Unreasoned order cancelling GST registration for wrongful ITC set aside by High Court

Issue

Whether an order cancelling GST registration is legally sustainable if it merely states that the “reply is not satisfactory” without providing any reasoning or addressing the specific contentions raised by the taxpayer.

Facts

Petitioner Profile: The petitioner is a Hindu Undivided Family (HUF) holding a valid GST registration.

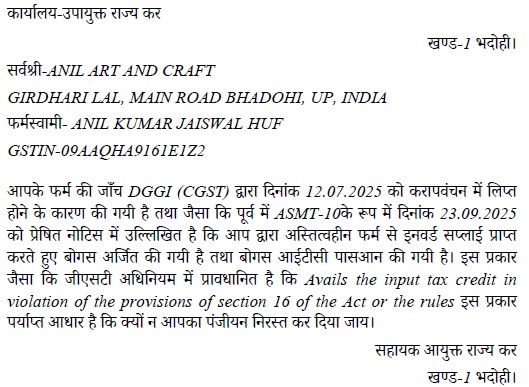

Show Cause Notice: The Department issued a Show Cause Notice (SCN) in Form GST REG-17, alleging that the petitioner had availed Input Tax Credit (ITC) wrongfully. A personal hearing was fixed.

Petitioner’s Defense: The petitioner submitted a reply stating that an investigation by the Directorate General of GST Intelligence (DGGI) regarding the same issue was already ongoing. Consequently, they requested that the cancellation proceedings be dropped.

Impugned Order: The Proper Officer passed an order in Form GST REG-19 cancelling the registration.

Lack of Reasoning: The cancellation order contained a cryptic one-line conclusion stating only that the petitioner’s “reply was not satisfactory,” without elaborating on why the defense regarding the DGGI investigation was rejected.

Decision

Violation of Natural Justice: The High Court held that an order which merely records a conclusion (“reply not satisfactory”) without disclosing the reasons for arriving at that conclusion violates the minimum procedural requirements and principles of natural justice.

Non-Speaking Order: The Court characterized the impugned order as “unreasoned” and “non-speaking.” An authority exercising quasi-judicial powers must apply its mind and provide reasons that are intelligible to the affected party.

Impact on Rights: The Court observed that cancelling a GST registration has serious civil consequences, gravely impairing a citizen’s right to carry on business. Such an action cannot be taken casually.

Order Set Aside: The impugned cancellation order was quashed.

Remand: The matter was remanded to the competent officer to continue the proceedings pursuant to the SCN and pass a fresh, reasoned order in accordance with the law.

Administrative Instruction: The Court expressed that administrative instructions should be issued to officers to prevent the recurrence of issuing such cryptic orders.

Key Takeaways

“Non-Speaking” Orders are Void: A one-line dismissal of a taxpayer’s reply (e.g., “Reply not found satisfactory”) renders an adjudication order legally unsustainable. The officer must explain why the reply was rejected.

Business Rights Protection: Courts view the cancellation of registration seriously as it stops business operations. Procedural safeguards must be strictly followed before taking such a drastic step.

Parallel Proceedings: While the Court set aside the order on technical grounds (lack of reasoning), it allowed the proceedings to continue, implying that the merit of the argument regarding the “ongoing DGGI investigation” must be decided by the officer in the fresh order.