ORDER

Anikesh Banerjee, Judicial Member.- The instant appeal of the revenue and cross objection of the assessee are filed against the order of the National Faceless Appeal Centre (NFAC), Delhi [in short, ‘Ld.CIT(A)’] passed under section 250 of the Income-tax Act, 1961 (in short, ‘the Act’) for Assessment Year 2022-23, date of order 16/07/2025. The impugned order emanated from the order of the Assessment Unit, Income-tax Department [in short, the “Ld. AO”], order passed under section 143(3) read with section 144 of the Act, date of order 16/03/2024.

2. The revenue has taken the following grounds of appeal:-

ITA No.5922/Mum/2025

“1. Whether on the facts and circumstances of the case, Ld CIT(A) is justified in deleting the addition of Rs. 1,04,79,916/- made by the assessing officer by disallowing the share premium without appreciating the fact that the assessee company did not provide relevant supporting documents during the assessment proceedings.

2. Whether on the facts and circumstances of the case, Ld CIT(A) is justified in deleting the addition of Rs. 1,04,79,916/- made by the assessing officer by disallowing the share premium without appreciating the fact that the assessee company did not provide relevant supporting documents during the assessment proceedings. Whether on the facts and circumstances of the case, Ld. CIT(A) is justified in deleting the addition of Rs. 1,04,79,916/- made by the assessing officer by disallowing the share premium without appreciating the fact that the CBDT circular No. F. No. 173/149/2019-ITA-I dated 10.10.2023 does not relevant for the purpose of section 68 of the Act.

3. “The appellant craves leave to add, alter, amend or delete all or any of the aforesaid grounds of appeal.”

3. The brief facts of the case are that the assessee is a start-up FMCG company (DPIIT Registration No. DIPP18237), primarily engaged in the manufacture of natural products, including the extraction of cold-pressed oils from various seeds such as groundnut, coconut, sesame, etc. The assessee filed its return of income for the impugned assessment year declaring a total loss of Rs.2,94,737/-. The assessee’s case was selected for scrutiny on account of (i) receipt of a substantial amount of share premium during the financial year requiring verification of the genuineness of the transactions, the source of the share premium, and the identity and creditworthiness of the shareholders, as well as the applicability of section 56(2)(viib) of the Act; and (ii) a significant mismatch between the turnover disclosed in the Income-tax Return (ITR) and the turnover reported in the GSTR-9C return.

The Ld. AO issued statutory notices and ultimately completed the assessment under section 143(3) r.w.s. 144B of the Act, making an addition under section 68 amounting to Rs.1,04,79,916/- on account of the share premium received during the relevant financial year. The assessee preferred an appeal before the Ld. CIT(A). During the appellate proceedings, the assessee submitted documentary evidence relating to the identity, creditworthiness, and genuineness of the transactions of the shareholders from whom the share premium had been received. Since the assessee had been unable to furnish these details during the assessment proceedings, the evidence was filed as additional evidence before the Ld. CIT(A), who accordingly called for a remand report from the Ld. AO.

During the course of the appeal hearing, the assessee further submitted that being a DPIIT-registered start-up, it was protected by the notification dated 19/02/2019 issued by the Ministry of Commerce & Industry (Department for Promotion of Industry & Internal Trade) as well as by CBDT Circular No. F.No.173/149/2019-ITA-1 dated 10/10/2023. As per these directives, where the assessee is a DPIIT-recognised start-up, the applicability of section 56(2)(viib) is not to be examined by the Assessing Officer. Notwithstanding this, the Ld. AO proceeded to treat the entire share premium as unexplained cash credit under section 68 of the Act.

The Ld. CIT(A) allowed the appeal of the assessee and deleted the addition. Aggrieved by the relief granted, the revenue is in appeal on merits. The assessee has filed a cross-objection challenging the legal grounds.

4. The Ld. DR argued that the addition was rightly made by the Ld. AO under section 68 of the Act due to the assessee’s failure to establish the identity, creditworthiness, and genuineness of the transactions relating to the share subscribers. According to the Ld. DR, failure to satisfy even one of these essential limbs mandates an addition under section 68. While the assessee may be protected by the CBDT circular dated 10/10/2023 in respect of proceedings under section 56(2)(viib), there is no bar on examining the share premium under section 68. The Ld. DR, therefore, prayed for restoration of the addition made by the Ld. AO.

5. The Ld. AR submitted that although the assessee could not furnish the required documents during the assessment proceedings, complete documentary evidence was placed before the Ld. CIT(A) as additional evidence. The Ld. AR drew our attention to paragraphs 2.4 to 2.4.4 of the appellate order, which reads as under:-

“2.4. On perusal of the details filed by the appellant following facts were found:

2.4.1. The appellant has not submitted any document in respect to share premium received from Ms. Swati Khandre, Ms. Surpriya Prasad Chavan and Sugeet Patinge. The appellant has claimed that these persons are NRI and hence no documents are available. Therefore, the appellant has failed to submit any documents like ledger account, confirmation, bank statement, ITR return either filed in India or abroad in respect to these persons.

