets as fixed by reliance Retail limited.

7. That the CIT(A) has erred in confirming the addition made by the AO in estimating expenses at 20% without allowing the benefit of a major portion of expenses Incurred in the shape of schemes, Trade discounts and sub-distributors margin.

8. That the CIT(A) has erred in confirming the action of the AO in estimating net profit margin @ 80% without appreciating that the net profit rate so estimated is not in conformity with the average industry net profit margin.

9. That the CIT(A) has erred in confirming the addition made by the AO without appreciating a major portion of expenses incurred in the shape of schemes, Trade discounts and sub-distributors margin.

10. That the Assessing craves and leave to add or amend the grounds of appeal before the appeal is finally heard or disposed off.”

27. In this case for the Asst year 2019-20, the Ld. AR of the assessee submitted that the nature of business activity of the assessee has remained the same as in immediately preceding year and he argued only on the merits of the case and submitted that due to the death of the authorized CA the return of income could not be filed, and on account of non-compliance to various notices issued by the AO in course of assessment proceedings, the assessment was completed on the basis of materials gathered u/s 133(6) and the income has been determined at Rs.40,36,821/-, which is arbitrary and excessive and is not as per the margin of commission specifically laid out in the distributor agreement with the parent company within the boundaries of which the entire business activity of recharge vouchers has been performed.

28. He further submitted that the matter carried in appeal has been dismissed by the Ld. CIT (A) without giving any cognizance to the documentary evidences (containing 72 pages) filed before the first appellate authority duly uploaded in appeal portal along with prayer for accepting of fresh evidence u/r 46A of IT Rules’ 62.

29. He further referred to the copy of agreement dated 23rd December, 2015, entered into with the parent company (part of pb 1-36) RIL, (Reliance Retail Ltd) laying down terms and conditions, under which the entire activity of the business is carried out and where the margin of commission of the distributor (assessee) is also fixed which are further supported by various communications in between the assessee and the parent company (placed in page – 37 of PB), where the distributor is entitled to only 2% margin as commission.

30. Referring to the above documentary evidences and a comparative case of similar distributor engaged in the same nature of business (Kapoor Bros placed in pb 45 to 65), the Ld. AR prayed for adequate relief.

31. The Ld. DR relied on the order of the first appellate authority but could not offer any reason as to why the documentary evidences uploaded in the appeal portal in course of first appeal proceedings, has not been given any cognizance before dismissing the appeal.

32. We are of the opinion that in this case the interest of justice will be served if the matter is remanded to the files of the Ld. first appellate authority for considering all the documentary evidences filed in the appeal portal and to adjudicate on the grounds contained in form 35 on merits of the case and the assessee is also directed to file all submissions and documentary evidences in support of his contention and to fully cooperate in appellate proceedings.

33. The assessee to be allowed reasonable opportunity of being heard.

34. We have not expressed any opinion on merits of the case for this year and all legal issues are left open.

35. In the result, the appeal for the Asstt. Year 2019-20 is allowed for statistical purposes.