2.4.2. The appellant has submitted bank statement of Sh. Mahendra Sankhe, Vidhyadhar Kulkarni and Vidul Kulkarni. On perusal of these bank statements, it was found that the bank account of these persons were credited with almost equal amount just before they advanced the amount to appellant company. Therefore, genuineness of the transaction is not proved in these transactions.

2.4.3. The appellant has also filed the copy of ITR and bank statement of Sh. Smita Lele. On perusal of bank statement filed by the appellant, it was noticed by the AO that, an amount equal to share premium was transferred to the account of subscriber from the bank account of director of the appellant company Smt. Prajakta Khare. Hence, the genuineness of the transaction also not proved in this case too.

2.4.4. Further, the AO has also observed that, the total income of Smt. SmitaLele for AY 2021-22 was at Rs. 16,59,280/- and total income of Smt. NamitaPendharkar was at Rs. 71,660/- for AY 2022-23. In this regard, the AO has noted that, the income returned by them was nominal in comparison to high share premium paid to assessee company. Hence, creditworthiness of these persons could not be established in view of low income shown in ITR.”

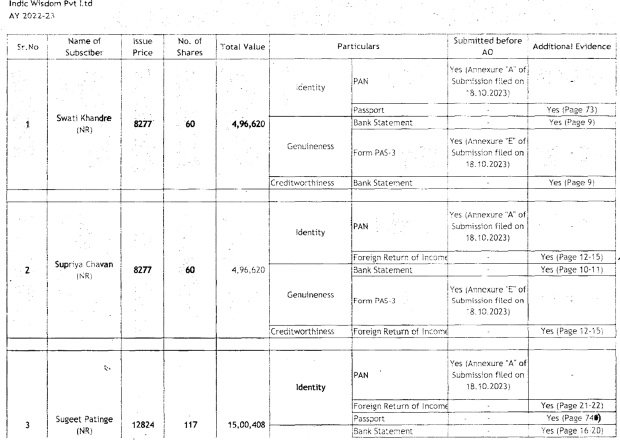

6. he Ld. AR submitted a tabular statement setting out the list of documents and evidences furnished before the Ld. CIT(A) in support of the identity, creditworthiness, and genuineness of the transactions pertaining to the share subscribers. It was emphasized that all payments received by the assessee from the subscribers were routed through normal banking channels. The said tabular statement filed by the Ld. AR is duly reproduced as below:

7. When the remand report was called for by the Ld.CIT(A), the Ld.AO had not made any reply against the notices of the Ld.CIT(A). The observation of the Ld.CIT(A) at paras 6.1 to 6.3 is extracted below:-

“6.1. I have carefully considered the assessment order, grounds of appeal, statement of facts, written submissions of the appellant, and additional evidences submitted during the appellate proceedings. Despite repeated reminders dated 15.04.2025, 05.05.2025, 20.05.2025, 30.05.2025 and 13.06.2025, the AO has not furnished any remand report. Therefore, this appeal is adjudicated on merits based on the material available on record.

6. 2. The appellant is a DPIIT-registered startup engaged in manufacture and distribution of natural products. During the year under consideration, it issued equity shares at a premium aggregating Rs.1,04,79,916/-. The AO added the said sum under section 68 of the Act, alleging that the identity and creditworthiness of the investors, and genuineness of the transactions, were not satisfactorily established.

6. 3. The appellant contends that all relevant details were submitted before the AO, including names and PANs of subscribers, bank statements, valuation reports by a registered valuer using the DCF method, Form PAS-3, and ITRs where available. However, due to procedural lapses in the faceless proceedings—including insufficient time to respond to the show cause notice dated 24.02.2024—the final submission was filed belatedly through grievance mechanisms and email after the assessment was concluded.”

8. The Ld.AR arguedd that there is no dispute that the assessee is DPIIT recognized start up and has placed the certificate on record which is annexed in appellate order page No.13. He further stated that related to compliance u/s 56(2)(viib) of the Act, the assessee has already got mandate from the circular of the CBDT dated 10/10/2023 and also the circular of Ministry of Commerce and Industry dated 19/02/2019. But related to section 68, the assessee discharged its onus by submitting the evidence / documents before the Ld. CIT(A). He invited our attention to the relevant part of the appeal order, paras 6.5 to 6.10, which is extracted below:-

“6. Decision:

xxxxxxxxxxxxxxxxxxxxxxxx

6.5. Coming to the requirements of section 68, the settled legal position is that the assessee must establish three ingredients: identity of the subscriber, their creditworthiness, and the genuineness of the transaction. In this case, the appellant has furnished:

• Full particulars and PANs of subscribers;

• Valuation reports as per Rule 11UA substantiating the share premium;

• Bank statements of the appellant showing receipt through banking channels;

• Bank statements and ITRs of several subscribers;

• An explanation that three subscribers were NRIs and payments were made from NRE accounts.

6.5.1. While the AO expressed doubts regarding layering of funds in certain cases, mere fund movement from the director’s account into investor’s account is not conclusive evidence of accommodation unless substantiated by further enquiry—which has not been undertaken. No adverse finding has been recorded by way of statements, inquiries, or cross-verification from the subscribers. The AO has merely presumed lack of creditworthiness based on ITRs or temporary bank inflows, without discharging the onus shifted onto the Department once the assessee provided prima facie evidence.

6.6. In PCIT v. NRA Iron & Steel

(2019) 412 ITR 161 (SC), it was held that once the assessee provides basic evidence to establish the identity, creditworthiness, and genuineness, the burden shifts to the AO to make independent inquiry. In this case, no such inquiry or report has been conducted or provided—even during the remand opportunity.

6.7. Additionally, the DCF-based valuation by a merchant banker is a recognized method under Rule 11UA. No defect has been specifically pointed out in the valuation methodology; the AO’s observation that the valuer increased the share value “without reason” is general and unsubstantiated. The Circular and the rules do not empower the AO to substitute his own valuation in place of a recognized valuer’s report unless shown to be patently incorrect or manipulated.

6.8 Most crucially, the CBDT Circular dated 10.10.2023, being binding on the Department under section 119, squarely applies to the appellant’s case and prohibits verification of share premium received by recognized startups during assessment proceedings. Ignoring such a circular without any contrary instruction or notification renders the assessment flawed. 6.9 In view of the above legal and factual matrix, I am of the considered opinion that:

6.9. In view of the above legal and factual matrix, I am of the considered opinion that:

• The appellant has discharged the initial onus under section 68 by submitting relevant documentary evidences;

• The AO has failed to rebut such evidences or conduct any independent inquiry;

• The assessment violates the CBDT’s instructions applicable to startups

6.10. Therefore, the addition of Rs.1,04,79,916/- made by the AO under section 68 is liable to be deleted.

7. Conclusion:

In view of the above findings, the addition of Rs. 1,04,79,916/- made under section 68 is hereby deleted. The appeal is accordingly allowed.”

[Emphasis supplied]

9. We have heard the rival submissions and perused the material available on record. The revenue has raised two grounds of appeal. Ground No. 1 pertains to the deletion of the addition made under section 68 of the Act, whereas Ground No. 2 concerns the applicability of CBDT Circular No. F.173/149/2019-ITA-1 dated 10/10/2023 in the context of an addition under section 68.

The Ld. CIT(A), in the impugned appellate order, addressed the issues in two distinct parts. The first related to the applicability of section 56(2)(viib) in the case of a DPIIT-registered start-up. We find that the assessee is indeed entitled to immunity from the applicability of section 56(2)(viib) in view of the CBDT Circular and the DPIIT notification. However, such immunity does not extend to proceedings under section 68 of the Act.

Accordingly, Ground No. 2 raised by the revenue is allowed.

10. With respect to Ground No. 1, concerning the deletion of the addition of Rs.1,04,79,916/- under section 68 of the Act, we note that the assessee had furnished all relevant documents before the Ld. CIT(A). The Ld. CIT(A) had repeatedly called for remand reports, and the specific instances of such directions are detailed in paragraph 6.1 of the appellate order. In these circumstances, it is evident that the Ld. CIT(A) afforded sufficient opportunities to the Ld. AO to examine the additional evidence. The assessee discharged its onus under section 68 of the Act by submitting requisite documentary evidence to establish the identity, creditworthiness, and genuineness of the share subscribers. The Ld. CIT(A), after considering the entire factual matrix and evidence placed on record, deleted the addition. The Ld. DR has not brought on record any substantive or convincing objection regarding the Ld. AO’s non-compliance with the repeated directions issued by the Ld. CIT(A) for submission of remand reports.

We therefore find no infirmity in the findings or conclusion of the Ld. CIT(A) in deleting the addition made under section 68. Consequently, Ground No. 1 of the revenue is dismissed.

As a result, the appeal of the revenue stands partly allowed.

11. Since the revenue’s appeal has been adjudicated on merits and partly allowed and the legal ground raised by the assessee in its cross-objection remains merely academic and is therefore left open. Accordingly, the cross-objection is dismissed as infructuous.

12. In the result, the appeal of the revenue bearing ITA No.5922/Mum/2025 is partly allowed & assessee’s CO-304/Mum/2025 is dismissed.